Chapter 4 Financial Statements Analysis Tools Outline Demand

- Slides: 27

Chapter 4 Financial Statements Analysis Tools

Outline Demand supply of financial analysis n Basic analytical procedures n Analysis methods n Comprehensive analysis of financial ratios n The limitations of financial analysis n

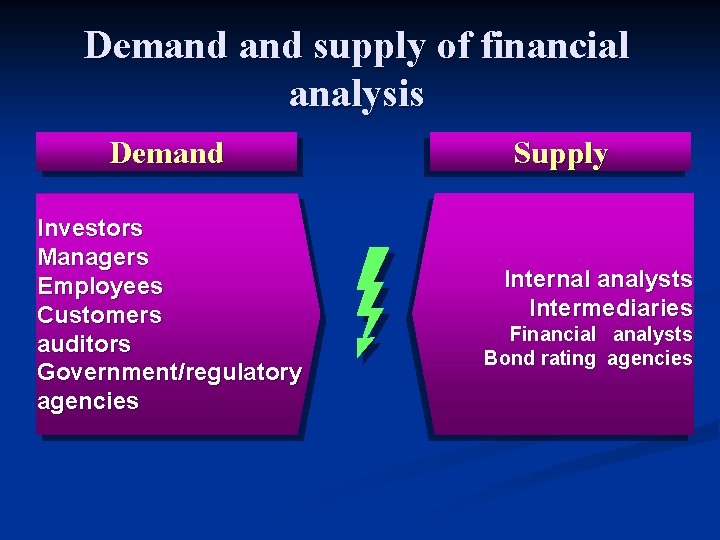

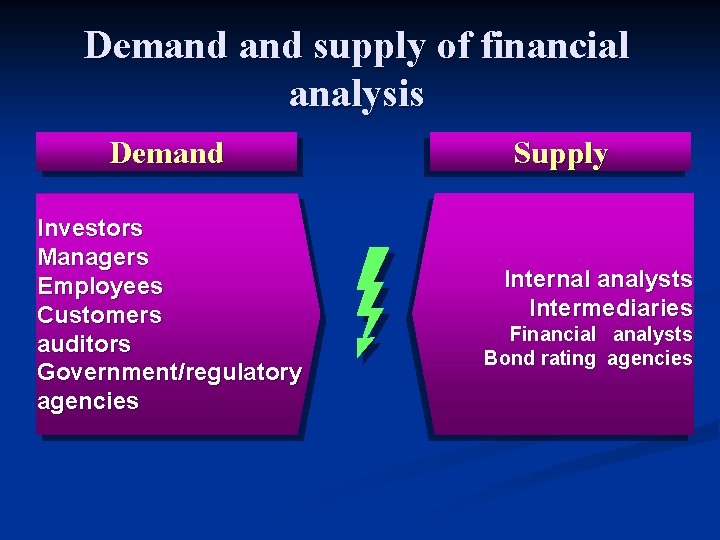

Demand supply of financial analysis Demand Investors Managers Employees Customers auditors Government/regulatory agencies Supply Internal analysts Intermediaries Financial analysts Bond rating agencies

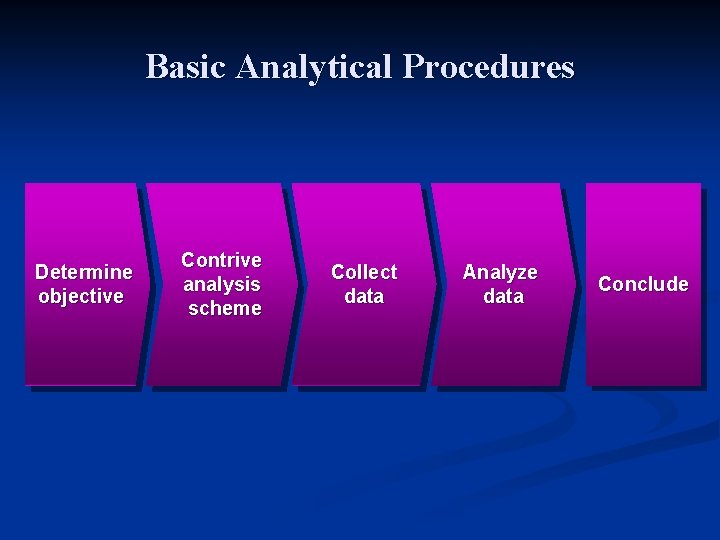

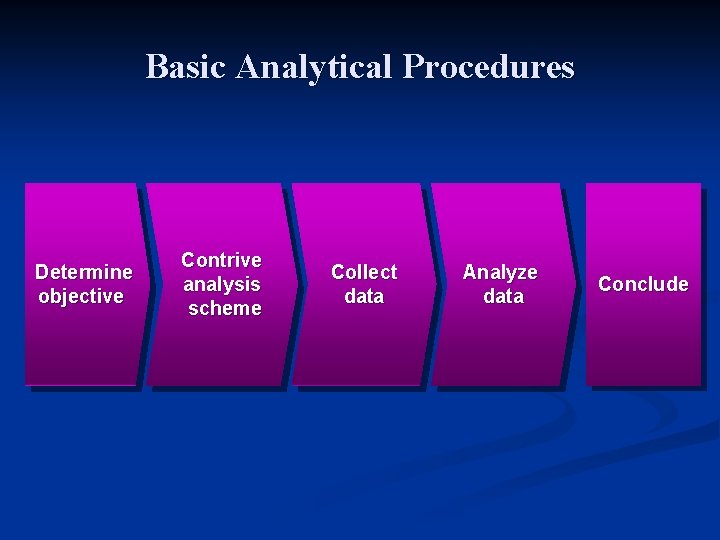

Basic Analytical Procedures Determine objective Contrive analysis scheme Collect data Analyze data Conclude

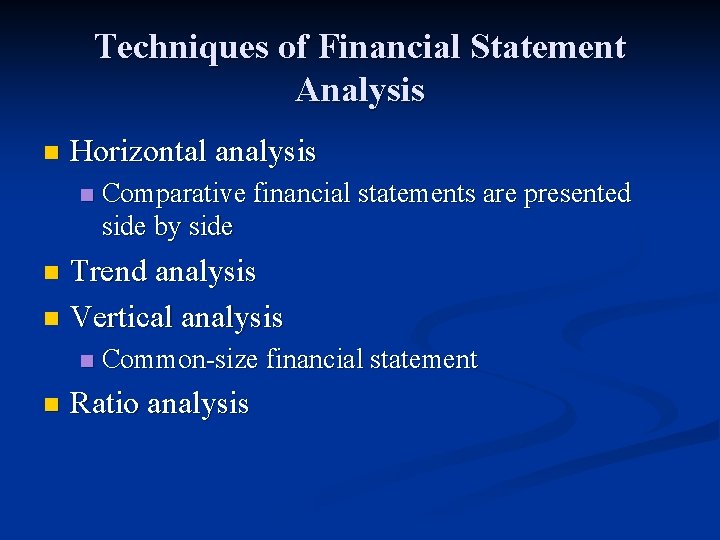

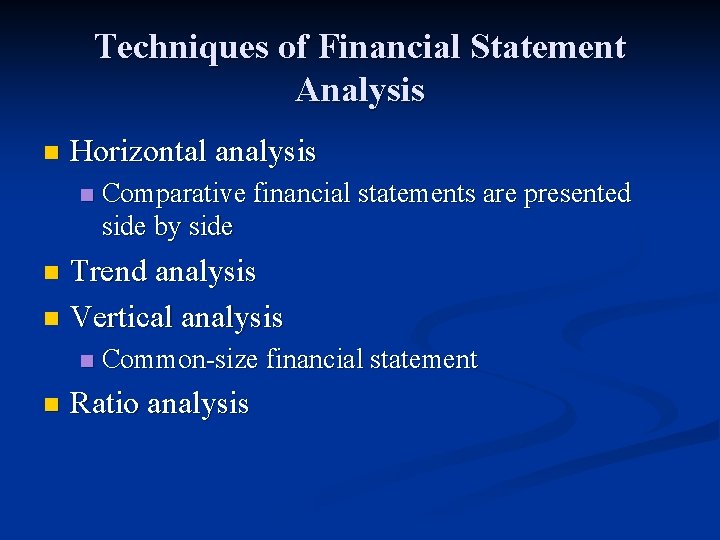

Techniques of Financial Statement Analysis n Horizontal analysis n Comparative financial statements are presented side by side Trend analysis n Vertical analysis n n n Common-size financial statement Ratio analysis

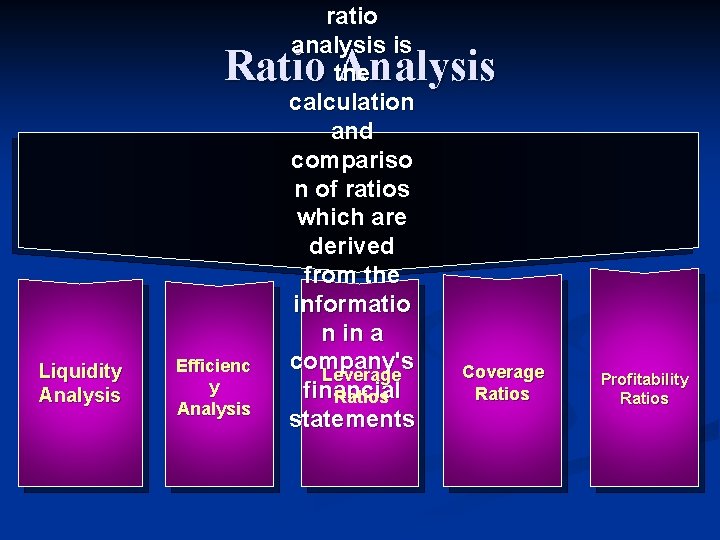

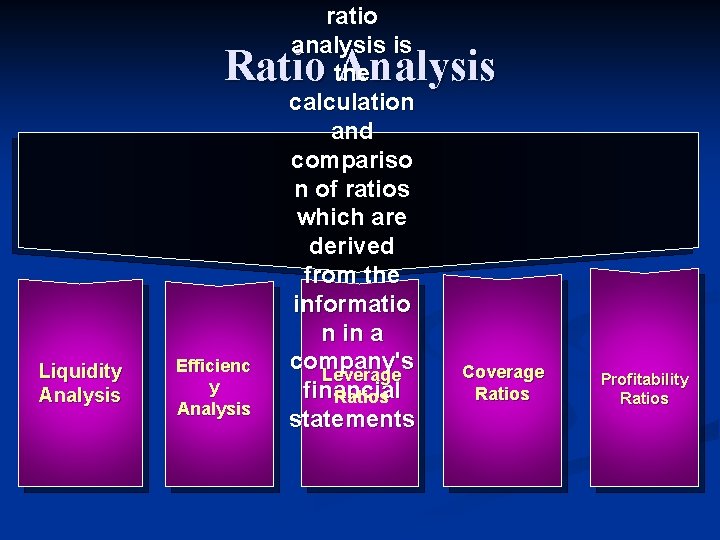

ratio analysis is the calculation and compariso n of ratios which are derived from the informatio n in a company's Leverage financial Ratios statements Ratio Analysis Liquidity Analysis Efficienc y Analysis Coverage Ratios Profitability Ratios

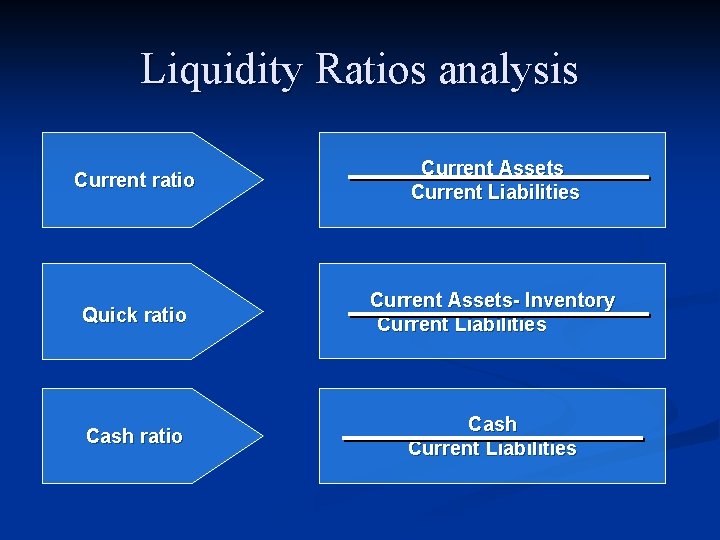

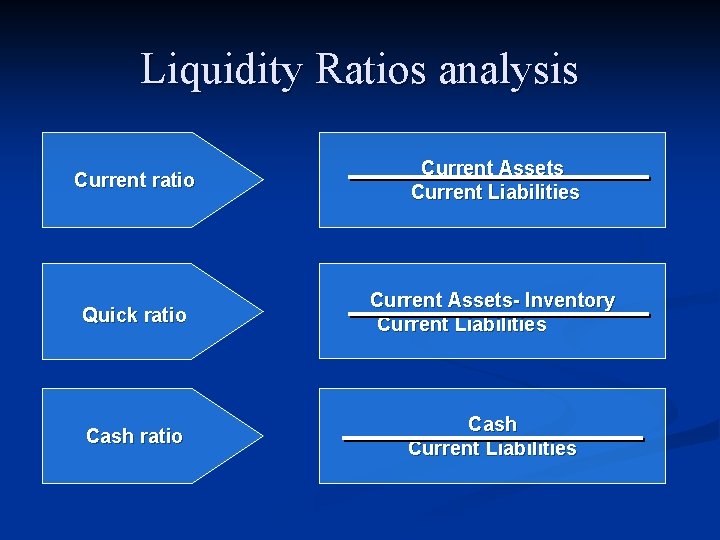

Liquidity Ratios analysis Current ratio Current Assets Current Liabilities Quick ratio Current Assets- Inventory Current Liabilities Cash ratio Cash Current Liabilities

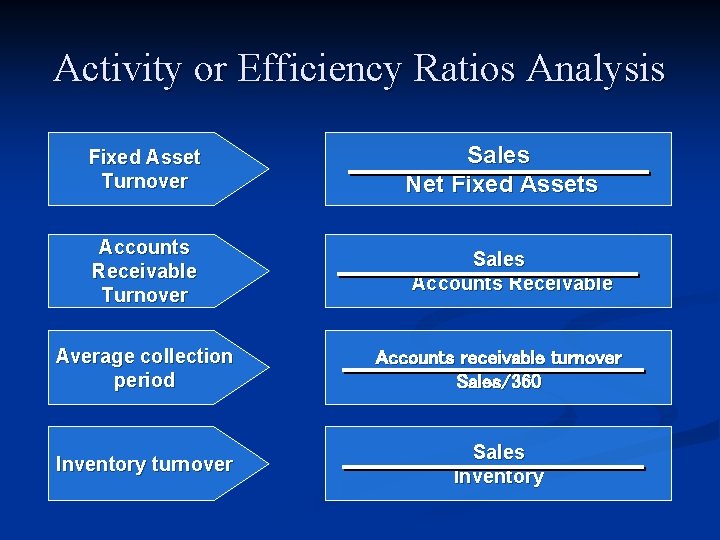

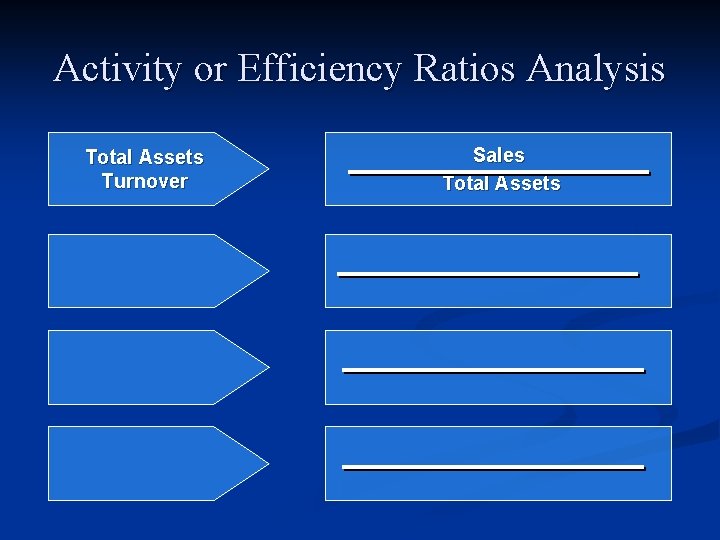

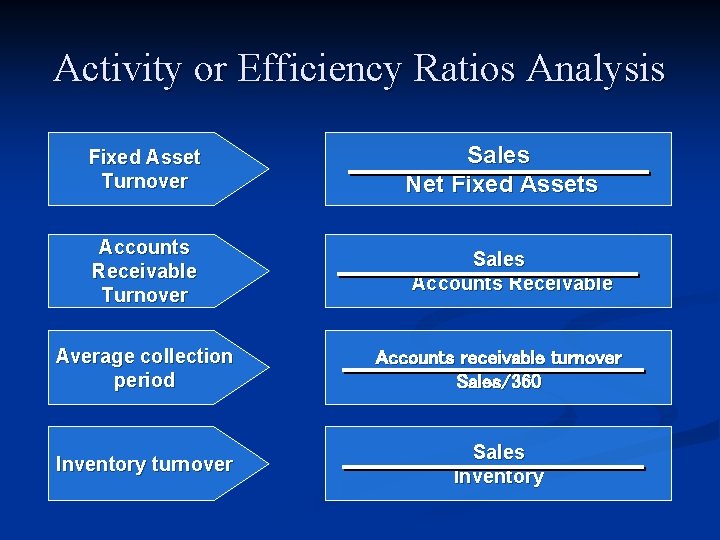

Activity or Efficiency Ratios Analysis Fixed Asset Turnover Accounts Receivable Turnover Sales Net Fixed Assets Sales Accounts Receivable Average collection period Accounts receivable turnover Sales/360 Inventory turnover Sales Inventory

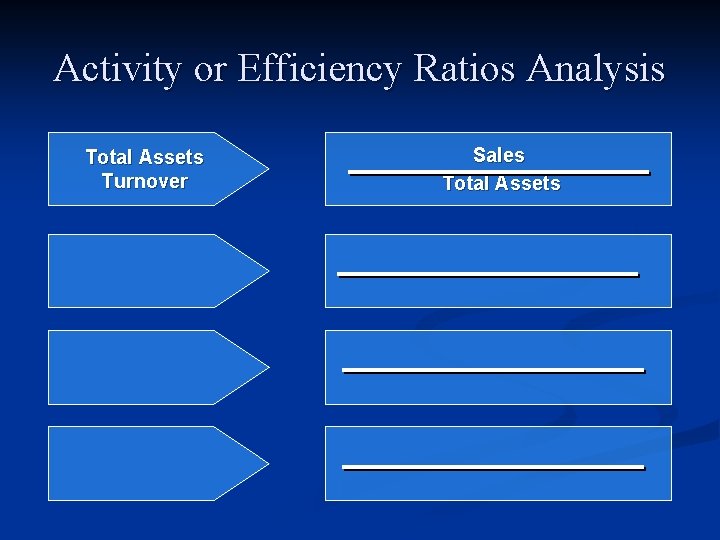

Activity or Efficiency Ratios Analysis Total Assets Turnover Sales Total Assets

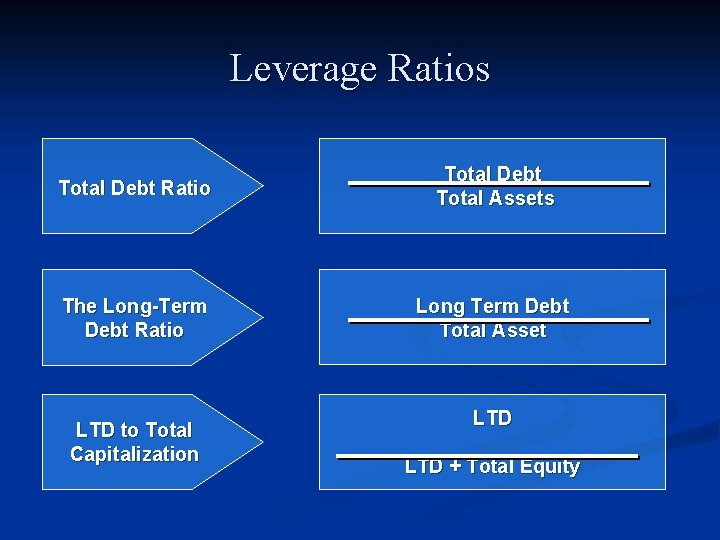

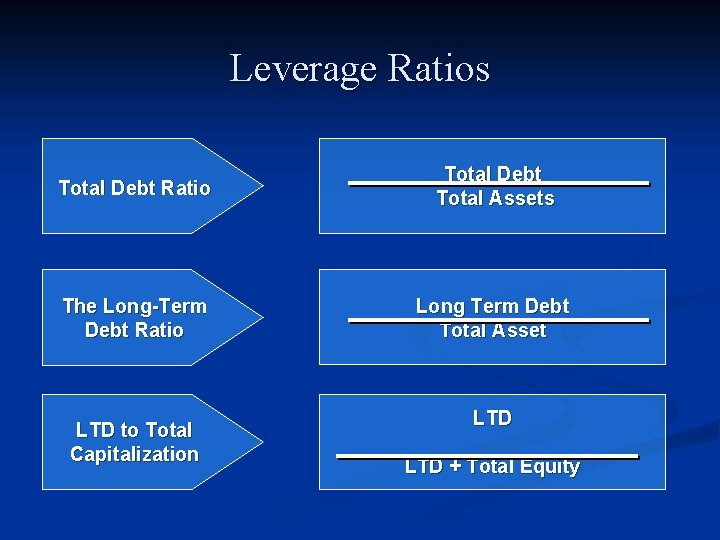

Leverage Ratios Total Debt Ratio Total Debt Total Assets The Long-Term Debt Ratio Long Term Debt Total Asset LTD to Total Capitalization LTD + Total Equity

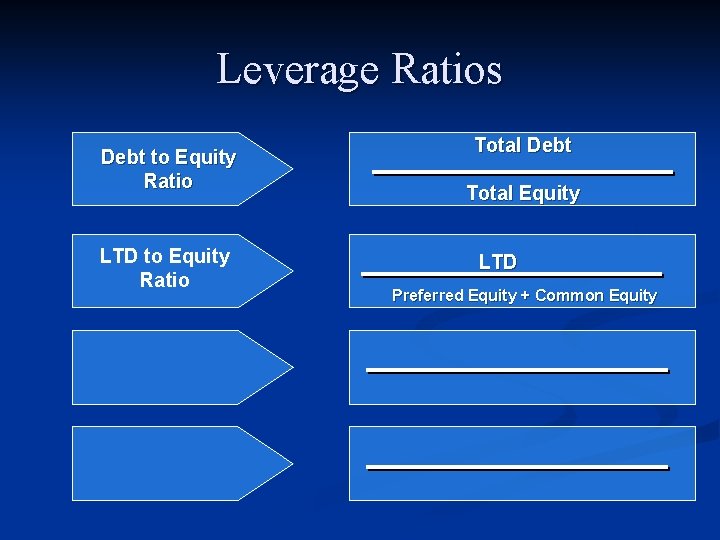

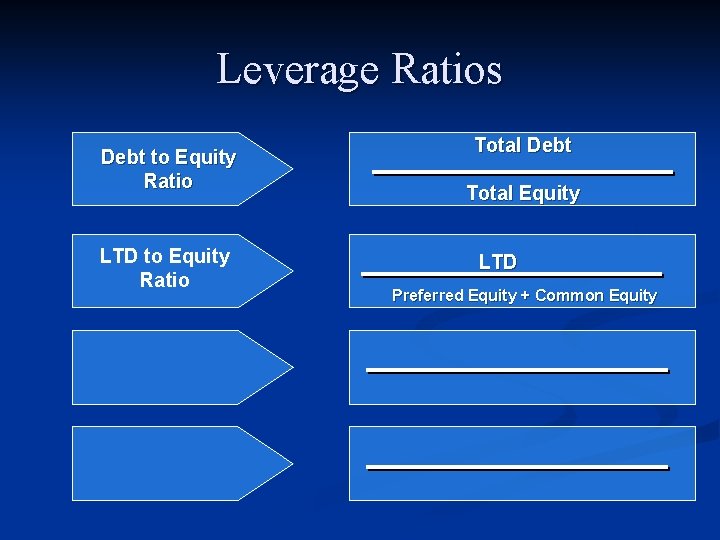

Leverage Ratios Debt to Equity Ratio LTD to Equity Ratio Total Debt Total Equity LTD Preferred Equity + Common Equity

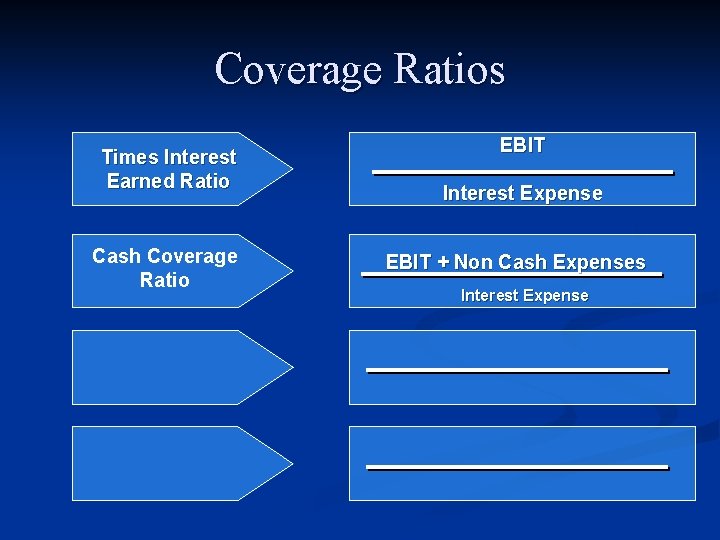

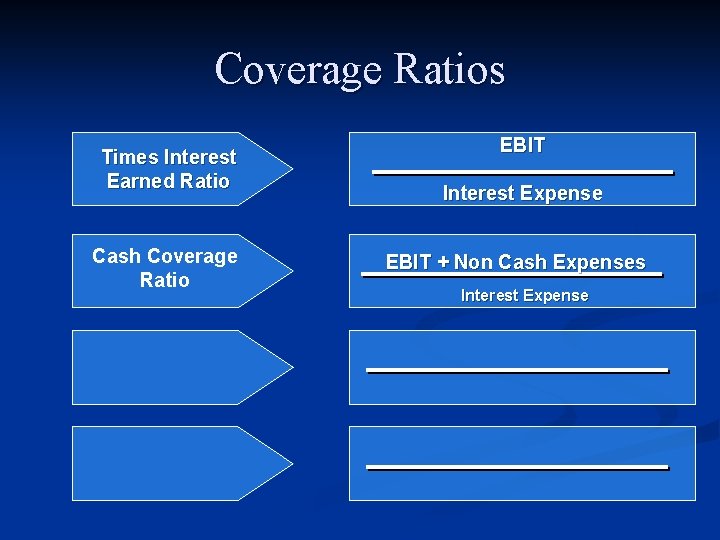

Coverage Ratios Times Interest Earned Ratio Cash Coverage Ratio EBIT Interest Expense EBIT + Non Cash Expenses Interest Expense

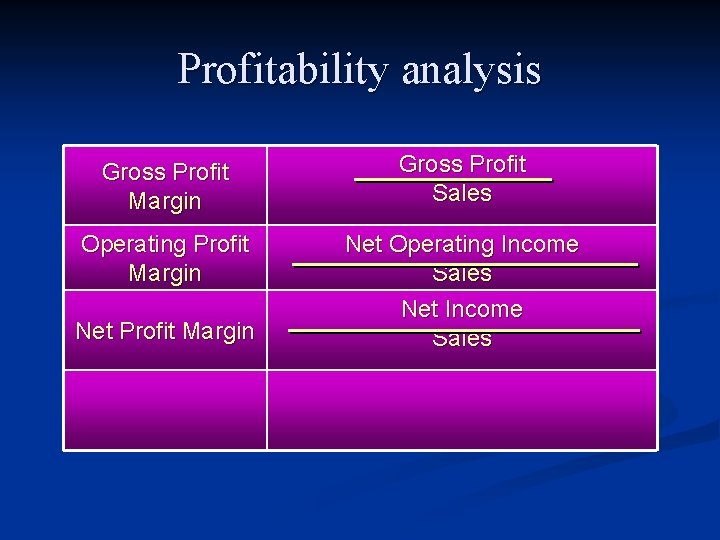

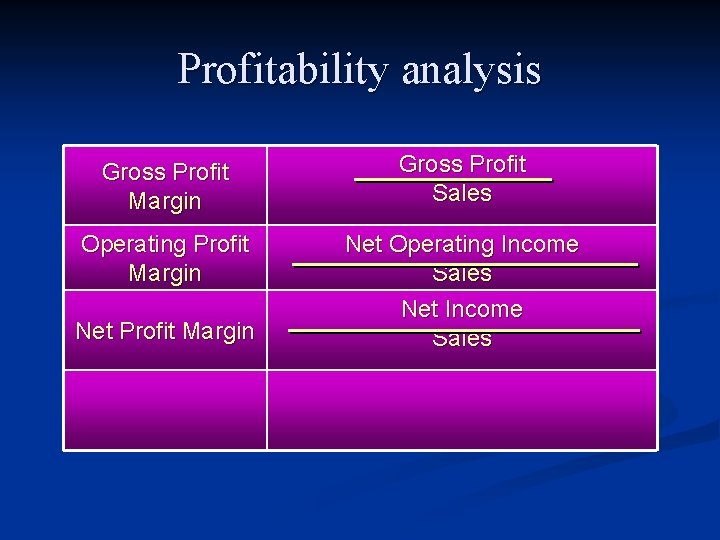

Profitability analysis Gross Profit Margin Gross Profit Sales Operating Profit Margin Net Operating Income Sales Net Profit Margin

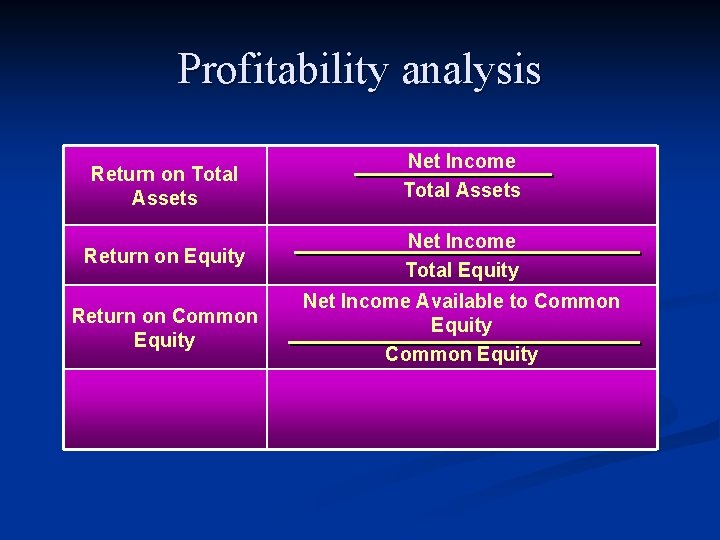

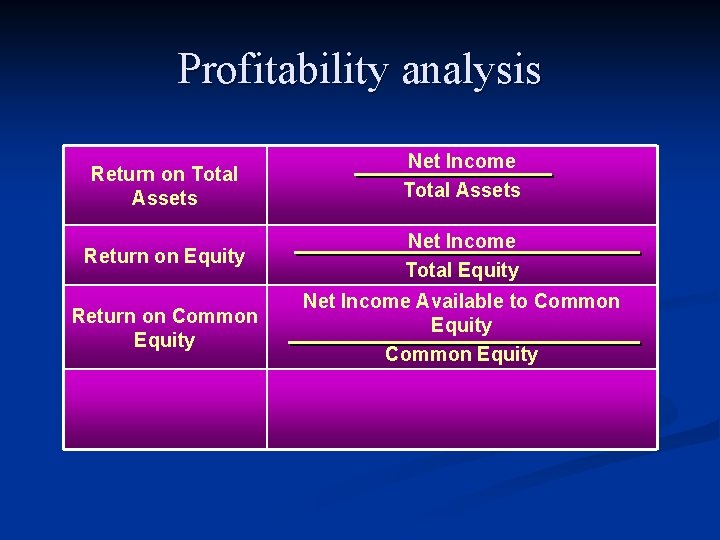

Profitability analysis Return on Total Assets Net Income Total Assets Return on Equity Net Income Total Equity Return on Common Equity Net Income Available to Common Equity

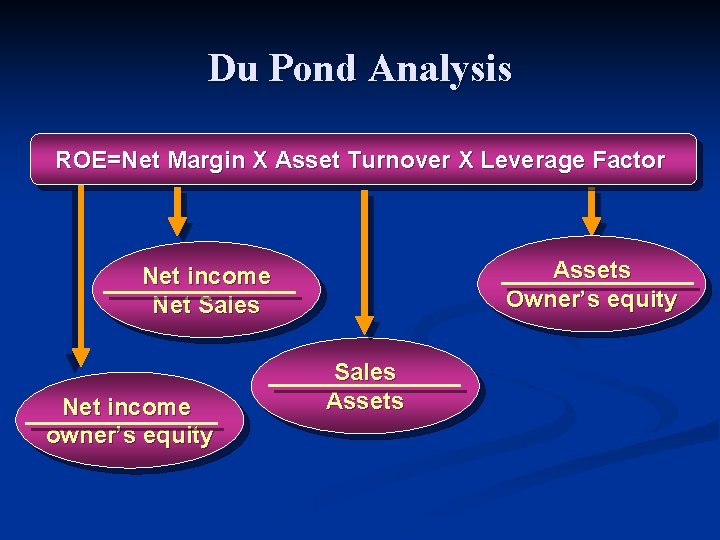

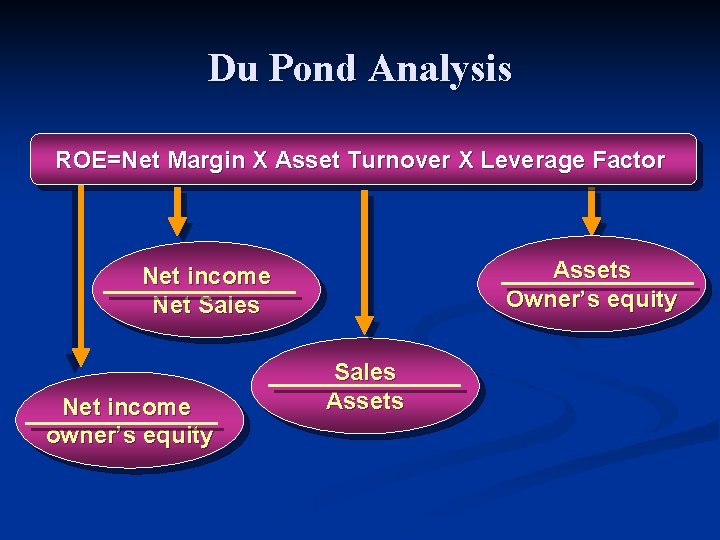

Du Pond Analysis ROE=Net Margin X Asset Turnover X Leverage Factor Assets Owner’s equity Net income Net Sales Net income owner’s equity Sales Assets

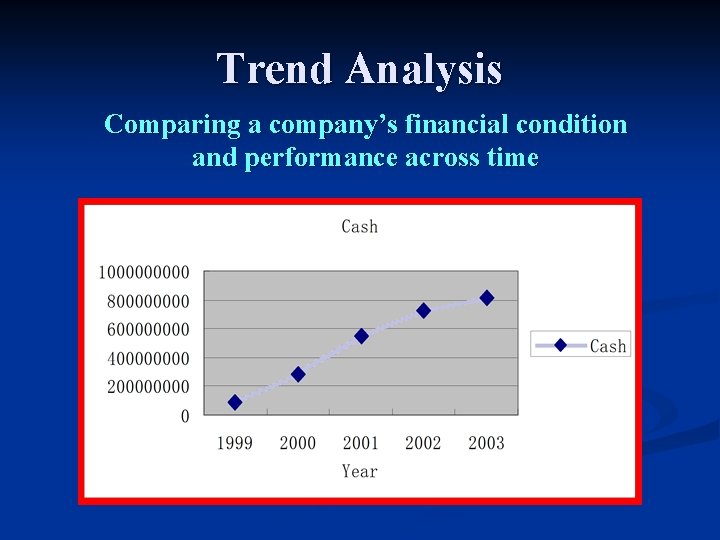

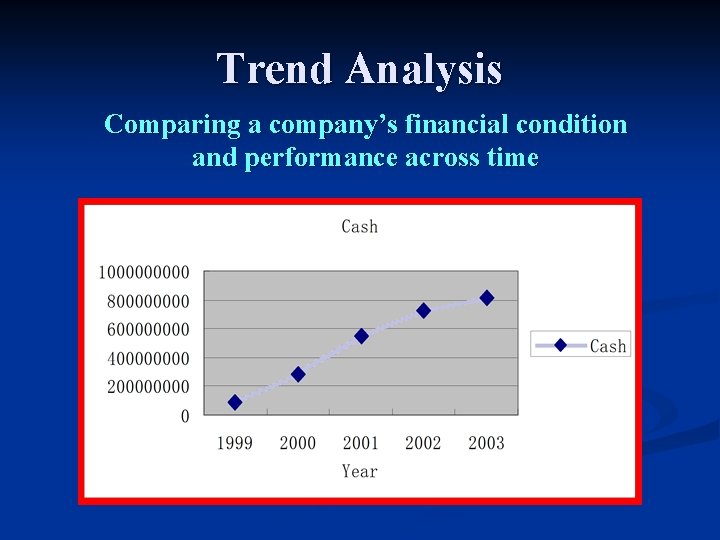

Trend Analysis Comparing a company’s financial condition and performance across time

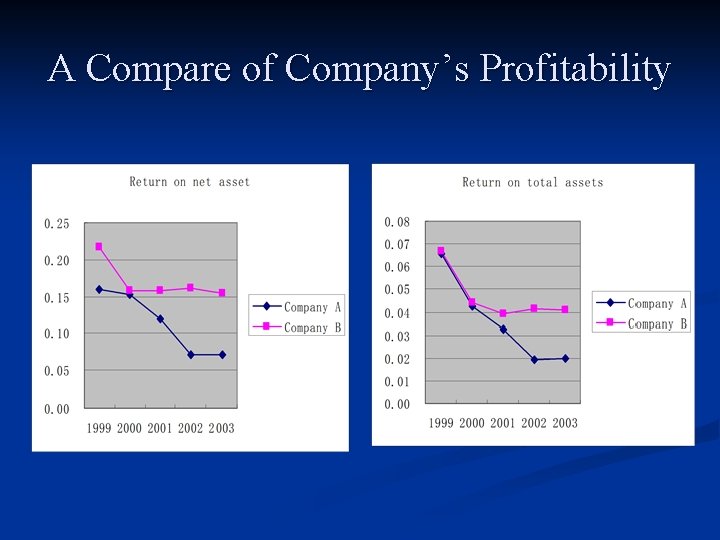

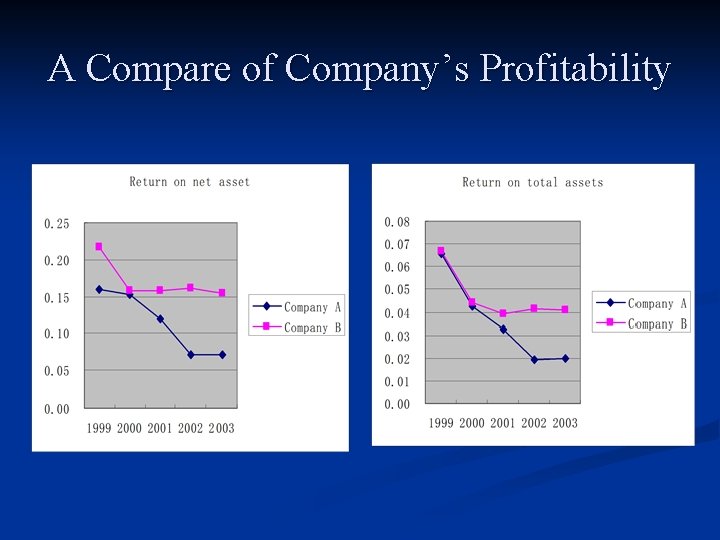

A Compare of Company’s Profitability

Why ratio analysis is useful? n n n They facilitate inter-company comparison; They downplay the impact of size and allow evaluation over time or across entities without undue concern for the effects of size difference; They serve as benchmarks for targets such as financing ratios and debt burden; They help provide an informed basis for making investmentrelated decisions by comparing an entity’s financial performance to another; ……

How is ratio analysis limited? It is restricted to information reported in the financial statements; n It is based on past performance. n Comparability is hampered when accounting policies are not uniform across an industry; n The past may not predict the future; n

How is ratio analysis limited? (cont) Trends and relationships must be carefully evaluated with reference to industry norms, budgets, and strategic decisions; n Because of some potential problems in standard, comparison must be careful; n

Potential problems and limitations of financial ratio analysis Comparison with industry averages is difficult for a conglomerate firm that operates in many different divisions. n “Average” performance is not necessarily good, perhaps the firm should aim higher. n Seasonal factors can distort ratios. n “Window dressing” techniques can make statements and ratios look better. n

More issues regarding ratios Different operating and accounting practices can distort comparisons. n Sometimes it is hard to tell if a ratio is “good” or “bad”. n Difficult to tell whether a company is, on balance, in strong or weak position. n

What should an analyst keep in mind about financial analysis? An overview of all ratios can provide important information concerning the strategic decisions of a company and the nature of its business; n However, accounting information can only provide so much data. An analyst must proceed with caution; n

Qualitative factors to be considered when evaluating a company’s future financial performance Are the firm’s revenues tied to 1 key customer, product, or supplier? n What percentage of the firm’s business is generated overseas? n Competition n Future prospects n Legal and regulatory environment n

Summary Users of financial statements often gain a clearer picture of the economic condition of an entity by the analysis of accounting information; n The analytical measures obtained from financial statements are usually expressed as ratios or percentages; n

Summary n Financial analysis techniques work best when they are used to confirm or refute other information. When using analytical tools to evaluate a company, the analyst should keep in mind the limitations of analysis

The End of Chapter 4