Chapter 7 Standard Costing and Variance Analysis Cost

- Slides: 46

Chapter 7: Standard Costing and Variance Analysis Cost Accounting: Foundations and Evolutions, 8 e Kinney ● Raiborn

Learning Objectives n n n How are material, labor, and overhead standards set? How are material, labor, and overhead variances calculated and recorded? Why are standard cost systems used? How have the setting and use of standards changed over time? How does the use of a single conversion element (rather than the traditional labor and overhead elements) affect standard costing? (Appendix) How are variances affected by multiple material and labor categories?

Standard Cost Systems n n Manufacturing Service Not-for-Profit Record standard and actual costs in the accounting records

Standards n Standard costs are budgeted costs to q q n Manufacture a single unit of product or Perform a single service To develop standards, identify q q Material and labor types, quantities, and prices Overhead types and behavior

Manufacturing Objective Minimize unit cost while achieving certain quality specifications. Input Resources Output Quality

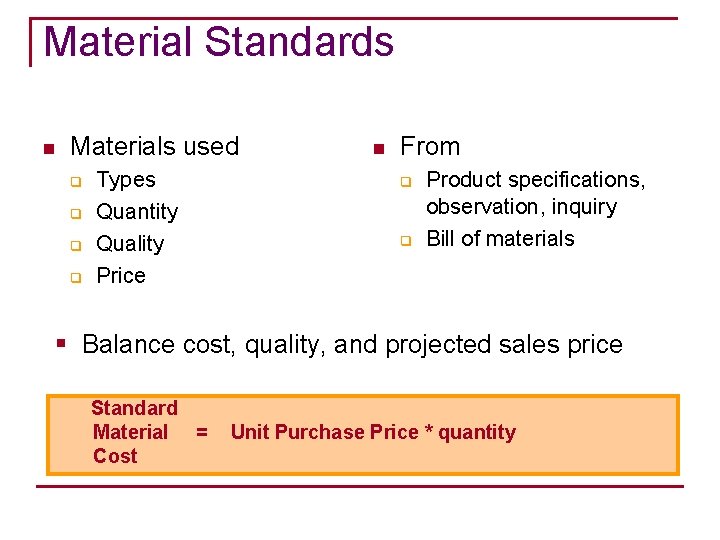

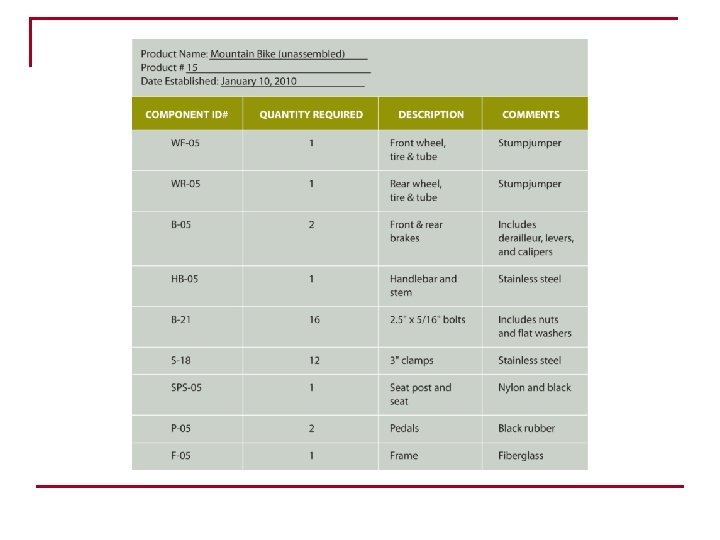

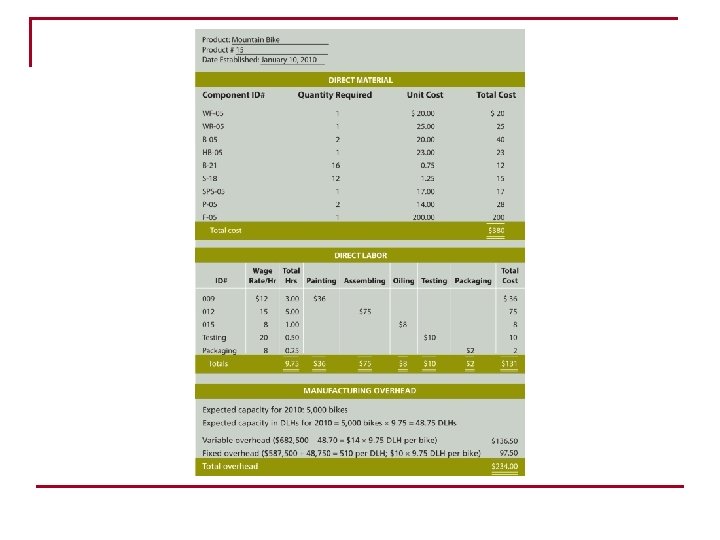

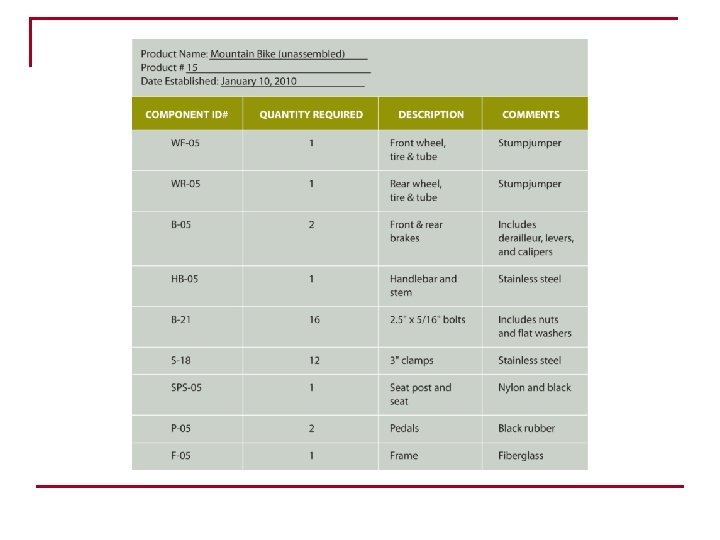

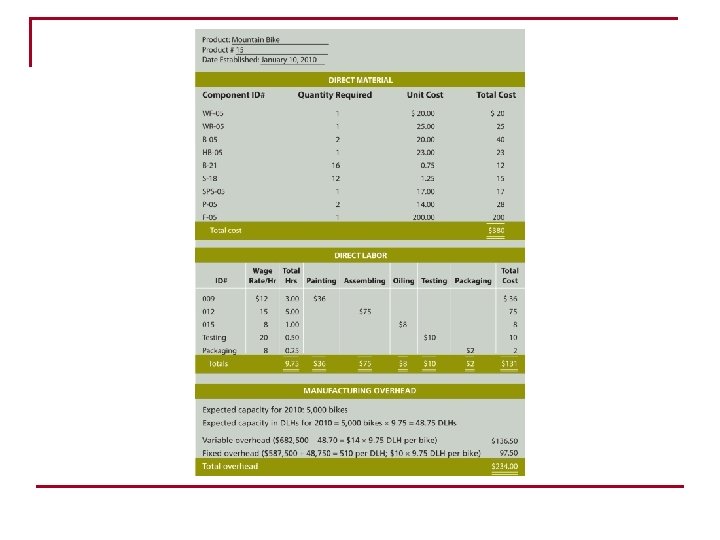

Material Standards n Materials used q q Types Quantity Quality Price n From q q Product specifications, observation, inquiry Bill of materials § Balance cost, quality, and projected sales price Standard Material = Cost Unit Purchase Price * quantity

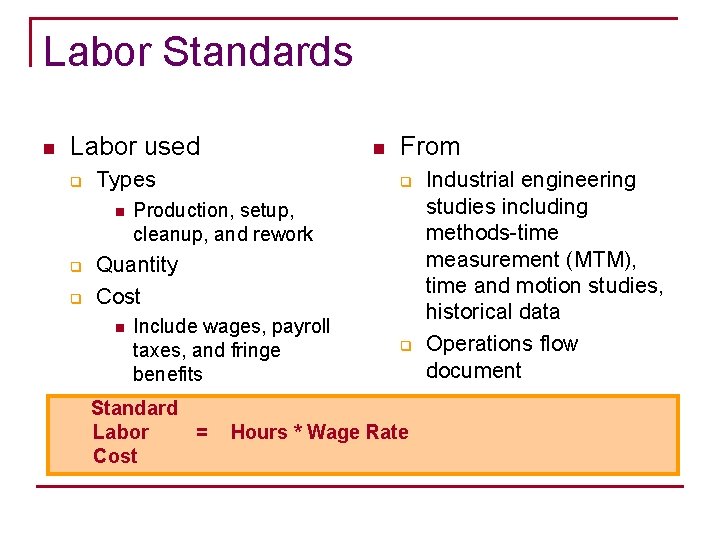

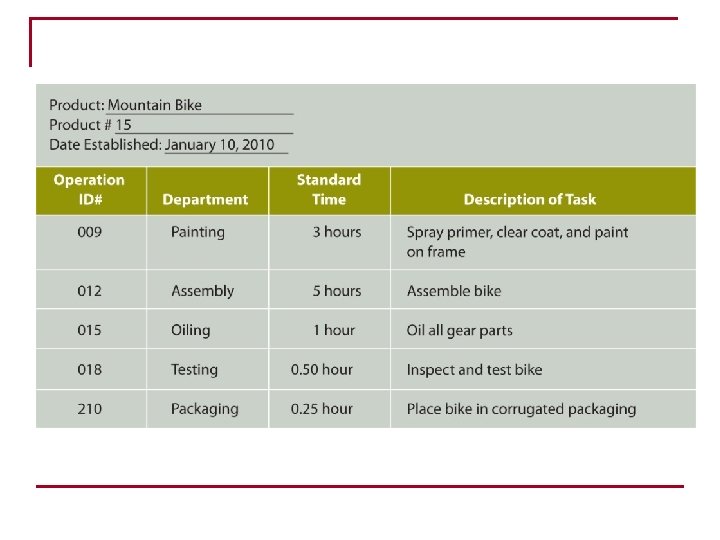

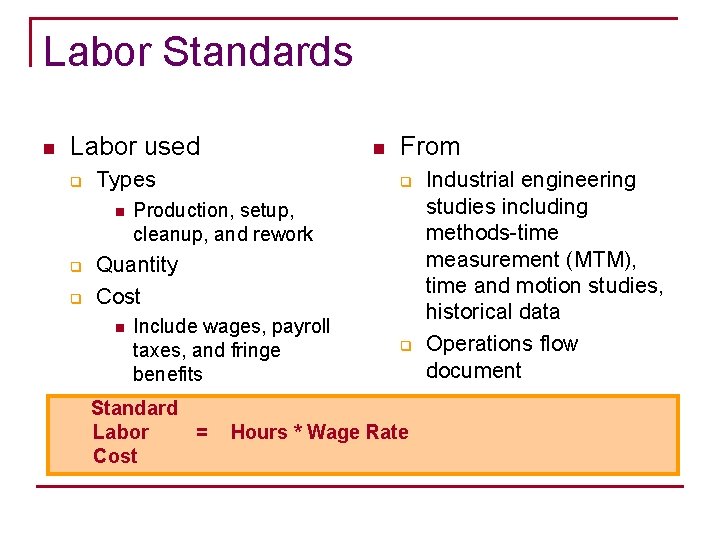

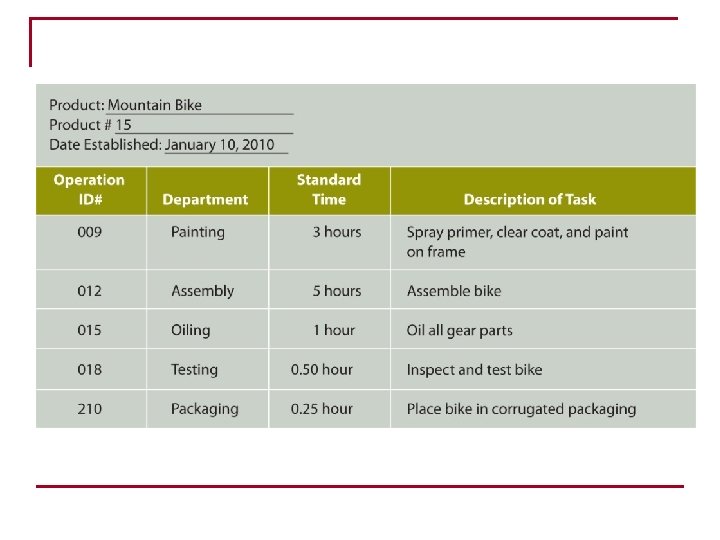

Labor Standards n Labor used q Types n q q n From q Production, setup, cleanup, and rework Quantity Cost n Include wages, payroll taxes, and fringe benefits Standard Labor = Cost q Hours * Wage Rate Industrial engineering studies including methods-time measurement (MTM), time and motion studies, historical data Operations flow document

Overhead Standards Variable and fixed manufacturing overhead n Estimated level of activity n Estimated costs n Predetermined factory overhead application rates n

Standard Cost Card For one unit of output (a bike) Standard Direct Material Components Standard Direct Labor Components Manufacturing Overhead Variable Overhead Fixed Overhead

Variance § Variance is the difference between an actual cost and a standard cost.

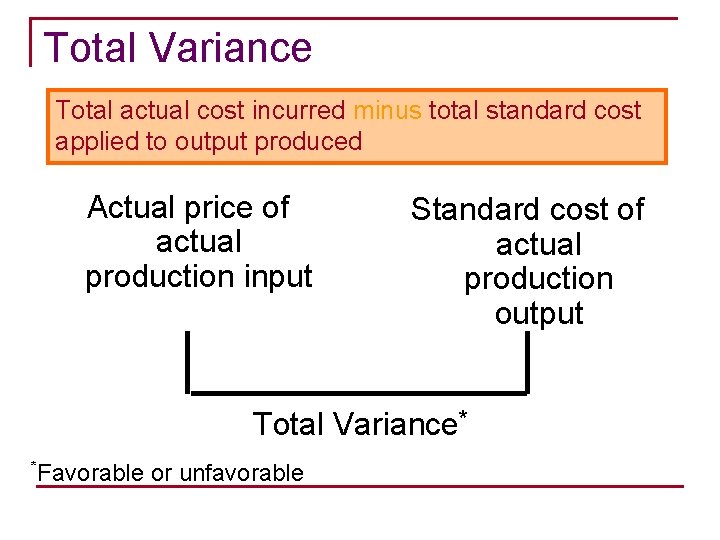

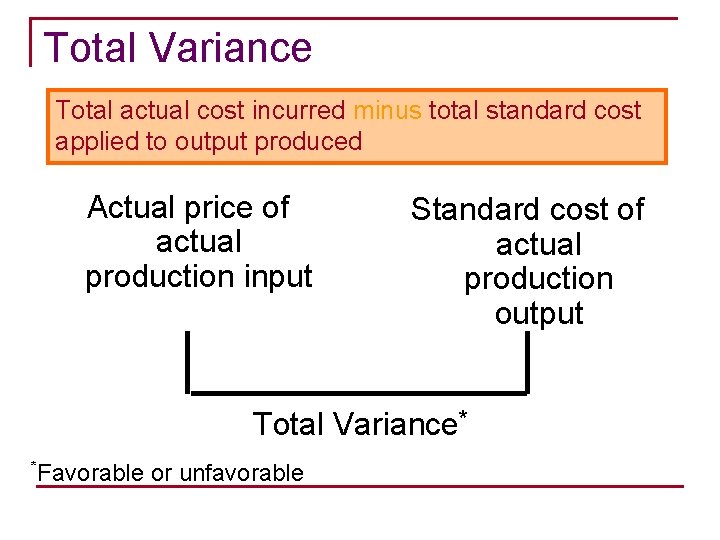

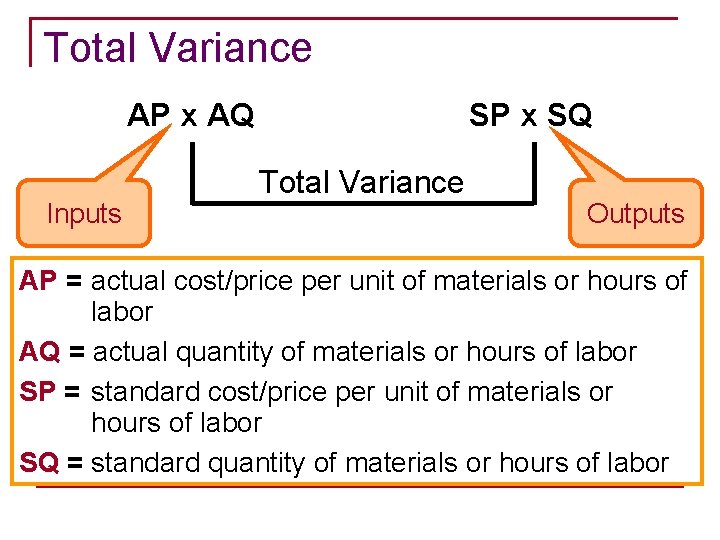

Total Variance Total actual cost incurred minus total standard cost applied to output produced Actual price of actual production input Standard cost of actual production output Total Variance* *Favorable or unfavorable

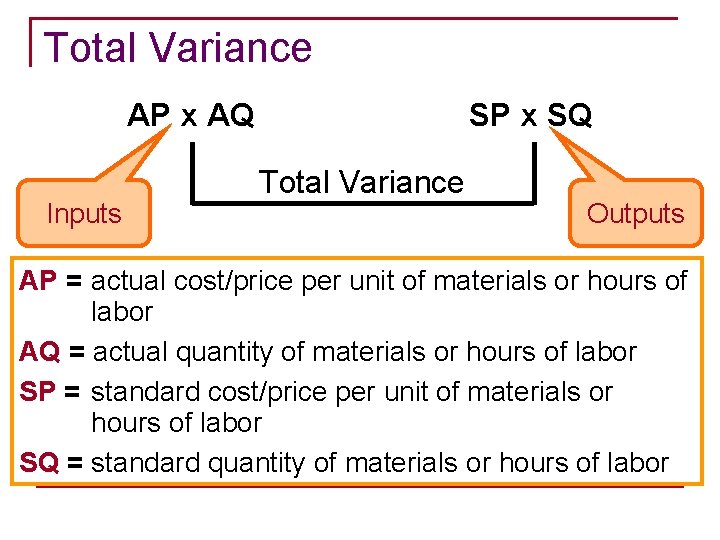

Total Variance AP x AQ Inputs SP x SQ Total Variance Outputs AP = actual cost/price per unit of materials or hours of labor AQ = actual quantity of materials or hours of labor SP = standard cost/price per unit of materials or hours of labor SQ = standard quantity of materials or hours of labor

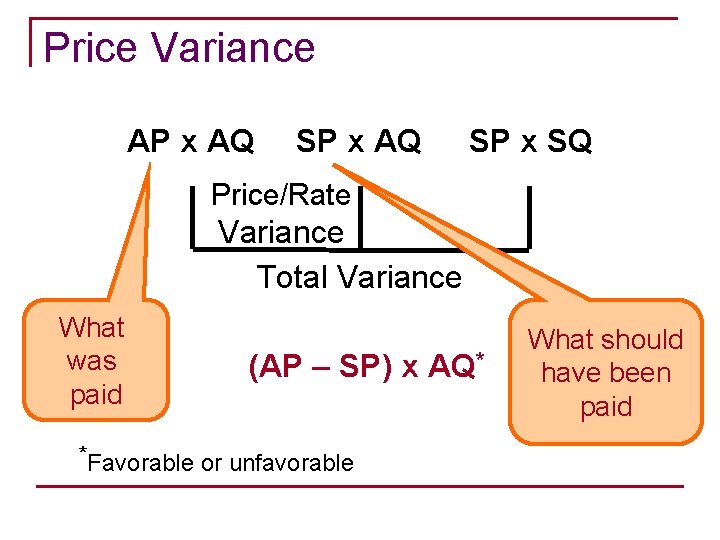

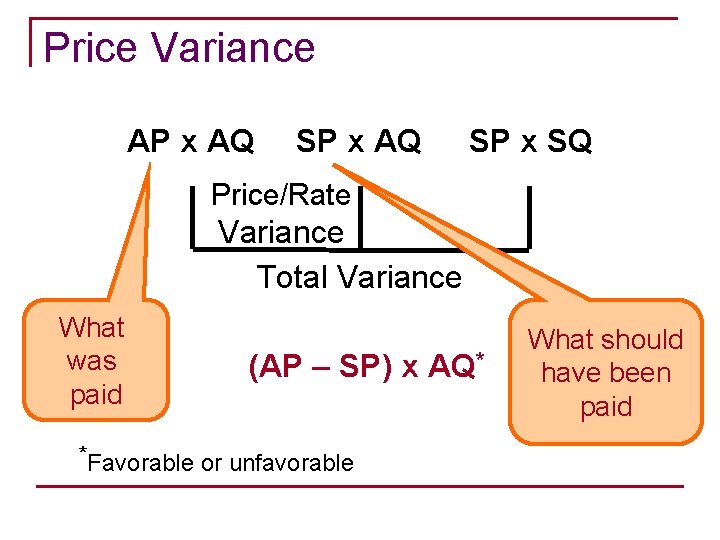

Price Variance AP x AQ SP x SQ Price/Rate Variance Total Variance What was paid (AP – SP) x AQ* *Favorable or unfavorable What should have been paid

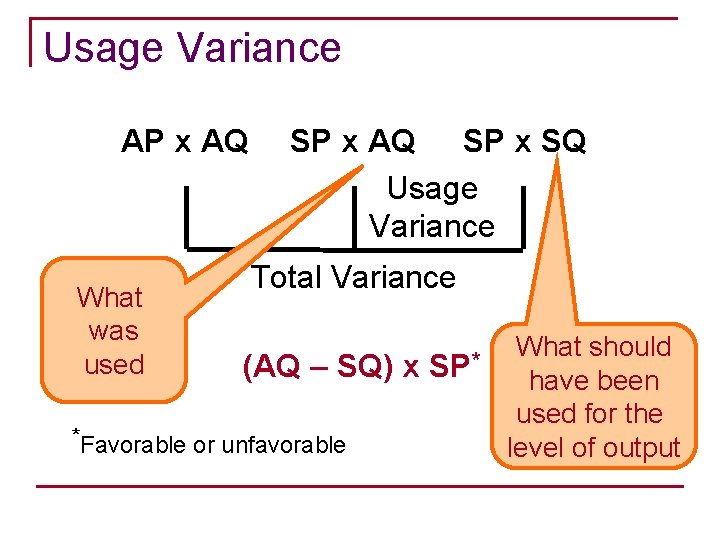

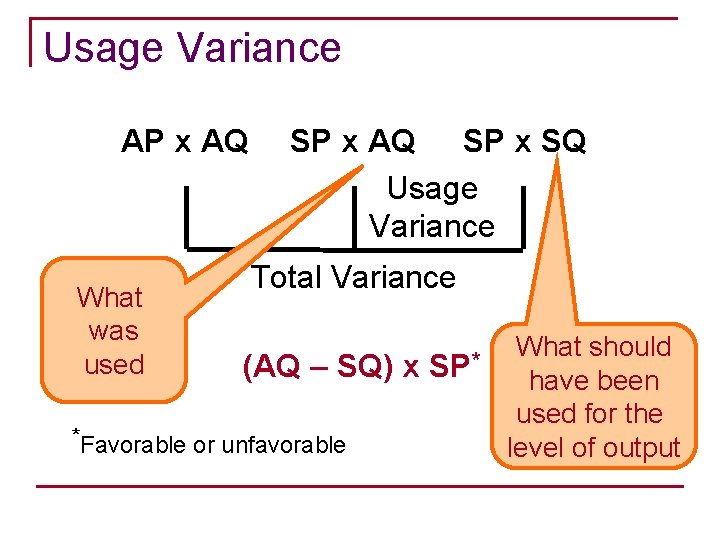

Usage Variance AP x AQ What was used SP x AQ SP x SQ Usage Variance Total Variance (AQ – SQ) x *Favorable or unfavorable SP* What should have been used for the level of output

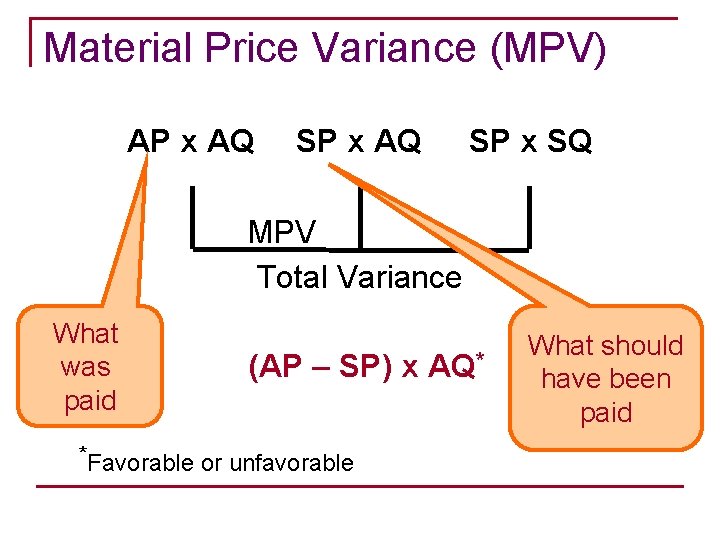

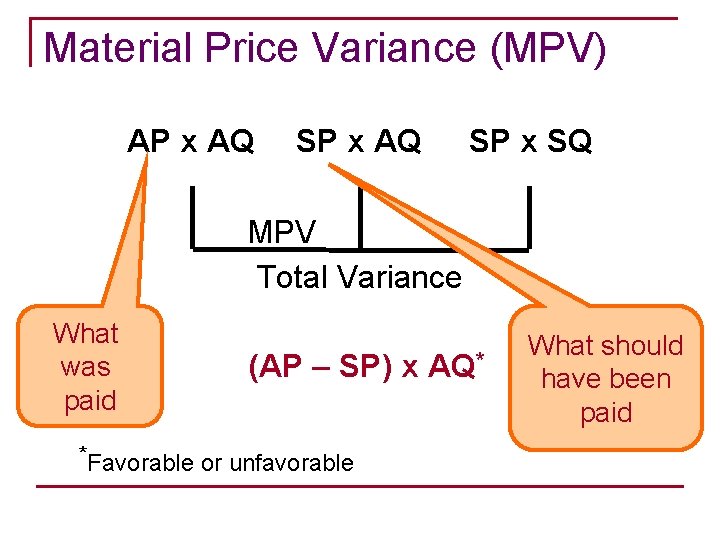

Material Price Variance (MPV) AP x AQ SP x SQ MPV Total Variance What was paid (AP – SP) x *Favorable or unfavorable AQ* What should have been paid

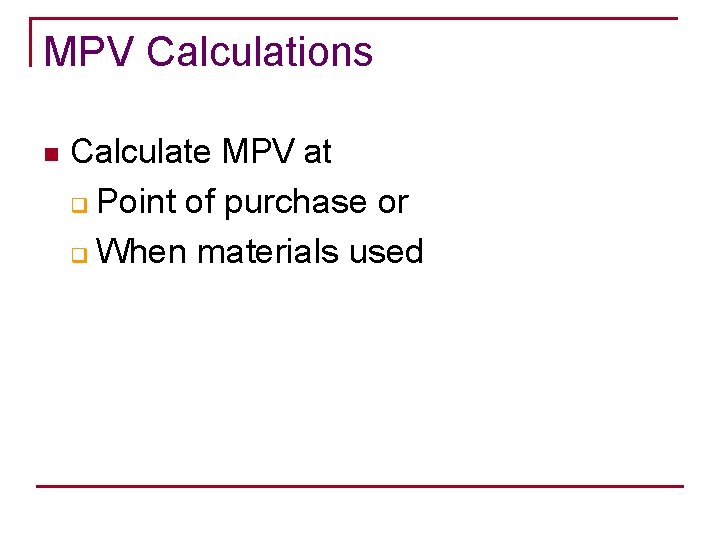

MPV Calculations n Calculate MPV at q Point of purchase or q When materials used

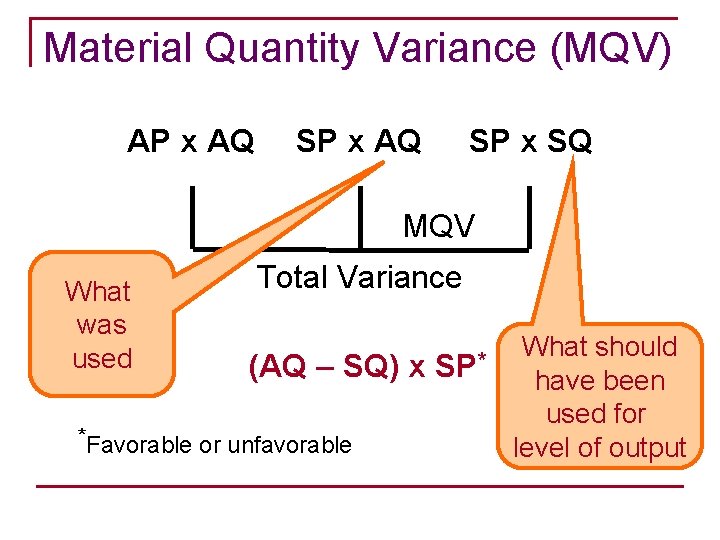

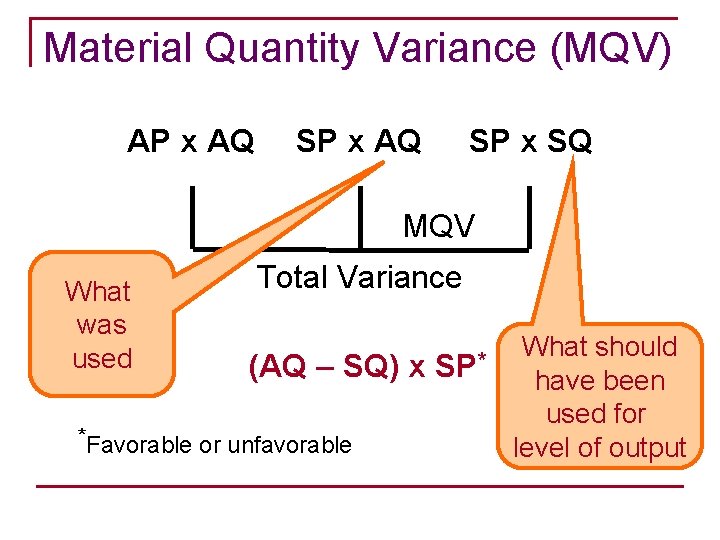

Material Quantity Variance (MQV) AP x AQ SP x SQ MQV What was used Total Variance (AQ – SQ) x *Favorable or unfavorable SP* What should have been used for level of output

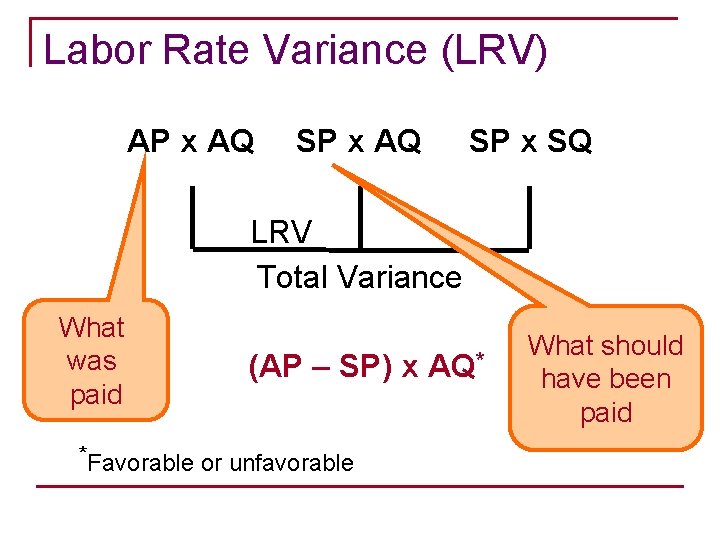

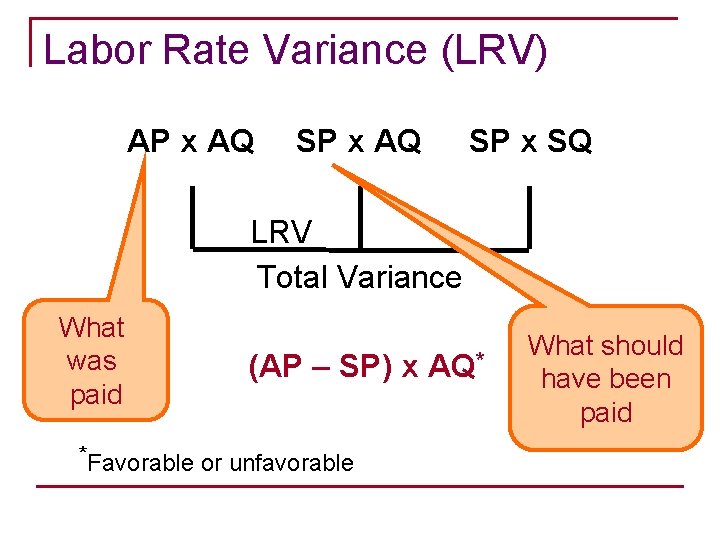

Labor Rate Variance (LRV) AP x AQ SP x SQ LRV Total Variance What was paid (AP – SP) x *Favorable or unfavorable AQ* What should have been paid

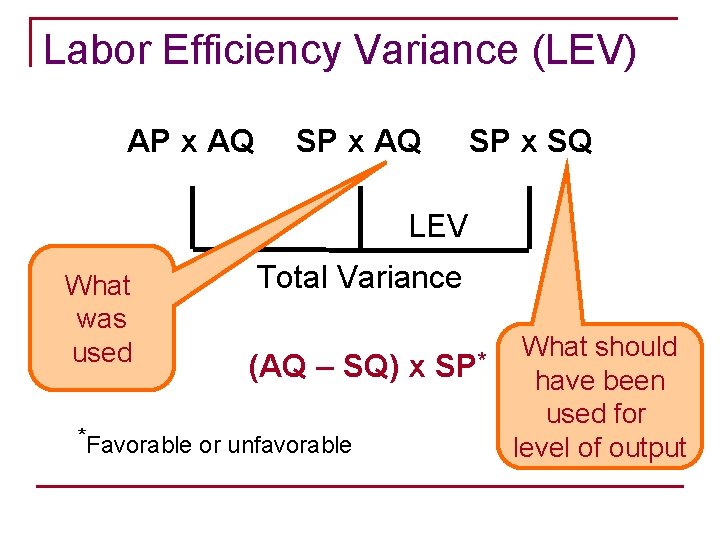

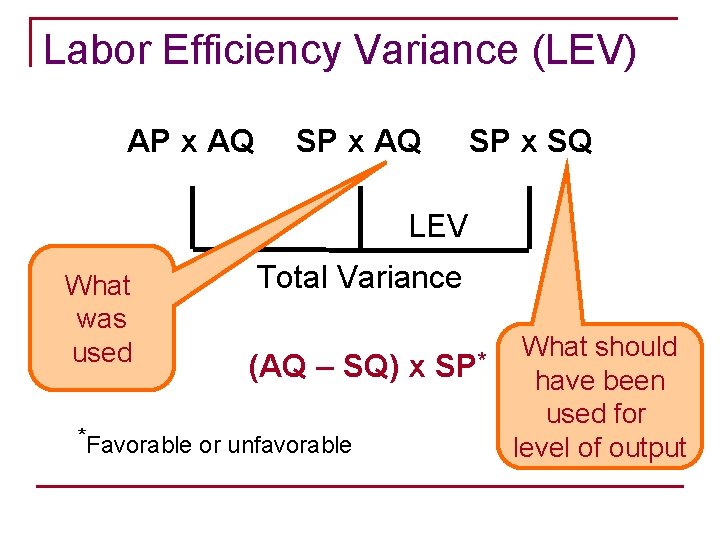

Labor Efficiency Variance (LEV) AP x AQ SP x SQ LEV What was used Total Variance (AQ – SQ) x *Favorable or unfavorable SP* What should have been used for level of output

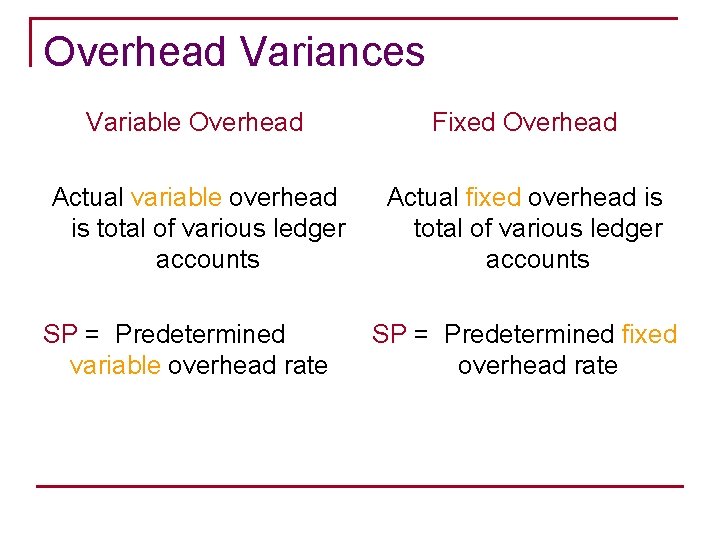

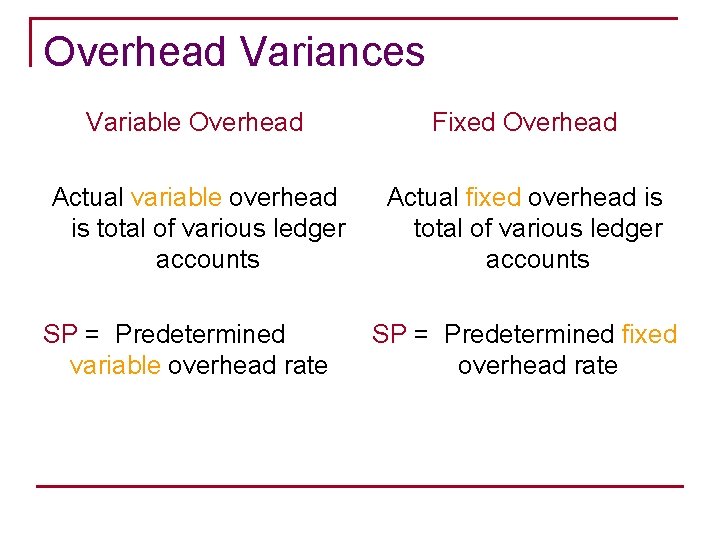

Overhead Variances Variable Overhead Fixed Overhead Actual variable overhead is total of various ledger accounts Actual fixed overhead is total of various ledger accounts SP = Predetermined variable overhead rate SP = Predetermined fixed overhead rate

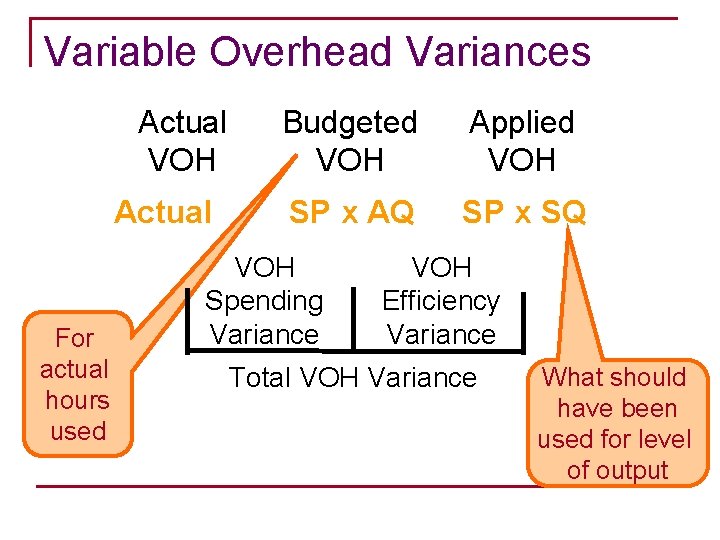

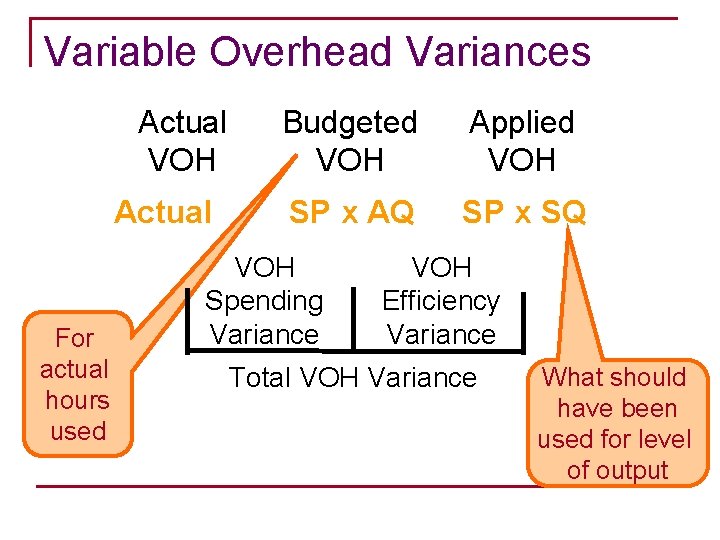

Variable Overhead Variances Actual VOH Actual For actual hours used Budgeted VOH Applied VOH SP x AQ SP x SQ VOH Spending Variance VOH Efficiency Variance Total VOH Variance What should have been used for level of output

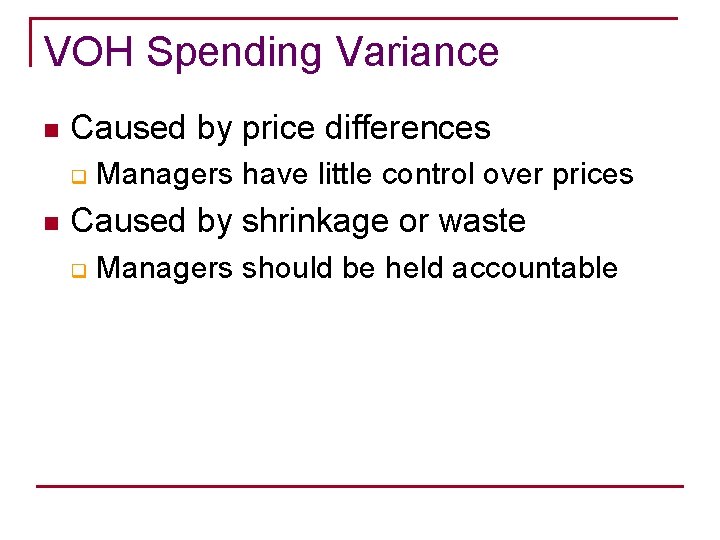

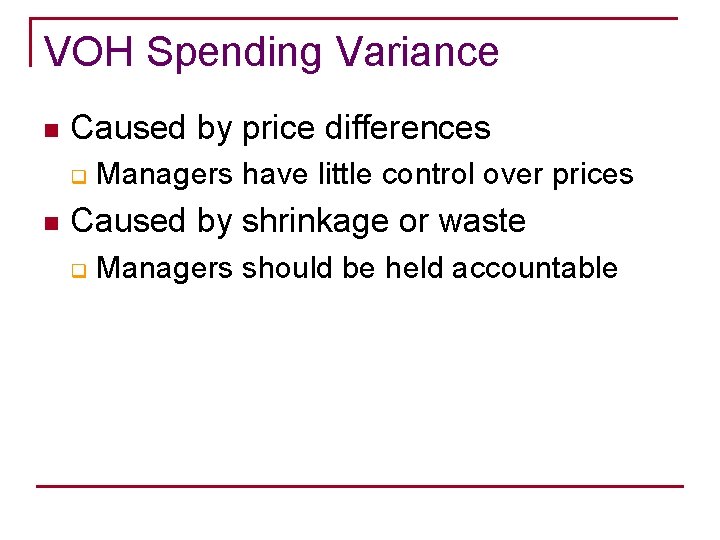

VOH Spending Variance n Caused by price differences q n Managers have little control over prices Caused by shrinkage or waste q Managers should be held accountable

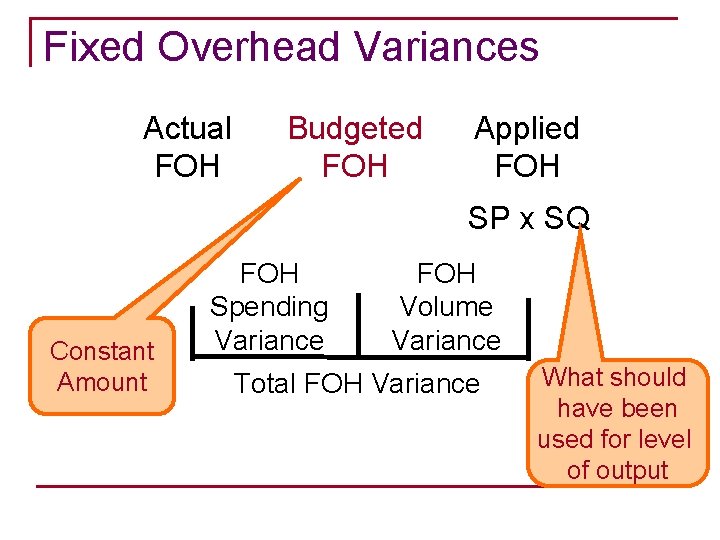

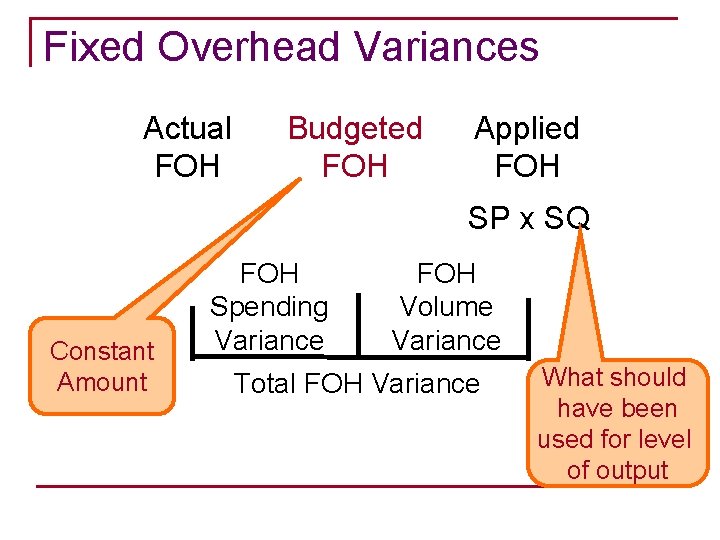

Fixed Overhead Variances Actual FOH Budgeted FOH Applied FOH SP x SQ Constant Amount FOH Spending Variance FOH Volume Variance Total FOH Variance What should have been used for level of output

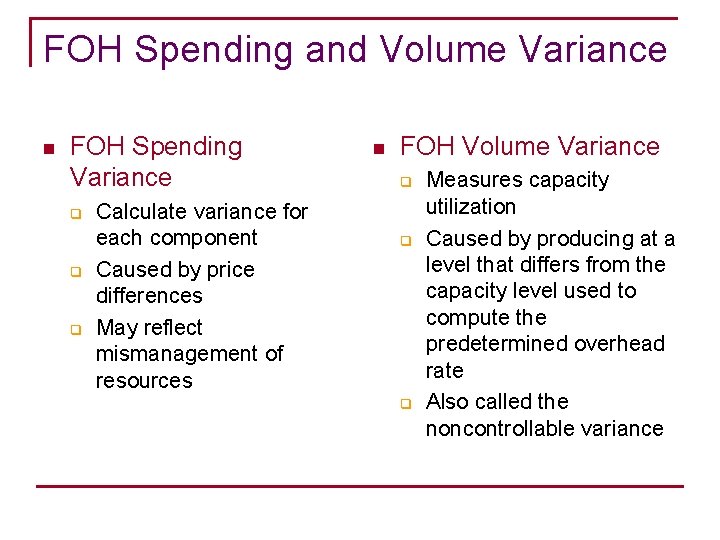

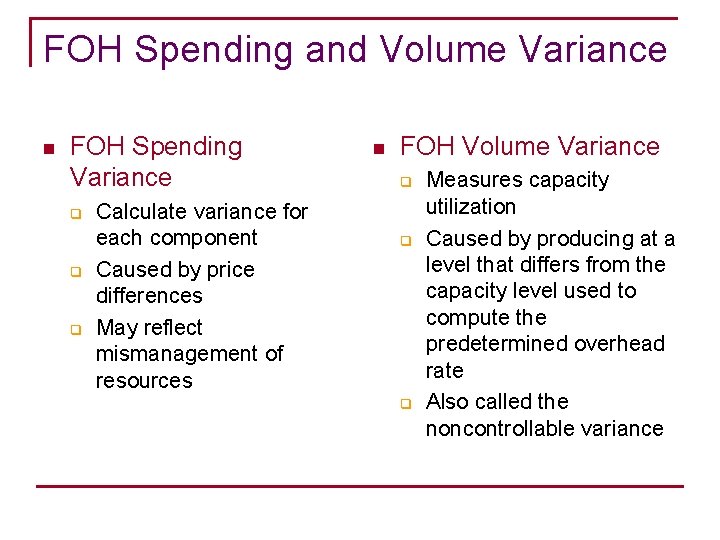

FOH Spending and Volume Variance n FOH Spending Variance q q q Calculate variance for each component Caused by price differences May reflect mismanagement of resources n FOH Volume Variance q q q Measures capacity utilization Caused by producing at a level that differs from the capacity level used to compute the predetermined overhead rate Also called the noncontrollable variance

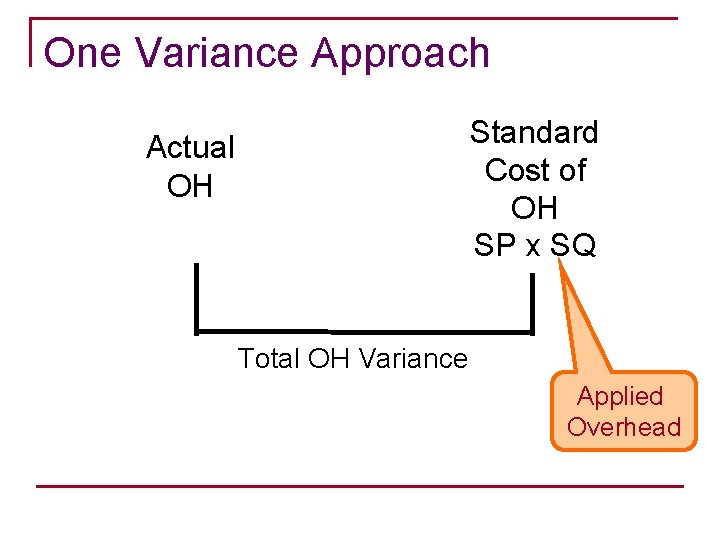

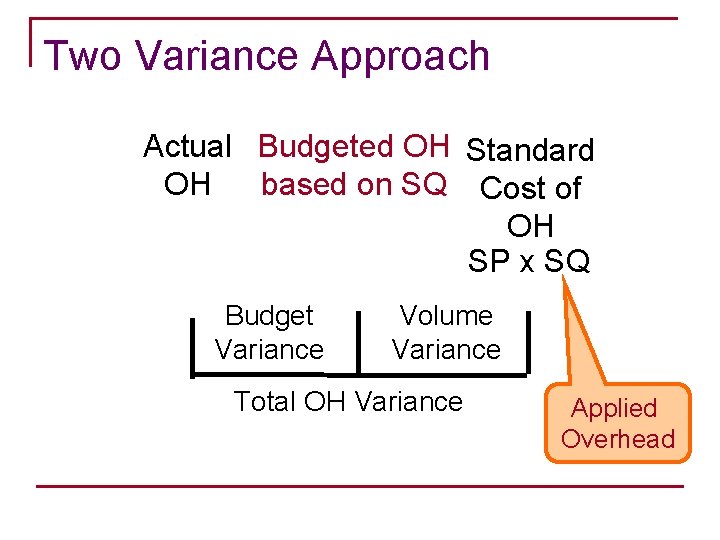

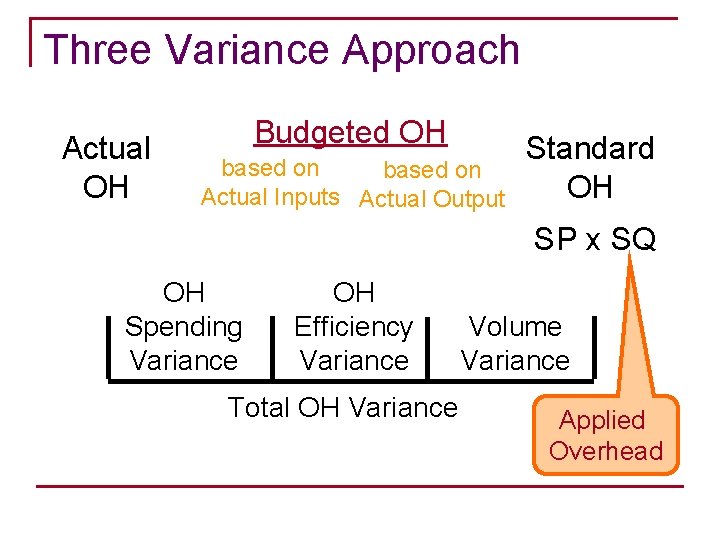

Alternative Overhead Variance Approaches One variance n Two variance n Three variance n Four variance n

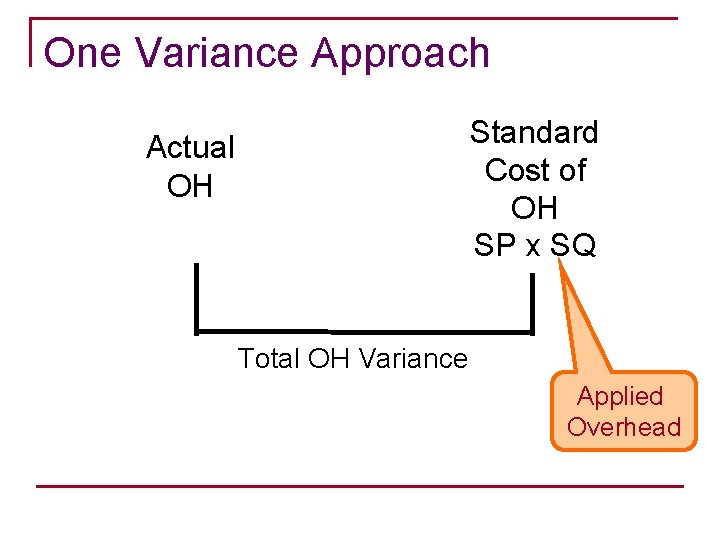

One Variance Approach Standard Cost of OH SP x SQ Actual OH Total OH Variance Applied Overhead

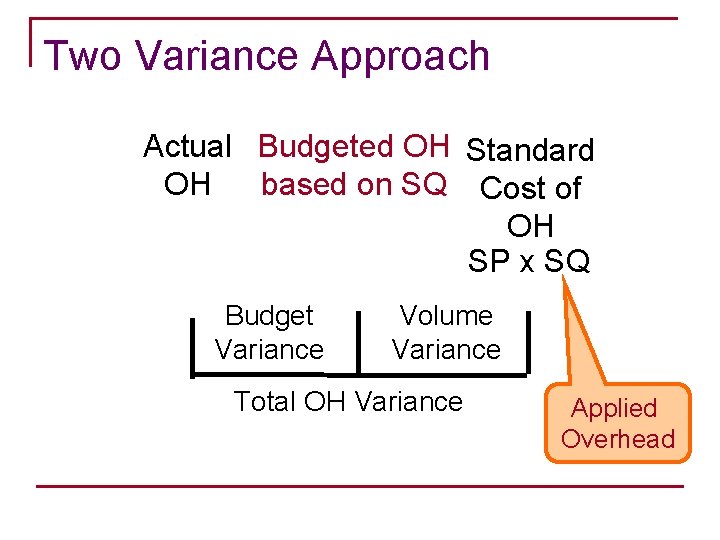

Two Variance Approach Actual Budgeted OH Standard OH based on SQ Cost of OH SP x SQ Budget Variance Volume Variance Total OH Variance Applied Overhead

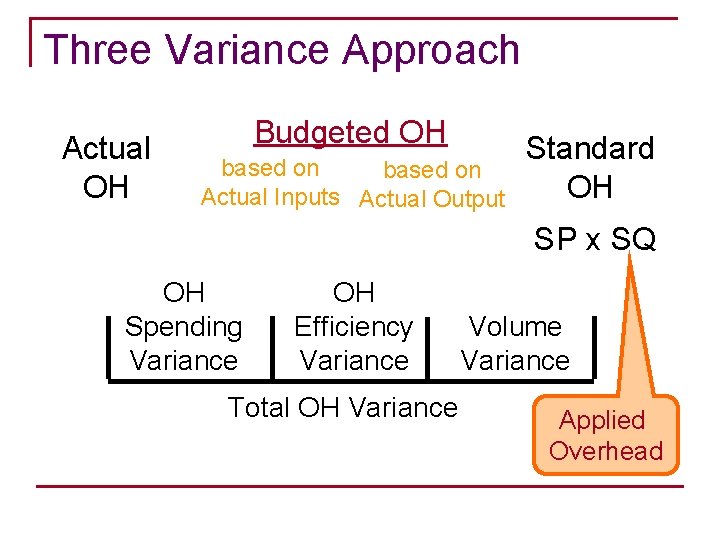

Three Variance Approach Actual OH Budgeted OH based on Actual Inputs Actual Output Standard OH SP x SQ OH Spending Variance OH Efficiency Variance Total OH Variance Volume Variance Applied Overhead

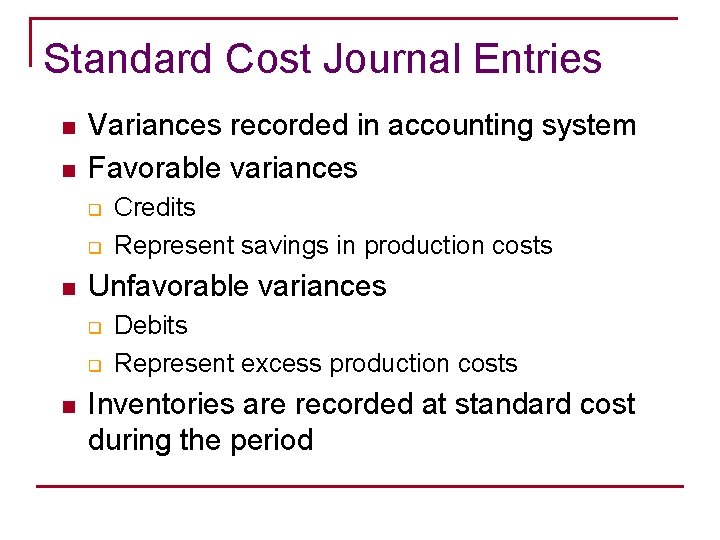

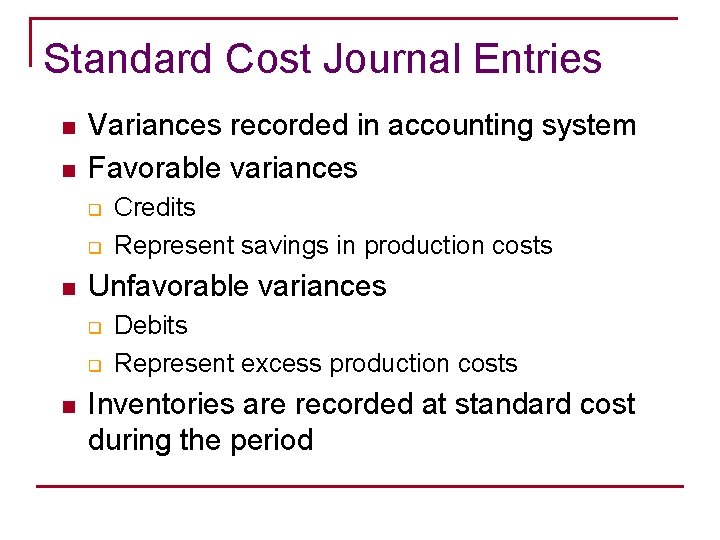

Standard Cost Journal Entries n n Variances recorded in accounting system Favorable variances q q n Unfavorable variances q q n Credits Represent savings in production costs Debits Represent excess production costs Inventories are recorded at standard cost during the period

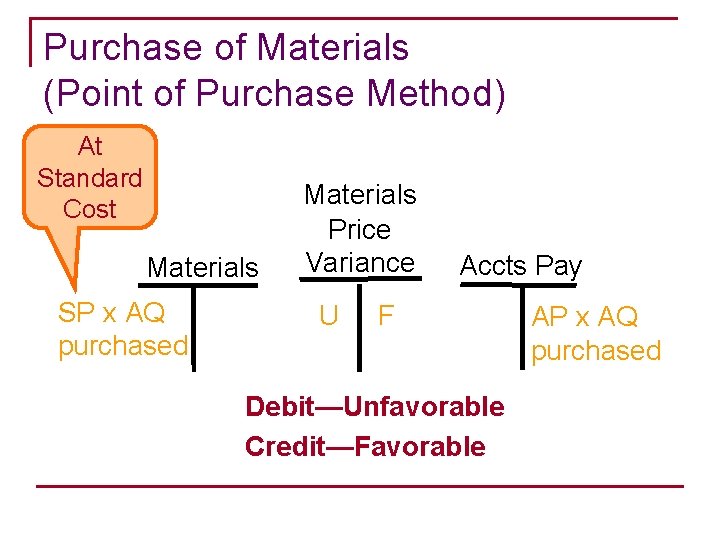

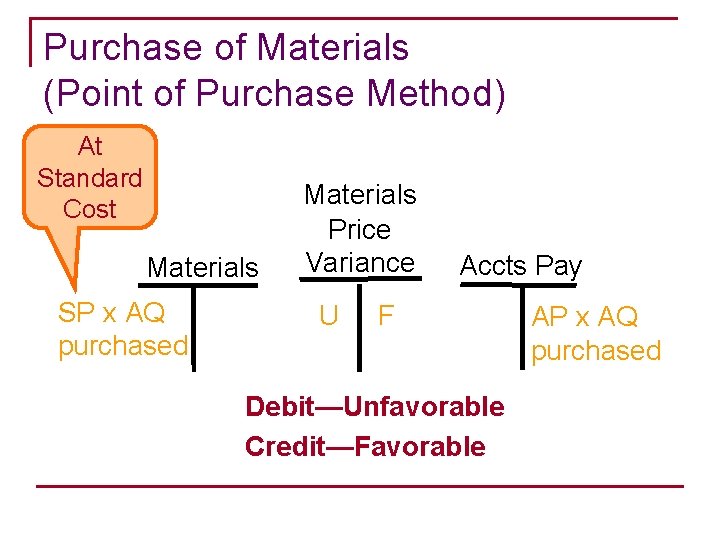

Purchase of Materials (Point of Purchase Method) At Standard Cost Materials SP x AQ purchased Materials Price Variance U Accts Pay F Debit—Unfavorable Credit—Favorable AP x AQ purchased

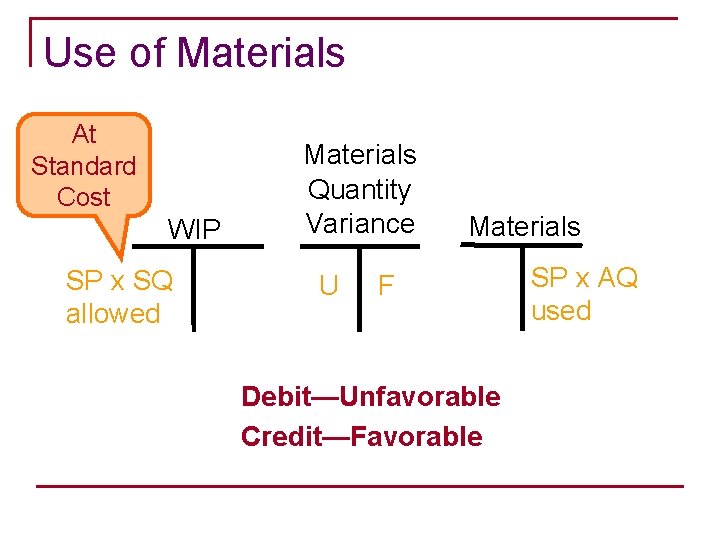

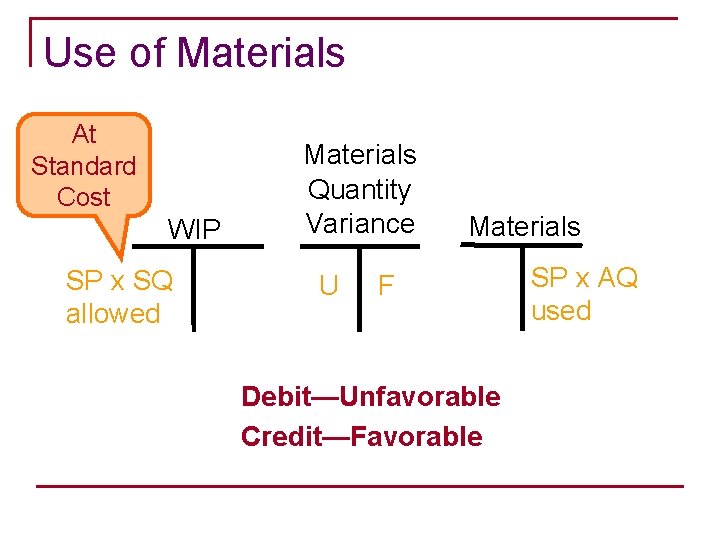

Use of Materials At Standard Cost WIP SP x SQ allowed Materials Quantity Variance U Materials F Debit—Unfavorable Credit—Favorable SP x AQ used

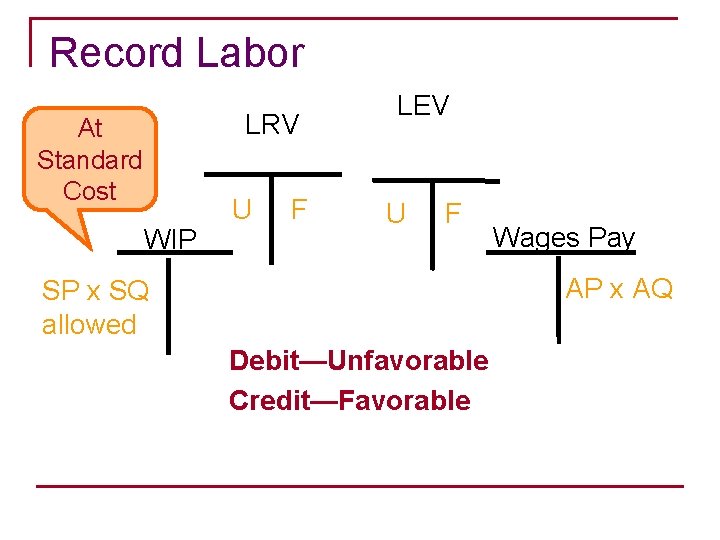

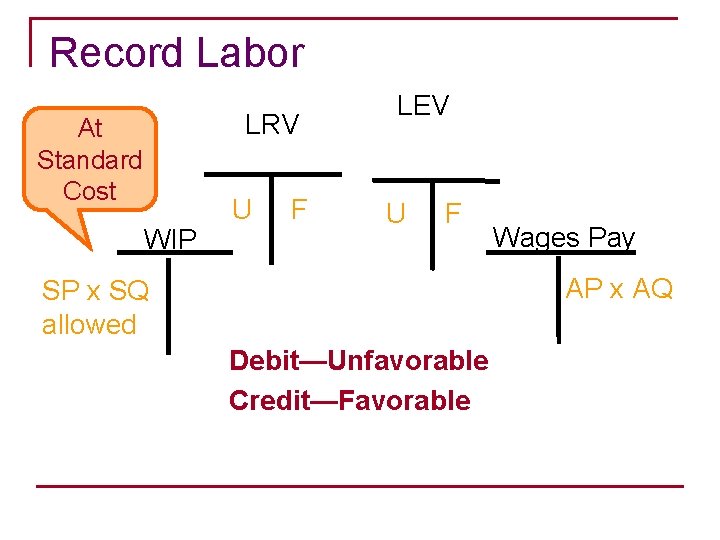

Record Labor LRV At Standard Cost WIP U F LEV U F Wages Pay AP x AQ SP x SQ allowed Debit—Unfavorable Credit—Favorable

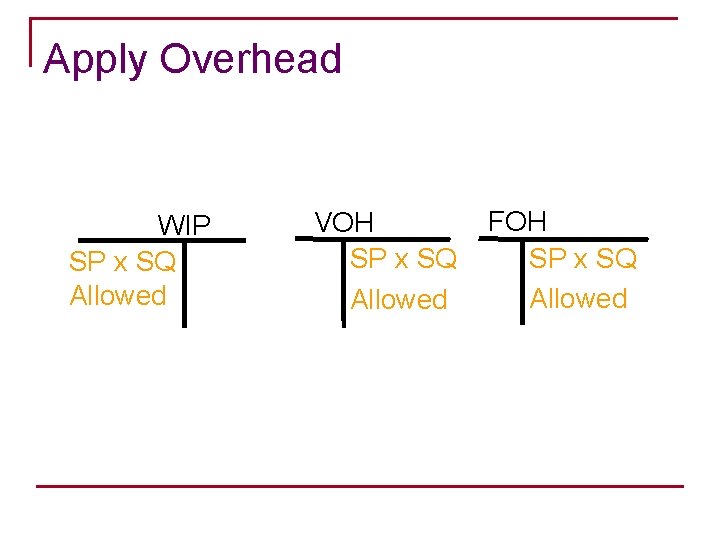

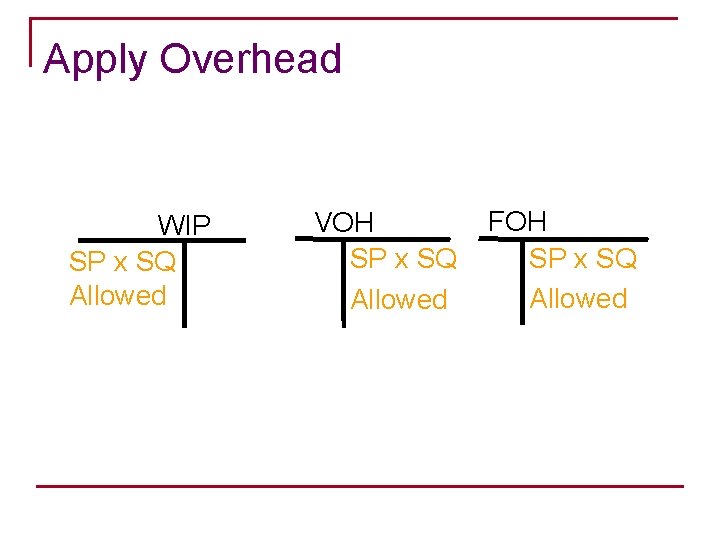

Apply Overhead WIP SP x SQ Allowed VOH SP x SQ Allowed FOH SP x SQ Allowed

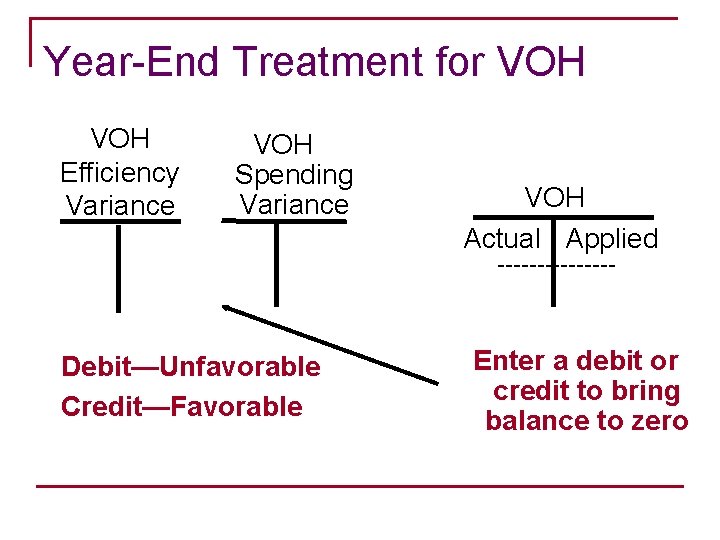

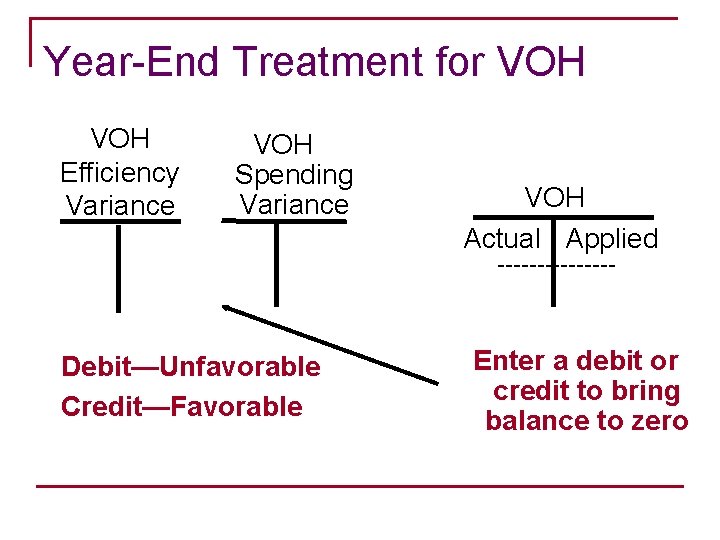

Year-End Treatment for VOH Efficiency Variance VOH Spending Variance VOH Actual Applied -------- Debit—Unfavorable Credit—Favorable Enter a debit or credit to bring balance to zero

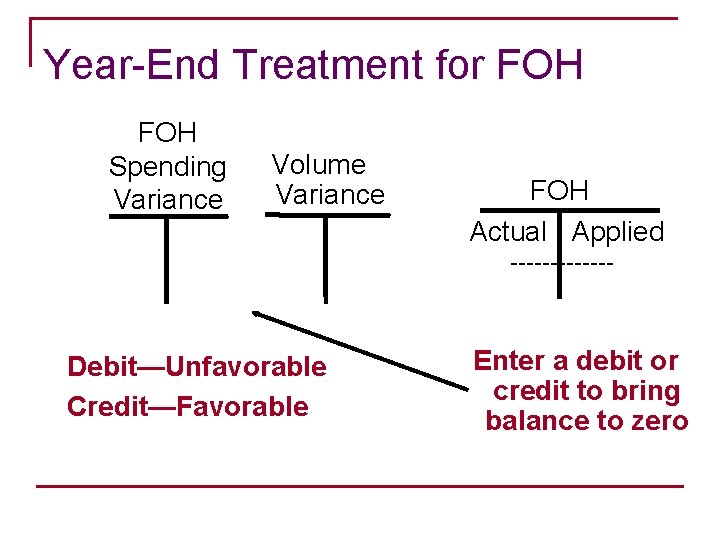

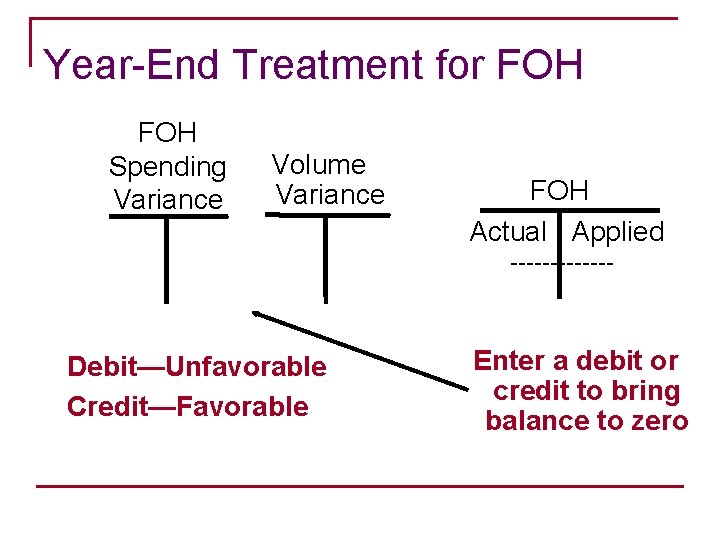

Year-End Treatment for FOH Spending Variance Volume Variance FOH Actual Applied ------- Debit—Unfavorable Credit—Favorable Enter a debit or credit to bring balance to zero

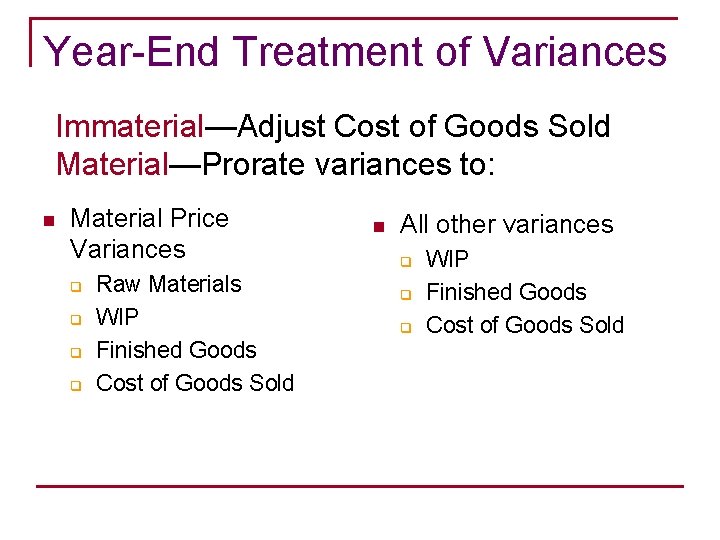

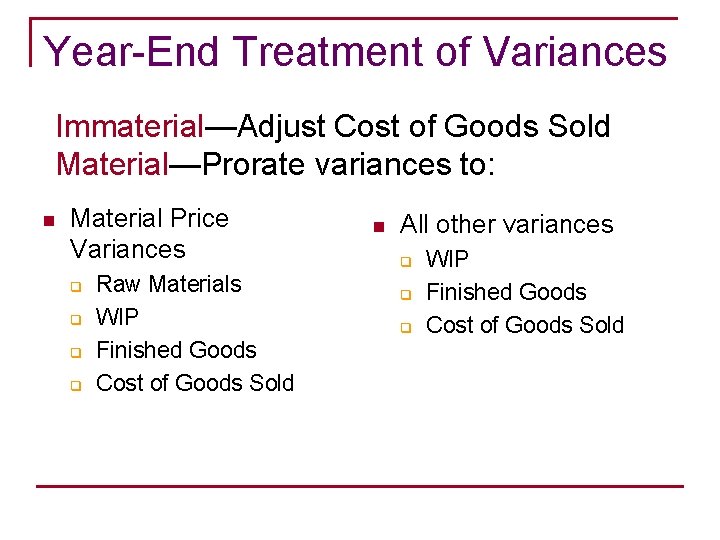

Year-End Treatment of Variances Immaterial—Adjust Cost of Goods Sold Material—Prorate variances to: n Material Price Variances q q Raw Materials WIP Finished Goods Cost of Goods Sold n All other variances q q q WIP Finished Goods Cost of Goods Sold

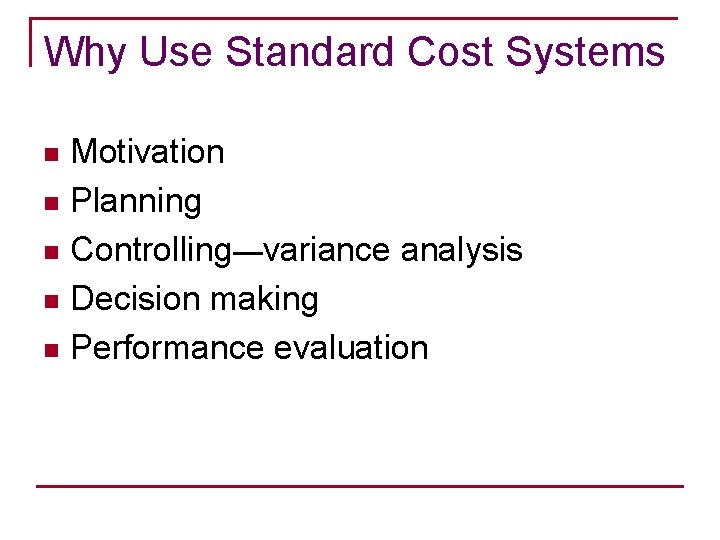

Why Use Standard Cost Systems Motivation n Planning n Controlling—variance analysis n Decision making n Performance evaluation n

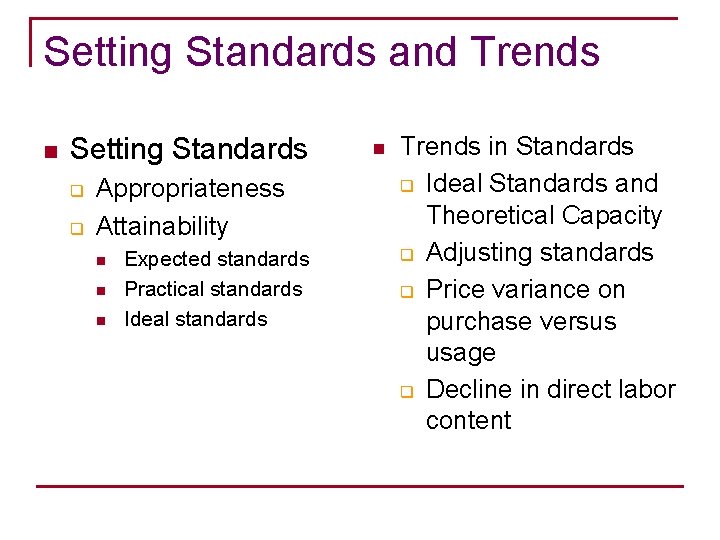

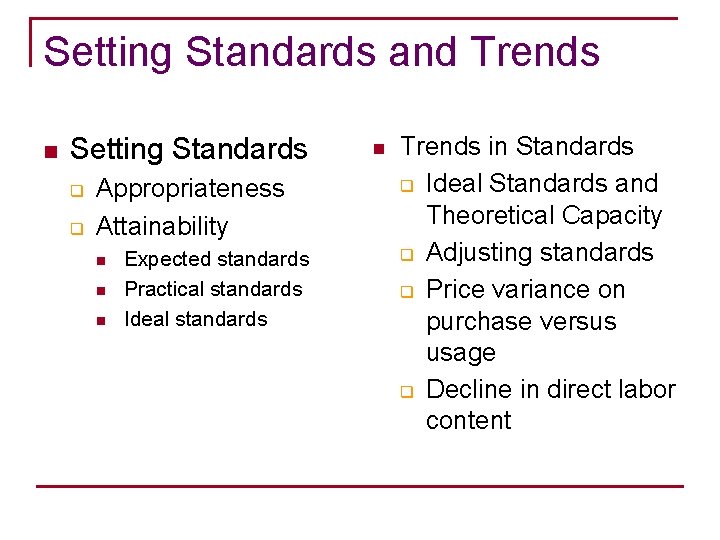

Setting Standards and Trends n Setting Standards q q Appropriateness Attainability n n n Expected standards Practical standards Ideal standards n Trends in Standards q Ideal Standards and Theoretical Capacity q Adjusting standards q Price variance on purchase versus usage q Decline in direct labor content

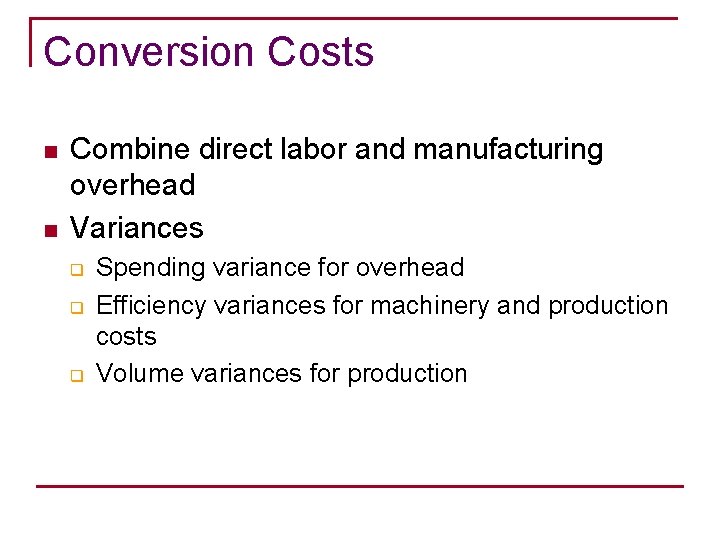

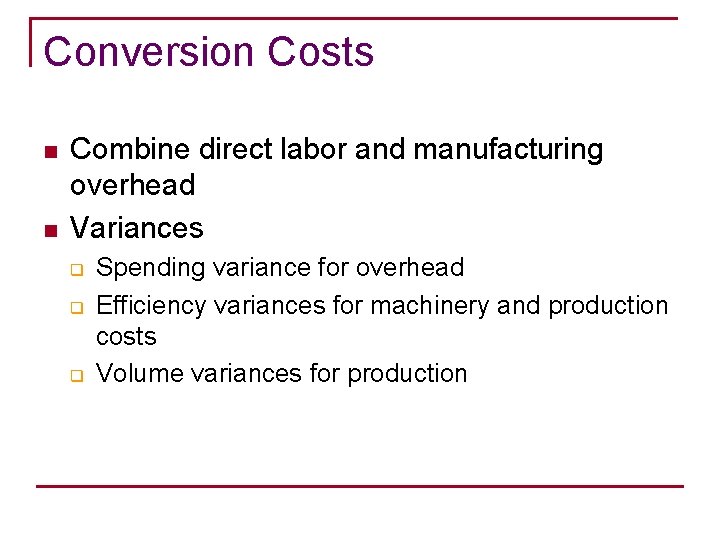

Conversion Costs n n Combine direct labor and manufacturing overhead Variances q q q Spending variance for overhead Efficiency variances for machinery and production costs Volume variances for production

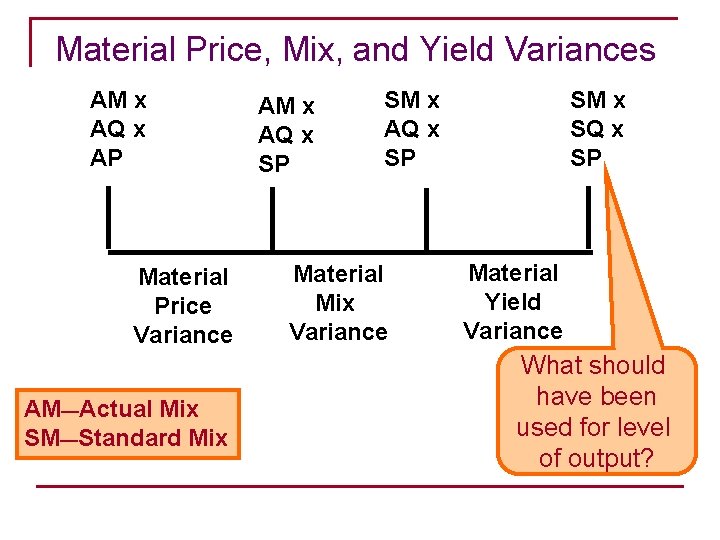

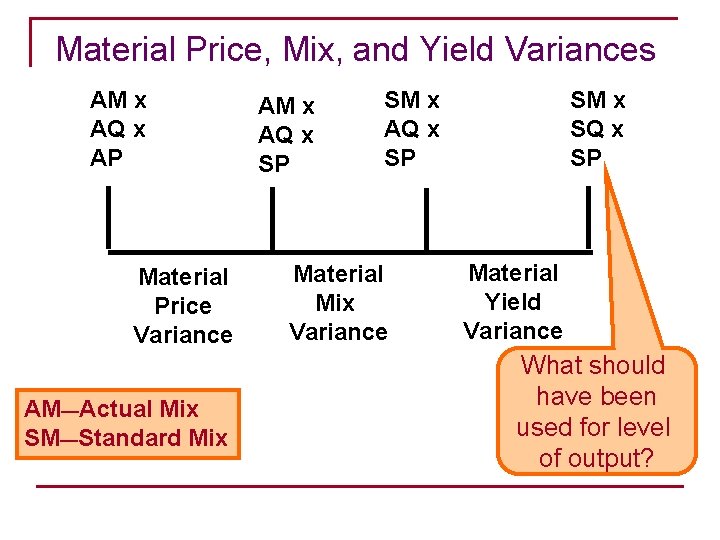

Material Price, Mix, and Yield Variances AM x AQ x AP Material Price Variance AM—Actual Mix SM—Standard Mix AM x AQ x SP SM x AQ x SP Material Mix Variance SM x SQ x SP Material Yield Variance What should have been used for level of output?

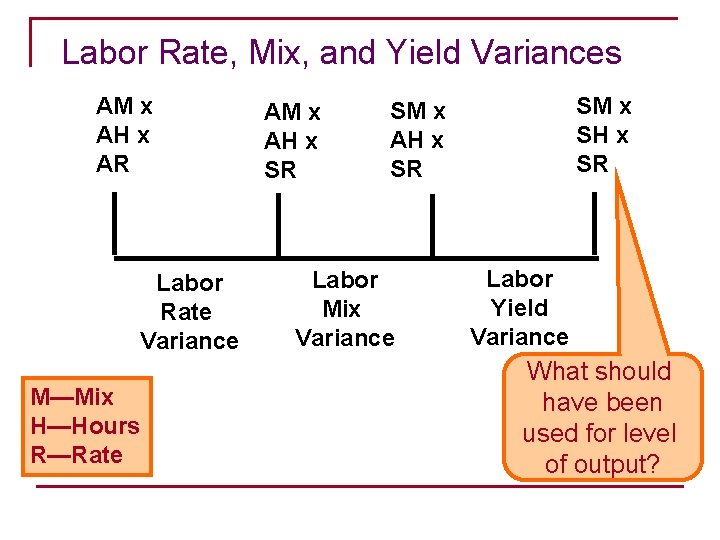

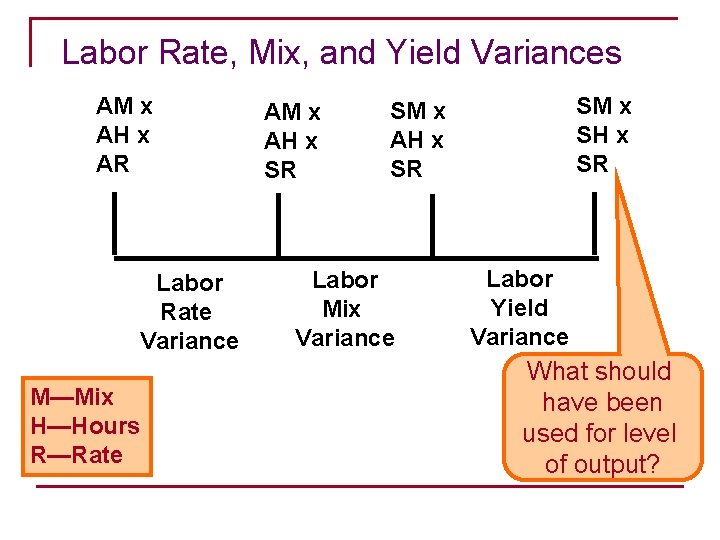

Labor Rate, Mix, and Yield Variances AM x AH x AR Labor Rate Variance M—Mix H—Hours R—Rate AM x AH x SR SM x SH x SR SM x AH x SR Labor Mix Variance Labor Yield Variance What should have been used for level of output?

Questions n n n How are standards set for material, labor, and overhead? How is variance analysis used for control and performance evaluation? Why are labor and overhead elements sometimes combined into a single conversion element?

Potential Ethical Issues n n n Setting high standards to create favorable variances Ignoring effects of one production area on another Setting overhead rates too low based on high production levels to distort inventory cost and operating income Producing inventory only to create a favorable volume variance Not updating standards so that favorable variances are created Using low quality materials or labor to create favorable variances and low quality products