Chapter 5 New Product Development Management and Strategy

- Slides: 97

Chapter 5 New Product Development, Management, and Strategy

Chapter Outline • • • Product Strategy in Business Marketing Product Lines Defined Business New Product Development Organization of the New Product Effort Product Life-Cycle Analysis Determinants of the Product Mix The Product Adoption–Diffusion Process Product Portfolio Classification, Analysis, and Strategy Product Deletion Strategy Marketing of Business Services Important Characteristics of Business Services Business Service Marketing—Challenges and Opportunities

Product Lines Defined • • Proprietary or catalog: Standard products offered to many customers and usually inventoried in anticipation of sales orders. For example, the Do. All Company keeps a large inventory of model No. C 916 A Band Saws to ensure quick delivery to customers. Custom-built: Different variations of accessories and options to complement proprietary or catalog products offered. For example, the Do. All company fills a request from a major company for a custom, made-to-order saw with a larger motor size, larger table size, and automatic indexing. Custom-designed: Products designed for (and usually only for) a particular user. For example, Do. All designed a unique band saw with a custom-fixtured table and remote-control operation for U. S. Army to use to cut up live ammunition. Industrial services: Intangibles, i. e. , maintenance, machine repair, consulting. For example, Do. All provides a saw and coolant specialist who makes courtesy inspections at customers’ plants to assist in using Do. All in product applications.

Custom Product Versus Proprietary Standard Line Manufacturers • Custom: BMW designs a windshield washer fluid container for their new model and sends part prints to a custom plastics component manufacturer. Manufacturer must build production equipment but BMW owns molding dies and rights to product. Supplier sales build relationship, work with customer on design, finalize terms of sale. • Standard line: BMW picks a standard wheel bearing for its new model and orders it directly from manufacturer. Manufacturer sells same wheel bearing to others. Supplier sales build relationship, work with customer on application, finalize terms of sale.

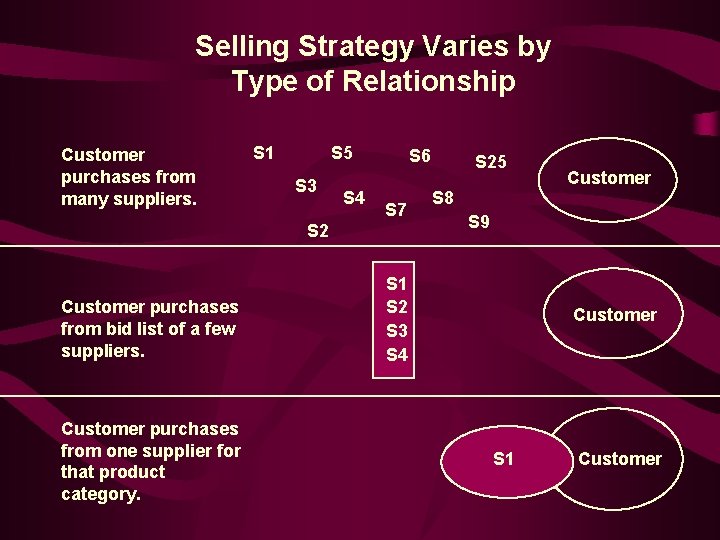

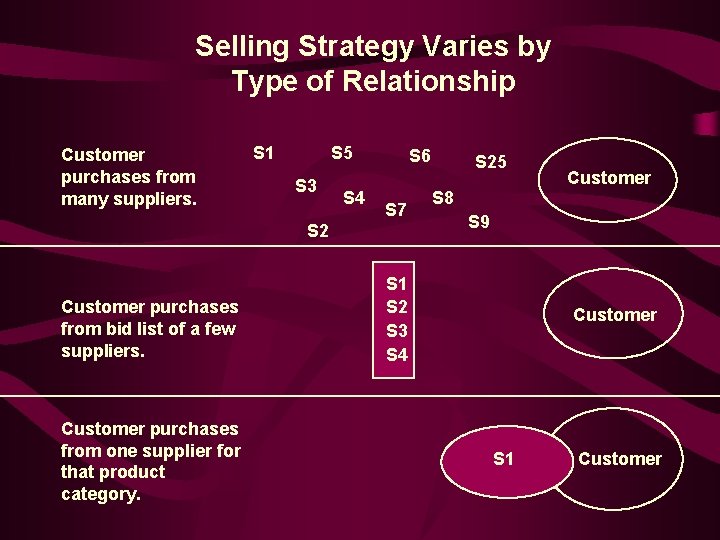

Selling Strategy Varies by Type of Relationship Customer purchases from many suppliers. S 1 S 5 S 3 S 4 S 6 S 7 S 2 Customer purchases from bid list of a few suppliers. Customer purchases from one supplier for that product category. S 25 S 8 Customer S 9 S 1 S 2 S 3 S 4 Customer S 1 Customer

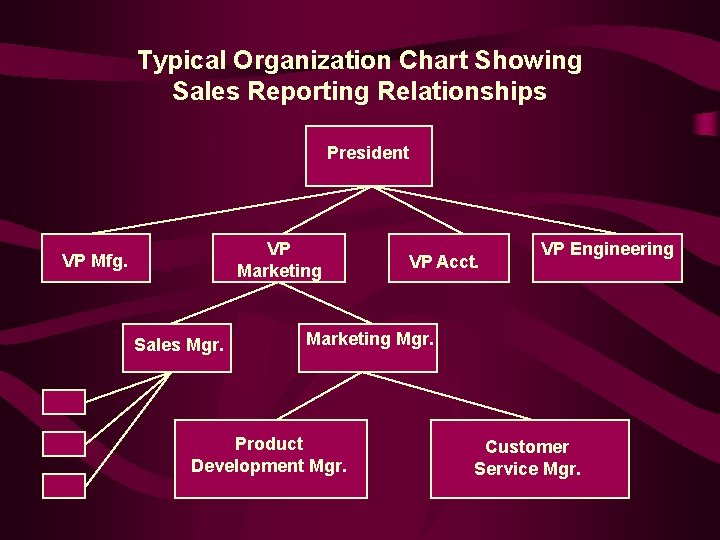

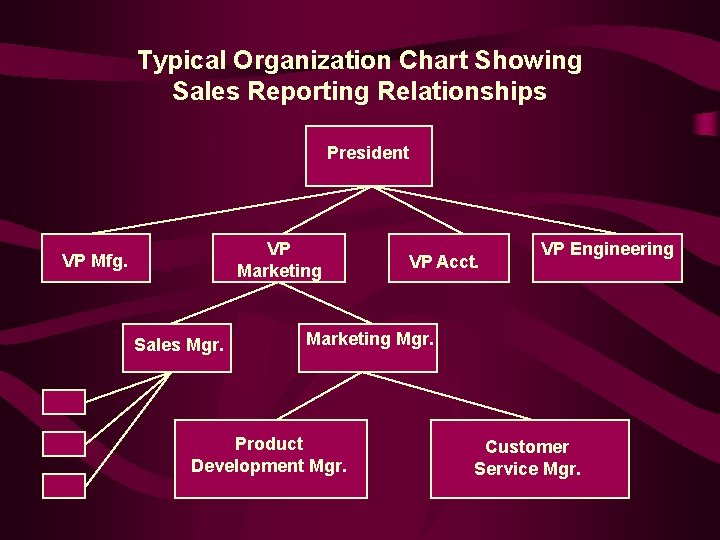

Typical Organization Chart Showing Sales Reporting Relationships President VP Marketing VP Mfg. Sales Mgr. VP Acct. VP Engineering Marketing Mgr. Product Development Mgr. Customer Service Mgr.

Does R&D Believe in the Marketing Concept? • It may depend on how long ago researchers graduated from college. Within past five years, some technical schools have begun teaching importance of studying customer’s needs as a first step in design process—following tenets of TQM. • Still, most technical departments aren’t known for their customer orientation.

Product Manager/ Marketing Manager Role Old View: Organize, coordinate, and control. New View: Calculated chaos and controlled disorder Communicate— Communicate: Make things happen. Questions: • What companies purchase products from these producers? • What would a Product Manager do to facilitate these transactions and relationships?

New Product Approaches • Technology push: When perceived value of particular technology is great; firm has only a vague notion of possible applications, and usually not much more. • Market pull: Primarily the result of marketing research methodologies of interviewing potential users about their needs, then developing solutions to those perceived market needs.

Phases of New Product Development Idea and concept generation Screening and evaluation Business analysis Product development Product testing Product commercialization and introduction

Marketing Activities at Each Phase 1. Idea and concept generation: involves the search for product ideas and concepts that meet company objectives 2. Screening and evaluation: involves analysis to determine which ideas submitted are pertinent and merit a more detailed study of potential feasibility and market acceptance 3. Business analysis: return-on-investment criteria are examined along with competition and the potential for market entry 4. Product development: involves taking the product from an idea generated during a brainstorming session to a state of readiness for product and market testing 5. Product testing: involves conducting commercial experiments necessary to verify earlier business judgements 6. Product commercialization and introduction: includes launching the new product through full-scale production and sales and committing the company's reputation and resources to the product's success

Organization of the New Product Effort • • Product manager: Individuals responsible for four P’s marketing mix decisions for specific product line as it travels through life cycle; responsibility often extends to new product development. New product committee: Part-time interdisciplinary management group reviews new product proposals; advantages outweigh disadvantages because committee is most common form of organizational structure for managing new products. New product department: Specific department generates and evaluates new product ideas, directs and coordinates development work, and implements field testing and precommercialization of new product; allows for maximum effort in new product development, but at expense of major overhead costs. New product venture team: Task force representing various departments responsible for new product development and implementation; normally dissolved once new product is established in market.

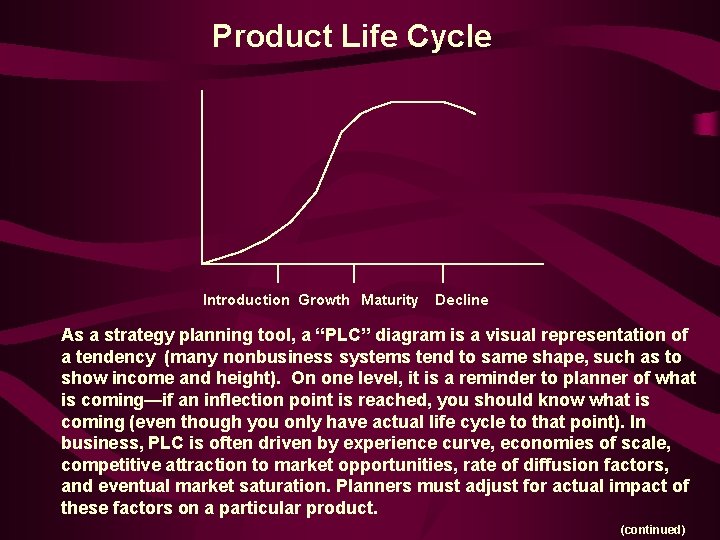

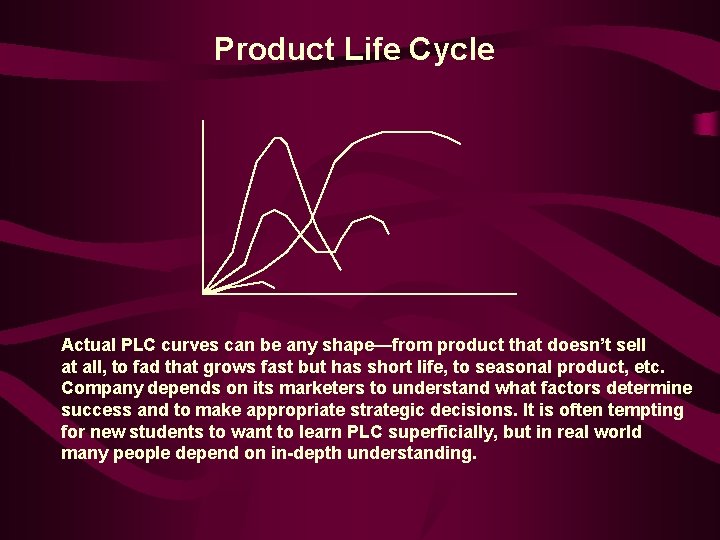

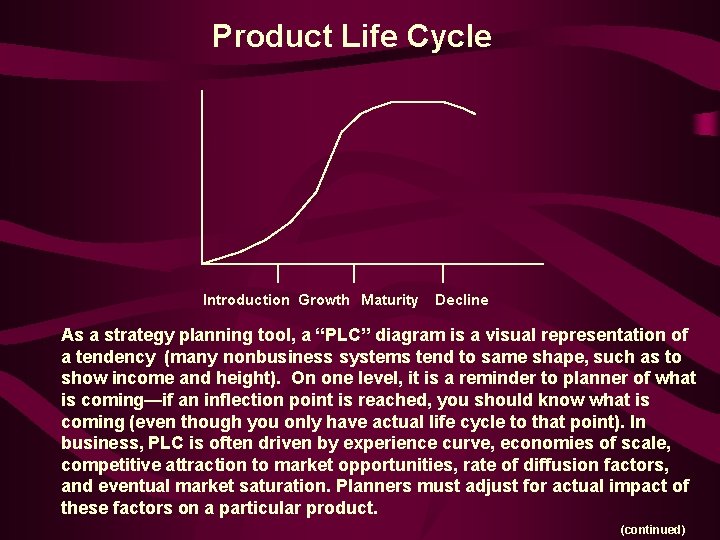

Product Life Cycle Introduction Growth Maturity Decline As a strategy planning tool, a “PLC” diagram is a visual representation of a tendency (many nonbusiness systems tend to same shape, such as to show income and height). On one level, it is a reminder to planner of what is coming—if an inflection point is reached, you should know what is coming (even though you only have actual life cycle to that point). In business, PLC is often driven by experience curve, economies of scale, competitive attraction to market opportunities, rate of diffusion factors, and eventual market saturation. Planners must adjust for actual impact of these factors on a particular product. (continued)

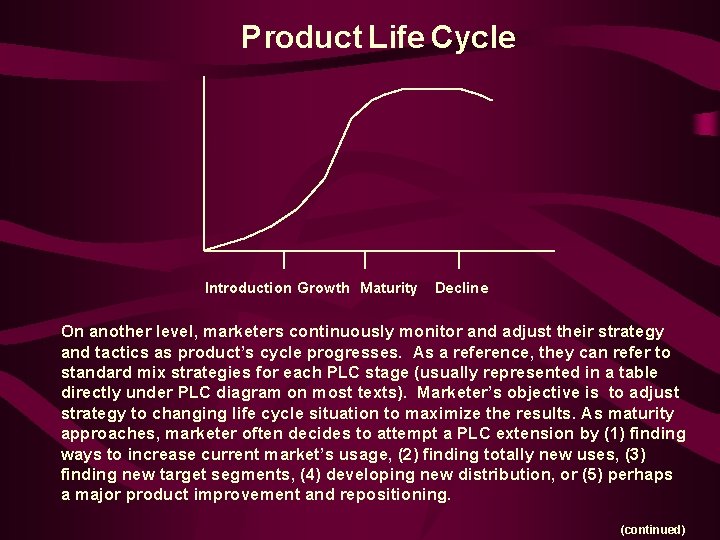

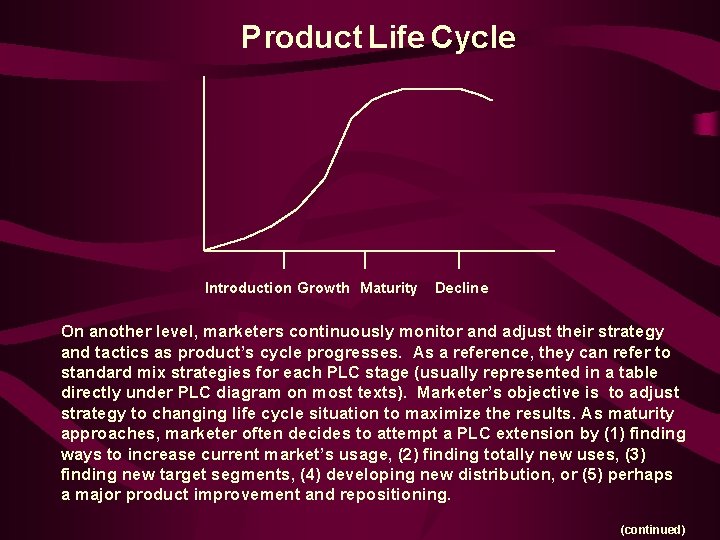

Product Life Cycle Introduction Growth Maturity Decline On another level, marketers continuously monitor and adjust their strategy and tactics as product’s cycle progresses. As a reference, they can refer to standard mix strategies for each PLC stage (usually represented in a table directly under PLC diagram on most texts). Marketer’s objective is to adjust strategy to changing life cycle situation to maximize the results. As maturity approaches, marketer often decides to attempt a PLC extension by (1) finding ways to increase current market’s usage, (2) finding totally new uses, (3) finding new target segments, (4) developing new distribution, or (5) perhaps a major product improvement and repositioning. (continued)

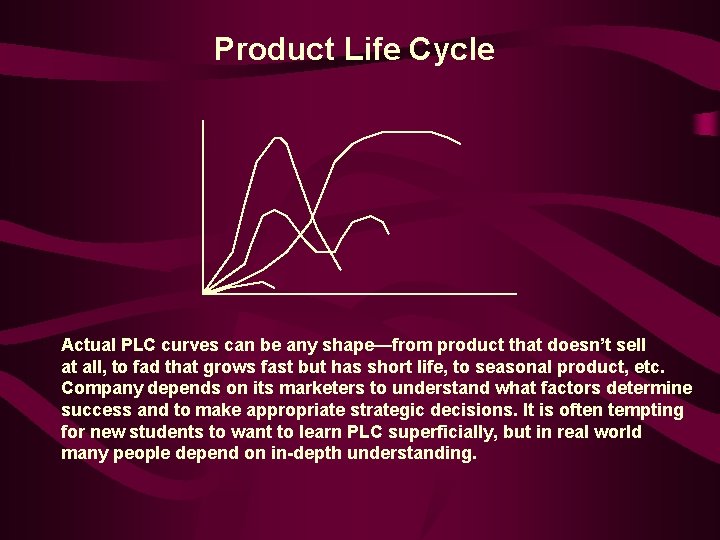

Product Life Cycle Actual PLC curves can be any shape—from product that doesn’t sell at all, to fad that grows fast but has short life, to seasonal product, etc. Company depends on its marketers to understand what factors determine success and to make appropriate strategic decisions. It is often tempting for new students to want to learn PLC superficially, but in real world many people depend on in-depth understanding.

Stages in Adoption Process • Awareness: Buyer learns of new product or service, but lacks information. • Interest: Buyer seeks out or requests additional information. • Evaluation: Buyer (or member of buying team) considers/evaluates usefulness of product/service; consideration might be given to value-analysis project or makebuy situation. • Trial: Buyer adopts product or service on limited basis. • Adoption: If trial purchase worked, then buyer decides to make regular use of product/service.

Factors Influencing Rate of Adoption-Diffusion • Diffusion: Spread of new product, innovation, or service throughout an industry over time. • Diffusion speed varies among industries—fast in electronics, slow in domestic steel. • As the marketer you must know, evaluate impact of, monitor, and where possible affect factors that influence adoption/diffusion rate.

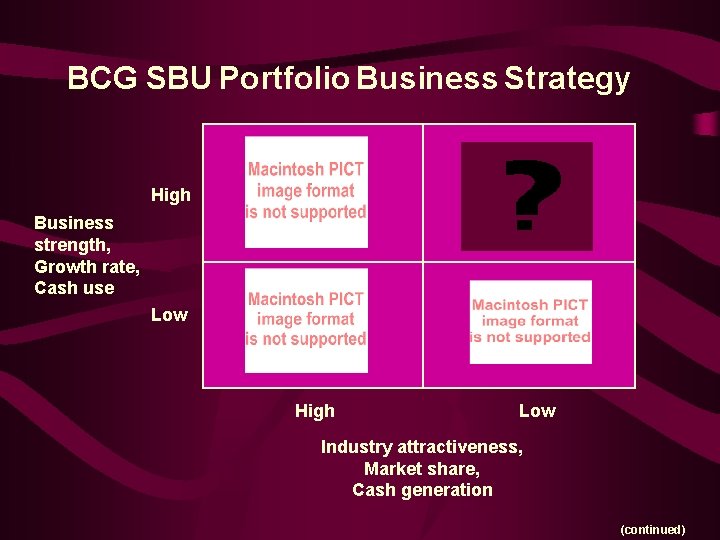

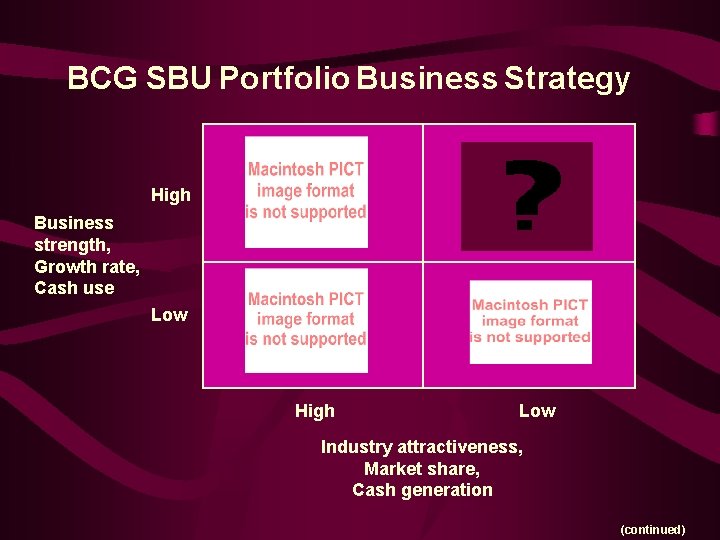

BCG SBU Portfolio Business Strategy High Business strength, Growth rate, Cash use Low High Low Industry attractiveness, Market share, Cash generation (continued)

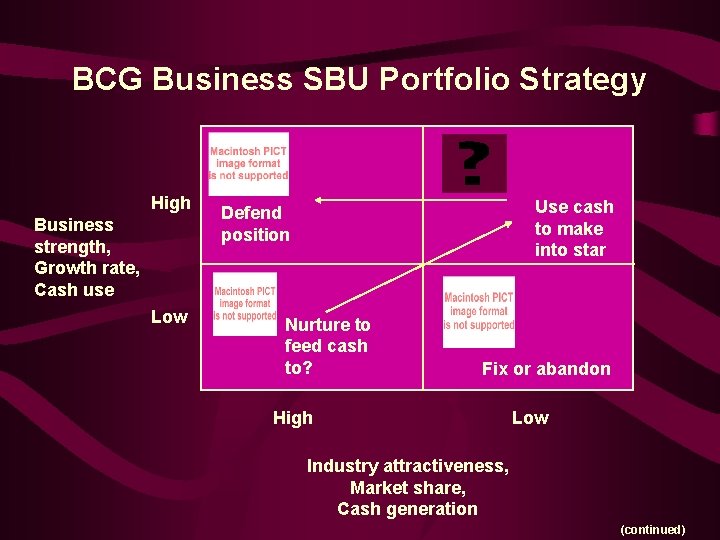

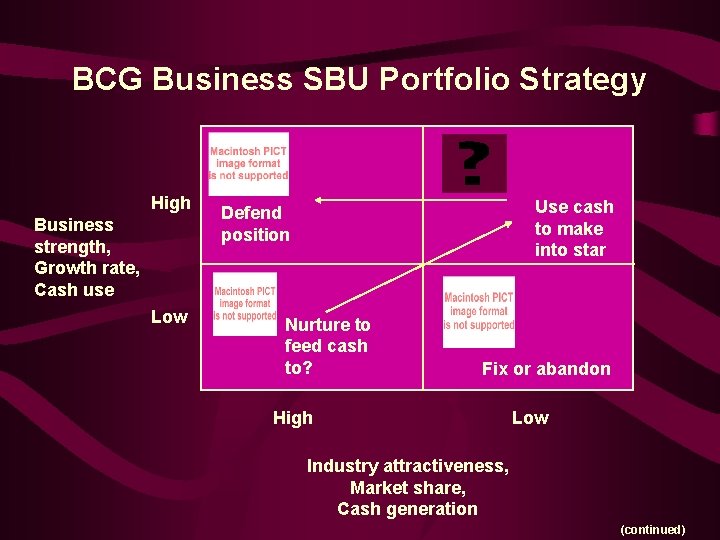

BCG Business SBU Portfolio Strategy High Business strength, Growth rate, Cash use Low Use cash to make into star Defend position Nurture to feed cash to? Fix or abandon High Low Industry attractiveness, Market share, Cash generation (continued)

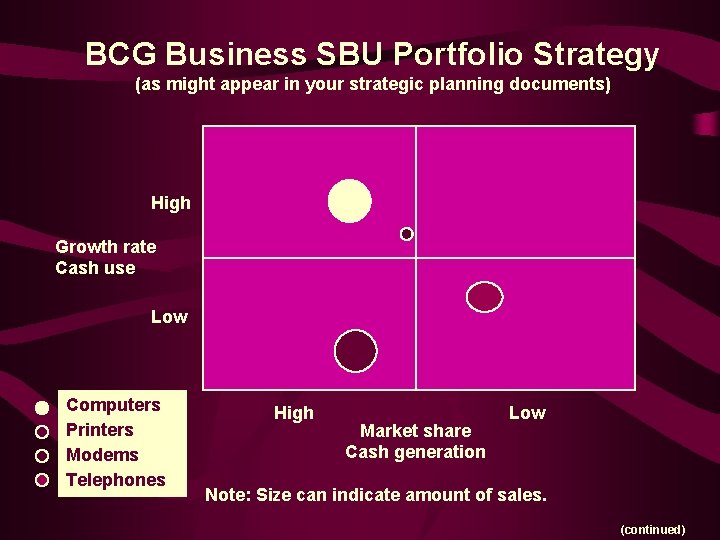

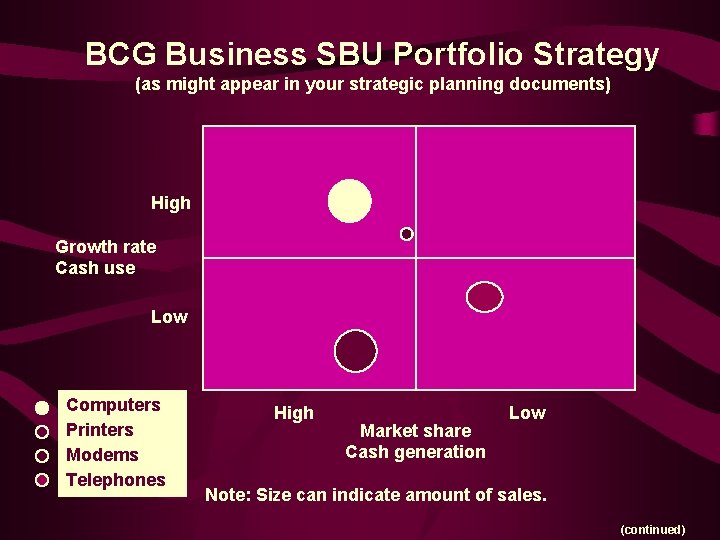

BCG Business SBU Portfolio Strategy (as might appear in your strategic planning documents) High Growth rate Cash use Low Computers Printers Modems Telephones High Market share Cash generation Low Note: Size can indicate amount of sales. (continued)

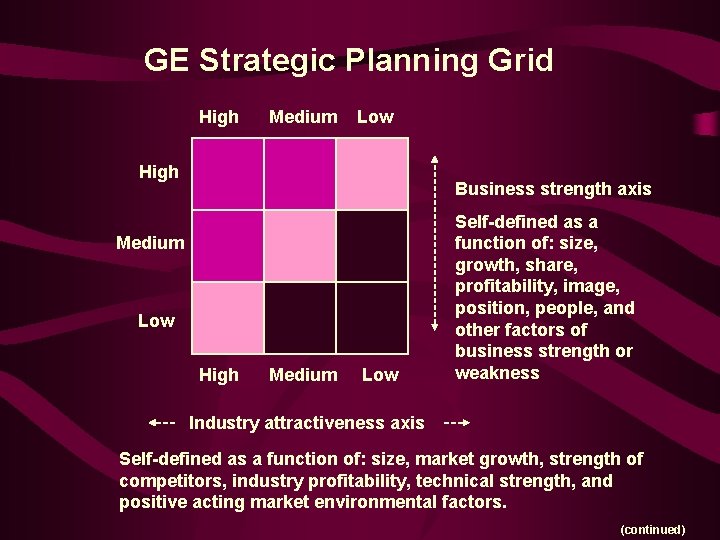

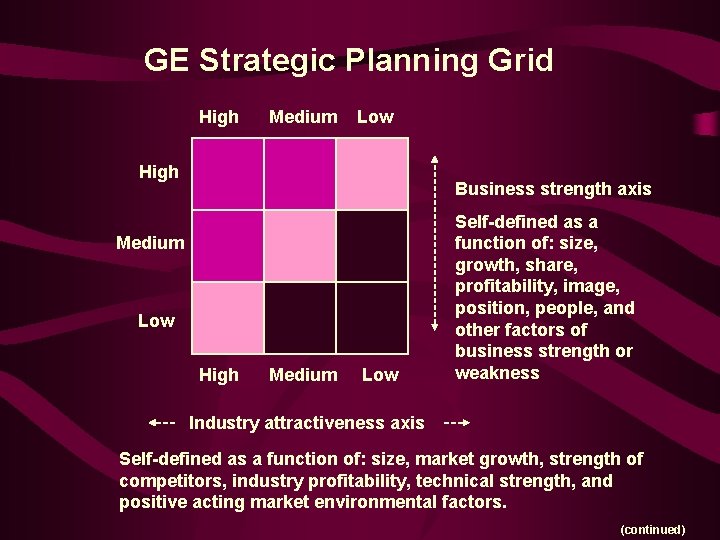

GE Strategic Planning Grid High Medium Low High Business strength axis Medium Low High Medium Low Self-defined as a function of: size, growth, share, profitability, image, position, people, and other factors of business strength or weakness Industry attractiveness axis Self-defined as a function of: size, market growth, strength of competitors, industry profitability, technical strength, and positive acting market environmental factors. (continued)

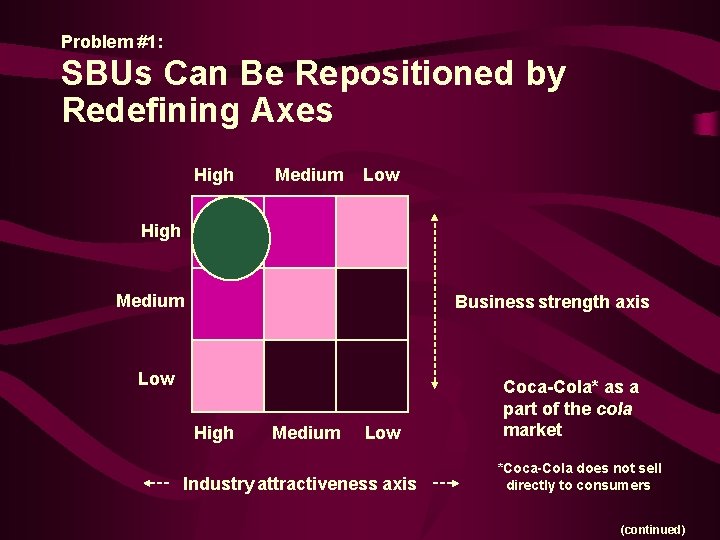

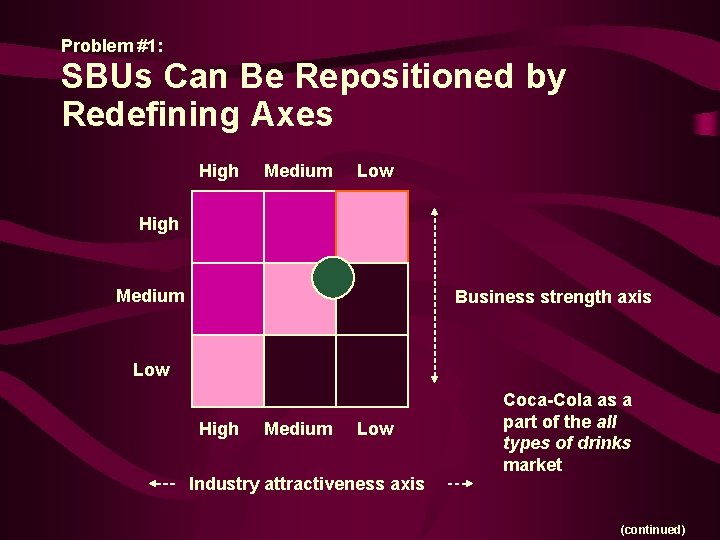

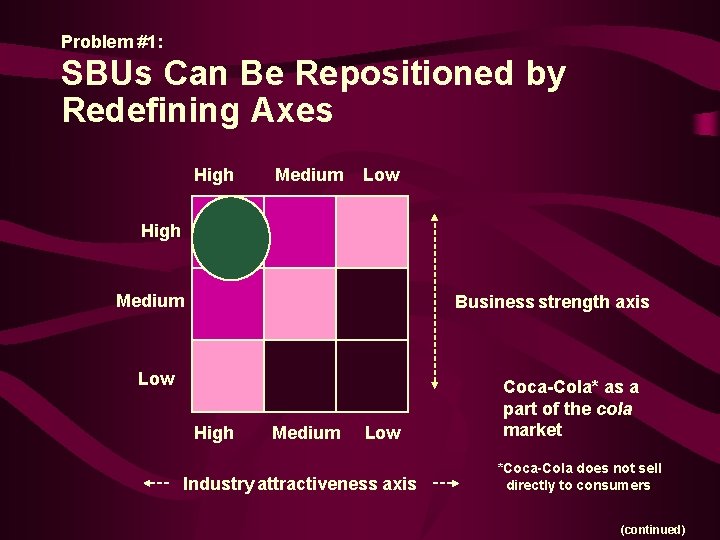

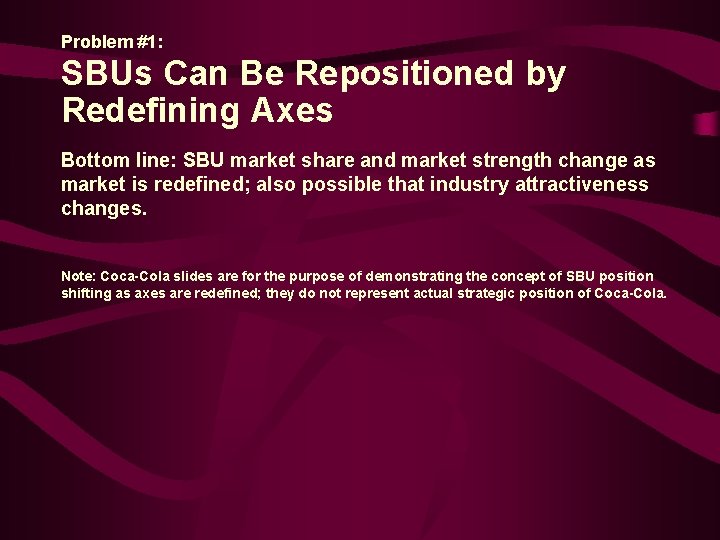

Problem #1: SBUs Can Be Repositioned by Redefining Axes High Medium Low High Medium Business strength axis Low High Medium Low Industry attractiveness axis Coca-Cola* as a part of the cola market *Coca-Cola does not sell directly to consumers (continued)

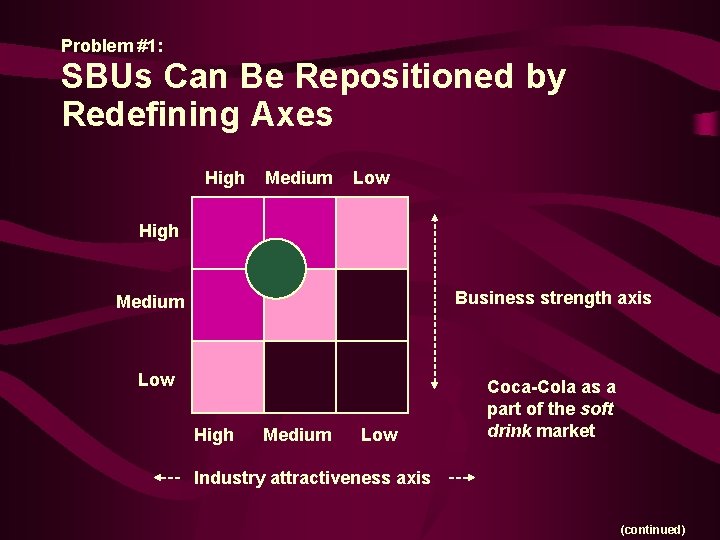

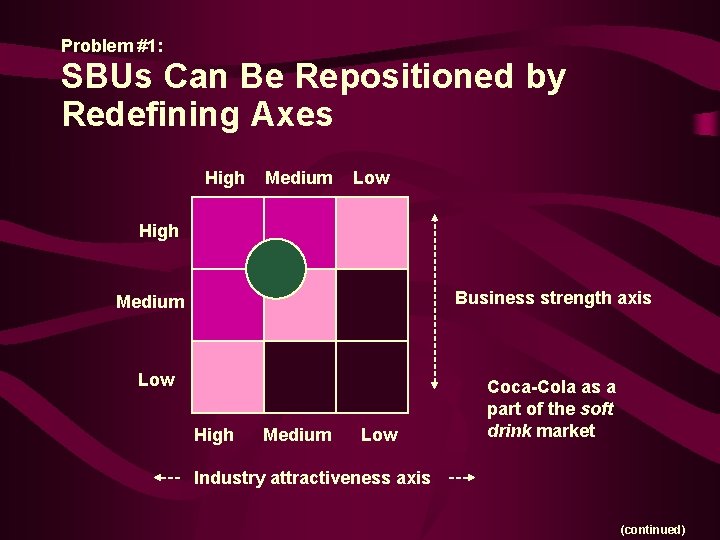

Problem #1: SBUs Can Be Repositioned by Redefining Axes High Medium Low High Business strength axis Medium Low High Medium Low Coca-Cola as a part of the soft drink market Industry attractiveness axis (continued)

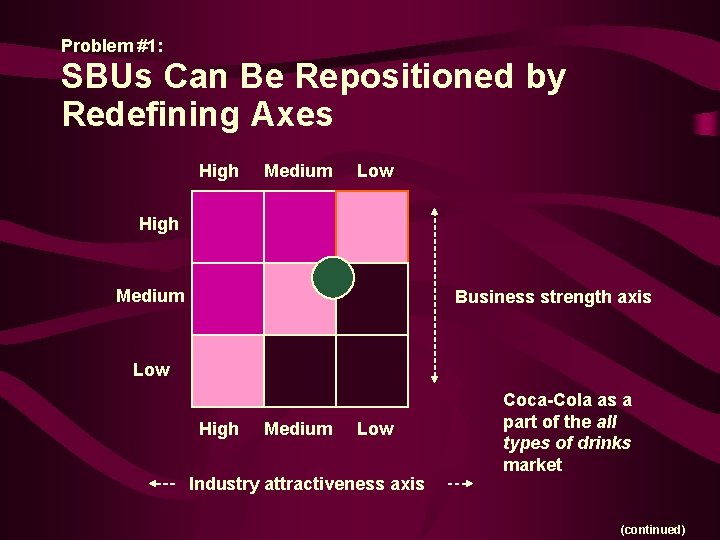

Problem #1: SBUs Can Be Repositioned by Redefining Axes High Medium Low High Medium Business strength axis Low High Medium Low Industry attractiveness axis Coca-Cola as a part of the all types of drinks market (continued)

Problem #1: SBUs Can Be Repositioned by Redefining Axes Bottom line: SBU market share and market strength change as market is redefined; also possible that industry attractiveness changes. Note: Coca-Cola slides are for the purpose of demonstrating the concept of SBU position shifting as axes are redefined; they do not represent actual strategic position of Coca-Cola.

Problem #2: Doing What the Grid Position Indicates • When portfolio models were first introduced, marketers did what the grid position indicated rather than using them as a tool to help visualize company’s mix of SBUs, interrelationships, relative strengths, etc. • If a larger percentage of business is in products in which company is not strong, margins are low, and market is not attractive, they may still be providing important coverage of fixed overhead. Don’t automatically get rid of “dog”-quadrant products. • Bottom line: Two-factor portfolio models are not decision models; they are tools to help marketers with their thinking. Even with multiple-factor computer decision support systems, the decision is still the marketer’s.

Important Characteristics of Business Services • Intangibility: Freight forwarding, consulting, repair, etc. can seldom be tried out/tested in advance of purchase; instead, buyers must view advertising copy, listen to sales presentation, or consult current users to gain insight into expected performance. • Heterogeneity: A service is an experience and thus cannot be duplicated; difficult to standardize and thus output quality may vary. • Perishability and fluctuating demand: Services cannot be stored and markets fluctuate by day, week, or season; idle service capacity is business that is lost forever—no inventory buffer. • Simultaneity: Production and consumption of services are inseparable; this typically puts marketer in very close contact with customer, requiring them to be highly professional.

Chapter 6 Price, Planning, and Strategy

Chapter Outline • • • Business Pricing: An Overview Major Factors Influencing Price Strategy Pricing Methods Demand Assessment and Strategy Life-Cycle Costing Price-Leadership Strategy Competitive Bidding in the Business Market Leasing in the Business Market Pricing Discount Strategies

Different Companies, Different Pricing Objectives Company Objective Alcoa 20% ROI American Can Maintain market share General Foods 33% gross margin National Steel Match the market U. S. Steel 8% ROI after taxes Du. Pont Target ROI, cost-plus (continued)

Different Companies, Different Pricing Objectives • Take three different products and produce them by exactly the same process in three different companies. • Because companies use different pricing calculations (1) product prices will most likely vary by company and (2) price difference usually will not be consistent. • Obviously, this is true if marketers use different strategic markups, but it also true of estimated cost (or even cost in production). • For example: One cost element would be fixed cost. How does each company determine how much fixed cost should be allocated to each product? • Moral: Competitors’ prices may be very different from yours. Study their historical patterns of bidding.

Major Factors Influencing Price Decision • Internal factors – Company objectives – Marketing mix value – Costs – Impact on other products – Product differentiation • External factors – Buyers – Demand – Economic considerations – Ethical considerations – Competition – Suppliers – Government/legal

Pricing Methods • Marginal pricing (contribution pricing): Attempts to maximize profits by producing number of units at which marginal cost is just less than or equal to marginal revenue. • Economic value to the customer: A higher price will be paid by buyers who perceive a greater value or benefit to them than what they would receive from buying a competitive product. • Break-even analysis: The point at which a firm’s revenue will equal its total fixed and variable costs at a given price. • Target return on investment pricing: An annual ROI target (i. e. , ROI of 20% over cost). Typically done by a mix of individual product markups over cost that average the target ROI. • Cost-plus pricing: A version of target ROI pricing in which all products are marked up by the same percentage.

Zero-Based Pricing • Zero-based pricing (ZBP): Actually not a pricing method as much as it is the accounting of the method to the customer, and the resulting requirement to maintain consistency. • With ZBP, buyers do not accept that an increase in price of one cost element will necessarily justify a price increase. Supplier is required to show actual cost of every element (from base zero)—perhaps other elements have gone down in cost; perhaps supplier has allowed some controllable costs to increase and should not pass those along to customer; perhaps supplier’s profit margin is already too high.

Pricing Across Product Life Cycle (Life-Cycle Costing) • Introduction phase: – Price skimming: Introductory price set relatively high, thereby attracting buyers at top of product’s demand curve. – Market penetration pricing: Low price is used as an entering wedge. • Growth phase • Maturity phase • Decline stage

Price-Leadership Strategy • Price-leadership strategy: One or a very few firms initiate price changes, with most or all the other firms in the industry following suit. • When price leadership prevails, price competition does not exist. The burden of making critical pricing decisions is placed on leading firm(s) and other simply follow the leader.

Competitive Bidding • Competitive bidding: Buyer sends inquiries (requests for quotations or RFQs) to firms able to produce in conformity with requested requirements. • Requests for proposals (RFPs) involve the same process, but here buyer is signaling that everything is preliminary and that a future RFQ will be sent once specifics are determined from the best proposals.

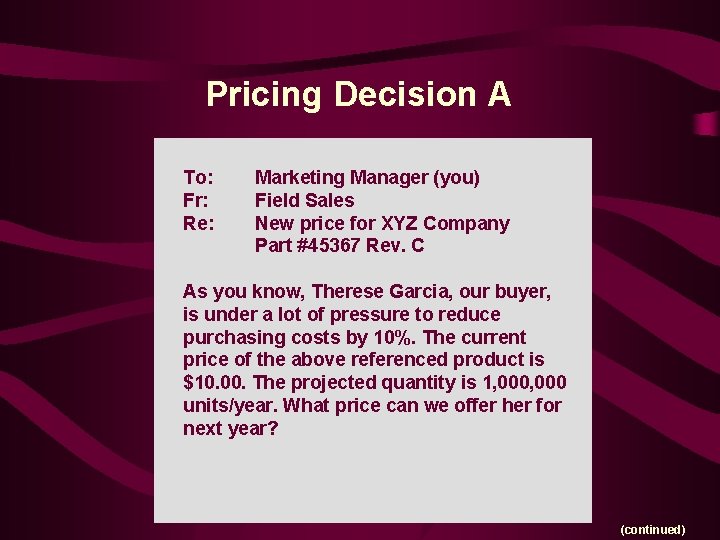

Pricing Decision A To: Fr: Re: Marketing Manager (you) Field Sales New price for XYZ Company Part #45367 Rev. C As you know, Therese Garcia, our buyer, is under a lot of pressure to reduce purchasing costs by 10%. The current price of the above referenced product is $10. 00. The projected quantity is 1, 000 units/year. What price can we offer her for next year? (continued)

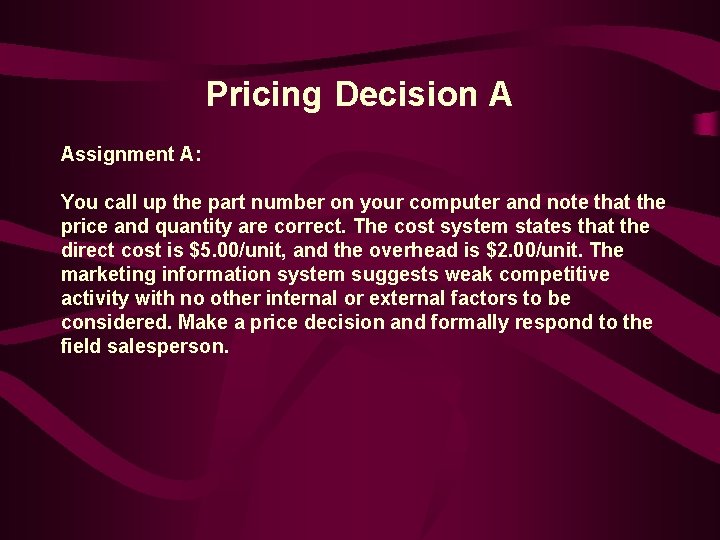

Pricing Decision A Assignment A: You call up the part number on your computer and note that the price and quantity are correct. The cost system states that the direct cost is $5. 00/unit, and the overhead is $2. 00/unit. The marketing information system suggests weak competitive activity with no other internal or external factors to be considered. Make a price decision and formally respond to the field salesperson.

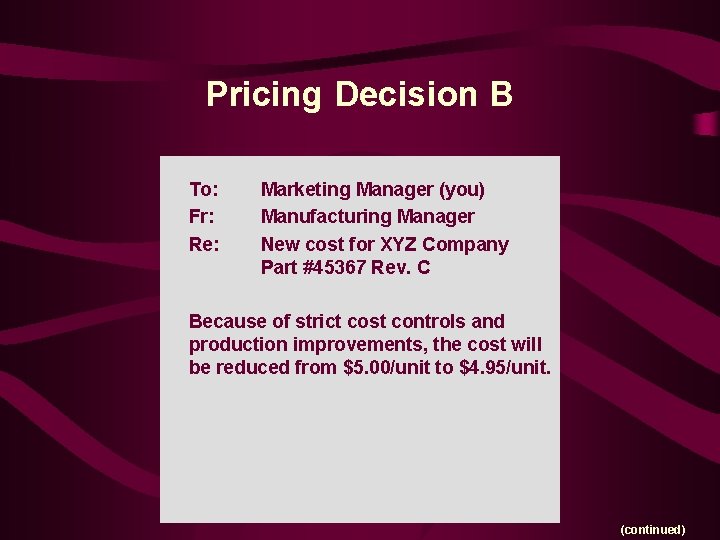

Pricing Decision B To: Fr: Re: Marketing Manager (you) Manufacturing Manager New cost for XYZ Company Part #45367 Rev. C Because of strict cost controls and production improvements, the cost will be reduced from $5. 00/unit to $4. 95/unit. (continued)

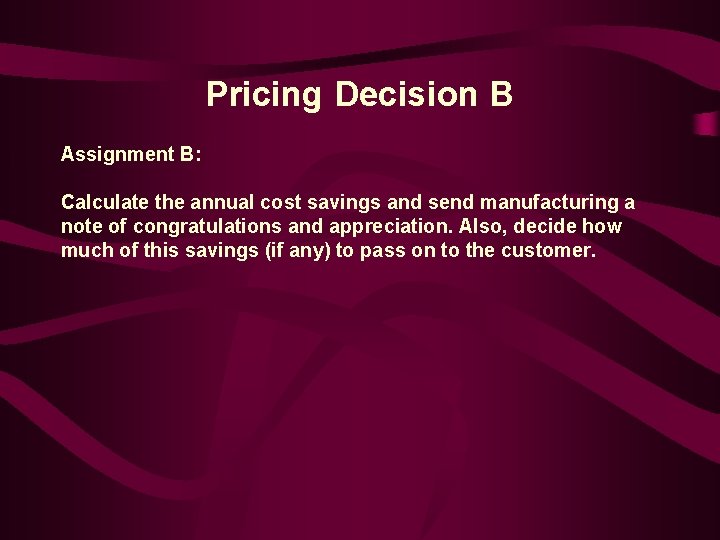

Pricing Decision B Assignment B: Calculate the annual cost savings and send manufacturing a note of congratulations and appreciation. Also, decide how much of this savings (if any) to pass on to the customer.

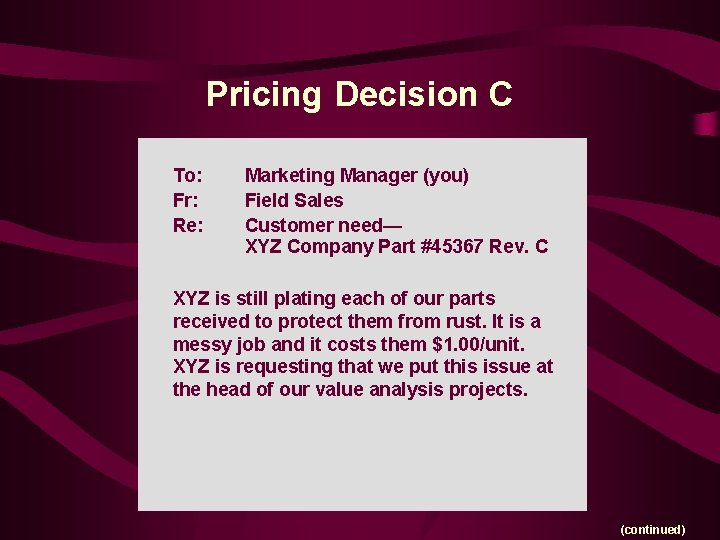

Pricing Decision C To: Fr: Re: Marketing Manager (you) Field Sales Customer need— XYZ Company Part #45367 Rev. C XYZ is still plating each of our parts received to protect them from rust. It is a messy job and it costs them $1. 00/unit. XYZ is requesting that we put this issue at the head of our value analysis projects. (continued)

Pricing Decision C Assignment C: Compose an e-mail to R&D requesting assistance and provide priority and spending guidelines.

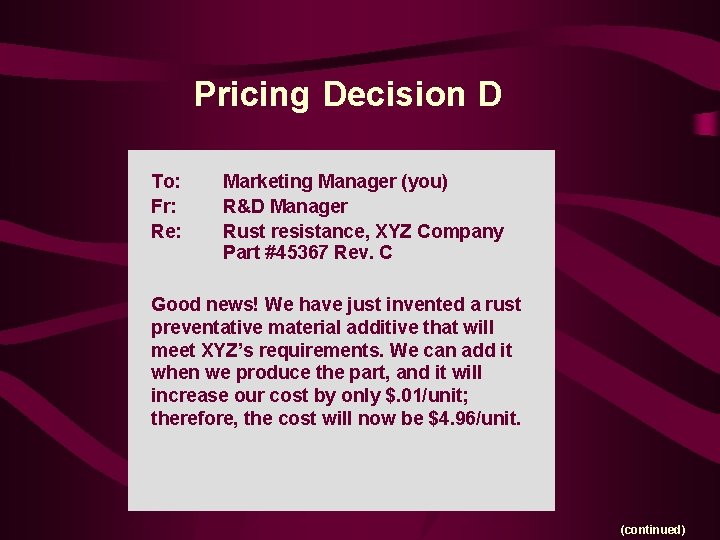

Pricing Decision D To: Fr: Re: Marketing Manager (you) R&D Manager Rust resistance, XYZ Company Part #45367 Rev. C Good news! We have just invented a rust preventative material additive that will meet XYZ’s requirements. We can add it when we produce the part, and it will increase our cost by only $. 01/unit; therefore, the cost will now be $4. 96/unit. (continued)

Pricing Decision D Assignment D: Calculate the savings based on alternative prices such as $11. 00/unit, $10. 51/unit, and $10. 01/unit. Develop and justify a final price and proposal for XYZ.

Leasing in the Business Market • Advantages to buyer – No down payment – No risk of ownership • Advantages to seller – Increased sales – Ongoing business relationship with lessee – Residual value retained

Ten Don’ts of Successful Selling 1. Don’t discuss with customers the price your company charges others. 2. Don’t attend meetings with competitors at which pricing is discussed (not even professional association meetings). 3. Don’t give lower prices to your company’s own subsidiaries. 4. Don’t enter into gentlepersons’ understandings with competitors on prices, terms of sale, discounts, market share, intent to bid, or customer terminations. 5. Don’t use one product as bait for selling another. 6. Don’t require a customer to buy a product only from you. 7. Don’t forget that individual states and other countries have antitrust laws. 8. Don’t disparage a competitor’s product without proof. 9. Don’t require reciprocal purchases. 10. Don’t hesitate to consult your company’s lawyer if you are unsure.

Chapter 7 Business Marketing Channel Participants

Chapter Outline • • Functions of the Channel Intermediary The Nature of Channel Decisions Direct Channels Indirect Channels Combining Direct and Indirect Channels Channel Cooperation Channel Conflict Channel Width

Business Marketing Channel Members • Channel members: A set of independent companies that form cooperative buyer-seller relationships involving transactions (such as raw material, components, process materials, and finished goods for resale), all leading to getting a particular product line to the final user. • It is important that each channel member see its competition not as the other companies that make its particular materials, but as the alternative channels that can supply equivalent finished products to the final user. • Cooperation, coordination, and strategically acting in the best interests of the channel are key. If the channel loses business to a competitive source of supply, then all channel members lose.

Business Marketing Distribution Channel Members • Where a producer has alternative channels of distribution available, the marketer’s challenge is to: – Select the channel (or combination of channels) that provides best coverage, provides best service to target segments, and meets revenue objectives of the organization. – Remember that title-taking intermediaries (i. e. , distributors) are customers of the producer, not just providers of a distribution service. (continued)

Business Marketing Distribution Channel Members • A distribution channel’s differential advantages can be difficult for competitors to copy and, done correctly, can form a sustainable differential advantage. • The study of distribution channels involves relationships between channel member companies. Don’t confuse this with physical distribution, which involves the actual flow of materials.

Functions of the Channel Intermediary • Buying: An intermediary buys products for resale to other intermediaries or to final business users. • Selling: An intermediary with a capable sales force supported by established warehouse distribution centers, which is already serving other product needs of a wide user customer base, would be a valuable channel addition. • Storing: An inventory commitment is composed of products to satisfy customer purchase requirements in a timely manner. • Transporting: A vast array of transportation alternatives are available for intermediaries to use to manage the physical flow of the product to the business user. (continued)

Functions of the Channel Intermediary • Sorting: Most intermediaries buy in large quantities and then sort (breaking of bulk) shipments into smaller lots (often in combinations) for resale to business users. • Financing: Intermediaries may invest in inventory, sell and deliver merchandise to business user, and provide credit terms, then finance the exchange process. • Risk taking: Because of obsolescence and deterioration, risk is inherent in the ownership of inventory; additional risk comes from uncollectable customer accounts. • Providing market information: Importance of continuous and accurate flow of market information concerning final user needs, pricing conditions, competitive conditions, and user satisfaction is critical to the success of the channel.

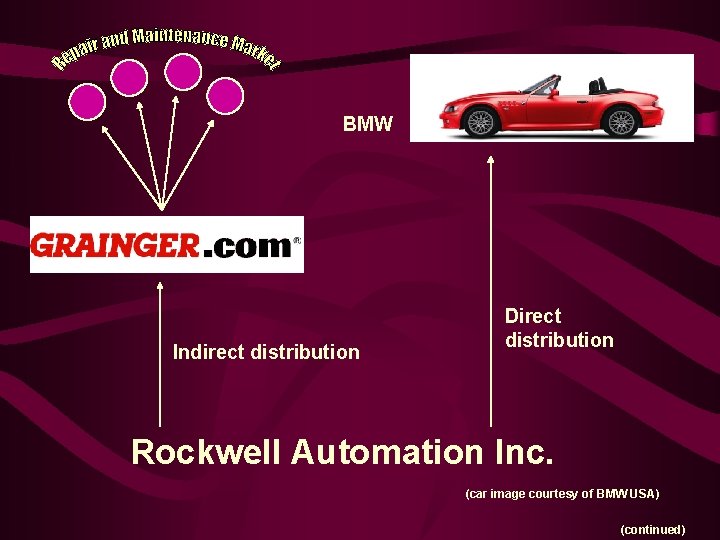

Direct Distribution Channel • Example: As a first-tier component supplier to automotive OEMs, Rockwell Automation Inc. may contract to supply BMW USA’s annual usage of wheel bearings. The requirement may include several sizes, each in 50, 000 to 100, 000 quantities. This Rockwell would sell direct. A Rockwell salesperson would call on BMW to review its requirements, coordinate purchase transactions, and maintain the relationship. Images courtesy of Rockwell Automation

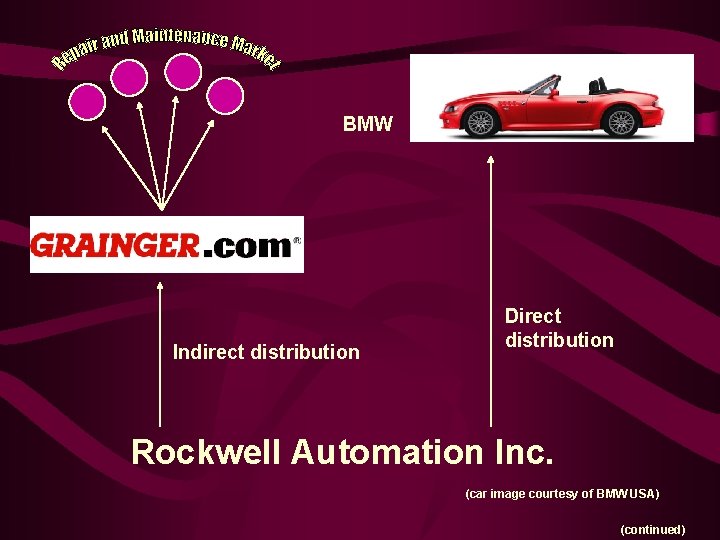

Indirect Distribution Channels • Example: Rockwell also produces similar wheel bearings that are used in automotive repair shops and to repair industrial material handling equipment. Individually these quantities are too small to be attractive but in total the quantities are quite high. In this case, Rockwell sells through a distributor, such as W. R. Grainger.

BMW Indirect distribution Direct distribution Rockwell Automation Inc. (car image courtesy of BMW USA) (continued)

BMW Both BMW and Grainger would be important customers of Rockwell, probably purchasing millions of dollars worth of bearings each year. Rockwell Automation Inc.

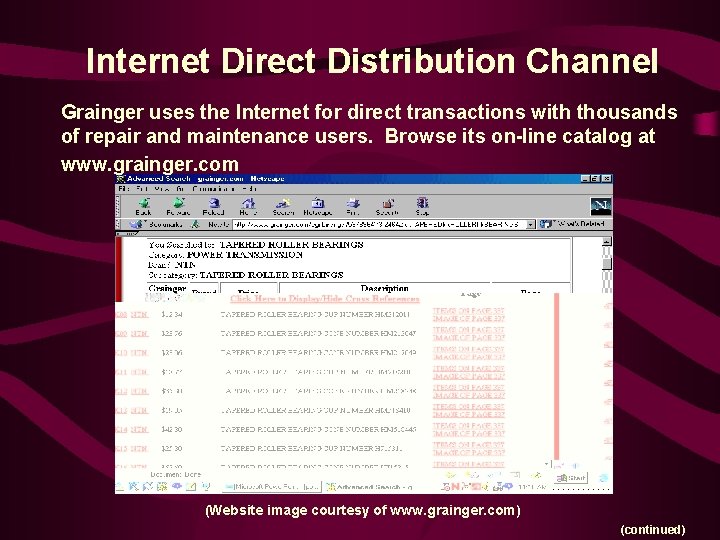

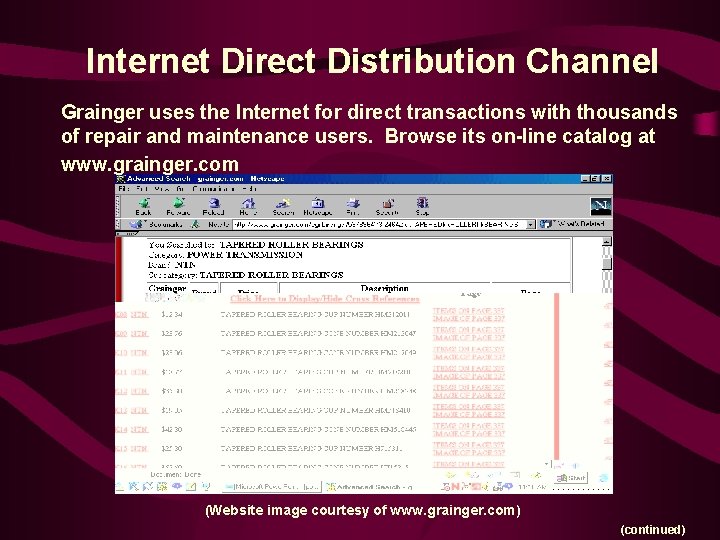

Internet Direct Distribution Channel Grainger uses the Internet for direct transactions with thousands of repair and maintenance users. Browse its on-line catalog at www. grainger. com (Website image courtesy of www. grainger. com) (continued)

Internet Direct Distribution Channel • At some point, Rockwell may decide that software technology exists to allow it to sell to small users directly over the Internet. Rockwell may then stop using the distributor, or alternatively use it for additional intensive distribution. • It is not unusual for industrial Internet buyers to be required to use company credit cards (such as American Express). That removes the necessity for a company like Rockwell to assess credit and set up an account for a small dollar purchase. Still, a company like Grainger has an advantage in direct Internet sales that Rockwell does not. What is it?

Grainger’s advantage is one-stop shopping, which means convenience for the customer. • • • Grainger is the nation's leading business-to-business distributor of maintenance, repair, and operating (MRO) supplies and related information. Its customers have access to over 560, 000 products available to them through on-line ordering, phone ordering, and stopping by branch locations. Rockwell Automation Inc. may agree that Grainger will be its exclusive distributor in the state of South Carolina. That is, of course, except for BMW’s South Carolina assembly plant, which Rockwell will supply directly.

Manufacturer’s Representatives • • • In the previous example of Rockwell Automation selling bearings through an exclusive distributor in South Carolina, it may have been because research indicated hundreds of small users. If research had suggested several additional medium-sized users, Rockwell may have gone with a manufacturer’s representative, who would sell its bearings plus complementary products from other manufacturers in return for a commission on sales. The hundreds of very small users may have been covered by several nonexclusive distributors. At some point, sales from the medium-sized users may grow to the point that manufacturer’s representative’s commissions exceed cost of supporting a direct Rockwell field salesperson. If a direct Rockwell field salesperson does take over the territory, at some point their commissions from their largest account may grow to the point that the company finds it logical to make the account into a house account to be handled by headquarters. As you might guess, distributors, manufacturer’s representatives, and direct field salespersons are not very happy about house accounts.

Channel Transaction Facilitators • Do not take title or carry inventory, but rather provide services such as storage, transportation, or arranging of sales. • Independent warehouses, carriers, and manufacturer’s representatives fall into this category. • Can be very important to the success of the channel.

Channel Conflict Channel conflict may result when channel members have mutually exclusive values, interests, or goals. Manufacturers may want control of distribution channels for better execution of their marketing strategies, whereas intermediaries may not see the manufacturer-determined strategies as in their best interest.

Problem Areas in Manufacturer. Intermediary Relationship • • Service and technical assistance House accounts Inventory levels Marketing information and feedback Training and support services Other product lines carried Other manufacturer-supplied channels competing with intermediary • Prices and discounts

Channel Conflict Revisited • Whether between channel members or between channel members and channel transaction facilitators, potential conflict is reduced by: – Relationship building and team management – Team-building efforts – Clear and complete contracts

Conflict Resolution (A) • As the senior (manufacturer’s) marketer involved, resolve the following: – The manufacturer’s rep who sells your products to IBM has been so successful that her commissions (7. 5% of gross sales) now exceed your company president’s compensation. – It is not clear in the contract whether commissions would end if the relationship ends.

Conflict Resolution (B) • As the senior (manufacturer’s) marketer involved, resolve the following: – Your company is a $200 million (annual) manufacturer of electric motors. – You have an exclusive distribution agreement with a multibillion dollar distributor with many distribution centers and sales branches throughout the U. S. and Canada. – Your distributor is in the process of dictating to you the prices it will pay, the inventory it will carry, and the service it will provide to customers.

Types of Channel Width • Intensive distribution: Gain access to as many resellers as possible within a particular geographic area. • Selective distribution: Distribute product to limited number of resellers in a particular geographic region; highly chosen based on distinctive capabilities and high-quality service. • Exclusive distribution: Only one channel member can sell a manufacturer’s products in a given geographic area.

Chapter 8 Physical Distribution Management and Strategy

Chapter Outline • • The Nature of Physical Distribution Supply Chain Management Traffic Management Functions of Traffic Management Deregulation Customer Service in Physical Distribution Warehousing Inventory Control

Physical Distribution • Physical distribution: The process of planning, implementing, and controlling efficient, effective flow and storage of goods, services, and related information from point of origin to point of consumption for the purpose of conforming to customer's requirements. • Why is it important to learn about physical distribution? • Physical distribution cost can represent 20% or more of the selling price of a product. • It is an integrated part of the entire company system— problems in other areas impact distribution and vice versa. • From customer’s perspective, supplier’s physical distribution function gets the right products to them, at the right place, at the right time. These are basic customer rights (along with right price and right condition).

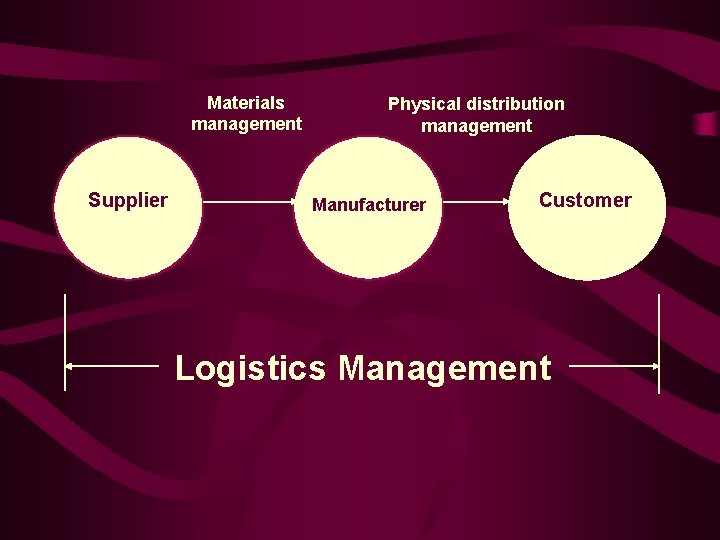

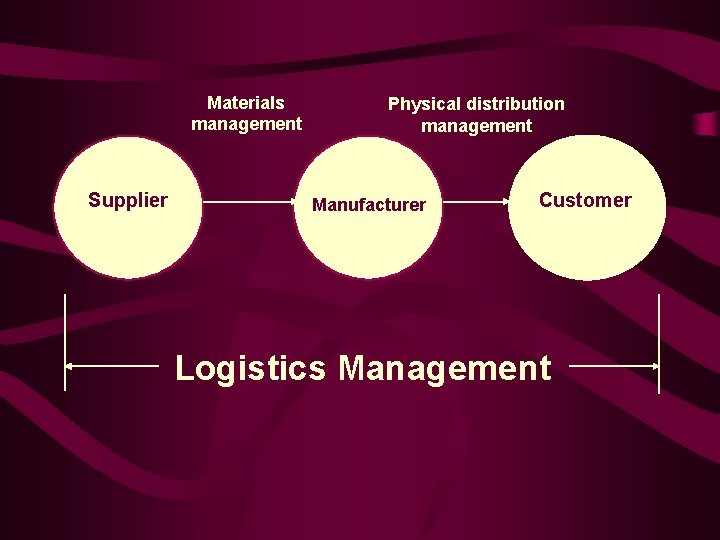

Logistics Management • Logistics involves more than physical distribution. In the science of logistics, the flow of materials is efficiently managed inbound-through and outbound of an organization. • Two primary product flows: – Physical supply (materials management): Flows that provide raw materials, components, and supplies to the production process. – Physical distribution management: Flows that deliver the completed product to customers and channel intermediaries.

Materials management Supplier Physical distribution management Manufacturer Customer Logistics Management

Supply Chain Management Supply chain management: An integrated philosophy to manage the multidirectional flow of materials and information through an entire channel, from the first raw material supplier to the ultimate user of the finished product.

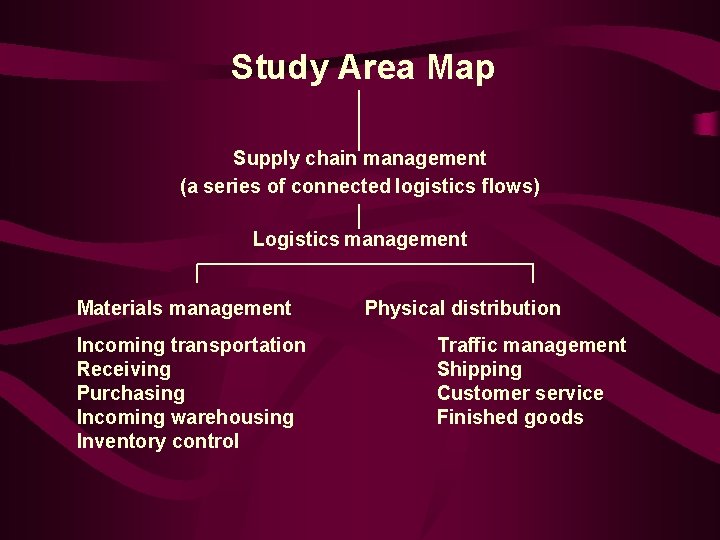

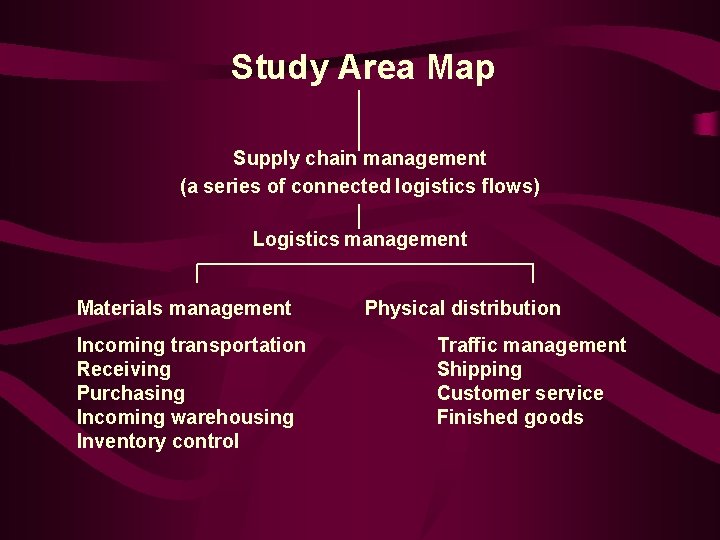

Study Area Map Supply chain management (a series of connected logistics flows) Logistics management Materials management Incoming transportation Receiving Purchasing Incoming warehousing Inventory control Physical distribution Traffic management Shipping Customer service Finished goods

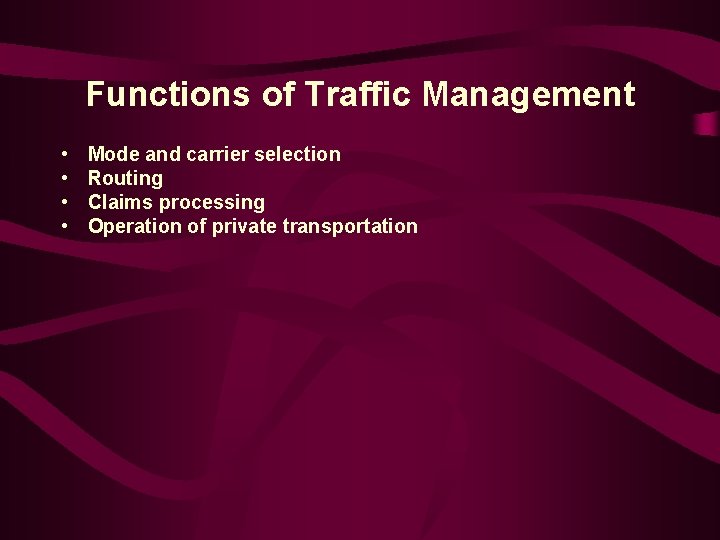

Functions of Traffic Management • • Mode and carrier selection Routing Claims processing Operation of private transportation

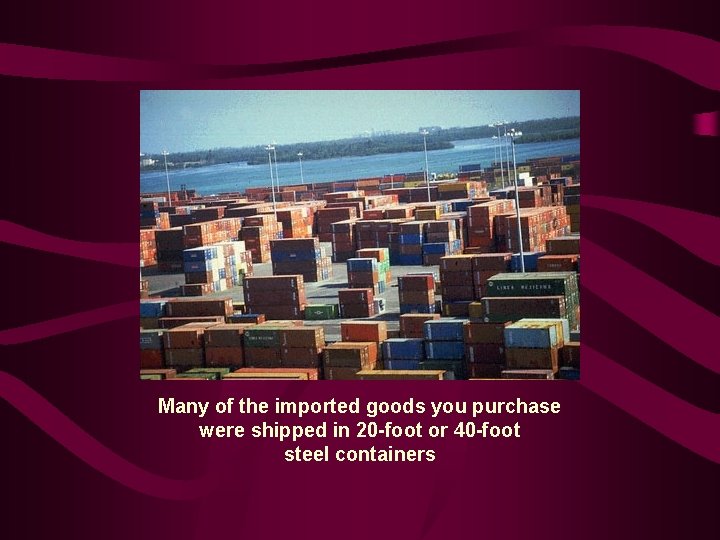

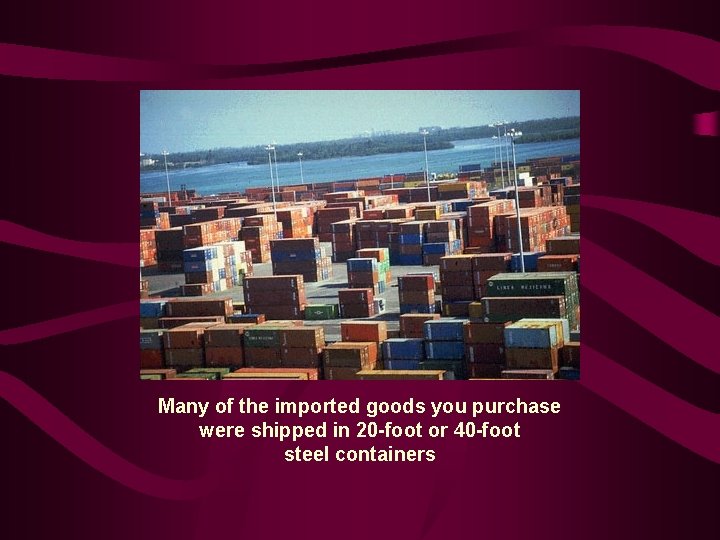

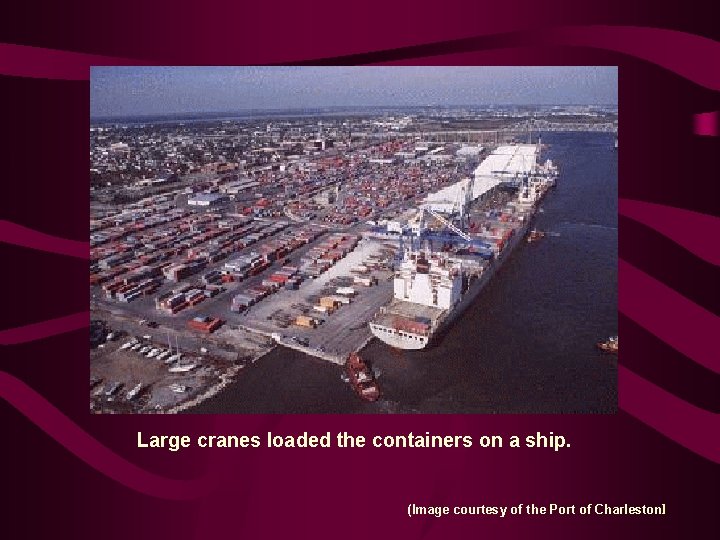

Many of the imported goods you purchase were shipped in 20 -foot or 40 -foot steel containers

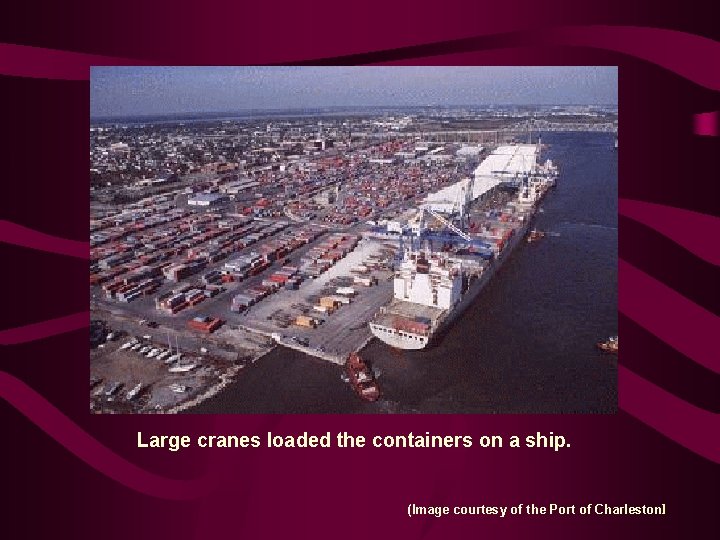

Large cranes loaded the containers on a ship. (Image courtesy of the Port of Charleston)

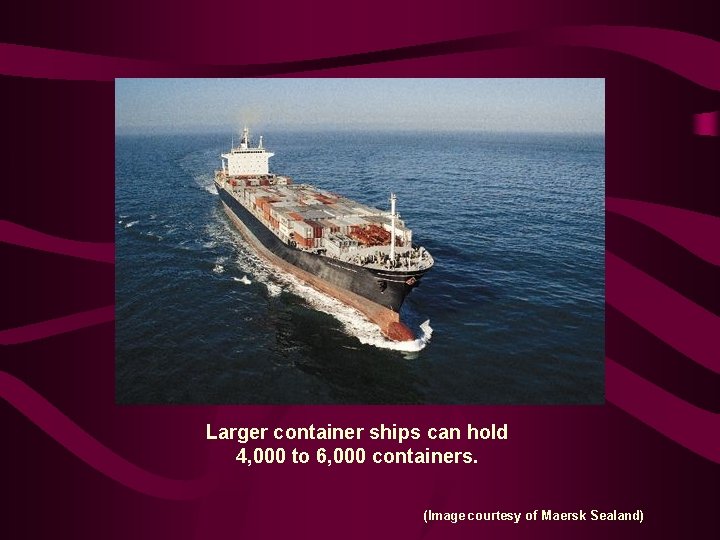

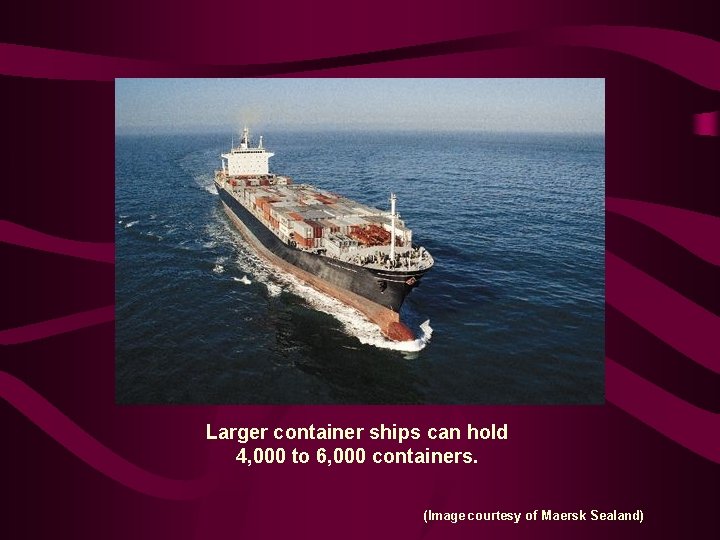

Larger container ships can hold 4, 000 to 6, 000 containers. (Image courtesy of Maersk Sealand)

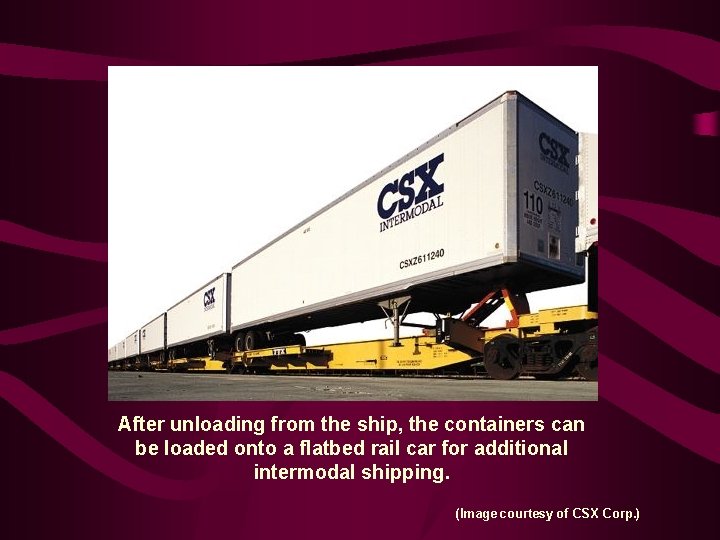

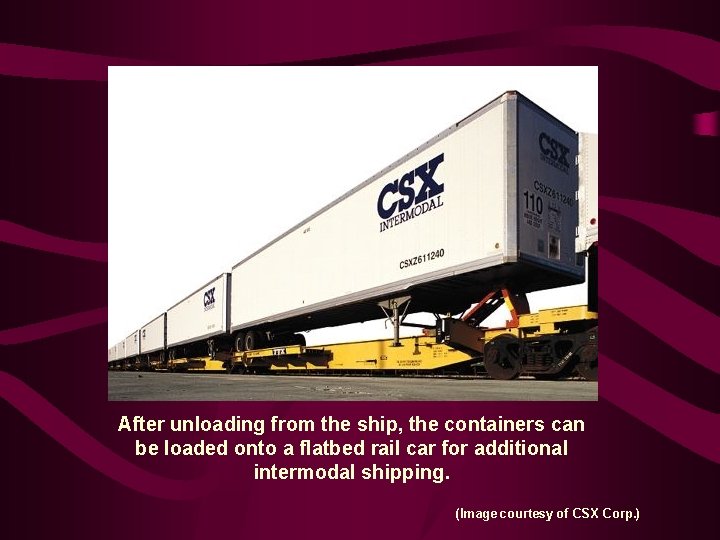

After unloading from the ship, the containers can be loaded onto a flatbed rail car for additional intermodal shipping. (Image courtesy of CSX Corp. )

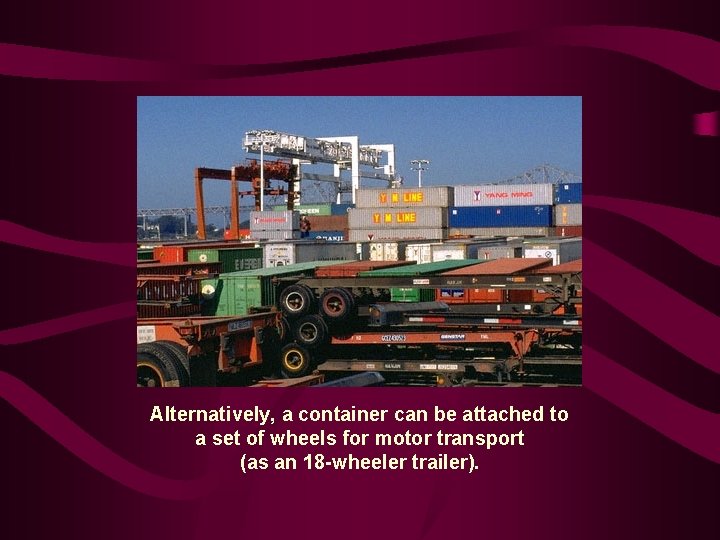

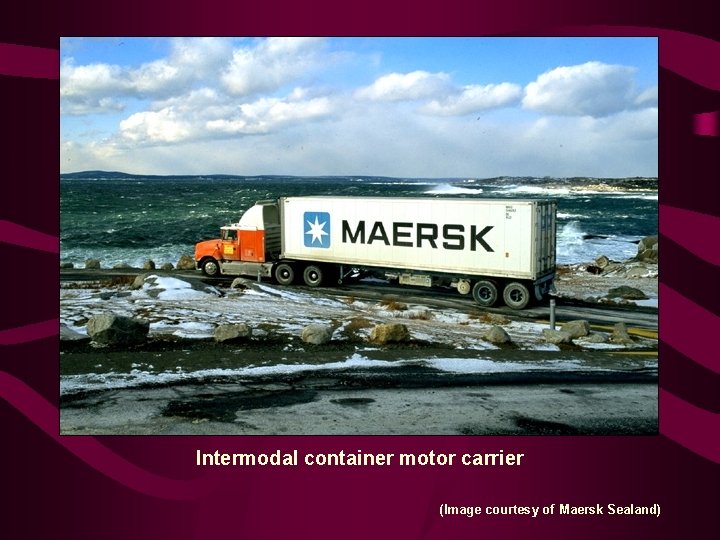

Alternatively, a container can be attached to a set of wheels for motor transport (as an 18 -wheeler trailer).

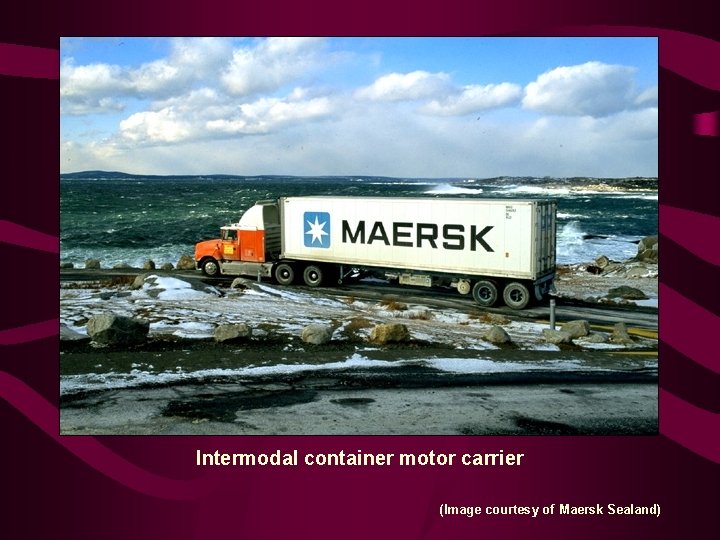

Intermodal container motor carrier (Image courtesy of Maersk Sealand)

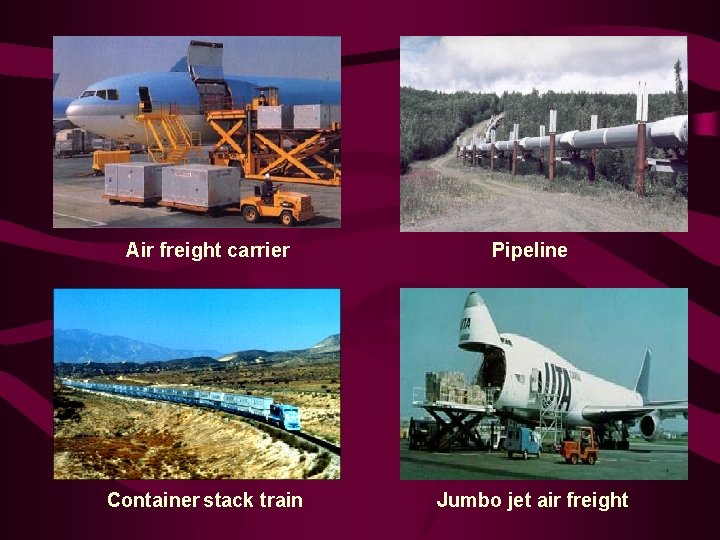

Rail freight carrier (Image courtesy of CSX Corp. ) Barge/river freight carrier

Air freight carrier Pipeline Container stack train Jumbo jet air freight

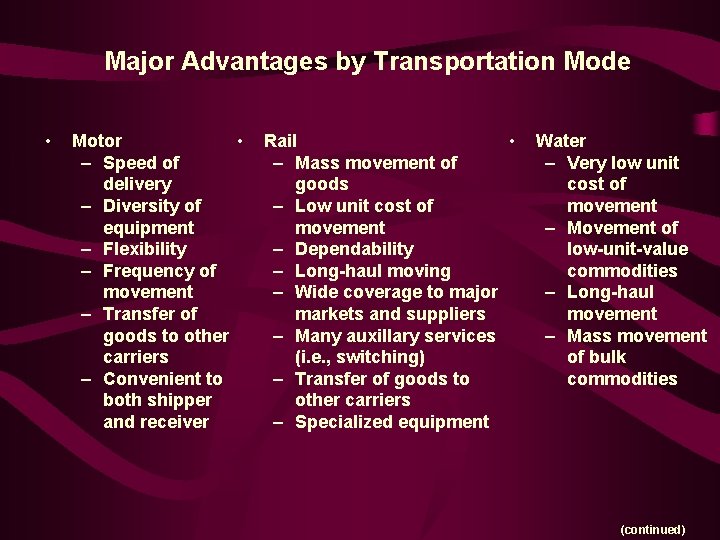

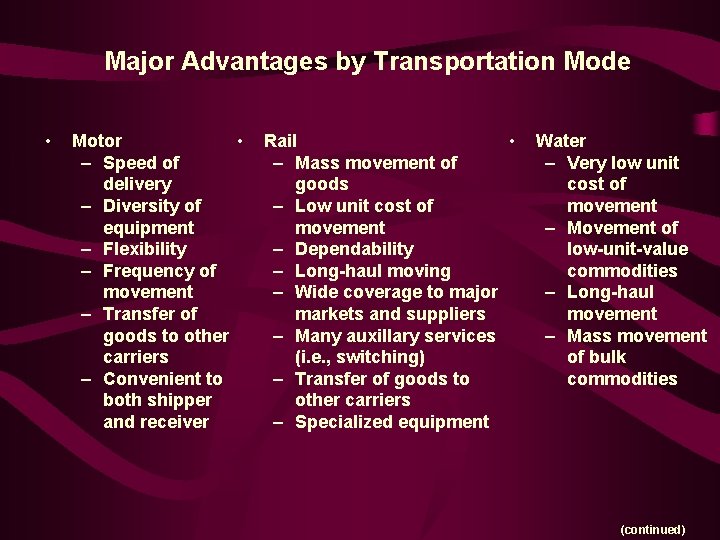

Major Advantages by Transportation Mode • Motor • – Speed of delivery – Diversity of equipment – Flexibility – Frequency of movement – Transfer of goods to other carriers – Convenient to both shipper and receiver Rail • – Mass movement of goods – Low unit cost of movement – Dependability – Long-haul moving – Wide coverage to major markets and suppliers – Many auxillary services (i. e. , switching) – Transfer of goods to other carriers – Specialized equipment Water – Very low unit cost of movement – Movement of low-unit-value commodities – Long-haul movement – Mass movement of bulk commodities (continued)

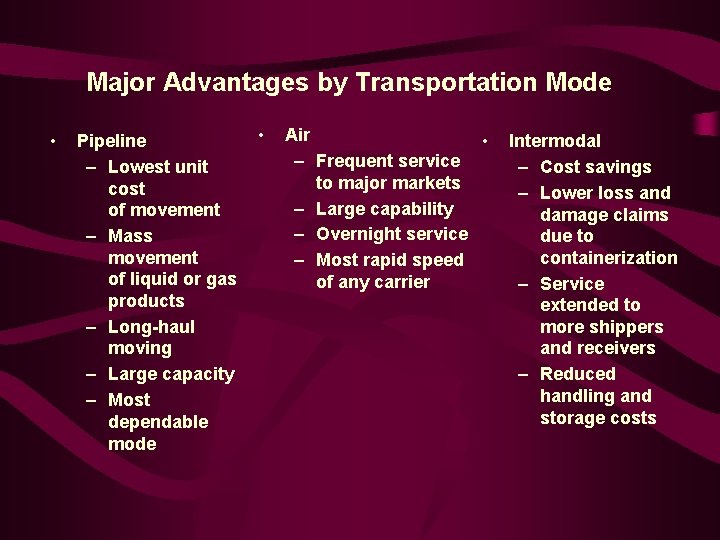

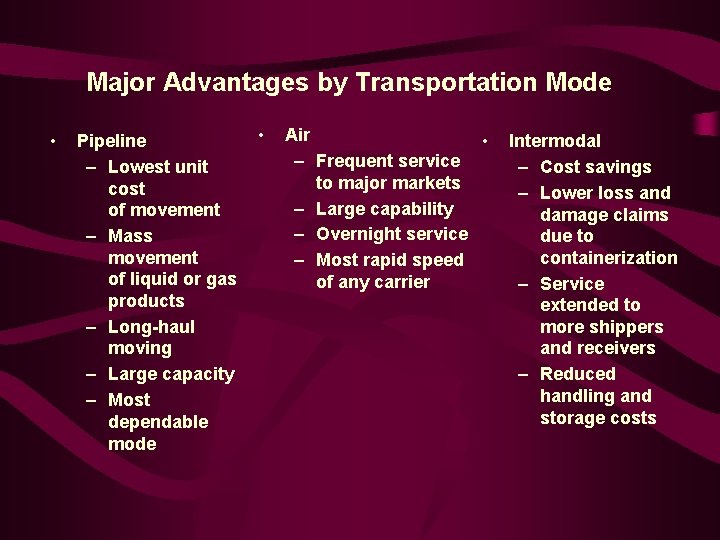

Major Advantages by Transportation Mode • Pipeline – Lowest unit cost of movement – Mass movement of liquid or gas products – Long-haul moving – Large capacity – Most dependable mode • Air • – Frequent service to major markets – Large capability – Overnight service – Most rapid speed of any carrier Intermodal – Cost savings – Lower loss and damage claims due to containerization – Service extended to more shippers and receivers – Reduced handling and storage costs

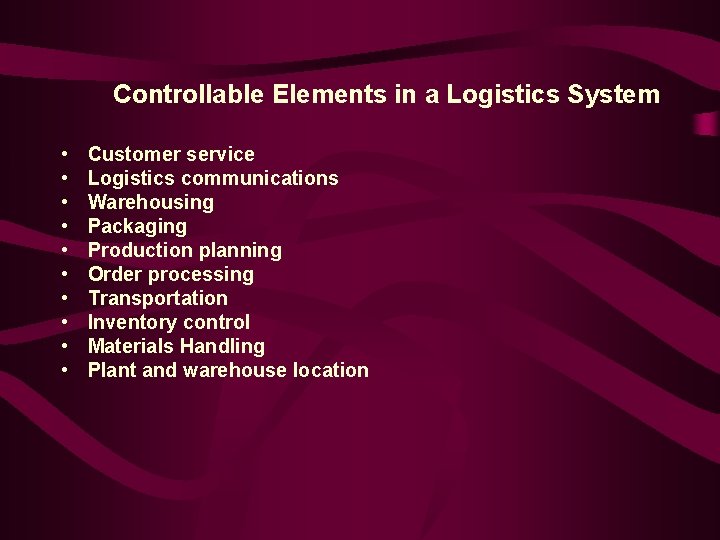

Controllable Elements in a Logistics System • • • Customer service Logistics communications Warehousing Packaging Production planning Order processing Transportation Inventory control Materials Handling Plant and warehouse location

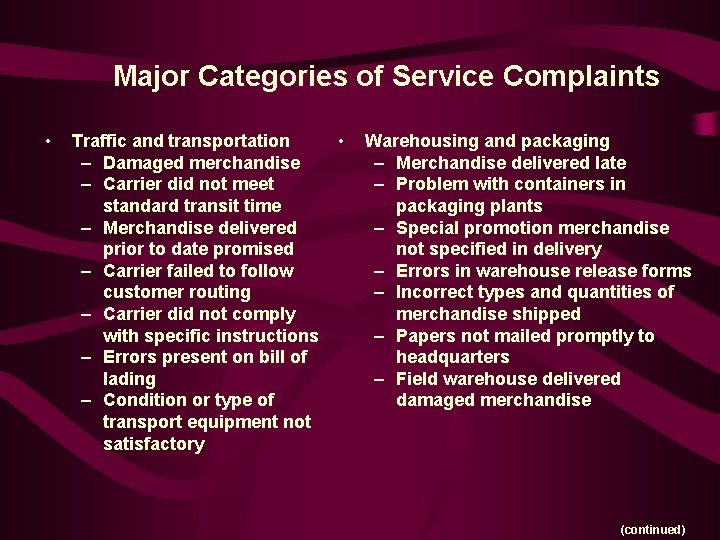

Major Categories of Service Complaints • Traffic and transportation – Damaged merchandise – Carrier did not meet standard transit time – Merchandise delivered prior to date promised – Carrier failed to follow customer routing – Carrier did not comply with specific instructions – Errors present on bill of lading – Condition or type of transport equipment not satisfactory • Warehousing and packaging – Merchandise delivered late – Problem with containers in packaging plants – Special promotion merchandise not specified in delivery – Errors in warehouse release forms – Incorrect types and quantities of merchandise shipped – Papers not mailed promptly to headquarters – Field warehouse delivered damaged merchandise (continued)

Major Categories of Service Complaints • Inventory control – Stockouts – Contaminated products received – Product identification errors – Poor merchandise shipped • Sales order service – Delayed shipments – Invoice, sales coding, or brokerage errors – Special instructions ignored – No notification of late shipments