Chapter 5 A conceptual framework for financial accounting

- Slides: 111

Chapter 5 A conceptual framework for financial accounting and reporting

Conceptual framework • A conceptual framework is a formal set of interrelated concepts specifying the function, scope and purpose of financial accounting and reporting • In Australia, the SACs represent the conceptual framework or constitution for financial reporting

Conceptual framework (cont’d) • A conceptual framework can be descriptive, prescriptive or a mixture of both: – a descriptive framework attempts to develop a set of interrelated concepts, which serves to codify and explain existing financial reporting practices – a prescriptive framework attempts to develop a conceptual basis for what financial accounting practices should be

History of the conceptual framework • The need for a conceptual framework was recognised in the USA after the stock market crash of 1929 • Leaders of the profession recognised the need to: – establish basic principles on which to base company reporting – correct permissive accounting practices of the 1920 s – restore public confidence in professional accountants

The Committee on Accounting Procedure (CAP) • The first standard-setting body, which was established by the American Institute of Accountants in 1936 • The CAP published bulletins that provided authoritative opinions or recommendations on preferred accounting practices • The CAP, however, failed to provide a conceptual framework

Discontent in the 1950 s Academic and professional opinion of the mid-1950 s stressed the inadequacies of company financial reporting: • The historical cost model, generally accepted in accounting practice at the time, was not being applied consistently, nor were its underlying principles well understood • A tradition was developing among academics that was against the whole principle of historic cost accounting

The Accounting Principles Board (APB) • The APB was established in the USA in 1959 to accelerate the development of a conceptual framework • The APB set itself the following tasks: – to establish basic postulates – to formulate a set of broad principles – to establish rules to guide the application of principles in specific situations – to base the entire program on research

APB Statement No. 4 • This statement was titled ‘Basic Concepts and Accounting Principles Underlying Financial Statements of Business Enterprises’ • Basically descriptive, it did not provide a conceptual framework, but influenced Australian attempts to formulate objectives of financial statements and to develop a conceptual framework

Objectives according to APB Statement No. 4 Paul Grady was commissioned by the APB in 1963 to develop a more descriptive framework, which was reflected in the objectives of APB Statement No. 4: 1. Particular objectives of financial statements are to present fairly, and in conformity with GAAP, financial position, results of operations and other changes in financial position

Objectives according to APB Statement No. 4 (cont’d) 2. The general objectives are: a. to provide reliable information about the economic resources and obligations of a business enterprise in order to: i. evaluate its strengths and weaknesses ii. show its financing and investments iii. evaluate its ability to meet its commitments iv. show its resource base for growth

Objectives according to APB Statement No. 4 (cont’d) b. to provide reliable information about changes in net resources resulting from a business enterprise’s profit-directed activities in order to: i. show expected dividend return to investors ii. demonstrate the operation’s ability to pay creditors and suppliers, provide jobs for employees, pay taxes and generate funds for expansion iii. provide management with information for planning and control

Objectives according to APB Statement No. 4 (cont’d) c. to provide financial information that can be used to estimate the earnings potential of the firm d. to provide other necessary information about changes in economic resources and obligations e. to disclose other information relevant to statement users’ needs

Objectives according to APB Statement No. 4 (cont’d) 3. The qualitative objectives of financial accounting are: a. relevance b. understandability c. verifiability d. neutrality e. timeliness f. comparability g. completeness

Developments in Australia • The development of a conceptual framework in Australia followed a similar pattern to that in the USA • Australia was able to evaluate and adapt APB and FASB initiatives for Australian conditions

The conceptual framework in Australia • Australian academics such as Mathews and Grant, and Chambers, proposed abandoning the historical cost system in favour of some form of current cost accounting system • In response, the accounting profession commissioned John Kenley, director of the Accountancy Research Foundation (later the AARF) to adapt Paul Grady’s AICPA studies to Australian conditions • A largely prescriptive approach was adopted, which has been very influential to this day

Elements of the Australian strategy to develop a conceptual framework were stated by a previous AARF director as: 1. maximising the use of FASB thinking 2. influenced by the notion that the importance of a conceptual framework would not be oversold, but gradually unveiled 3. the first stage of development was to be the tentative identification of the building blocks of a workable framework

Elements of the Australian strategy (cont’d) 4. the second stage was to be the selection of certain building blocks to formalise specific projects 5. the third stage was to be the investigation of interrelationships between the building blocks and any consequential redefinition of those blocks 6. the fourth stage was to be the commissioning of projects for the remaining blocks 7. publication of the SACs would then commence

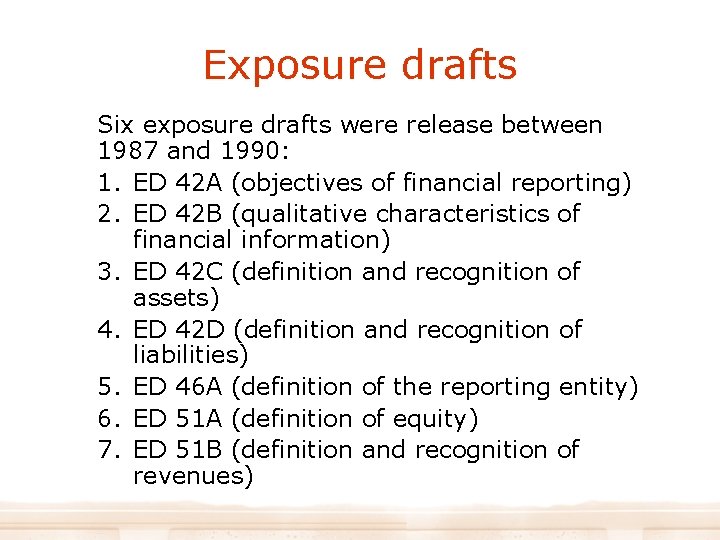

Exposure drafts Six exposure drafts were release between 1987 and 1990: 1. ED 42 A (objectives of financial reporting) 2. ED 42 B (qualitative characteristics of financial information) 3. ED 42 C (definition and recognition of assets) 4. ED 42 D (definition and recognition of liabilities) 5. ED 46 A (definition of the reporting entity) 6. ED 51 A (definition of equity) 7. ED 51 B (definition and recognition of revenues)

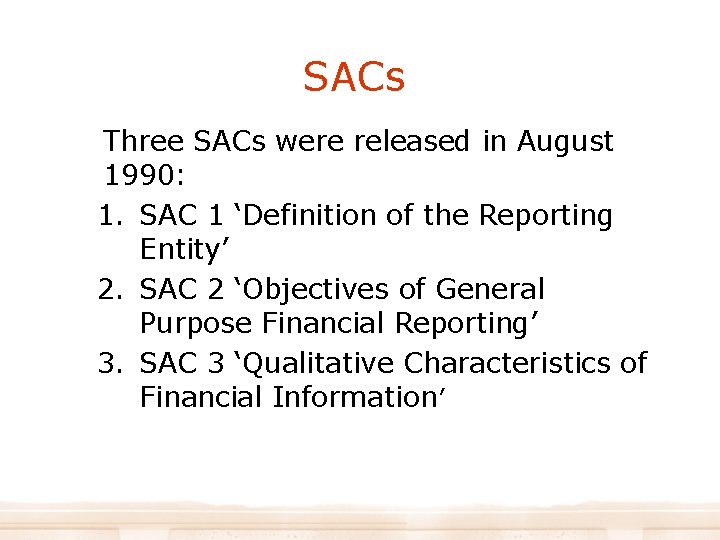

SACs Three SACs were released in August 1990: 1. SAC 1 ‘Definition of the Reporting Entity’ 2. SAC 2 ‘Objectives of General Purpose Financial Reporting’ 3. SAC 3 ‘Qualitative Characteristics of Financial Information’

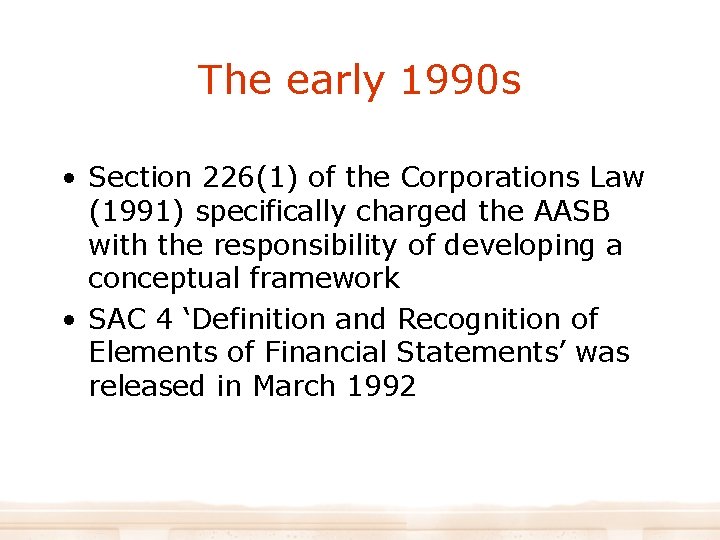

The early 1990 s • Section 226(1) of the Corporations Law (1991) specifically charged the AASB with the responsibility of developing a conceptual framework • SAC 4 ‘Definition and Recognition of Elements of Financial Statements’ was released in March 1992

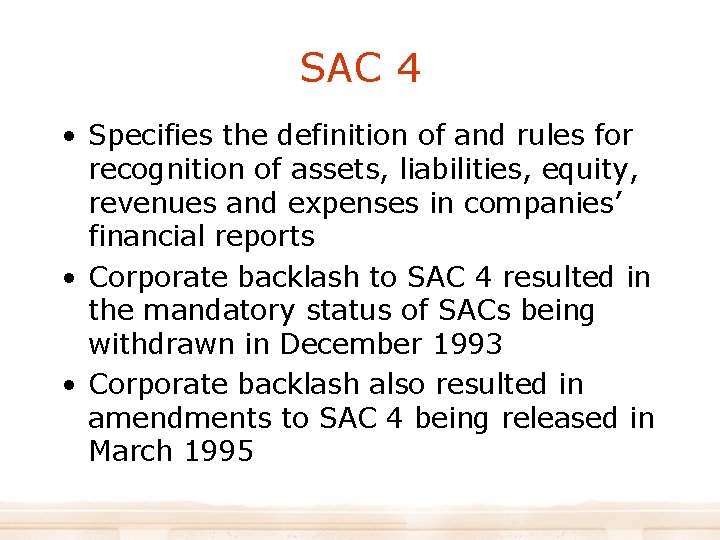

SAC 4 • Specifies the definition of and rules for recognition of assets, liabilities, equity, revenues and expenses in companies’ financial reports • Corporate backlash to SAC 4 resulted in the mandatory status of SACs being withdrawn in December 1993 • Corporate backlash also resulted in amendments to SAC 4 being released in March 1995

The need for a conceptual framework According to standard setters, the following situations demonstrate the need for a conceptual framework: • Two or more methods of accounting are accepted for the same facts • Less-conservative accounting methods are used rather than earlier, more conservative methods • Reserves are used to artificially smooth earnings fluctuations • Financial statements fail to warn of impending liquidity crunches

The need for a conceptual framework (cont’d) • Deferrals are followed by ‘big bath’ writeoffs • There is unadjusted optimism in estimates of recoverability • Off balance-sheet financing is common • An unwarranted assertion of immateriality has been used to justify non-disclosure of unfavourable information or departures from standards • Form is relevant over substance

FASB definition ‘A conceptual framework is a constitution, a coherent system of interrelated objectives and fundamentals that can lead to consistent standards and that prescribes the nature, function and limits of financial accounting and financial statements. The objectives identify the goals and the purposes of accounting. The fundamentals are the underlying concepts of accounting – concepts that guide the selection of events to be accounted for, the measurement of those events and the means of summarizing and communicating to interested parties. Concepts of that type are fundamental in the sense that other concepts flow from them and repeated references to them will be necessary in establishing, interpreting and applying accounting and reporting standards. ’

Description of a conceptual framework • A conceptual framework is therefore intended to act as a constitution for the standard-setting process • The AARF described the conceptual framework in similar terms, as: – ‘a set of inter-related concepts which will define the nature, subject, purpose and broad content of financial reporting. It will be an explicit rendition of the thinking which is governing the decisionmaking of (standard-setters)’

Advantages of a conceptual framework • A conceptual framework is useful in the development of more consistent and logical standards and in removing the necessity to re-debate conceptual issues when preparing new accounting standards • The issue of standards overload can be potentially reduced because a conceptual framework can enable resolution of particular accounting problems, which avoids the necessity of issuing new accounting standards

Advantages of a conceptual framework (cont’d) • Can lead to better communication among accountants, auditors and users because all parties are using a common set of definitions and criteria • Has potential to reduce the activities and influence of lobbies and interest groups

Potential benefits according to the AARF According to the AARF’s Guide to Proposed Statements of Accounting Concepts, the potential benefits are: ‘a. reporting requirements should be more consistent and logical, because they will stem from an orderly set of concepts ‘b. avoidance of reporting requirements will be much more difficult because of the existence of all-embracing provisions

Potential benefits according to the AARF (cont’d) ‘c. the Boards which set down the requirements will be more accountable for their actions in that the thinking behind specific requirements will be more explicit, as will any compromises that may be included in particular accounting standards ‘d. the need for specific accounting standards will be reduced to those circumstances in which the appropriate application of concepts is

Potential benefits according to the AARF (cont’d) not clear-cut, thus mitigating the risks of over-regulation ‘e. preparers and auditors should be able to better understand the financial reporting requirements they face ‘f. the setting of requirements should be more economical because issues should not need to be re-debated from differing viewpoints’

Strategic objectives for a conceptual framework • The literature indicates that conceptual-framework projects have been developed as an instrument for the accounting profession’s self-preservation • One test used by Hines to determine whether conceptual frameworks could be viewed as strategic manoeuvres was to ascertain whether these projects were undertaken at times of threat to accountancy’s legitimacy or at times of competition • Hines concluded that ‘the major rationale for undertaking conceptual frameworks was not functional or technical, it was a strategic manoeuvre for providing legitimacy to standardsetting bodies …’

Conflicts of interest • Financial statements result from the interaction of three groups: – firms, which by their operational, functional and extraordinary activities, justify the production of financial statements – users, which include investors, financial analysts, bankers, creditors, consumers, employees, suppliers and government agencies – the accounting profession, which acts principally as ‘auditor’ in charge of verifying that financial statements conform to generally accepted accounting principles

Cyert and Ijiri’s three approaches • Simply stated, these are: 1. the firm-oriented approach 2. the profession-oriented approach 3. the user-oriented approach • The user-oriented approach is employed by the SACs in Australia, by the FASB in the USA and by The Corporate Report in the UK

Conceptual framework issues • In the process of developing a conceptual framework, the AARF and its Boards have had to resolve several fundamental conceptual issues • These issues have determined the nature and content of SACs

Issue 1: Balance sheet versus profit and loss account orientation There are two distinct approaches to determining an entity’s income during a reporting period: • the asset/liability view, which maintains that revenues and expenses result only from changes in the value of assets and liabilities • the revenue/expense view, which holds that revenues and expenses result from the need for a proper matching

Criticisms of the asset/liability view • It excludes debit and credit items because they do not constitute economic benefits or resources to the entity • It is unwilling, therefore, to recognise as revenues and expenses anything except current changes in economic resources and obligations to transfer resources, making it incapable of dealing with the complexities of the modern business world

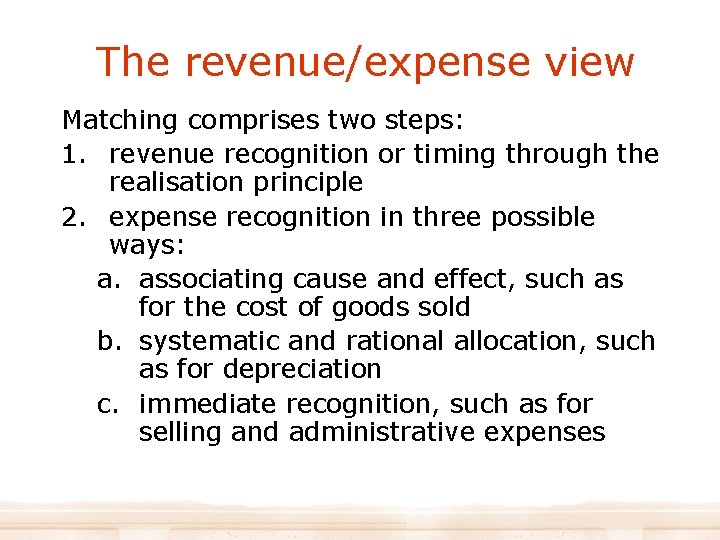

The revenue/expense view Matching comprises two steps: 1. revenue recognition or timing through the realisation principle 2. expense recognition in three possible ways: a. associating cause and effect, such as for the cost of goods sold b. systematic and rational allocation, such as for depreciation c. immediate recognition, such as for selling and administrative expenses

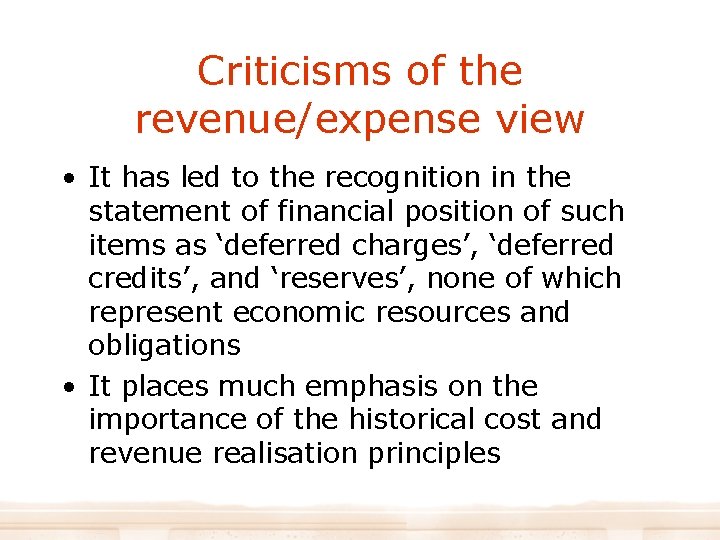

Criticisms of the revenue/expense view • It has led to the recognition in the statement of financial position of such items as ‘deferred charges’, ‘deferred credits’, and ‘reserves’, none of which represent economic resources and obligations • It places much emphasis on the importance of the historical cost and revenue realisation principles

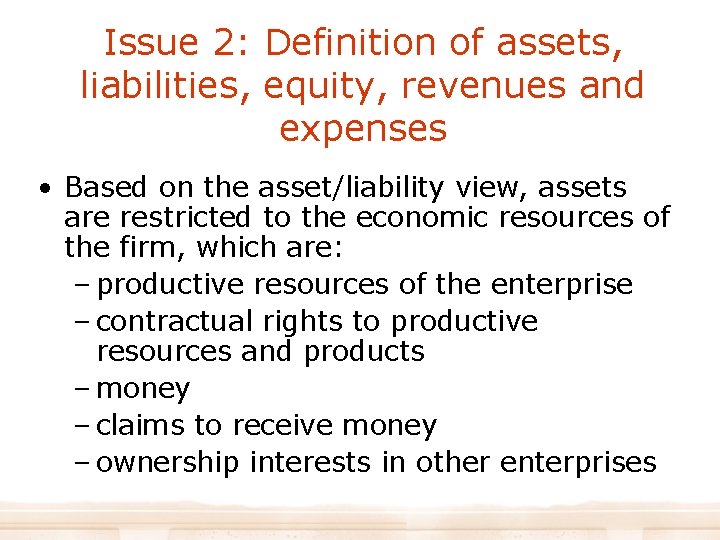

Issue 2: Definition of assets, liabilities, equity, revenues and expenses • Based on the asset/liability view, assets are restricted to the economic resources of the firm, which are: – productive resources of the enterprise – contractual rights to productive resources and products – money – claims to receive money – ownership interests in other enterprises

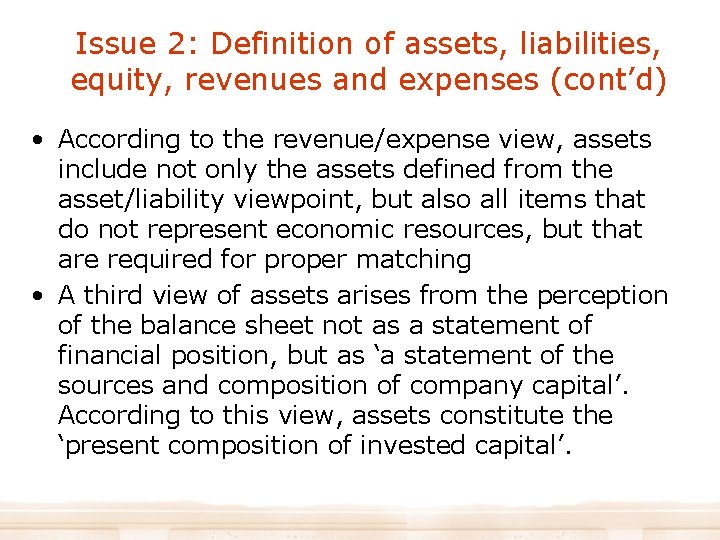

Issue 2: Definition of assets, liabilities, equity, revenues and expenses (cont’d) • According to the revenue/expense view, assets include not only the assets defined from the asset/liability viewpoint, but also all items that do not represent economic resources, but that are required for proper matching • A third view of assets arises from the perception of the balance sheet not as a statement of financial position, but as ‘a statement of the sources and composition of company capital’. According to this view, assets constitute the ‘present composition of invested capital’.

Issue 2: Definition of assets, liabilities, equity, revenues and expenses (cont’d) • If we exclude the element of ‘deferred charges’ on the statement of financial position, the definitions of assets presented in these three different views have the following characteristics in common: 1. An asset represents potential cash flow to a firm 2. Potential benefits are obtainable by the firm

Issue 2: Definition of assets, liabilities, equity, revenues and expenses (cont’d) 3. The legal concept of property may affect the accounting definition of assets 4. The way an asset is acquired may be part of the definitions 5. Exchangeability may be an essential characteristic of assets

Definitions to take into account for a conceptual framework 1. An asset represents only economic resources and does not include ‘deferred charges’ 2. An asset represents potential cash flows to a firm 3. Potential benefits are obtainable by the firm 4. An asset represents the legal binding right to a particular benefit, results from a past or current transaction, and includes all commitments, as in wholly executory contracts 5. Exchangeability is not an essential characteristic of assets except for ‘deferred charges’

Definitions of liabilities • According to the asset/liability view, liabilities are the obligations of the firm to transfer economic resources to other entities in the future • According to the revenue/expense view, liabilities comprise not only the liabilities defined from the asset/liability viewpoint but also certain deferred credits and reserves that do not represent obligations to transfer economic benefits but that are required for proper matching and income determination

Definitions of liabilities (cont’d) • A third view arises from the perception of the balance sheet as ‘a statement of the sources and composition of company capital’: – according to this view, liabilities constitute sources of capital and include certain deferred credits and reserves that do not represent obligations to transfer economic resources

Definitions of liabilities (cont’d) • If we disregard the element of ‘deferred credits’, the definitions of liabilities presented in these three different views have the following characteristics in common: 1. A liability is a future sacrifice of economic resources 2. A liability represents an obligation of a particular enterprise 3. A liability may be restricted to legal debt 4. A liability results from past or current transactions or events

Definitions of income • According to the asset/liability view, income is the net assets of the firm except for ‘capital’ changes • According to the revenue/expense view, income results from the matching of revenues and expenses and, perhaps, from gains and losses: – gains and losses, therefore, may be distinguished from the revenues and expenses, or they may be considered part of these

Revenues and expenses • According to the asset/liability view, revenues are defined as increases in the assets or decreases in the liabilities that do not affect capital • Expenses are defined as decreases in the assets or increases in the liabilities arising from the use of economic resources or services during a given period

Revenues and expenses (cont’d) • According to the revenue/expense view, revenues result from the sale of goods and services and include gains from the sale and exchange of assets other than inventories, interests and dividends earned on investments, and other increases in owners’ equity during a period other than capital contributions and adjustments • Expenses comprise all of the expired costs that correspond to the revenues of the period. If gains and losses are defined as a separate element of income, however, revenues are defined as measures of an entity’s outputs that result from the production or delivery of goods and the rendering of services during a period

Gains and losses • According to the asset/liability view, gains are defined as increases in net assets other than increases from revenues or from changes in capital • Losses are defined as decreases in net assets other than decreases from expenses or from changes in capital • Thus, gains and losses constitute that part of income not explained by revenues and expenses

Gains and losses (cont’d) • According to the revenue/expense view, gains are defined as the excess of proceeds over the cost of assets sold, or as windfalls and other benefits obtained at no cost or sacrifice • Losses are defined as the excess over the related proceeds, if any, of all or an appropriate portion of the costs of assets sold, abandoned, or wholly or partially destroyed by casualty, or as costs that expire without producing revenues

Relationships between income and components of income Three major relationships exist between income and the components of income: 1. Income = Revenues – Expenses + Gains – Losses 2. Income = Revenues – Expenses 3. Income = Revenues (including gains) – Expenses (including losses)

Income relationships (cont’d) • In 1. , each component is separate and essential to a definition of income • In 2. , gains and losses are not separate and are not essential to the definition of income. All increases and decreases are treated similarly as either revenues or expenses • In 3. , although gains and losses are separate concepts, they are part of revenues and expenses

Accrual accounting • Accrual accounting measures the effects of transactions having cash consequences for an entity as they are incurred, not simply as cash is received or paid – they are recorded in accounting records, and reported in the financial statements of the reporting period to which they relate • Accrual accounting rests on the concepts of accrual, deferral, allocation, amortisation, realisation and recognition

FASB definitions ‘Accrual is the accounting process of recognizing non-cash events and circumstances as they occur; specifically, accrual entails recognizing revenues and related increases in assets and expenses and related increases in liabilities for amounts expected to be received or paid, usually in cash, in the future. . . ‘Deferral is the accounting process of recognizing a liability for a current cash receipt or an asset for a current cash payment (or current incurrence of a liability) with an expected future impact on revenues and expenses. . .

FASB definitions (cont’d) ‘Allocation is the accounting process of assigning or distributing an amount according to a plan or a formula. It is a broader term than “amortisation”; that is, amortisation is an allocation process. . . ‘Amortisation is the accounting process of systematically reducing an amount by periodic payments, or write-downs. . . ‘Realisation is the process of converting noncash resources and rights into money; it is most precisely used in accounting and financial reporting to refer to sales of assets for cash or claims of cash. The related terms, “realised”

FASB definitions (cont’d) and “unrealised”, therefore identify revenues or gains and losses on assets sold and unsold, respectively. . . ‘Recognition is the process of formally recording or incorporating an item in the accounts and financial statements of an enterprise. Thus, an element may be recognized (recorded) or unrecognized (unrecorded). “Realisation” and “recognition” are not used synonymously, as they sometimes are in the accounting and financial literature’

Issue 3: Concepts of capital maintenance • The concept of capital maintenance allows us to make a distinction between the return on capital, or income, and the return of capital, or cost recovery • There are four possible concepts of capital maintenance: 1. financial capital measured in units of money 2. financial capital measured in units of the same general purchasing power

Issue 3: Concepts of capital maintenance (cont’d) 3. physical capital measured in units of money 4. physical capital measured in units of the same general purchasing power

Issue 4: Which measurement method should be adopted? • The issue of measurement concerns determination of both the unit of measure and the attribute to be measured • For unit of measure, the choice is between actual dollars and general purchasing power adjusted dollars • For the particular attribute, there are five options (see next slide)

Measurement options The five options for measurement of a particular attribute are as follows: 1. historical cost method 2. current cost 3. current exit value 4. expected exit value 5. present value of expected cash flows

Issue 5: Applicability of the conceptual framework to the public sector • Australian standard setters have not maintained a strong distinction between the private sector, the public sector and not-for-profit entities • Standard setters in the USA have tended to maintain greater distinctions between profit-seeking and not-for-profit entities • In Australia, comprehensive accrual accounting has been progressively introduced into the public sector

AAS 29 ‘Financial Reporting by Government Departments’ According to AAS 29, government departments would have the following similarities to private-sector entities: 1. similarities in the economic environment 2. similarities in user needs for information 3. similarities in the objectives of the financial statements

SAC 2: Definition of financial reporting • There is no generally accepted definition of general purpose financial reporting, but SAC 2 provides an indication that its scope may extend beyond financial information: ‘Financial reporting encompasses the provision of financial statements and related financial and other information’ (paragraph 10) • Paragraph 10 of SAC 2 also states that general purpose financial reports (GPFRs) include: ‘financial statements, notes, supplementary schedules and explanatory material intended to be read with the financial statements’

SAC 2: Definition of financial reporting (cont’d) • Other parts of paragraph 10 obscure the issue completely: ‘This Statement does not attempt to draw a clear distinction between financial reports and financial reporting, nor does it attempt to define the boundaries of general purpose financial reporting’ Hence, the scope of financial reporting can be potentially very broad

What criteria should be used? A critical issue is what criteria should be used to determine which information will be included within the scope of financial reporting: 1. SAC 2 specifies that the overall objective of GPFRs is to provide relevant information for economic decision making by users 2. SAC 3 specifies the necessary characteristics that information should possess, and emphasises the importance of the relevance and reliability of information

Definition of a reporting entity SAC 1 defines a reporting entity as: ‘entities (including economic entities) in respect of which it is reasonable to expect the existence of users dependent on GPFRs for information which will be useful to them for making and evaluating decisions about the allocation of scarce resources’

Definition of a reporting entity (cont’d) Because the definition of a reporting entity is linked to the information needs of external users, the existence of a reporting entity will not depend on: 1. the sector within which the entity operates 2. the purpose for which the entity was created 3. the manner in which the entity is constituted

Determination of dependent external users SAC 1 provides three general guidelines to assist in determining the existence of dependent external users: 1. separation of management from economic interests 2. economic or political importance/influence 3. financial characteristics

Objective of general purpose financial reporting SAC 2 states that: ‘General purpose financial reports focuses [sic] on providing information to meet the common information needs of users who are unable to command the preparation of reports tailored to their particular information needs. These users must rely on the information communicated to them by the reporting entity’

Objective of general purpose financial reporting (cont’d) • Because efficient resource allocation is the ideal, SAC 2 states that the primary objective of GPFRs is to provide relevant information to various external users so that they can make and evaluate decisions about the allocation of scarce resources • SAC 2 also describes a secondary objective, which is to demonstrate the discharge of accountability

Types of users and information • SAC 2 describes three classes of user: 1. resource providers 2. recipients of goods and services 3. parties performing a review or oversight function • SAC 2 also defines the types of information these users need in order to make informed decisions: 1. performance 2. financial position 3. financing and investing 4. compliance

Qualitative characteristics of financial information Primary characteristics • Relevance is defined in SAC 3 to mean that quality of financial information which exists when information influences the decisions of users about the allocation of scarce resources • Reliability is defined as: ‘that quality of financial information which exists when the information can be depended upon to represent faithfully, and without bias or undue error, the transactions or events that it either purports to represent or could reasonably be expected to represent’

Qualitative characteristics of financial information (cont’d) Secondary and interactive qualities • Comparability is defined in SAC 3 as: ‘that quality of financial information which exists when users of that information are able to evaluate similarities in and differences between, the nature and effects of transactions and events, at one time and over time, either when assessing aspects of a single reporting entity or a number of reporting entities’ • Understandability means that quality of financial information which exists when users of that information are able to comprehend its meaning

Qualitative characteristics of financial information (cont’d) Constraints on relevance • Timeliness: SAC 3 cautions that information will lose its relevance if there is a delay in the reporting of that information • Costs versus benefits: Financial information will be sought if the benefit to be derived from the information exceeds its cost

Qualitative characteristics of financial information (cont’d) Materiality • Materiality is defined in SAC 3 as: ‘the extent to which relevant and reliable information may be omitted, misstated or not disclosed separately without having the potential to adversely affect the decisions made about the allocation of scarce resources made by users’ • SAC 3 emphasises that consideration must be given to whether or not the information is likely to have a significant, or material, impact on decisions

Definition and recognition of assets • SAC 4 embraces the asset/liability viewpoint and defines assets as future economic benefits or controlled by the entity as a result of past transactions or other past events • SAC 4 further stipulates that an asset should only be recognised on the balance sheet when: – it is probable that the future economic benefits embodied in the asset will eventuate; and – the asset possesses a cost or other value that can be measured reliably

Definition and recognition of liabilities • SAC 4 defines liabilities as: ‘future sacrifices of economic benefits that the entity is presently obliged to make to other entities as a result of past transactions or other past events’ • SAC 4 further states that a liability should be recognised on the balance sheet when: – it is probable that the future sacrifice of economic benefits will be required; and – the amount of the liability can be measured reliably

Definition and recognition of equity • SAC 4 defines equity as a residual interest in the assets of the entity after the deduction of its liabilities • Because equity is defined as residual, the recognition of equity will be consequential to procedures used to recognise assets and liabilities

Definition and recognition of revenues • SAC 4 defines revenues as: ‘inflows or other enhancements, or savings in outflows, of future economic benefits in the form of increases in assets or reductions in liabilities of the entity, other than those relating to contributions by owners, that result in an increase in equity during the reporting period’ • A revenue should be recognised in the profit and loss account when: – it is probable that the revenue has occurred; and – the revenue can be measured reliably

Definition and recognition of expenses • SAC 4 defines an expense as: ‘consumptions or losses of future economic benefits in the form of reductions in assets or increases in liabilities of the entity, other than those relating to distributions to owners, that result in a decrease in equity during the reporting period’ • An expense should be recognised when: – it is probable that the expense has been incurred; and – the amount of the expense can be reliably measured

Measurement • SAC 4 does not explicitly deal with how assets and liabilities should be measured • The AARF now seems aware of the need to address publicly the critical issue of measurement in financial statements • In mid-1994, the AARF released a public Invitation to Comment on a ‘Proposed Program for the Development of Concepts on Measurement of the Elements of Financial Statements’

AARF Invitation to Comment The AARF Invitation to Comment recognised that measurement is one of the most significant contemporary issues in financial reporting because of: a. the frequently significant impact of measurement choices on reported results b. the existence of widely divergent views among practitioners, users and other parties about the relevance of historical cost accounting

AARF Invitation to Comment (cont’d) c. the widely divergent measurement practices under the present system of modified historical cost accounting in Australia d. the voluntary adoption of current market value measurements industries such as life insurance, banking and funds management e. the range of existing accounting standards that specify currentvalue accounting approaches

Display of financial information • This level of the conceptual framework considers in detail the nature of the information to be displayed in financial reports • This involves identifying the appropriate information groupings (financial position, performance, investing and financing, and compliance) and analysing the components of those groupings

Standard-setting policy and enforcement This lowest level of the conceptual framework considers policy issues, such as: • audit status • applicability and timing of financial reporting • policy enforcement

Corporate backlash • The only aspect of the Australian conceptual framework to attract significant corporate concern was SAC 4 • Many of the concerns were captured in a statement from a submission by Caltex Oil Australia: ‘(SAC 4) is a laudable aim but I contend it does not address commercial reality, or focus on that very important issue of the credibility of the accounting profession in Australia’

Specific corporate concerns with SAC 4 1. Balance sheet versus profit and loss account orientation 2. Definition of elements too prescriptive and uncertain. Accounting treatments that raised the most controversy were: a. contracts where agreements are equally and proportionately un-performed b. accounting for leases c. treatment of debt/equity items d. revaluation practices e. financial instruments

Specific corporate concerns with SAC 4 (cont’d) 3. Recognition criteria – the probability test 4. Inconsistency with existing accounting standards 5. Departure from international accounting standards and practices

The AARF’s backdown on SAC 4 • In late 1993, a Joint Standing Committee of the ASCPA and ICAA decided that SACs should no longer have mandatory status for members of the accounting profession • The AASB and PSASB decided to amend SAC 4 • An amended SAC 4 was released in March 1995

Substantive amendments to SAC 4 1. Removal of mandatory status and transitional provisions 2. Removal of an operative date 3. Removal of the detailed Appendix that provided guidance on the interpretation and application of SAC 4 concepts to a number of specific accounting transactions

Substantive amendments to SAC 4 (cont’d) 4. Changes to the commentary sections, including a tightening up in the classification of liabilities, greater discussion on the nature of reciprocal and non-reciprocal transfers and greater discussion on when an increase in asset value would constitute an item of revenue or an equity adjustment 5. Greater attention given to conventional accounting principles, such as matching and periodicity

Other concerns with SAC 4 A number of other concerns were not reflected in the changes made to SAC 4: • the Boards of the AARF decided against providing definitions for gains and losses that were separate from the general definition of revenues and expenses • the Boards maintained their policy on requiring recognition of agreements equally proportionately underperformed in the statement of financial position

Development of the US conceptual framework In 1971, The American Institute of Certified Practicing Accountants formed two study groups: 1. the ‘Wheat Committee’, which was a study group on the establishment of accounting principles, and which was charged with the task of improving the standard-setting process

Development of the US conceptual framework (cont’d) 2. the ‘Trueblood Committee’, which was charged with developing the objective of financial reporting in terms of: a. who needs financial statements b. what information they need c. how much of this information can be provided through accounting d. what framework is required to provide the information

Objectives of financial statements The Trueblood Report identified six objective-levels: 1. The basic objective – to provide information on which to base economic decisions 2. Four objectives that specify the diverse users and uses of accounting information 3. Two objectives that specify enterprise earning power and management ability as the type of information needed

Objectives of financial statements (cont’d) 4. One objective (No. 6) that specifies the nature of the needed information as factual and interpretive 5. Four objectives that describe the financial statements required to meet objective No. 6 6. A number of specific recommendations for the financial statements are made in order to meet each of the preceding objectives

Qualitative characteristics of reporting The Trueblood Report mentioned seven qualitative characteristics of reporting: 1. relevance and materiality 2. form and substance 3. reliability 4. freedom from bias 5. comparability 6. consistency 7. understandability

Six statements of financial accounting concepts 1. The objectives of financial reporting by business undertakings 2. Qualitative characteristics of accounting financial information 3. Elements of the financial statements 4. Objectives of financial reporting by nonbusiness entities

Six statements of financial accounting concepts (cont’d) 5. Recognition and measurement in financial statements of business undertakings 6. A statement of amendments to previous concepts statements

Comparison of SACs and SFACs are more detailed, more explicitly stated and more prescriptive than SACs. For example, SFACs: 1. recommend more conservative recognition criteria for the elements of financial statements 2. differentiate between revenues, expenses, gains and losses in a manner consistent with conventional practice 3. make greater reference to conventional accounting principles

The Corporate Report was published in 1976 by the Institute of Chartered Accountants in England Wales. Its major findings and recommendations were that: • financial statements should be appropriate to their expected use by potential users • responsibility for reporting belongs to the ‘economic entity’ having an impact on society through its activities

The Corporate Report (cont’d) • users are defined as those having a reasonable right to information, whose information needs should be recognised by corporate reports • the corporate report should be relevant, understandable, reliable, complete, objective, timely and comparable • there is a need for additional statements

Additional statements 1. A statement of value added 2. A statement of money exchange with government 3. A statement of transactions in foreign currency 4. A statement of future prospects 5. A statement of corporate objectives

The Stamp Report • The Stamp Report was published in 1980 by the Canadian Institute of Chartered Accountants • The report identifies problems and conceptual issues and provides solutions in terms of: – the objective of corporate financial reporting – the users of corporate reports – the nature of the users’ needs – criteria for assessment of the quality of standards and of corporate accountability

Objectives of corporate financial reporting 1. 2. 3. 4. The Stamp Report identified four objectives: accountability uncertainty and risk change and innovation complexity and the unsophisticated user

Conceptual framework conclusions • In order to be effective, a conceptual framework must gain general acceptance, represent collective behaviour, and protect the public interest in areas in which it is affected by financial reporting • One prevailing idea is that it is impossible to develop a set of accounting standards that can be applied to accounting alternatives in a way that will satisfy everybody, and that such standards could be hampered by the level of abstractness in definition and recognition criteria

Conceptual framework conclusions (cont’d) • The conceptual framework has been referred to as a kind of constitution, yet there are great differences. Solomons, for example, cites three: 1. a constitution has the force of law 2. constitutions contain many arbitrary elements, but there is no room for arbitrariness in a conceptual framework 3. there are significant differences among the nations of the world in their constitutional arrangements

Conceptual framework conclusions (cont’d) Miller’s myths • Miller points to eight myths about the FASB conceptual framework, which are: 1. that the APB failed because it did not have a conceptual framework 2. that FASB cannot succeed unless it has a conceptual framework 3. that a conceptual framework will lead to consistent standards 4. that a conceptual framework will eliminate the problem of overload

Conceptual framework conclusions (cont’d) Miller’s myths (cont’d) 5. that the FASB’s conceptual framework captures only the status quo of accounting practice 6. that the conceptual framework project has cost more than it should have 7. that the FASB will revise the existing standards to make them consistent with the conceptual framework 8. that the FASB has abandoned the conceptual framework project

Conceptual framework conclusions (cont’d) • The conceptual framework is not going to provide all the answers, but at least it will provide a direction for setting standards and reduce the influence of personal biases and political pressures in making accounting judgements