Chapter 3 The Internal Environment Resources Capabilities and

Chapter 3 The Internal Environment: Resources, Capabilities, and Activities Copyright © 2012 Pearson Canada Inc. 0

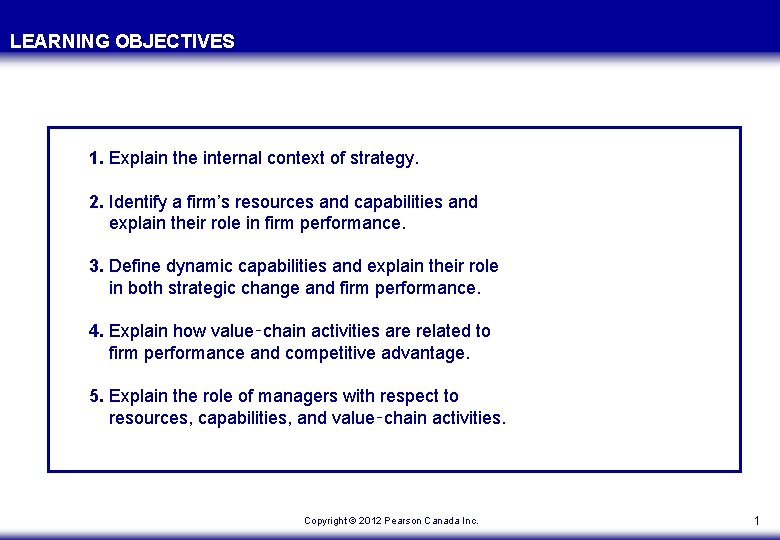

LEARNING OBJECTIVES 1. Explain the internal context of strategy. 2. Identify a firm’s resources and capabilities and explain their role in firm performance. 3. Define dynamic capabilities and explain their role in both strategic change and firm performance. 4. Explain how value‑chain activities are related to firm performance and competitive advantage. 5. Explain the role of managers with respect to resources, capabilities, and value‑chain activities. Copyright © 2012 Pearson Canada Inc. 1

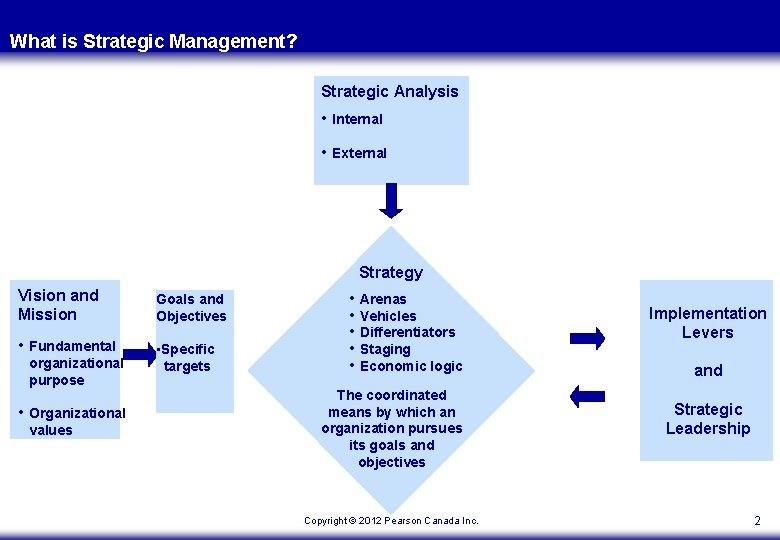

What is Strategic Management? Strategic Analysis • Internal • External Strategy Vision and Mission Goals and Objectives • Fundamental • Specific targets organizational purpose • Organizational values • • • Arenas Vehicles Differentiators Staging Economic logic The coordinated means by which an organization pursues its goals and objectives Copyright © 2012 Pearson Canada Inc. Implementation Levers and Strategic Leadership 2

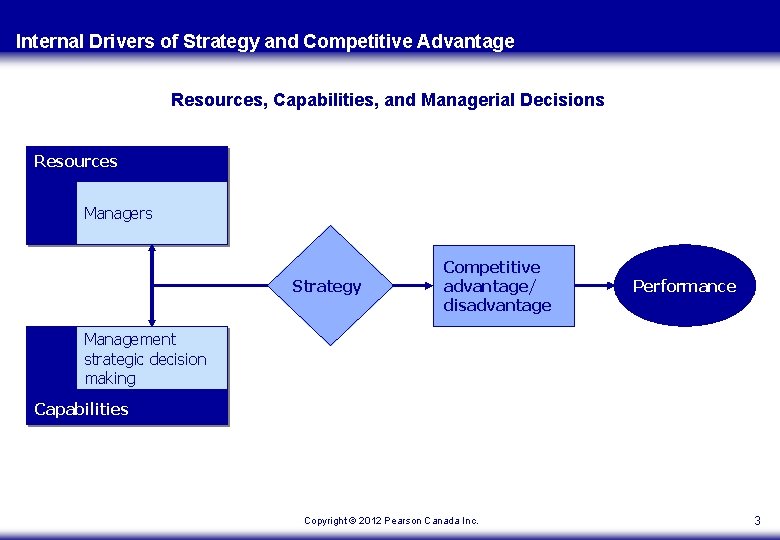

Internal Drivers of Strategy and Competitive Advantage Resources, Capabilities, and Managerial Decisions Resources Managers Strategy Competitive advantage/ disadvantage Performance Management strategic decision making Capabilities Copyright © 2012 Pearson Canada Inc. 3

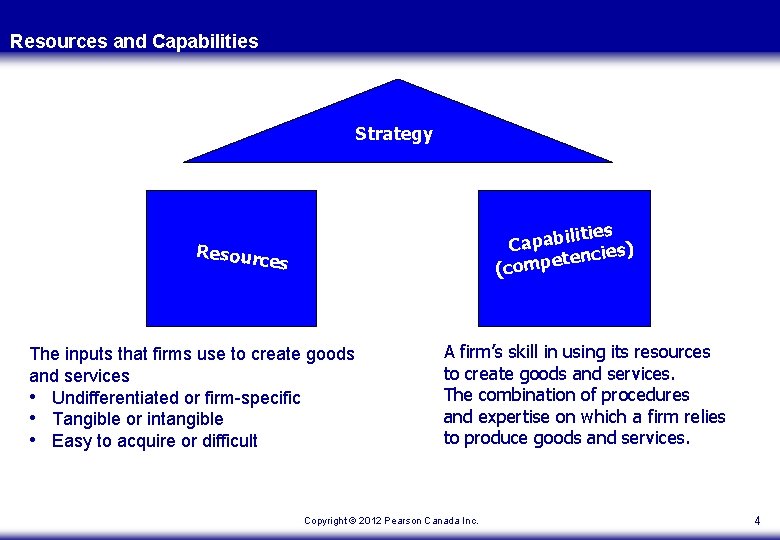

Resources and Capabilities Strategy lities Capabi cies) ten (compe Resourc es The inputs that firms use to create goods and services • Undifferentiated or firm-specific • Tangible or intangible • Easy to acquire or difficult A firm’s skill in using its resources to create goods and services. The combination of procedures and expertise on which a firm relies to produce goods and services. Copyright © 2012 Pearson Canada Inc. 4

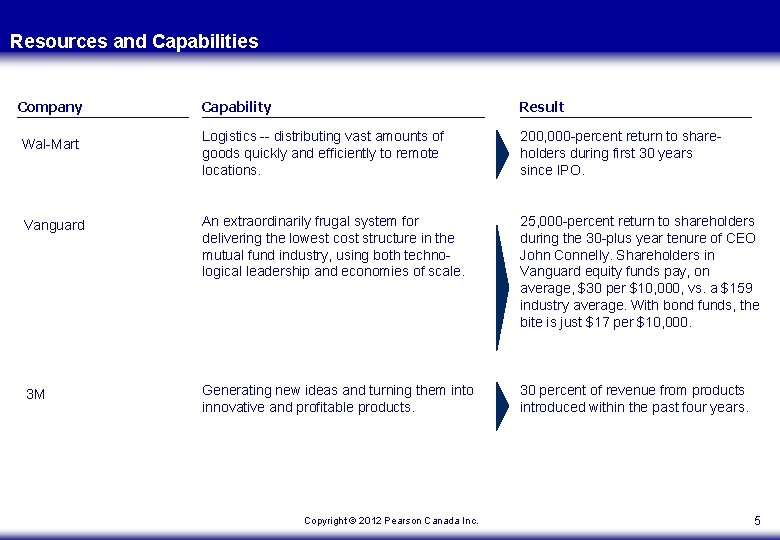

Resources and Capabilities Company Capability Result Logistics -- distributing vast amounts of goods quickly and efficiently to remote locations. 200, 000 -percent return to shareholders during first 30 years since IPO. Vanguard An extraordinarily frugal system for delivering the lowest cost structure in the mutual fund industry, using both technological leadership and economies of scale. 25, 000 -percent return to shareholders during the 30 -plus year tenure of CEO John Connelly. Shareholders in Vanguard equity funds pay, on average, $30 per $10, 000, vs. a $159 industry average. With bond funds, the bite is just $17 per $10, 000. 3 M Generating new ideas and turning them into innovative and profitable products. 30 percent of revenue from products introduced within the past four years. Wal-Mart Copyright © 2012 Pearson Canada Inc. 5

Resource-Based View of the Firm (vs the S-C-P Model (Ch 4) Resources and Capabilities • Intangible resources • Tangible resources • Organizational capabilities (competencies) Copyright © 2012 Pearson Canada Inc.

Resources and Capabilities Distinctive competence: Capability that sets a company apart from other companies; something that a company can do that competitors cannot duplicate easily. Core competence: Capability that is central to a corporation’s main business operations and allows it to generate new products and services. Copyright © 2012 Pearson Canada Inc. 7

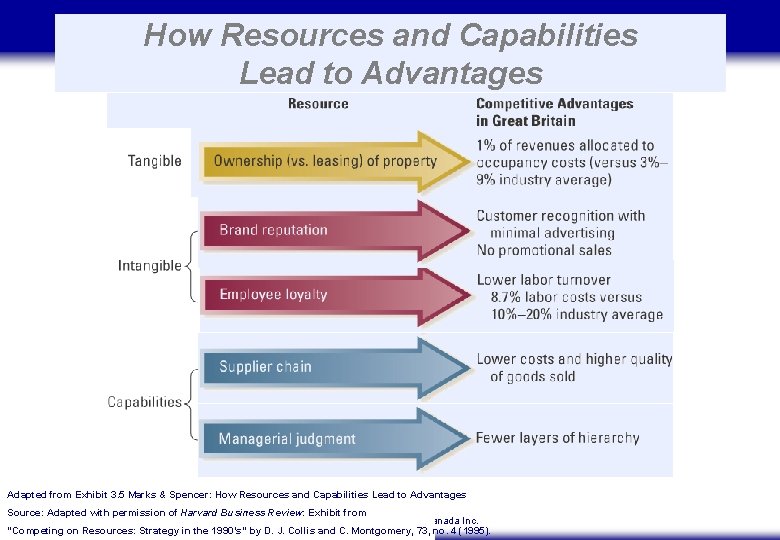

How Resources and Capabilities Lead to Advantages Adapted from Exhibit 3. 5 Marks & Spencer: How Resources and Capabilities Lead to Advantages Source: Adapted with permission of Harvard Business Review: Exhibit from Copyright © 2012 Pearson Canada Inc. “Competing on Resources: Strategy in the 1990’s” by D. J. Collis and C. Montgomery, 73, no. 4 (1995).

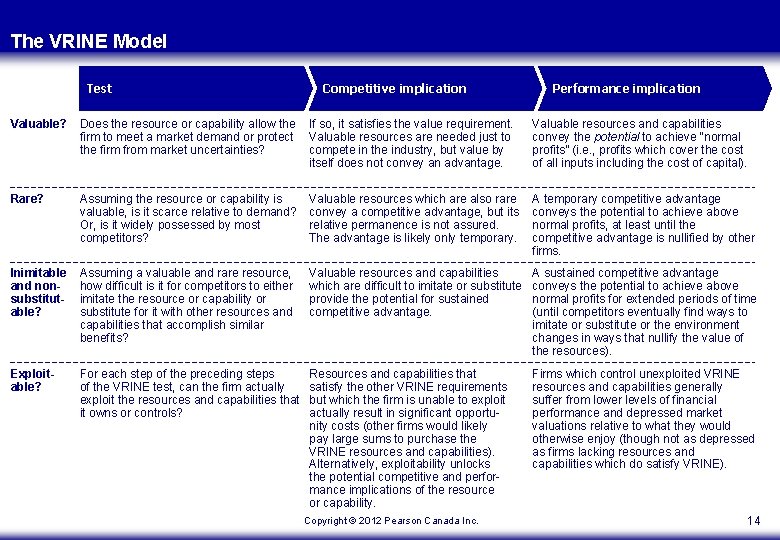

VRINE MODEL How does a company know if its resources and capabilities are strengths, weaknesses, etc? How does a company know if its resources and capabilities can drive competitive advantage? Answer: We need criteria to judge the resources and capabilities. VRINE (originally VRIO) is one method. Copyright © 2012 Pearson Canada Inc. 9

The VRINE Model VALUE: A resource or capability is valuable if it enables a company to take advantage of opportunities or to fend off threats in its environment. RARITY: Rarity is scarcity relative to demand. An otherwise valuable resource that isn’t rare won’t necessarily contribute to competitive advantage. Copyright © 2012 Pearson Canada Inc. 10

The VRINE Model INIMITABILITY: That which cannot be imitated is inimitable. But imitation is typically a matter of time as aspiring competitors can eventually imitate most resources. Several factors can limit the ability of competitors to imitate resources or capabilities: 1. high cost 2. property rights 3. time 4. causal ambiguity Copyright © 2012 Pearson Canada Inc. 11

The VRINE Model NON-SUBSTITUTABILITY: The non-substitutability criterion is satisfied if a competitor cannot achieve the same results using a different combination of resources and capabilities. EXPLOITABILITY: The business can be organized to exploit the full potential of the resource or capability. The organizational capabilities include organizational structure, systems, and processes. Copyright © 2012 Pearson Canada Inc. 12

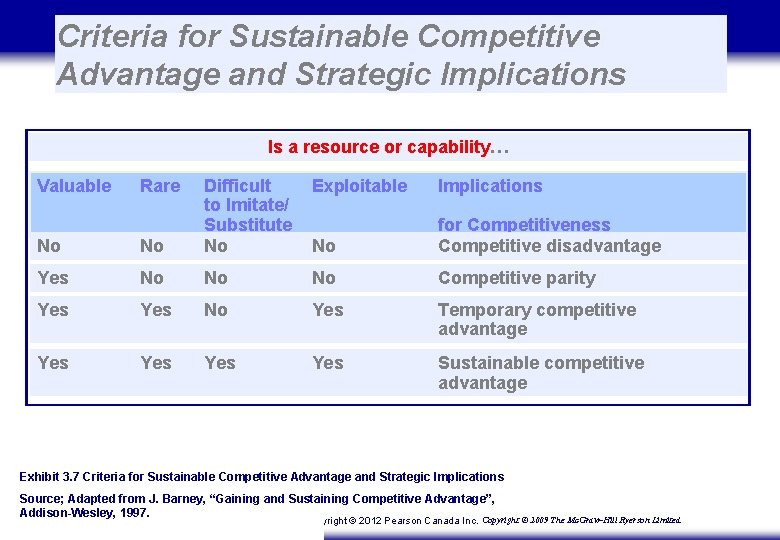

Criteria for Sustainable Competitive Advantage and Strategic Implications Is a resource or capability… Valuable Rare No No Difficult to Imitate/ Substitute No Exploitable Implications No for Competitiveness Competitive disadvantage Yes No No No Competitive parity Yes No Yes Temporary competitive advantage Yes Yes Sustainable competitive advantage Exhibit 3. 7 Criteria for Sustainable Competitive Advantage and Strategic Implications Source; Adapted from J. Barney, “Gaining and Sustaining Competitive Advantage”, Addison-Wesley, 1997. Copyright © 2009 The Mc. Graw-Hill Ryerson Limited. Copyright © 2012 Pearson Canada Inc.

The VRINE Model Test Competitive implication Performance implication Valuable? Does the resource or capability allow the firm to meet a market demand or protect the firm from market uncertainties? If so, it satisfies the value requirement. Valuable resources are needed just to compete in the industry, but value by itself does not convey an advantage. Valuable resources and capabilities convey the potential to achieve “normal profits” (i. e. , profits which cover the cost of all inputs including the cost of capital). Rare? Assuming the resource or capability is valuable, is it scarce relative to demand? Or, is it widely possessed by most competitors? Valuable resources which are also rare convey a competitive advantage, but its relative permanence is not assured. The advantage is likely only temporary. A temporary competitive advantage conveys the potential to achieve above normal profits, at least until the competitive advantage is nullified by other firms. Inimitable and nonsubstitutable? Assuming a valuable and rare resource, how difficult is it for competitors to either imitate the resource or capability or substitute for it with other resources and capabilities that accomplish similar benefits? Valuable resources and capabilities which are difficult to imitate or substitute provide the potential for sustained competitive advantage. A sustained competitive advantage conveys the potential to achieve above normal profits for extended periods of time (until competitors eventually find ways to imitate or substitute or the environment changes in ways that nullify the value of the resources). Exploitable? For each step of the preceding steps of the VRINE test, can the firm actually exploit the resources and capabilities that it owns or controls? Resources and capabilities that satisfy the other VRINE requirements but which the firm is unable to exploit actually result in significant opportunity costs (other firms would likely pay large sums to purchase the VRINE resources and capabilities). Alternatively, exploitability unlocks the potential competitive and performance implications of the resource or capability. Firms which control unexploited VRINE resources and capabilities generally suffer from lower levels of financial performance and depressed market valuations relative to what they would otherwise enjoy (though not as depressed as firms lacking resources and capabilities which do satisfy VRINE). Copyright © 2012 Pearson Canada Inc. 14

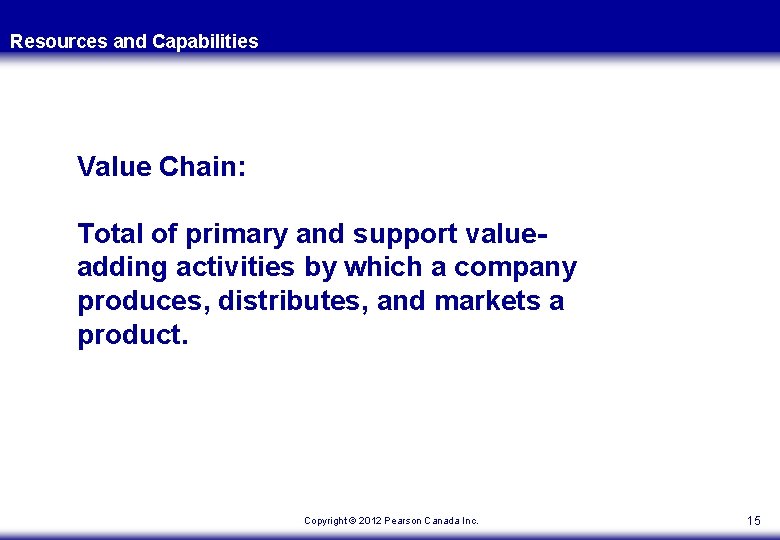

Resources and Capabilities Value Chain: Total of primary and support valueadding activities by which a company produces, distributes, and markets a product. Copyright © 2012 Pearson Canada Inc. 15

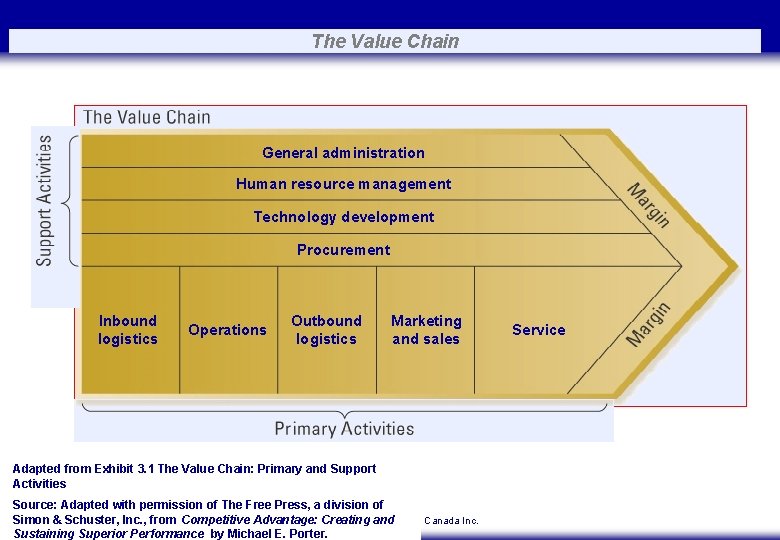

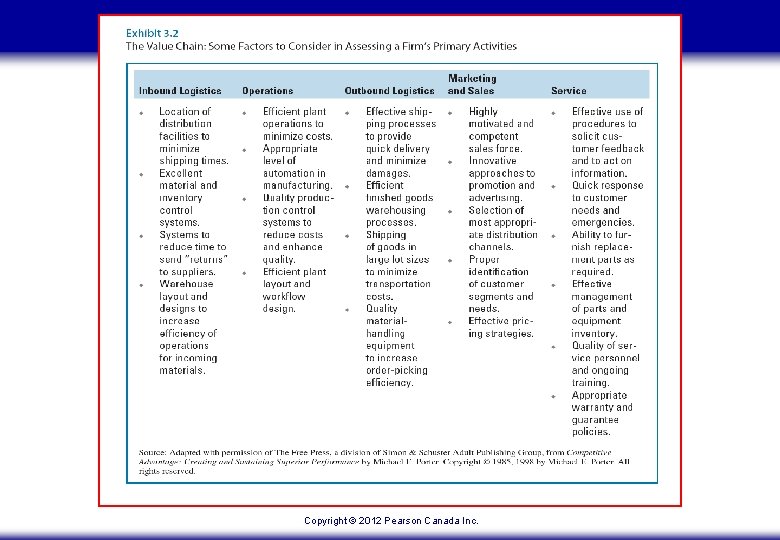

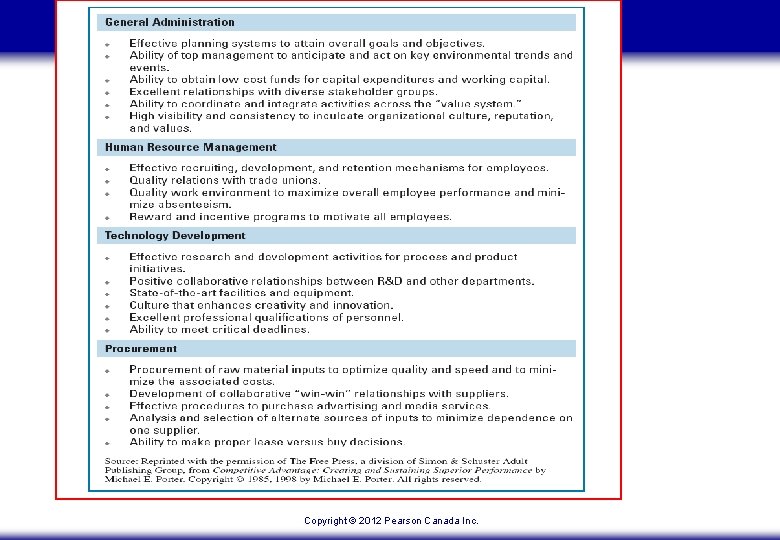

The Value Chain General administration Human resource management Technology development Procurement Inbound logistics Operations Outbound logistics Marketing and sales Adapted from Exhibit 3. 1 The Value Chain: Primary and Support Activities Source: Adapted with permission of The Free Press, a division of Simon & Schuster, Inc. , from Competitive Advantage: Creating and Copyright © 2012 Pearson Canada Inc. Sustaining Superior Performance by Michael E. Porter. Service

Copyright © 2012 Pearson Canada Inc.

Copyright © 2012 Pearson Canada Inc.

Interrelationships among Value-Chain Activities within and across Organizations Importance of relationships among value activities • Interrelationships among activities within the firm • Relationships among activities within the firm and with other organizations (e. g. , customers and suppliers) Copyright © 2012 Pearson Canada Inc.

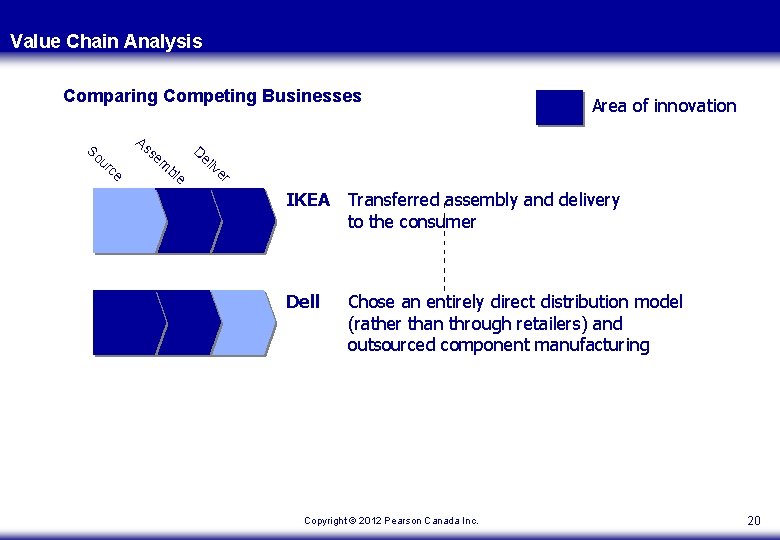

Value Chain Analysis Comparing Competing Businesses So ur ce As s em bl De e Area of innovation liv er IKEA Transferred assembly and delivery to the consumer Dell Chose an entirely direct distribution model (rather than through retailers) and outsourced component manufacturing Copyright © 2012 Pearson Canada Inc. 20

Resources and Capabilities Outsourcing: Activity performed for a company by people other than its full-time employees. Copyright © 2012 Pearson Canada Inc. 21

Value Chain Analysis Outsourcing is sourcing the function, product, or service of a value-chain activity from another company. Offshoring is taking that activity from a high-cost country to a low-cost country. These are separate decisions and a “yes” to one could be a “no” to the other. Copyright © 2012 Pearson Canada Inc. 22

Value Chain Analysis Management may consider the following when selecting activities to outsource: ■ Would outsourcing an activity improve results such as reduced lead time, higher flexibility, reduced inventory, and/ or lower cost? ■ Would outsourcing reduce the risk associated with performing the activity in-house? If the activity relies on fast-changing technology or the product is sold in a rapidly changing market, it may be advantageous to outsource the activity in order to maintain flexibility and avoid the risk of investing in specialized assets. ■ Is the activity a source of competitive advantage that stems from a cost advantage or product differentiation? Copyright © 2012 Pearson Canada Inc. 23

KSFs for outsourcing and off-shoring Commit time and effort Treat other firm as a partner, not just a vendor Involve middle management Copyright © 2012 Pearson Canada Inc. 24

Strategic Leadership: Linking Resources and Capability to Strategy SENIOR MANAGERS • Decide how to use resources and capabilities. • Configure a company’s value-chain activities. • Senior managers also set the context that determines how front-line and middle managers can add value. Copyright © 2012 Pearson Canada Inc. 25

Strategic Leadership: Linking Resources and Capability to Strategy MIDDLE MANAGERS • Middle managers are responsible for executing • • what senior managers want done. They play a key role in what the firm is doing and what it may be adept at doing in the future. This is why senior management considers the firm’s leadership pool as they shape strategy and align their leadership-development programs with longterm aspirations. Copyright © 2012 Pearson Canada Inc. 26

Evaluating Firm Performance Two approaches for evaluating firm performance • Financial ratio analysis – Balance sheet – Income statement – See text for Du. Pont Analysis example (page 63) to integrate B/S and I/S • Balanced scorecard (stakeholder perspective) – Employees – Customers – Owners Copyright © 2012 Pearson Canada Inc.

Financial Ratio Analysis Five types of financial ratios • Short-term solvency or liquidity • Long-term solvency measures • Asset management (or turnover) • Profitability • Market value Meaningful ratio analysis must include • Analysis of how ratios change over time • How ratios are interrelated Copyright © 2012 Pearson Canada Inc.

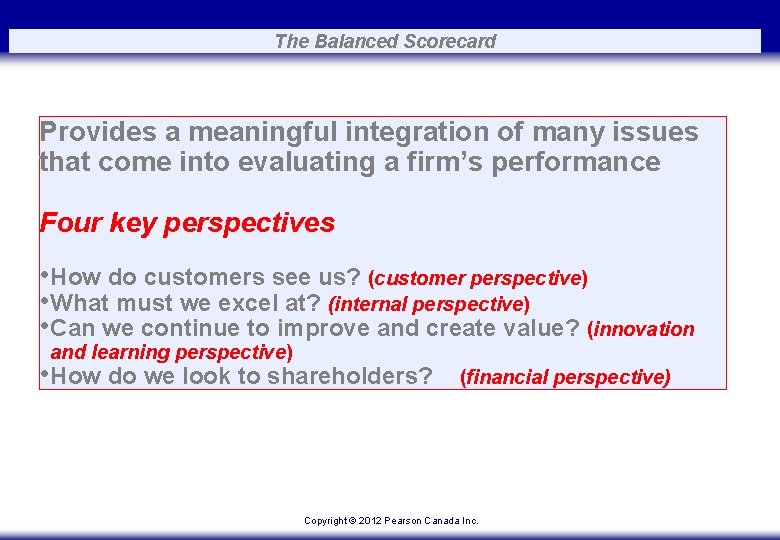

The Balanced Scorecard Provides a meaningful integration of many issues that come into evaluating a firm’s performance Four key perspectives • How do customers see us? (customer perspective) • What must we excel at? (internal perspective) • Can we continue to improve and create value? (innovation and learning perspective) • How do we look to shareholders? (financial perspective) Copyright © 2012 Pearson Canada Inc.

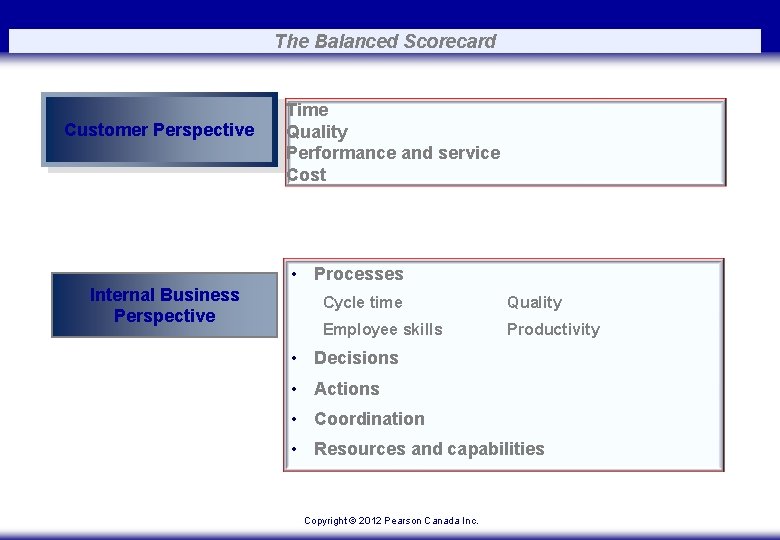

The Balanced Scorecard Customer Perspective Time Quality Performance and service Cost • Processes Internal Business Perspective Cycle time Quality Employee skills Productivity • Decisions • Actions • Coordination • Resources and capabilities Copyright © 2012 Pearson Canada Inc.

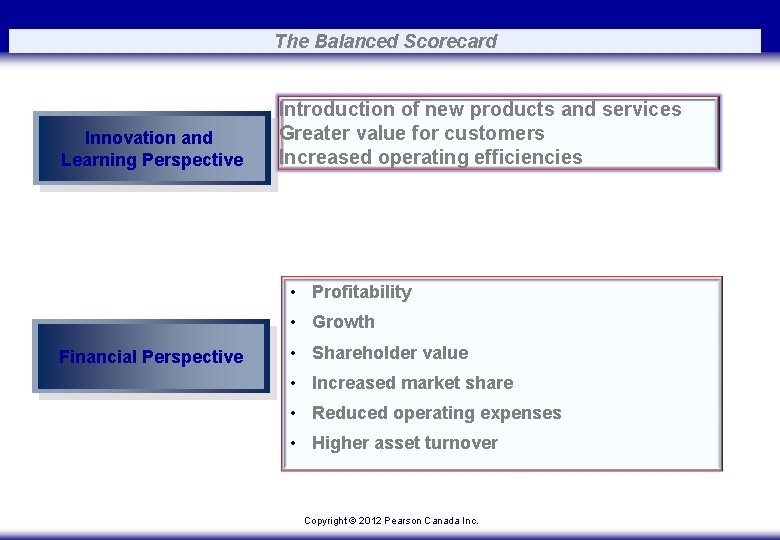

The Balanced Scorecard Innovation and Learning Perspective Introduction of new products and services Greater value for customers Increased operating efficiencies • Profitability • Growth Financial Perspective • Shareholder value • Increased market share • Reduced operating expenses • Higher asset turnover Copyright © 2012 Pearson Canada Inc.

- Slides: 32