Chapter 6 Tariffs Copyright 2010 Pearson AddisonWesley All

- Slides: 62

Chapter 6 Tariffs Copyright © 2010 Pearson Addison-Wesley. All rights reserved.

Topics to be Covered • Types of Commercial Policies • Tariffs and Types • Consumer Surplus vs. Producer Surplus • Static Gains vs. Dynamic Gains from Free Trade • Effects of a Tariff • Small Country vs. Large Country Case • Deadweight Losses • Optimal Tariff Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -2

INTRODUCTION • We have seen that I T leads to the redistribution of production in an economy. It also affect the returns paid to factors of production. For both of these reasons, some individuals of every society favor gov’t policies aimed at affecting the volume & composition of I T. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -3

Commercial Policy • Actions taken by government to influence the country’s volume and composition of trade. A gov’t has a variety of options in conducting commercial policy. • Types of Commercial Policy – Tariff – Quota – Subsidy – Nontariff Barriers Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -4

Commercial polcy • Tariff: A tax imposed by government on either imports or exports. • Quota: A government-imposed limit on the value or quantity of an import or export good. • Subsidy: A government payment to a domestic industry to encourage exports or discourage imports Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -5

Nontariff Barriers • A wide range of government policies other than tariffs designed to affect the volume or composition of a country’s international trade • These NTBs include: – Health and safety standards – Government procurement policy Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -6

Gains from Free Trade • Economic Gains—increase in standard of living and economic growth that result from a country’s engaging in free international trade – Static Gains – Dynamic Gains • Political Gains—increases in well-being that accrue to a country because expanded trade and economic interdependency may increase the likelihood of reduced international hostility Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -7

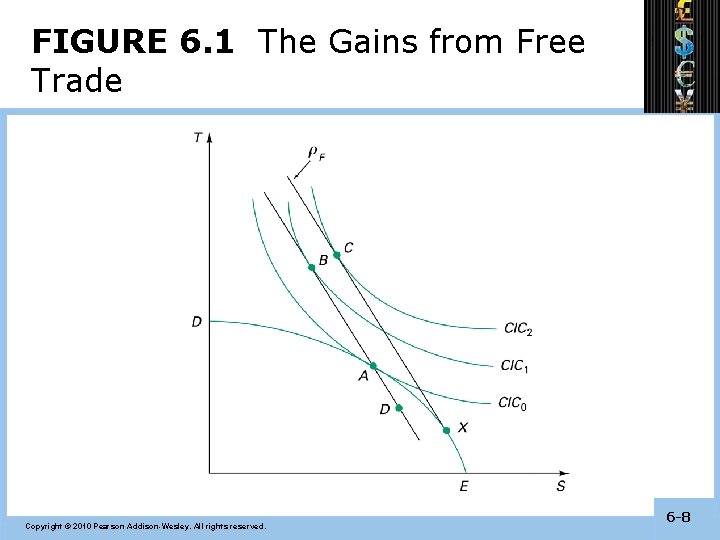

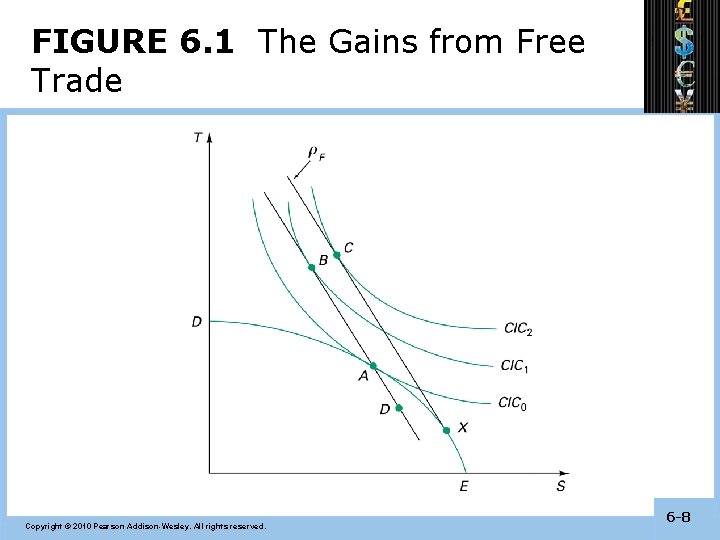

FIGURE 6. 1 The Gains from Free Trade Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -8

Static Gains from Free Trade • Consumption gains • Production gains Refer to Figure 6. 1 (next slide) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -9

Dynamic Gains from Free Trade • Increases in economic well-being that accrue to a country because trade expands the country’s productive resources or raises resource productivity Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -10

Relationship Between Trade and Economic Growth • Trade enhances economic growth through imports of capital goods. • Trade enhances international diffusion of technology. • Trade is pro-competition. • Trade expands market size if economies of scale exist. • Trade can enlarge the pool of savings necessary for investment spending. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -11

TARIFFS: SOME PRELIMINARY DETAILS • A tariff is a tax on an imported good – It affects the domestic consumption of an imported good – It affects the domestic production of goods that compete with the imported good – It affects the foreign production of the imported good – It changes the structure of the domestic economy • Tariffs are no longer a major form of tax revenue for the U. S. , but they still have important economic effects Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -12

TARIFFS: SOME PRELIMINARY DETAILS • Some tariffs are revenue tariffs which is a tax levied on a good that is not domestically produced • Most common in the developing countries • In developed countries, protective tariffs are more common • Protective tariffs protect a domestic industry from foreign competition • In 2006, U. S. tariffs generated tax revenues of $26. 7 billion Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -13

TARIFFS: SOME PRELIMINARY DETAILS • Types of Tariffs – The simplest form is a specific tariff – This is a per-unit tax on an imported good – Easy to administer but may not be uniform if there are large differences in imported prices – A specific tariff encourages domestic producers to produce less expensive goods Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -14

TARIFFS: SOME PRELIMINARY DETAILS • An ad valorem tariffs is expressed as a fraction of the value of the imported goods • It avoids the regressive nature of the specific tariff but the price becomes an important factor • Importers have an incentive to under-invoice the price of the imported good • Requires knowledgeable customs officials • Ad valorem tariffs are more difficult for a country to administer than specific tariffs Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -15

TARIFFS: SOME PRELIMINARY DETAILS • A compound tariff is a combination of an ad valorem and a specific tariff • Common on agricultural products whose prices tend to fluctuate Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -16

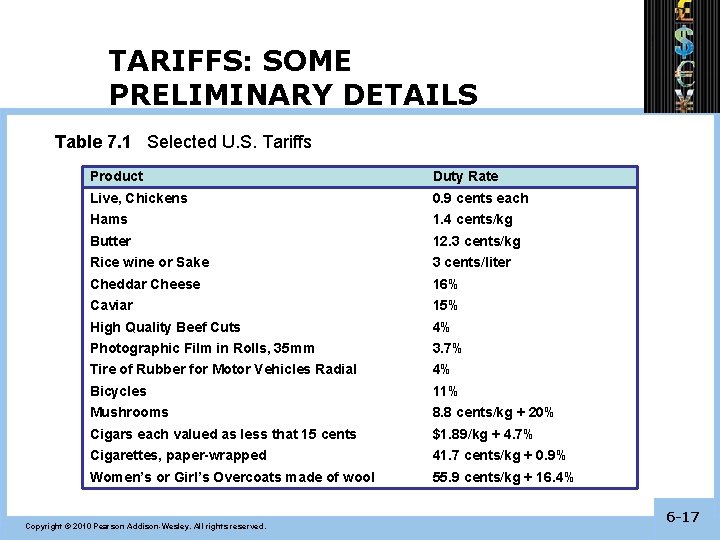

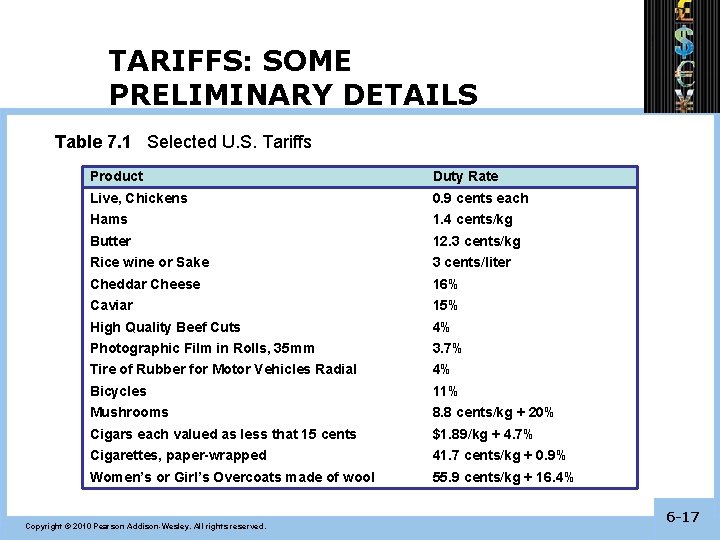

TARIFFS: SOME PRELIMINARY DETAILS Table 7. 1 Selected U. S. Tariffs Product Duty Rate Live, Chickens 0. 9 cents each Hams 1. 4 cents/kg Butter 12. 3 cents/kg Rice wine or Sake 3 cents/liter Cheddar Cheese 16% Caviar 15% High Quality Beef Cuts 4% Photographic Film in Rolls, 35 mm 3. 7% Tire of Rubber for Motor Vehicles Radial 4% Bicycles 11% Mushrooms 8. 8 cents/kg + 20% Cigars each valued as less that 15 cents $1. 89/kg + 4. 7% Cigarettes, paper-wrapped 41. 7 cents/kg + 0. 9% Women’s or Girl’s Overcoats made of wool 55. 9 cents/kg + 16. 4% Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -17

TARIFFS: SOME PRELIMINARY DETAILS • Methods of Valuing Imports – There are three methods of valuing imports – The free alongside (F. A. S. ) price defines the price of the imported good as the foreign country’s market price before loading the good for shipment to the importing country – The free on board (FOB) price defines the price of the imported good as the foreign country’s market price plus the cost of loading the good in the means of conveyance Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -18

TARIFFS: SOME PRELIMINARY DETAILS • The third method is the cost, insurance, and freight (C. I. F. ) price which is the foreign country’s market price plus the cost of loading the goods into the means of conveyance plus all inter-country transportation costs up to the importing country’s port of entry • Most countries use the C. I. F. price for calculating ad valorem tariffs • U. S. currently uses the FOB price for calculating ad valorem tariffs Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -19

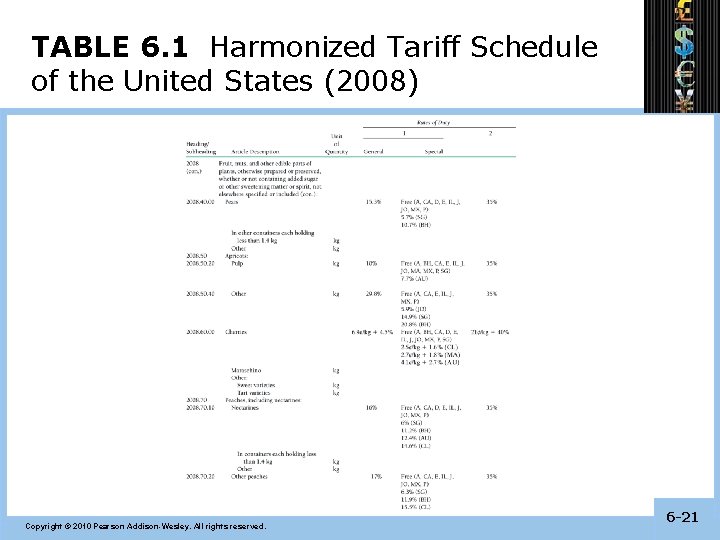

U. S. Tariff Schedule • Column 1 General Rates of Duty (Refer to Table 6. 1) – Most Favored Nation (MFN) Status—a country confers MFN status upon another by agreeing not to charge tariffs on that country’s goods which are no higher than those it imposes on the goods of any other country. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -20

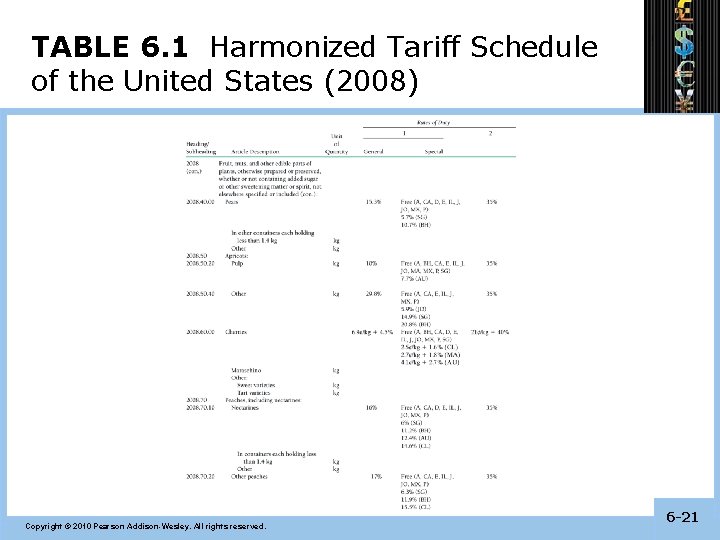

TABLE 6. 1 Harmonized Tariff Schedule of the United States (2008) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -21

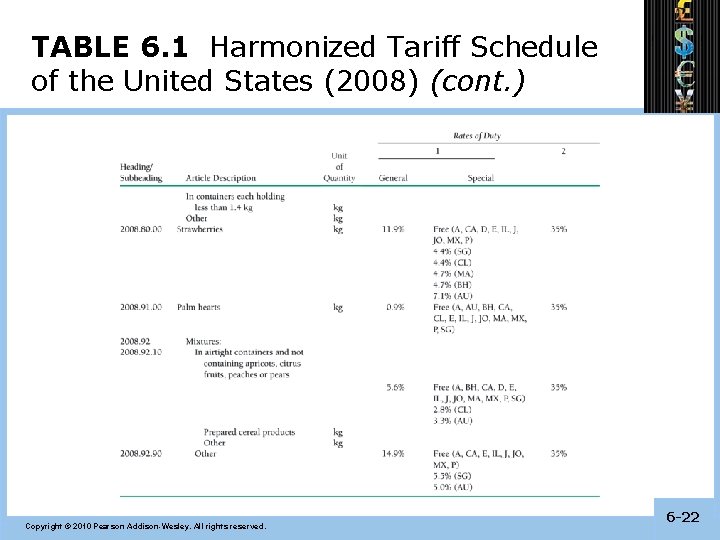

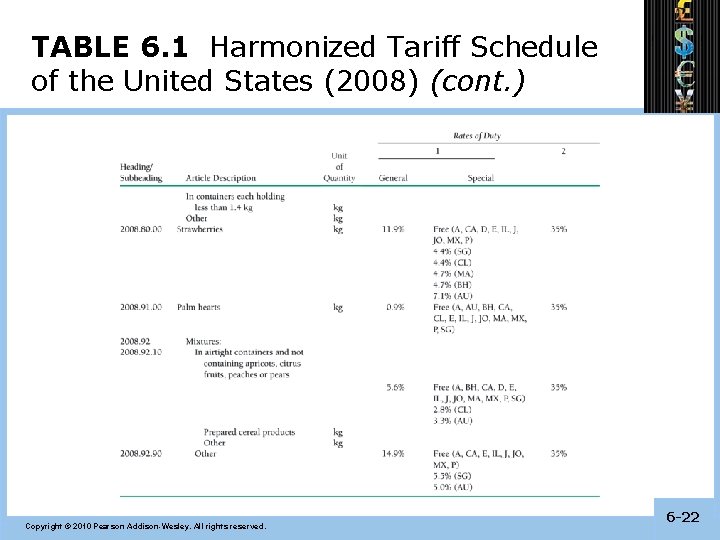

TABLE 6. 1 Harmonized Tariff Schedule of the United States (2008) (cont. ) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -22

U. S. Tariff Schedule (cont. ) • Column 1 Special Rates of Duty— tariffs applied to goods from many developing countries or from countries with special trade agreements with the U. S. including: – Generalized System of Preferences (GSP)—a system in which developed countries charge preferential lower tariffs on goods from certain developing countries. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -23

U. S. Tariff Schedule (cont. ) • Column 2 Rates of Duty—tariffs applied to goods from countries (Cuba and North Korea) without U. S. -granted MFN status; these rates are substantially higher than MFN rates. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -24

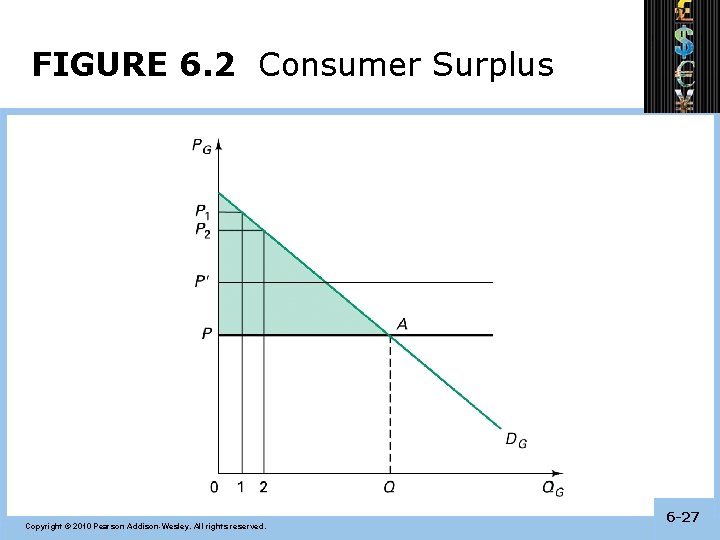

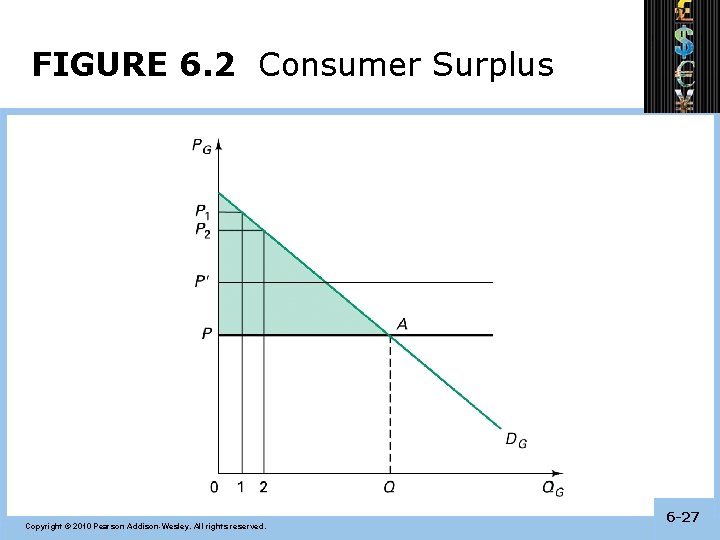

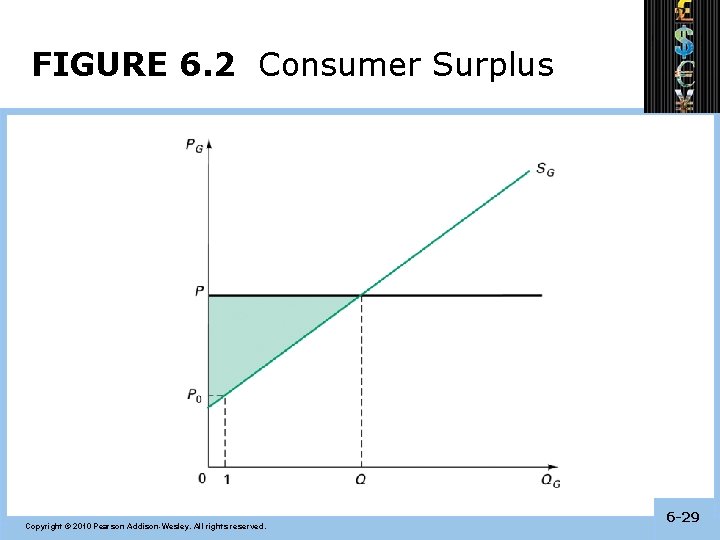

Tools for Analyzing Tariff Effects • Consumer Surplus • Producer Surplus Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -25

Consumer Surplus • The difference between the amount consumers are willing to pay to purchase a given quantity of a good and the amount they have to pay to purchase the good Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -26

FIGURE 6. 2 Consumer Surplus Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -27

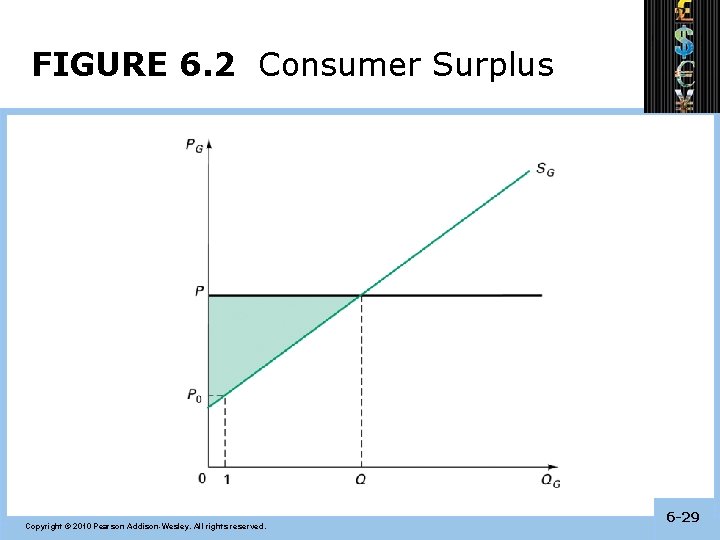

Producer Surplus • The difference between the price paid in the market for a good and the minimum price required by the industry to produce and market the good Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -28

FIGURE 6. 2 Consumer Surplus Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -29

Gains from Free Trade for a Small Country • Imports Side • Exports Side Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -30

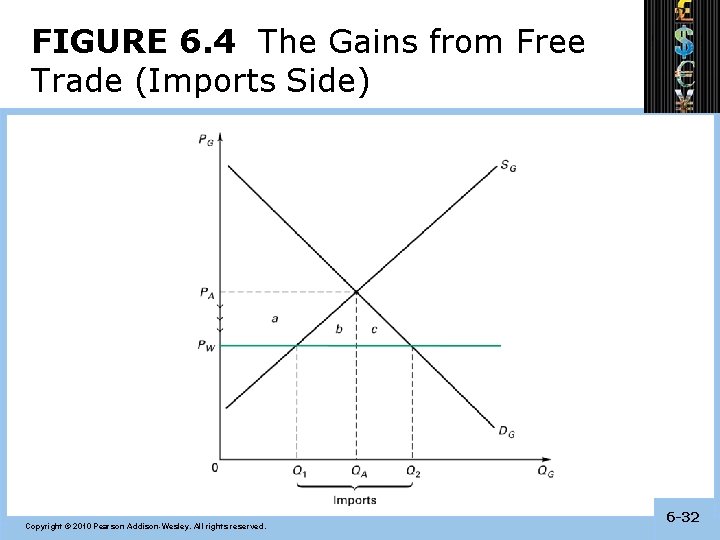

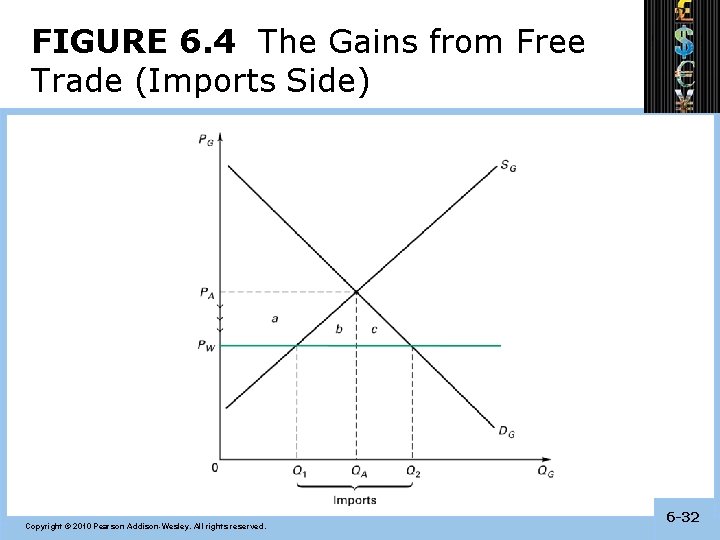

Effects of Free Trade on the Imports Side • • Refer to Figure 6. 4 Gains (imports side) Price effect Consumption effect Production effect Imports effect Consumer surplus effect Producer surplus effect Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -31

FIGURE 6. 4 The Gains from Free Trade (Imports Side) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -32

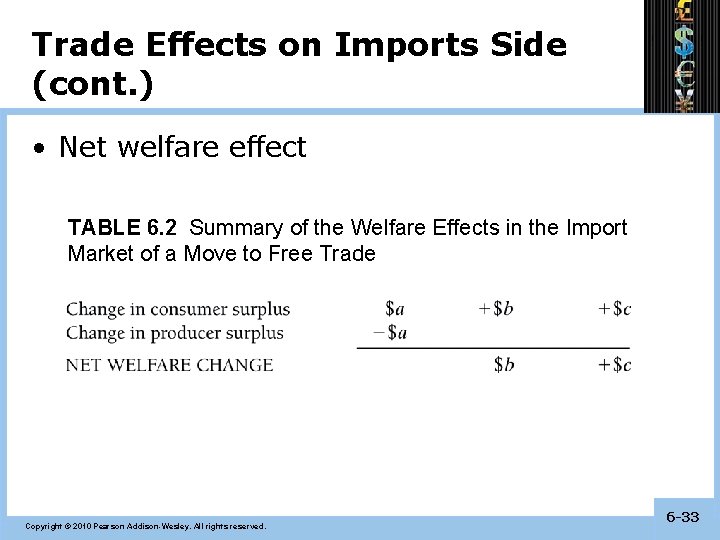

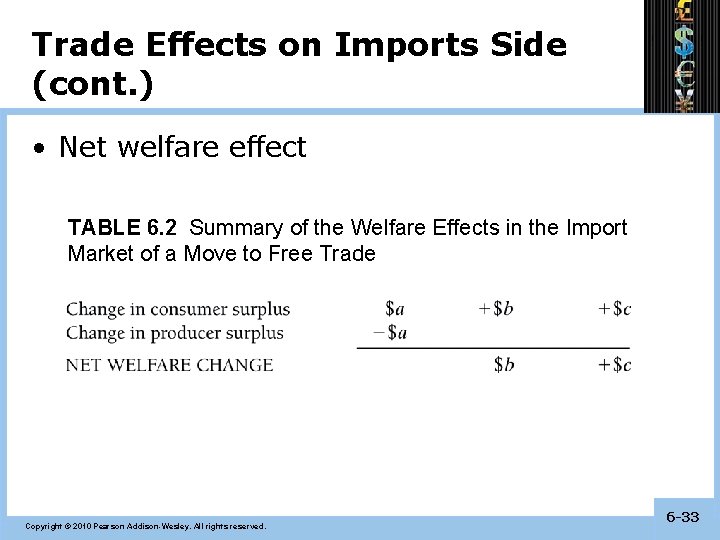

Trade Effects on Imports Side (cont. ) • Net welfare effect TABLE 6. 2 Summary of the Welfare Effects in the Import Market of a Move to Free Trade Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -33

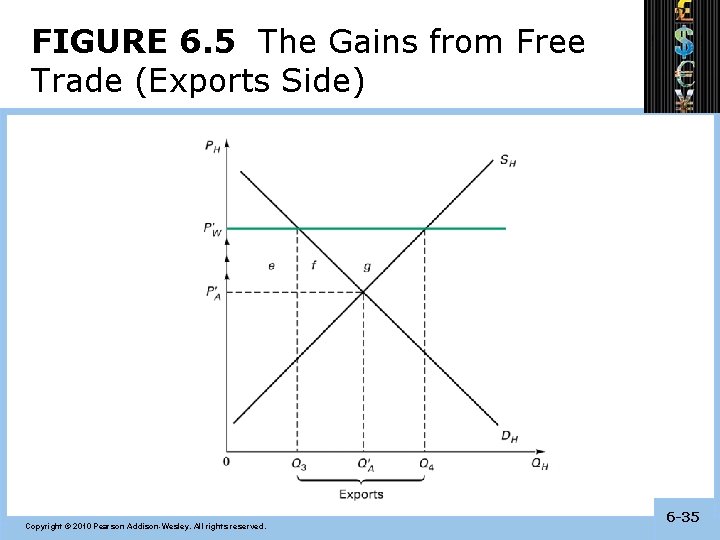

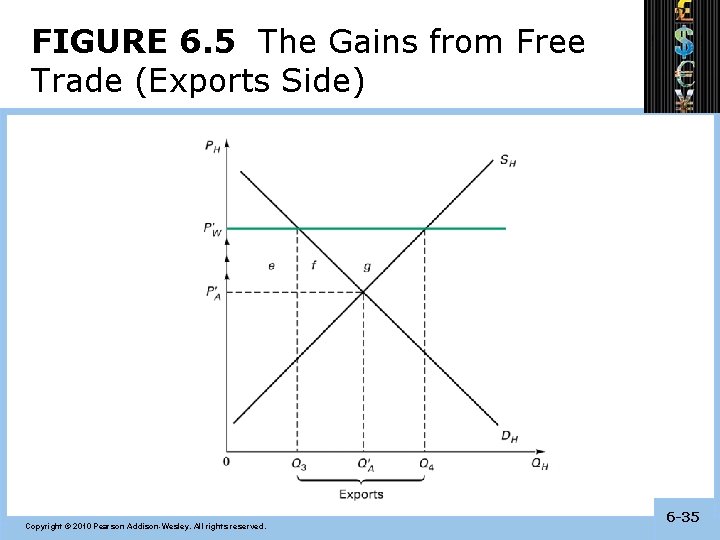

Effects of Free Trade on Exports Side • • Refer to Figure 6. 5 Gains (Exports Side) Price effect Consumption effect Production effect Exports effect Consumer surplus effect Producer surplus effect Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -34

FIGURE 6. 5 The Gains from Free Trade (Exports Side) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -35

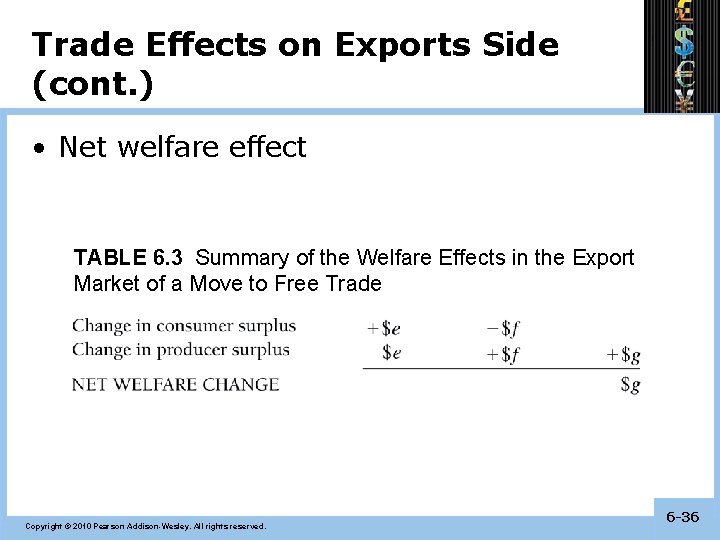

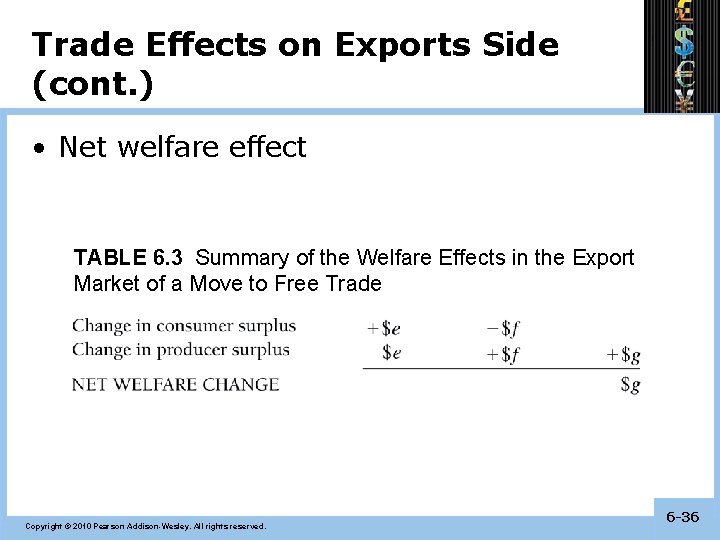

Trade Effects on Exports Side (cont. ) • Net welfare effect TABLE 6. 3 Summary of the Welfare Effects in the Export Market of a Move to Free Trade Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -36

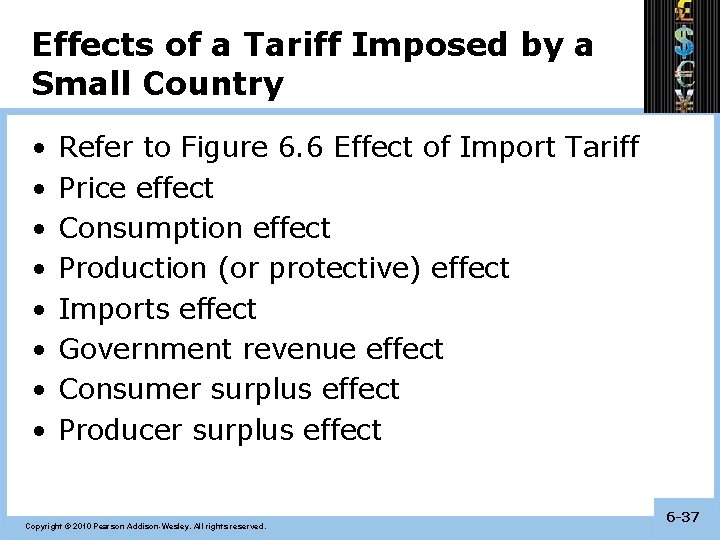

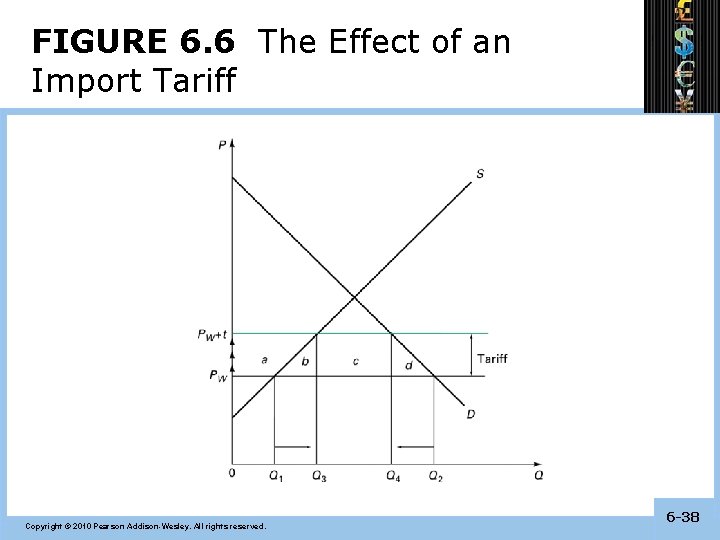

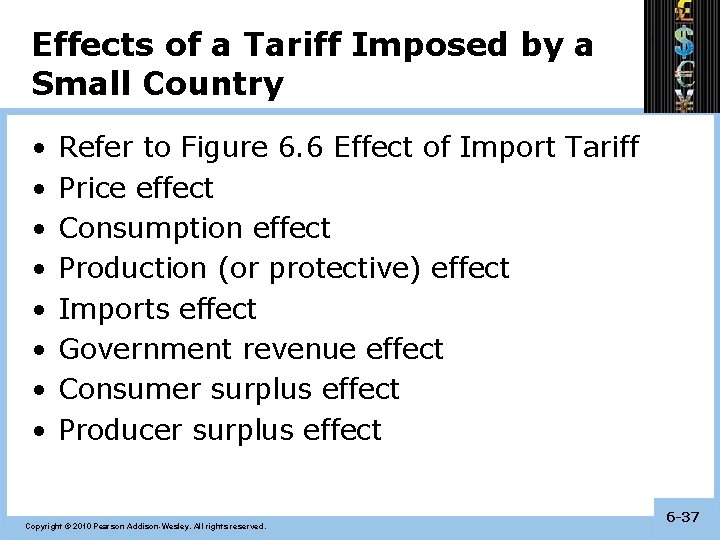

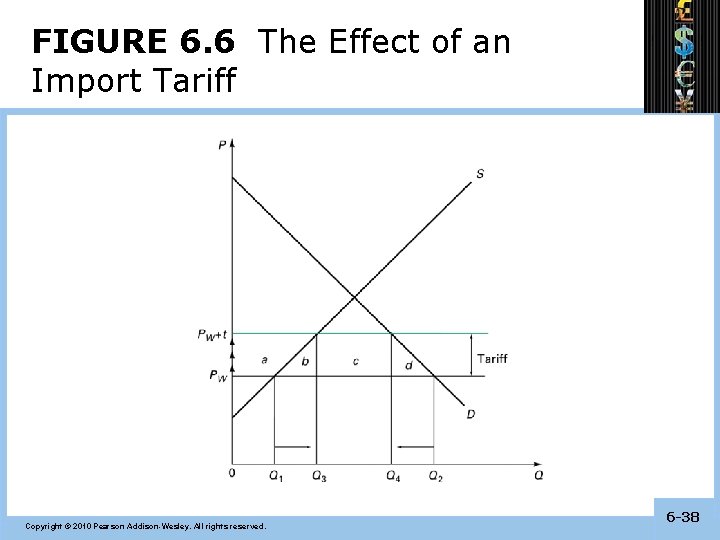

Effects of a Tariff Imposed by a Small Country • • Refer to Figure 6. 6 Effect of Import Tariff Price effect Consumption effect Production (or protective) effect Imports effect Government revenue effect Consumer surplus effect Producer surplus effect Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -37

FIGURE 6. 6 The Effect of an Import Tariff Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -38

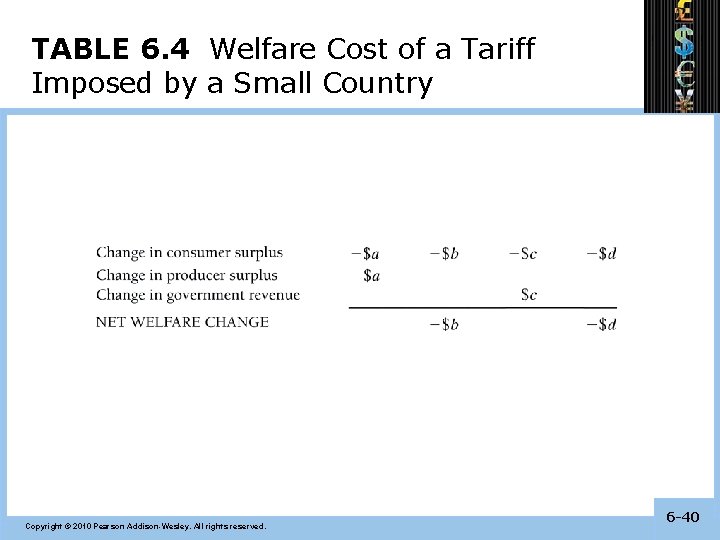

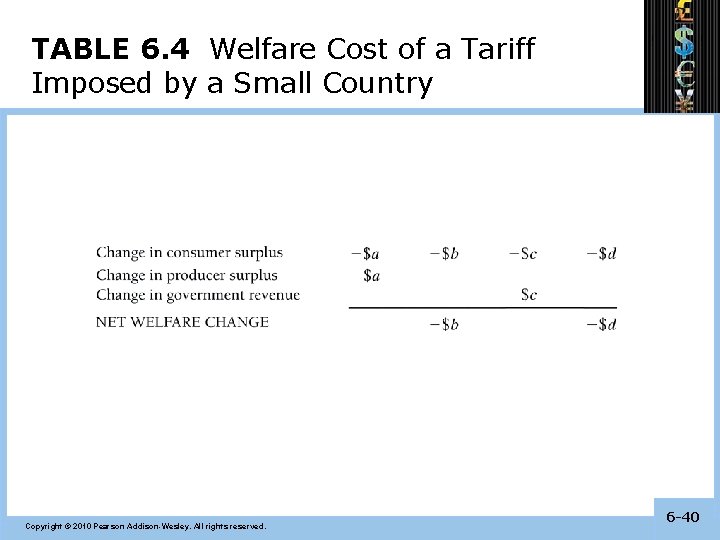

Welfare Cost of Tariff Imposed by a Small Country • Deadweight cost—value of wasted resources devoted to expanded domestic production and expenditures devoted to less-desired substitutes brought about by a tariff Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -39

TABLE 6. 4 Welfare Cost of a Tariff Imposed by a Small Country Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -40

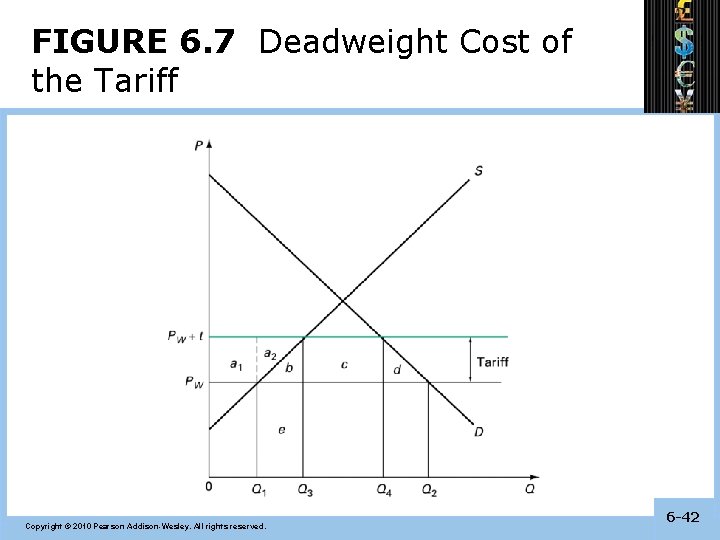

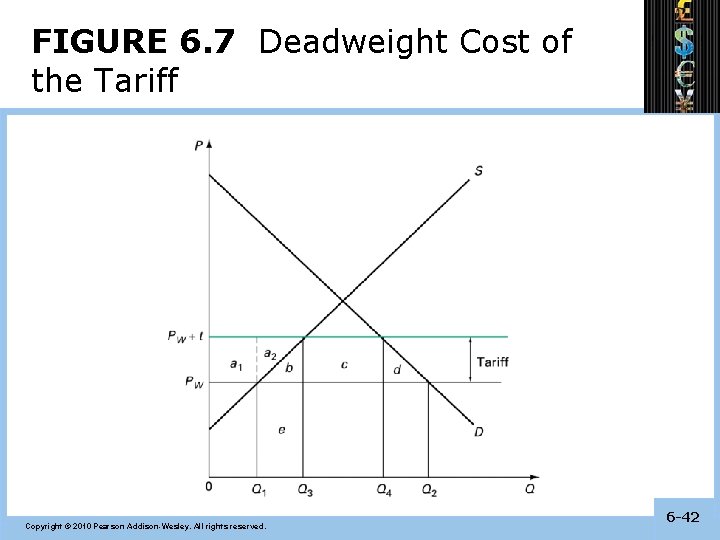

Two Deadweight Costs of the Tariff • Refer to Figure 6. 7 Deadweight Cost of Tariff • Production deadweight cost—refers to the protective effect of the tariff which allows domestic firms to increase production above free trade levels (area b). • Consumer deadweight cost—the value of lost consumer satisfaction due to a shift in consumption to less-desired substitutes brought on by the higher price (area d). • Total deadweight cost = ½ x tariff x reduction in imports • Consider Global Insights 6. 2 for estimates of the welfare costs of tariffs on U. S. industries Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -41

FIGURE 6. 7 Deadweight Cost of the Tariff Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -42

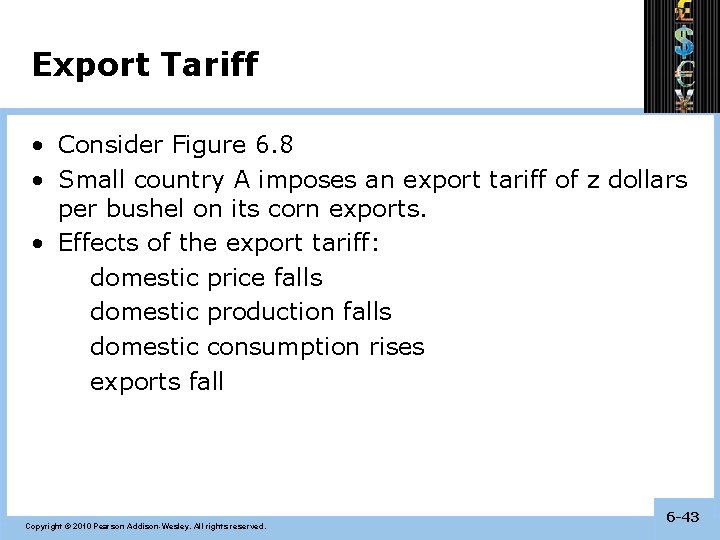

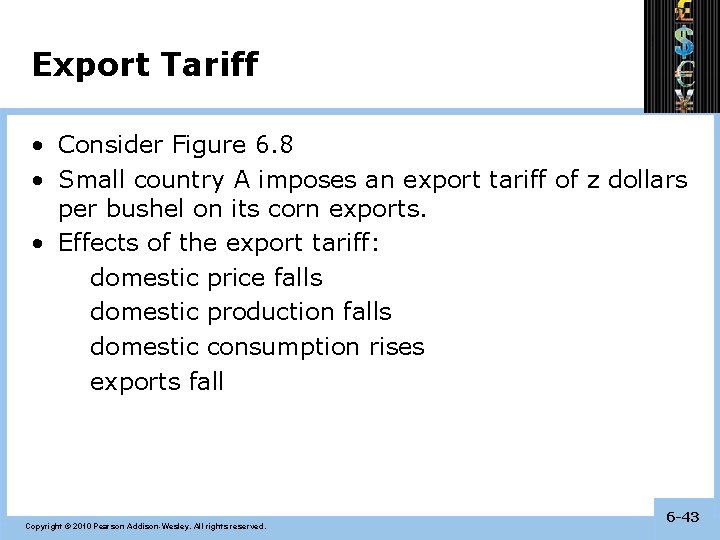

Export Tariff • Consider Figure 6. 8 • Small country A imposes an export tariff of z dollars per bushel on its corn exports. • Effects of the export tariff: domestic price falls domestic production falls domestic consumption rises exports fall Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -43

FIGURE 6. 8 The Effect of an Export Tariff Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -44

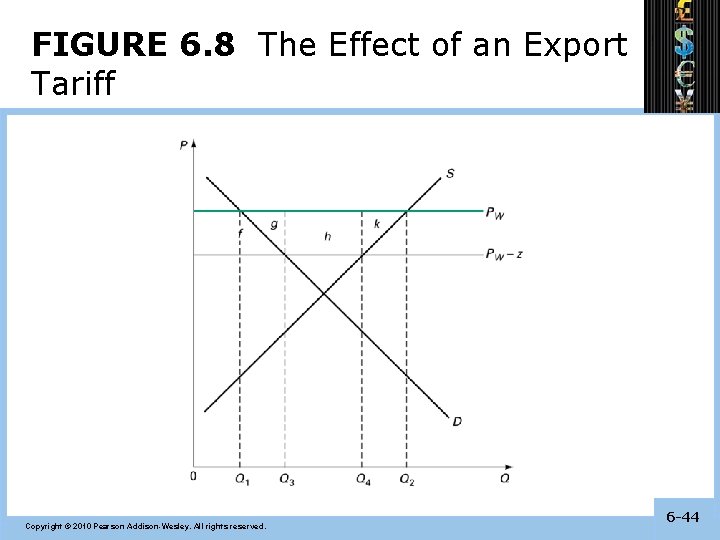

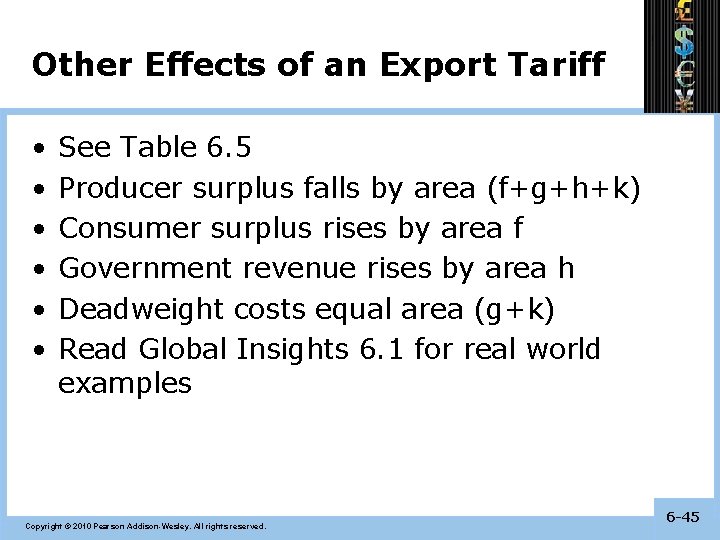

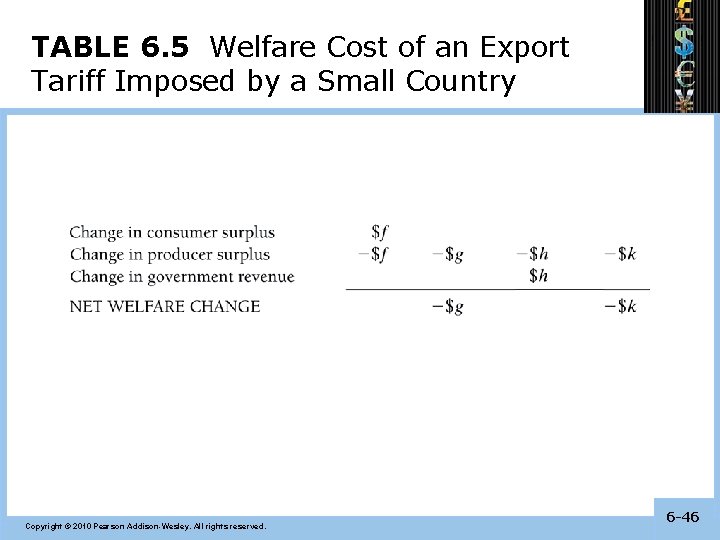

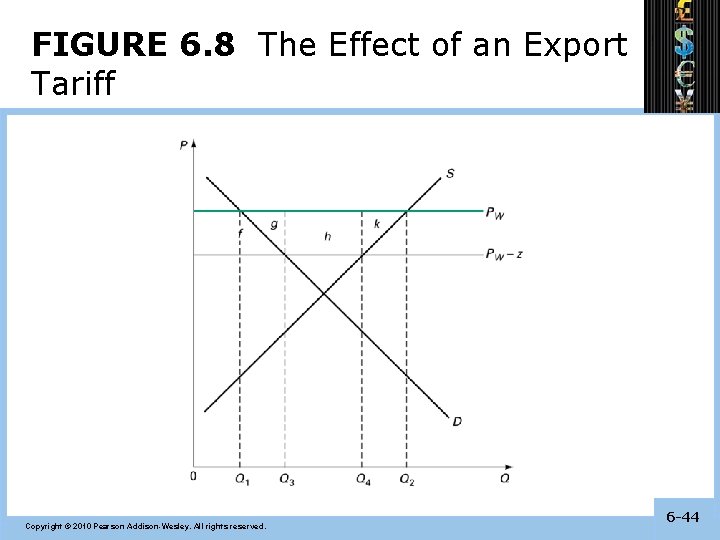

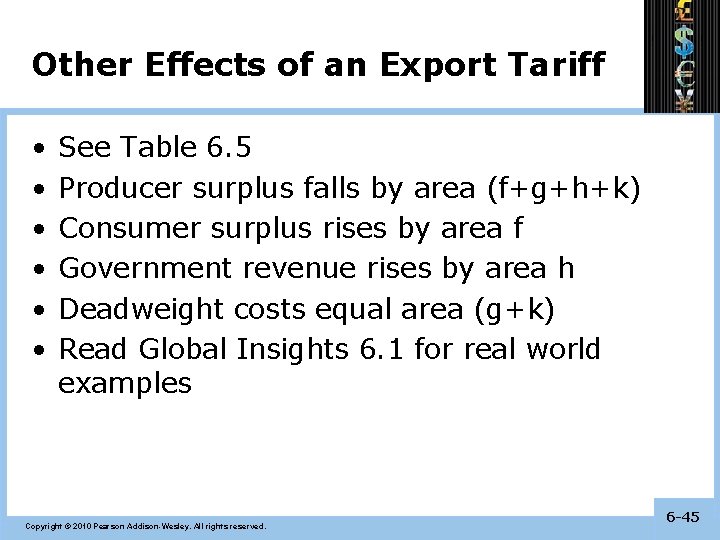

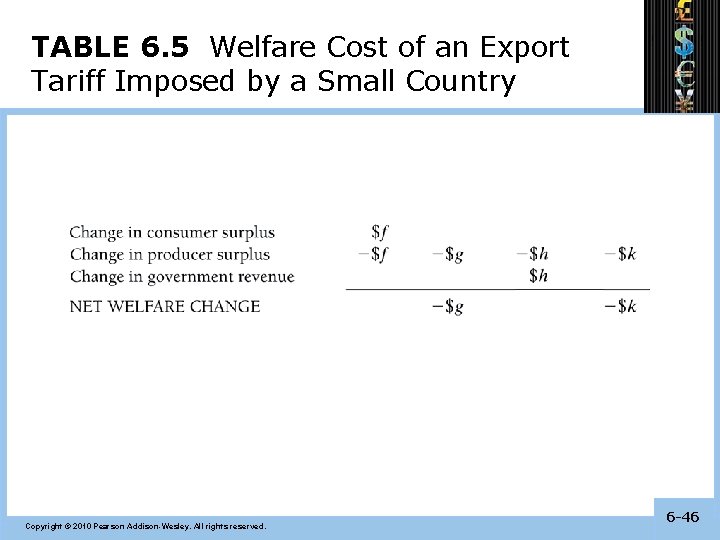

Other Effects of an Export Tariff • • • See Table 6. 5 Producer surplus falls by area (f+g+h+k) Consumer surplus rises by area f Government revenue rises by area h Deadweight costs equal area (g+k) Read Global Insights 6. 1 for real world examples Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -45

TABLE 6. 5 Welfare Cost of an Export Tariff Imposed by a Small Country Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -46

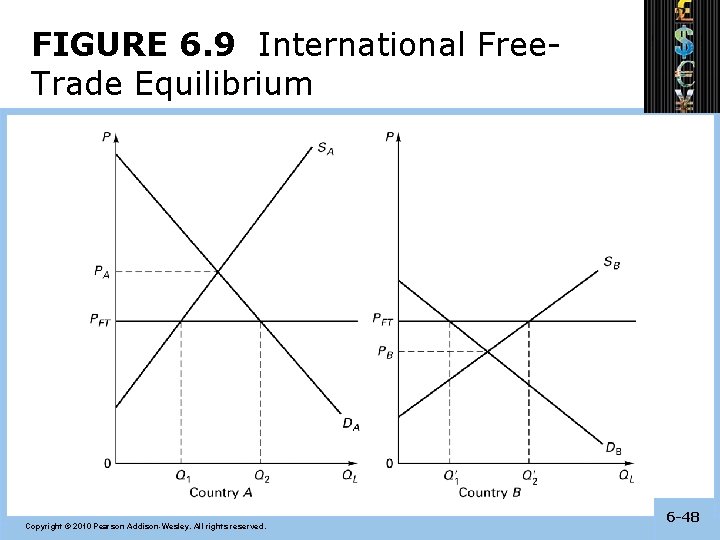

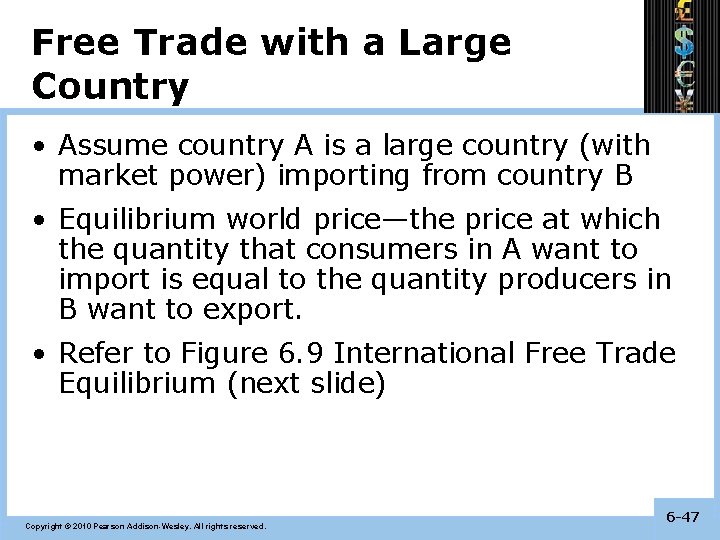

Free Trade with a Large Country • Assume country A is a large country (with market power) importing from country B • Equilibrium world price—the price at which the quantity that consumers in A want to import is equal to the quantity producers in B want to export. • Refer to Figure 6. 9 International Free Trade Equilibrium (next slide) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -47

FIGURE 6. 9 International Free. Trade Equilibrium Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -48

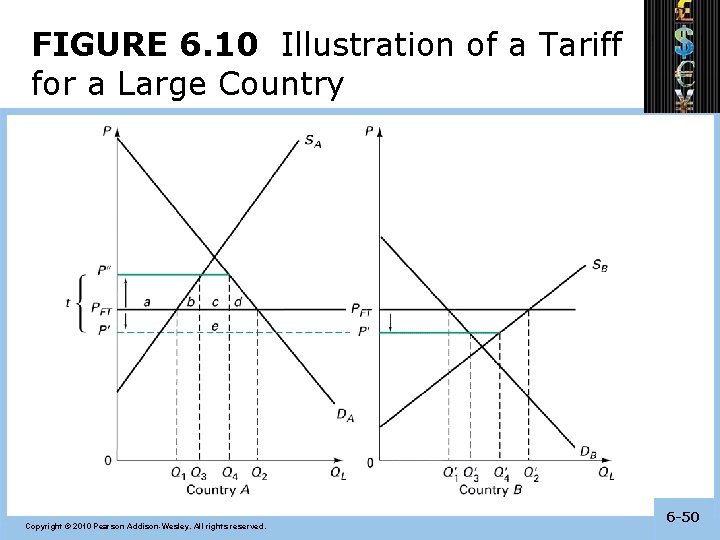

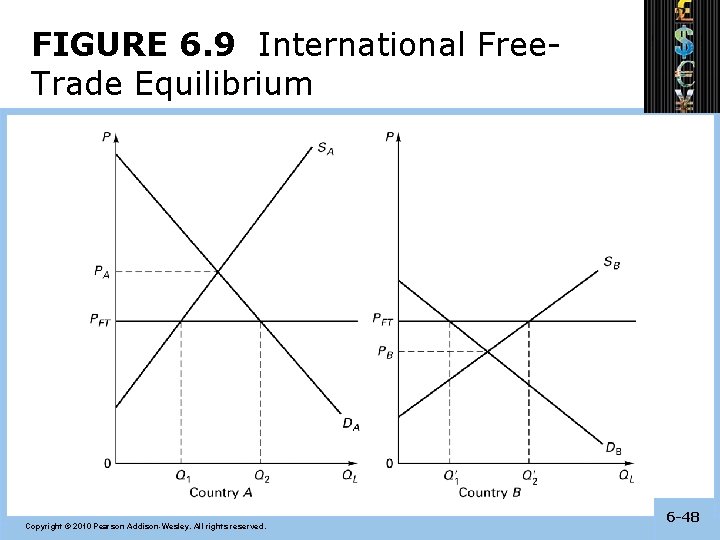

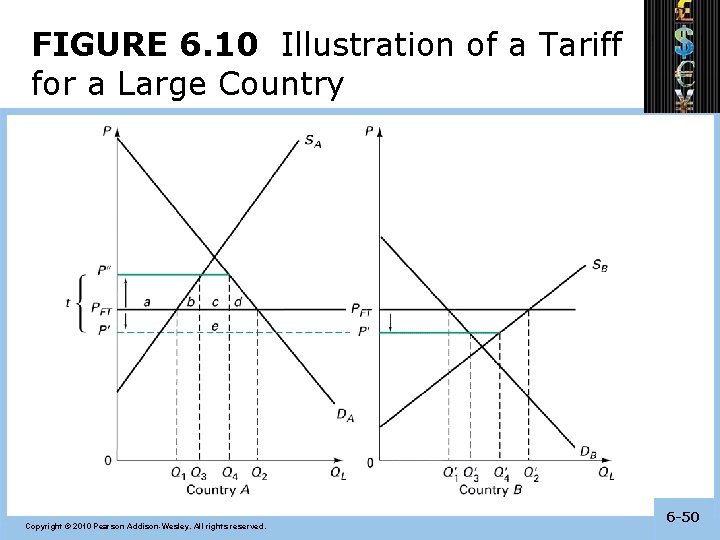

Effects of a Tariff Imposed by a Large Country • • Refer to Figure 6. 10 Tariff for Large Country Price effect Consumption effect Production (or protective) effect Imports effect Government revenue effect Consumer surplus effect Producer surplus effect Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -49

FIGURE 6. 10 Illustration of a Tariff for a Large Country Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -50

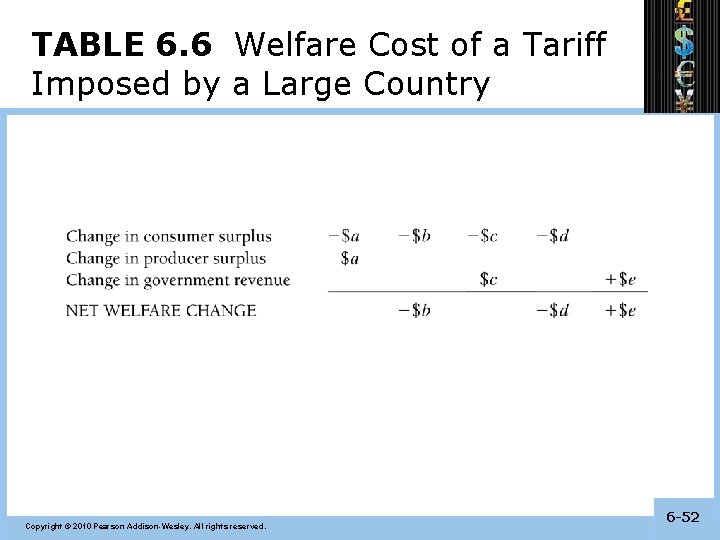

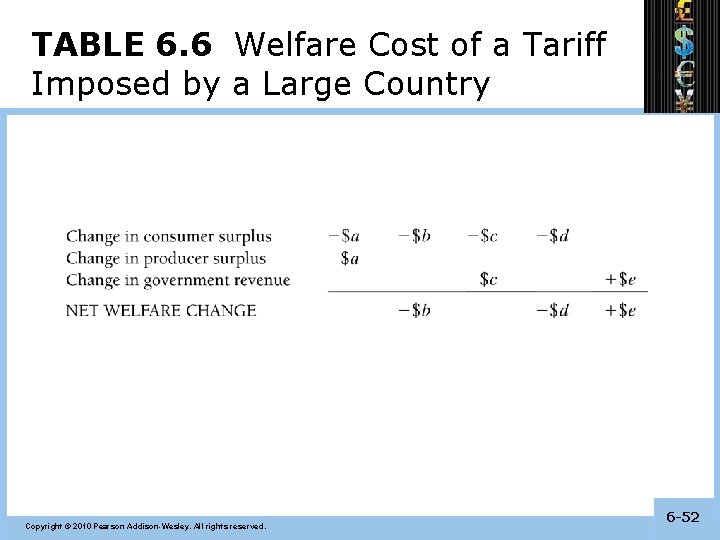

Welfare Effects of a Tariff on a Large Country • Because of its market power, the large country is able to shift part of the burden of the tariff onto the exporting country. • The greater the tariff burden or revenue paid by foreign exporters compared to the large country’s deadweight costs, the greater the welfare increase in the large country (Refer to Table 6. 6) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -51

TABLE 6. 6 Welfare Cost of a Tariff Imposed by a Large Country Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -52

Optimal Tariff • The size of a tariff that raises the welfare of a tariff-imposing country by the greatest amount relative to free-trade welfare levels. • In this the optimal tariff or the welfare due to tariff, the larger area $e is, every thing else held constant, the greater is the welfare that A’s has increased because of the imposition of the tariff. Also, the smaller area $b+d, the greater welfare increase in A. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -53

Trade (or Tariff) War • A general reduction in world trade brought about by retaliation and increases in trade barriers around the world. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -54

Effective Rate of Protection • The effective rate of protection measures how much protection a tariff or other trade policy provides domestic producers. – It represents the change in value that firms in an industry add to the production process when trade policy changes. – The change in value that firms in an industry provide depends on the change in prices when trade policies change. – Effective rates of protection often differ from tariff rates because tariffs affect sectors other than the protected sector, causing indirect effects on the prices and value added for the protected sector. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -55

Effective Rate of Protection (cont. ) • For example, suppose that automobiles sell in world markets for $8, 000, and they are made from factors of production worth $6, 000. – The value added of the production process is $8, 000 -$6, 000 • Suppose that a country puts a 25% tariff on imported autos so that domestic auto assembly firms can now charge up to $10, 000 instead of $8, 000. – Auto assembly will occur in the domestic country if the value added is at least $10, 000 -$6, 000. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 8 -56 6 -56

Effective Rate of Protection (cont. ) • The effective rate of protection for domestic auto assembly firms is the change in value added: ($4, 000 - $2, 000)/$2, 000 = 100% • In this case, the effective rate of protection is greater than the tariff rate. Copyright © 2009 Pearson Addison-Wesley. All rights reserved. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 8 -57 6 -57

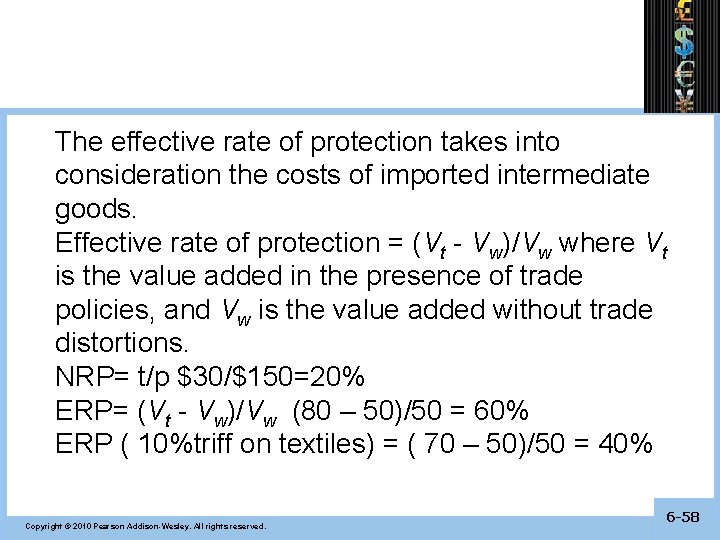

The effective rate of protection takes into consideration the costs of imported intermediate goods. Effective rate of protection = (Vt - Vw)/Vw where Vt is the value added in the presence of trade policies, and Vw is the value added without trade distortions. NRP= t/p $30/$150=20% ERP= (Vt - Vw)/Vw (80 – 50)/50 = 60% ERP ( 10%triff on textiles) = ( 70 – 50)/50 = 40% Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -58

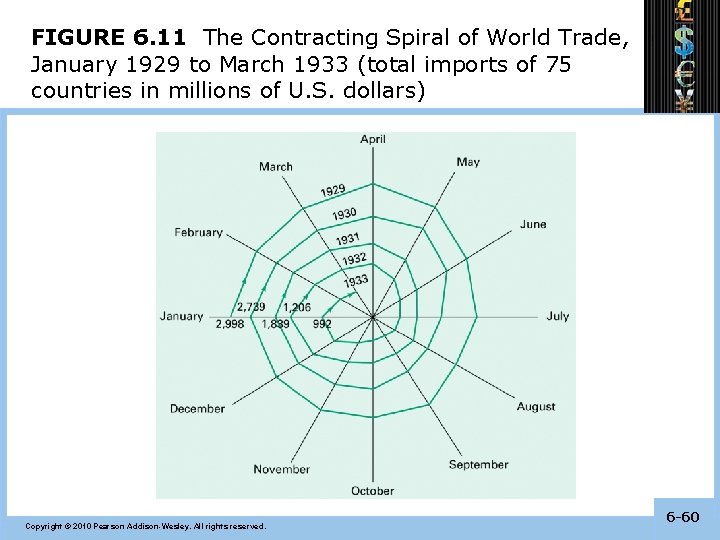

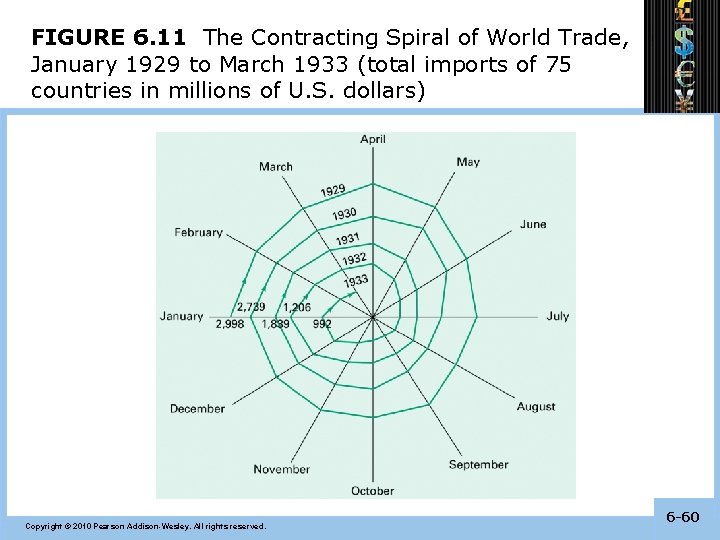

Effects of the Smoot-Hawley Tariff Act of 1930 • Refer to Global Insights 6. 3 • The Tariff Act resulted in average tariff levels rising to almost 60% and covered more than 12, 000 products. • Other countries retaliated by raising their tariff levels. • World trade and U. S. exports dropped (see Figure 6. 11). Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -59

FIGURE 6. 11 The Contracting Spiral of World Trade, January 1929 to March 1933 (total imports of 75 countries in millions of U. S. dollars) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -60

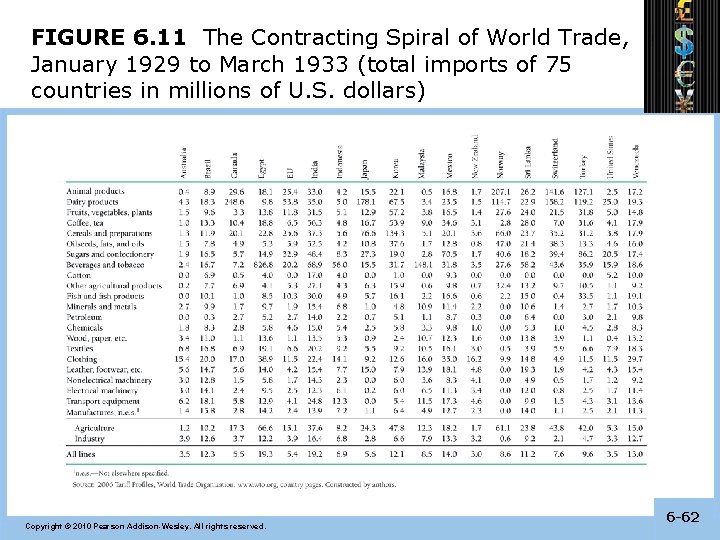

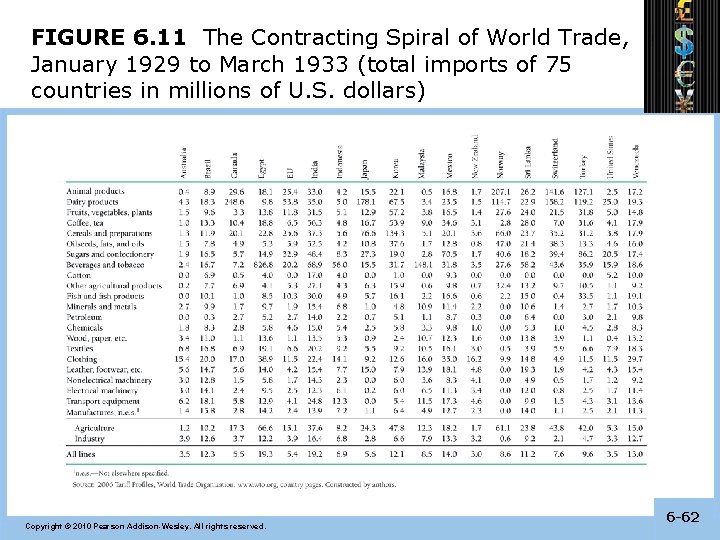

How High are Tariffs? • Refer to Table 6. 7 MFN Applied Tariff Rates • Tariffs for individual products may be different than the average rates shown. • The tariffs differ by product (tariffs on agricultural goods exceed those of manufactured goods). • Tariffs on manufactured final goods are higher than those on intermediate goods (tariff escalation by stages of processing). • Tariffs are generally lower for high-income countries. Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -61

FIGURE 6. 11 The Contracting Spiral of World Trade, January 1929 to March 1933 (total imports of 75 countries in millions of U. S. dollars) Copyright © 2010 Pearson Addison-Wesley. All rights reserved. 6 -62