Chapter 6 Orderdriven Markets Orderdriven markets Most important

- Slides: 107

Chapter 6 Order-driven Markets

Order-driven markets Most important exchanges are orderdriven markets. Ø Most newly organized trading systems are electronic order-driven markets. Ø All order-driven markets use order precedence rule and trade pricing rule. Ø

Examples of pure order-driven markets - Tokyo Stock Exchange, - KRX (previously KSE, KOSDAQ) - Paris Bourse, - Toronto Stock Exchange, - Most Future Markets, - Most European Exchanges for equities (Milan, Barcelona, Madrid, Bilbao, Zurich, …. )

Types of order-driven markets Ø Oral auctions Ø Rule-based order matching systems Single price auctions • Continuous order book auctions • Crossing networks •

In order-driven markets, trading rules specify how trades are arranged: - order precedence rules: match buy orders with sell orders 1. Price priority 2. Time precedence or time priority trade price rules: determine the trade price 1. Uniform pricing rule (single price auction) 2. Discriminatory pricing rule -

Oral auctions Ø Used by many futures, options, and stock exchanges. • Ø The largest example is the US government long treasury bond futures market (CBOT, 500 floor traders). Traders arrange their trades face-to-face on an exchange trading floor. • • Cry out bids and offers (offer liquidity) Listen for bids and offers (take liquidity) “Take it” = accept offer “Sold” = accept bid

Ø Open outcry rule – the first rule of oral auctions Traders must publicly announce their bids and offers so that all other traders may react to them (no whispering…). • Traders must also publicly announce that they accept bids/offers. • Why is this necessary? •

Ø Order • Price priority n • precedence rules Should a trader be allowed to bid below the best bid, above the best ask in an oral auction? Time precedence Is time precedence maintained for subsequent orders at the best bid or offer? Why not? n How can a trader keep his bid or offer “live”? n The minimum tick size is the price a trader has to pay to acquire precedence. n • Public order precedence n Why do you think this is necessary?

Ø Trade pricing rule Trades take place at the price that is accepted, i. e. , the bid or offer. • Discriminatory pricing rule in oral auction. n Why do you think it is called discriminatory? •

Ø Trading floors • Trading floors can be arranged in several rooms as on the NYSE, with each stock being traded at a specific “trading post. ” • Trading floors can also be arranged in “pits” as in the futures markets.

Rule-based order-matching systems Used by most exchanges and almost all ECNs. Ø Trading rules arrange trades from the orders that traders submit to them. Ø No face-to-face negotiation. Ø Most systems accept only limit orders. Ø • Why do you think most systems are reluctant to accept market orders?

Orders are for a specified size. Ø Electronic trading systems process the orders. Ø Trades may take place in a call, or continuously. • A new order arrival “activates” the trading system. Ø Systems match orders using order precedence rules, determine which matches can trade, and price the resulting trades. Ø

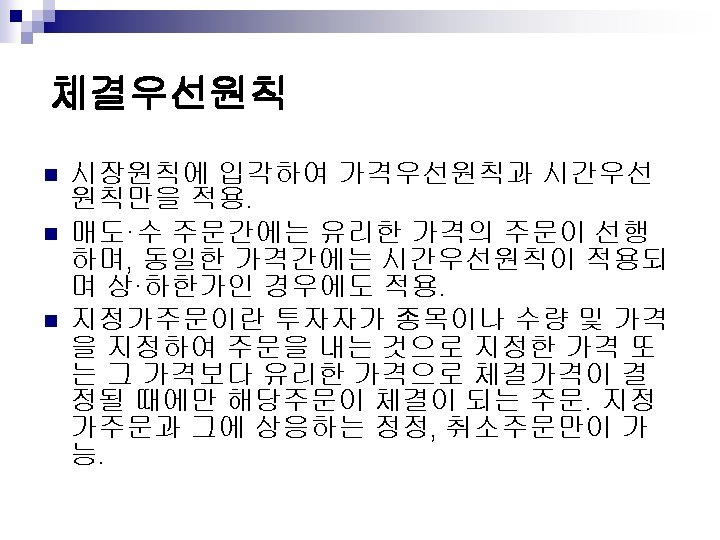

Order precedence rules ØPrice • • • priority Market orders always rank above limit orders. Limit buy orders with high prices have priority over limit buy orders with low prices Limit sell orders with low prices have priority over limit sell orders with high prices.

ØTime precedence • Under time precedence, the first order at a given price has precedence over all other orders at that price. Gives orders precedence according to their time of submission. • The pure price-time rule uses only price priority and time precedence. • Floor time precedence to first order at price. All subsequent orders at that price have parity (Oral auction)

Ø Display • Why do markets use display precedence? Ø Size • precedence Some markets give precedence to small orders, other markets favor large orders (NYSE). Ø Public • precedence order precedence Public orders have precedence over member orders at a given price.

Ø Trades are arranged by matching the highest ranking buy orders with the highest ranking sell orders. Ø Order precedence rules are used to rank orders. Ø Order precedence rules vary across markets. However, the first rule is almost always price priority.

Trade pricing rules Single price auctions use the uniform pricing rule. Most continuous orderdriven markets use the discriminatory pricing rule.

Uniform pricing rule Ø All matched orders are executed at the same price. Ø This rule is used for opening markets in many equities markets, following trading halts for many continuous markets, and in the AZX, ….

Discriminatory pricing rule Ø In a continuous market trade takes place when an incoming order is matched with a standing limit order. Ø Under the discriminatory pricing rule, the trade price is the limit price of the standing limit order.

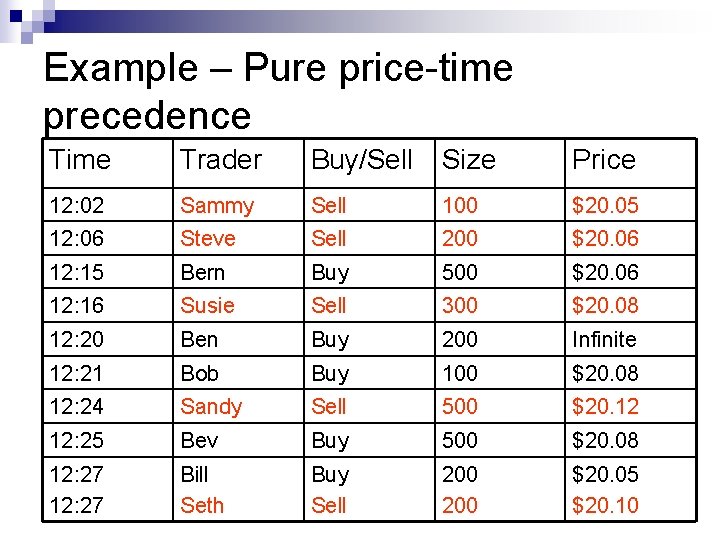

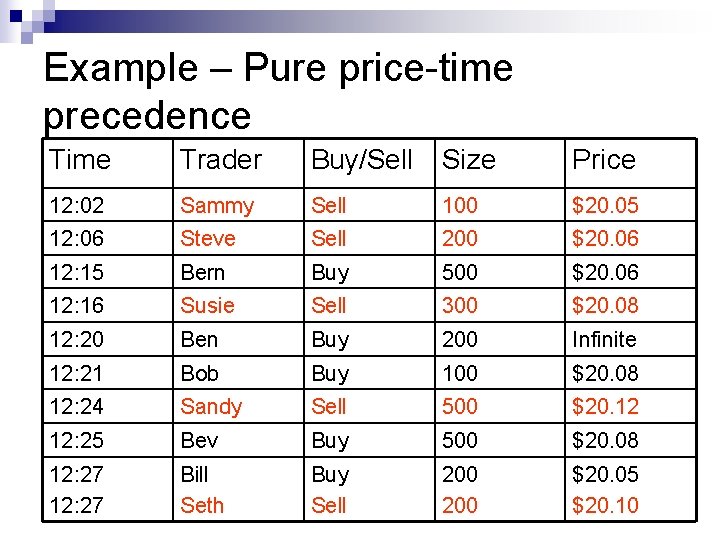

Example – Pure price-time precedence Time Trader Buy/Sell Size Price 12: 02 Sammy Sell 100 $20. 05 12: 06 Steve Sell 200 $20. 06 12: 15 Bern Buy 500 $20. 06 12: 16 Susie Sell 300 $20. 08 12: 20 Ben Buy 200 Infinite 12: 21 Bob Buy 100 $20. 08 12: 24 Sandy Sell 500 $20. 12 12: 25 Bev Buy 500 $20. 08 12: 27 Bill Seth Buy Sell 200 $20. 05 $20. 10

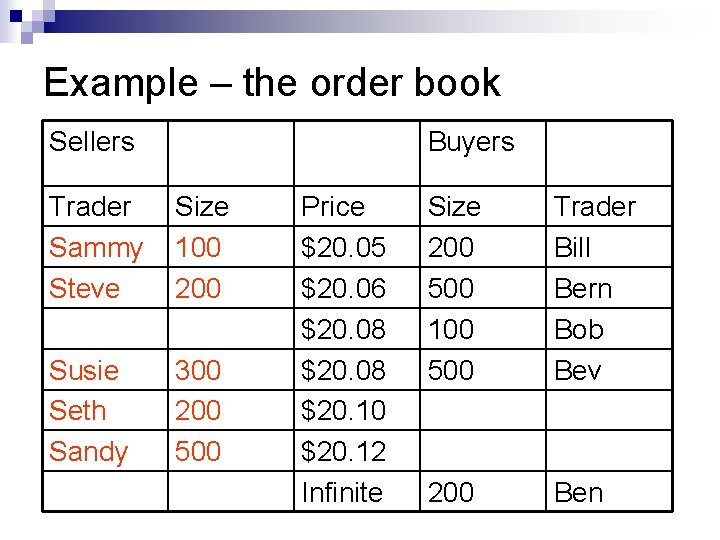

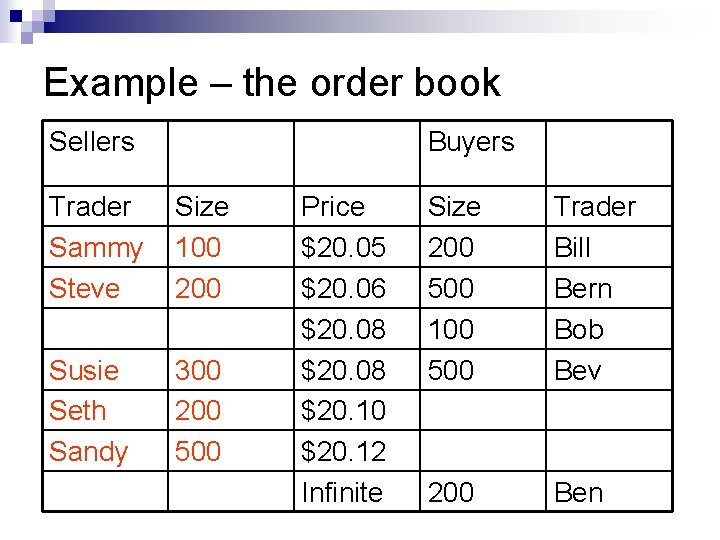

Example – the order book Sellers Buyers Trader Sammy Steve Size 100 200 Susie Seth Sandy 300 200 500 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Size 200 500 100 500 Trader Bill Bern Bob Bev 200 Ben

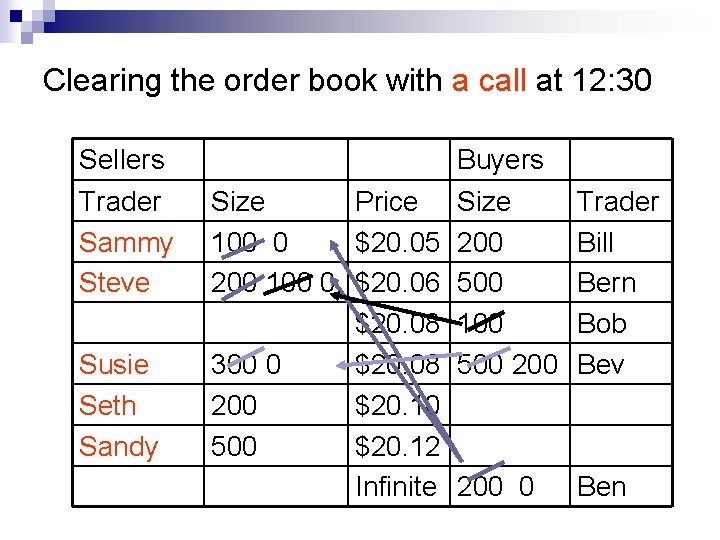

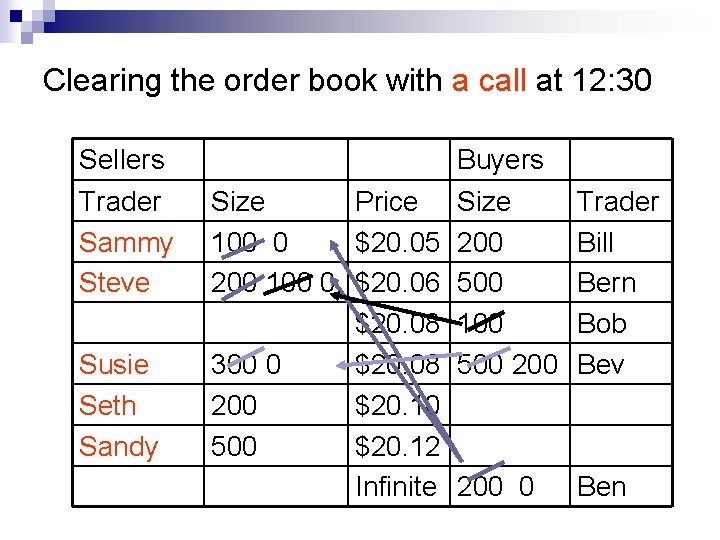

Clearing the order book with a call at 12: 30 Sellers Trader Sammy Steve Susie Seth Sandy Buyers Size 200 500 100 500 200 Size Price 100 0 $20. 05 200 100 0 $20. 06 $20. 08 300 0 $20. 08 200 $20. 10 500 $20. 12 Infinite 200 0 Trader Bill Bern Bob Bev Ben

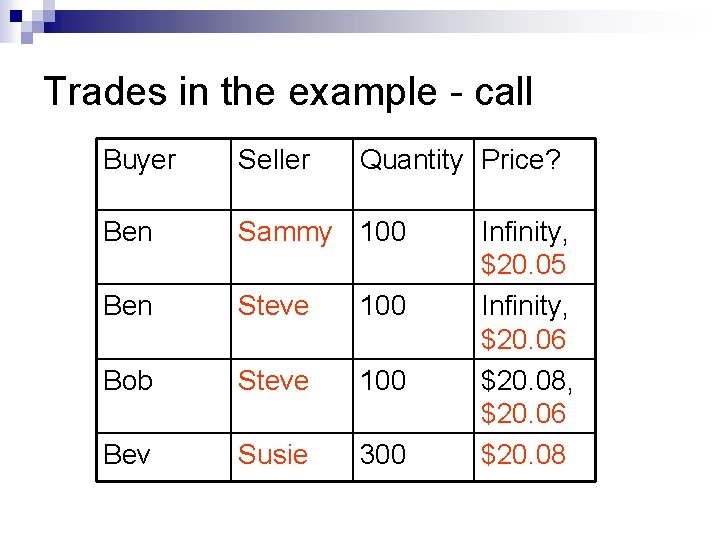

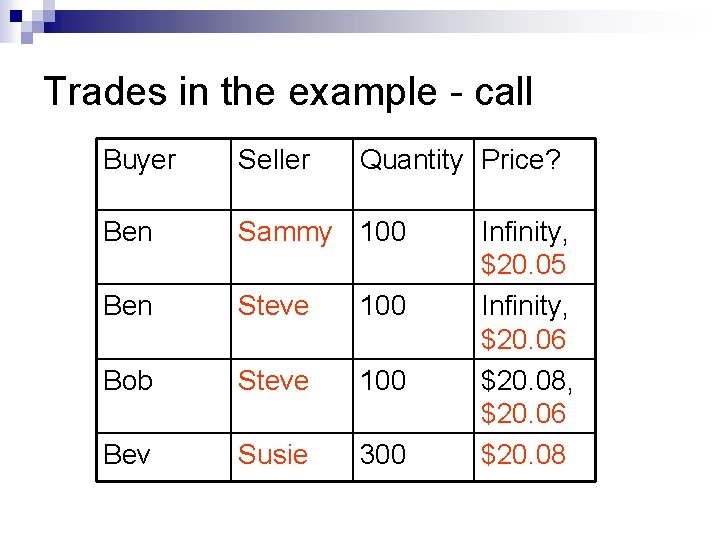

Trades in the example - call Buyer Seller Quantity Price? Ben Sammy 100 Ben Steve 100 Bob Steve 100 Bev Susie 300 Infinity, $20. 05 Infinity, $20. 06 $20. 08

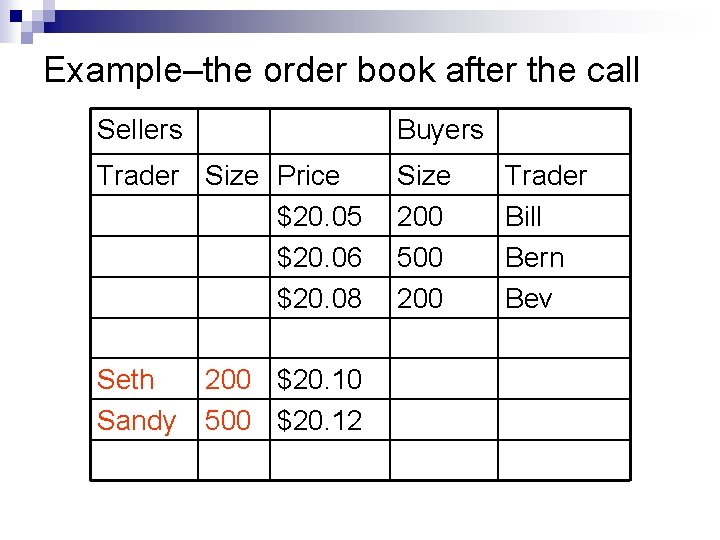

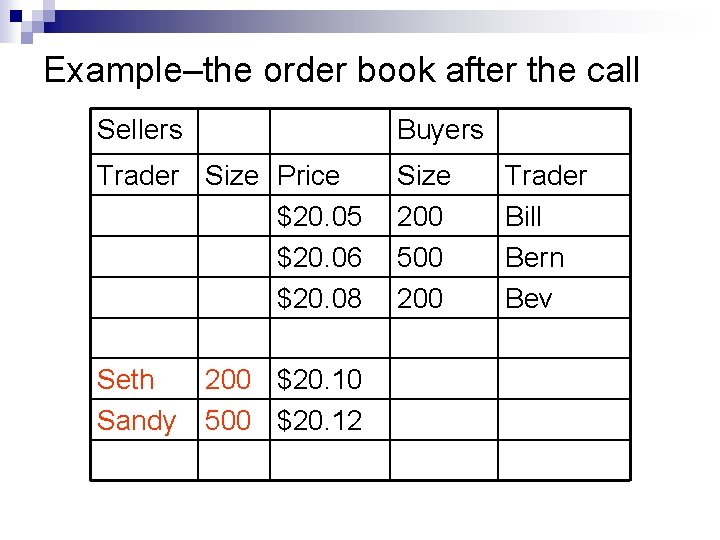

Example–the order book after the call Sellers Buyers Trader Size Price $20. 05 $20. 06 $20. 08 Size 200 500 200 Seth Sandy 200 $20. 10 500 $20. 12 Trader Bill Bern Bev

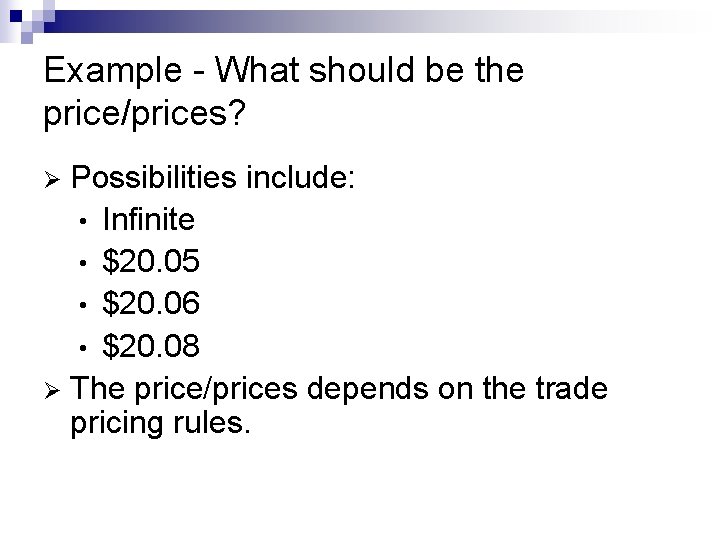

Example - What should be the price/prices? Possibilities include: • Infinite • $20. 05 • $20. 06 • $20. 08 Ø The price/prices depends on the trade pricing rules. Ø

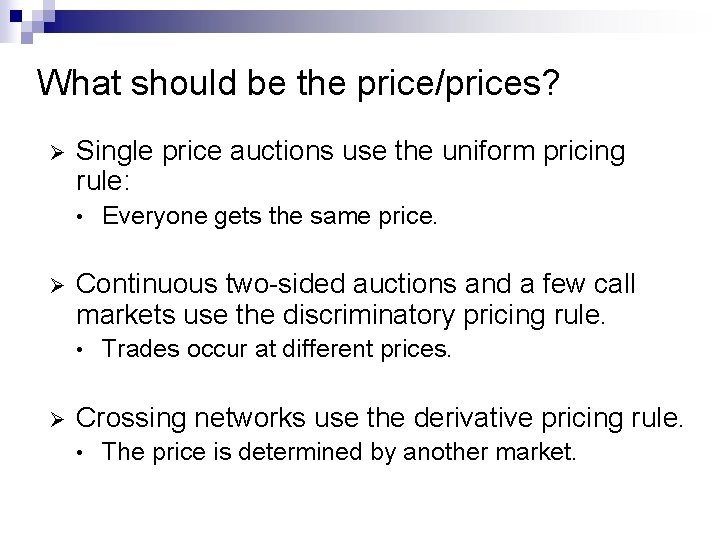

What should be the price/prices? Ø Single price auctions use the uniform pricing rule: • Ø Continuous two-sided auctions and a few call markets use the discriminatory pricing rule. • Ø Everyone gets the same price. Trades occur at different prices. Crossing networks use the derivative pricing rule. • The price is determined by another market.

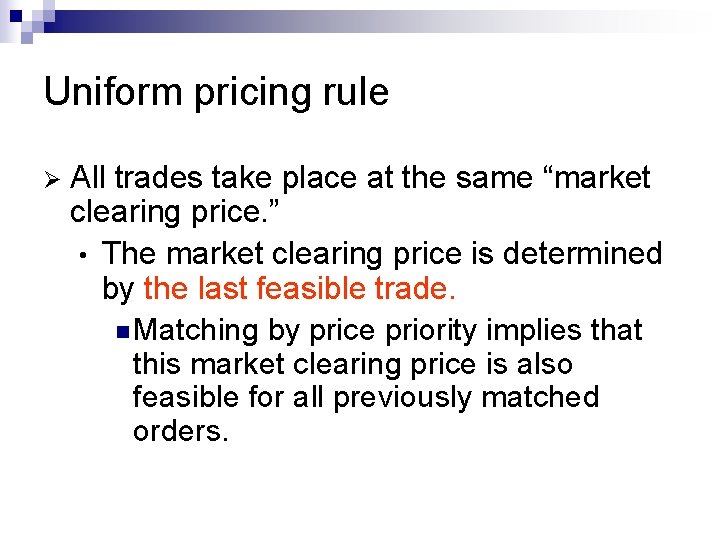

Uniform pricing rule Ø All trades take place at the same “market clearing price. ” • The market clearing price is determined by the last feasible trade. n Matching by price priority implies that this market clearing price is also feasible for all previously matched orders.

n In Example 1, the last feasible trade is between Bev and Susie, so the market clearing price is $20. 08. • Sam, Steve and Susie are happy with a market clearing price of $20. 08 since they were willing to sell at $20. 08 or lower. • Ben, Bob, and Bev are happy to with a market clearing price of $20. 08 since they were willing to buy at $20. 08 or higher.

Ø If the buy and sell orders in the last feasible trade specify different prices, the market clearing price can be at either the price of the buy or the price of the sell order. Ø The trade pricing rules will dictate which one to use.

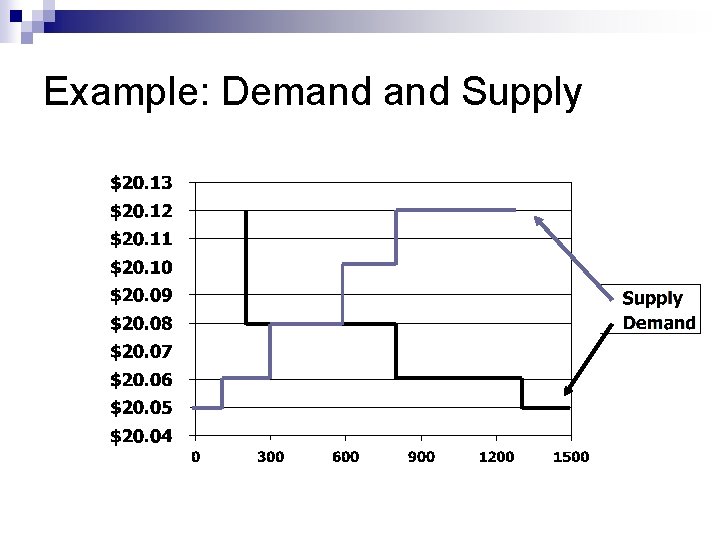

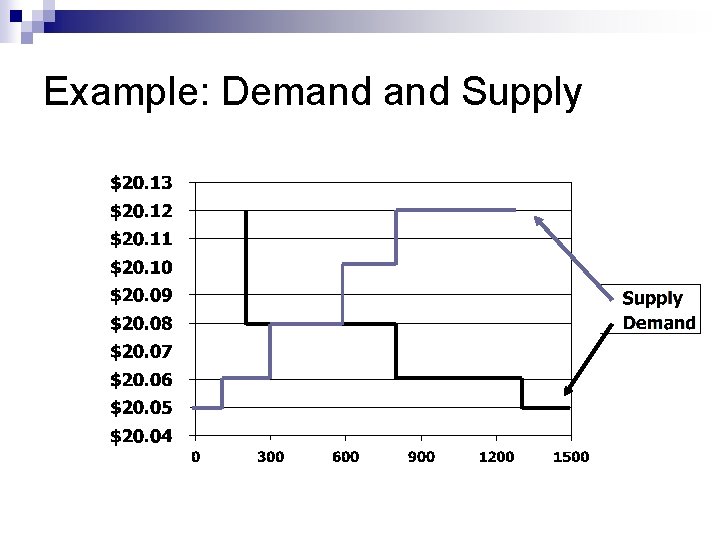

Supply and Demand Ø The single-price auction clears at the price where supply equals demand. • At prices below the market clearing price, there is excess demand. • At prices above the market clearing price, there is excess supply.

Ø Single price auctions maximize the volume of trading by setting the price where supply equals demand. • Because prices in most securities markets are discrete, there is typically excess demand or excess supply at the market clearing price. • In the Example, what is the excess demand or supply?

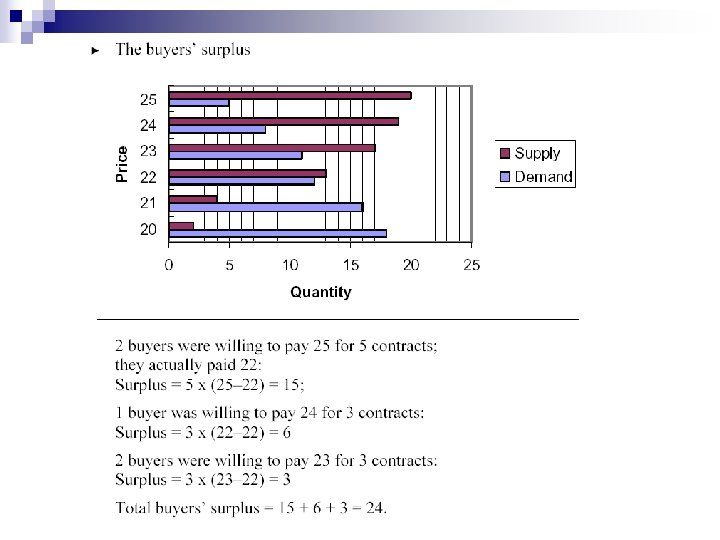

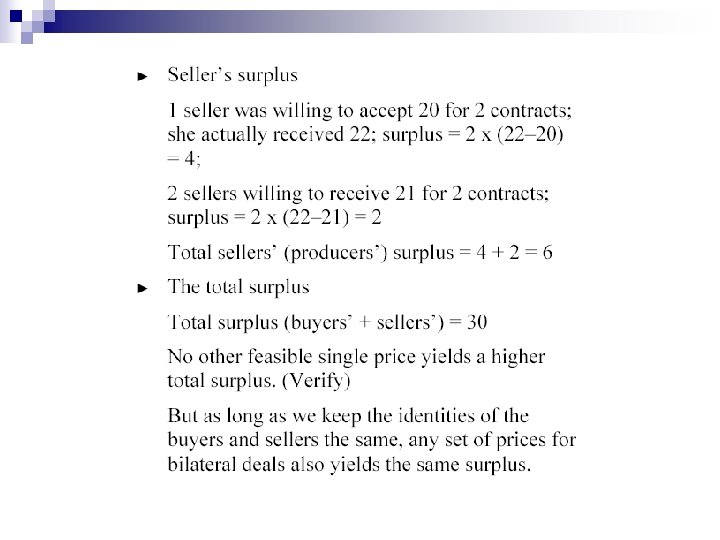

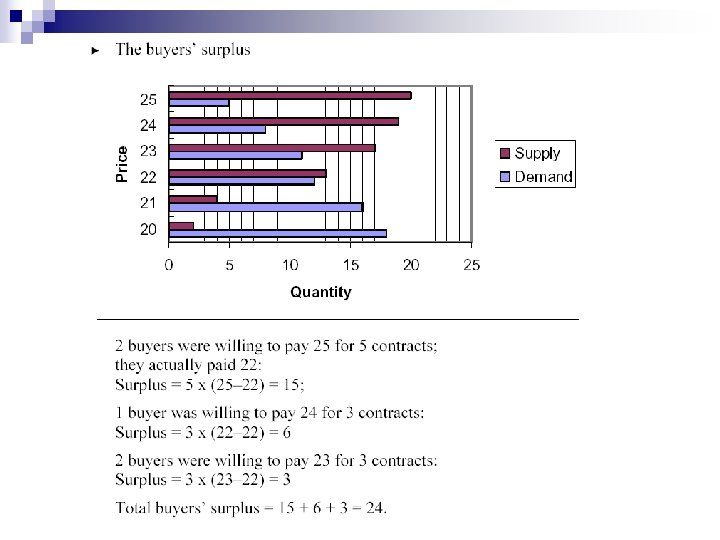

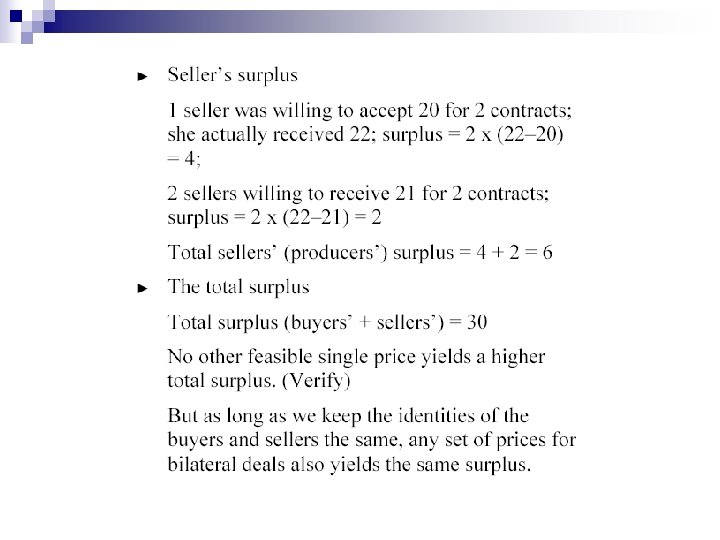

Ø The single price auction also maximizes the benefits that traders derive from participating in the auction. • Trader surplus for a seller = the difference between the trade price and the seller’s valuation • Trader surplus for a buyer = the difference between the buyer’s valuation and the trade price. • Valuations are unobservable, but we may assume that they at least are linked to limit prices.

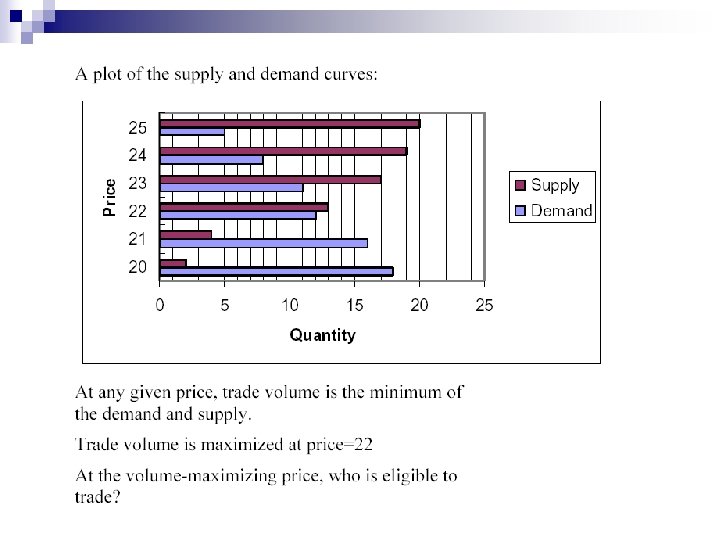

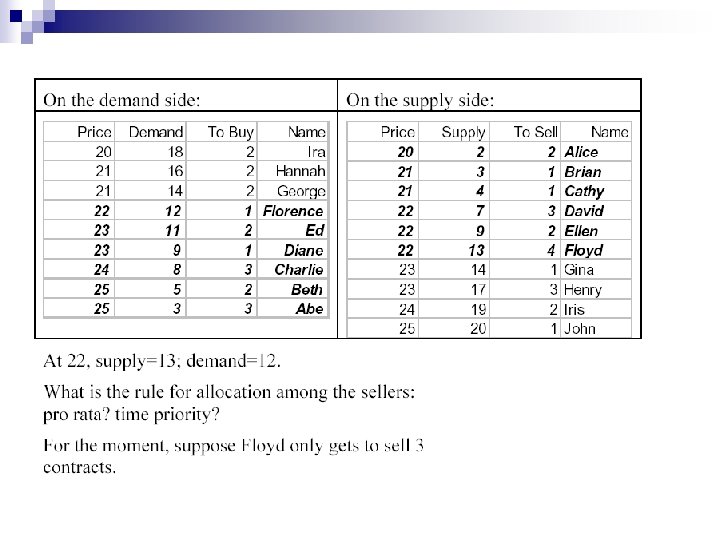

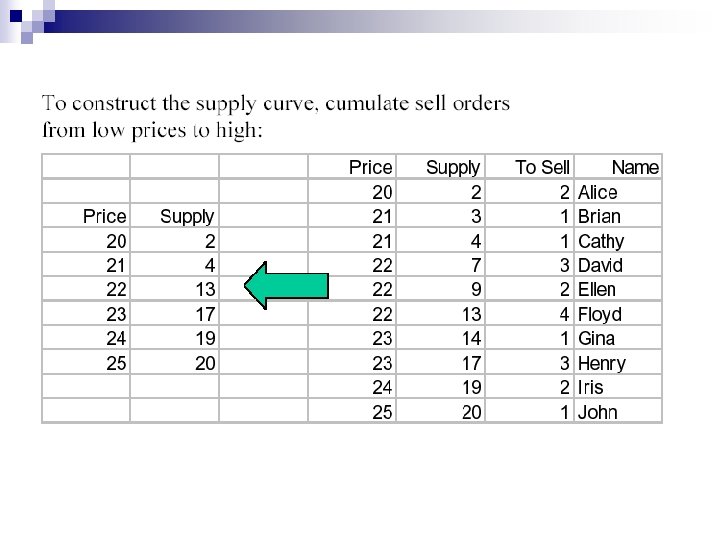

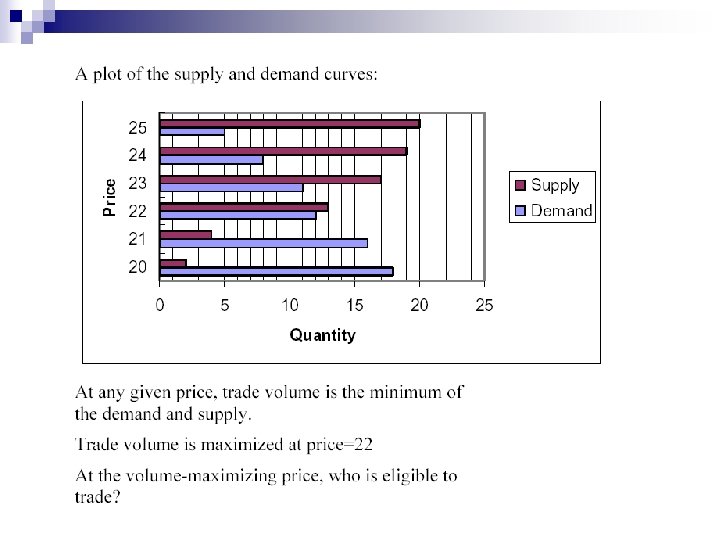

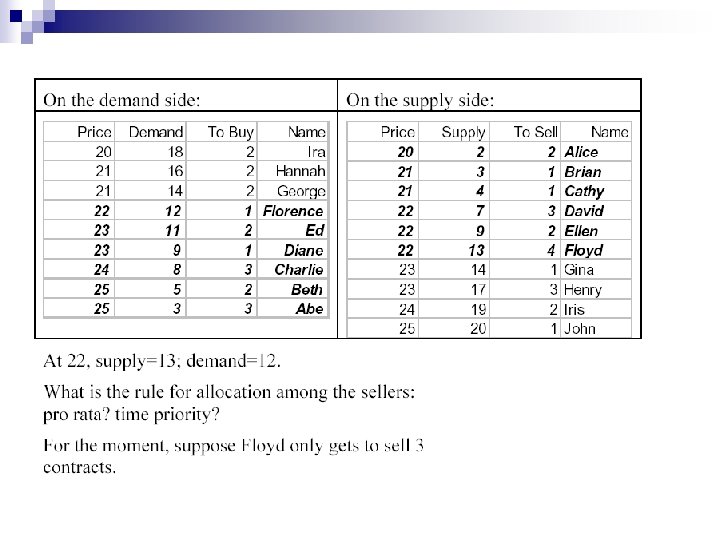

Example: Demand Supply

Discriminatory Pricing Rule Ø Continuous two-sided auction markets maintain an order book. • The buy and sell orders are separately sorted by their precedence. n The highest bid and the lowest offer are the best bid and offer respectively.

• When a new order arrives, the system tries to match this order with orders on the other side. n If a trade is possible, e. g. , the limit buy order is for a price at or above the best offer, the order is called a marketable order. n If a trade is not possible, the order will be sorted into the book according to its precedence.

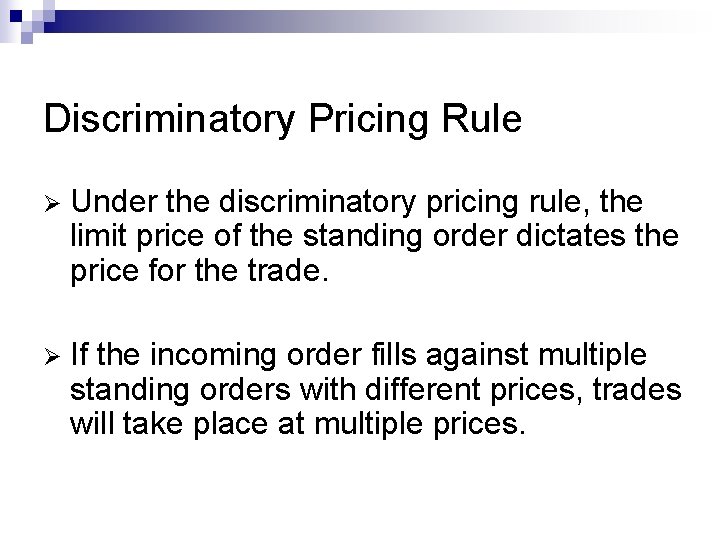

Discriminatory Pricing Rule Ø Under the discriminatory pricing rule, the limit price of the standing order dictates the price for the trade. Ø If the incoming order fills against multiple standing orders with different prices, trades will take place at multiple prices.

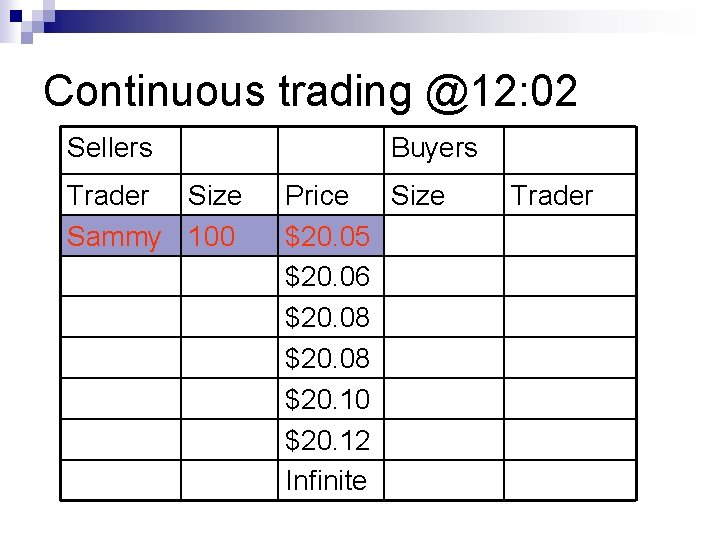

Continuous trading @12: 02 Sellers Trader Size Sammy 100 Buyers Price Size $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Trader

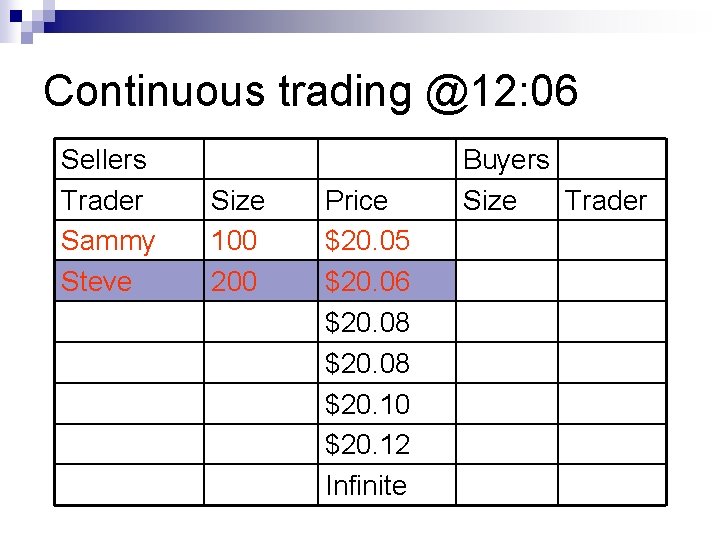

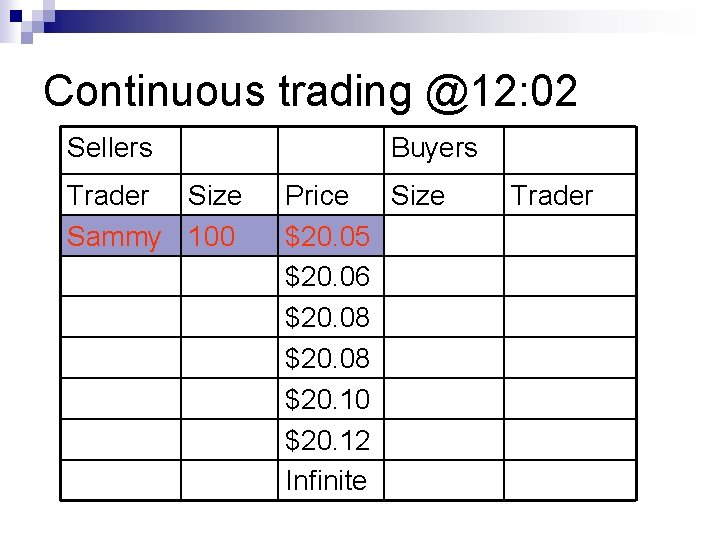

Continuous trading @12: 06 Sellers Trader Sammy Steve Size 100 200 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Buyers Size Trader

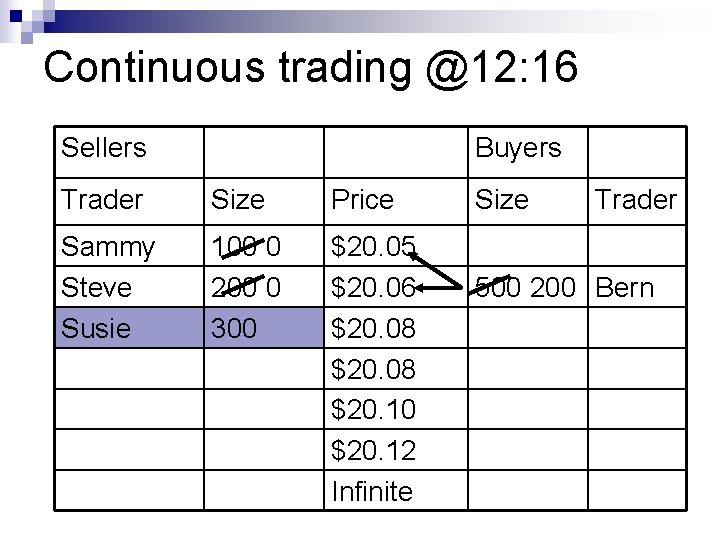

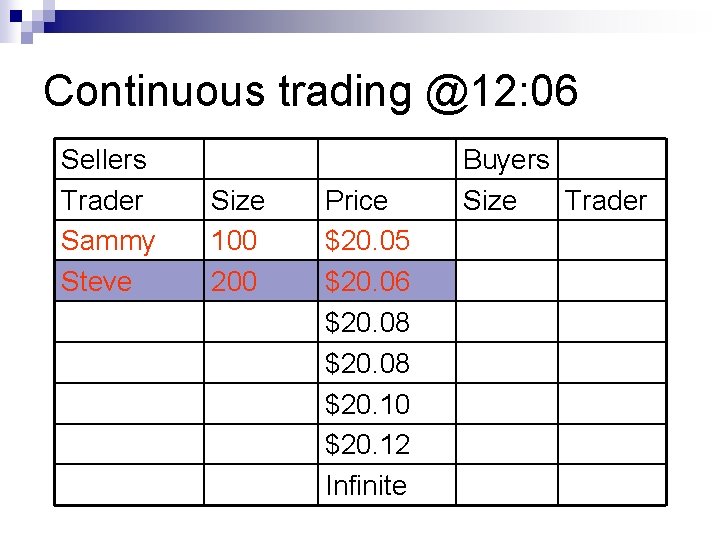

Continuous trading @12: 15 Sellers Trader Size Sammy 100 0 Steve 200 0 Buyers Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Size Trader 500 200 Bern

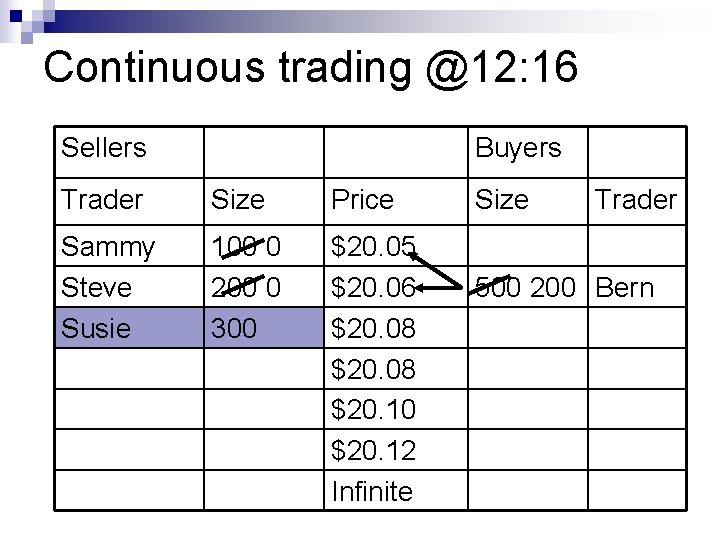

Continuous trading @12: 16 Sellers Buyers Trader Size Price Sammy Steve Susie 100 0 200 0 300 $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Size Trader 500 200 Bern

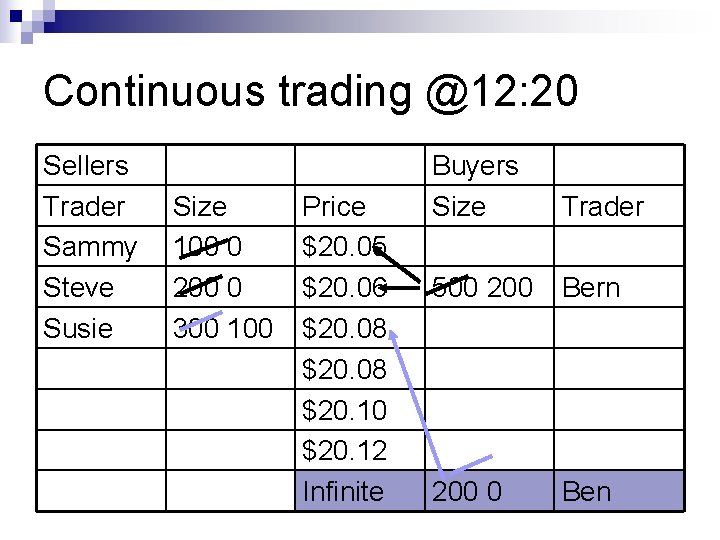

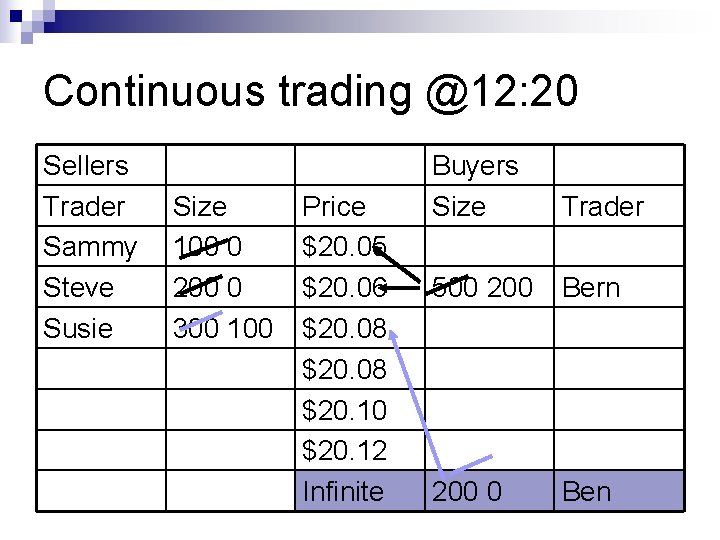

Continuous trading @12: 20 Sellers Trader Sammy Steve Susie Size 100 0 200 0 300 100 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Buyers Size Trader 500 200 Bern 200 0 Ben

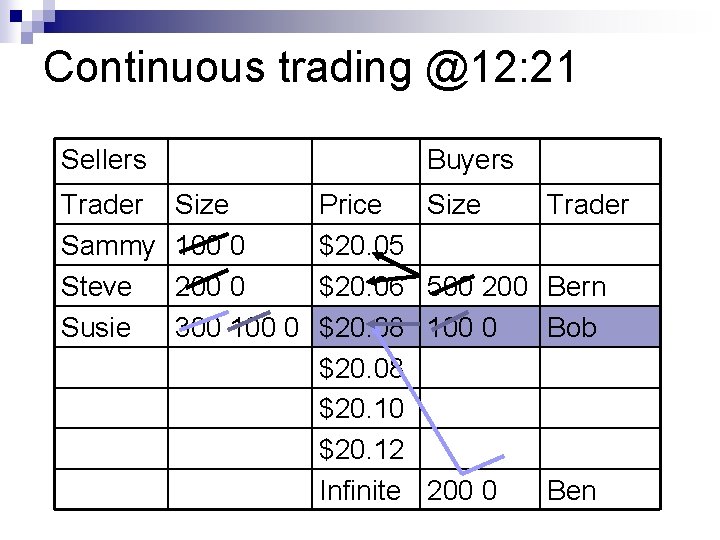

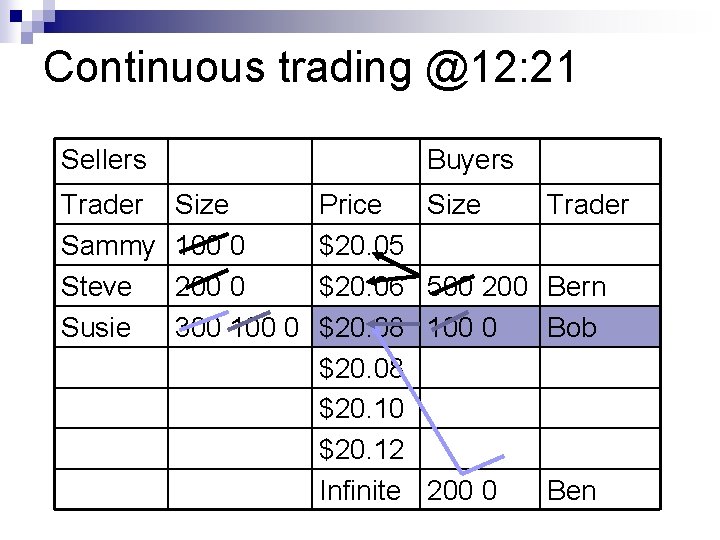

Continuous trading @12: 21 Sellers Trader Sammy Steve Susie Buyers Size 100 0 200 0 300 100 0 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Size Trader 500 200 Bern 100 0 Bob 200 0 Ben

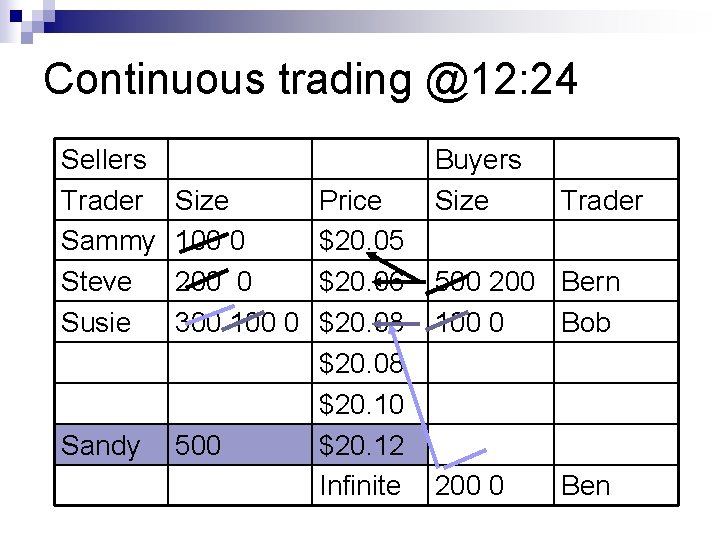

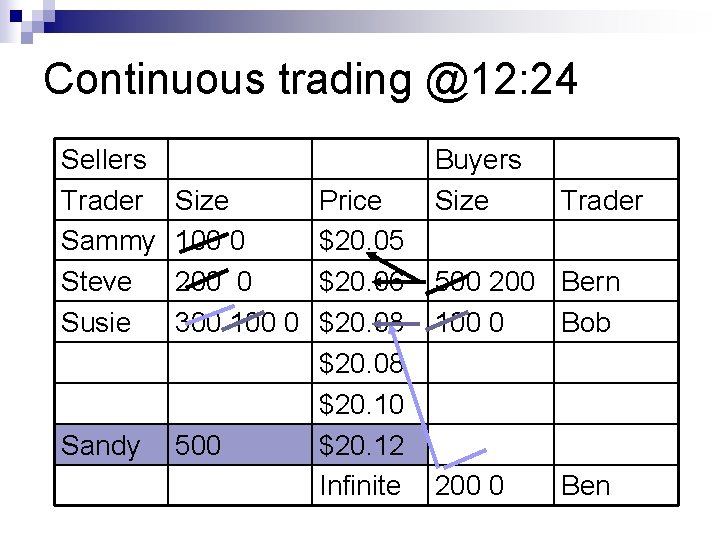

Continuous trading @12: 24 Sellers Trader Sammy Steve Susie Size 100 0 200 0 300 100 0 Sandy 500 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Buyers Size Trader 500 200 Bern 100 0 Bob 200 0 Ben

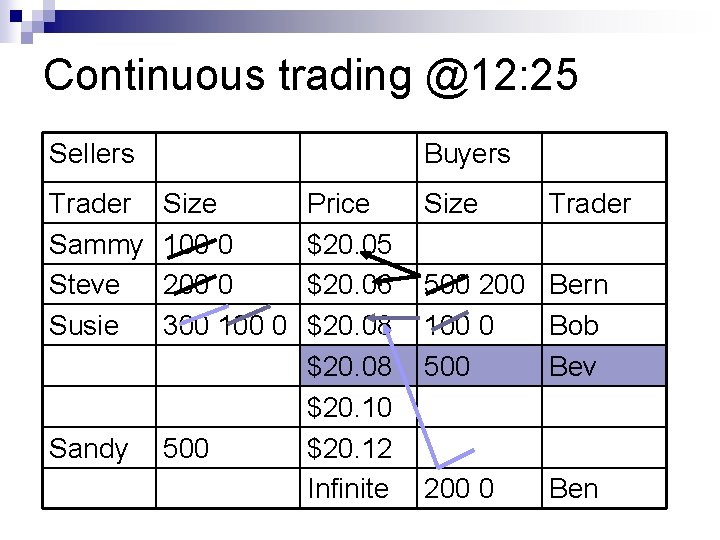

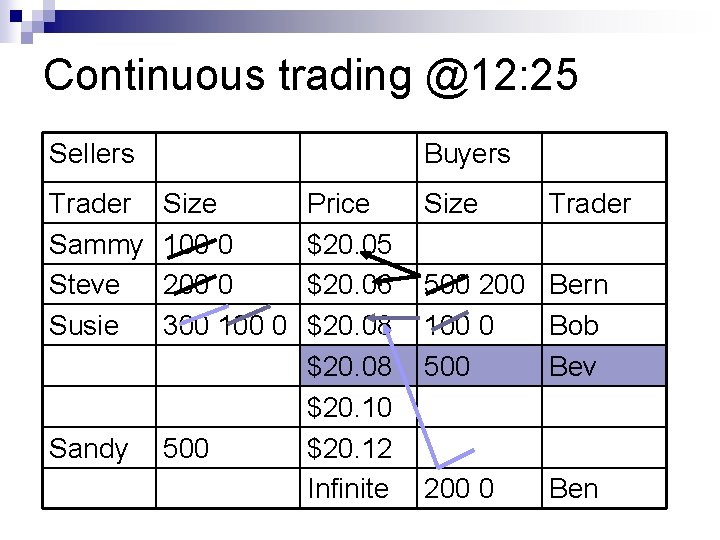

Continuous trading @12: 25 Sellers Buyers Trader Sammy Steve Susie Size 100 0 200 0 300 100 0 Sandy 500 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Size Trader 500 200 Bern 100 0 Bob 500 Bev 200 0 Ben

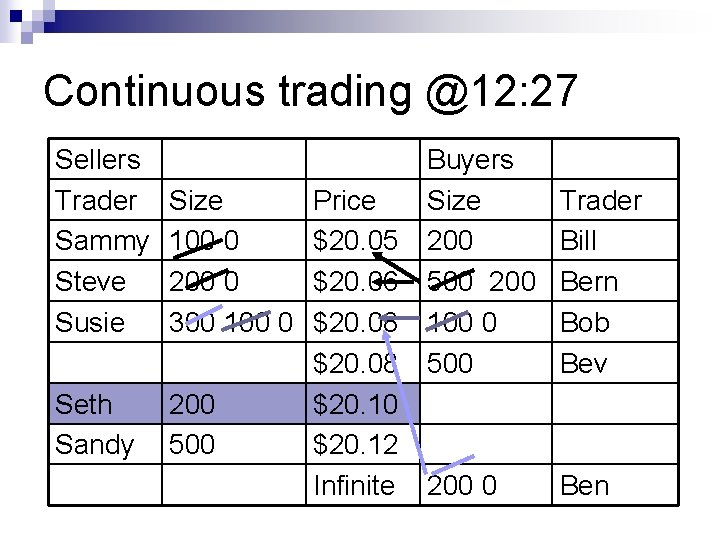

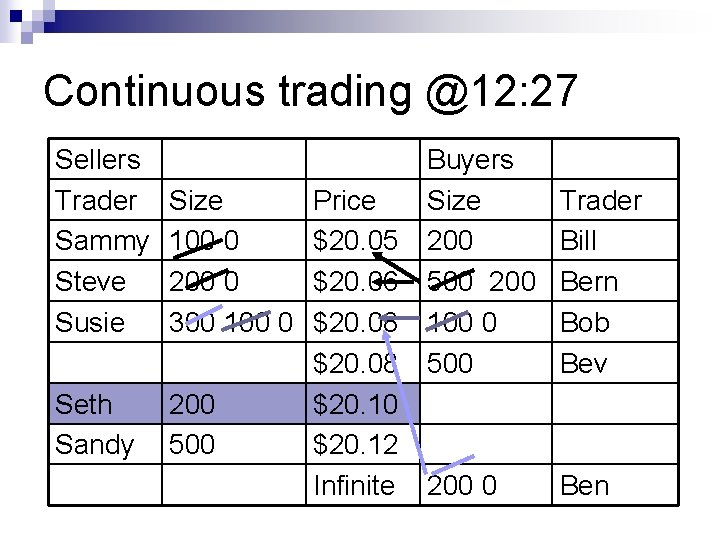

Continuous trading @12: 27 Sellers Trader Sammy Steve Susie Size 100 0 200 0 300 100 0 Seth Sandy 200 500 Price $20. 05 $20. 06 $20. 08 $20. 10 $20. 12 Infinite Buyers Size 200 500 200 100 0 500 Trader Bill Bern Bob Bev 200 0 Ben

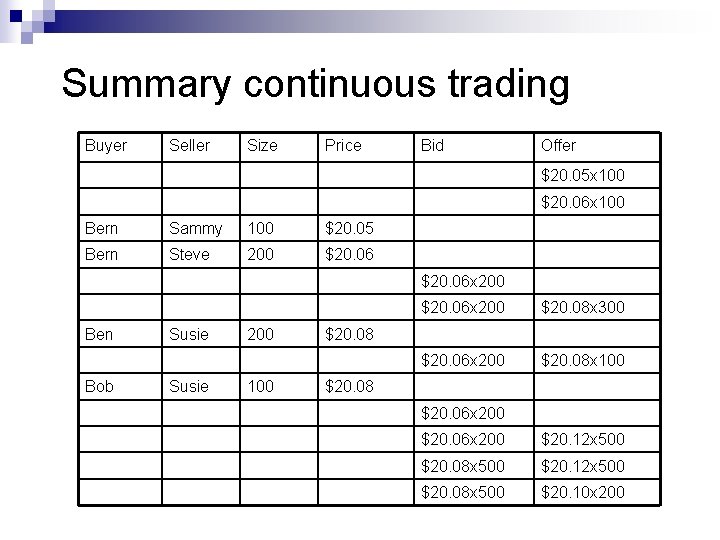

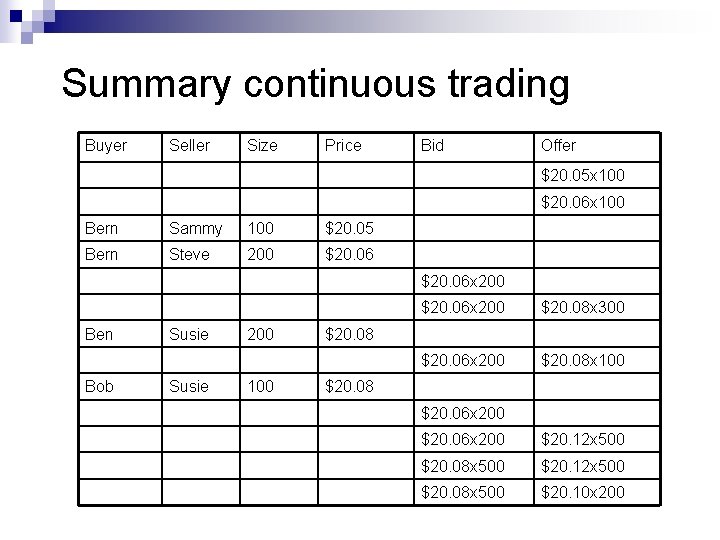

Summary continuous trading Buyer Seller Size Price Bid Offer $20. 05 x 100 $20. 06 x 100 Bern Sammy 100 $20. 05 Bern Steve 200 $20. 06 x 200 Ben Bob Susie 200 100 $20. 06 x 200 $20. 08 x 300 $20. 06 x 200 $20. 08 x 100 $20. 08 $20. 06 x 200 $20. 12 x 500 $20. 08 x 500 $20. 10 x 200

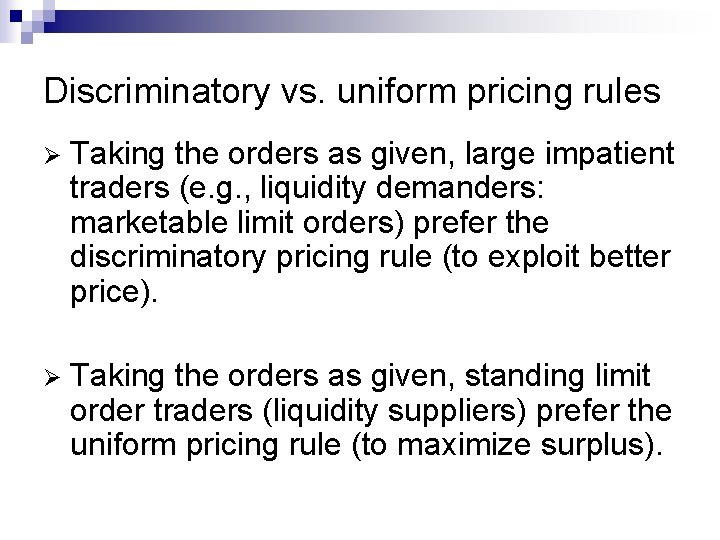

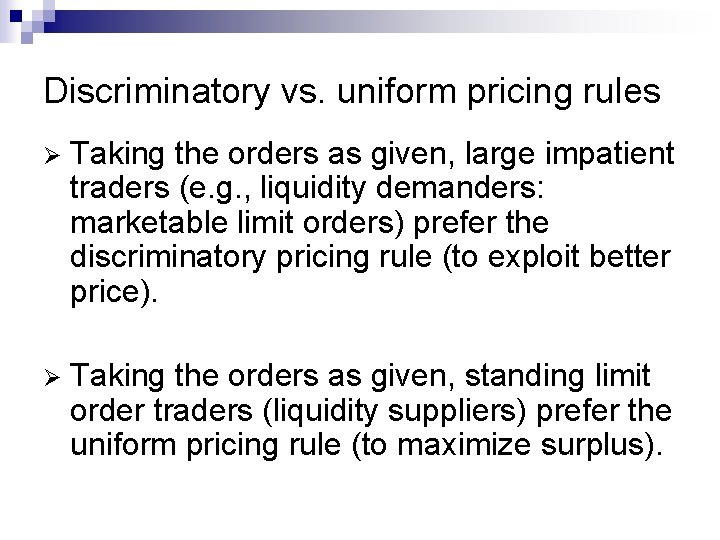

Discriminatory vs. uniform pricing rules Ø Taking the orders as given, large impatient traders (e. g. , liquidity demanders: marketable limit orders) prefer the discriminatory pricing rule (to exploit better price). Ø Taking the orders as given, standing limit order traders (liquidity suppliers) prefer the uniform pricing rule (to maximize surplus).

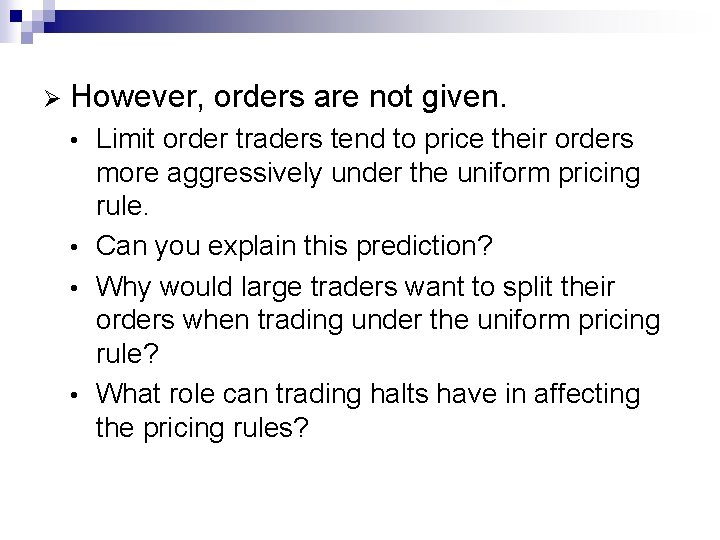

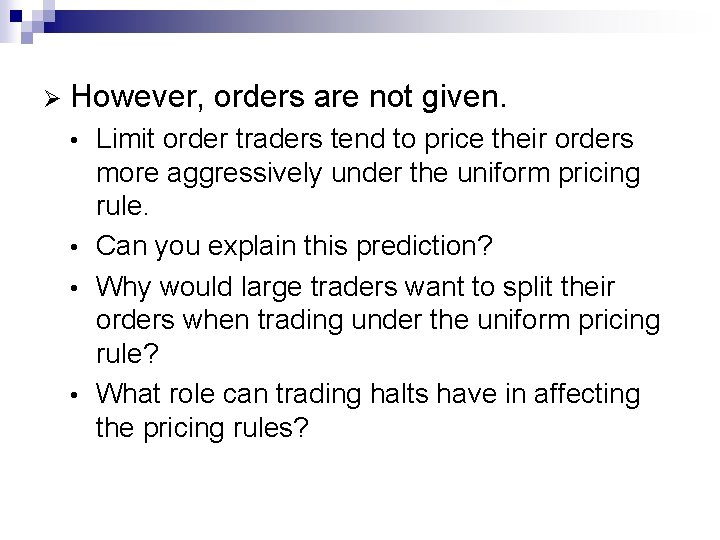

Ø However, orders are not given. Limit order traders tend to price their orders more aggressively under the uniform pricing rule. • Can you explain this prediction? • Why would large traders want to split their orders when trading under the uniform pricing rule? • What role can trading halts have in affecting the pricing rules? •

Continuous versus call markets Ø The single price auction produces a larger trader surplus than the continuous auction when processing the same order flow (example). • Concentration of order flow increases total trader surplus. • In practice, traders will not send the same order flow to call and continuous markets.

Ø The single price auction will typically trade a lower volume than the continuous auction. In our example, both trade 600 shares… • See textbook example (Table 6 -7 & 6 -8) • Ø However, there is another benefit of the continuous market – it allows traders to trade when they state their demands.

Additional examples

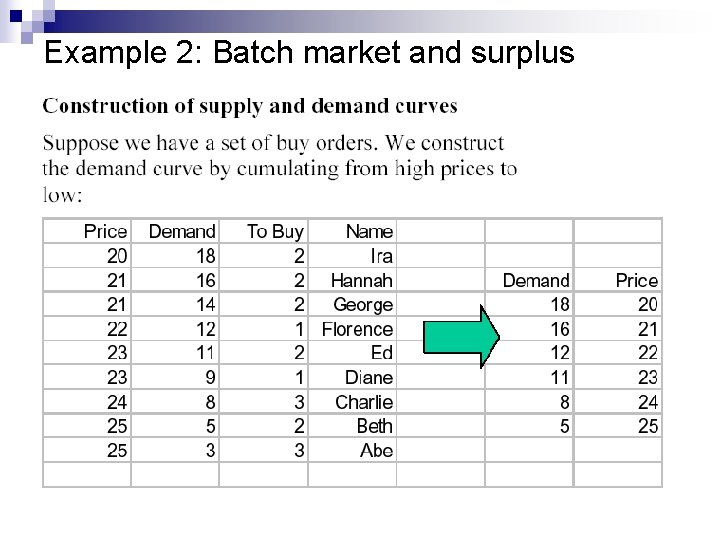

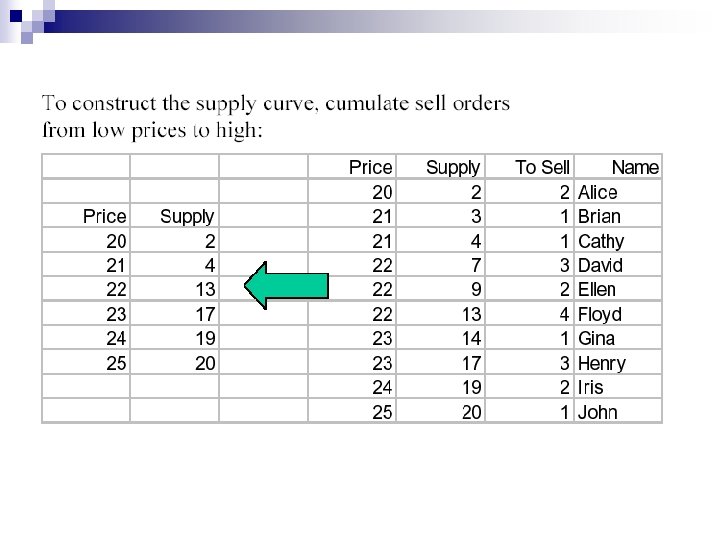

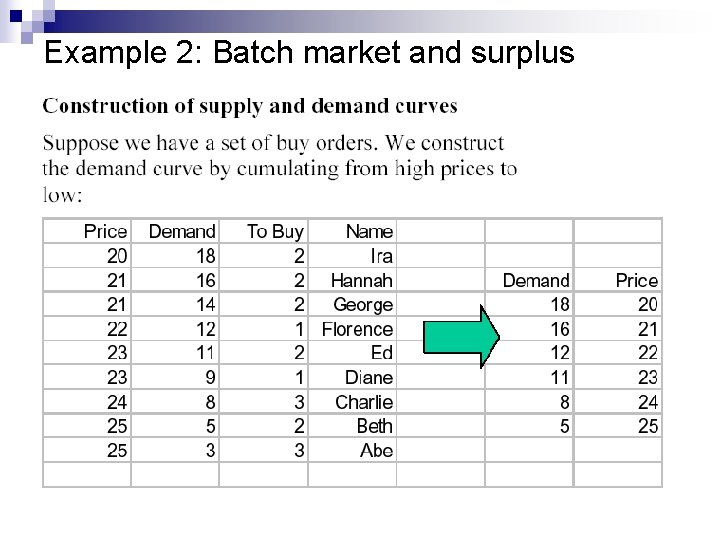

Example 2: Batch market and surplus

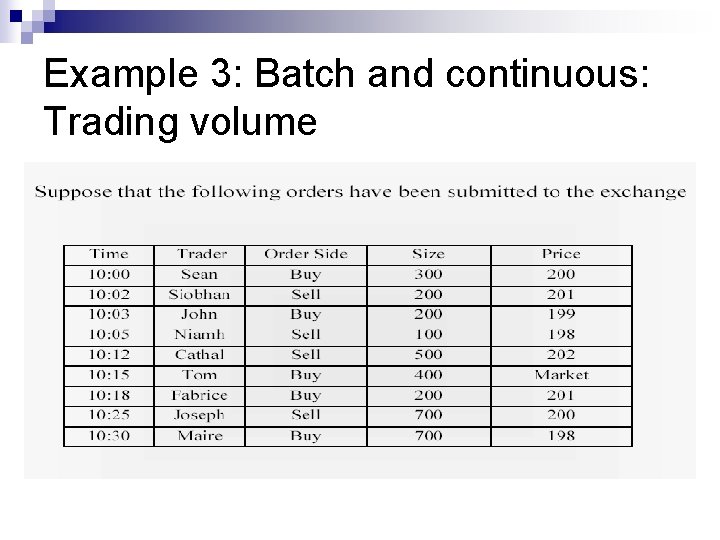

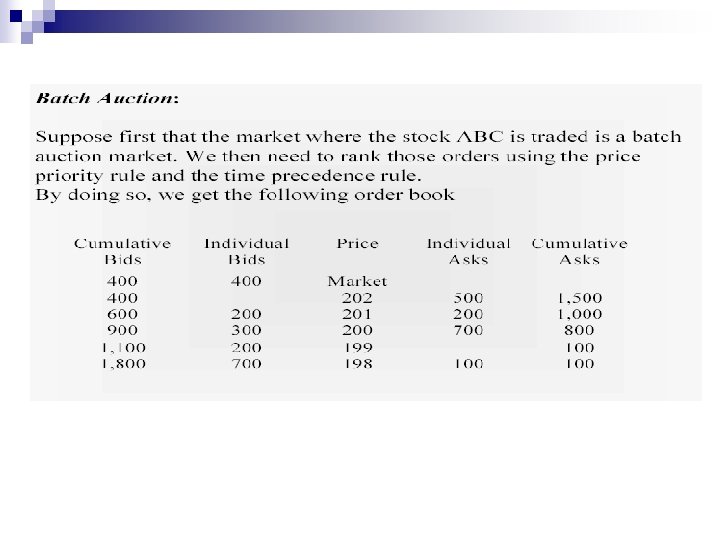

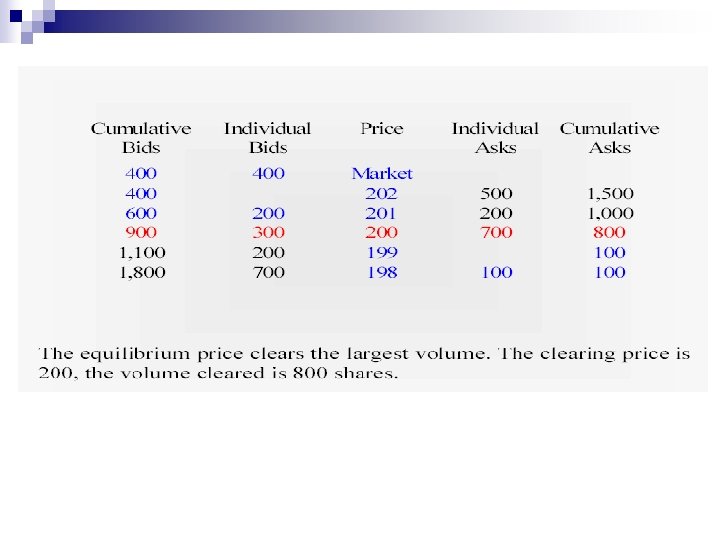

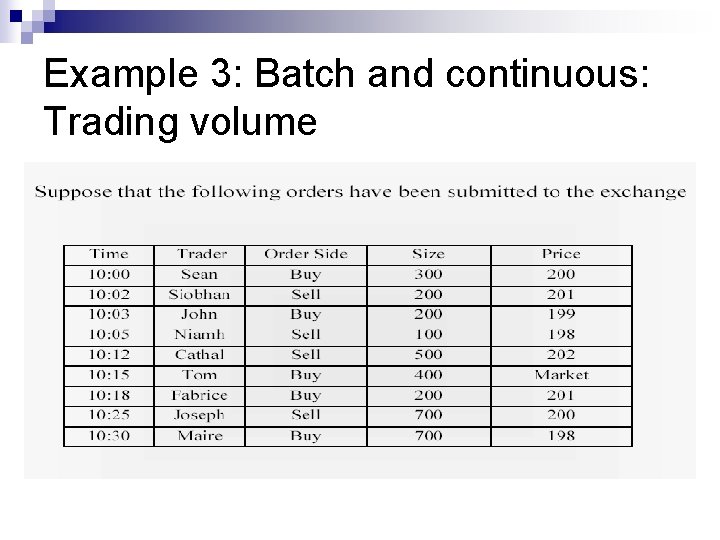

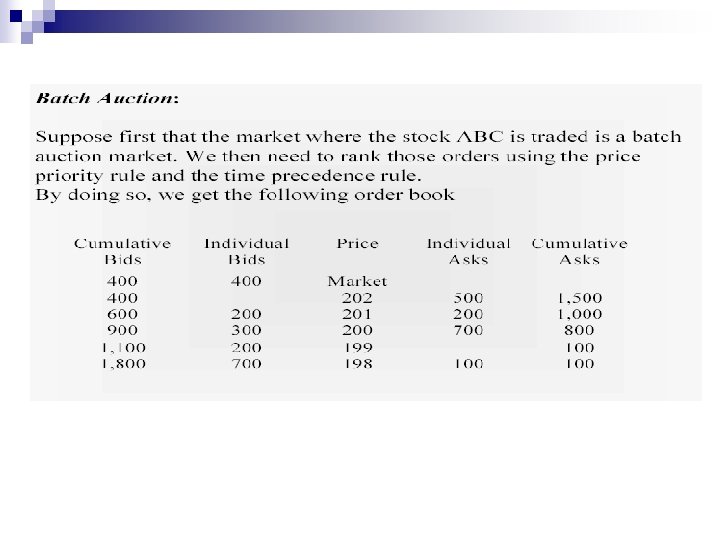

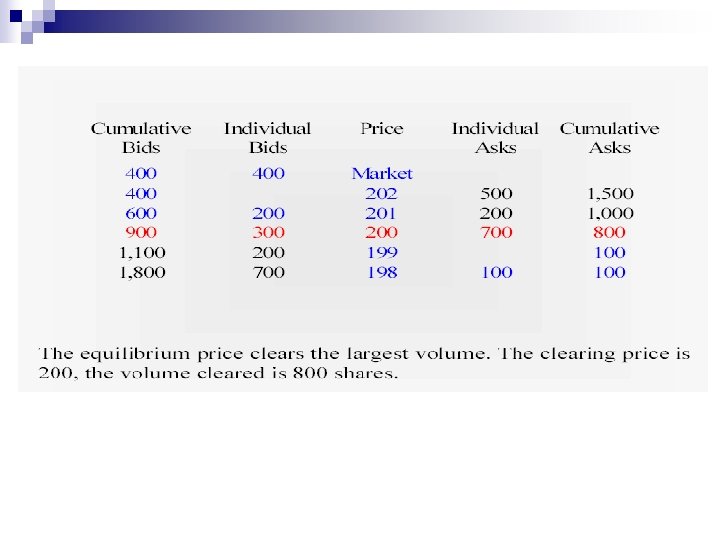

Example 3: Batch and continuous: Trading volume

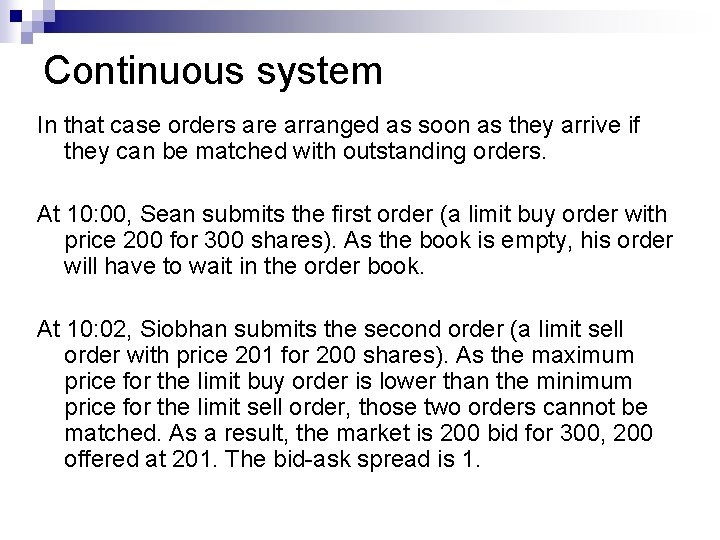

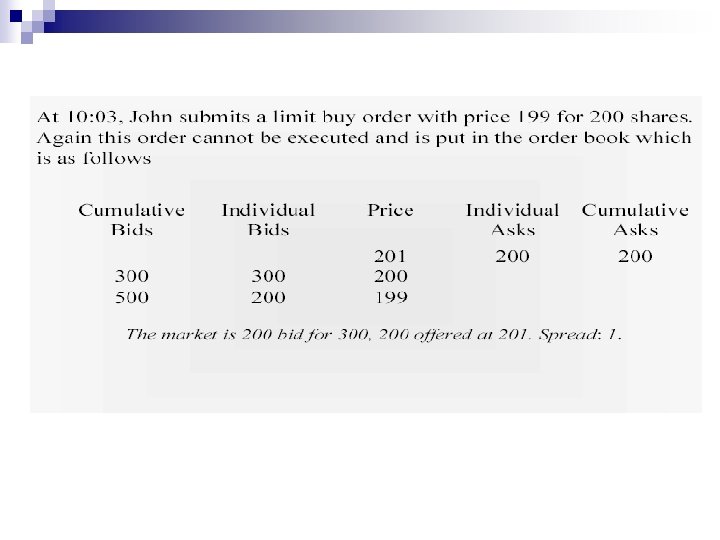

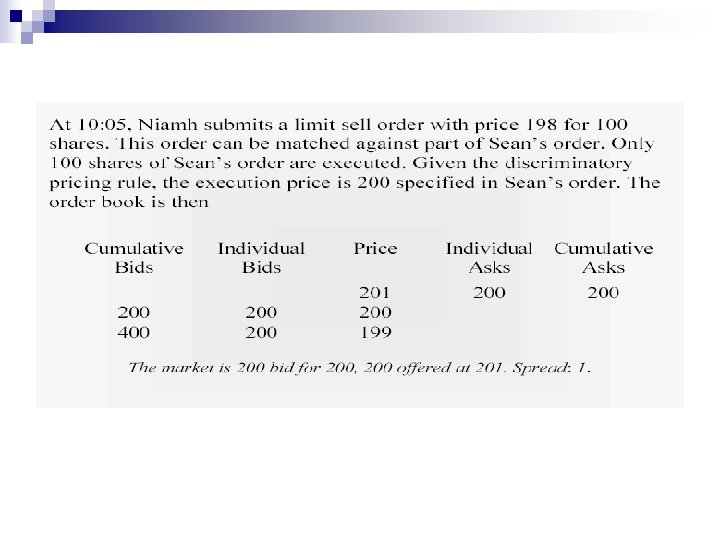

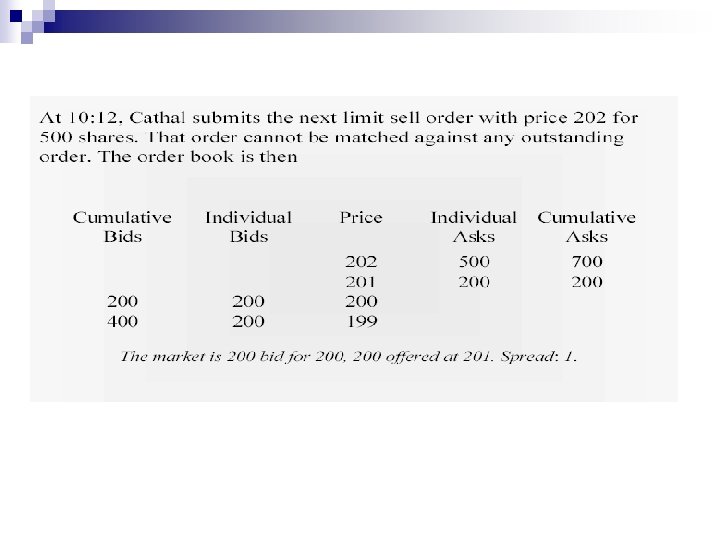

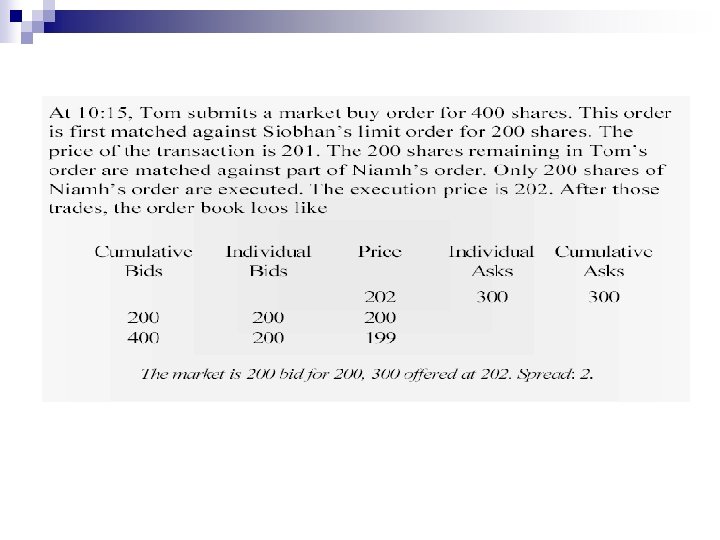

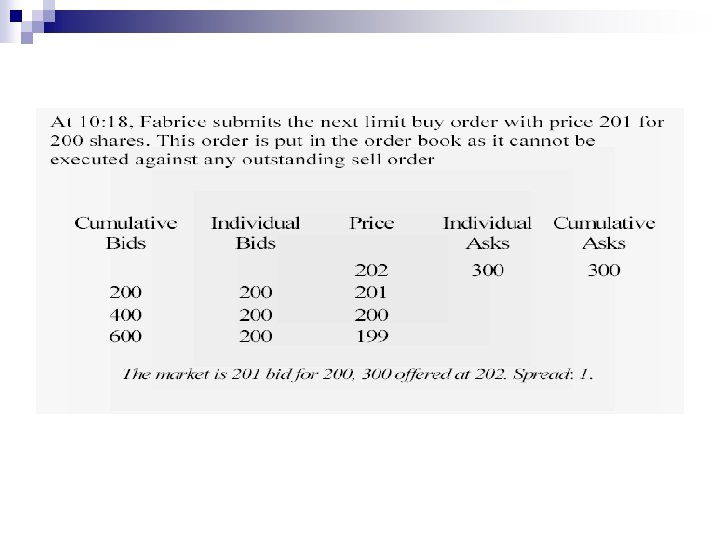

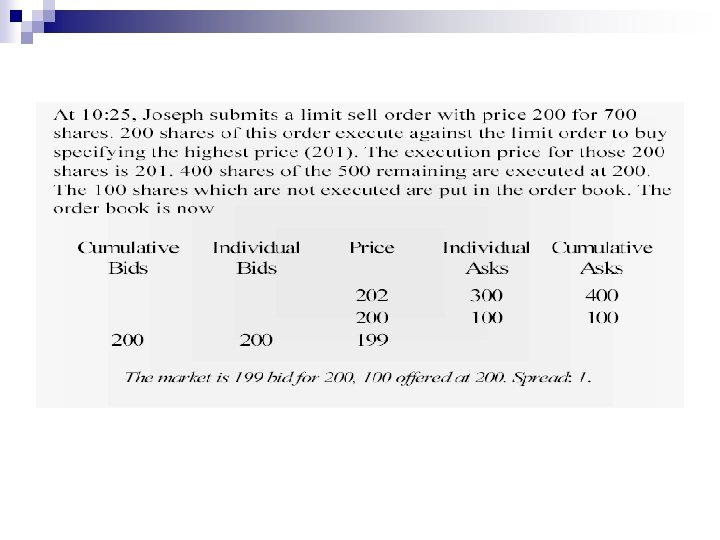

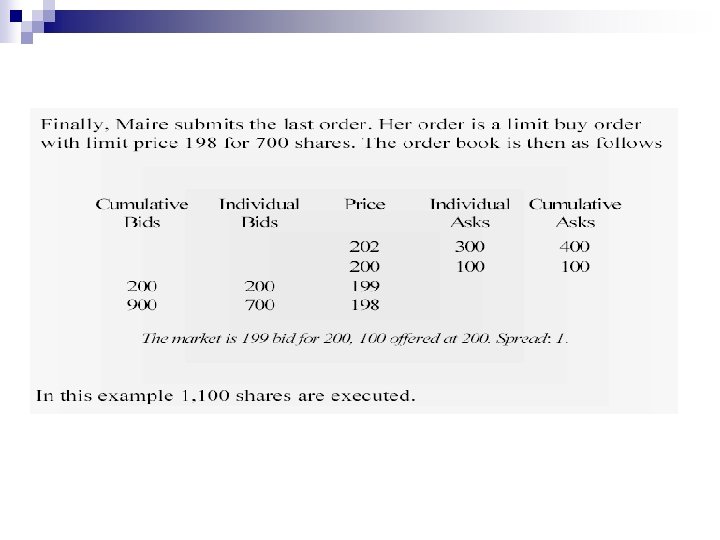

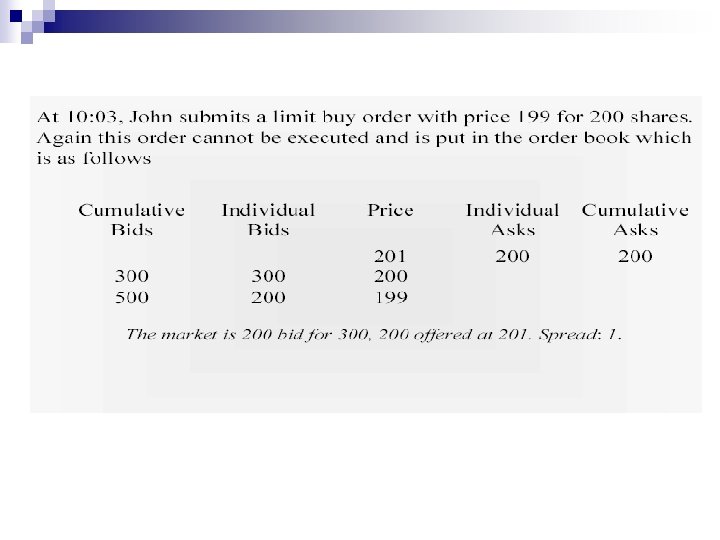

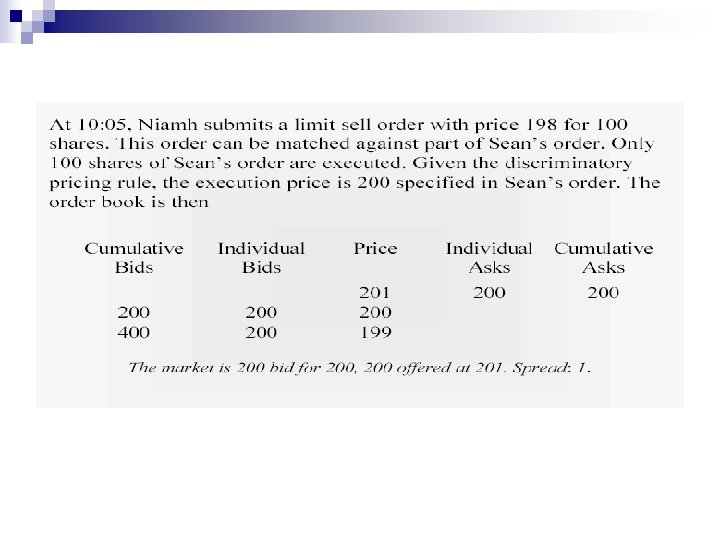

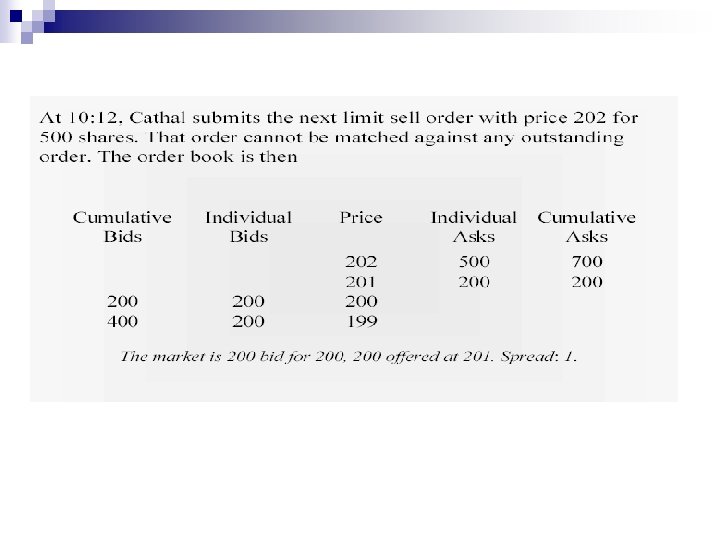

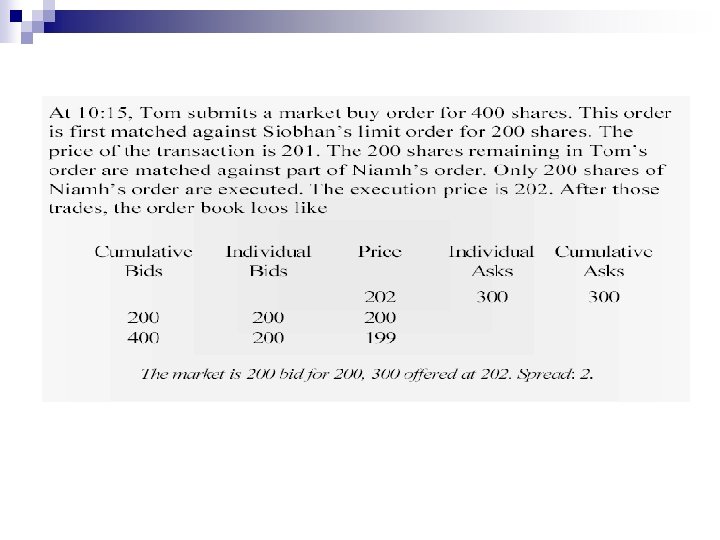

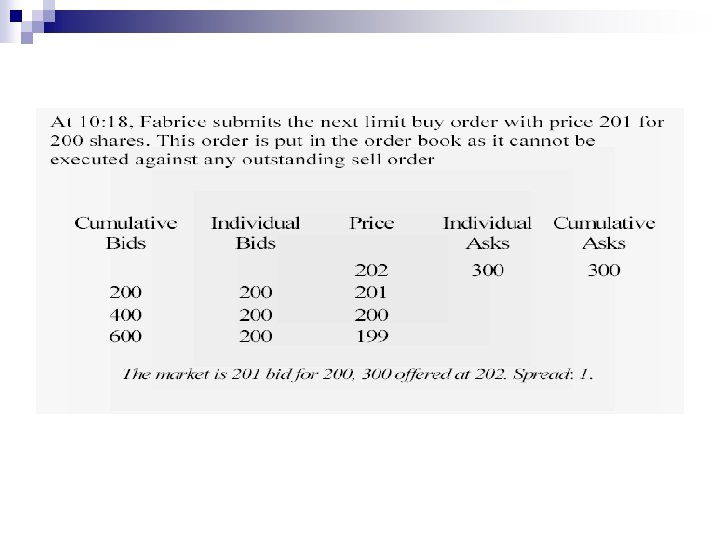

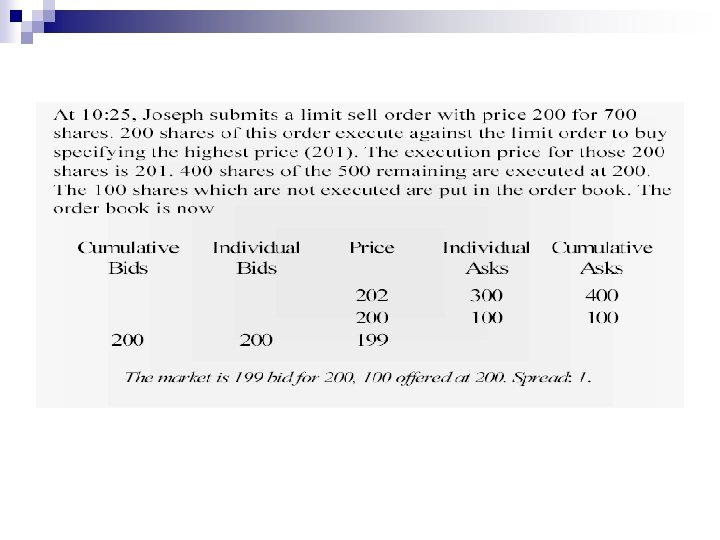

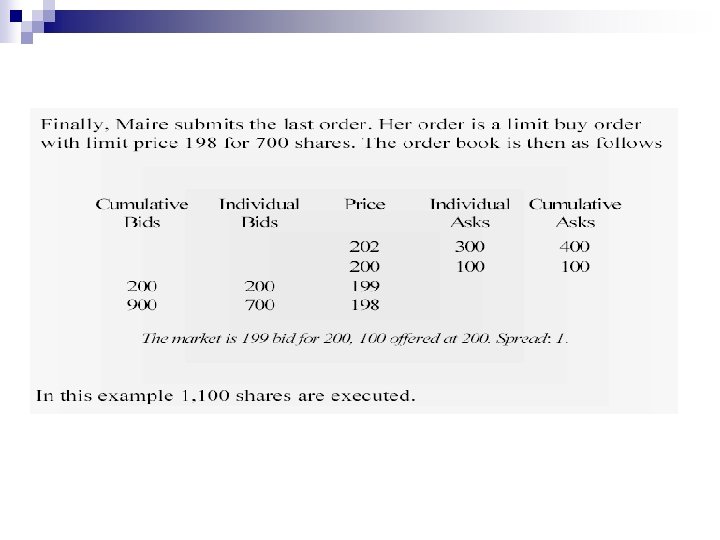

Continuous system In that case orders are arranged as soon as they arrive if they can be matched with outstanding orders. At 10: 00, Sean submits the first order (a limit buy order with price 200 for 300 shares). As the book is empty, his order will have to wait in the order book. At 10: 02, Siobhan submits the second order (a limit sell order with price 201 for 200 shares). As the maximum price for the limit buy order is lower than the minimum price for the limit sell order, those two orders cannot be matched. As a result, the market is 200 bid for 300, 200 offered at 201. The bid-ask spread is 1.

The derivative pricing rule and crossing networks Ø Crossing networks are the only orderdriven markets that are not auction markets. • All trades take place at a price discovered elsewhere. n Who owns prices discovered in primary markets? • Discover how much buy and sell volume there is at the crossing price.

• ITG’s POSIT, Instinet’s Global Instinet Crossing, and the NYSE’s After-hours Trading Session I. n Second chance at getting the closing price (4 pm)

Ø Crossing networks are call markets to which traders can submit limit orders and market orders. • Order precedence rules determine which orders will trade after the crossing price has been announced.

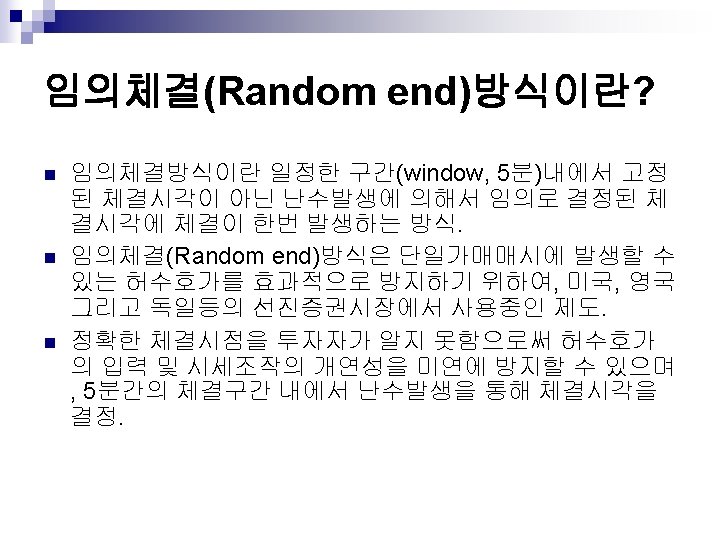

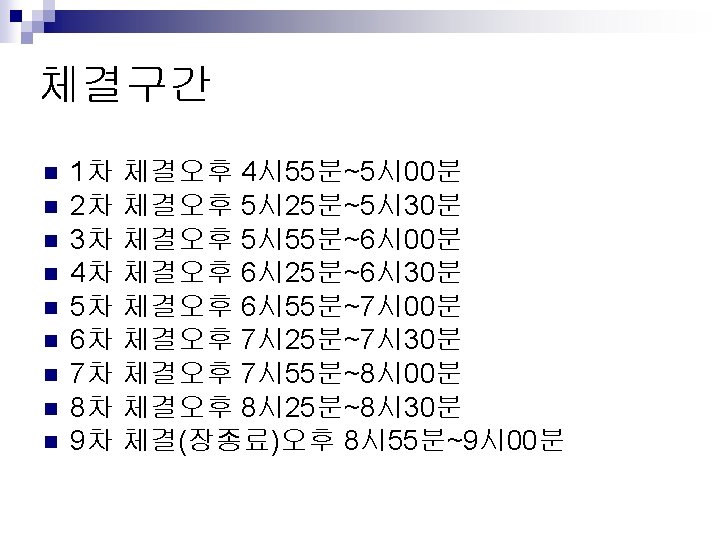

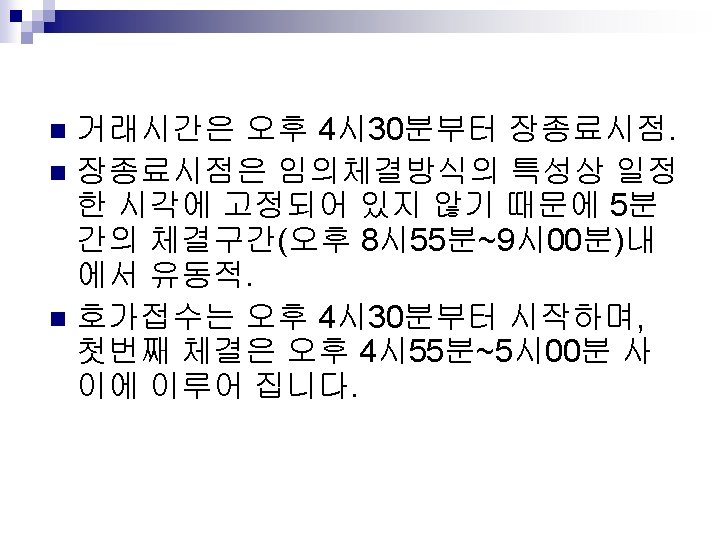

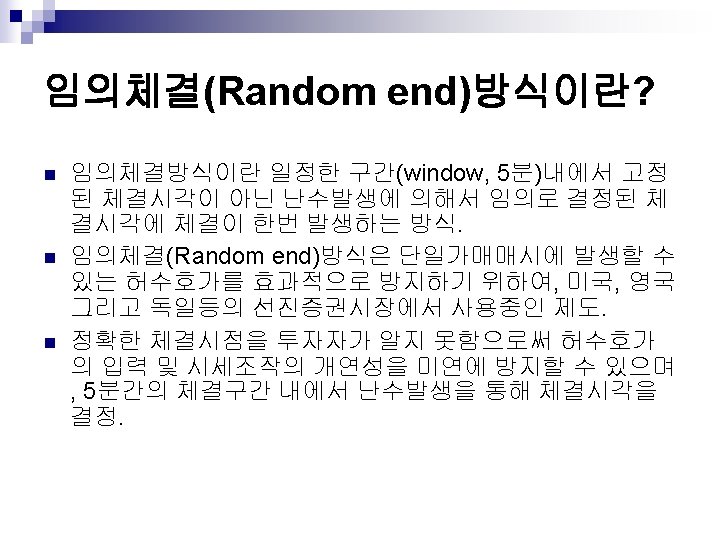

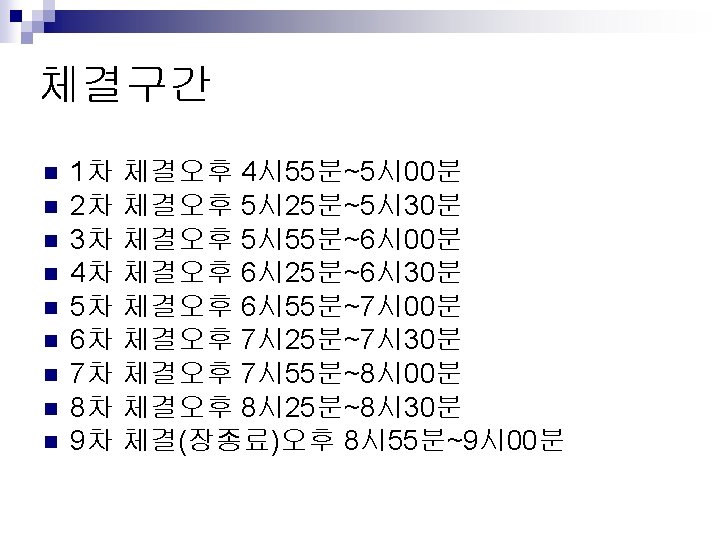

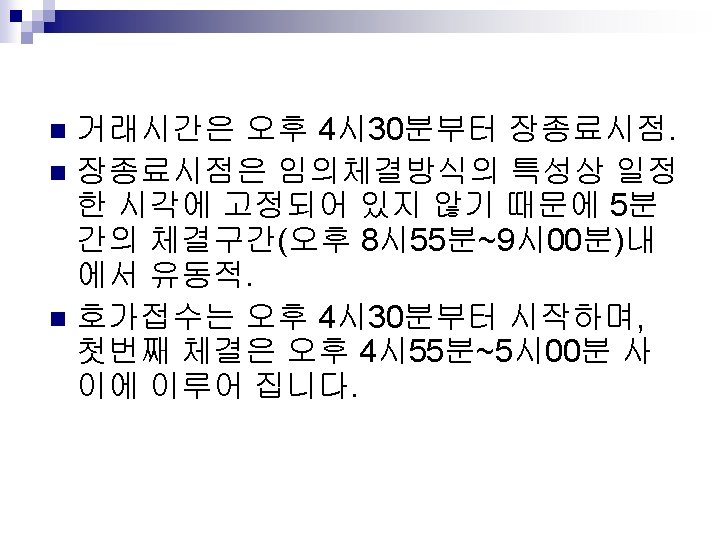

Ø POSIT runs 8 crosses per day. Choosing a time at random in the 7 minutes following the crossing time. n Why do you think they are randomizing the timing? • Permits traders to fill their orders at the midquote, without price impact. • Crosses are completely anonymous and order imbalances are never disclosed. n Why do you think this is attractive to traders? •

Ø Crossing networks almost invariably have excess demand or supply. • Order precedence rules. • Rationing mechanism. • Less than 10 percent of their order volume ever crosses. • Commissions are reasonable, 12 c/share.

Problems with derivative prices Ø Stale prices and well-informed traders • Crosses take place with some delay relative to the reference price. • Between the trade and the establishment of the reference price, news might have been released. n After-hours trading at Regionals and ECNs… • Adverse selection (well-informed traders)

Ø Price manipulation • Temptation to manipulate the price in advance of the cross. • Particularly a problem in less liquid stocks. n Push prices down (up) if anticipate to buy (sell) in the cross. • Illegal, but difficult to detect and prosecute.

Electronic trading platforms Centralized order-driven market with automated order routing. Ø Decentralized computer network for access. Ø Member firms act as brokers or principals. Ø No designated market makers Ø Central limit order book/information system/clearing and settlement Ø Off-book trading is sometimes significant Ø

The (limit order) book The broker might have other limit orders besides ours. A collection of unexecuted limit orders is a “book”. Ø The book may have buy and sell orders. Ø In US futures pits, each broker may have his/her own book. Ø In many other markets, the book is consolidated: all unexecuted limit orders are recorded in one book. Ø

The electronic limit order book All orders are limit orders. Ø The book is electronically visible. Ø “Anyone” may enter an order. Ø There has to be some established relationship for clearing and credit purposes. Ø The electronic limit order book is probably the most common form of new market organization today, but it is far from universal. Ø

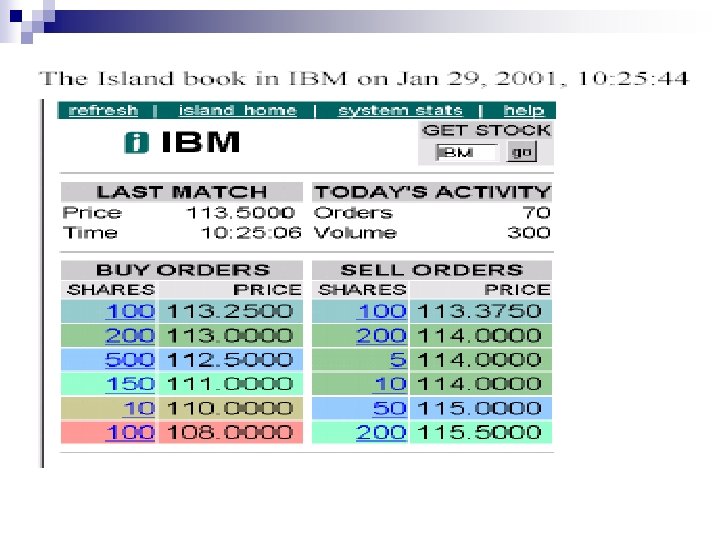

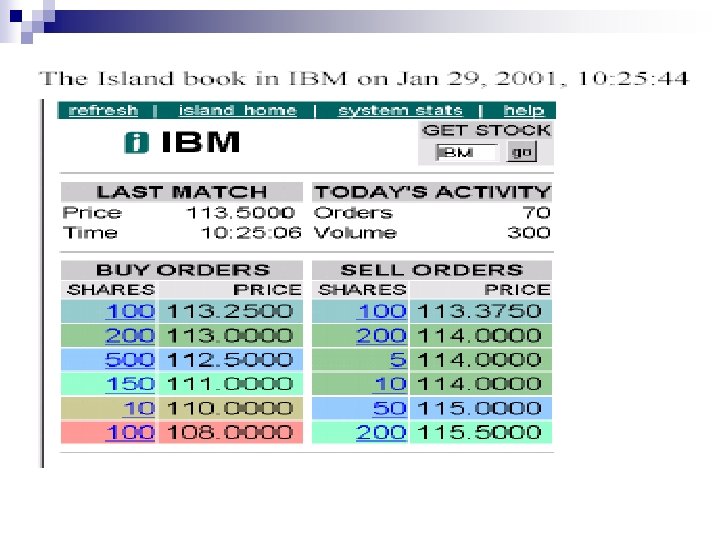

The Island ECN Island is a limit order market Ø Island is an Electronic Communications Network (ECN) Ø It has no trading floor. All orders are sent electronically. Ø

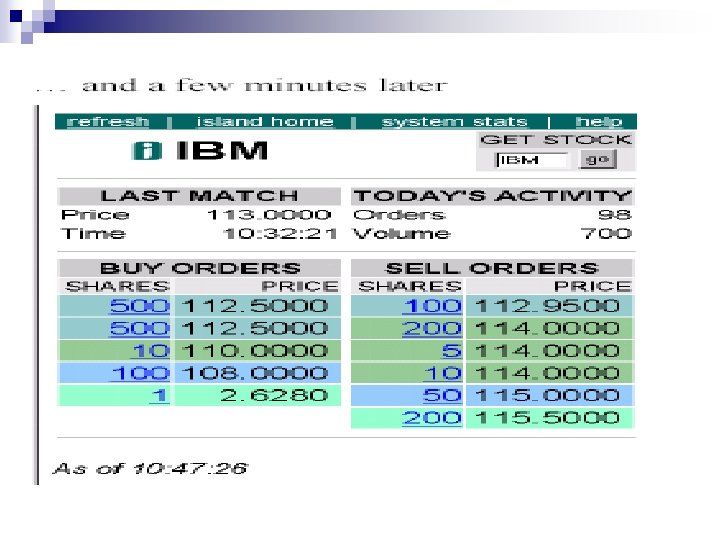

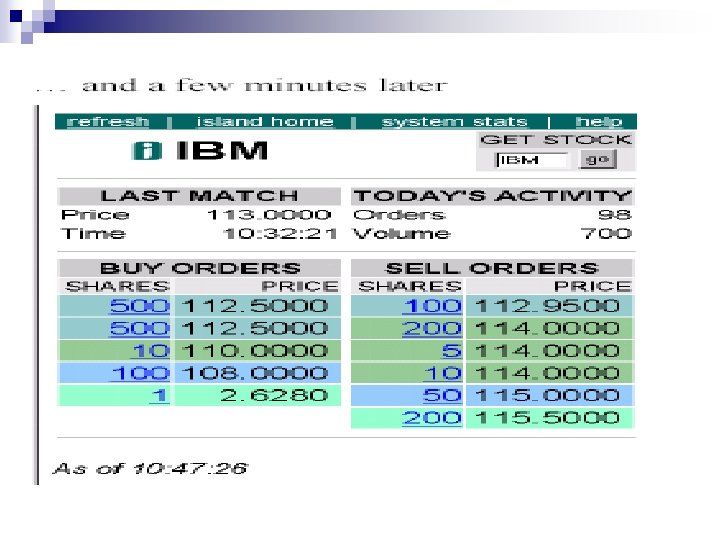

A likely scenario: Seller(s), using market orders, took out the 113. 25 bid and the 113. 00 bid, leaving 112. 5 as the best bid. On the sell side of the book, sellers realized that 113. 375 was unrealistically high. They’re now offering at a lower price (112. 95)

A survey of usage Ø Some markets have a single consolidated limit order book, where everything happens. This is mostly true of the Tokyo Stock Exchange, Euronext, the Singapore Stock Exchange, the Taiwan Stock Exchange, etc. Ø Other markets are fragmented. There are multiple limit order books in different physical venues (or computers).

Ø In addition to the Island ECN, there is a limit order book for IBM at the New York Stock Exchange, the Boston Stock Exchange, the Pacific Stock Exchange, etc. Ø The largest (deepest) limit order book for IBM is at the NYSE.

Different markets/different solutions The pit markets in US futures exchanges do not have a centralized limit order book. Ø The Chicago Board Options Exchange does have a centralized book (run by a clerk). Ø The NYSE has a limit order book, run by the specialist. (But there are other books in NYSE-listed stocks on regional exchanges and other dealers. ) Ø NASDAQ has multiple books. Ø

Terminology A centralized limit order book is often referred to as a “CLOB” (pron. kl. b) Ø Hard CLOB: All activity is forced (by law) through the book. Ø Soft CLOB: A CLOB exists, but trades can take place outside of it. Ø

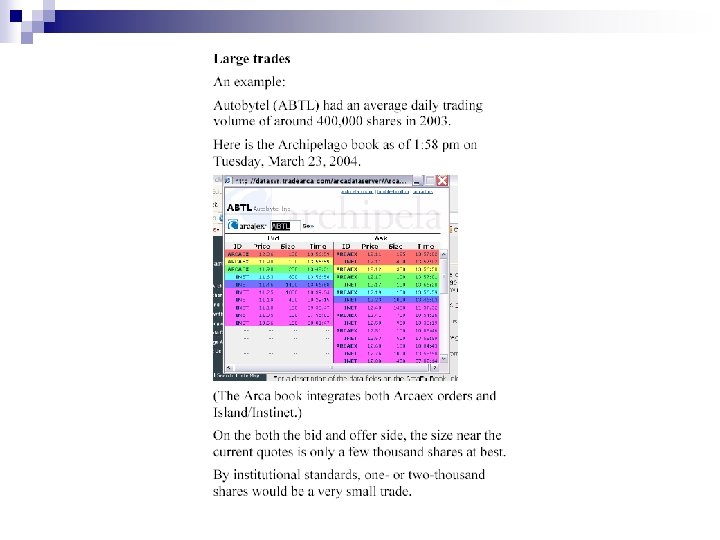

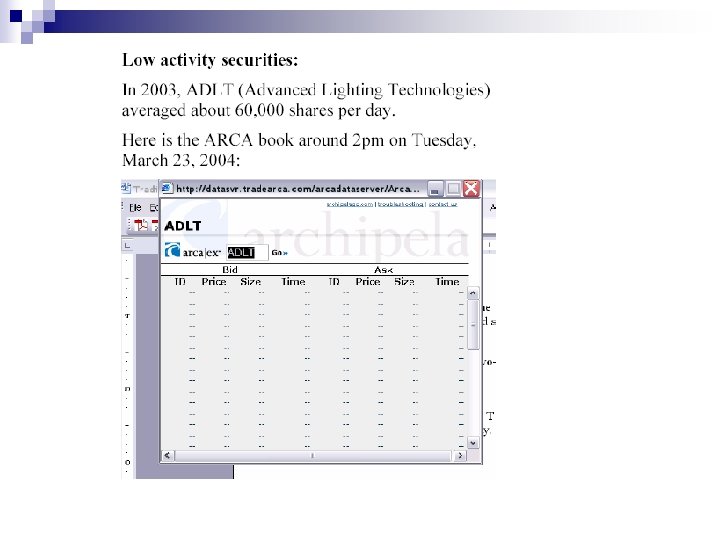

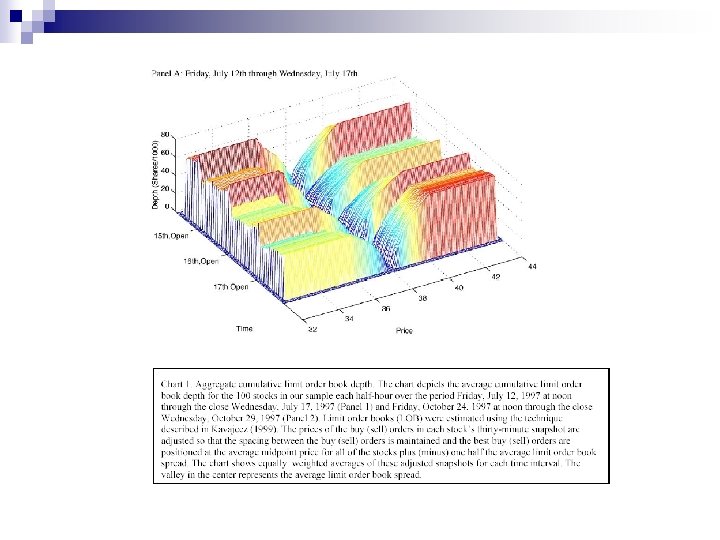

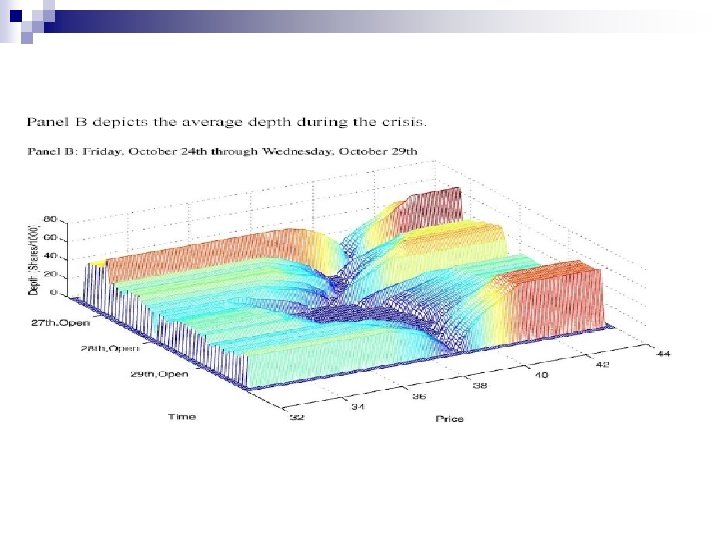

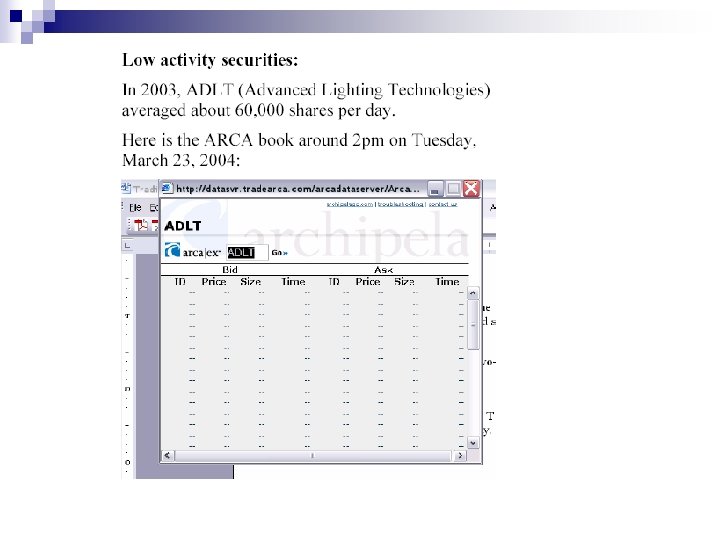

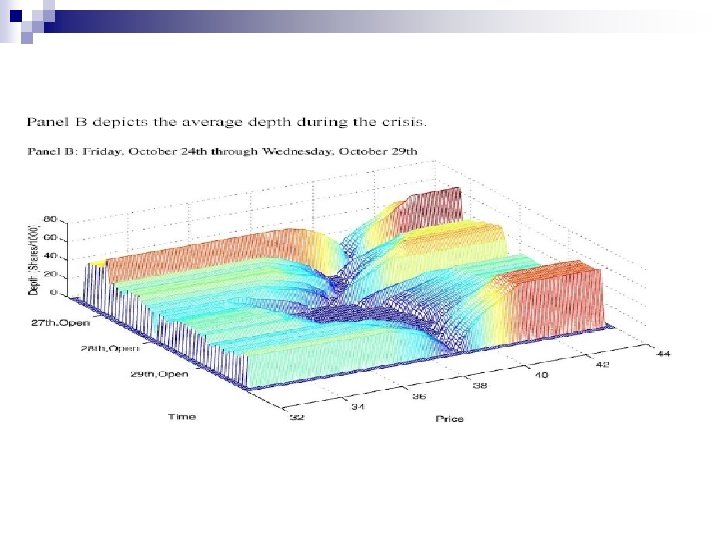

Limit order books: The problem areas Electronic limit order books are the predominant continuous trading mechanism. Ø They do not seem to work well, however, in all circumstances. These include large trades, low activity securities and market breaks (“crashes”) Ø In these circumstances, some sort of active marketmaking presence (a dealer) seems to be necessary. Ø