Chapter 7 Corporations Reorganizations Corporations Partnerships Estates Trusts

- Slides: 45

Chapter 7 Corporations: Reorganizations Corporations, Partnerships, Estates & Trusts Copyright © 2008 South-Western/Thomson Learning

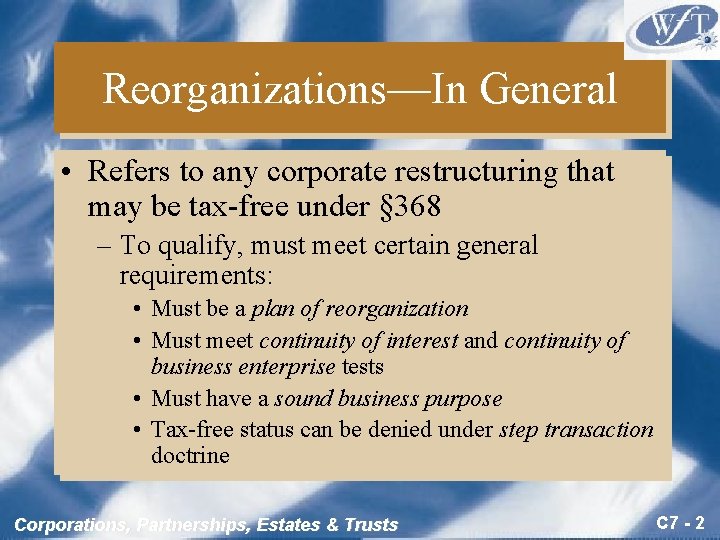

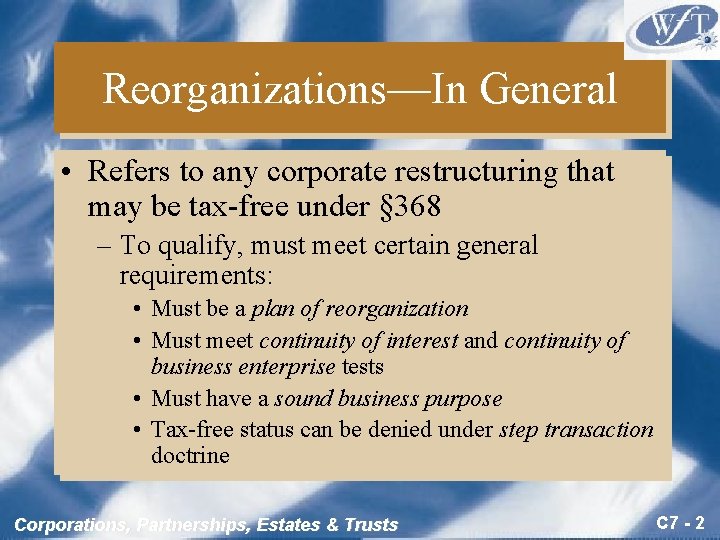

Reorganizations—In General • Refers to any corporate restructuring that may be tax-free under § 368 – To qualify, must meet certain general requirements: • Must be a plan of reorganization • Must meet continuity of interest and continuity of business enterprise tests • Must have a sound business purpose • Tax-free status can be denied under step transaction doctrine Corporations, Partnerships, Estates & Trusts C 7 - 2

Summary of Different Types of Reorganizations • The term reorganization includes: – – – – Statutory merger or consolidation Stock for stock exchange Stock for assets exchange Divisive exchange Recapitalization Change in identity, form, or place of organization Transfers in bankruptcy or receivership Corporations, Partnerships, Estates & Trusts C 7 - 3

Tax Free Reorganization Consequences, in General (slide 1 of 3) • Consequences to Acquiring Corporation – No gain or loss recognized unless it transfers property to the Target corporation as part of the transaction • Then gain, but not loss, may be recognized – Basis of property received retains basis it had in hands of Target corp plus any gain recognized by the target Corporations, Partnerships, Estates & Trusts C 7 - 4

Tax Free Reorganization Consequences, in General (slide 2 of 3) • Consequences to Target Corporation – No gain or loss unless it retains “other property” received in the exchange or it distributes its own property to shareholders • Other property is defined as anything received other than stock or securities – Treated as boot • Gain, but not loss, may be recognized Corporations, Partnerships, Estates & Trusts C 7 - 5

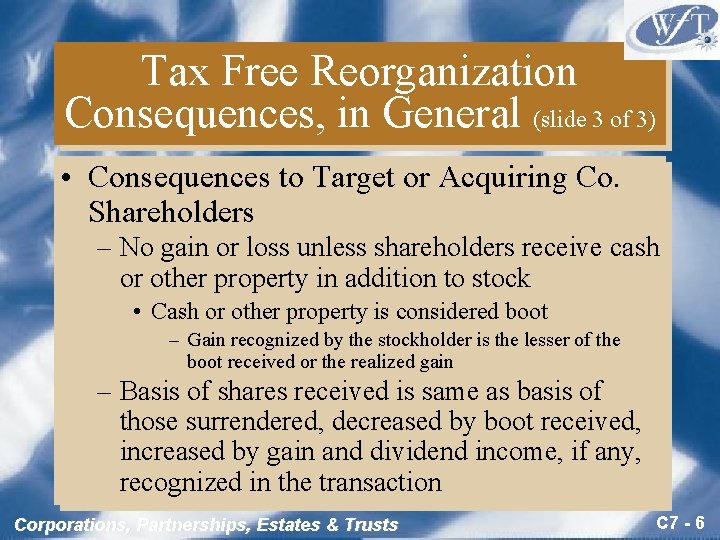

Tax Free Reorganization Consequences, in General (slide 3 of 3) • Consequences to Target or Acquiring Co. Shareholders – No gain or loss unless shareholders receive cash or other property in addition to stock • Cash or other property is considered boot – Gain recognized by the stockholder is the lesser of the boot received or the realized gain – Basis of shares received is same as basis of those surrendered, decreased by boot received, increased by gain and dividend income, if any, recognized in the transaction Corporations, Partnerships, Estates & Trusts C 7 - 6

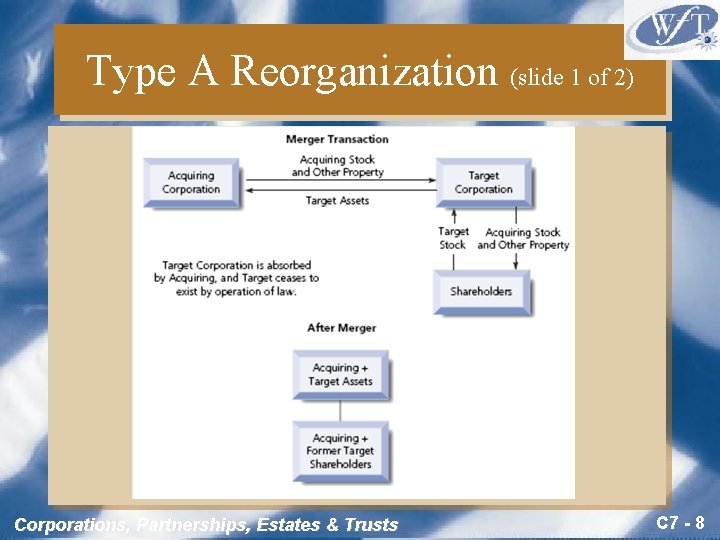

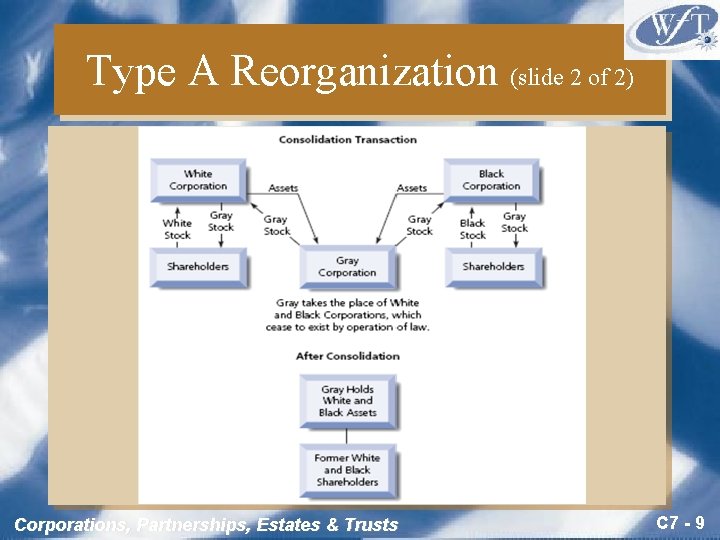

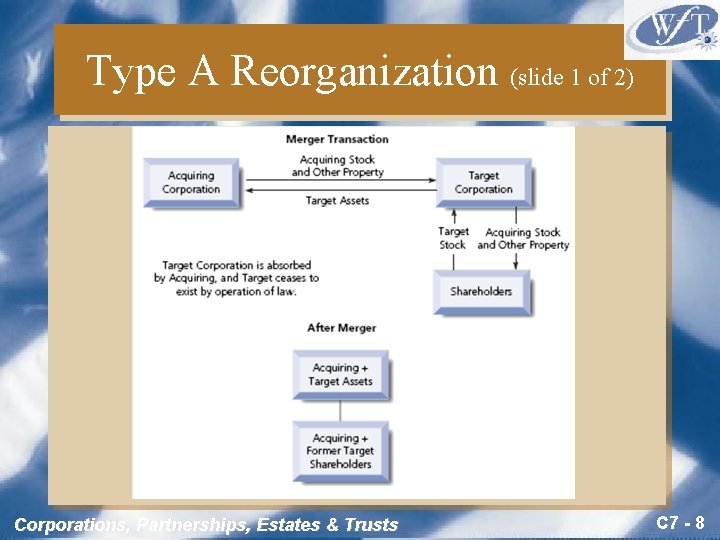

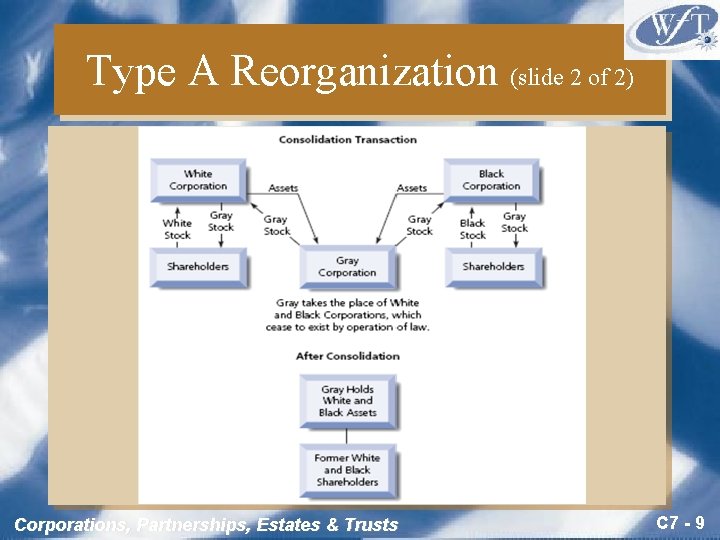

Type A Reorganization • Includes mergers and consolidations – Merger is union of two or more corporations • One corporation retains it existence and absorbs the others – Consolidation occurs when a new corporation is created to take the place of two or more corporations Corporations, Partnerships, Estates & Trusts C 7 - 7

Type A Reorganization (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 8

Type A Reorganization (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 9

Type A Reorganization Issues (slide 1 of 2) • Advantages: – Type A reorganization is flexible – Consideration need not be voting stock – Money or other property can be transferred without disqualifying the transaction, as long as “continuity of interest” is met (at least 50% of consideration used in reorganization must be stock) Corporations, Partnerships, Estates & Trusts C 7 - 10

Type A Reorganization Issues (slide 2 of 2) • Disadvantages: – Money or other property transferred is “boot” so some gain may be required to be recognized – Shareholders of either entity may dissent; in most states their shares must be redeemed – Acquiring entity must assume all liabilities of Target Corporations, Partnerships, Estates & Trusts C 7 - 11

Type B Reorganization (Stock-for-Stock Reorganization) Corporations, Partnerships, Estates & Trusts C 7 - 12

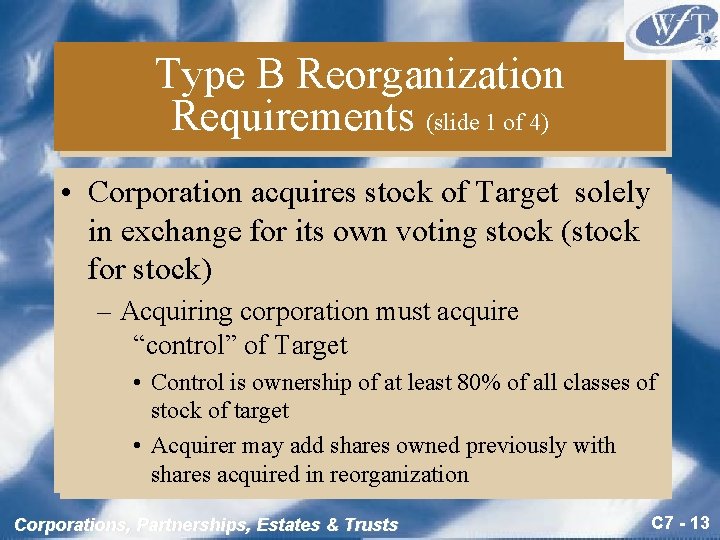

Type B Reorganization Requirements (slide 1 of 4) • Corporation acquires stock of Target solely in exchange for its own voting stock (stock for stock) – Acquiring corporation must acquire “control” of Target • Control is ownership of at least 80% of all classes of stock of target • Acquirer may add shares owned previously with shares acquired in reorganization Corporations, Partnerships, Estates & Trusts C 7 - 13

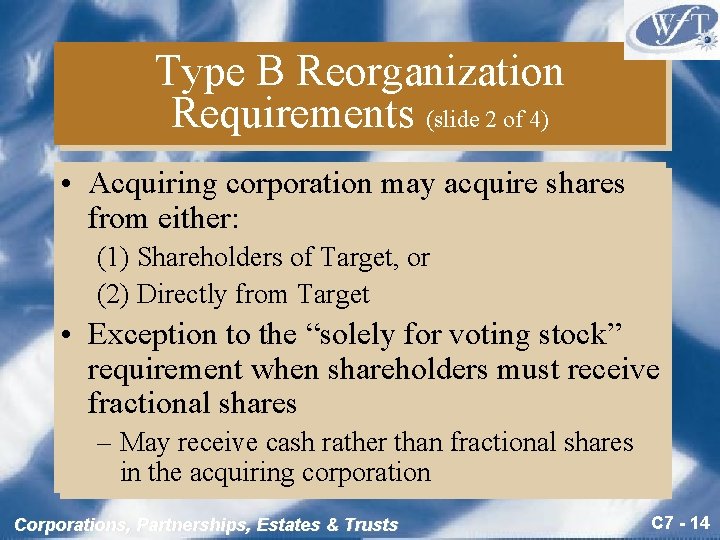

Type B Reorganization Requirements (slide 2 of 4) • Acquiring corporation may acquire shares from either: (1) Shareholders of Target, or (2) Directly from Target • Exception to the “solely for voting stock” requirement when shareholders must receive fractional shares – May receive cash rather than fractional shares in the acquiring corporation Corporations, Partnerships, Estates & Trusts C 7 - 14

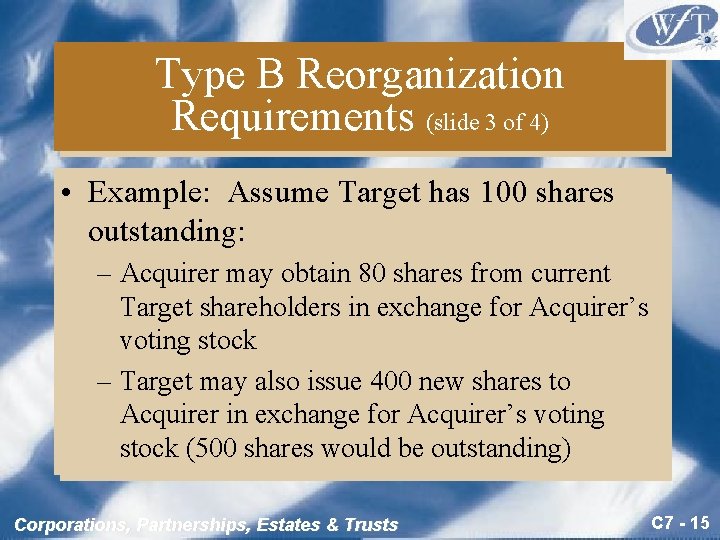

Type B Reorganization Requirements (slide 3 of 4) • Example: Assume Target has 100 shares outstanding: – Acquirer may obtain 80 shares from current Target shareholders in exchange for Acquirer’s voting stock – Target may also issue 400 new shares to Acquirer in exchange for Acquirer’s voting stock (500 shares would be outstanding) Corporations, Partnerships, Estates & Trusts C 7 - 15

Type B Reorganization Requirements (slide 4 of 4) • Consideration paid by Acquirer can only include Acquirer’s voting stock or transaction does not qualify Corporations, Partnerships, Estates & Trusts C 7 - 16

Type C Reorganization (Stock-for-Assets Reorganization) Corporations, Partnerships, Estates & Trusts C 7 - 17

Type C Reorganization Requirements (slide 1 of 3) • A ‘‘Type C’’ reorganization is essentially an exchange of voting stock for assets followed by liquidation of the target corporation – Called a “Stock-for-Assets” reorganization – Transfer is generally between the entities, not the shareholders Corporations, Partnerships, Estates & Trusts C 7 - 18

Type C Reorganization Requirements (slide 2 of 3) • Consideration paid by Acquirer normally consists only of voting stock – However, if at least 80% of FMV of Target is acquired with voting stock, cash or other property can be used for remainder – Limitation: liabilities assumed by Acquirer are considered “other property” if any additional “other property” is used Corporations, Partnerships, Estates & Trusts C 7 - 19

Type C Reorganization Requirements (slide 3 of 3) • “Substantially all” of Target’s assets must be transferred to Acquirer • There is no statutory definition of ‘‘substantially all’’ – To receive a favorable ruling from the IRS, the target must transfer at least 90% of net asset value or 70% of the gross asset value to the acquiring corporation Corporations, Partnerships, Estates & Trusts C 7 - 20

Type D Reorganization (slide 1 of 4) • Generally a mechanism for corporate division – Called a “divisive reorganization” but can be used to carry out a corporate combination – In a Type D acquisitive reorganization • Entity transferring assets is considered the acquiring corporation • Corporation receiving the property is the target Corporations, Partnerships, Estates & Trusts C 7 - 21

Type D Reorganization (slide 2 of 4) • In an acquisitive Type D reorganization – Substantially all of acquiring corp’s property must be transferred to target corporation – The acquiring corp must be in control (at least 50%) of the target – Target stock received by the acquiring corp and any remaining assets of acquiring corp must be distributed to its shareholders – Acquiring corporation must liquidate Corporations, Partnerships, Estates & Trusts C 7 - 22

Type D Reorganization (slide 3 of 4) • In a divisive Type D reorganization – A corporation is divided – One or more new corps are formed to receive assets of original corp – Original corp must receive stock representing control (80%) of new corps – Stock of new corps is then distributed to shareholders of original corp Corporations, Partnerships, Estates & Trusts C 7 - 23

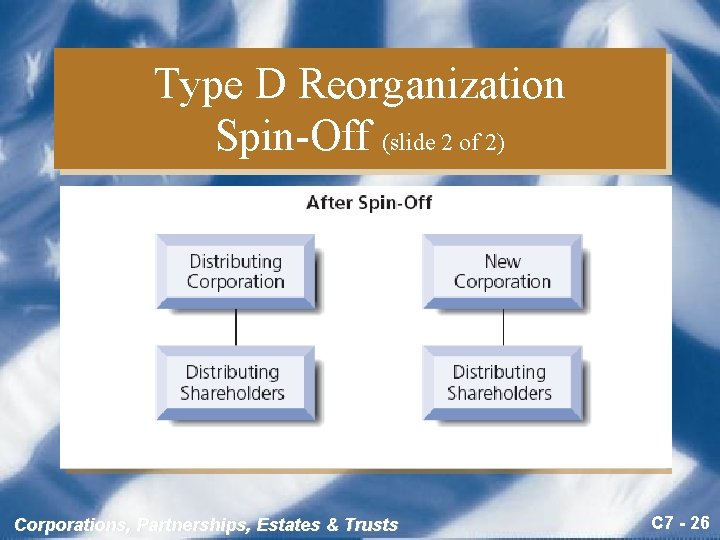

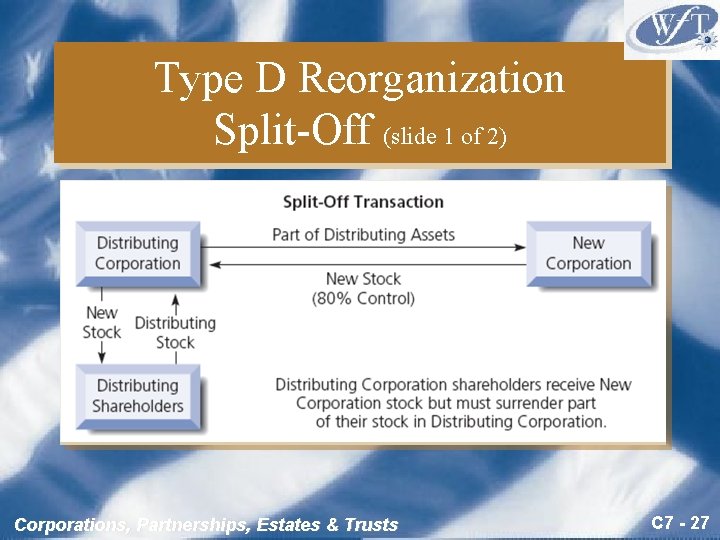

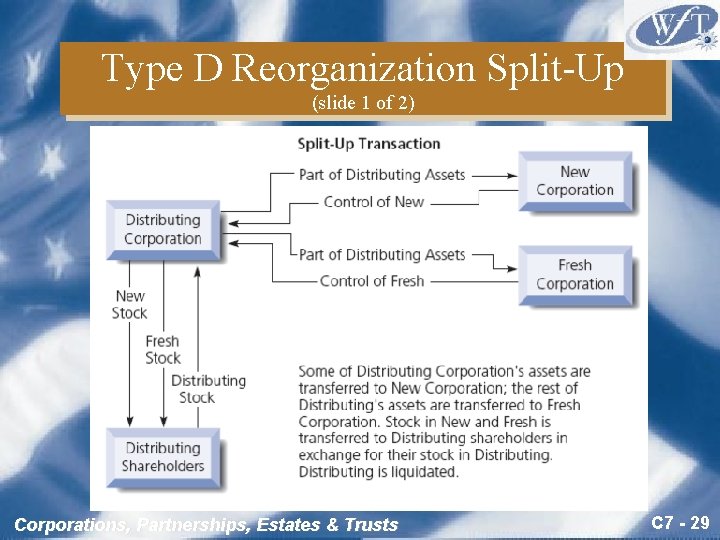

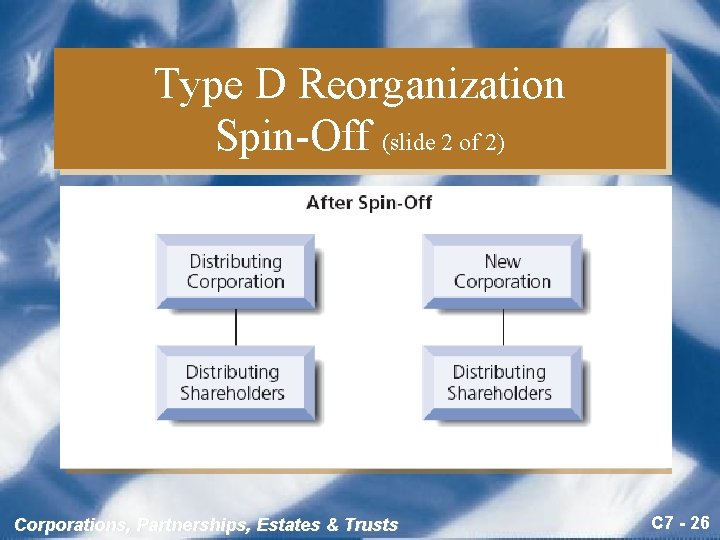

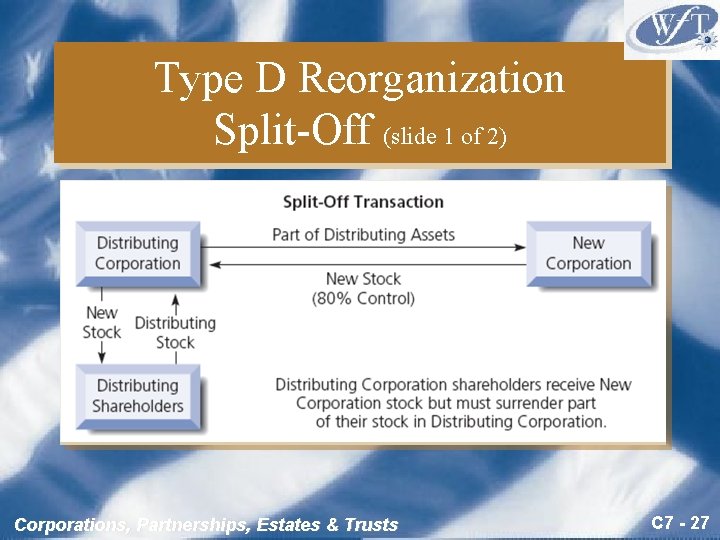

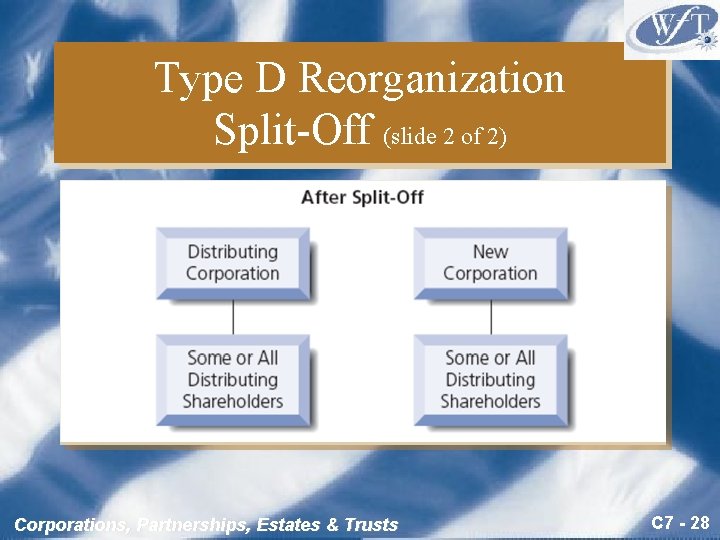

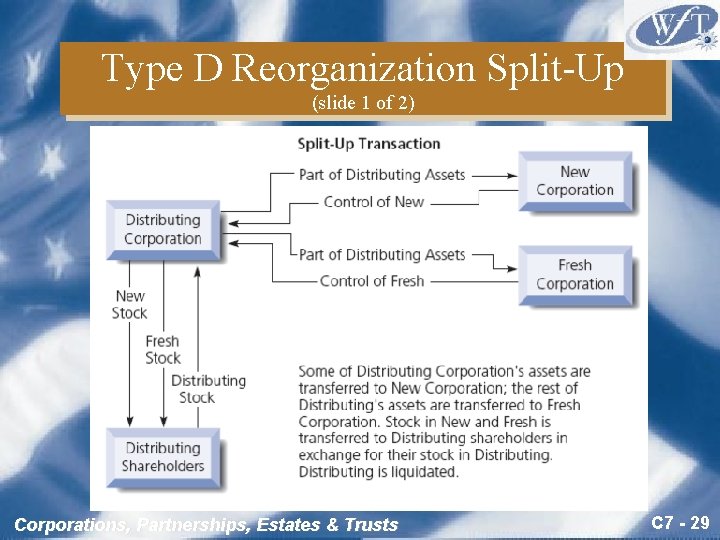

Type D Reorganization (slide 4 of 4) • Three types of divisive “Type D” reorganizations – Spin-Off and Split-Off • A new corporation is formed to receive some of the assets of the original corporation in exchange for the new corporation's stock – Split-Up • Two or more corporations are formed to receive substantially all of the assets of the original corporation Corporations, Partnerships, Estates & Trusts C 7 - 24

Type D Reorganization Spin-Off (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 25

Type D Reorganization Spin-Off (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 26

Type D Reorganization Split-Off (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 27

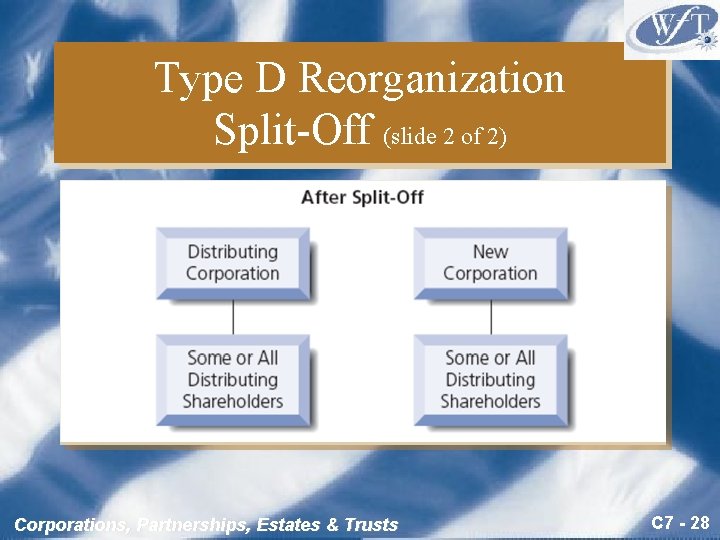

Type D Reorganization Split-Off (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 28

Type D Reorganization Split-Up (slide 1 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 29

Type D Reorganization Split-Up (slide 2 of 2) Corporations, Partnerships, Estates & Trusts C 7 - 30

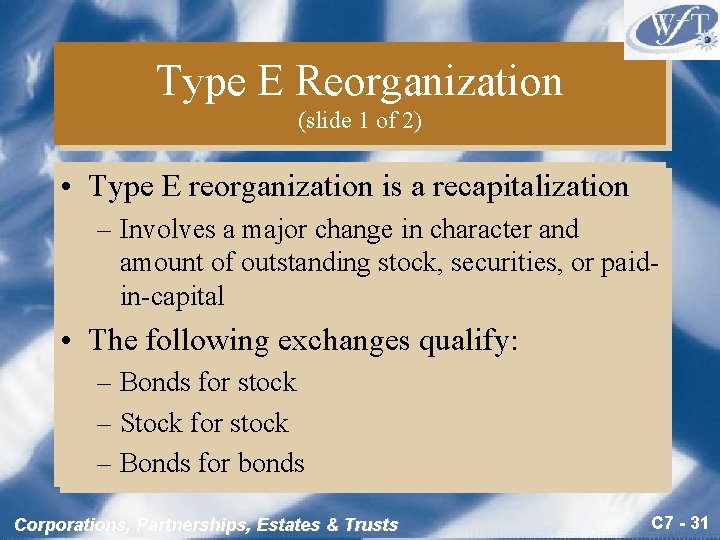

Type E Reorganization (slide 1 of 2) • Type E reorganization is a recapitalization – Involves a major change in character and amount of outstanding stock, securities, or paidin-capital • The following exchanges qualify: – Bonds for stock – Stock for stock – Bonds for bonds Corporations, Partnerships, Estates & Trusts C 7 - 31

Type E Reorganization (slide 2 of 2) • Corporation can exchange its common stock for preferred stock or its preferred stock for common stock tax-free – The exchange of bonds for other bonds is taxfree when the debt received has a principal amount that is not more than the surrendered debt’s principal amount Corporations, Partnerships, Estates & Trusts C 7 - 32

Type F Reorganization • A mere change in identity, form, or place of organization, however effected – Restricted to a single operating corporation – Tax characteristics of predecessor corp carry over to successor corp – Does not jeopardize status of § 1244 stock or terminate a valid S corp election Corporations, Partnerships, Estates & Trusts C 7 - 33

Type G Reorganization • All or part of assets of debtor corp are transferred to an acquiring corp in bankruptcy – Debtor corp’s creditors must receive voting stock of the acquiring corp in exchange for debt representing 80% or more of total FMV of debtor corp Corporations, Partnerships, Estates & Trusts C 7 - 34

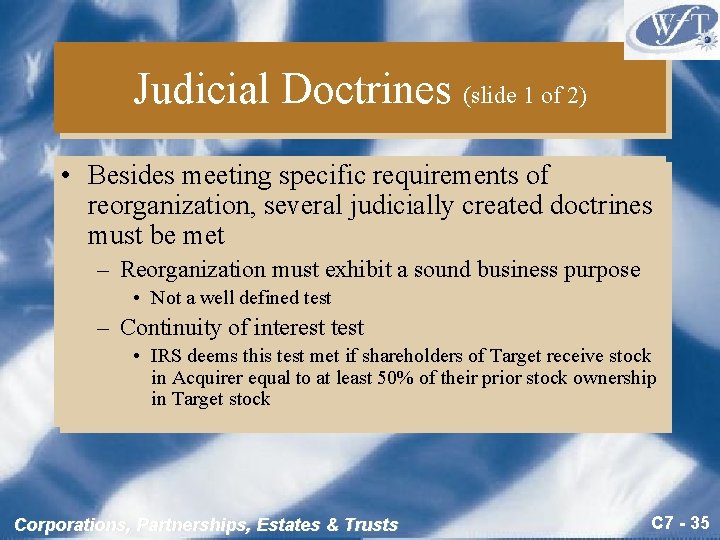

Judicial Doctrines (slide 1 of 2) • Besides meeting specific requirements of reorganization, several judicially created doctrines must be met – Reorganization must exhibit a sound business purpose • Not a well defined test – Continuity of interest test • IRS deems this test met if shareholders of Target receive stock in Acquirer equal to at least 50% of their prior stock ownership in Target stock Corporations, Partnerships, Estates & Trusts C 7 - 35

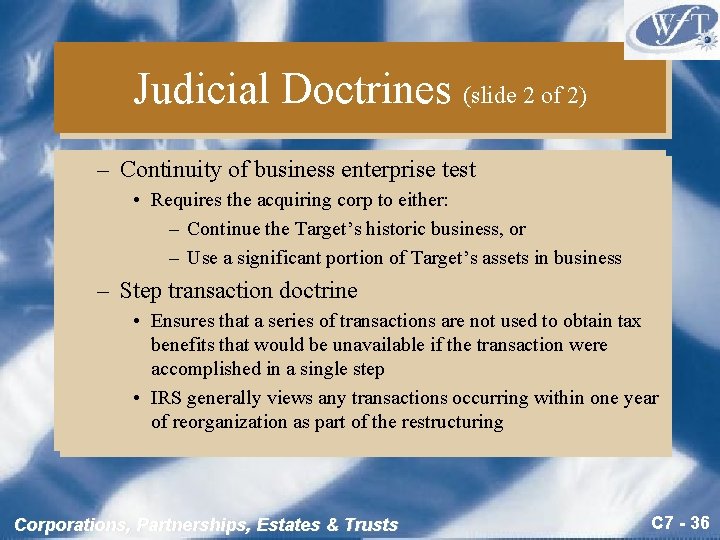

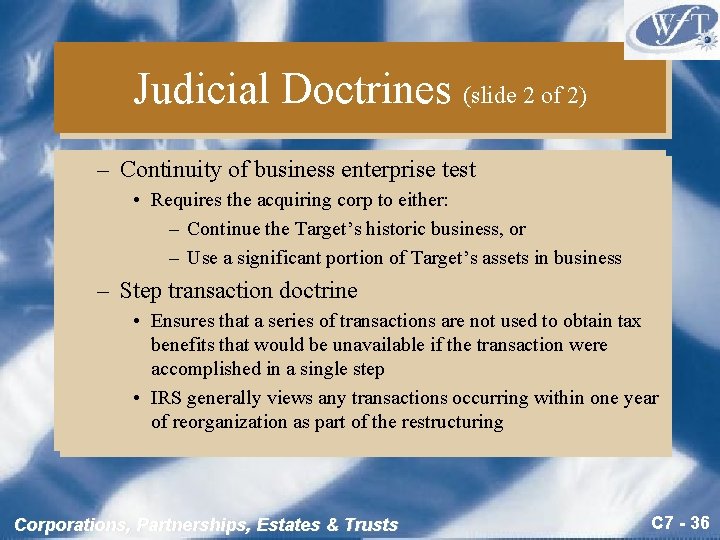

Judicial Doctrines (slide 2 of 2) – Continuity of business enterprise test • Requires the acquiring corp to either: – Continue the Target’s historic business, or – Use a significant portion of Target’s assets in business – Step transaction doctrine • Ensures that a series of transactions are not used to obtain tax benefits that would be unavailable if the transaction were accomplished in a single step • IRS generally views any transactions occurring within one year of reorganization as part of the restructuring Corporations, Partnerships, Estates & Trusts C 7 - 36

Carryover of Corporate Tax Attributes (slide 1 of 4) • Assumption of liabilities – Acquiring corp either assumes liabilities of Target or takes property subject to liabilities • Allowance of Carryovers – In Type A, C, acquisitive D, and G reorganizations, the Target’s tax attributes are acquired – In Type B reorganizations, Target retains its assets and tax attributes Corporations, Partnerships, Estates & Trusts C 7 - 37

Carryover of Corporate Tax Attributes (slide 2 of 4) • NOL Carryovers – Amount of NOL that can be used in year ownership change occurs is limited to a percentage representing the remaining days in the tax year over the total number of days in the year Corporations, Partnerships, Estates & Trusts C 7 - 38

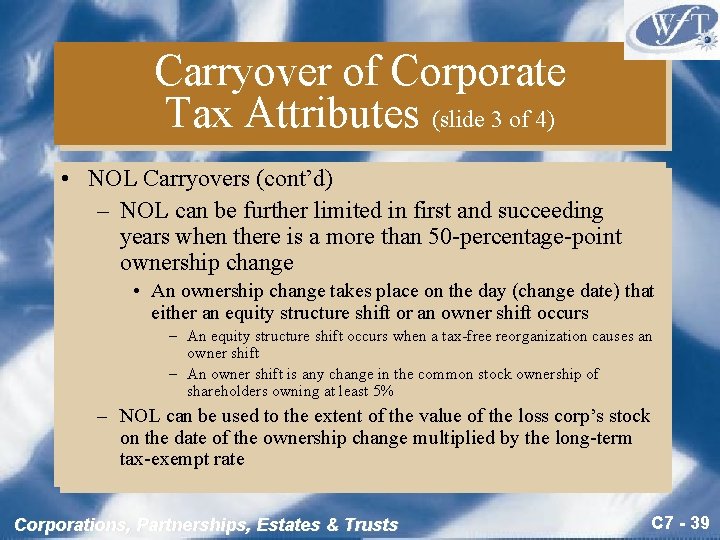

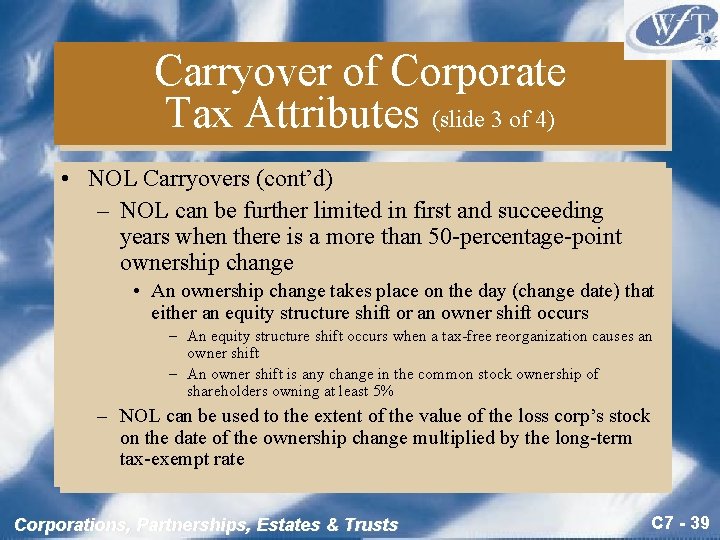

Carryover of Corporate Tax Attributes (slide 3 of 4) • NOL Carryovers (cont’d) – NOL can be further limited in first and succeeding years when there is a more than 50 -percentage-point ownership change • An ownership change takes place on the day (change date) that either an equity structure shift or an owner shift occurs – An equity structure shift occurs when a tax-free reorganization causes an owner shift – An owner shift is any change in the common stock ownership of shareholders owning at least 5% – NOL can be used to the extent of the value of the loss corp’s stock on the date of the ownership change multiplied by the long-term tax-exempt rate Corporations, Partnerships, Estates & Trusts C 7 - 39

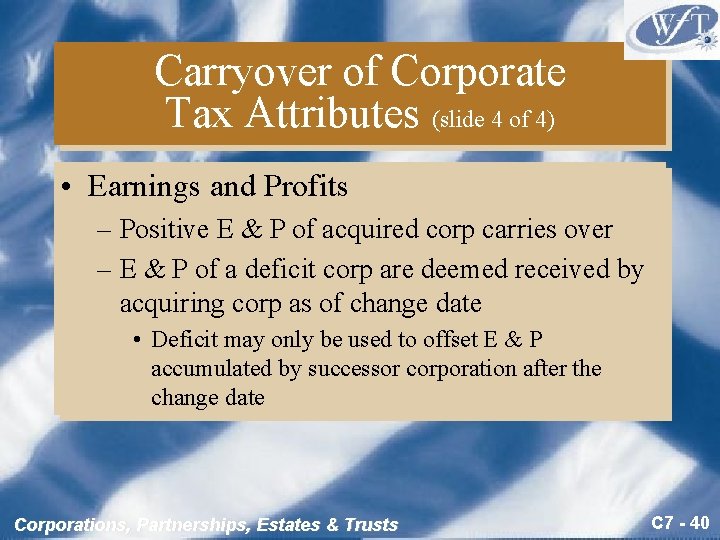

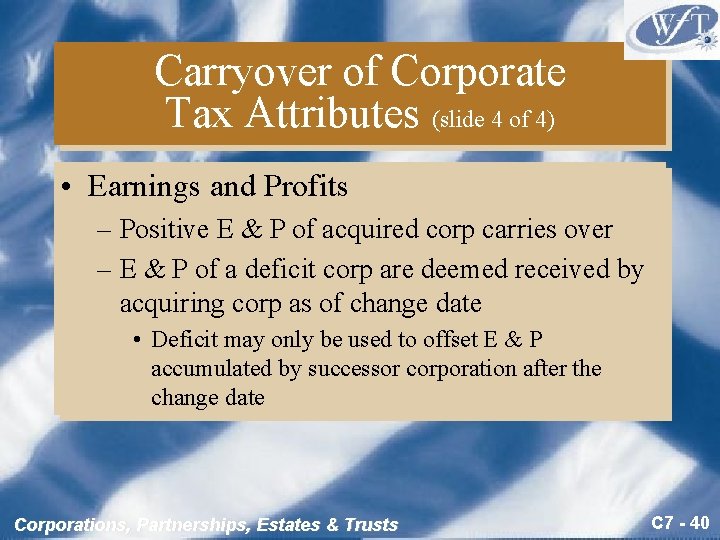

Carryover of Corporate Tax Attributes (slide 4 of 4) • Earnings and Profits – Positive E & P of acquired corp carries over – E & P of a deficit corp are deemed received by acquiring corp as of change date • Deficit may only be used to offset E & P accumulated by successor corporation after the change date Corporations, Partnerships, Estates & Trusts C 7 - 40

Comparison of Reorganization Types (slide 1 of 5) Corporations, Partnerships, Estates & Trusts C 7 - 41

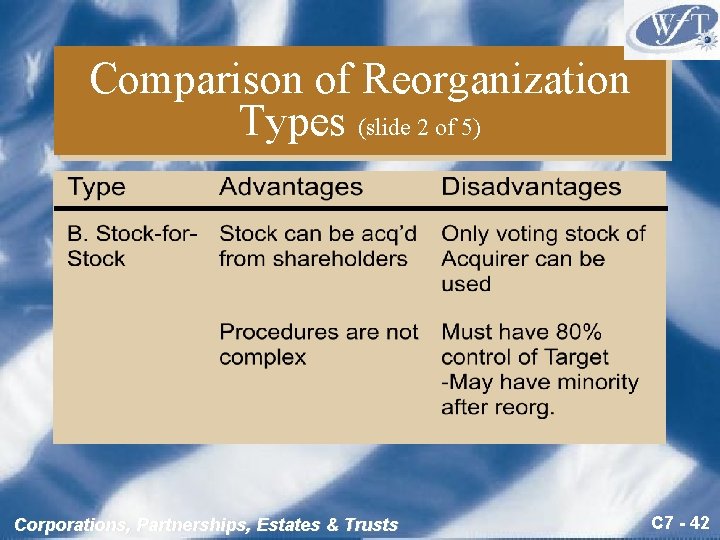

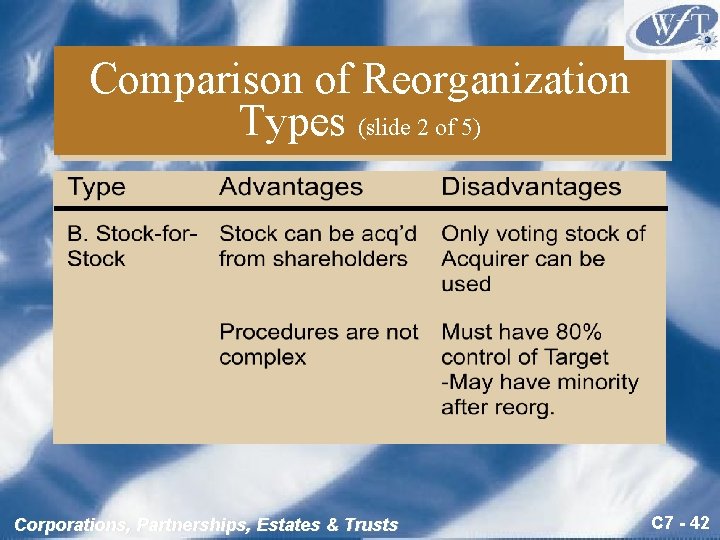

Comparison of Reorganization Types (slide 2 of 5) Corporations, Partnerships, Estates & Trusts C 7 - 42

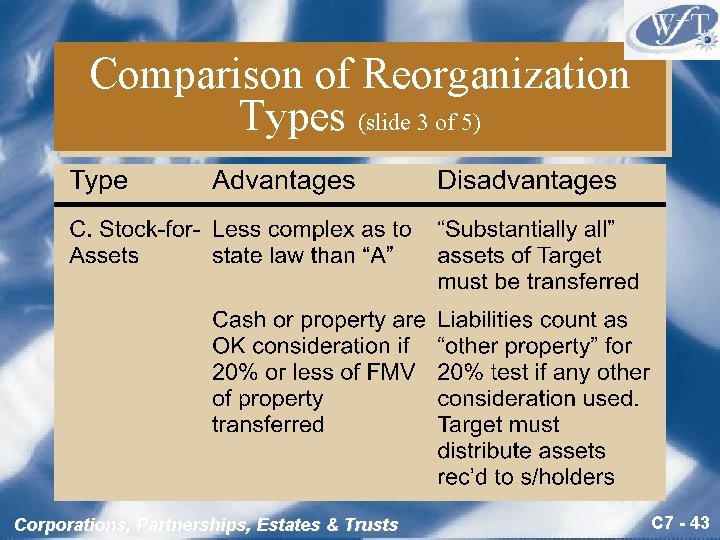

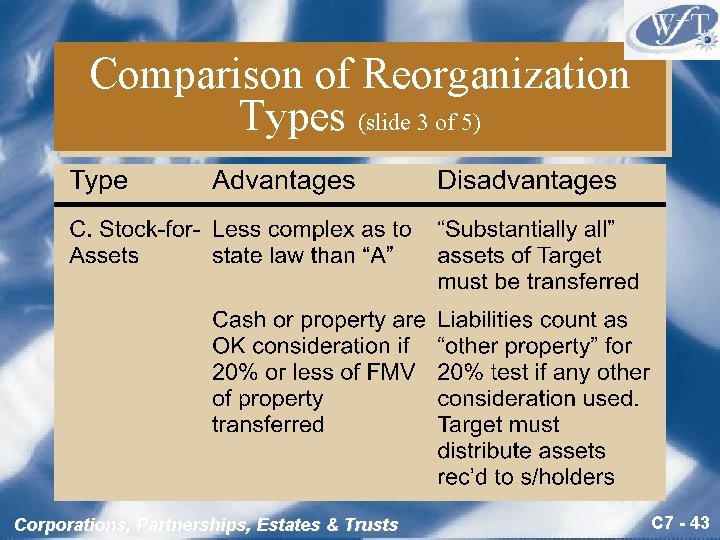

Comparison of Reorganization Types (slide 3 of 5) Corporations, Partnerships, Estates & Trusts C 7 - 43

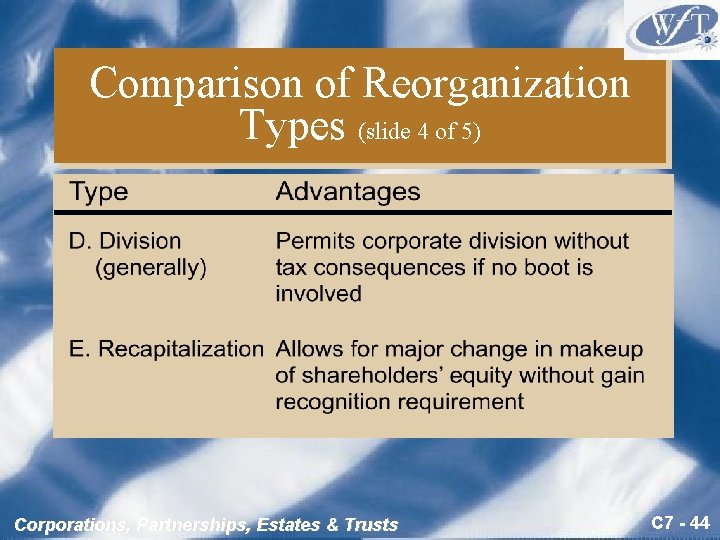

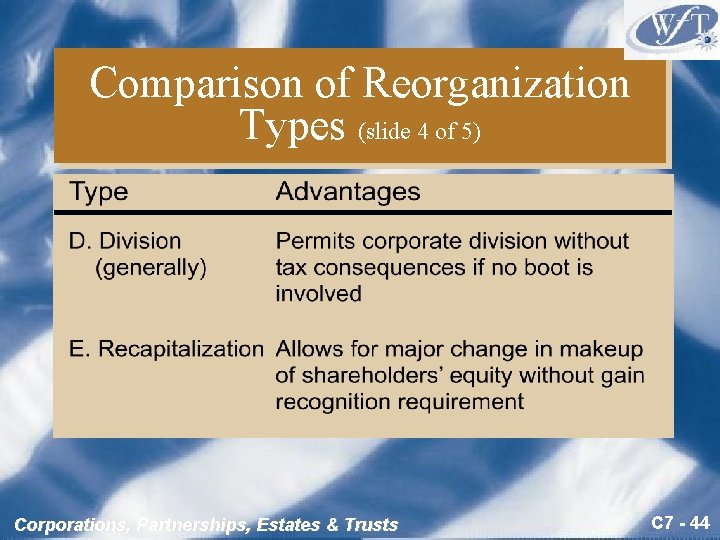

Comparison of Reorganization Types (slide 4 of 5) Corporations, Partnerships, Estates & Trusts C 7 - 44

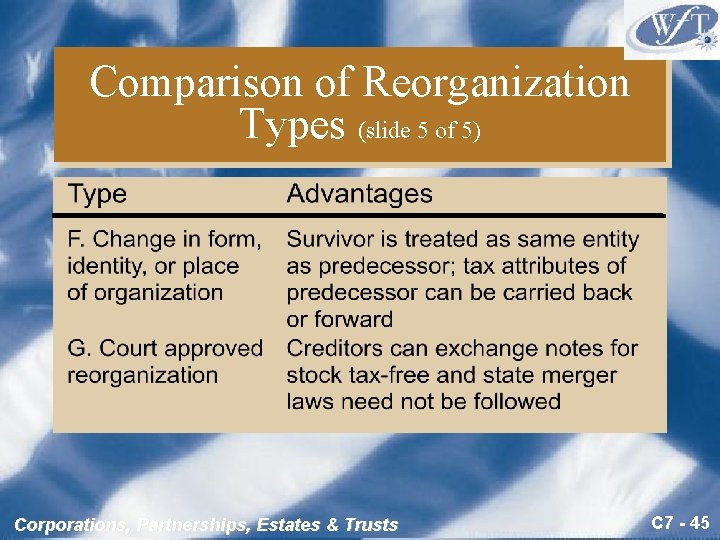

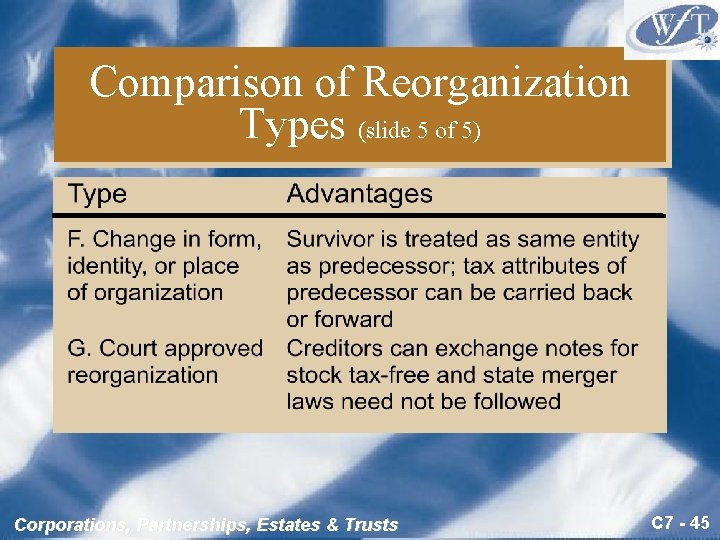

Comparison of Reorganization Types (slide 5 of 5) Corporations, Partnerships, Estates & Trusts C 7 - 45

Accounting for partnerships chapter 12 solutions

Accounting for partnerships chapter 12 solutions Chapter 12 accounting for partnerships answers

Chapter 12 accounting for partnerships answers Learnnowbiz

Learnnowbiz Corporate capital

Corporate capital Characteristics of corporation

Characteristics of corporation Learnnowbiz

Learnnowbiz Accounting for corporations chapter 13

Accounting for corporations chapter 13 What steps did roosevelt take to solve each problem?

What steps did roosevelt take to solve each problem? The vulture's roost political cartoon

The vulture's roost political cartoon The principal message of this cartoon is that standard oil

The principal message of this cartoon is that standard oil Industrialists of the late 1800s used pools and trusts to

Industrialists of the late 1800s used pools and trusts to Content filtering trusts

Content filtering trusts Colorado special needs trust

Colorado special needs trust Apsit moodle

Apsit moodle History of equity and trusts

History of equity and trusts Neville estates v madden

Neville estates v madden Cy pres

Cy pres Development trusts ni

Development trusts ni 53 trusts

53 trusts Canadian oil and gas trusts

Canadian oil and gas trusts California land trusts

California land trusts Trust fund meaning

Trust fund meaning Accenture development partnerships

Accenture development partnerships Marketing word partnerships

Marketing word partnerships Product development partnerships

Product development partnerships Jit scheduling tactics

Jit scheduling tactics Maintaining effective partnerships

Maintaining effective partnerships Account www.publicpartnerships.com

Account www.publicpartnerships.com Epsrc prosperity partnerships

Epsrc prosperity partnerships Multinational company

Multinational company Multinational vs international

Multinational vs international Disadvantages of corporations

Disadvantages of corporations Corporations mergers and multinationals

Corporations mergers and multinationals Definition of mnc

Definition of mnc Strategic management a dynamic perspective

Strategic management a dynamic perspective Types of corporations

Types of corporations Crabtree-vickers v australian direct mail

Crabtree-vickers v australian direct mail Organisasi multinasional dan pengendalian proyek

Organisasi multinasional dan pengendalian proyek Organizational structure of mnc

Organizational structure of mnc Objectives of mnc

Objectives of mnc Corporations developed rapidly in the 1830s

Corporations developed rapidly in the 1830s Characteristics of corporations

Characteristics of corporations Three estates

Three estates Great estates club

Great estates club Causes of french revolution

Causes of french revolution Features of industrial park

Features of industrial park