Chapter 3 Financial Decision Making Essential Question What

- Slides: 33

Chapter 3 Financial Decision Making Essential Question: What is involved in financial decision making?

Learning Objectives • Differentiate between cash inflow and cash outflow • Explain the steps in financial decision making Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -2

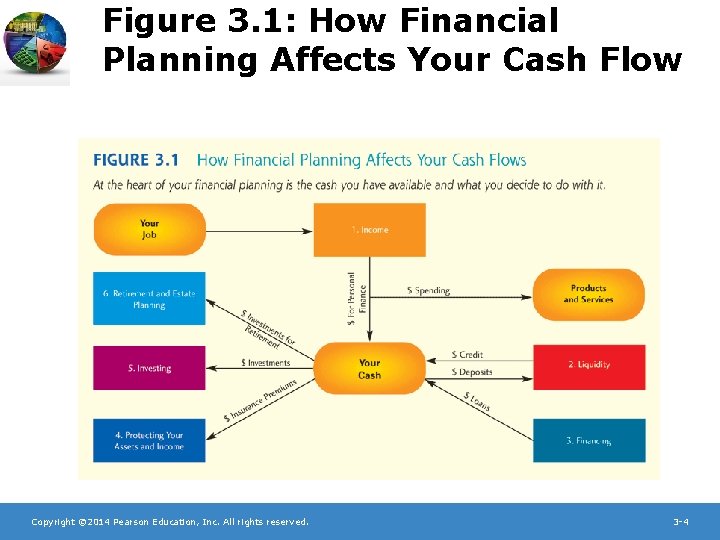

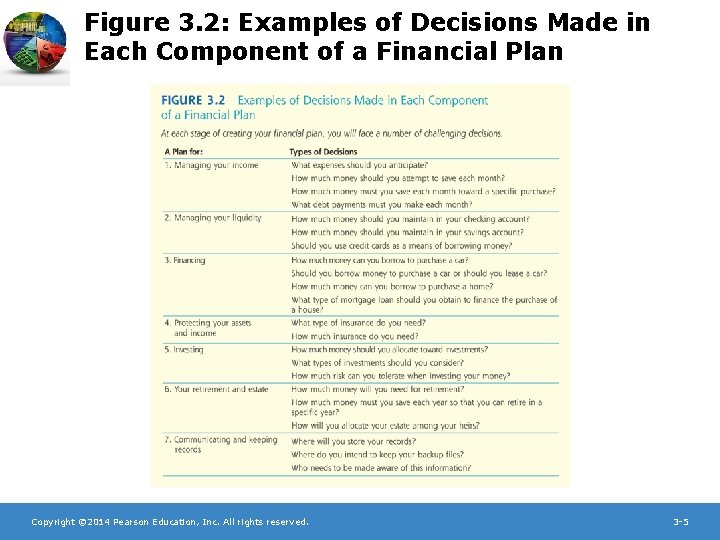

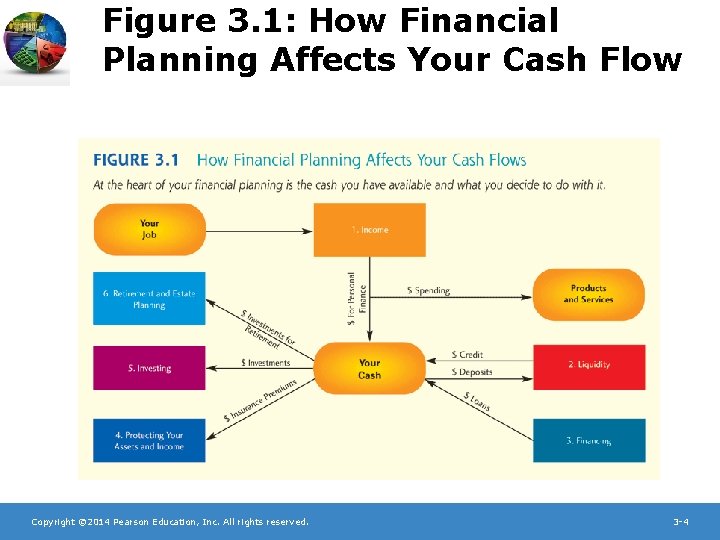

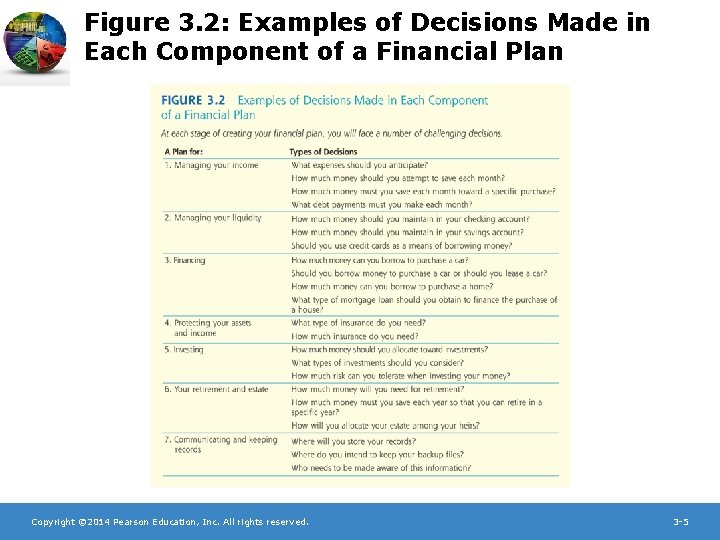

Cash Flows and Your Financial Future • Cash inflows – Money received from various sources • Cash outflows – Money paid out or spent • Cash flows are important to each component of a financial plan • Each component of the plan reflects decisions about how you get or use cash • Figure 3. 1 shows the central role of cash in your financial plan • Figure 3. 2 shows example of questions you might have as you build your financial plan Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -3

Figure 3. 1: How Financial Planning Affects Your Cash Flow Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -4

Figure 3. 2: Examples of Decisions Made in Each Component of a Financial Plan Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -5

What are cash inflows and cash outflows? Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -6

Cash inflows include all the money you receive from all sources. Cash outflows are all the monies you have going out. Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -7

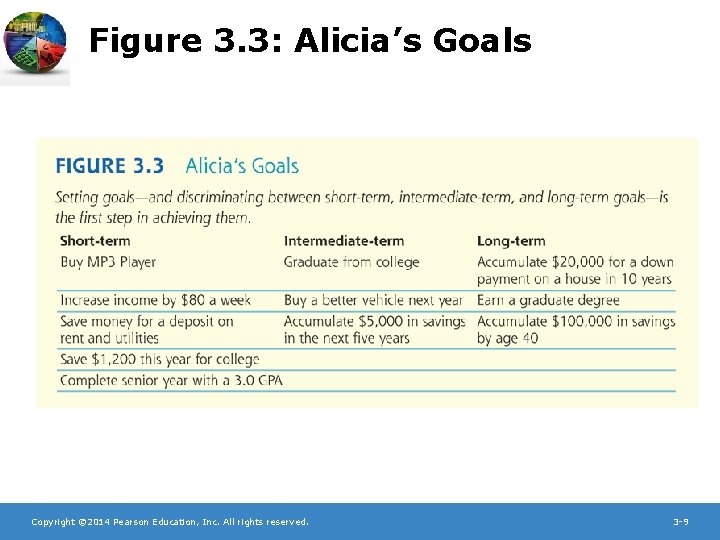

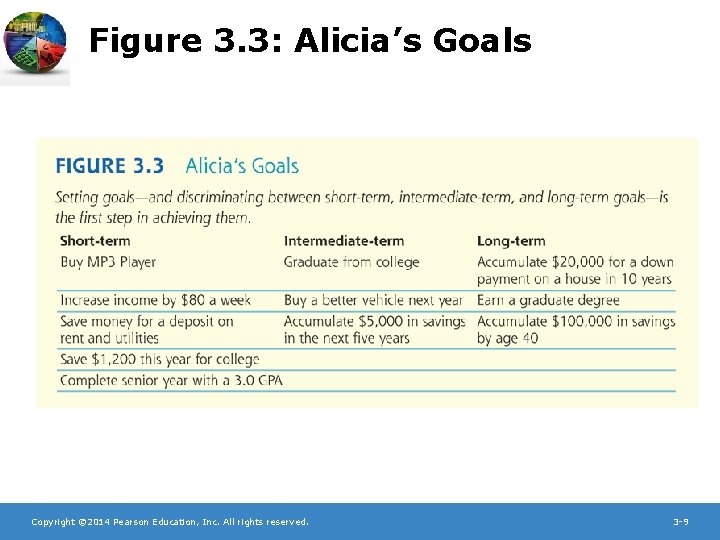

The Step-by-Step Decision. Making Process: Step 1 • Establish your financial goals – Short term goals are those you plan to accomplish within the next year – Intermediate-term goals are those you achieve within the next 1 to 5 years – Long-term goals will take more than 5 years to accomplish • Set realistic goals! • Take a look at Figure 3. 3 for an example of financial goals Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -8

Figure 3. 3: Alicia’s Goals Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -9

Math for Personal Finance • Dewanna needs to save $1, 500 by August to pay for her tuition. She only has 12 weeks remaining before school starts, and her boss is letting her work 20 hours per week. She brings home about $9 an hour after taxes are withdrawn from her check • Is it possible for her to save the $1, 500? Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -10

Math for Personal Finance • Solution: Yes, it is possible. She makes $9 an hour x 20 hours per week = $180 per week x 12 weeks = $2, 160 she will make prior to school starting Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -11

The Step-by-Step Decision. Making Process: Step 2 • Evaluate your current financial position • Your decisions on how much money to spend or to save depend on your current situation • Financial goals are tied to your income • Better the income = loftier goals Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -12

Math for Personal Finance • Jared anticipates working 10 hours a week during the 34 -week school year. He will work 40 hours per week for the remaining 18 weeks when school is out. • Assuming he makes $8 an hour, what is his forecast for income next year? Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -13

Math for Personal Finance • Solution: 34 weeks x 10 hours per week = 340 hours worked during the school year. Forty hours per week x 18 weeks while not in school = 720 hours. His total hours worked = 340 + 720 = 1, 060 hours x $8 an hour = $8, 480 in forecasted income. Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -14

The Step-by-Step Decision. Making Process: Step 2 • People also have to consider cash outflows (expenses) Anything on which we spend • Examples include phone bill money or car payment • Expenses can be fixed or variable • An expense – Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -15

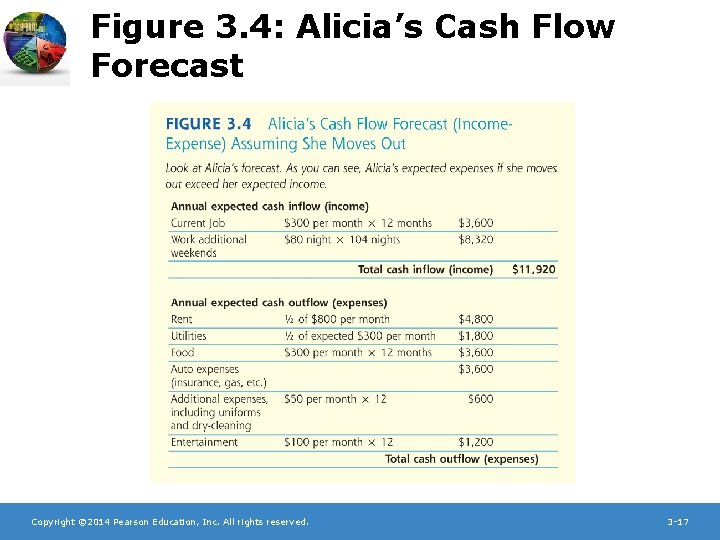

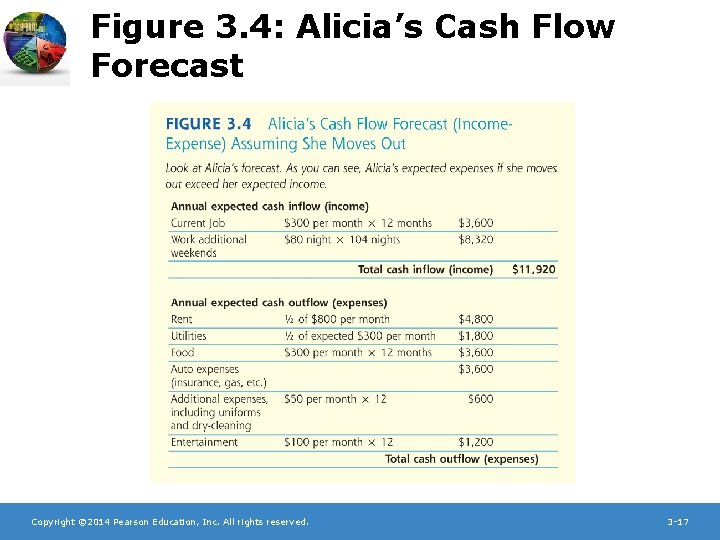

The Step-by-Step Decision. Making Process: Step 2 • Fixed expense – Remains the same from period to period • Variable expense – Changes from one period to the next • An example of a fixed expense is a car payment • An example of a variable expense is a phone bill • Take a look at Figure 3. 4 to see an example of a cash flow forecast Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -16

Figure 3. 4: Alicia’s Cash Flow Forecast Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -17

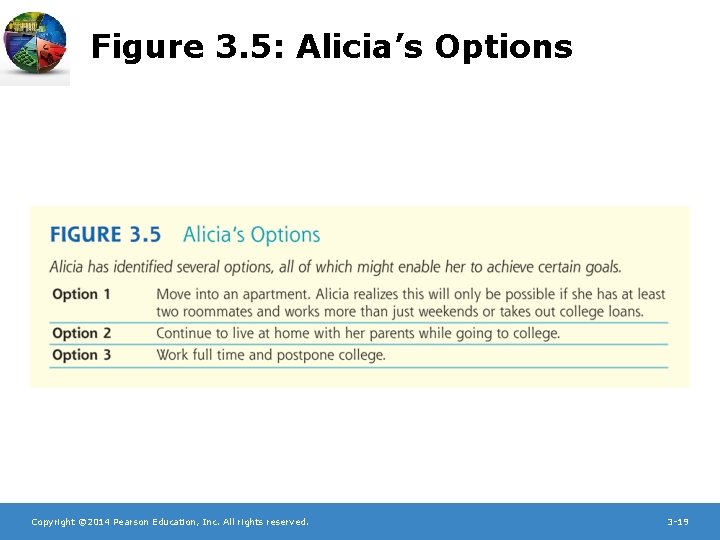

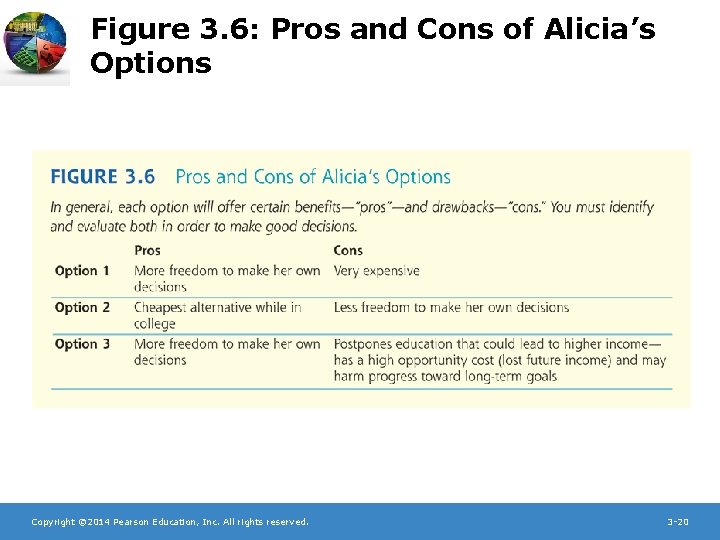

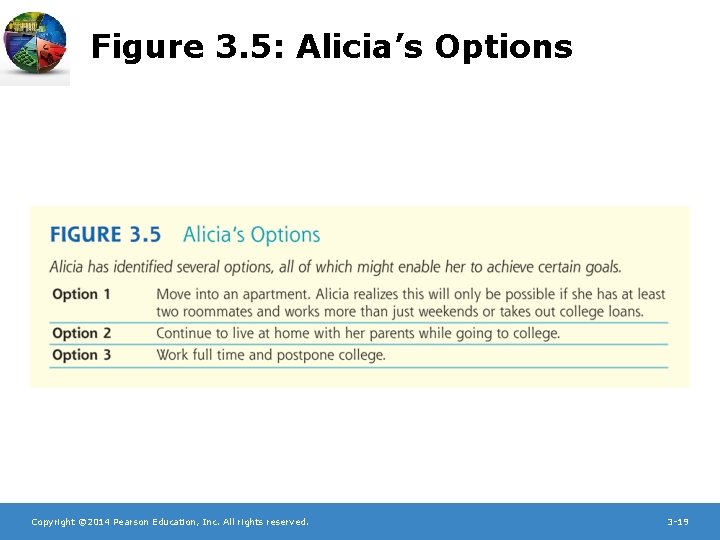

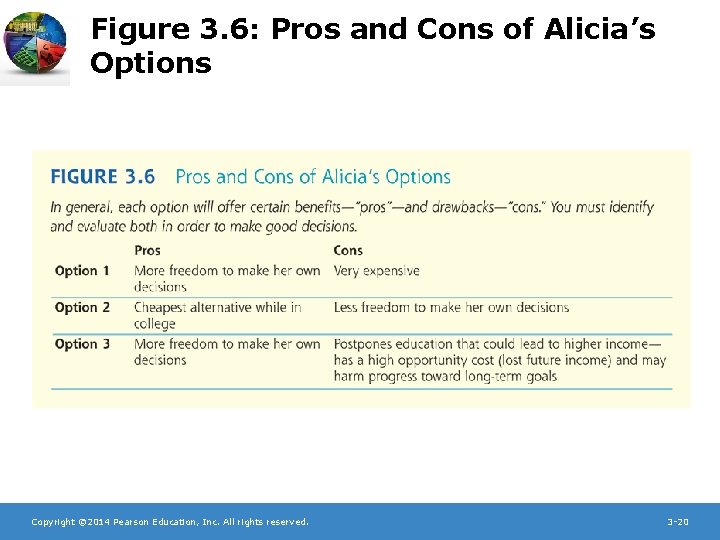

The Step-by-Step Decision. Making Process: Step 3 • Identify and evaluate your options for achieving your goals • There are several ways to achieve a financial goal • What will the best decision to make in the long run? • Take a look at Figure 3. 5 for an example of how to evaluate options • Refer to Figure 3. 6 for an example of making a pros and cons list Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -18

Figure 3. 5: Alicia’s Options Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -19

Figure 3. 6: Pros and Cons of Alicia’s Options Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -20

The Step-by-Step Decision. Making Process: Step 4 • Risk – Often defined as the likelihood of loss • Pick the best plan • Choose the goal that is more realistic • Your tolerance for risk and your self discipline often determine which plan is the best option for achieving a specific goal Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -21

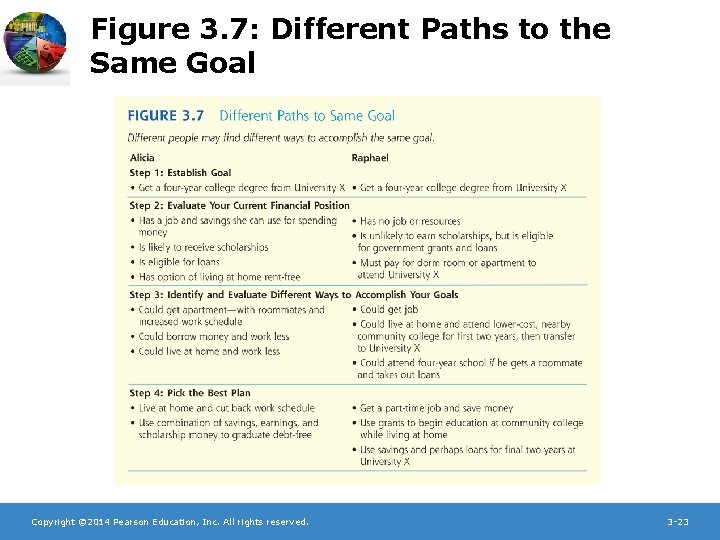

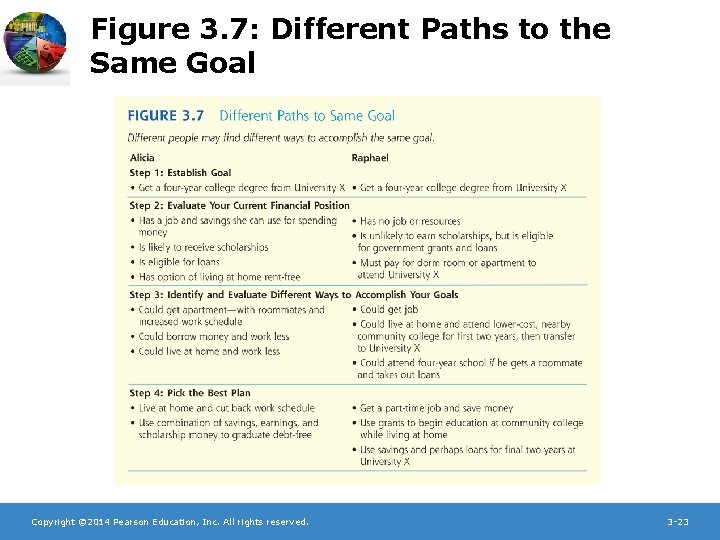

The Step-by-Step Decision. Making Process: Step 4 • Some people choose plans with a higher level of risk of loss • These plans also have a higher potential payoff • Others choose plans with lower risk that are more certain to accomplish the ultimate goal • Refer to Figure 3. 7 for an example of how there can be different paths to the same goal Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -22

Figure 3. 7: Different Paths to the Same Goal Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -23

The Step-by-Step Decision. Making Process: Step 5 • • Periodically evaluate your plan Monitor your progress Sometimes plans may get off track This will help you notice if there is a problem or if you should make adjustments Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -24

Math for Personal Finance • Lesia’s original financial plan required that she save $100 a month for two years in order to have $2, 400 for the down payment on a car. However, after one year she has only managed to save $1, 000. • What will Lesia need to do in order to accomplish her original goal? Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -25

Math for Personal Finance • Solution: Lesia needs to save another $1, 400 to reach her original goal or $2, 400 - $1, 000 she has saved = $1, 400. To accomplish that goal in 12 months she will need to save $1, 400/12 = $116. 67 per month. She will have to increase her savings to $116. 67 per month to accumulate the original $2, 400 by the end of next year Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -26

The Step-by-Step Decision. Making Process: Step 6 • Revise your financial plan as necessary • If the plan becomes unachievable or too restrictive, adjust it • If you need to revise one part of your plan, other aspects might also need to be revised as well Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -27

EQ: What are the steps of financial decision making? Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -28

1. Establish your goals 2. Evaluate your current financial position 3. Identify and evaluate the options for reaching your goals 4. Pick the best plan 5. Evaluate your plan periodically 6. Revise your plan as necessary Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -29

Summary • Financial decisions and planning start with questions about cash flows • Decisions about cash inflows and outflows affect each component of your financial plan Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -30

Summary • There are 6 steps for making financial decisions and creating your financial plan: 1. Establish your goals 2. Evaluate your current financial position 3. Identify and evaluate the options for reaching your goals 4. Pick the best plan 5. Evaluate your plan periodically 6. Revise your plan as necessary Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -31

Key Terms and Concepts • • Cash inflow Cash outflow Expense Fixed expense Copyright © 2014 Pearson Education, Inc. All rights reserved. • • • Long-term goal Middle-term goal Risk Short-term goal Variable expense 3 -32

Websites www. mymoneyanswers. com/goals. htm Copyright © 2014 Pearson Education, Inc. All rights reserved. 3 -33