Chapter 3 Financial Statements Analysis and LongTerm Planning

- Slides: 31

Chapter 3 Financial Statements Analysis and Long-Term Planning Mc. Graw-Hill/Irwin Copyright © 2010 by the Mc. Graw-Hill Companies, Inc. All rights reserved.

Key Concepts and Skills o Know how to standardize financial statements for comparison purposes o Know how to compute and interpret important financial ratios o Be able to develop a financial plan using the percentage of sales approach o Understand how capital structure and dividend policies affect a firm’s ability to grow 3 -1

Chapter Outline 3. 1 Financial Statements Analysis 3. 2 Ratio Analysis 3. 3 The Du Pont Identity 3. 4 Financial Models 3. 5 External Financing and Growth 3. 6 Some Caveats Regarding Financial Planning Models 3 -2

3. 1 Financial Statements Analysis o Common-Size Balance Sheets n o Common-Size Income Statements n o o Compute all accounts as a percent of total assets Compute all line items as a percent of sales Standardized statements make it easier to compare financial information, particularly as the company grows. They are also useful for comparing companies of different sizes, particularly within the same industry. 3 -3

3. 2 Ratio Analysis o Ratios also allow for better comparison through time or between companies. o As we look at each ratio, ask yourself: How is the ratio computed? n What is the ratio trying to measure and why? n What is the unit of measurement? n What does the value indicate? n How can we improve the company’s ratio? n 3 -4

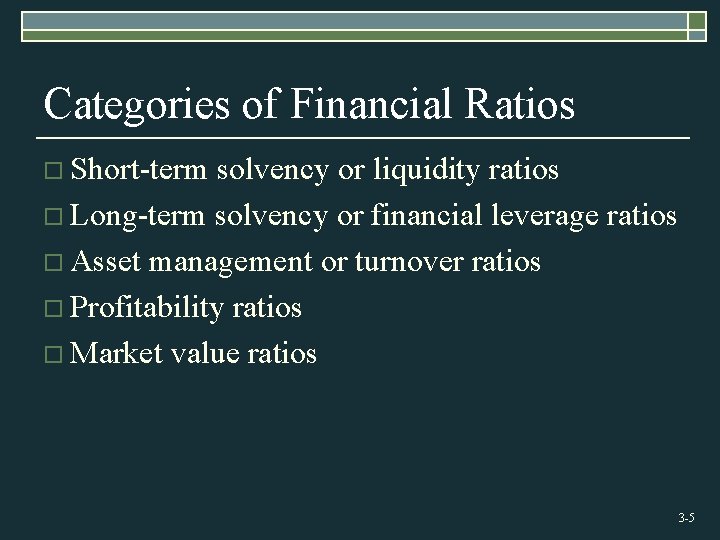

Categories of Financial Ratios o Short-term solvency or liquidity ratios o Long-term solvency or financial leverage ratios o Asset management or turnover ratios o Profitability ratios o Market value ratios 3 -5

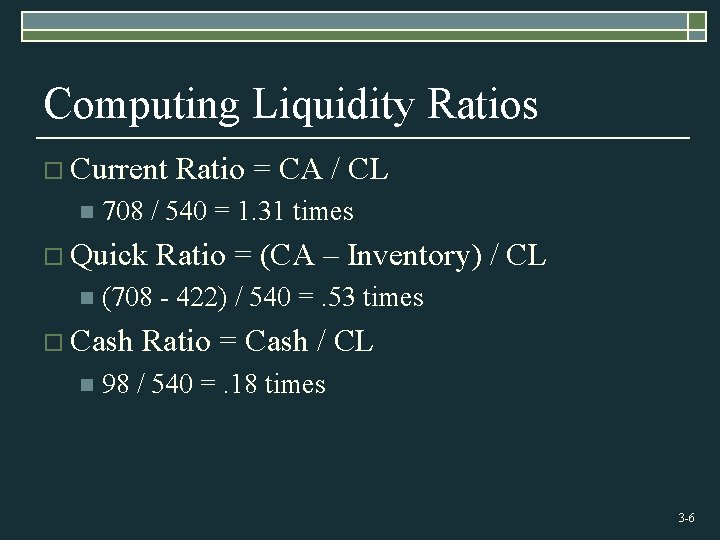

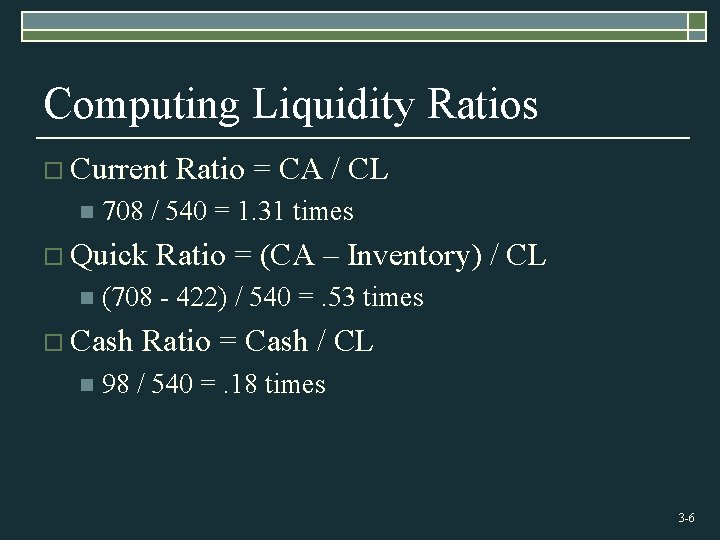

Computing Liquidity Ratios o Current n 708 / 540 = 1. 31 times o Quick n Ratio = (CA – Inventory) / CL (708 - 422) / 540 =. 53 times o Cash n Ratio = CA / CL Ratio = Cash / CL 98 / 540 =. 18 times 3 -6

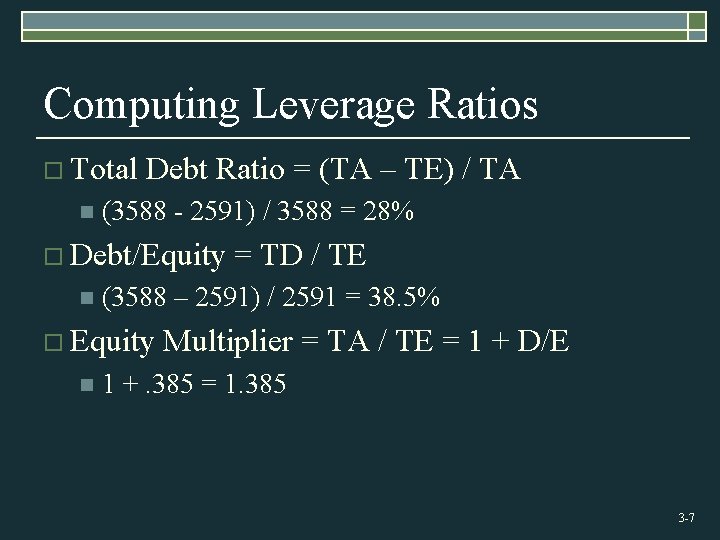

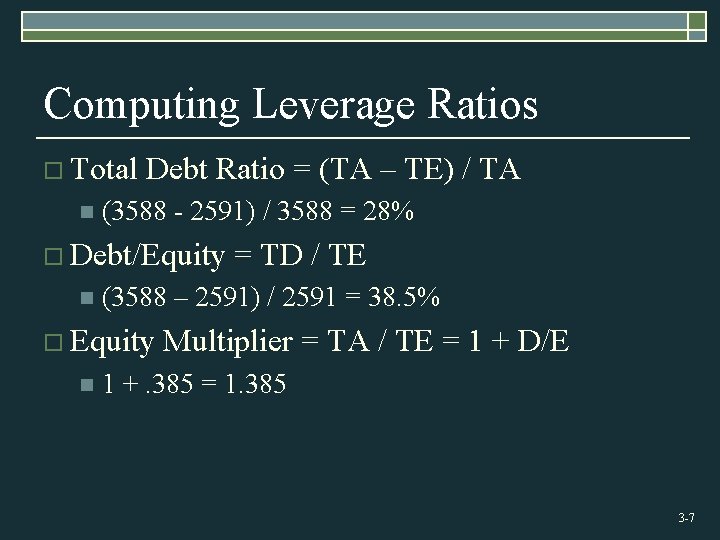

Computing Leverage Ratios o Total n Debt Ratio = (TA – TE) / TA (3588 - 2591) / 3588 = 28% o Debt/Equity n (3588 – 2591) / 2591 = 38. 5% o Equity n = TD / TE Multiplier = TA / TE = 1 + D/E 1 +. 385 = 1. 385 3 -7

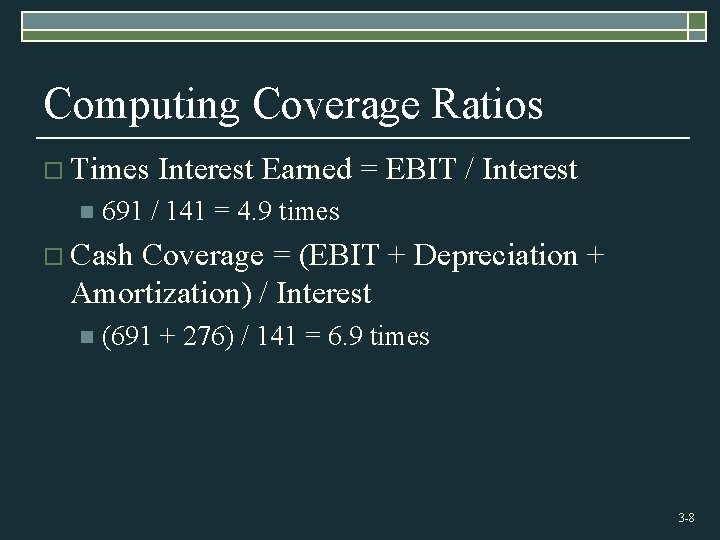

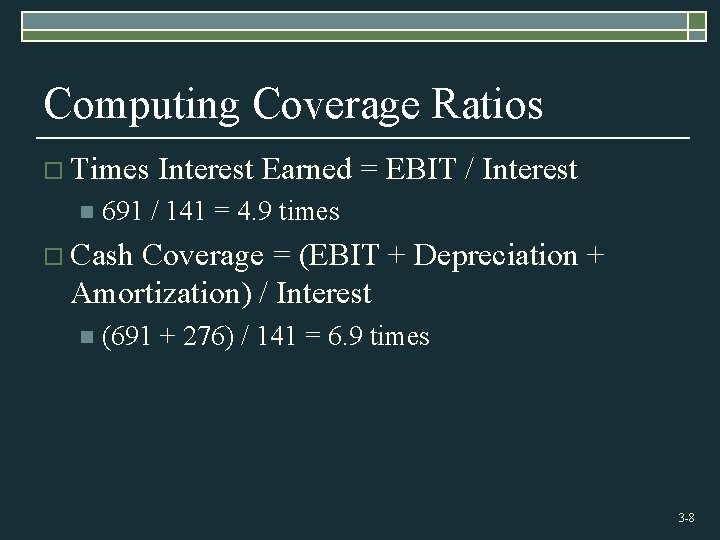

Computing Coverage Ratios o Times n Interest Earned = EBIT / Interest 691 / 141 = 4. 9 times o Cash Coverage = (EBIT + Depreciation + Amortization) / Interest n (691 + 276) / 141 = 6. 9 times 3 -8

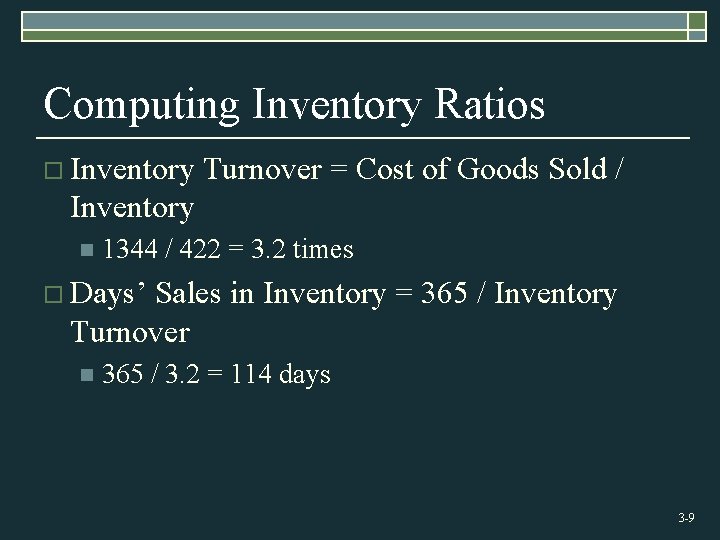

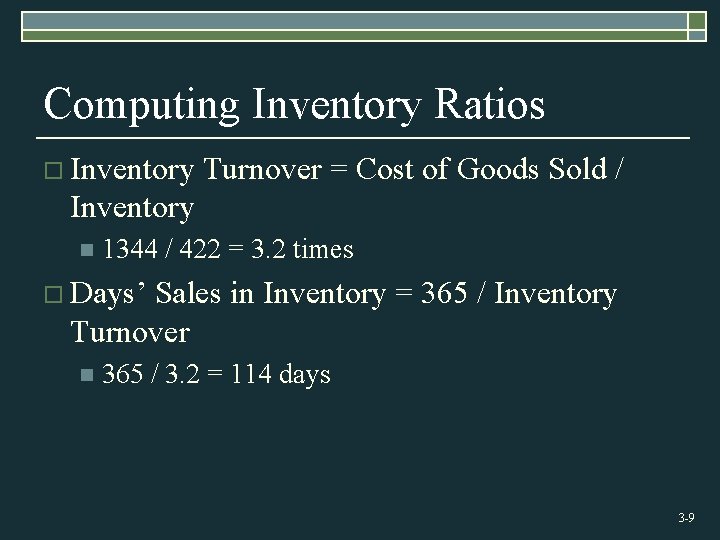

Computing Inventory Ratios o Inventory Turnover = Cost of Goods Sold / Inventory n 1344 / 422 = 3. 2 times o Days’ Sales in Inventory = 365 / Inventory Turnover n 365 / 3. 2 = 114 days 3 -9

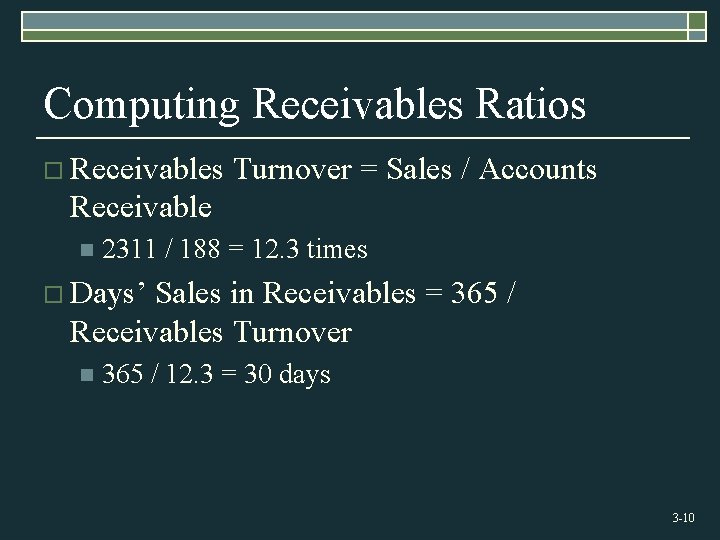

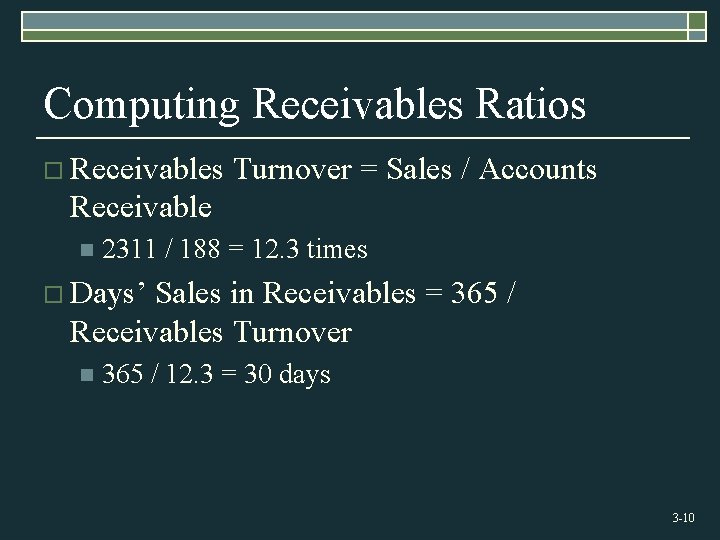

Computing Receivables Ratios o Receivables Turnover = Sales / Accounts Receivable n 2311 / 188 = 12. 3 times o Days’ Sales in Receivables = 365 / Receivables Turnover n 365 / 12. 3 = 30 days 3 -10

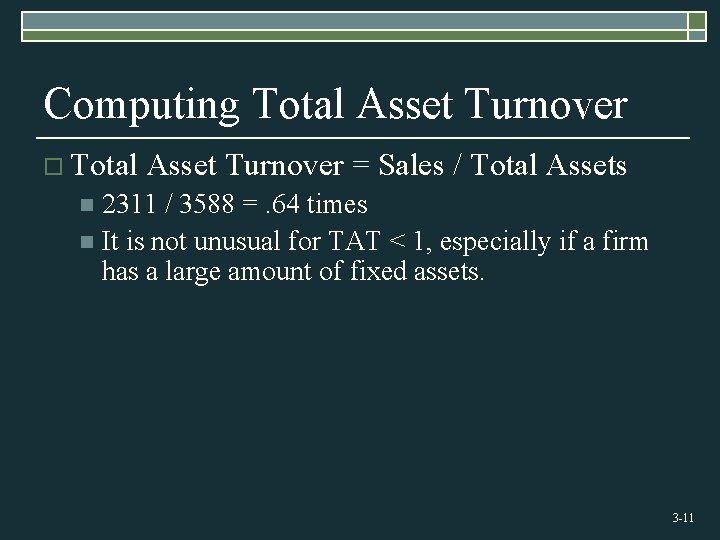

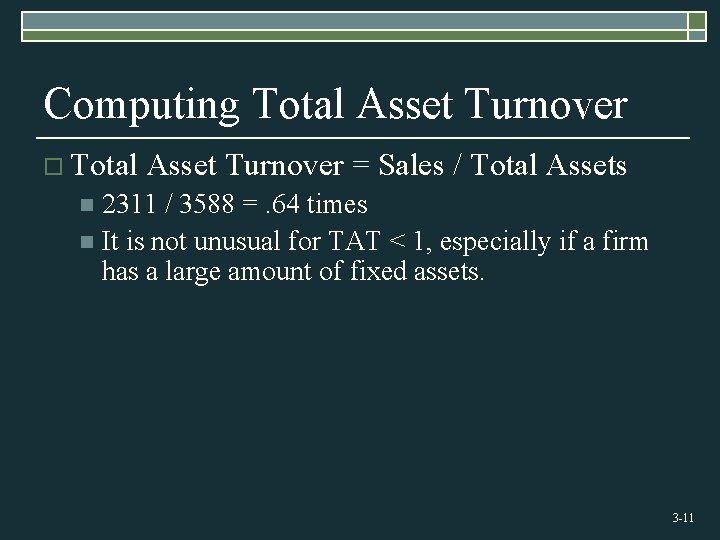

Computing Total Asset Turnover o Total Asset Turnover = Sales / Total Assets 2311 / 3588 =. 64 times n It is not unusual for TAT < 1, especially if a firm has a large amount of fixed assets. n 3 -11

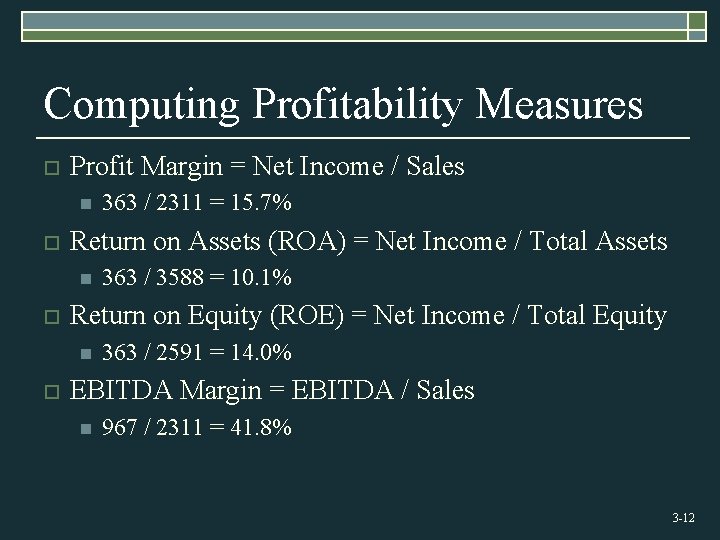

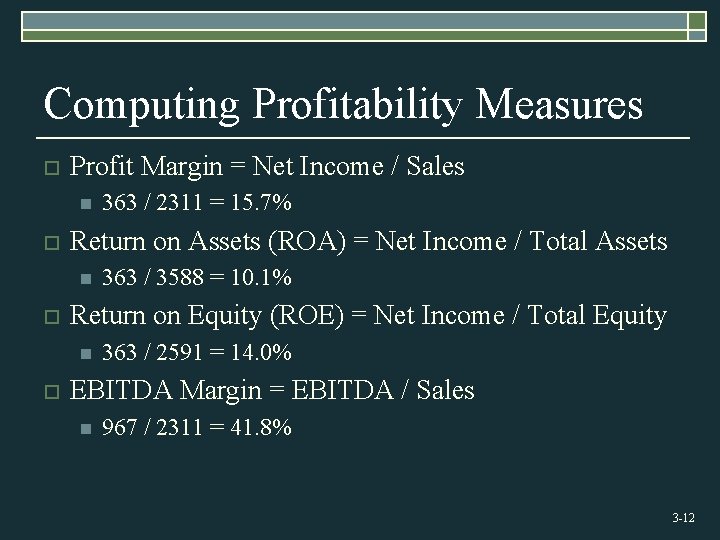

Computing Profitability Measures o Profit Margin = Net Income / Sales n o Return on Assets (ROA) = Net Income / Total Assets n o 363 / 3588 = 10. 1% Return on Equity (ROE) = Net Income / Total Equity n o 363 / 2311 = 15. 7% 363 / 2591 = 14. 0% EBITDA Margin = EBITDA / Sales n 967 / 2311 = 41. 8% 3 -12

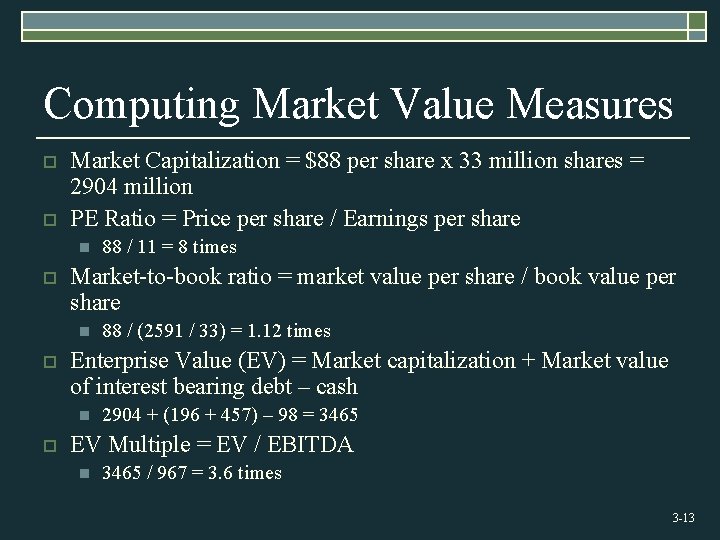

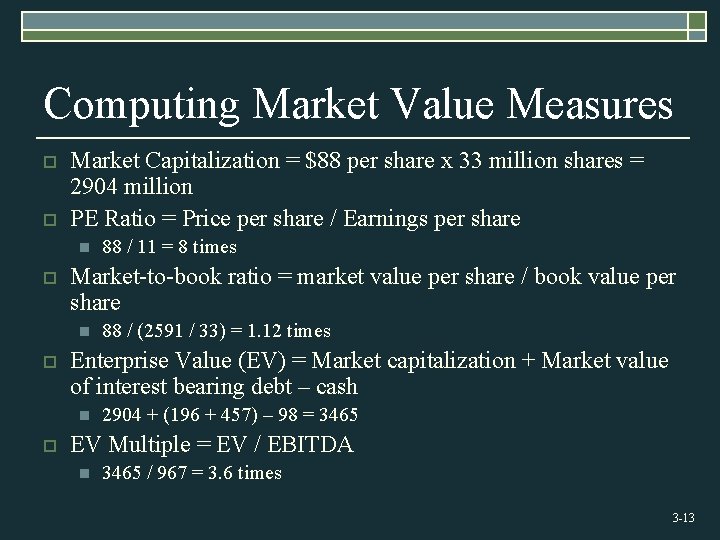

Computing Market Value Measures o o Market Capitalization = $88 per share x 33 million shares = 2904 million PE Ratio = Price per share / Earnings per share n o Market-to-book ratio = market value per share / book value per share n o 88 / (2591 / 33) = 1. 12 times Enterprise Value (EV) = Market capitalization + Market value of interest bearing debt – cash n o 88 / 11 = 8 times 2904 + (196 + 457) – 98 = 3465 EV Multiple = EV / EBITDA n 3465 / 967 = 3. 6 times 3 -13

Using Financial Statements o Ratios are not very helpful by themselves: they need to be compared to something o Time-Trend Analysis n Used to see how the firm’s performance is changing through time o Peer Group Analysis Compare to similar companies or within industries n SIC and NAICS codes n 3 -14

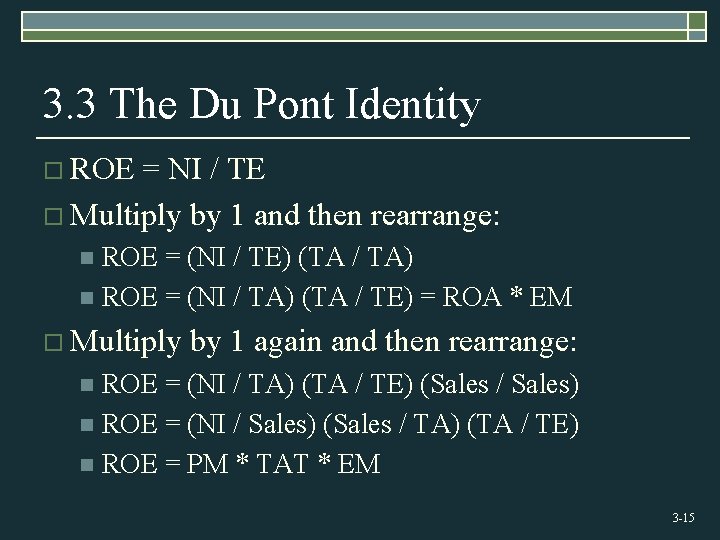

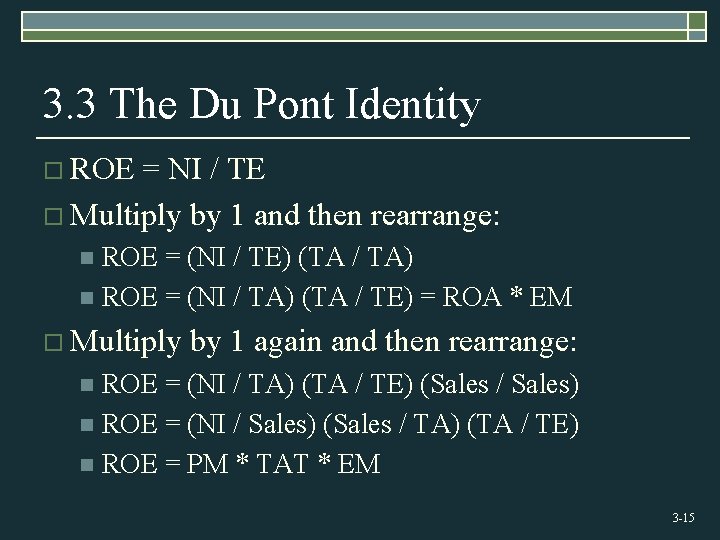

3. 3 The Du Pont Identity o ROE = NI / TE o Multiply by 1 and then rearrange: ROE = (NI / TE) (TA / TA) n ROE = (NI / TA) (TA / TE) = ROA * EM n o Multiply by 1 again and then rearrange: ROE = (NI / TA) (TA / TE) (Sales / Sales) n ROE = (NI / Sales) (Sales / TA) (TA / TE) n ROE = PM * TAT * EM n 3 -15

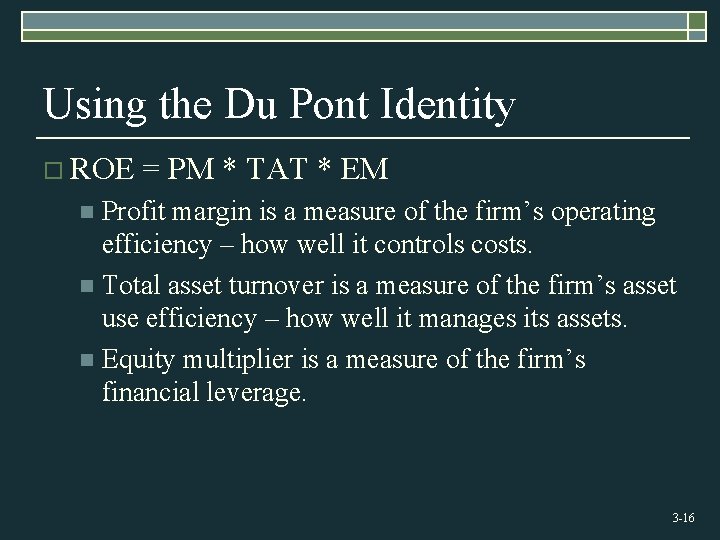

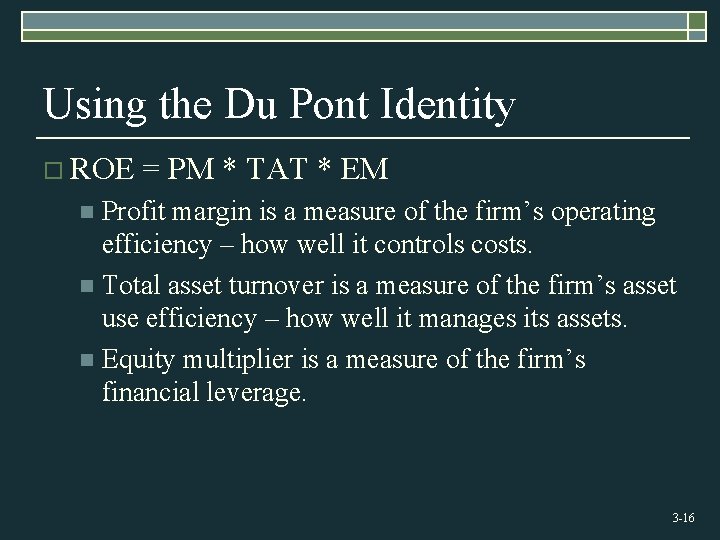

Using the Du Pont Identity o ROE = PM * TAT * EM Profit margin is a measure of the firm’s operating efficiency – how well it controls costs. n Total asset turnover is a measure of the firm’s asset use efficiency – how well it manages its assets. n Equity multiplier is a measure of the firm’s financial leverage. n 3 -16

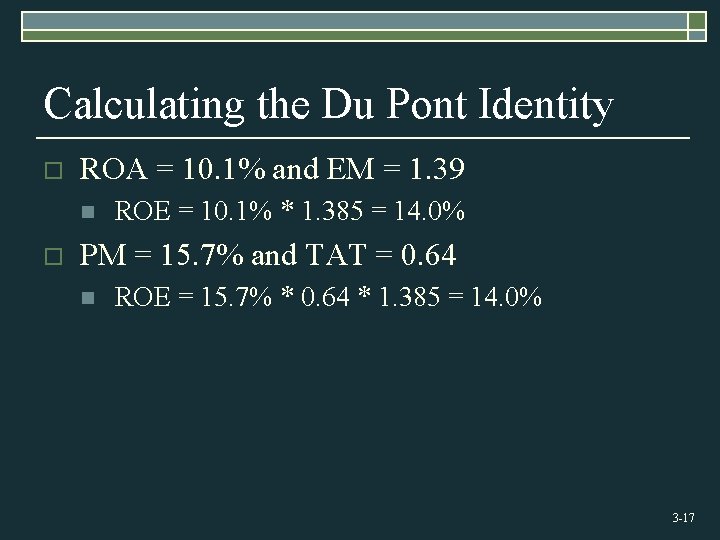

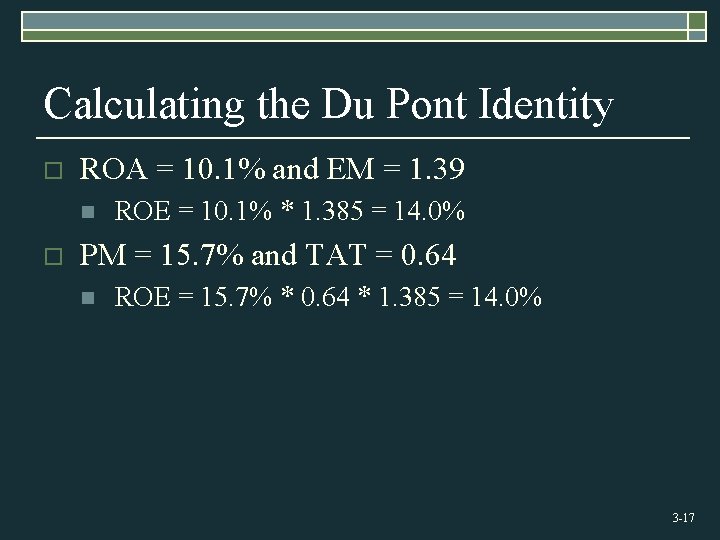

Calculating the Du Pont Identity o ROA = 10. 1% and EM = 1. 39 n o ROE = 10. 1% * 1. 385 = 14. 0% PM = 15. 7% and TAT = 0. 64 n ROE = 15. 7% * 0. 64 * 1. 385 = 14. 0% 3 -17

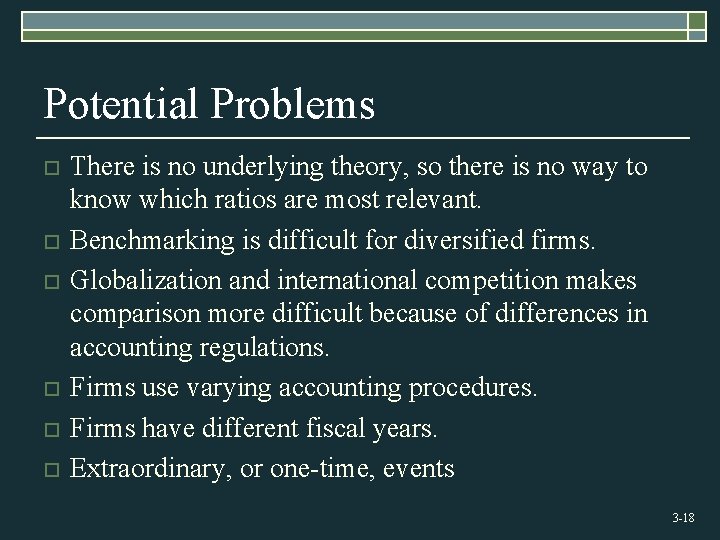

Potential Problems o o o There is no underlying theory, so there is no way to know which ratios are most relevant. Benchmarking is difficult for diversified firms. Globalization and international competition makes comparison more difficult because of differences in accounting regulations. Firms use varying accounting procedures. Firms have different fiscal years. Extraordinary, or one-time, events 3 -18

3. 4 Financial Models o Investment in new assets – determined by capital budgeting decisions o Degree of financial leverage – determined by capital structure decisions o Cash paid to shareholders – determined by dividend policy decisions o Liquidity requirements – determined by net working capital decisions 3 -19

Financial Planning Ingredients o o o Sales Forecast – many cash flows depend directly on the level of sales (often estimate sales growth rate) Pro Forma Statements – setting up the plan as projected (pro forma) financial statements allows for consistency and ease of interpretation Asset Requirements – the additional assets that will be required to meet sales projections Financial Requirements – the amount of financing needed to pay for the required assets Plug Variable – determined by management decisions about what type of financing will be used (makes the balance sheet balance) Economic Assumptions – explicit assumptions about the 3 -20 coming economic environment

Percent of Sales Approach o o Some items vary directly with sales, others do not. Income Statement n n n Costs may vary directly with sales - if this is the case, then the profit margin is constant Depreciation and interest expense may not vary directly with sales – if this is the case, then the profit margin is not constant Dividends are a management decision and generally do not vary directly with sales – this affects additions to retained earnings 3 -21

Percent of Sales Approach o Balance Sheet n n o Initially assume all assets, including fixed, vary directly with sales. Accounts payable also normally vary directly with sales. Notes payable, long-term debt, and equity generally do not vary with sales because they depend on management decisions about capital structure. The change in the retained earnings portion of equity will come from the dividend decision. External Financing Needed (EFN) n The difference between the forecasted increase in assets and the forecasted increase in liabilities and equity. 3 -22

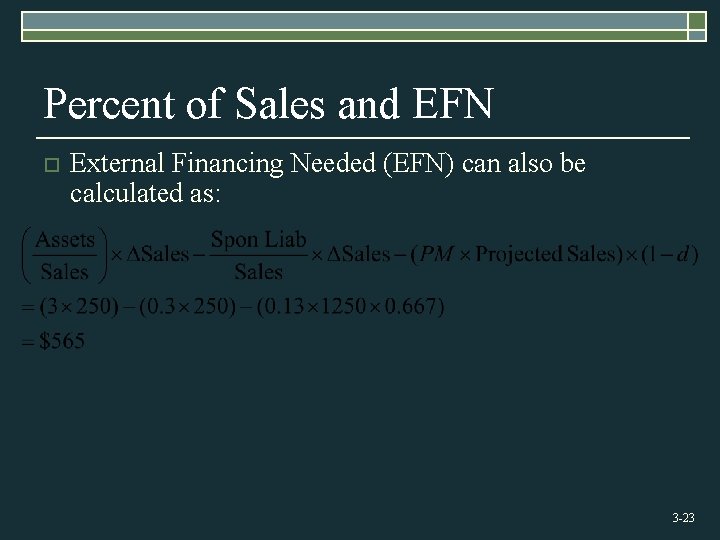

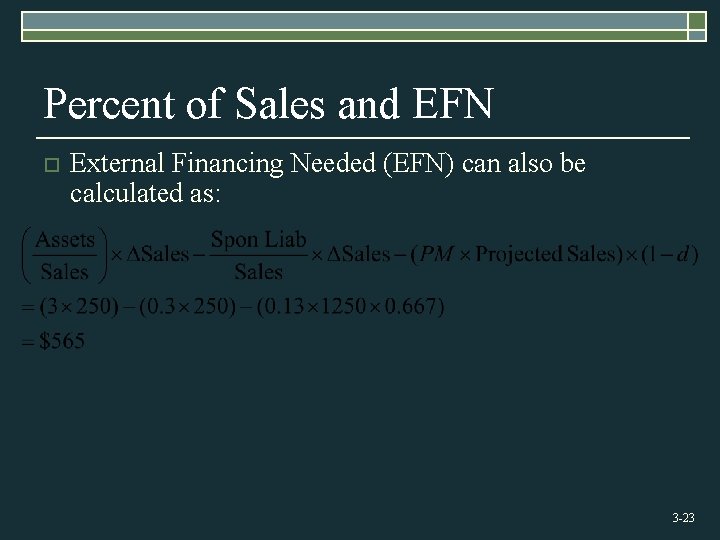

Percent of Sales and EFN o External Financing Needed (EFN) can also be calculated as: 3 -23

3. 5 External Financing and Growth o At low growth levels, internal financing (retained earnings) may exceed the required investment in assets. o As the growth rate increases, the internal financing will not be enough, and the firm will have to go to the capital markets for financing. o Examining the relationship between growth and external financing required is a useful tool in financial planning. 3 -24

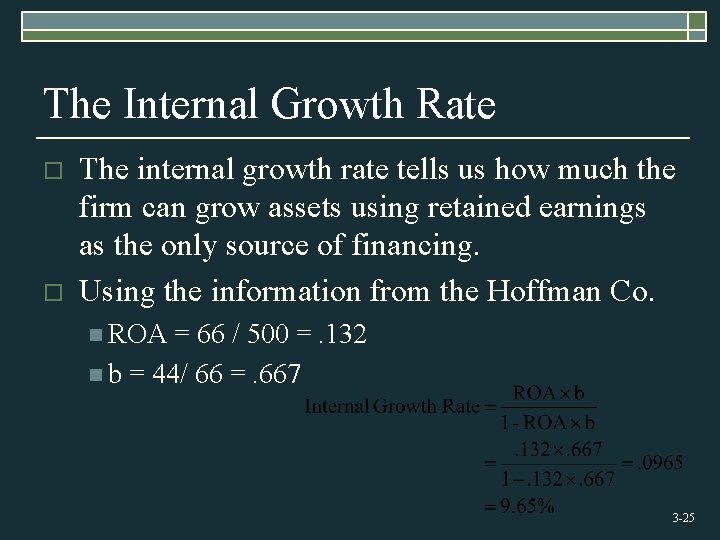

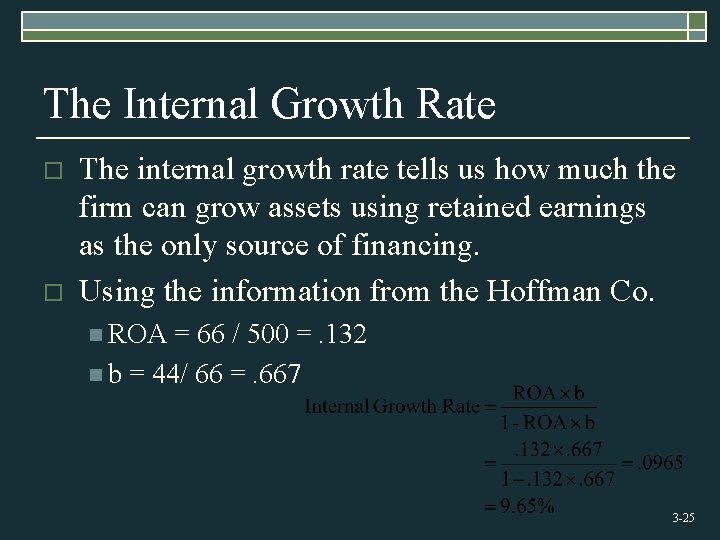

The Internal Growth Rate o o The internal growth rate tells us how much the firm can grow assets using retained earnings as the only source of financing. Using the information from the Hoffman Co. n ROA = 66 / 500 =. 132 n b = 44/ 66 =. 667 3 -25

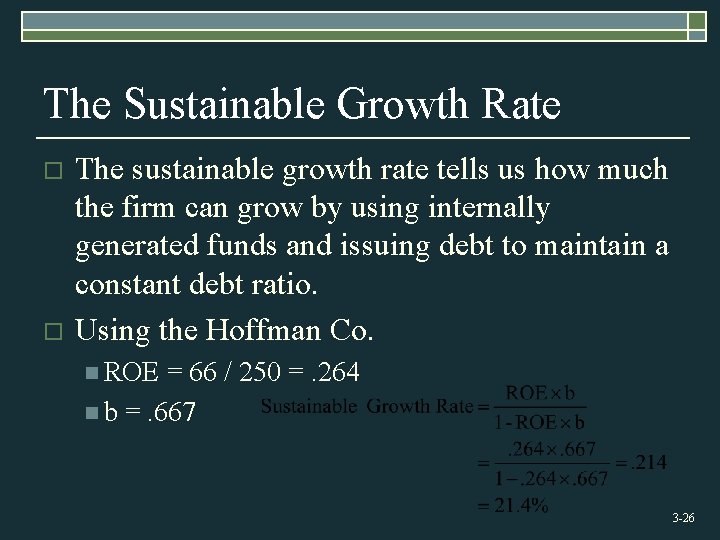

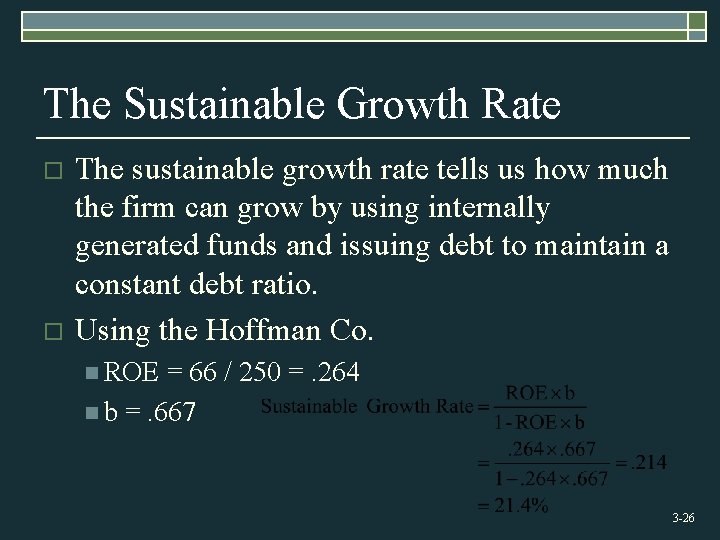

The Sustainable Growth Rate o o The sustainable growth rate tells us how much the firm can grow by using internally generated funds and issuing debt to maintain a constant debt ratio. Using the Hoffman Co. n ROE = 66 / 250 =. 264 n b =. 667 3 -26

Determinants of Growth o o Profit margin – operating efficiency Total asset turnover – asset use efficiency Financial leverage – choice of optimal debt ratio Dividend policy – choice of how much to pay to shareholders versus reinvesting in the firm 3 -27

3. 6 Some Caveats o Financial planning models do not indicate which financial polices are the best. o Models are simplifications of reality, and the world can change in unexpected ways. o Without some sort of plan, the firm may find itself adrift in a sea of change without a rudder for guidance. 3 -28

Quick Quiz How do you standardize balance sheets and income statements? o Why is standardization useful? o What are the major categories of financial ratios? o How do you compute the ratios within each category? o What are some of the problems associated with financial statement analysis? o 3 -29

Quick Quiz What is the purpose of financial planning? o What are the major decision areas involved in developing a plan? o What is the percentage of sales approach? o What is the internal growth rate? o What is the sustainable growth rate? o What are the major determinants of growth? o 3 -30