CHAPTER 4 STRATEGY FUNDAMENTALS AND CORPORATE STRATEGY Learning

- Slides: 34

CHAPTER 4 STRATEGY FUNDAMENTALS AND CORPORATE STRATEGY

Learning Objectives • After studying this chapter, you should be able to explain: – The definitions of strategy – The strategy process – The different levels of strategy – Corporate-level strategy: • Mergers and acquisitions • Alliances • Internal diversification

Strategy Fundamentals • Strategy is a coordinated set of actions that allows the firm to set its objective and goals. • Strategic planning is the process by which a firm decides its direction over the next several years. – Strategy is an effort by which organization defines the nature of the products and/or services it provides, and the markets in which the firm competes. – It helps define the type of organization the firm intends to be, and the nature of the contribution it intends to make to its various constituents – From the strategy, the firm will establish policies that ensure its efforts are consistently targeted in the desired direction

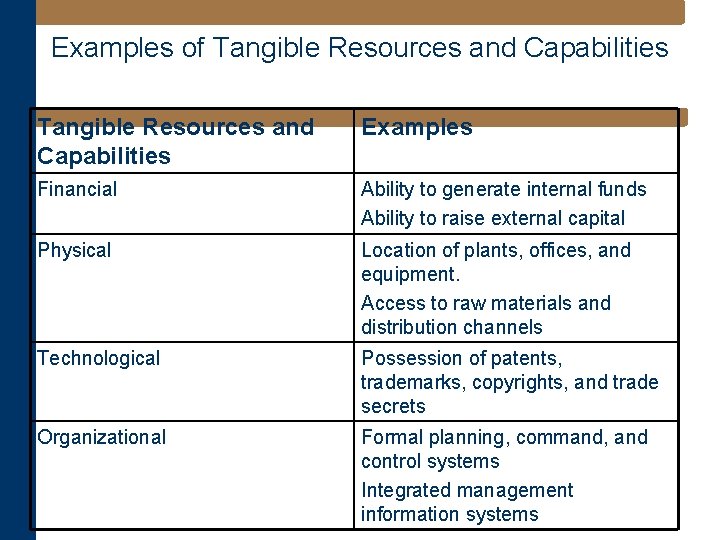

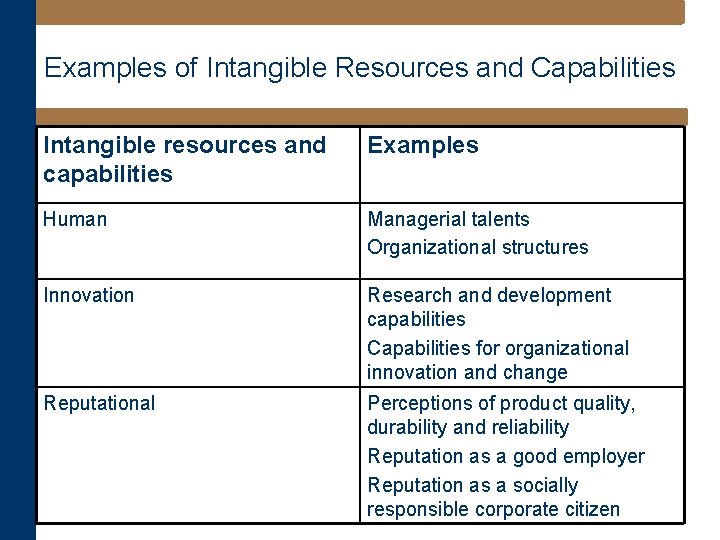

Strategy Fundamentals • The building blocks of a firm’s strategy: resources and capabilities • Resources and capabilities – Resources are the tangible and intangible assets the firms possess, essentially that which can be bought and sold, hired and fired, valued and depreciated. – Tangible assets include things such as plant and equipment that a firm possesses. – Intangible assets include aspects like the reputation of the firm, relationship with customers, and culture of the firm. Typically, intangible assets are the harder resources to develop but are more likely to differ from those of other competitors

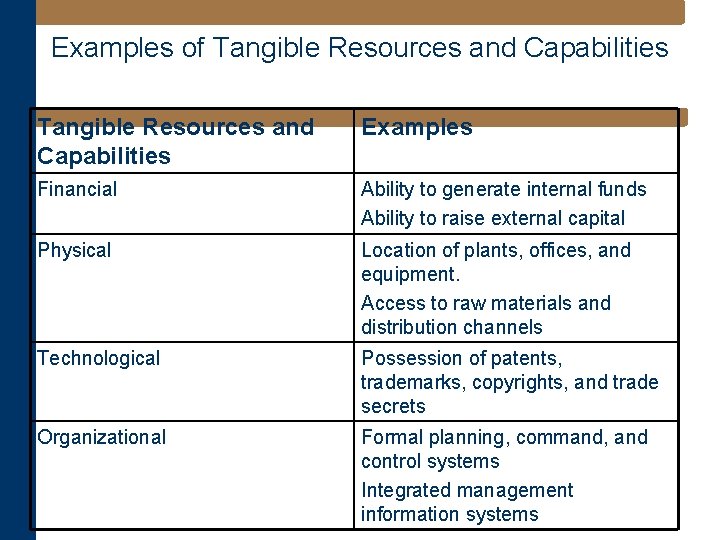

Examples of Tangible Resources and Capabilities Examples Financial Ability to generate internal funds Ability to raise external capital Physical Location of plants, offices, and equipment. Access to raw materials and distribution channels Technological Possession of patents, trademarks, copyrights, and trade secrets Organizational Formal planning, command, and control systems Integrated management information systems

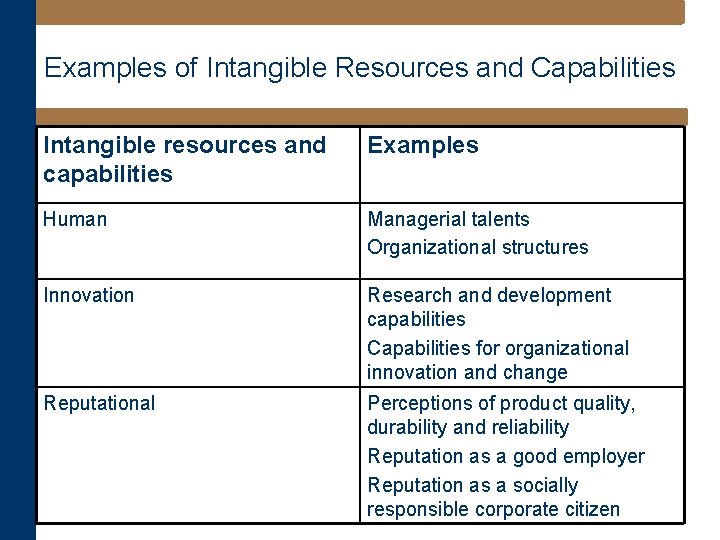

Examples of Intangible Resources and Capabilities Intangible resources and capabilities Examples Human Managerial talents Organizational structures Innovation Research and development capabilities Capabilities for organizational innovation and change Reputational Perceptions of product quality, durability and reliability Reputation as a good employer Reputation as a socially responsible corporate citizen

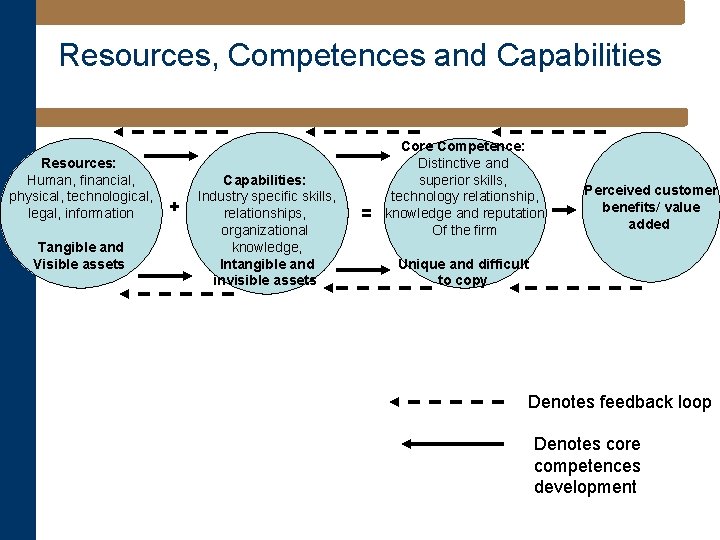

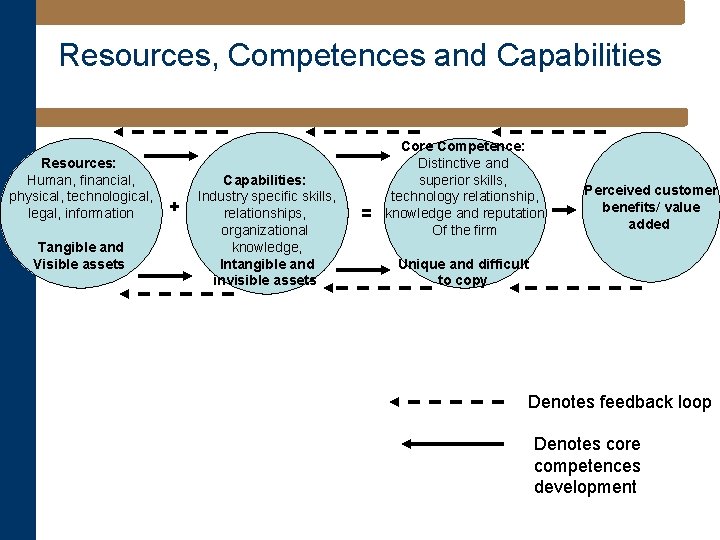

Resources, Competences and Capabilities Resources: Human, financial, physical, technological, legal, information Tangible and Visible assets + Capabilities: Industry specific skills, relationships, organizational knowledge, Intangible and invisible assets = Core Competence: Distinctive and superior skills, technology relationship, knowledge and reputation Of the firm Perceived customer benefits/ value added Unique and difficult to copy Denotes feedback loop Denotes core competences development

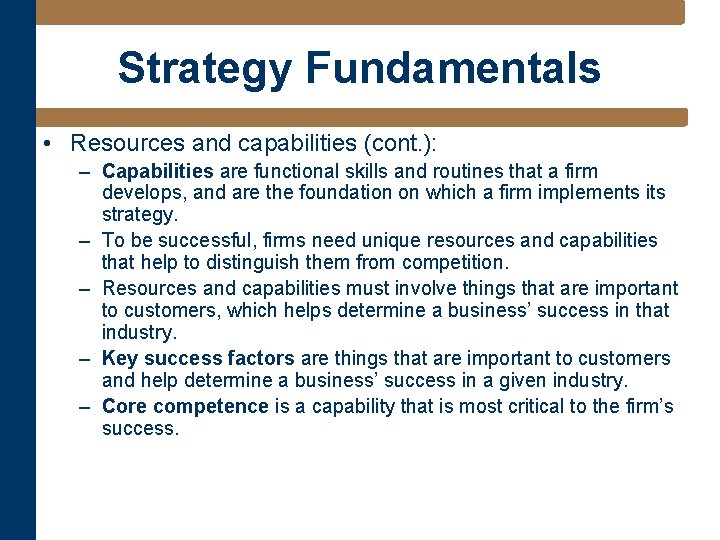

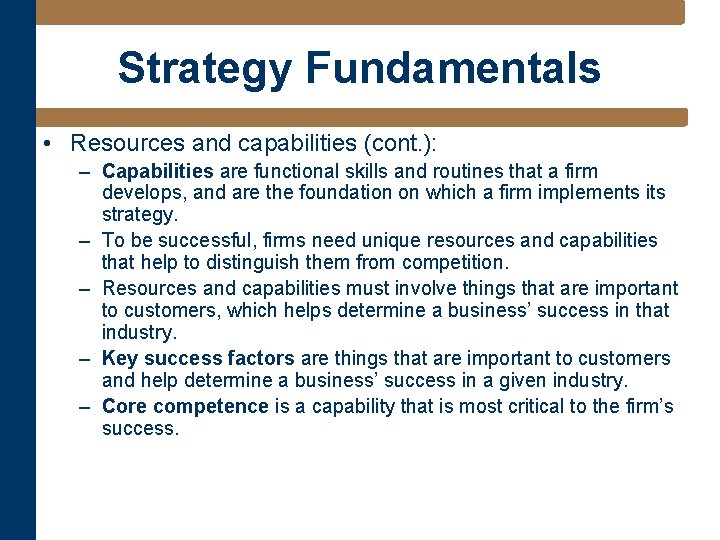

Strategy Fundamentals • Resources and capabilities (cont. ): – Capabilities are functional skills and routines that a firm develops, and are the foundation on which a firm implements its strategy. – To be successful, firms need unique resources and capabilities that help to distinguish them from competition. – Resources and capabilities must involve things that are important to customers, which helps determine a business’ success in that industry. – Key success factors are things that are important to customers and help determine a business’ success in a given industry. – Core competence is a capability that is most critical to the firm’s success.

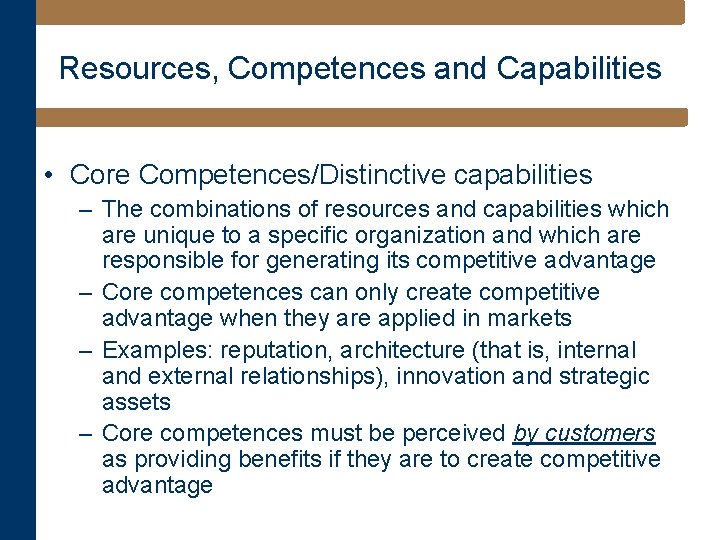

Resources, Competences and Capabilities • Core Competences/Distinctive capabilities – The combinations of resources and capabilities which are unique to a specific organization and which are responsible for generating its competitive advantage – Core competences can only create competitive advantage when they are applied in markets – Examples: reputation, architecture (that is, internal and external relationships), innovation and strategic assets – Core competences must be perceived by customers as providing benefits if they are to create competitive advantage

Core Competence • Examples: – 3 M and Johnson & Johnson – 3 M has a core competence in substrates, adhesives, and coatings. Collectively, employees at 3 M know more about developing and applying adhesives and coatings on different kinds of substrates than do employees in any other organization – Johnson & Johnson has a core competence in developing or acquiring pharmaceutical and medical products and then marketing them to the public. – Nike leveraged has successfully its expertise in marketing by extending its brand beyond sneakers to athletic clothing and retail stores and by hosting athletic clubs and online communities that are likely to buy its products

Strategy Fundamentals • Resources and capabilities (cont. ): – Competitive advantage is something that a firm does better than any of its competitors, which allows the firm to have an advantage over their competitors. – Sustainable competitive advantage is the ability to have competitive advantage over a period of time.

Strategy Fundamentals • Strategy process – The three components of the strategy process include planning, implementation, and evaluation and control. – Planning is the systematic gathering of information from which the firm sets its mission, performance objectives, and its strategy.

Strategy Fundamentals • Strategy process (cont. ): – Data gathering involves obtaining extensive information on a firm’s external environment and its internal capabilities. – This process is critical as it helps establish the foundation on which the firm bases its plans. – Mission is a statement of the basic purpose or reason for the business to exist and its activities; these statements are longer with approximately 30 to 60 words.

Strategy Fundamentals • Strategy process (cont. ): – Objective setting is the process of establishing measurable objectives and performance targets that will help the firm fulfill its mission. – The time period over which objectives and performance are targeted may be as long as five years.

Strategy Fundamentals • Strategy process (cont. ): – Strategy establishment helps ensure that the actions a firm takes will lead to the accomplishment of objectives and targets. – Corporate-level strategy determines how diversified the firm is to become and in what domains will the diversification occur.

Strategy Fundamentals • Types of Strategy(cont. ): – Corporate-level strategy determines how diversified the firm is to become and in what domains will the diversification occur. – Business strategy is concerned with how the firm will compete in a specific product-market. – Functional strategies are strategies of different departments, such as accounting, engineering, and marketing that act in support of the given business strategy.

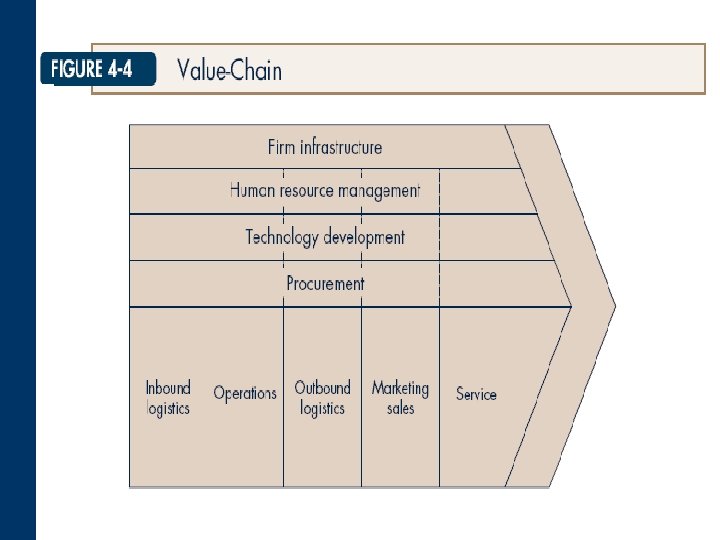

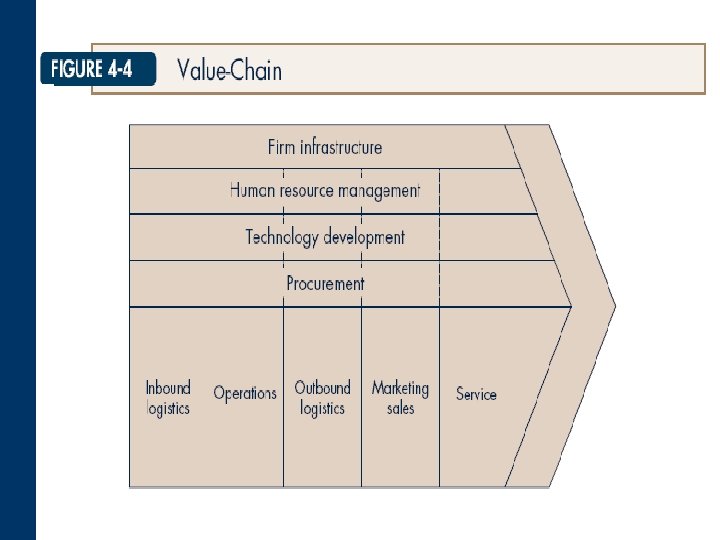

Strategy Fundamentals • Strategy process (cont. ): – Implementation of a strategy requires that the firm conduct all of its activities in a manner that is consistent with the mission and chosen strategy. – Value chain analysis is a useful tool to conceptualize how all aspects of the firm’s implementation of its strategy fit together.

Strategy Fundamentals • Strategy process (cont. ): – Value chain analysis breaks the firm’s activities into primary activities and support activities. – Primary activities are major categories of activities that take place in a firm to produce its products and services. – Support activities back up all the primary activities.

Strategy Fundamentals • Strategy process (cont. ): – Evaluation and control is the process of ensuring that the goals and objectives are being met and if they are not, the necessary adjustments are made. – Evaluation involves comparison of actual outcomes with expected outcomes. – Control refers to the adjustments needed.

Diversification and Corporate-Level Strategy • Mergers and acquisitions – Mergers occur when two firms combine as relative equals. – Acquisition refers to the outright purchase of a firm or some part of that firm.

Diversification and Corporate-Level Strategy • Reasons for mergers and acquisitions – Enter a new market quickly. – Avoid costs and risks of new product development. – Acquire an established brand name. – Offer a portfolio of products that complement each other, referred to as product platform.

Diversification and Corporate-Level Strategy • Reasons for mergers and acquisitions (cont. ): – Gain market power. – Acquire new knowledge and capabilities. – Enhanced reputation to the manager or increase in their financial returns; theory for this belief is called the agency theory. – Agency theory: The recognition that those who own firms and manage them are now separated.

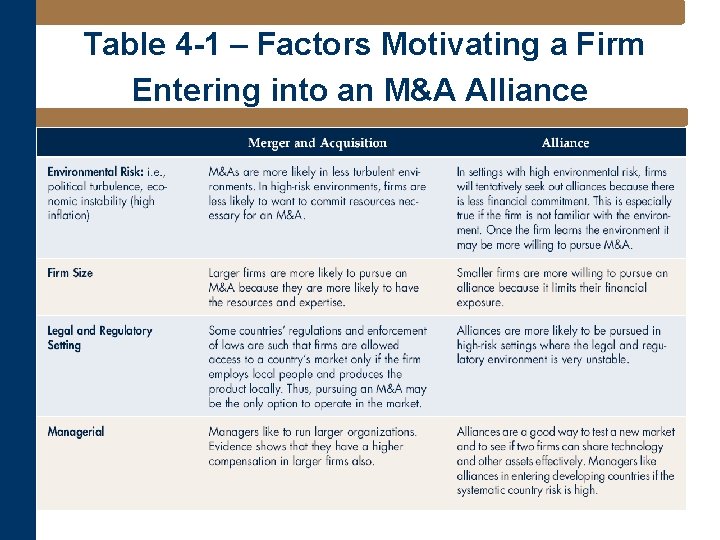

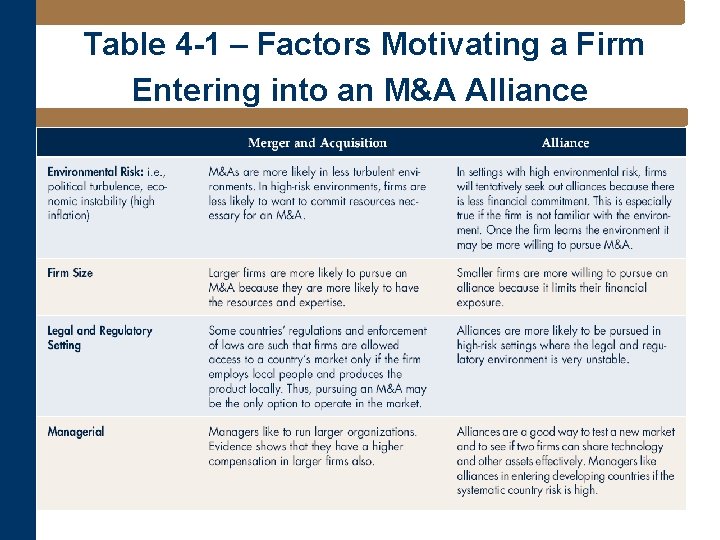

Table 4 -1 – Factors Motivating a Firm Entering into an M&A Alliance

Diversification and Corporate-Level Strategy • Types of mergers and acquisitions – If the firms in the merger or acquisition rely on similar skills to conduct the critical activities of the firm, then it is related diversification. – In case of firms that have dissimilar skills or abilities, it is an unrelated or conglomerate diversification.

Diversification and Corporate-Level Strategy • Types of mergers and acquisitions (cont. ) – Horizontal integration occurs when the acquired and acquiring firms are in the same industry. – Vertical integration occurs when a firm expands its business into areas that are at different points along its production path for a given product. – Vertical integration leads to better quality control of supplies and quality of distribution to customers; it also helps reduce opportunism and market uncertainty.

Diversification and Corporate-Level Strategy • Challenges of mergers and acquisitions – Implementation problems include: • Cultural differences in the firms involved. • Insufficient planning for the necessary degree of integration of the two firms. • Moving too slowly to combine the firms. • Not identifying key individuals to retain in the newly combined firm. • Not integrating the two firms’ operational systems.

Diversification and Corporate-Level Strategy • Strategic alliances – Strategic alliance is a partnership of two or more corporations or business units to achieve strategically significant objectives that are mutually beneficial. – The reasons for alliances are organizational learning, cost savings, and strategic behavior.

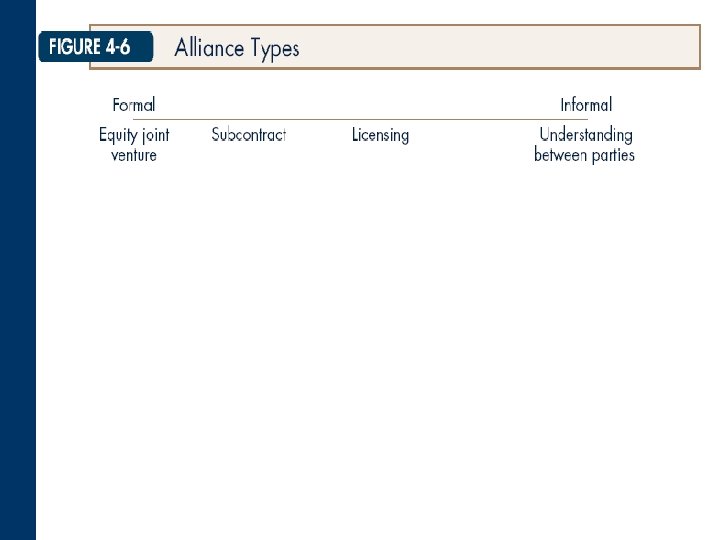

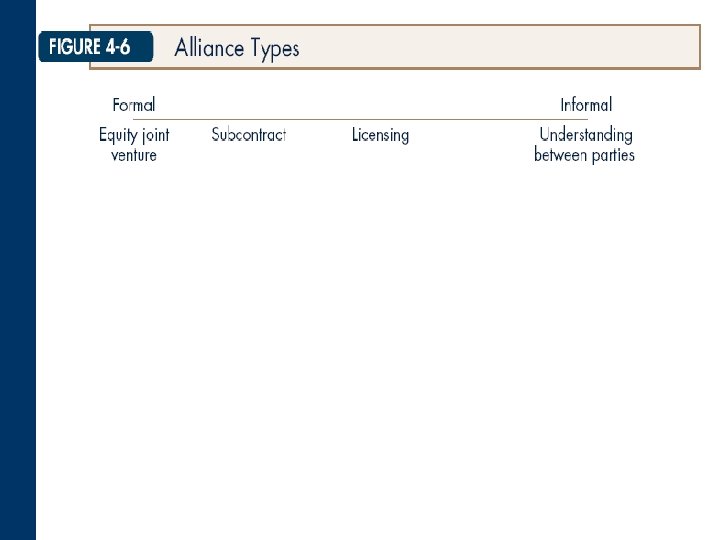

Diversification and Corporate-Level Strategy • Types of alliances: formal versus informal – In an equity joint venture, two or more firms put some resources into a new, separate entity. – A joint venture commonly has detailed agreements covering what each party is to provide, what each party can expect, and how each party is to operate.

Diversification and Corporate-Level Strategy • Types of alliances (cont. ): – Alliances that are intermediate in their formality are agreements that have clear documentation but less interaction between the parties. – Examples of intermediate alliances include consortia and licensing agreements.

Diversification and Corporate-Level Strategy • Types of alliances (cont. ): – Consortia is characterized by several organizations joining together to share expertise and funding for developing, gathering, and distributing new knowledge. – In a licensing arrangement, one firm agrees to pay another firm for the right to either manufacture or sell a product.

Diversification and Corporate-Level Strategy • Types of alliances (cont. ): – In informal alliances, two firms agree to support each other’s activities in some manner. The agreements are strictly informal with few legal protections to enforce the agreements.

Diversification and Corporate-Level Strategy • The challenges of alliances: – Find the proper partner. – Ensure that there is a shared vision. – Get the timing right. – Communicate effectively and efficiently. – Protect intellectual property. – Measure real costs and profits from the alliance.