Chapter 6 The Foreign Exchange Market The Foreign

- Slides: 40

Chapter 6 The Foreign Exchange Market

The Foreign Exchange Market • The Foreign Exchange Market provides: – the physical and institutional structure through which the money of one country is exchanged for that of another country; – the determination rate of exchange between currencies; and – is where foreign exchange transactions are physically completed. 1 -2 6 -2 © 2013 Pearson Education

The Foreign Exchange Market • Foreign exchange means the money of a foreign country; that is, foreign currency bank balances, banknotes, checks and drafts. • A foreign exchange transaction is an agreement between a buyer and a seller that a fixed amount of one currency will be delivered for some other currency at a specified date. 1 -3 6 -3 © 2013 Pearson Education

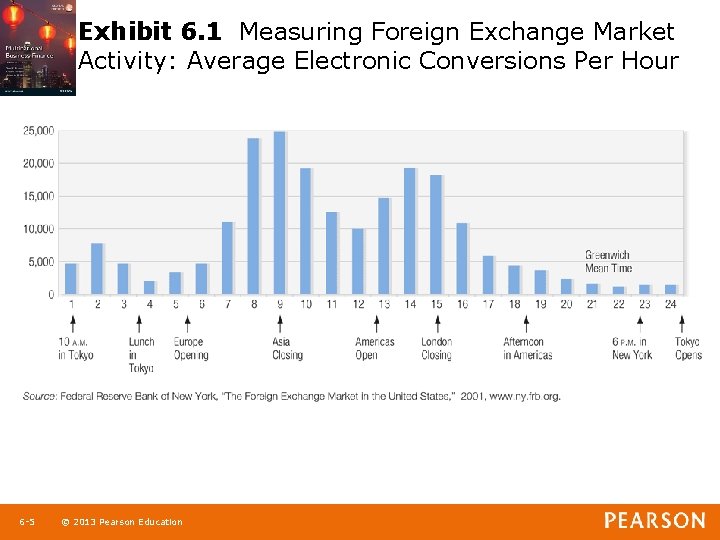

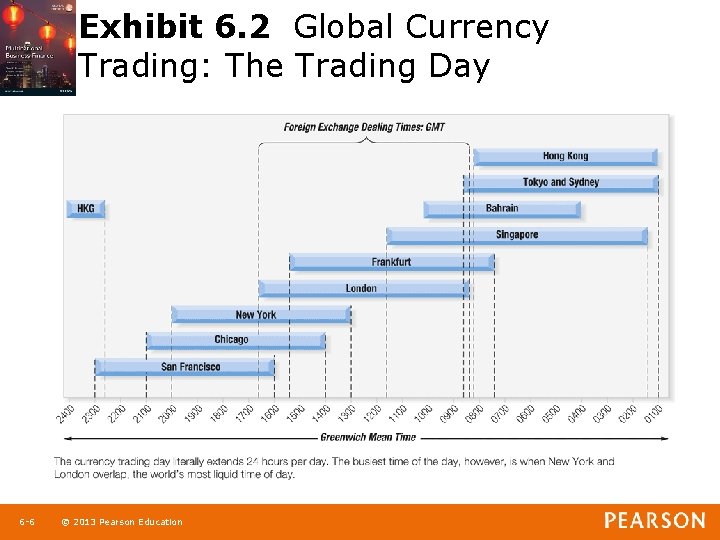

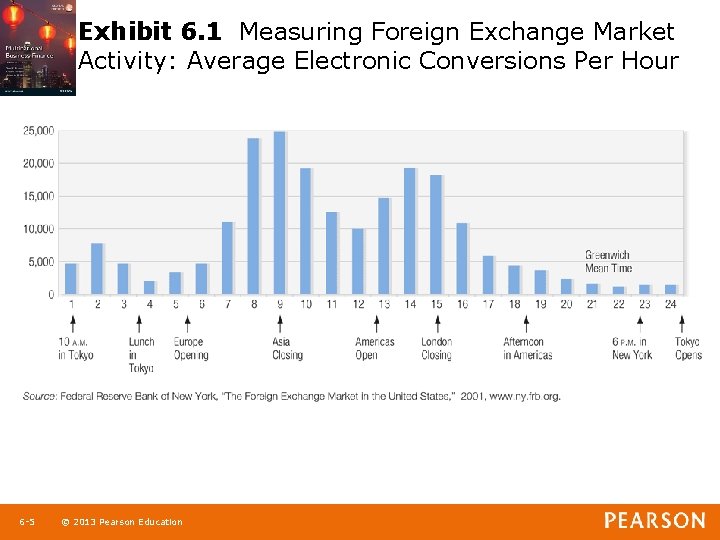

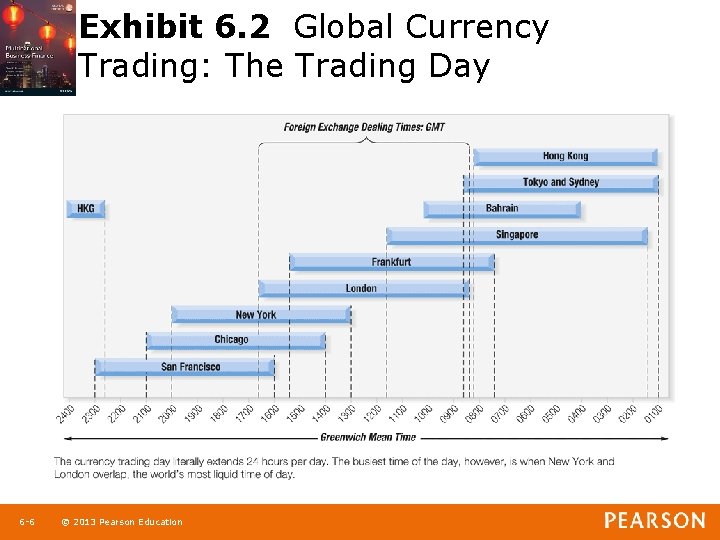

Geography • The foreign exchange market spans the globe, with prices moving and currencies trading somewhere every hour of every business day. • As Exhibit 6. 1 illustrates, the volume of currency transactions ebbs and flows across the globe as the major currency trading centers open and close throughout the day. • Exhibit 6. 2 highlights the major trading centers that keep currency trading a 24 -hour activity. 1 -4 6 -4 © 2013 Pearson Education

Exhibit 6. 1 Measuring Foreign Exchange Market Activity: Average Electronic Conversions Per Hour 1 -5 6 -5 © 2013 Pearson Education

Exhibit 6. 2 Global Currency Trading: The Trading Day 1 -6 6 -6 © 2013 Pearson Education

Functions of the Foreign Exchange Market • The foreign exchange market is the mechanism by which participants: – transfer purchasing power between countries; – obtain or provide credit for international trade transactions; and – minimize exposure to the risks of exchange rate changes. 1 -7 6 -7 © 2013 Pearson Education

Market Participants • The foreign exchange market consists of two tiers: – the interbank or wholesale market (multiples of $1 MM US or equivalent in transaction size), and – the client or retail market (specific, smaller amounts). • Five broad categories of participants operate within these two tiers; bank and nonbank foreign exchange dealers, individuals and firms conducting commercial or investment transactions, speculators and arbitragers, central banks and treasuries, and foreign exchange brokers. 1 -8 6 -8 © 2013 Pearson Education

Market Participants: Bank and Nonbank Foreign Exchange Dealers • Banks and a few nonbank foreign exchange dealers operate in both the interbank and client markets. • The profit from buying foreign exchange at a “bid” price and reselling it at a slightly higher “offer” or “ask” price. • Dealers in the foreign exchange department of large international banks often function as “market makers. ” • These dealers stand willing at all times to buy and sell those currencies in which they specialize and thus maintain an “inventory” position in those currencies. 1 -9 6 -9 © 2013 Pearson Education

Market Participants: Individuals and Firms • Individuals (such as tourists) and firms (such as importers, exporters and MNEs) conduct commercial and investment transactions in the foreign exchange market. • Their use of the foreign exchange market is necessary but nevertheless incidental to their underlying commercial or investment purpose. • Some of the participants use the market to “hedge” foreign exchange risk. 1 -10 6 -10 © 2013 Pearson Education

Market Participants: Speculators and Arbitragers • Speculators and arbitragers seek to profit from trading in the market itself. • They operate in their own interest, without a need or obligation to serve clients or ensure a continuous market. • While dealers seek the bid/ask spread, speculators seek all the profit from exchange rate changes and arbitragers try to profit from simultaneous exchange rate differences in different markets. 1 -11 6 -11 © 2013 Pearson Education

Market Participants: Central Banks and Treasuries • Central banks and treasuries use the market to acquire or spend their country’s foreign exchange reserves as well as to influence the price at which their own currency is traded. • They may act to support the value of their own currency because of policies adopted at the national level or because of commitments entered into through membership in joint agreements such as the European Monetary System. • The motive is not to earn a profit as such, but rather to influence the foreign exchange value of their currency in a manner that will benefit the interests of their citizens. • As willing loss takers, central banks and treasuries differ in motive from all other market participants. 1 -12 6 -12 © 2013 Pearson Education

Market Participants: Foreign Exchange Brokers • Foreign exchange brokers are agents who facilitate trading between dealers without themselves becoming principals in the transaction. • Dealers use brokers to expedite the transaction and to remain anonymous, since the identity of participants may influence short-term quotes. 1 -13 6 -13 © 2013 Pearson Education

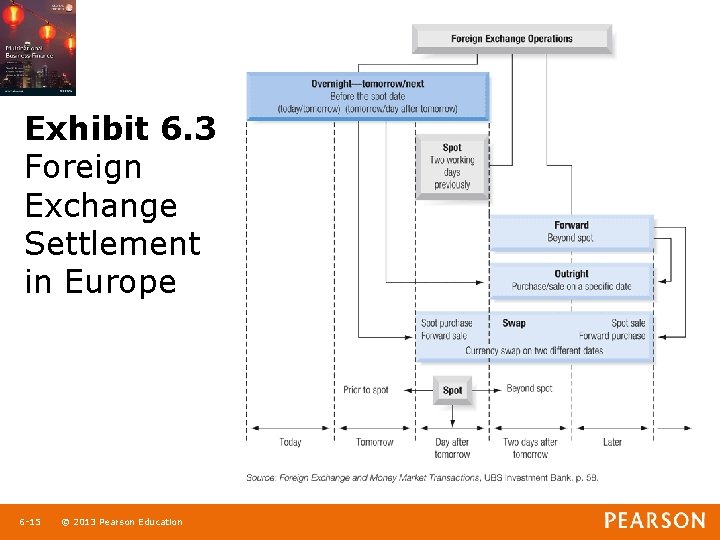

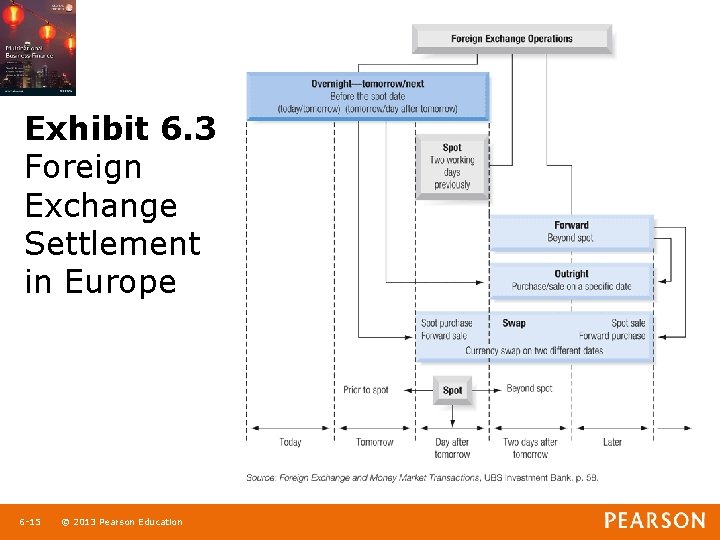

Transactions in the Interbank Market • A spot transaction in the interbank market is the purchase of foreign exchange, with delivery and payment between banks to take place, normally, on the second following business day. • Exhibit 6. 3 provides a structured map of when settlement occurs within the European market. • The date of settlement is referred to as the value date. 1 -14 6 -14 © 2013 Pearson Education

Exhibit 6. 3 Foreign Exchange Settlement in Europe 1 -15 6 -15 © 2013 Pearson Education

Transactions in the Interbank Market • An outright forward transaction (usually called just forward) requires delivery at a future value date of a specified amount of one currency for a specified amount of another currency. • The exchange rate is established at the time of the agreement, but payment and delivery are not required until maturity. • Forward exchange rates are usually quoted for value dates of one, two, three, six and twelve months. • Buying forward and selling forward describe the same transaction (the only difference is the order in which currencies are referenced. ) 1 -16 6 -16 © 2013 Pearson Education

Transactions in the Interbank Market • A swap transaction in the interbank market is the simultaneous purchase and sale of a given amount of foreign exchange for two different value dates. • Both purchase and sale are conducted with the same counterparty. • Some different types of swaps are: – spot against forward, – forward-forward, – nondeliverable forwards (NDF). 1 -17 6 -17 © 2013 Pearson Education

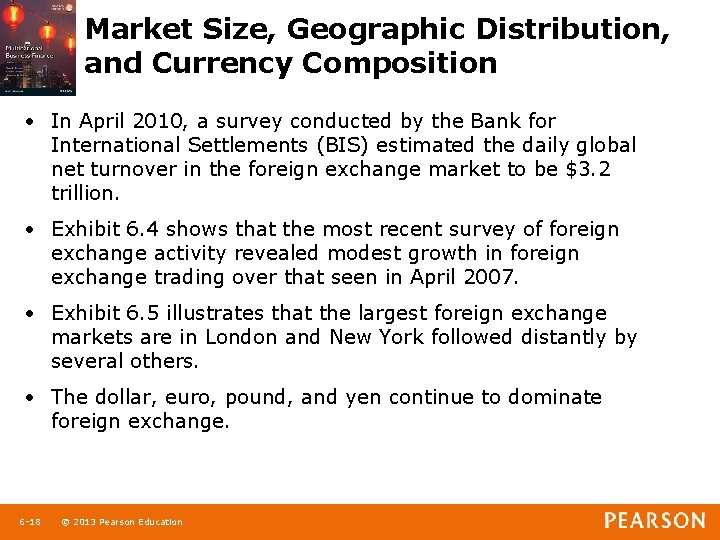

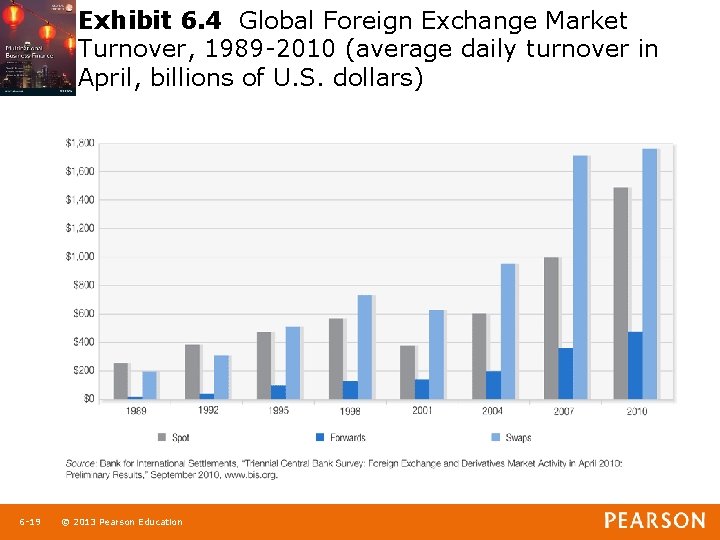

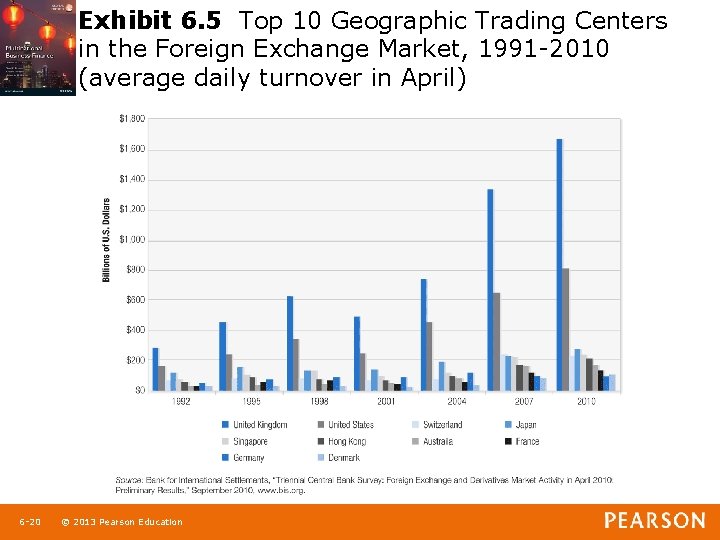

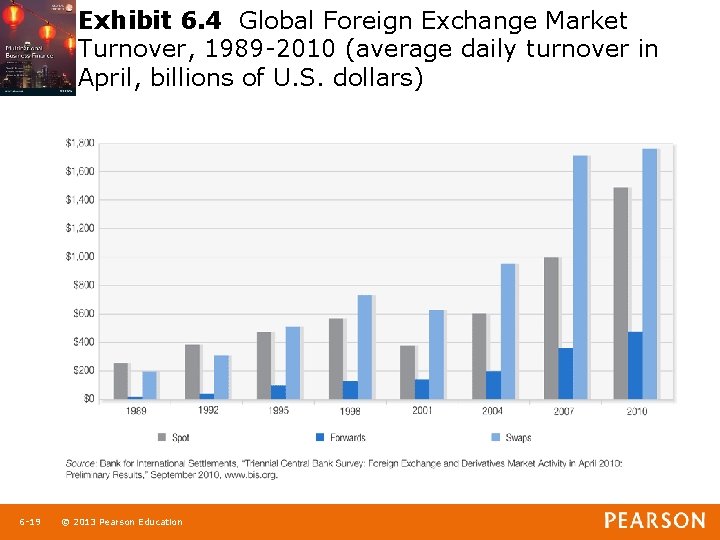

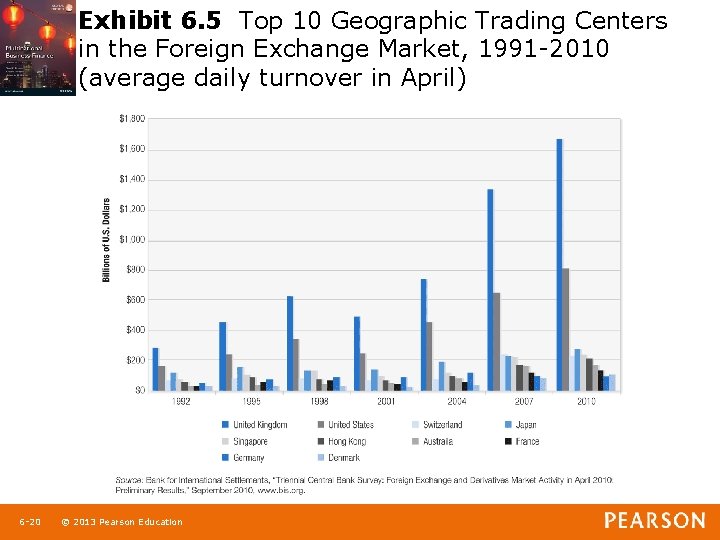

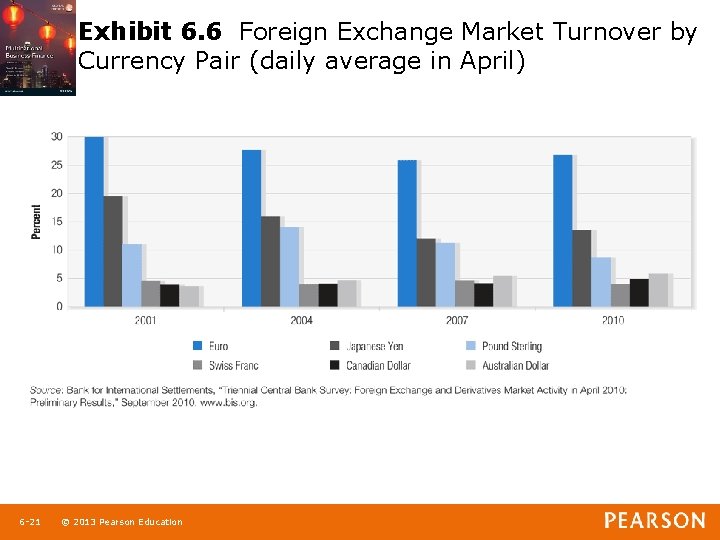

Market Size, Geographic Distribution, and Currency Composition • In April 2010, a survey conducted by the Bank for International Settlements (BIS) estimated the daily global net turnover in the foreign exchange market to be $3. 2 trillion. • Exhibit 6. 4 shows that the most recent survey of foreign exchange activity revealed modest growth in foreign exchange trading over that seen in April 2007. • Exhibit 6. 5 illustrates that the largest foreign exchange markets are in London and New York followed distantly by several others. • The dollar, euro, pound, and yen continue to dominate foreign exchange. 1 -18 6 -18 © 2013 Pearson Education

Exhibit 6. 4 Global Foreign Exchange Market Turnover, 1989 -2010 (average daily turnover in April, billions of U. S. dollars) 1 -19 6 -19 © 2013 Pearson Education

Exhibit 6. 5 Top 10 Geographic Trading Centers in the Foreign Exchange Market, 1991 -2010 (average daily turnover in April) 1 -20 6 -20 © 2013 Pearson Education

Exhibit 6. 6 Foreign Exchange Market Turnover by Currency Pair (daily average in April) 1 -21 6 -21 © 2013 Pearson Education

Foreign Exchange Rates and Quotations • A foreign exchange rate is the price of one currency expressed in terms of another currency. • A foreign exchange quotation (or quote) is a statement of willingness to buy or sell at an announced rate. 1 -22 6 -22 © 2013 Pearson Education

Foreign Exchange Rates and Quotations • Most foreign exchange transactions involve the U. S. dollar. • Professional dealers and brokers may state foreign exchange quotations in one of two ways: – the foreign currency price of one dollar, or – the dollar price of a unit of foreign currency. • Most foreign currencies in the world are stated in terms of the number of units of foreign currency needed to buy one dollar. 1 -23 6 -23 © 2013 Pearson Education

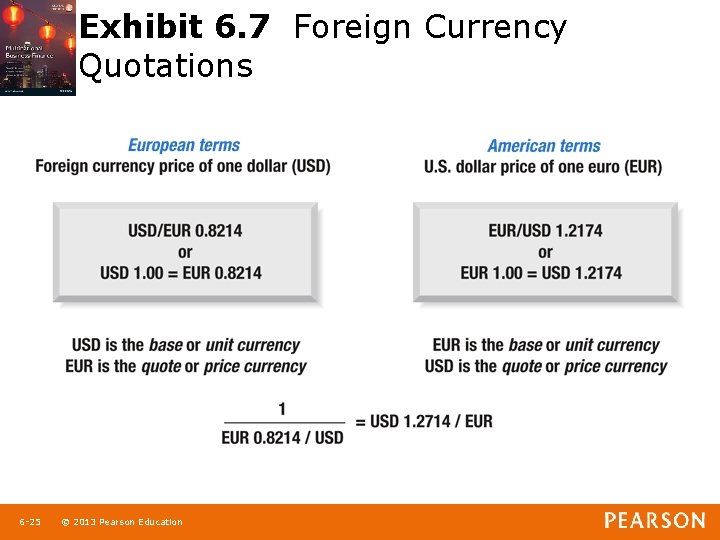

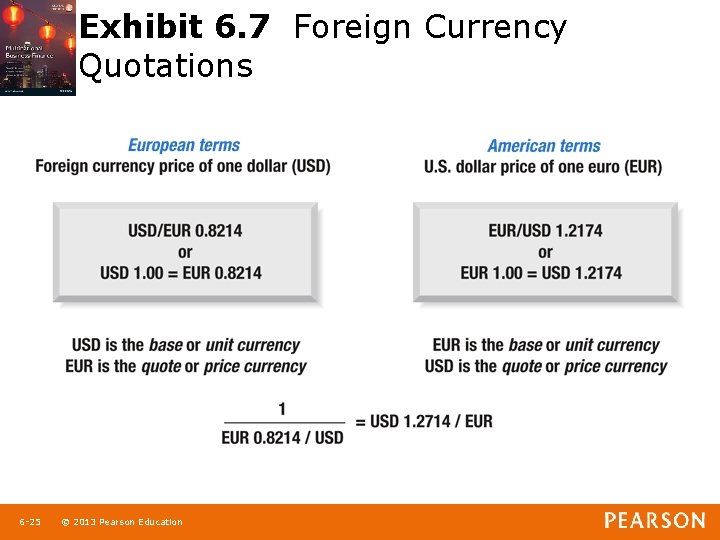

Foreign Exchange Rates and Quotations • For example, the exchange rate between U. S. dollars and the Swiss franc is normally stated: – SF 1. 6000/$ (European terms) • However, this rate can also be stated as: – $0. 6250/SF (American terms) • Exhibit 6. 7 is an example of a foreign exchange quote • Excluding two important exceptions, most interbank quotations around the world are stated in European terms. 1 -24 6 -24 © 2013 Pearson Education

Exhibit 6. 7 Foreign Currency Quotations 1 -25 6 -25 © 2013 Pearson Education

Foreign Exchange Rates and Quotations • As mentioned, several exceptions exist to the use of European terms quotes. • The two most important are quotes for the euro and U. K. pound sterling which are both normally quoted in American terms. • American terms are also utilized in quoting rates for most foreign currency options and futures, as well as in retail markets that deal with tourists. 1 -26 6 -26 © 2013 Pearson Education

Foreign Exchange Rates and Quotations • Foreign exchange quotes are at times described as either direct or indirect. • In this pair of definitions, the home or base country of the currencies being discussed is critical. • A direct quote is a home currency price of a unit of foreign currency. • An indirect quote is a foreign currency price of a unit of home currency. • The form of the quote depends on what the speaker regards as “home. ” 1 -27 6 -27 © 2013 Pearson Education

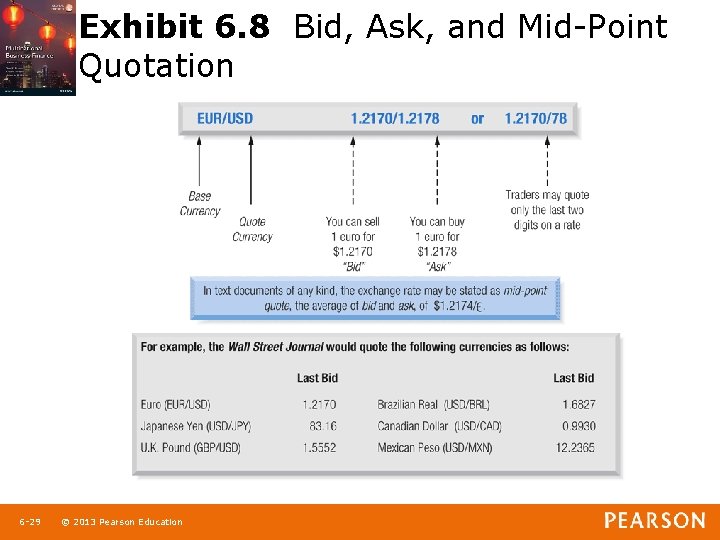

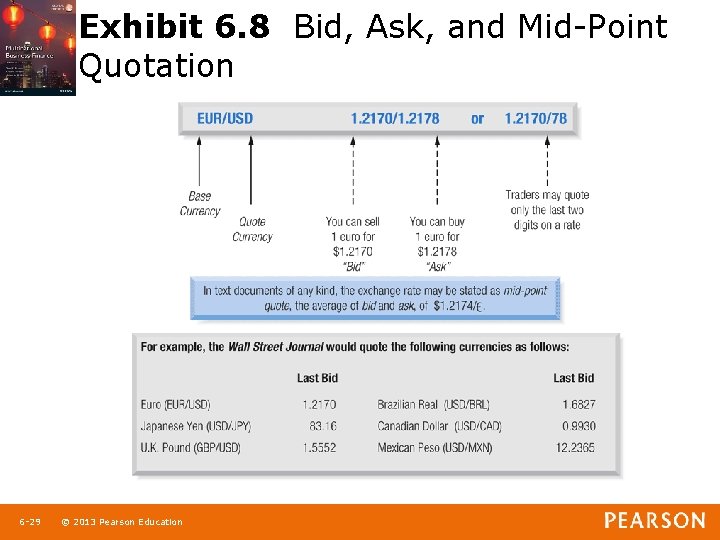

Foreign Exchange Rates and Quotations • Interbank quotations are given as a bid and ask (also referred to as offer). • A bid is the price (i. e. exchange rate) in one currency at which a dealer will buy another currency. • An ask is the price (i. e. exchange rate) at which a dealer will sell the other currency. • Dealers bid (buy) at one price and ask (sell) at a slightly higher price, making their profit from the spread between the buying and selling prices. • A bid for one currency is also the offer for the opposite currency. • Exhibit 6. 8 shows a bid, ask, and mid-point quotation. 1 -28 6 -28 © 2013 Pearson Education

Exhibit 6. 8 Bid, Ask, and Mid-Point Quotation 1 -29 6 -29 © 2013 Pearson Education

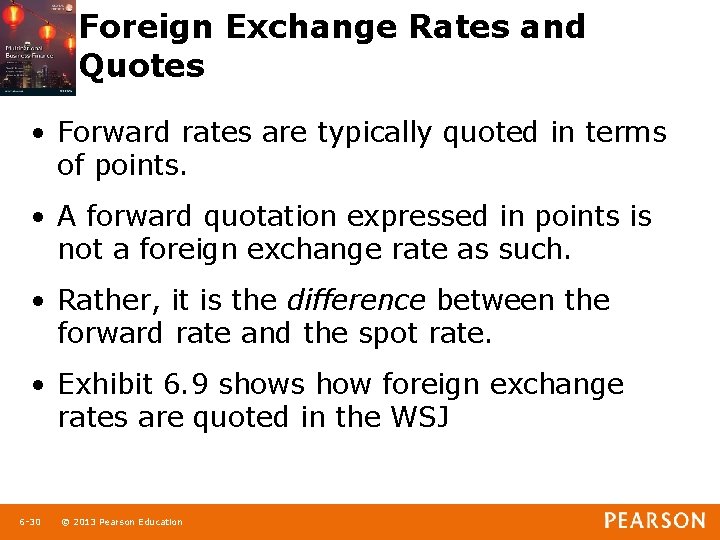

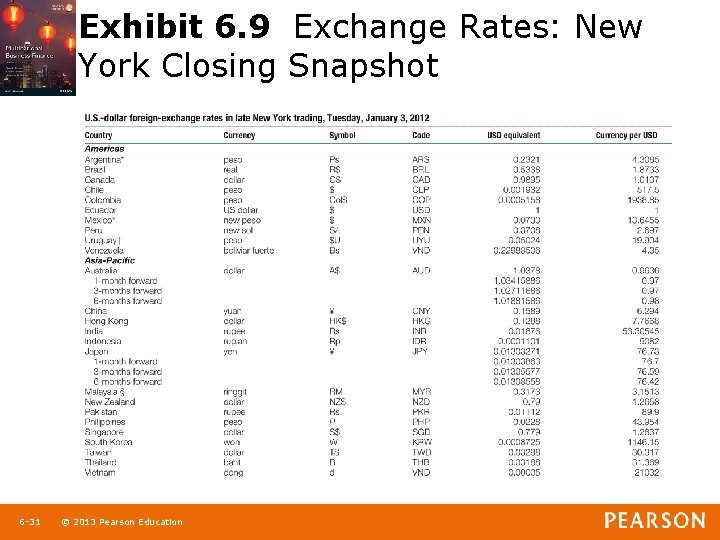

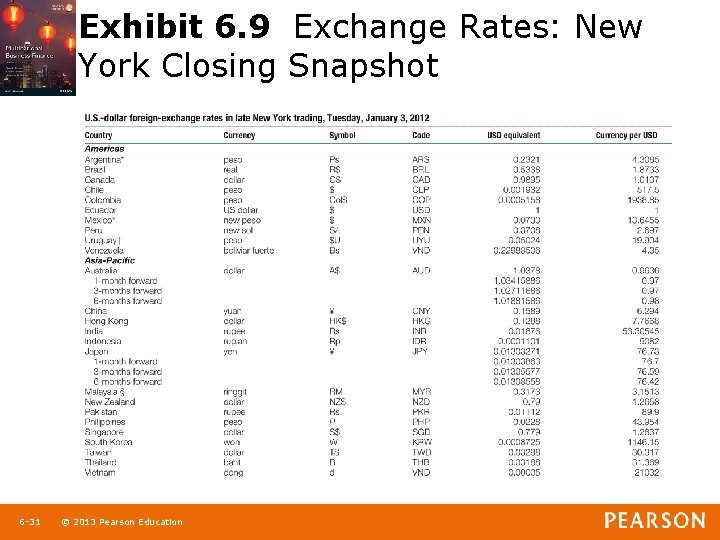

Foreign Exchange Rates and Quotes • Forward rates are typically quoted in terms of points. • A forward quotation expressed in points is not a foreign exchange rate as such. • Rather, it is the difference between the forward rate and the spot rate. • Exhibit 6. 9 shows how foreign exchange rates are quoted in the WSJ 1 -30 6 -30 © 2013 Pearson Education

Exhibit 6. 9 Exchange Rates: New York Closing Snapshot 1 -31 6 -31 © 2013 Pearson Education

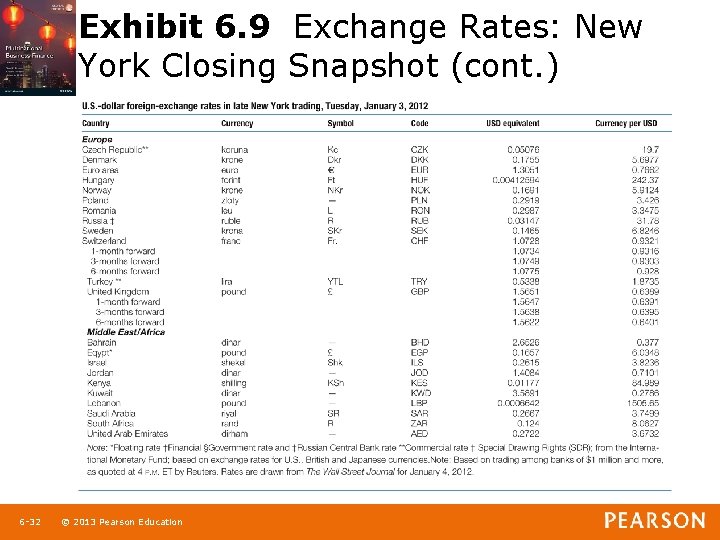

Exhibit 6. 9 Exchange Rates: New York Closing Snapshot (cont. ) 1 -32 6 -32 © 2013 Pearson Education

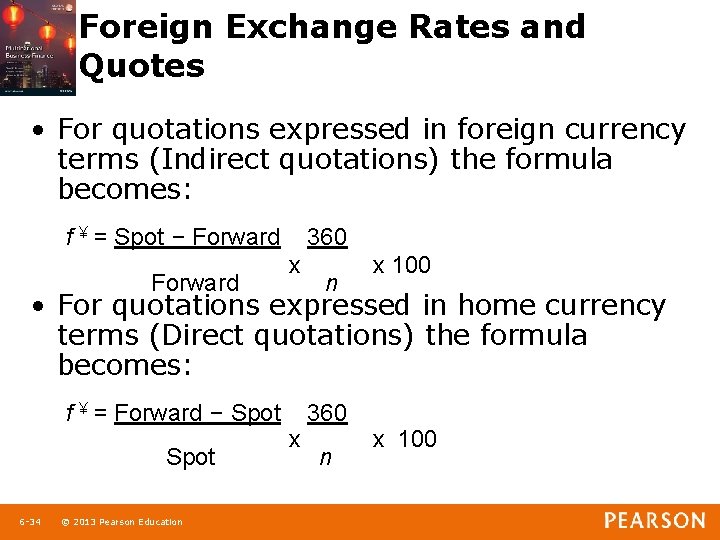

Foreign Exchange Rates and Quotes • Forward quotations may also be expressed as the percent-per-annum deviation from the spot rate. • This method of quotation facilitates comparing premiums or discounts in the forward market with interest rate differentials. 1 -33 6 -33 © 2013 Pearson Education

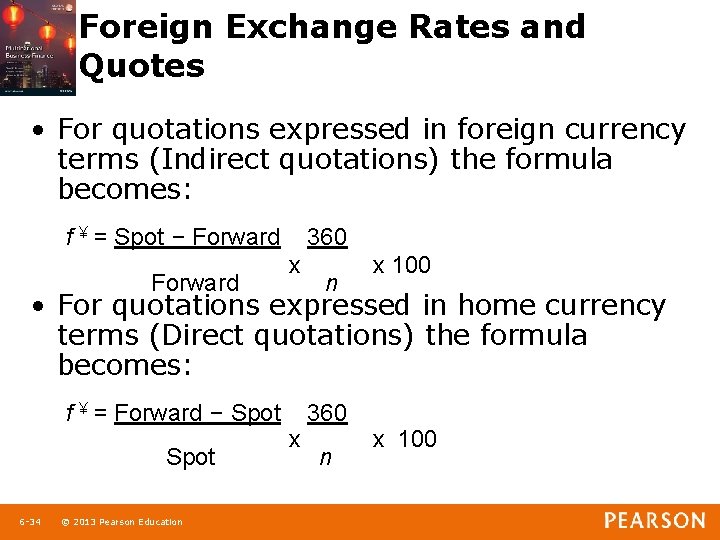

Foreign Exchange Rates and Quotes • For quotations expressed in foreign currency terms (Indirect quotations) the formula becomes: f ¥ = Spot – Forward 360 x n x 100 • For quotations expressed in home currency terms (Direct quotations) the formula becomes: f ¥ = Forward – Spot 1 -34 6 -34 © 2013 Pearson Education x 360 n x 100

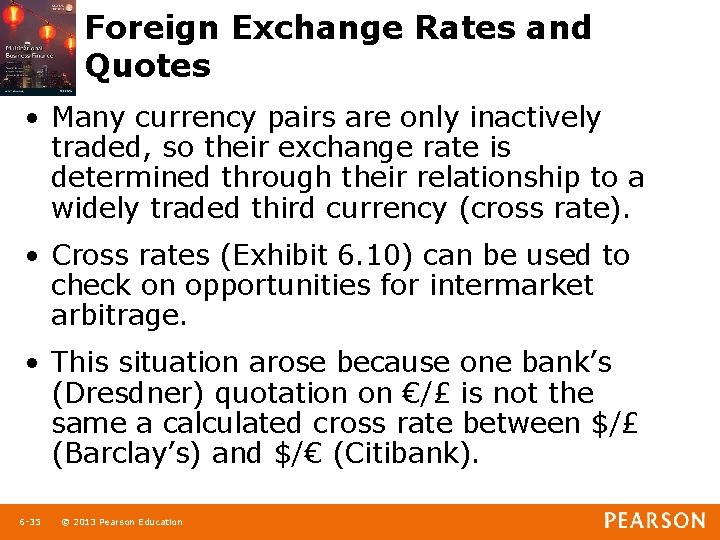

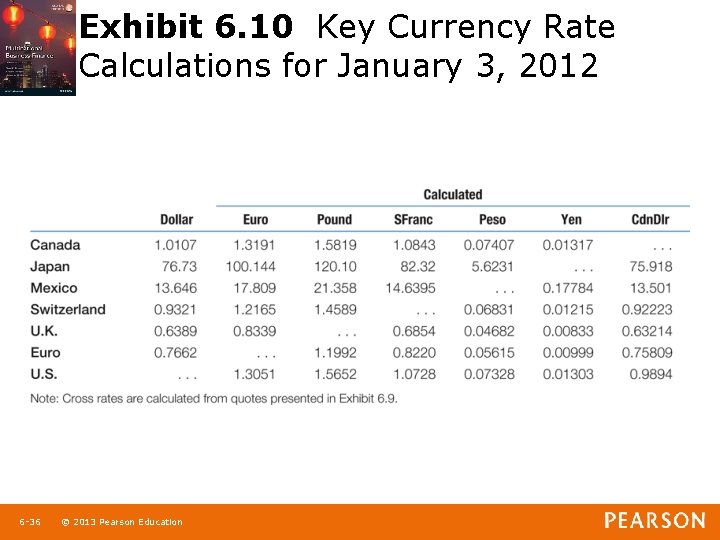

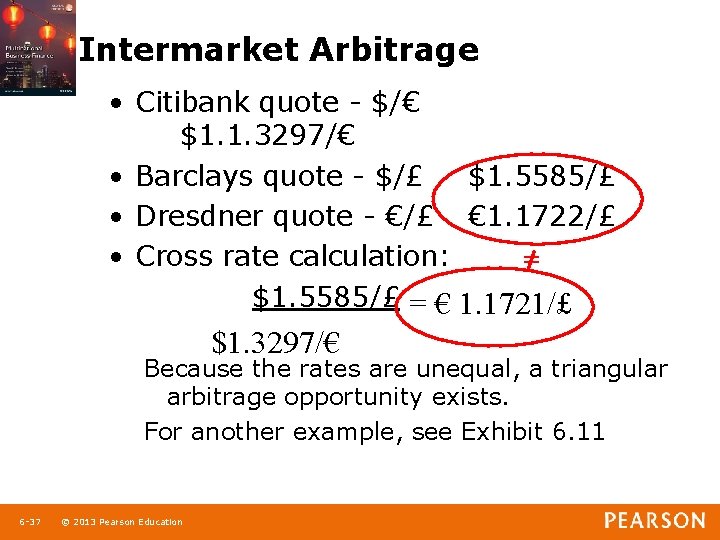

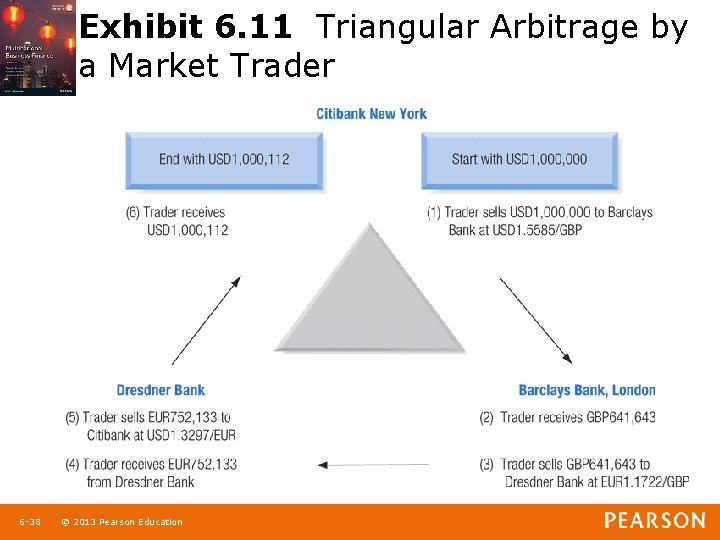

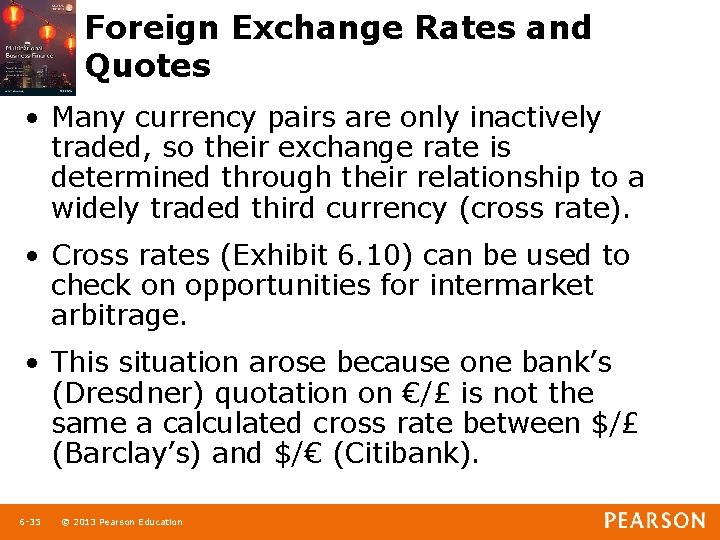

Foreign Exchange Rates and Quotes • Many currency pairs are only inactively traded, so their exchange rate is determined through their relationship to a widely traded third currency (cross rate). • Cross rates (Exhibit 6. 10) can be used to check on opportunities for intermarket arbitrage. • This situation arose because one bank’s (Dresdner) quotation on €/£ is not the same a calculated cross rate between $/£ (Barclay’s) and $/€ (Citibank). 1 -35 6 -35 © 2013 Pearson Education

Exhibit 6. 10 Key Currency Rate Calculations for January 3, 2012 1 -36 6 -36 © 2013 Pearson Education

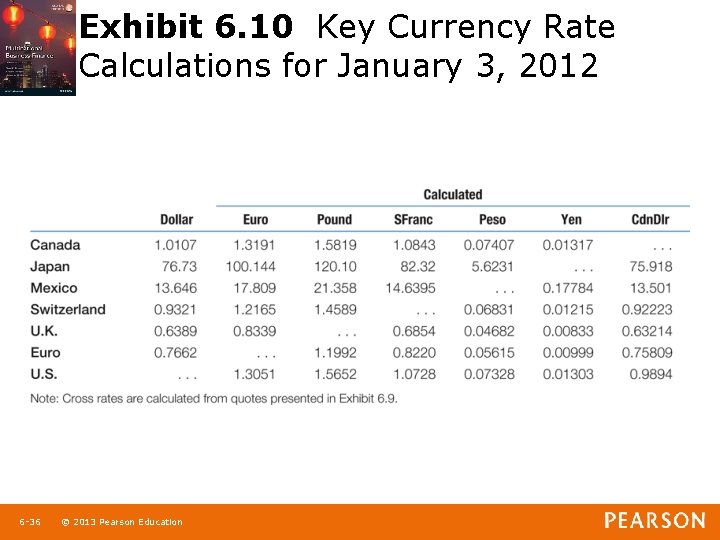

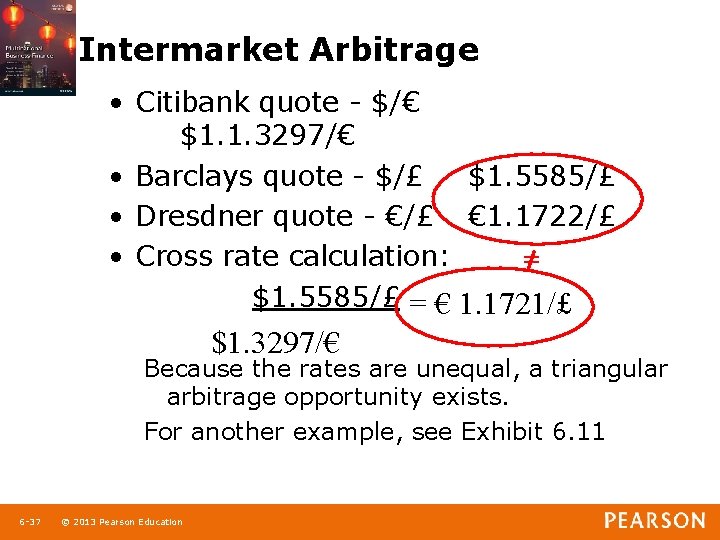

Intermarket Arbitrage • Citibank quote - $/€ $1. 1. 3297/€ • Barclays quote - $/£ $1. 5585/£ • Dresdner quote - €/£ € 1. 1722/£ • Cross rate calculation: = $1. 5585/£ = € 1. 1721/£ $1. 3297/€ Because the rates are unequal, a triangular arbitrage opportunity exists. For another example, see Exhibit 6. 11 1 -37 6 -37 © 2013 Pearson Education

Exhibit 6. 11 Triangular Arbitrage by a Market Trader 1 -38 6 -38 © 2013 Pearson Education

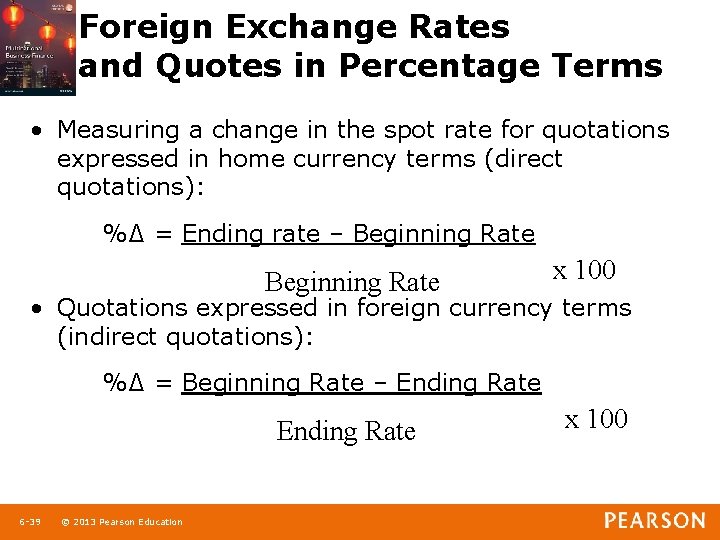

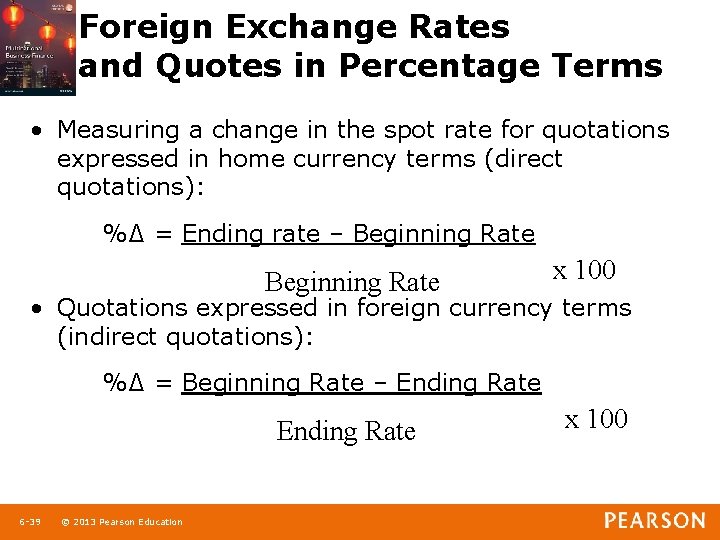

Foreign Exchange Rates and Quotes in Percentage Terms • Measuring a change in the spot rate for quotations expressed in home currency terms (direct quotations): %∆ = Ending rate – Beginning Rate x 100 • Quotations expressed in foreign currency terms (indirect quotations): %∆ = Beginning Rate – Ending Rate 1 -39 6 -39 © 2013 Pearson Education x 100

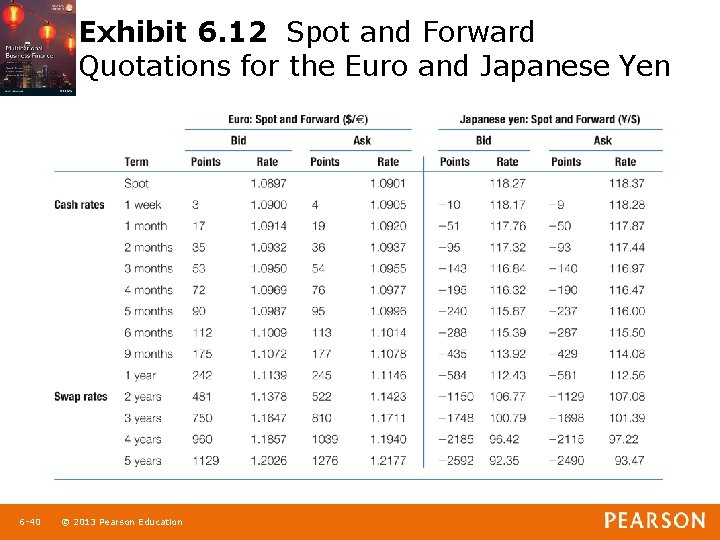

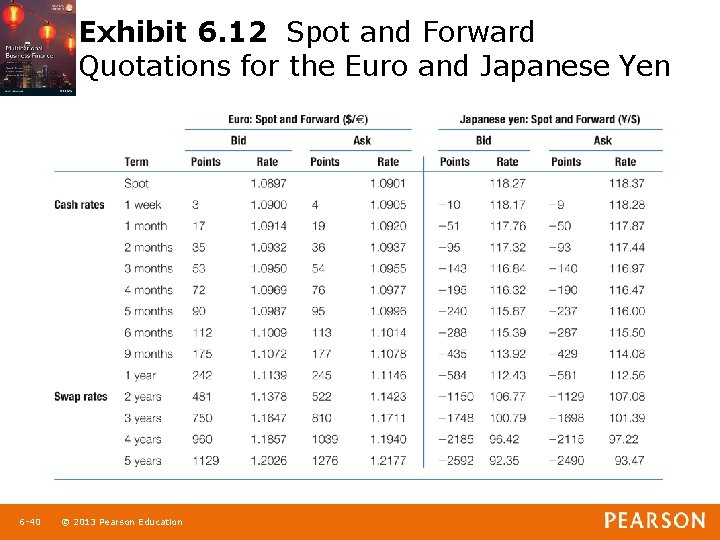

Exhibit 6. 12 Spot and Forward Quotations for the Euro and Japanese Yen 1 -40 6 -40 © 2013 Pearson Education