Chapter 2 Analyzing Transactions Accounting 21 st Edition

- Slides: 85

Chapter 2 Analyzing Transactions Accounting, 21 st Edition Warren Reeve Fess Power. Point Presentation by Douglas Cloud Professor Emeritus of Accounting Pepperdine University © Copyright 2004 South-Western, a division of Thomson Learning. All rights reserved. Task Force Image Gallery clip art included in this electroni presentation is used with the permission of NVTech Inc.

Some of the action has been automated, so click the mouse when you see this lightning bolt in the lower right-hand corner of the screen. You can point and click anywhere on the screen.

Objectives 1. Explain why accounts After studyingare thisused to record and summarize the effects chapter, you shouldof transactions on financial statements. be able to: 2. Describe the characteristics of an account. 3. List the rules of debit and credit and the normal balances of accounts. 4. Analyze and summarize the financial statement effects of transactions.

Objectives 5. Prepare a trial balance and explain how it can be used to discover errors. 6. Discover errors in recording transactions and correct them. 7. Use horizontal analysis to compare financial statements from different periods.

Each financial statement item, called an account, is included in the ledger.

A group of accounts for a business entity is called a ledger.

A list of the accounts in a ledger is called a chart of accounts.

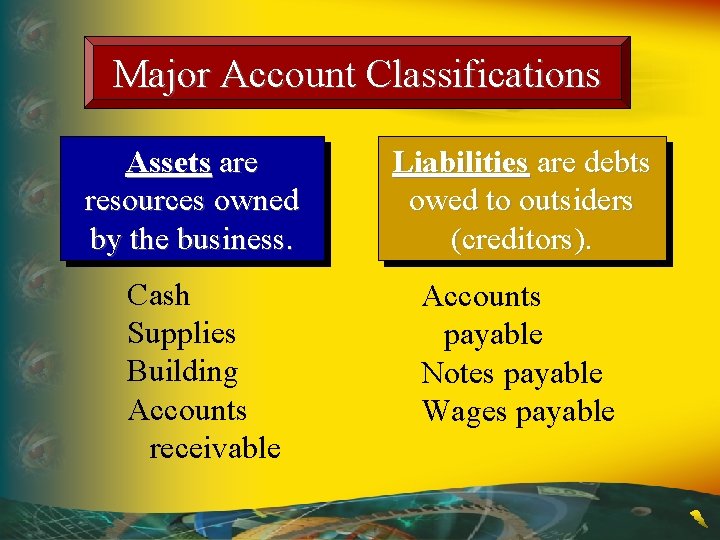

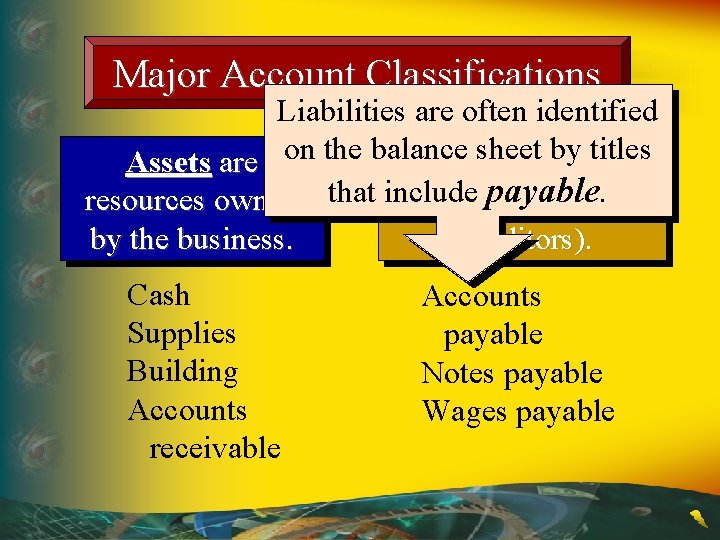

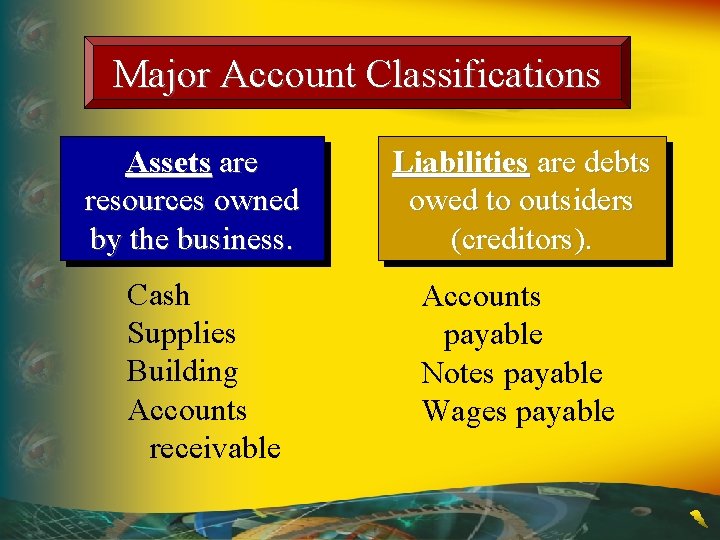

Major Account Classifications Assets are resources owned by the business. Cash Supplies Building Accounts receivable Liabilities are debts owed to outsiders (creditors). Accounts payable Notes payable Wages payable

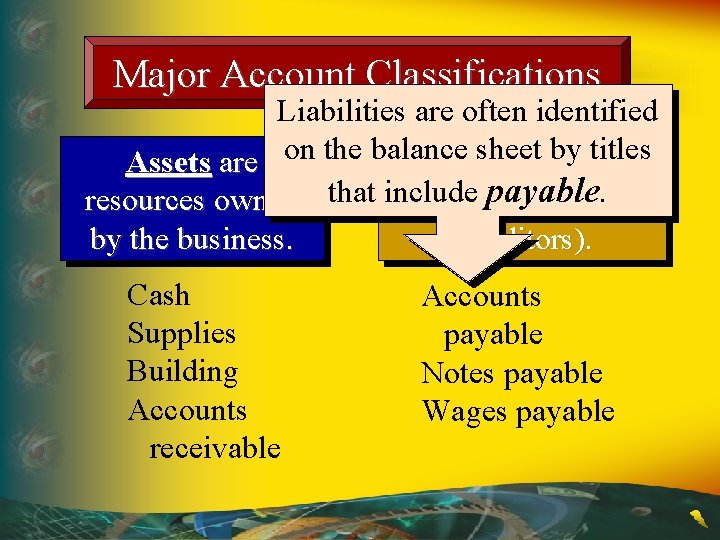

Major Account Classifications Liabilities are often identified sheetare by debts titles Assets are on the balance Liabilities. resources owned that include owed payable to outsiders by the business. (creditors). Cash Supplies Building Accounts receivable Accounts payable Notes payable Wages payable

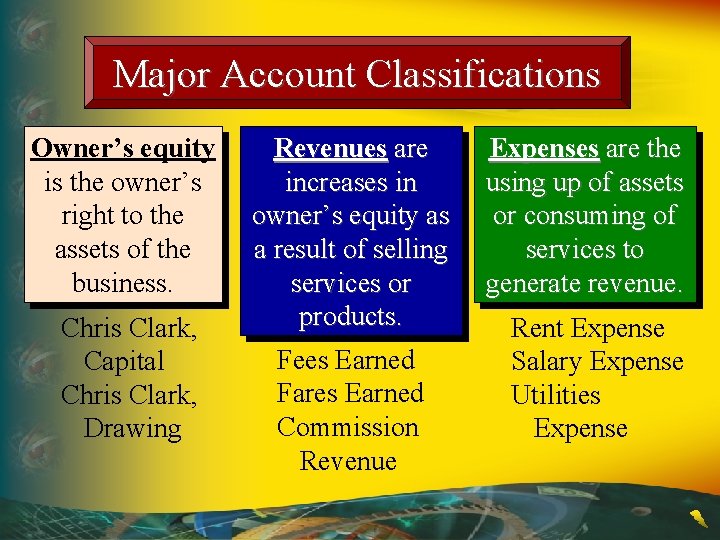

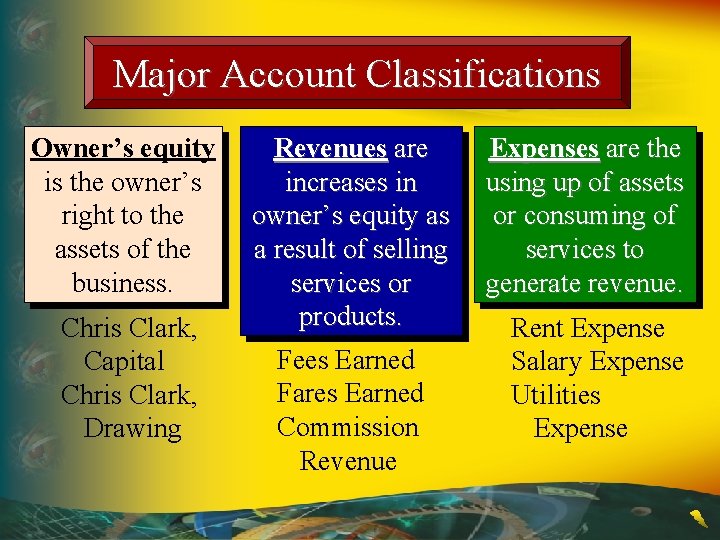

Major Account Classifications Owner’s equity is the owner’s right to the assets of the business. Chris Clark, Capital Chris Clark, Drawing Revenues are increases in owner’s equity as a result of selling services or products. Fees Earned Fares Earned Commission Revenue Expenses are the using up of assets or consuming of services to generate revenue. Rent Expense Salary Expense Utilities Expense

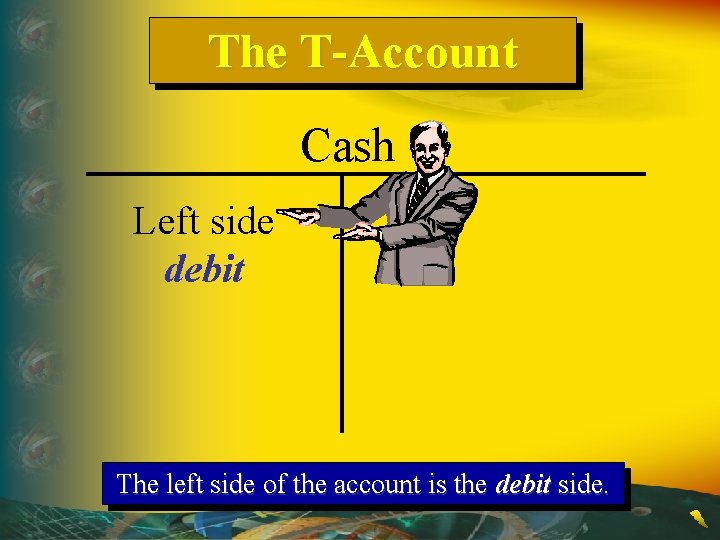

To assist you in learning, an account can be drawn to resemble the letter T.

The T-Account Cash The T-account has a title.

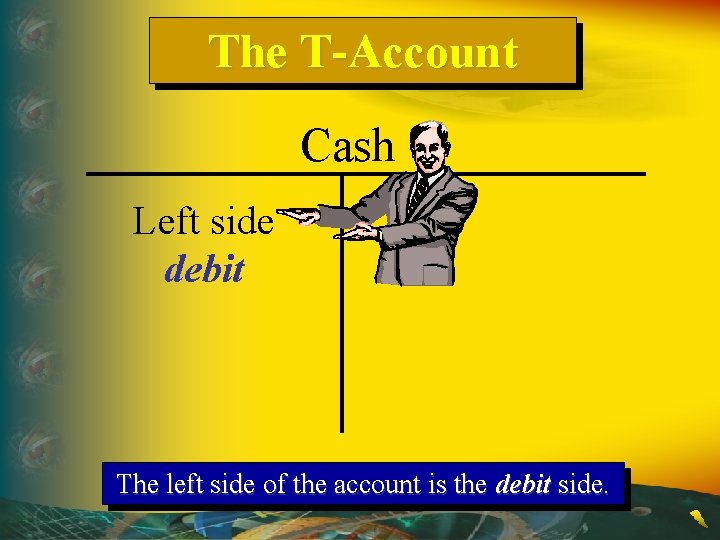

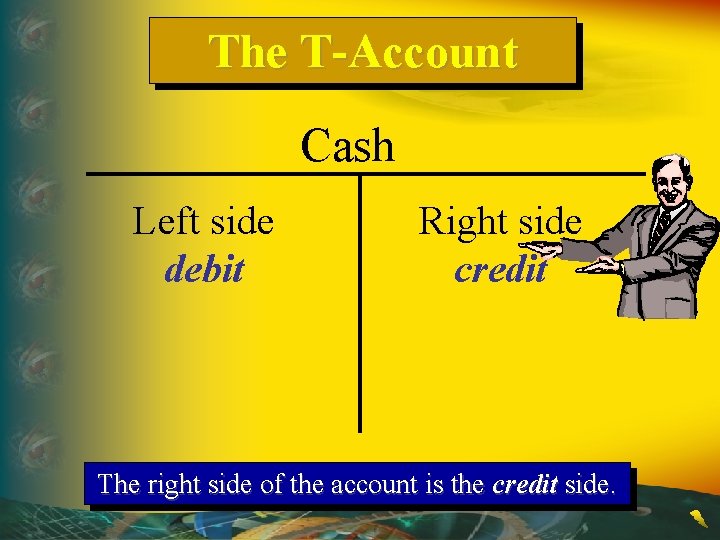

The T-Account Cash Left side debit The left side of the account is the debit side.

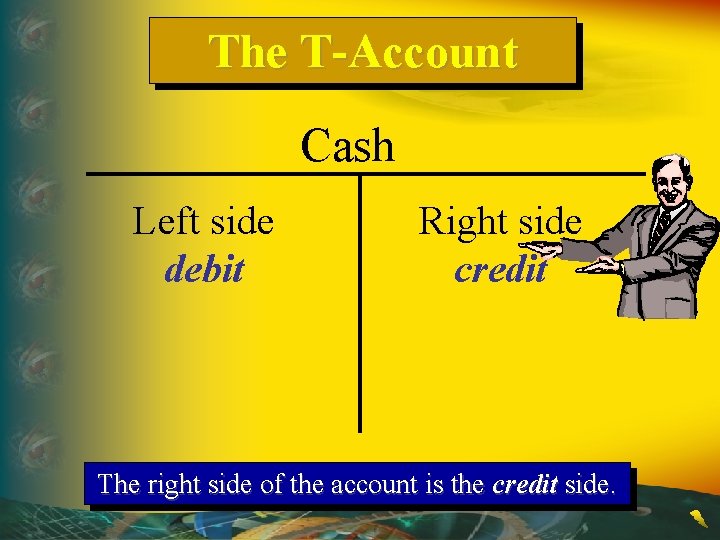

The T-Account Cash Left side debit Right side credit The right side of the account is the credit side.

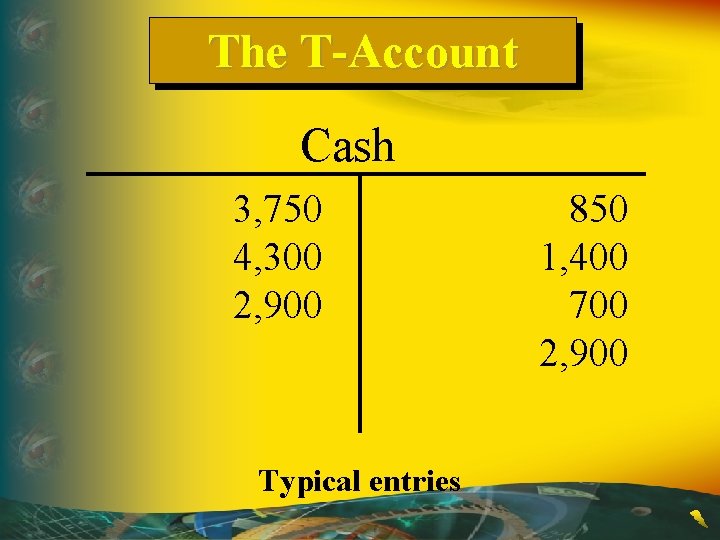

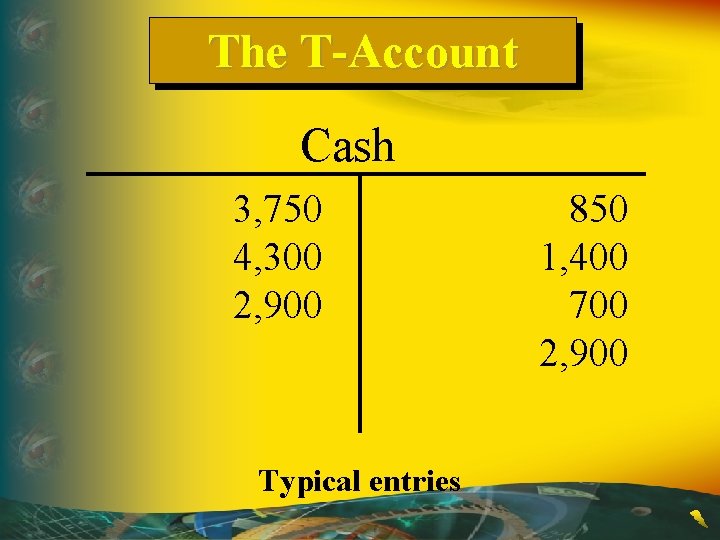

The T-Account Cash 3, 750 4, 300 2, 900 Typical entries 850 1, 400 700 2, 900

Balancing a T-Account

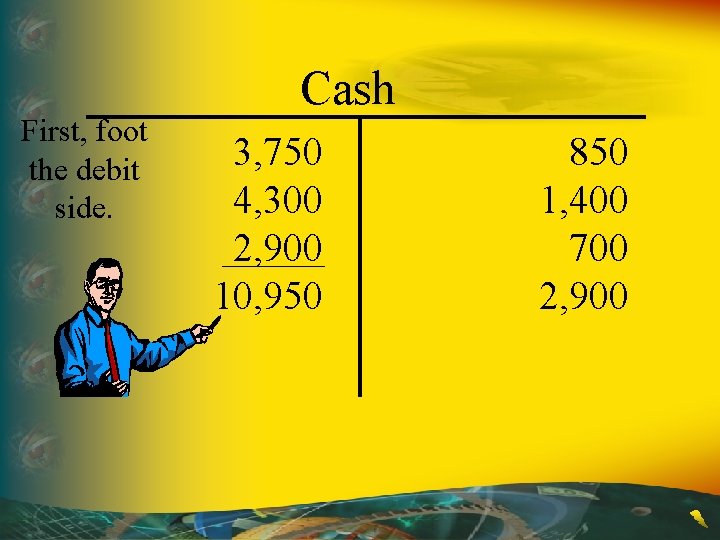

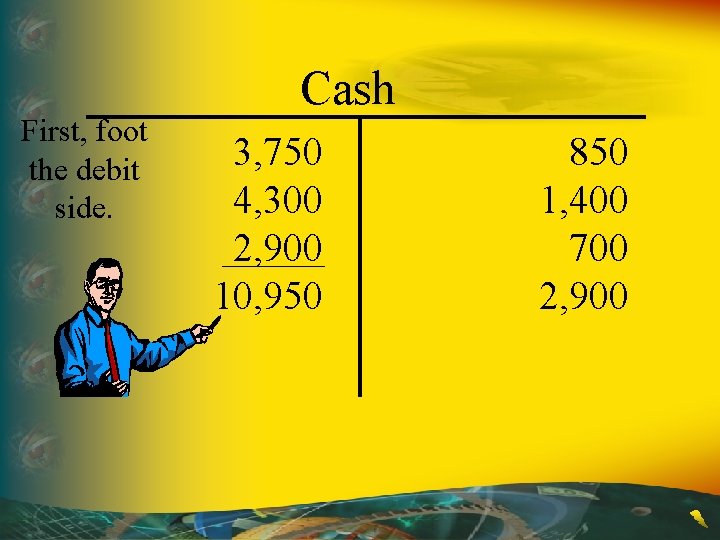

First, foot the debit side. Cash 3, 750 4, 300 2, 900 10, 950 850 1, 400 700 2, 900

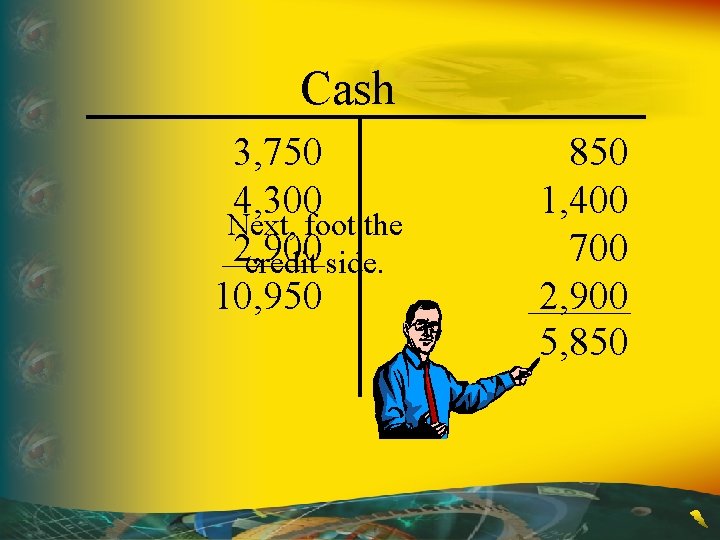

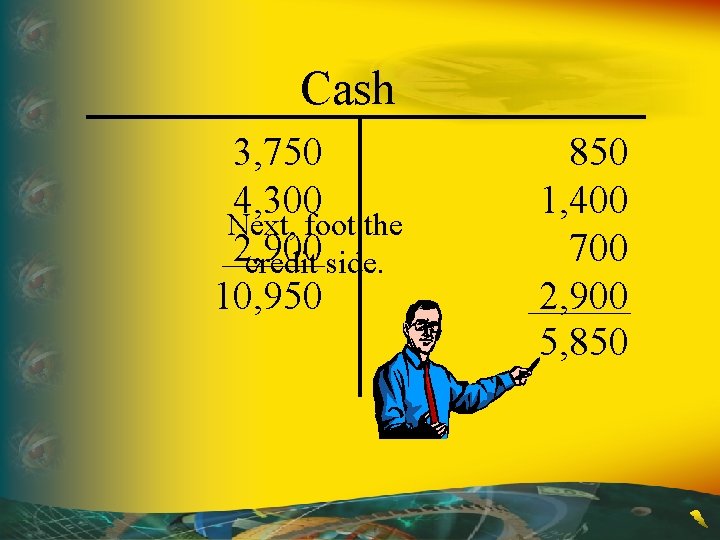

Cash 3, 750 4, 300 Next, foot the 2, 900 credit side. 10, 950 850 1, 400 700 2, 900 5, 850

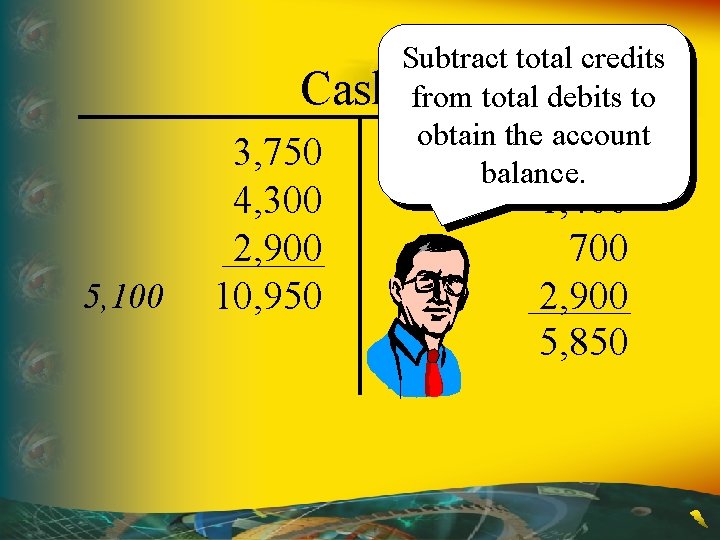

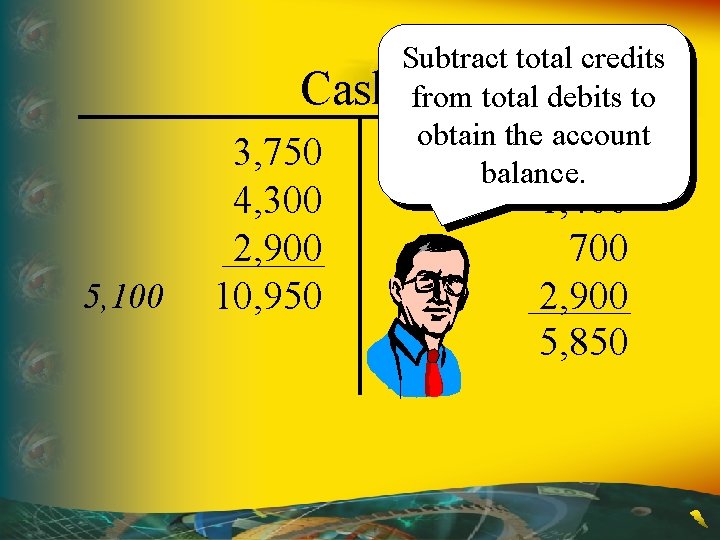

Subtract total credits Cash from total debits to obtain the account 3, 750 850 balance. 5, 100 4, 300 2, 900 10, 950 1, 400 700 2, 900 5, 850

Transactions and Balance Sheet Accounts

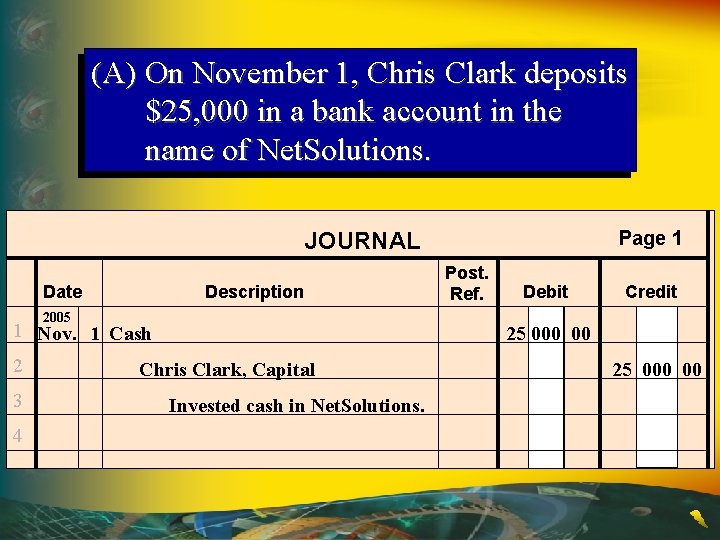

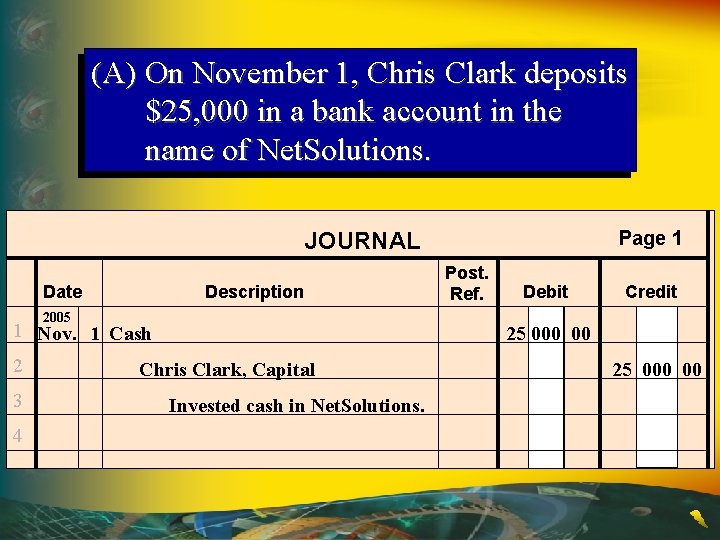

(A) On November 1, Chris Clark deposits $25, 000 in a bank account in the name of Net. Solutions. Page 1 JOURNAL Date Description 2005 1 Nov. 1 Cash 2 3 4 Post. Ref. Debit Credit 25 000 00 Chris Clark, Capital Invested cash in Net. Solutions. 25 000 00

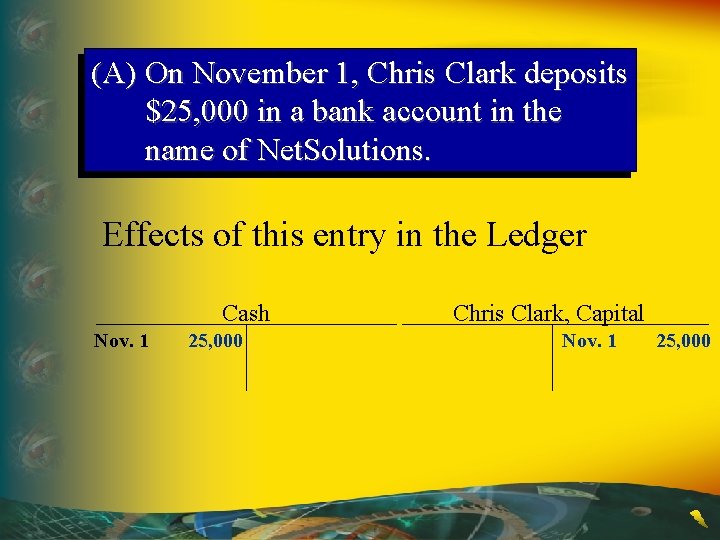

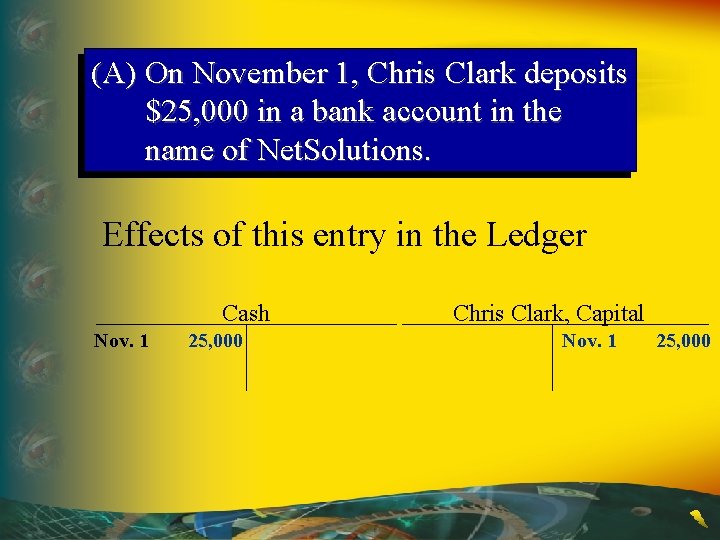

(A) On November 1, Chris Clark deposits $25, 000 in a bank account in the name of Net. Solutions. Effects of this entry in the Ledger Cash Nov. 1 25, 000 Chris Clark, Capital Nov. 1 25, 000

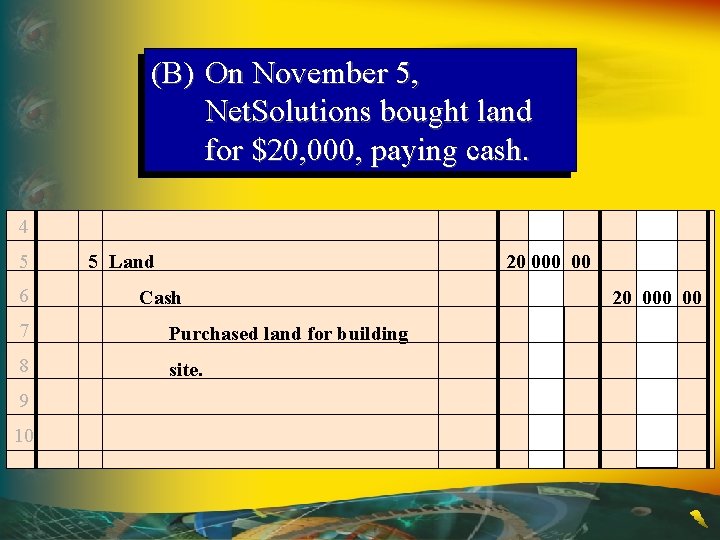

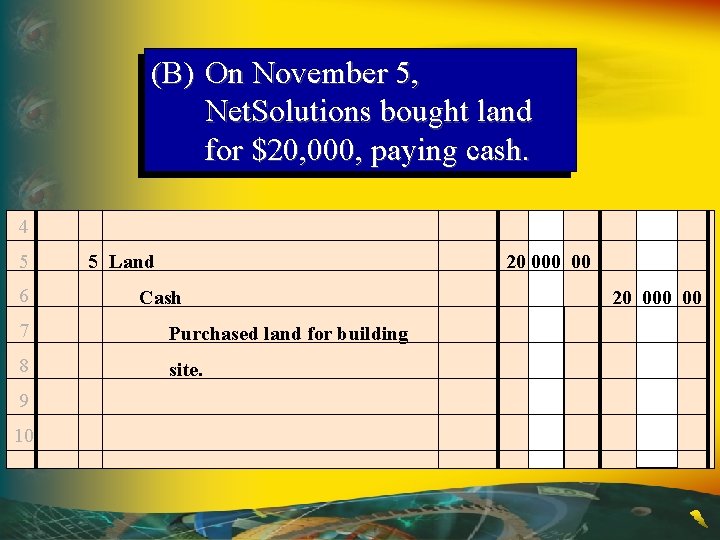

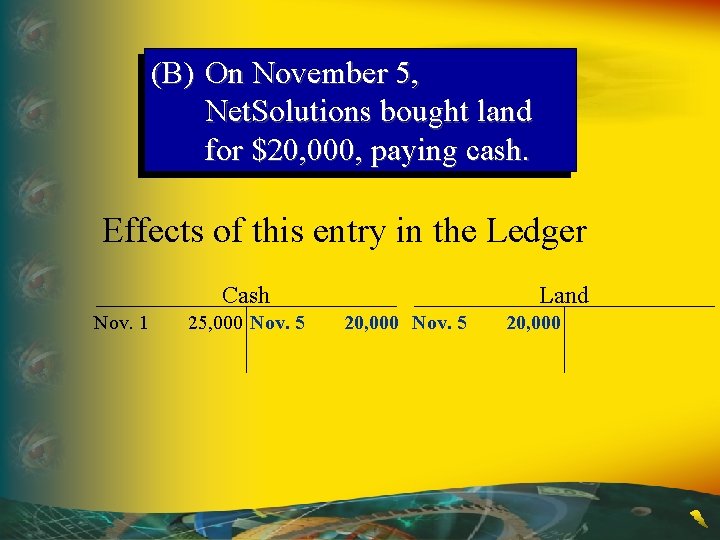

(B) On November 5, Net. Solutions bought land for $20, 000, paying cash. 4 5 6 5 Land 20 00 Cash 7 Purchased land for building 8 site. 9 10 20 00

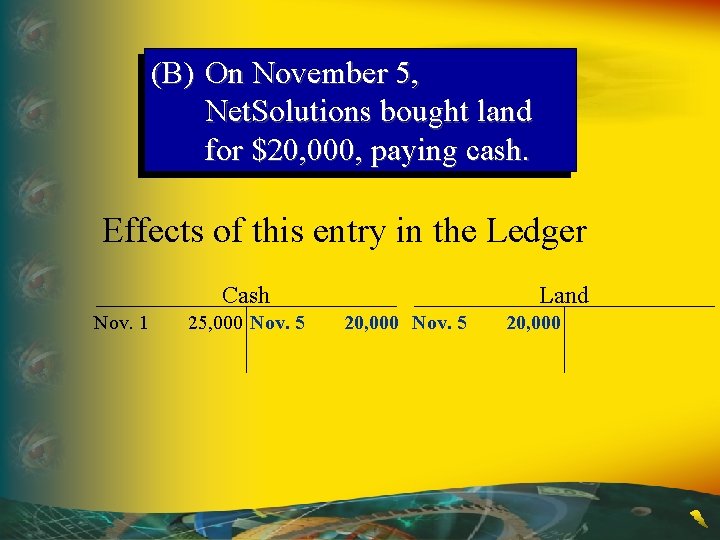

(B) On November 5, Net. Solutions bought land for $20, 000, paying cash. Effects of this entry in the Ledger Cash Nov. 1 25, 000 Nov. 5 Land 20, 000 Nov. 5 20, 000

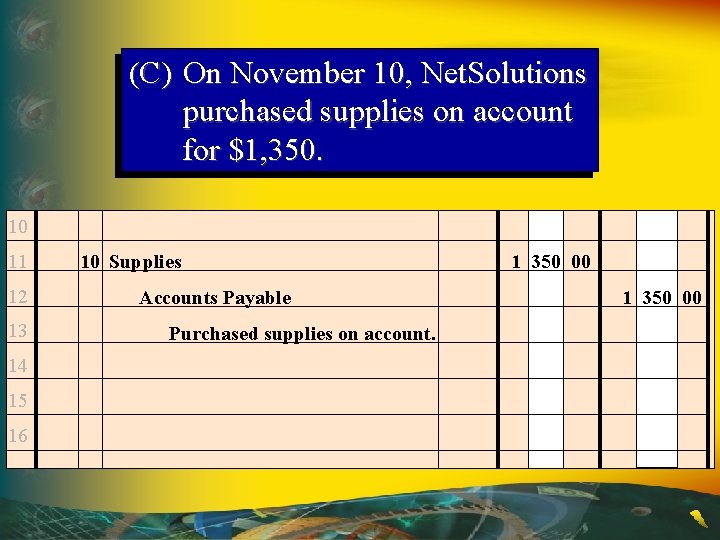

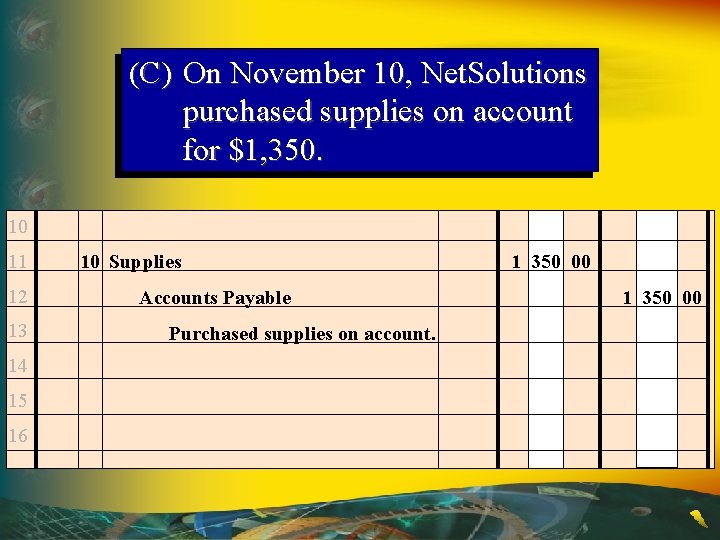

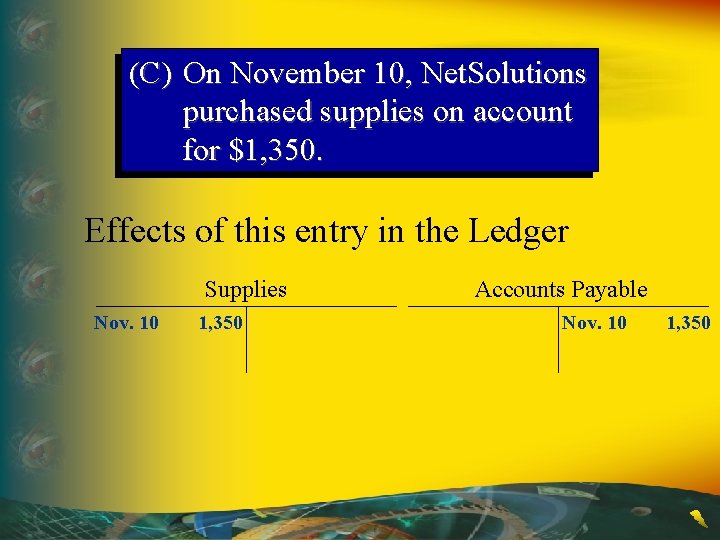

(C) On November 10, Net. Solutions purchased supplies on account for $1, 350. 10 11 12 13 14 15 16 10 Supplies Accounts Payable Purchased supplies on account. 1 350 00

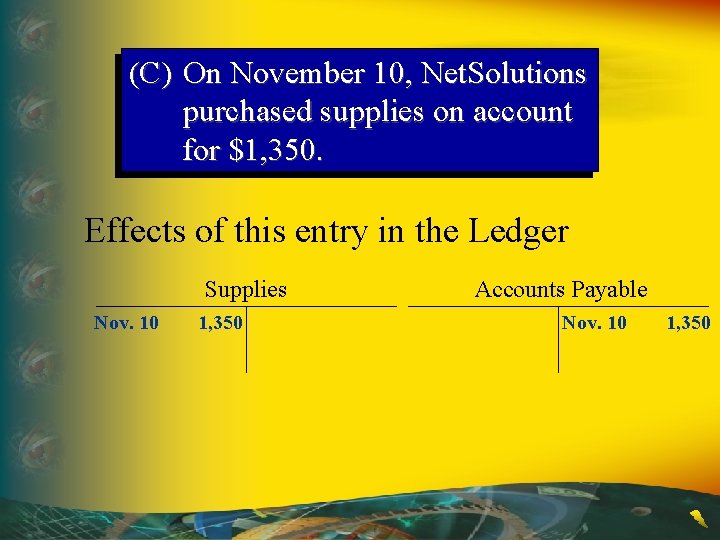

(C) On November 10, Net. Solutions purchased supplies on account for $1, 350. Effects of this entry in the Ledger Supplies Nov. 10 1, 350 Accounts Payable Nov. 10 1, 350

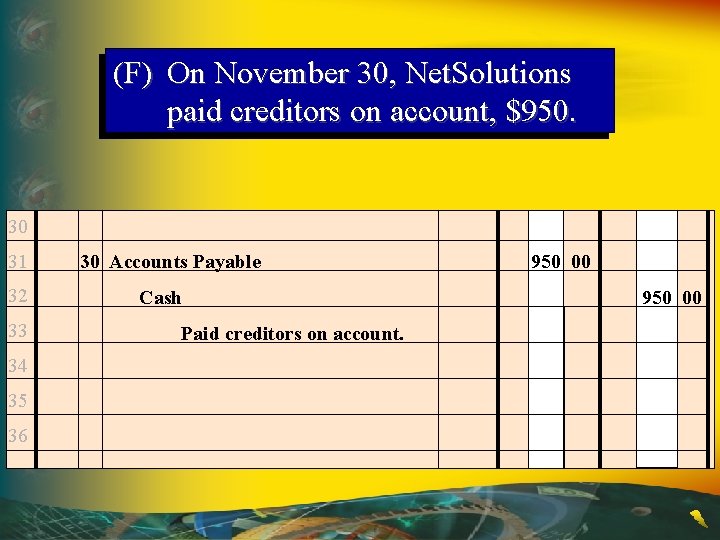

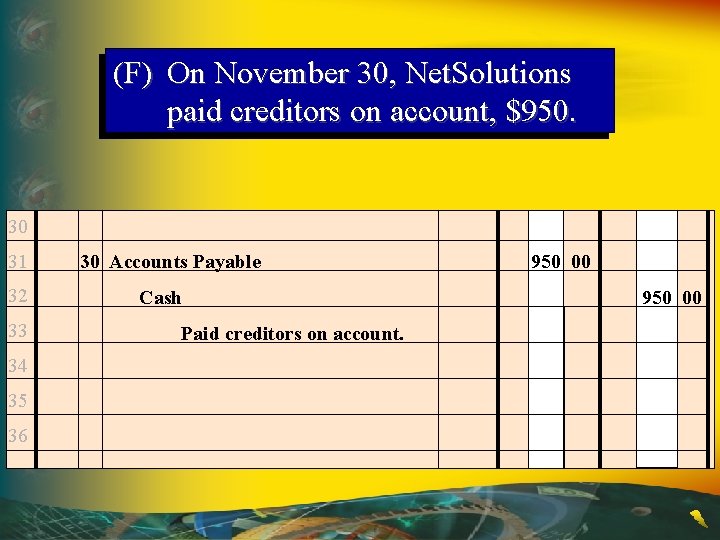

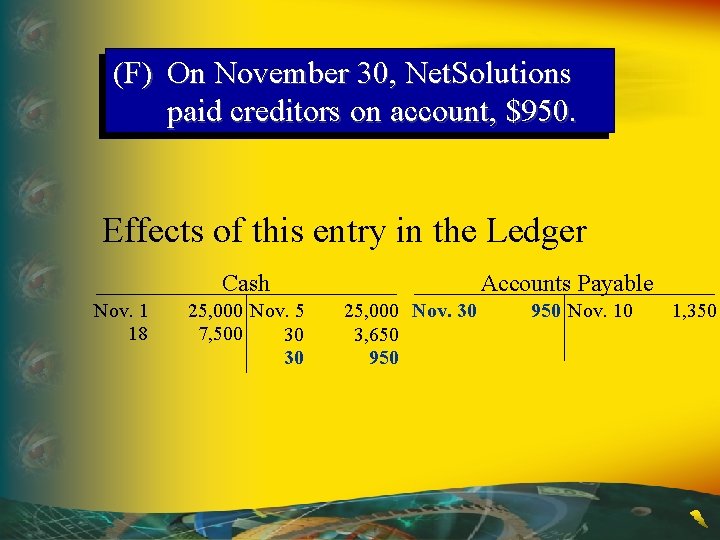

(F) On November 30, Net. Solutions paid creditors on account, $950. 30 31 32 33 34 35 36 30 Accounts Payable Cash Paid creditors on account. 950 00

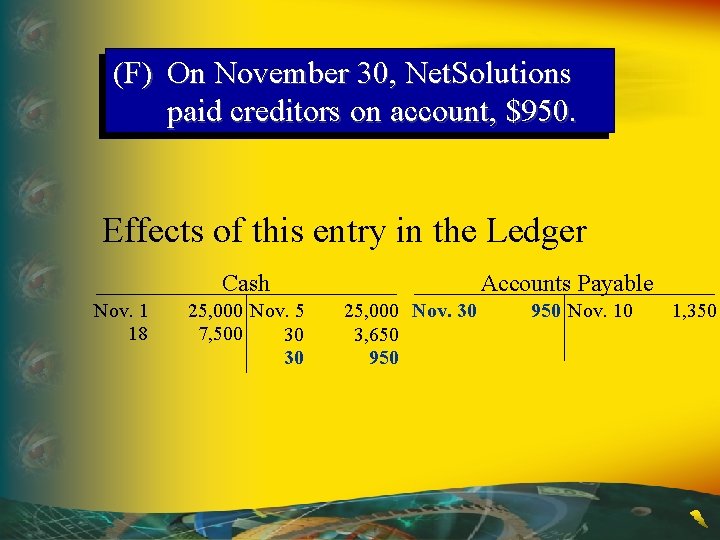

(F) On November 30, Net. Solutions paid creditors on account, $950. Effects of this entry in the Ledger Cash Nov. 1 18 25, 000 Nov. 5 7, 500 30 30 Accounts Payable 25, 000 Nov. 30 3, 650 950 Nov. 10 1, 350

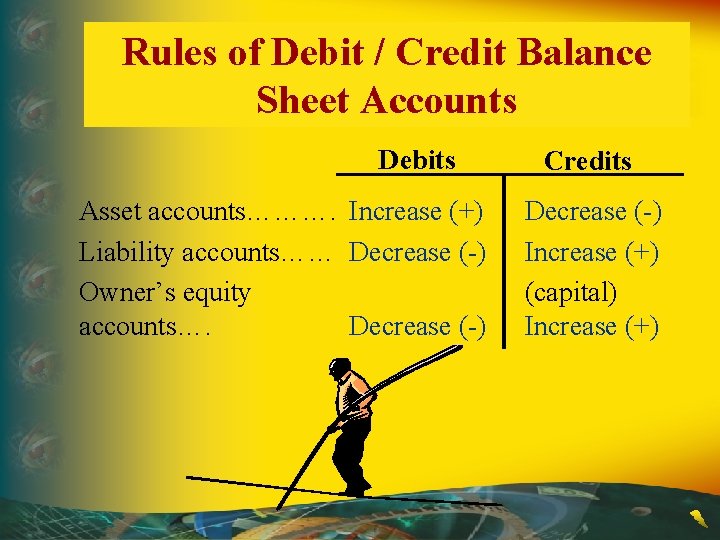

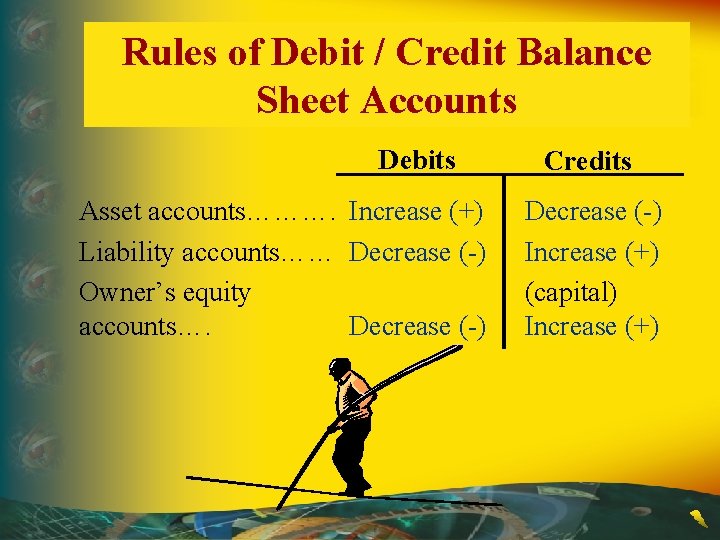

Rules of Debit / Credit Balance Sheet Accounts Debits Asset accounts………. Increase (+) Liability accounts…… Decrease (-) Owner’s equity accounts…. Decrease (-) Credits Decrease (-) Increase (+) (capital) Increase (+)

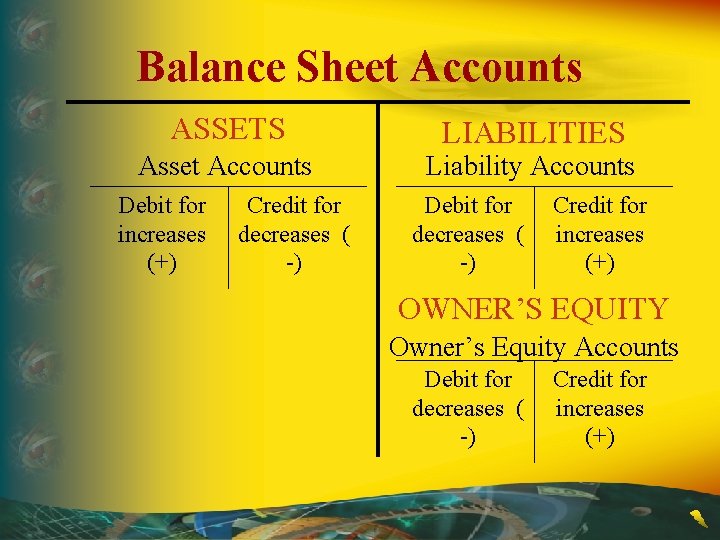

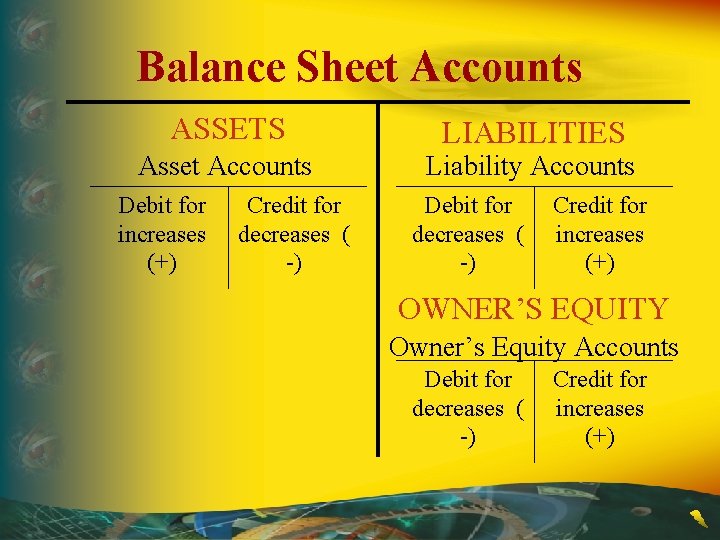

Balance Sheet Accounts ASSETS LIABILITIES Asset Accounts Liability Accounts Debit for increases (+) Credit for decreases ( -) Debit for decreases ( -) Credit for increases (+) OWNER’S EQUITY Owner’s Equity Accounts Debit for decreases ( -) Credit for increases (+)

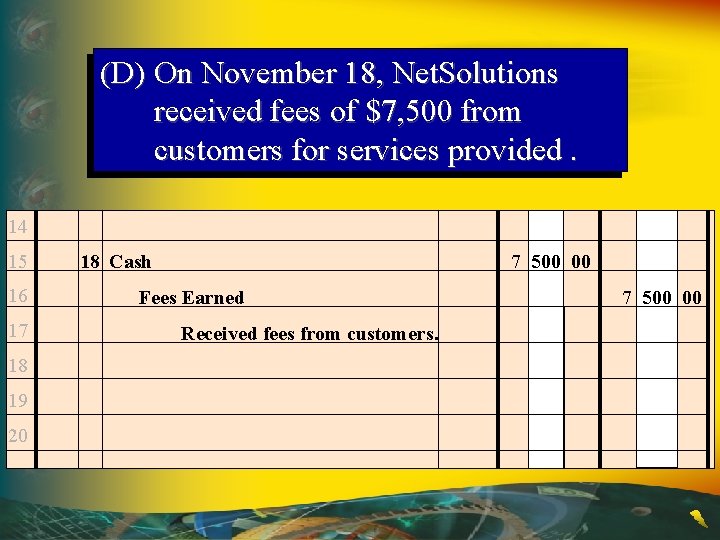

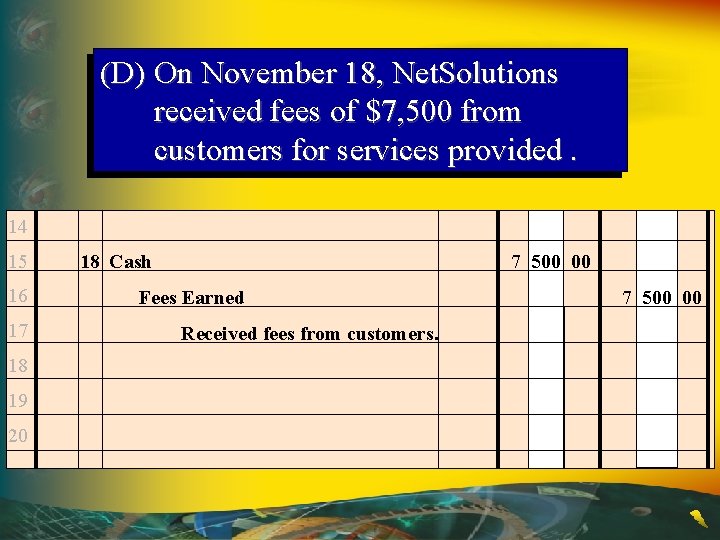

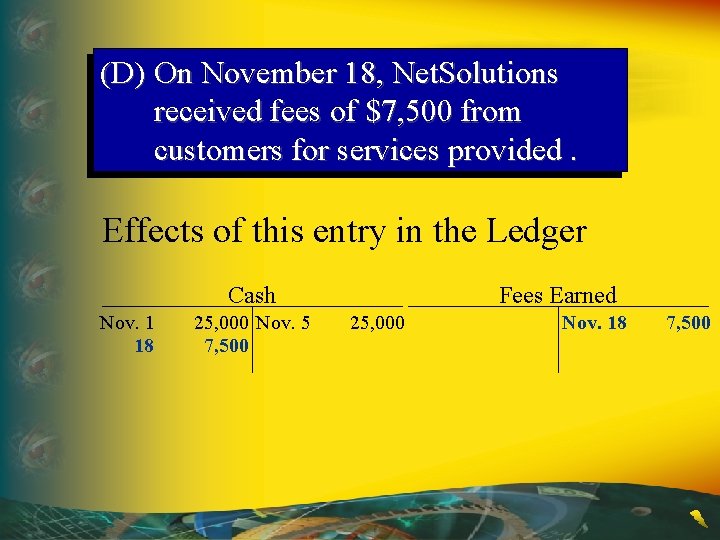

(D) On November 18, Net. Solutions received fees of $7, 500 from customers for services provided. 14 15 16 17 18 19 20 18 Cash 7 500 00 Fees Earned Received fees from customers. 7 500 00

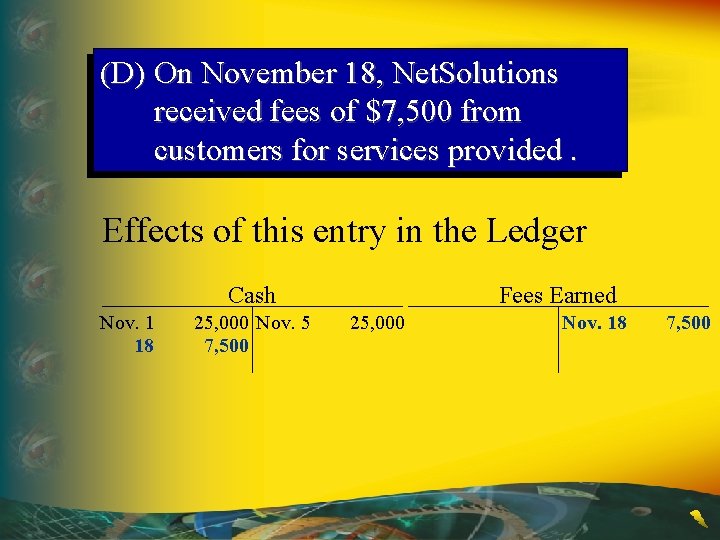

(D) On November 18, Net. Solutions received fees of $7, 500 from customers for services provided. Effects of this entry in the Ledger Cash Nov. 1 18 25, 000 Nov. 5 7, 500 Fees Earned 25, 000 Nov. 18 7, 500

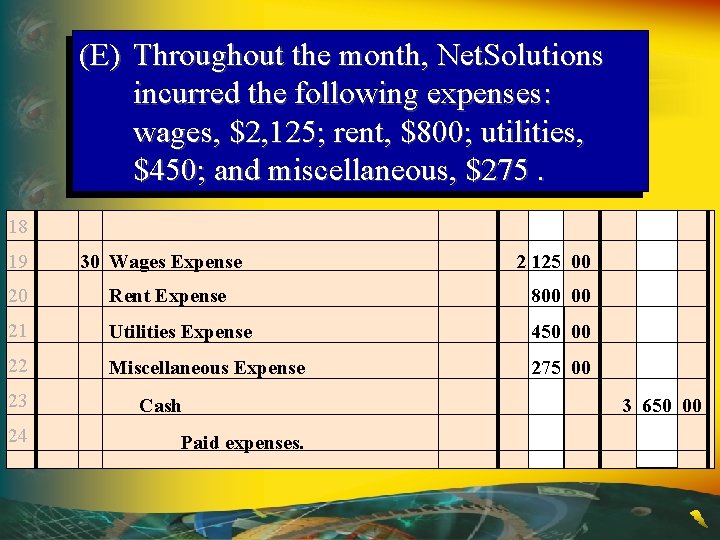

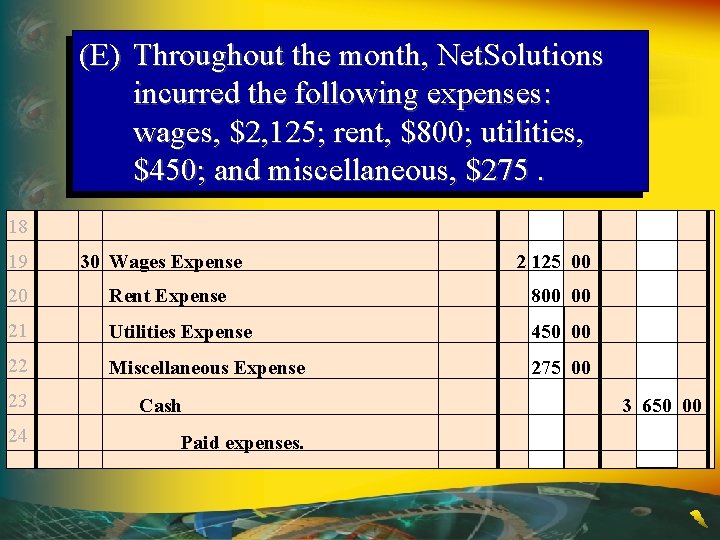

(E) Throughout the month, Net. Solutions incurred the following expenses: wages, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. 18 19 30 Wages Expense 2 125 00 20 Rent Expense 800 00 21 Utilities Expense 450 00 22 Miscellaneous Expense 275 00 23 24 Cash Paid expenses. 3 650 00

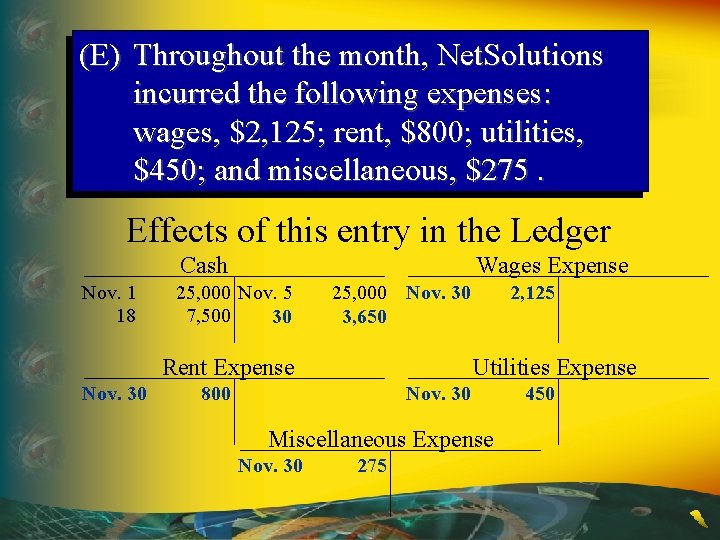

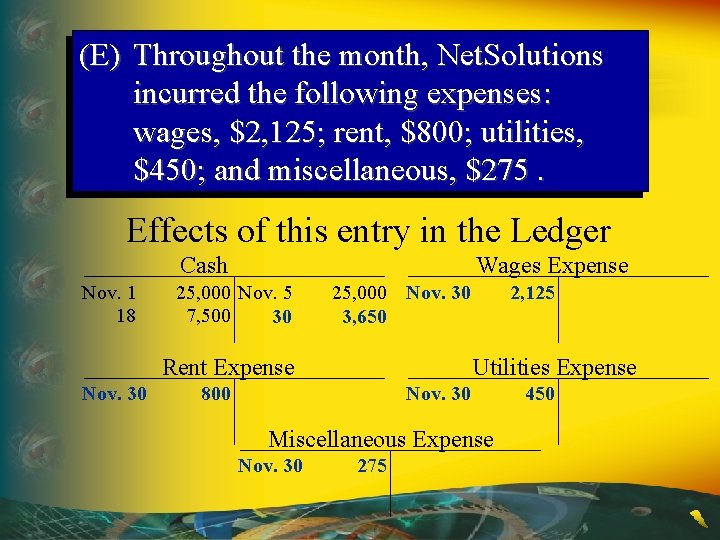

(E) Throughout the month, Net. Solutions incurred the following expenses: wages, $2, 125; rent, $800; utilities, $450; and miscellaneous, $275. Effects of this entry in the Ledger Cash Nov. 1 18 Wages Expense 25, 000 Nov. 5 7, 500 30 25, 000 Nov. 30 3, 650 Rent Expense Nov. 30 2, 125 Utilities Expense 800 Nov. 30 Miscellaneous Expense Nov. 30 275 450

In every entry the sum of the debits always equal the sum of the credits.

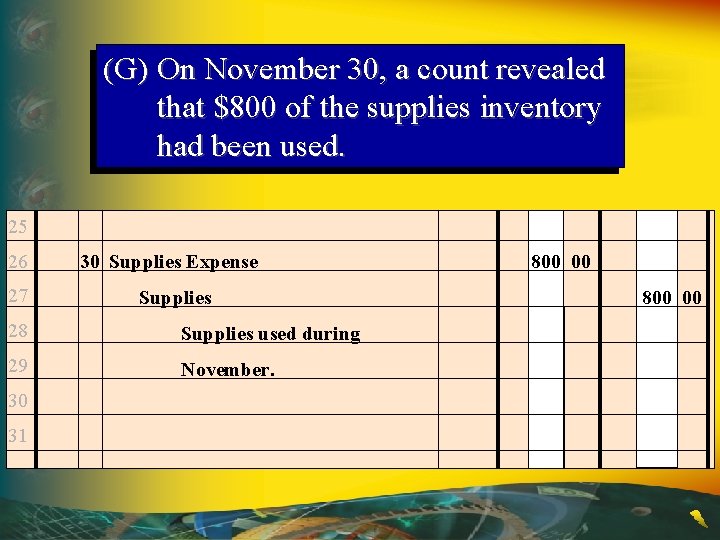

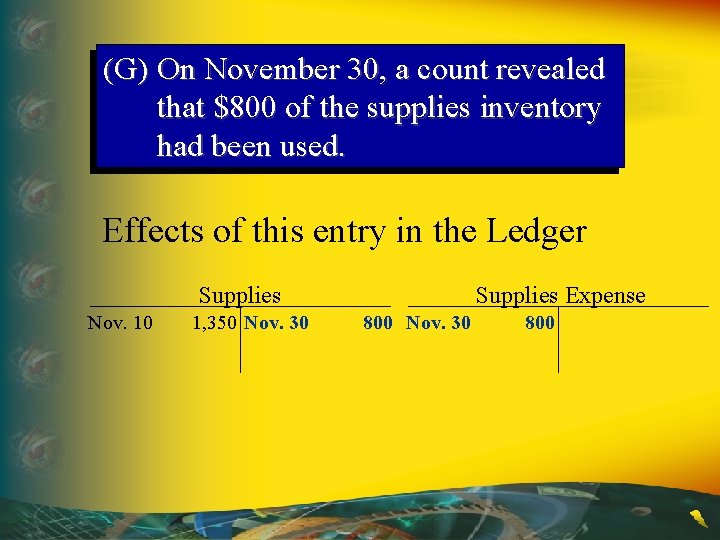

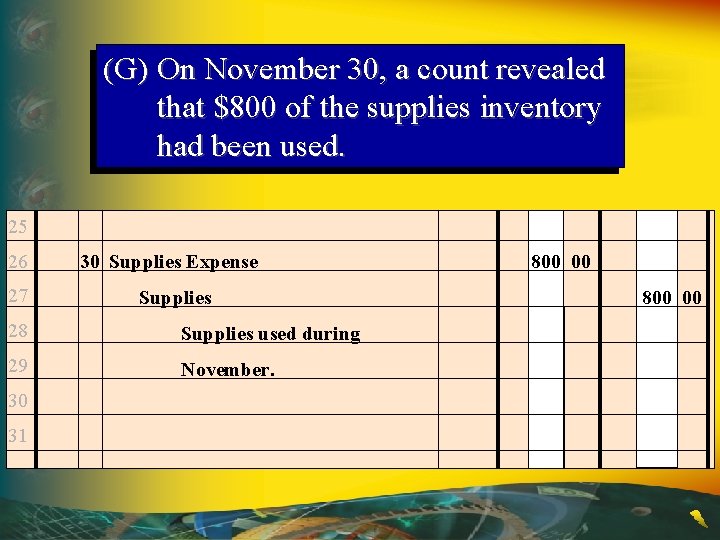

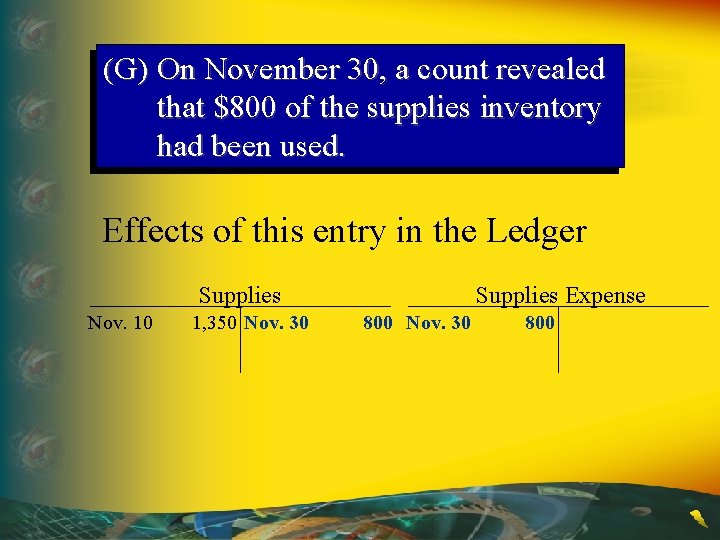

(G) On November 30, a count revealed that $800 of the supplies inventory had been used. 25 26 27 30 Supplies Expense Supplies 28 Supplies used during 29 November. 30 31 800 00

(G) On November 30, a count revealed that $800 of the supplies inventory had been used. Effects of this entry in the Ledger Supplies Nov. 10 1, 350 Nov. 30 Supplies Expense 800 Nov. 30 800

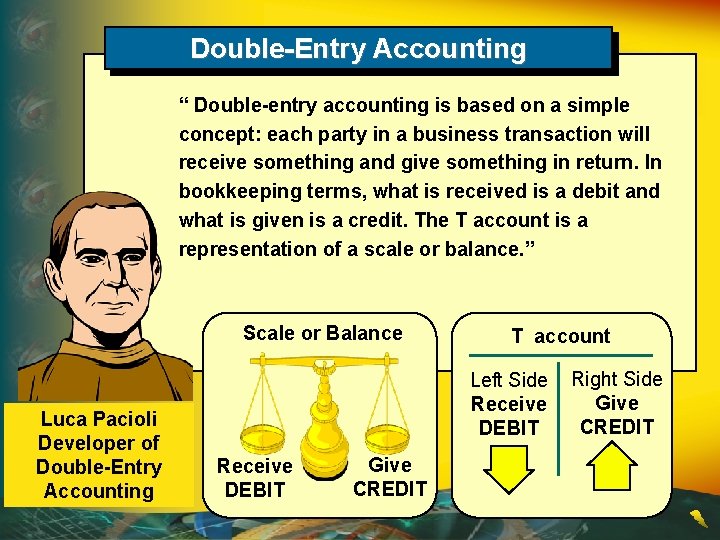

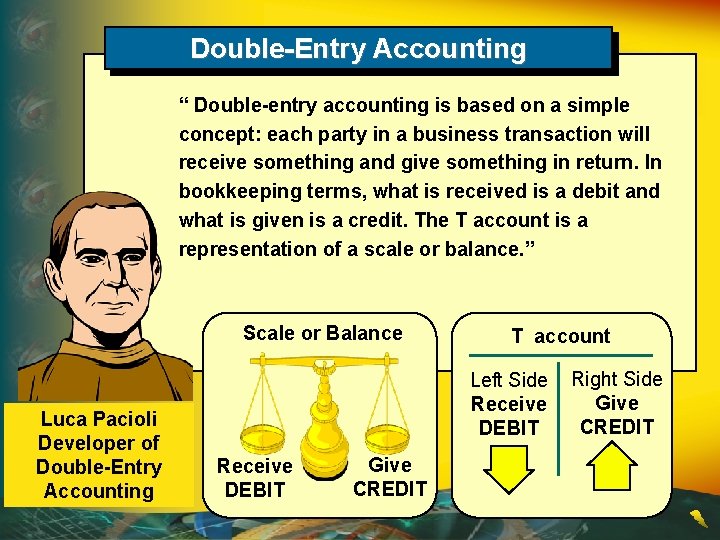

Double-Entry Accounting “ Double-entry accounting is based on a simple concept: each party in a business transaction will receive something and give something in return. In bookkeeping terms, what is received is a debit and what is given is a credit. The T account is a representation of a scale or balance. ” Scale or Balance Luca Pacioli Developer of Double-Entry Accounting T account Left Side Receive DEBIT Give CREDIT Right Side Give CREDIT

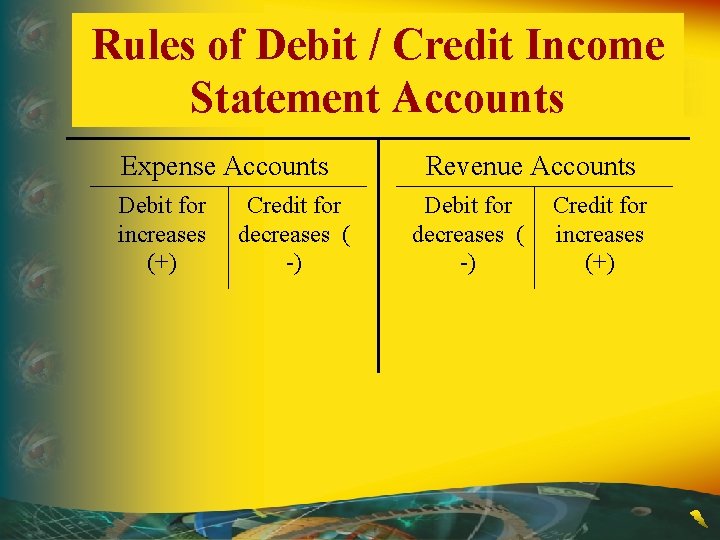

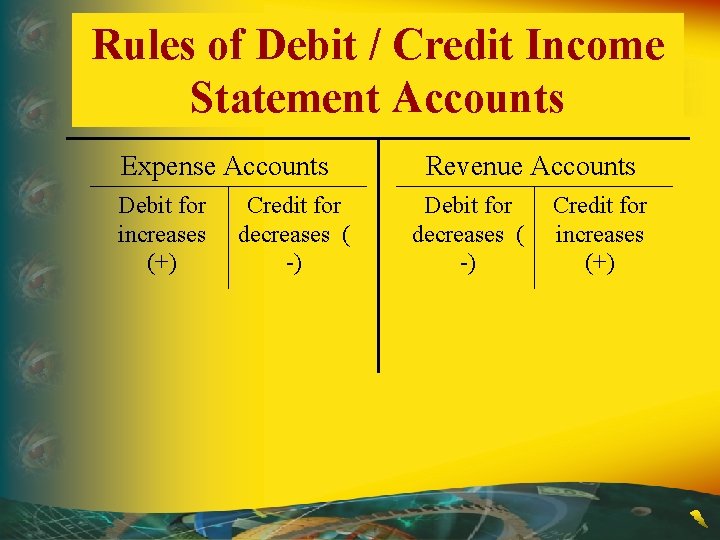

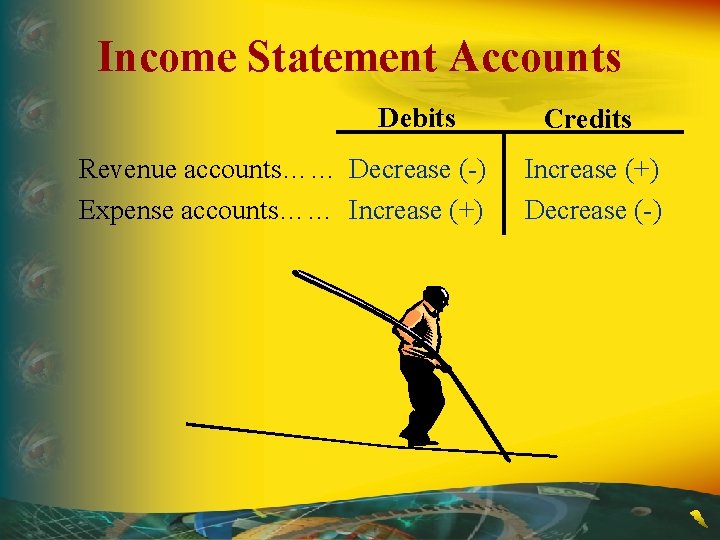

Rules of Debit / Credit Income Statement Accounts Expense Accounts Debit for increases (+) Credit for decreases ( -) Revenue Accounts Debit for decreases ( -) Credit for increases (+)

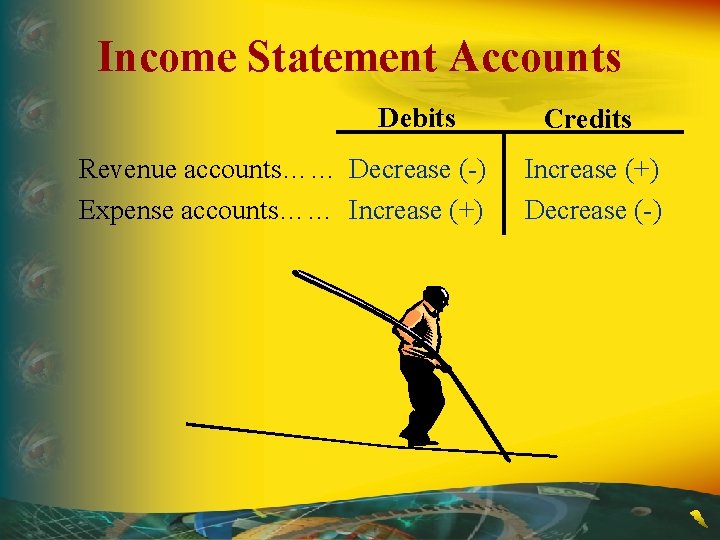

Income Statement Accounts Debits Revenue accounts…… Decrease (-) Expense accounts…… Increase (+) Credits Increase (+) Decrease (-)

Withdrawals by the Owner

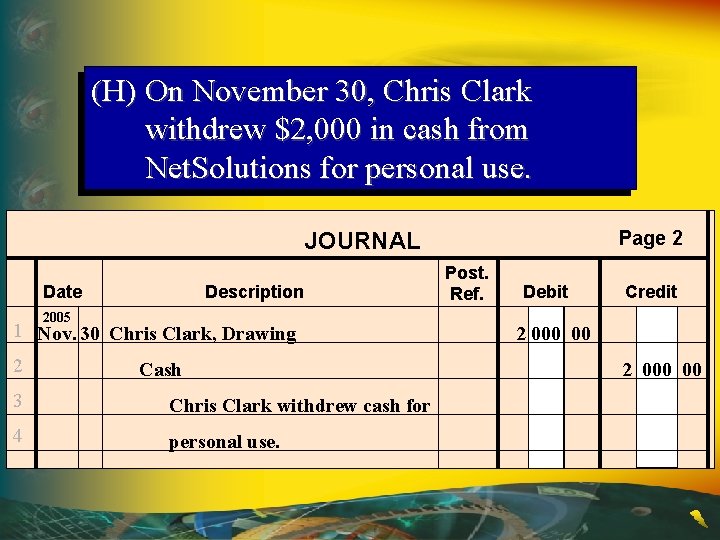

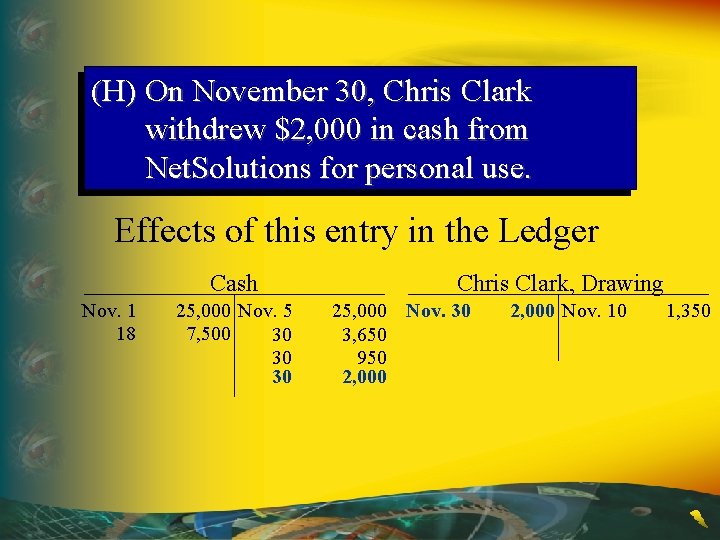

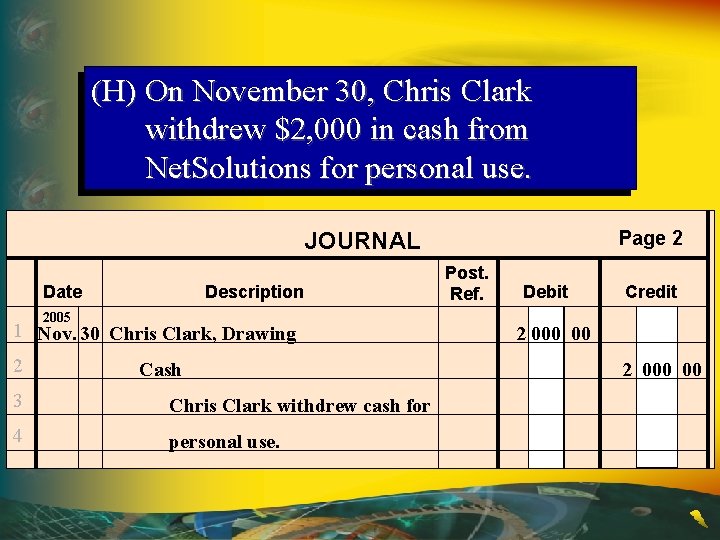

(H) On November 30, Chris Clark withdrew $2, 000 in cash from Net. Solutions for personal use. Page 2 JOURNAL Date Description 2005 1 Nov. 30 Chris Clark, Drawing 2 Cash 3 Chris Clark withdrew cash for 4 personal use. Post. Ref. Debit Credit 2 000 00

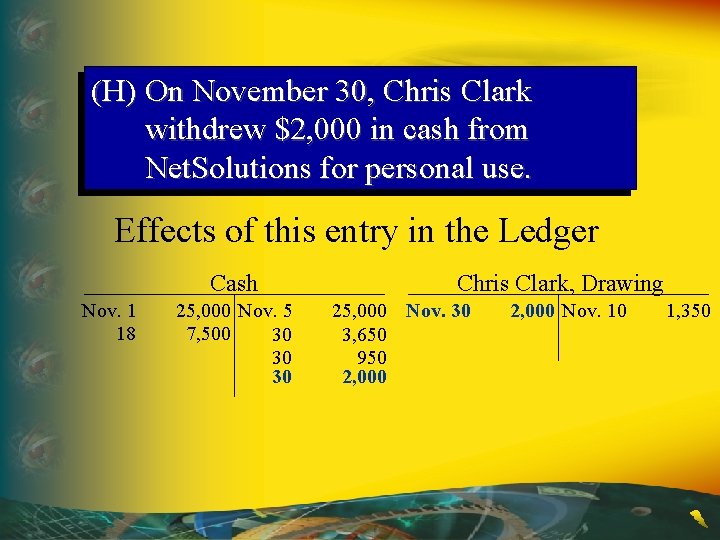

(H) On November 30, Chris Clark withdrew $2, 000 in cash from Net. Solutions for personal use. Effects of this entry in the Ledger Cash Nov. 1 18 25, 000 Nov. 5 7, 500 30 30 30 Chris Clark, Drawing 25, 000 Nov. 30 3, 650 950 2, 000 Nov. 10 1, 350

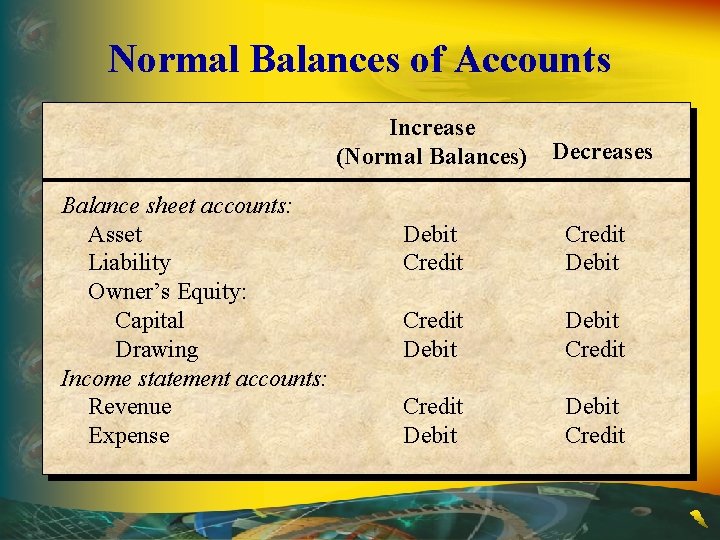

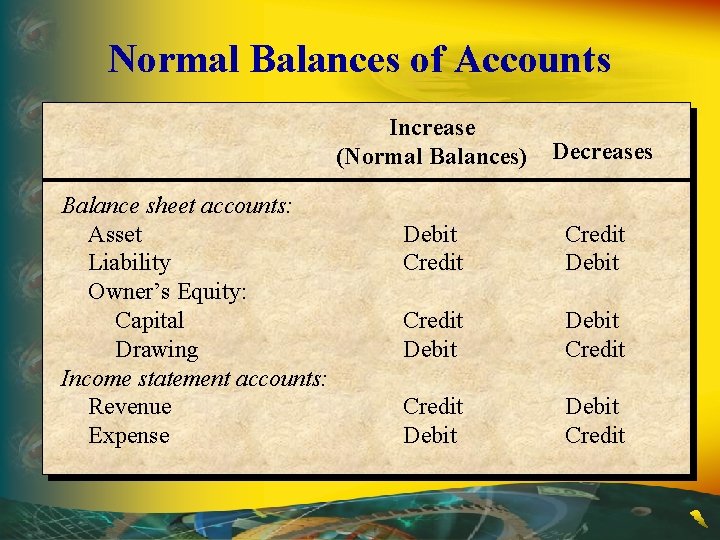

Normal Balances of Accounts Increase (Normal Balances) Balance sheet accounts: Asset Liability Owner’s Equity: Capital Drawing Income statement accounts: Revenue Expense Decreases Debit Credit Debit Credit

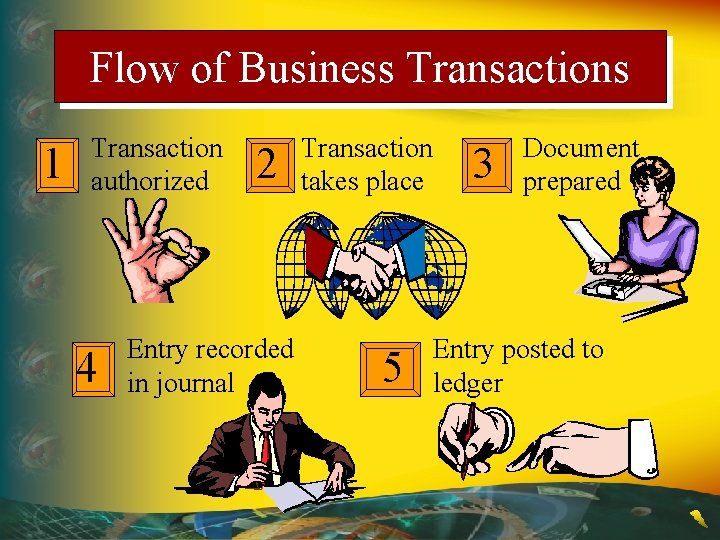

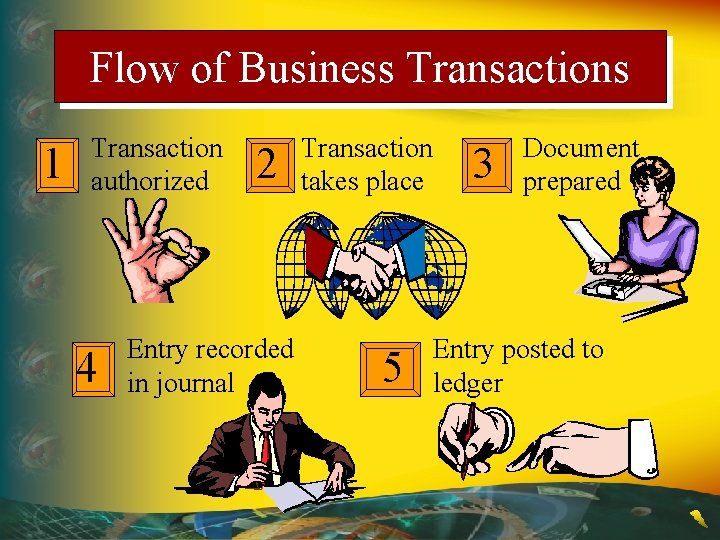

Flow of Business Transactions 1 Transaction authorized 4 2 Entry recorded in journal Transaction takes place 5 3 Document prepared Entry posted to ledger

System to Analyze Transactions 1. Determine whether an asset, a liability, owner’s equity, revenue, or expense account is affected by the transaction. 2. For each account affected by the transaction, determine whether the account increases or decreases. 3. Determine whether each increase or decrease should be recorded as a debit or a credit.

Journalizing and Posting

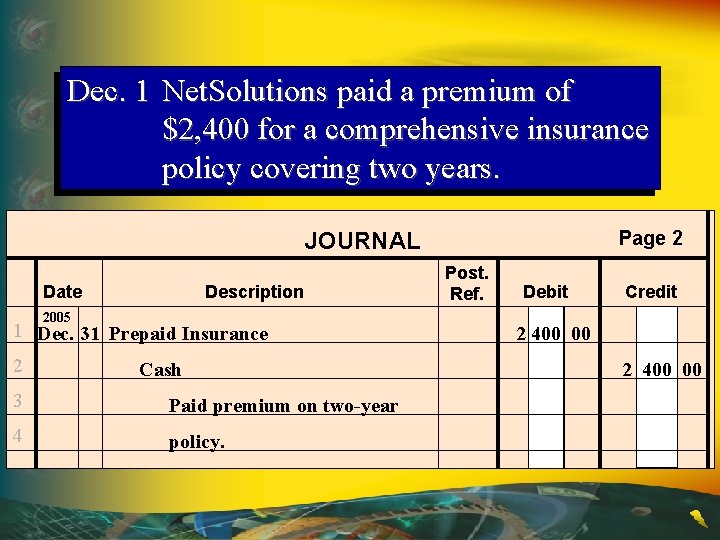

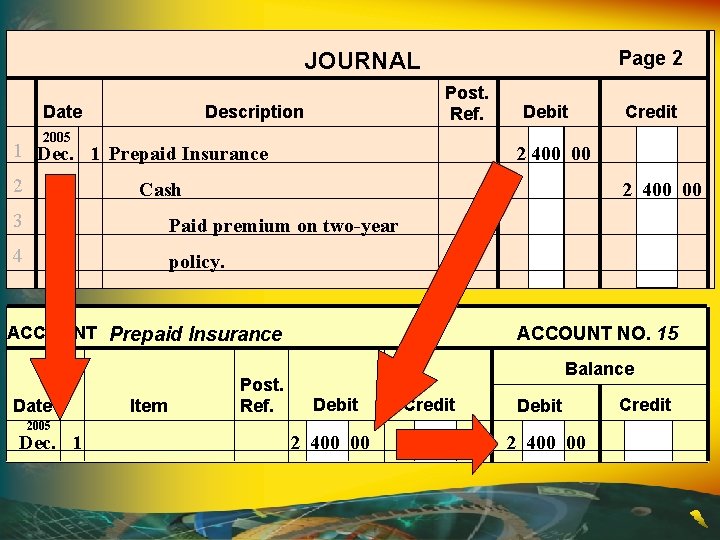

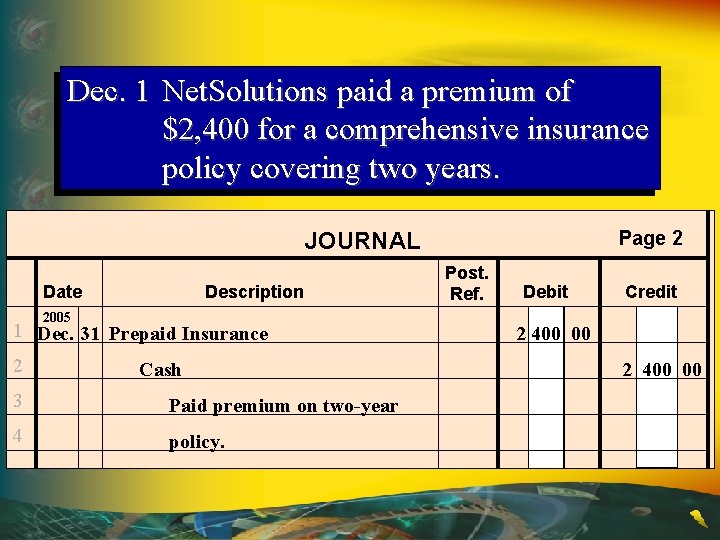

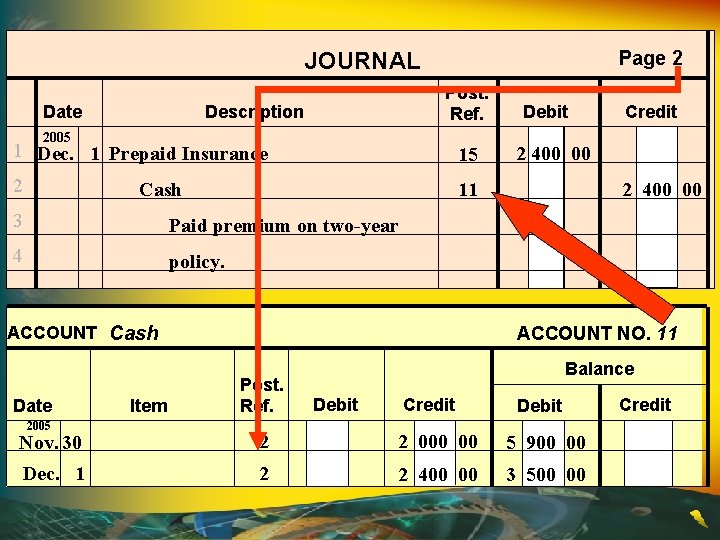

Dec. 1 Net. Solutions paid a premium of $2, 400 for a comprehensive insurance policy covering two years. Page 2 JOURNAL Date Description 2005 1 Dec. 31 Prepaid Insurance 2 Cash 3 Paid premium on two-year 4 policy. Post. Ref. Debit Credit 2 400 00

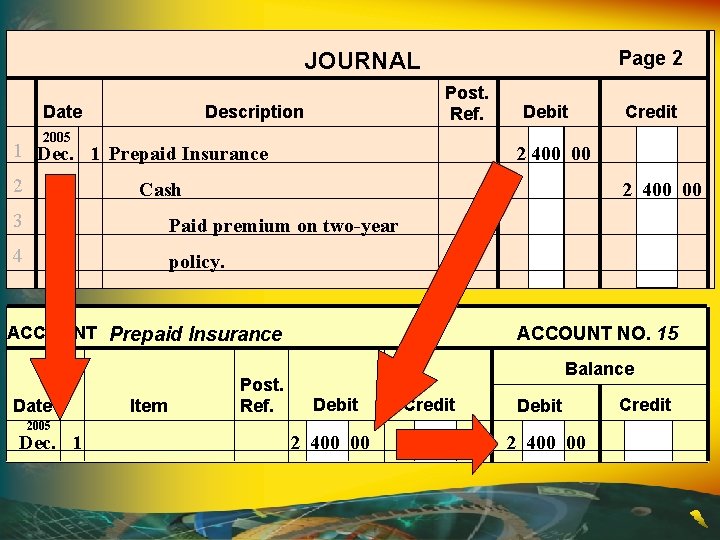

Page 2 JOURNAL Date Post. Ref. Description 2005 1 Dec. 1 Prepaid Insurance 2 Debit 2 400 00 Cash 2 400 00 3 Paid premium on two-year 4 policy. ACCOUNT NO. 15 ACCOUNT Prepaid Insurance Date 2005 Dec. 1 Item Credit Post. Ref. Balance Debit 2 400 00 Credit

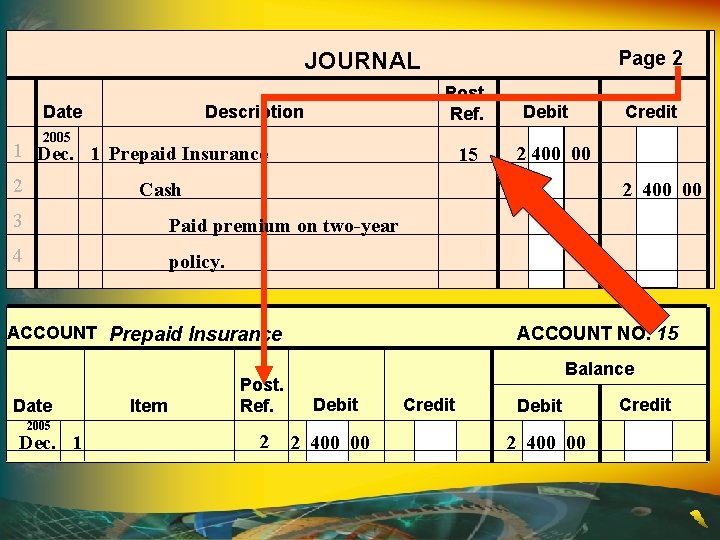

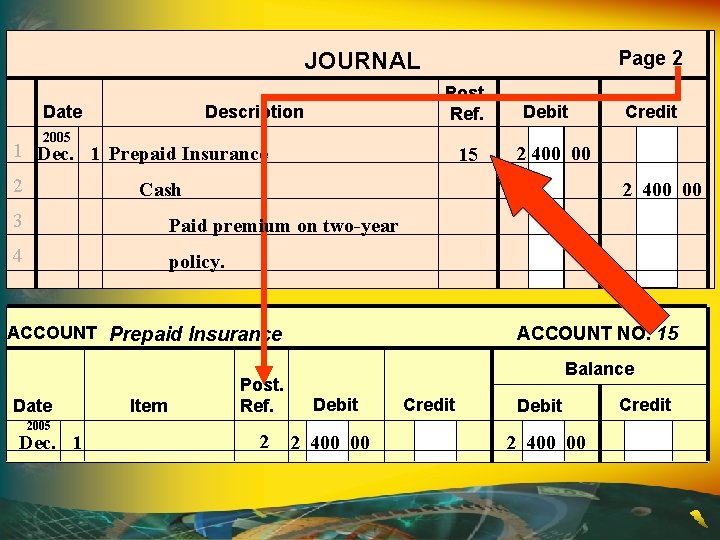

Page 2 JOURNAL Date Post. Ref. Description 2005 1 Dec. 1 Prepaid Insurance 2 15 Debit 2 400 00 Cash 2 400 00 3 Paid premium on two-year 4 policy. ACCOUNT NO. 15 ACCOUNT Prepaid Insurance Date 2005 Dec. 1 Item Credit Post. Ref. 2 Balance Debit 2 400 00 Credit

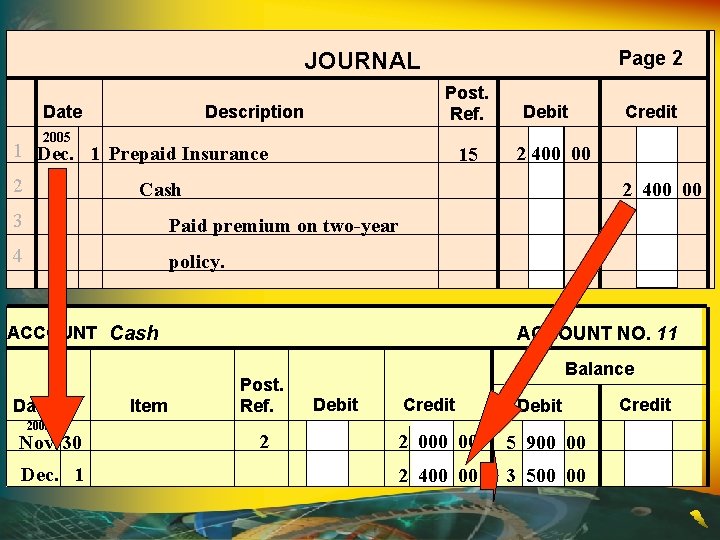

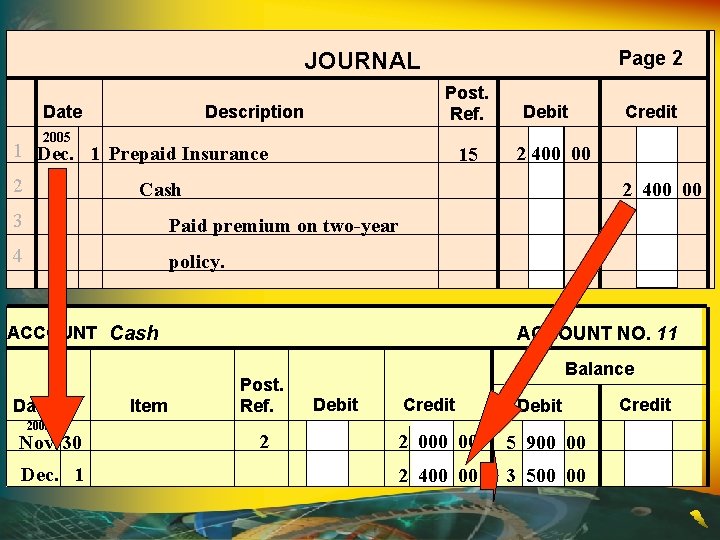

Page 2 JOURNAL Date Post. Ref. Description 2005 1 Dec. 1 Prepaid Insurance 2 15 Debit 2 400 00 Cash 2 400 00 3 Paid premium on two-year 4 policy. ACCOUNT Cash Date 2005 Nov. 30 Dec. 1 Item Credit ACCOUNT NO. 11 Post. Ref. 2 Balance Debit Credit Debit 2 000 00 5 900 00 2 400 00 3 500 00 Credit

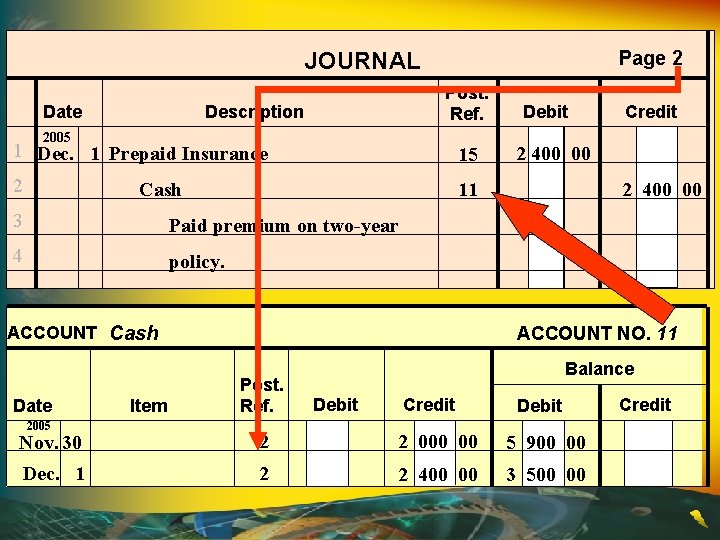

Page 2 JOURNAL Date Post. Ref. Description 2005 1 Dec. 1 Prepaid Insurance 15 2 11 Cash 3 Paid premium on two-year 4 policy. ACCOUNT Cash Date 2005 Item Debit Credit 2 400 00 ACCOUNT NO. 11 Post. Ref. Balance Debit Credit Debit Nov. 30 2 2 000 00 5 900 00 Dec. 1 2 2 400 00 3 500 00 Credit

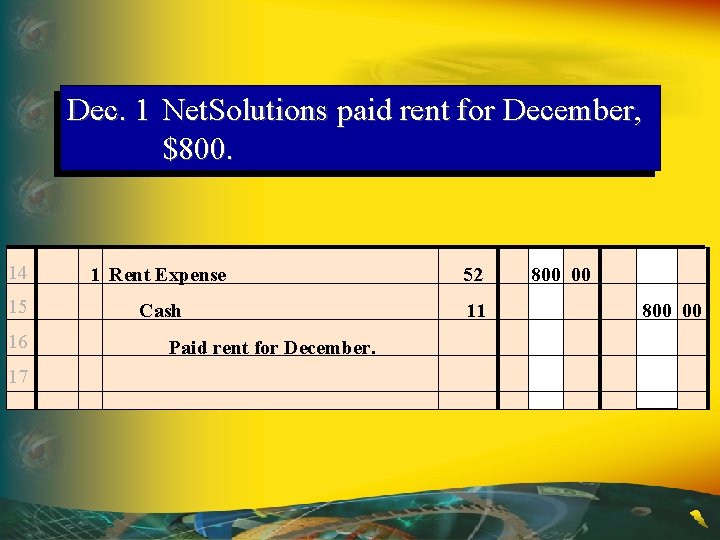

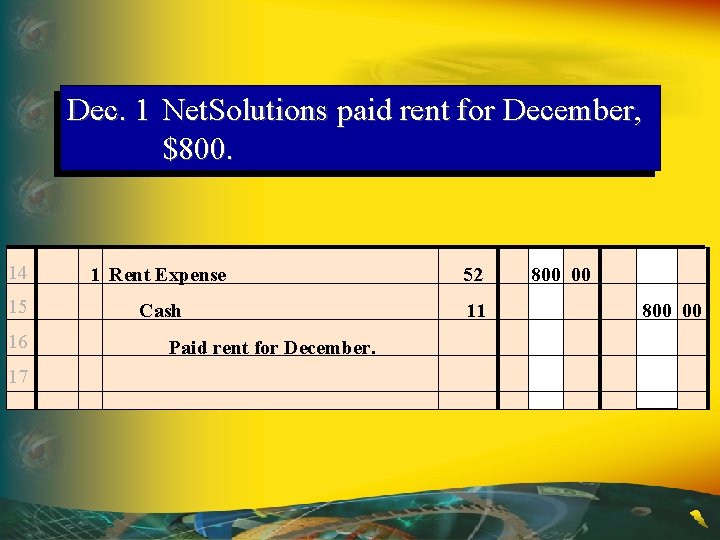

Dec. 1 Net. Solutions paid rent for December, $800. 14 1 Rent Expense 52 15 Cash 11 16 17 Paid rent for December. 800 00

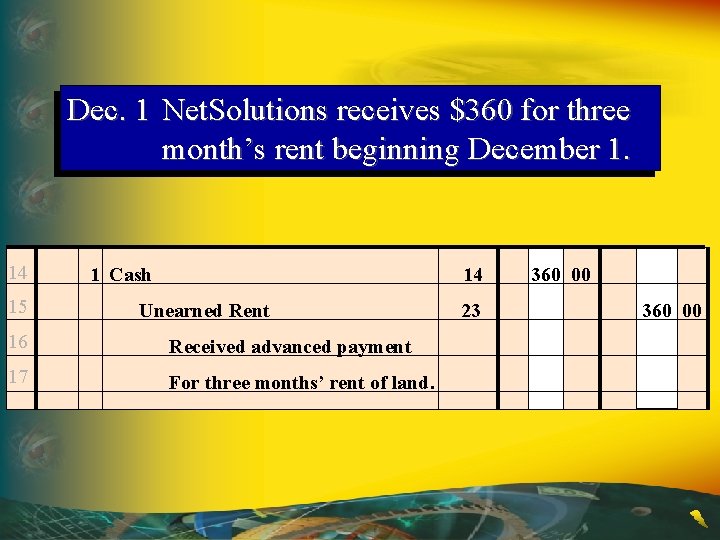

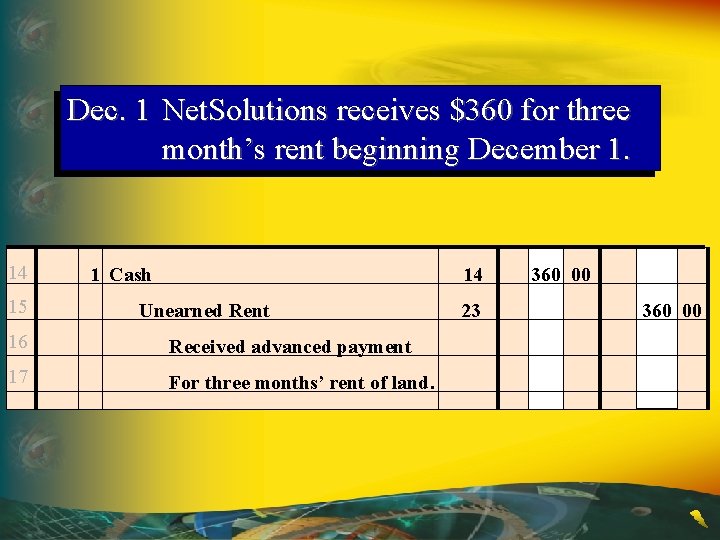

Dec. 1 Net. Solutions receives $360 for three month’s rent beginning December 1. 14 15 1 Cash 14 Unearned Rent 16 Received advanced payment 17 For three months’ rent of land. 23 360 00

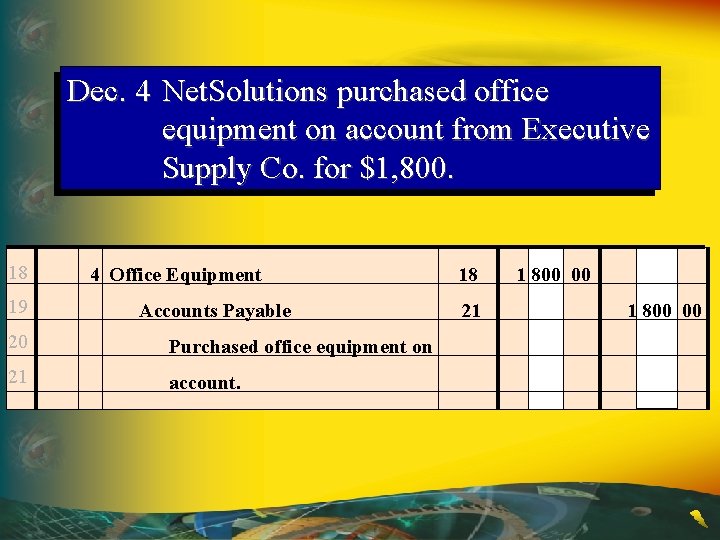

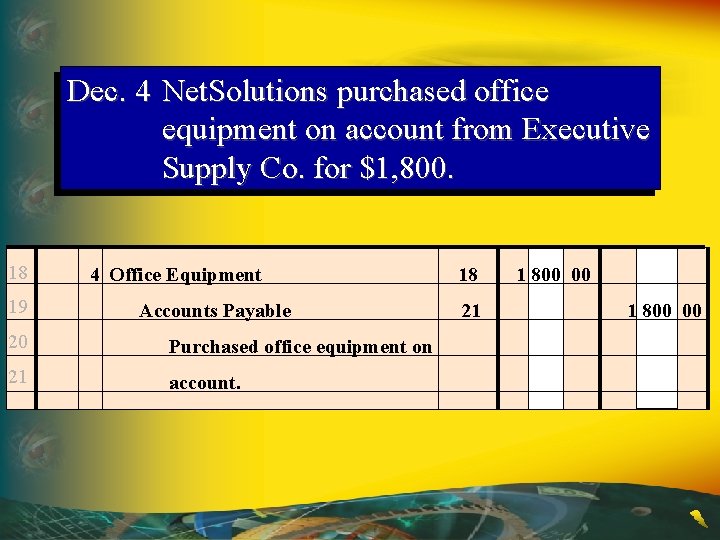

Dec. 4 Net. Solutions purchased office equipment on account from Executive Supply Co. for $1, 800. 18 19 4 Office Equipment Accounts Payable 20 Purchased office equipment on 21 account. 18 21 1 800 00

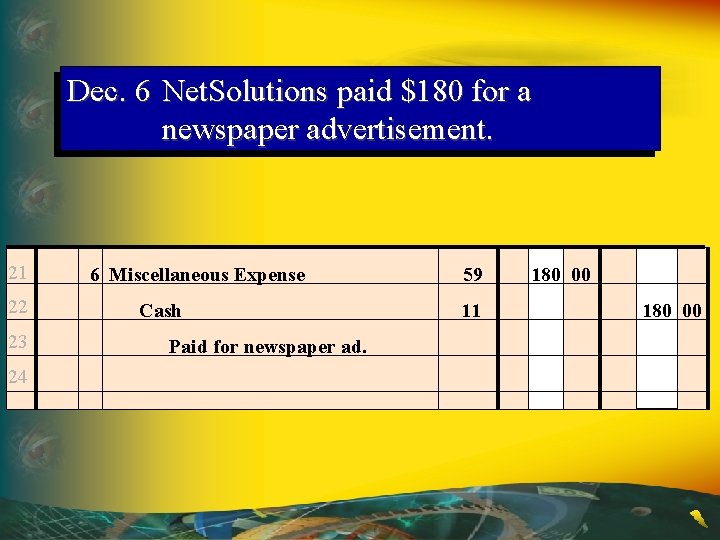

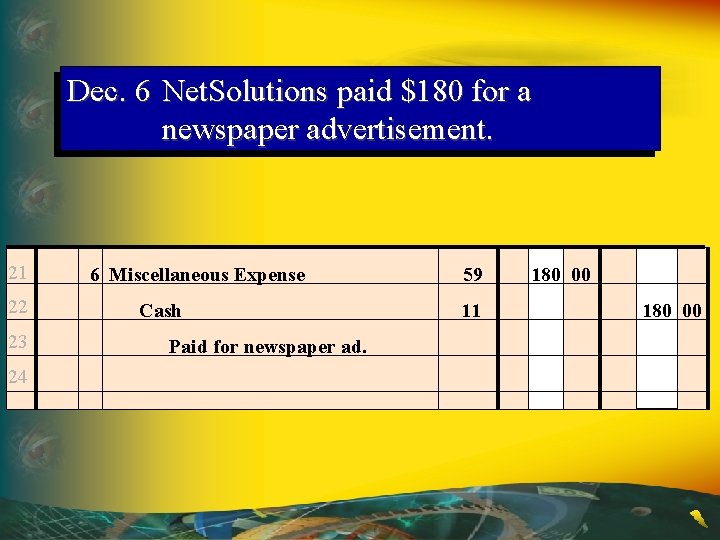

Dec. 6 Net. Solutions paid $180 for a newspaper advertisement. 21 22 23 24 6 Miscellaneous Expense Cash Paid for newspaper ad. 59 11 180 00

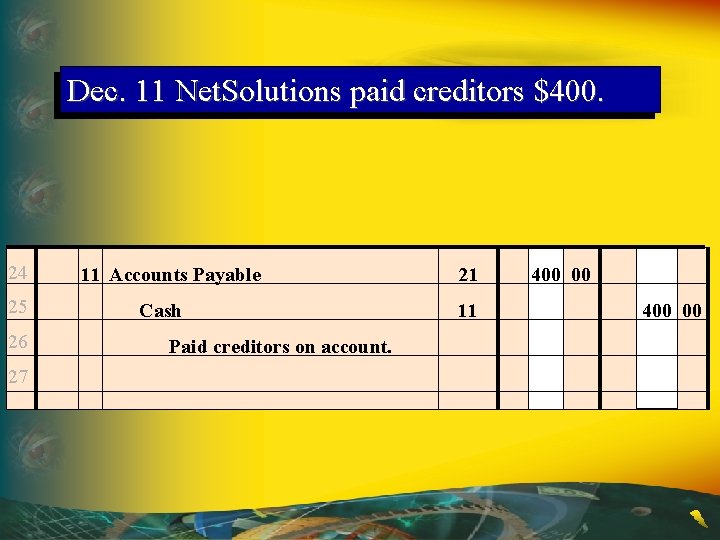

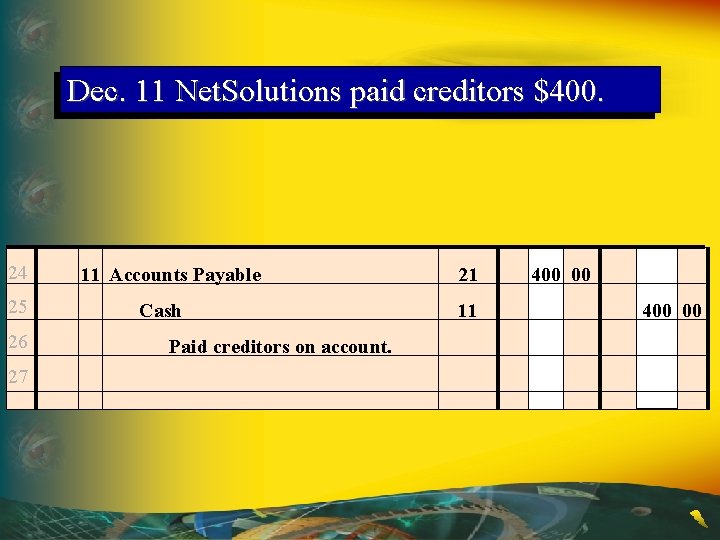

Dec. 11 Net. Solutions paid creditors $400. 24 25 26 27 11 Accounts Payable Cash Paid creditors on account. 21 11 400 00

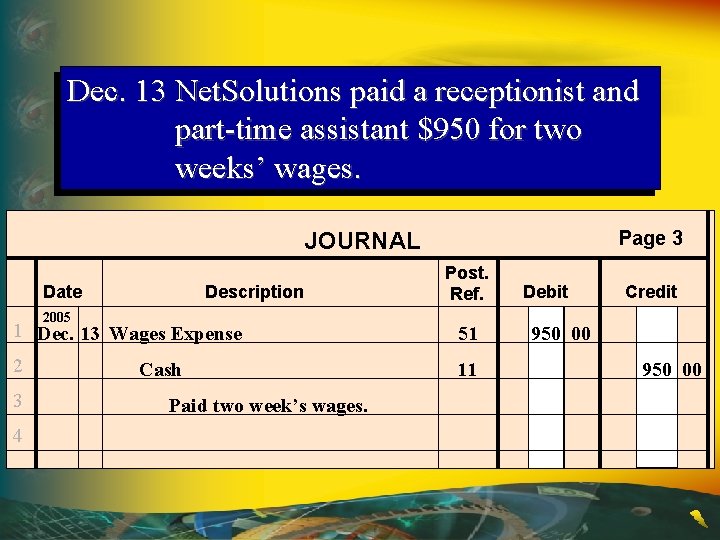

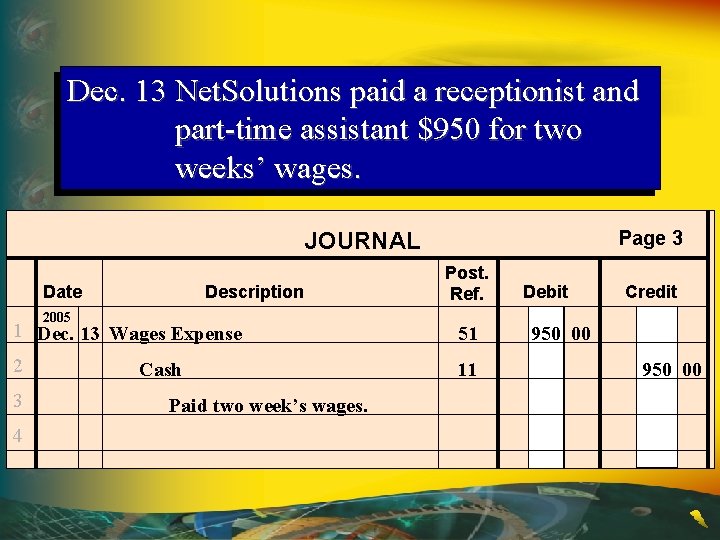

Dec. 13 Net. Solutions paid a receptionist and part-time assistant $950 for two weeks’ wages. Page 3 JOURNAL Date Description 2005 Post. Ref. 1 Dec. 13 Wages Expense 51 2 11 3 4 Cash Paid two week’s wages. Debit Credit 950 00

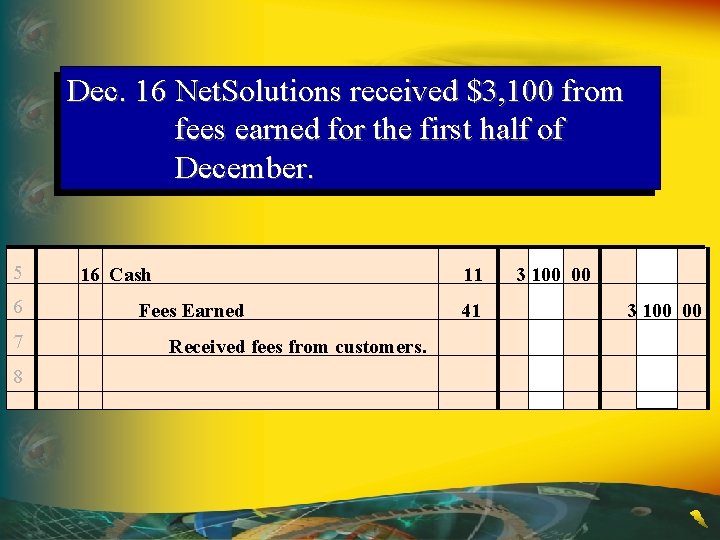

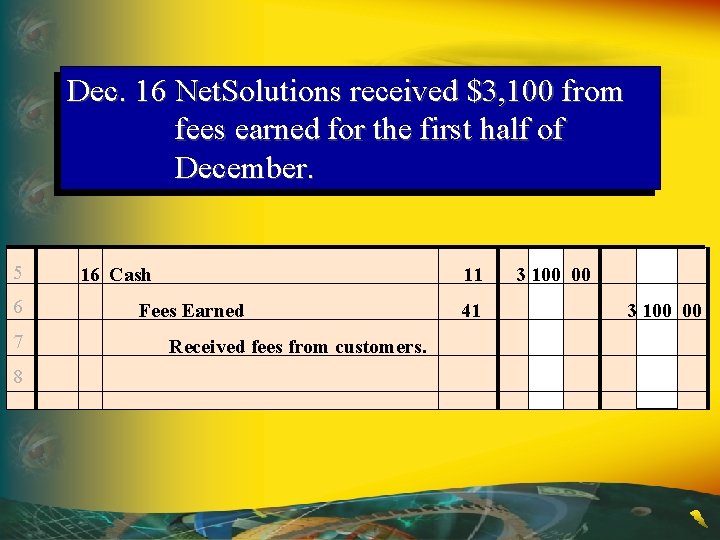

Dec. 16 Net. Solutions received $3, 100 from fees earned for the first half of December. 5 6 7 8 16 Cash 11 Fees Earned Received fees from customers. 41 3 100 00

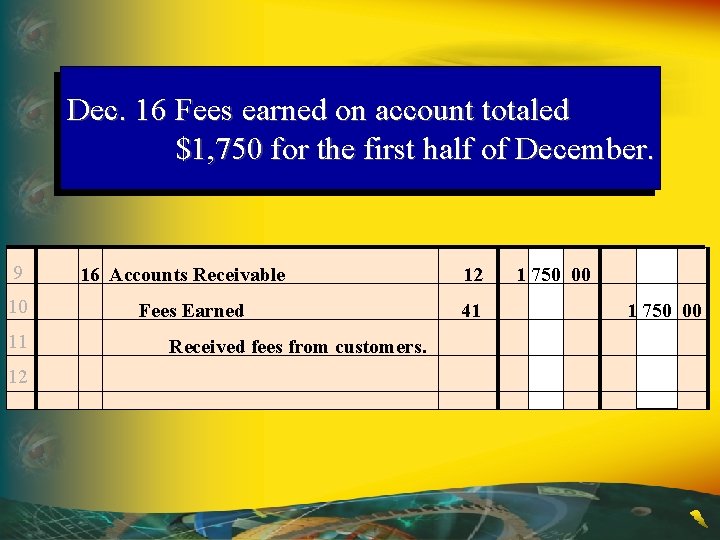

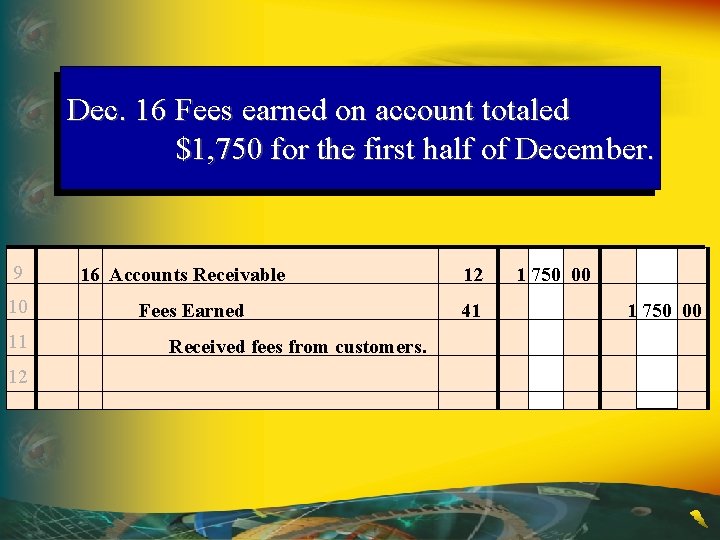

Dec. 16 Fees earned on account totaled $1, 750 for the first half of December. 9 10 11 12 16 Accounts Receivable Fees Earned Received fees from customers. 12 41 1 750 00

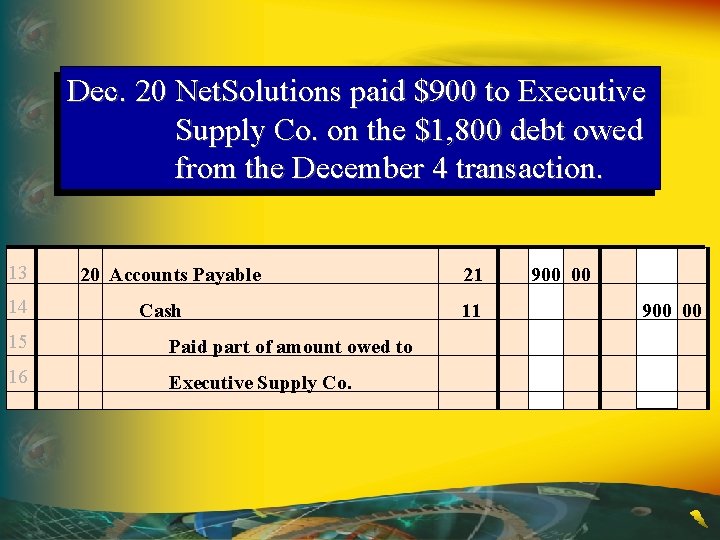

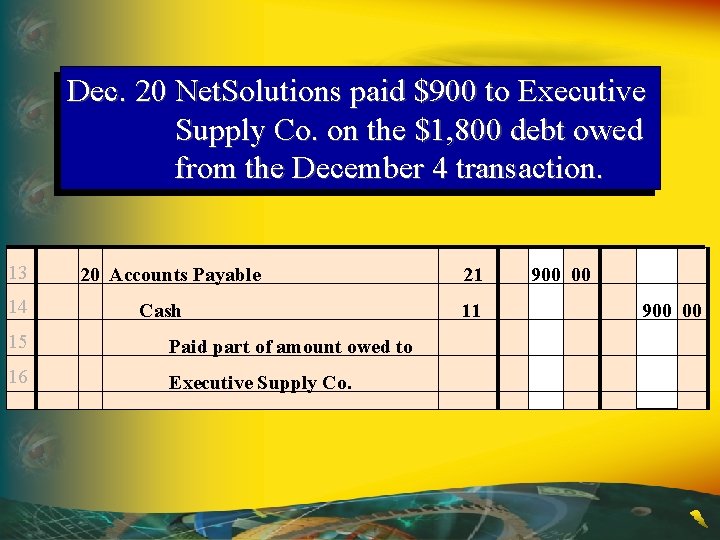

Dec. 20 Net. Solutions paid $900 to Executive Supply Co. on the $1, 800 debt owed from the December 4 transaction. 13 14 20 Accounts Payable Cash 15 Paid part of amount owed to 16 Executive Supply Co. 21 11 900 00

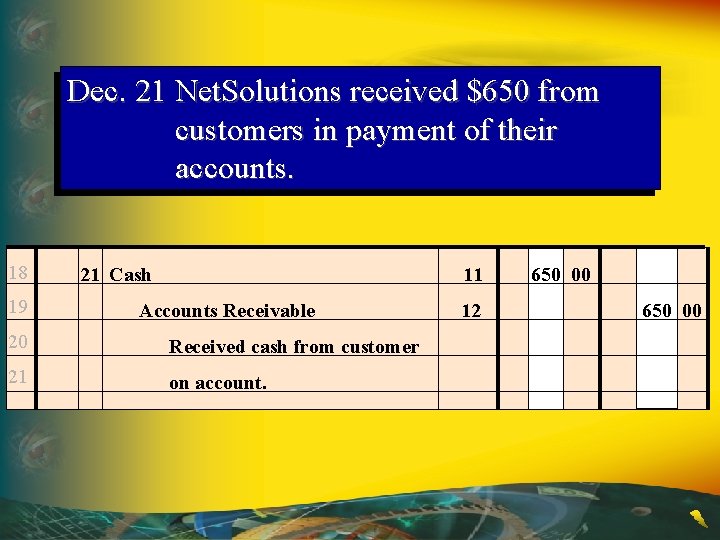

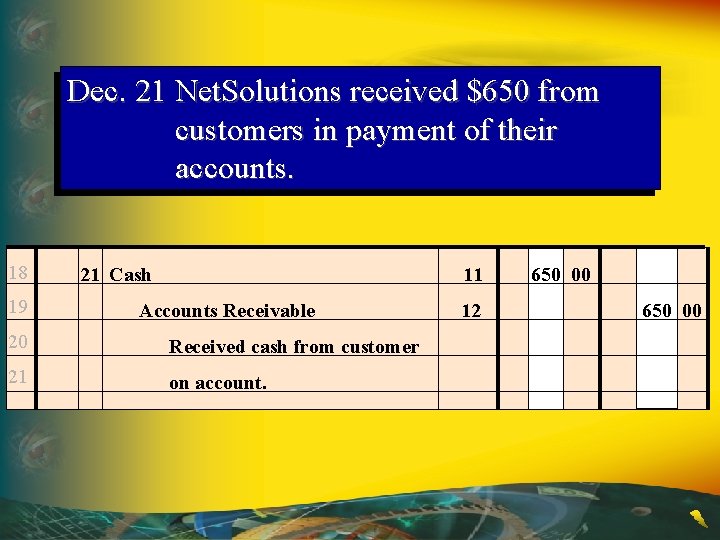

Dec. 21 Net. Solutions received $650 from customers in payment of their accounts. 18 19 21 Cash 11 Accounts Receivable 20 Received cash from customer 21 on account. 12 650 00

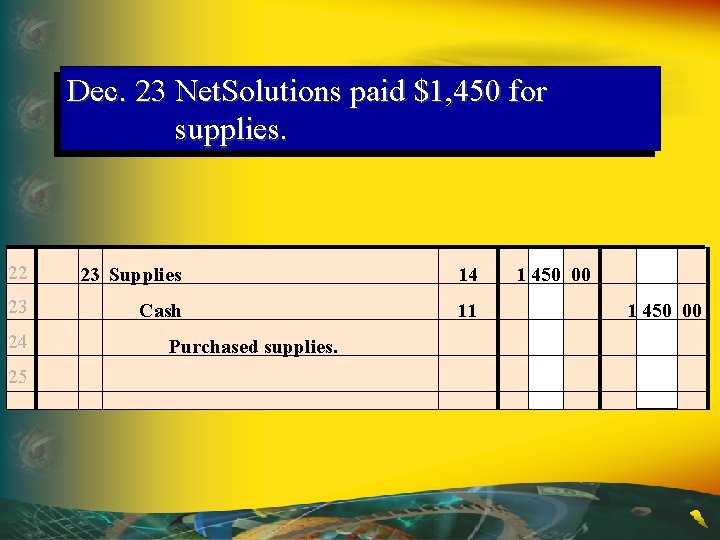

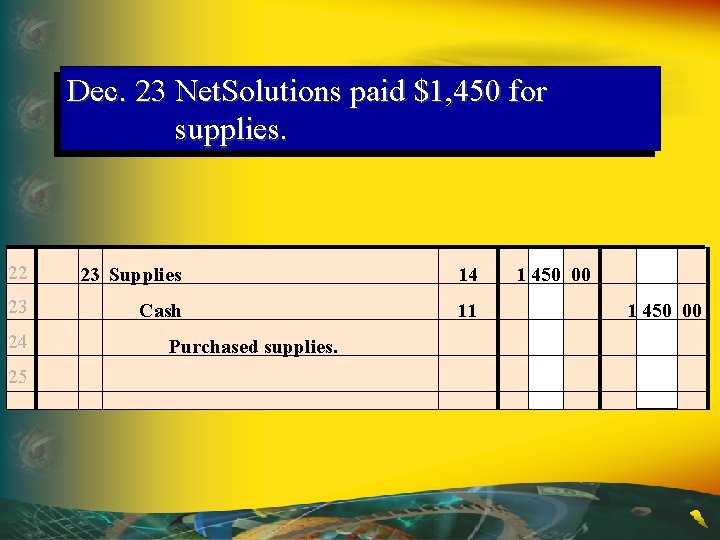

Dec. 23 Net. Solutions paid $1, 450 for supplies. 22 23 Supplies 14 23 Cash 11 24 25 Purchased supplies. 1 450 00

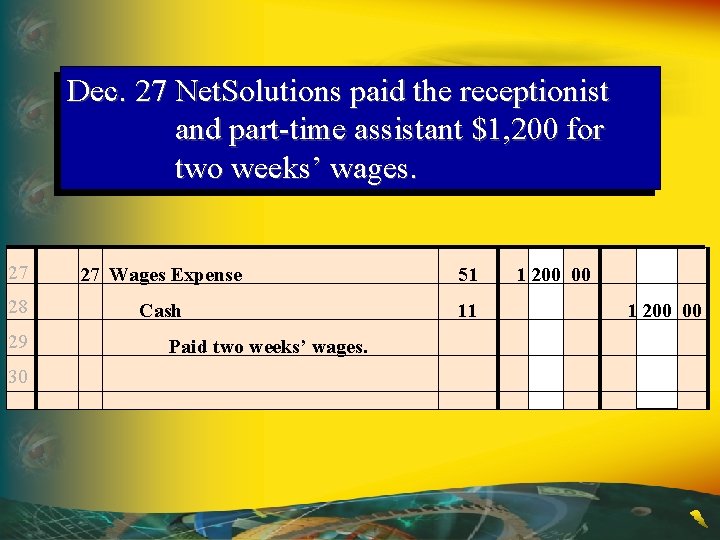

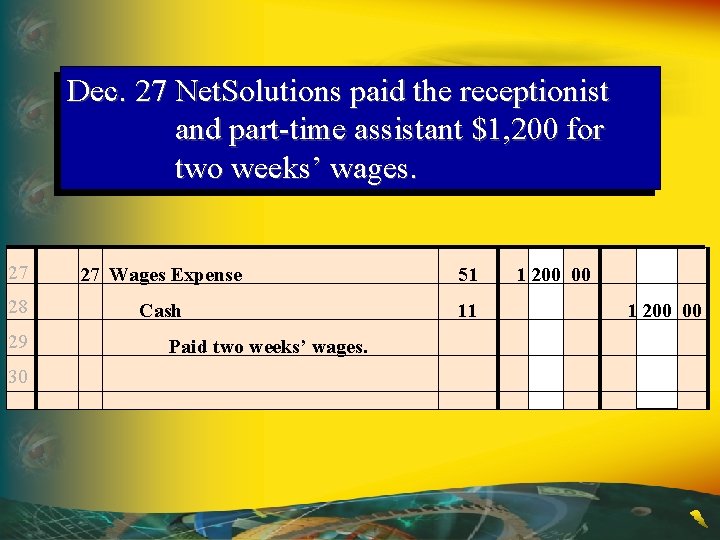

Dec. 27 Net. Solutions paid the receptionist and part-time assistant $1, 200 for two weeks’ wages. 27 27 Wages Expense 51 28 Cash 11 29 30 Paid two weeks’ wages. 1 200 00

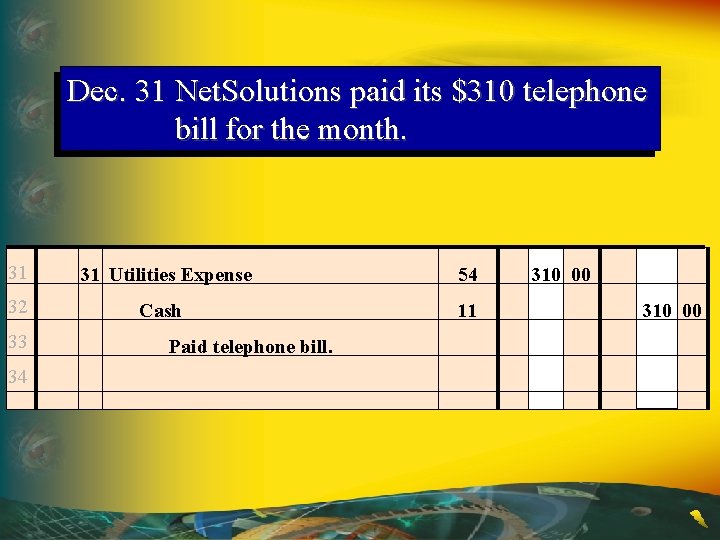

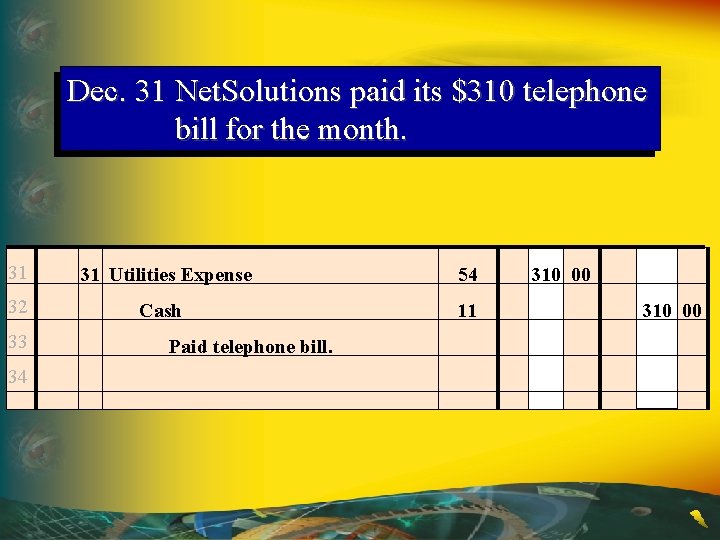

Dec. 31 Net. Solutions paid its $310 telephone bill for the month. 31 31 Utilities Expense 54 32 Cash 11 33 34 Paid telephone bill. 310 00

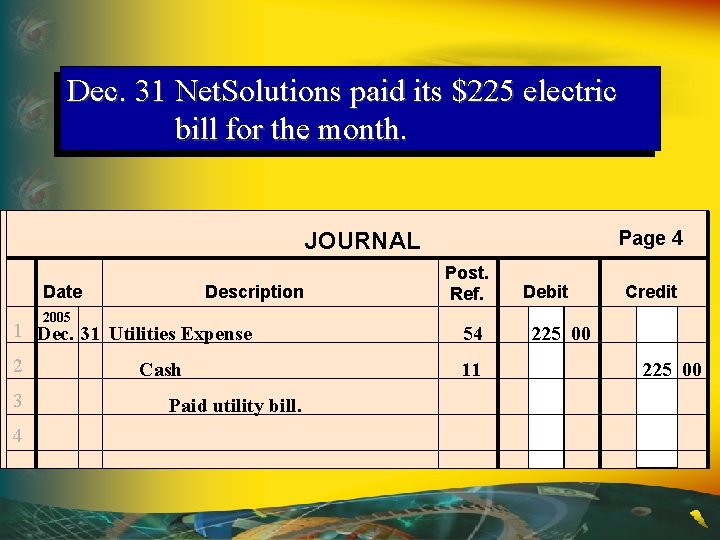

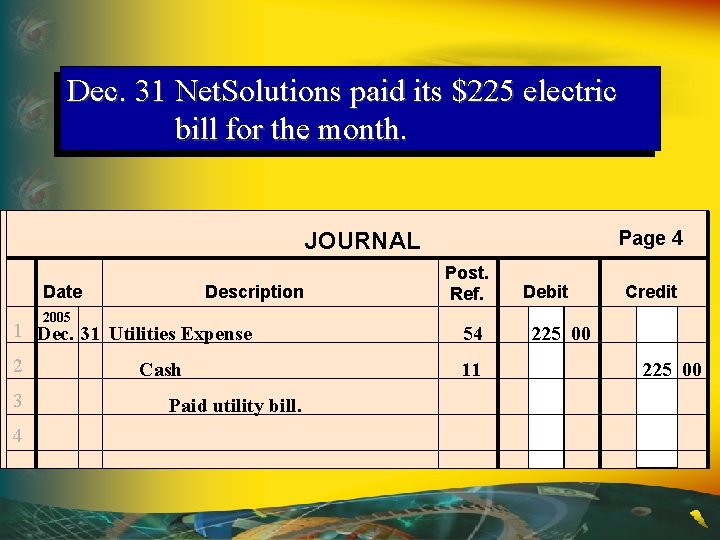

Dec. 31 Net. Solutions paid its $225 electric bill for the month. Page 4 JOURNAL Date Description 2005 Post. Ref. 1 Dec. 31 Utilities Expense 54 2 11 3 4 Cash Paid utility bill. Debit Credit 225 00

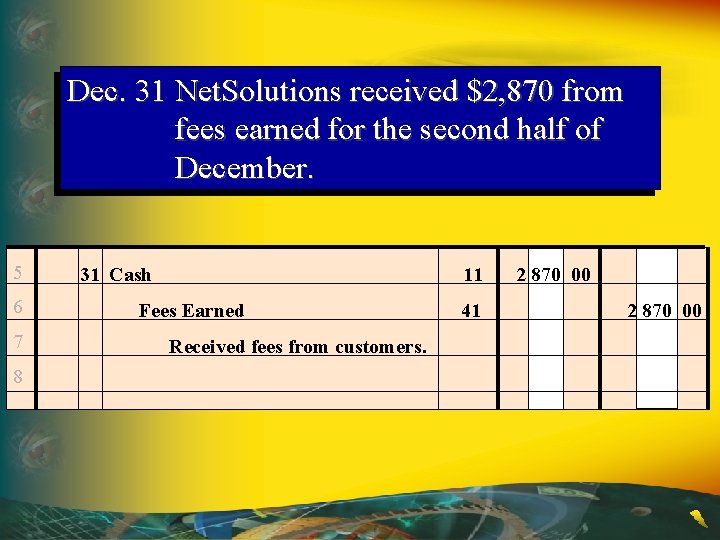

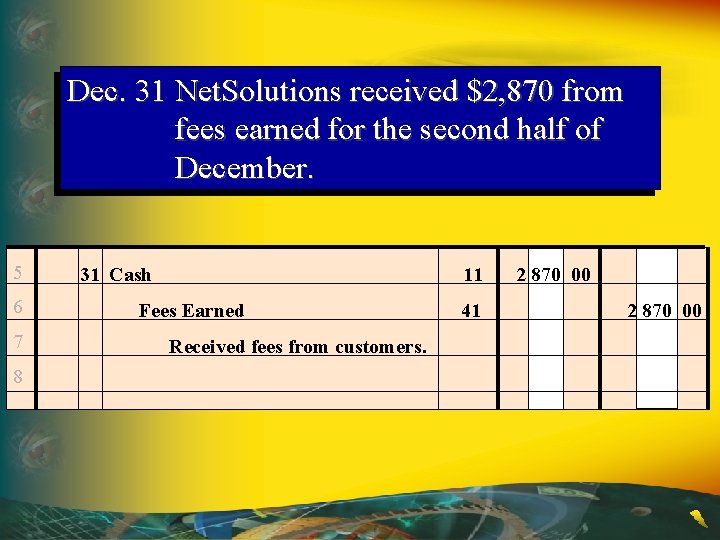

Dec. 31 Net. Solutions received $2, 870 from fees earned for the second half of December. 5 6 7 8 31 Cash 11 Fees Earned Received fees from customers. 41 2 870 00

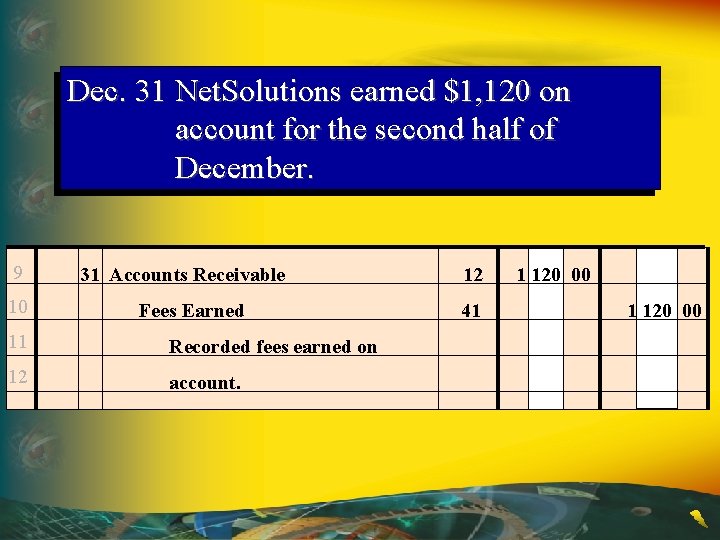

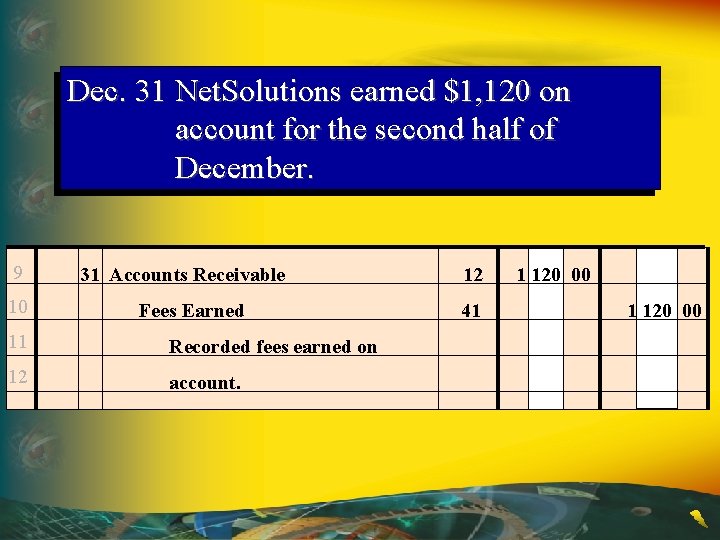

Dec. 31 Net. Solutions earned $1, 120 on account for the second half of December. 9 10 31 Accounts Receivable Fees Earned 11 Recorded fees earned on 12 account. 12 41 1 120 00

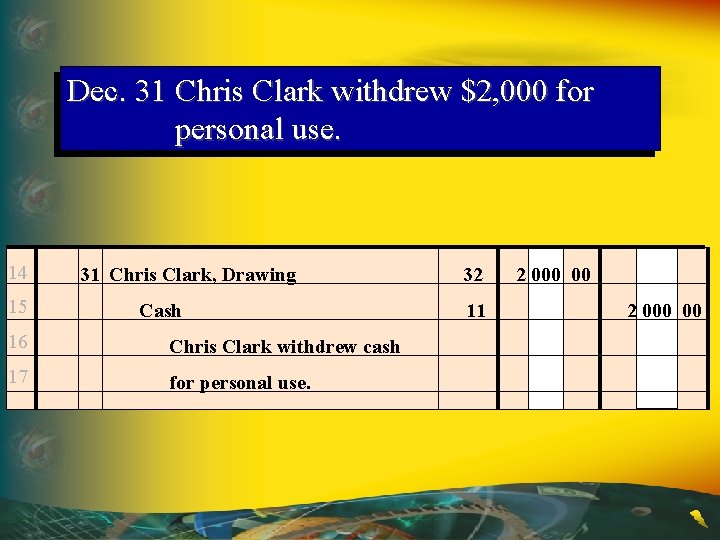

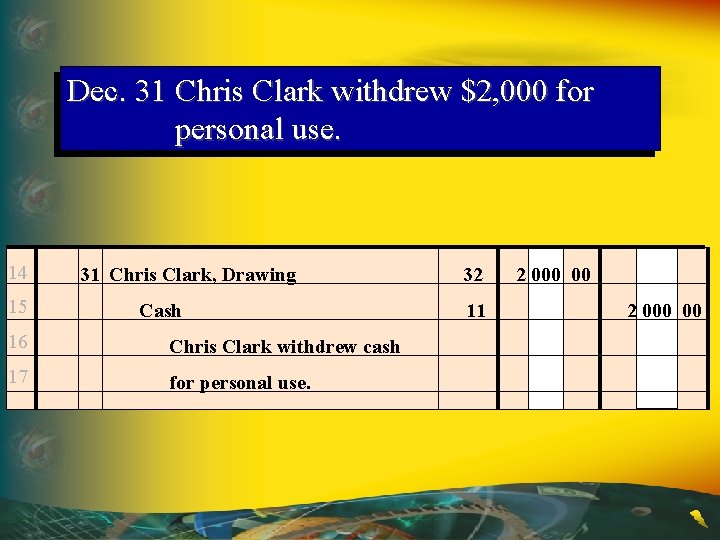

Dec. 31 Chris Clark withdrew $2, 000 for personal use. 14 15 31 Chris Clark, Drawing Cash 16 Chris Clark withdrew cash 17 for personal use. 32 11 2 000 00

Trial Balance

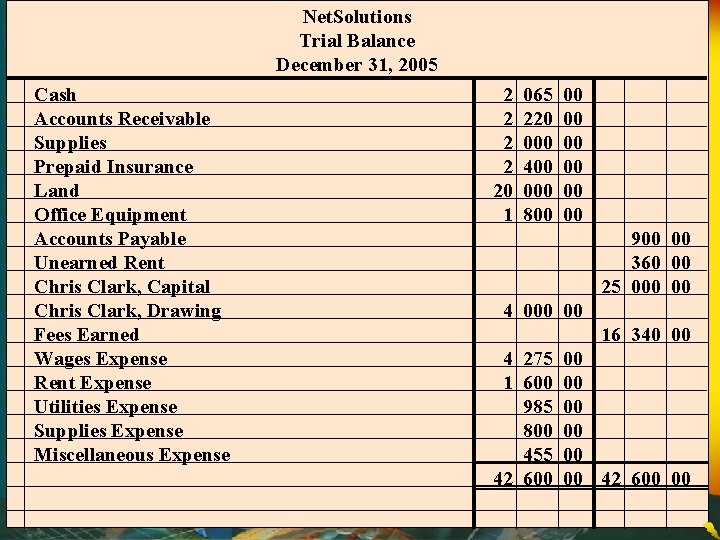

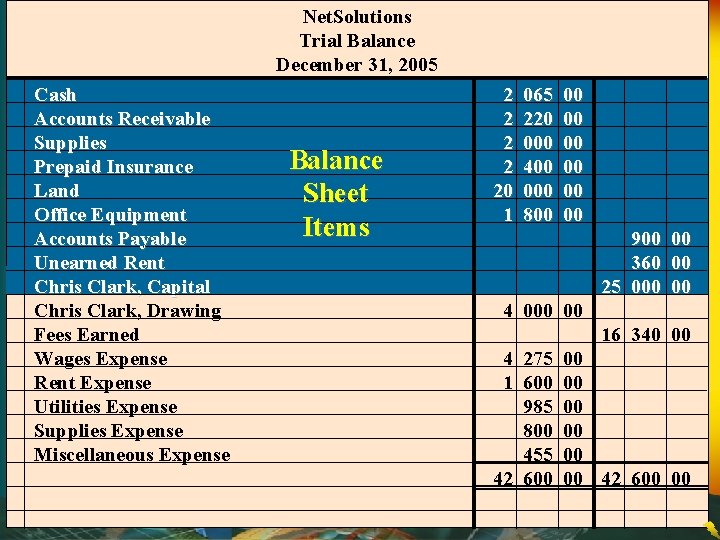

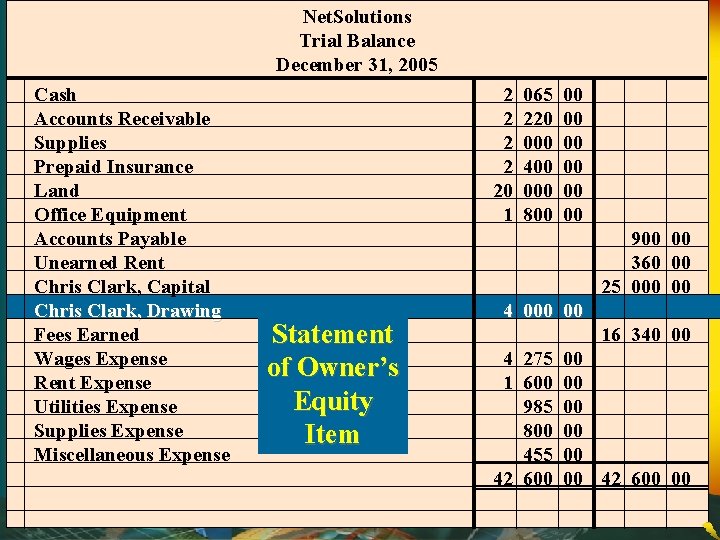

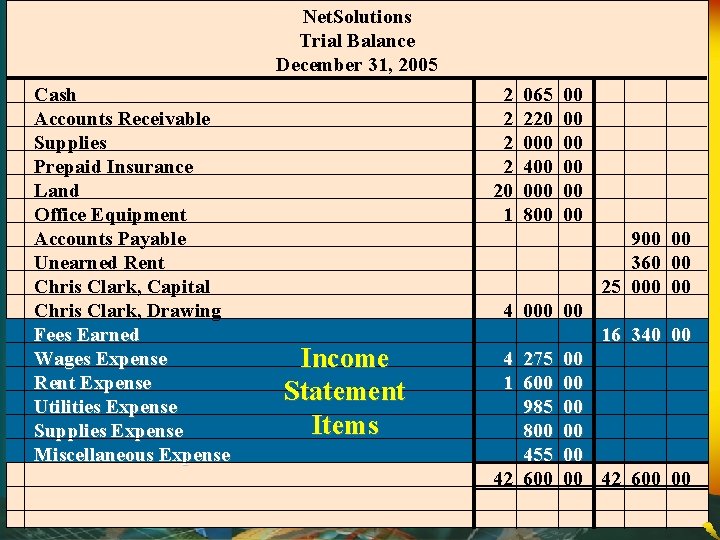

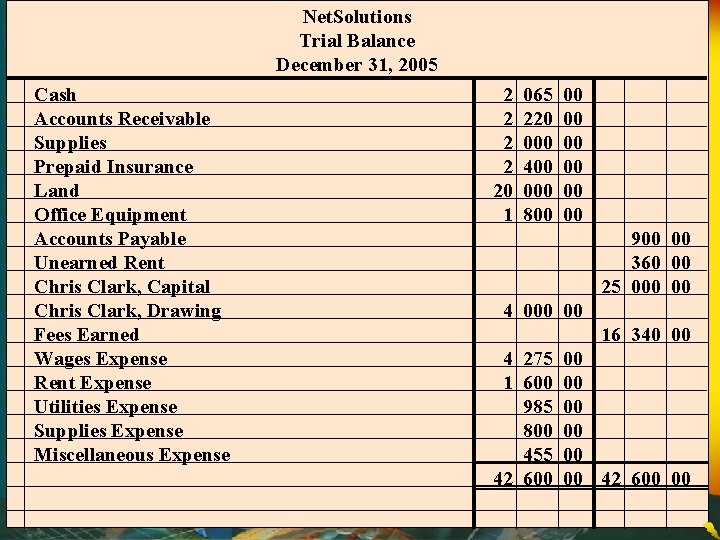

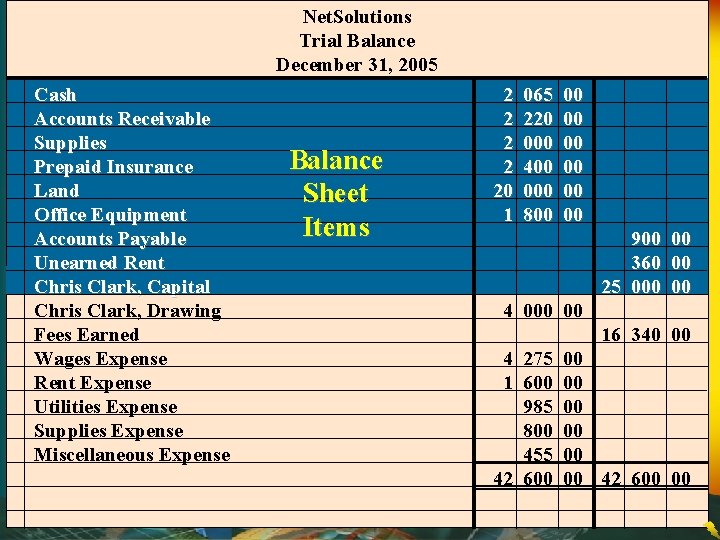

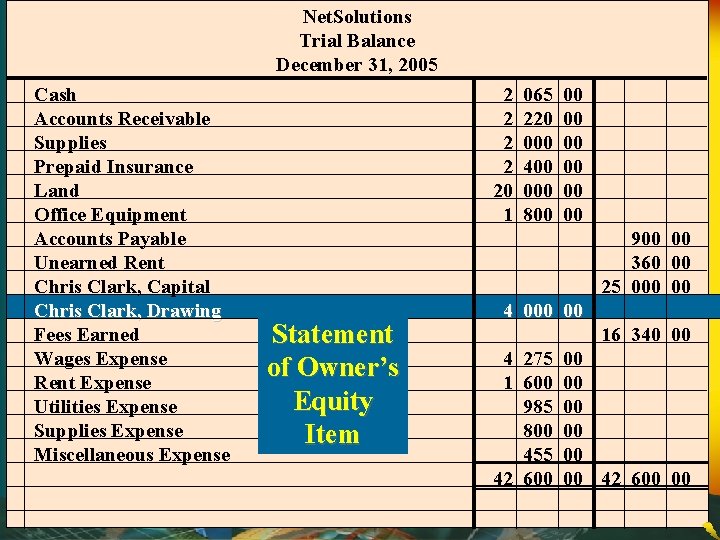

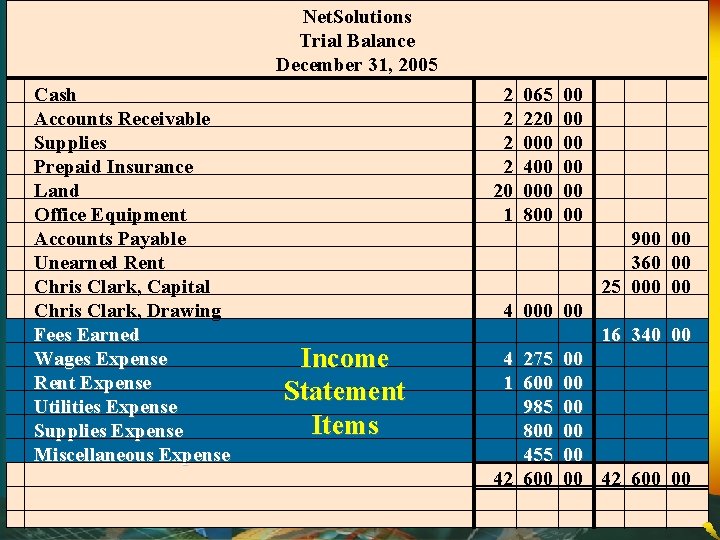

Net. Solutions Trial Balance December 31, 2005 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Chris Clark, Capital Chris Clark, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense 2 2 20 1 065 220 000 400 000 800 00 900 00 360 00 25 000 00 4 000 00 16 340 00 4 275 00 1 600 00 985 00 800 00 455 00 42 600 00

Net. Solutions Trial Balance December 31, 2005 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Chris Clark, Capital Chris Clark, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense Balance Sheet Items 2 2 20 1 065 220 000 400 000 800 00 900 00 360 00 25 000 00 4 000 00 16 340 00 4 275 00 1 600 00 985 00 800 00 455 00 42 600 00

Net. Solutions Trial Balance December 31, 2005 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Chris Clark, Capital Chris Clark, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense 2 2 20 1 065 220 000 400 000 800 00 900 00 360 00 25 000 00 Statement of Owner’s Equity Item 4 000 00 16 340 00 4 275 00 1 600 00 985 00 800 00 455 00 42 600 00

Net. Solutions Trial Balance December 31, 2005 Cash Accounts Receivable Supplies Prepaid Insurance Land Office Equipment Accounts Payable Unearned Rent Chris Clark, Capital Chris Clark, Drawing Fees Earned Wages Expense Rent Expense Utilities Expense Supplies Expense Miscellaneous Expense 2 2 20 1 065 220 000 400 000 800 00 900 00 360 00 25 000 00 4 000 00 Income Statement Items 16 340 00 4 275 00 1 600 00 985 00 800 00 455 00 42 600 00

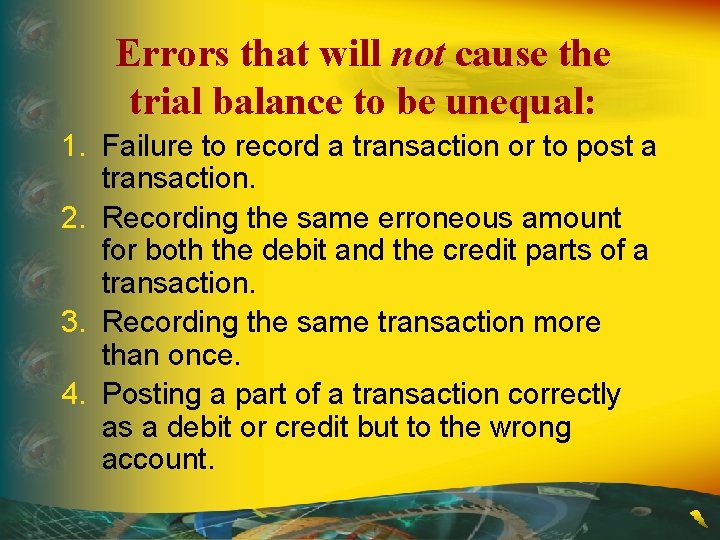

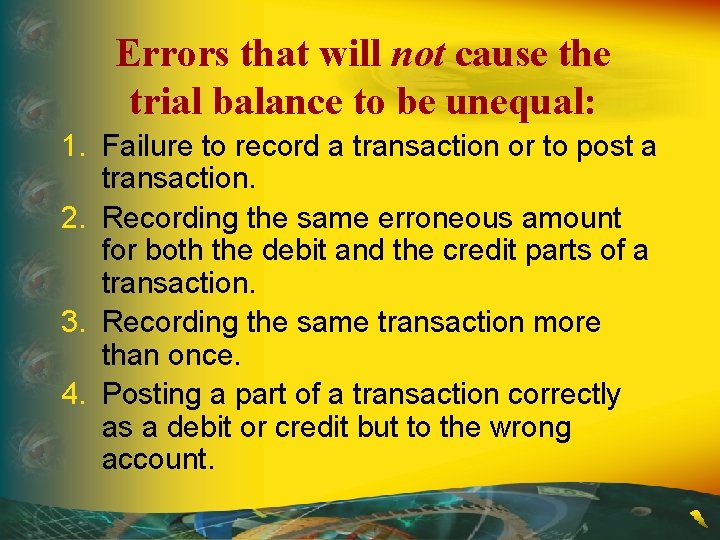

Errors that will not cause the trial balance to be unequal: 1. Failure to record a transaction or to post a transaction. 2. Recording the same erroneous amount for both the debit and the credit parts of a transaction. 3. Recording the same transaction more than once. 4. Posting a part of a transaction correctly as a debit or credit but to the wrong account.

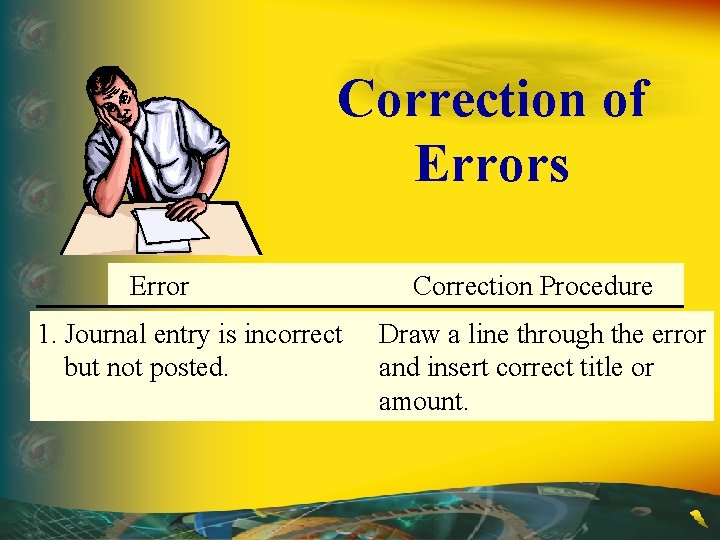

Correction of Errors Error 1. Journal entry is incorrect but not posted. Correction Procedure Draw a line through the error and insert correct title or amount.

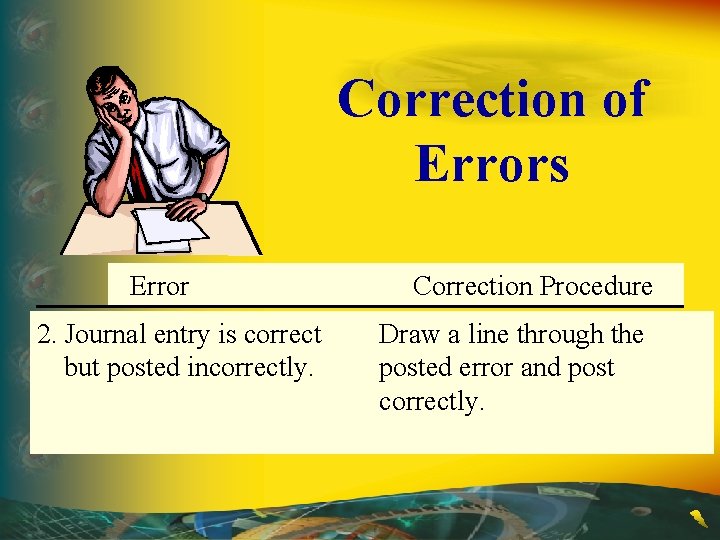

Correction of Errors Error 1. Journal entry is correct incorrect 2. not posted. but posted incorrectly. Correction Procedure Draw a line through the error and insert correct title or posted error and post amount. correctly.

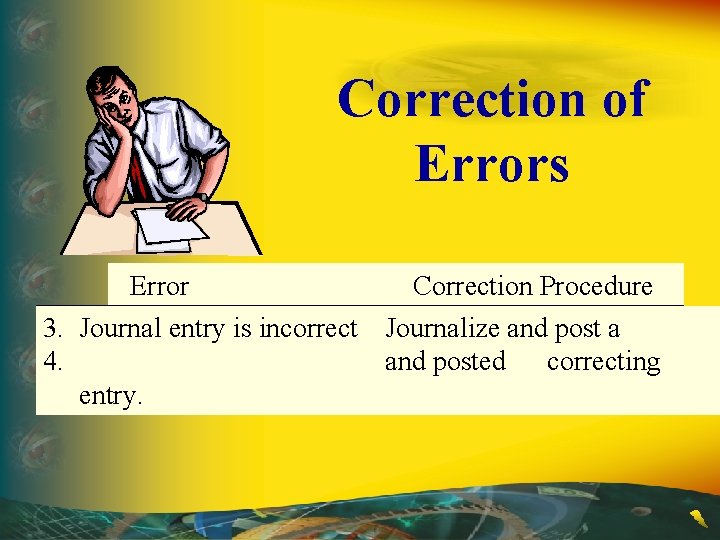

Correction of Errors Error Correction Procedure 3. Journal entry is incorrect Journalize and post a 4. and posted correcting entry.

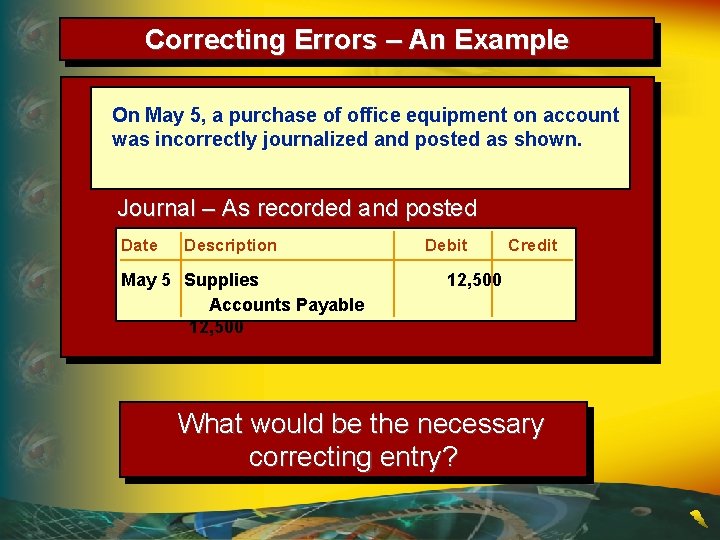

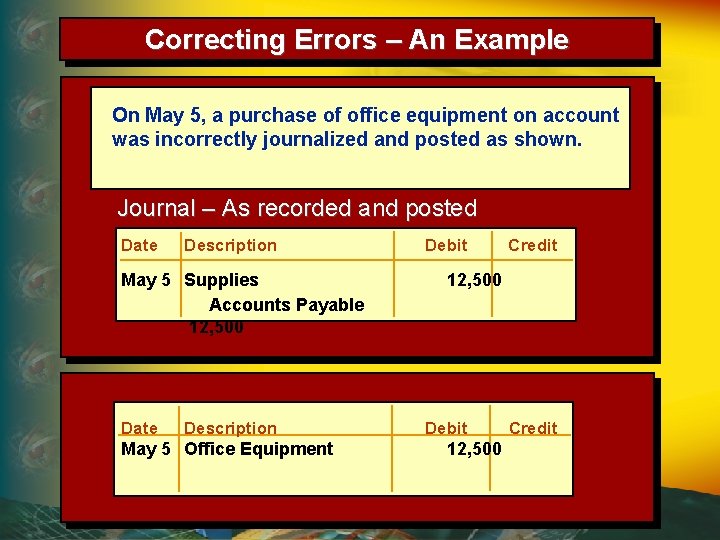

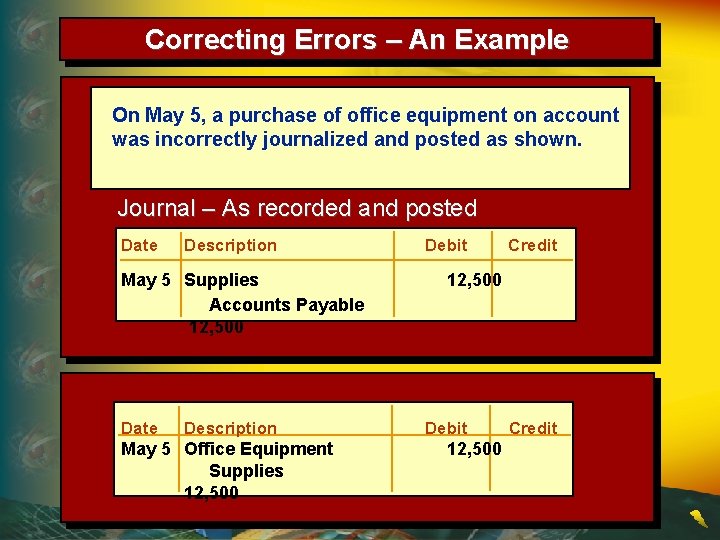

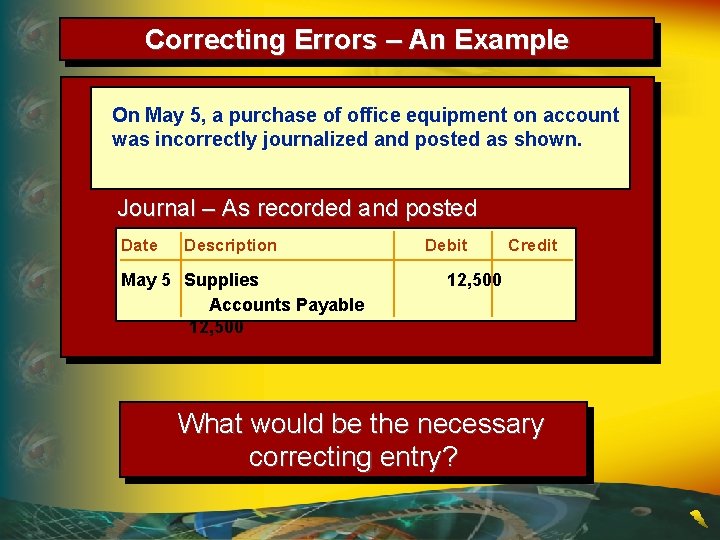

Correcting Errors – An Example On May 5, a purchase of office equipment on account was incorrectly journalized and posted as shown. Journal – As recorded and posted Date Description May 5 Supplies Accounts Payable 12, 500 Debit Credit 12, 500 What would be the necessary correcting entry?

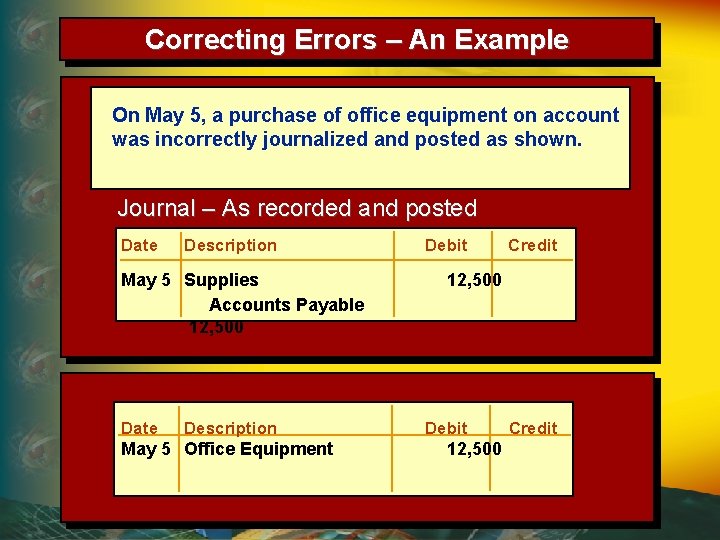

Correcting Errors – An Example On May 5, a purchase of office equipment on account was incorrectly journalized and posted as shown. Journal – As recorded and posted Date Description May 5 Supplies Accounts Payable 12, 500 Date Description May 5 Office Equipment Debit Credit 12, 500 Debit 12, 500 Credit

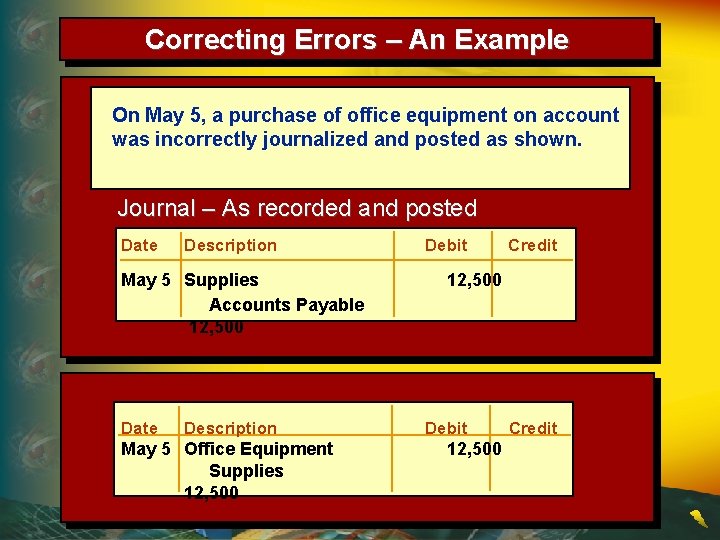

Correcting Errors – An Example On May 5, a purchase of office equipment on account was incorrectly journalized and posted as shown. Journal – As recorded and posted Date Description May 5 Supplies Accounts Payable 12, 500 Date Description May 5 Office Equipment Supplies 12, 500 Debit Credit 12, 500 Debit 12, 500 Credit

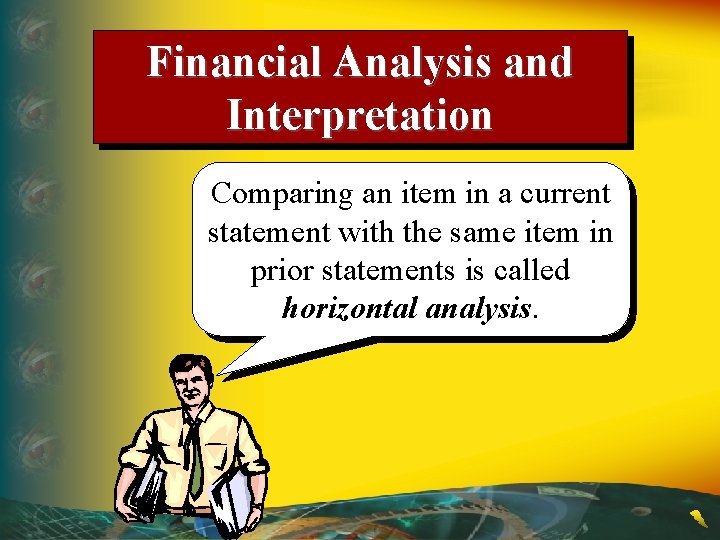

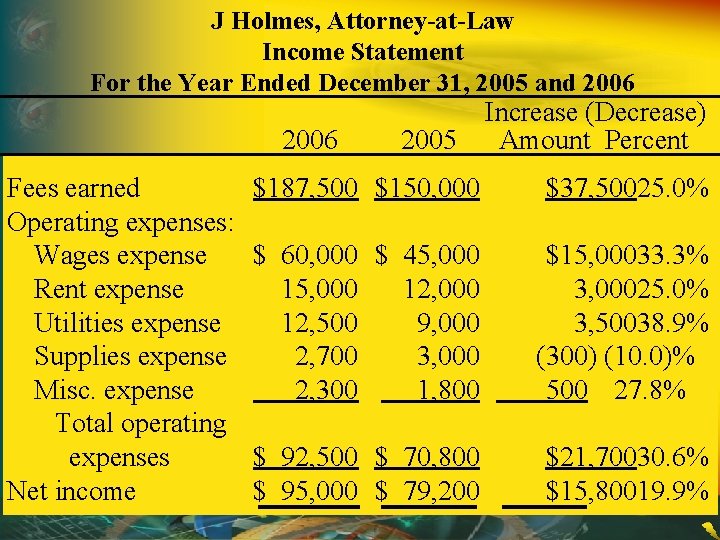

Financial Analysis and Interpretation Comparing an item in a current statement with the same item in prior statements is called horizontal analysis.

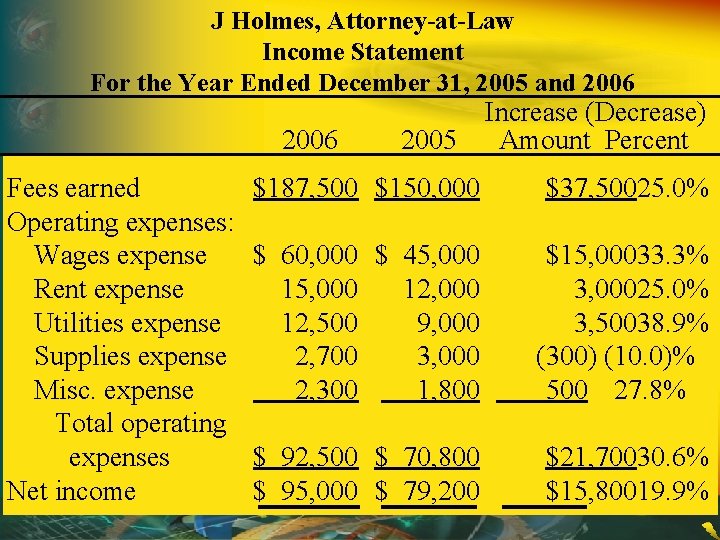

J Holmes, Attorney-at-Law Income Statement For the Year Ended December 31, 2005 and 2006 Fees earned Operating expenses: Wages expense Rent expense Utilities expense Supplies expense Misc. expense Total operating expenses Net income 2005 Increase (Decrease) Amount Percent $187, 500 $150, 000 $37, 50025. 0% $ 60, 000 $ 45, 000 12, 500 9, 000 2, 700 3, 000 2, 300 1, 800 $15, 00033. 3% 3, 00025. 0% 3, 50038. 9% (300) (10. 0)% 500 27. 8% $ 92, 500 $ 70, 800 $ 95, 000 $ 79, 200 $21, 70030. 6% $15, 80019. 9%

Chapter 2 The End