Chapter 3 Audit Planning Types of Audit Tests

- Slides: 33

Chapter 3 Audit Planning, Types of Audit Tests and Materiality © Mc. Graw-Hill Education 2014

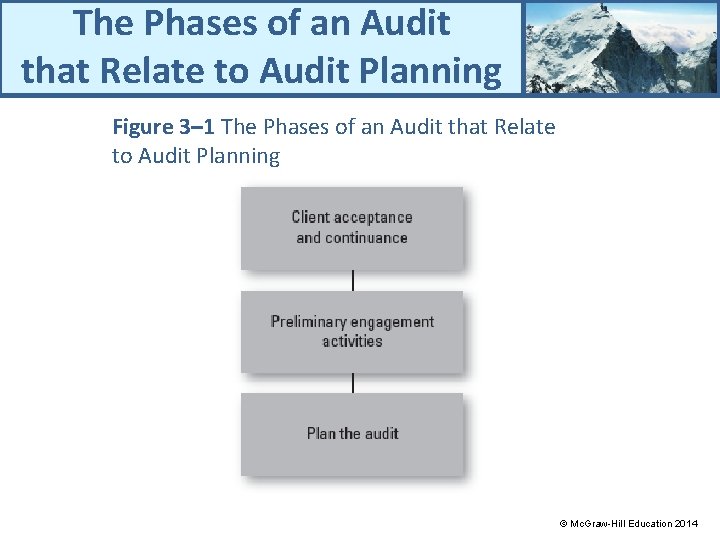

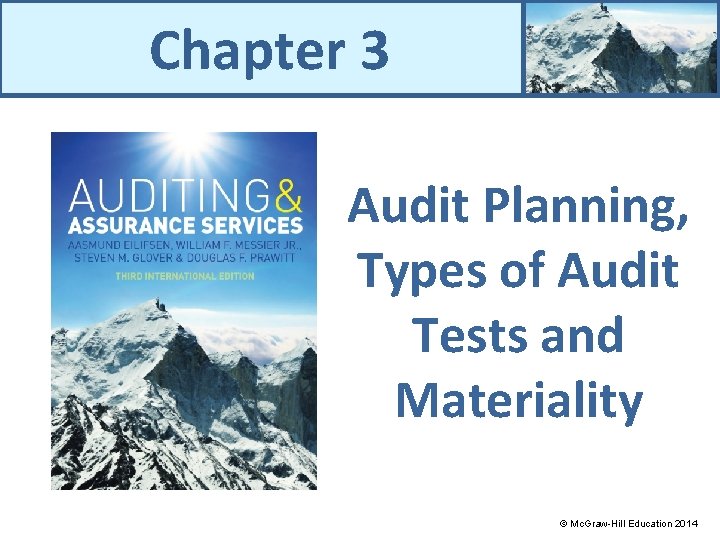

The Phases of an Audit that Relate to Audit Planning Figure 3– 1 The Phases of an Audit that Relate to Audit Planning © Mc. Graw-Hill Education 2014

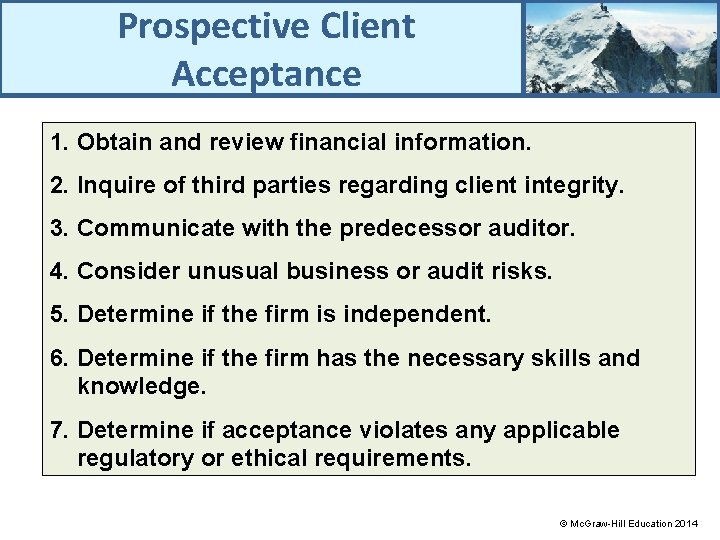

Prospective Client Acceptance 1. Obtain and review financial information. 2. Inquire of third parties regarding client integrity. 3. Communicate with the predecessor auditor. 4. Consider unusual business or audit risks. 5. Determine if the firm is independent. 6. Determine if the firm has the necessary skills and knowledge. 7. Determine if acceptance violates any applicable regulatory or ethical requirements. © Mc. Graw-Hill Education 2014

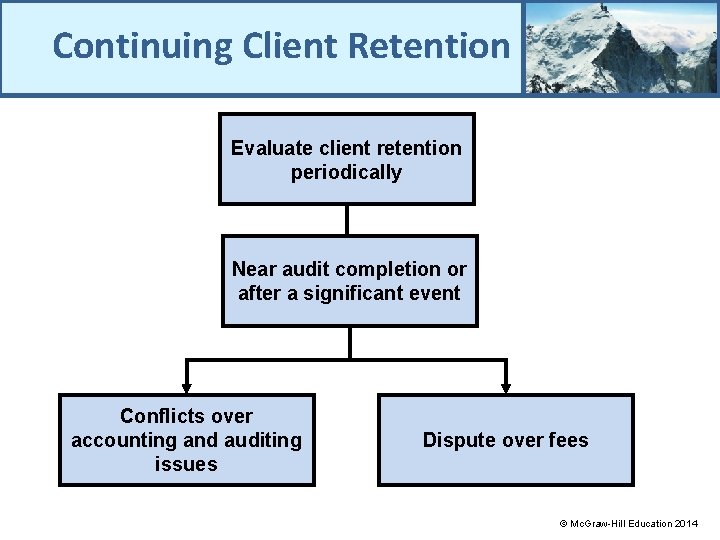

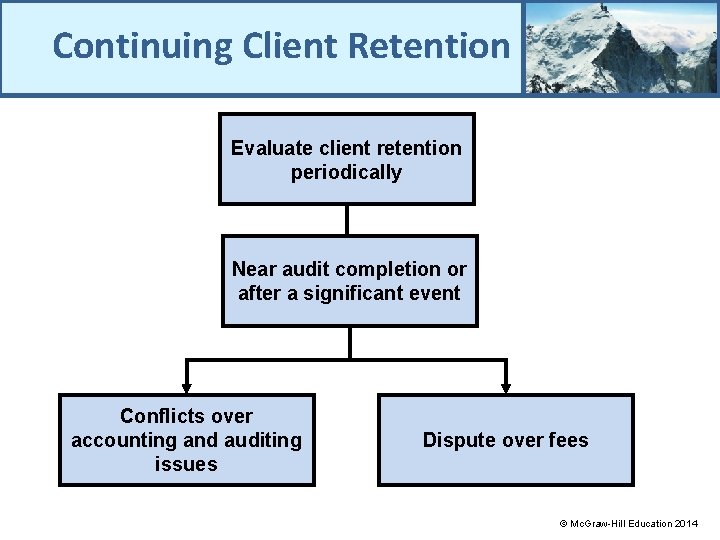

Continuing Client Retention Evaluate client retention periodically Near audit completion or after a significant event Conflicts over accounting and auditing issues Dispute over fees © Mc. Graw-Hill Education 2014

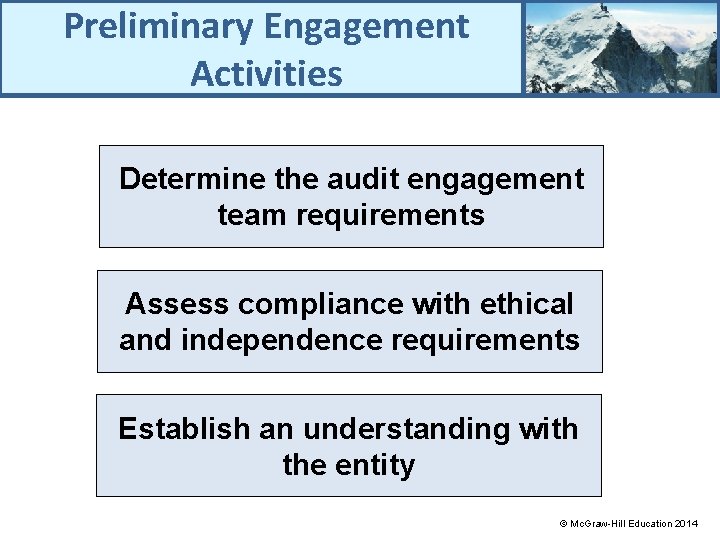

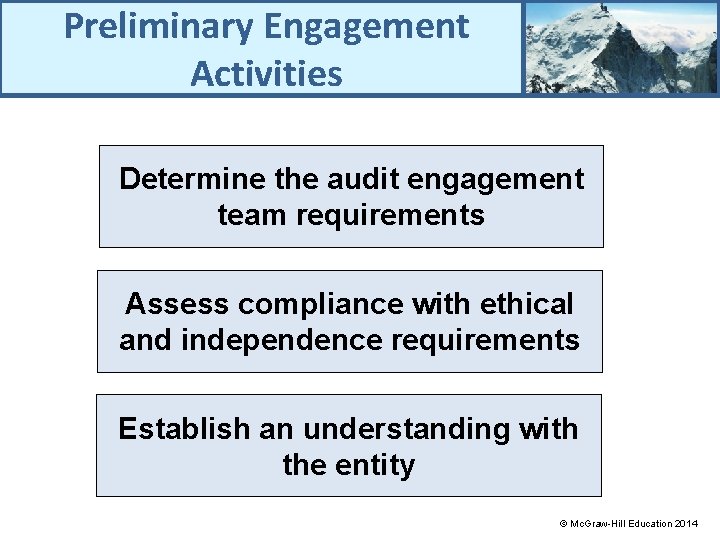

Preliminary Engagement Activities Determine the audit engagement team requirements Assess compliance with ethical and independence requirements Establish an understanding with the entity © Mc. Graw-Hill Education 2014

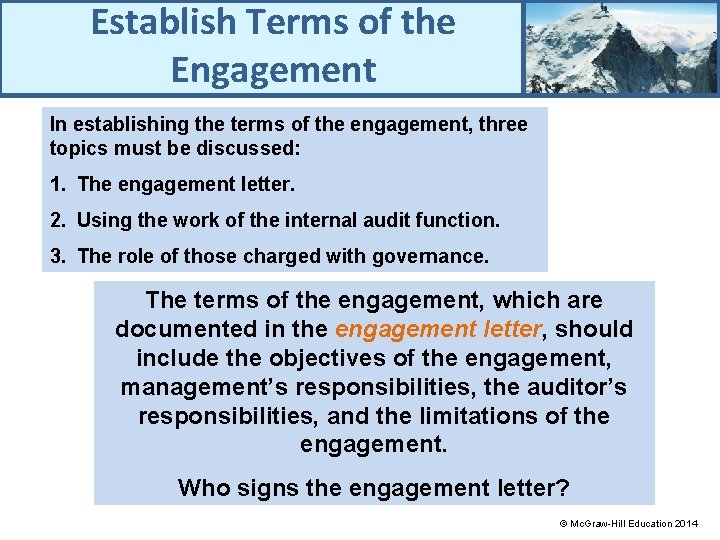

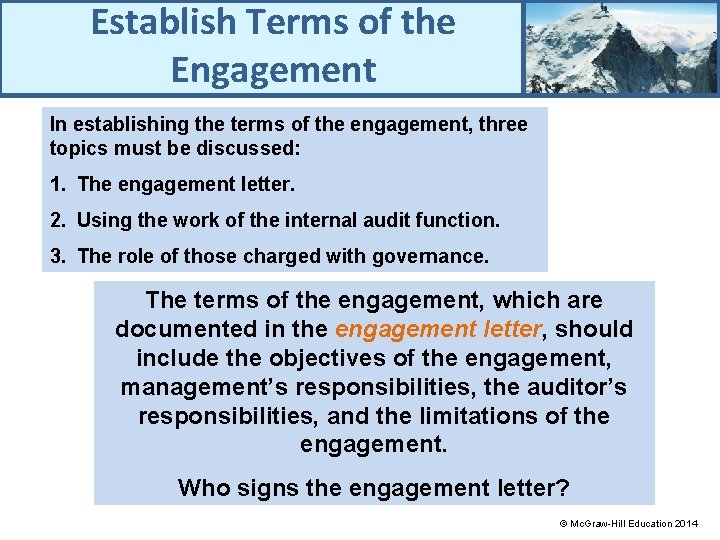

Establish Terms of the Engagement In establishing the terms of the engagement, three topics must be discussed: 1. The engagement letter. 2. Using the work of the internal audit function. 3. The role of those charged with governance. The terms of the engagement, which are documented in the engagement letter, should include the objectives of the engagement, management’s responsibilities, the auditor’s responsibilities, and the limitations of the engagement. Who signs the engagement letter? © Mc. Graw-Hill Education 2014

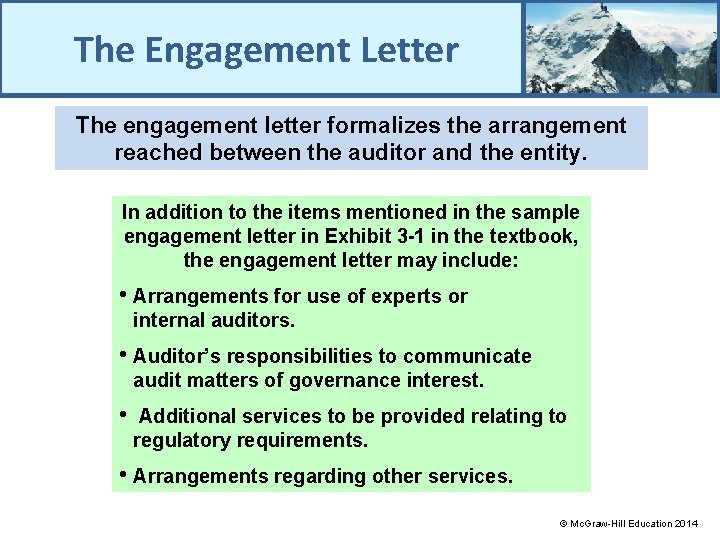

The Engagement Letter The engagement letter formalizes the arrangement reached between the auditor and the entity. In addition to the items mentioned in the sample engagement letter in Exhibit 3 -1 in the textbook, the engagement letter may include: • Arrangements for use of experts or internal auditors. • Auditor’s responsibilities to communicate audit matters of governance interest. • Additional services to be provided relating to regulatory requirements. • Arrangements regarding other services. © Mc. Graw-Hill Education 2014

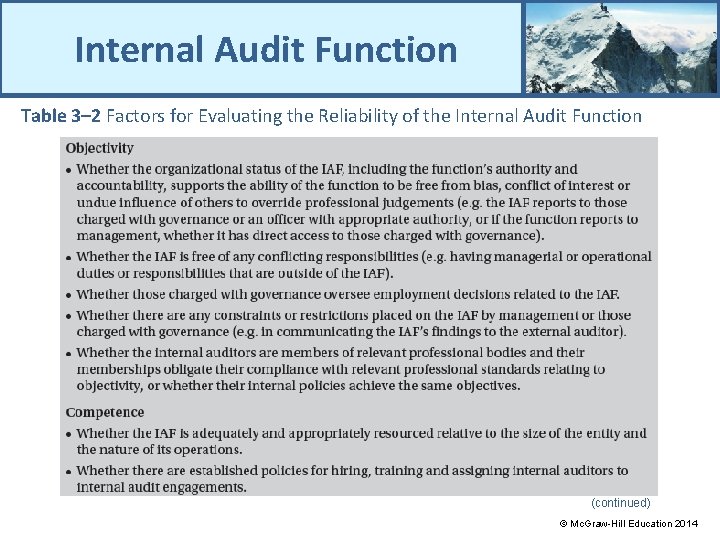

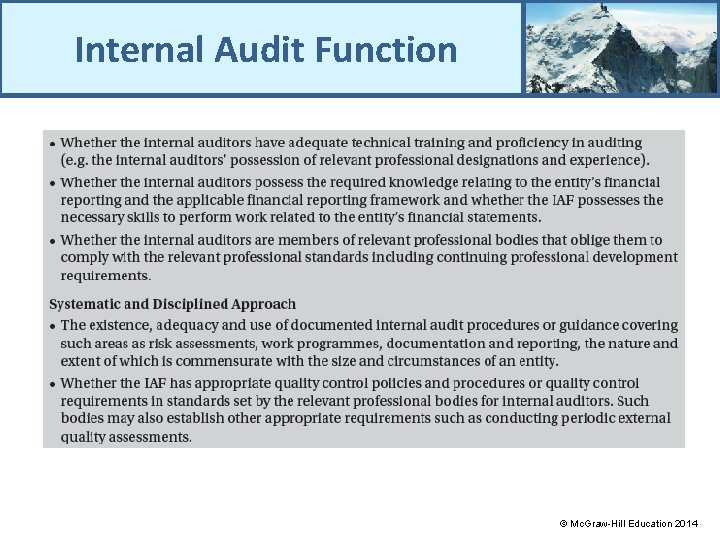

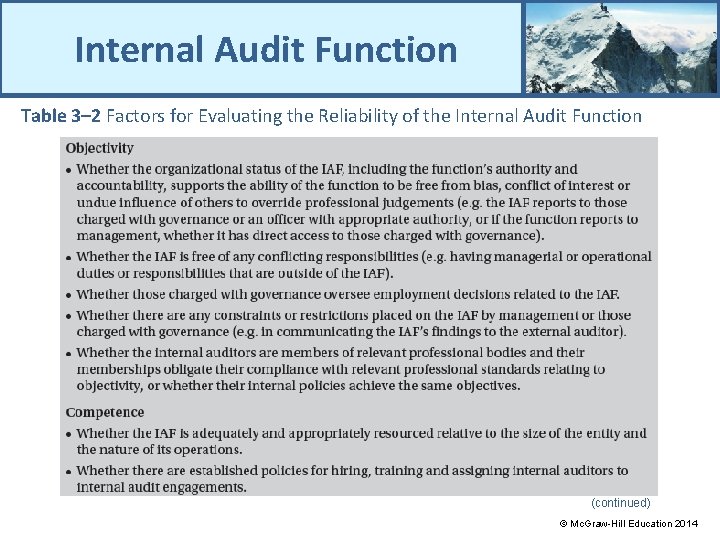

Internal Audit Function Table 3– 2 Factors for Evaluating the Reliability of the Internal Audit Function (continued) © Mc. Graw-Hill Education 2014

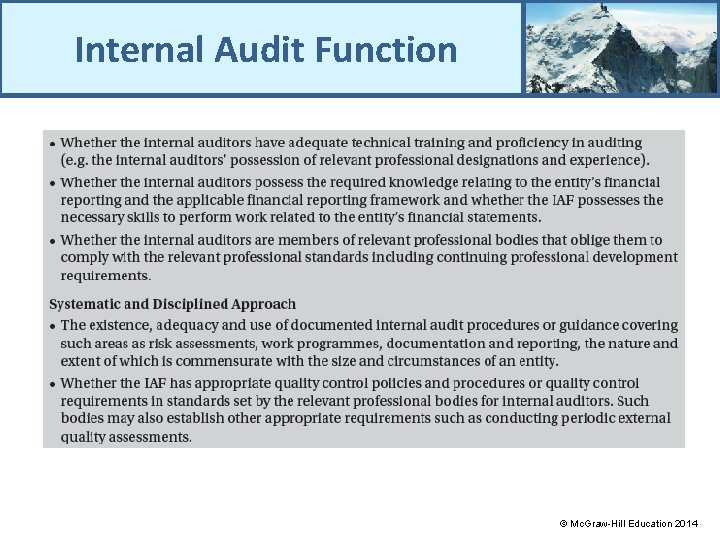

Internal Audit Function © Mc. Graw-Hill Education 2014

Those Charged with Governance Board of Directors Audit Committee © Mc. Graw-Hill Education 2014

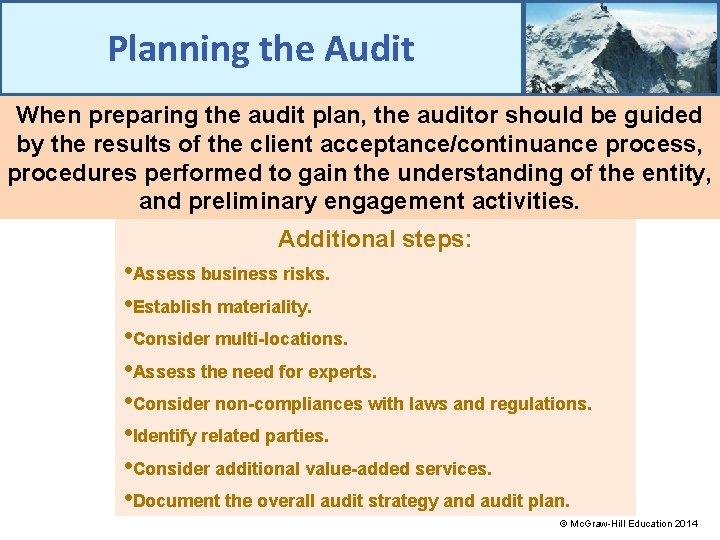

Planning the Audit • The auditor will develop an overall audit strategy for conducting the audit. This will help the auditor to determine what resources are needed to perform the engagement. • An audit plan is more detailed than the audit strategy. Basically, the audit plan should consider how to conduct the engagement in an effective and efficient manner. © Mc. Graw-Hill Education 2014

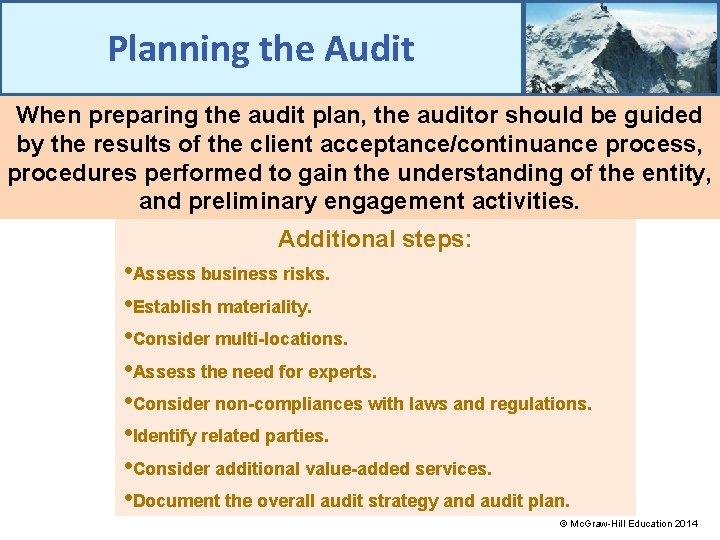

Planning the Audit When preparing the audit plan, the auditor should be guided by the results of the client acceptance/continuance process, procedures performed to gain the understanding of the entity, and preliminary engagement activities. Additional steps: • Assess business risks. • Establish materiality. • Consider multi-locations. • Assess the need for experts. • Consider non-compliances with laws and regulations. • Identify related parties. • Consider additional value-added services. • Document the overall audit strategy and audit plan. © Mc. Graw-Hill Education 2014

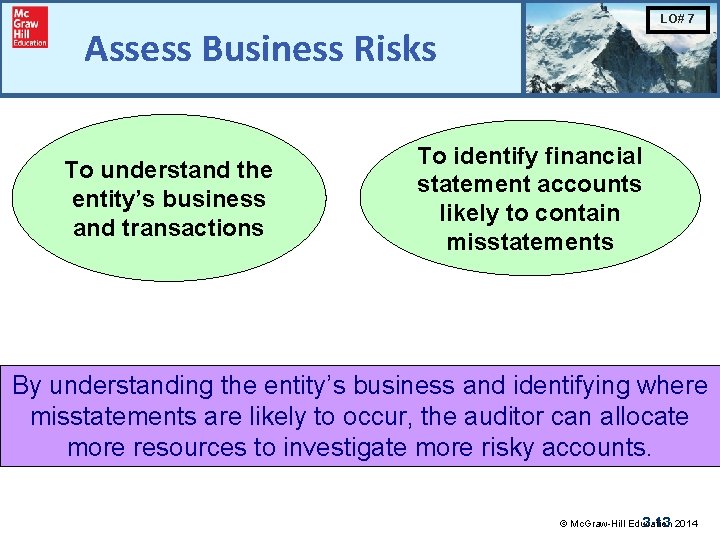

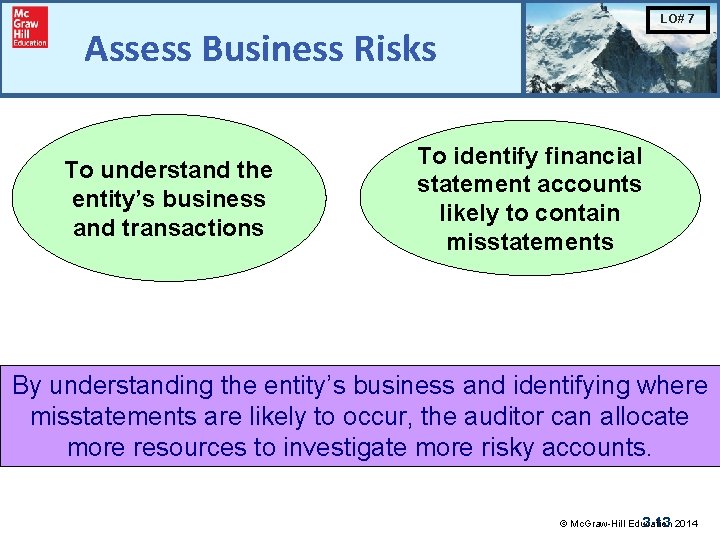

LO# 7 Assess Business Risks To understand the entity’s business and transactions To identify financial statement accounts likely to contain misstatements By understanding the entity’s business and identifying where misstatements are likely to occur, the auditor can allocate more resources to investigate more risky accounts. © Mc. Graw-Hill Education 3 -13 2014

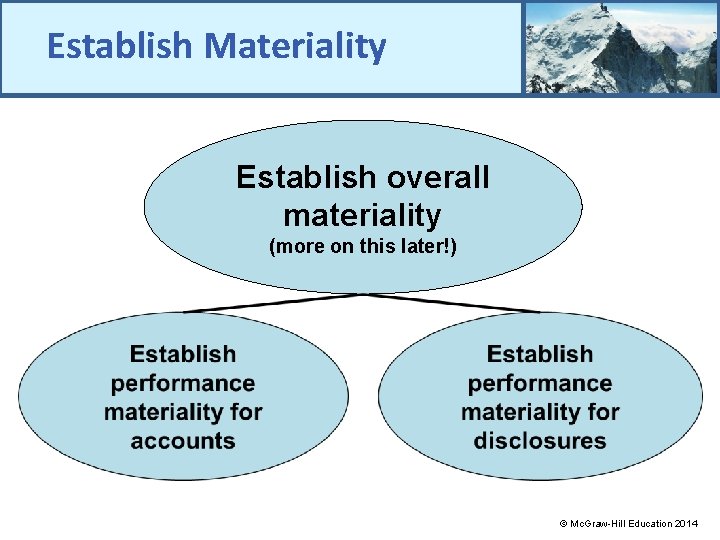

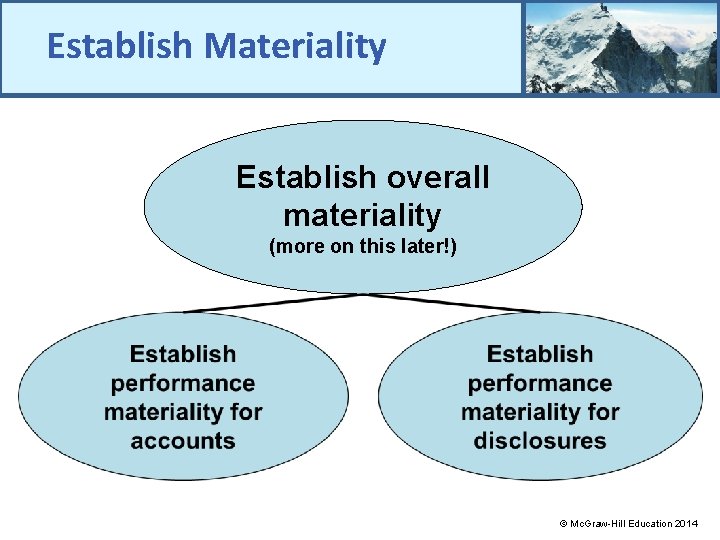

Establish Materiality Establish overall materiality (more on this later!) © Mc. Graw-Hill Education 2014

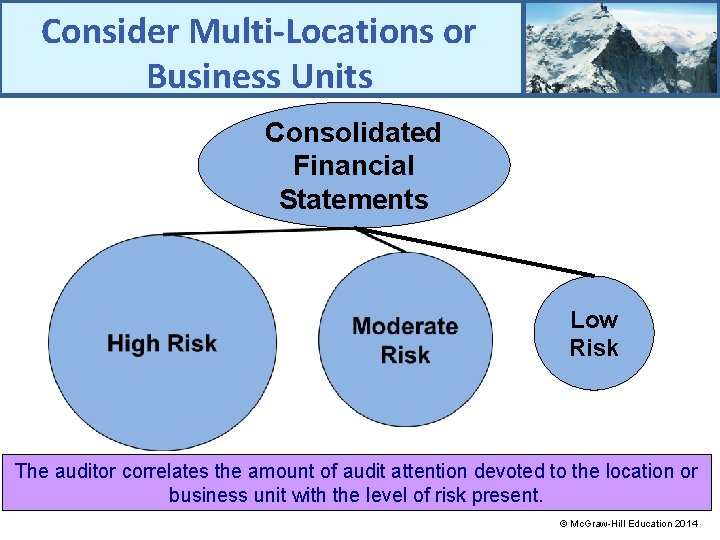

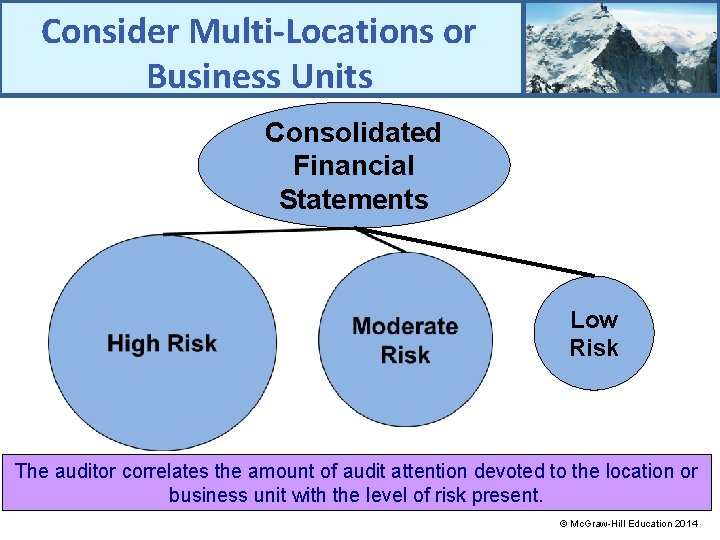

Consider Multi-Locations or Business Units Consolidated Financial Statements Low Risk The auditor correlates the amount of audit attention devoted to the location or business unit with the level of risk present. © Mc. Graw-Hill Education 2014

Assess the Need for Experts A major consideration in planning the audit is the need for an auditor’s expert. The presence of complex information technology may require the use of an IT expert. What other types of experts might be needed? © Mc. Graw-Hill Education 2014

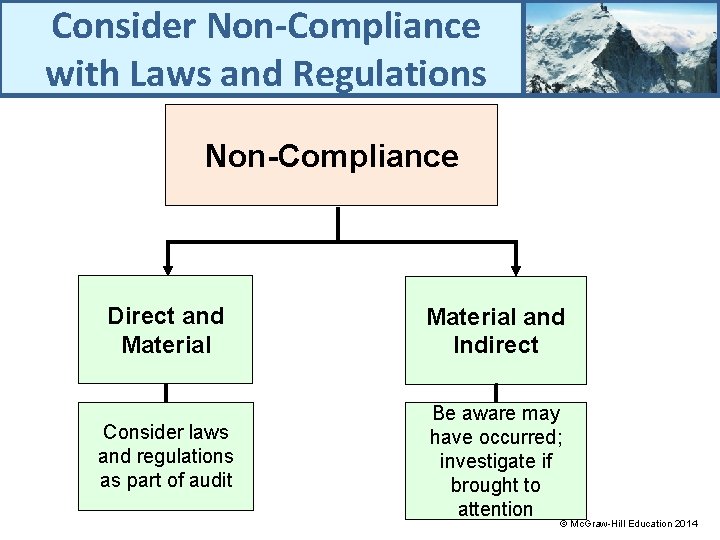

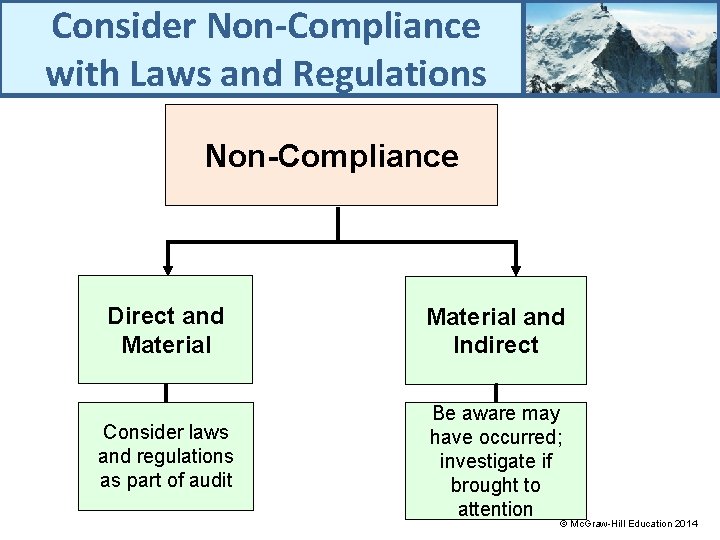

Consider Non-Compliance with Laws and Regulations Non-Compliance Direct and Material and Indirect Consider laws and regulations as part of audit Be aware may have occurred; investigate if brought to attention © Mc. Graw-Hill Education 2014

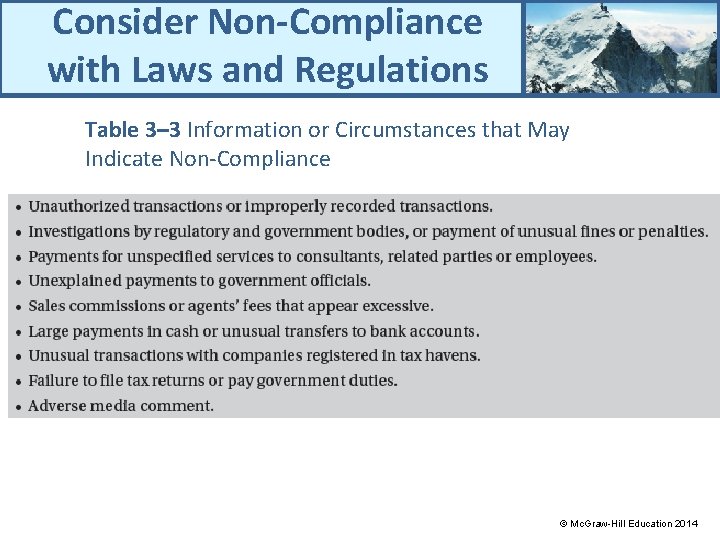

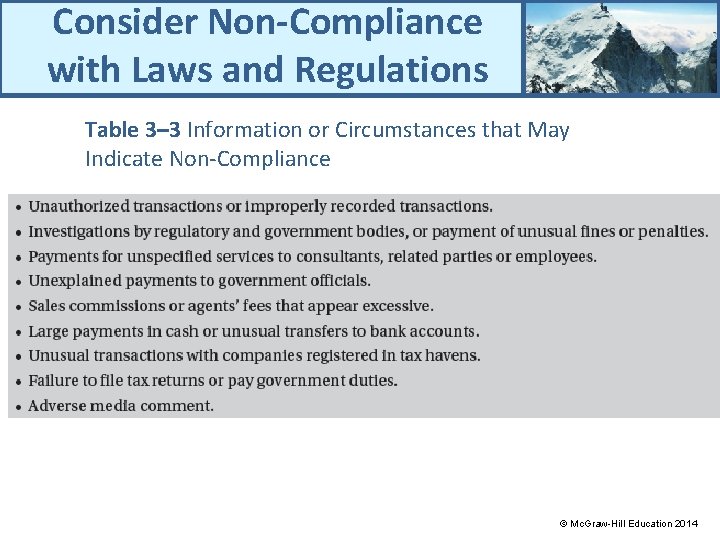

Consider Non-Compliance with Laws and Regulations Table 3– 3 Information or Circumstances that May Indicate Non-Compliance © Mc. Graw-Hill Education 2014

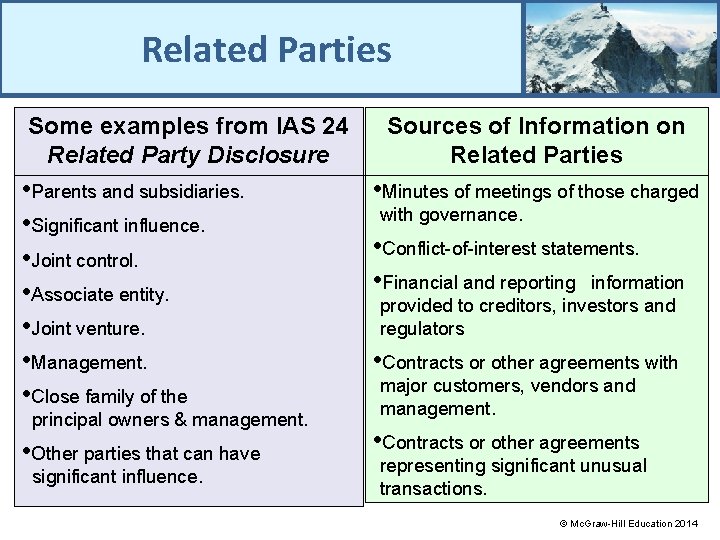

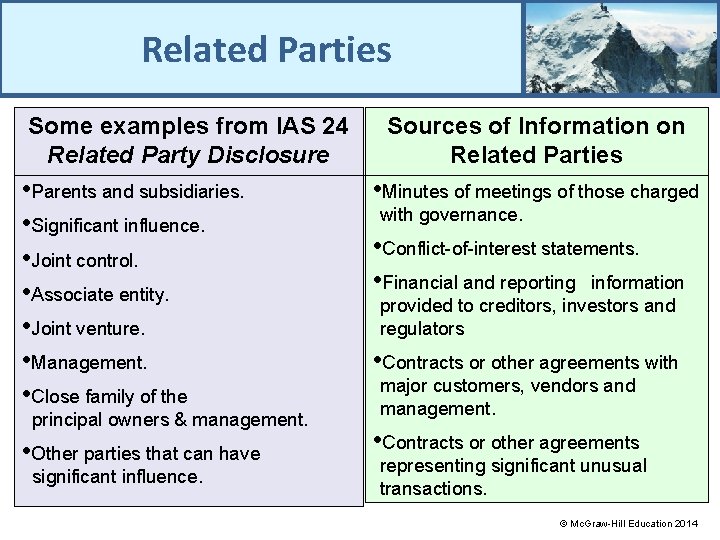

Related Parties Some examples from IAS 24 Related Party Disclosure Sources of Information on Related Parties • Parents and subsidiaries. • Significant influence. • Joint control. • Associate entity. • Joint venture. • Management. • Close family of the • Minutes of meetings of those charged • Other parties that can have • Contracts or other agreements principal owners & management. significant influence. with governance. • Conflict-of-interest statements. • Financial and reporting information provided to creditors, investors and regulators • Contracts or other agreements with major customers, vendors and management. representing significant unusual transactions. © Mc. Graw-Hill Education 2014

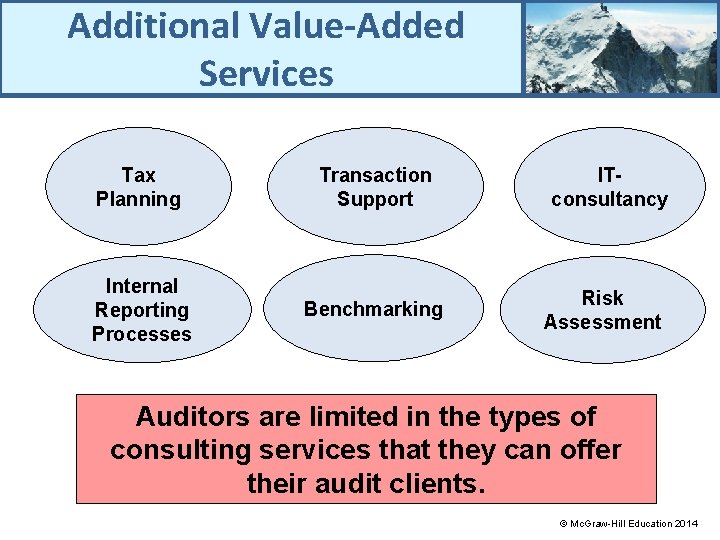

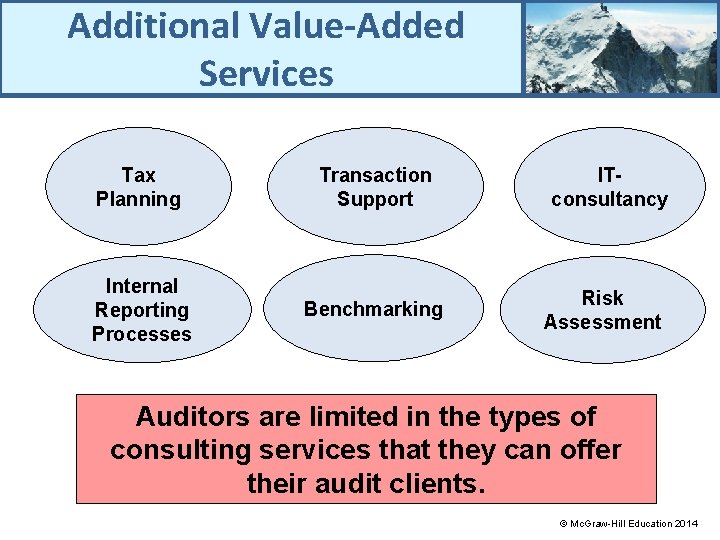

Additional Value-Added Services Tax Planning Transaction Support Internal Reporting Processes Benchmarking ITconsultancy Risk Assessment Auditors are limited in the types of consulting services that they can offer their audit clients. © Mc. Graw-Hill Education 2014

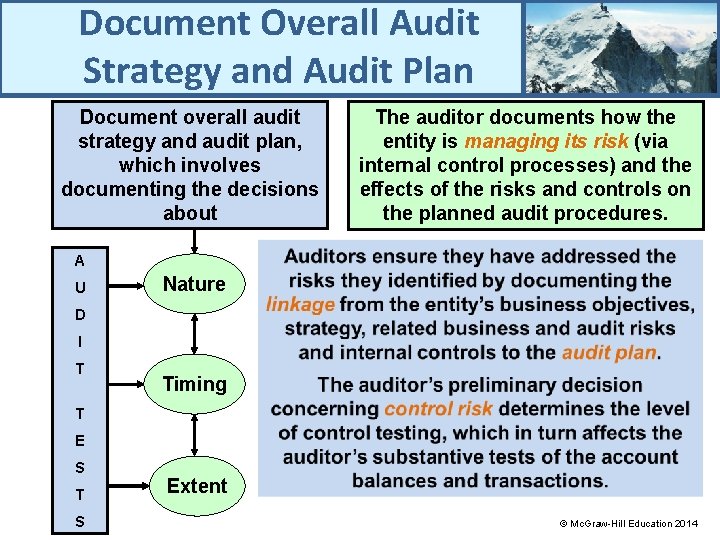

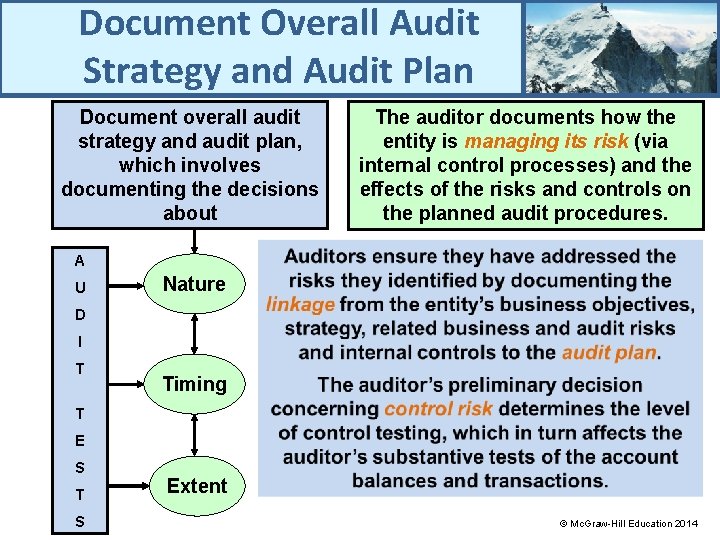

Document Overall Audit Strategy and Audit Plan Document overall audit strategy and audit plan, which involves documenting the decisions about The auditor documents how the entity is managing its risk (via internal control processes) and the effects of the risks and controls on the planned audit procedures. A U Nature D I T Timing T E S T S Extent © Mc. Graw-Hill Education 2014

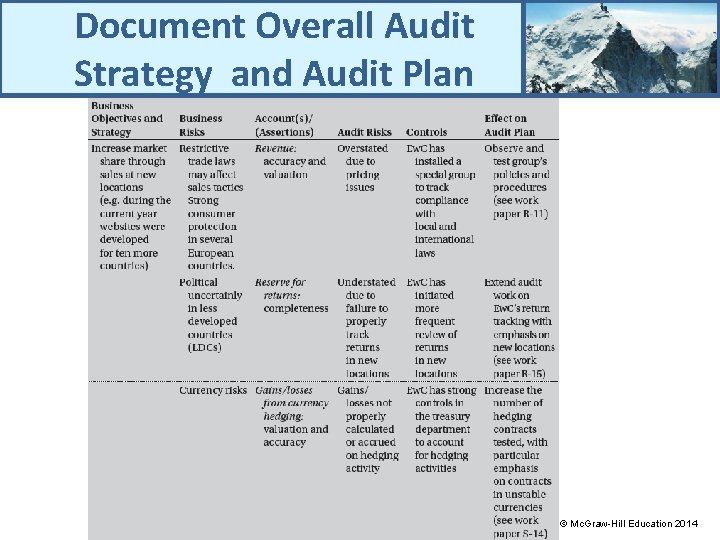

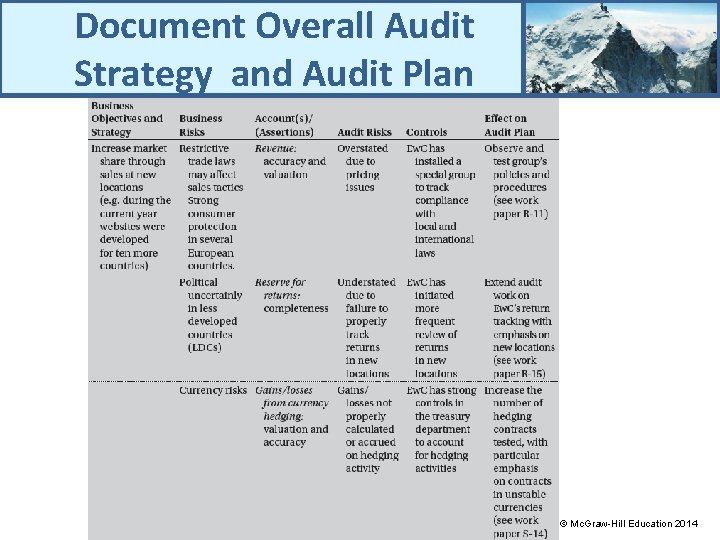

Document Overall Audit Strategy and Audit Plan © Mc. Graw-Hill Education 2014

Supervision of the Audit • Engagement partner should: • Inform engagement team members of their responsibilities • Direct engagement team members to identify and communicate audit issues • Review the work of the engagement team members © Mc. Graw-Hill Education 2014

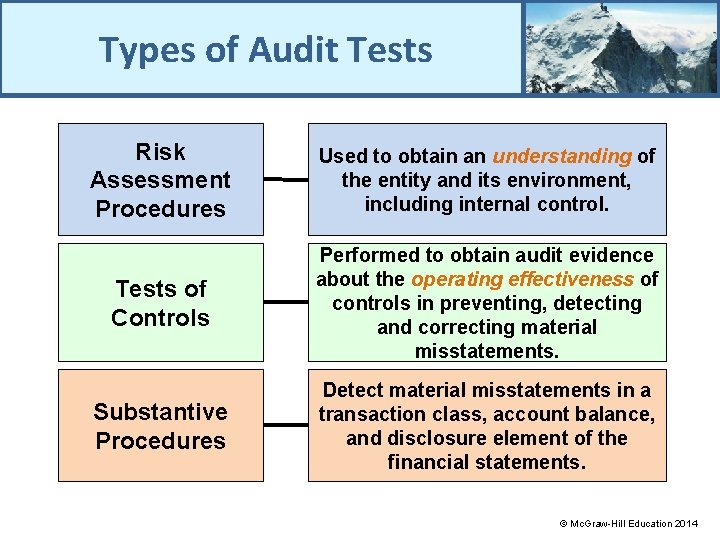

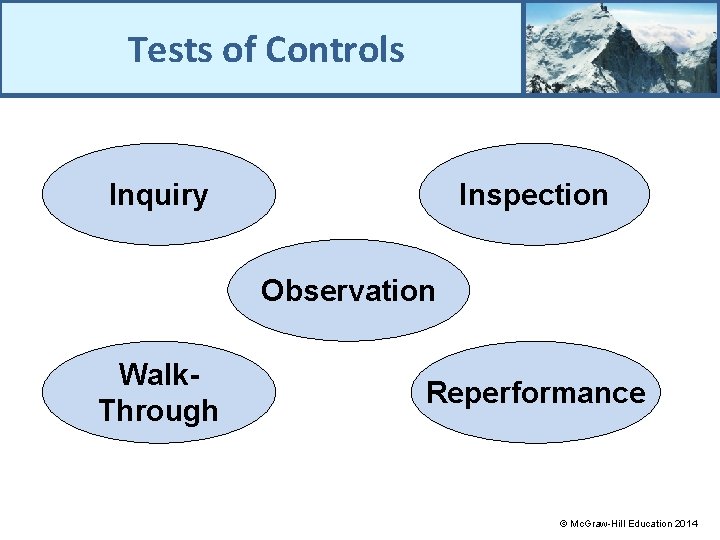

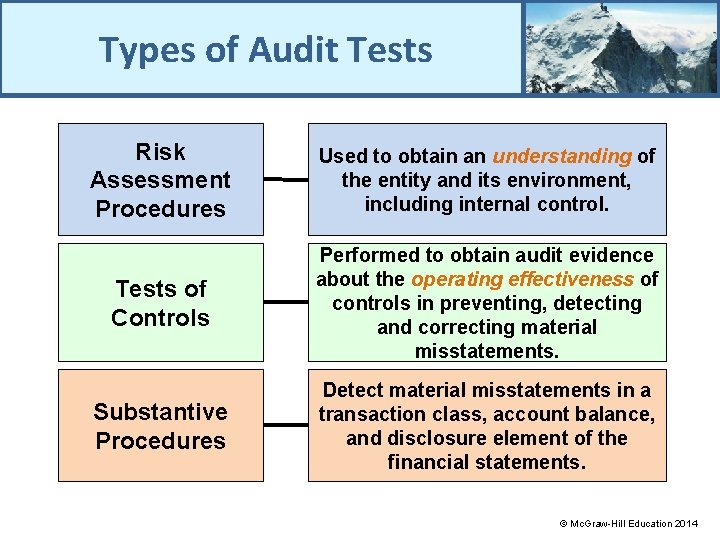

Types of Audit Tests Risk Assessment Procedures Used to obtain an understanding of the entity and its environment, including internal control. Tests of Controls Performed to obtain audit evidence about the operating effectiveness of controls in preventing, detecting and correcting material misstatements. Substantive Procedures Detect material misstatements in a transaction class, account balance, and disclosure element of the financial statements. © Mc. Graw-Hill Education 2014

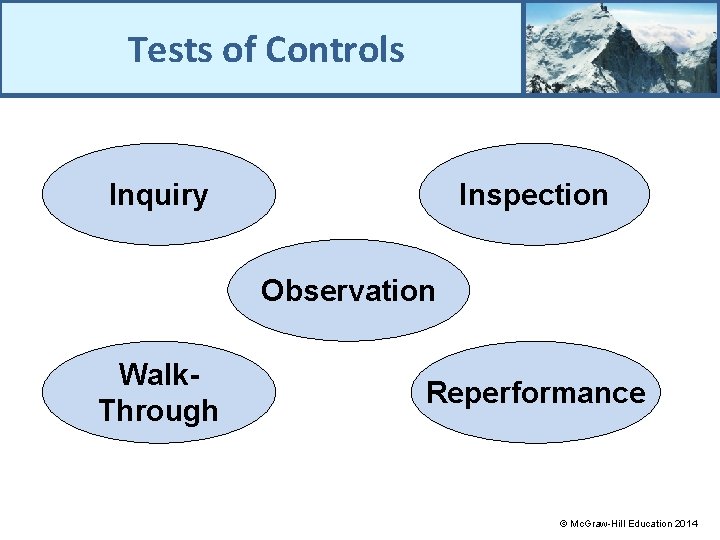

Tests of Controls Inquiry Inspection Observation Walk. Through Reperformance © Mc. Graw-Hill Education 2014

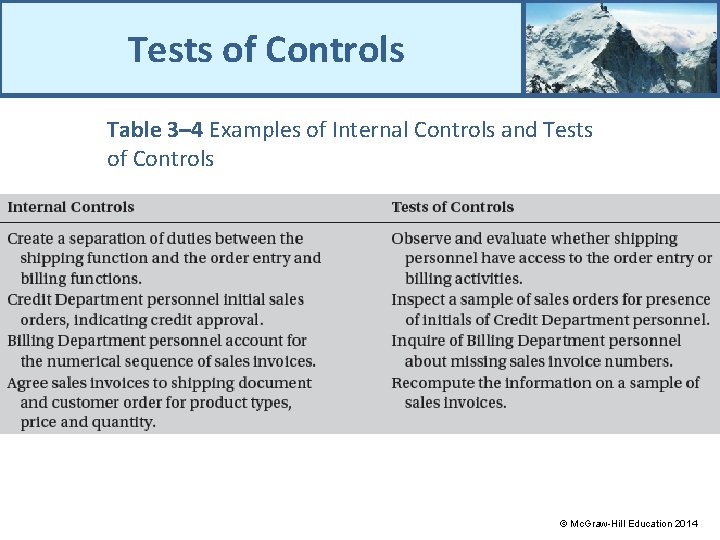

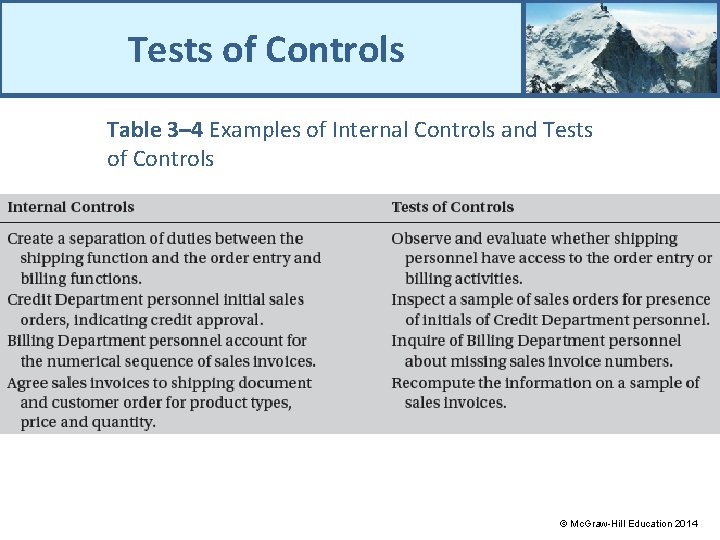

Tests of Controls Table 3– 4 Examples of Internal Controls and Tests of Controls © Mc. Graw-Hill Education 2014

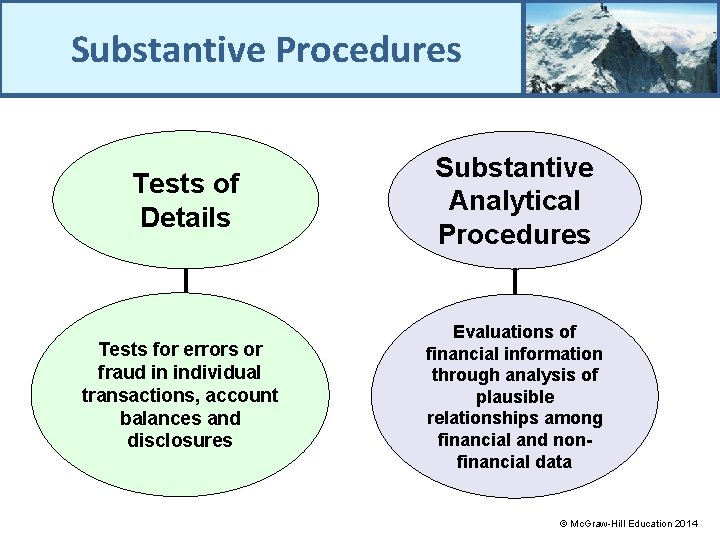

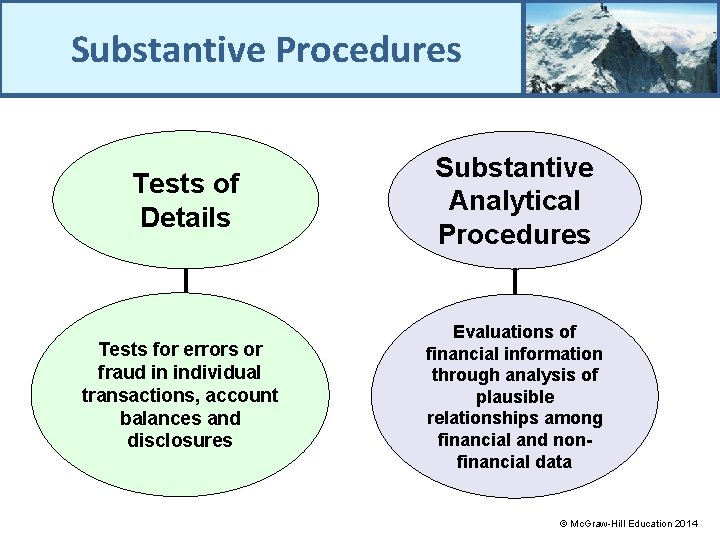

Substantive Procedures Tests of Details Tests for errors or fraud in individual transactions, account balances and disclosures Substantive Analytical Procedures Evaluations of financial information through analysis of plausible relationships among financial and nonfinancial data © Mc. Graw-Hill Education 2014

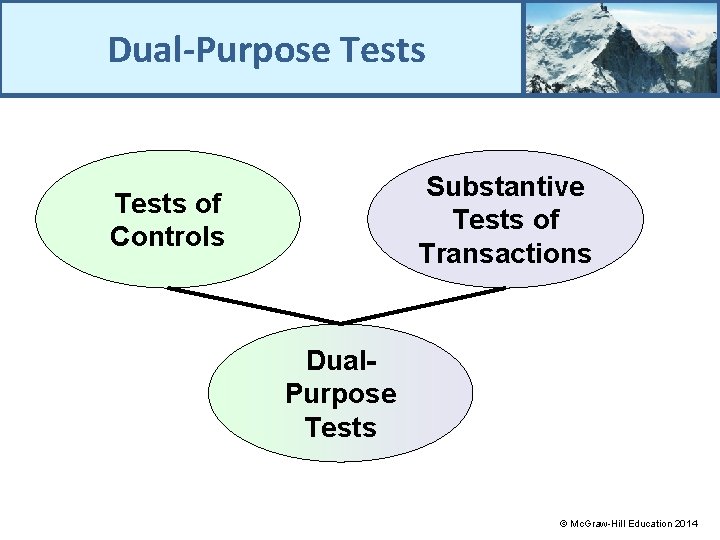

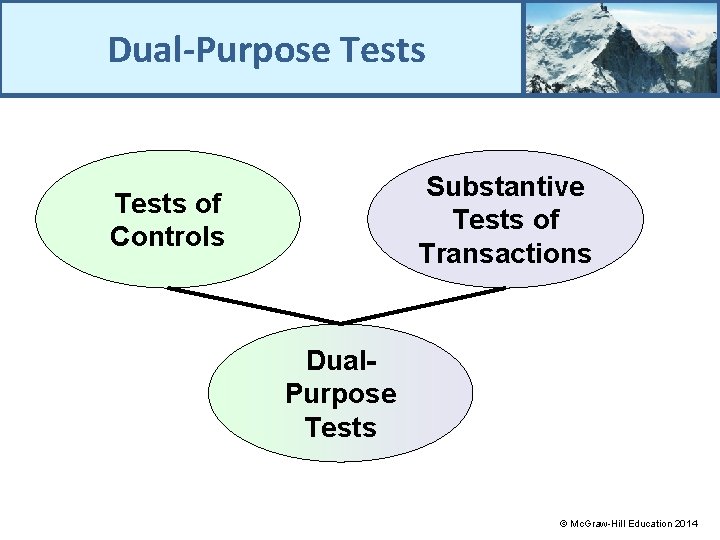

Dual-Purpose Tests Substantive Tests of Transactions Tests of Controls Dual. Purpose Tests © Mc. Graw-Hill Education 2014

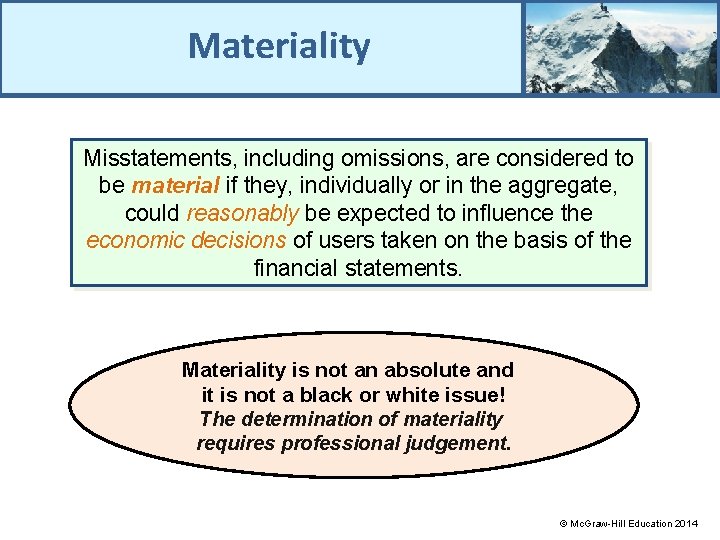

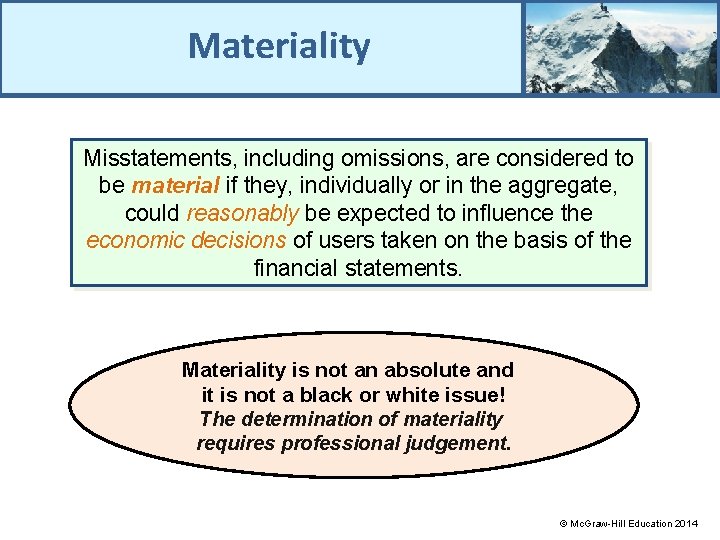

Materiality Misstatements, including omissions, are considered to be material if they, individually or in the aggregate, could reasonably be expected to influence the economic decisions of users taken on the basis of the financial statements. Materiality is not an absolute and it is not a black or white issue! The determination of materiality requires professional judgement. © Mc. Graw-Hill Education 2014

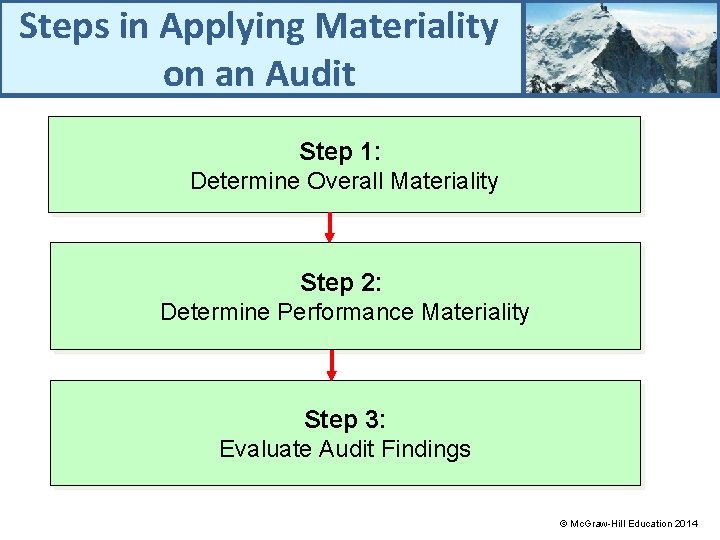

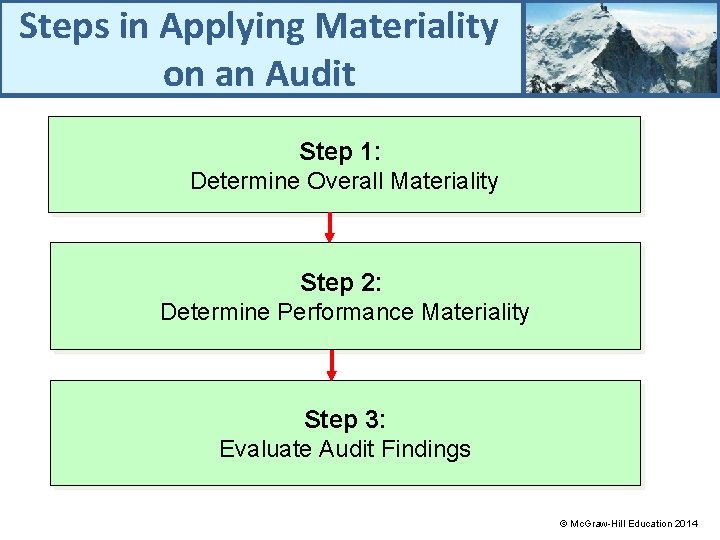

Steps in Applying Materiality on an Audit Step 1: Determine Overall Materiality Step 2: Determine Performance Materiality Step 3: Evaluate Audit Findings © Mc. Graw-Hill Education 2014

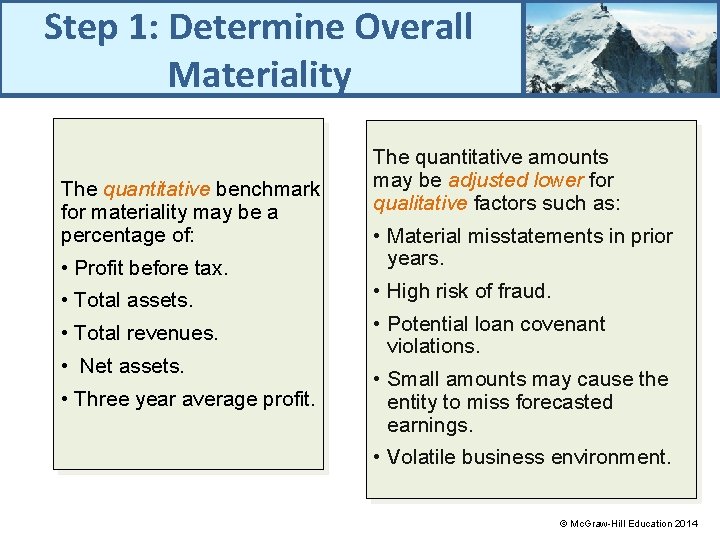

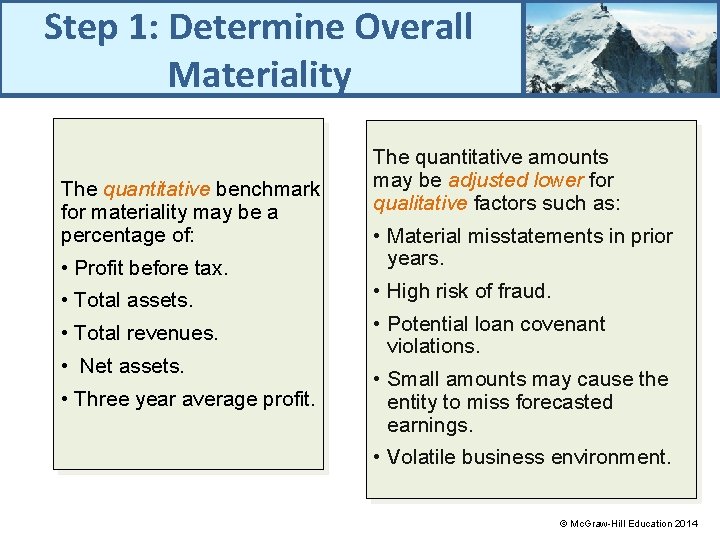

Step 1: Determine Overall Materiality The quantitative benchmark for materiality may be a percentage of: • Profit before tax. • Total assets. • Total revenues. • Net assets. • Three year average profit. The quantitative amounts may be adjusted lower for qualitative factors such as: • Material misstatements in prior years. • High risk of fraud. • Potential loan covenant violations. • Small amounts may cause the entity to miss forecasted earnings. • Volatile business environment. © Mc. Graw-Hill Education 2014

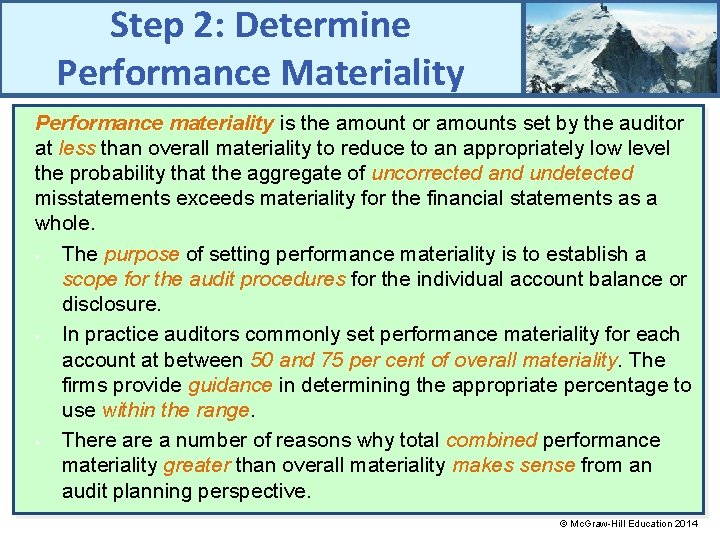

Step 2: Determine Performance Materiality Performance materiality is the amount or amounts set by the auditor at less than overall materiality to reduce to an appropriately low level the probability that the aggregate of uncorrected and undetected misstatements exceeds materiality for the financial statements as a whole. • The purpose of setting performance materiality is to establish a scope for the audit procedures for the individual account balance or disclosure. • In practice auditors commonly set performance materiality for each account at between 50 and 75 per cent of overall materiality. The firms provide guidance in determining the appropriate percentage to use within the range. • There a number of reasons why total combined performance materiality greater than overall materiality makes sense from an audit planning perspective. © Mc. Graw-Hill Education 2014

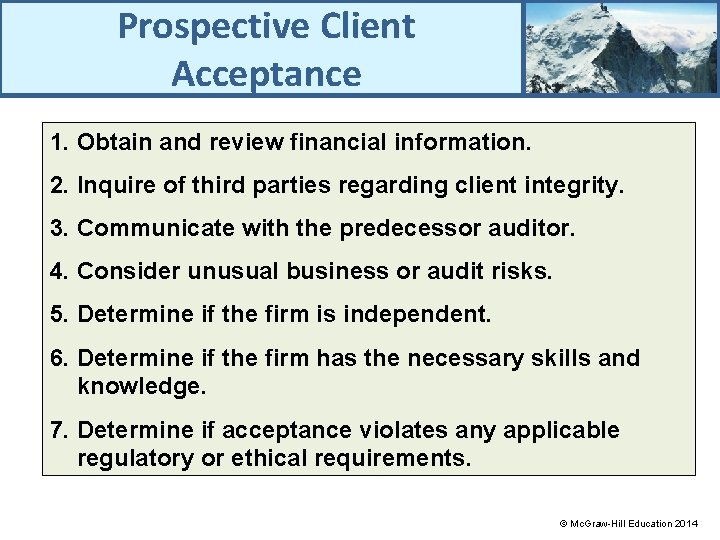

Step 3: Evaluate Audit Findings When the audit evidence is gathered, the auditor: Aggregates misstatements from each account or class of transactions. Considers the effect of misstatements not adjusted in the prior period. Examines the cause of the misstatements and determines the impact of the material misstatements on the assessment of fraud and control risk. The auditor compares the aggregate misstatement to overall materiality. Performance materiality can be used for determining the fair presentation of the individual accounts. If the aggregated misstatements are greater than overall materiality, or if misstatements for individual accounts are in excess of performance materiality, the auditor would require the entity to adjust the financial statements or the auditor would have to issue a qualified or adverse opinion. © Mc. Graw-Hill Education 2014