Chapter 4 Assessing Strengths and Weaknesses Internal Analysis

- Slides: 41

Chapter 4 Assessing Strengths and Weaknesses: Internal Analysis Instructor: Moses Acquaah, Ph. D. 377 Bryan Building Phone: (336)334 -5305 Email: acquaah@uncg. edu

Lecture Objectives (1) Define internal analysis and discuss why it is important. (2) Describe the relationship between organizational resources, organizational capabilities, core competencies, and distinctive organizational capabilities. (3) Explain what organizational strengths and weaknesses are. (4) Define the value chain and describe the primary and support activities on the value chain. (5) Explain the strategic options for correcting cost competitiveness on the value chain system. (6) Discuss the steps in conducting a competitive strength assessment (7) Explain how to use the internal audit process (8) Discuss the features of an internal environmental analysis process (9) Describe the steps in capabilities assessment profile

What is Internal Analysis? • The process of identifying and evaluating an organization’s specific characteristics – Resources, capabilities, and core competencies – Looks at organization’s • • Current vision Mission(s) Strategic & financial objectives Strategies

Why Do an Internal Analysis? • Enables a firm to identify its strengths and weaknesses. • Enables a firm to make good strategic decisions. • Information from internal environment provides basis for developing strategic alternatives.

A Quick Review of Organizational Resources • Organizational resources are assets an organization has for carrying out work activities and processes – Financial resources • Current debt, credit lines, equity, cash reserves, etc. – Physical resources • Plant & equipment, inventories, supplies, fixtures, etc. – Human resources • Management & employee skills, training, experiences, etc

A Quick Review of Organizational Resources – Intangible resources • Brand names, patents, trademarks, copyrights, etc. – Structural-cultural resources • Culture, history, work systems policies, formal reporting structures, etc • Human, intangible, and structural-cultural resources can be a source of competitive advantage – Play important role in determining capabilities or competencies and core competencies

Organizational Capabilities • Organizational capabilities/competencies – The complex and coordinated network of company routines and processes that determines how efficiently and effectively the organization transforms its resources into products (goods & services) – Involves complex pattern of coordination between people, & between people and resources – It’s an internal activity that a company performs better than other internal activities

Organizational Capabilities • Organizational routines & processes: • Regular, predictable, and sequential patterns of work activity by organizational members • Sustainable Competitive Advantage (CA): • The prolonged maintenance of competitive advantage • Capabilities that are capable of leading to CA today may not continue to do so as conditions & rivals change • Dynamic capabilities • An organization’s ability to build, integrate and reconfigure capabilities to address rapidly changing environments over time.

Core Competencies • Core competencies – A well-performed internal activity that is central, not peripheral, to a company’s strategy, competitiveness, and profitability – Major value-creating skills and capabilities that • are shared across multiple product lines or multiple businesses • Results from the collaboration among different parts of an organization – Gives a company a potentially valuable competitive capability

Core Competencies • Types of Capabilities/Core Competencies – – – – – Skills in manufacturing a high quality product System to fill customer orders accurately and swiftly Fast development of new products Better after-sale service capability Superior know-how in selecting good retail locations Innovativeness in developing popular product features Merchandising and product display skills Expertise in an important technology Expertise in integrating multiple technologies to create whole families of new products

From Core Competencies to Distinctive Capabilities • Distinctive Capabilities – Special and unique capabilities that distinguish the organization from its competitors – A competitively valuable activity that a company performs better than its rivals – Allow a company to develop a sustainable competitive advantage and outperform its competition

From Core Competencies to Distinctive Capabilities • Characteristics of distinctive capabilities: (1) Contribute to superior customer value and offers real benefits to customers (2) Difficult for competitors to imitate (3) Allow the organization to use that capability in a variety of ways • What’s the relationship between organizational capabilities, core competencies and distinctive capabilities?

Examples of Distinctive Capabilities • Sharp Corporation – Expertise in flat-panel display technology • Toyota – Low-cost, high-quality manufacturing capability and short design-to-market cycles • Intel Corporation – Ability to design and manufacture ever more powerful microprocessors for PCs • Motorola – Defect-free manufacture (six-sigma quality) of cell phones

Strengths and Weaknesses • Strengths – Resources that an organization possesses and capabilities that the organization has developed – Both can be exploited and developed into a sustainable competitive advantage • Weaknesses – Resources and capabilities that are lacking or deficient; and that – Prevents an organization from developing a sustainable competitive advantage

How to Do an Internal Analysis Approaches to internal analysis (1) Value Chain Analysis (2) Competitive Strength Assessment (3) An Internal Audit (4) Internal Environmental Analysis Process (5) Capabilities Assessment Profile

(1) Value Chain Analysis • Value Chain Analysis – Customers want (demand) some type of value from the goods and services they purchase or obtain – Customer value arises from (1) Uniqueness of product or service (2) Low-priced product/service (3) Quick response to specific or distinctive customer needs – Allow assessment of cost competitiveness of organization with those of its rivals

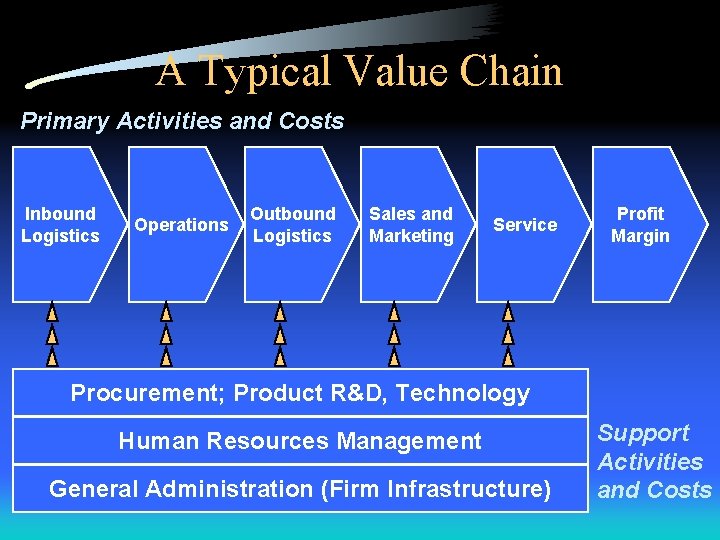

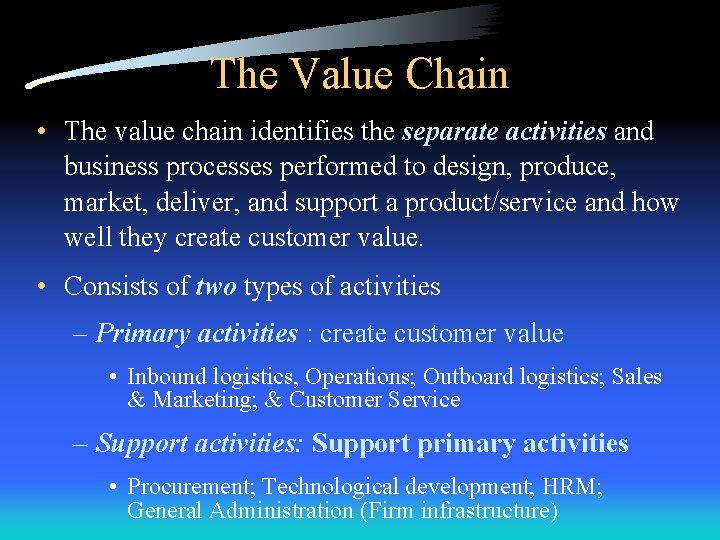

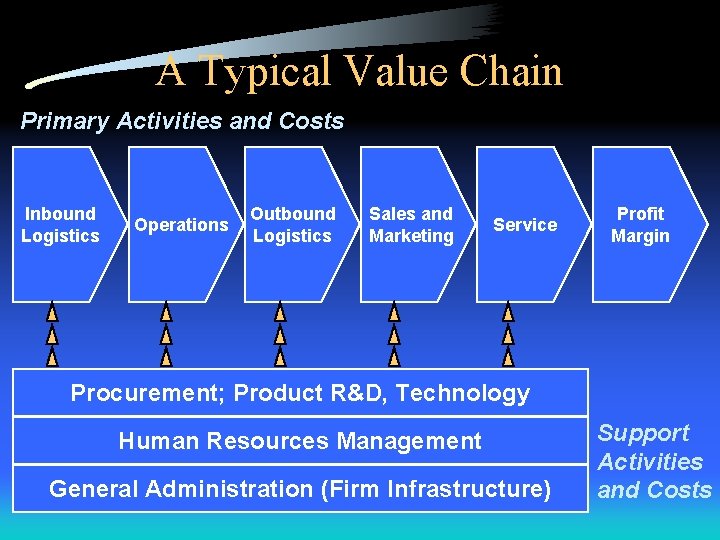

The Value Chain • The value chain identifies the separate activities and business processes performed to design, produce, market, deliver, and support a product/service and how well they create customer value. • Consists of two types of activities – Primary activities : create customer value • Inbound logistics, Operations; Outboard logistics; Sales & Marketing; & Customer Service – Support activities: Support primary activities • Procurement; Technological development; HRM; General Administration (Firm infrastructure)

A Typical Value Chain Primary Activities and Costs Inbound Logistics Operations Outbound Logistics Sales and Marketing Service Profit Margin Procurement; Product R&D, Technology Human Resources Management General Administration (Firm Infrastructure) Support Activities and Costs

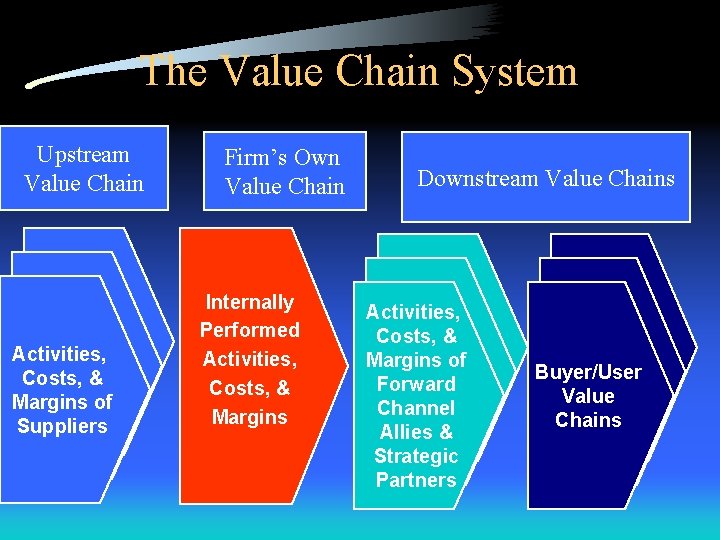

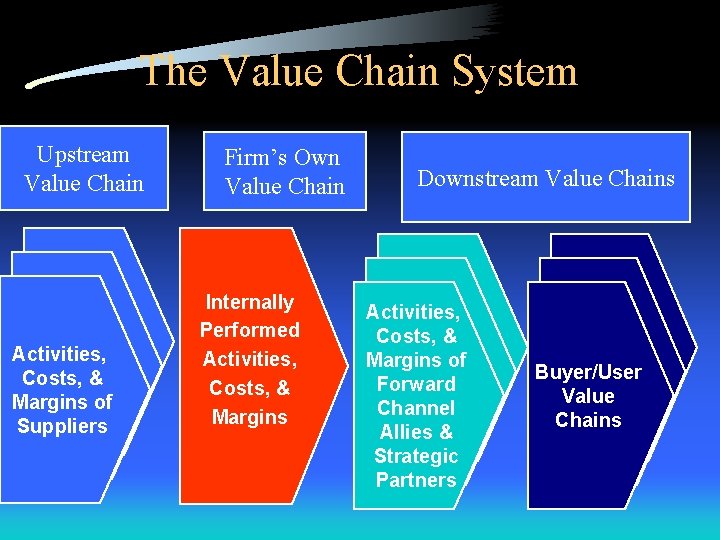

The Value Chain System Upstream Value Chain Activities, Costs, & Margins of Suppliers Firm’s Own Value Chain Internally Performed Activities, Costs, & Margins Downstream Value Chains Activities, Costs, & Margins of Forward Channel Allies & Strategic Partners Buyer/User Value Chains

Examples of Key Value Chain Activities • Soft Drinks Industry Processing of basic ingredients Syrup manufacture Bottling & can filling Wholesale distribution Retailing • Computer Software Industry Programming Disk Loading Marketing Distribution

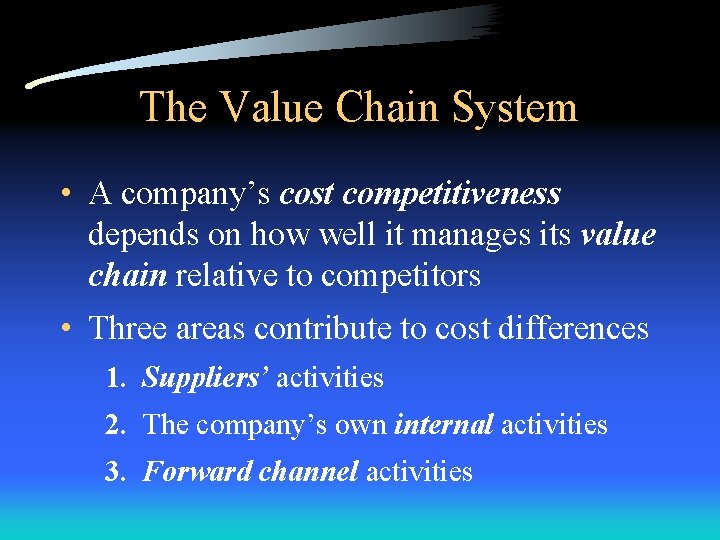

The Value Chain System • A company’s cost competitiveness depends on how well it manages its value chain relative to competitors • Three areas contribute to cost differences 1. Suppliers’ activities 2. The company’s own internal activities 3. Forward channel activities

The Value Chain System • Assessing a company’s cost competitiveness involves comparing costs along the industry’s value chain • Suppliers’ value chains are relevant because – Costs, quality, and performance of inputs provided by suppliers influence a firm’s own costs and product performance • Forward channel allies’ value chains are relevant because – Forward channel allies’ costs and margins are part of price paid by ultimate end-user – Activities performed affect end-user satisfaction

Strategic Options for Correcting Costs Competitiveness • Supplier-related costs disadvantages: – Negotiate more favorable prices with suppliers – Work with suppliers to achieve lower costs – Integrate backward – Use lower-priced substitute inputs – Do a better job of managing linkages between suppliers’ value chains and firm’s own chain – Make up difference by initiating cost savings in other areas of value chain

Strategic Options for Correcting Costs Competitiveness • Forward channel allies’ costs disadvantages: – Push for more favorable terms with distributors and other forward channel allies – Work closely with forward channel allies and customers to identify win-win opportunities to reduce costs – Change to a more economical distribution strategy – Make up difference by initiating cost savings earlier in value chain

Strategic Options for Correcting Costs Competitiveness • Firm’s own internal cost disadvantages: – Reengineer performance of high-cost activities or business processes – Eliminate some cost-producing activities altogether by revamping value chain system (VCS) – Relocate high-cost activities to lower-cost geographic areas – See if high-cost activities can be performed cheaper by outside vendors/suppliers – Invest in cost-saving technology – Simplify product design – Achieving savings in backward or forward portions of VCS

From Value Chain Analysis to Competitive Advantage • A company can create competitive advantage by managing its value chain so as to – Integrate the knowledge and skills of employees in competitively valuable ways – Leverage economies of learning or experience curve effects – Coordinate related activities in ways that build valuable capabilities – Build dominating expertise in a value chain activity critical to customer satisfaction or market success

From Value Chain Analysis to Competitive Advantage • The strategy-making lesson of value chain analysis is that sustainable competitive advantage can be created by: (1). Managing the value chain activities better than competitors; and (2). Developing distinctive capabilities to serve the needs of customers better

(2) Assessing Organization’s Competitive Strength • How does the firm rank relative to key rivals on each industry KSF and relevant measure of competitive strength (capabilities or core competencies)? • Does the firm have a sustainable competitive advantage or disadvantage • What is the ability of the firm to defend its position in light of – Industry driving forces – Competitive pressures – Anticipated moves of rivals

Assessing Organization’s Competitive Strength 1. List industry key success factors and other relevant measures of competitive strength 2. Rate firm and key rivals on each factor using rating scale of 1 - 10 (1 = weak; 10 = strong) 3. Decide whether to use a weighted or unweighted rating system 4. Sum individual ratings to get overall measure of competitive strength for each rival 5. Determine whether the firm enjoys a competitive advantage or suffers from competitive disadvantage

Assessing Organization’s Competitive Strength • A weighted competitive strength analysis is conceptually stronger than an unweighted competitive strength analysis because – All the strength measures are not equally important. – E. g. , in an industry with strong product differentiation, the significant strength measures may be • • Brand awareness Reputation for quality Amount of advertising Distribution capability, etc.

Some KSF/Strength Measures • • • Quality/product performance Reputation/image Manufacturing capability Technological skills Dealer network/Distribution channels New product innovation Financial resources Relative cost position Customer service capability

Assessing Organization’s Competitive Strength • What does a high competitive strength rating relative to rivals mean? – Strong competitive position & possession of competitive advantages – Opportunity for company to improve its long-term market position • Good strategy entails – Looking for opportunities to leverage company strengths into competitive advantage – Using company strengths to attack the competitive weaknesses of rivals

Why Do a Competitive Strength Assessment? • Reveals strength of firm’s competitive position • Shows how firm stacks up against rivals, measureby-measure -- pinpoints the company’s competitive strengths and competitive weaknesses • Indicates whether firm is at a competitive advantage / disadvantage against each rival • Identifies possible offensive attacks (pit company strengths against rivals’ weaknesses) • Identifies possible defensive actions (a need to correct competitive weaknesses)

(3) Using an Internal Audit • Internal Audit – A thorough assessment of an organization’s various internal functional areas – Strategic decision makers use the internal audit to assess the organization’s resources and capabilities from the perspectives of its different functions

Using an Internal Audit • Six primary functional areas – – – Production-operations Marketing Research & development Financial and accounting Management, including HRM Information System • Depending on products, markets, and industries, individual organizational structures may vary and, therefore, may emphasize different sets of functional areas

(4) Using an Internal Environmental Analysis Process • Assesses an organization’s internal activities – Step 1: Survey strengths and weaknesses – Step 2: Categorize these strengths & weaknesses (S&W) in terms of resources & capabilities – Step 3: Investigate the potential of strengths to lead to competitive advantage – Step 4: Evaluate the ability of these competitively resources & capabilities to serve as the basis for an appropriate competitive strategy

(5) Capabilities Assessment Profile • Resembles the internal environmental analysis – Similarity: Focuses on deeper evaluation of S&W – Difference: Focuses only on an firm’s capabilities • Analysis of capabilities is complex – Not as easily identified as organization’s function or even the value creating primary & support activities – Complex nature of capabilities makes it hard for competitors to imitate

Capabilities Assessment Profile • Analysis Consists of two phases: – Phase I: Identify distinctive capabilities – Phase II: Develop and leverage distinctive capabilities • Identifying Distinctive Organizational Capabilities – Step 1: Prepare current product-market profile • • Emphasize organization-customer interactions What is the organization selling? Who are the organization selling to? Is the organization providing superior customer value & desirable benefits?

Capabilities Assessment Profile – Step 2: Identify sources of competitive advantage & disadvantage in the main productmarket segment • Determine why customers choose the organization’s products vs. those of competitors • Involves information on cost, product, and service attributes – When customers purchase – What they’re actually purchasing – What bundle of attributes satisfies their needs

Capabilities Assessment Profile – Step 3: Describe all organizational capabilities & competencies • Examine resources, skills, & abilities of the various divisions • Determine which resources, skills, & abilities lead to a competitive advantage – Step 4: Sort the core capabilities/competencies according to strategic importance • Can capability provide wide access to a number of different markets? • Does the capability provide tangible customer benefits? • Is the capability difficult for competitors to imitate?

Capabilities Assessment Profile – Step 5: Identify and agree on the key capabilities or competencies • Provide basis for resource allocation • Classifying an Organization’s S&W – Past performance trends • Measures such as financial ratios, operations efficiency, etc, – Specific goal or targets • Organization’s goals are statements of desired outcomes – Comparison against competitors • How are competitors doing? – Personal opinions of decision makers & consultants