Chapter 5 Consumer Welfare and Elasticities Copyright 2005

- Slides: 57

Chapter 5 Consumer Welfare and Elasticities Copyright © 2005 by South-Western, a division of Thomson Learning. All rights reserved. 1

Consumer Welfare • An important problem in welfare economics is to devise a monetary measure of the gains and losses that individuals experience when prices change • This is important for economic policy because economic policy usually changes prices due to either taxes or subsidies • Usually, we would like to design policies that maximize consumer welfare, so we need to measure it 2

Consumer Welfare • One way to evaluate the welfare cost of a price increase (from px 0 to px 1) would be to compare the expenditures required to achieve U 0 (initial level of utility) under these two situations expenditure at px 0 = E(px 0, py, U 0) expenditure at px 1 = E(px 1, py, U 0) 3

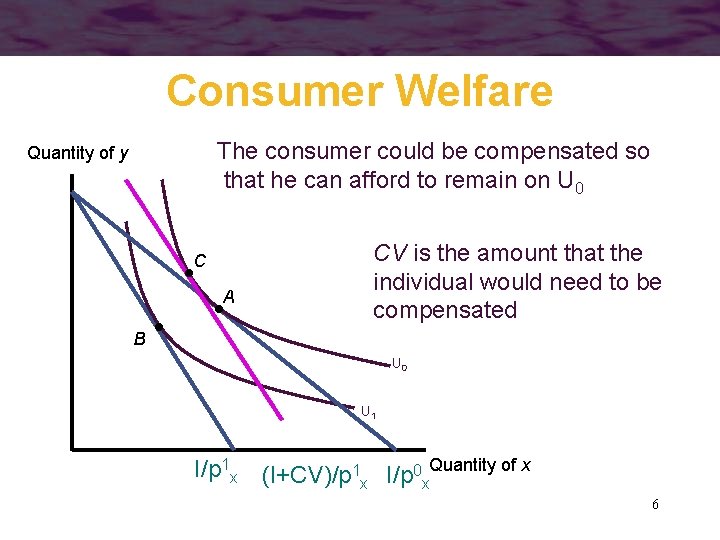

Consumer Welfare • In order to compensate for the price rise, this person would require a compensating variation (CV) of V(px 0, py, I)= V(px 1, py, I+CV), U 0= V(px 1, py, I+CV) Solving for CV… CV +I= E(px 1, py, U 0), CV= E(px 1, py, U 0) – I, CV= E(px 1, py, U 0) – E(p 0 x, py, U 0) The CV is how much money we would have to give the consumer after the price change to make him just as well off as he was before the price 4 change

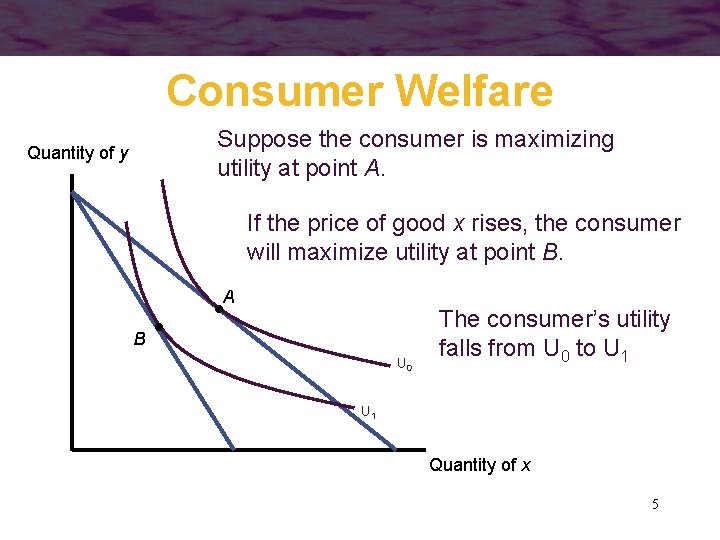

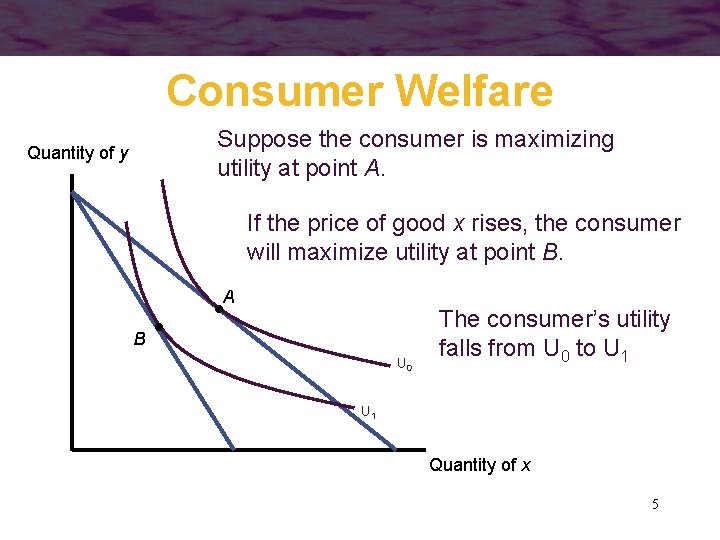

Consumer Welfare Suppose the consumer is maximizing utility at point A. Quantity of y If the price of good x rises, the consumer will maximize utility at point B. A B U 0 The consumer’s utility falls from U 0 to U 1 Quantity of x 5

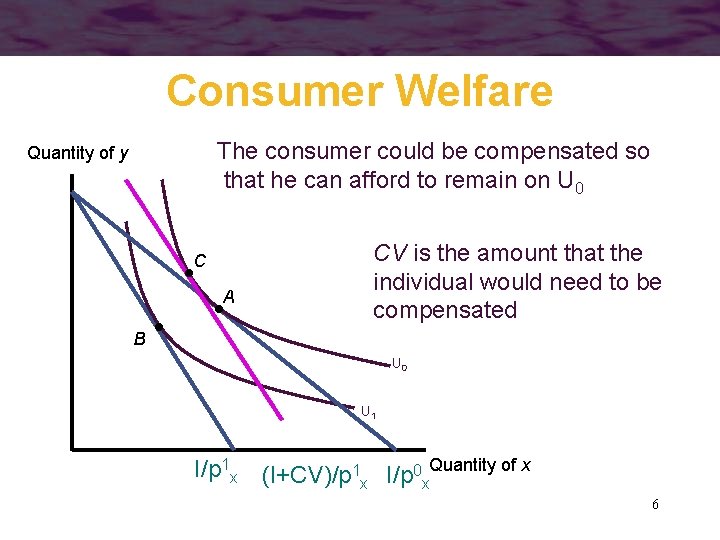

Consumer Welfare The consumer could be compensated so that he can afford to remain on U 0 Quantity of y C A CV is the amount that the individual would need to be compensated B U 0 U 1 I/p 1 x (I+CV)/p 1 x I/p 0 x. Quantity of x 6

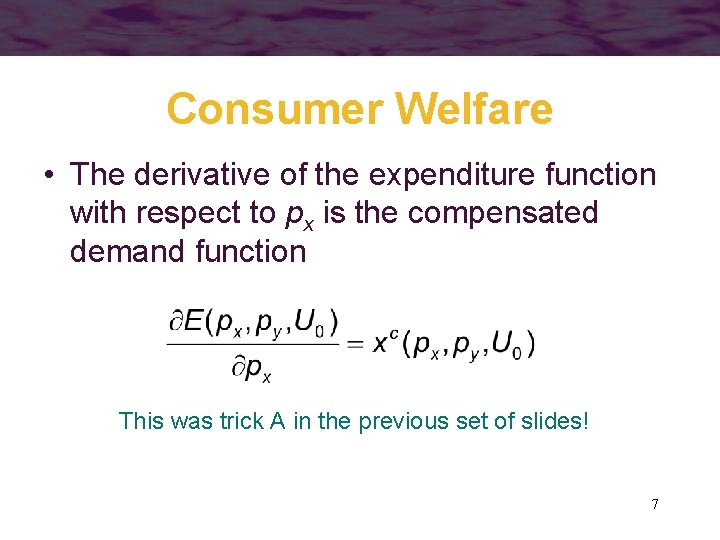

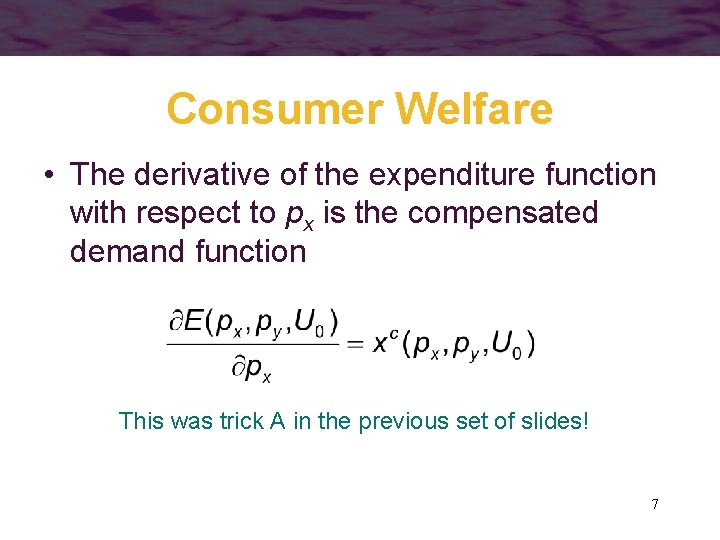

Consumer Welfare • The derivative of the expenditure function with respect to px is the compensated demand function This was trick A in the previous set of slides! 7

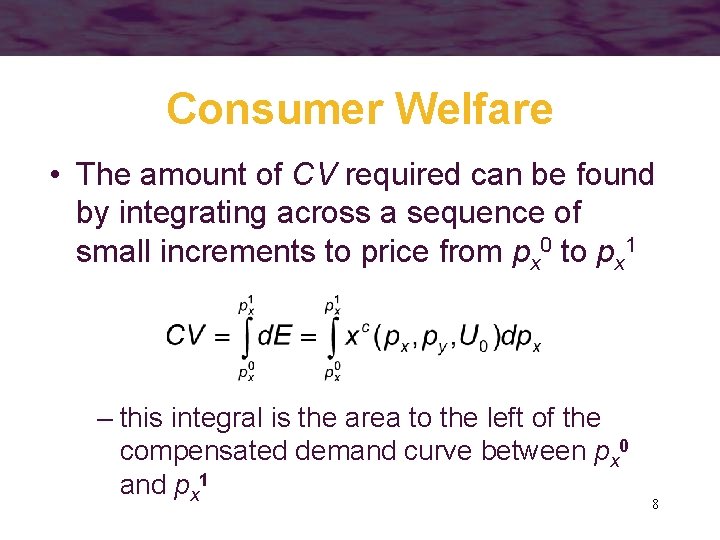

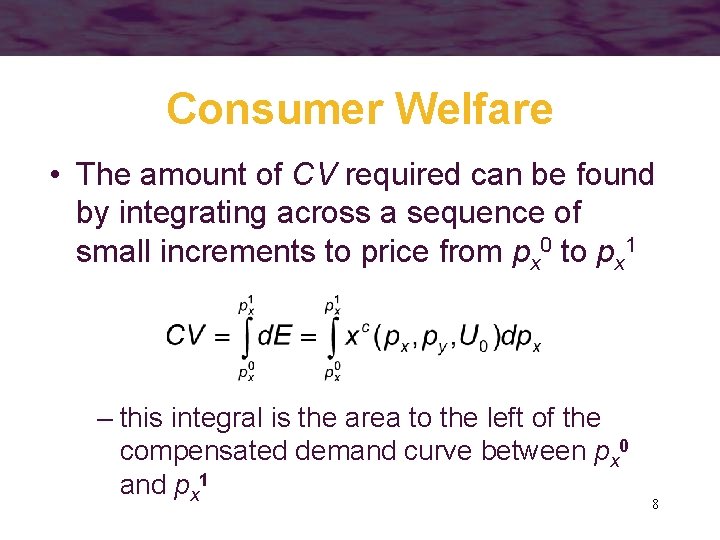

Consumer Welfare • The amount of CV required can be found by integrating across a sequence of small increments to price from px 0 to px 1 – this integral is the area to the left of the compensated demand curve between px 0 and px 1 8

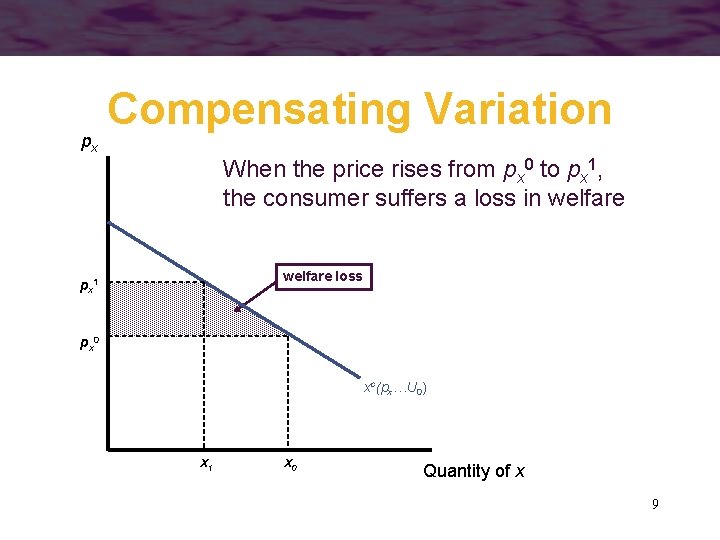

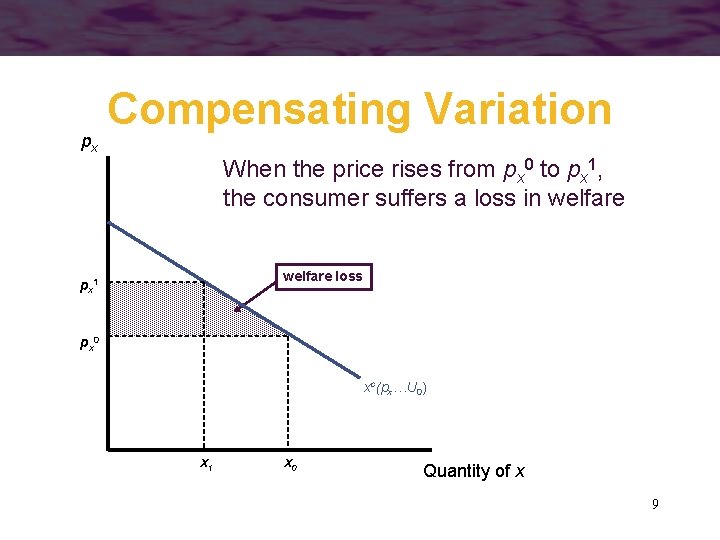

px Compensating Variation When the price rises from px 0 to px 1, the consumer suffers a loss in welfare loss px 1 px 0 xc(px…U 0) x 1 x 0 Quantity of x 9

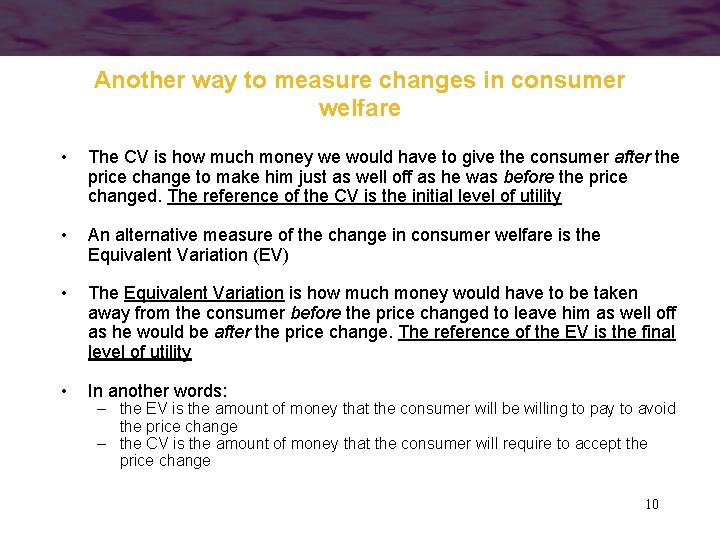

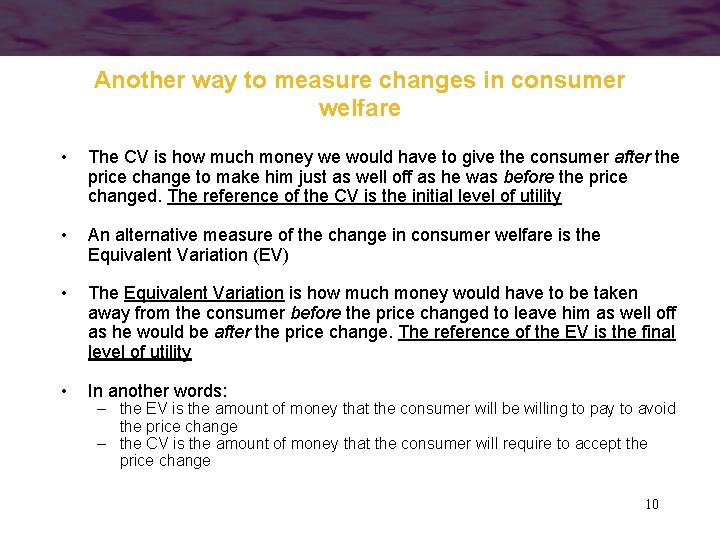

Another way to measure changes in consumer welfare • The CV is how much money we would have to give the consumer after the price change to make him just as well off as he was before the price changed. The reference of the CV is the initial level of utility • An alternative measure of the change in consumer welfare is the Equivalent Variation (EV) • The Equivalent Variation is how much money would have to be taken away from the consumer before the price changed to leave him as well off as he would be after the price change. The reference of the EV is the final level of utility • In another words: – the EV is the amount of money that the consumer will be willing to pay to avoid the price change – the CV is the amount of money that the consumer will require to accept the price change 10

Example CV and EV • CV: compensate individuals for an increase in the price of air travel due to a green tax • EV: The government promised to lower the VAT in their political manifesto to win the elections. After they are elected, they realise that EU does not allow them. The government uses the EV to compensate individuals for that. 11

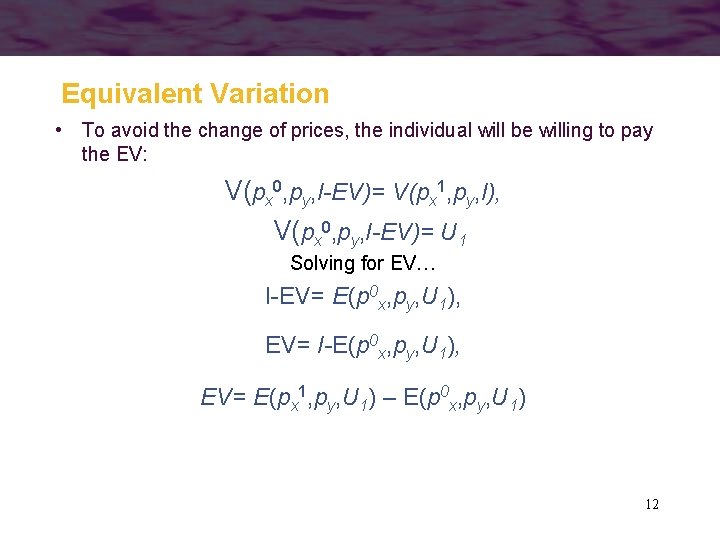

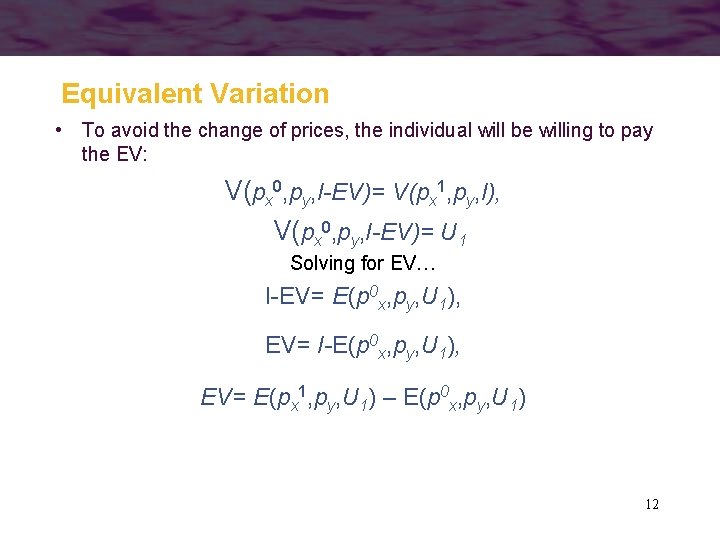

Equivalent Variation • To avoid the change of prices, the individual will be willing to pay the EV: V(px 0, py, I-EV)= V(px 1, py, I), V(px 0, py, I-EV)= U 1 Solving for EV… I-EV= E(p 0 x, py, U 1), EV= I-E(p 0 x, py, U 1), EV= E(px 1, py, U 1) – E(p 0 x, py, U 1) 12

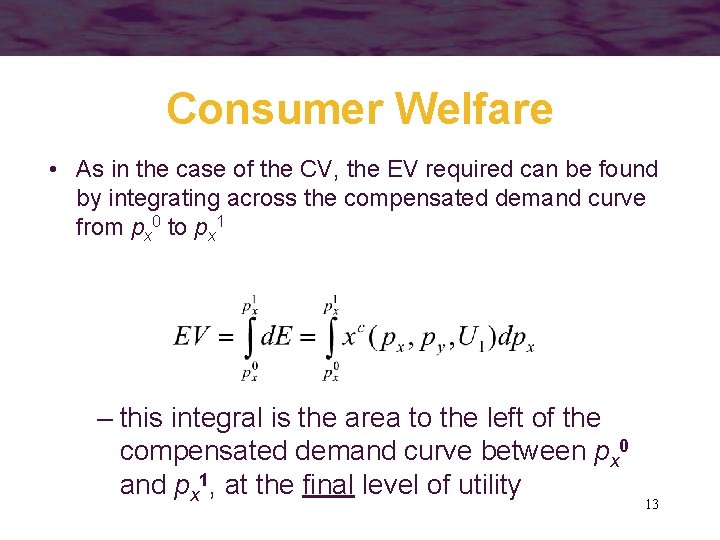

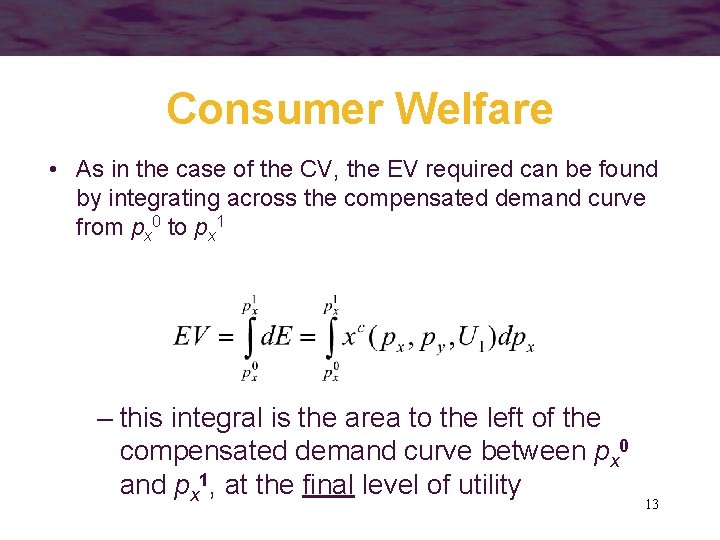

Consumer Welfare • As in the case of the CV, the EV required can be found by integrating across the compensated demand curve from px 0 to px 1 – this integral is the area to the left of the compensated demand curve between px 0 and px 1, at the final level of utility 13

Consumer Welfare • It is unclear which one should be used: CV or EV • They are different: notice, areas of different compensated demand curves (according to the level of utility: initial or final) • Do we use the compensated demand curve for the original target utility (U 0) (that is, the CV) or the new level of utility after the price change (U 1) (that is, the EV)? 14

The Consumer Surplus Concept • Another way to look at this issue is to ask how much the person would be willing to pay for the right to consume all of this good that he wanted at the market price of px 0 15

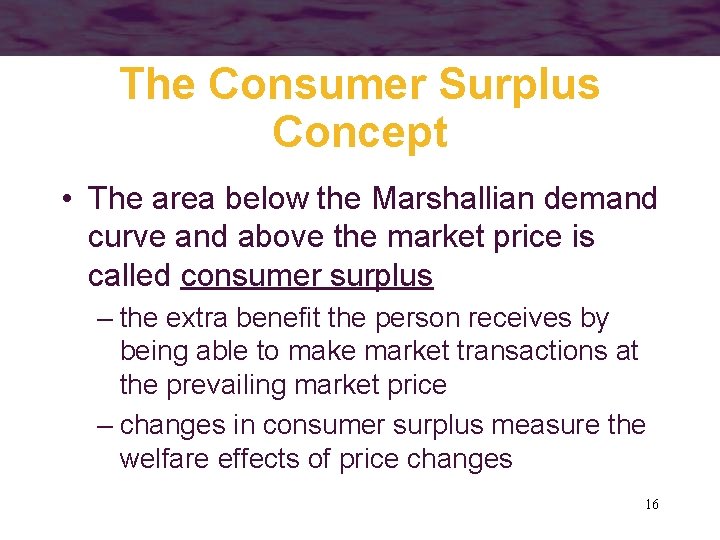

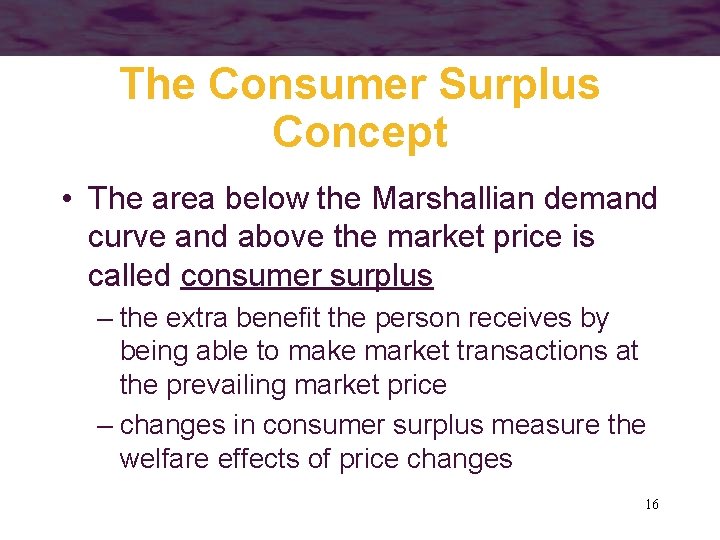

The Consumer Surplus Concept • The area below the Marshallian demand curve and above the market price is called consumer surplus – the extra benefit the person receives by being able to make market transactions at the prevailing market price – changes in consumer surplus measure the welfare effects of price changes 16

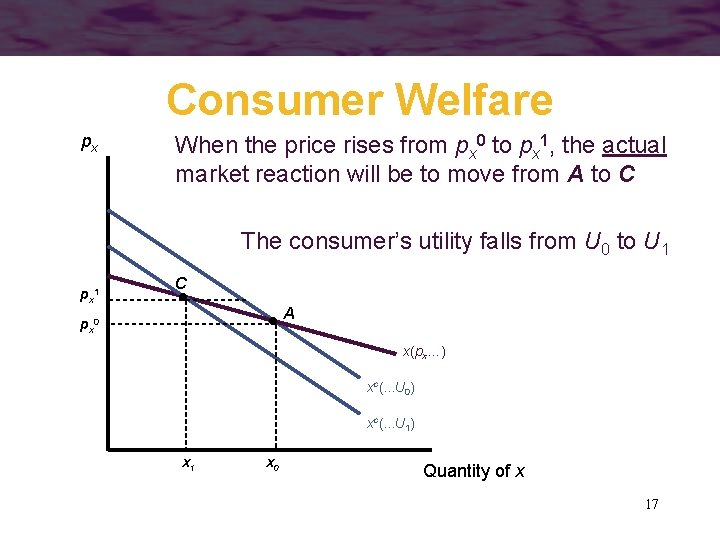

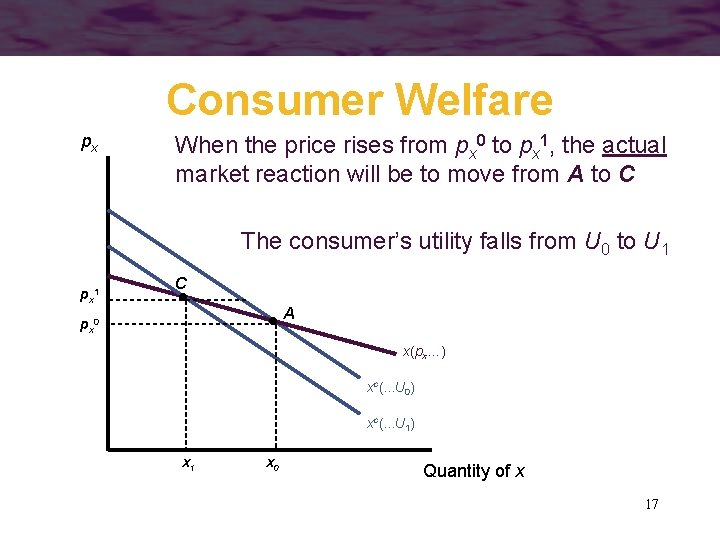

Consumer Welfare px When the price rises from px 0 to px 1, the actual market reaction will be to move from A to C The consumer’s utility falls from U 0 to U 1 px 1 C A px 0 x(px…) xc(. . . U 0) xc(. . . U 1) x 1 x 0 Quantity of x 17

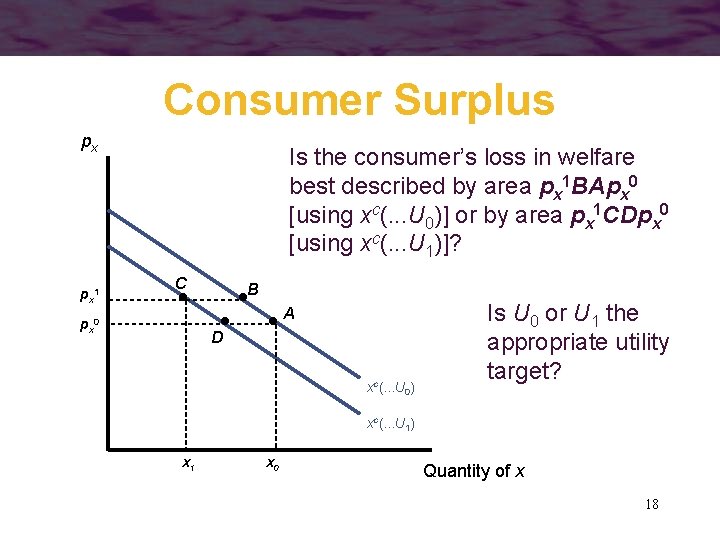

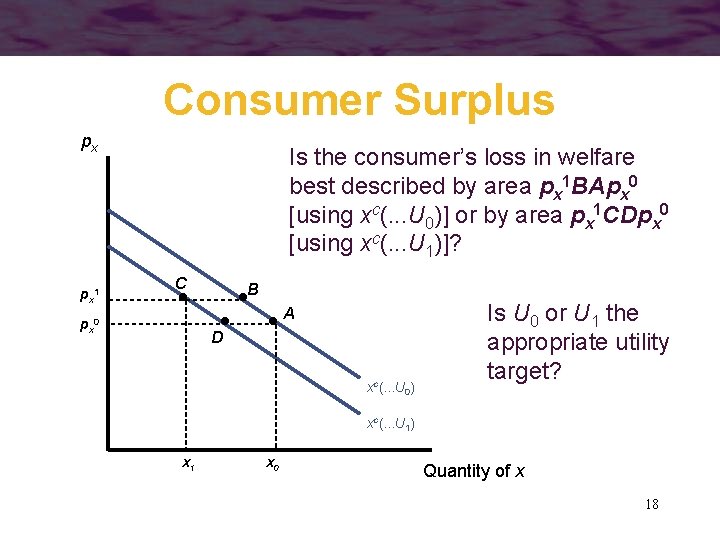

Consumer Surplus px px 1 Is the consumer’s loss in welfare best described by area px 1 BApx 0 [using xc(. . . U 0)] or by area px 1 CDpx 0 [using xc(. . . U 1)]? C B A px 0 D xc(. . . U 0) Is U 0 or U 1 the appropriate utility target? xc(. . . U 1) x 1 x 0 Quantity of x 18

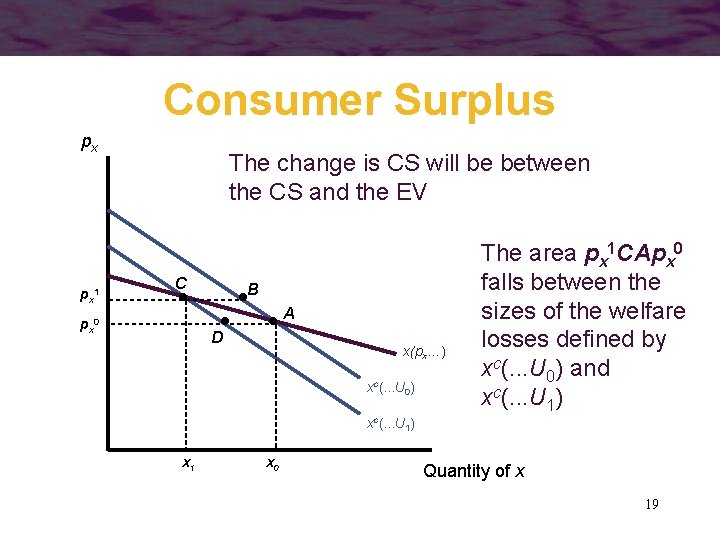

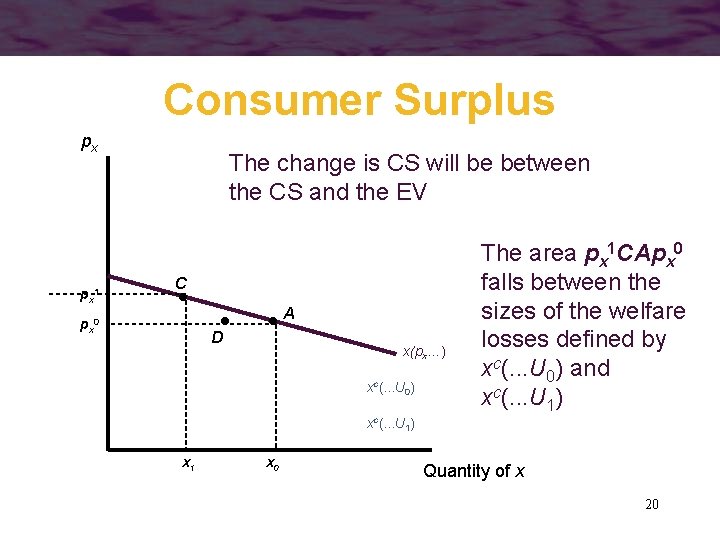

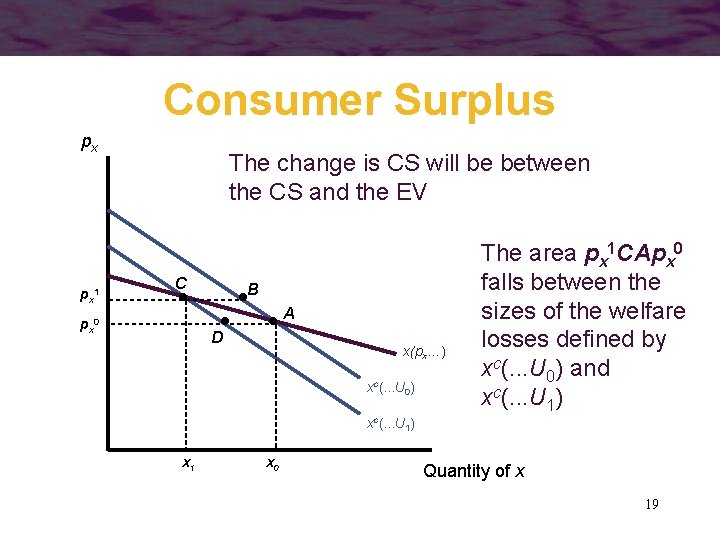

Consumer Surplus px px 1 The change is CS will be between the CS and the EV C B A px 0 D x(px…) xc(. . . U 0) The area px 1 CApx 0 falls between the sizes of the welfare losses defined by xc(. . . U 0) and xc(. . . U 1) x 1 x 0 Quantity of x 19

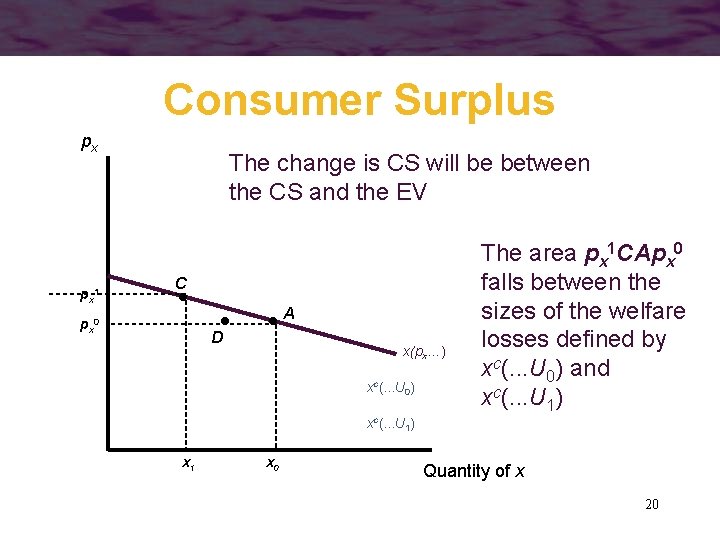

Consumer Surplus px px 1 The change is CS will be between the CS and the EV C A px 0 D x(px…) xc(. . . U 0) The area px 1 CApx 0 falls between the sizes of the welfare losses defined by xc(. . . U 0) and xc(. . . U 1) x 1 x 0 Quantity of x 20

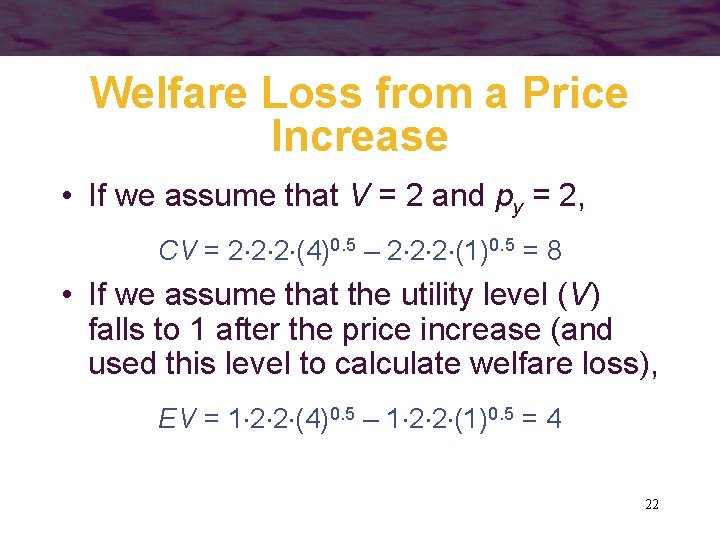

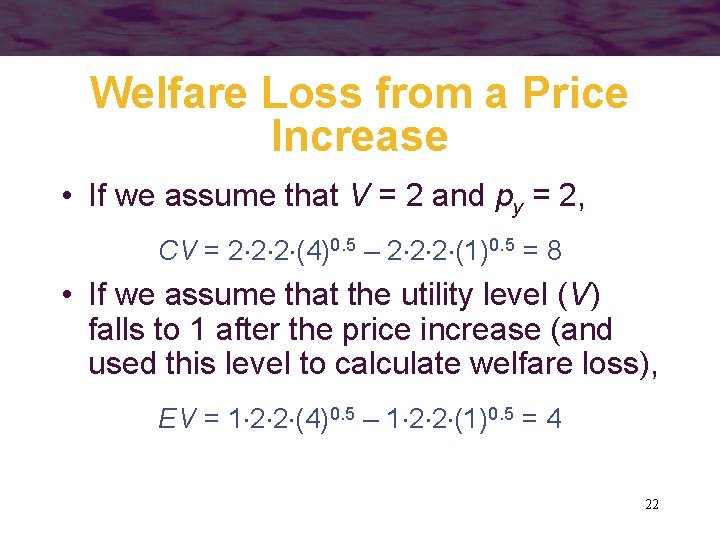

Welfare Loss from a Price Increase • Suppose that the compensated demand function for x is given by • The welfare cost of a price increase from px = 1 to px = 4 is given by 21

Welfare Loss from a Price Increase • If we assume that V = 2 and py = 2, CV = 2 2 2 (4)0. 5 – 2 2 2 (1)0. 5 = 8 • If we assume that the utility level (V) falls to 1 after the price increase (and used this level to calculate welfare loss), EV = 1 2 2 (4)0. 5 – 1 2 2 (1)0. 5 = 4 22

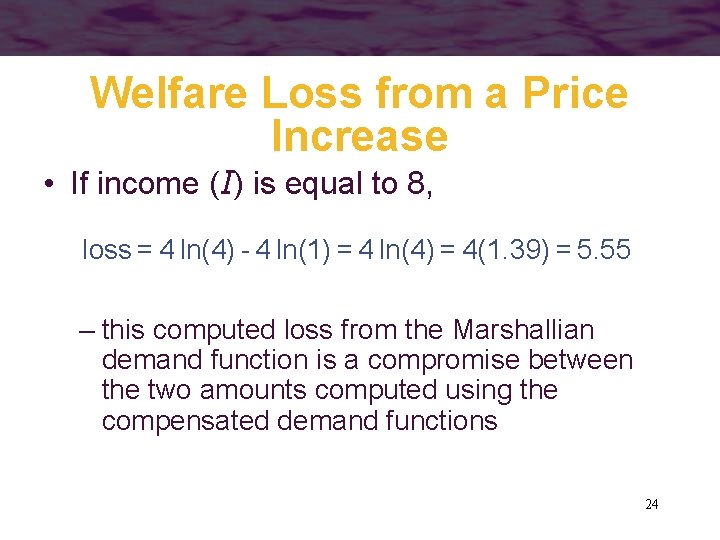

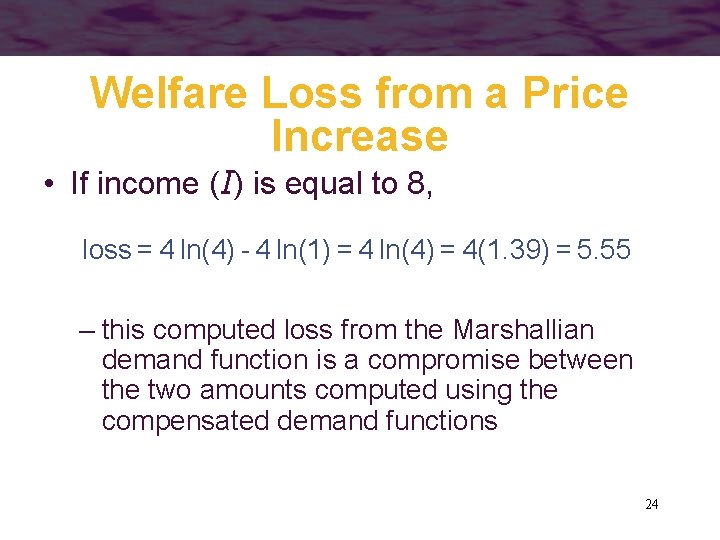

Welfare Loss from Price Increase • Suppose that we use the Marshallian demand function instead • The welfare loss from a price increase from px = 1 to px = 4 is given by 23

Welfare Loss from a Price Increase • If income (I) is equal to 8, loss = 4 ln(4) - 4 ln(1) = 4 ln(4) = 4(1. 39) = 5. 55 – this computed loss from the Marshallian demand function is a compromise between the two amounts computed using the compensated demand functions 24

Elasticities 25

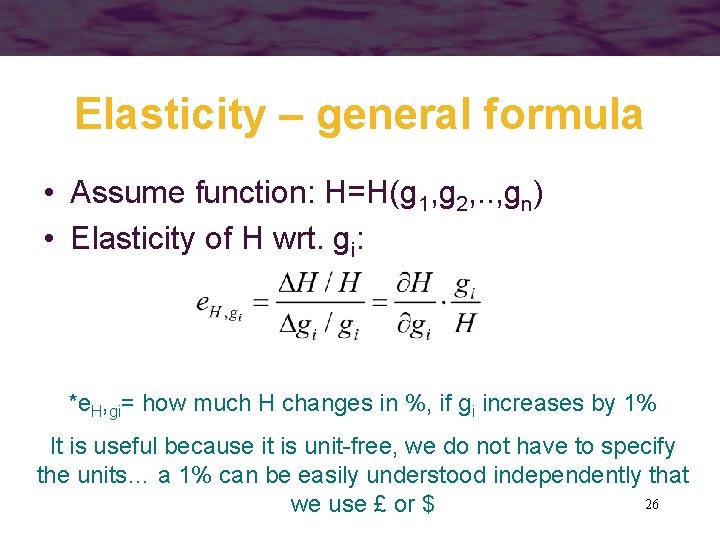

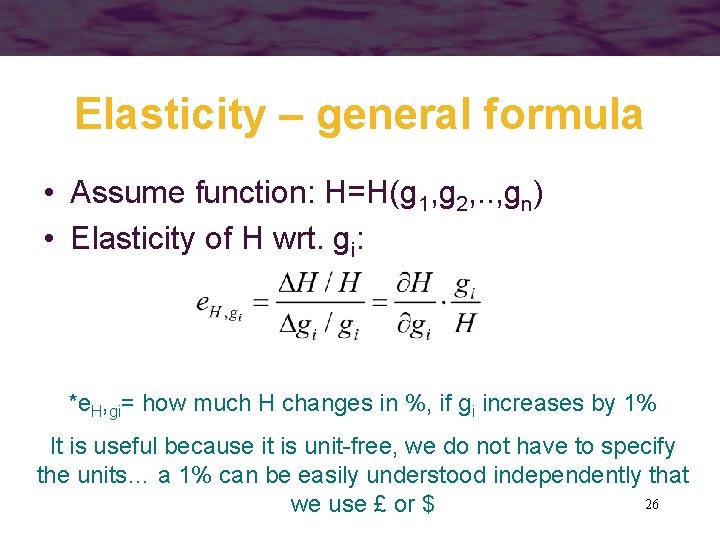

Elasticity – general formula • Assume function: H=H(g 1, g 2, . . , gn) • Elasticity of H wrt. gi: *e. H, gi= how much H changes in %, if gi increases by 1% It is useful because it is unit-free, we do not have to specify the units… a 1% can be easily understood independently that 26 we use £ or $

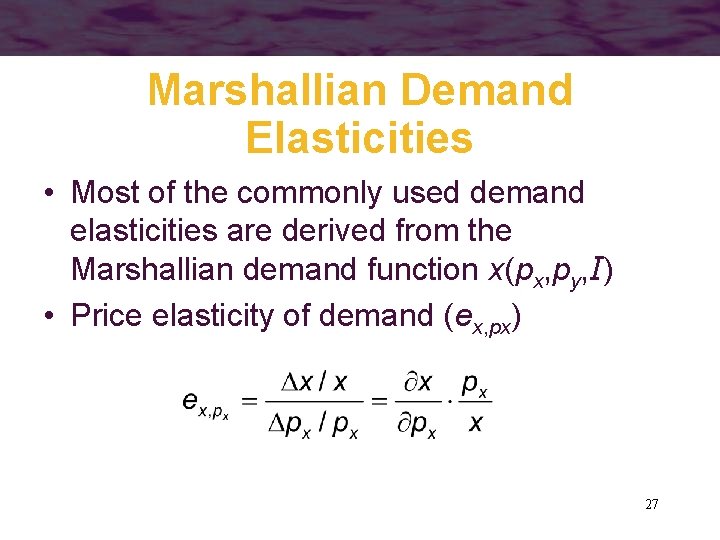

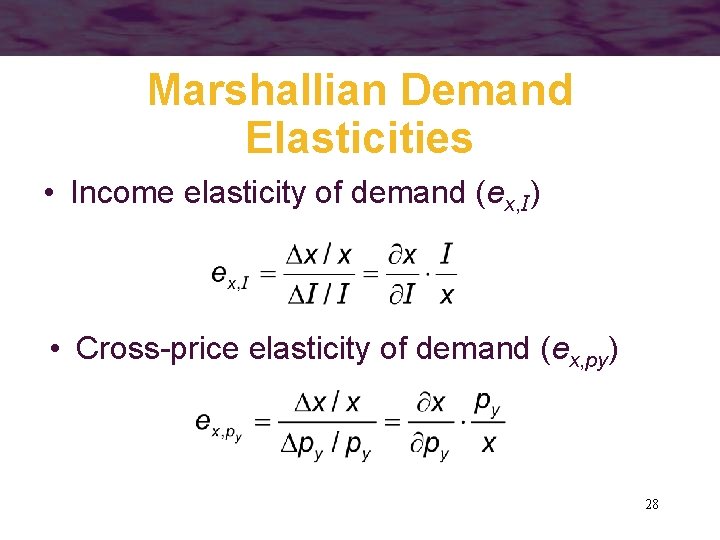

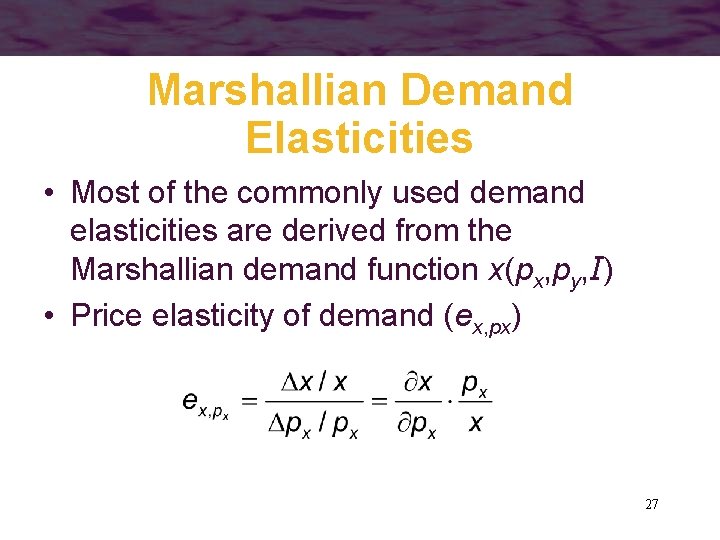

Marshallian Demand Elasticities • Most of the commonly used demand elasticities are derived from the Marshallian demand function x(px, py, I) • Price elasticity of demand (ex, px) 27

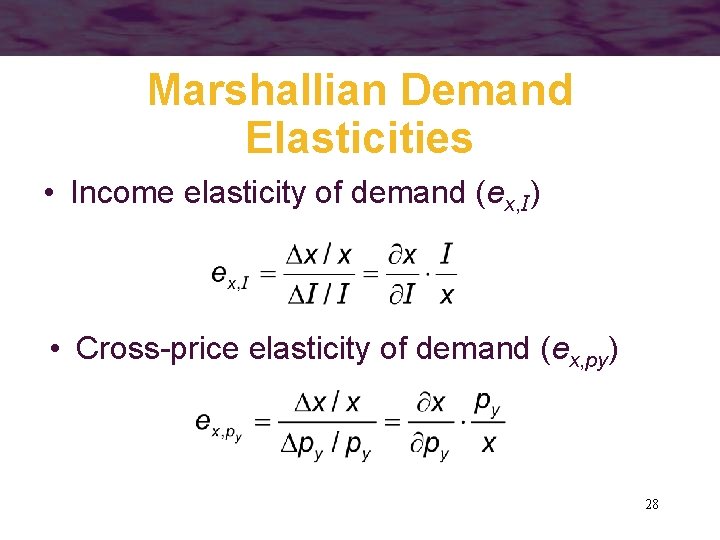

Marshallian Demand Elasticities • Income elasticity of demand (ex, I) • Cross-price elasticity of demand (ex, py) 28

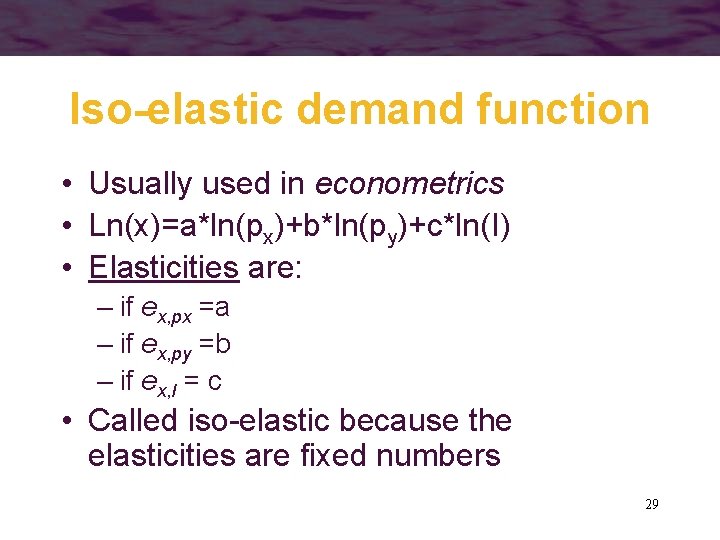

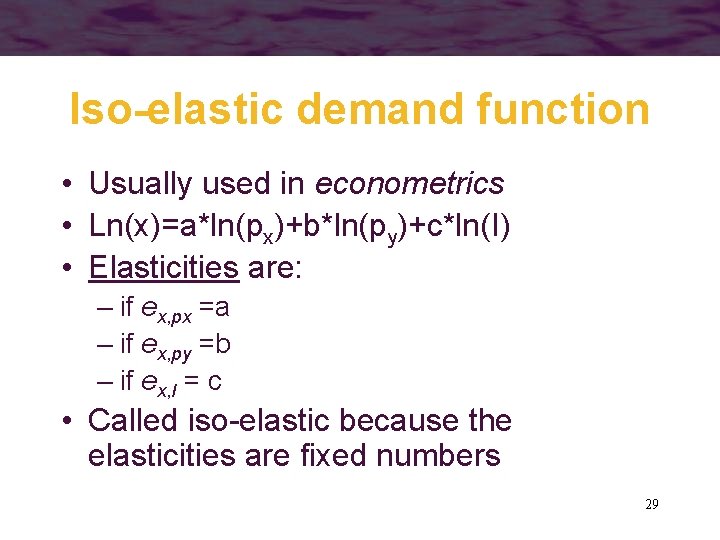

Iso-elastic demand function • Usually used in econometrics • Ln(x)=a*ln(px)+b*ln(py)+c*ln(I) • Elasticities are: – if ex, px =a – if ex, py =b – if ex, I = c • Called iso-elastic because the elasticities are fixed numbers 29

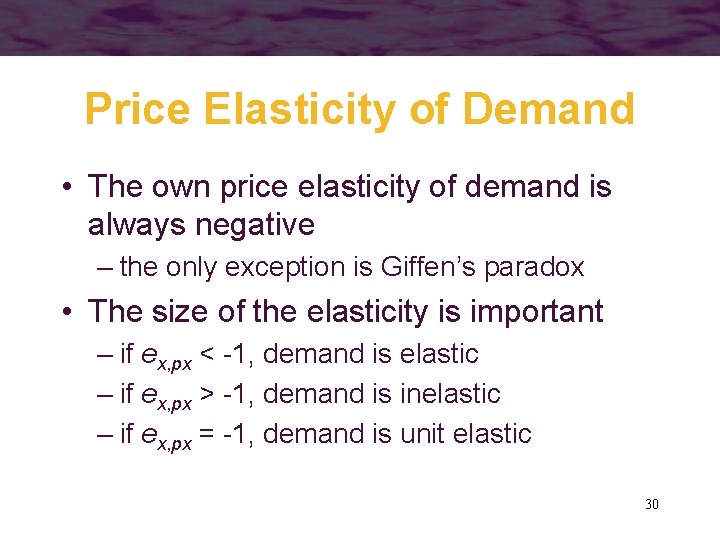

Price Elasticity of Demand • The own price elasticity of demand is always negative – the only exception is Giffen’s paradox • The size of the elasticity is important – if ex, px < -1, demand is elastic – if ex, px > -1, demand is inelastic – if ex, px = -1, demand is unit elastic 30

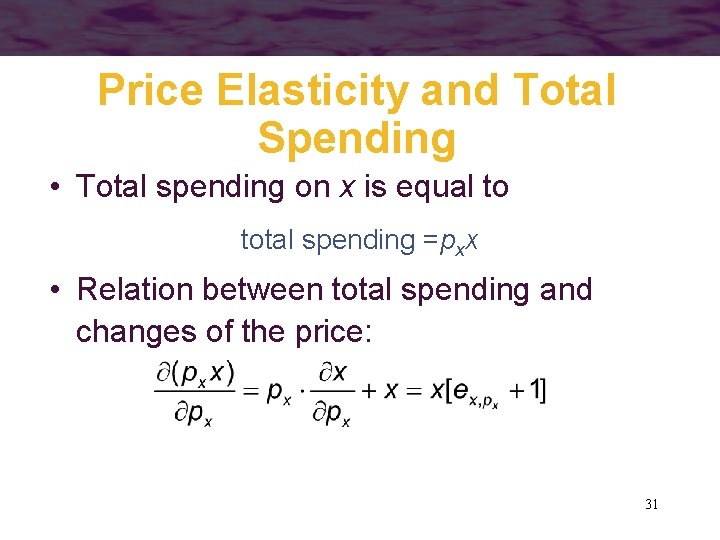

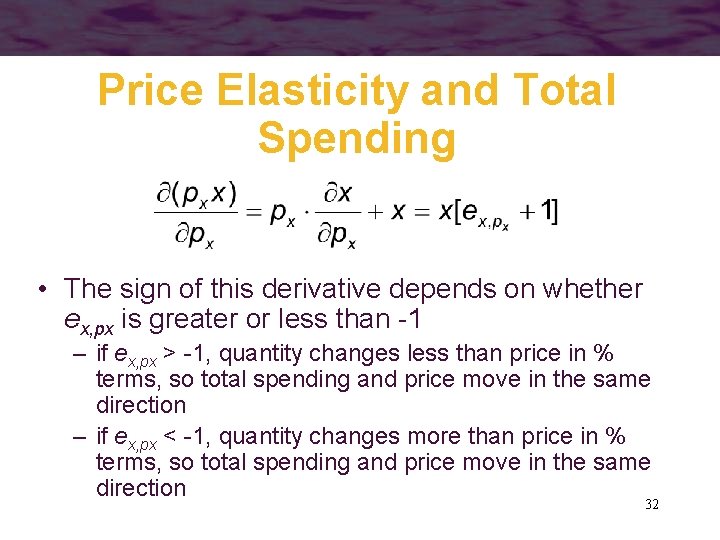

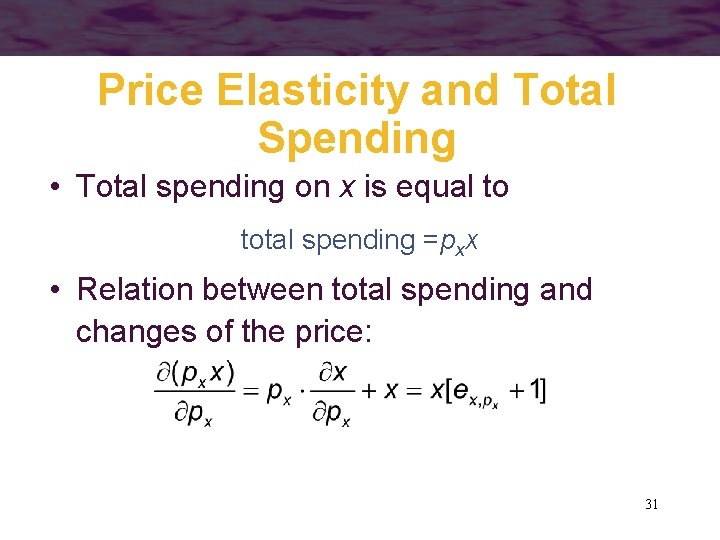

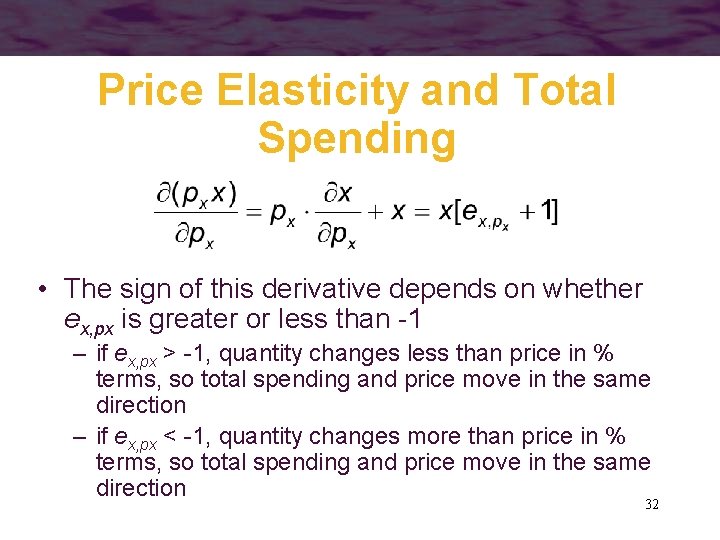

Price Elasticity and Total Spending • Total spending on x is equal to total spending =pxx • Relation between total spending and changes of the price: 31

Price Elasticity and Total Spending • The sign of this derivative depends on whether ex, px is greater or less than -1 – if ex, px > -1, quantity changes less than price in % terms, so total spending and price move in the same direction – if ex, px < -1, quantity changes more than price in % terms, so total spending and price move in the same direction 32

Compensated Price Elasticities • It is also useful to define elasticities based on the compensated demand function 33

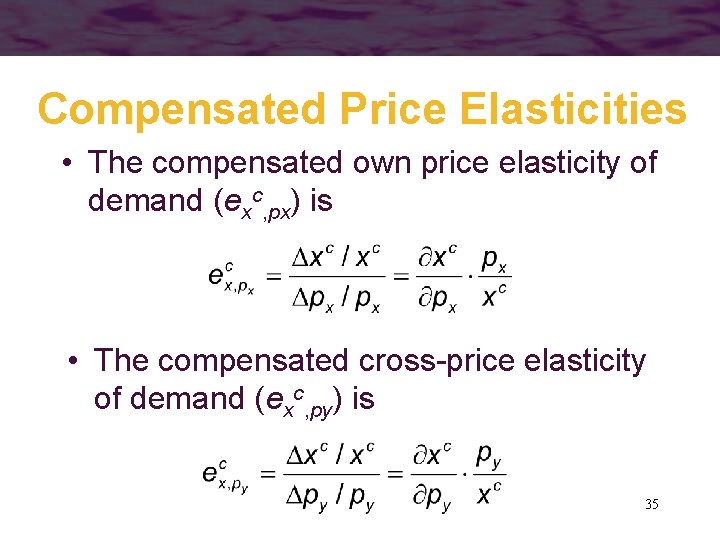

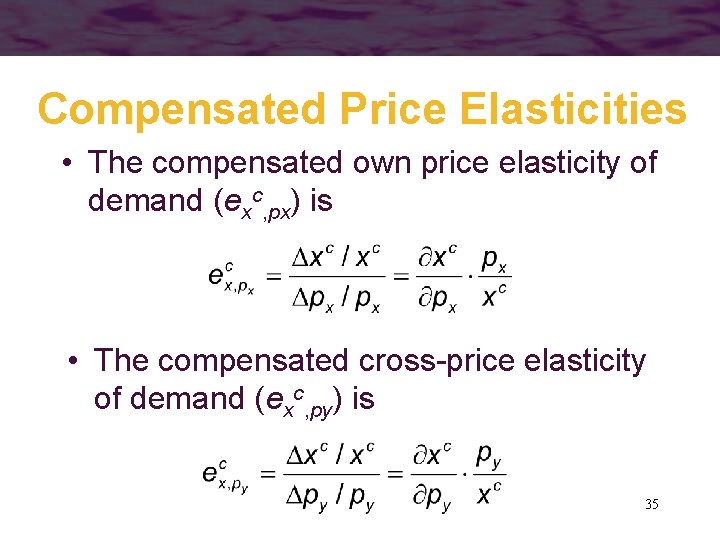

Compensated Price Elasticities • If the compensated demand function is xc = xc(px, py, U) we can calculate – compensated own price elasticity of demand (exc, px) – compensated cross-price elasticity of demand (exc, py) 34

Compensated Price Elasticities • The compensated own price elasticity of demand (exc, px) is • The compensated cross-price elasticity of demand (exc, py) is 35

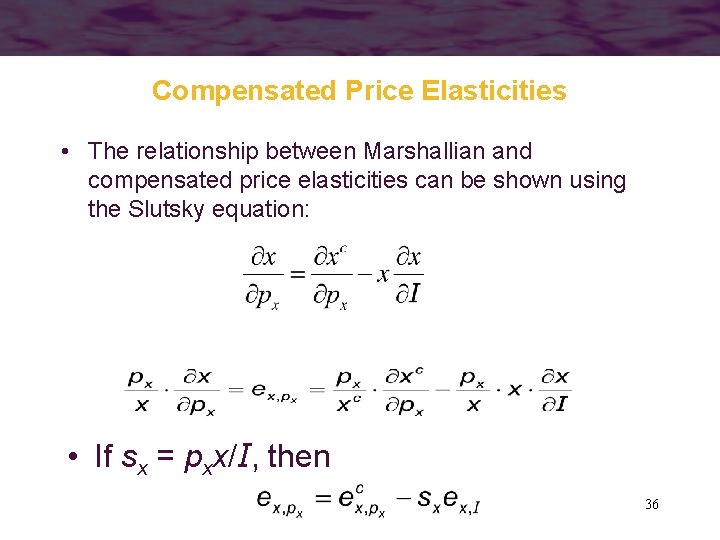

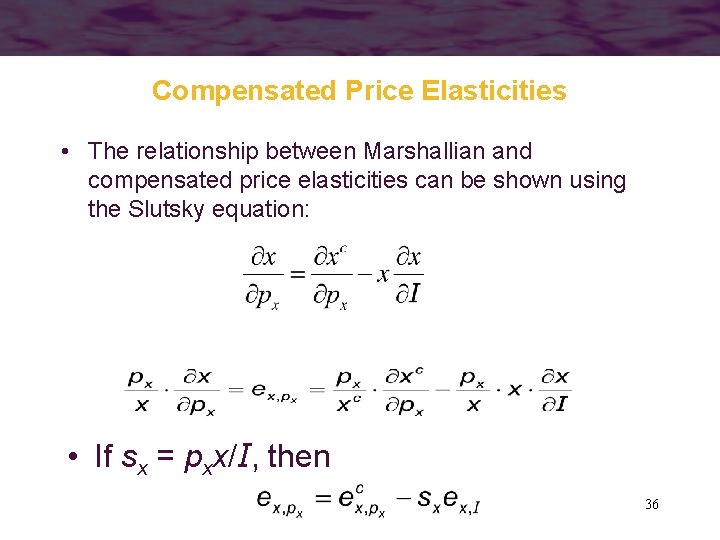

Compensated Price Elasticities • The relationship between Marshallian and compensated price elasticities can be shown using the Slutsky equation: • If sx = pxx/I, then 36

Compensated Price Elasticities • The Slutsky equation shows that the compensated and uncompensated price elasticities will be similar if – the share of income devoted to x is small – the income elasticity of x is small • So, the different measures of welfare will be very similar if: – the share of income devoted to x is small – the income elasticity of x is small 37

Another interesting relation • If we increase prices and income by the same percentage, optimal quantities will not change. So: • Any proportional change in all prices and income will leave the quantity of x demanded unchanged 38

Why is the previous relation useful? • The previous relation could be used to either: – Test the assumptions embedded in econometric models – Incorporate restrictions in econometric models to gain efficiency – Find out the value of some elasticities when we have information about other elasticities • The following expressions can also be used for the same purposes • Notice that econometrics is very important in our context… we need numbers to compute the welfare measures !!! 39

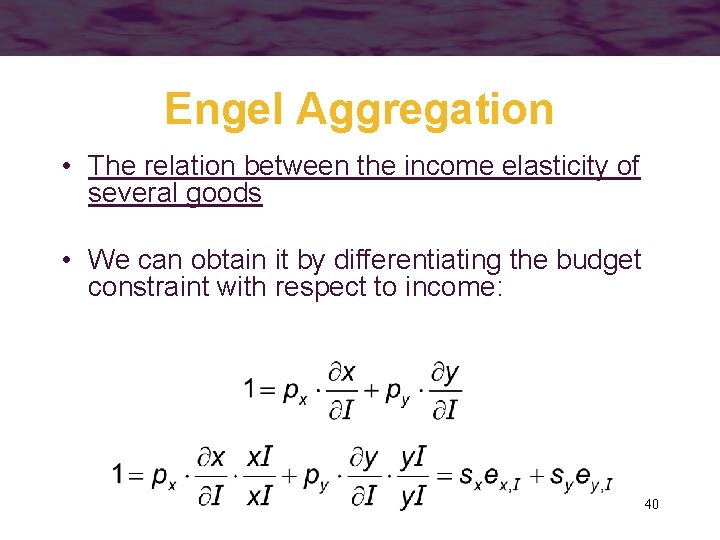

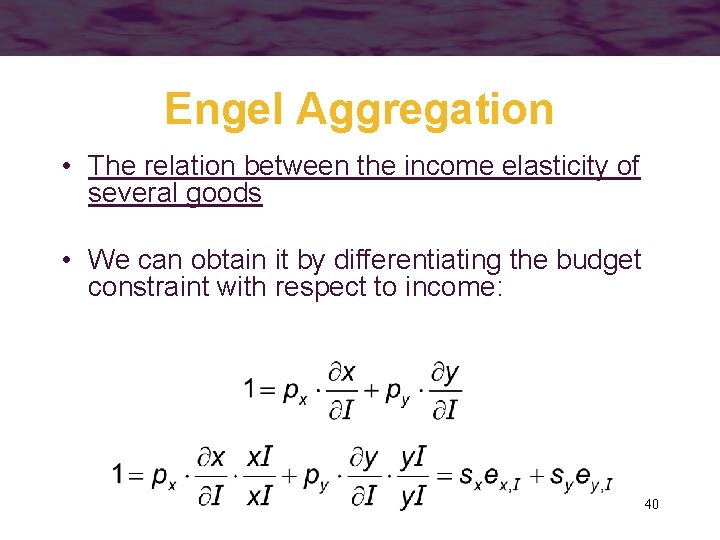

Engel Aggregation • The relation between the income elasticity of several goods • We can obtain it by differentiating the budget constraint with respect to income: 40

Engel Aggregation • This relation is useful because it might be easier to estimate the elasticities of some goods rather than others… 41

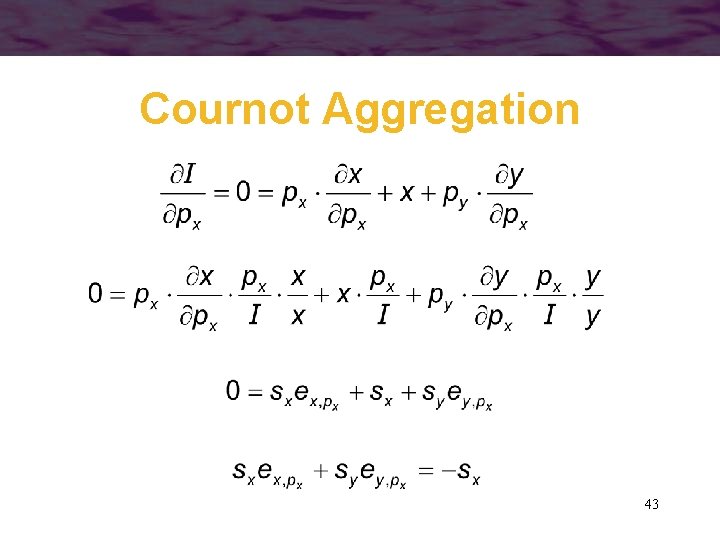

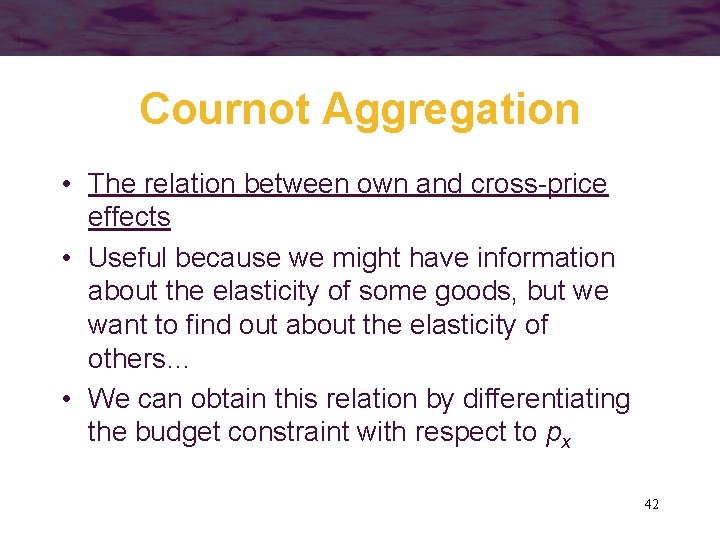

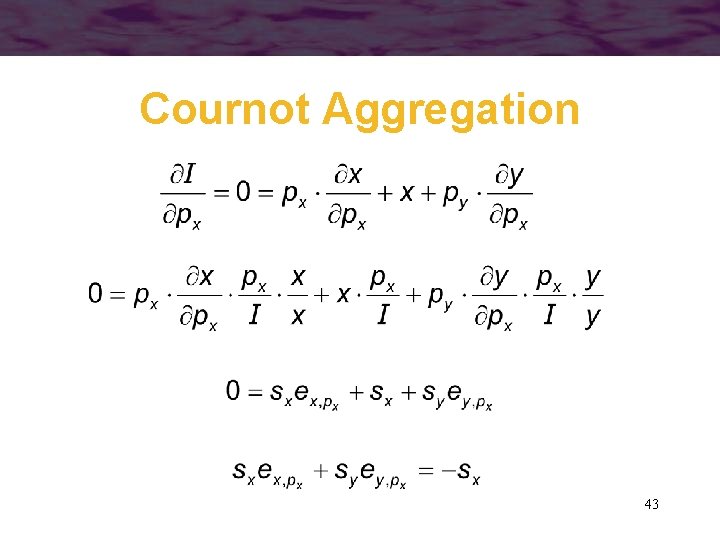

Cournot Aggregation • The relation between own and cross-price effects • Useful because we might have information about the elasticity of some goods, but we want to find out about the elasticity of others… • We can obtain this relation by differentiating the budget constraint with respect to px 42

Cournot Aggregation 43

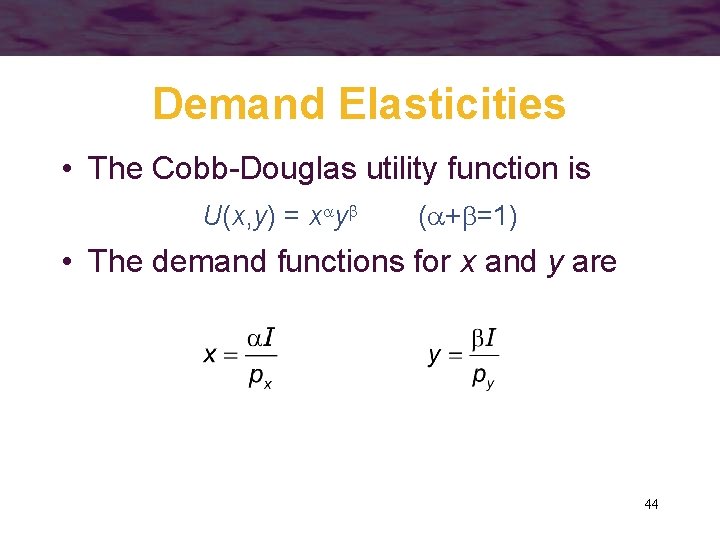

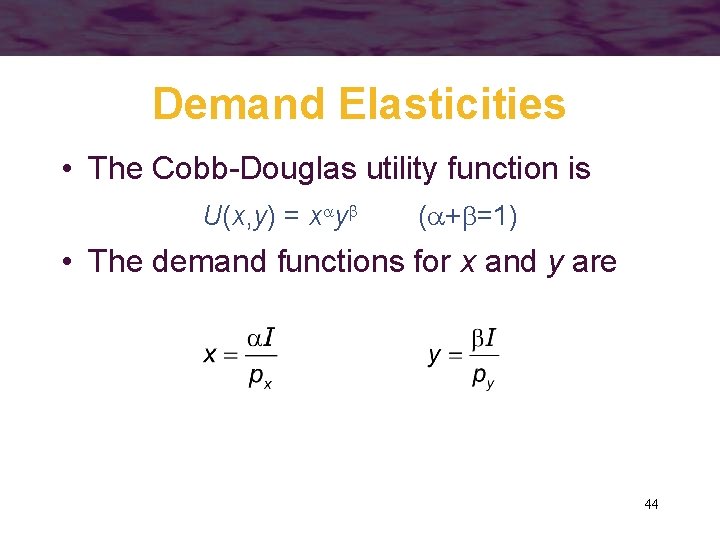

Demand Elasticities • The Cobb-Douglas utility function is U(x, y) = x y ( + =1) • The demand functions for x and y are 44

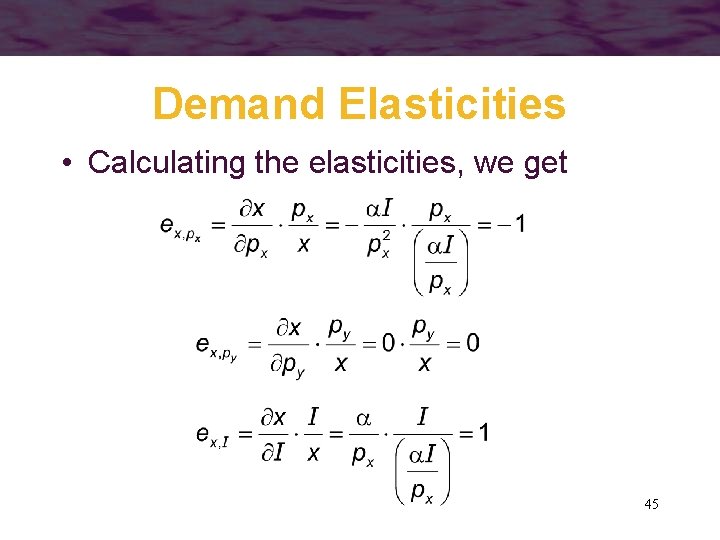

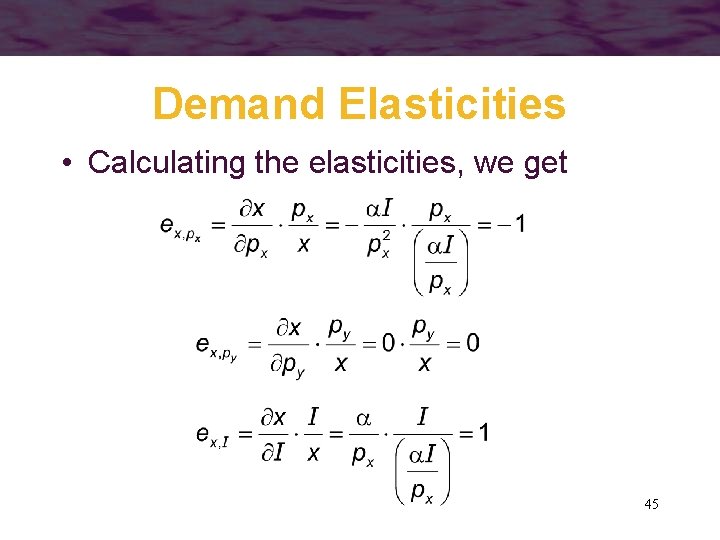

Demand Elasticities • Calculating the elasticities, we get 45

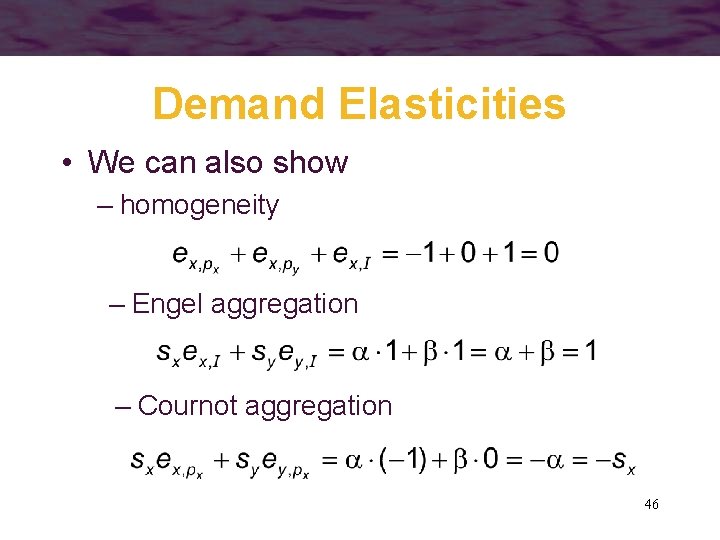

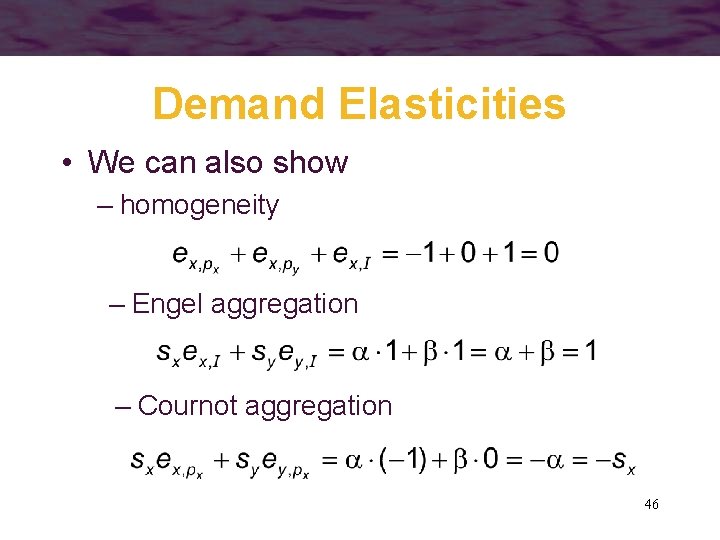

Demand Elasticities • We can also show – homogeneity – Engel aggregation – Cournot aggregation 46

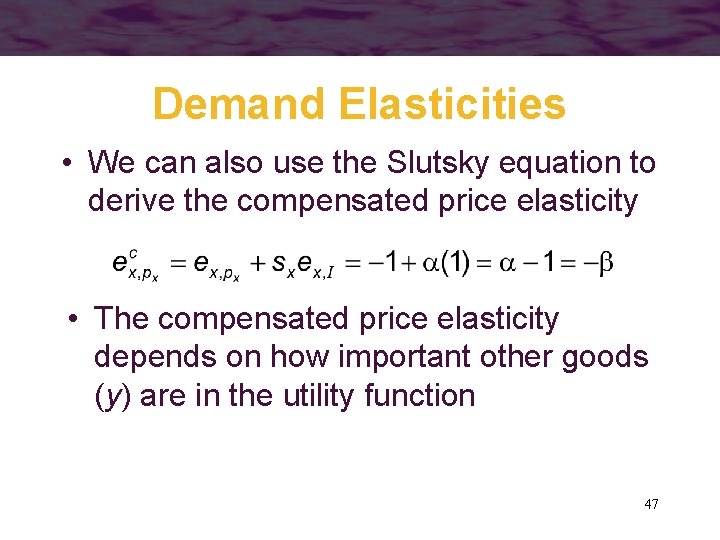

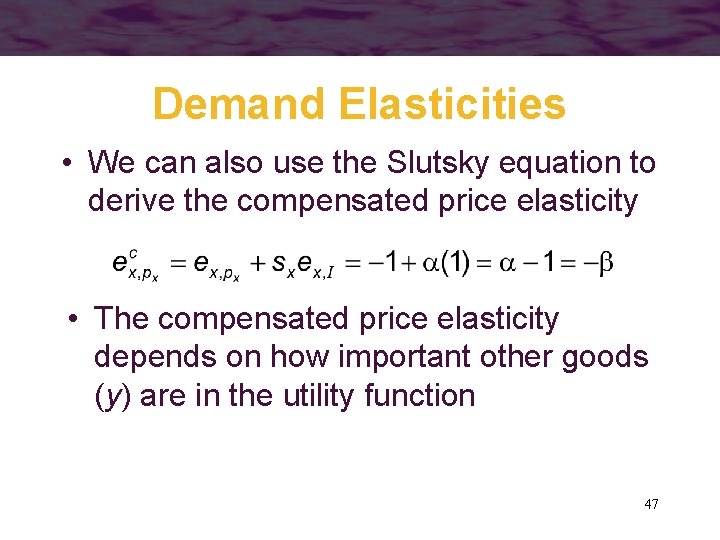

Demand Elasticities • We can also use the Slutsky equation to derive the compensated price elasticity • The compensated price elasticity depends on how important other goods (y) are in the utility function 47

Important Points to Note: • Proportional changes in all prices and income do not shift the individual’s budget constraint and therefore do not alter the quantities of goods chosen – demand functions are homogeneous of degree zero in all prices and income 48

Important Points to Note: • When purchasing power changes (income changes but prices remain the same), budget constraints shift – for normal goods, an increase in income means that more is purchased – for inferior goods, an increase in income means that less is purchased 49

Important Points to Note: • A fall in the price of a good causes substitution and income effects – for a normal good, both effects cause more of the good to be purchased – for inferior goods, substitution and income effects work in opposite directions • no unambiguous prediction is possible 50

Important Points to Note: • A rise in the price of a good also causes income and substitution effects – for normal goods, less will be demanded – for inferior goods, the net result is ambiguous 51

Important Points to Note: • The Marshallian demand curve summarizes the total quantity of a good demanded at each possible price – changes in price prompt movements along the curve – changes in income, prices of other goods, or preferences may cause the demand curve to shift 52

Important Points to Note: • Compensated demand curves illustrate movements along a given indifference curve for alternative prices – they are constructed by holding utility constant and exhibit only the substitution effects from a price change – their slope is unambiguously negative (or zero) 53

Important Points to Note: • Demand elasticities are often used in empirical work to summarize how individuals react to changes in prices and income – the most important is the price elasticity of demand • measures the proportionate change in quantity in response to a 1 percent change in price 54

Important Points to Note: • There are many relationships among demand elasticities – own-price elasticities determine how a price change affects total spending on a good – substitution and income effects can be summarized by the Slutsky equation – various aggregation results hold among elasticities 55

Important Points to Note: • Welfare effects of price changes can be measured by changing areas below either compensated or ordinary demand curves – such changes affect the size of the consumer surplus that individuals receive by being able to make market transactions 56

Important Points to Note: • The negativity of the substitution effect is one of the most basic findings of demand theory – this result can be shown using revealed preference theory and does not necessarily require assuming the existence of a utility function 57