Chapter 3 Saving Investment and the Financial System

- Slides: 24

Chapter (3) Saving, Investment and the Financial System (Chapter 26 in the book)

Introduction In this chapter, we will simplify our analysis by assuming that the economy we are examining is a closed economy. A closed economy is one that does not interact with other economies nor engage in international borrowing and lending (no imports & Exports). In measuring terms: In a closed economy, GDP = Y = C + I + G (where NX = 0)

Introduction Consequently I = Y – C – G Which defines Investment as: that part of total income in the economy that remains after paying for consumption and government purchases. This remaining part of total income after all economy expenditures are done can also be defined as National Savings of the economy designated as S. As such we conclude that S (Saving) = (I) Investment

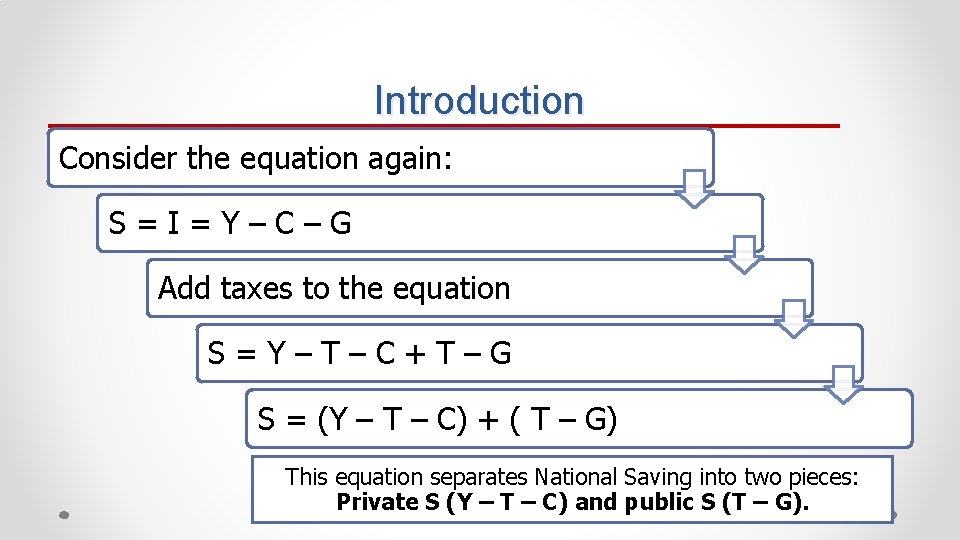

Introduction Consider the equation again: S=I=Y–C–G Add taxes to the equation S=Y–T–C+T–G S = (Y – T – C) + ( T – G) This equation separates National Saving into two pieces: Private S (Y – T – C) and public S (T – G).

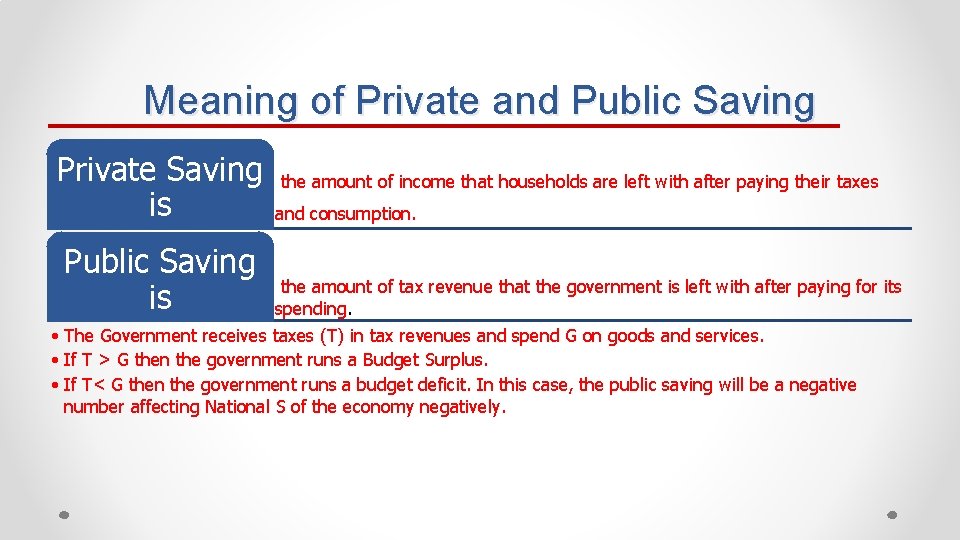

Meaning of Private and Public Saving Private Saving is Public Saving is the amount of income that households are left with after paying their taxes and consumption. the amount of tax revenue that the government is left with after paying for its spending. • The Government receives taxes (T) in tax revenues and spend G on goods and services. • If T > G then the government runs a Budget Surplus. • If T< G then the government runs a budget deficit. In this case, the public saving will be a negative number affecting National S of the economy negatively.

Relationship between Consumption and Saving • G is the largest component of GDP. • What are the major elements of C? (which is the 2 nd largest) o Among the most important consumption goods are consumption on food, housing, clothing, transportation, education and medication. o However, not two families spend their income exactly the same manner. Yet statistics show that poor families spent their incomes largely on the necessities of life such as food, clothing, etc. o As income increases, expenditures on many food, clothing items go up to more expensive food, clothes and cars etc.

Relationship between Consumption and Saving o However, the increase in consumption of these goods stops at a limit even though income is still increasing. o Now consumption pattern moves towards more luxury items such as recreation, travel, jewelry etc. o At this level, spending on these luxury items and income increases more and more with high levels of income. o However the most important luxury good that rises very rapidly with the rise in income is Savings. o Savings is the greatest and highest luxury goods which rapidly increases as income highly increases

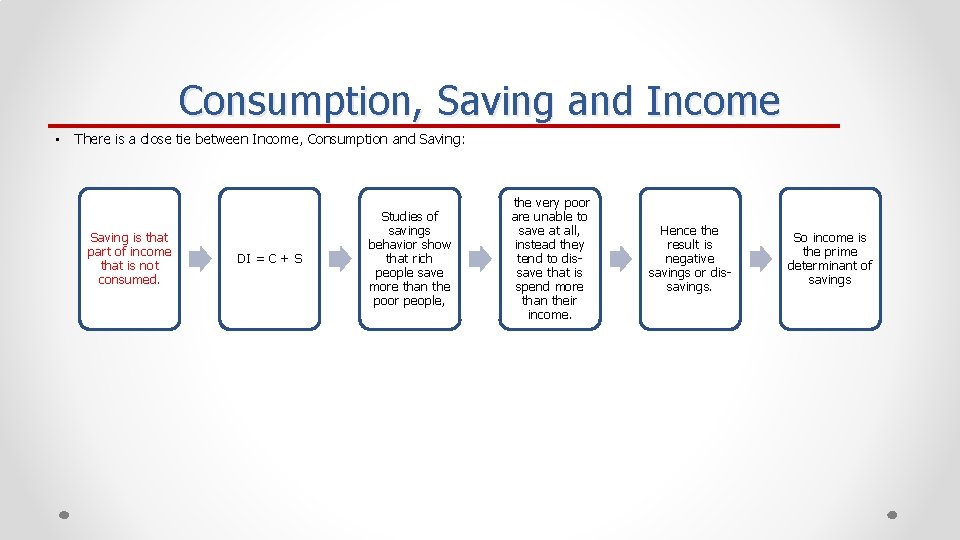

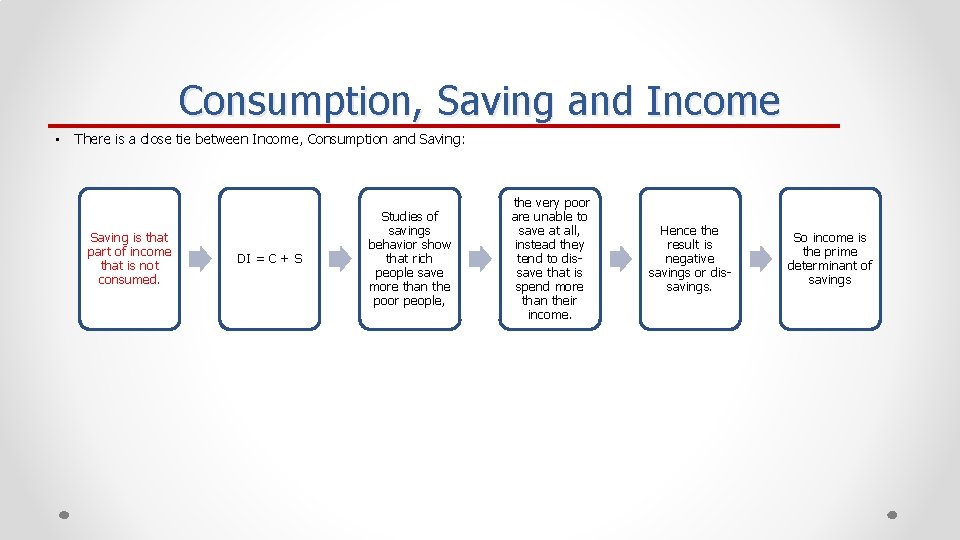

Consumption, Saving and Income • There is a close tie between Income, Consumption and Saving: Saving is that part of income that is not consumed. DI = C + S Studies of savings behavior show that rich people save more than the poor people, the very poor are unable to save at all, instead they tend to dissave that is spend more than their income. Hence the result is negative savings or dissavings. So income is the prime determinant of savings

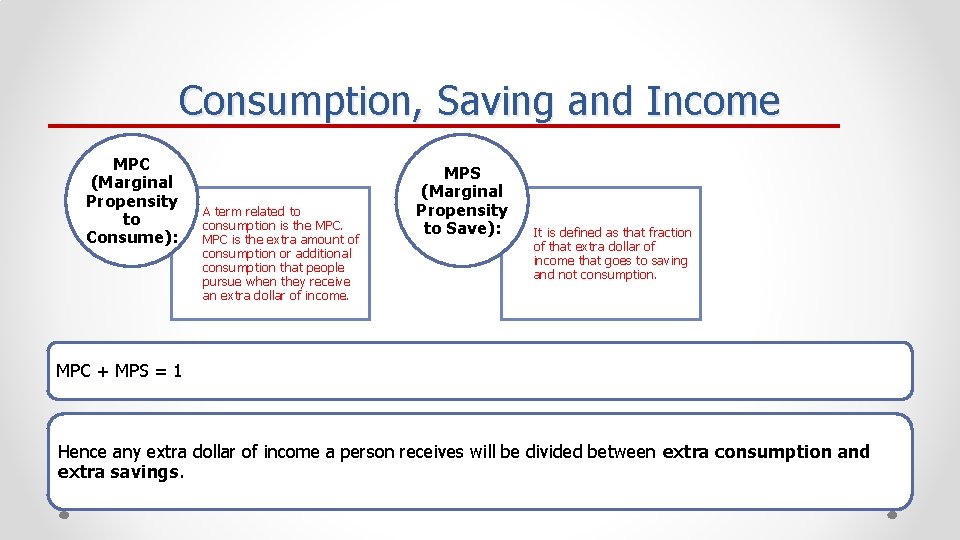

Consumption, Saving and Income MPC (Marginal Propensity to Consume): A term related to consumption is the MPC is the extra amount of consumption or additional consumption that people pursue when they receive an extra dollar of income. MPS (Marginal Propensity to Save): It is defined as that fraction of that extra dollar of income that goes to saving and not consumption. MPC + MPS = 1 Hence any extra dollar of income a person receives will be divided between extra consumption and extra savings.

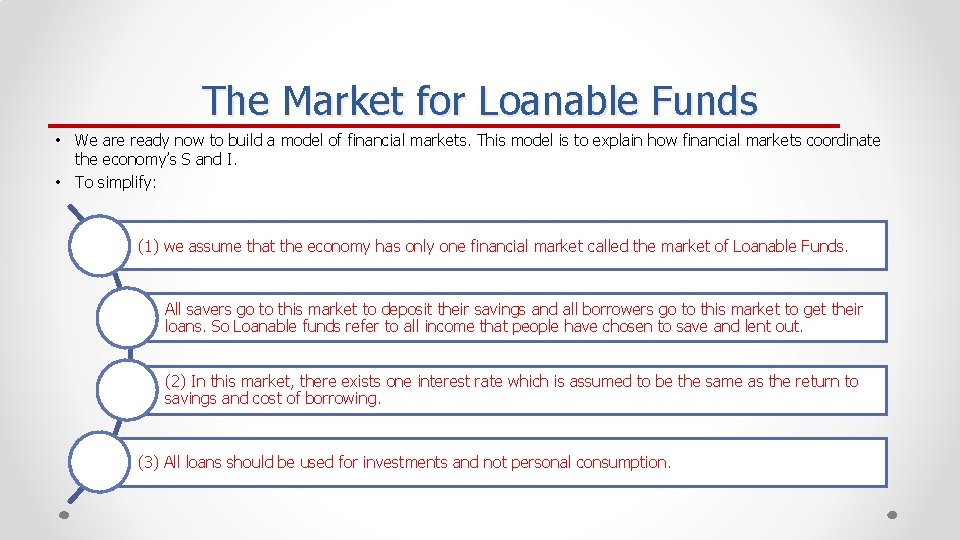

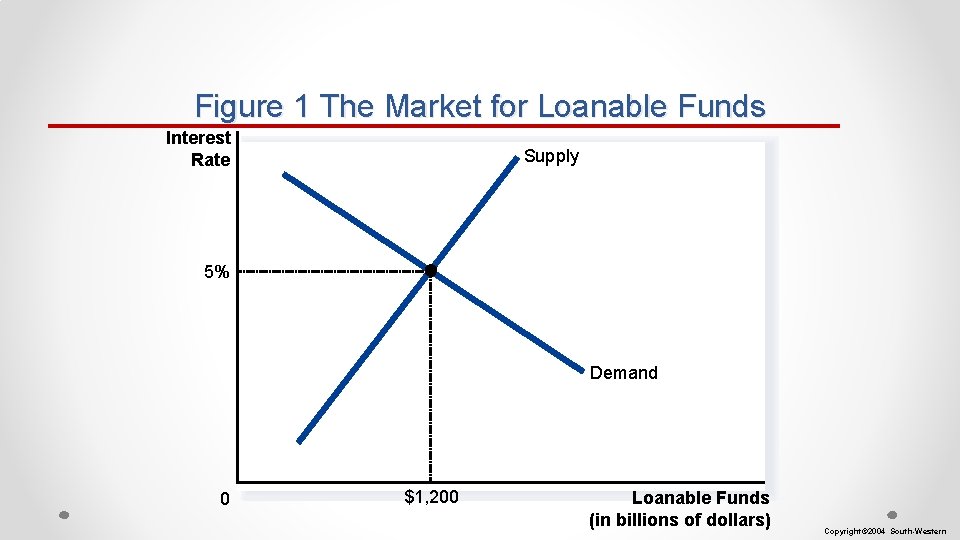

The Market for Loanable Funds • We are ready now to build a model of financial markets. This model is to explain how financial markets coordinate the economy’s S and I. • To simplify: (1) we assume that the economy has only one financial market called the market of Loanable Funds. All savers go to this market to deposit their savings and all borrowers go to this market to get their loans. So Loanable funds refer to all income that people have chosen to save and lent out. (2) In this market, there exists one interest rate which is assumed to be the same as the return to savings and cost of borrowing. (3) All loans should be used for investments and not personal consumption.

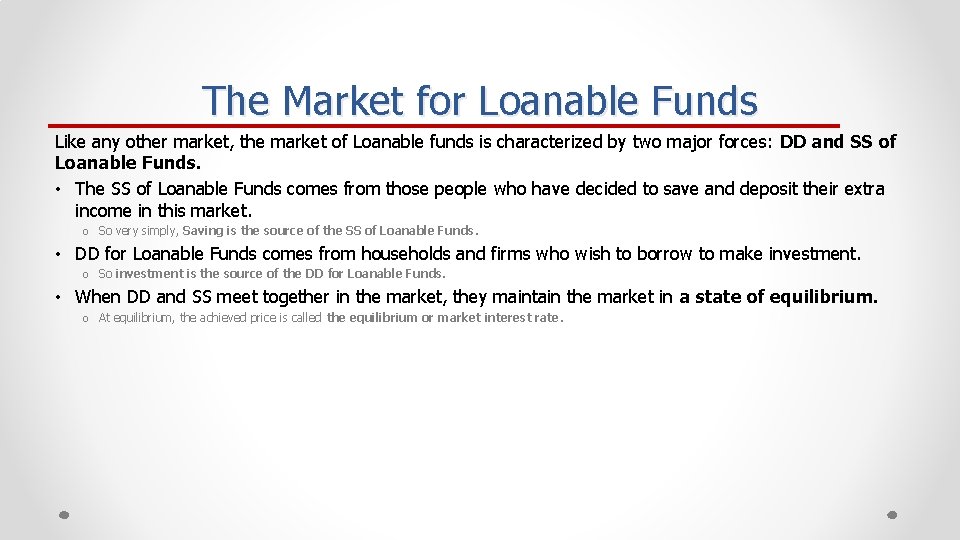

The Market for Loanable Funds Like any other market, the market of Loanable funds is characterized by two major forces: DD and SS of Loanable Funds. • The SS of Loanable Funds comes from those people who have decided to save and deposit their extra income in this market. o So very simply, Saving is the source of the SS of Loanable Funds. • DD for Loanable Funds comes from households and firms who wish to borrow to make investment. o So investment is the source of the DD for Loanable Funds. • When DD and SS meet together in the market, they maintain the market in a state of equilibrium. o At equilibrium, the achieved price is called the equilibrium or market interest rate.

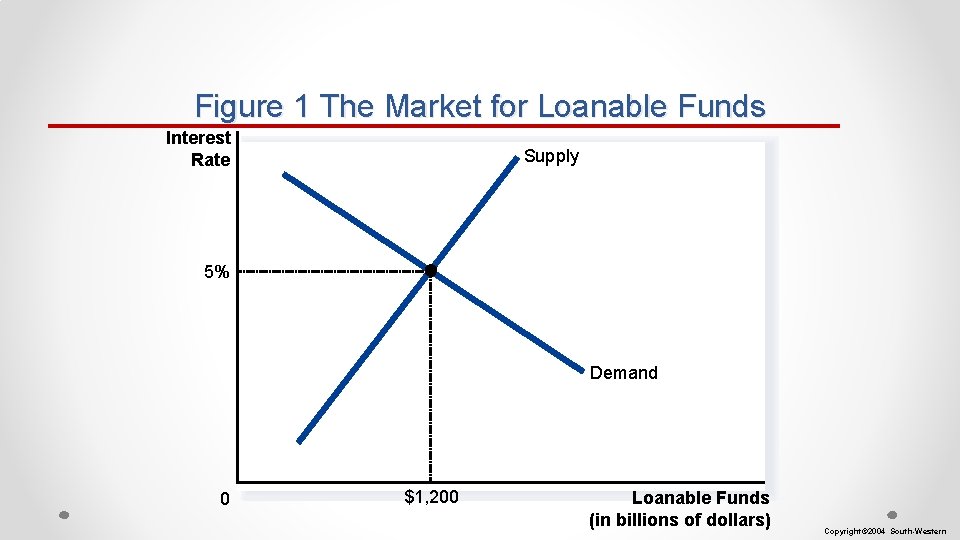

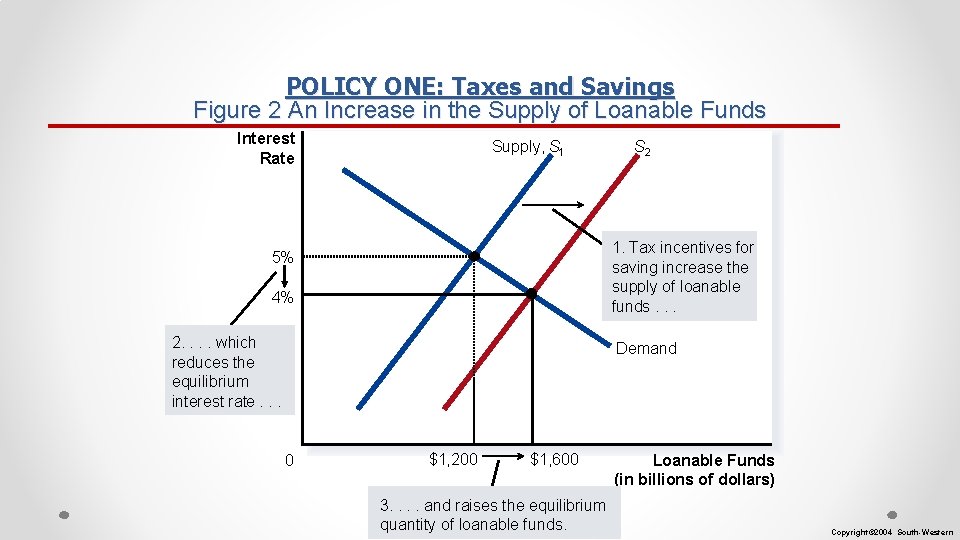

Figure 1 The Market for Loanable Funds Interest Rate Supply 5% Demand 0 $1, 200 Loanable Funds (in billions of dollars) Copyright© 2004 South-Western

Government Policies that affect the economy’s saving and investment • We can now use the analysis of the market of Loanable Funds to examine various government policies that affect the economy’s saving and investment: POLICY ONE: Taxes and Savings POLICY TWO: Taxes and Investment POLICY THREE: Government Budget Deficits and its effect on the market

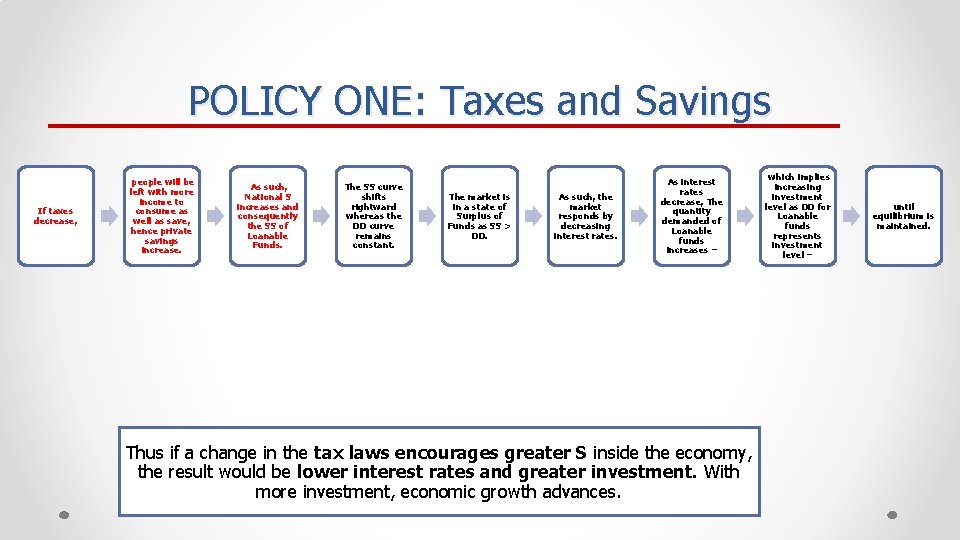

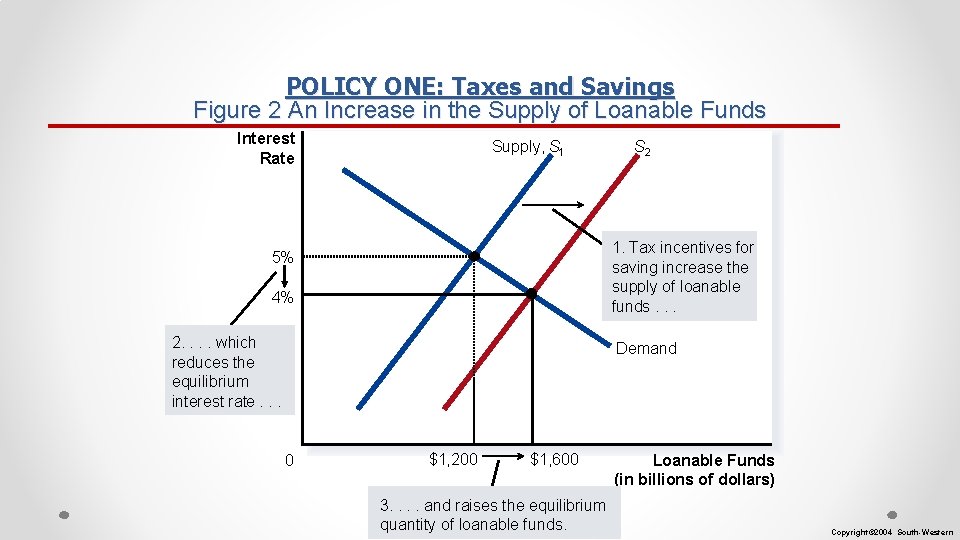

POLICY ONE: Taxes and Savings If government decided to decrease taxes, how would this government policy affect the market of Loanable funds? And consequently the economic growth of the country?

POLICY ONE: Taxes and Savings Figure 2 An Increase in the Supply of Loanable Funds Interest Rate Supply, S 1 S 2 1. Tax incentives for saving increase the supply of loanable funds. . . 5% 4% 2. . which reduces the equilibrium interest rate. . . Demand 0 $1, 200 $1, 600 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) Copyright© 2004 South-Western

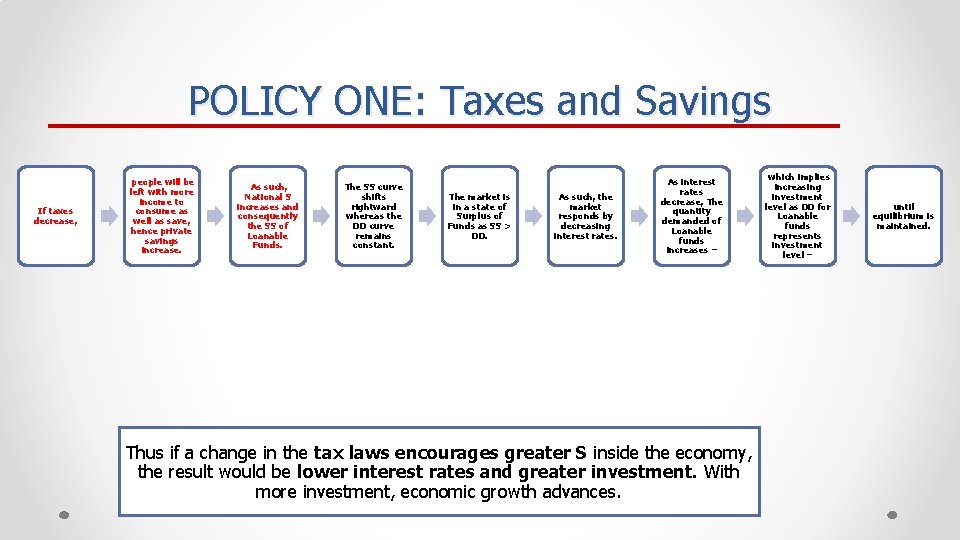

POLICY ONE: Taxes and Savings If taxes decrease, people will be left with more income to consume as well as save, hence private savings increase. As such, National S increases and consequently the SS of Loanable Funds. The SS curve shifts rightward whereas the DD curve remains constant. The market is in a state of Surplus of Funds as SS > DD. As such, the market responds by decreasing interest rates. As interest rates decrease, The quantity demanded of Loanable funds increases – Thus if a change in the tax laws encourages greater S inside the economy, the result would be lower interest rates and greater investment. With more investment, economic growth advances. which implies increasing investment level as DD for Loanable funds represents investment level – until equilibrium is maintained.

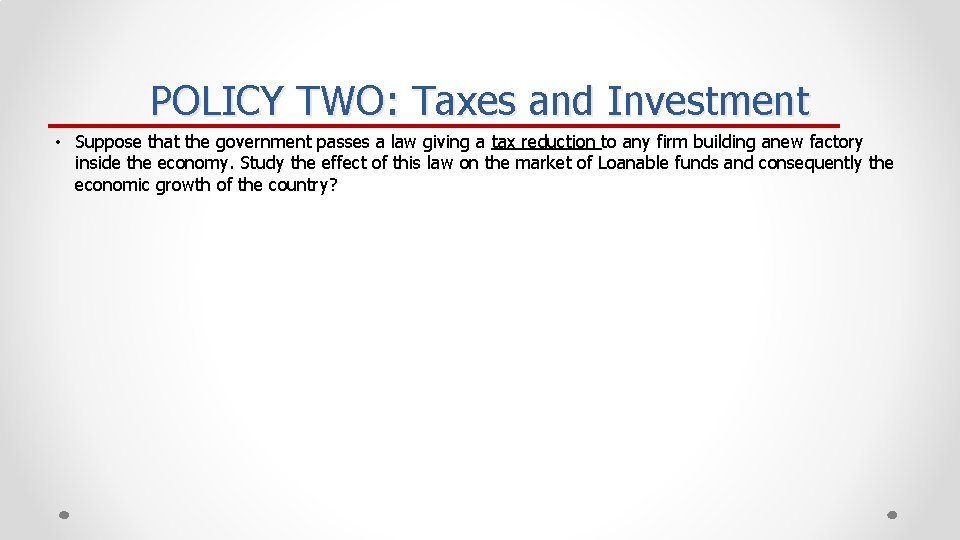

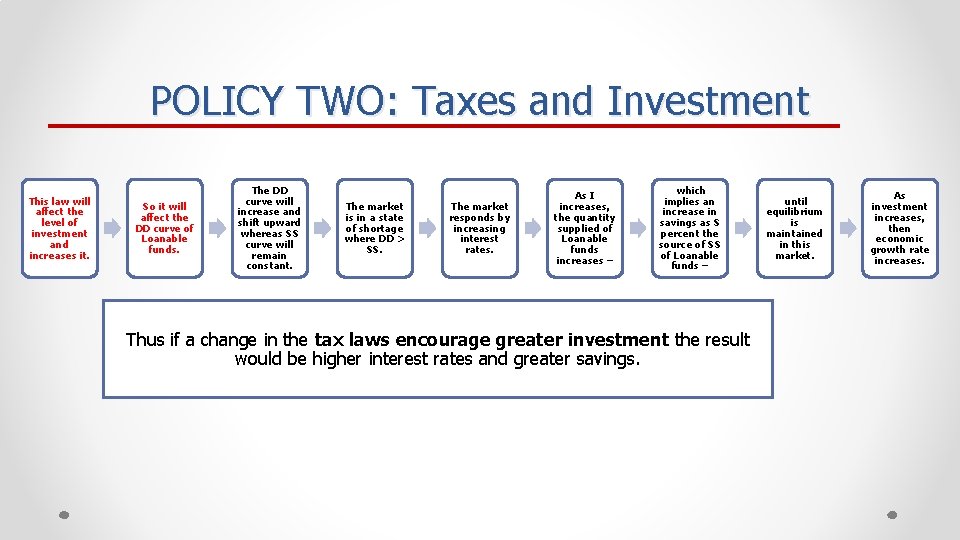

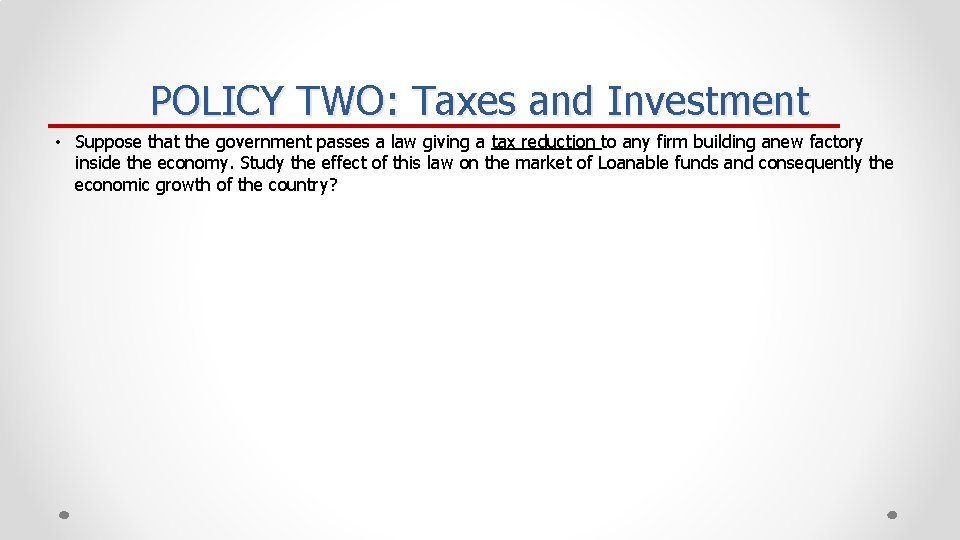

POLICY TWO: Taxes and Investment • Suppose that the government passes a law giving a tax reduction to any firm building anew factory inside the economy. Study the effect of this law on the market of Loanable funds and consequently the economic growth of the country?

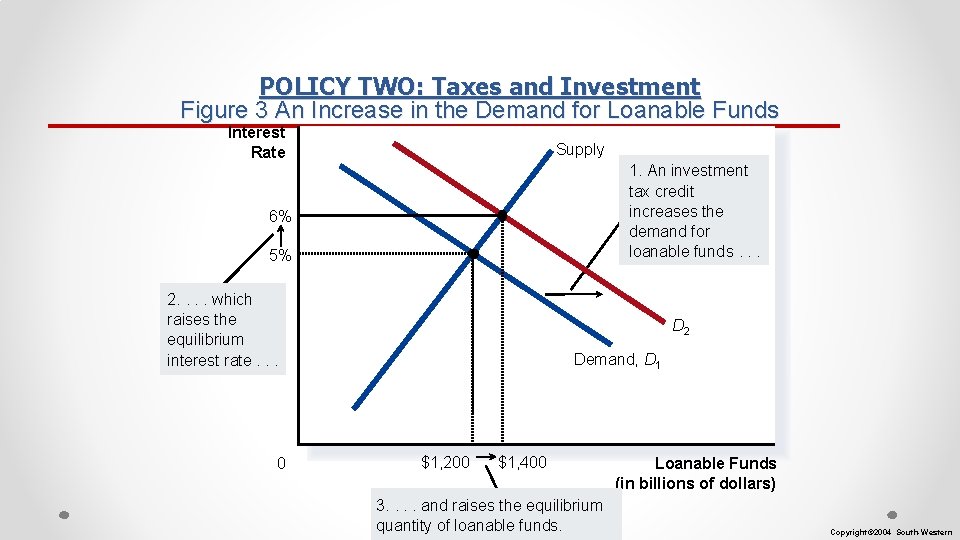

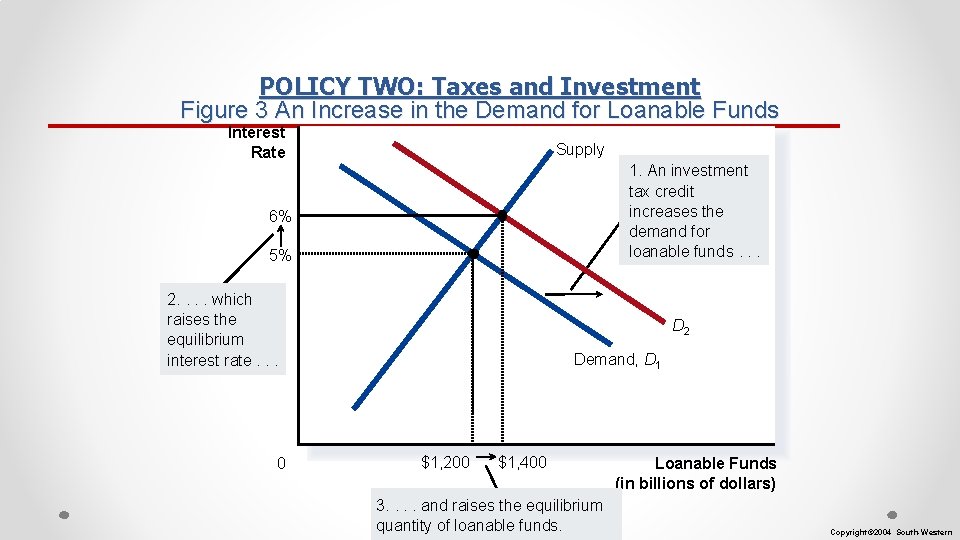

POLICY TWO: Taxes and Investment Figure 3 An Increase in the Demand for Loanable Funds Interest Rate Supply 1. An investment tax credit increases the demand for loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . 0 D 2 Demand, D 1 $1, 200 $1, 400 3. . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) Copyright© 2004 South-Western

POLICY TWO: Taxes and Investment This law will affect the level of investment and increases it. So it will affect the DD curve of Loanable funds. The DD curve will increase and shift upward whereas SS curve will remain constant. The market is in a state of shortage where DD > SS. The market responds by increasing interest rates. As I increases, the quantity supplied of Loanable funds increases – which implies an increase in savings as S percent the source of SS of Loanable funds – Thus if a change in the tax laws encourage greater investment the result would be higher interest rates and greater savings. until equilibrium is maintained in this market. As investment increases, then economic growth rate increases.

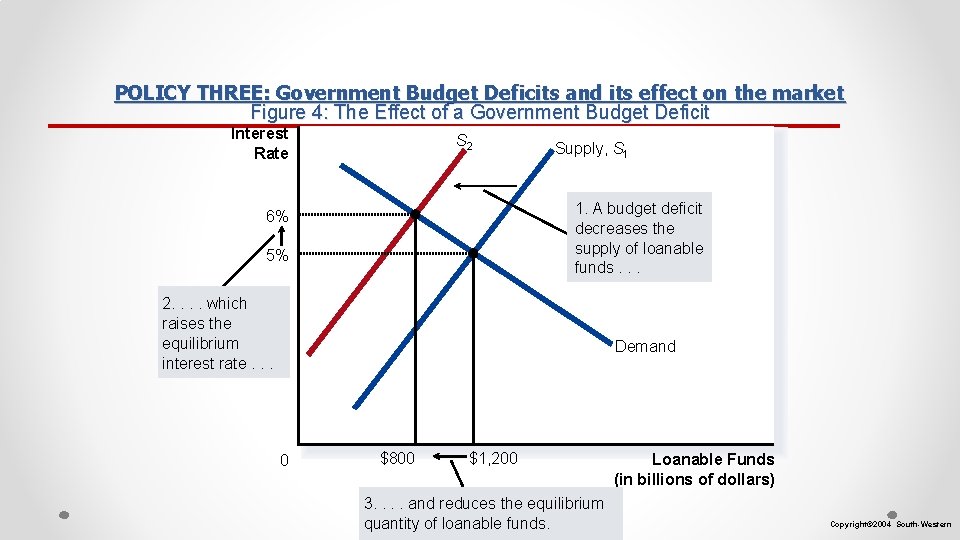

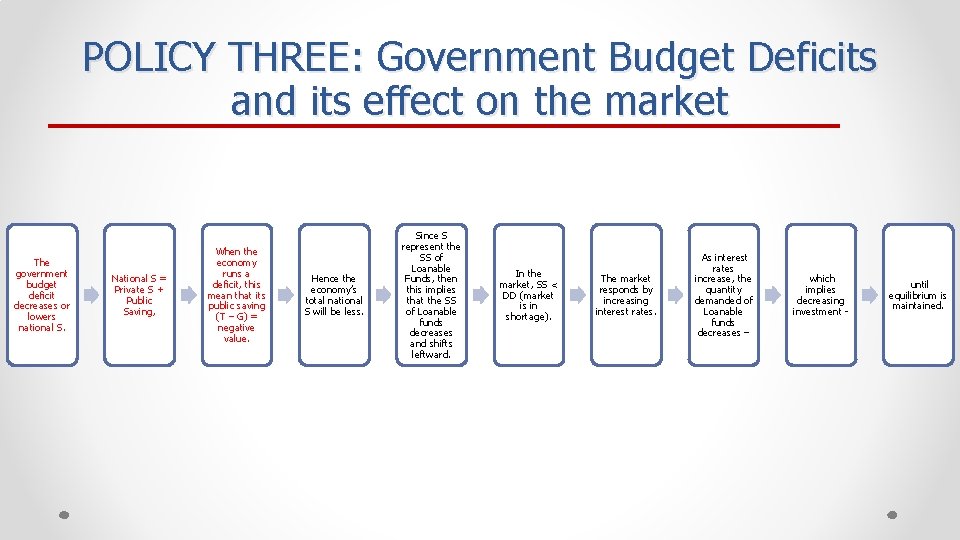

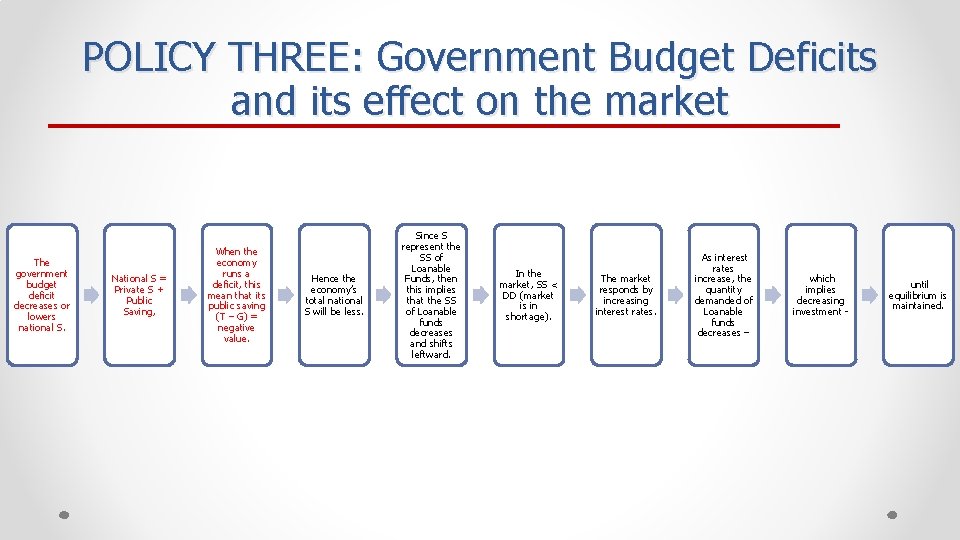

POLICY THREE: Government Budget Deficits and its effect on the market • Assume that the government budget deficit for this year increases. That is the government expenditures are increasing more and more every year relative to its receipts in tax revenues. • Study the effect of this deficit on the market of Loanable funds and consequently the economic growth of the economy?

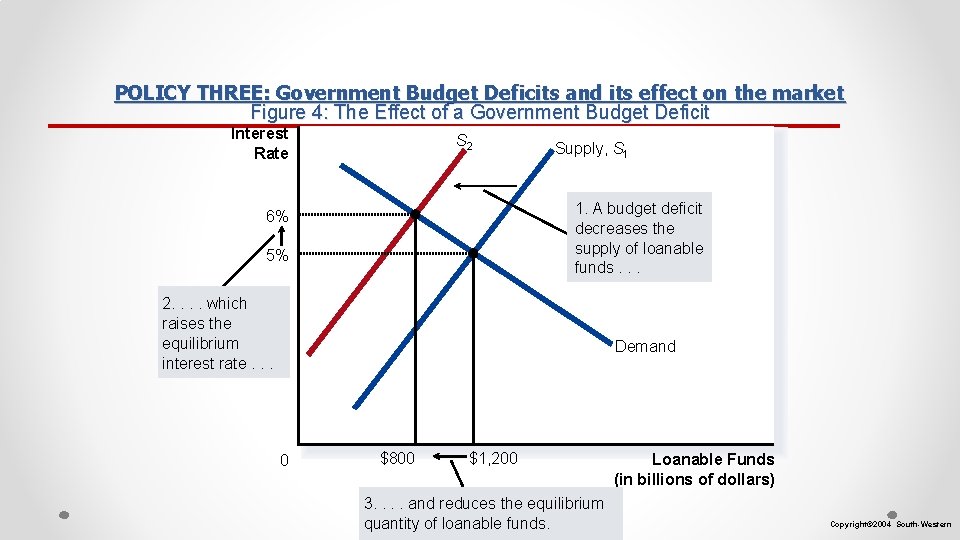

POLICY THREE: Government Budget Deficits and its effect on the market Figure 4: The Effect of a Government Budget Deficit Interest Rate S 2 Supply, S 1 1. A budget deficit decreases the supply of loanable funds. . . 6% 5% 2. . which raises the equilibrium interest rate. . . Demand 0 $800 $1, 200 3. . and reduces the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) Copyright© 2004 South-Western

POLICY THREE: Government Budget Deficits and its effect on the market The government budget deficit decreases or lowers national S. National S = Private S + Public Saving, When the economy runs a deficit, this mean that its public saving (T – G) = negative value. Hence the economy’s total national S will be less. Since S represent the SS of Loanable Funds, then this implies that the SS of Loanable funds decreases and shifts leftward. In the market, SS < DD (market is in shortage). The market responds by increasing interest rates. As interest rates increase, the quantity demanded of Loanable funds decreases – which implies decreasing investment - until equilibrium is maintained.

POLICY THREE: Government Budget Deficits and its effect on the market In the other words, we say when the government borrows to finance its budget deficit, it crowds out (decreases) private borrowings who are to be used to Finance investment, hence reducing investment. Because investment is important for long term economic growth, then having a budget deficit reduces the economy’s economic growth rate enormously.

Thank You