CHAPTER 6 COSTVOLUME PROFIT ANALYSIS ADDITIONAL ISSUES Chapter

- Slides: 84

CHAPTER 6 COST–VOLUME– PROFIT ANALYSIS: ADDITIONAL ISSUES Chapter 6 -1

Study Objectives 1. Describe the essential features of a cost-volumeprofit income statement. 2. Apply basic CVP concepts. 3. Explain the term sales mix and its effects on break-even sales. 4. Determine sales mix when a company has limited resources. 5. Understand how operating leverage affects profitability. Chapter 6 -2

Formulas and Formats to Be Used in the Chapter Traditional Income Statement Revenue Cost of goods sold Gross margin Administrative and selling expense Operating income CVP income statement Revenue Variable Expense Contribution margin Fixed Expense Operating income These sound alike but they are different concepts Chapter 6 -3

Formulas and Formats to Be Used in the Chapter – Review from Chapter 5 l Formula for contribution margin ratio (CMR) l l Formula for breakeven in dollars l l Fixed Cost/Contribution Margin per Unit Formula for margin of safety l Chapter 6 -4 Fixed Cost/Contribution Margin Ratio Formula for breakeven in units l l CM per Unit/Unit Sales Price Actual Sales – Breakeven Sales

Formulas and Formats to Be Used in the Chapter l Formula for margin of safety ratio l l Breakeven with multiple products l l Divide fixed costs by the weighted average unit contribution margin of all products Formula for weighted average unit contribution margin l Chapter 6 -5 Margin of Safety in Dollars/ Actual or Expected Sales Dollars weighted contribution margin per-unit of each product

Formulas and Formats to Be Used in the Chapter l Formula for margin of safety ratio l l Breakeven with multiple products l Chapter 6 -6 Margin of Safety in Dollars/ Actual or Expected Sales Dollars Divide fixed costs by the weighted average unit contribution margin of all products

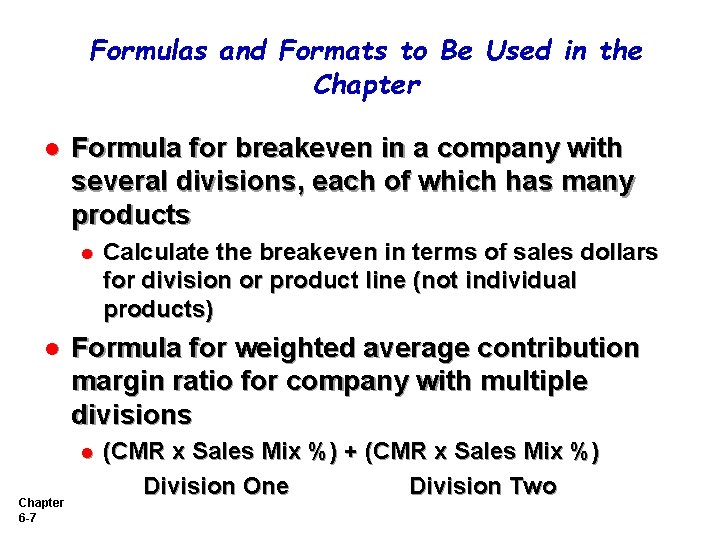

Formulas and Formats to Be Used in the Chapter l Formula for breakeven in a company with several divisions, each of which has many products l l Formula for weighted average contribution margin ratio for company with multiple divisions l Chapter 6 -7 Calculate the breakeven in terms of sales dollars for division or product line (not individual products) (CMR x Sales Mix %) + (CMR x Sales Mix %) Division One Division Two

Formulas and Formats to Be Used in the Chapter l Formula for breakeven in dollars using a weighted average contribution margin ratio l Chapter 6 -8 Fixed Costs/Weighted-Average CMR = BE in $

Formulas and Formats to Be Used in the Chapter l Maximizing net income with a limited resource l l Formula for degree of operating leverage l Chapter 6 -9 First produce the product with the largest contribution margin per unit of scarce resource Total Contribution Margin in Dollars/Net Income

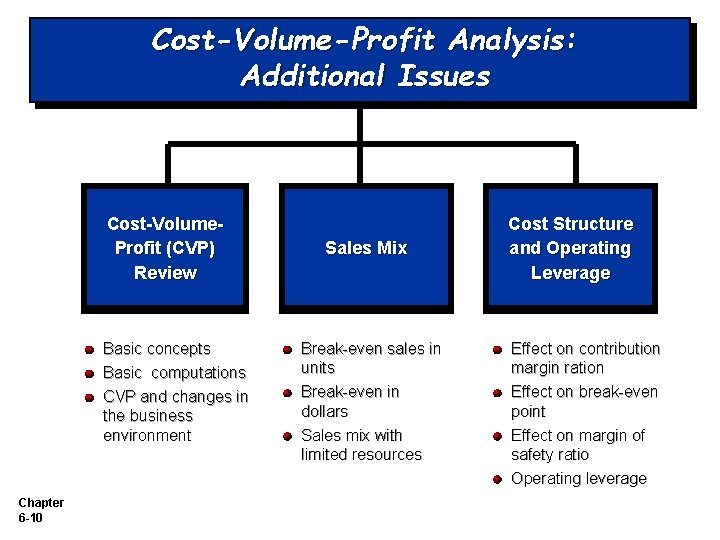

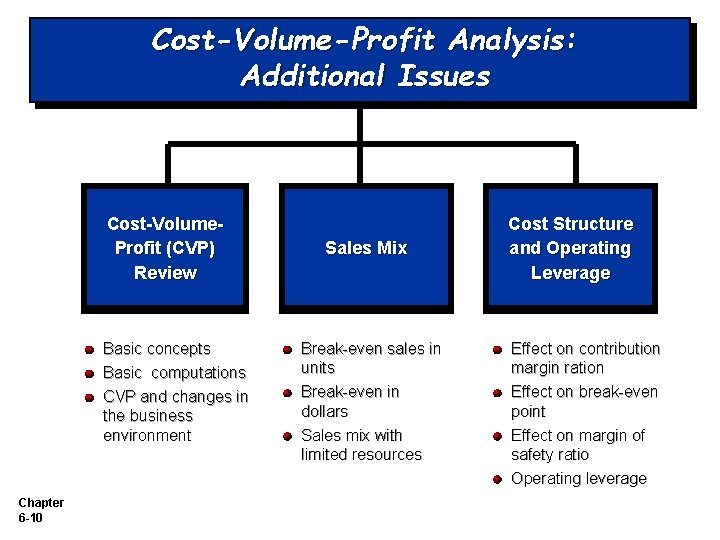

Cost-Volume-Profit Analysis: Additional Issues Cost-Volume. Profit (CVP) Review Basic concepts Basic computations CVP and changes in the business environment Chapter 6 -10 Sales Mix Break-even sales in units Break-even in dollars Sales mix with limited resources Cost Structure and Operating Leverage Effect on contribution margin ration Effect on break-even point Effect on margin of safety ratio Operating leverage

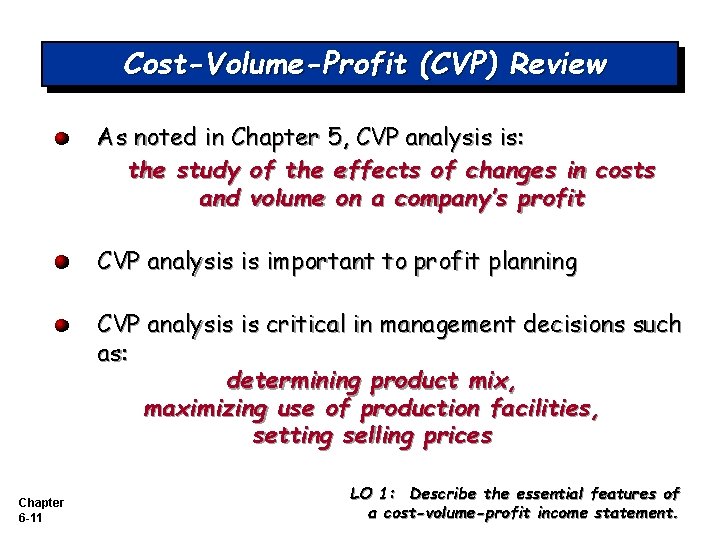

Cost-Volume-Profit (CVP) Review As noted in Chapter 5, CVP analysis is: the study of the effects of changes in costs and volume on a company’s profit CVP analysis is important to profit planning CVP analysis is critical in management decisions such as: determining product mix, maximizing use of production facilities, setting selling prices Chapter 6 -11 LO 1: Describe the essential features of a cost-volume-profit income statement.

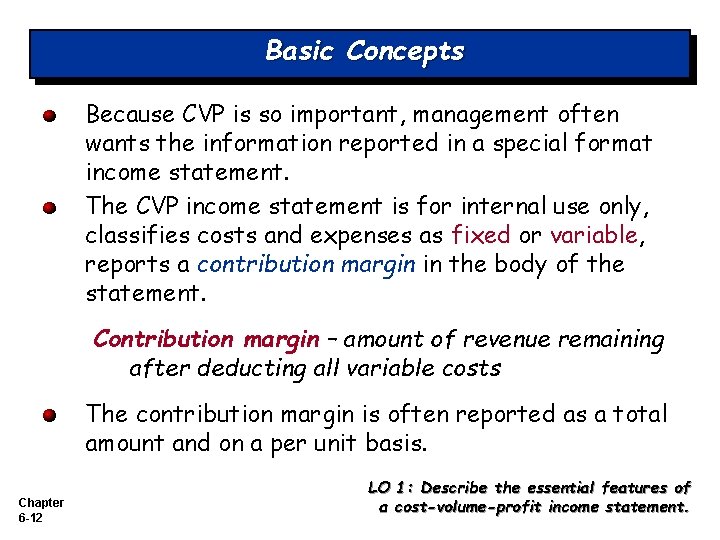

Basic Concepts Because CVP is so important, management often wants the information reported in a special format income statement. The CVP income statement is for internal use only, classifies costs and expenses as fixed or variable, reports a contribution margin in the body of the statement. Contribution margin – amount of revenue remaining after deducting all variable costs The contribution margin is often reported as a total amount and on a per unit basis. Chapter 6 -12 LO 1: Describe the essential features of a cost-volume-profit income statement.

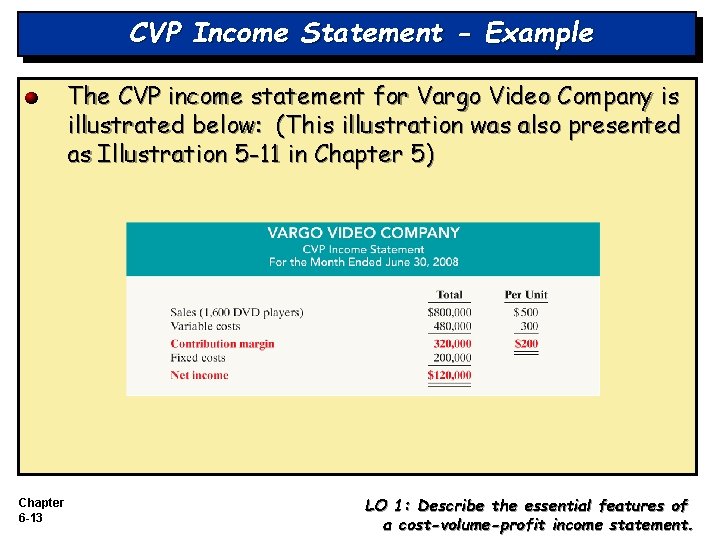

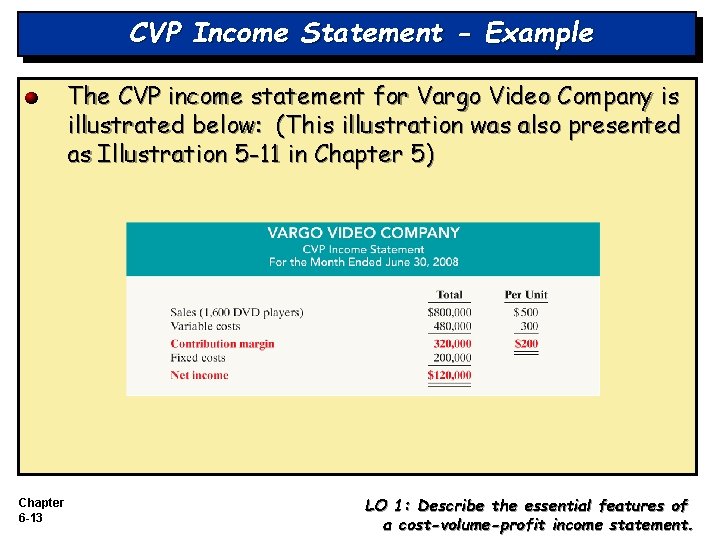

CVP Income Statement - Example The CVP income statement for Vargo Video Company is illustrated below: (This illustration was also presented as Illustration 5 -11 in Chapter 5) Chapter 6 -13 LO 1: Describe the essential features of a cost-volume-profit income statement.

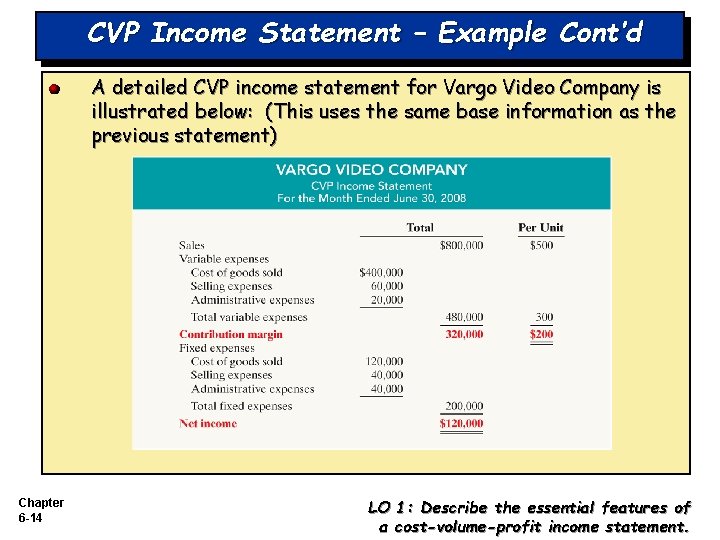

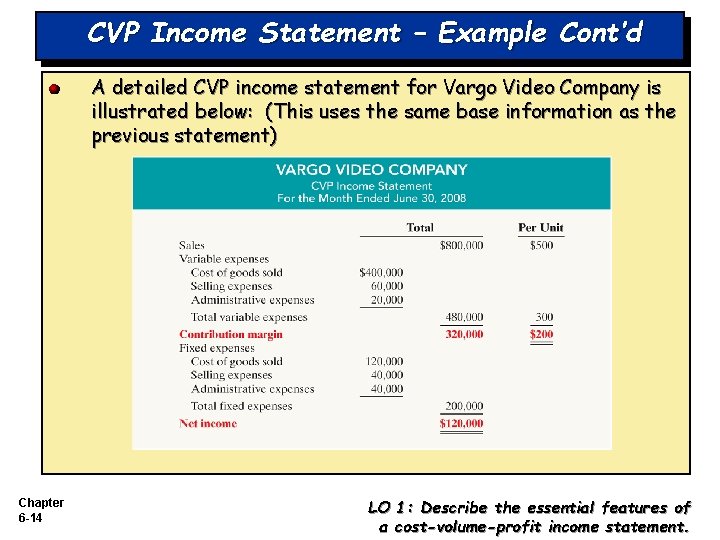

CVP Income Statement – Example Cont’d A detailed CVP income statement for Vargo Video Company is illustrated below: (This uses the same base information as the previous statement) Chapter 6 -14 LO 1: Describe the essential features of a cost-volume-profit income statement.

Basic Computations – A Review Break-Even Analysis As noted in Chapter 5, Vargo Company’s contribution margin per unit is $200 (sales price $500 - $300 variable costs) It was also shown that Vargo Company’s contribution margin ratio was: Chapter 6 -15 LO 2: Apply basic CVP concepts.

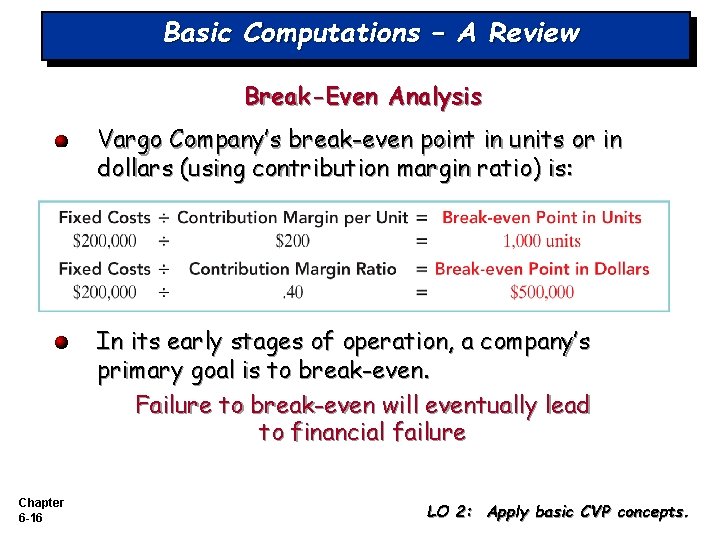

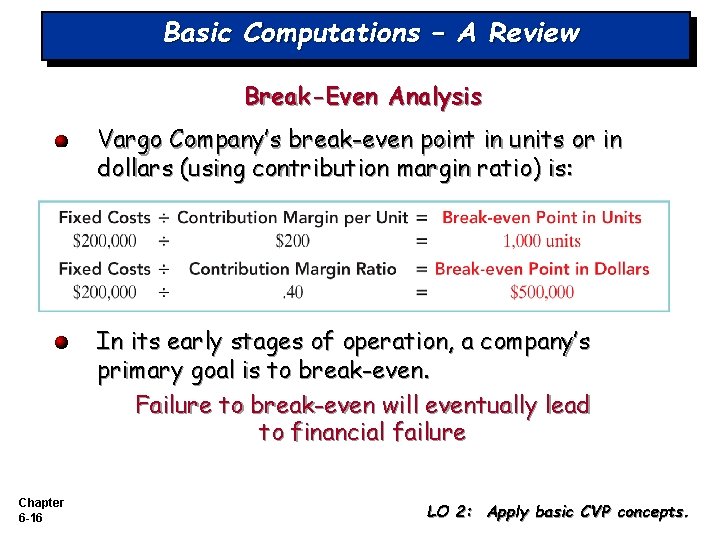

Basic Computations – A Review Break-Even Analysis Vargo Company’s break-even point in units or in dollars (using contribution margin ratio) is: In its early stages of operation, a company’s primary goal is to break-even. Failure to break-even will eventually lead to financial failure Chapter 6 -16 LO 2: Apply basic CVP concepts.

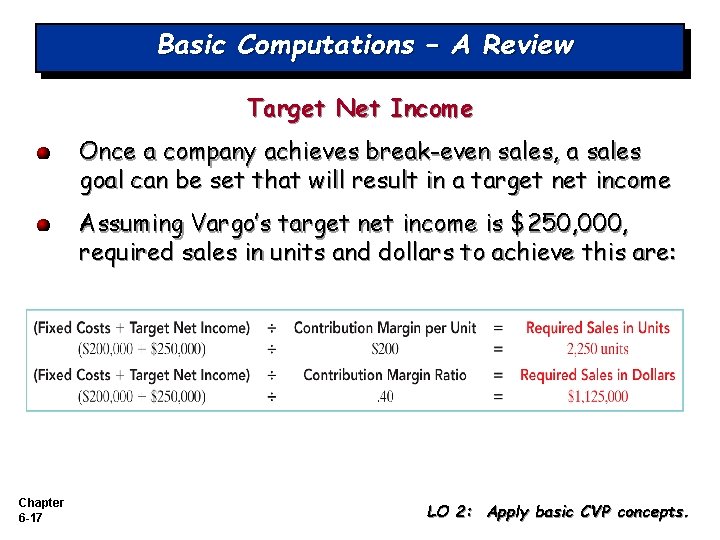

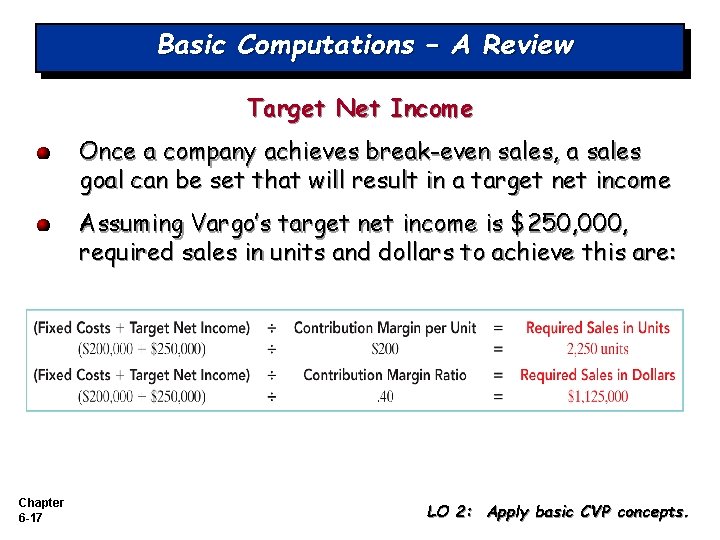

Basic Computations – A Review Target Net Income Once a company achieves break-even sales, a sales goal can be set that will result in a target net income Assuming Vargo’s target net income is $250, 000, required sales in units and dollars to achieve this are: Chapter 6 -17 LO 2: Apply basic CVP concepts.

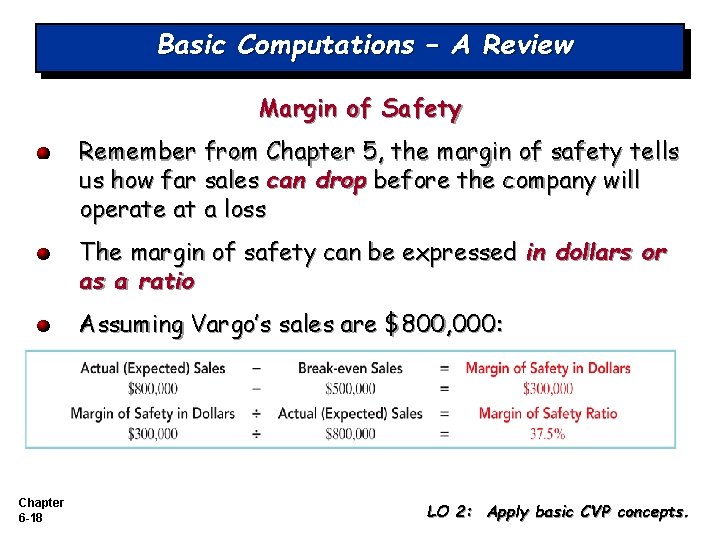

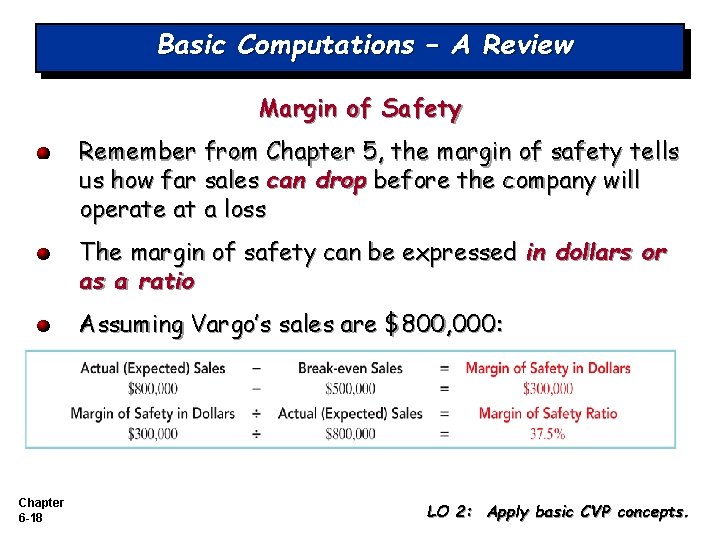

Basic Computations – A Review Margin of Safety Remember from Chapter 5, the margin of safety tells us how far sales can drop before the company will operate at a loss The margin of safety can be expressed in dollars or as a ratio Assuming Vargo’s sales are $800, 000: Chapter 6 -18 LO 2: Apply basic CVP concepts.

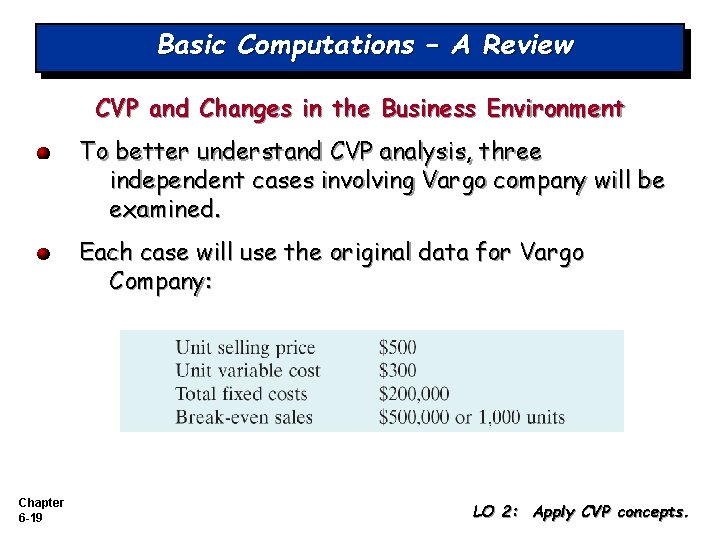

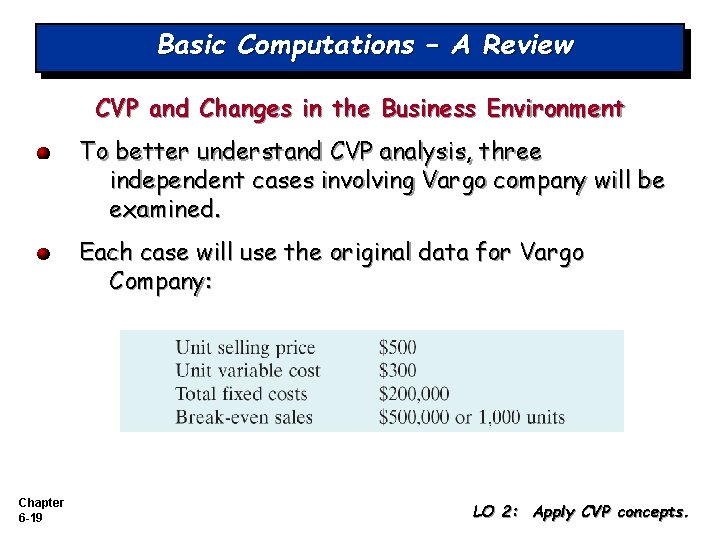

Basic Computations – A Review CVP and Changes in the Business Environment To better understand CVP analysis, three independent cases involving Vargo company will be examined. Each case will use the original data for Vargo Company: Chapter 6 -19 LO 2: Apply CVP concepts.

Basic Computations – A Review: Case I Should Vargo Company match a competitor’s 10% discount and reduce selling price to $450 per unit? With variable costs per unit unchanged, a 10% discount in selling price will decrease the contribution margin to $150 and increase break-even sales to 1, 333 units Management must decide how likely it is that Vargo can achieve the increase in sales as well as the likelihood of lost sales if the discount is not matched Chapter 6 -20 LO 2: Apply basic CVP concepts.

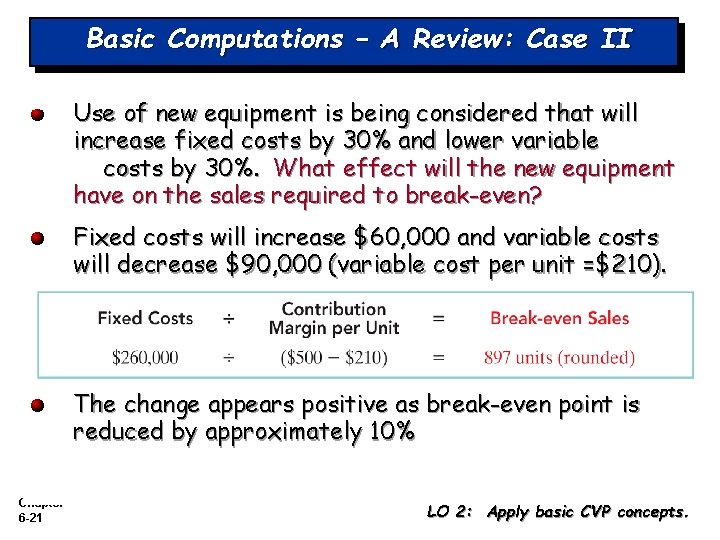

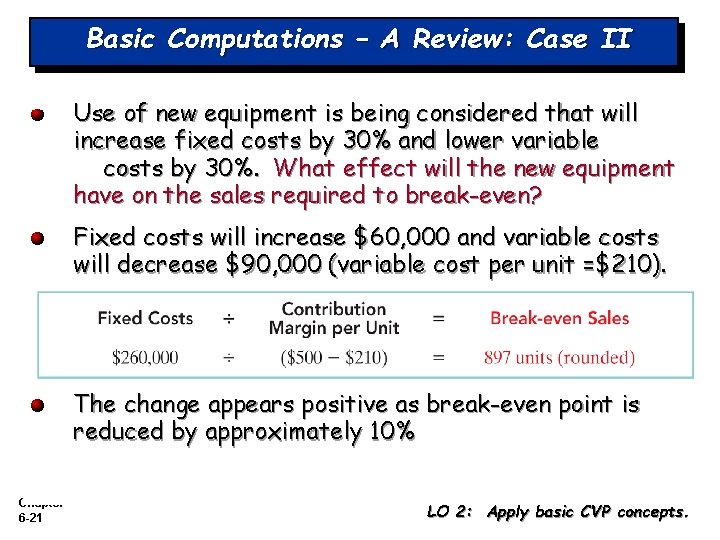

Basic Computations – A Review: Case II Use of new equipment is being considered that will increase fixed costs by 30% and lower variable costs by 30%. What effect will the new equipment have on the sales required to break-even? Fixed costs will increase $60, 000 and variable costs will decrease $90, 000 (variable cost per unit =$210). The change appears positive as break-even point is reduced by approximately 10% Chapter 6 -21 LO 2: Apply basic CVP concepts.

Basic Computations – A Review: Case III Vargo’s supplier of raw materials has increased the cost of raw materials which will increase the variable cost per unit by $25. Management will not change the selling price of the DVDs. Management intends to cut fixed costs by $17, 500 Vargo currently has a net income of $80, 000 on sales of 1, 400 DVDs How many more units will need to be sold to maintain the $80, 000 net income? Chapter 6 -22 LO 2: Apply basic CVP concepts.

Basic Computations – A Review: Case III Variable cost per unit increases to $325 as a result of the $25 increase in raw materials cost Fixed costs decrease to $182, 500 Contribution margin per unit is now $175 If Vargo cannot sell an additional 100 units, management must further reduce costs, increase the selling price of the DVDs, or accept a lower net income. Chapter 6 -23 LO 2: Apply basic CVP concepts.

Let’s Review Croc Catchers calculates its contribution margin to be less than zero. Which statement is true? a. Its fixed costs are less than the variable cost per unit b. Its profits are greater than its total costs. c. The company should sell more units. d. Its selling price is less than its variable costs. LO 1: Describe the essential features of a cost-volume-profit income statement. Chapter 6 -24 LO 2: Apply basic CVP concepts.

Sales Mix When a company sells more than one product It is important to understand its sales mix The sales mix is the relative percentage in which a company sells its products. If a company’s unit sales are 80% printers and 20% computers, its sales mix is 80% to 20%. Sales mix is important because different products often have very different contribution margins. Chapter 6 -25 LO 3: Explain the term sales mix and its effects on break-even sales.

Break-Even Sales in Units A company can compute break-even sales for a mix of two or more products by determining the Weighted-average unit contribution margin of all products The weighted-average unit contribution margin is the sum of the weighted contribution margin of each product Chapter 6 -26 LO 3: Explain the term sales mi and its effects on break-even sales.

Break-Even Sales in Units - Example Assume that Vargo Company sells two products and has the following sales mix and related information: Chapter 6 -27 LO 3: Explain the term sales mix and its effects on break-even sales.

Break-Even Sales in Units - Example First, determine the weighted-average contribution margin for Vargo’s two products: Second, use the weighted-average unit contribution margin to compute the break-even point in units Chapter 6 -28 LO 3: Explain the term sales mix and its effects on break-even sales.

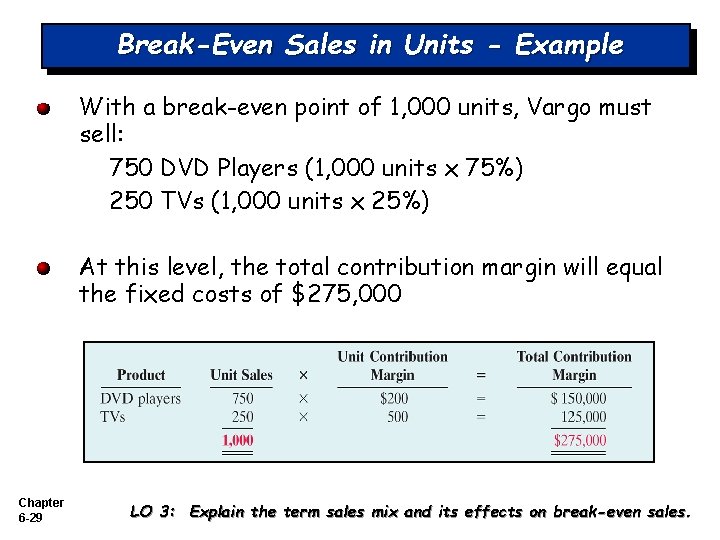

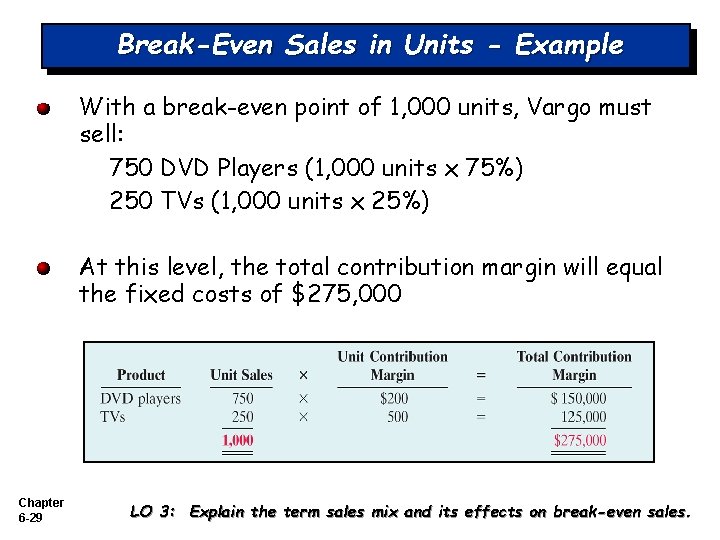

Break-Even Sales in Units - Example With a break-even point of 1, 000 units, Vargo must sell: 750 DVD Players (1, 000 units x 75%) 250 TVs (1, 000 units x 25%) At this level, the total contribution margin will equal the fixed costs of $275, 000 Chapter 6 -29 LO 3: Explain the term sales mix and its effects on break-even sales.

Break-Even Sales in Dollars The calculation of break-even point in units works well if the company has only a few products Consider 3 M which has over 30, 000 different products: 3 M would need to calculate 30, 000 different unit contribution margins When there are many products, calculate the breakeven point in terms of sales dollars for divisions or product lines, NOT individual products Chapter 6 -30 LO 3: Explain the term sales mix and its effects on break-even sales.

Break-Even Sales in Dollars - Example Assume that Kale Garden Supply Company has two divisions: Indoor Plants and Outdoor Plants Each division has hundreds of different plant types Compute sales mix as a percentage of total dollar sales rather than units sold and Compute the contribution margin ratio rather than the contribution margin per unit Chapter 6 -31 LO 3: Explain the term sales mix and its effects on break-even sales.

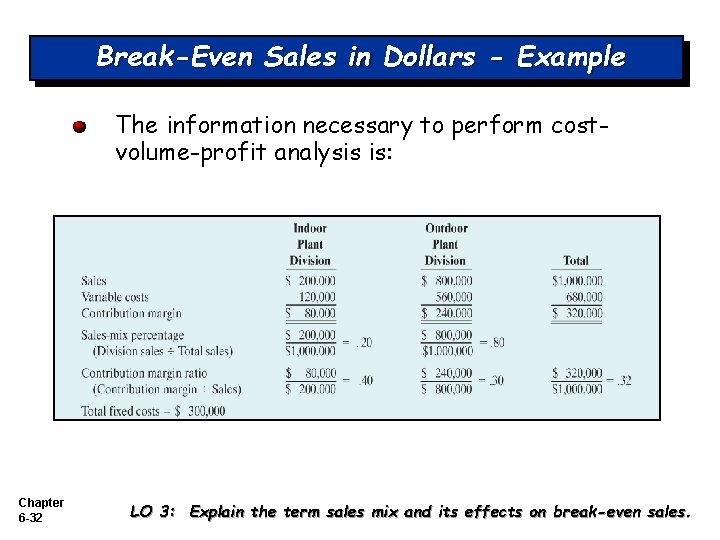

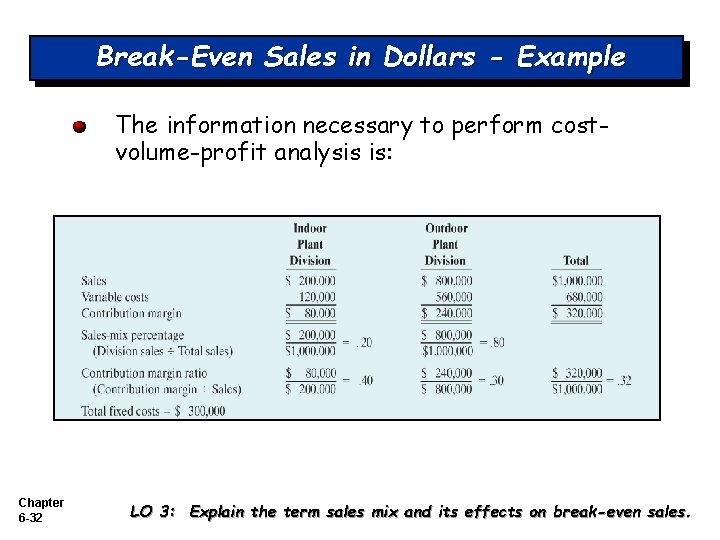

Break-Even Sales in Dollars - Example The information necessary to perform costvolume-profit analysis is: Chapter 6 -32 LO 3: Explain the term sales mix and its effects on break-even sales.

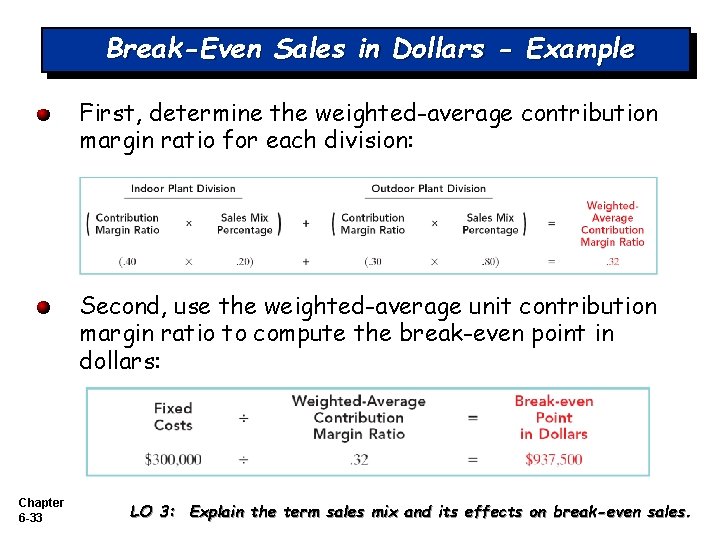

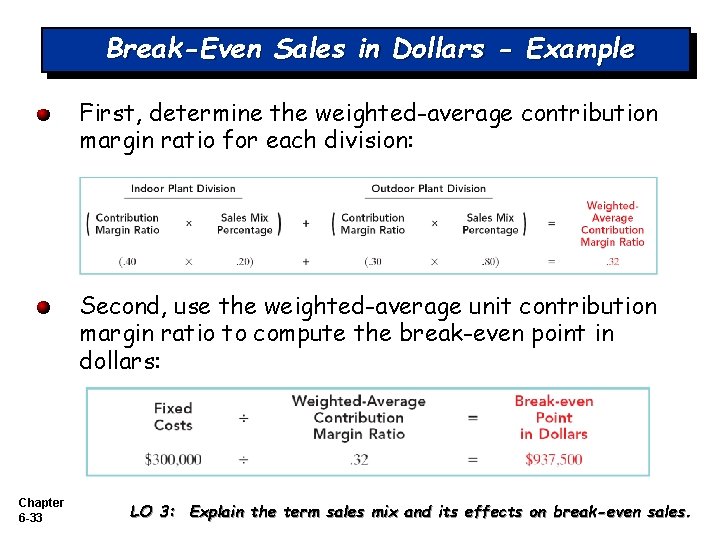

Break-Even Sales in Dollars - Example First, determine the weighted-average contribution margin ratio for each division: Second, use the weighted-average unit contribution margin ratio to compute the break-even point in dollars: Chapter 6 -33 LO 3: Explain the term sales mix and its effects on break-even sales.

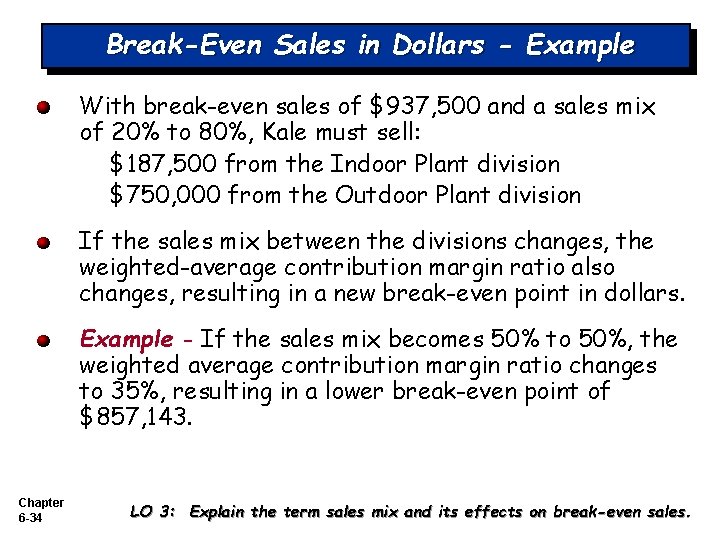

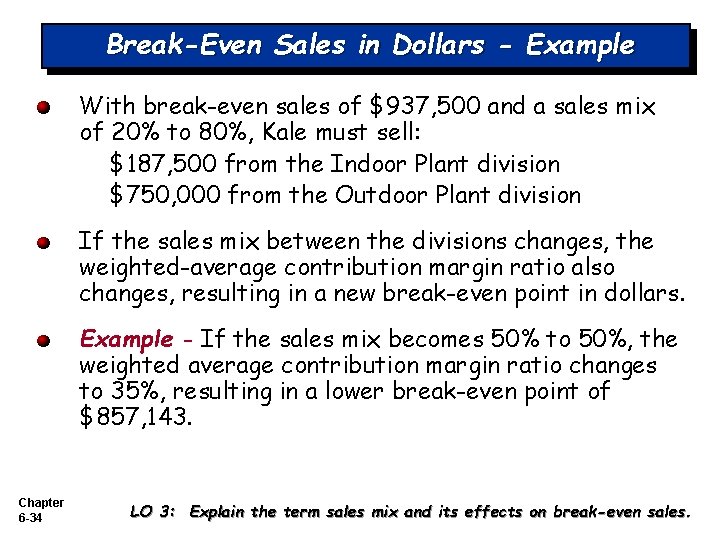

Break-Even Sales in Dollars - Example With break-even sales of $937, 500 and a sales mix of 20% to 80%, Kale must sell: $187, 500 from the Indoor Plant division $750, 000 from the Outdoor Plant division If the sales mix between the divisions changes, the weighted-average contribution margin ratio also changes, resulting in a new break-even point in dollars. Example - If the sales mix becomes 50% to 50%, the weighted average contribution margin ratio changes to 35%, resulting in a lower break-even point of $857, 143. Chapter 6 -34 LO 3: Explain the term sales mix and its effects on break-even sales.

Let’s Review Net income will be: a. Greater if more higher-contribution margin units are sold than lower-contribution margin units b. Greater is more lower-contribution margin units are sold than higher-contribution margin units. c. Equal as song as total sales remain equal, regardless of which products are sold. d. Unaffected by changes in the mix of products sold. Chapter 6 -35 LO 3: Explain the term sales mix and its effects on break-even sales.

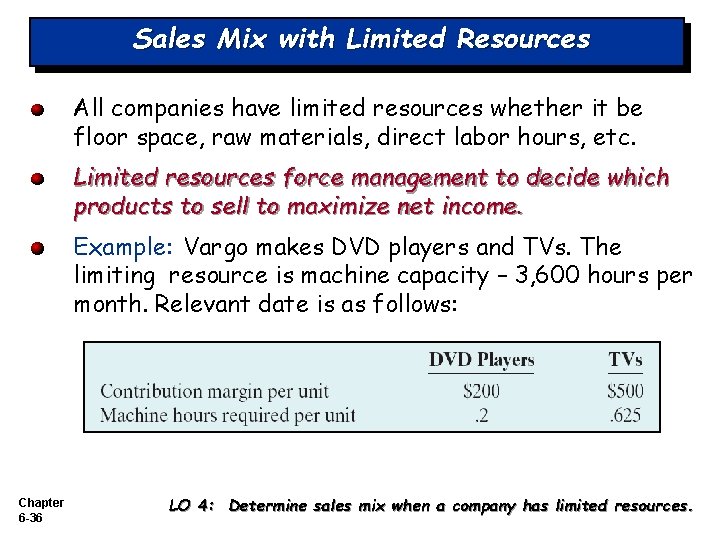

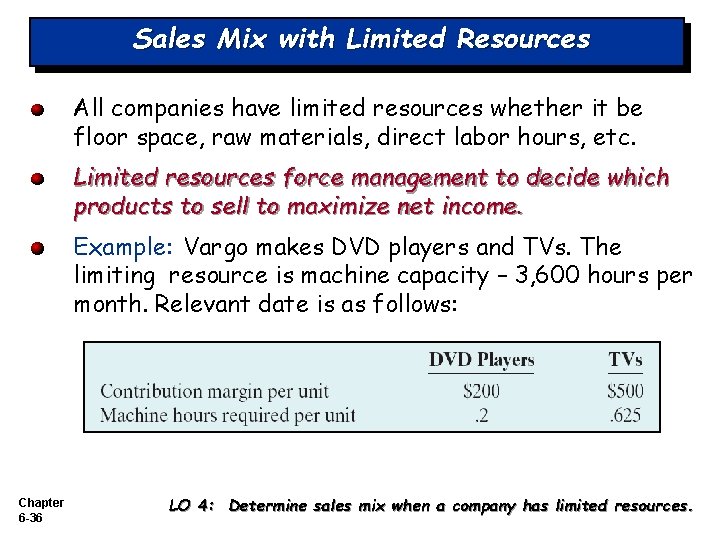

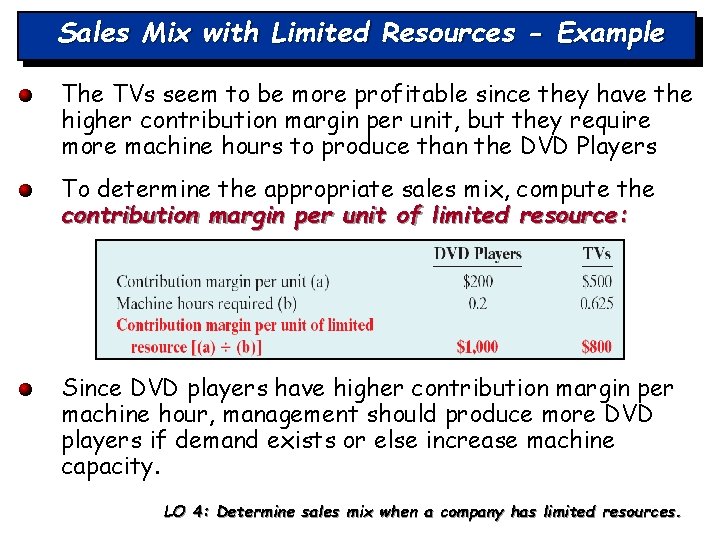

Sales Mix with Limited Resources All companies have limited resources whether it be floor space, raw materials, direct labor hours, etc. Limited resources force management to decide which products to sell to maximize net income. Example: Vargo makes DVD players and TVs. The limiting resource is machine capacity – 3, 600 hours per month. Relevant date is as follows: Chapter 6 -36 LO 4: Determine sales mix when a company has limited resources.

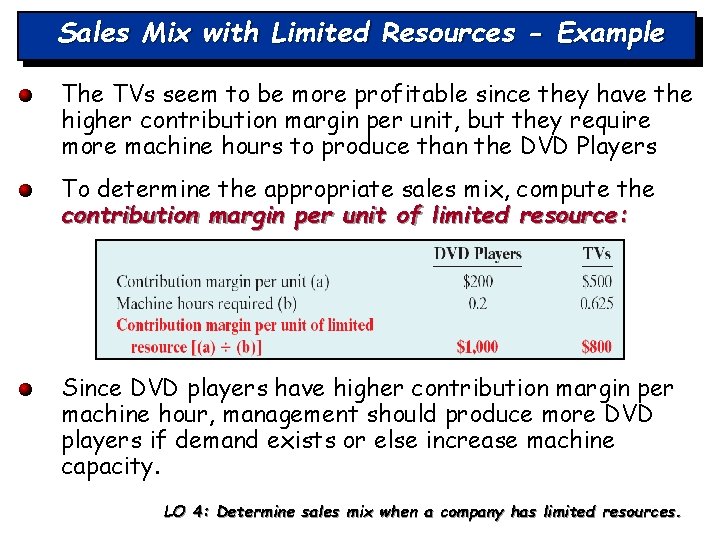

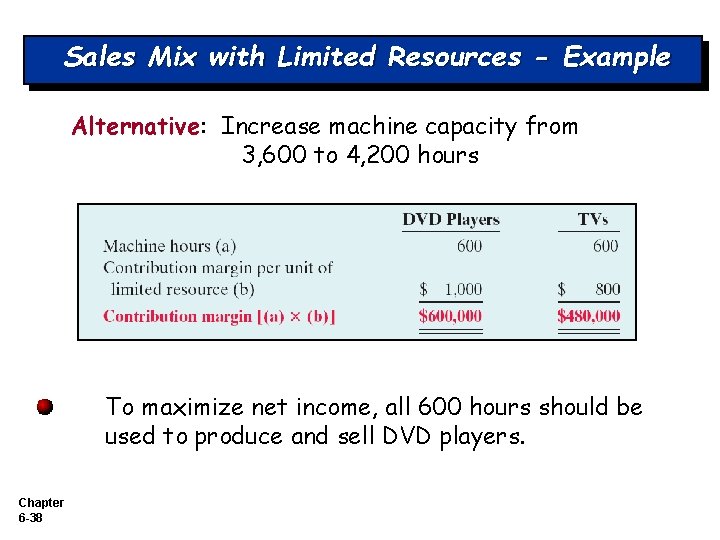

Sales Mix with Limited Resources - Example The TVs seem to be more profitable since they have the higher contribution margin per unit, but they require more machine hours to produce than the DVD Players To determine the appropriate sales mix, compute the contribution margin per unit of limited resource: Since DVD players have higher contribution margin per machine hour, management should produce more DVD players if demand exists or else increase machine capacity. Chapter 6 -37 LO 4: Determine sales mix when a company has limited resources.

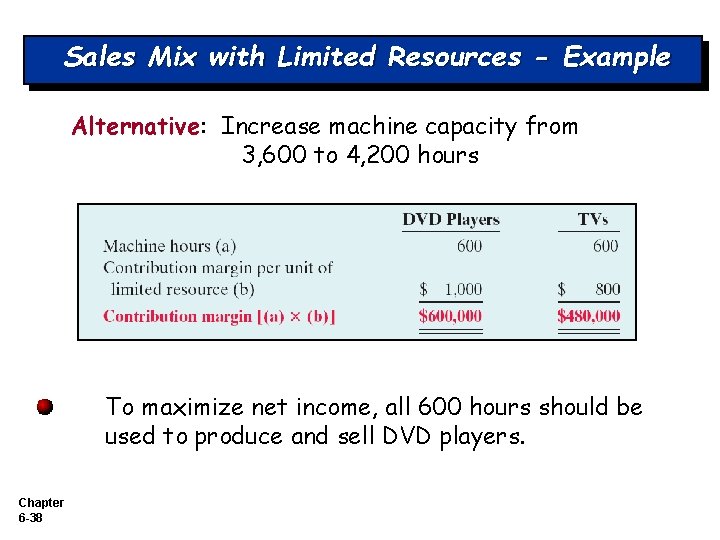

Sales Mix with Limited Resources - Example Alternative: Increase machine capacity from 3, 600 to 4, 200 hours To maximize net income, all 600 hours should be used to produce and sell DVD players. Chapter 6 -38

Theory of Constraints Approach used to identify and manage constraints so as to achieve company goals Requires identification of constraints Continual attempts to reduce or eliminate constraints Chapter 6 -39 LO 4: Determine sales mix when a company has limited resources.

Let’s Review If the contribution margin per unit is $15 and it takes 3. 0 machine hours to produce the unit, the contribution margin per unit of limited resource is: a. $25 b. $5. c. $4. d. No correct answer is given. Chapter 6 -40 LO 4: Determine the sales mix when a company has limited resources.

Cost Structure and Operating Leverage Cost Structure is the relative proportion of fixed versus variable costs that a company incurs May have a significant effect on profitability Thus, a company must carefully choose its cost structure. Chapter 6 -41 LO 5: Understand how operating leverage affects profitability.

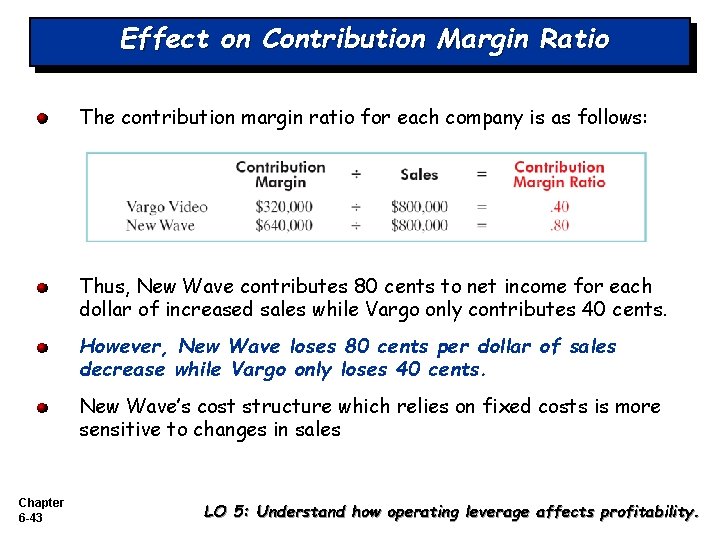

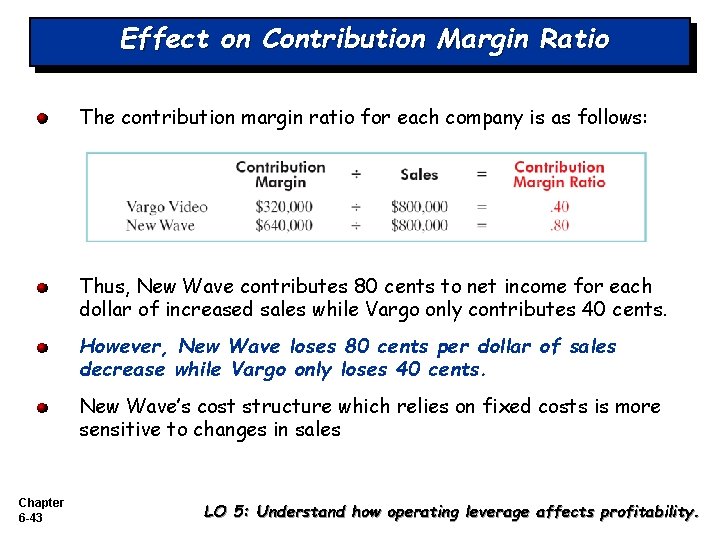

Comparison of Cost Structures Vargo Video manufactures DVD players using a traditional, labor -intensive manufacturing process New Wave Company also manufactures DVD players, but uses a completely automated system where factory employees only set up, adjust, and maintain the machinery. Both companies have the same sales and net income; however, each has different risks and rewards due to changes in sales as a result of their cost structures. Chapter 6 -42 LO 5: Understand how operating leverage affects profitability.

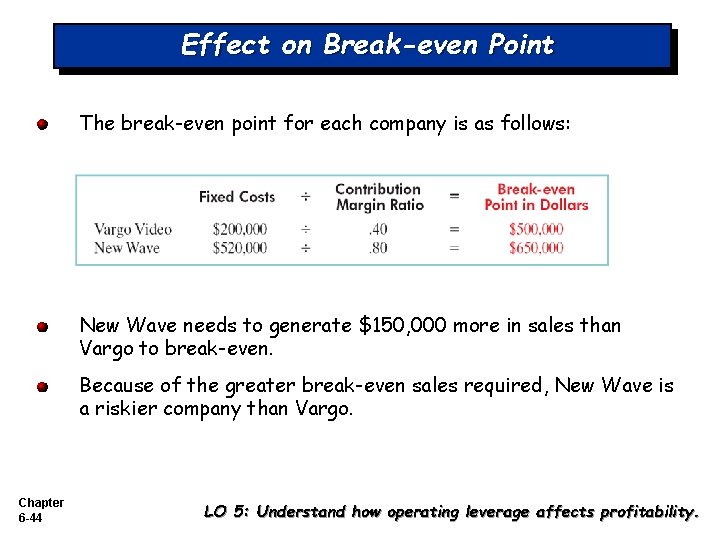

Effect on Contribution Margin Ratio The contribution margin ratio for each company is as follows: Thus, New Wave contributes 80 cents to net income for each dollar of increased sales while Vargo only contributes 40 cents. However, New Wave loses 80 cents per dollar of sales decrease while Vargo only loses 40 cents. New Wave’s cost structure which relies on fixed costs is more sensitive to changes in sales Chapter 6 -43 LO 5: Understand how operating leverage affects profitability.

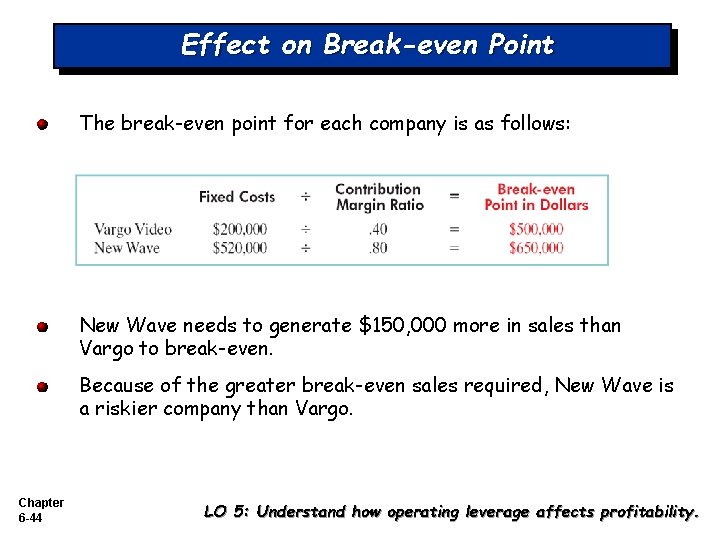

Effect on Break-even Point The break-even point for each company is as follows: New Wave needs to generate $150, 000 more in sales than Vargo to break-even. Because of the greater break-even sales required, New Wave is a riskier company than Vargo. Chapter 6 -44 LO 5: Understand how operating leverage affects profitability.

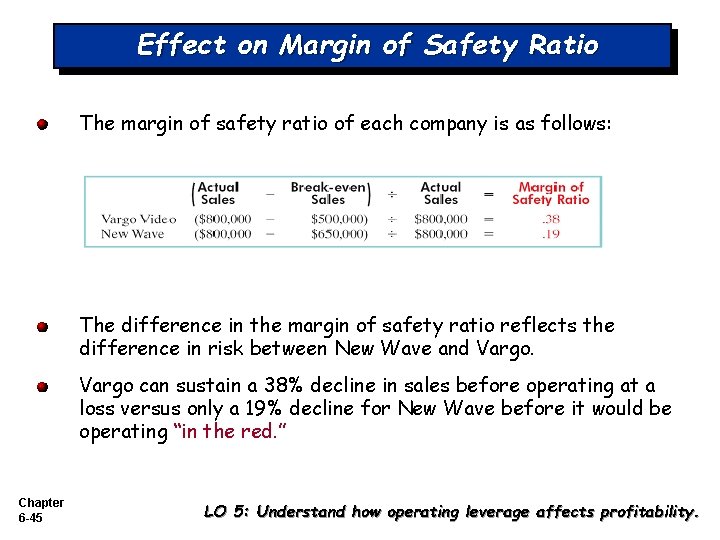

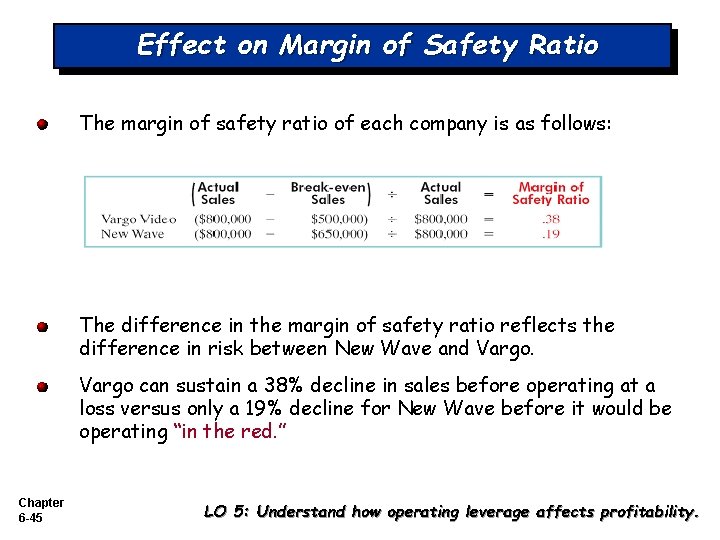

Effect on Margin of Safety Ratio The margin of safety ratio of each company is as follows: The difference in the margin of safety ratio reflects the difference in risk between New Wave and Vargo can sustain a 38% decline in sales before operating at a loss versus only a 19% decline for New Wave before it would be operating “in the red. ” Chapter 6 -45 LO 5: Understand how operating leverage affects profitability.

Operating Leverage Operating leverage refers to the extent that net income reacts to a given change in sales. Higher fixed costs relative to variable costs cause a company to have higher operating leverage. When sales revenues are increasing, high operating leverage means that profits will increase rapidly – a good thing. When sales revenues are declining, too much operating leverage can have devastating consequences. Chapter 6 -46 LO 5: Understand how operating leverage affects profitability.

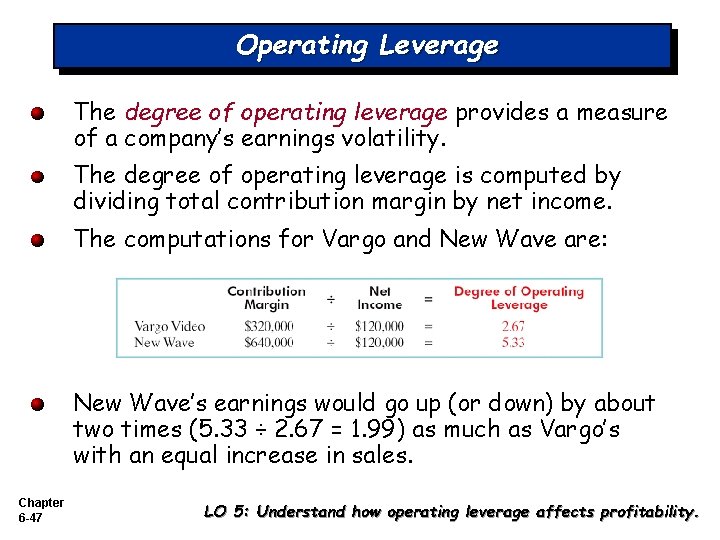

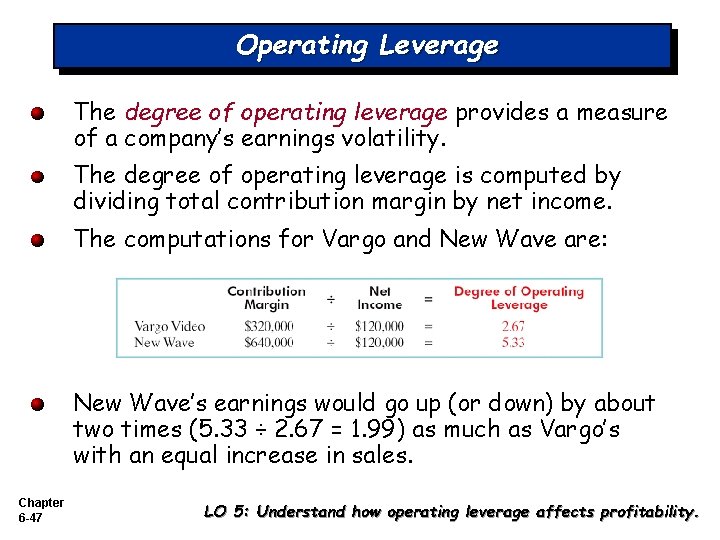

Operating Leverage The degree of operating leverage provides a measure of a company’s earnings volatility. The degree of operating leverage is computed by dividing total contribution margin by net income. The computations for Vargo and New Wave are: New Wave’s earnings would go up (or down) by about two times (5. 33 ÷ 2. 67 = 1. 99) as much as Vargo’s with an equal increase in sales. Chapter 6 -47 LO 5: Understand how operating leverage affects profitability.

Let’s Review The degree of operating leverage: a. Can be computed by dividing total contribution margin by net income. b. Provides a measure of the company’s earnings volatility. c. Affects a company’s break-even point. d. All of the above. Chapter 6 -48 LO 5: Understand how operating leverage affects profitability.

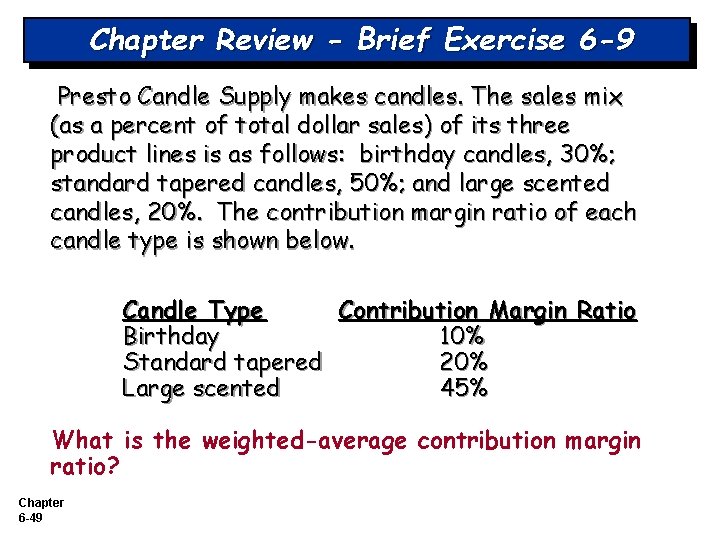

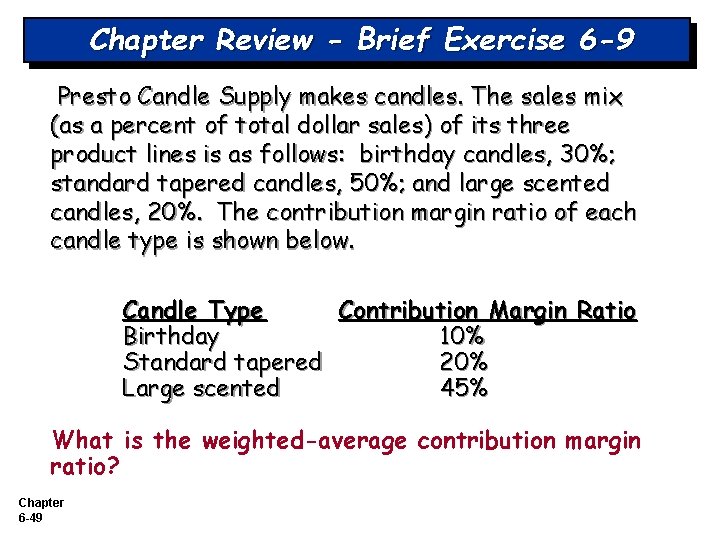

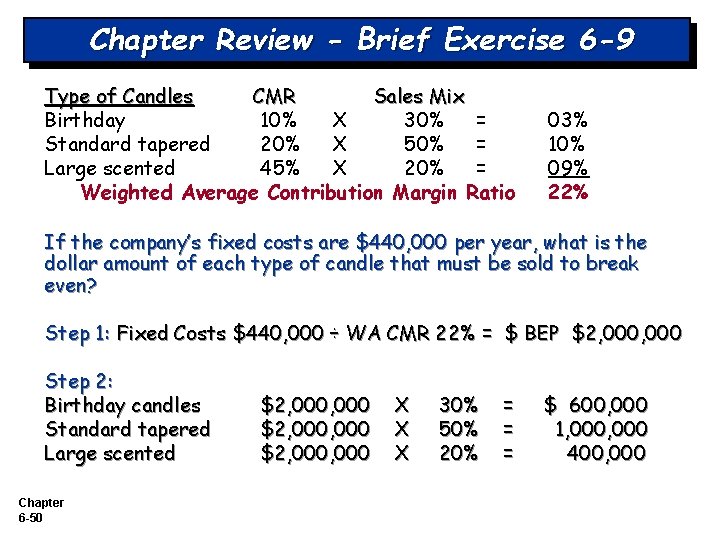

Chapter Review - Brief Exercise 6 -9 Presto Candle Supply makes candles. The sales mix (as a percent of total dollar sales) of its three product lines is as follows: birthday candles, 30%; standard tapered candles, 50%; and large scented candles, 20%. The contribution margin ratio of each candle type is shown below. Candle Type Contribution Margin Ratio Birthday 10% Standard tapered 20% Large scented 45% What is the weighted-average contribution margin ratio? Chapter 6 -49

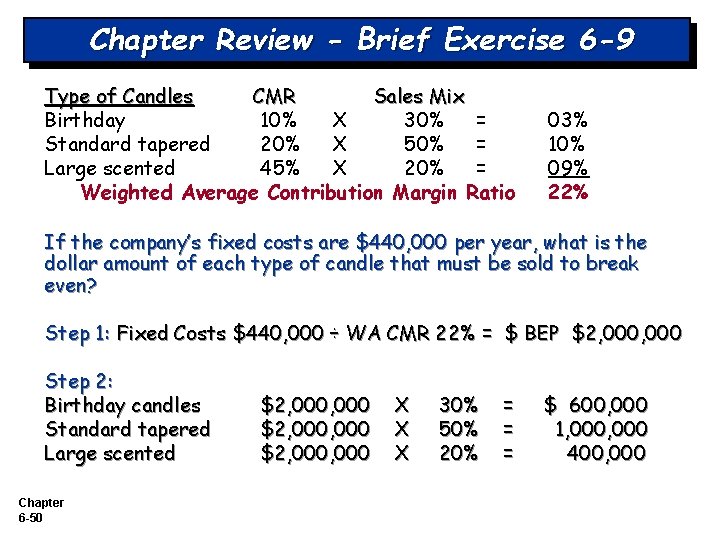

Chapter Review - Brief Exercise 6 -9 Type of Candles CMR Sales Mix Birthday 10% X 30% = Standard tapered 20% X 50% = Large scented 45% X 20% = Weighted Average Contribution Margin Ratio 03% 10% 09% 22% If the company’s fixed costs are $440, 000 per year, what is the dollar amount of each type of candle that must be sold to break even? Step 1: Fixed Costs $440, 000 ÷ WA CMR 22% = $ BEP $2, 000 Step 2: Birthday candles Standard tapered Large scented Chapter 6 -50 $2, 000, 000 $2, 000 X X X 30% 50% 20% = = = $ 600, 000 1, 000 400, 000

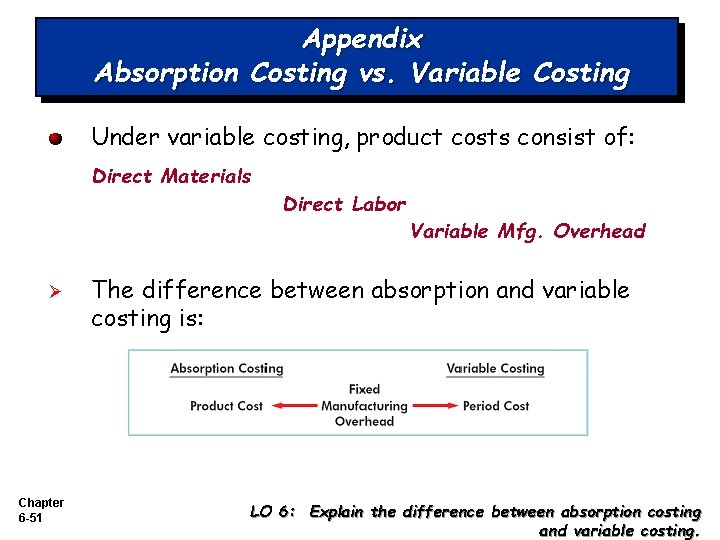

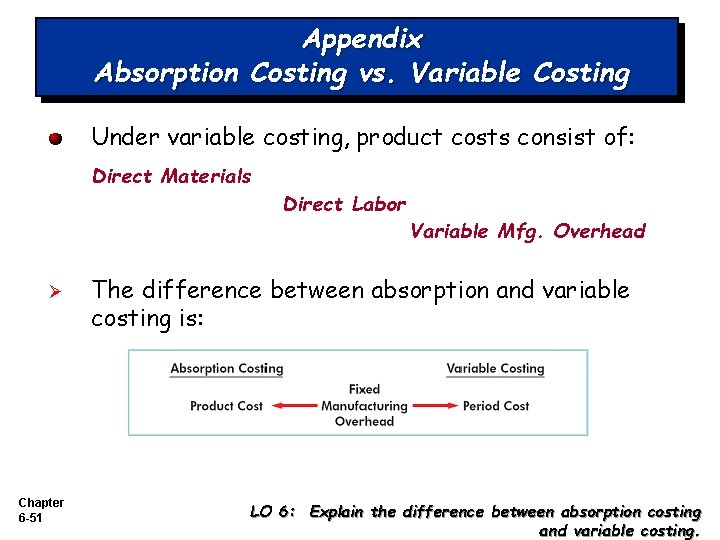

Appendix Absorption Costing vs. Variable Costing Under variable costing, product costs consist of: Direct Materials Ø Chapter 6 -51 Direct Labor Variable Mfg. Overhead The difference between absorption and variable costing is: LO 6: Explain the difference between absorption costing and variable costing.

Appendix Absorption Costing vs. Variable Costing Under both costing methods, selling and administrative expenses are treated as period costs. Companies may not use variable costing for external financial reports because GAAP requires that fixed manufacturing overhead be treated as a product cost. Chapter 6 -52 Fixed Mfg. Overhead LO 6: Explain the difference between absorption costing and variable costing.

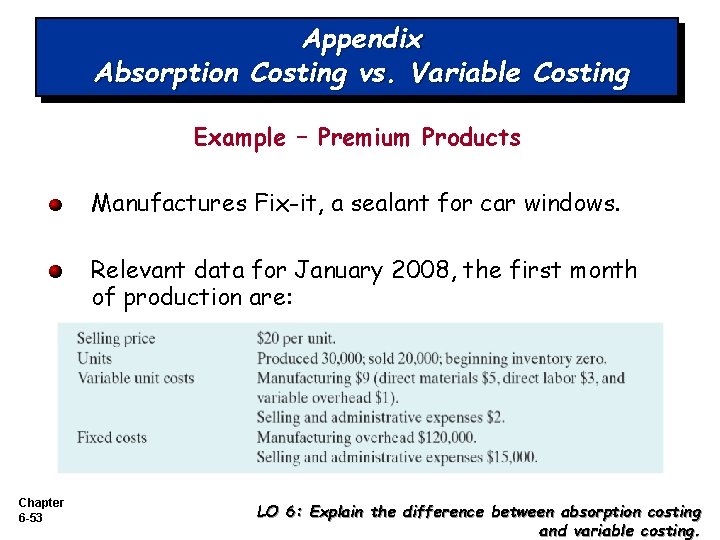

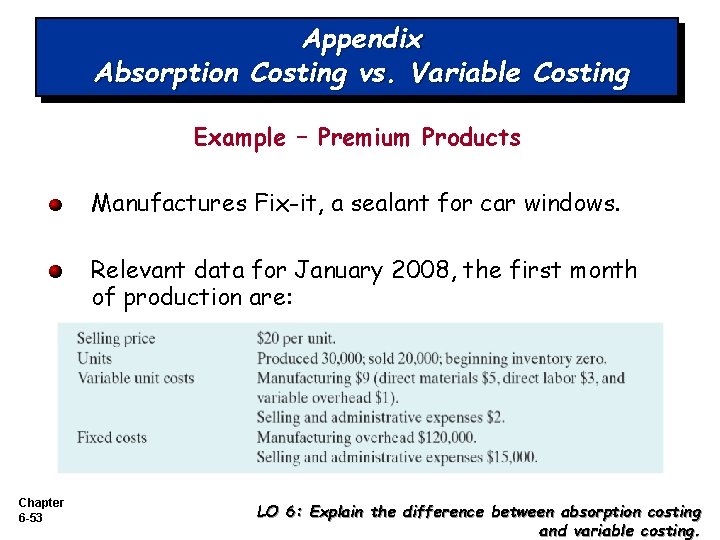

Appendix Absorption Costing vs. Variable Costing Example – Premium Products Manufactures Fix-it, a sealant for car windows. Relevant data for January 2008, the first month of production are: Chapter 6 -53 LO 6: Explain the difference between absorption costing and variable costing.

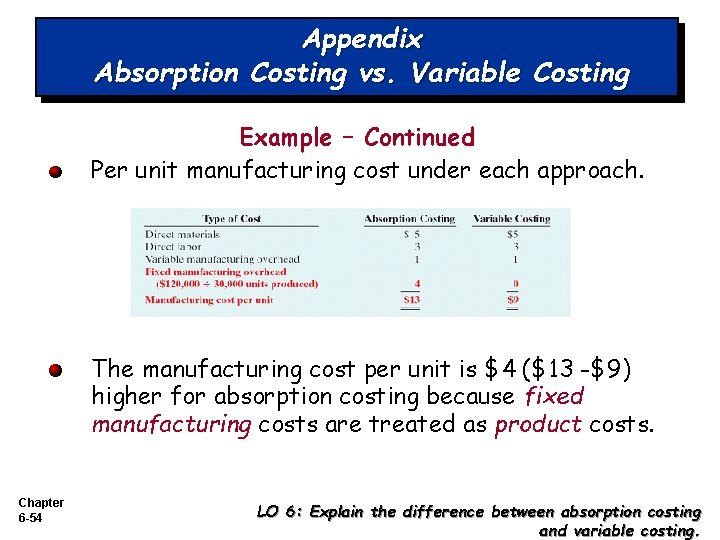

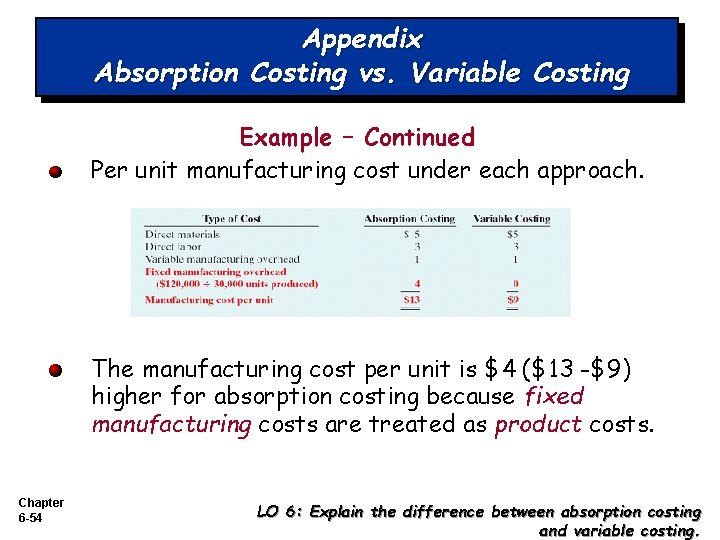

Appendix Absorption Costing vs. Variable Costing Example – Continued Per unit manufacturing cost under each approach. The manufacturing cost per unit is $4 ($13 -$9) higher for absorption costing because fixed manufacturing costs are treated as product costs. Chapter 6 -54 LO 6: Explain the difference between absorption costing and variable costing.

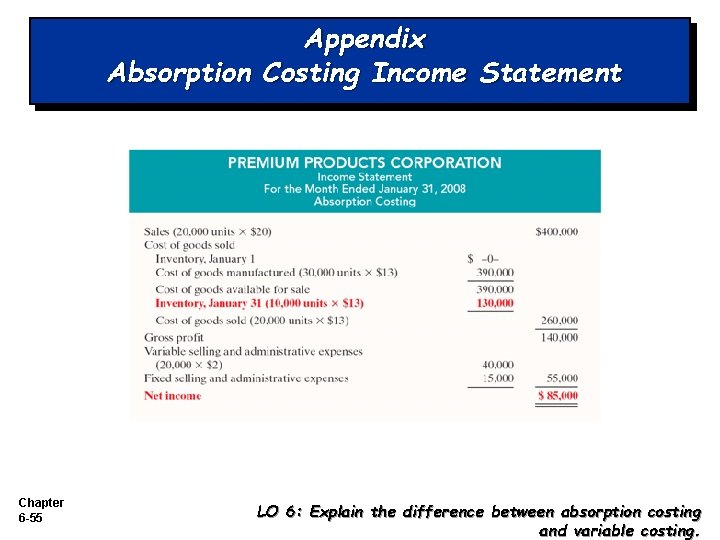

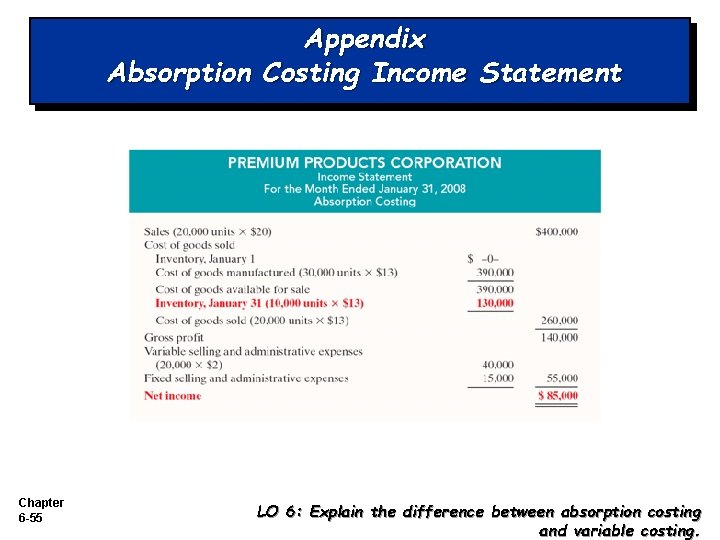

Appendix Absorption Costing Income Statement Chapter 6 -55 LO 6: Explain the difference between absorption costing and variable costing.

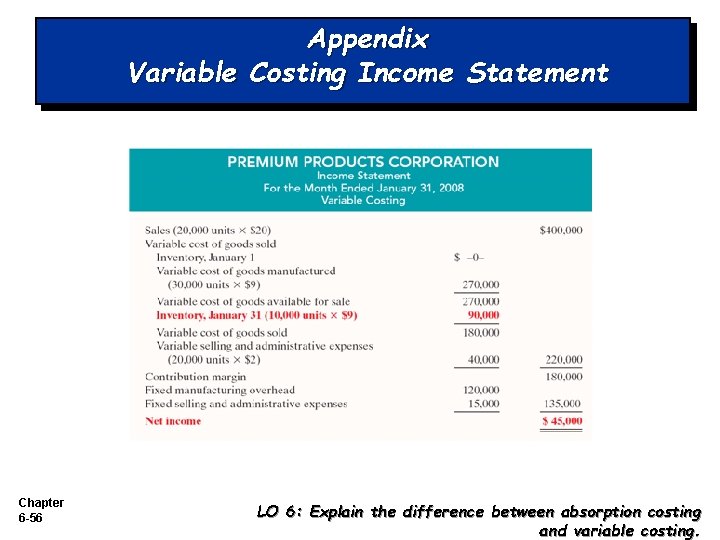

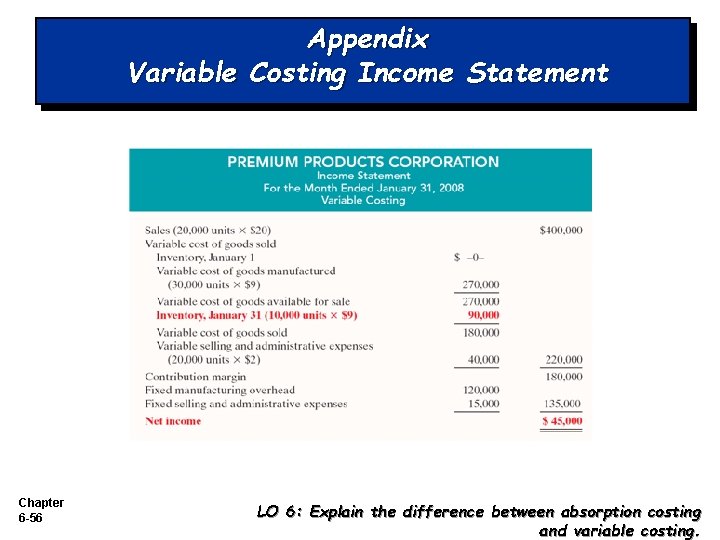

Appendix Variable Costing Income Statement Chapter 6 -56 LO 6: Explain the difference between absorption costing and variable costing.

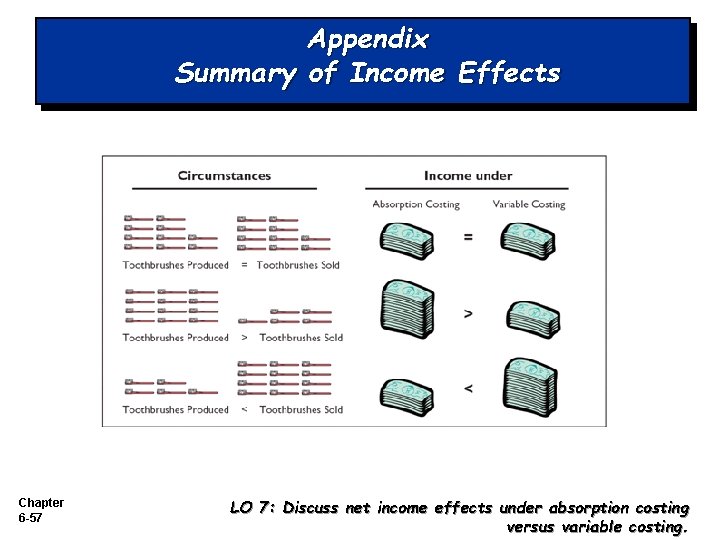

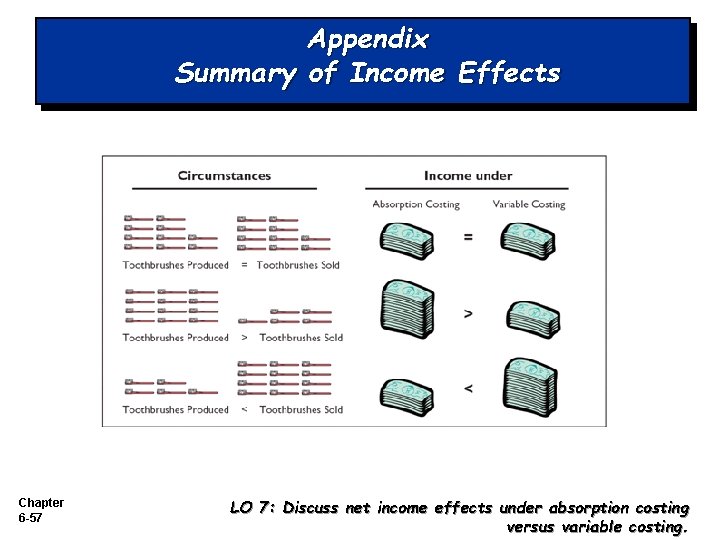

Appendix Summary of Income Effects Chapter 6 -57 LO 7: Discuss net income effects under absorption costing versus variable costing.

Let’s Review Fixed manufacturing overhead costs are recognized as: a. Period costs under absorption costing b. Product costs under absorption costing. c. Product costs under variable costing. d. Part of ending inventory costs under both absorption and variable costing. Chapter 6 -58 LO 6: Explain the difference between absorption costing and variable costing.

Exercise 6 -1 l l The San Marcos is trying to determine its breakeven point. The inn has 75 rooms that are rented at $50 a night. It incurred the following costs during the year. l l l Chapter 6 -59 Salaries $8, 500 per month Utilities $2, 000 per month Depreciation $1, 000 per month Maintenance $500 per month Maid service $5 per room Other costs $33 per room

Exercise 6 -1 l l Determine the breakeven point in rooms per month. Breakeven point in rooms for months formula: l l l Chapter 6 -60 Fixed Costs/Contribution Margin = BEu Contribution Margin = $50 - $5 - $35 = $12 Breakeven in rooms per month = ($8, 500 + $2, 000 + $1, 000 + $500)/12 = 1, 000 rooms

Exercise 6 -1 l l Determine the breakeven point in dollars. Breakeven in dollars formula+ l l Contribution Margin Ratio (CMR) = l l Chapter 6 -61 Fixed Costs/Contribution Margin Ratio = BE$ Contribution Margin Per Room/Price Contribution Margin = $50 - $5 - $35 = $12 Contribution Margin Ratio = $12/$50 =. 24 Breakeven in rooms per month = ($8, 500 + $2, 000 + $1, 000 + $500)/. 24 = $50, 000

Exercise 6 -1 l l l Chapter 6 -62 If the inn plans on renting an average of 50 rooms per day, what is the monthly margin of safety in dollars? Expected sales = 50 rooms × $50 × 30 days = $75, 000 - $50, 000 = $25, 000 margin of safety What is the margin safety ratio? $25, 000/$75, 000 = 33 1/3 rd

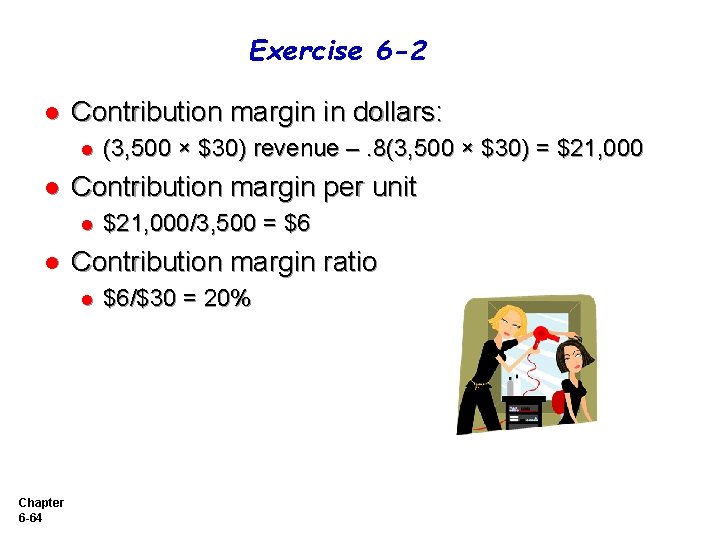

Exercise 6 -2 l l l Chapter 6 -63 In the month of June, Angelo’s Beauty Salon gave 3500 haircuts, shampoos, and permanents at an average price of $30. During the month, fixed cost were $16, 800 and variable costs were 80% of sales. Determine the contribution margin in dollars, per unit, and as a ratio.

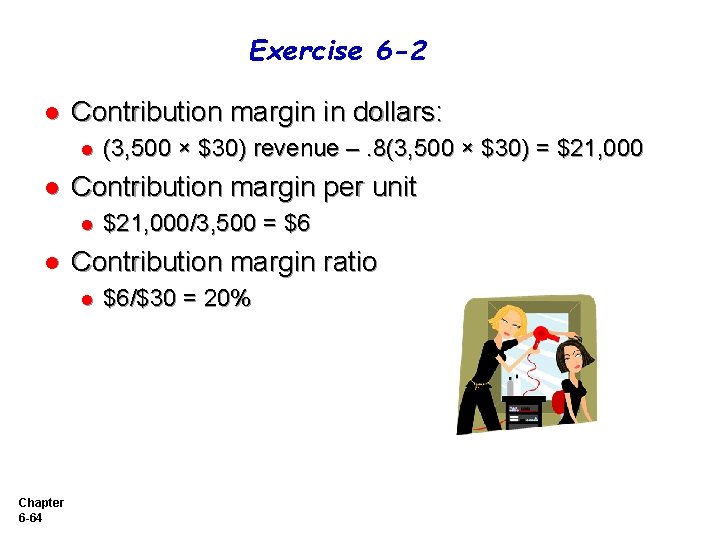

Exercise 6 -2 l Contribution margin in dollars: l l Contribution margin per unit l l $21, 000/3, 500 = $6 Contribution margin ratio l Chapter 6 -64 (3, 500 × $30) revenue –. 8(3, 500 × $30) = $21, 000 $6/$30 = 20%

Exercise 6 -2 l l l Chapter 6 -65 Compute the margin of safety in dollars and as a ratio Breakeven in dollars = $16, 800/. 20 = $84, 000 Breakeven in units = $16, 800/$6 = 2, 800 Margin of safety in dollars = (3, 500 x $30) - $84, 000 = $21, 000 Margin of safety ratio = $21, 000/$105, 000 = . 20%

Exercise 6 -3 l Get Company reports the following operating results for the month of August. l l l Chapter 6 -66 Sales $300, 000 (5, 000 units) Variable cost $210, 000 Fixed cost $70, 000

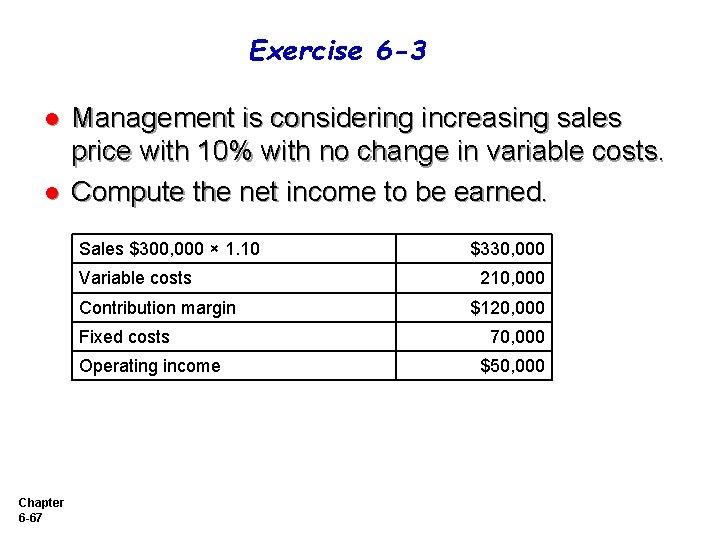

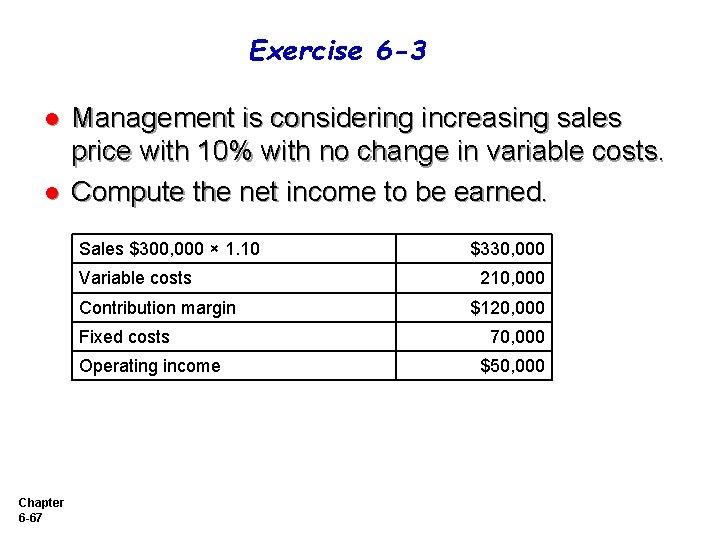

Exercise 6 -3 l l Management is considering increasing sales price with 10% with no change in variable costs. Compute the net income to be earned. Sales $300, 000 × 1. 10 Variable costs Contribution margin Fixed costs Operating income Chapter 6 -67 $330, 000 210, 000 $120, 000 70, 000 $50, 000

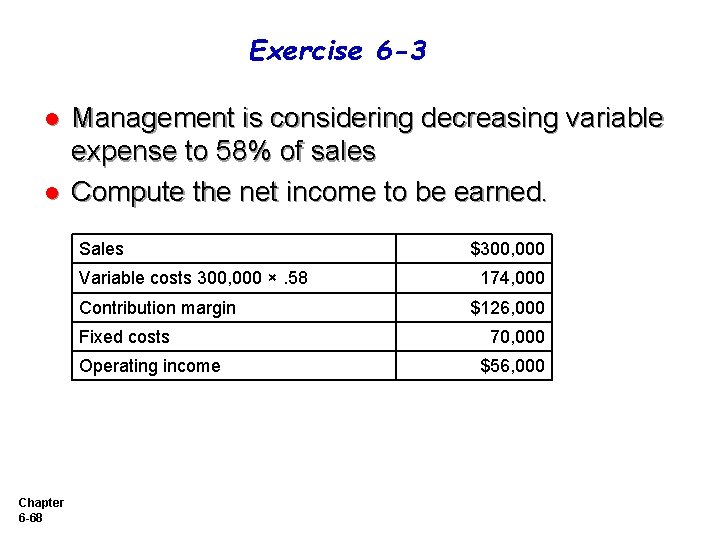

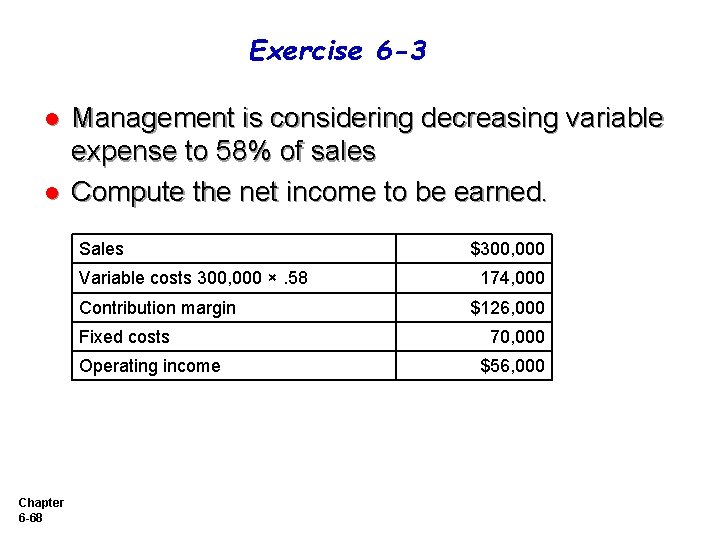

Exercise 6 -3 l l Management is considering decreasing variable expense to 58% of sales Compute the net income to be earned. Sales Variable costs 300, 000 ×. 58 Contribution margin Fixed costs Operating income Chapter 6 -68 $300, 000 174, 000 $126, 000 70, 000 $56, 000

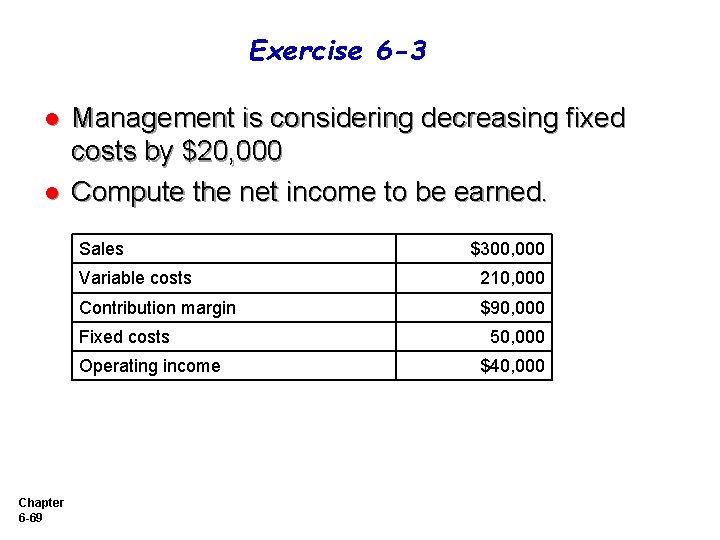

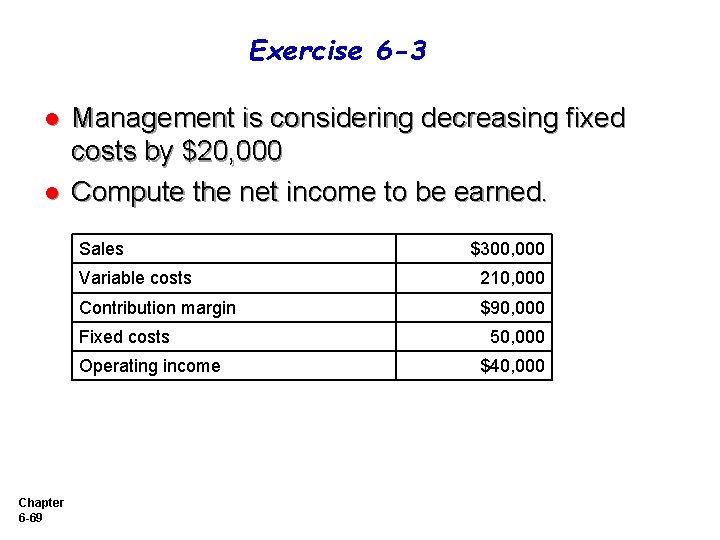

Exercise 6 -3 l l Management is considering decreasing fixed costs by $20, 000 Compute the net income to be earned. Sales Variable costs 210, 000 Contribution margin $90, 000 Fixed costs Operating income Chapter 6 -69 $300, 000 50, 000 $40, 000

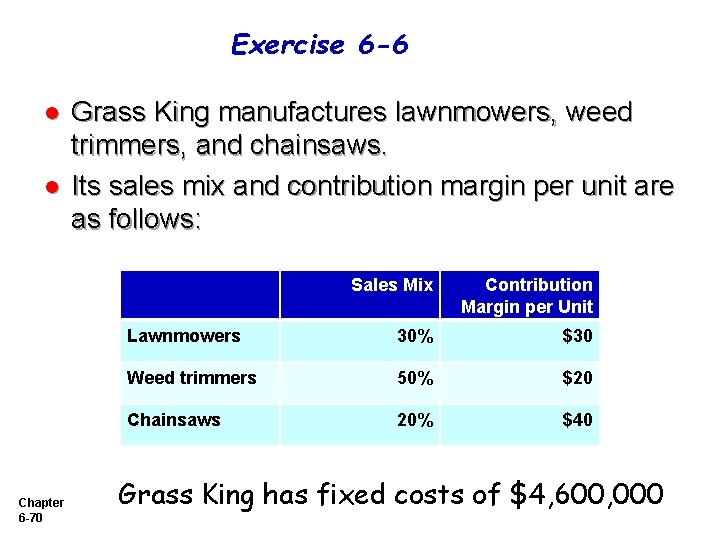

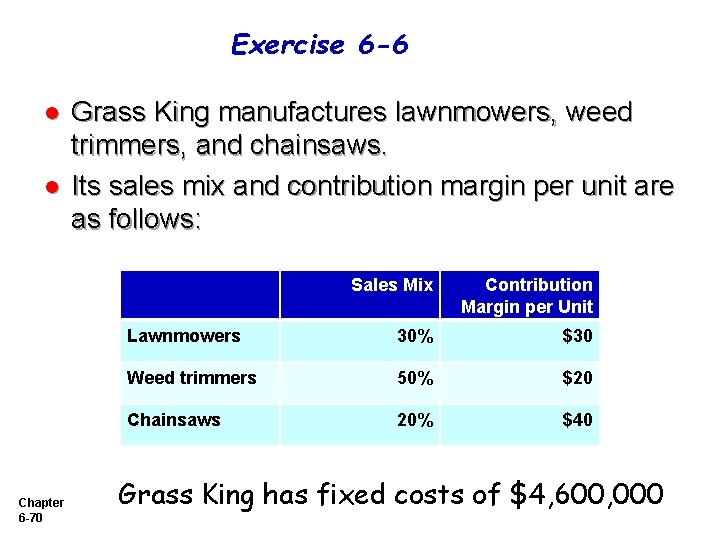

Exercise 6 -6 l l Chapter 6 -70 Grass King manufactures lawnmowers, weed trimmers, and chainsaws. Its sales mix and contribution margin per unit are as follows: Sales Mix Contribution Margin per Unit Lawnmowers 30% $30 Weed trimmers 50% $20 Chainsaws 20% $40 Grass King has fixed costs of $4, 600, 000

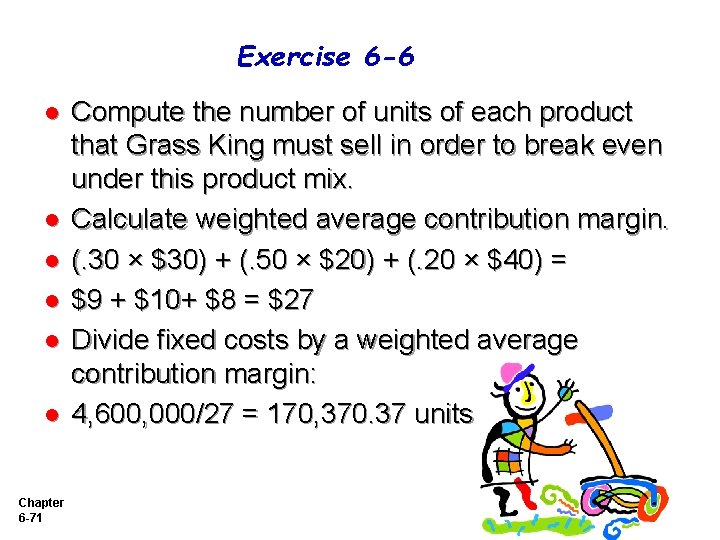

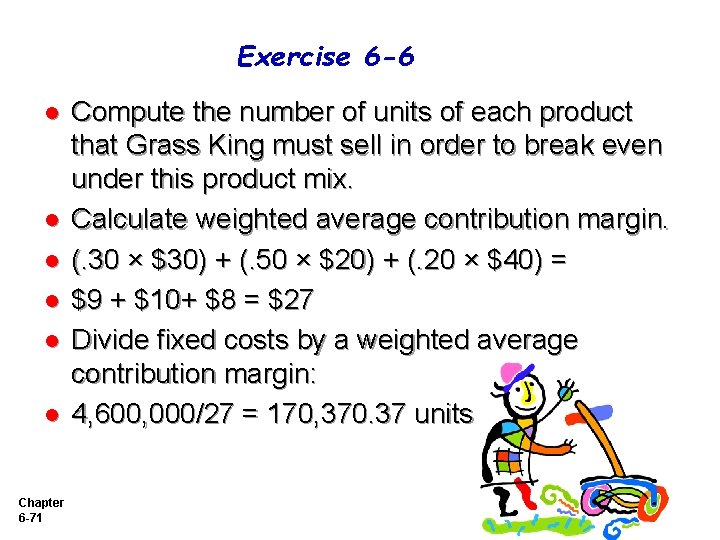

Exercise 6 -6 l l l Chapter 6 -71 Compute the number of units of each product that Grass King must sell in order to break even under this product mix. Calculate weighted average contribution margin. (. 30 × $30) + (. 50 × $20) + (. 20 × $40) = $9 + $10+ $8 = $27 Divide fixed costs by a weighted average contribution margin: 4, 600, 000/27 = 170, 370. 37 units

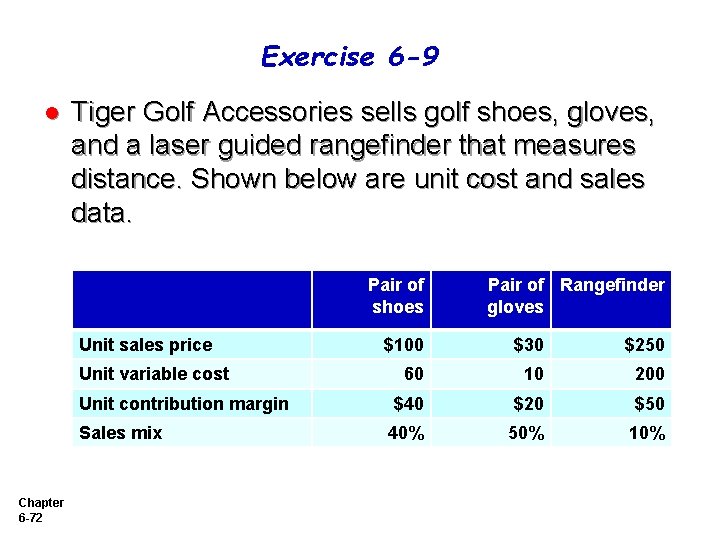

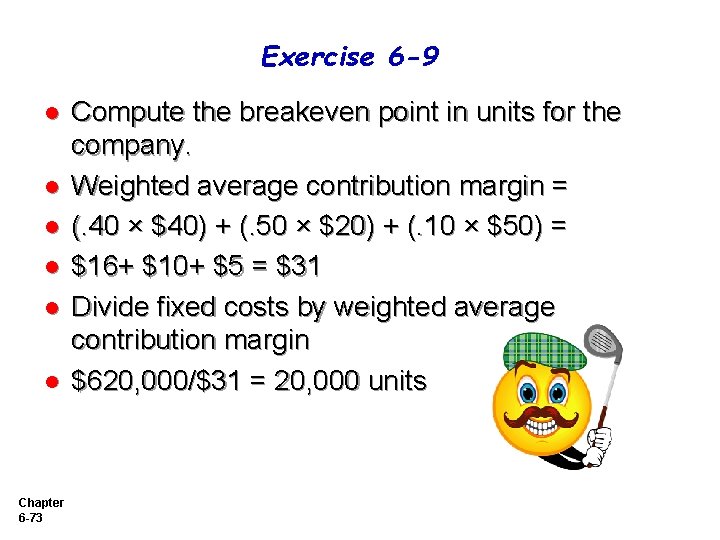

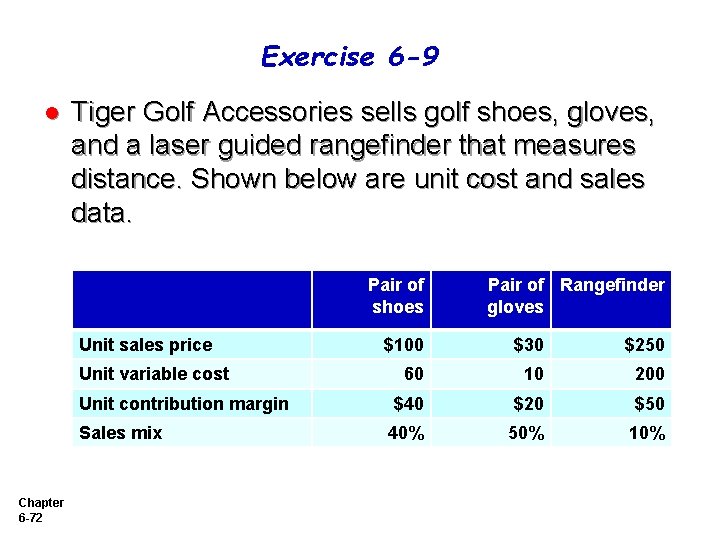

Exercise 6 -9 l Tiger Golf Accessories sells golf shoes, gloves, and a laser guided rangefinder that measures distance. Shown below are unit cost and sales data. Pair of shoes Unit sales price Unit variable cost Unit contribution margin Sales mix Chapter 6 -72 Pair of Rangefinder gloves $100 $30 $250 60 10 200 $40 $20 $50 40% 50% 10%

Exercise 6 -9 l l l Chapter 6 -73 Compute the breakeven point in units for the company. Weighted average contribution margin = (. 40 × $40) + (. 50 × $20) + (. 10 × $50) = $16+ $10+ $5 = $31 Divide fixed costs by weighted average contribution margin $620, 000/$31 = 20, 000 units

Exercise 6 -9 l l Chapter 6 -74 Determine the number of units to be sold at the breakeven point for each product line. Shoes (20, 000 X. 40) = 8, 000 pairs of shoes Gloves (20, 000 X. 50) = 10, 000 pairs of gloves Range finders (20, 000 X. 10) = 2, 000 range finders

Exercise 6 -9 l Verify that the mix of sales determined will generate a zero net income. l Shoes: 8, 000 X $40 = $320, 000 Gloves: 10, 000 X $20 = 200, 000 Range finders: 2, 000 X $50 = 100, 000 Total contribution margin 620, 000 Fixed costs 620, 000 Net income $ 0 l l l Chapter 6 -75

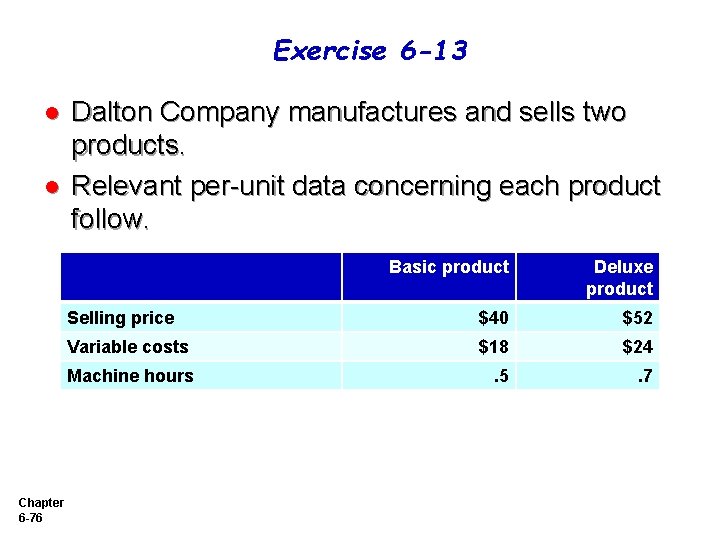

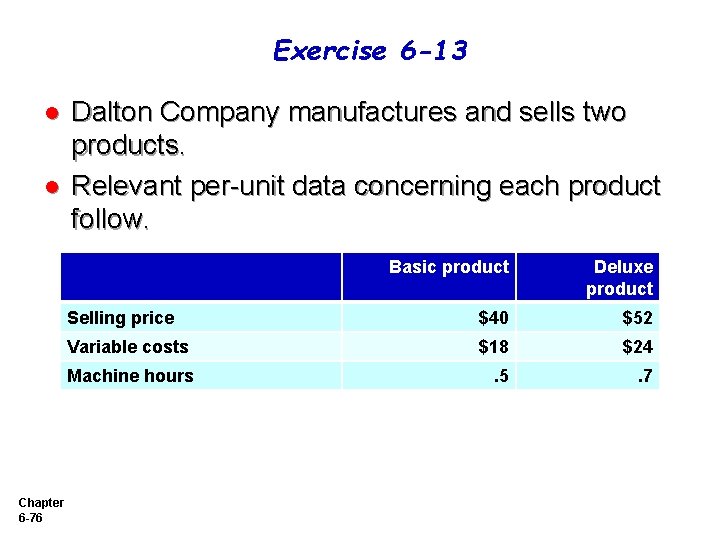

Exercise 6 -13 Dalton Company manufactures and sells two products. Relevant per-unit data concerning each product follow. l l Basic product Deluxe product Selling price $40 $52 Variable costs $18 $24 Machine hours . 5 . 7 Chapter 6 -76

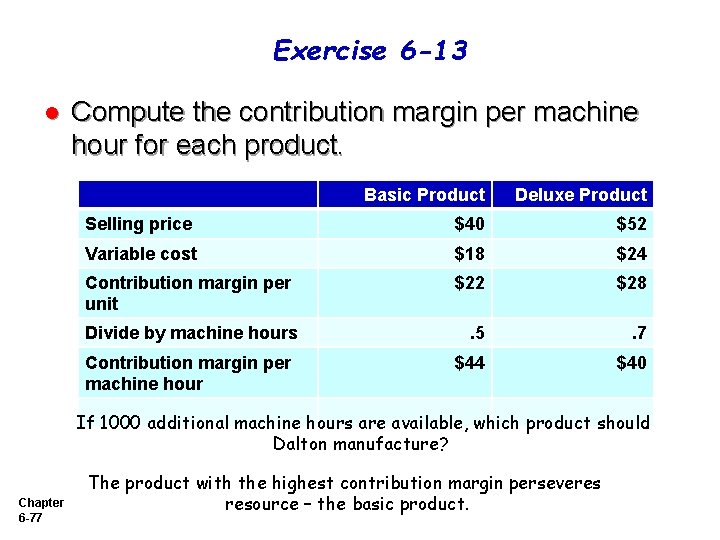

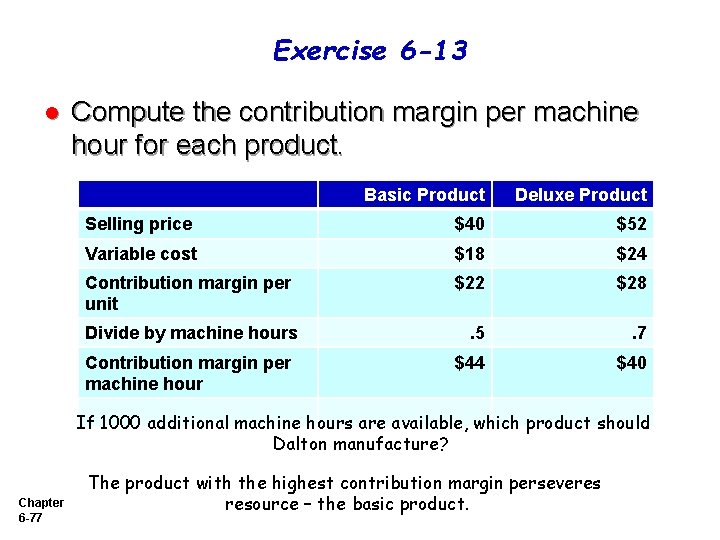

Exercise 6 -13 l Compute the contribution margin per machine hour for each product. Basic Product Deluxe Product Selling price $40 $52 Variable cost $18 $24 Contribution margin per unit $22 $28 Divide by machine hours . 5 . 7 Contribution margin per machine hour $44 $40 If 1000 additional machine hours are available, which product should Dalton manufacture? Chapter 6 -77 The product with the highest contribution margin perseveres resource – the basic product.

Exercise 6 -13 Total contribution margin if the hours are divided equally among the products. l Basic Deluxe Total 500 1, 000 X Contribution margin per machine hour $44 $40 Contribution margin $22, 000 $20, 000 $42, 000 Machine hours allocated Chapter 6 -78

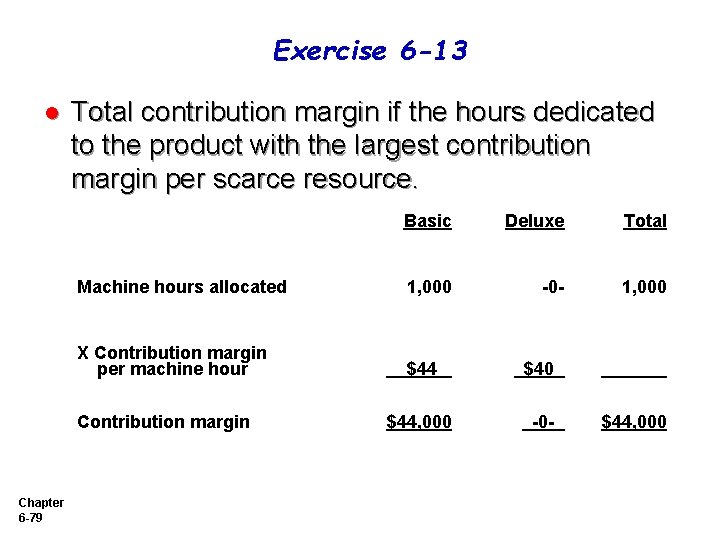

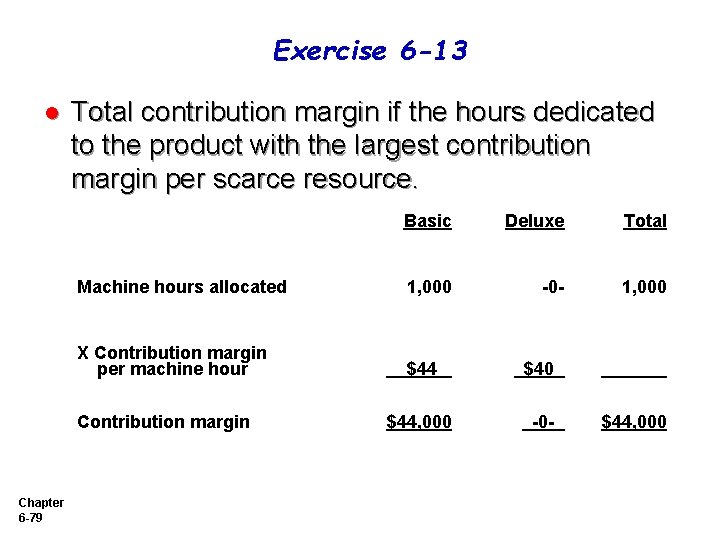

Exercise 6 -13 l Total contribution margin if the hours dedicated to the product with the largest contribution margin per scarce resource. Basic Deluxe Total 1, 000 -0 - 1, 000 X Contribution margin per machine hour $44 $40 Contribution margin $44, 000 -0 - $44, 000 Machine hours allocated Chapter 6 -79

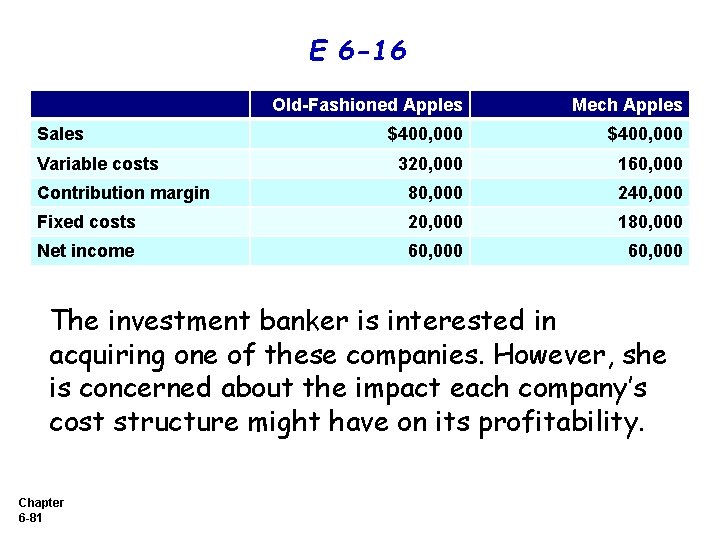

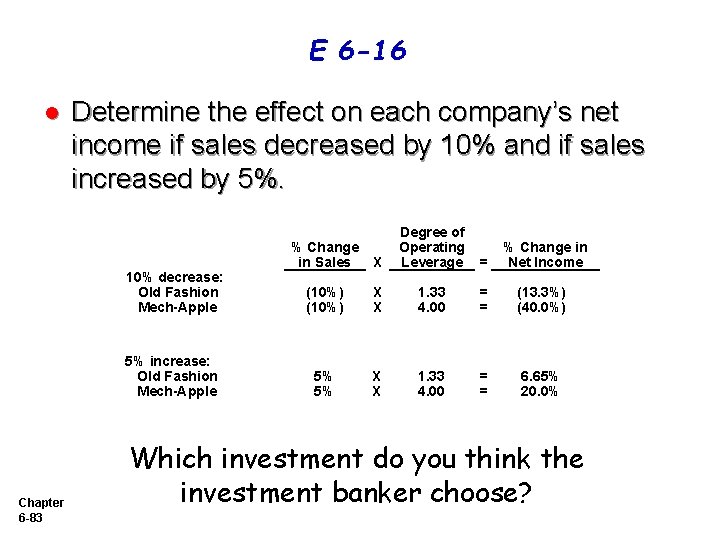

E 6 -16 l l l Chapter 6 -80 An investment banker is analyzing two companies that specialize in the production and sale of candied apples. Old Fashion Apples uses a labor-intensive approach, and Mech-Apple uses a mechanized system. CVP income statements for the two companies are shown below.

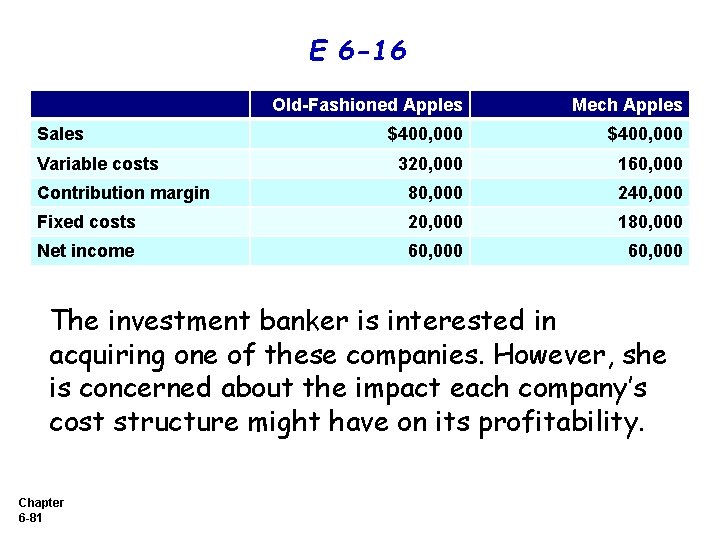

E 6 -16 Old-Fashioned Apples Mech Apples $400, 000 320, 000 160, 000 Contribution margin 80, 000 240, 000 Fixed costs 20, 000 180, 000 Net income 60, 000 Sales Variable costs The investment banker is interested in acquiring one of these companies. However, she is concerned about the impact each company’s cost structure might have on its profitability. Chapter 6 -81

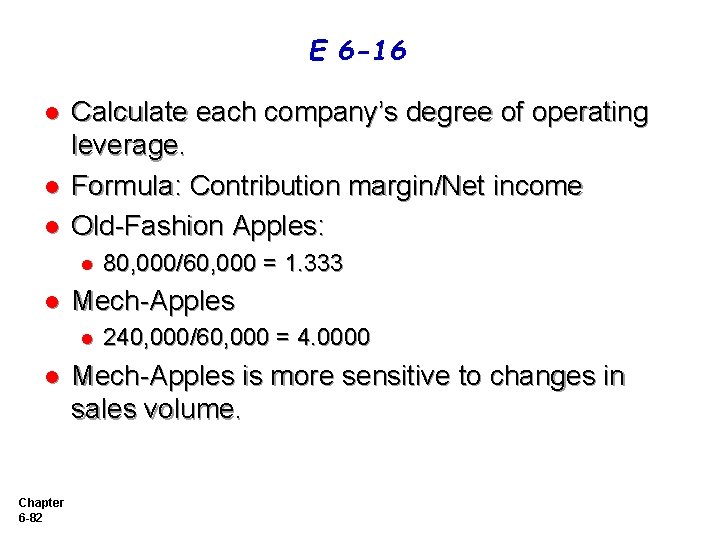

E 6 -16 l l l Calculate each company’s degree of operating leverage. Formula: Contribution margin/Net income Old-Fashion Apples: l l Mech-Apples l l Chapter 6 -82 80, 000/60, 000 = 1. 333 240, 000/60, 000 = 4. 0000 Mech-Apples is more sensitive to changes in sales volume.

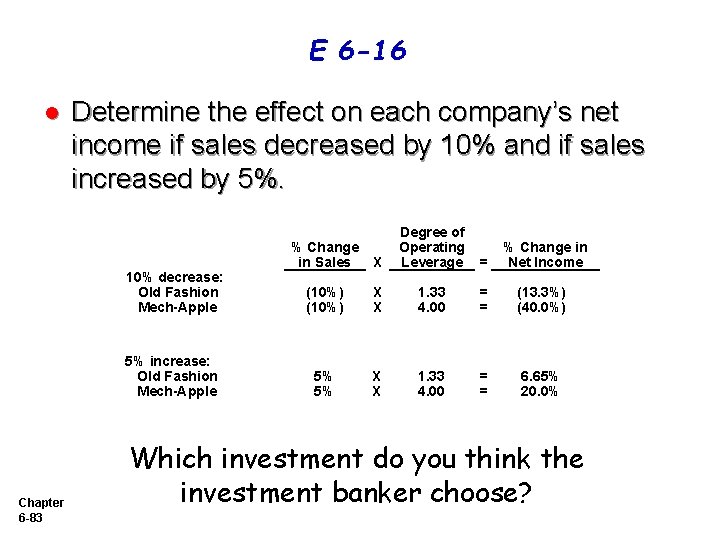

E 6 -16 l Determine the effect on each company’s net income if sales decreased by 10% and if sales increased by 5%. 10% decrease: Old Fashion Mech-Apple 5% increase: Old Fashion Mech-Apple Chapter 6 -83 % Change in Sales X Degree of Operating Leverage = % Change in Net Income (10%) X X 1. 33 4. 00 = = (13. 3%) (40. 0%) 5% 5% X X 1. 33 4. 00 = = 6. 65% 20. 0% Which investment do you think the investment banker choose?

The End! Chapter 6 -84