Chapter 4 Future Value Present Value and Interest

- Slides: 13

Chapter 4 Future Value, Present Value and Interest Rates

Bond: A promise to make a series of payments on specific future date Bond Price = Present Value of payments Bond Basics 4 -2

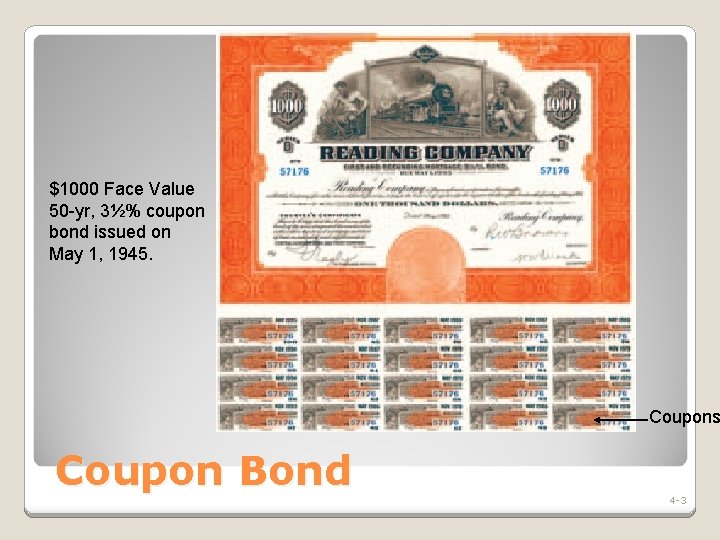

$1000 Face Value 50 -yr, 3½% coupon bond issued on May 1, 1945. Coupons Coupon Bond 4 -3

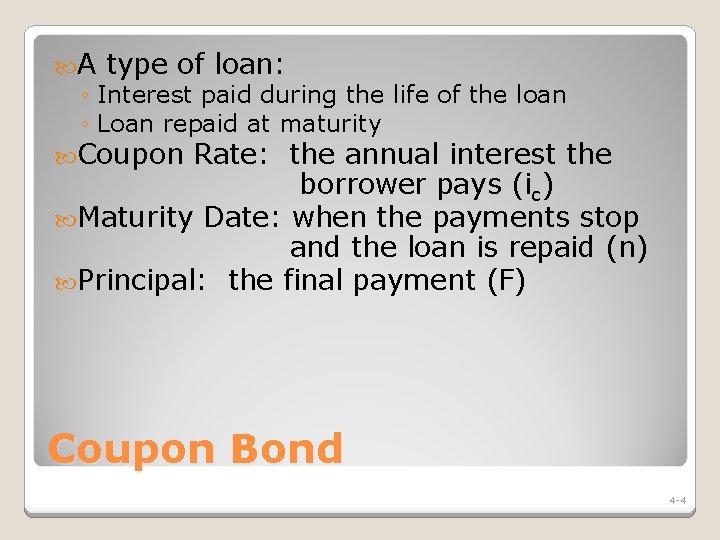

A type of loan: ◦ Interest paid during the life of the loan ◦ Loan repaid at maturity Coupon Rate: the annual interest the borrower pays (ic) Maturity Date: when the payments stop and the loan is repaid (n) Principal: the final payment (F) Coupon Bond 4 -4

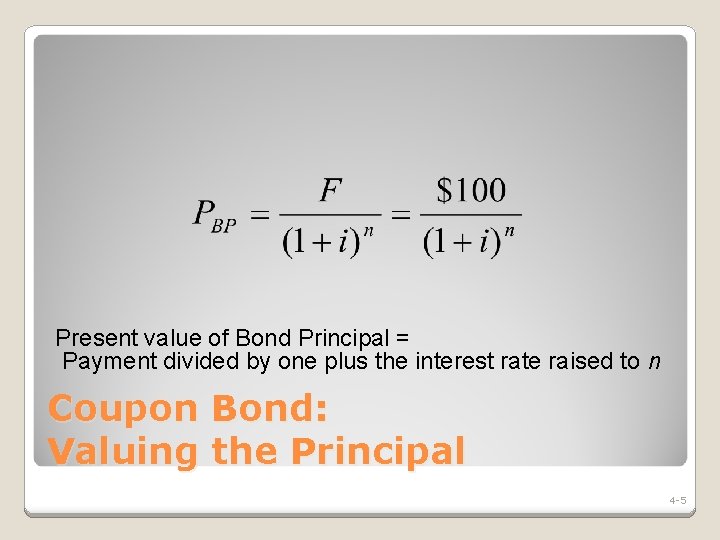

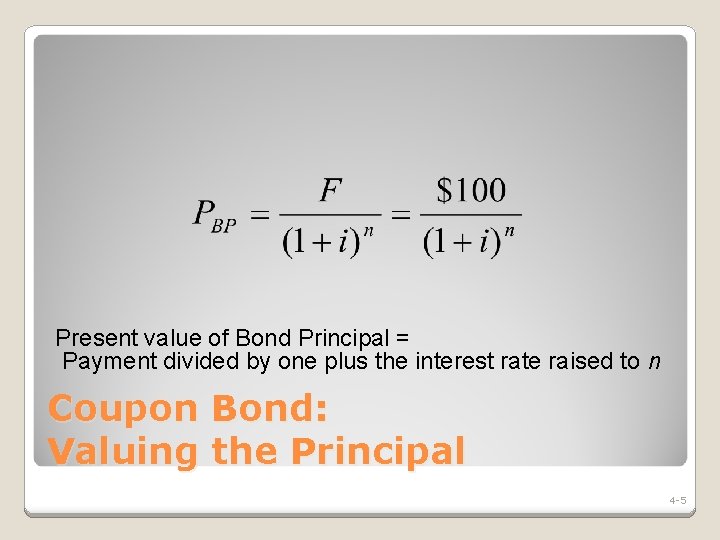

Present value of Bond Principal = Payment divided by one plus the interest rate raised to n Coupon Bond: Valuing the Principal 4 -5

Value of Coupon Payments = Present value of the sequence Note that C= ic x F Coupon Bond: Valuing the Coupon Payments 4 -6

Price of Coupon Bond (PCB) = Present value of Coupon Payments (PCP) + Present Value of the Principal (PBP) Price of Coupon Bond: Principal + Coupons 4 -7

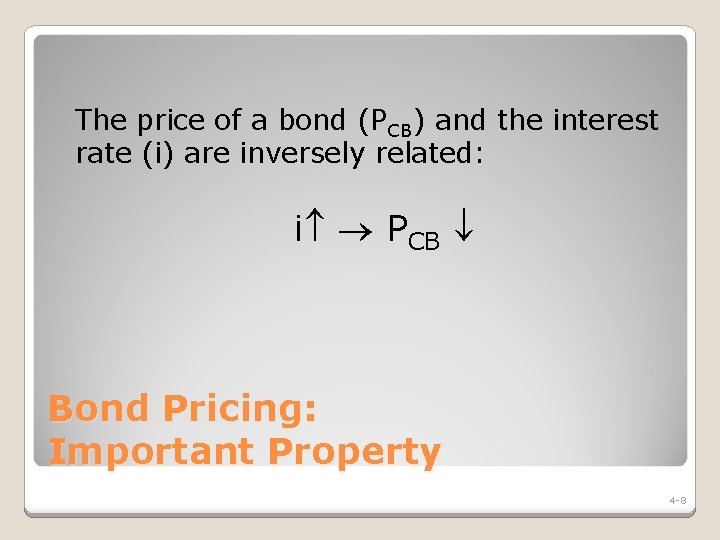

The price of a bond (PCB) and the interest rate (i) are inversely related: i PCB Bond Pricing: Important Property 4 -8

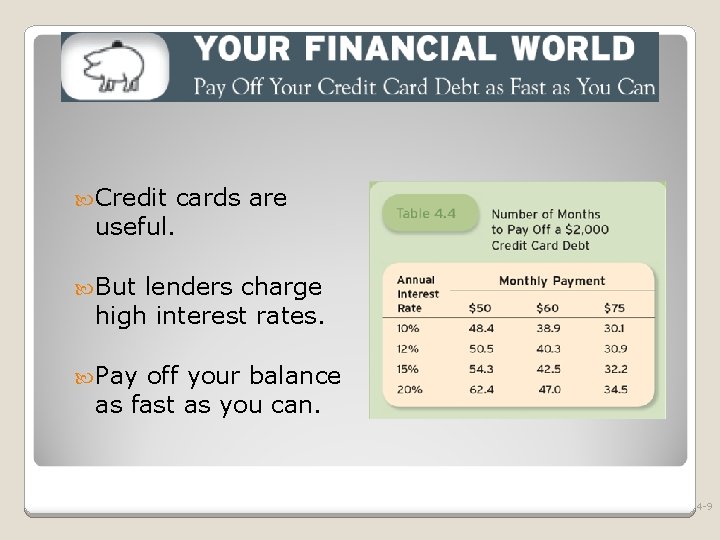

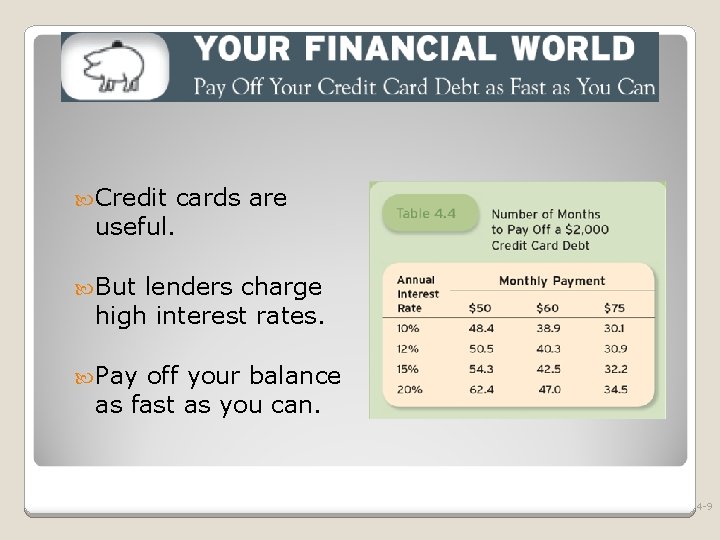

Credit cards are useful. But lenders charge high interest rates. Pay off your balance as fast as you can. 4 -9

Borrowers care about the resources required to repay. Lenders care about the purchasing power of the payments they received. Neither cares solely about the number of dollars, they care about what the dollars buy. Real and Nominal Interest Rates 410

Nominal Interest Rates (i) Interest Rates expressed in current dollar terms. Real Interest Rates (r) Nominal Interest Rate adjusted for inflation. Real and Nominal Interest Rates 411

Nominal interest rate = Real Interest Rate + Expected Inflation i = r + e (This is called the “Fisher Equation”) Real and Nominal Interest Rates 412

Real and Nominal Interest Rates Countries with high nominal interest rates have high inflation: i 4 -13