CHAPTER 8 Risk and Rate of Return Introduction

- Slides: 54

CHAPTER 8 Risk and Rate of Return

Introduction Investors like returns and dislike risk; hence, they will invest in risky assets only if those assets offer higher expected returns. While doing ‘risk analysis’ it can help if we keep in mind that: 1. 2. 3. ▪ ▪ All business assets are expected to produce cash flows, and the riskiness of an asset is based on the riskiness of its cash flows. The riskier the cash flows, the riskier the asset. Assets can be categorized as financial assets, especially stocks and bonds, and as real assets, such as trucks, machines, and whole businesses. Our focus in this chapter is to carry out risk analysis for financial assets, especially stocks. A stock’s risk can be considered in two ways: (a) on a stand-alone, or single-stock, basis, or (b) in a portfolio context, where a number of stocks are combined and their consolidated cash flows are analyzed. There is an important difference between stand-alone and portfolio risk, and a stock that has a great deal of risk held by itself may be much less risky when held as part of a larger portfolio. Stand-alone risk, is important in stock analysis primarily because it serves as a lead-in to portfolio analysis.

Introduction (contd. ) 4. In a portfolio context, a stock’s risk can be divided into two components: 5. Diversifiable risk: Diversifiable risk can be diversified away and is thus of little concern to diversified investors. Market risk: Market risk reflects the risk of a general stock market decline and cannot be eliminated by diversification (hence, does concern investors). Only market risk is relevant to rational investors because diversifiable risk can and will be eliminated. A stock with high market risk must offer a relatively high expected rate of return to attract investors. Investors in general are averse to risk, so they will not buy risky assets unless they are compensated with high expected returns.

Return �Whenever an individual makes an investment he does so with the expectation of earning more money in the future. �Return can be defined as ‘something over and above my basic investment’. �Return can be expressed both in dollar terms and percentage return terms.

Return in dollar terms � In dollar or rupees terms, return can simply be stated as the total amount of dollar or rupees received from an investment less the original invested amount. Dollar return = Amount received – Amount invested � Two main problems arise when expressing returns in dollar/rupee terms: Size/scale of investment: If returns are expressed in dollar terms one cannot make a meaningful judgment about the value of return unless and until we compare it with the size/scale of investment. For e. g. a $100 return on $1000 investment is a good return, but a $100 return on $100, 000 investment is not. Timing of return: Furthermore, making a meaningful judgment about dollar return also requires us to know about timing of return. For e. g. a $100 return on $1000 investment 1 year from now is a good return, but the same return received after 20 years is not.

Return in percentage terms � The scale of investment and timing of return problem associated with expressing returns in $ form can be resolved if we express investment result in rate of return or percentage return form. � ROR in % form can be calculated as: ROR = Amount received – Amount invested ROR solves the problem of knowing scale of investment forming a meaningful judgment about value of return as it takes into account the size of investment. For example a $10 return on $100 investment produces a 10% ROR while a $10 return on $1000 investment produces only 1% ROR solves timing of return problem as returns normally are expressed on an annual basis.

Risk � Risk is defined as: A hazard, exposure to loss or injury. Chance of occurrence of an unfavorable event. Risk is the dispersion of returns around mean, or expected mean. In the last chapter (Interest rate) we studied how risk premiums were paid to cover the risk associated with investment in treasury or corporate securities. For a treasury security, for example, investment comes with the risk of decrease in purchasing power in the future (inflation risk) or increase in interest rates (interest rate risk). The risk premiums (inflation risk premium and maturity risk premium) thus paid on the treasury security reflects these two risks. In this chapter our focus will be to carry out risk analysis for stocks.

Investment in stocks and the associated riskiness � Individuals and firms invest funds today with the expectation of receiving additional funds in the future. � Bonds offer relatively low returns, but with relatively little risk—at least if you stick to Treasury and highgrade corporate bonds. � Stocks offer the chance of higher returns, but stocks are generally riskier than bonds. If you invest in speculative stocks (or, really, any stock), you are taking a significant risk in the hope of making an appreciable return.

Investment in stocks and the associated riskiness �It is important to remember that, “No investment should be undertaken unless the expected rate of return is high enough to compensate for the perceived risk. ” � Investment in risky assets generally results in returns that is less or more than what was originally expected of them, rarely if ever do they produce their expected returns. � Investment risk, then, is related to the probability of earning a low or negative actual return on an investment. The greater the chance of earning lower than expected or negative returns, the riskier the investment.

1. Stand-alone Risk and Returns Calculation of the expected rate of return and volatility for a single stock.

Methods for analyzing riskiness of an asset �An asset’s risk can be analyzed in two ways: Stand-alone basis: On a stand alone basis the riskiness of the asset is considered all by itself. Portfolio basis: When analyzing the riskiness of a stock on a portfolio basis the riskiness of the asset is considered in relation to other assets held in the portfolio. �We’ll first analyze how to measure a stock’s risk on a stand-alone basis.

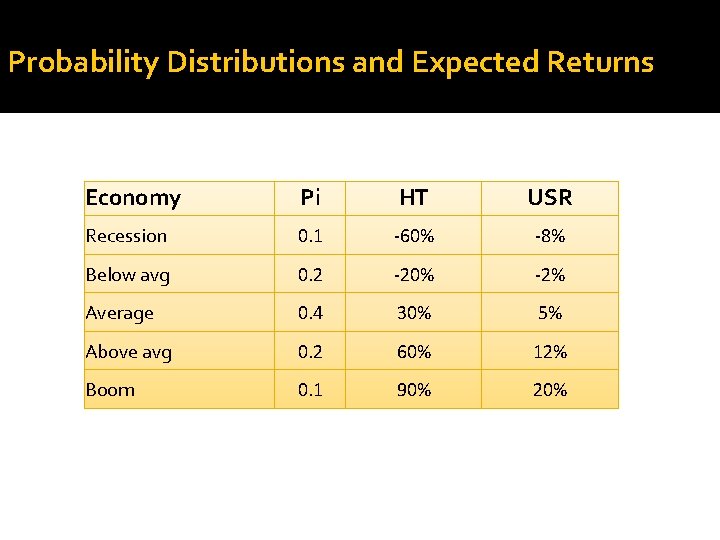

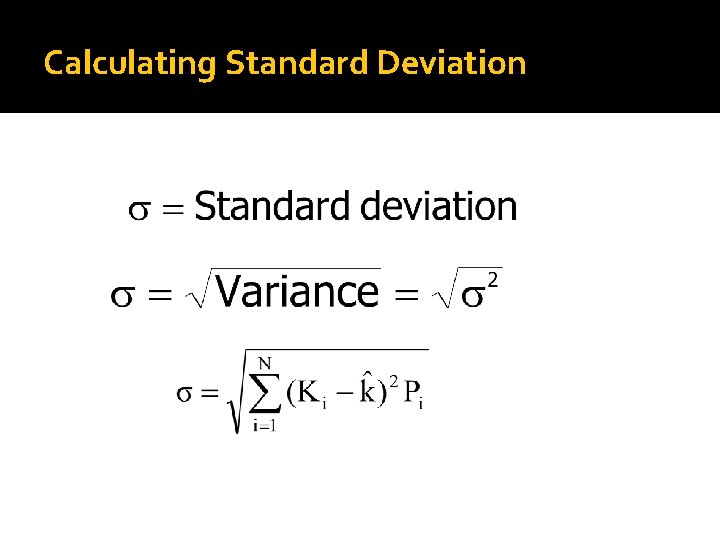

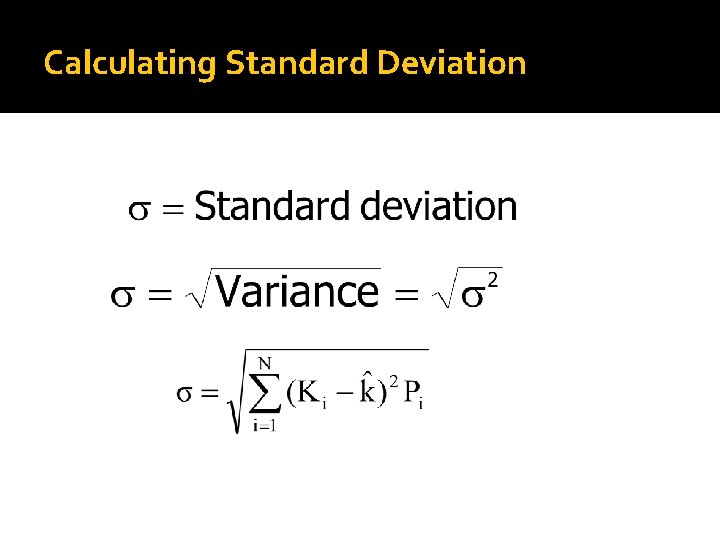

Measuring Stand alone risk • Risk is the dispersion of returns around mean, or expected mean. • Risk is measured by variance or standard deviation. • For standard deviation calculation we need to know expected rate of return or k, thus before calculating standard deviation we calculate expected rate of return. • For performing these calculations we will use the data given (in the next slide).

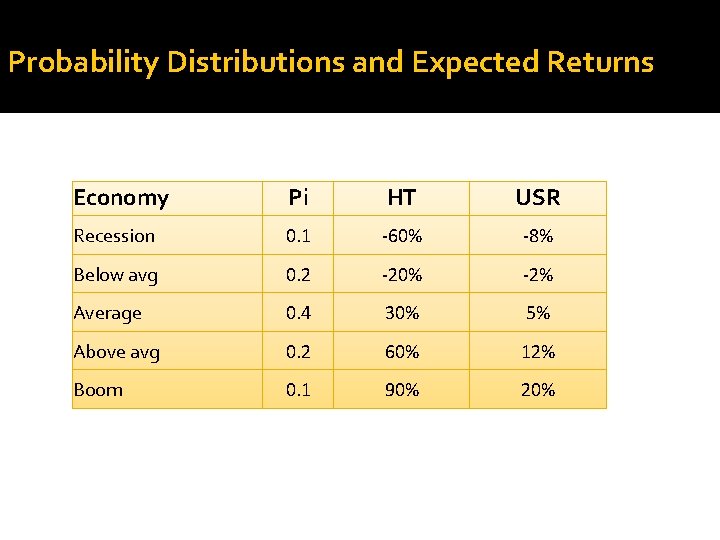

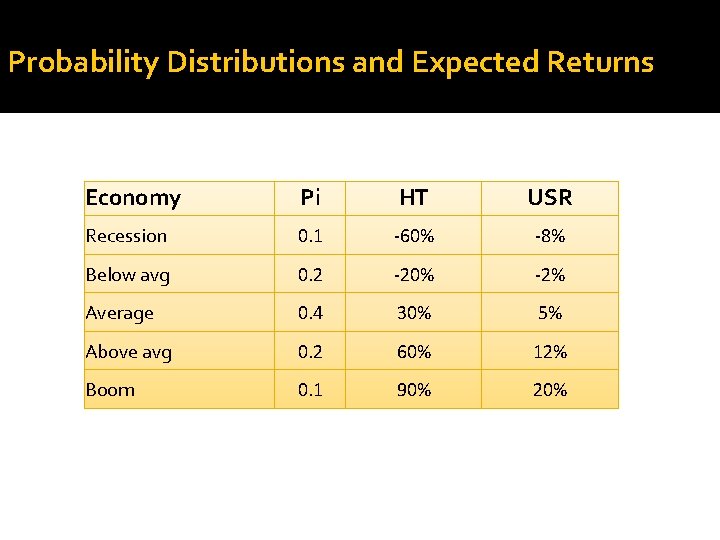

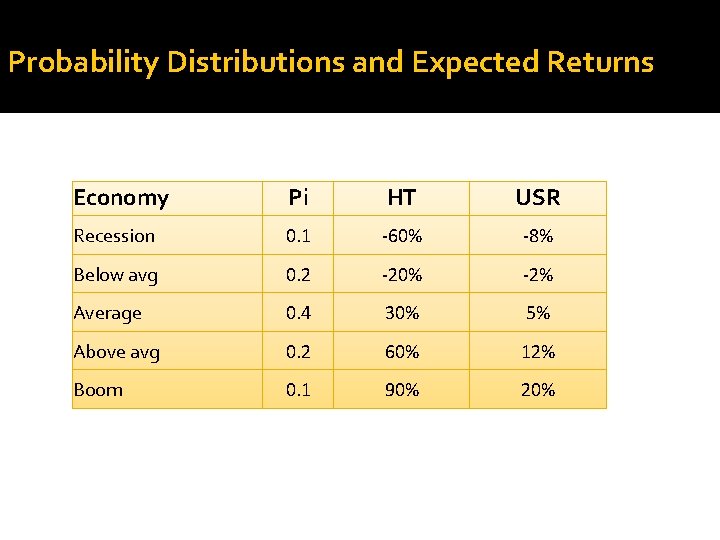

Probability Distributions and Expected Returns Economy Pi HT USR Recession 0. 1 -60% -8% Below avg 0. 2 -20% -2% Average 0. 4 30% 5% Above avg 0. 2 60% 12% Boom 0. 1 90% 20%

Example 1 � In order to see how a stock’s stand-alone risk and return are calculated let’s proceed with an example where we calculate stand-alone return and risk of two stocks, HT and USR.

Expected Rate of Return for HT Stock

Expected Rate of Return for USR Stock

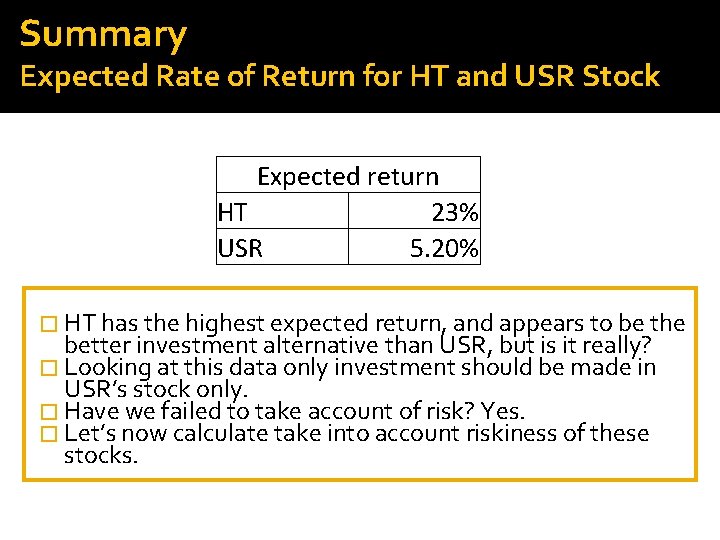

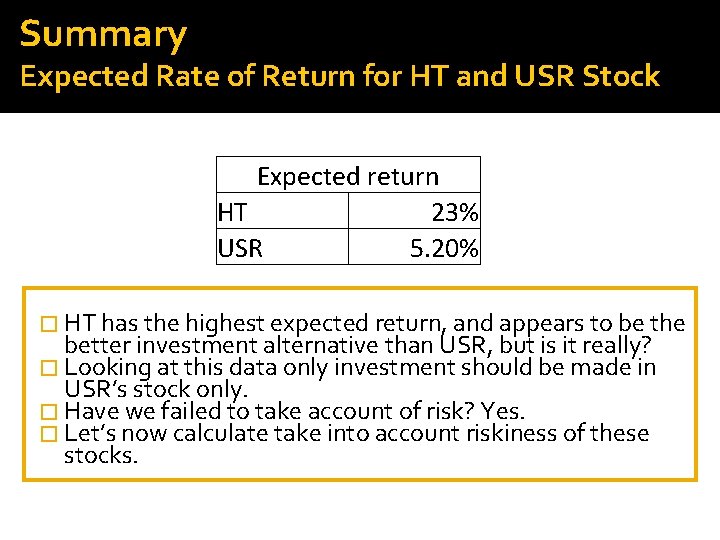

Summary Expected Rate of Return for HT and USR Stock Expected return HT 23% USR 5. 20% � HT has the highest expected return, and appears to be the better investment alternative than USR, but is it really? � Looking at this data only investment should be made in USR’s stock only. � Have we failed to take account of risk? Yes. � Let’s now calculate take into account riskiness of these stocks.

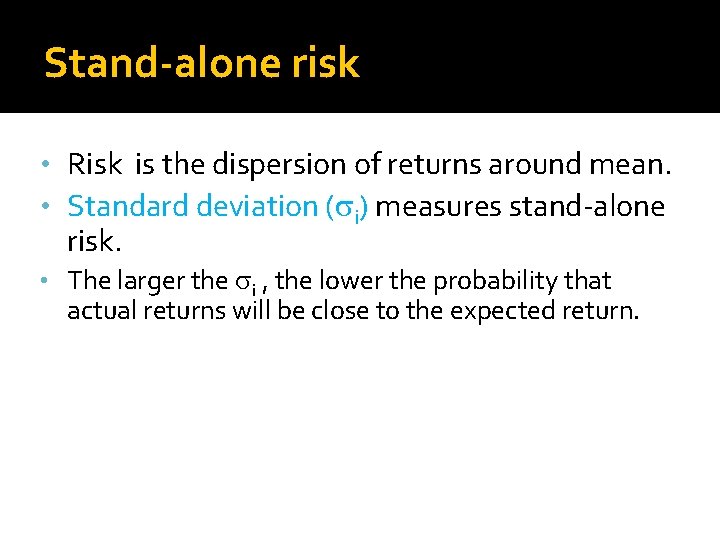

Stand-alone risk • Risk is the dispersion of returns around mean. • Standard deviation ( i) measures stand-alone risk. • The larger the i , the lower the probability that actual returns will be close to the expected return.

Calculating Standard Deviation

Probability Distributions and Expected Returns Economy Pi HT USR Recession 0. 1 -60% -8% Below avg 0. 2 -20% -2% Average 0. 4 30% 5% Above avg 0. 2 60% 12% Boom 0. 1 90% 20%

Standard Deviation for HT

Standard Deviation for USR

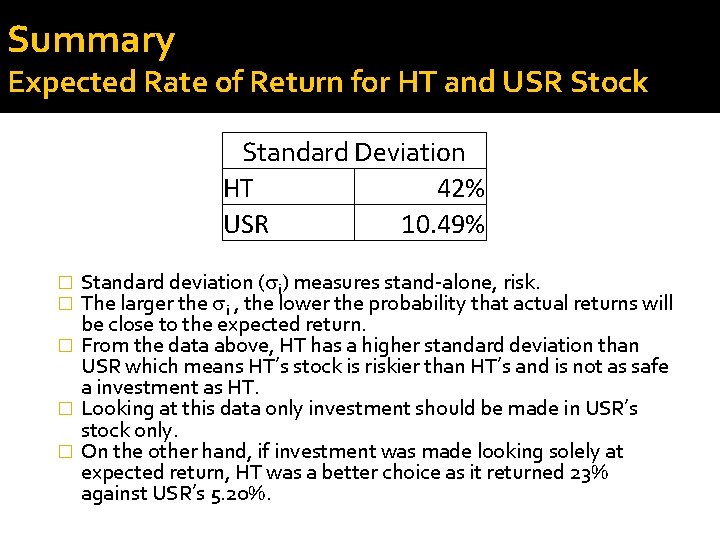

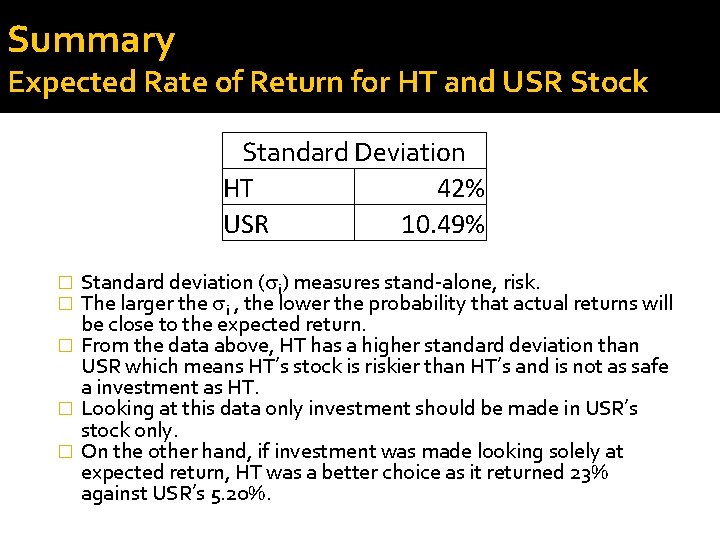

Summary Expected Rate of Return for HT and USR Stock Standard Deviation HT 42% USR 10. 49% Standard deviation ( i) measures stand-alone, risk. The larger the i , the lower the probability that actual returns will be close to the expected return. � From the data above, HT has a higher standard deviation than USR which means HT’s stock is riskier than HT’s and is not as safe a investment as HT. � Looking at this data only investment should be made in USR’s stock only. � On the other hand, if investment was made looking solely at expected return, HT was a better choice as it returned 23% against USR’s 5. 20%. � �

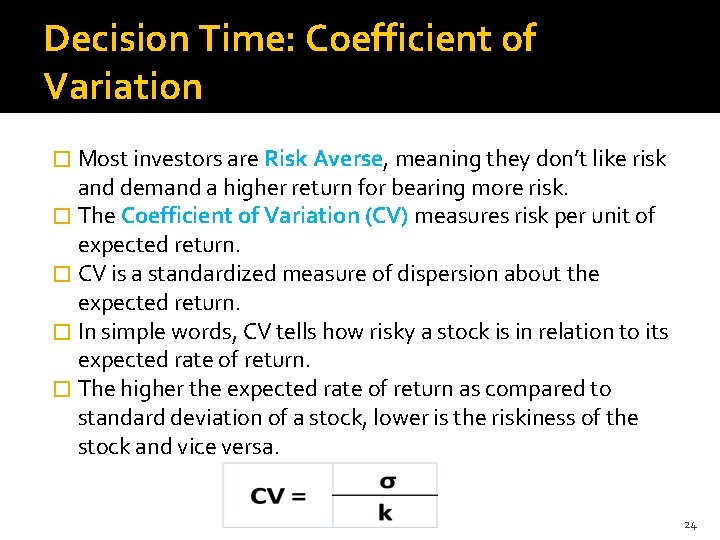

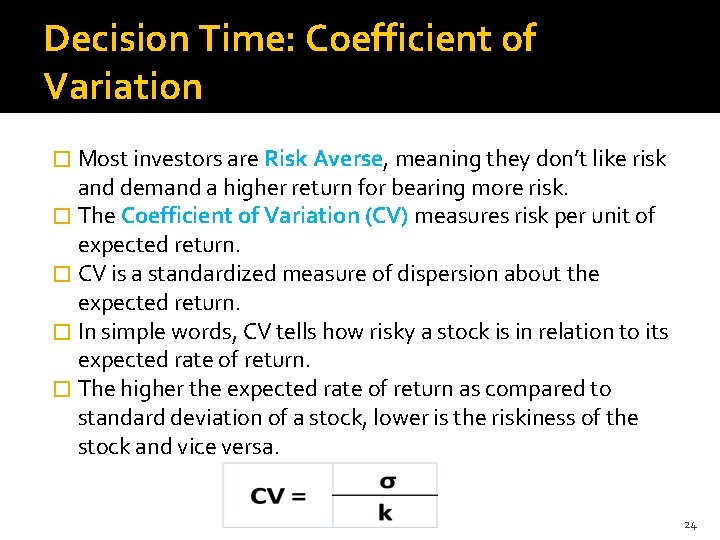

Decision Time: Coefficient of Variation � Most investors are Risk Averse, meaning they don’t like risk and demand a higher return for bearing more risk. � The Coefficient of Variation (CV) measures risk per unit of expected return. � CV is a standardized measure of dispersion about the expected return. � In simple words, CV tells how risky a stock is in relation to its expected rate of return. � The higher the expected rate of return as compared to standard deviation of a stock, lower is the riskiness of the stock and vice versa. 24

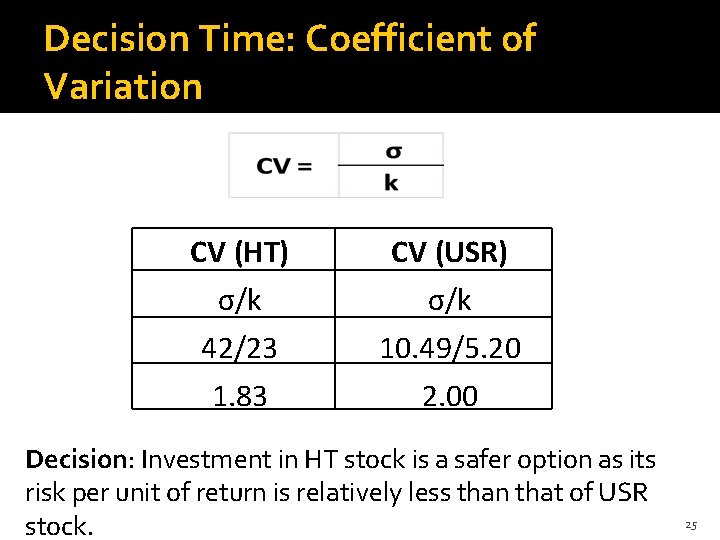

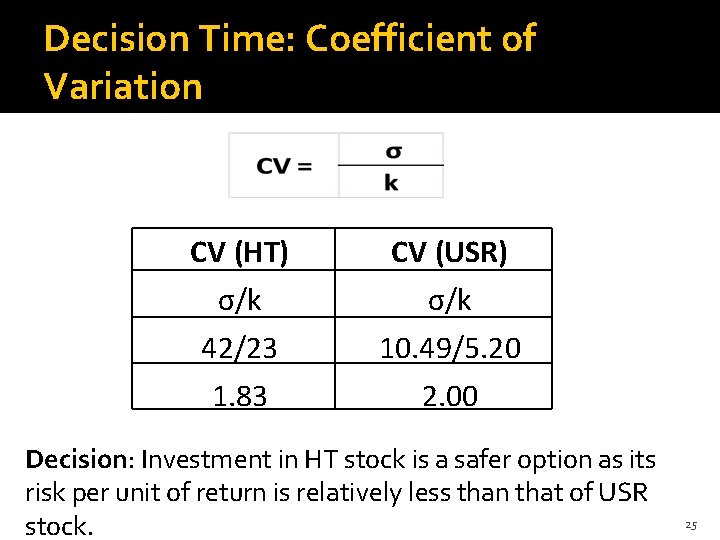

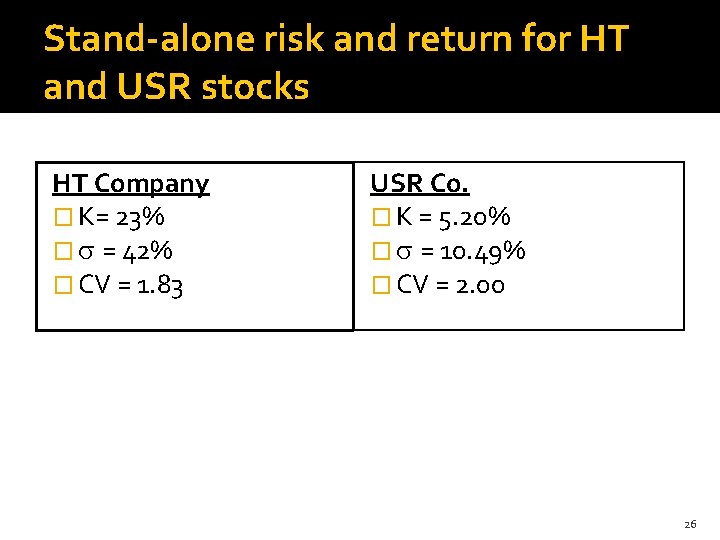

Decision Time: Coefficient of Variation CV (HT) σ/k 42/23 1. 83 CV (USR) σ/k 10. 49/5. 20 2. 00 Decision: Investment in HT stock is a safer option as its risk per unit of return is relatively less than that of USR stock. 25

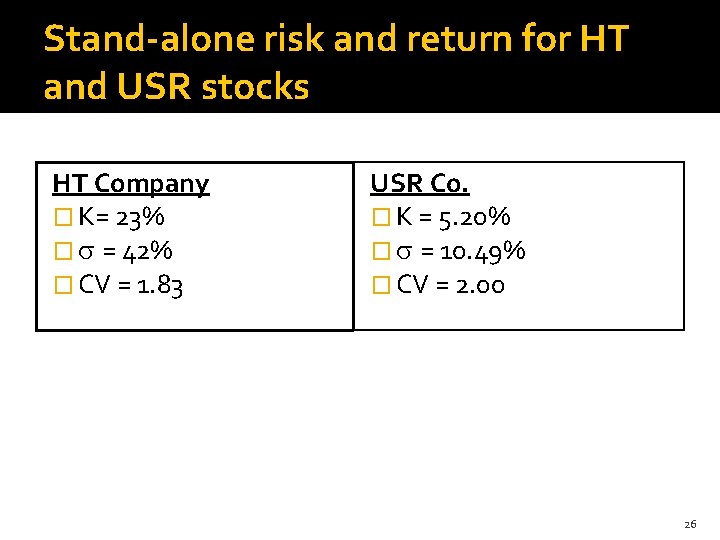

Stand-alone risk and return for HT and USR stocks HT Company � K= 23% � = 42% � CV = 1. 83 USR Co. � K = 5. 20% � = 10. 49% � CV = 2. 00 26

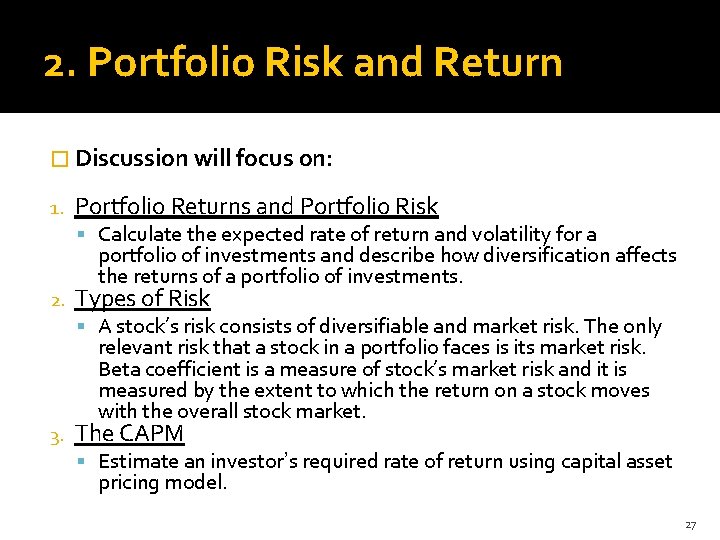

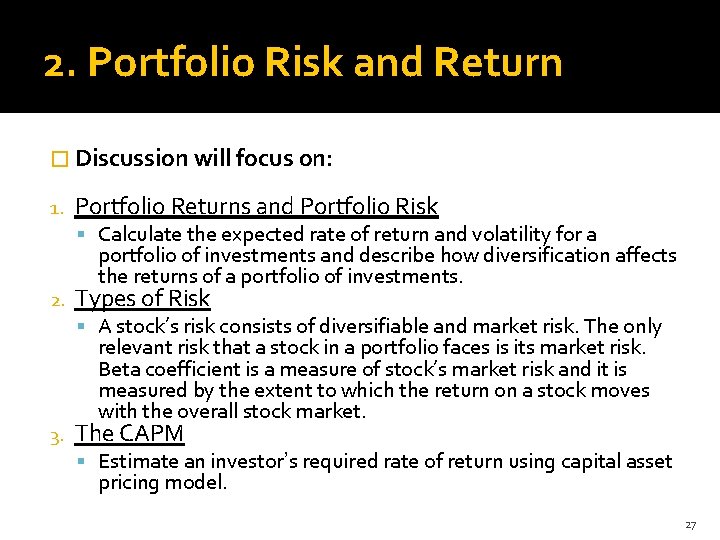

2. Portfolio Risk and Return � Discussion will focus on: 1. Portfolio Returns and Portfolio Risk Calculate the expected rate of return and volatility for a 2. portfolio of investments and describe how diversification affects the returns of a portfolio of investments. Types of Risk A stock’s risk consists of diversifiable and market risk. The only 3. relevant risk that a stock in a portfolio faces is its market risk. Beta coefficient is a measure of stock’s market risk and it is measured by the extent to which the return on a stock moves with the overall stock market. The CAPM Estimate an investor’s required rate of return using capital asset pricing model. 27

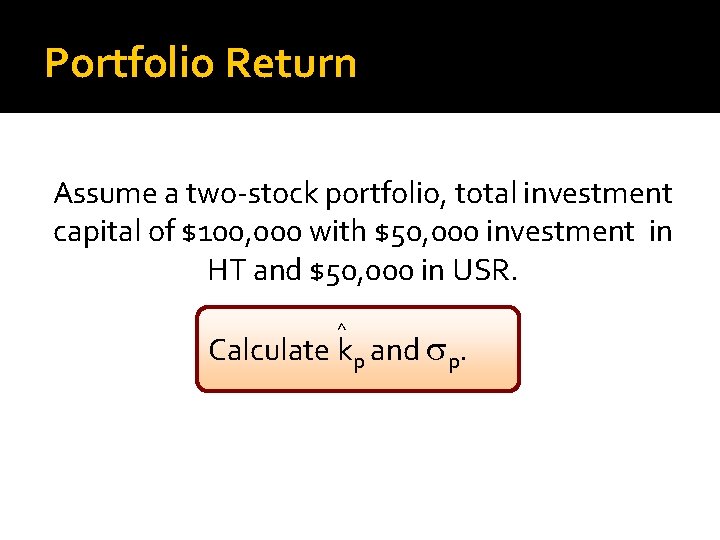

Portfolio Return Assume a two-stock portfolio, total investment capital of $100, 000 with $50, 000 investment in HT and $50, 000 in USR. ^ Calculate kp and p.

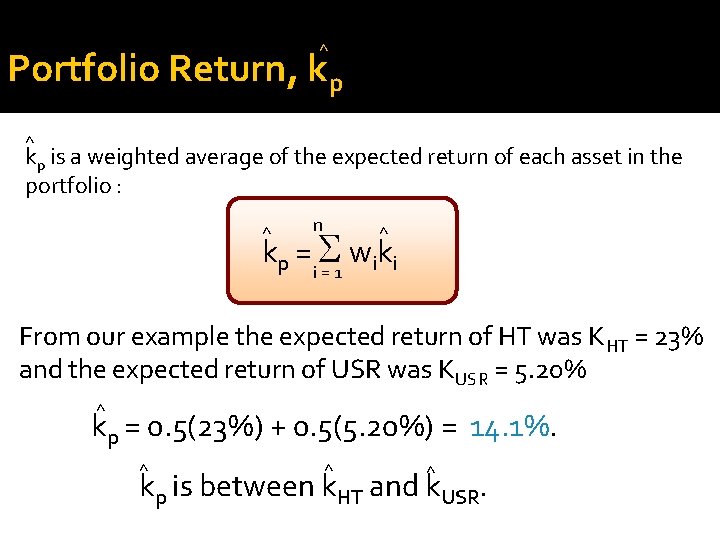

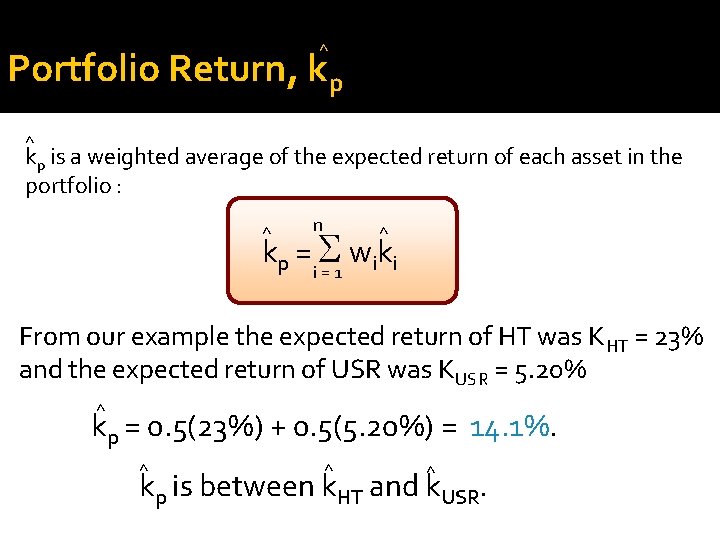

^ Portfolio Return, kp ^ ^ kp is a weighted average of the expected return of each asset in the portfolio : n kp = S wiki ^ ^ i=1 From our example the expected return of HT was KHT = 23% and the expected return of USR was KUSR = 5. 20% ^ kp = 0. 5(23%) + 0. 5(5. 20%) = 14. 1%. ^ ^ ^ kp is between k. HT and k. USR.

Types of Risk A stock’s risk consists of diversifiable and market risk. 1. Diversifiable risk • Firm-specific risk is that part of a security’s stand-alone risk that can be eliminated by proper diversification. 2. Market risk. • Market risk is that part of a security’s standalone risk that cannot be eliminated by diversification, and is measured by beta.

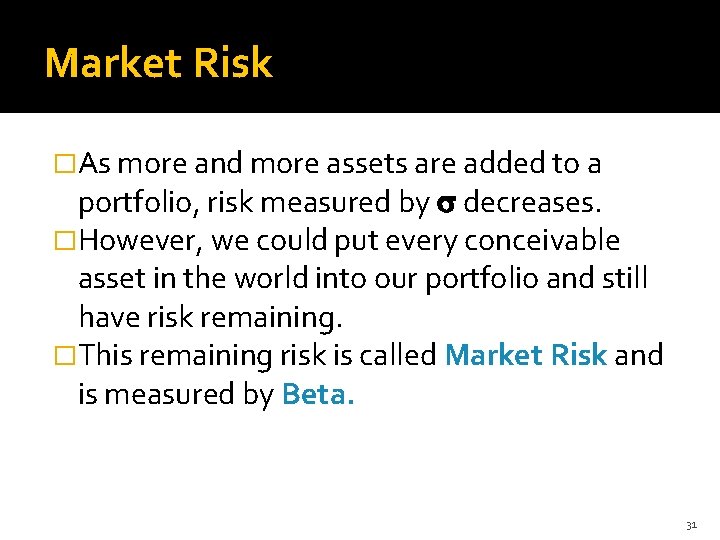

Market Risk �As more and more assets are added to a portfolio, risk measured by decreases. �However, we could put every conceivable asset in the world into our portfolio and still have risk remaining. �This remaining risk is called Market Risk and is measured by Beta. 31

Portfolio Risk �It is important to remember that whenever we hold stock in a portfolio we eliminate its diversifiable risk with the help of efficient diversification. The only relevant risk then a stock in a portfolio faces is its market risk. �Beta coefficient is a measure of stock’s market risk and it is measured by the extent to which the return on a stock moves with the overall stock market.

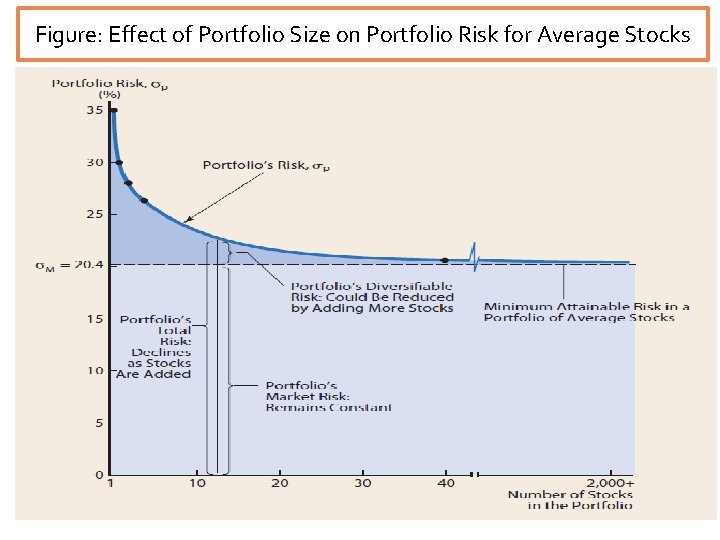

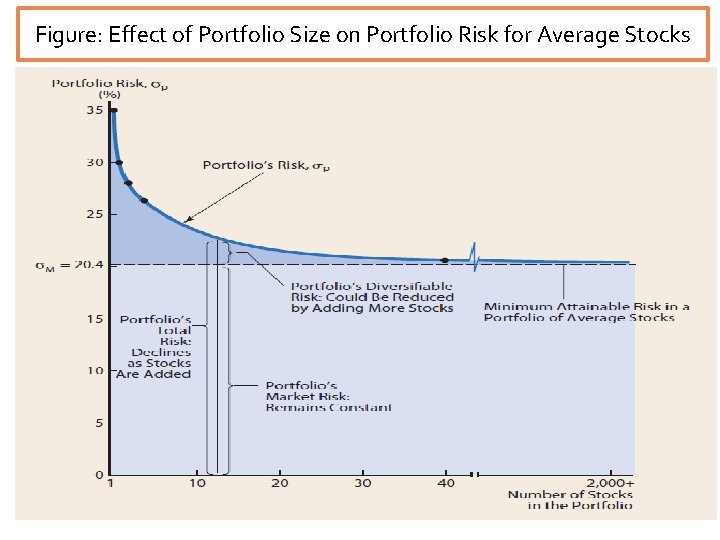

Figure: Effect of Portfolio Size on Portfolio Risk for Average Stocks

Effect of Portfolio Size on Portfolio Risk for Average Stocks �As more stocks are added, each new stock has a smaller risk-reducing impact. � p falls very slowly after about 10 stocks are included, and after 40 stocks, there is little, if any, effect.

Beta Coefficient For measuring relevant risk of a stock �Beta is a key element of the CAPM theory. �Stand-alone risk as measured by a stock’s or CV is not important to a well-diversified investor. �The only relevant risk that a stock in a portfolio faces is its market risk. Beta coefficient is a measure of stock’s market risk and it is measured by the extent to which the return on a stock moves with the overall stock market.

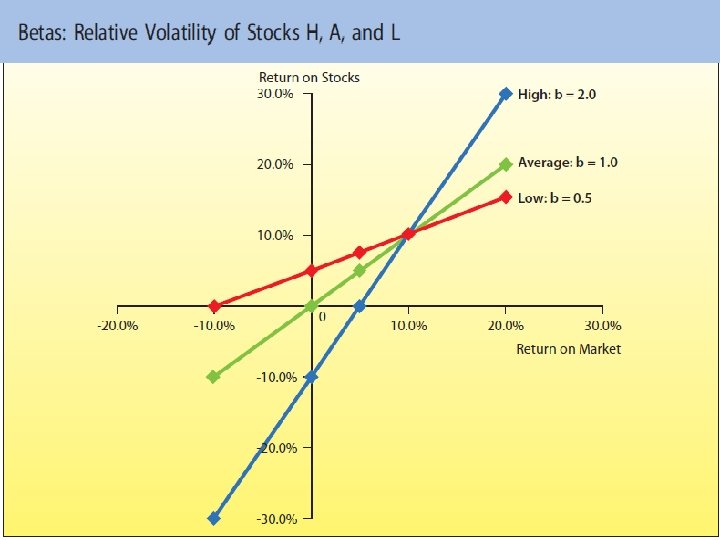

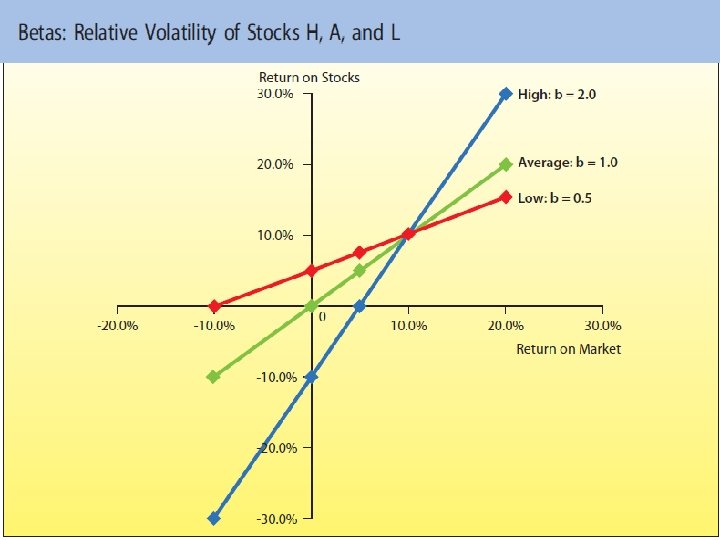

Beta Coefficient For measuring relevant risk of a stock �Rational, risk averse investors are concerned with p , which is based on market risk. �Market stock beta is always equal to 1. �For a stock having a beta of 1 it means it is as risky as market. If market moves up by 10% stock also moves up by 10% similarly if market moves down by 10% stock also moves down by 10%.

Beta Coefficient For measuring relevant risk of a stock �For a stock having a beta of 2 it means it is more volatile than the market. If market moves up by 10% stock moves up by 20% similarly if market moves down by 10% stock moves down by 20%. �For a stock having a beta of 0. 5 it means it is only half as volatile as the market. If market moves up by 10% stock moves up by 5% similarly if market moves down by 10% stock moves down by 5%.

�If beta = 1. 0, average stock. �If beta > 1. 0, stock riskier than average. �If beta < 1. 0, stock less risky than average. �Most stocks have betas in the range of 0. 5 to 1. 5.

Beta Coefficient For measuring relevant risk of a stock �Beta measures a stock’s market risk. It shows a stock’s volatility relative to the market. �Beta shows how risky a stock is if the stock is held in a well-diversified portfolio.

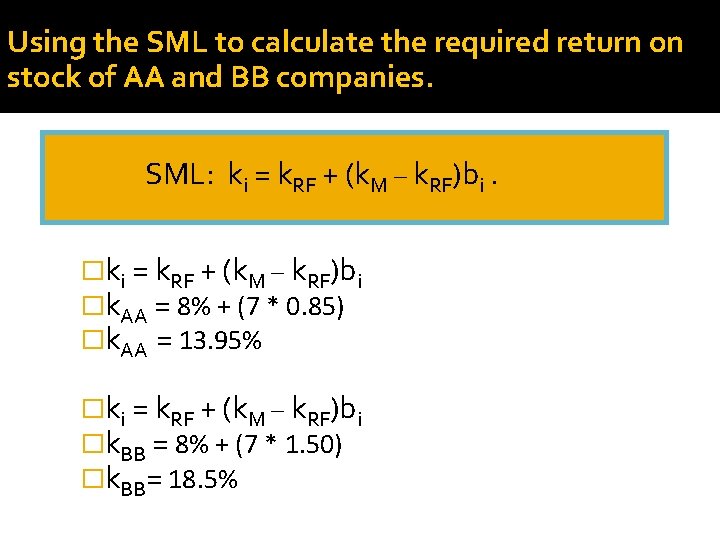

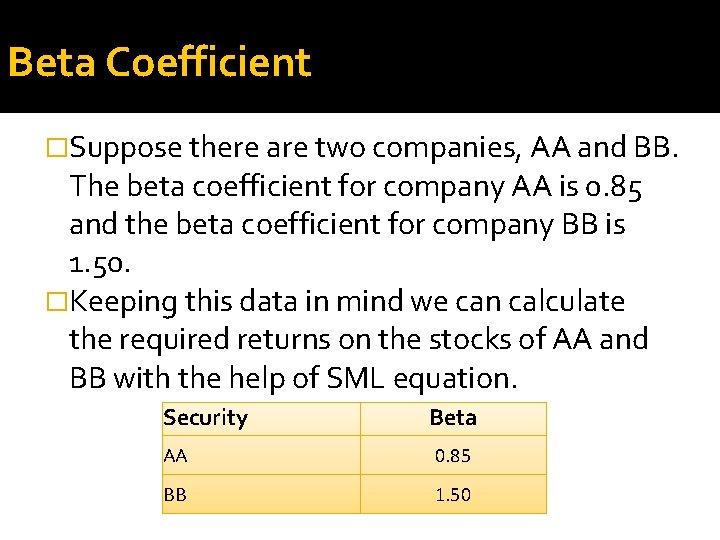

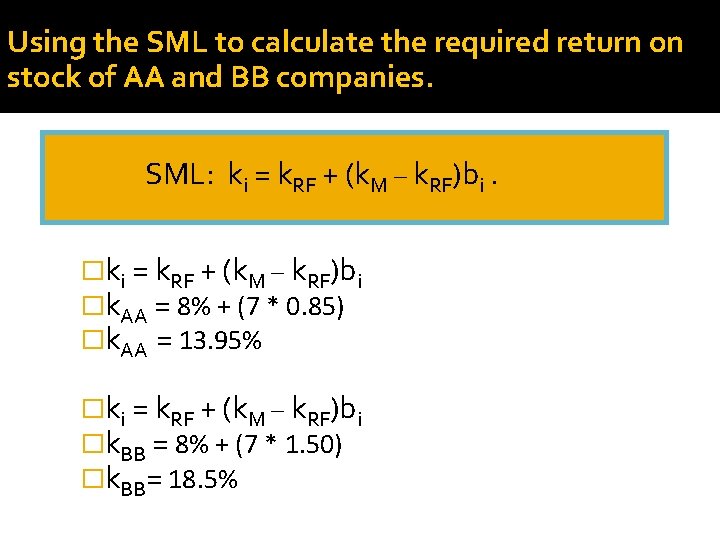

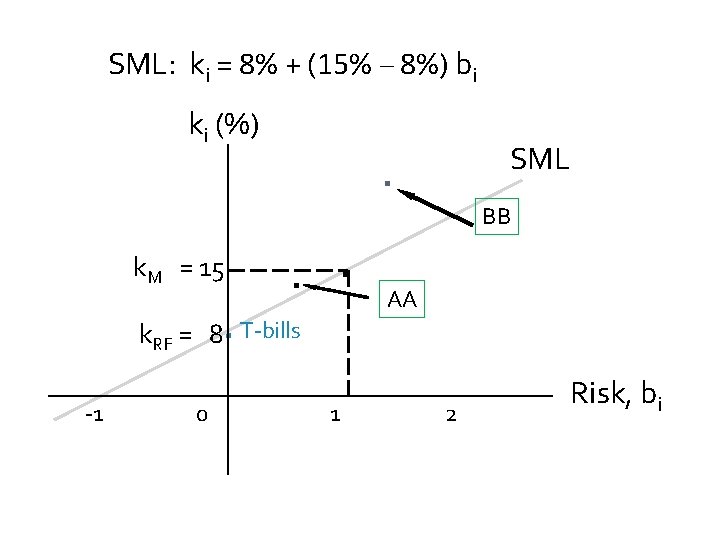

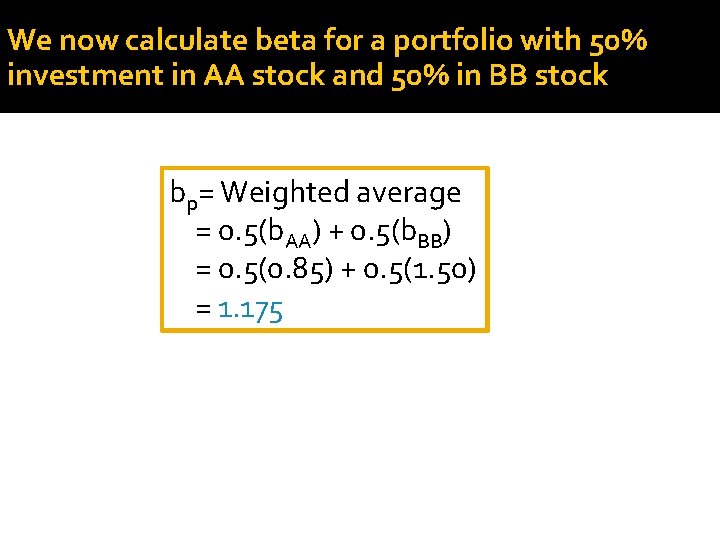

Beta Coefficient �Suppose there are two companies, AA and BB. The beta coefficient for company AA is 0. 85 and the beta coefficient for company BB is 1. 50. �Keeping this data in mind we can calculate the required returns on the stocks of AA and BB with the help of SML equation. Security Beta AA 0. 85 BB 1. 50

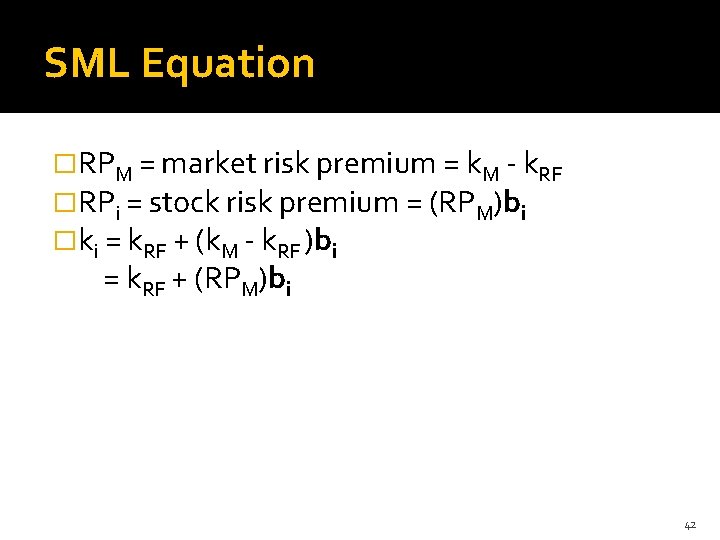

SML Equation �RPM = market risk premium = k. M - k. RF �RPi = stock risk premium = (RPM)bi �ki = k. RF + (k. M - k. RF )bi = k. RF + (RPM)bi 42

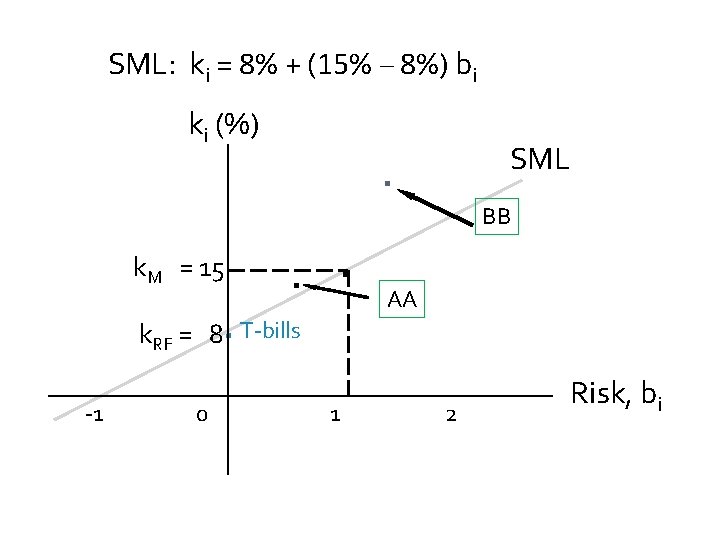

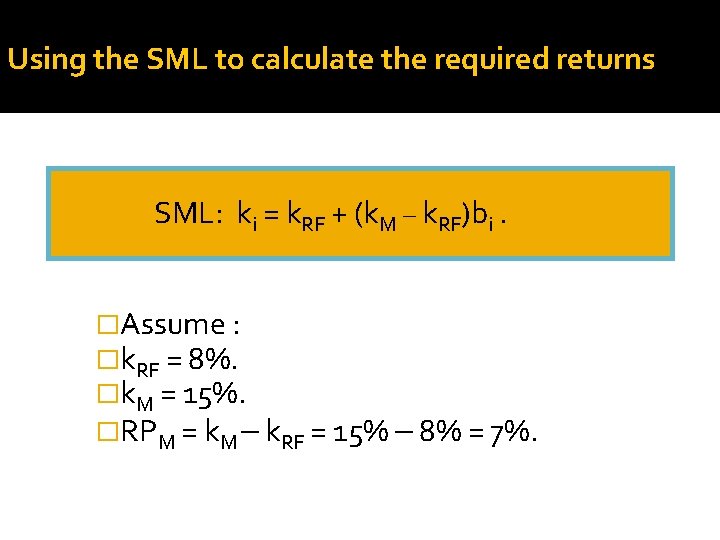

Using the SML to calculate the required returns SML: ki = k. RF + (k. M – k. RF)bi. �Assume : �k. RF = 8%. �k. M = 15%. �RPM = k. M – k. RF = 15% – 8% = 7%.

Using the SML to calculate the required return on stock of AA and BB companies. SML: ki = k. RF + (k. M – k. RF)bi. �ki = k. RF + (k. M – k. RF)bi �k. AA = 8% + (7 * 0. 85) �k. AA = 13. 95% �ki = k. RF + (k. M – k. RF)bi �k. BB = 8% + (7 * 1. 50) �k. BB= 18. 5%

SML: ki = 8% + (15% – 8%) bi ki (%) k. M = 15 . . SML BB AA k. RF = 8 T-bills -1 0 1 2 Risk, bi

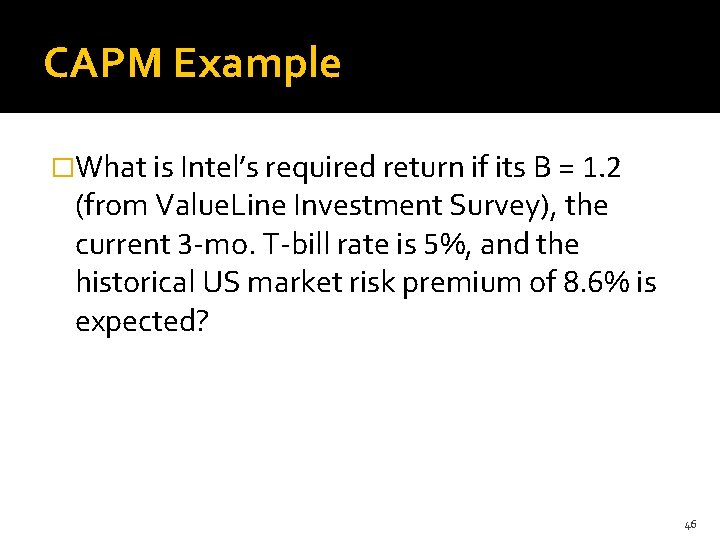

CAPM Example �What is Intel’s required return if its B = 1. 2 (from Value. Line Investment Survey), the current 3 -mo. T-bill rate is 5%, and the historical US market risk premium of 8. 6% is expected? 46

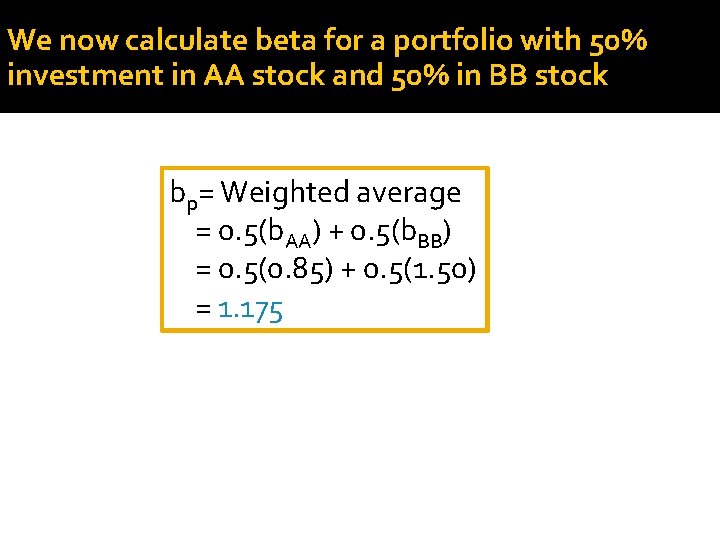

We now calculate beta for a portfolio with 50% investment in AA stock and 50% in BB stock bp= Weighted average = 0. 5(b. AA) + 0. 5(b. BB) = 0. 5(0. 85) + 0. 5(1. 50) = 1. 175

Changes to SML Equation �What happens if inflation increases? �What happens if investors become more risk averse about the stock market? �What happens if beta increases? 48

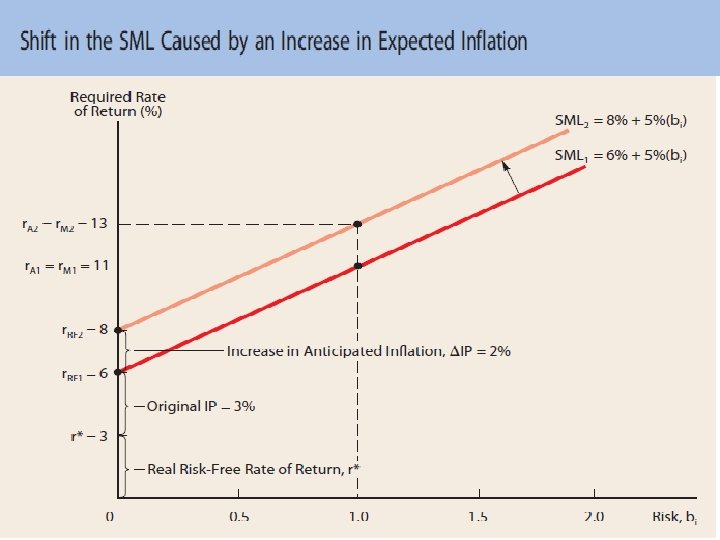

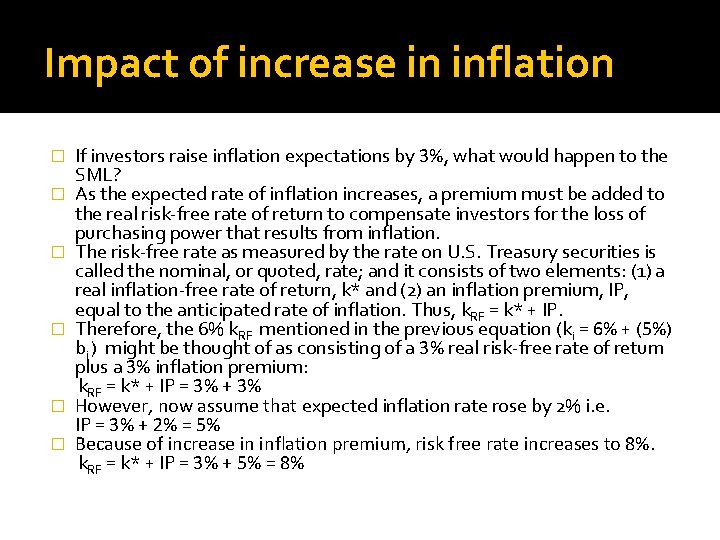

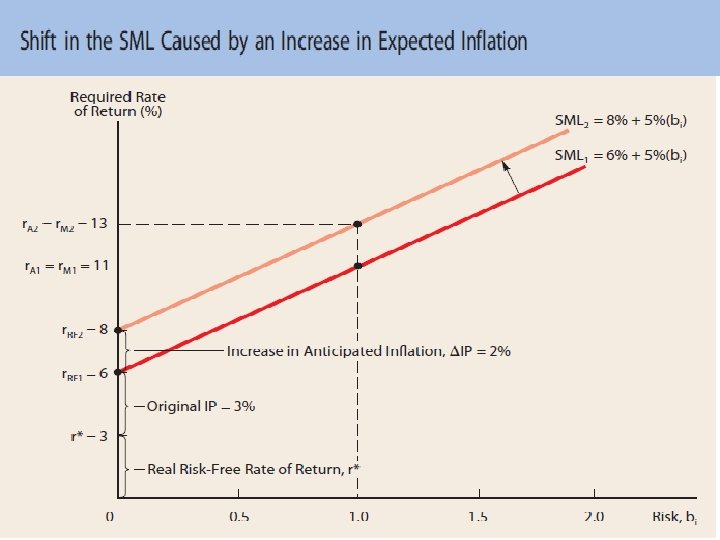

Impact of increase in inflation � � � If investors raise inflation expectations by 3%, what would happen to the SML? As the expected rate of inflation increases, a premium must be added to the real risk-free rate of return to compensate investors for the loss of purchasing power that results from inflation. The risk-free rate as measured by the rate on U. S. Treasury securities is called the nominal, or quoted, rate; and it consists of two elements: (1) a real inflation-free rate of return, k* and (2) an inflation premium, IP, equal to the anticipated rate of inflation. Thus, k. RF = k* + IP. Therefore, the 6% k. RF mentioned in the previous equation (ki = 6% + (5%) bi ) might be thought of as consisting of a 3% real risk-free rate of return plus a 3% inflation premium: k. RF = k* + IP = 3% + 3% However, now assume that expected inflation rate rose by 2% i. e. IP = 3% + 2% = 5% Because of increase in inflation premium, risk free rate increases to 8%. k. RF = k* + IP = 3% + 5% = 8%

Impact of increase in inflation �In simple words, As inflation increases, k. RF increases. �ki = k. RF + (k. M – k. RF)bi k. RF = k* + IP �Under CAPM an increase in k. RF leads to an equal increase in ROR of all risky assets.

Impact of increase in investor’s risk aversion �An increase in investor’s risk aversion means they now require a greater return for buying riskier assets (stocks) which leads to increased k. M as k. RF (risk free rate) remains constant.

Impact of increase in beta �An increase in beta means an increase in market riskiness of the stock which leads to increased required rate of return on stocks.