CISI Financial Products Markets Services Topic Equities 4

- Slides: 10

CISI – Financial Products, Markets & Services Topic – Equities (4. 1. 8) Stock Exchanges cisi. org

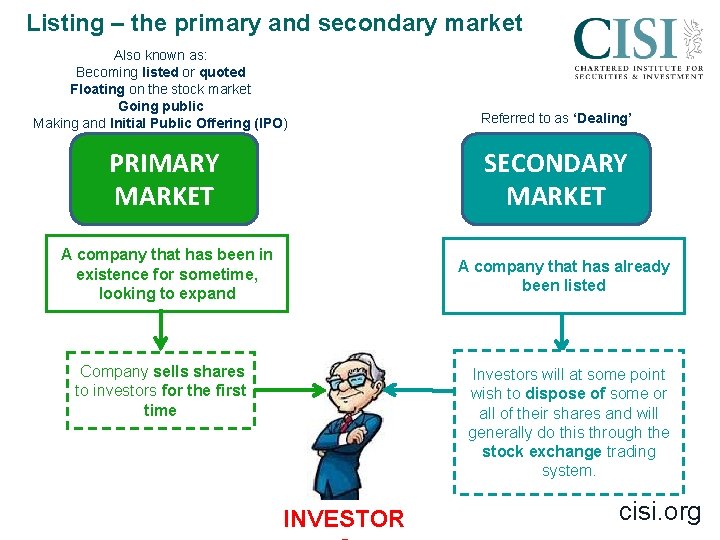

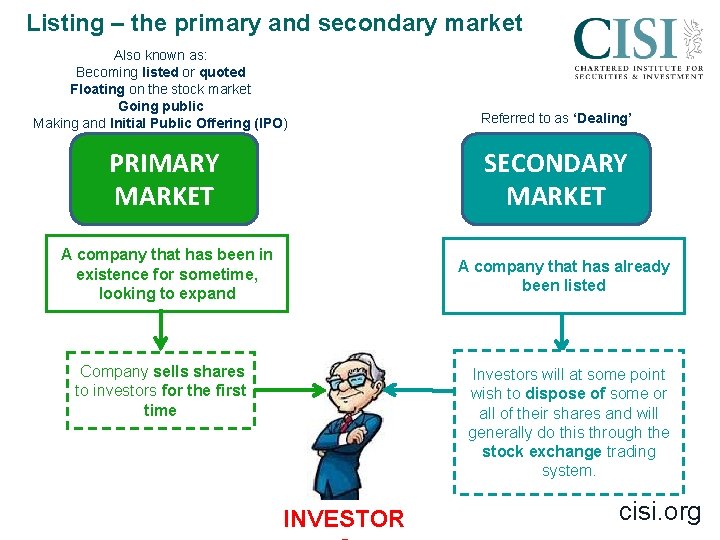

Listing – the primary and secondary market Also known as: Becoming listed or quoted Floating on the stock market Going public Making and Initial Public Offering (IPO) Referred to as ‘Dealing’ PRIMARY MARKET SECONDARY MARKET A company that has been in existence for sometime, looking to expand A company that has already been listed i. Company sells shares to investors for the first time Investors will at some point wish to dispose of some or all of their shares and will generally do this through the stock exchange trading system. INVESTOR cisi. org

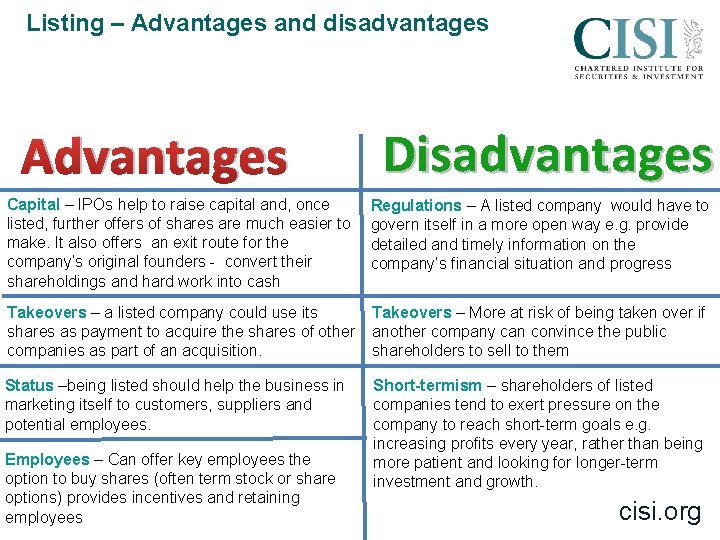

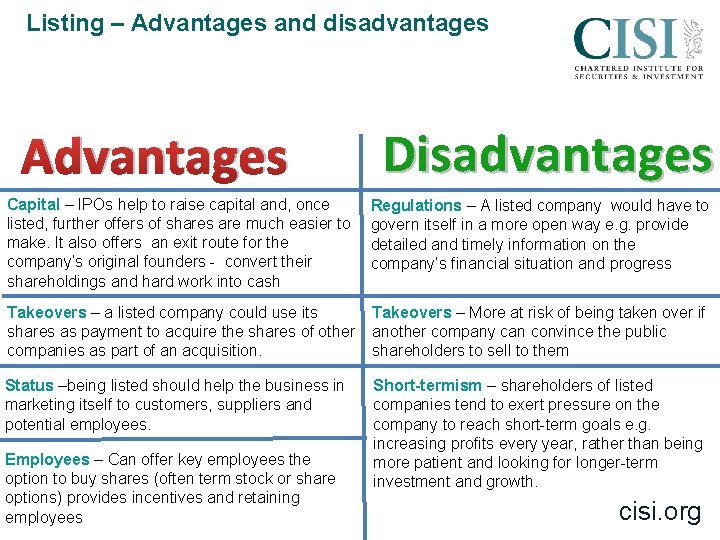

Listing – Advantages and disadvantages Advantages Disadvantages Capital – IPOs help to raise capital and, once listed, further offers of shares are much easier to make. It also offers an exit route for the company’s original founders - convert their shareholdings and hard work into cash Regulations – A listed company would have to govern itself in a more open way e. g. provide detailed and timely information on the company’s financial situation and progress Takeovers – a listed company could use its shares as payment to acquire the shares of other companies as part of an acquisition. Takeovers – More at risk of being taken over if another company can convince the public shareholders to sell to them Status –being listed should help the business in marketing itself to customers, suppliers and potential employees. Short-termism – shareholders of listed companies tend to exert pressure on the company to reach short-term goals e. g. increasing profits every year, rather than being more patient and looking for longer-term investment and growth. Employees – Can offer key employees the option to buy shares (often term stock or share options) provides incentives and retaining employees cisi. org

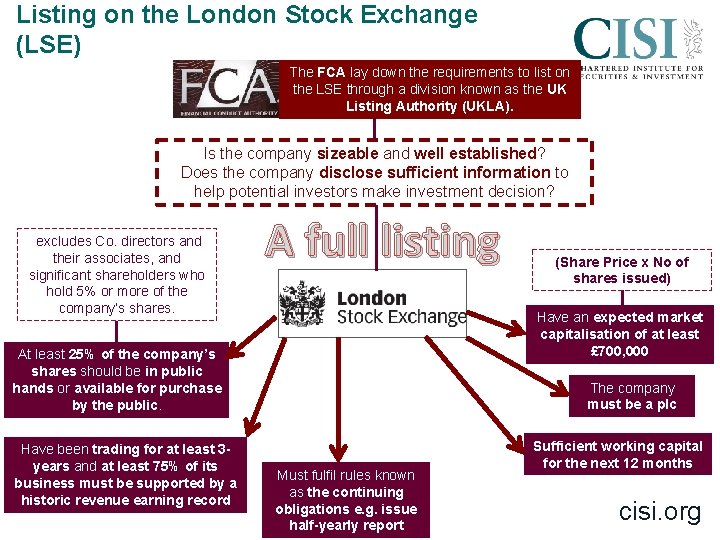

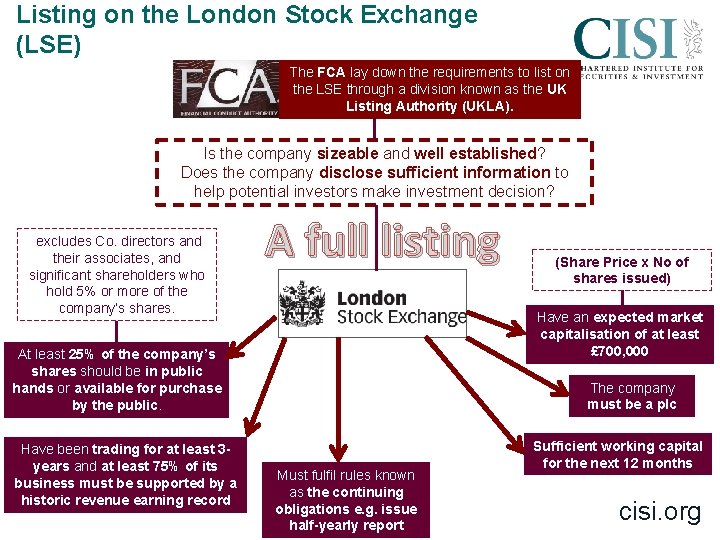

Listing on the London Stock Exchange (LSE) The FCA lay down the requirements to list on the LSE through a division known as the UK Listing Authority (UKLA). Is the company sizeable and well established? Does the company disclose sufficient information to help potential investors make investment decision? (excludes Co. directors and their associates, and significant shareholders who hold 5% or more of the company’s shares. A full listing Have an expected market capitalisation of at least £ 700, 000 At least 25% of the company’s shares should be in public hands or available for purchase by the public. Have been trading for at least 3 years and at least 75% of its business must be supported by a historic revenue earning record (Share Price x No of shares issued) The company must be a plc Must fulfil rules known as the continuing obligations e. g. issue half-yearly report Sufficient working capital for the next 12 months cisi. org

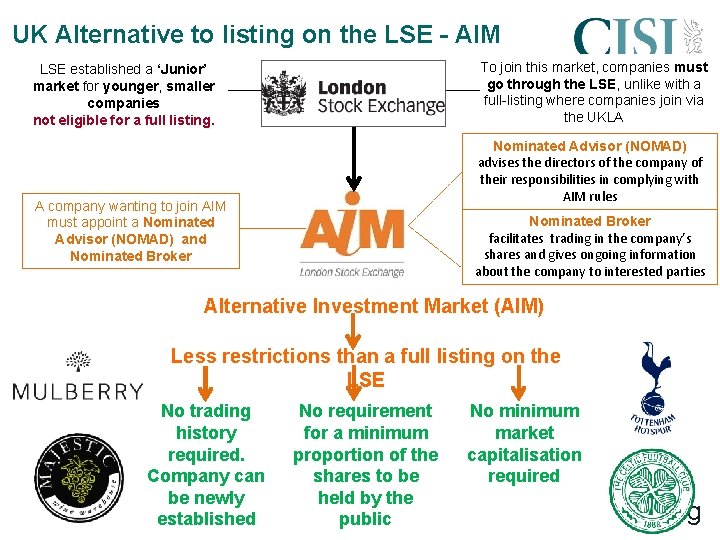

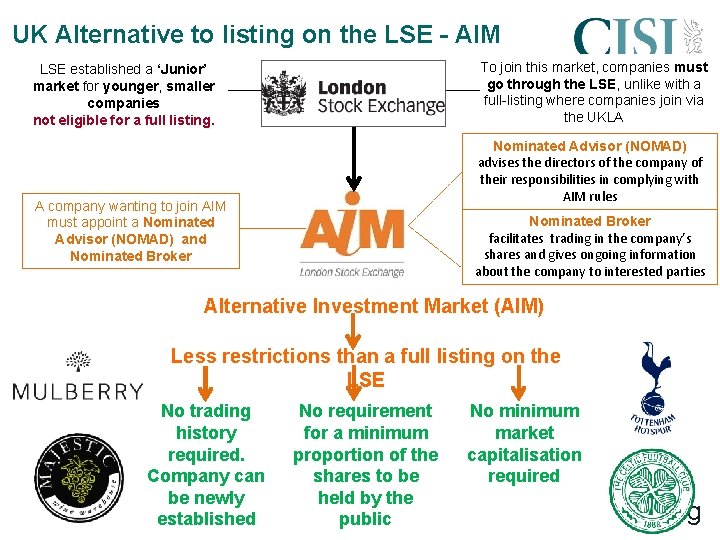

UK Alternative to listing on the LSE - AIM To join this market, companies must go through the LSE, unlike with a full-listing where companies join via the UKLA LSE established a ‘Junior’ market for younger, smaller companies not eligible for a full listing. Nominated Advisor (NOMAD) advises the directors of the company of their responsibilities in complying with AIM rules A company wanting to join AIM must appoint a Nominated Advisor (NOMAD) and Nominated Broker facilitates trading in the company’s shares and gives ongoing information about the company to interested parties Alternative Investment Market (AIM) Less restrictions than a full listing on the LSE No trading history required. Company can be newly established No requirement for a minimum proportion of the shares to be held by the public No minimum market capitalisation required cisi. org

Stock Exchanges Stock exchanges (also known as stock markets) have been around for centuries They began simply as meeting places where investors gathered to discuss companies and their shares, and to trade shares As they became more formal, these meeting places became the trading floors of exchanges, where traders made deals face to face. Today, many of these exchange floors have been replaced by sophisticated electronic dealing systems run on computer systems that now operate in major cities throughout the world. At certain times, these floors became very noisy and busy and the trading was therefore described as open outcry. cisi. org

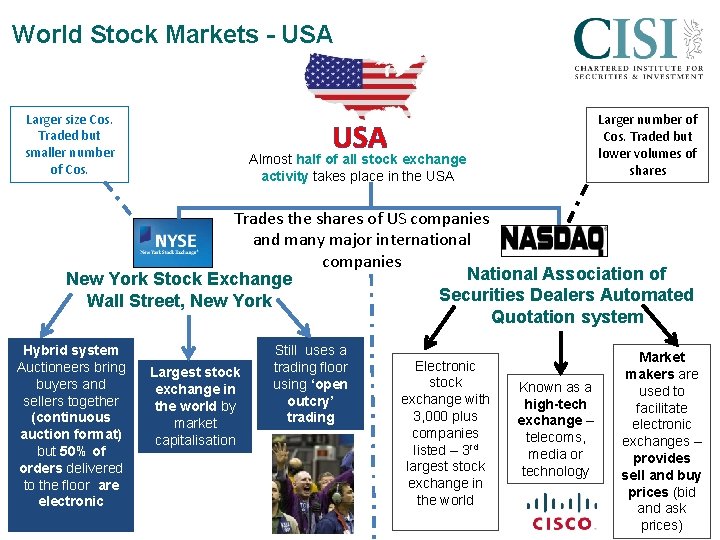

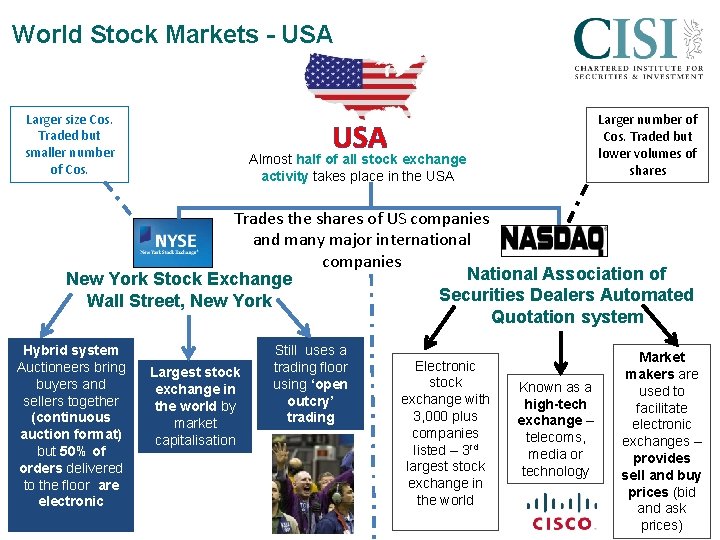

World Stock Markets - USA Larger size Cos. Traded but smaller number of Cos. Larger number of Cos. Traded but lower volumes of shares USA Almost half of all stock exchange activity takes place in the USA Trades the shares of US companies and many major international companies National Association of New York Stock Exchange Securities Dealers Automated Wall Street, New York Quotation system Hybrid system Auctioneers bring buyers and sellers together (continuous auction format) but 50% of orders delivered to the floor are electronic Largest stock exchange in the world by market capitalisation Still uses a trading floor using ‘open outcry’ trading Electronic stock exchange with 3, 000 plus companies listed – 3 rd largest stock exchange in the world Known as a high-tech exchange – telecoms, media or technology Market makers are used to facilitate electronic exchanges – provides sell and buy prices (bid and ask prices) cisi. org

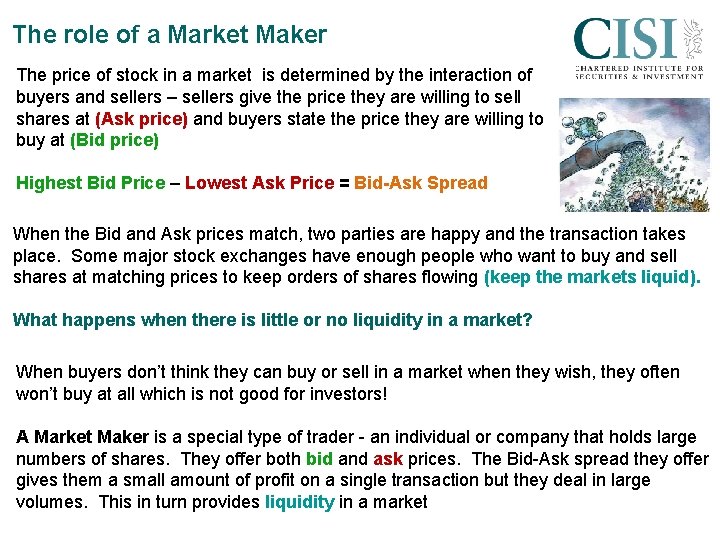

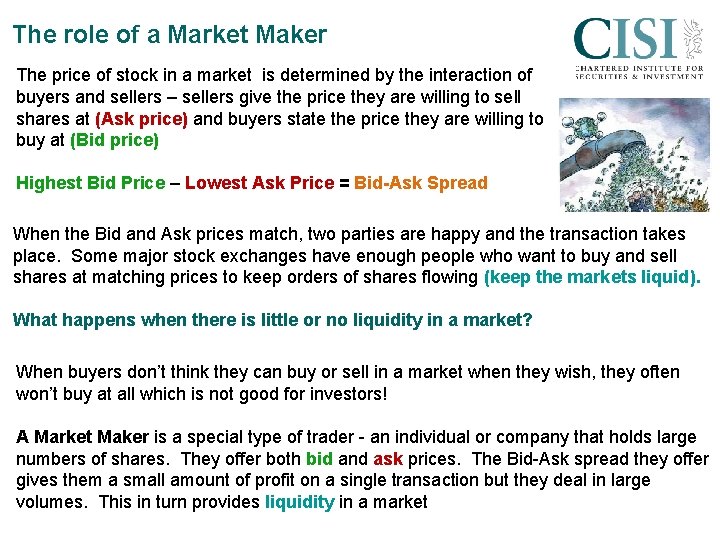

The role of a Market Maker The price of stock in a market is determined by the interaction of buyers and sellers – sellers give the price they are willing to sell shares at (Ask price) and buyers state the price they are willing to buy at (Bid price) Highest Bid Price – Lowest Ask Price = Bid-Ask Spread When the Bid and Ask prices match, two parties are happy and the transaction takes place. Some major stock exchanges have enough people who want to buy and sell shares at matching prices to keep orders of shares flowing (keep the markets liquid). What happens when there is little or no liquidity in a market? When buyers don’t think they can buy or sell in a market when they wish, they often won’t buy at all which is not good for investors! A Market Maker is a special type of trader - an individual or company that holds large numbers of shares. They offer both bid and ask prices. The Bid-Ask spread they offer gives them a small amount of profit on a single transaction but they deal in large volumes. This in turn provides liquidity in a market cisi. org

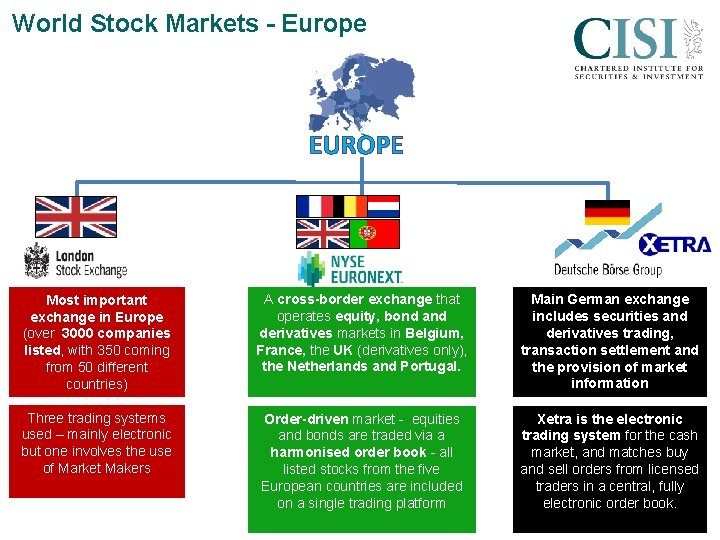

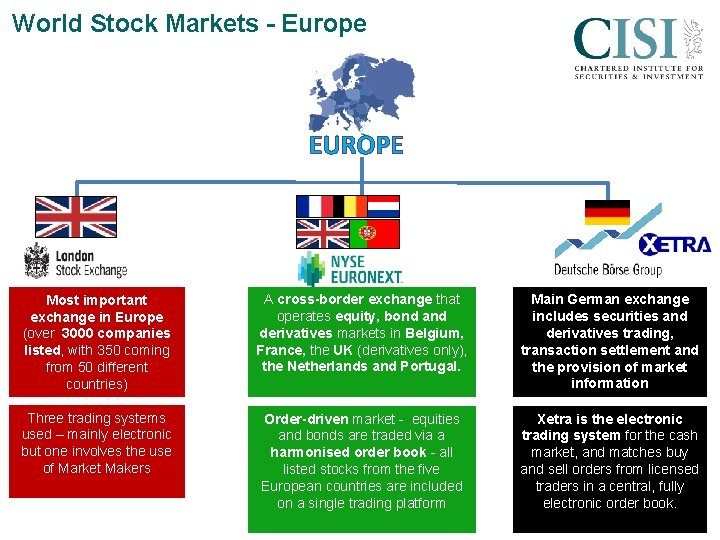

World Stock Markets - Europe EUROPE Most important exchange in Europe (over 3000 companies listed, with 350 coming from 50 different countries) A cross-border exchange that operates equity, bond and derivatives markets in Belgium, France, the UK (derivatives only), the Netherlands and Portugal. Main German exchange includes securities and derivatives trading, transaction settlement and the provision of market information Three trading systems used – mainly electronic but one involves the use of Market Makers Order-driven market - equities and bonds are traded via a harmonised order book - all listed stocks from the five European countries are included on a single trading platform Xetra is the electronic trading system for the cash market, and matches buy and sell orders from licensed traders in a central, fully electronic order book. cisi. org

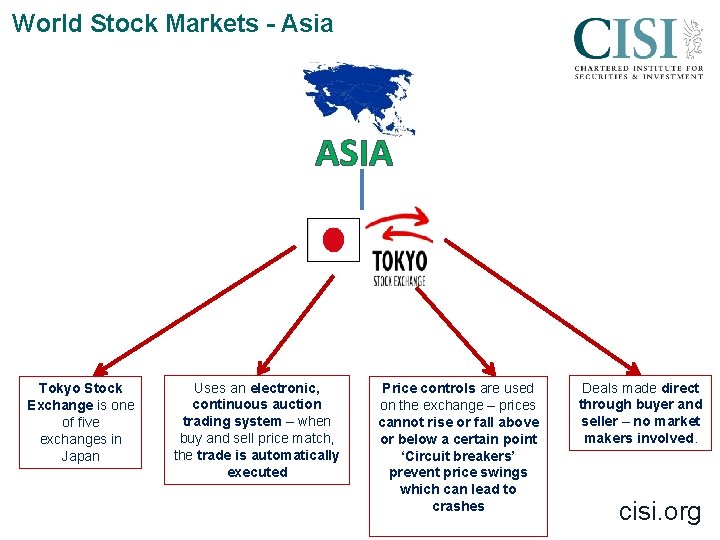

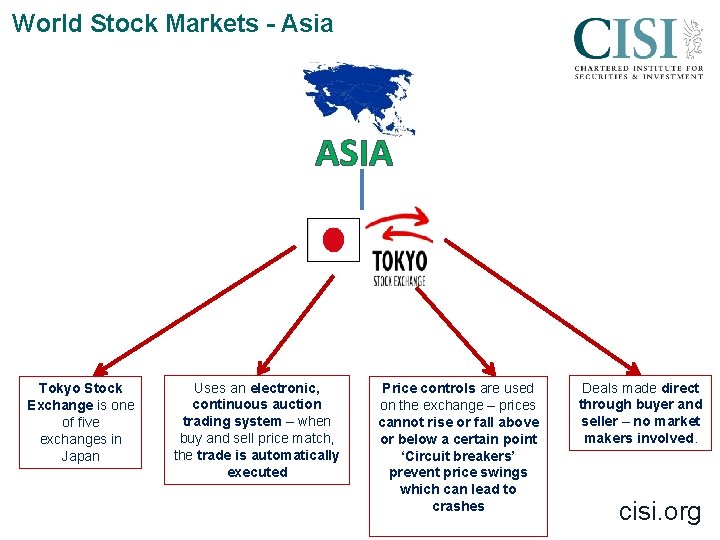

World Stock Markets - Asia ASIA Tokyo Stock Exchange is one of five exchanges in Japan Uses an electronic, continuous auction trading system – when buy and sell price match, the trade is automatically executed Price controls are used on the exchange – prices cannot rise or fall above or below a certain point ‘Circuit breakers’ prevent price swings which can lead to crashes Deals made direct through buyer and seller – no market makers involved. cisi. org

Cisi financial markets

Cisi financial markets Bernstein value equities

Bernstein value equities What is cost of equity

What is cost of equity Statistical arbitrage in the us equities market

Statistical arbitrage in the us equities market Chartered wealth manager cisi

Chartered wealth manager cisi Chartered wealth manager cisi

Chartered wealth manager cisi Cisi wallin

Cisi wallin Cisi introduction to securities and investment

Cisi introduction to securities and investment Aktutor.in mcq

Aktutor.in mcq Creating products for consumers in global markets

Creating products for consumers in global markets Why study financial markets and institutions

Why study financial markets and institutions