CHAPTER 17 DIVIDEND POLICY DIVIDEND POLICY Dividend Payout

- Slides: 17

CHAPTER 17 DIVIDEND POLICY

DIVIDEND POLICY Dividend Payout Ratio (DPR): the amount of dividend relative to the company’s net income or EPS. The trade-offs in setting a firm’s dividend policy: 1. If a company pays a large dividend, it will therefore: a. Have a low retention of profits within the firm b. Need to rely heavily on a new common stock issue for equity financing. 2. If a company pays a small dividend, it will therefore: 1. Have a high retention of profits within the firm 2. Will not need to rely heavily on a new common stock issue for equity financing. The profits retained for reinvestment will provide the needed equity financing.

DIVIDEND POLICY 3 views about the importance of a firm’s dividend policy: i. Dividend do not matter: Assumes that the dividend decision does not change the firm’s capital budgeting and financing decisions. b. Assumes perfect capital markets, which means: 1) There are no brokerage commissions when investors buy and sell stocks. 2) New securities can be issued without incurring any flotation costs. 3) There are no personal or corporate income taxes. 4) Complete information about the firm is free and equally readily available to all investors. 5) There are no conflicts of interest between management and stockholders. 6) Financial distress and bankruptcy costs are none existent. a.

DIVIDEND POLICY High dividends increase stock value a. Concept of ‘bird-in-the-hand’ - the dividend income has a higher value to the investor than does capital gain income, because dividends are more certain the capital gains. b. Criticisms: 1) No impact on the riskiness of the firm. 2) Increasing a firm’s dividend does not reduce the basic riskiness of the stock; rather, if dividend payment requires management to issue new stock, it only transfers risk and ownership from the current owners to the new owners. iii. Low dividends increase stock price - If earnings are retained within the firm, the stock price increase, but the increased is not taxed until the stock is sold. ii.

DIVIDEND POLICY Cash dividend Payment Procedures – the amount to pays cash dividends to corporate stockholders is decided by the firm’s board of director at quarterly or semiannual meetings. i. Amount of dividends ii. Relevant date o Declaration date – the date upon which a dividend is formally declared by the B. O. D o Date of record (dividends) - set by the firm’s directors, the date on which all persons whose names are recorded as stockholders receive a declared dividend at a specified future time. o Ex dividend date – the date upon which stock brokerage companies have uniformly decide to terminate the right of ownership to the dividend, which is 4 days prior to the record date. o Payment date – set by the firm’s directors, the actual date on which the firm mails the dividend payment to the holders of

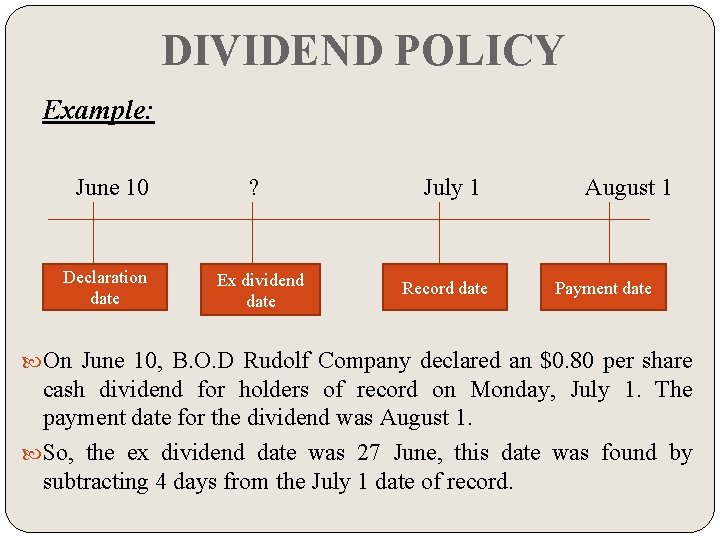

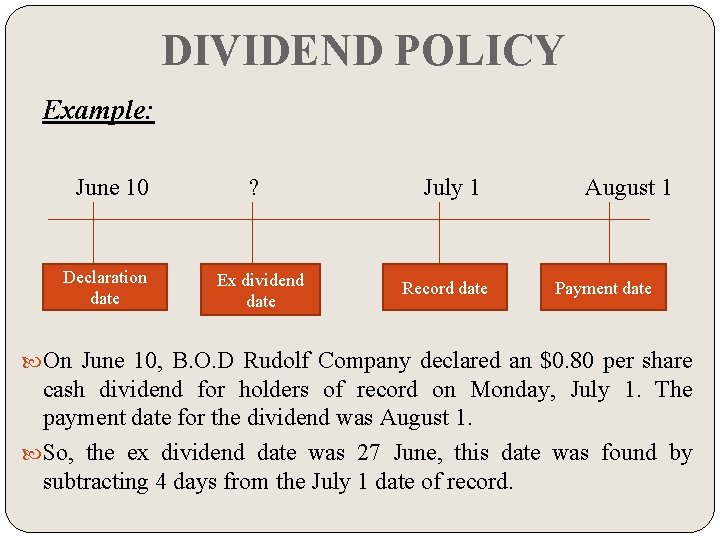

DIVIDEND POLICY Example: June 10 Declaration date ? Ex dividend date July 1 Record date August 1 Payment date On June 10, B. O. D Rudolf Company declared an $0. 80 per share cash dividend for holders of record on Monday, July 1. The payment date for the dividend was August 1. So, the ex dividend date was 27 June, this date was found by subtracting 4 days from the July 1 date of record.

DIVIDEND POLICY Dividend Reinvestment Plans (DRIPs) - enables stockholders to use dividends received on the firm’s stock to acquire additional shares at little or no transaction cost. Factors Affecting Dividend Policy – the firm’s plan of action to be followed whenever a dividend decision is made. Contractual Constraints - restrictive provisions in a loan agreement. ii. Liquidity iii. Owner Control iv. Growth Prospect v. Lack of other sources of financing or cost incurred when take other sources i.

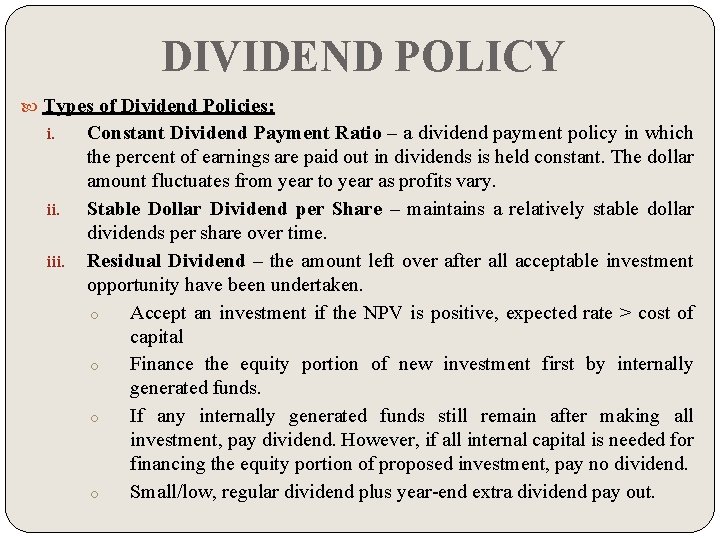

DIVIDEND POLICY Types of Dividend Policies: i. ii. iii. Constant Dividend Payment Ratio – a dividend payment policy in which the percent of earnings are paid out in dividends is held constant. The dollar amount fluctuates from year to year as profits vary. Stable Dollar Dividend per Share – maintains a relatively stable dollar dividends per share over time. Residual Dividend – the amount left over after all acceptable investment opportunity have been undertaken. o Accept an investment if the NPV is positive, expected rate > cost of capital o Finance the equity portion of new investment first by internally generated funds. o If any internally generated funds still remain after making all investment, pay dividend. However, if all internal capital is needed for financing the equity portion of proposed investment, pay no dividend. o Small/low, regular dividend plus year-end extra dividend pay out.

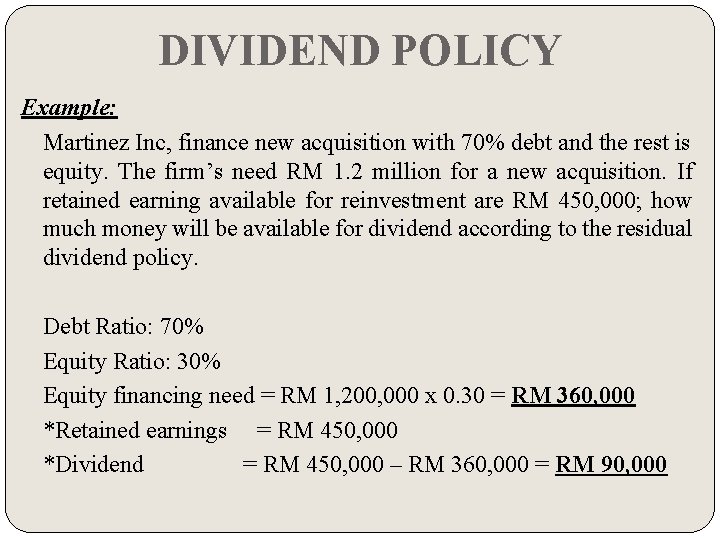

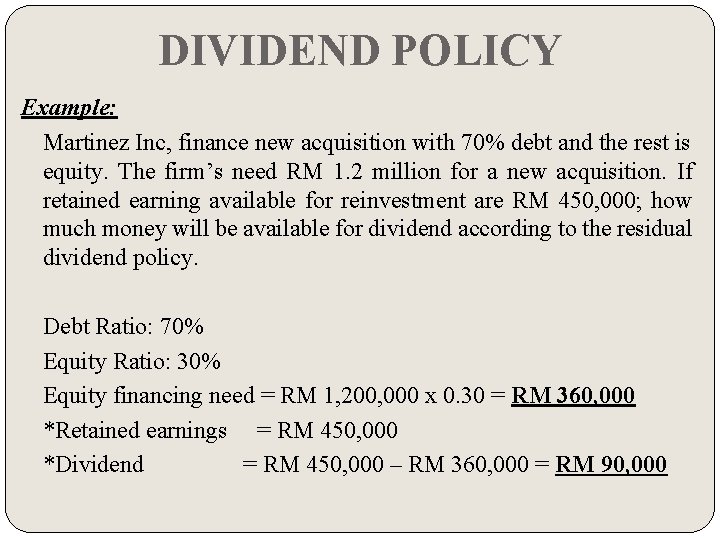

DIVIDEND POLICY Example: Martinez Inc, finance new acquisition with 70% debt and the rest is equity. The firm’s need RM 1. 2 million for a new acquisition. If retained earning available for reinvestment are RM 450, 000; how much money will be available for dividend according to the residual dividend policy. Debt Ratio: 70% Equity Ratio: 30% Equity financing need = RM 1, 200, 000 x 0. 30 = RM 360, 000 *Retained earnings = RM 450, 000 *Dividend = RM 450, 000 – RM 360, 000 = RM 90, 000

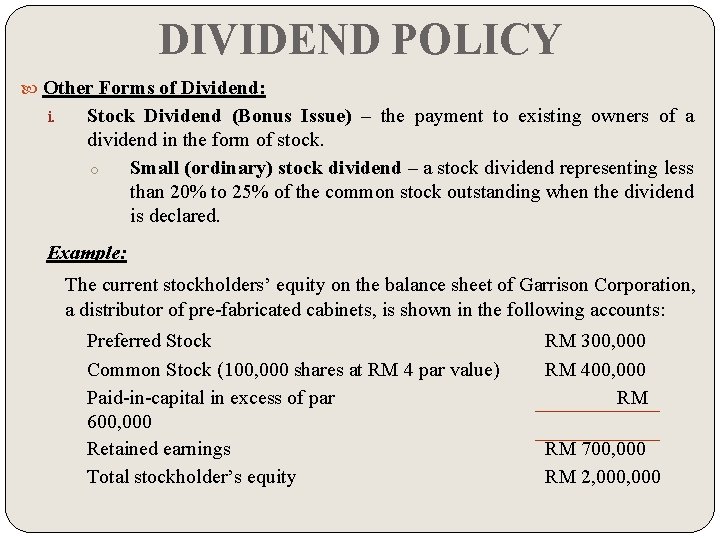

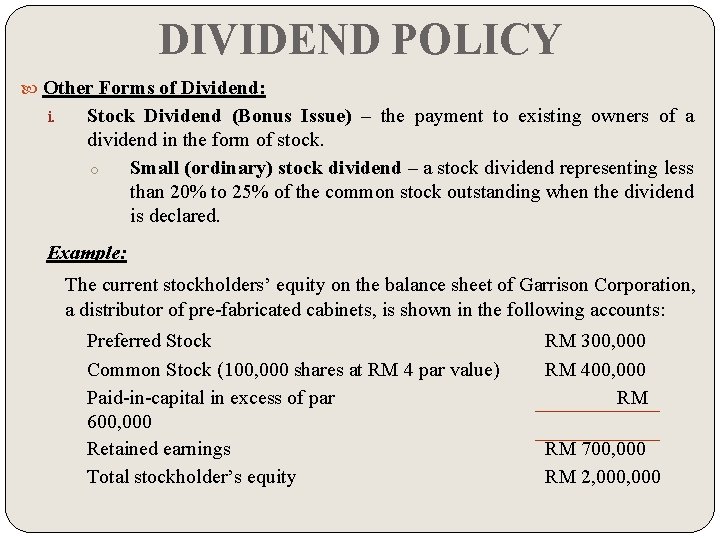

DIVIDEND POLICY Other Forms of Dividend: i. Stock Dividend (Bonus Issue) – the payment to existing owners of a dividend in the form of stock. o Small (ordinary) stock dividend – a stock dividend representing less than 20% to 25% of the common stock outstanding when the dividend is declared. Example: The current stockholders’ equity on the balance sheet of Garrison Corporation, a distributor of pre-fabricated cabinets, is shown in the following accounts: Preferred Stock Common Stock (100, 000 shares at RM 4 par value) Paid-in-capital in excess of par 600, 000 Retained earnings Total stockholder’s equity RM 300, 000 RM 400, 000 RM RM 700, 000 RM 2, 000

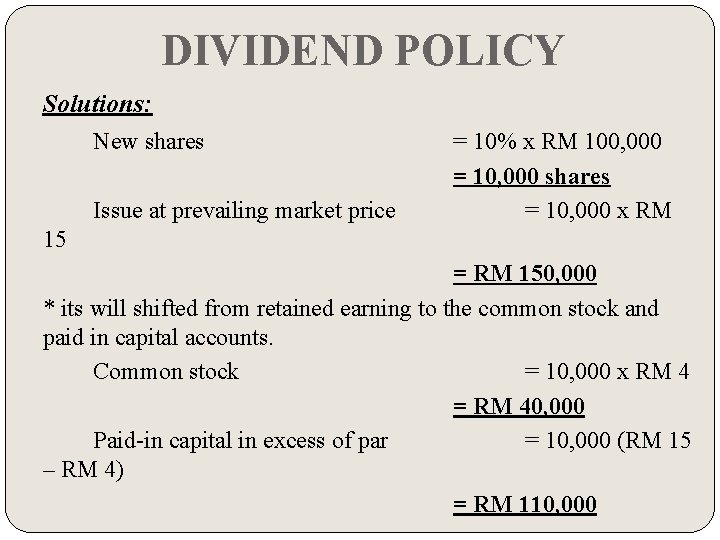

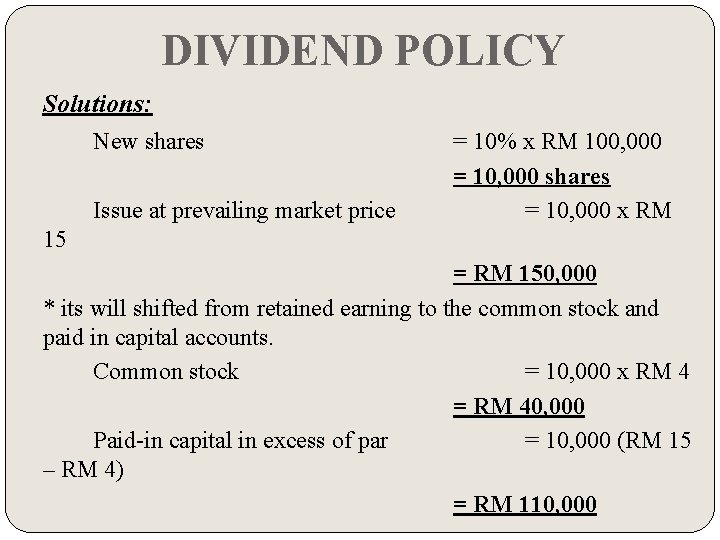

DIVIDEND POLICY Solutions: New shares Issue at prevailing market price = 10% x RM 100, 000 = 10, 000 shares = 10, 000 x RM 15 = RM 150, 000 * its will shifted from retained earning to the common stock and paid in capital accounts. Common stock = 10, 000 x RM 4 = RM 40, 000 Paid-in capital in excess of par = 10, 000 (RM 15 – RM 4) = RM 110, 000

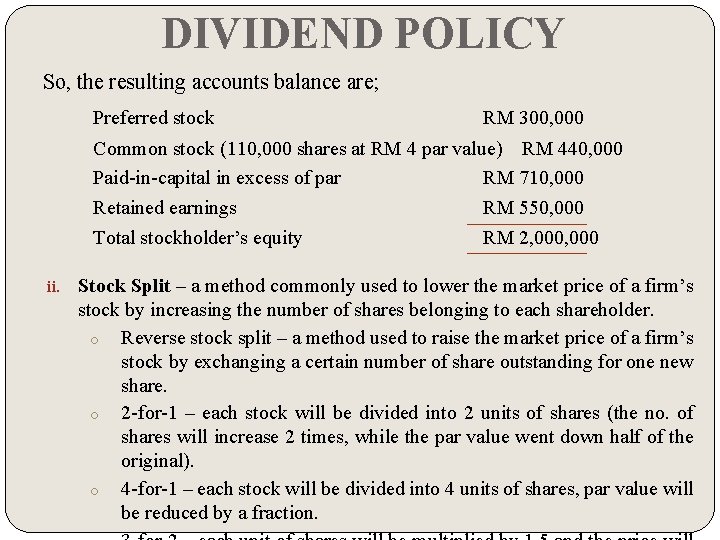

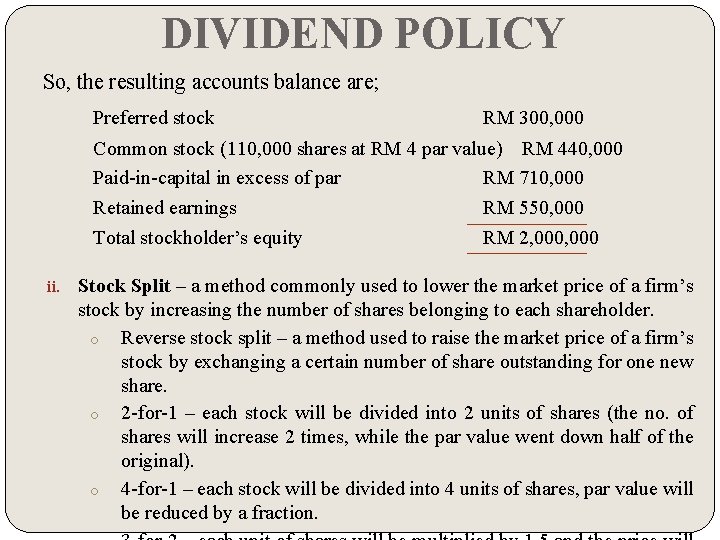

DIVIDEND POLICY So, the resulting accounts balance are; Preferred stock RM 300, 000 Common stock (110, 000 shares at RM 4 par value) RM 440, 000 Paid-in-capital in excess of par RM 710, 000 Retained earnings RM 550, 000 Total stockholder’s equity RM 2, 000 ii. Stock Split – a method commonly used to lower the market price of a firm’s stock by increasing the number of shares belonging to each shareholder. o Reverse stock split – a method used to raise the market price of a firm’s stock by exchanging a certain number of share outstanding for one new share. o 2 -for-1 – each stock will be divided into 2 units of shares (the no. of shares will increase 2 times, while the par value went down half of the original). o 4 -for-1 – each stock will be divided into 4 units of shares, par value will be reduced by a fraction.

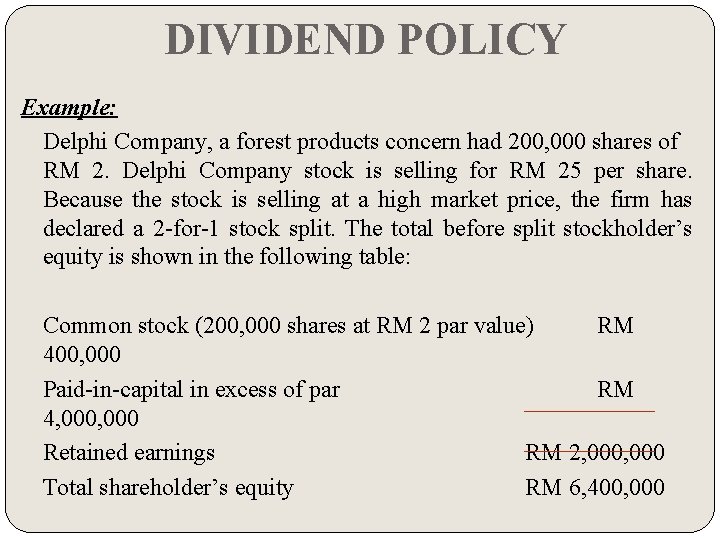

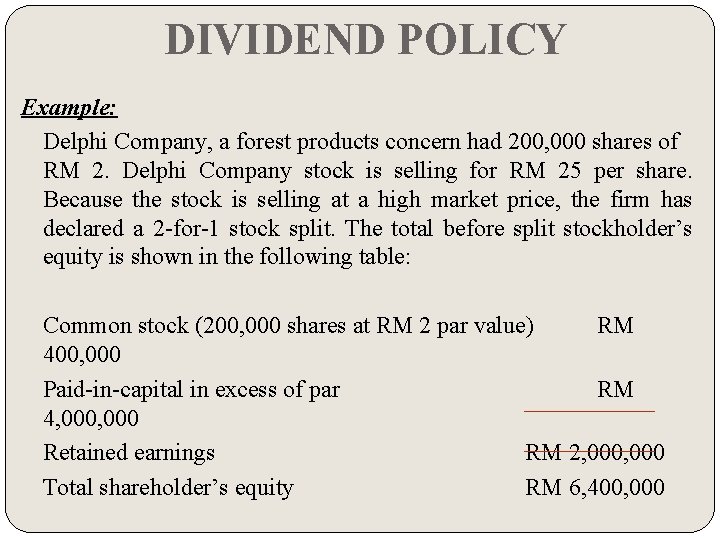

DIVIDEND POLICY Example: Delphi Company, a forest products concern had 200, 000 shares of RM 2. Delphi Company stock is selling for RM 25 per share. Because the stock is selling at a high market price, the firm has declared a 2 -for-1 stock split. The total before split stockholder’s equity is shown in the following table: Common stock (200, 000 shares at RM 2 par value) RM 400, 000 Paid-in-capital in excess of par RM 4, 000 Retained earnings RM 2, 000 Total shareholder’s equity RM 6, 400, 000

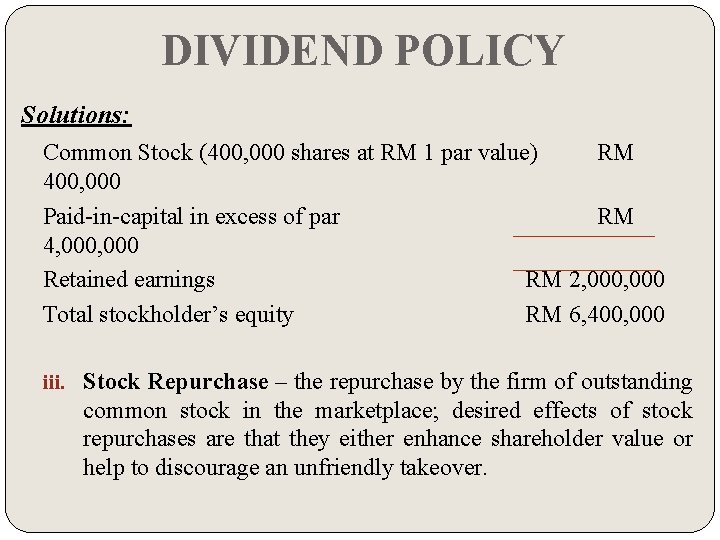

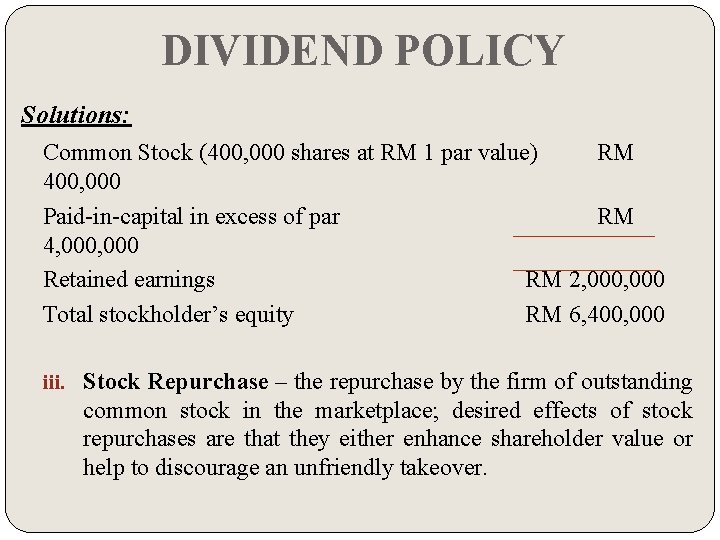

DIVIDEND POLICY Solutions: Common Stock (400, 000 shares at RM 1 par value) RM 400, 000 Paid-in-capital in excess of par RM 4, 000 Retained earnings RM 2, 000 Total stockholder’s equity RM 6, 400, 000 iii. Stock Repurchase – the repurchase by the firm of outstanding common stock in the marketplace; desired effects of stock repurchases are that they either enhance shareholder value or help to discourage an unfriendly takeover.

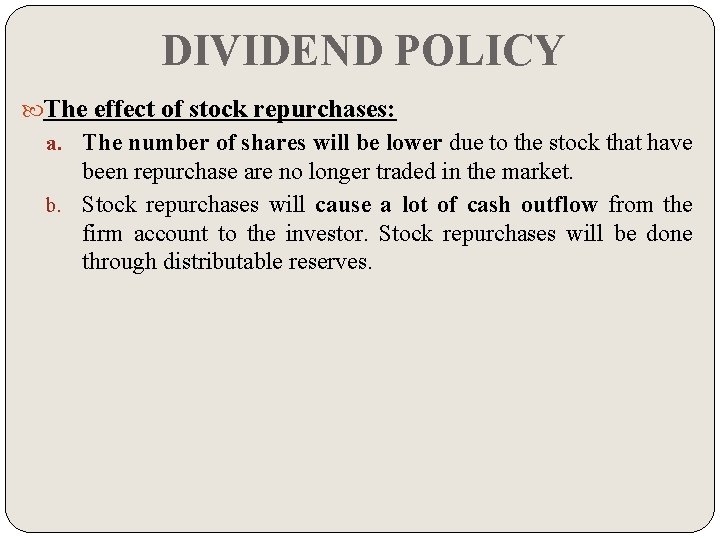

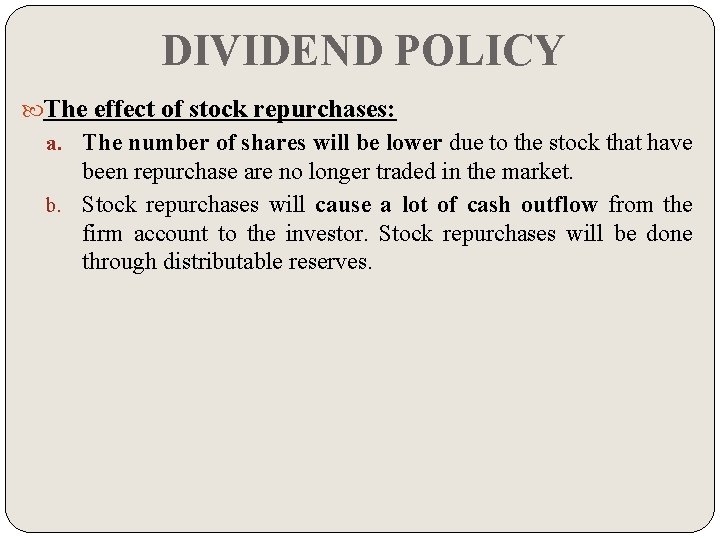

DIVIDEND POLICY The effect of stock repurchases: a. The number of shares will be lower due to the stock that have been repurchase are no longer traded in the market. b. Stock repurchases will cause a lot of cash outflow from the firm account to the investor. Stock repurchases will be done through distributable reserves.

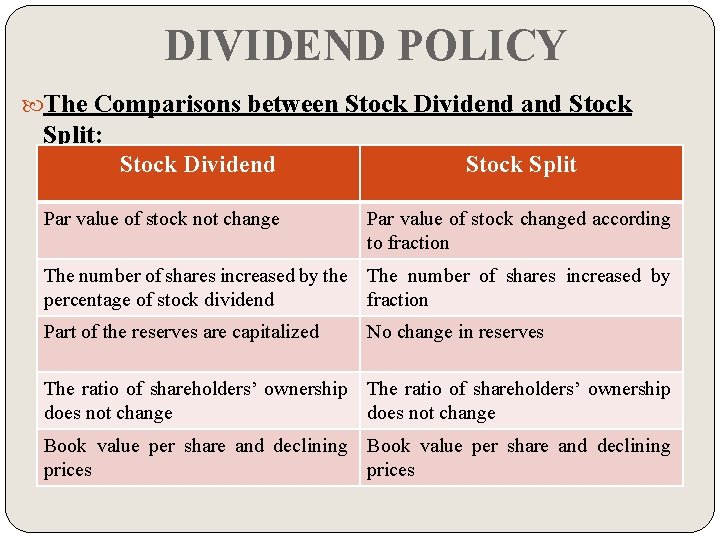

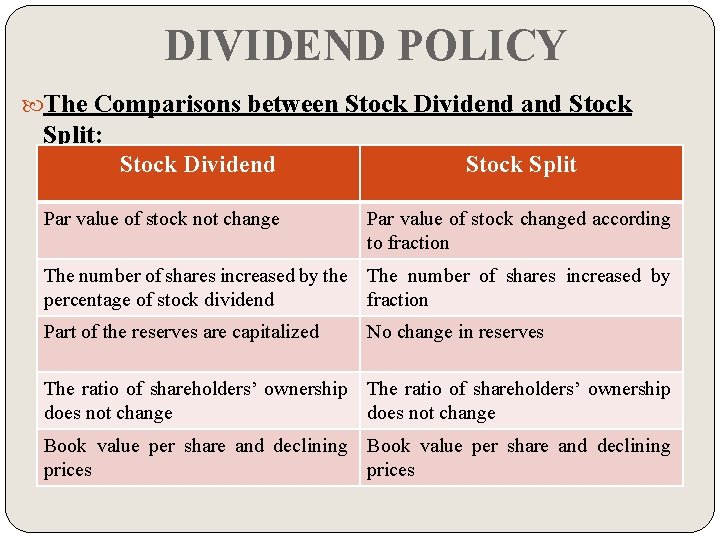

DIVIDEND POLICY The Comparisons between Stock Dividend and Stock Split: Stock Dividend Par value of stock not change Stock Split Par value of stock changed according to fraction The number of shares increased by the The number of shares increased by percentage of stock dividend fraction Part of the reserves are capitalized No change in reserves The ratio of shareholders’ ownership does not change Book value per share and declining prices

THE END