Class 2020 Princeton Preview Presented by Prof Alain

Class 2020 Princeton Preview Presented by Prof. Alain Kornhauser Department Representative For more info see orfe. princeton. edu

Why ORFE? • Study and work on challenging and relevant problems. • Learn and apply mathematical & computational skills to address interesting, useful and timely applications. – These skills are recognized and rewarded in the marketplace by employers & top graduate schools. – They will make you a better Leader.

Marketable Skills • Probability: Modeling & understanding of uncertainty. • Statistics: Quantifying uncertainty. • Optimization: Modeling & understanding of the tradeoffs associated with the good fortune of having alternatives (and choosing among them even though they are uncertain) – These skills are recognized and rewarded in the marketplace by employers & top graduate schools. – They will make you a better Leader.

Skills are Focused on Improving Societal Challenges • Operations Research: – Logistics & Transportation – Energy Systems – Telecommunications & e. Commerce – Health Care • Financial Engineering: – Risk Management – Investment Strategies – Financial Instruments – Economic Stimulation • Machine Learning: – Real-time Decision Systems – Addressing High Dimensional Problems (aka “Big Data”)

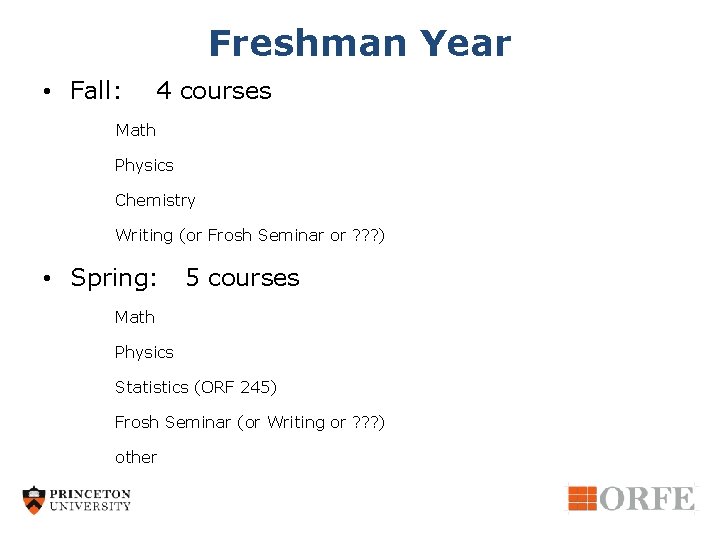

Freshman Year • Fall: 4 courses Math Physics Chemistry Writing (or Frosh Seminar or ? ? ? ) • Spring: 5 courses Math Physics Statistics (ORF 245) Frosh Seminar (or Writing or ? ? ? ) other

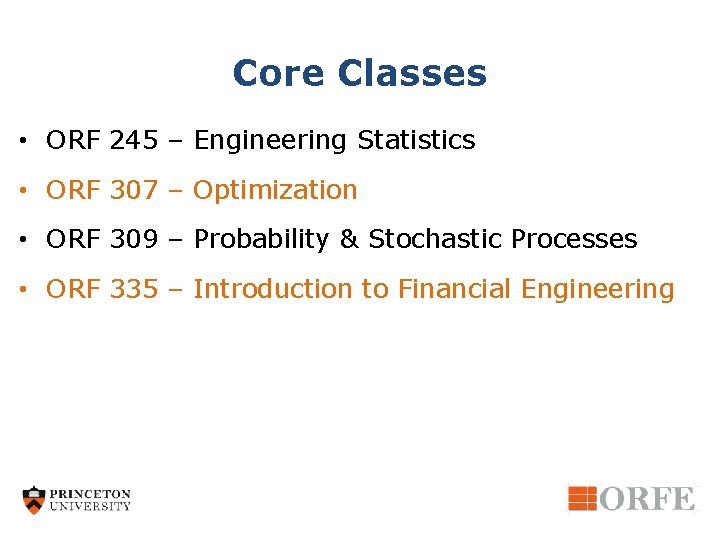

Core Classes • ORF 245 – Engineering Statistics • ORF 307 – Optimization • ORF 309 – Probability & Stochastic Processes • ORF 335 – Introduction to Financial Engineering

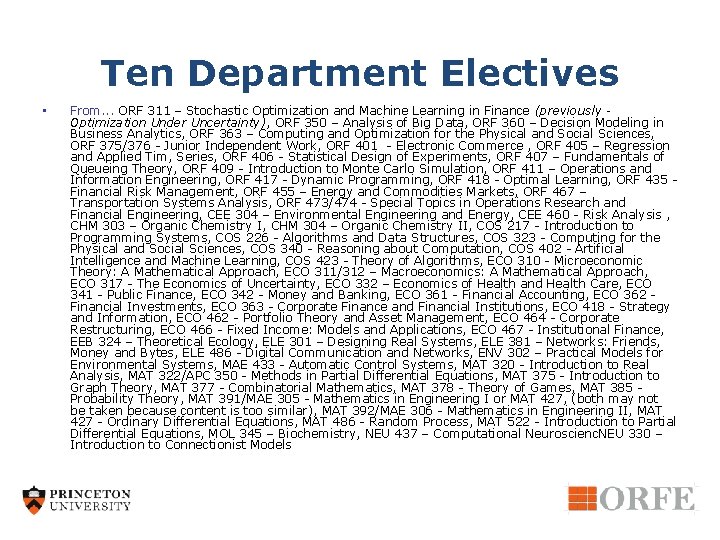

Ten Department Electives • From. . . ORF 311 – Stochastic Optimization and Machine Learning in Finance (previously Optimization Under Uncertainty), ORF 350 – Analysis of Big Data, ORF 360 – Decision Modeling in Business Analytics, ORF 363 – Computing and Optimization for the Physical and Social Sciences, ORF 375/376 - Junior Independent Work, ORF 401 - Electronic Commerce , ORF 405 – Regression and Applied Tim, Series, ORF 406 - Statistical Design of Experiments, ORF 407 – Fundamentals of Queueing Theory, ORF 409 - Introduction to Monte Carlo Simulation, ORF 411 – Operations and Information Engineering, ORF 417 - Dynamic Programming, ORF 418 - Optimal Learning, ORF 435 Financial Risk Management, ORF 455 – Energy and Commodities Markets, ORF 467 – Transportation Systems Analysis, ORF 473/474 - Special Topics in Operations Research and Financial Engineering, CEE 304 – Environmental Engineering and Energy, CEE 460 - Risk Analysis , CHM 303 – Organic Chemistry I, CHM 304 – Organic Chemistry II, COS 217 - Introduction to Programming Systems, COS 226 - Algorithms and Data Structures, COS 323 - Computing for the Physical and Social Sciences, COS 340 - Reasoning about Computation, COS 402 - Artificial Intelligence and Machine Learning, COS 423 - Theory of Algorithms, ECO 310 - Microeconomic Theory: A Mathematical Approach, ECO 311/312 – Macroeconomics: A Mathematical Approach, ECO 317 - The Economics of Uncertainty, ECO 332 – Economics of Health and Health Care, ECO 341 - Public Finance, ECO 342 - Money and Banking, ECO 361 - Financial Accounting, ECO 362 Financial Investments, ECO 363 - Corporate Finance and Financial Institutions, ECO 418 - Strategy and Information, ECO 462 - Portfolio Theory and Asset Management, ECO 464 - Corporate Restructuring, ECO 466 - Fixed Income: Models and Applications, ECO 467 - Institutional Finance, EEB 324 – Theoretical Ecology, ELE 301 – Designing Real Systems, ELE 381 – Networks: Friends, Money and Bytes, ELE 486 - Digital Communication and Networks, ENV 302 – Practical Models for Environmental Systems, MAE 433 - Automatic Control Systems, MAT 320 - Introduction to Real Analysis, MAT 322/APC 350 - Methods in Partial Differential Equations, MAT 375 - Introduction to Graph Theory, MAT 377 - Combinatorial Mathematics, MAT 378 - Theory of Games, MAT 385 Probability Theory, MAT 391/MAE 305 - Mathematics in Engineering I or MAT 427, (both may not be taken because content is too similar), MAT 392/MAE 306 - Mathematics in Engineering II, MAT 427 - Ordinary Differential Equations, MAT 486 - Random Process, MAT 522 - Introduction to Partial Differential Equations, MOL 345 – Biochemistry, NEU 437 – Computational Neuroscienc. NEU 330 – Introduction to Connectionist Models

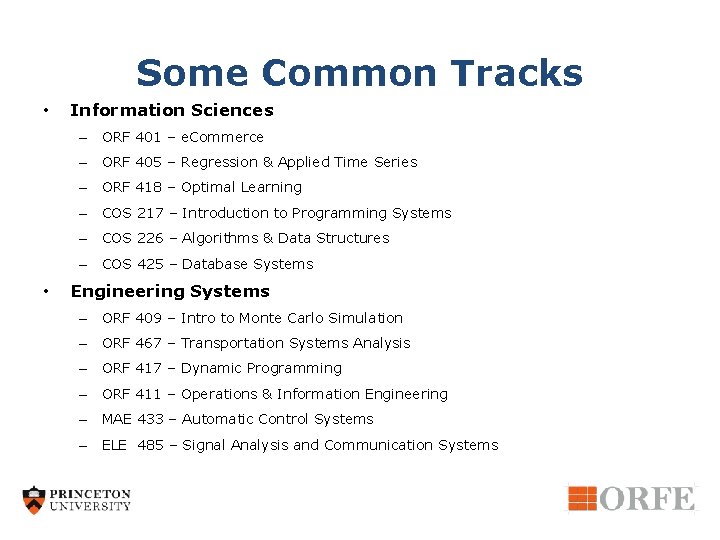

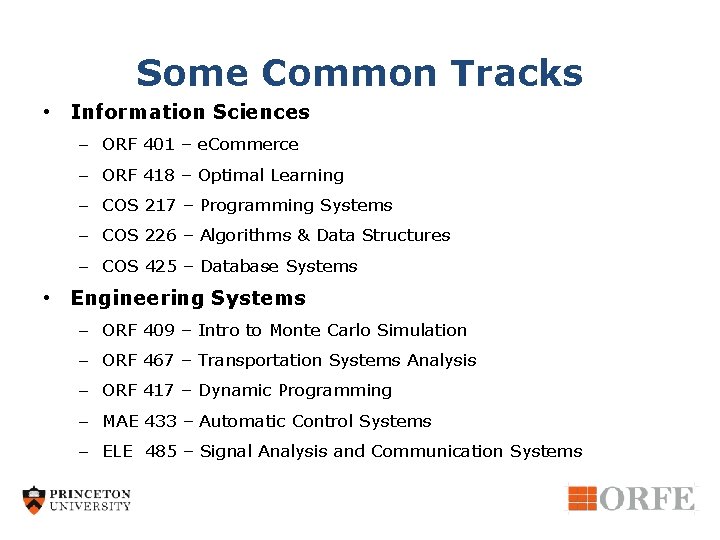

Some Common Tracks • Information Sciences – ORF 401 – e. Commerce – ORF 405 – Regression & Applied Time Series – ORF 418 – Optimal Learning – COS 217 – Introduction to Programming Systems – COS 226 – Algorithms & Data Structures – COS 425 – Database Systems • Engineering Systems – ORF 409 – Intro to Monte Carlo Simulation – ORF 467 – Transportation Systems Analysis – ORF 417 – Dynamic Programming – ORF 411 – Operations & Information Engineering – MAE 433 – Automatic Control Systems – ELE 485 – Signal Analysis and Communication Systems

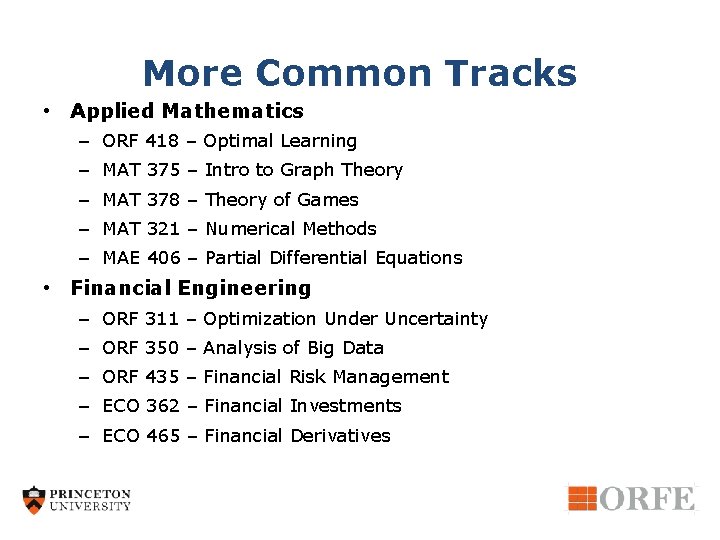

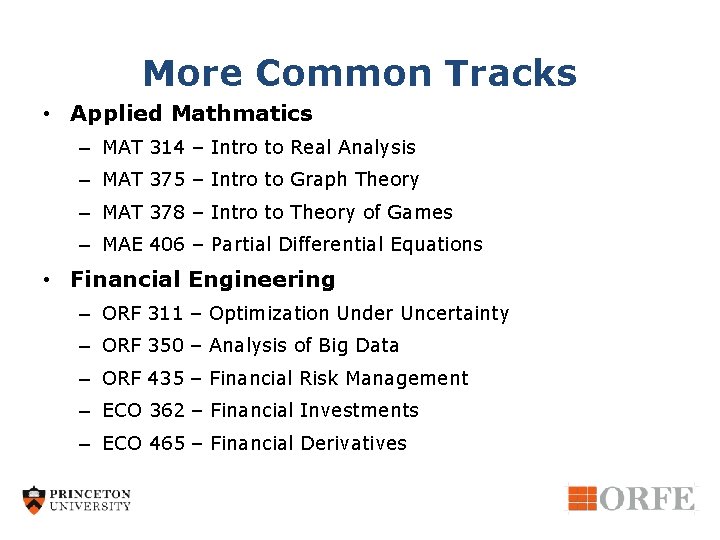

More Common Tracks • Applied Mathematics – ORF 418 – Optimal Learning – MAT 375 – Intro to Graph Theory – MAT 378 – Theory of Games – MAT 321 – Numerical Methods – MAE 406 – Partial Differential Equations • Financial Engineering – ORF 311 – Optimization Under Uncertainty – ORF 350 – Analysis of Big Data – ORF 435 – Financial Risk Management – ECO 362 – Financial Investments – ECO 465 – Financial Derivatives

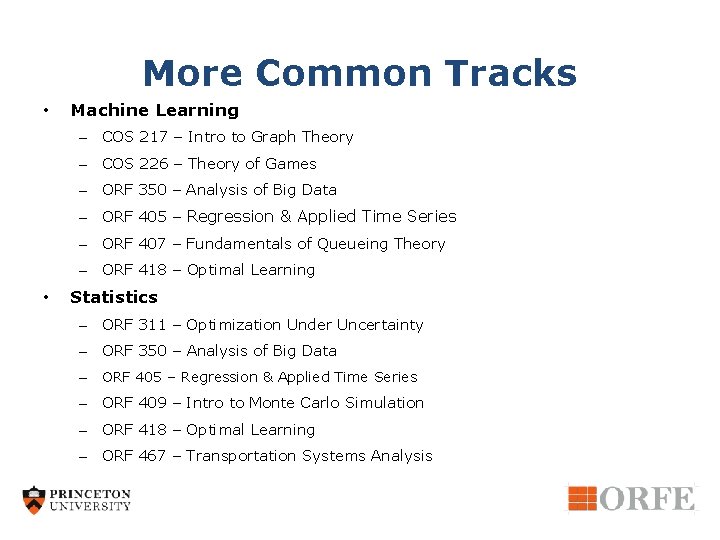

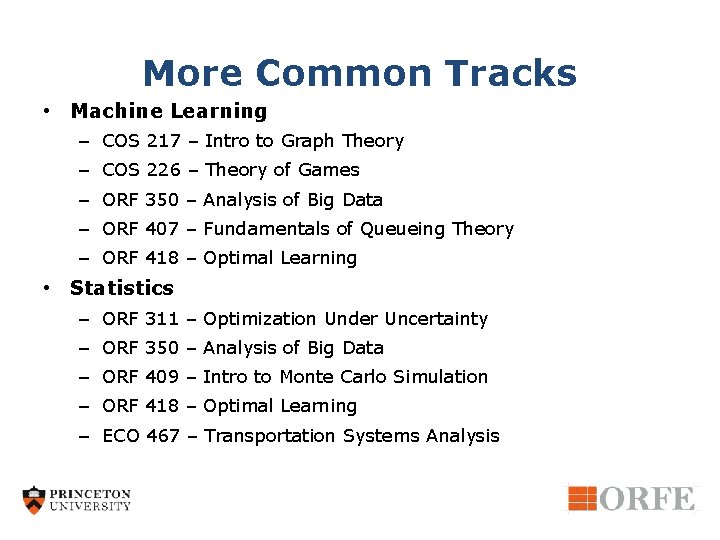

More Common Tracks • Machine Learning – COS 217 – Intro to Graph Theory – COS 226 – Theory of Games – ORF 350 – Analysis of Big Data – ORF 405 – Regression & Applied Time Series – ORF 407 – Fundamentals of Queueing Theory – ORF 418 – Optimal Learning • Statistics – ORF 311 – Optimization Under Uncertainty – ORF 350 – Analysis of Big Data – ORF 405 – Regression & Applied Time Series – ORF 409 – Intro to Monte Carlo Simulation – ORF 418 – Optimal Learning – ORF 467 – Transportation Systems Analysis

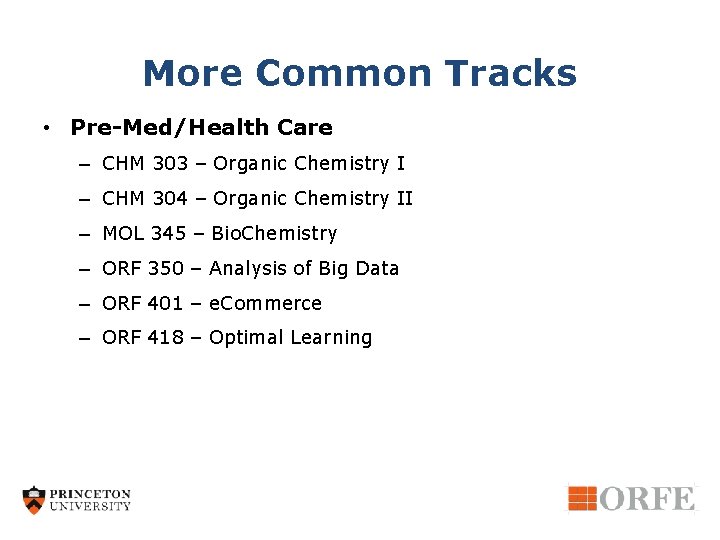

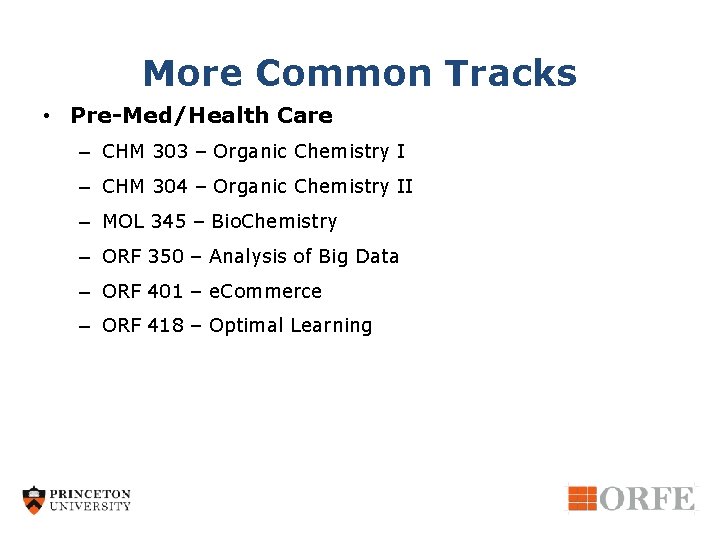

More Common Tracks • Pre-Med/Health Care – CHM 303 – Organic Chemistry I – CHM 304 – Organic Chemistry II – MOL 345 – Bio. Chemistry – ORF 350 – Analysis of Big Data – ORF 401 – e. Commerce – ORF 418 – Optimal Learning

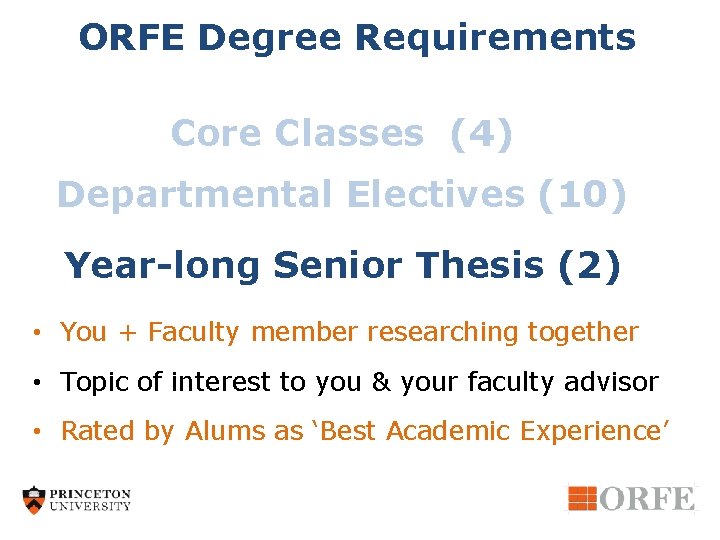

ORFE Degree Requirements Core Classes (4) Departmental Electives (10) Year-long Senior Thesis (2) • You + Faculty member researching together • Topic of interest to you & your faculty advisor • Rated by Alums as ‘Best Academic Experience’

Selected Senior Theses • Eileen Lee’ 14 – Uncovering Systematic Corruption in the ER: An Empirical Analysis of Motor Vehicle-Related Hospital Bills and their Impacts on Insurance Companies • Adam Esquer’ 14 - The Real Moneyball: Modelling Baseball Salary Arbitration • Suraj Bhat’ 16 - Quantifying the Potential for Dynamic Ride-Sharing of New York City’s Taxicabs • Stephanie Lubiak’ 11 – Neighborhood Nukes: Great for America? Great for the Environment? Great for Al Qaeda? • James Tate’ 12 – The Game Behind the Game: An Analysis of Baseball Player Evaluation Models • A. Hill Wyrough, Jr. ’ 14 – A National Disaggregate Transportation Demand Model for the Analysis of Autonomous Taxi Systems • Bharath Alamanda’ 13 – Customer Targeting in e. Commerce: A Feature Selection and Machine Learning Approach • Jordan Meyers’ 16 – Kernel Support Vector Machine Learning of Limit Order Book Dynamics for Short Term Price Prediction

Recent Graduates • Graduate Schools: Harvard, Stanford, Cornell, Georgia Tech, Texas A&M, U. of Kentucky (Med School) • Banks & Investment Firms: Goldman Sachs, Morgan Stanley, JP Morgan, Deutche, Black. Rock, • Industries: Aspect Medical Systems, Parsons Brinkerhoff, Walt Disney, Abercrombie, • Management/Economic Consulting: Mercer, Accenture, Monitor, Mc. Kinsey, Bates

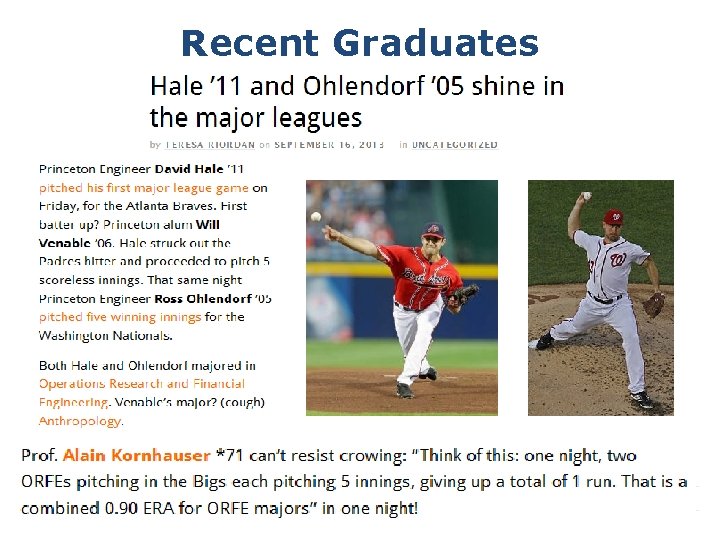

Recent Graduates

Questions / Discussion For more info see orfe. princeton. edu

Recent Graduates

Some Common Tracks • Information Sciences – ORF 401 – e. Commerce – ORF 418 – Optimal Learning – COS 217 – Programming Systems – COS 226 – Algorithms & Data Structures – COS 425 – Database Systems • Engineering Systems – ORF 409 – Intro to Monte Carlo Simulation – ORF 467 – Transportation Systems Analysis – ORF 417 – Dynamic Programming – MAE 433 – Automatic Control Systems – ELE 485 – Signal Analysis and Communication Systems

More Common Tracks • Applied Mathmatics – MAT 314 – Intro to Real Analysis – MAT 375 – Intro to Graph Theory – MAT 378 – Intro to Theory of Games – MAE 406 – Partial Differential Equations • Financial Engineering – ORF 311 – Optimization Under Uncertainty – ORF 350 – Analysis of Big Data – ORF 435 – Financial Risk Management – ECO 362 – Financial Investments – ECO 465 – Financial Derivatives

More Common Tracks • Machine Learning – COS 217 – Intro to Graph Theory – COS 226 – Theory of Games – ORF 350 – Analysis of Big Data – ORF 407 – Fundamentals of Queueing Theory – ORF 418 – Optimal Learning • Statistics – ORF 311 – Optimization Under Uncertainty – ORF 350 – Analysis of Big Data – ORF 409 – Intro to Monte Carlo Simulation – ORF 418 – Optimal Learning – ECO 467 – Transportation Systems Analysis

More Common Tracks • Pre-Med/Health Care – CHM 303 – Organic Chemistry I – CHM 304 – Organic Chemistry II – MOL 345 – Bio. Chemistry – ORF 350 – Analysis of Big Data – ORF 401 – e. Commerce – ORF 418 – Optimal Learning

Selected Senior Theses • Eileen Lee’ 14 – Uncovering Systematic Corruption in the ER: An Empirical Analysis of Motor Vehicle-Related Hospital Bills and their Impacts on Insurance Companies • Adam Esquer’ 14 - The Real Moneyball: Modelling Baseball Salary Arbitration • Lauren Hedinger’ 11 - The Quadrivalent Human Papillomavirus Vaccine: A Cost-Benefit Analysis of Cervical Cancer Prevention Strategies • Stephanie Lubiak’ 11 – Neighborhood Nukes: Great for America? Great for the Environment? Great for Al Qaeda? • James Tate’ 12 – The Game Behind the Game: An Analysis of Baseball Player Evaluation Models • A. Hill Wyrough, Jr. ’ 14 – A National Disaggregate Transportation Demand Model for the Analysis of Autonomous Taxi Systems • Bharath Alamanda’ 13 – Customer Targeting in e. Commerce: A Feature Selection and Machine Learning Approach • Raj K. Hathiramani’ 10 – Dissecting the Collapse of Amaranth Advisors LLC (2006): Natural Gas Stochastic Volatility, Irrational Position-Sizing and Predatory Trading

Recent Graduates • Graduate Schools: Harvard, Stanford, Cornell, Georgia Tech, Texas A&M, U. of Kentucky (Med School) • Banks & Investment Firms: Goldman Sachs, Morgan Stanley, JP Morgan, Deutche, Black. Rock, • Industries: Aspect Medical Systems, Parsons Brinkerhoff, Walt Disney, Abercrombie, • Management/Economic Consulting: Mercer, Accenture, Monitor, Mc. Kinsey, Bates

- Slides: 23