Chapter 5 Cash or Liquid Asset Management Professor

- Slides: 40

Chapter 5 Cash or Liquid Asset Management Professor Payne, Finance 4100

Learning Objectives 1. Manage your cash and understand why you need liquid assets. 2. Automate your savings. 3. Choose from among the different types of financial institutions that provide cash management services. 4. Compare the various cash management alternatives. 2

Learning Objectives 4. Compare rates on the different liquid investment alternatives. 5. Establish and use a checking account. 6. Transfer funds electronically and understand how electronic funds transfers (EFTs) work. 3

Introduction Liquid assets are a necessity of personal financial management. Without liquid funds, you might have to compromise your long-term investments to cover unexpected expenses. You could ruin your financial plan if you don’t manage liquid funds effectively. 4

Managing Liquid Assets Cash management—the management of cash and near cash (liquid) assets. Making choices from among alternatives, maintaining and managing the results of those choices. Liquid assets—cash and investments that can easily be converted into cash. Low risk and low return but the more cash your have, the more you’re tempted to spend. 5

Automating Savings: Pay Yourself First Have savings automatically deducted from your paycheck—pay yourself first. Automatic savings are not in liquid reservoir therefore less likely to spend that money. The earlier you start to save, the easier it is to achieve your goals—time value of money. 6

Financial Institutions “Banks” or Deposit-type financial institutions—Financial institutions that provide traditional checking and savings accounts Commercial banks, credit unions, savings banks, etc. 7

8

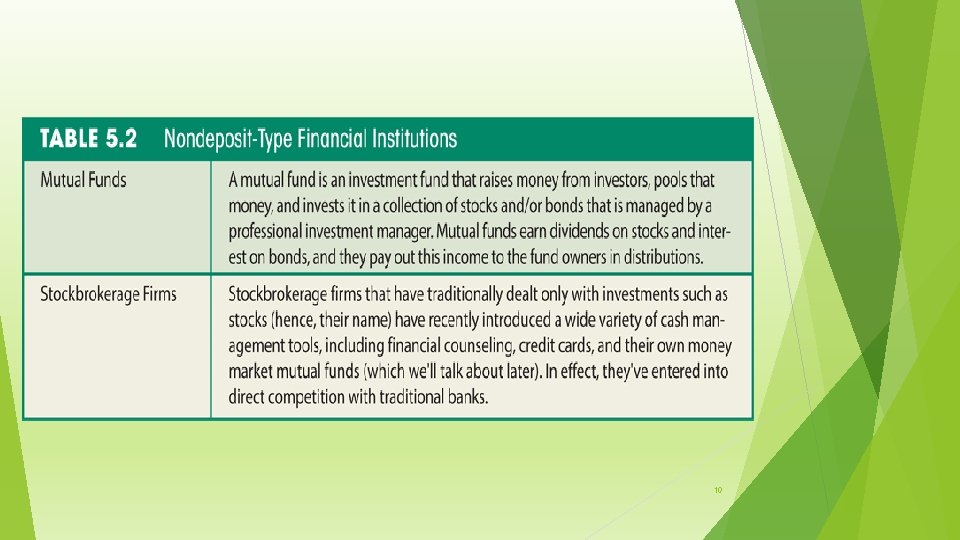

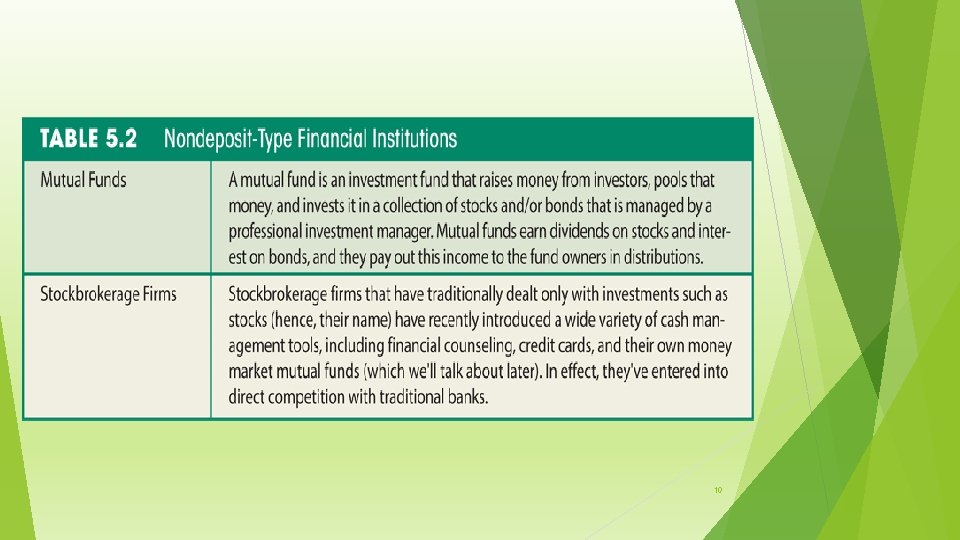

Financial Institutions Nondeposit-type financial institutions—mutual fund companies, brokerage firms, insurance companies offer similar services as those offered by banks. 9

10

Online Banking Access to your accounts to: check balances, transfer funds, paying bills, and view your financial information through the internet, a mobile phone, or other electronic device. Allows you to choose an internet-only bank. 11

12

What to Look For in a Financial Institution Which financial institution offers the kind of services you want and need? Is your investment safe? Is your investment insured? Is the financial institution sound? What are all the costs and returns associated with the services you want? Are there minimum deposit requirements or hidden fees? 13

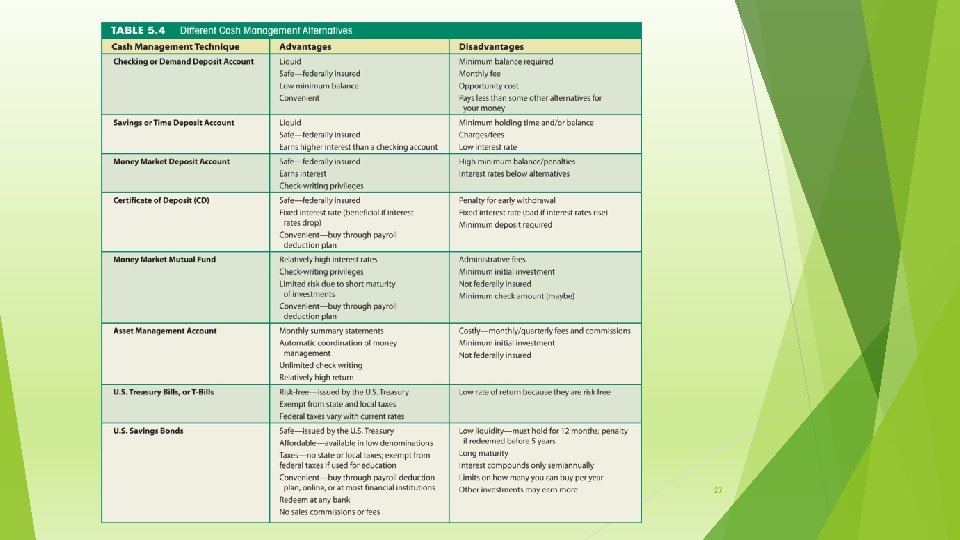

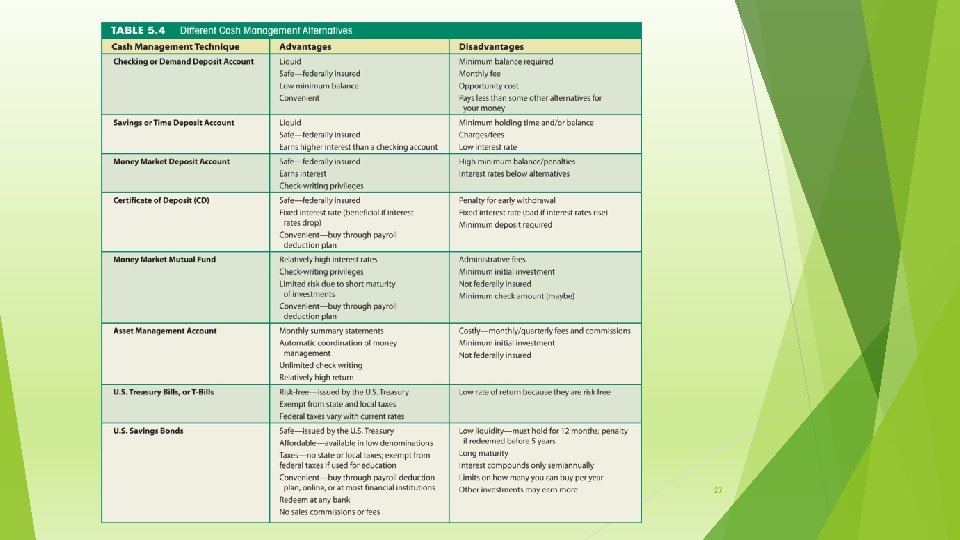

Cash Management Alternatives Checking Accounts Advantages: Liquid, Safe, Low minimum balance, Convenient Non-interest bearing—demand deposits Interest bearing—NOW accounts Disadvantages: minimum balance required, monthly fee, opportunity cost, interest less than alternatives 14

Cash Management Alternatives Savings Accounts Advantages: Liquid Safe—federally insured Earns higher interest than a Checking Account Disadvantages Minimum holding time Charges/fees Low interest rate inconvenient 15

Cash Management Alternatives Money Market Deposit Account (MMDA) —alternative to savings account, variable interest rates, check and ATM access. Advantages: Safe, Earns interest, Check writing privileges Disadvantages: High minimum balances/penalties, interest rates below alternatives 16

Cash Management Alternatives Certificates of Deposit (CD)—pays a fixed rate of interest while funds are on deposit for a period of time (30 days to years). Advantages: Safe, fixed interest rate, convenient. Disadvantages: Early withdrawal penalty, fixed interest rate, minimum deposit required. 17

Cash Management Alternatives Money Market Mutual Funds (MMMF’s)—investors receive interest on a pool of investments less an administrative (usually less than 1% of total investment) Advantages: High interest rates, check writing, limited risk, convenient. Disadvantages: Administrative fees, minimum initial investment, not insured, minimum checks. 18

Cash Management Alternatives Asset Management Account—a comprehensive financial services package (checking account, credit card, MMFs, etc. ) offered by a brokerage firm. Advantages: Monthly statements, coordination of money management, checks, high return, convenient. Disadvantages: Costly, minimum initial investment, not insured. 19

Cash Management Alternatives U. S. Treasury bills, or T-bills—short-term debt issued by the federal government with maturities from 3 -12 months. Advantages: Risk-free, exempt from state and local taxes, federal tax vary with current rates Disadvantages: Low rate of return 20

Cash Management Alternatives U. S. Savings Bonds—Series EE and I bonds are safe, low risk savings products issued by the Treasury with low denominations. Advantages: Safe, affordable, no taxes, convenient, redeem at any bank, no commissions or fees. Disadvantages: Low liquidity, long maturity, semi-annual compounding. 21

Comparing Cash Management Alternatives Comparable Interest Rates—use the annual percentage yield (APY) to easily compare. Tax Considerations—taxes affect the real rate of return on investments. Safety—some deposits are federally insured FDIC deposits at commercial banks NCUA deposits at credit unions MMMF—not insured but diversified 22

23

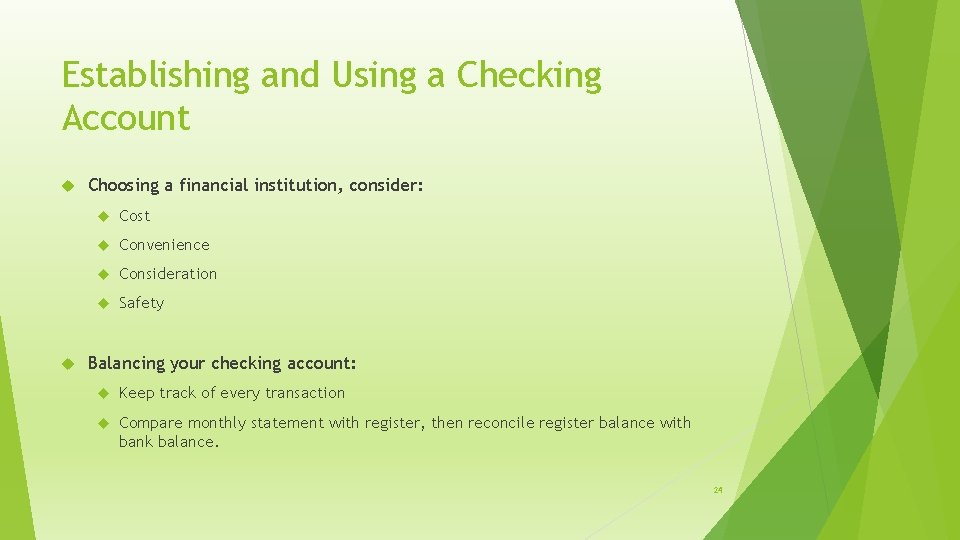

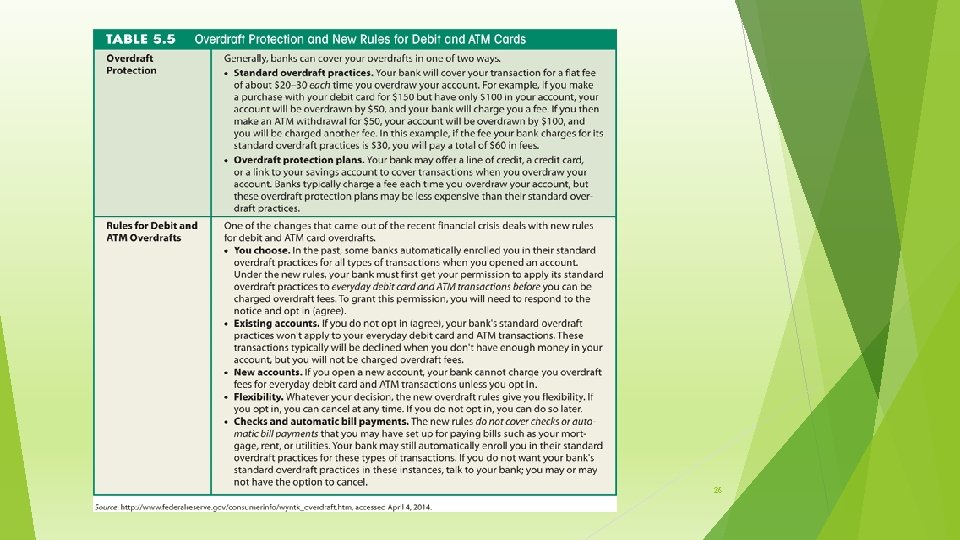

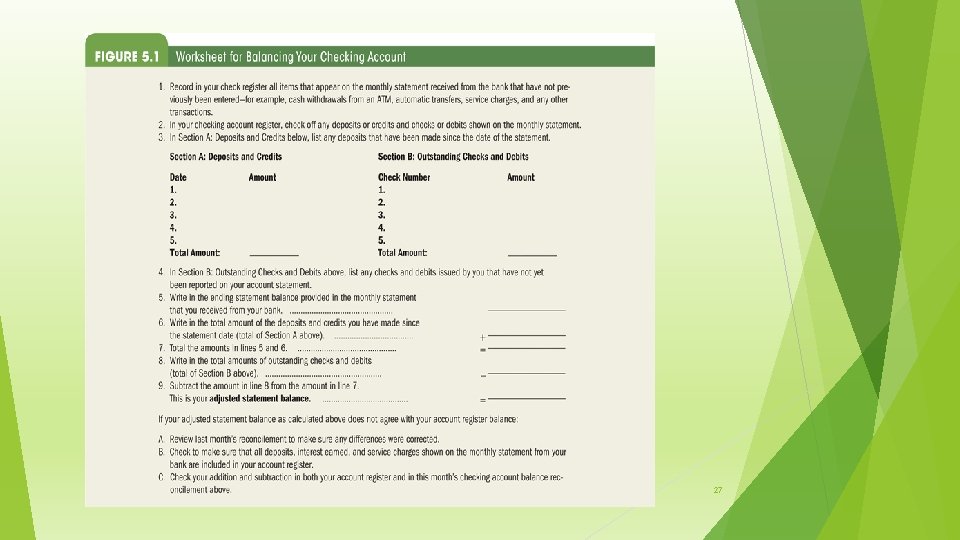

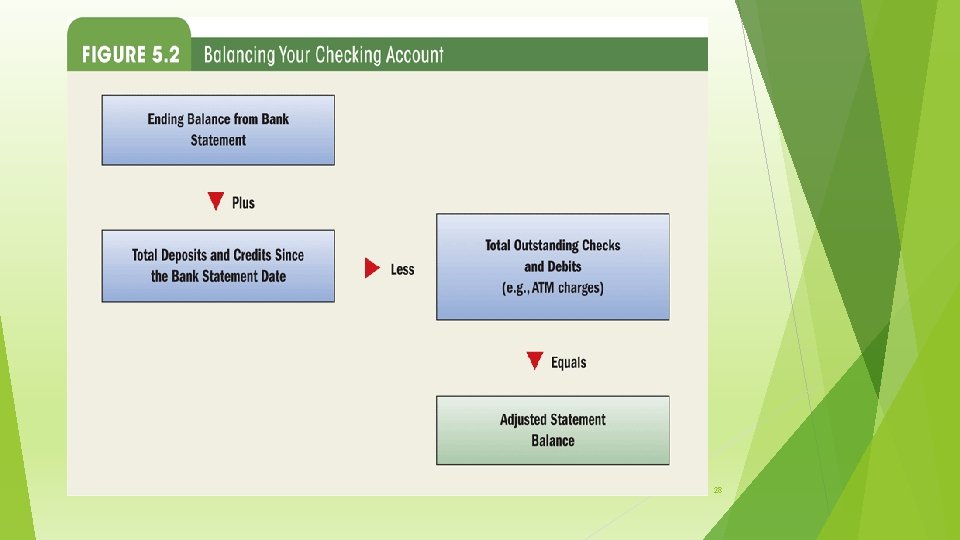

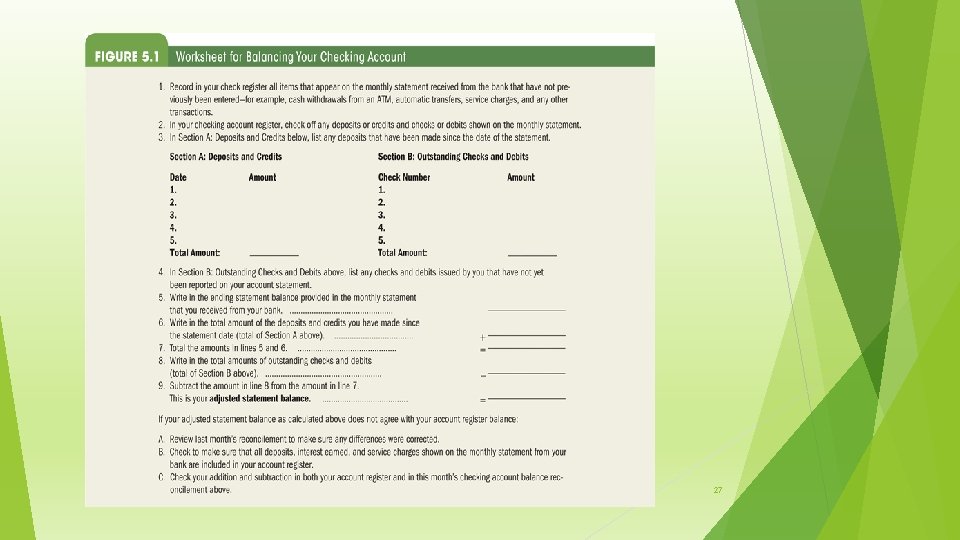

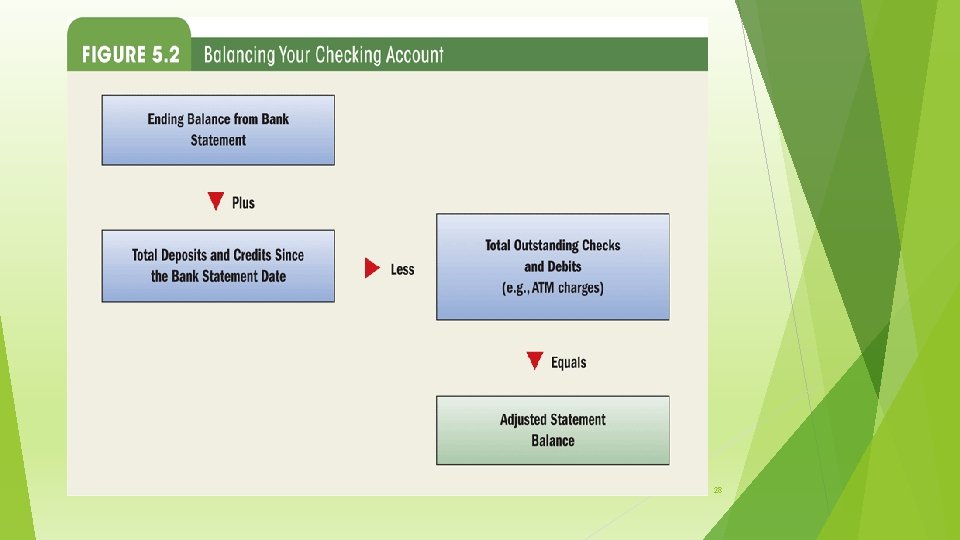

Establishing and Using a Checking Account Choosing a financial institution, consider: Cost Convenience Consideration Safety Balancing your checking account: Keep track of every transaction Compare monthly statement with register, then reconcile register balance with bank balance. 24

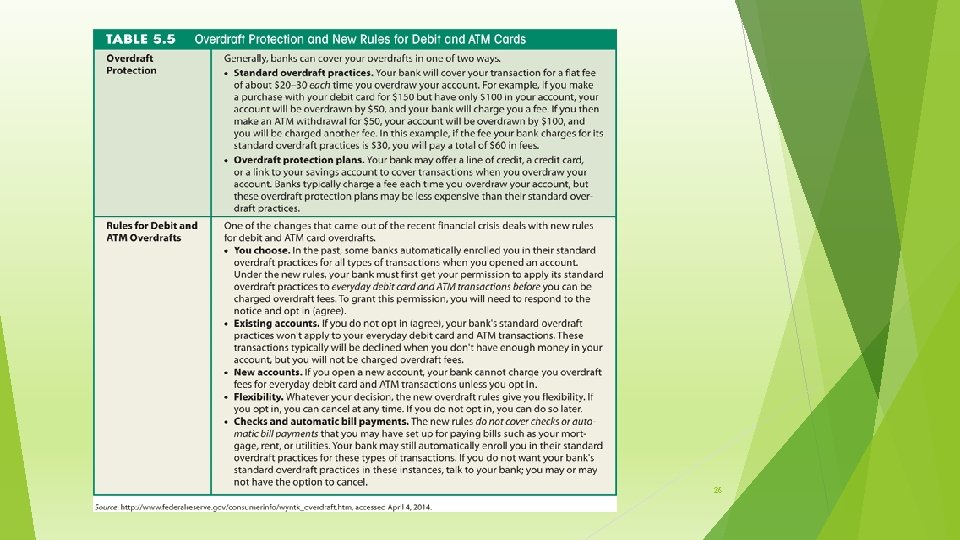

25

26

27

28

Other Types of Checks Cashier’s Check Certified Check Money Order Traveler’s Checks 29

Electronic Funds Transfer (EFT) Any financial transaction that takes place electronically. Advantages: Transactions take place immediately Don’t have to carry cash or write a check Pay all kinds of bills 30

Electronic Funds Transfer Examples: ATM transactions Debit card transactions Smart cards Stored Value Cards 31

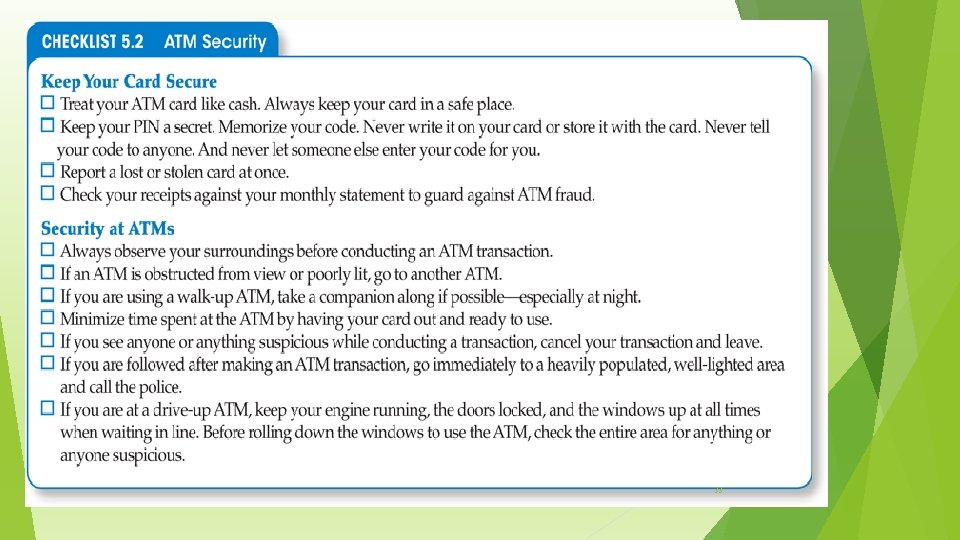

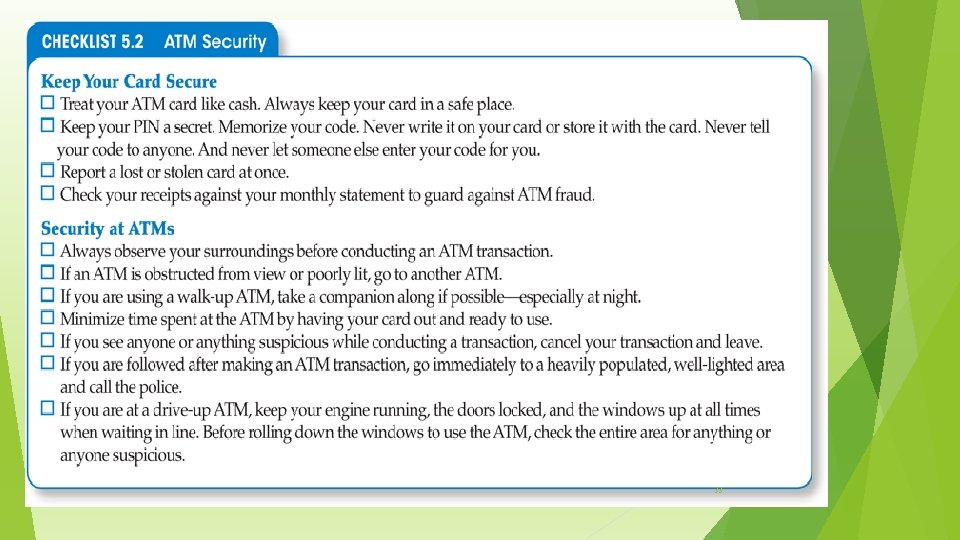

Automated Teller Machines Provide cash instantly and accessed through a credit or debit card Convenient but can be costly Banks charge access fee. Using ATM not owned by your bank can cost several dollars Attract crime 32

33

Debit Cards Allow you access to money in your accounts electronically. Looks like a credit card but acts like a checking account. ATM card is type of debit card but with access to savings accounts. Check card blocking policies. 34

Smart Cards Funds are transferred into cards which are used like debit cards, but withdraw from an account that’s actually stored magnetically on the card. Perform the same services as a debit or credit card. Allocated funds can run out. Some have issuer-limited usage. 35

Prepaid Debit or Gift Cards Two main types: Single purpose or “closed-loop” cards which can be used at only one store. Multi-purpose or “open-loop” cards which can be used just like a credit card and can be reloaded. Many have activation fees, maintenance fees, and ATM transaction fees. 36

Fixing Mistakes—Theirs, Not Yours Human and computer errors. Avoid human errors such as those involved with deposits at ATMs. Report immediately. Call or write the bank. By law, write within 60 days of receiving your statement. 37

Summary Cash management is balancing the risk of not having enough in liquid assets with the potential for greater return on other investments. Automatically save some of your income and learn to live on take-home income. Choose cash management alternatives from among deposit-type and nondeposit-type institutions. 38

Summary Compare various cash management alternatives. Compare their rates, return, and safety. With checking accounts look into cost, convenience, consideration, and safety. Electronic funds transfer transactions occur immediately and avoid use of cash or check. 39

End of Chapter 5 Slides 40