CHAPTER 9 Corporate Strategy Acquisitions Alliances and Networks

- Slides: 38

CHAPTER 9 Corporate Strategy: Acquisitions, Alliances, and Networks Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

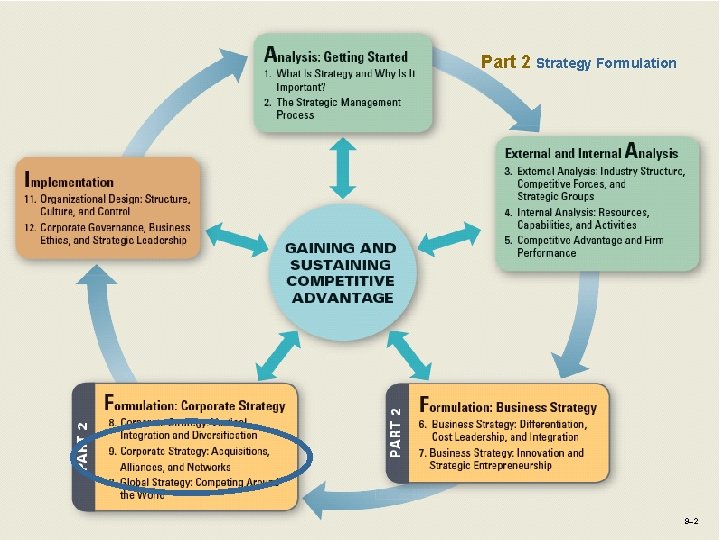

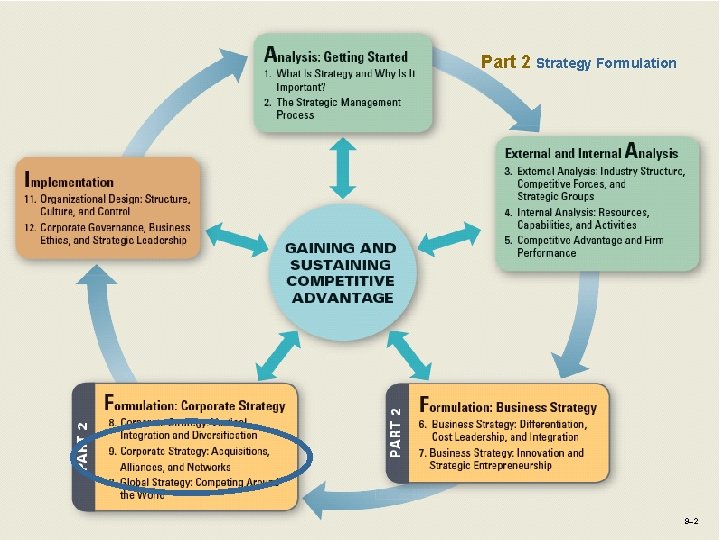

Part 2 Strategy Formulation 9– 2

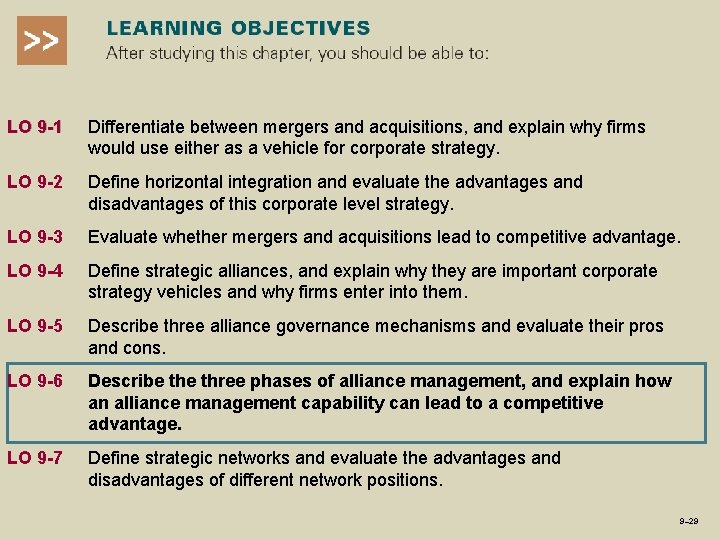

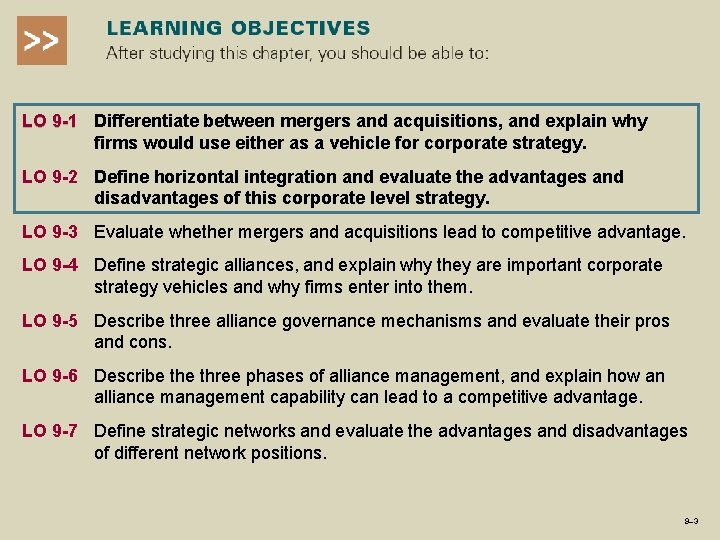

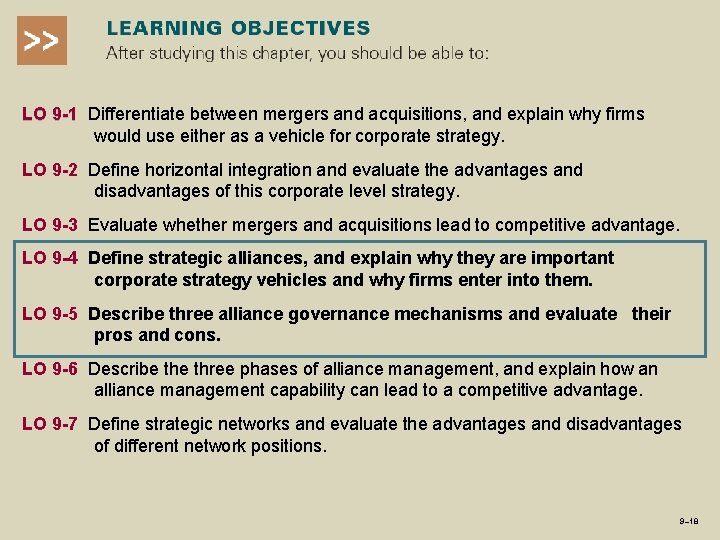

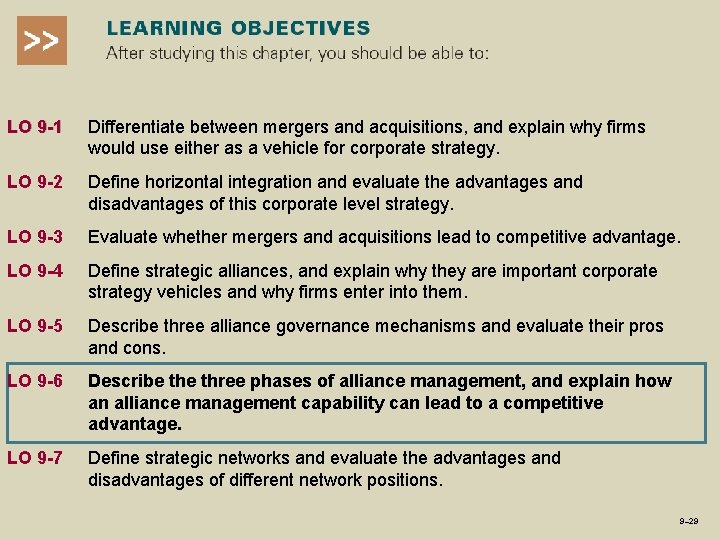

LO 9 -1 Differentiate between mergers and acquisitions, and explain why firms would use either as a vehicle for corporate strategy. LO 9 -2 Define horizontal integration and evaluate the advantages and disadvantages of this corporate level strategy. LO 9 -3 Evaluate whether mergers and acquisitions lead to competitive advantage. LO 9 -4 Define strategic alliances, and explain why they are important corporate strategy vehicles and why firms enter into them. LO 9 -5 Describe three alliance governance mechanisms and evaluate their pros and cons. LO 9 -6 Describe three phases of alliance management, and explain how an alliance management capability can lead to a competitive advantage. LO 9 -7 Define strategic networks and evaluate the advantages and disadvantages of different network positions. 9– 3

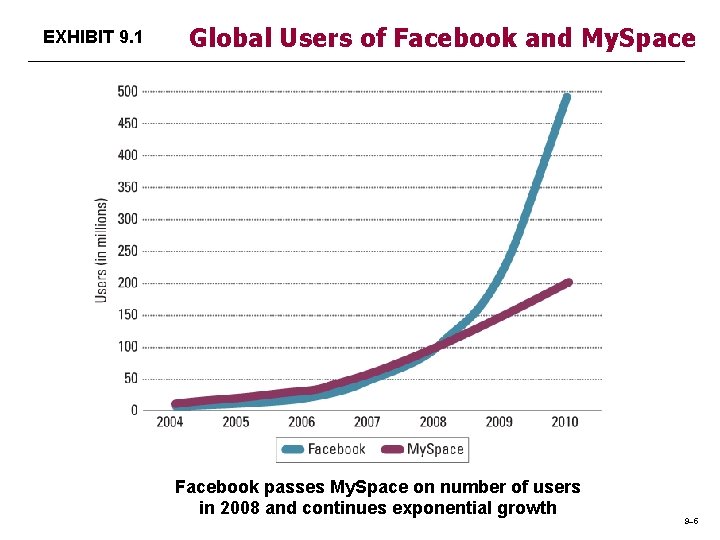

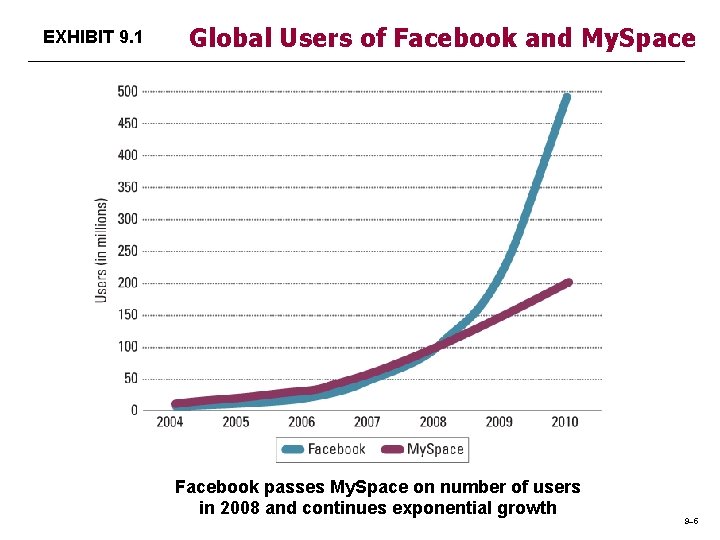

Chapter Case 9 Facebook: From Dorm Room to Dominant Social Network • Facebook: “most powerful and transformative social change” Ø Started by Mark Zuckerberg in 2004 Ø Overcame the first-mover advantage held by My. Space Ø True global strategy: more users first, profits later Ø Adding different functions to go after a wide range of users Ø Innovative network marketing approach v Word of mouth through online social network • Frequently attacked for insufficient protection of users’ privacy • Needs a sustainable business model • Implications for alliances and networks

EXHIBIT 9. 1 Global Users of Facebook and My. Space Facebook passes My. Space on number of users in 2008 and continues exponential growth 9– 5

Integrating Companies: Mergers and Acquisitions • Merger: combining two companies Ø Friendly approach v Ex: Disney & Pixar Ø Generally similar in size • Acquisition: purchase or takeover a company Ø Can be friendly or unfriendly Ø Hostile takeover v Ex: Vodafone buys Mannesmann Dell Makeover Video

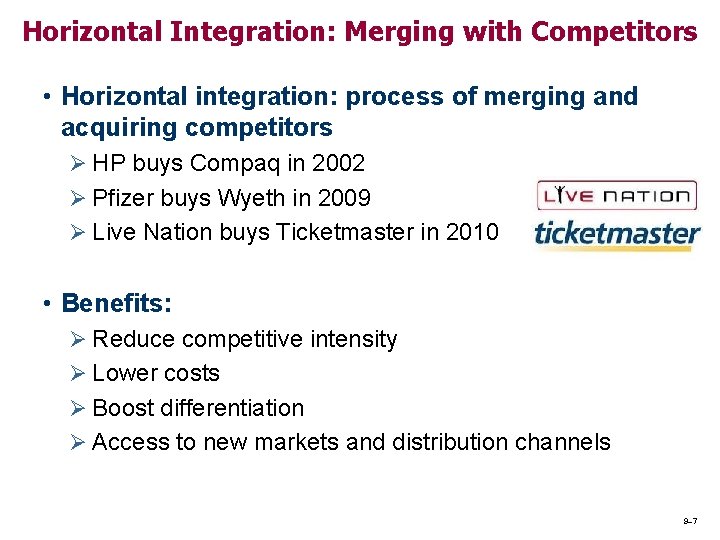

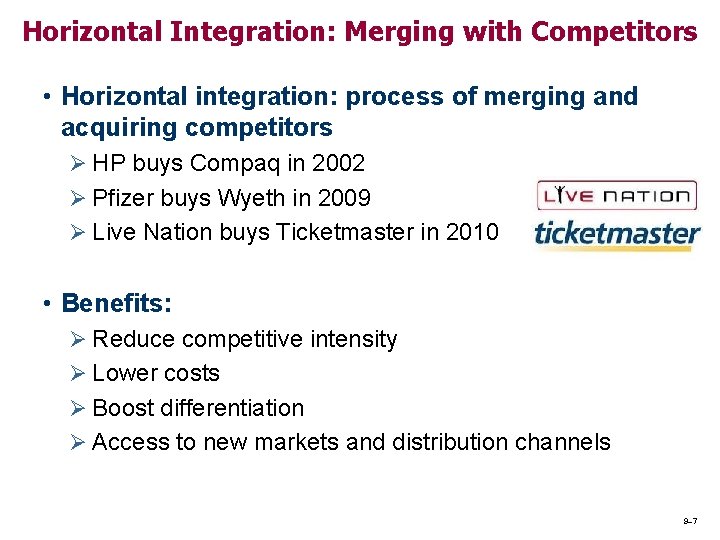

Horizontal Integration: Merging with Competitors • Horizontal integration: process of merging and acquiring competitors Ø HP buys Compaq in 2002 Ø Pfizer buys Wyeth in 2009 Ø Live Nation buys Ticketmaster in 2010 • Benefits: Ø Reduce competitive intensity Ø Lower costs Ø Boost differentiation Ø Access to new markets and distribution channels 9– 7

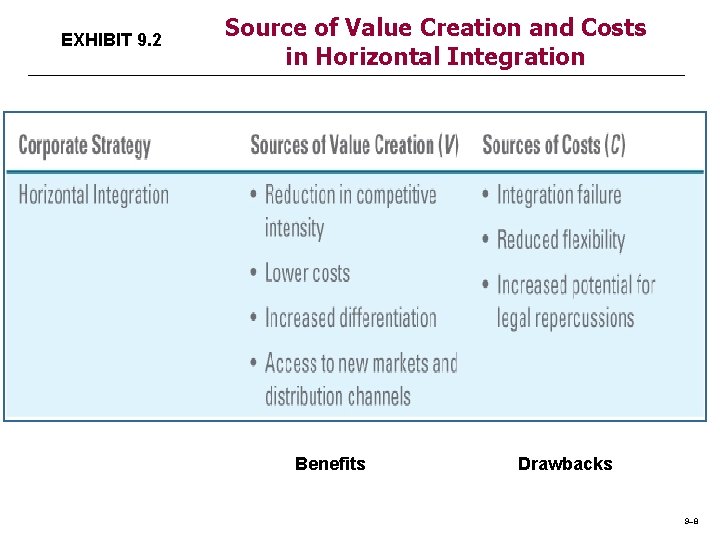

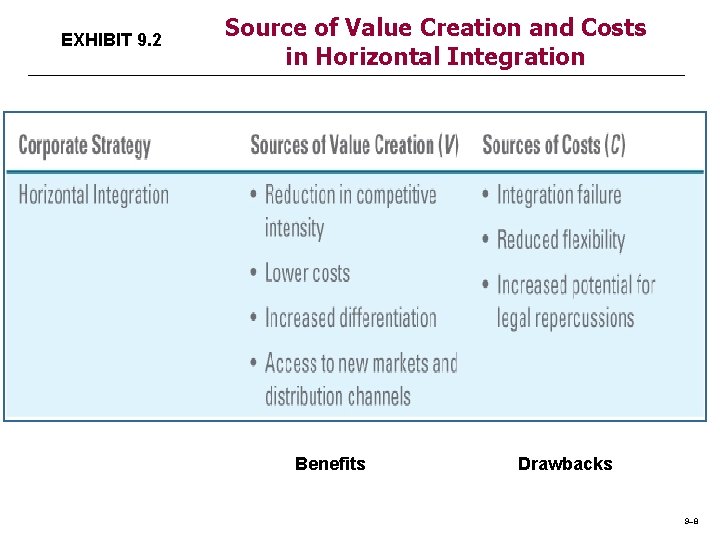

EXHIBIT 9. 2 Source of Value Creation and Costs in Horizontal Integration Benefits Drawbacks 9– 8

Reduction in Competitive Intensity • Changes underlying industry structure Ø Taking out excessive capacity from rivals Ø Increased industry consolidation v Example: U. S. airlines in recent years • Increasing bargaining power vis-à-vis suppliers and buyers • Stable industry and more profits • Usually need government’s approval Ø Example: FTC rejected Office Depot & Staples merger 9– 9

Horizontal Integration: Lower Costs • How? Ø Through economies of scale Ø Enhancing economic value creation • Crucial to the industries with high fixed costs Ø Example: pharmaceutical industry Ø Large sales force = fixed cost v Need $1 billion in drug revenues to cover these costs 9– 10

STRATEGY HIGHLIGHT 9. 1 Food Fight: Kraft Hostile Takeover of Cadbury • Kraft acquired Cadbury in UK Ø Hostile takeover, $20 billion deal Ø Cadbury has strong position in emerging economies v Perfected distribution system in countries like India Ø Kraft faces strong rivalries worldwide, including China • The acquisition forces Hershey and other competitors to rethink their strategies Ø Hershey 90% revenues from U. S. market 1– 11 9– 11

Horizontal Integration • Increased differentiation Ø Strengthen competitive positions v Differentiation of products and services – Example: Oracle buys People. Soft ($10 B in 2005) • Joined enterprise software with HR management software • Access to new markets and distribution channel Ø Enter new markets by M&A – Ex: Kraft buys Cadbury • New distribution in emerging markets & domestically

LO 9 -1 Differentiate between mergers and acquisitions, and explain why firms would use either as a vehicle for corporate strategy. LO 9 -2 Define horizontal integration and evaluate the advantages and disadvantages of this corporate level strategy. LO 9 -3 Evaluate whether mergers and acquisitions lead to competitive advantage. LO 9 -4 Define strategic alliances, and explain why they are important corporate strategy vehicles and why firms enter into them. LO 9 -5 Describe three alliance governance mechanisms and evaluate their pros and cons. LO 9 -6 Describe three phases of alliance management, and explain how an alliance management capability can lead to a competitive advantage. LO 9 -7 Define strategic networks and evaluate the advantages and disadvantages of different network positions. 9– 13

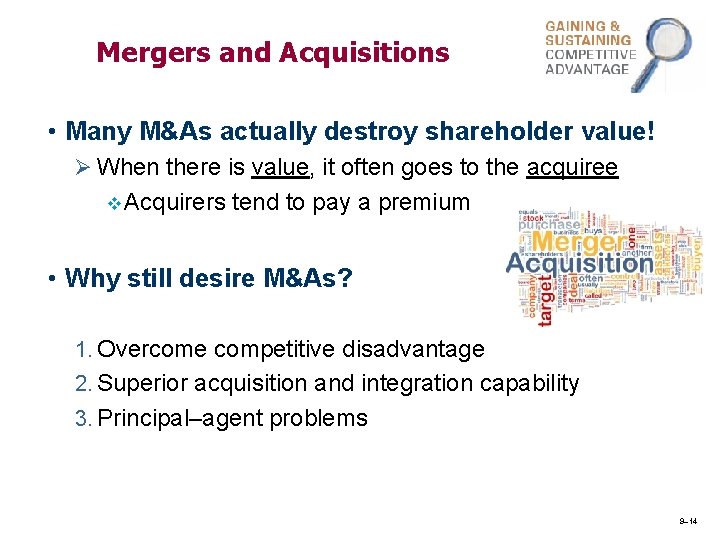

Mergers and Acquisitions • Many M&As actually destroy shareholder value! Ø When there is value, it often goes to the acquiree v Acquirers tend to pay a premium • Why still desire M&As? 1. Overcome competitive disadvantage 2. Superior acquisition and integration capability 3. Principal–agent problems 9– 14

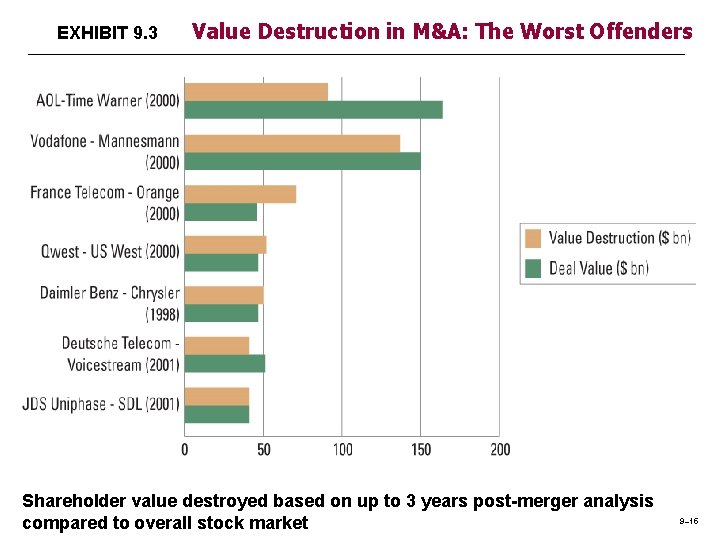

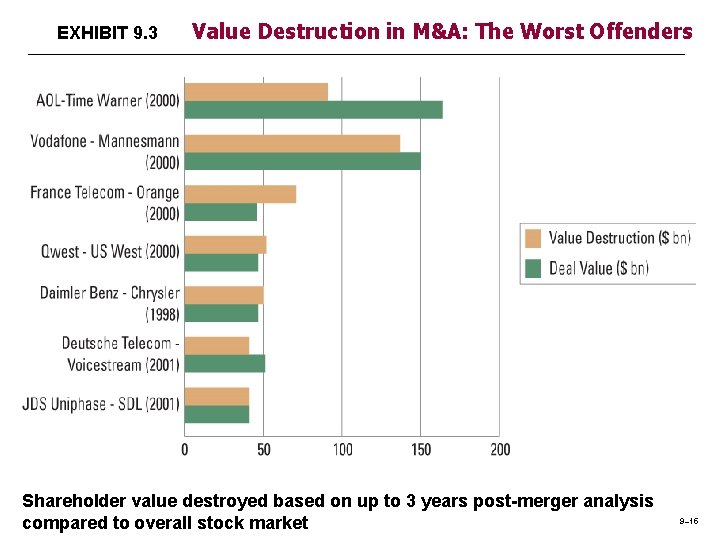

EXHIBIT 9. 3 Value Destruction in M&A: The Worst Offenders Shareholder value destroyed based on up to 3 years post-merger analysis compared to overall stock market 9– 15

Mergers and Acquisitions • Desire to Overcome Competitive Disadvantage Ø Adidas acquired Reebok in 2006 Benefits from economies of scale and scope v Compete more effectively with #1 Nike v • Superior Acquisition and Integration Capability • Some firms have superior M&A abilities Ø They identify, acquire, and integrate target companies v Example: Cisco Systems • Sought complementary assets • Bought over 130 firms since 2001, including large firms: Linksys, Scientific Atlanta, & Web. Ex

Mergers and Acquisitions • Principal–agent problems Ø Managers have incentives to diversify through M&As to receive more prestige, power, and pay. Not for shareholder value appreciation v This is principal—agent problem v • Managerial hubris Ø Self-delusion v Beliefs in their own capability despite evidence to the contrary Ø “Exception to the rule” Example: Quaker Oats purchase of Snapple v Sony purchase of Columbia Pictures v

LO 9 -1 Differentiate between mergers and acquisitions, and explain why firms would use either as a vehicle for corporate strategy. LO 9 -2 Define horizontal integration and evaluate the advantages and disadvantages of this corporate level strategy. LO 9 -3 Evaluate whether mergers and acquisitions lead to competitive advantage. LO 9 -4 Define strategic alliances, and explain why they are important corporate strategy vehicles and why firms enter into them. LO 9 -5 Describe three alliance governance mechanisms and evaluate their pros and cons. LO 9 -6 Describe three phases of alliance management, and explain how an alliance management capability can lead to a competitive advantage. LO 9 -7 Define strategic networks and evaluate the advantages and disadvantages of different network positions. 9– 18

Strategic Alliances: Causes and Consequences of Partnering • Strategic alliances: voluntary arrangements between firms Ø Sharing knowledge, resources, and capabilities Ø Leading to gaining and sustaining competitive advantage • Relational view of competitive advantage Ø VRI resources are embedded in alliances v (VRIO framework from Chapter 4) • HP’s alliance with Dream. Works SKG Ø Resulted in Halo Collaboration conferencing

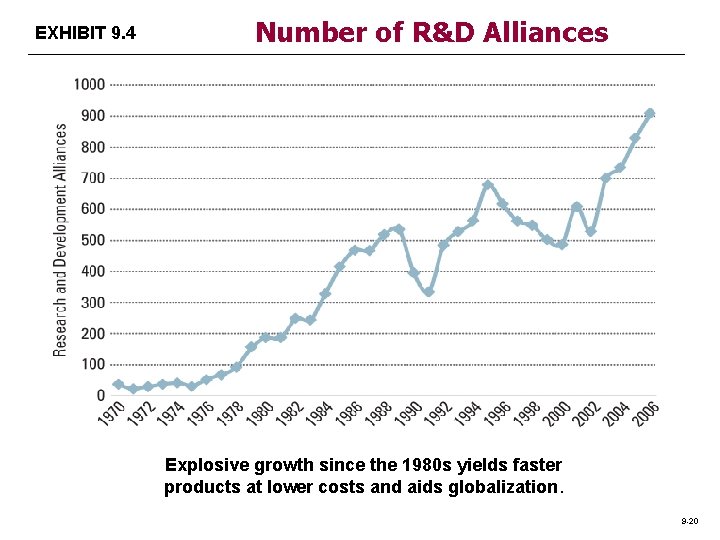

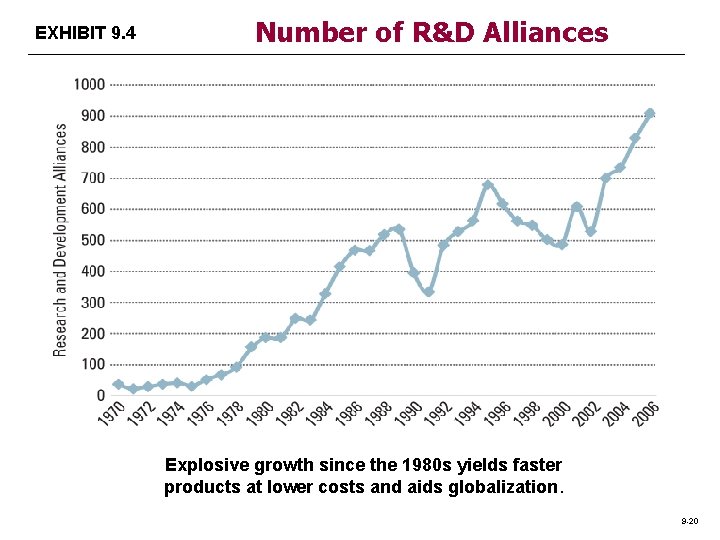

EXHIBIT 9. 4 Number of R&D Alliances Explosive growth since the 1980 s yields faster products at lower costs and aids globalization. 9 -20

STRATEGY HIGHLIGHT 9. 2 Strategic Alliances to Challenge Amazon • Amazon’s Kindle Ø E-reader selling content below cost v Content providers do not want fixed price for e-books ($9. 99) v Similar strategy Amazon used for printed books earlier • Apple’s i. Pad Ø Allied with major publishers v Let publishers set the prices directly v Apple worked with publishers to increase the bargaining power over customers 1– 21 9– 21

Why Do Firms Enter Strategic Alliances? • Strengthen competitive position Ø Apple vs. Amazon • Enter new markets Ø Local partner for global growth Ø Microsoft partners with Yahoo on search • Hedge against uncertainty Ø Real options approach v Roche invests in Genentech 1990 & buys it in 2009 • Access critical complementary assets Ø Pixar partners with Disney • Learn new capabilities Ø GM & Toyota (NUMMI) – formed in 1984 9– 22

STRATEGY HIGHLIGHT 9. 3 Pixar and Disney: From Alliance to Acquisition • Pixar and Disney • Early strategic alliance • Successful products: Toy Story, Monsters, Inc. , Finding Nemo, etc. • In 2005, Disney acquired Pixar for $7. 4 billion • Steve Jobs became the largest shareholder of Disney • Early alliance serves as a vehicle to match two parties’ complementary assets and eventually led to the acquisition • Disney later acquired Marvel Entertainment, which made Spiderman, Pixar Video Iron Man, The Incredible Hulk…etc. 1– 23 9– 23

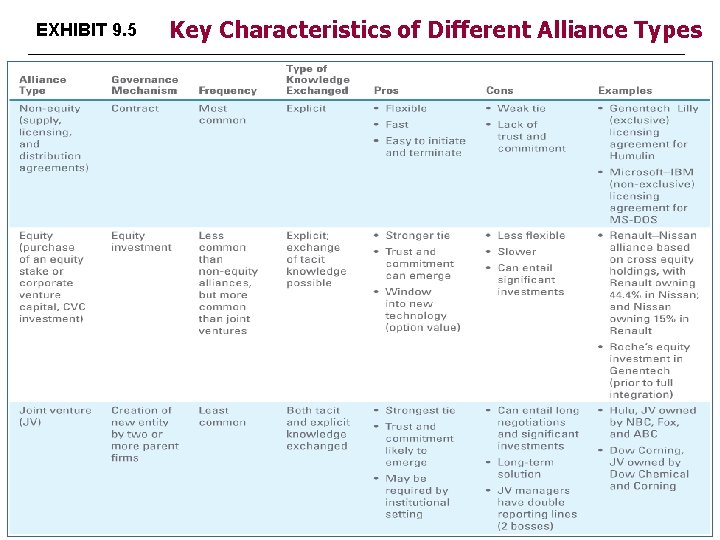

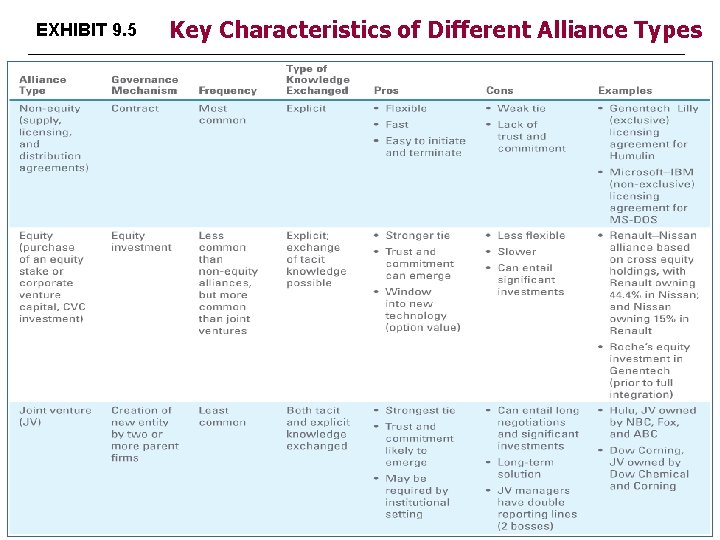

Governing Strategic Alliances • Governing mechanisms: Ø Contractual agreements for non-equity alliances v Based on contracts Ø Equity alliances v One firm takes partial ownership in the other Ø Joint ventures v Stand-alone organization owned by 2 or more firms 9– 24

Non-Equity Alliances • Most common forms of contracts Ø Supply agreements Ø Distribution agreements Ø Licensing agreements • Vertical strategic alliances Ø Firms tend to share explicit knowledge that are codified Ø Licensing agreements, partners exchange codified knowledge regularly v Ex: Genentech & Eli Lilly • Genentech R&D focused • Eli Lilly manufacturing & FDA approvals

Equity Alliances • At least one partner takes partial ownership position Ø Stronger commitment toward the relationship • Allow the sharing of tacit knowledge Ø Tacit knowledge concerns the “know how” • Partners exchange personnel to acquire tacit knowledge Ø 1984 Toyota + GM = NUMMI (New United Motor Manufacturing Inc. ) Ø 2010 Toyota + Tesla to use the NUMMI plant • Corporate venture capital is another equity source Ø Established firms invest in new startups • Tends to produce stronger ties and greater trust 9– 26

Joint Ventures • Created and owned by two or more companies Ø Hulu owned by NBC, ABC, and Fox • Long-term commitment Ø Exchange both tacit and explicit knowledge Ø Frequent interaction of personnel • Stepping stone toward full integration of the partnership • “Try before you buy” concept • Used to enter foreign markets 9– 27

EXHIBIT 9. 5 Key Characteristics of Different Alliance Types

LO 9 -1 Differentiate between mergers and acquisitions, and explain why firms would use either as a vehicle for corporate strategy. LO 9 -2 Define horizontal integration and evaluate the advantages and disadvantages of this corporate level strategy. LO 9 -3 Evaluate whether mergers and acquisitions lead to competitive advantage. LO 9 -4 Define strategic alliances, and explain why they are important corporate strategy vehicles and why firms enter into them. LO 9 -5 Describe three alliance governance mechanisms and evaluate their pros and cons. LO 9 -6 Describe three phases of alliance management, and explain how an alliance management capability can lead to a competitive advantage. LO 9 -7 Define strategic networks and evaluate the advantages and disadvantages of different network positions. 9– 29

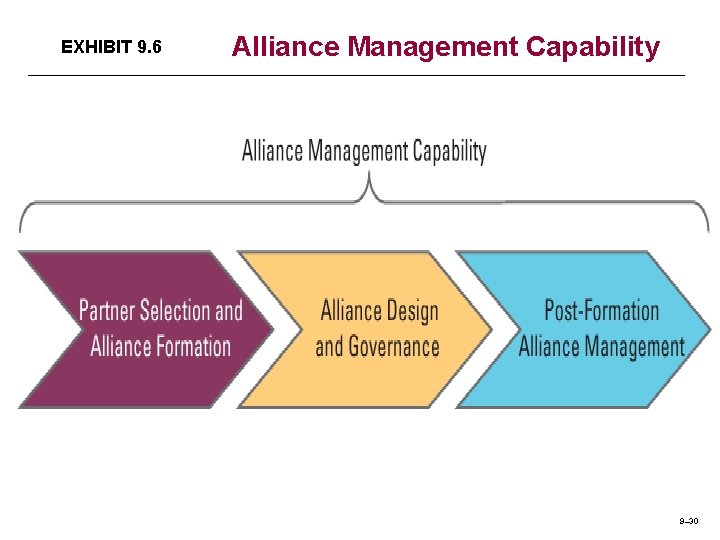

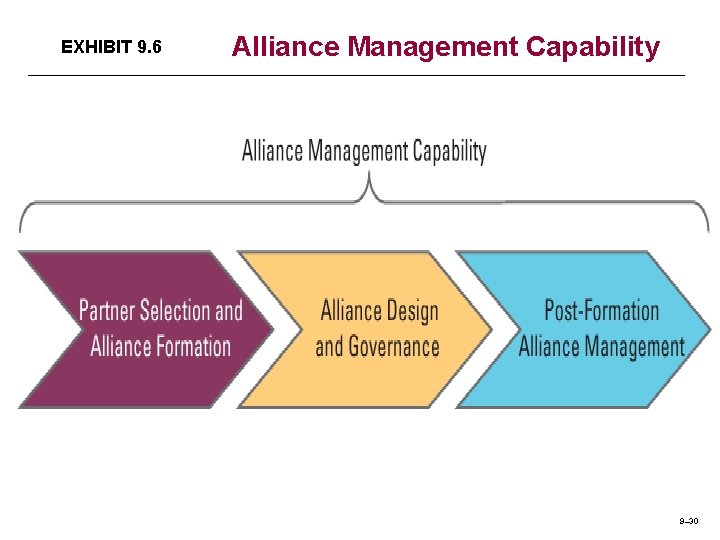

EXHIBIT 9. 6 Alliance Management Capability 9– 30

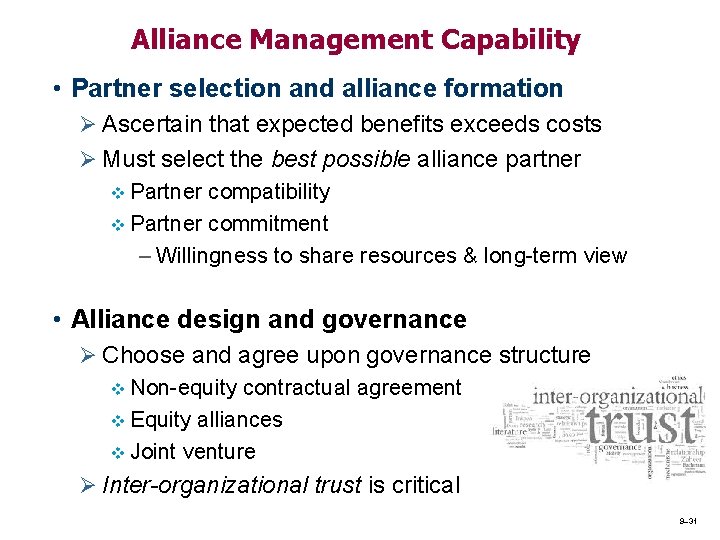

Alliance Management Capability • Partner selection and alliance formation Ø Ascertain that expected benefits exceeds costs Ø Must select the best possible alliance partner v Partner compatibility v Partner commitment – Willingness to share resources & long-term view • Alliance design and governance Ø Choose and agree upon governance structure v Non-equity contractual agreement v Equity alliances v Joint venture Ø Inter-organizational trust is critical 9– 31

Alliance Management Capability • Post-formation alliance management • To effectively manage the ongoing relationship Ø Tips: Make relationship-specific investments v Establish knowledge-sharing routines v Build interfirm trust v Ø Example: HP’s dense network of alliances vs. DEC • Dedicated alliance function Ø Coordinate alliance-related tasks – at corporate level Ø Knowledge base about how to manage alliance v Ex: Eli Lilly is a clear leader in alliance management Ø Best to develop a relational capability 9– 32

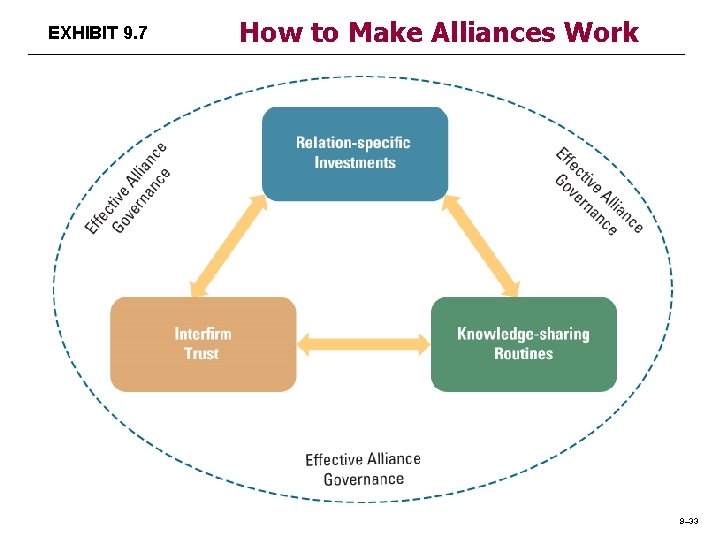

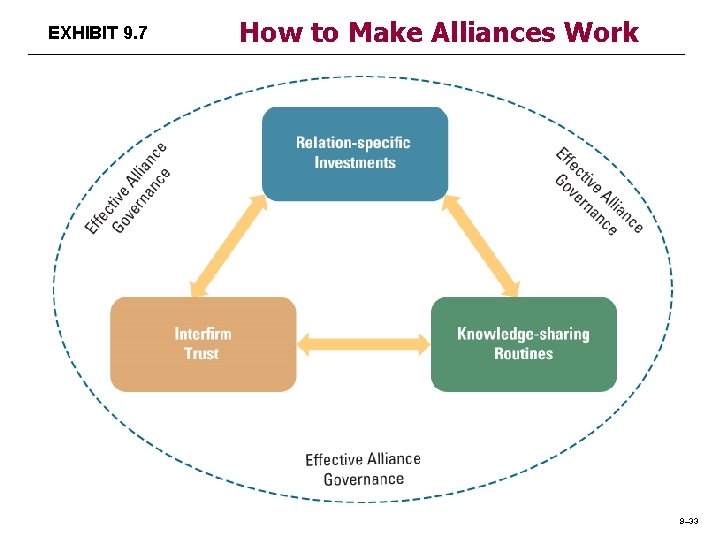

EXHIBIT 9. 7 How to Make Alliances Work 9– 33

LO 9 -1 Differentiate between mergers and acquisitions, and explain why firms would use either as a vehicle for corporate strategy. LO 9 -2 Define horizontal integration and evaluate the advantages and disadvantages of this corporate level strategy. LO 9 -3 Evaluate whether mergers and acquisitions lead to competitive advantage. LO 9 -4 Define strategic alliances, and explain why they are important corporate strategy vehicles and why firms enter into them. LO 9 -5 Describe three alliance governance mechanisms and evaluate their pros and cons. LO 9 -6 Describe three phases of alliance management, and explain how an alliance management capability can lead to a competitive advantage. LO 9 -7 Define strategic networks and evaluate the advantages and disadvantages of different network positions. 9– 34

Strategic Networks • Social structure with multiple organizations Ø Network nodes – the organizations Ø Network ties – the links between organizations • Network achieves goals that cannot be done by only one firm • Example - Star Alliance Ø 1 st global airline network Air Canada, Air China, Continental Airlines, Lufthansa, Singapore Airlines, United Airlines, etc. v Seamless travel on 25 international airlines v 9– 35

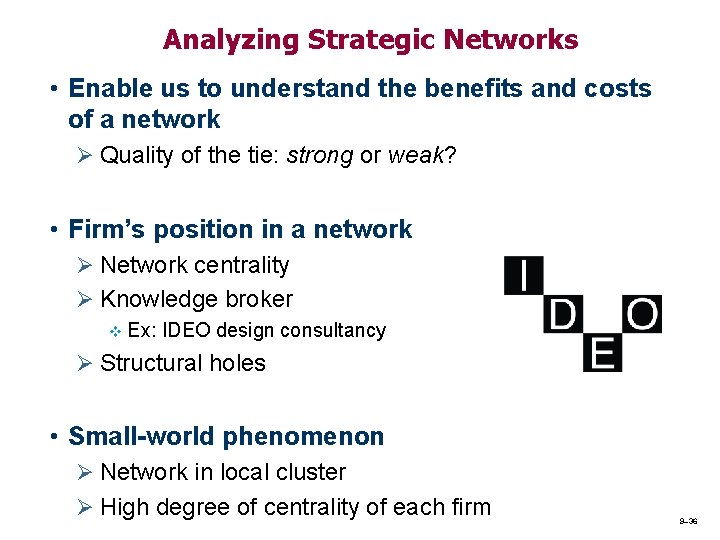

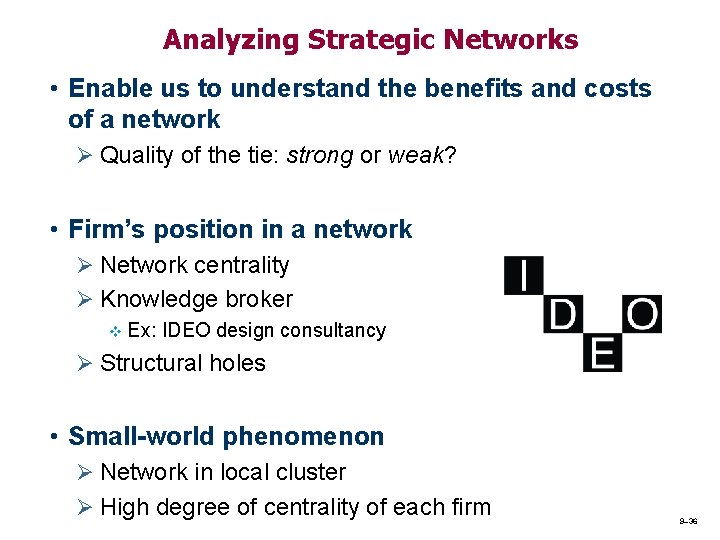

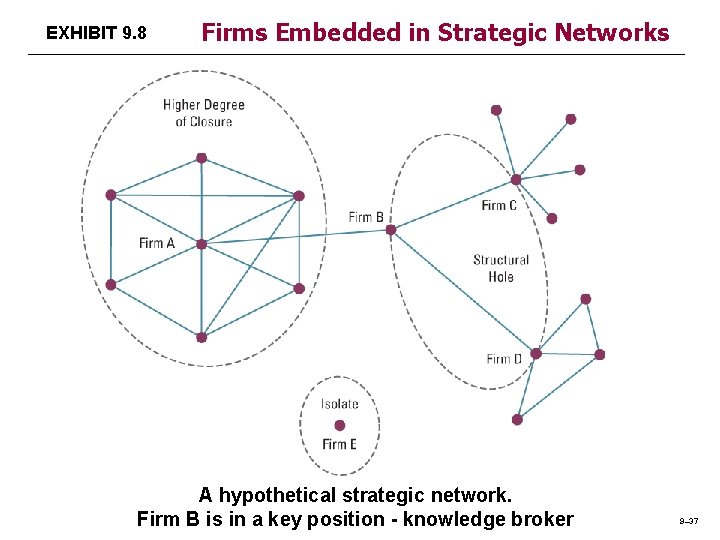

Analyzing Strategic Networks • Enable us to understand the benefits and costs of a network Ø Quality of the tie: strong or weak? • Firm’s position in a network Ø Network centrality Ø Knowledge broker v Ex: IDEO design consultancy Ø Structural holes • Small-world phenomenon Ø Network in local cluster Ø High degree of centrality of each firm 9– 36

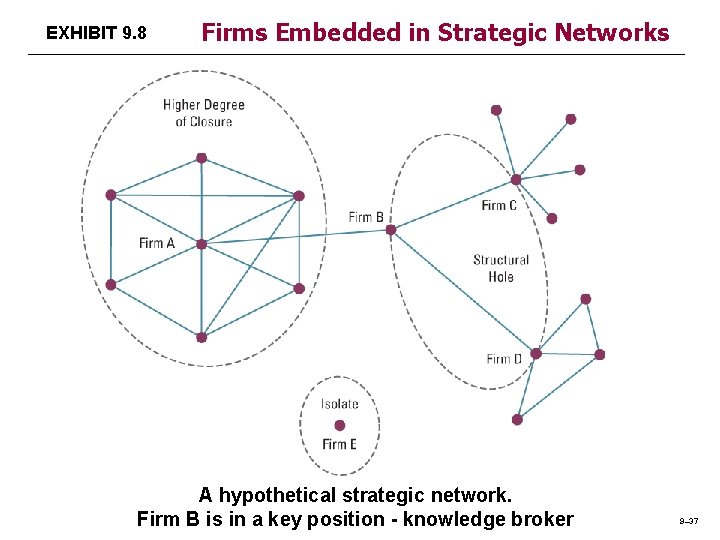

EXHIBIT 9. 8 Firms Embedded in Strategic Networks A hypothetical strategic network. Firm B is in a key position - knowledge broker 9– 37

STRATEGY HIGHLIGHT 9. 4 When Strategic Networks Become Dysfunctional • Deregulation of EU telecoms, competitive intensity rises Ø Swedish Telia and Dutch KPN form a JV called Unisource • Unisource became a global strategic network Ø 25 telecom companies in 11 countries • The flexibility and autonomy of smaller firms in the network has been severely restricted by large partners Ø Large firms such as AT&T could dominate the network • Members exited the network and it collapsed 1– 38 9– 38