CHAPTER 8 Corporate Strategy Vertical Integration and Diversification

- Slides: 15

CHAPTER 8 Corporate Strategy: Vertical Integration and Diversification Instructor: Dr. Gehan Shanmuganathan Mc. Graw-Hill/Irwin Copyright © 2013 by The Mc. Graw-Hill Companies, Inc. All rights reserved.

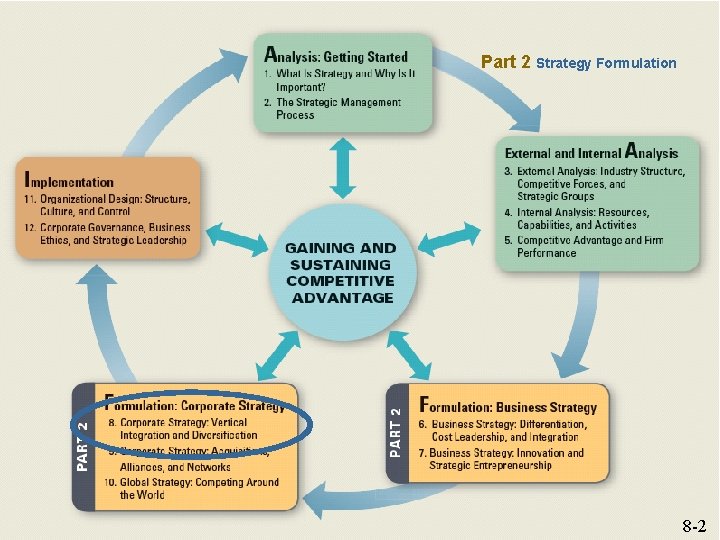

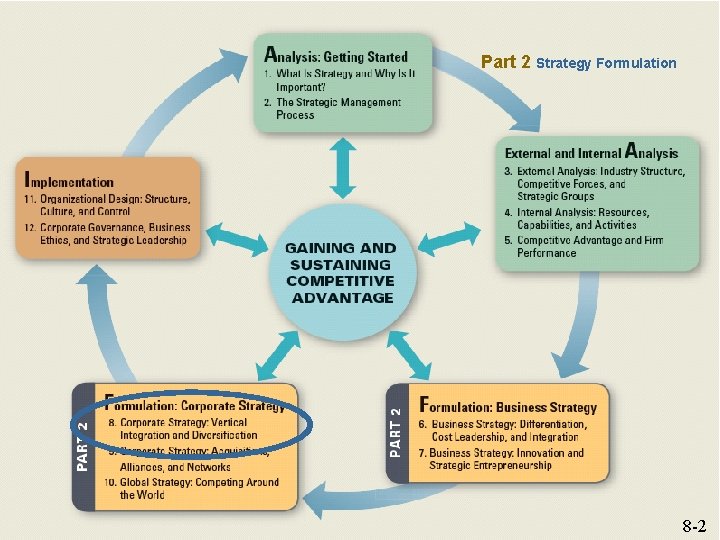

Part 2 Strategy Formulation 8 -2

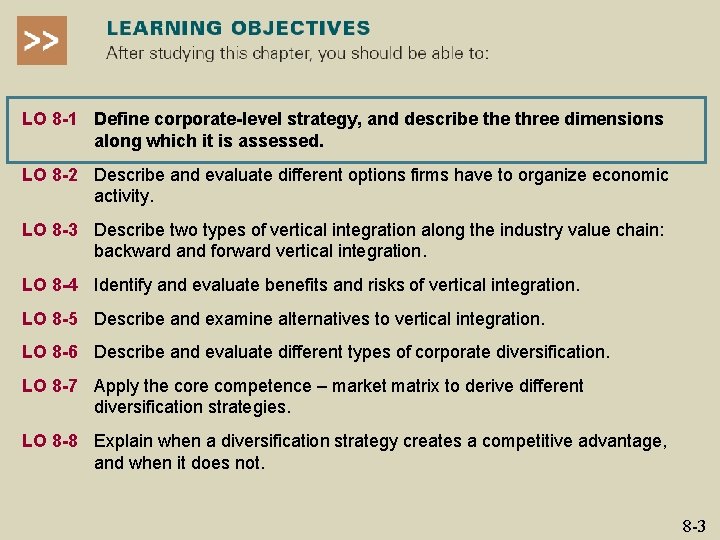

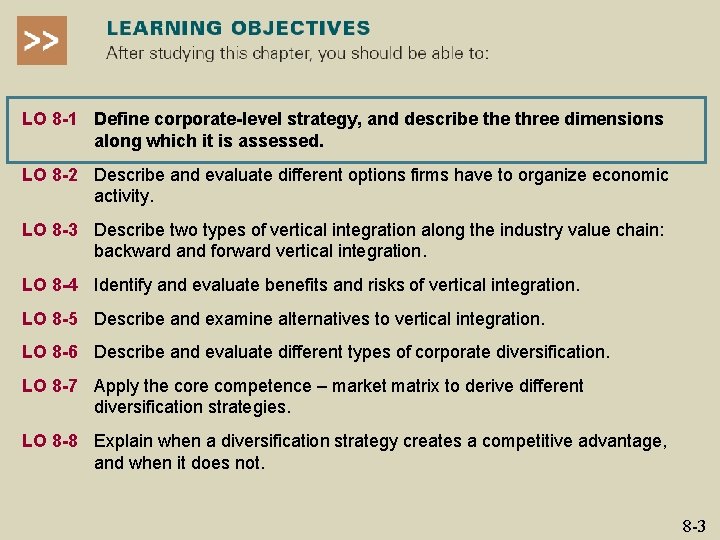

LO 8 -1 Define corporate-level strategy, and describe three dimensions along which it is assessed. LO 8 -2 Describe and evaluate different options firms have to organize economic activity. LO 8 -3 Describe two types of vertical integration along the industry value chain: backward and forward vertical integration. LO 8 -4 Identify and evaluate benefits and risks of vertical integration. LO 8 -5 Describe and examine alternatives to vertical integration. LO 8 -6 Describe and evaluate different types of corporate diversification. LO 8 -7 Apply the core competence – market matrix to derive different diversification strategies. LO 8 -8 Explain when a diversification strategy creates a competitive advantage, and when it does not. 8 -3

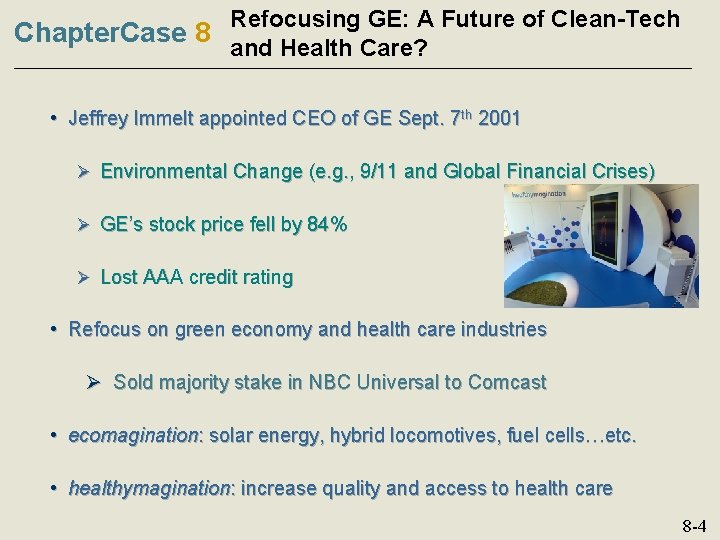

Refocusing GE: A Future of Clean-Tech Chapter. Case 8 and Health Care? • Jeffrey Immelt appointed CEO of GE Sept. 7 th 2001 Ø Environmental Change (e. g. , 9/11 and Global Financial Crises) Ø GE’s stock price fell by 84% Ø Lost AAA credit rating • Refocus on green economy and health care industries Ø Sold majority stake in NBC Universal to Comcast • ecomagination: solar energy, hybrid locomotives, fuel cells…etc. • healthymagination: increase quality and access to health care 8 -4

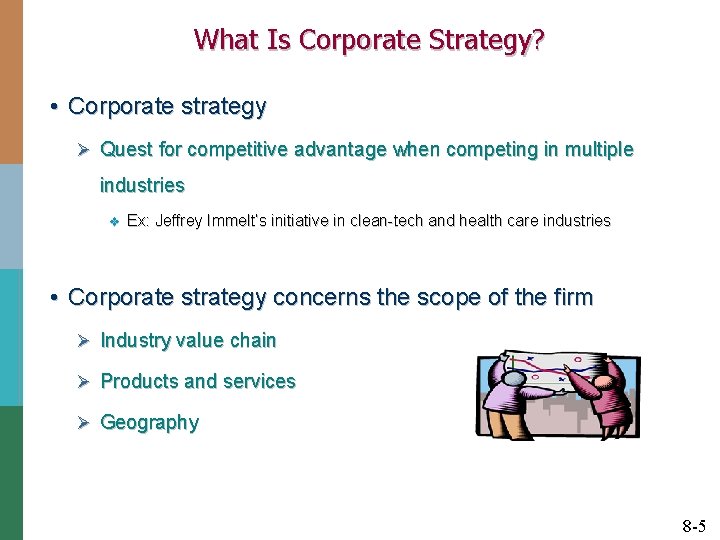

What Is Corporate Strategy? • Corporate strategy Ø Quest for competitive advantage when competing in multiple industries v Ex: Jeffrey Immelt’s initiative in clean-tech and health care industries • Corporate strategy concerns the scope of the firm Ø Industry value chain Ø Products and services Ø Geography 8 -5

What Is Corporate Strategy? (cont'd) • Economies of scale Ø Average per-unit cost decreases as its output increases v Ex: Anheuser-Busch Inbev largest global brewer • Economies of scope Ø Savings that come from producing more outputs or providing different services at less cost v Ex: Amazon range of products & services • Transaction cost Ø The cost associated with economic exchange v "Make or buy" decision 8 -6

Transaction Cost Economics and Scope of the Firm • Transaction cost economics Ø Explains and predicts the scope of the firm Ø "Market vs. firms" have differential costs • Transaction costs Ø Costs associated with economic exchanges v Either in the firm OR in the markets v Ex: negotiating and enforcing contracts • Administrative costs Ø Costs pertaining to organizing an exchange within a hierarchy v Ex: recruiting & training employees 8 -7

STRATEGY HIGHLIGHT 8. 1 Toyota Locks Up Lithium for Car Batteries • World demand for lithium-ion batteries for cars Ø Grow from $278 million in ‘ 09 to $25 billion in 2014 • Toyota wants to secure long-term supply of lithium to power its hybrid fleet • Orocobre holds exploration rights to a large salt-lake area Ø Upfront investment to extract of lithium is very high • Should Orocobre make the investment to supply Toyota? Ø To encourage investment, Toyota took an equity position China Rare Earth Video 1– 8 8 -8

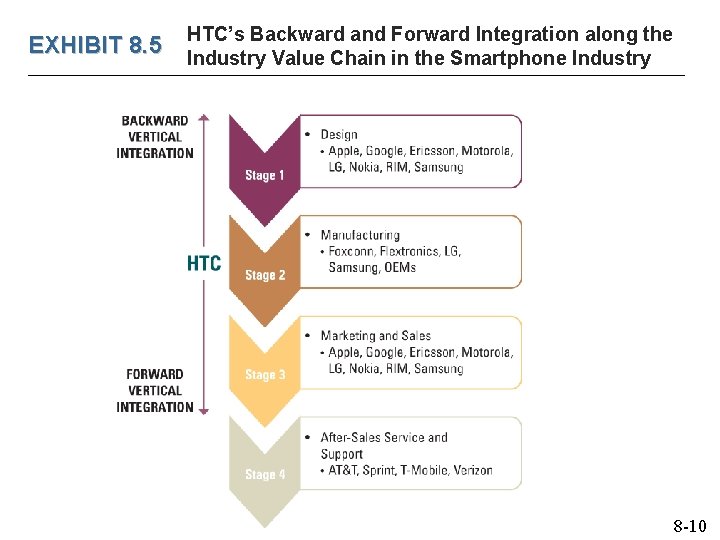

Vertical Integration along the Industry Value Chain • In what stages of the industry value chain should the firm participate? • Vertical integration Ø Ownership of its inputs, production, & outputs in the value chain Ø Horizontal value chain v Internal, firm-level value chains (Chapter 4) • Vertical value chain Ø Industry-level integration from upstream to downstream v Examples: cell phone industry value chain • Many different industries and firms 8 -9

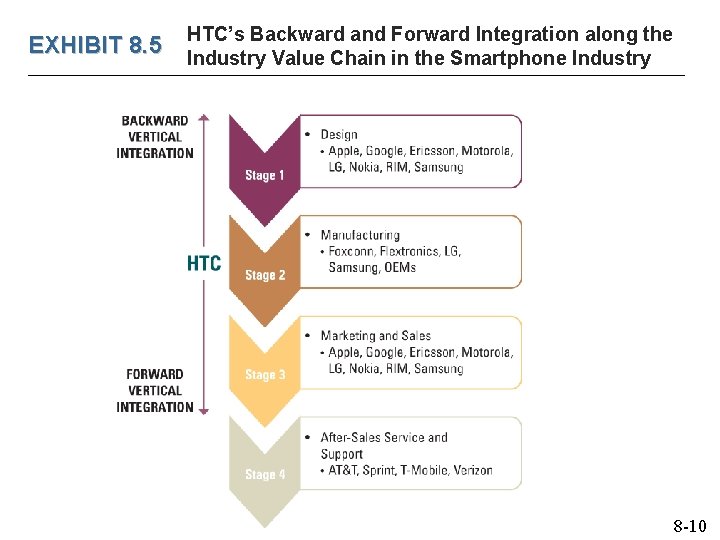

EXHIBIT 8. 5 HTC’s Backward and Forward Integration along the Industry Value Chain in the Smartphone Industry 8 -10

Types of Corporate Diversification • Single business v Google • Dominant business v Microsoft • Related diversification Ø Related constrained v Exxon. Mobil Ø Related linked v Disney • Unrelated diversification v GE 8 -11

Leveraging Core Competencies for Corporate Diversification • Core competence Ø Unique skills and strengths Ø Allows firms to increase the value of product/service Ø Lowers the cost • Examples: Walmart – global supply chain v Infosys – low-cost global delivery system v • The core competence – market matrix Ø Provides guidance to executives on how to diversify in order to achieve continued growth 8 -12

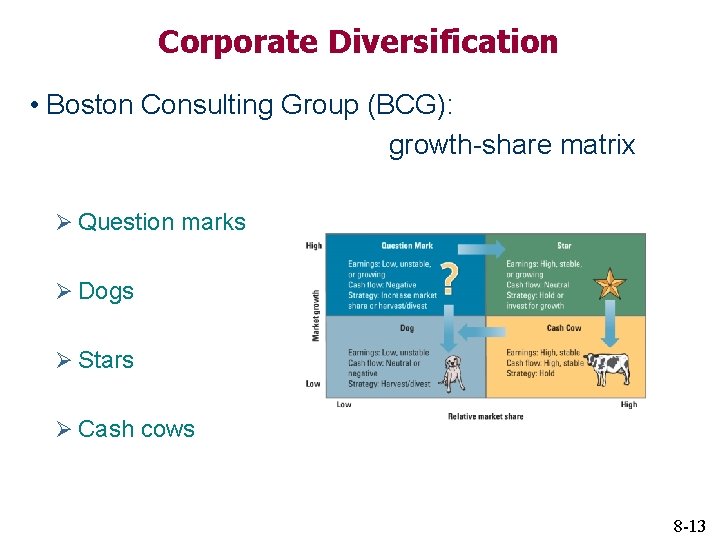

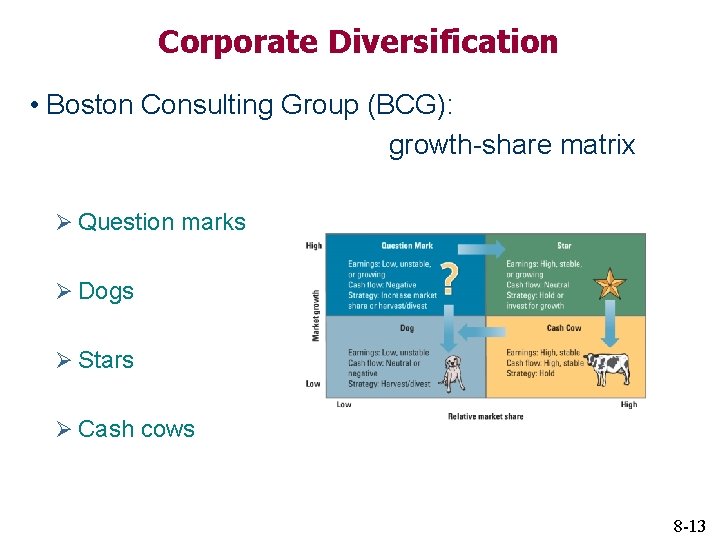

Corporate Diversification • Boston Consulting Group (BCG): growth-share matrix Ø Question marks Ø Dogs Ø Stars Ø Cash cows 8 -13

Corporate Strategy: Combining Vertical Integration and Diversification • Firms’ corporate strategy Ø Concerns level of integration on value chain AND Ø Level of diversification Ex: Oracle earned $23 B in 2009 v Enterprise software is core competency – Backward integration – Sun Microsystems – Forward integration – People. Soft v Diversification at Oracle: – Related – IP management bought Sophoi – Unrelated – ID theft bought Bharosa v 8 -14

CHAPTERCASE 8/ Consider This… 1. Where do ecomagination and healthymagination fit on the core competence – market matrix for GE? 2. Take either the energy or health care industry and draw the industry value chain. What areas of potential vertical integration should GE consider? 3. What related diversification would you suggest for GE in reference to its focus for the future? 4. How do GE’s corporate-level strategic initiatives of energy, health care, and globalization reinforce each other? How might they generate conflicts in the company? 8 -15