Chapter 4 Negative Externalities General Overview Production Externalities

- Slides: 36

Chapter 4: Negative Externalities General Overview Production Externalities Policy 1: Externality Tax Policy 2: Output-reduction Subsidy Policy 3: Standards Elasticity Effects on Magnitude of Externalities Imperfect Competition and Externality Policy Consumption Externalities from Cigarette Smoking The Economics of Illicit Drugs

General Overview Externalities are a type of market failure -prices in a market do not reflect the true marginal costs and/or marginal benefits associated with the goods and services traded in the market. Externalities may be related to production activities, consumption activities, or both. -Production externalities: production activities of one individual imposes costs/benefits on other individuals that are not transmitted accurately through a market. -Consumption externalities: consumption of an individual imposes costs or benefits on other individuals that are not accurately transmitted through a market.

Examples of production externalities 1. 2. 3. 4. 5. 6. Air pollution from burning coal Ground water pollution from fertilizer use Food contamination and farm worker exposure to toxic chemicals from pesticide use Irrigation water and consequential decline of waterfowl population in nearby wildlife refuge Production of refrigerators using CFC’s Health issues resulting from gold mining

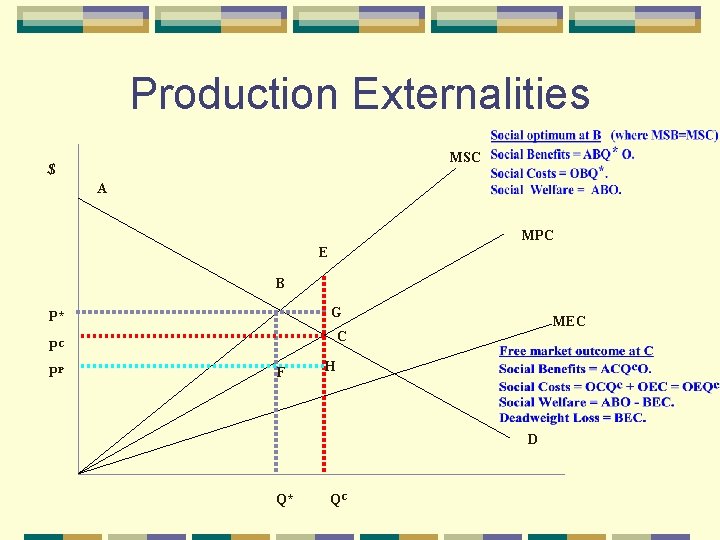

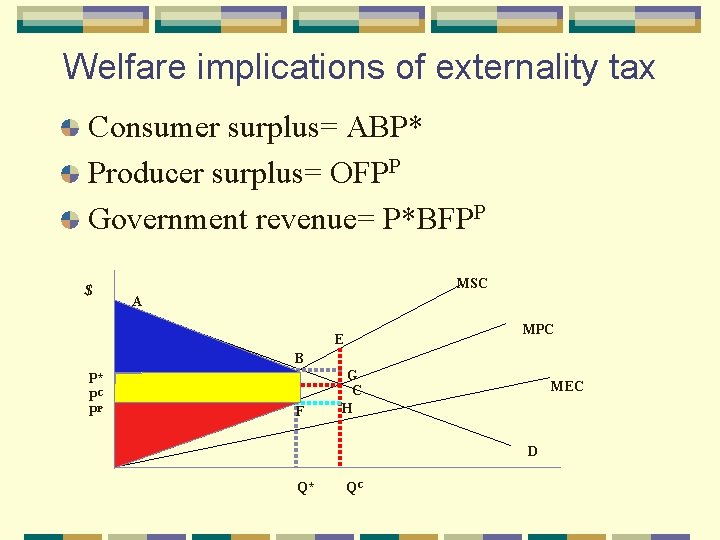

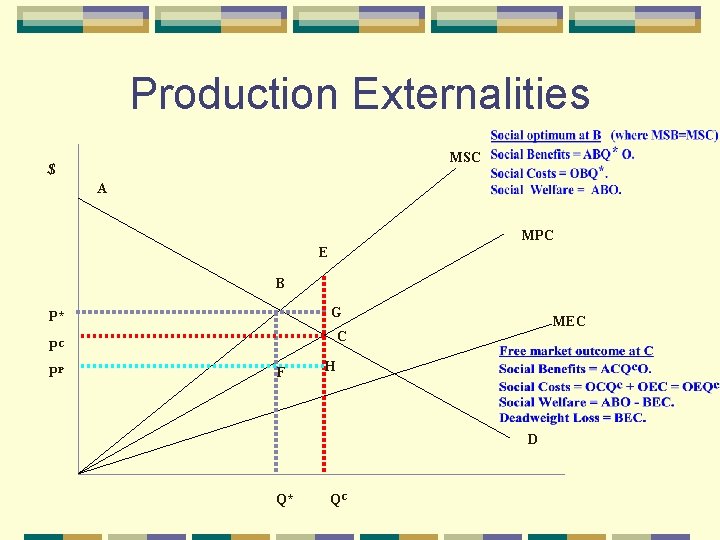

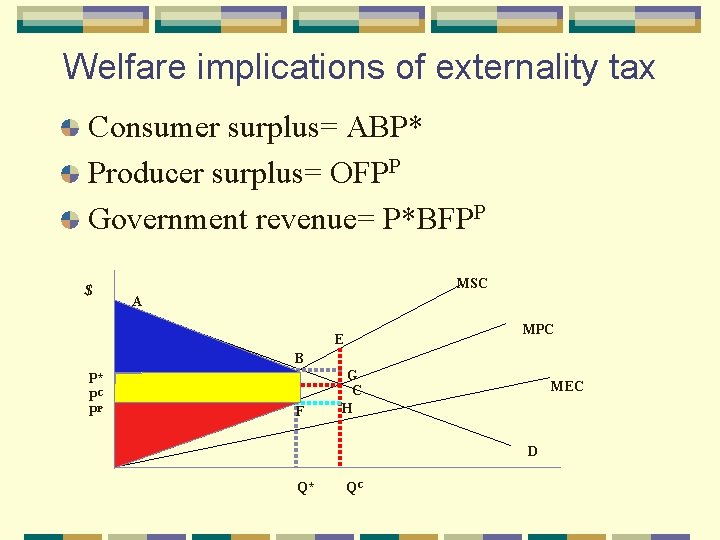

Production Externalities MSC $ A MPC E B G P* C PC PP MEC F H D Q* QC

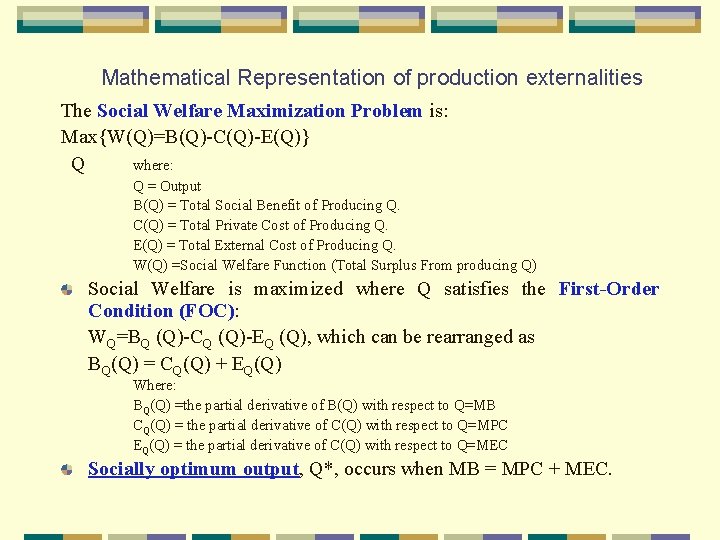

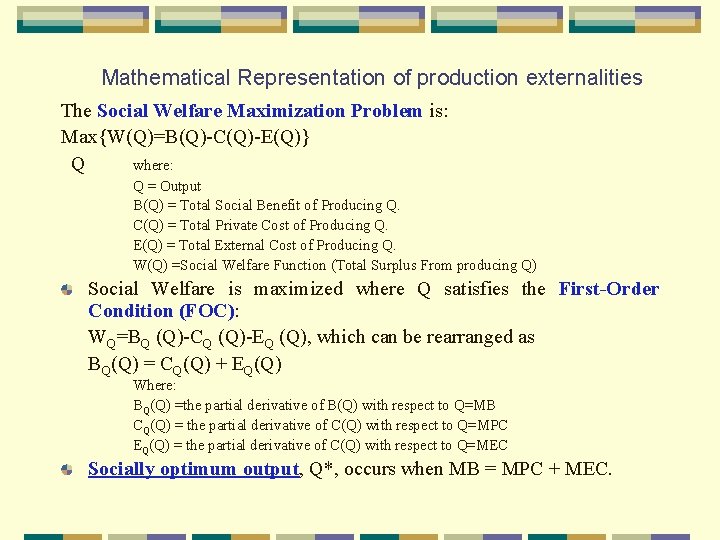

Mathematical Representation of production externalities The Social Welfare Maximization Problem is: Max{W(Q)=B(Q)-C(Q)-E(Q)} Q where: Q = Output B(Q) = Total Social Benefit of Producing Q. C(Q) = Total Private Cost of Producing Q. E(Q) = Total External Cost of Producing Q. W(Q) =Social Welfare Function (Total Surplus From producing Q) Social Welfare is maximized where Q satisfies the First-Order Condition (FOC): WQ=BQ (Q)-CQ (Q)-EQ (Q), which can be rearranged as BQ(Q) = CQ(Q) + EQ(Q) Where: BQ(Q) =the partial derivative of B(Q) with respect to Q=MB CQ(Q) = the partial derivative of C(Q) with respect to Q=MPC EQ(Q) = the partial derivative of C(Q) with respect to Q=MEC Socially optimum output, Q*, occurs when MB = MPC + MEC.

Unregulated competition with externalities Under unregulated competition, firms maximize profits, resulting in the FOC: BQ(Q) = CQ(Q), or MB = MPC. When this FOC is solved for Q, call it QC, we find that QC< Q* whenever MEC > 0. Because QC Q*, QC is inefficient.

Policies to achieve social optimum Q* Three possible policies: -Tax -Subsidy -Restriction, Standard, or Quota Choice of policy affects the distribution of economic benefits among producers, consumers and government. Targeting: Process of deciding which economic variable to control to reduce externality. Ex. Outputs, inputs, or the externality-generating activity itself (i. e. , the pollutant).

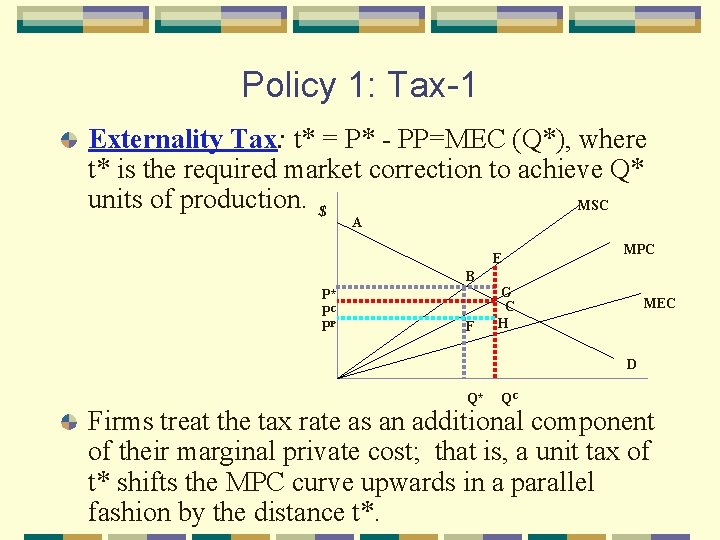

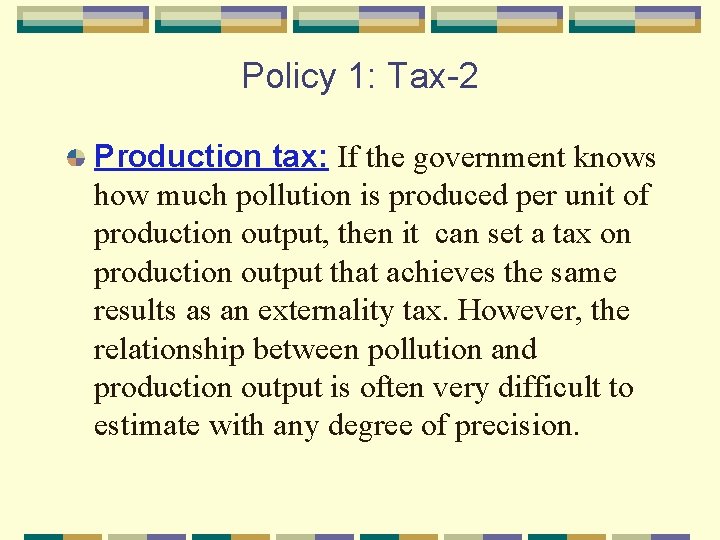

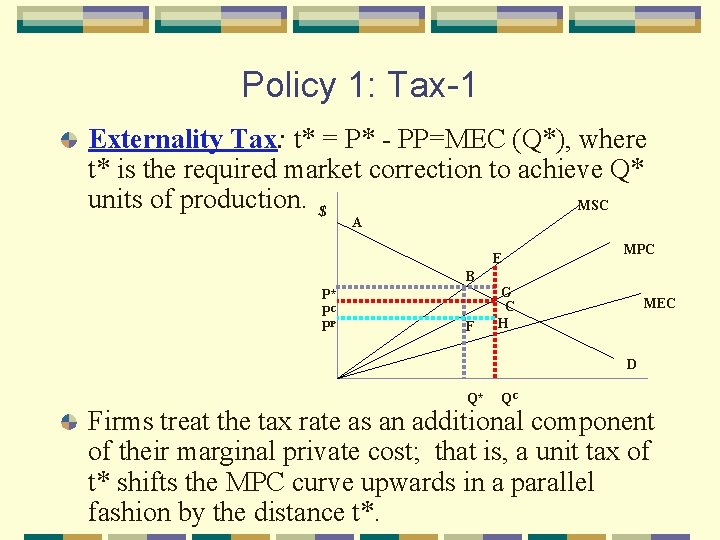

Policy 1: Tax-1 Externality Tax: t* = P* - PP=MEC (Q*), where t* is the required market correction to achieve Q* units of production. $ MSC A E MPC B P* PC PP F G C H MEC D Q* QC Firms treat the tax rate as an additional component of their marginal private cost; that is, a unit tax of t* shifts the MPC curve upwards in a parallel fashion by the distance t*.

Mathematical expression t* = EQ(Q*) = MEC(Q*). Private optimization problem: Max { (Q)=PQ-C(Q)-t*Q} Q FOC: Q(Q)-P-C Q(Q)-t*=0 or, P = CQ(Q) + t*. Since P = MB at all points along the demand curve, and t* = EQ(Q*), we can express the private condition (which is identical to the condition for a social optimum) under the tax as: BQ(Q*) = CQ(Q*) + EQ(Q*)

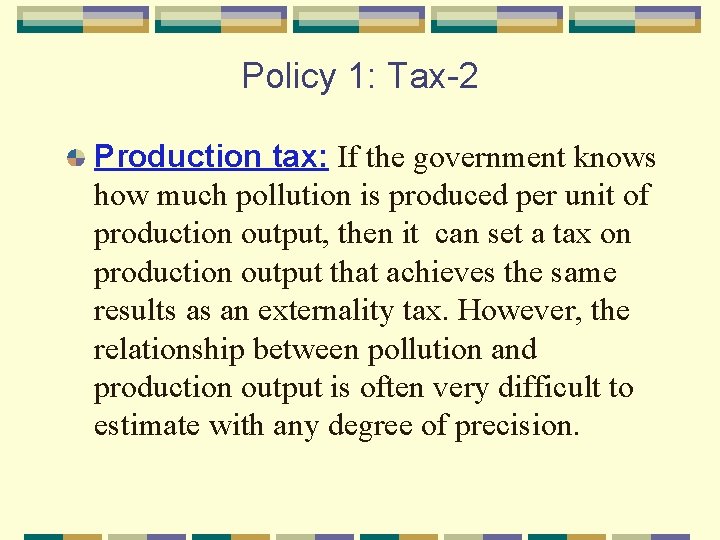

Welfare implications of externality tax Consumer surplus= ABP* Producer surplus= OFPP Government revenue= P*BFPP $ MSC A MPC E B P* PC PP F G C H MEC D Q* QC

Policy 1: Tax-2 Production tax: If the government knows how much pollution is produced per unit of production output, then it can set a tax on production output that achieves the same results as an externality tax. However, the relationship between pollution and production output is often very difficult to estimate with any degree of precision.

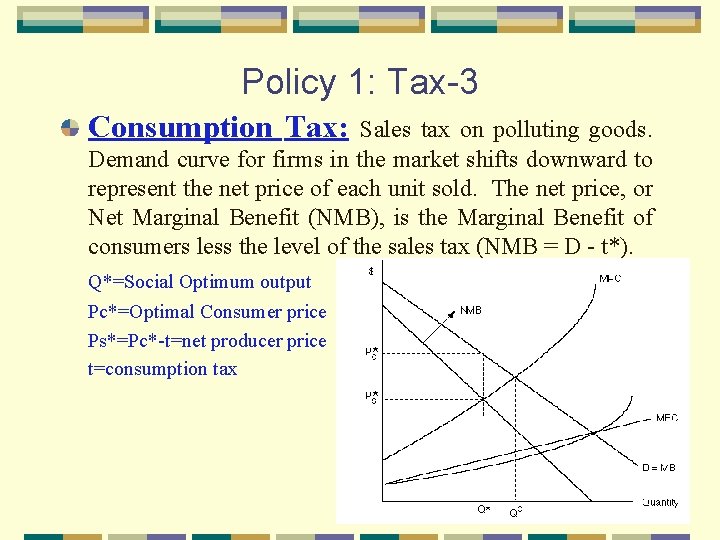

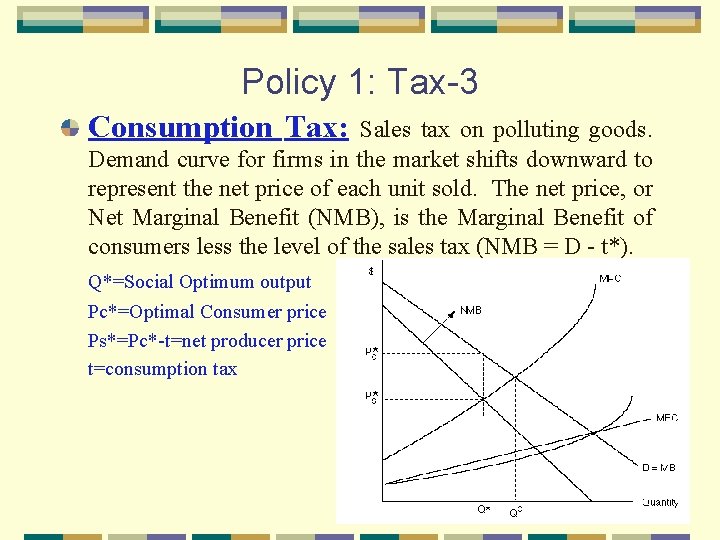

Policy 1: Tax-3 Consumption Tax: Sales tax on polluting goods. Demand curve for firms in the market shifts downward to represent the net price of each unit sold. The net price, or Net Marginal Benefit (NMB), is the Marginal Benefit of consumers less the level of the sales tax (NMB = D - t*). Q*=Social Optimum output Pc*=Optimal Consumer price Ps*=Pc*-t=net producer price t=consumption tax

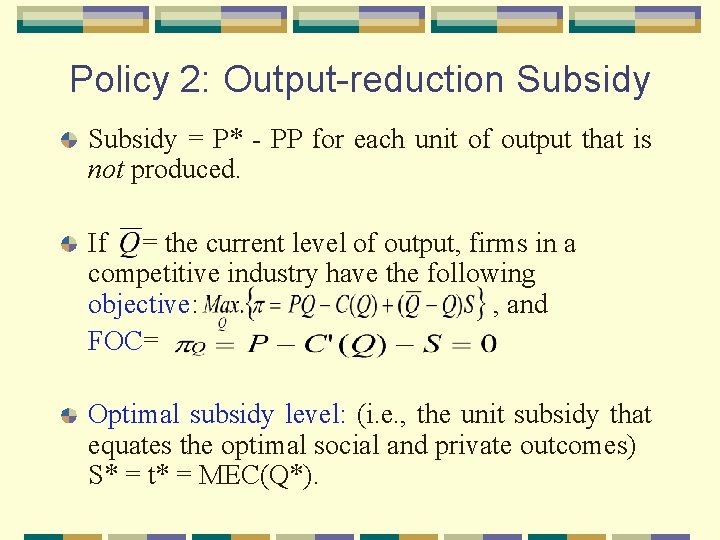

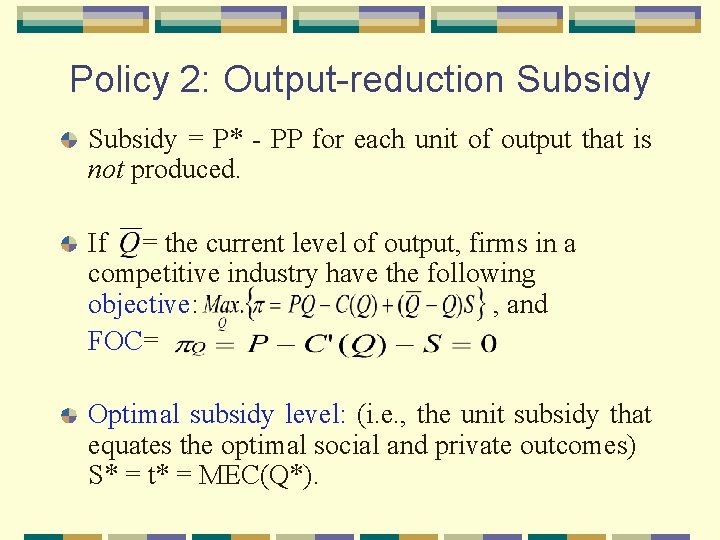

Policy 2: Output-reduction Subsidy = P* - PP for each unit of output that is not produced. If = the current level of output, firms in a competitive industry have the following objective: , and FOC= Optimal subsidy level: (i. e. , the unit subsidy that equates the optimal social and private outcomes) S* = t* = MEC(Q*).

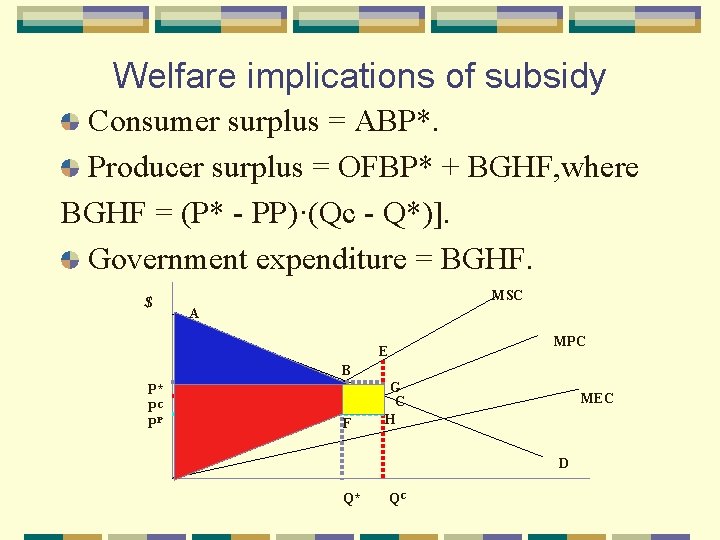

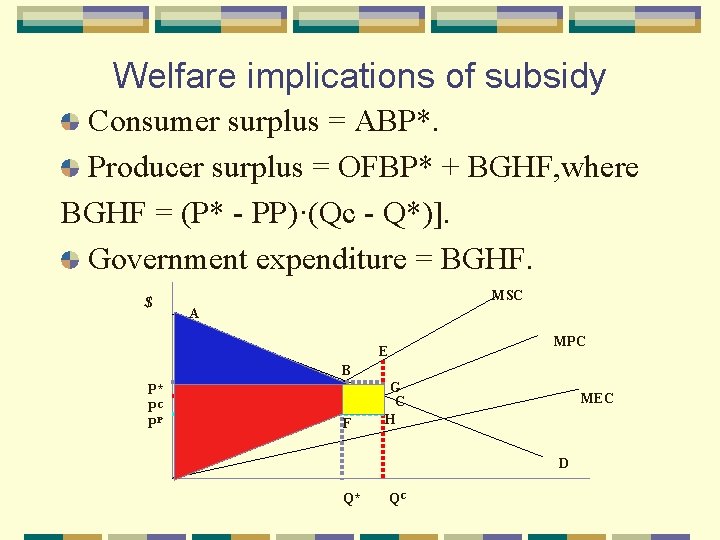

Welfare implications of subsidy Consumer surplus = ABP*. Producer surplus = OFBP* + BGHF, where BGHF = (P* - PP)·(Qc - Q*)]. Government expenditure = BGHF. $ MSC A MPC E B P* PC PP F G C H MEC D Q* QC

Problem with subsidy In the long run, subsidies for pollution reduction may actually increase pollution because the subsidy may attract more firms into the market.

Policy 3: Standards on Pollution/Output Command-control approach through production quotas to restrict output to Q*.

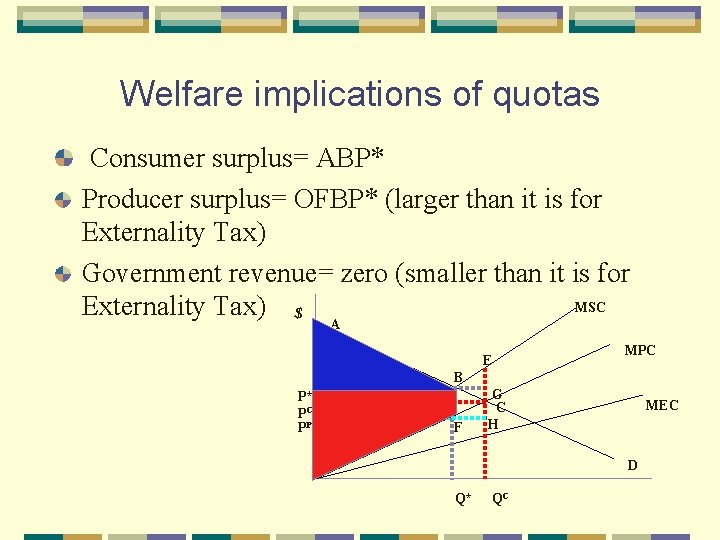

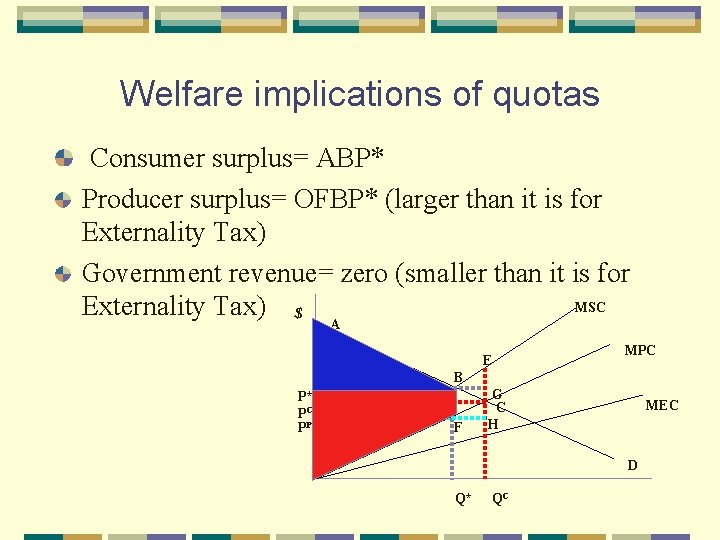

Welfare implications of quotas Consumer surplus= ABP* Producer surplus= OFBP* (larger than it is for Externality Tax) Government revenue= zero (smaller than it is for MSC Externality Tax) $ A E MPC B P* PC PP F G C H MEC D Q* QC

Quotas v. externality taxes Producers prefer quotas to externality taxes because they gain a larger share of social surplus. If quota is transferable, producers will bid against each other for the quota rights until the quota price equals P*- PP. -Whoever initially had the legal rights to the transferable quota will earn quota rents equal to P*BFPP by selling the quota rights. -Buyer of the rights will be have surplus= PPFO. *Note: producer surplus is the same as it is under an externality tax. The quota rents is the same as government revenue under the externality tax.

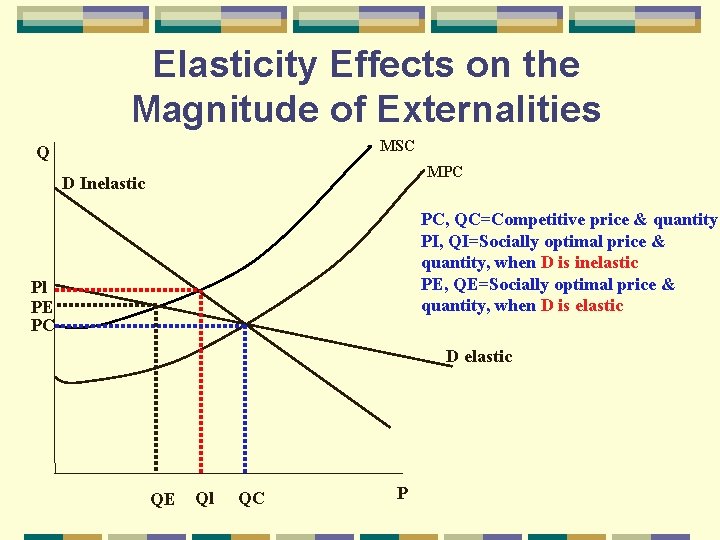

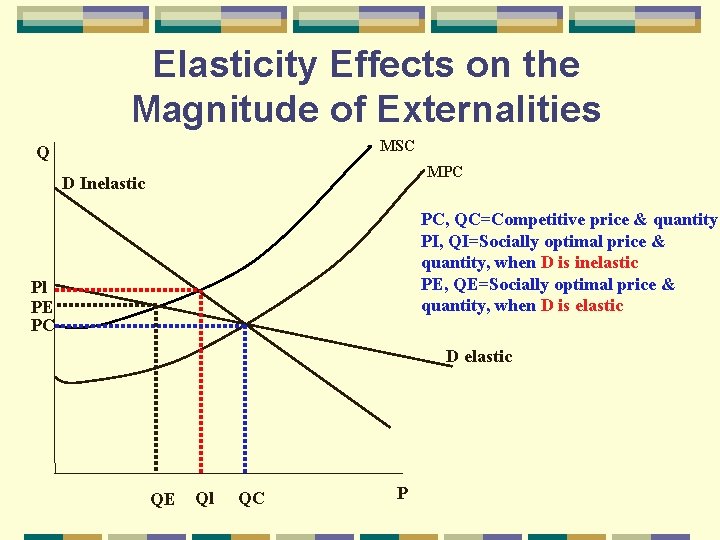

Elasticity Effects on the Magnitude of Externalities MSC Q MPC D Inelastic PC, QC=Competitive price & quantity PI, QI=Socially optimal price & quantity, when D is inelastic PE, QE=Socially optimal price & quantity, when D is elastic Pl PE PC D elastic QE Ql QC P

Elasticity and regulation When demand is inelastic, the socially optimal level of production, Qi, is not too far from the competitive level of production, Qc. Therefore, the inefficiency associated with a production externality may be small, and it may not be worth regulating the externality. When demand is elastic, the socially optimal level of production, Qe, is farther away from the competitive level, Qc. In this case, the inefficiency associated with the production externality may be relatively large, and regulation may be desirable.

Unexpected result of regulation? ! If demand is inelastic, pollution regulation may increase producer profit. -regulations that decrease production, such as a quota, will move producers towards the monopoly level of output. This decrease in turn will raise the market price of the final product and increase producers revenues. The more inelastic the demand, the higher the producer revenues under regulation!

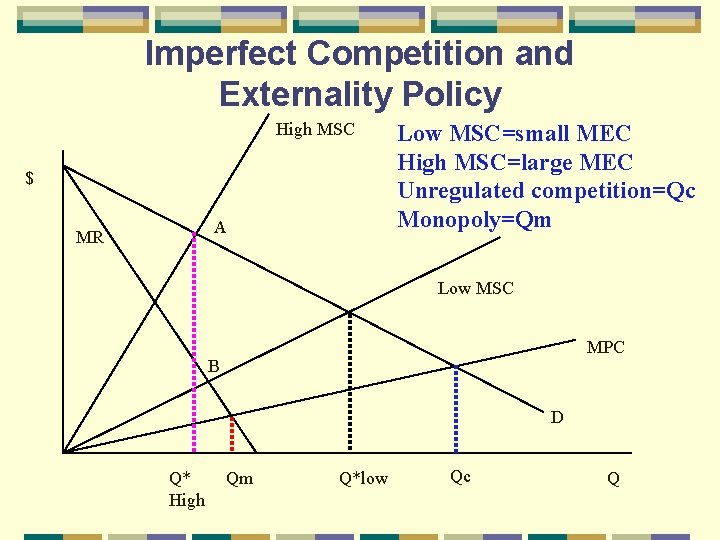

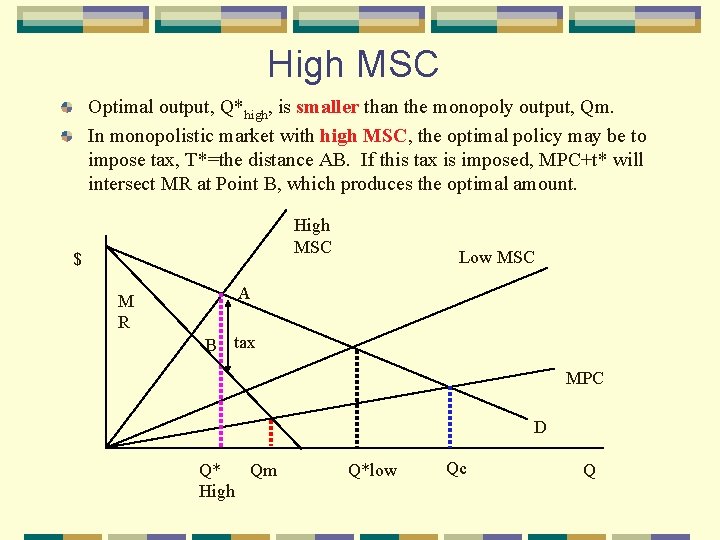

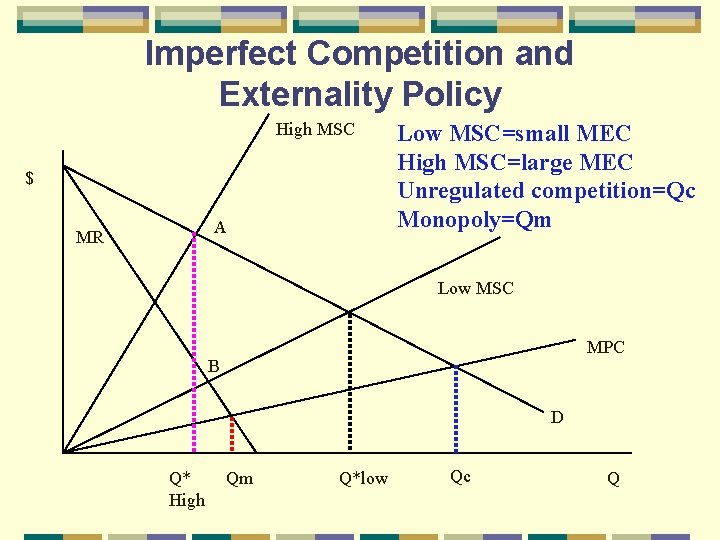

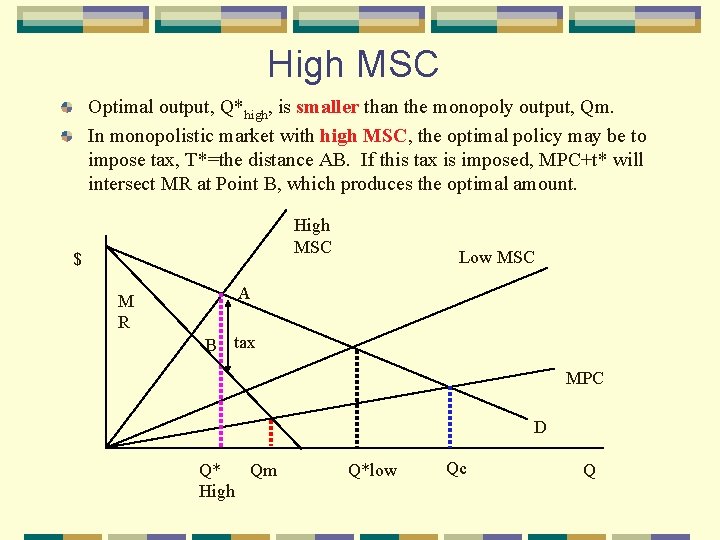

Imperfect Competition and Externality Policy High MSC $ A MR Low MSC=small MEC High MSC=large MEC Unregulated competition=Qc Monopoly=Qm Low MSC MPC B D Q* High Qm Q*low Qc Q

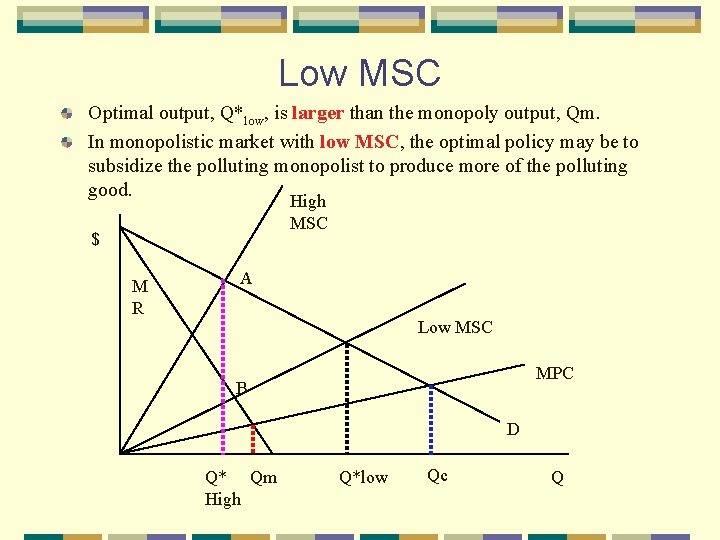

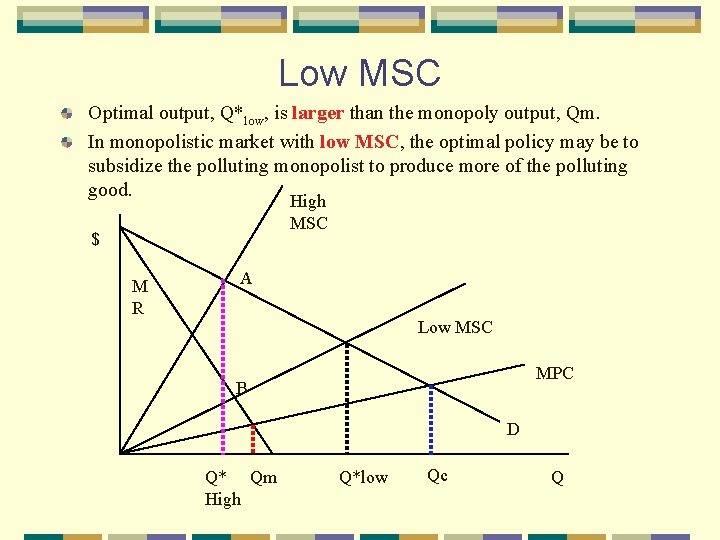

Low MSC Optimal output, Q*low, is larger than the monopoly output, Qm. In monopolistic market with low MSC, the optimal policy may be to subsidize the polluting monopolist to produce more of the polluting good. High MSC $ M R A Low MSC MPC B D Q* Qm High Q*low Qc Q

High MSC Optimal output, Q*high, is smaller than the monopoly output, Qm. In monopolistic market with high MSC, the optimal policy may be to impose tax, T*=the distance AB. If this tax is imposed, MPC+t* will intersect MR at Point B, which produces the optimal amount. High MSC $ M R Low MSC A B tax MPC D Q* Qm High Q*low Qc Q

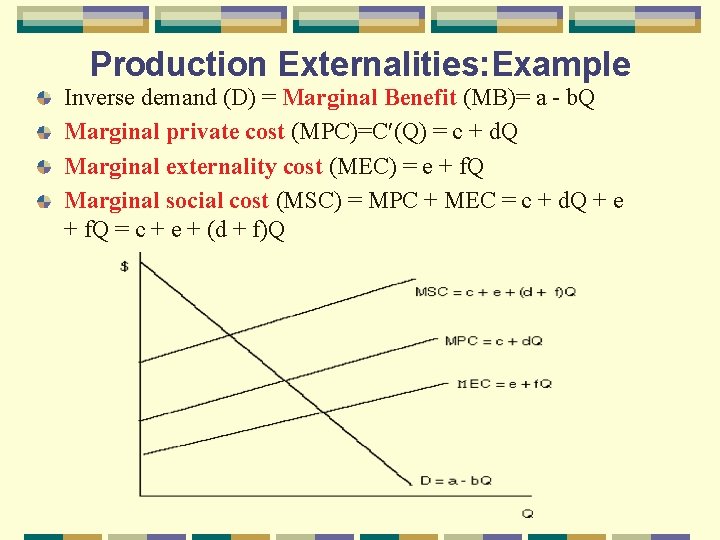

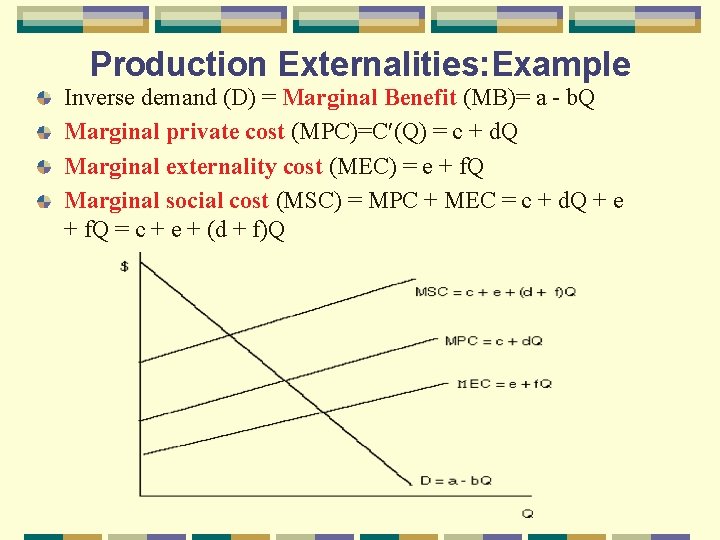

Production Externalities: Example Inverse demand (D) = Marginal Benefit (MB)= a - b. Q Marginal private cost (MPC)=C (Q) = c + d. Q Marginal externality cost (MEC) = e + f. Q Marginal social cost (MSC) = MPC + MEC = c + d. Q + e + f. Q = c + e + (d + f)Q

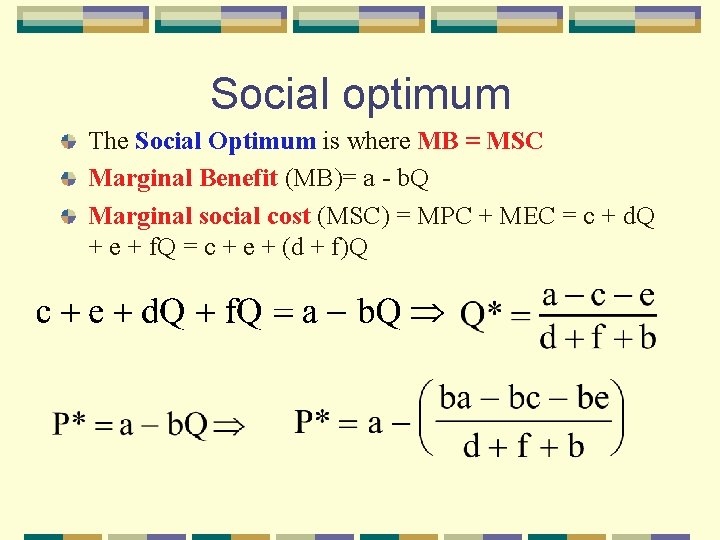

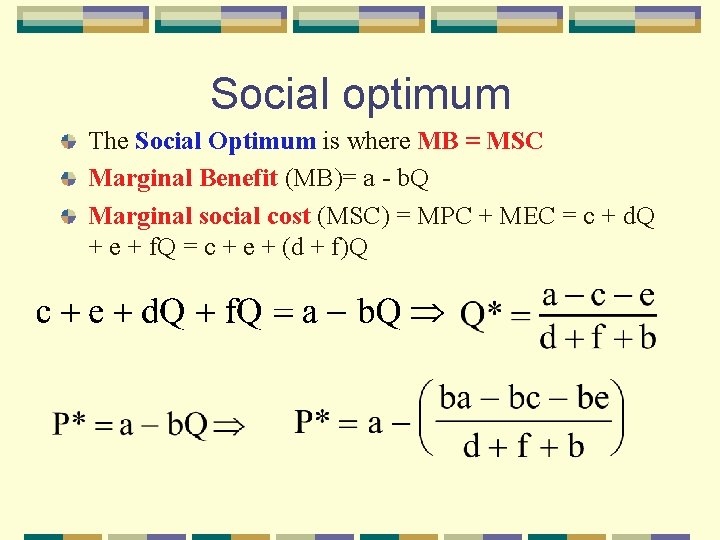

Social optimum The Social Optimum is where MB = MSC Marginal Benefit (MB)= a - b. Q Marginal social cost (MSC) = MPC + MEC = c + d. Q + e + f. Q = c + e + (d + f)Q

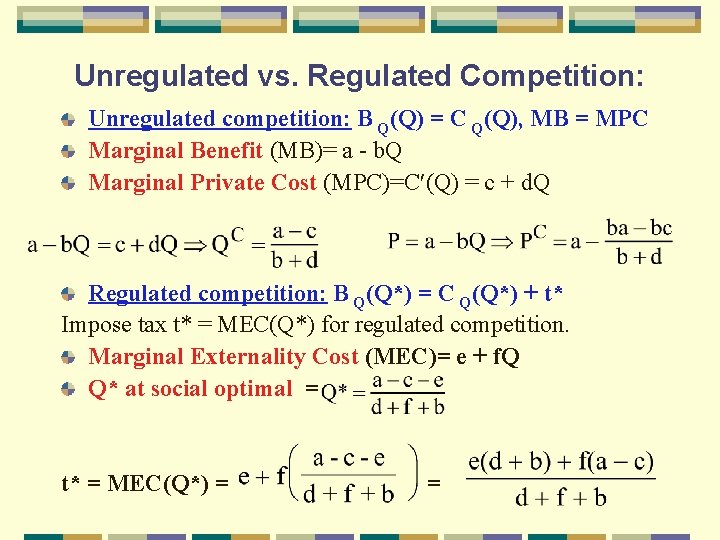

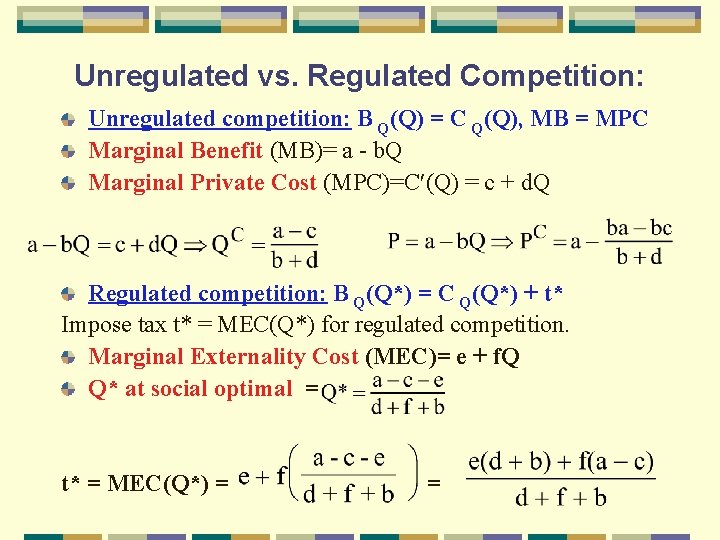

Unregulated vs. Regulated Competition: Unregulated competition: B Q(Q) = C Q(Q), MB = MPC Marginal Benefit (MB)= a - b. Q Marginal Private Cost (MPC)=C (Q) = c + d. Q Regulated competition: B Q(Q*) = C Q(Q*) + t* Impose tax t* = MEC(Q*) for regulated competition. Marginal Externality Cost (MEC)= e + f. Q Q* at social optimal = t* = MEC(Q*) = =

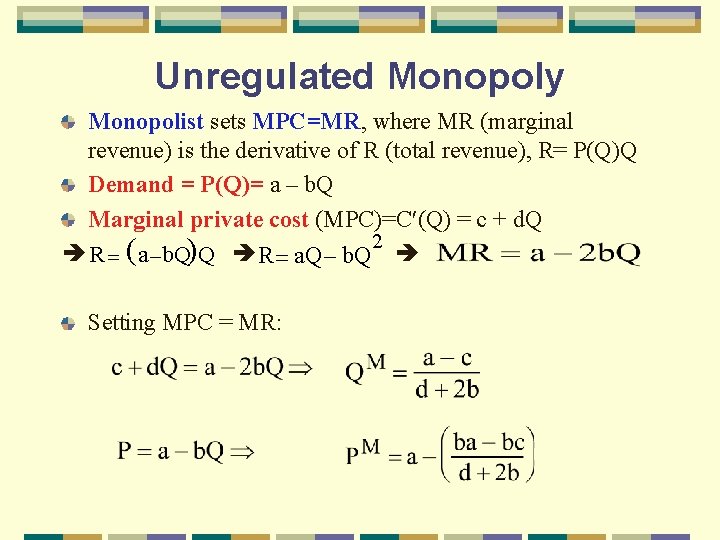

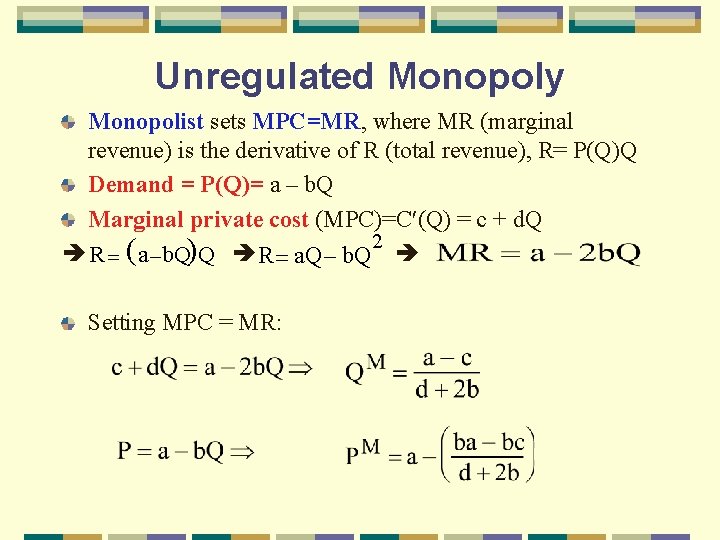

Unregulated Monopoly Monopolist sets MPC=MR, where MR (marginal revenue) is the derivative of R (total revenue), R= P(Q)Q Demand = P(Q)= a – b. Q Marginal private cost (MPC)=C (Q) = c + d. Q 2 R = ( a-b. Q) Q R= a. Q- b. Q Setting MPC = MR:

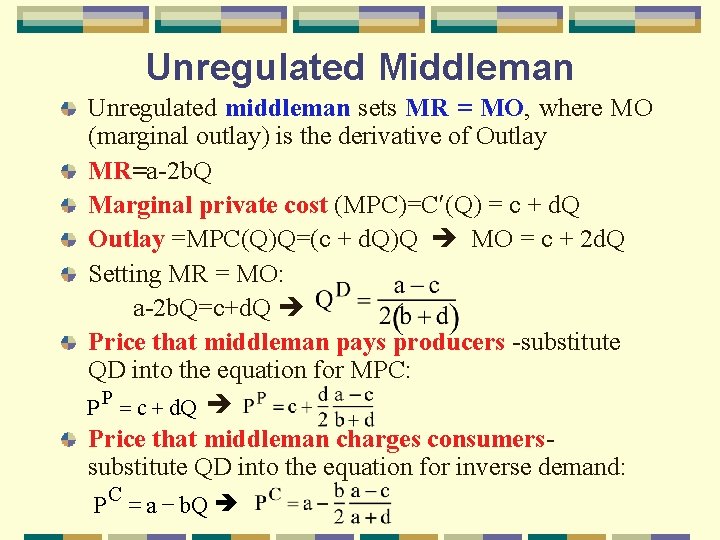

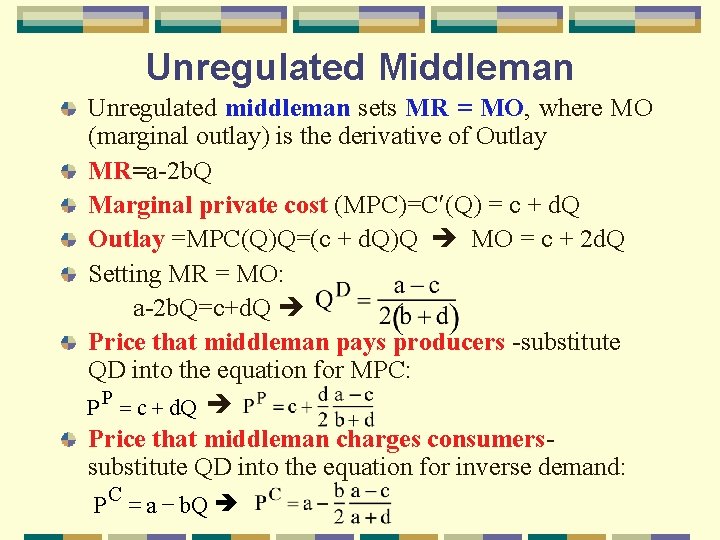

Unregulated Middleman Unregulated middleman sets MR = MO, where MO (marginal outlay) is the derivative of Outlay MR=a-2 b. Q Marginal private cost (MPC)=C (Q) = c + d. Q Outlay =MPC(Q)Q=(c + d. Q)Q MO = c + 2 d. Q Setting MR = MO: a-2 b. Q=c+d. Q Price that middleman pays producers -substitute QD into the equation for MPC: P P = c + d. Q Price that middleman charges consumerssubstitute QD into the equation for inverse demand: P C = a - b. Q

Consumption Externalities We now turn to consumption externalities. Consumption externality exists when one individuals’ consumption imposes costs on other individuals that are not transmitted through a market.

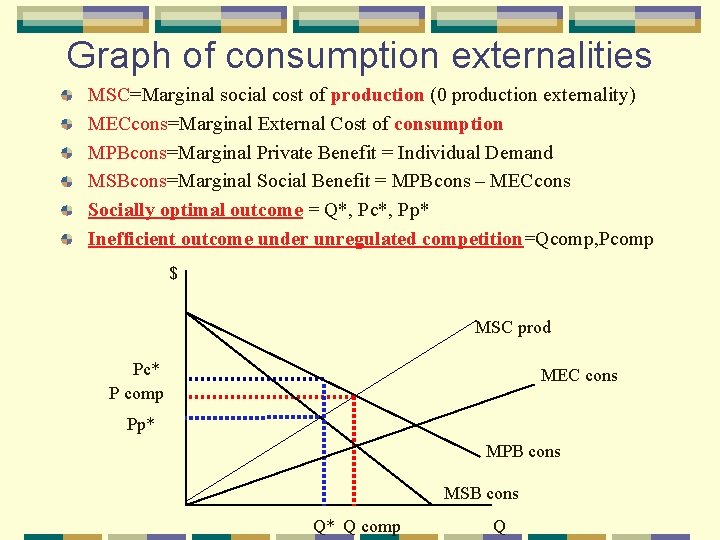

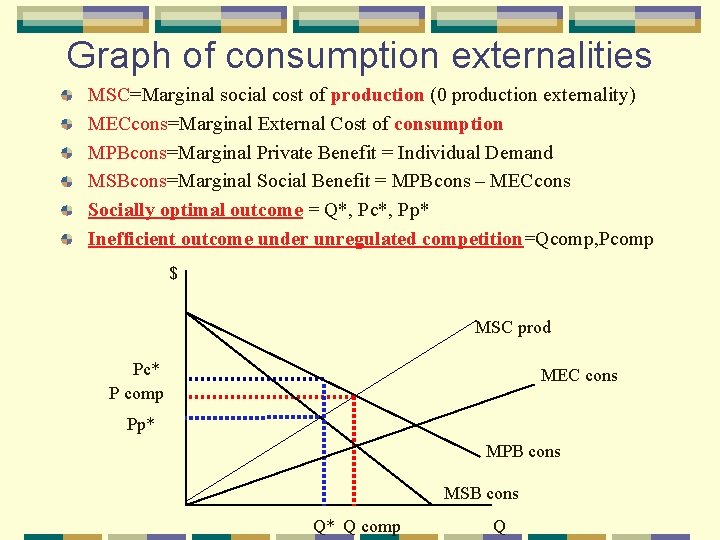

Graph of consumption externalities MSC=Marginal social cost of production (0 production externality) MECcons=Marginal External Cost of consumption MPBcons=Marginal Private Benefit = Individual Demand MSBcons=Marginal Social Benefit = MPBcons – MECcons Socially optimal outcome = Q*, Pc*, Pp* Inefficient outcome under unregulated competition=Qcomp, Pcomp $ MSC prod Pc* P comp MEC cons Pp* MPB cons MSB cons Q* Q comp Q

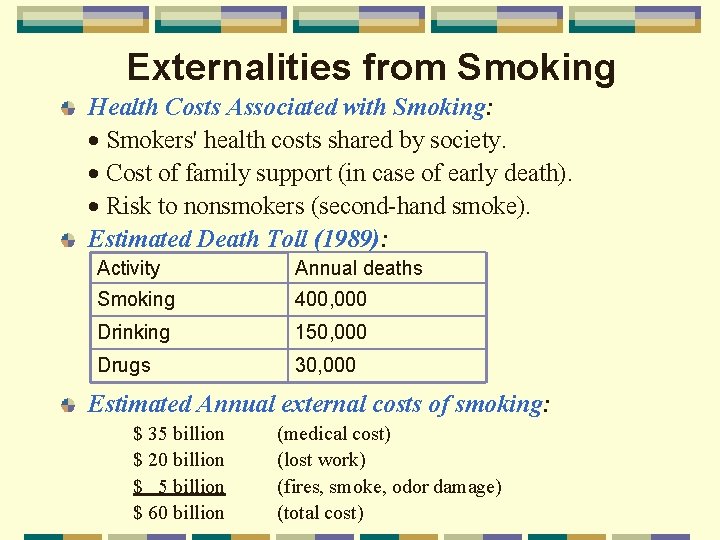

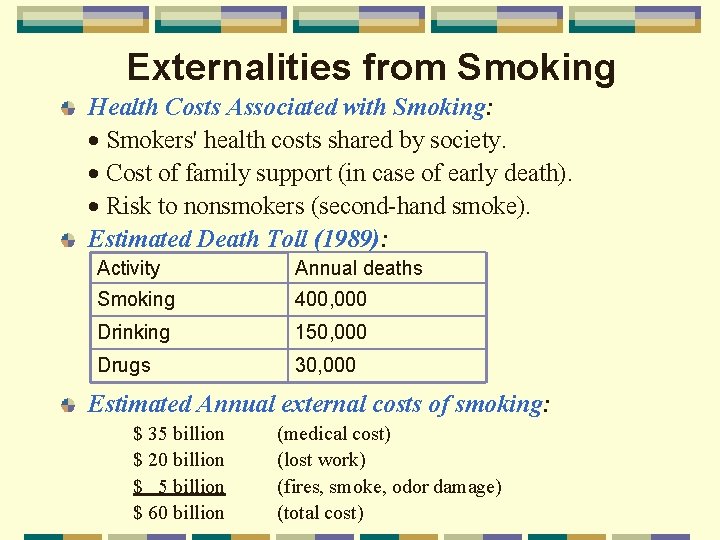

Externalities from Smoking Health Costs Associated with Smoking: Smokers' health costs shared by society. Cost of family support (in case of early death). Risk to nonsmokers (second-hand smoke). Estimated Death Toll (1989): Activity Annual deaths Smoking 400, 000 Drinking 150, 000 Drugs 30, 000 Estimated Annual external costs of smoking: $ 35 billion $ 20 billion $ 5 billion $ 60 billion (medical cost) (lost work) (fires, smoke, odor damage) (total cost)

Policies to control cigarettes A cigarette tax or tobacco tax. (2) A standard/quota to restrict quantities of cigarettes and tobacco. Ø Approximately 30 billion packs of cigarettes are smoked annually. Ø If marginal externality cost = average externality cost, then the tax should be $2. 00 per pack ($60 billion of externality cost / 30 billion packs). (1)

Policy consequences Producers: Restriction on quantities may benefit producers or distributors if elasticity of demand is smaller than 1. (2) Government: Tax revenues can be used to compensate victims of smoking damages, or it can be used in lieu of other distortionary taxes (such as income taxes and sales taxes) to support government programs. (3) Unintended Consequences: May strengthen the case for the legalization of drugs. (1)

The Economics of Illicit Drugs Should there be a drug legalization policy similar to the one for cigarettes? Proposals Legalize illicit drugs. Ban advertisement and sale to minors. Institute a tax on drugs. Benefits: Increased government revenue. Reduced government costs (fewer prisoners and less drug enforcement). Reduced crime. Costs: Increased addiction. Legalization may induce more to try.

Economic impacts of drug policy 1. Legalization of drugs would shift income from the illegal network of drug traffickers to government (taxes) and legal marketers (pharmacies). 2. Drug producers may be better off if drug cartels behave like the middlemen, since eliminating drug trafficker middlemen may result in increased quantity and higher producer prices. 3. Costs of crime enforcement may go down. 4. Consumer prices (inclusive of taxes) may go down and quantity may go up. There may be higher health costs associated with drug addiction.