CHAPTER 17 Types of Credit Structure INTRODUCTION The

- Slides: 8

CHAPTER 17 Types of Credit Structure

INTRODUCTION The amount of credit risk depends largely on the structure of the agreement between the bank and its customers For example, in a loan, the amount that the customer owes is fixed, whereas in a line of credit, the customer chooses how much to borrow each month An agreement between a bank and a customer that creates credit exposure is often called a credit structure or a credit facility

INTRODUCTION For a single facility, there are three parameters that are important in quantifying the credit risk The exposure at default (EAD) n The loss in the event of default (LIED) n The probability of default (PO) n n The probability of default is also known as the default rate or the expected default frequency (EDF). It is most strongly associated with the characteristics of the counterparty or customer

INTRODUCTION The exposure at default (EAD) is also known as the loan equivalence (LEQ) and is the outstanding amount at the time of default The loss in the event of default (LIED) is the loss as a percentage of the EAD It is also known as loss given default (LGD) or severity (S)

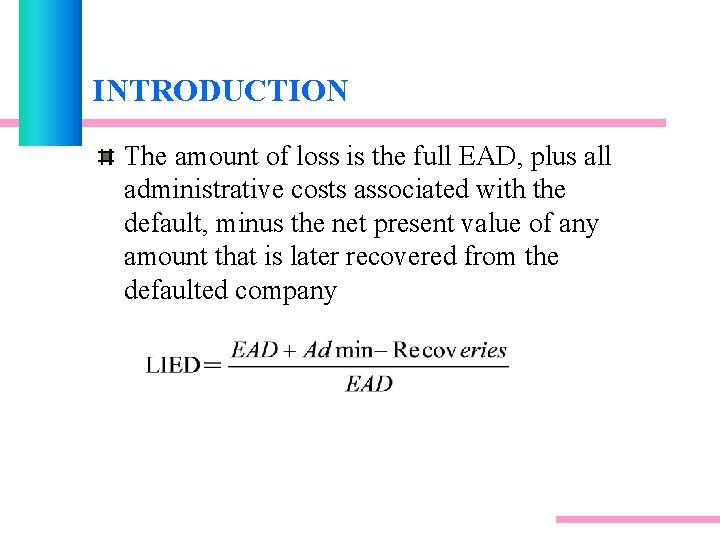

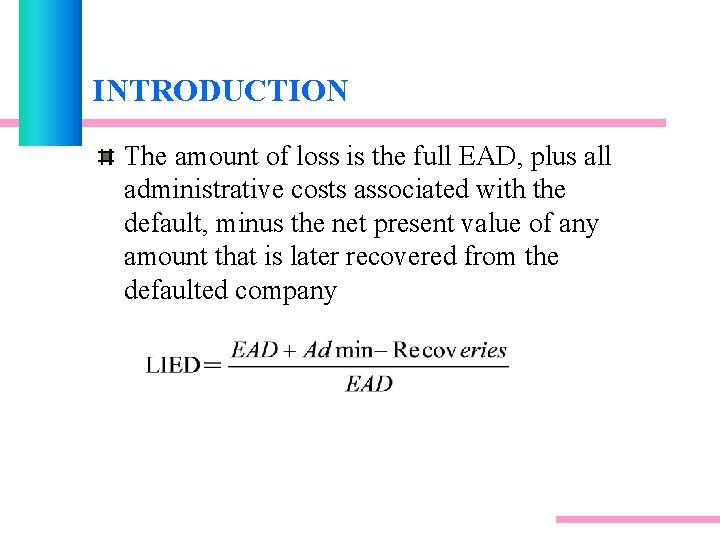

INTRODUCTION The amount of loss is the full EAD, plus all administrative costs associated with the default, minus the net present value of any amount that is later recovered from the defaulted company

INTRODUCTION The EAD and LIED are strongly influenced by the type of credit structure In discussing the alternative types of credit, we focus on how the structure affects these two loss parameters

INTRODUCTION The credit structures discussed in this chapter are as follows: Credit exposures to large corporations � Commercial loans � Commercial lines � Letters of credit and guarantees. Leases � Credit derivatives Credit exposures to retail customers � Personal loans � Credit cards � Car loans Leases and hire-purchase agreements � Mortgages � Home-equity lines of credit

INTRODUCTION Credit exposures in trading operations � Bonds � Asset-backed securities � Securities lending and repos � Margin accounts � Credit exposure for derivatives u Please refer to Page 233 to 253 for the detail