CHAPTER FOUR REVENUE AND EXPENSE ACCOUNTS 3 REVENUE

- Slides: 26

CHAPTER FOUR REVENUE AND EXPENSE ACCOUNTS

3 REVENUE AND EXPENSE ACCOUNTS Objectives: 1. Record debits and credits in revenue, expense, and withdrawal accounts. 2. Explain the rules of debit and credit. 3. Apply the rules of debit and credit for revenue, expense, and withdrawals on owner’s equity. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

4 Recording Revenue • The increase in the owner’s equity that results from revenue is recorded in a separate revenue account. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

5 Recording Expenses • Separate expense accounts should be used to record costs of doing business. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

6 Recording the Owner’s Withdrawals • The owner of a business may use cash or other assets personally. This is recorded in the withdrawal account. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

7 The Rules of Debit and Credit Assets • Balance side is debit side • Increase side is debit side • Decrease side is credit side Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

8 The Rules of Debit and Credit (continued) Liabilities • Balance side is credit side • Increase side is credit side • Decrease side is debit side Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

9 The Rules of Debit and Credit (continued) Owner’s Equity • Beginning investment is on credit side • Increases are on credit side • Decrease are on debit side Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

10 The Rules of Debit and Credit (continued) Revenue Accounts • Increases in owner’s equity through revenue are on the credit side • Decreases in owner’s equity through reduction of revenue are on the debit side Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

11 The Rules of Debit and Credit (continued) Expense Accounts • Decreases in owner’s equity through expenses on the debit side • Increases in owner’s equity through reduction of expense on the credit side Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

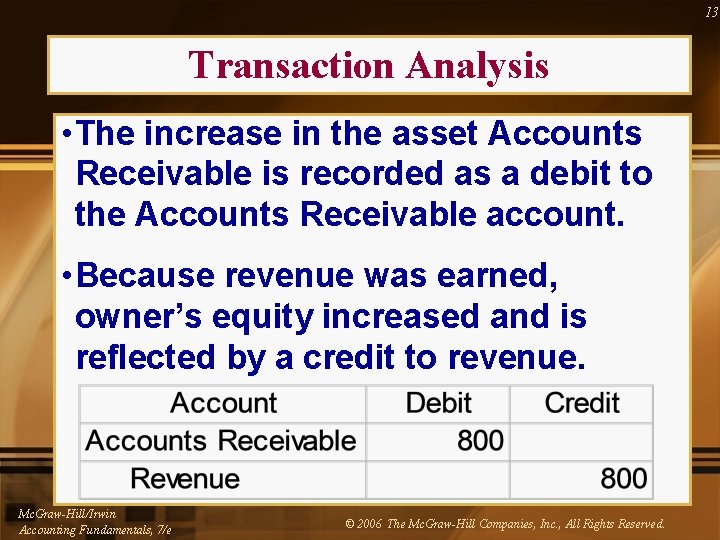

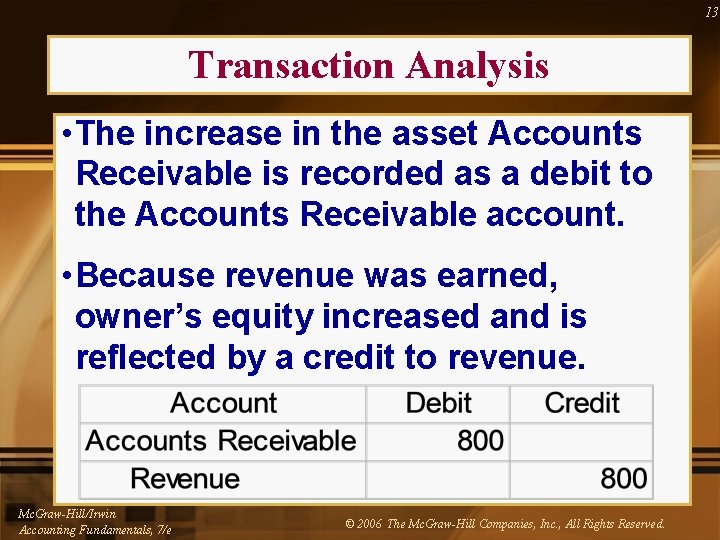

12 Transaction • Rebecca Van Lieu tested and screened job applicants for $800 on credit for a client, Donald Lynch. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

13 Transaction Analysis • The increase in the asset Accounts Receivable is recorded as a debit to the Accounts Receivable account. • Because revenue was earned, owner’s equity increased and is reflected by a credit to revenue. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

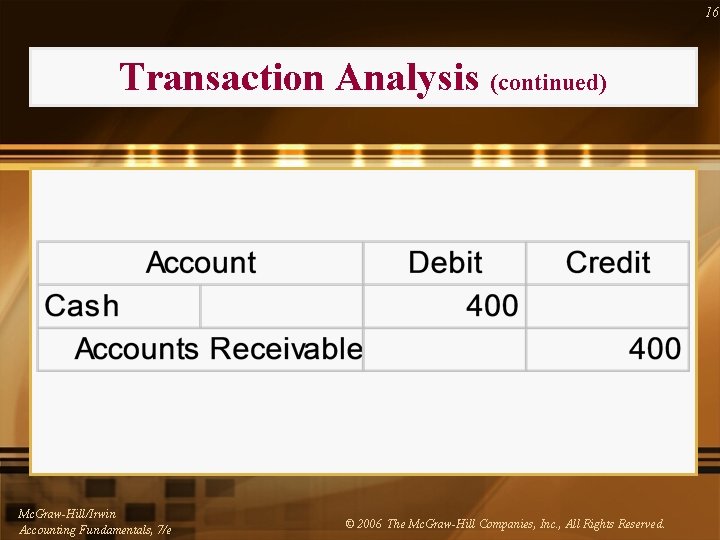

14 Transaction • Rebecca Van Lieu received $400 on account from Donald Lynch. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

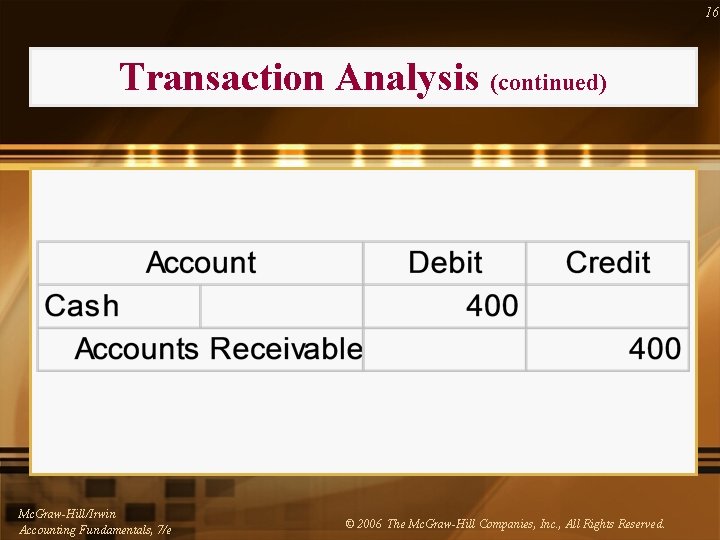

15 Transaction Analysis • This transaction involves only an exchange of one asset (accounts receivable) for another (cash). • It is recorded by debiting the Cash account and crediting the Accounts Receivable account. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

16 Transaction Analysis (continued) Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

17 Transaction • Rebecca Van Lieu withdrew $500 in cash from her business for her personal use. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

18 Transaction Analysis • Owner’s equity is decreased by $500 by debiting the Withdrawals account. • The asset Cash is decreased by $500 by crediting the Cash account Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

19 Accounting Terminology • Owner’s equity accounts • Withdrawals Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

20 Chapter Summary • Many business transactions involve earning revenue and incurring expenses. • A separate account is opened for each major revenue and expense. • A separate withdrawal account is opened to record the owner’s withdrawals. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

21 Chapter Summary (continued) • At the end of the period of operations, all revenue and expenses are totaled. • Net income or loss is derived after subtracting expenses from revenue and increases or decreases the owner’s equity. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

22 Chapter Summary (continued) • Withdrawals are subtracted from the net income to show the net increase or decrease in the owner’s equity. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

23 Topic Quiz Answer the following true/false questions: 1. The balance side of a revenue account is the debit side. FALSE 2. The balance side of an expense account is the debit side. TRUE 3. If withdrawals exceed net income, the owner’s equity is increased. FALSE Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

24 Investigating on the Internet Sources of information about revenue and expense accounts can be accessed at a website for a business. As a research assignment, access the corporate website and report those sources of information that might concern revenue and expense accounts used in the operation of the business. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

25 1. The balance side of a revenue account is the debit side. FALSE The balance side of a revenue account is the credit side. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e (Return to Topic Quiz) © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

26 3. If withdrawals exceed net income, the owner’s equity is increased. FALSE The owner’s equity is decreased. Mc. Graw-Hill/Irwin Accounting Fundamentals, 7/e (Return to Topic Quiz) © 2006 The Mc. Graw-Hill Companies, Inc. , All Rights Reserved.

Revenue function graph

Revenue function graph Drawings expense

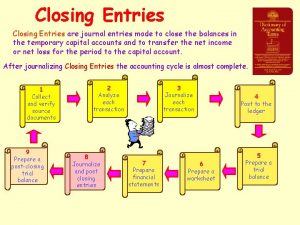

Drawings expense Closing entries are made

Closing entries are made Temporary accounts

Temporary accounts Accounts receivable unearned revenue

Accounts receivable unearned revenue Average

Average The fifth step in the accounting cycle is

The fifth step in the accounting cycle is Importance of ledger

Importance of ledger Shape with one side

Shape with one side Revenue expenditure vs capital expenditure

Revenue expenditure vs capital expenditure Capital and revenue receipts and expenditure

Capital and revenue receipts and expenditure Competent negative prefix

Competent negative prefix Expense prefix and suffix

Expense prefix and suffix Deductible and nondeductible expense pajak

Deductible and nondeductible expense pajak Promissory note

Promissory note Chapter 9 checking accounts and banking services

Chapter 9 checking accounts and banking services 4 eyes in 4 hours

4 eyes in 4 hours Consumable stores on hand in income statement

Consumable stores on hand in income statement Deferred tax asset journal entry

Deferred tax asset journal entry Accrued expenses adjusting entry

Accrued expenses adjusting entry How to calculate pension expense

How to calculate pension expense Accuaries

Accuaries Accretion expense

Accretion expense Liabilitas kontinjensi

Liabilitas kontinjensi Reversing entries

Reversing entries Reversing entries

Reversing entries Expense wire

Expense wire