Chapter 9 Properties of Stock Options Outline n

- Slides: 20

Chapter 9 Properties of Stock Options

Outline n Factors affecting option price n Assumptions and notation n Upper and lower bounds for option price n Put-call parity n Early exercise : calls on a nondividends-paying stock n Early exercise : puts on a non- 1

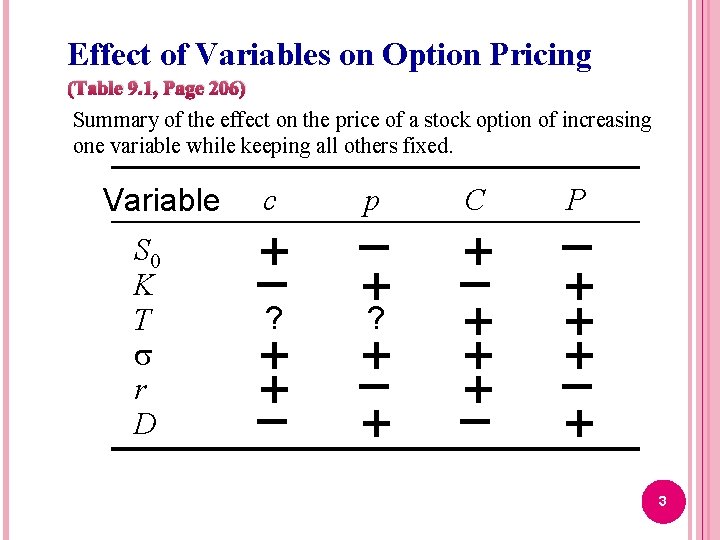

Factors affecting option prices n There are six factors affecting the price of a stock option: 1. The current stock price, S 0 2. The strike price, K 3. The time to expiration, T 4. The volatility of the stock prive, 5. The risk-free interest rate, r 6. The dividends expected during the 2

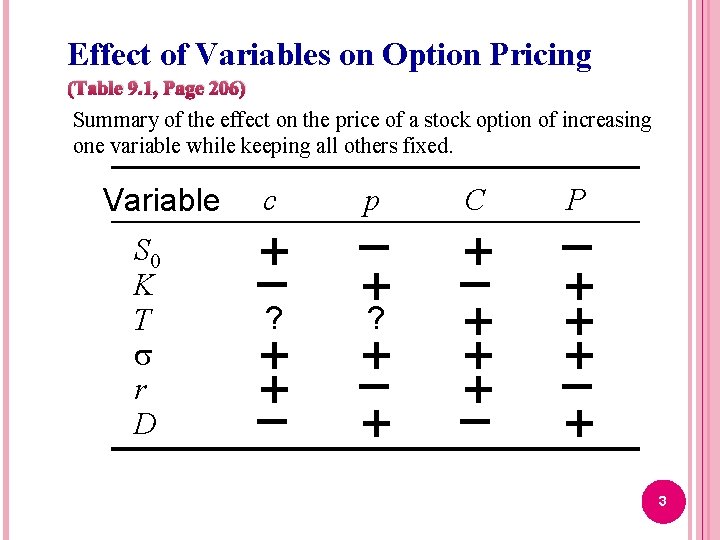

Effect of Variables on Option Pricing (Table 9. 1, Page 206) Summary of the effect on the price of a stock option of increasing one variable while keeping all others fixed. Variable S 0 K T r D c + – ? + + – p – +? + – + C + – + + + – P – + + + – + 3

Assumptions and Notation(1/2) We assume that there are some market participants, such as large investment banks, for which the following statements are true: 1. There are no transactions costs. 2. All trading profits (net of trading losses) are subject to the same tax rate. 4

Assumptions and Notation(2/2) S 0 : Stock price today ST : Stock price at option maturity K : Strike price T : Life of option p : European put option price : Volatility of stock price c : European call option price r : Risk-free interest rate P : American Put option price C : American Call option price D : Present value of dividends during option’s life 5

American vs European Options An American option is worth at least as much as the corresponding European option C c P p 6

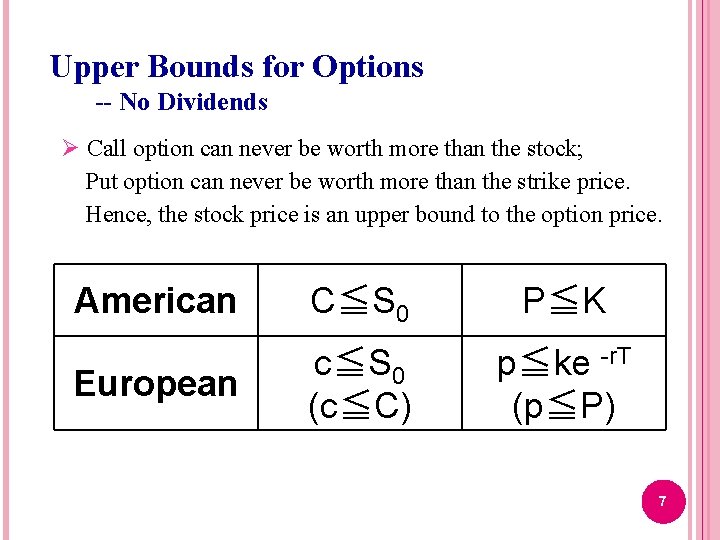

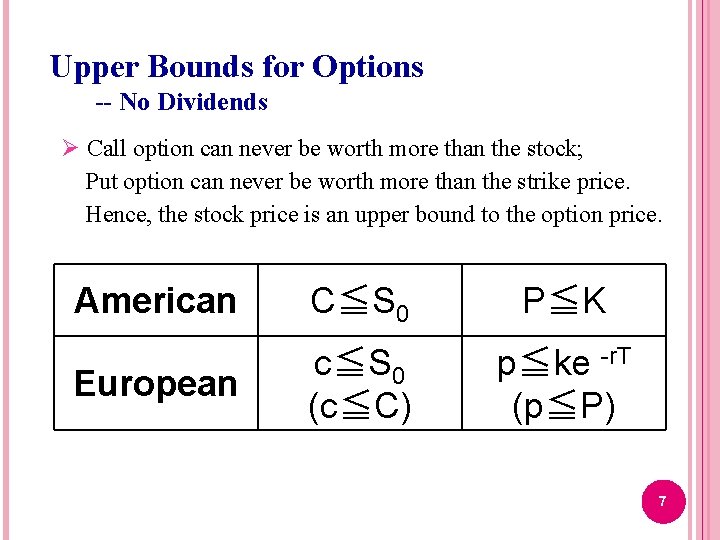

Upper Bounds for Options -- No Dividends Ø Call option can never be worth more than the stock; Put option can never be worth more than the strike price. Hence, the stock price is an upper bound to the option price. American C≦S 0 P≦K European c≦S 0 (c≦C) p≦ke -r. T (p≦P) 7

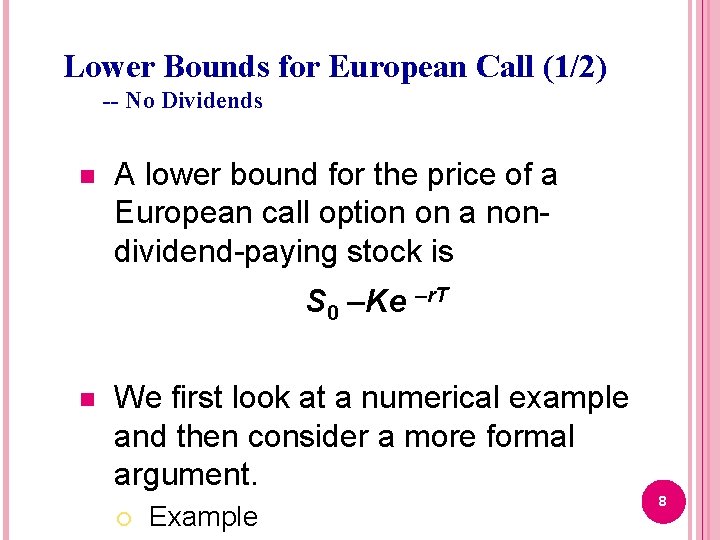

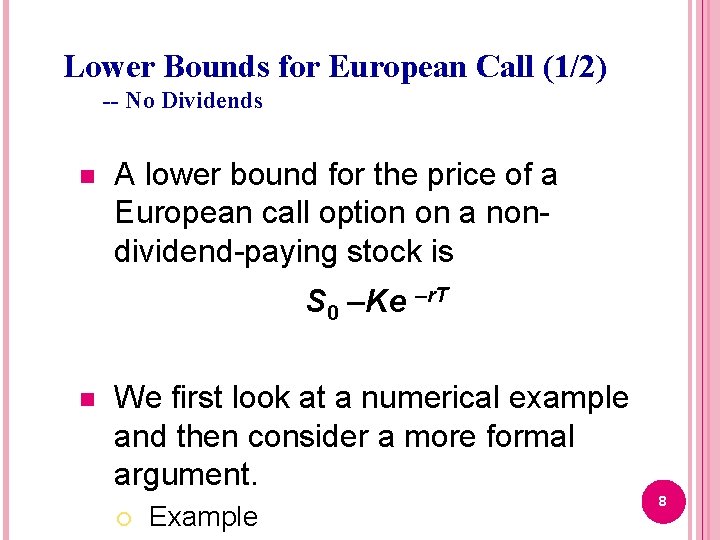

Lower Bounds for European Call (1/2) -- No Dividends n A lower bound for the price of a European call option on a nondividend-paying stock is S 0 –Ke –r. T n We first look at a numerical example and then consider a more formal argument. ¡ Example 8

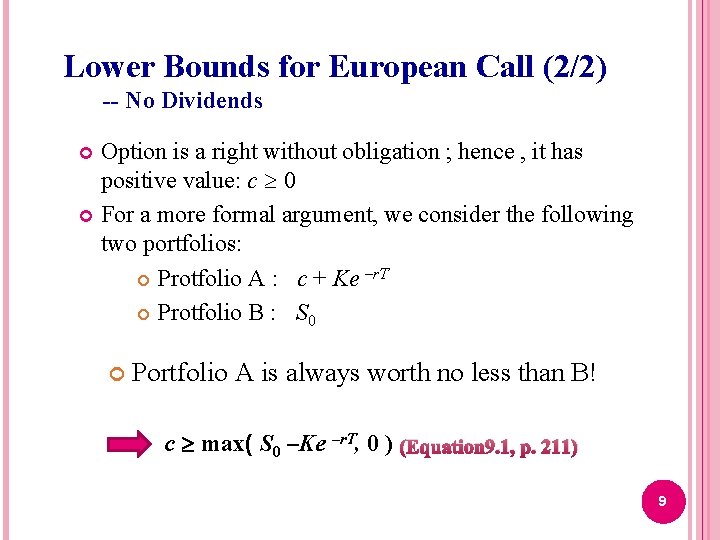

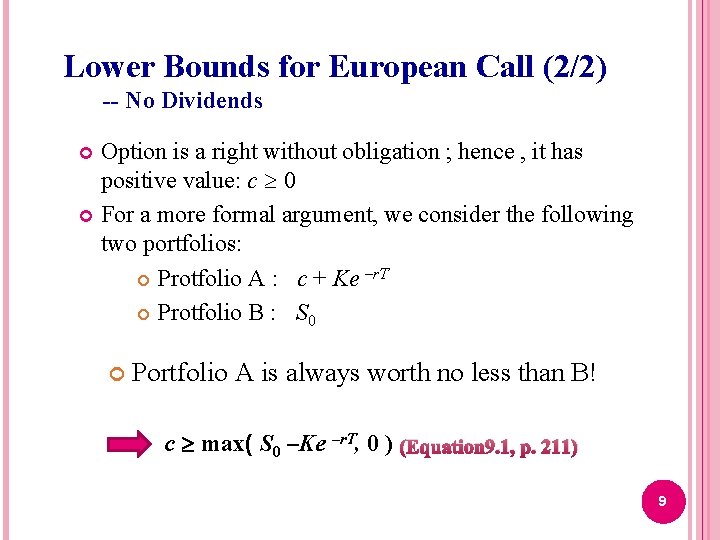

Lower Bounds for European Call (2/2) -- No Dividends Option is a right without obligation ; hence , it has positive value: c 0 For a more formal argument, we consider the following two portfolios: Protfolio A : c + Ke –r. T Protfolio B : S 0 Portfolio A is always worth no less than B! c max( S 0 –Ke –r. T, 0 ) (Equation 9. 1, p. 211) 9

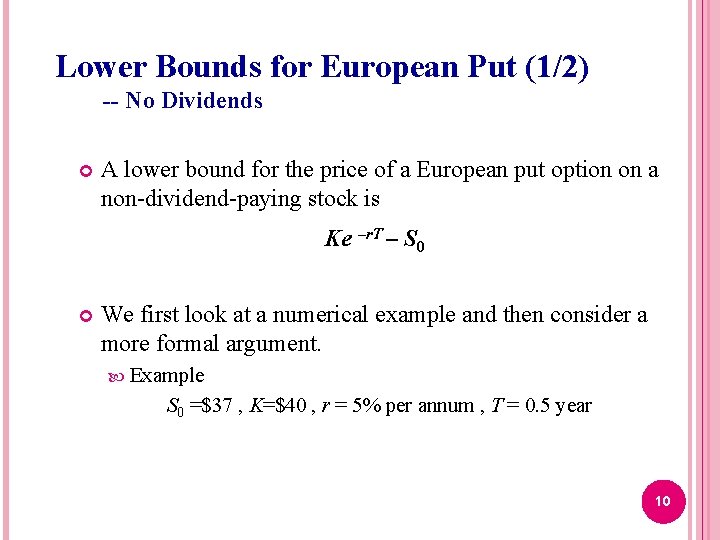

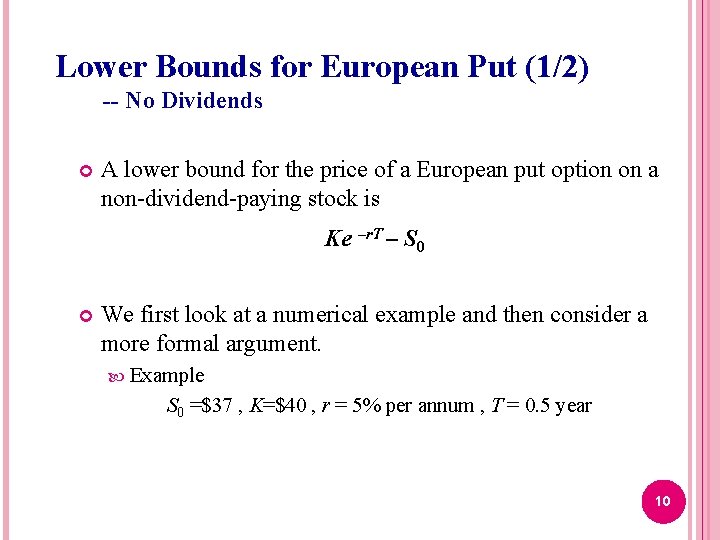

Lower Bounds for European Put (1/2) -- No Dividends A lower bound for the price of a European put option on a non-dividend-paying stock is Ke –r. T – S 0 We first look at a numerical example and then consider a more formal argument. Example S 0 =$37 , K=$40 , r = 5% per annum , T = 0. 5 year 10

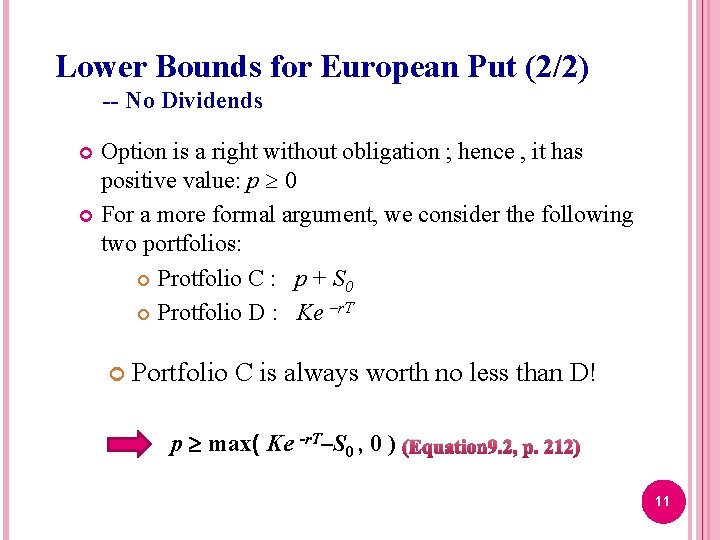

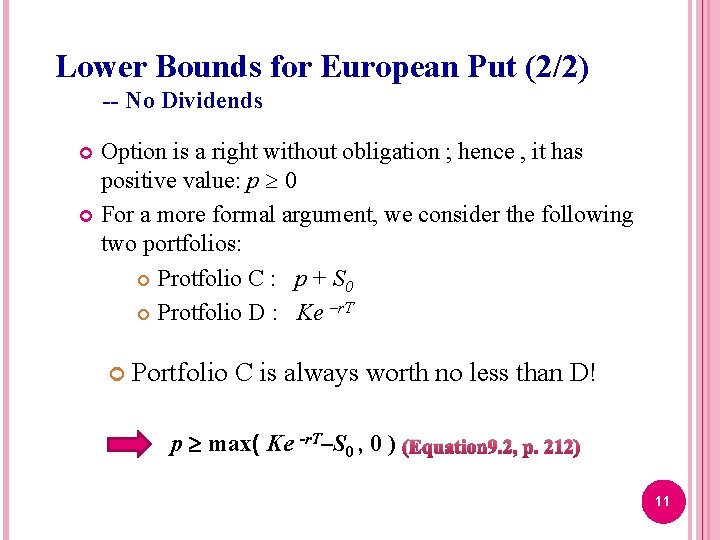

Lower Bounds for European Put (2/2) -- No Dividends Option is a right without obligation ; hence , it has positive value: p 0 For a more formal argument, we consider the following two portfolios: Protfolio C : p + S 0 Protfolio D : Ke –r. T Portfolio C is always worth no less than D! p max( Ke -r. T–S 0 , 0 ) (Equation 9. 2, p. 212) 11

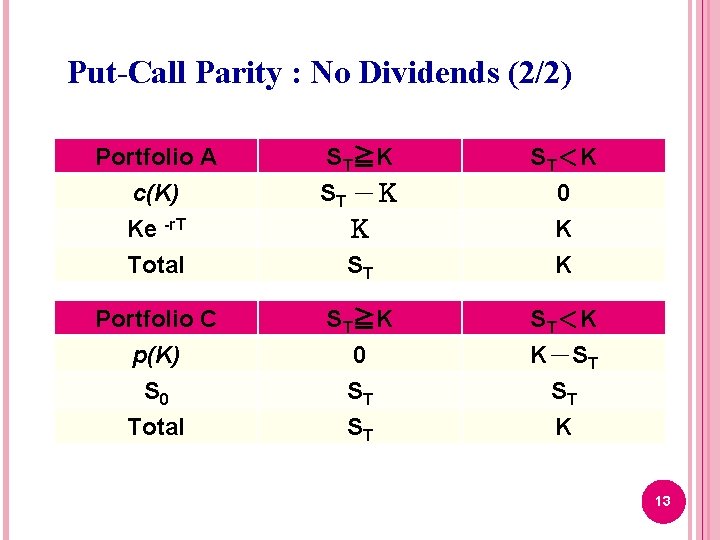

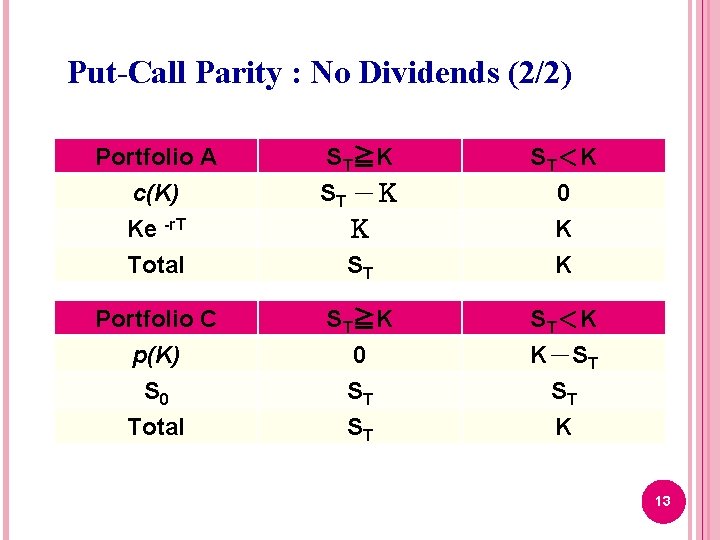

Put-Call Parity : No Dividends (1/2) Consider the following 2 portfolios: Portfolio A: European call on a stock + PV of the strike price in cash Portfolio C: European put on the stock + the stock Both are worth max(ST , K ) at the maturity of the options They must therefore be worth the same today. This means that c + Ke -r. T = p + S 0 (Equation 9. 3, p. 211) 12

Put-Call Parity : No Dividends (2/2) Portfolio A c(K) Ke -r. T Total ST≧K ST -K K Portfolio C p(K) S 0 Total ST≧K 0 ST ST<K 0 K K ST<K K-ST ST K 13

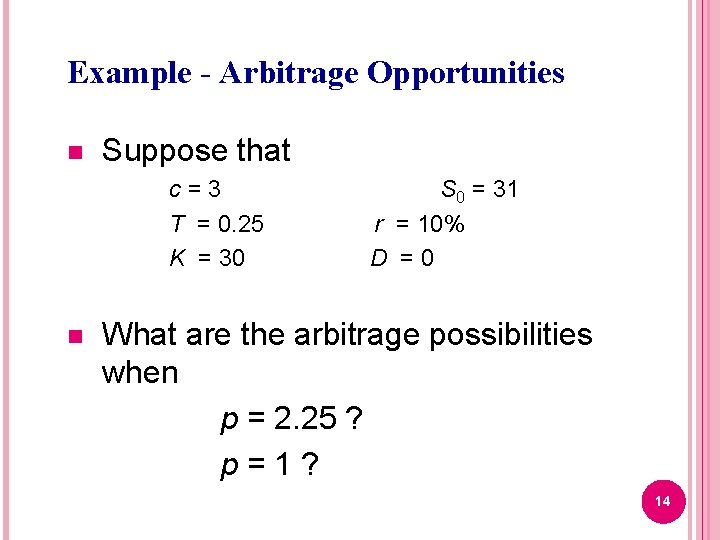

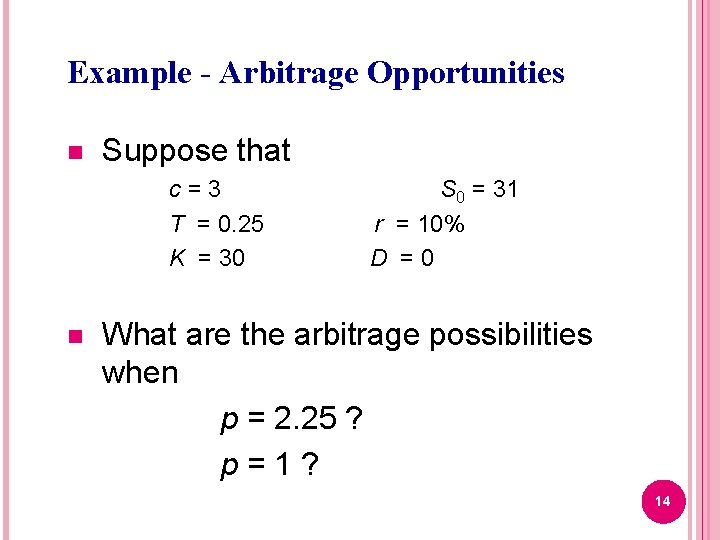

Example - Arbitrage Opportunities n Suppose that c=3 T = 0. 25 K = 30 n S 0 = 31 r = 10% D =0 What are the arbitrage possibilities when p = 2. 25 ? p=1? 14

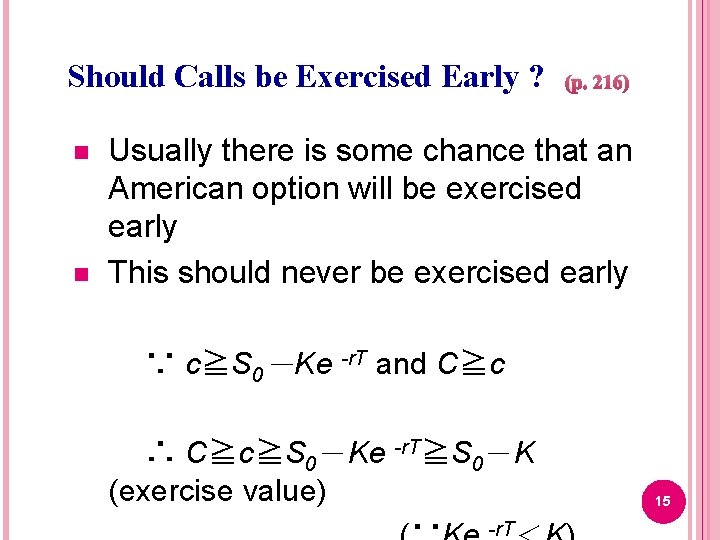

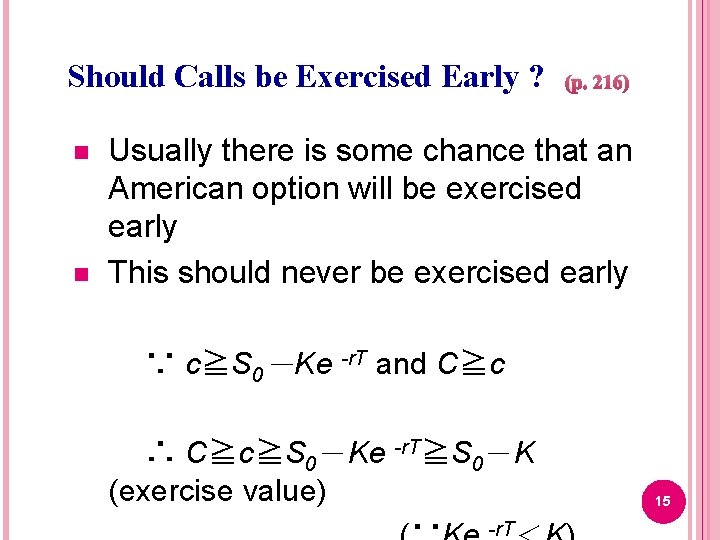

Should Calls be Exercised Early ? n n (p. 216) Usually there is some chance that an American option will be exercised early This should never be exercised early ∵ c≧S 0-Ke -r. T and C≧c ∴ C≧c≧S 0-Ke -r. T≧S 0-K (exercise value) -r. T 15

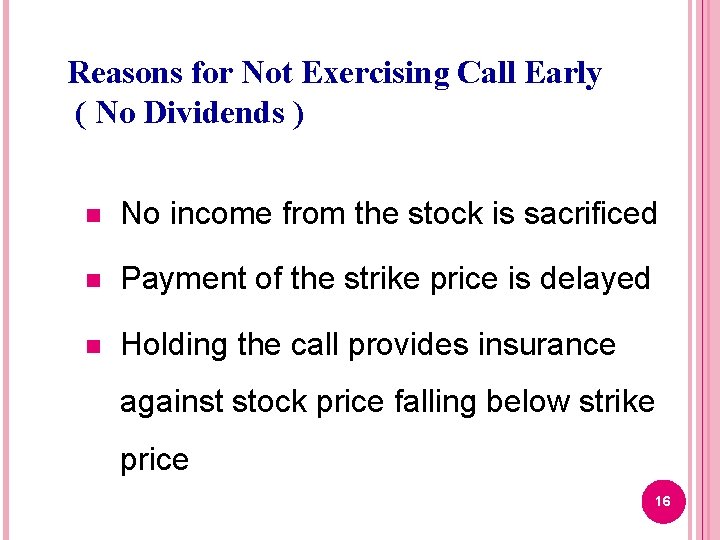

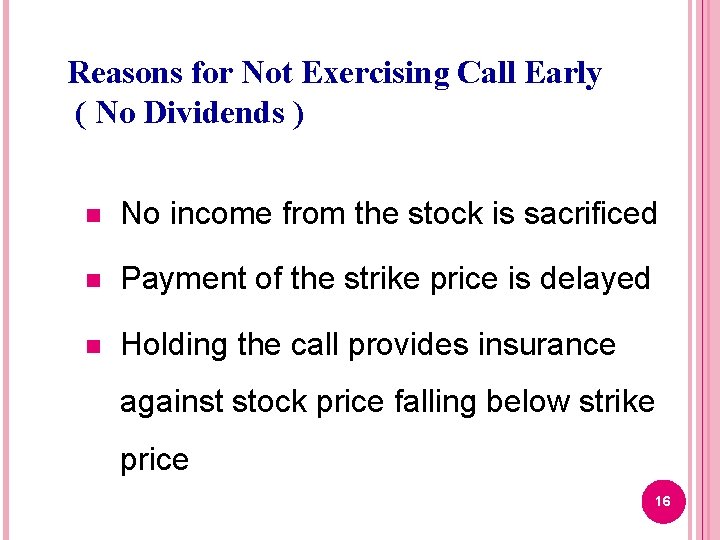

Reasons for Not Exercising Call Early ( No Dividends ) n No income from the stock is sacrificed n Payment of the strike price is delayed n Holding the call provides insurance against stock price falling below strike price 16

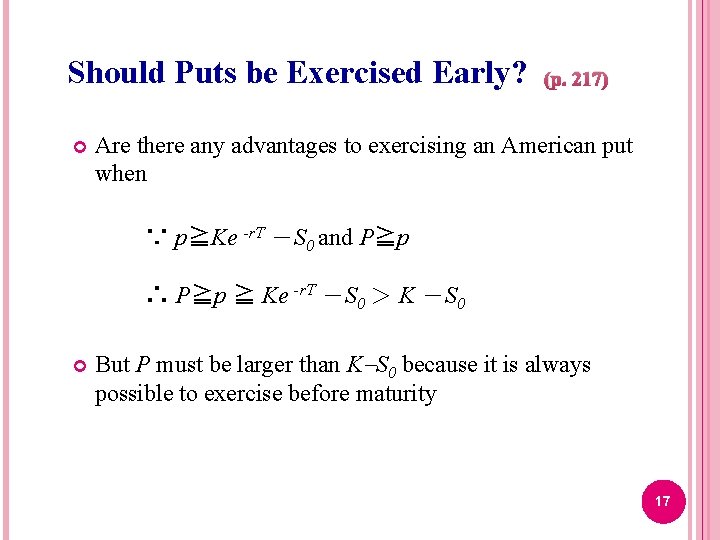

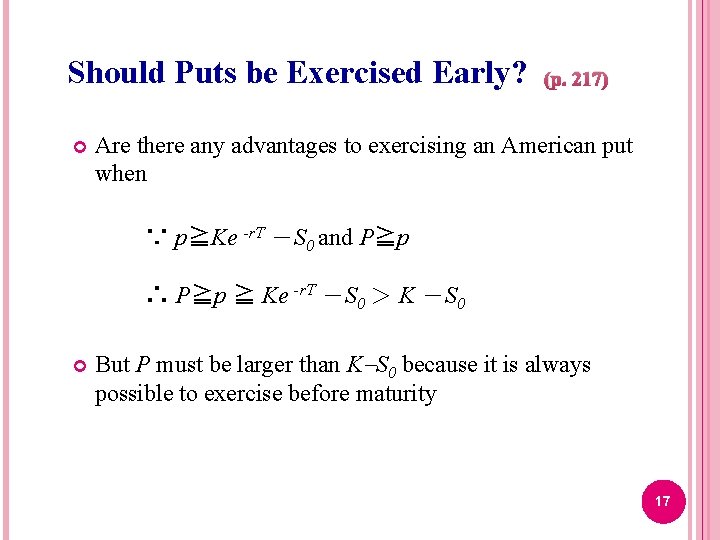

Should Puts be Exercised Early? (p. 217) Are there any advantages to exercising an American put when ∵ p≧Ke -r. T -S 0 and P≧p ∴ P≧p ≧ Ke -r. T -S 0 > K -S 0 But P must be larger than K S 0 because it is always possible to exercise before maturity 17

The Impact of Dividends on Lower Bounds to Option Prices (Page 218) ØWe will use D to denote the present value of the dividends during the life of the option. In the calaulation of D, a dividend is assumed to occur at the time of its ex-dividend date. 18

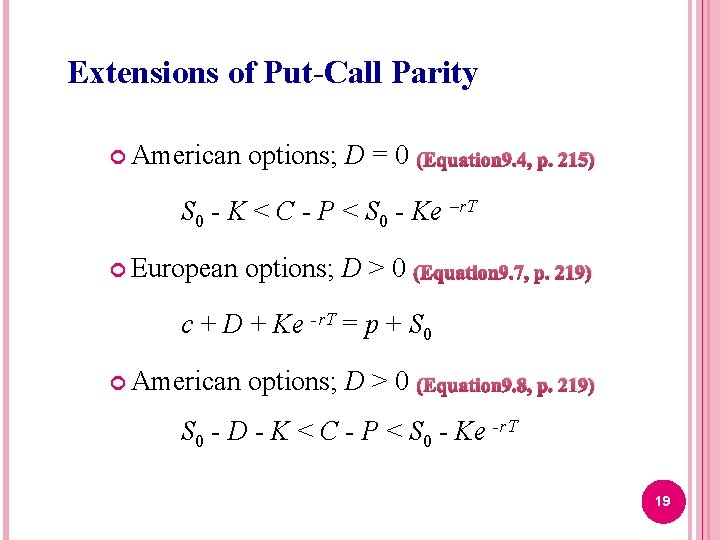

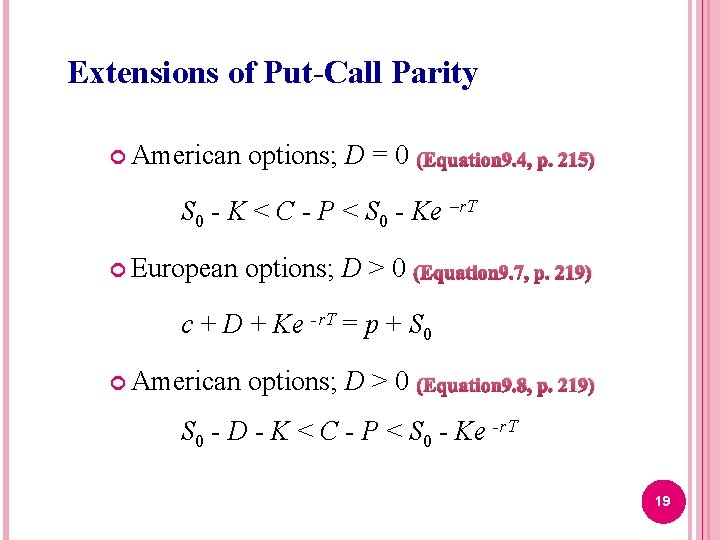

Extensions of Put-Call Parity American options; D = 0 (Equation 9. 4, p. 215) S 0 - K < C - P < S 0 - Ke –r. T European options; D > 0 (Equation 9. 7, p. 219) c + D + Ke -r. T = p + S 0 American options; D > 0 (Equation 9. 8, p. 219) S 0 - D - K < C - P < S 0 - Ke -r. T 19

Properties of stock options

Properties of stock options Gigaplex academy

Gigaplex academy Stock options terminology

Stock options terminology Option stock

Option stock Features of preferred stock

Features of preferred stock White stock yang sesuai dengan kriteria yaitu

White stock yang sesuai dengan kriteria yaitu Characteristics of common stock

Characteristics of common stock Stock initial

Stock initial Sandwich statements

Sandwich statements Lesson 2 physical properties answer key

Lesson 2 physical properties answer key Lesson outline lesson 2 wave properties answer key

Lesson outline lesson 2 wave properties answer key Chapter 3 foodservice career options

Chapter 3 foodservice career options Extensive vs intensive properties

Extensive vs intensive properties Physical and chemical properties

Physical and chemical properties Chapter 8 the stock market

Chapter 8 the stock market What is the labelling theory

What is the labelling theory Romans outline by chapter

Romans outline by chapter Methodology chapter outline

Methodology chapter outline Foner chapter 27

Foner chapter 27 Methodology chapter outline

Methodology chapter outline Chapter 38 a world without borders outline

Chapter 38 a world without borders outline