CHAPTER 16 PRODUCT COSTING SYSTEMS IN MANUFACTURING OPERATIONS

- Slides: 30

CHAPTER 16 PRODUCT COSTING SYSTEMS IN MANUFACTURING OPERATIONS 1

Chapter Overview q How does the way a manufacturing company determine the cost of its inventory and cost of goods sold differ from the way a merchandising company determines them? q How does a cost accounting system help a manufacturing company assign costs to its products? q Since factory overhead is not a physical part of the product, how does a company include the cost of overhead in the cost of its products? 2

Chapter Overview q Why is there more than one type of cost accounting system? q What is a job order cost accounting system, and how does a company use this system? q What is a process cost accounting system, and how does a company use this system? 3

Cost Accounting Systems q Cost accounting systems track the flow of manufacturing inputs through the manufacturing process. q As raw materials, direct labor, and factory overhead inputs move through the manufacturing process, the costs of manufacturing the products are accumulated. q Cost accounting systems accumulate and track this activity. 4

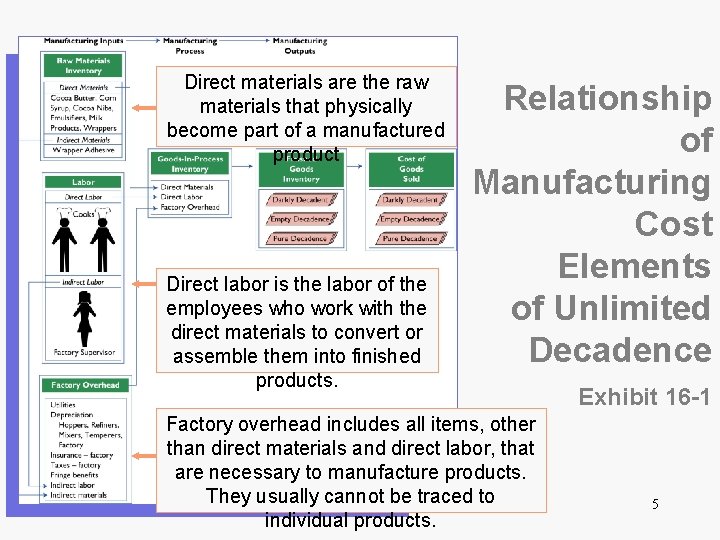

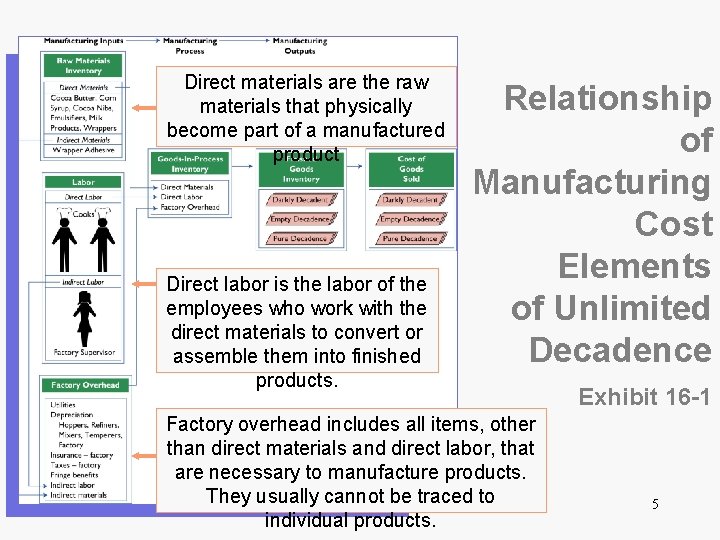

Direct materials are the raw materials that physically become part of a manufactured product Direct labor is the labor of the employees who work with the direct materials to convert or assemble them into finished products. Relationship of Manufacturing Cost Elements of Unlimited Decadence Factory overhead includes all items, other than direct materials and direct labor, that are necessary to manufacture products. They usually cannot be traced to individual products. Exhibit 16 -1 5

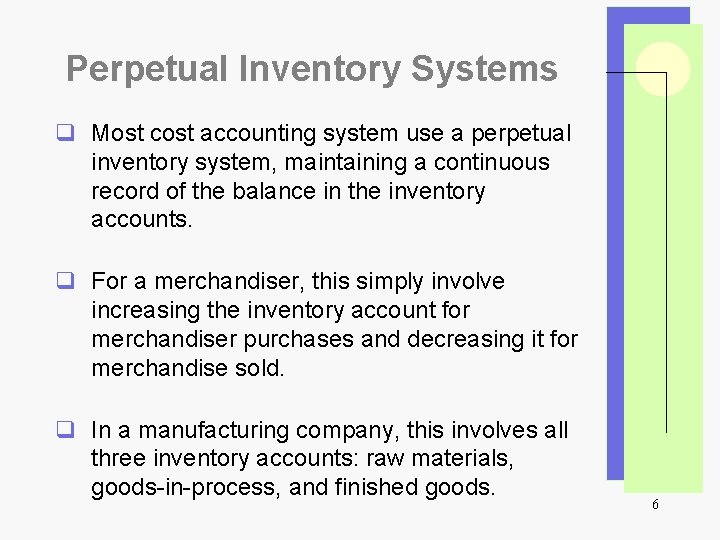

Perpetual Inventory Systems q Most cost accounting system use a perpetual inventory system, maintaining a continuous record of the balance in the inventory accounts. q For a merchandiser, this simply involve increasing the inventory account for merchandiser purchases and decreasing it for merchandise sold. q In a manufacturing company, this involves all three inventory accounts: raw materials, goods-in-process, and finished goods. 6

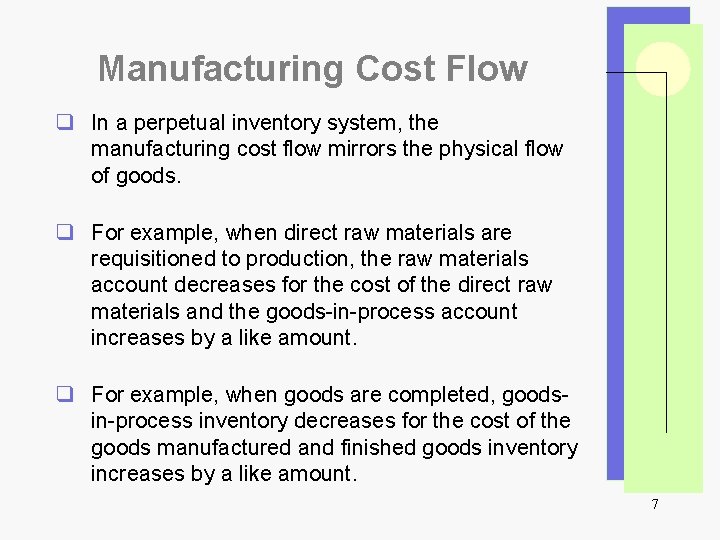

Manufacturing Cost Flow q In a perpetual inventory system, the manufacturing cost flow mirrors the physical flow of goods. q For example, when direct raw materials are requisitioned to production, the raw materials account decreases for the cost of the direct raw materials and the goods-in-process account increases by a like amount. q For example, when goods are completed, goodsin-process inventory decreases for the cost of the goods manufactured and finished goods inventory increases by a like amount. 7

Cost Accounting Systems q Two different types of cost accounting systems are used, depending on the nature of the manufacturing process. q Job-order cost systems accumulate and track the cost of products by job. Each job is unique and easily identifiable. q Process costing systems accumulate and track the cost of products by process. Products are homogeneous and may go through one or several different processes until a finished product is obtained. 8

Job Order Cost Systems q When a company manufactures one unit of a unique product or manufactures a unique group of products, it treats that unit or group as a job order. q Examples of different “jobs” include a construction project, a custom set of kitchen cabinets, an audit by a public accounting firm, or the first printing of a textbook in a publishing company. q It is easy to determine when a job starts and when it ends because each job is unique. 9

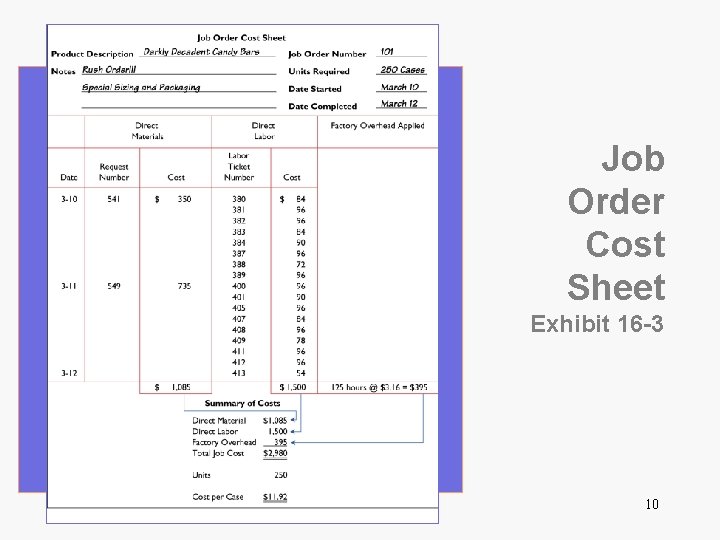

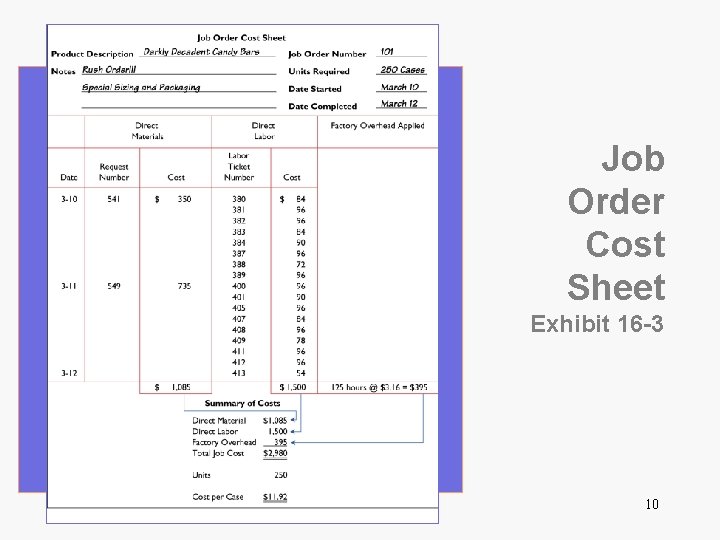

Job Order Cost Sheet Exhibit 16 -3 10

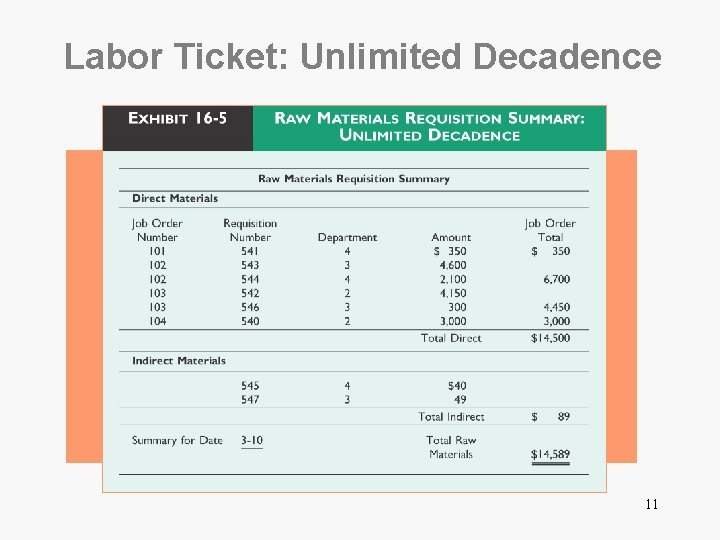

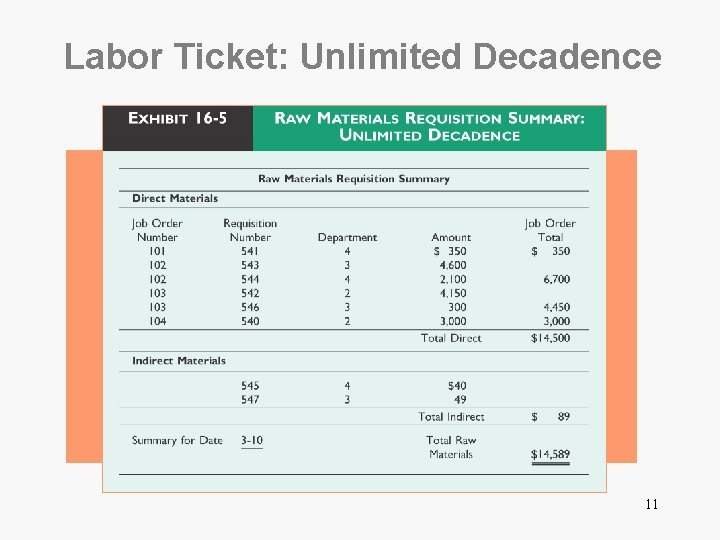

Labor Ticket: Unlimited Decadence 11

Factory Overhead Allocation q While direct materials and direct labor are easy to track and can be assigned to jobs through the raw materials requisition and labor ticket forms, factory overhead is more difficult. q Factory overhead includes all of the indirect cost of manufacturing all jobs, such as indirect materials and labor, factory rent, depreciation, insurance and other factory operating costs. q These cost can’t be allocate on a job specific basis, but are instead allocated based on a predetermined overhead rate. 12

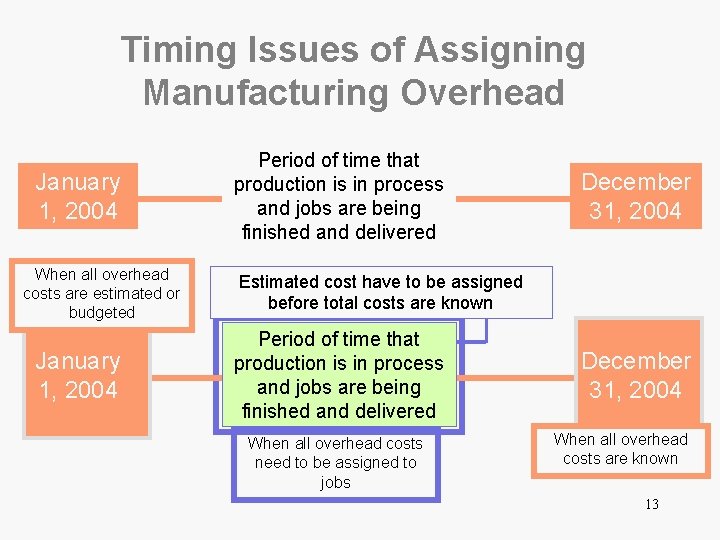

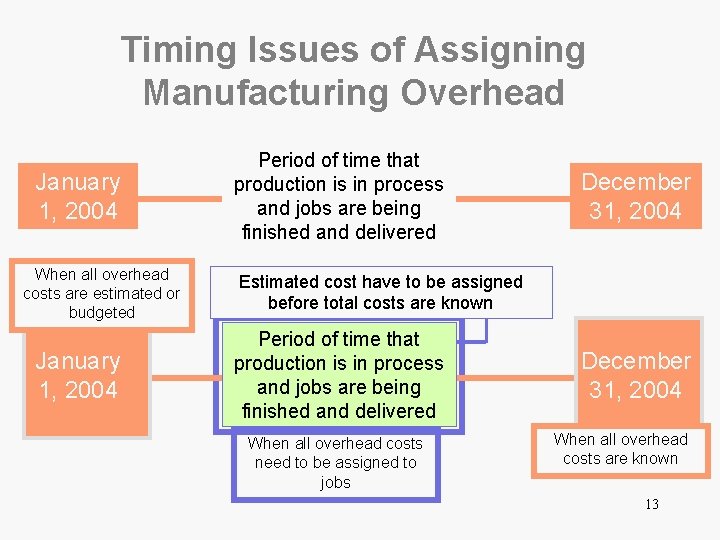

Timing Issues of Assigning Manufacturing Overhead January 1, 2004 When all overhead costs are estimated or budgeted January 1, 2004 Period of time that production is in process and jobs are being finished and delivered December 31, 2004 Estimated cost have to be assigned before total costs are known Period of time that production is in process and jobs are being finished and delivered When all overhead costs need to be assigned to jobs December 31, 2004 When all overhead costs are known 13

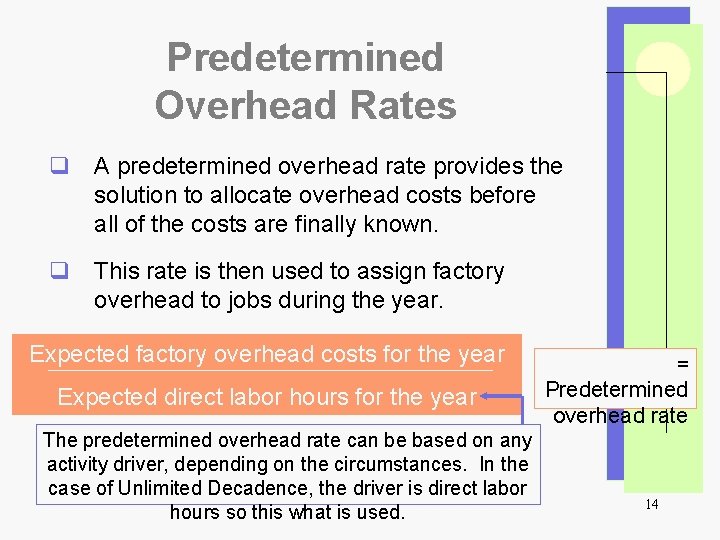

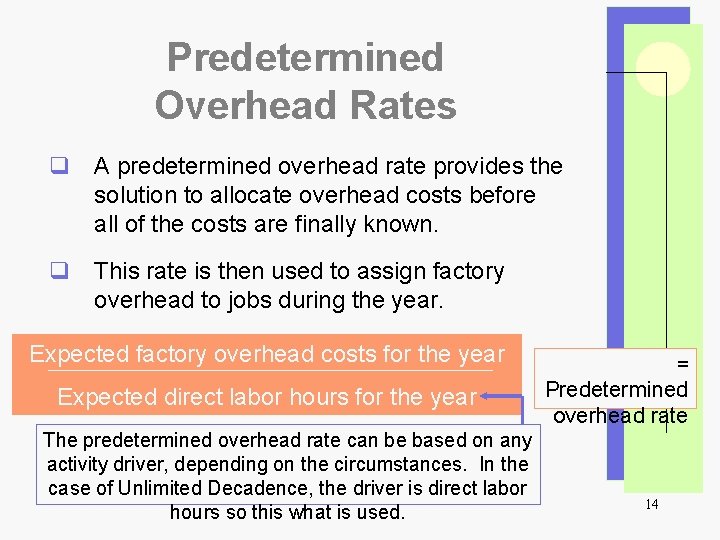

Predetermined Overhead Rates q A predetermined overhead rate provides the solution to allocate overhead costs before all of the costs are finally known. q This rate is then used to assign factory overhead to jobs during the year. Expected factory overhead costs for the year Expected direct labor hours for the year The predetermined overhead rate can be based on any activity driver, depending on the circumstances. In the case of Unlimited Decadence, the driver is direct labor hours so this what is used. = Predetermined overhead rate 14

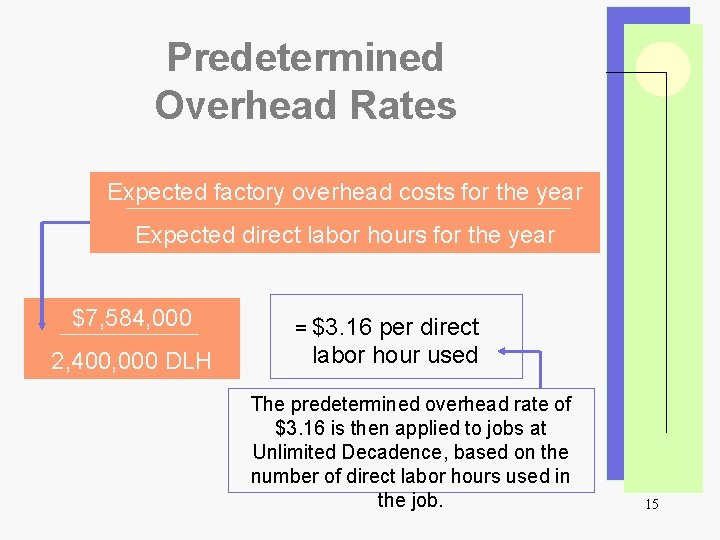

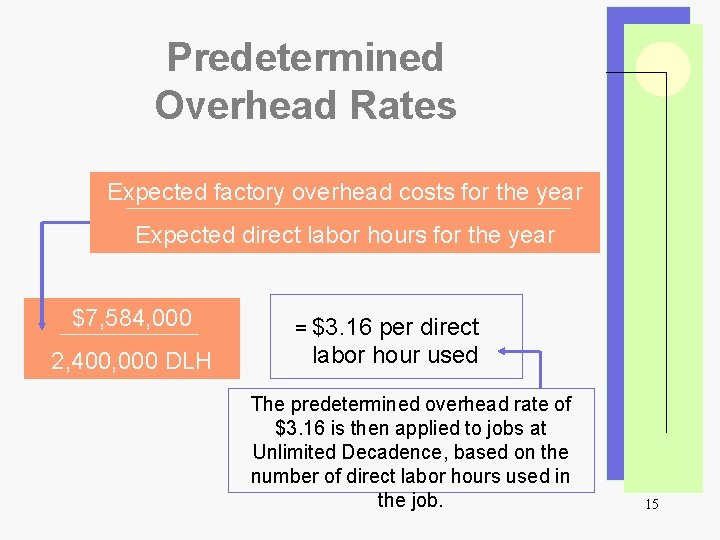

Predetermined Overhead Rates Expected factory overhead costs for the year Expected direct labor hours for the year $7, 584, 000 2, 400, 000 DLH = $3. 16 per direct labor hour used The predetermined overhead rate of $3. 16 is then applied to jobs at Unlimited Decadence, based on the number of direct labor hours used in the job. 15

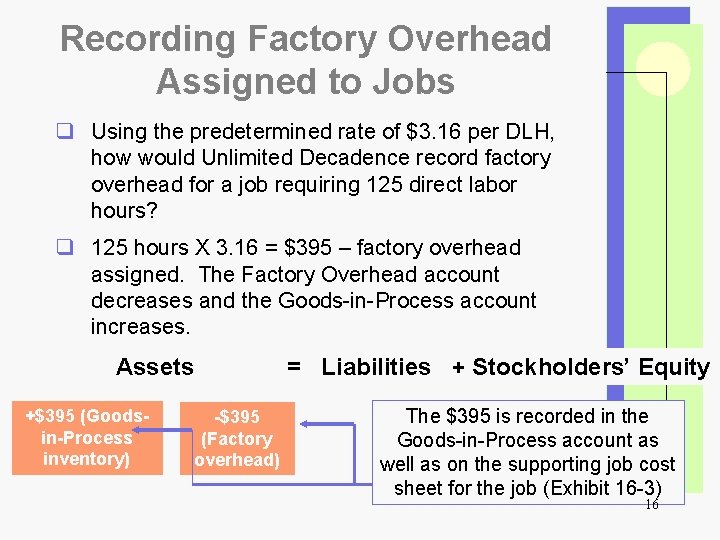

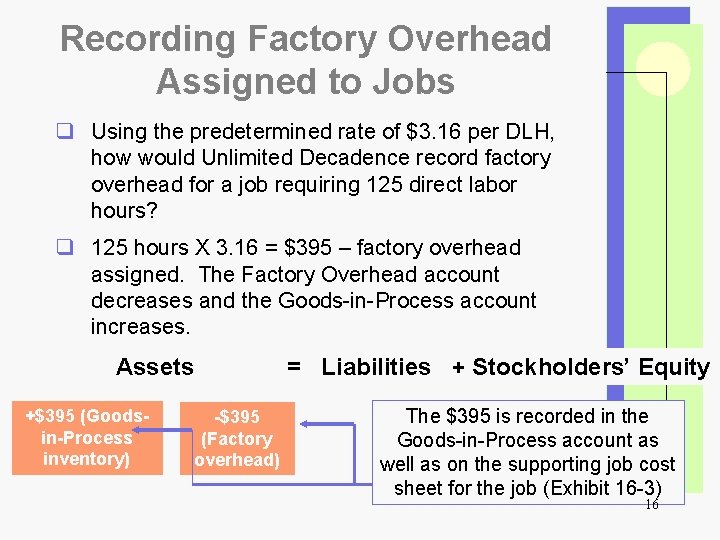

Recording Factory Overhead Assigned to Jobs q Using the predetermined rate of $3. 16 per DLH, how would Unlimited Decadence record factory overhead for a job requiring 125 direct labor hours? q 125 hours X 3. 16 = $395 – factory overhead assigned. The Factory Overhead account decreases and the Goods-in-Process account increases. Assets +$395 (Goodsin-Process inventory) -$395 (Factory overhead) = Liabilities + Stockholders’ Equity The $395 is recorded in the Goods-in-Process account as well as on the supporting job cost sheet for the job (Exhibit 16 -3) 16

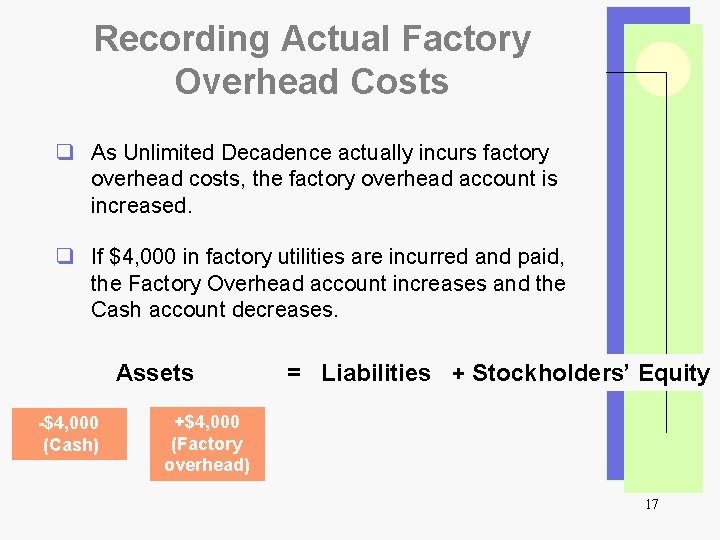

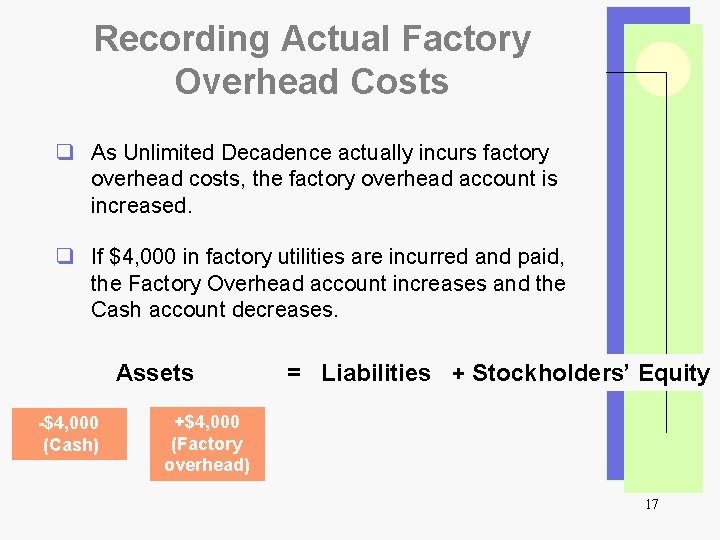

Recording Actual Factory Overhead Costs q As Unlimited Decadence actually incurs factory overhead costs, the factory overhead account is increased. q If $4, 000 in factory utilities are incurred and paid, the Factory Overhead account increases and the Cash account decreases. Assets -$4, 000 (Cash) = Liabilities + Stockholders’ Equity +$4, 000 (Factory overhead) 17

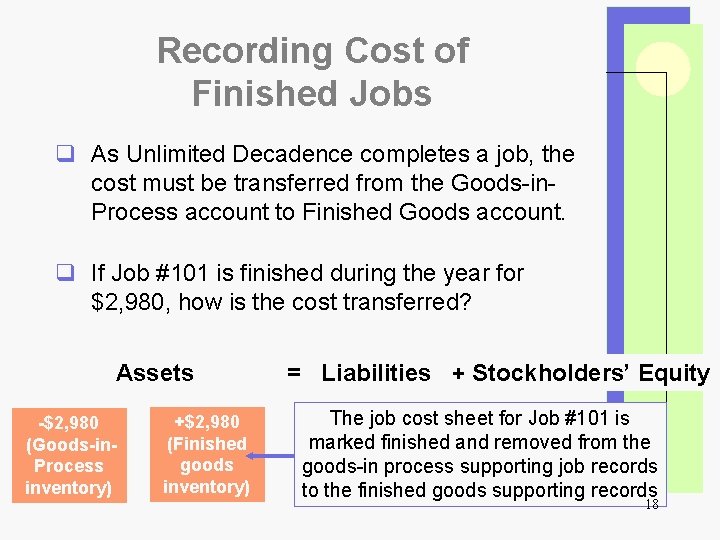

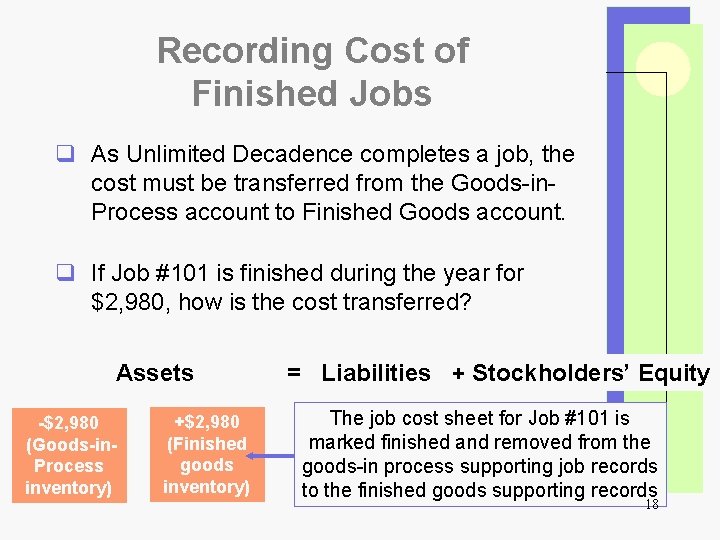

Recording Cost of Finished Jobs q As Unlimited Decadence completes a job, the cost must be transferred from the Goods-in. Process account to Finished Goods account. q If Job #101 is finished during the year for $2, 980, how is the cost transferred? Assets -$2, 980 (Goods-in. Process inventory) +$2, 980 (Finished goods inventory) = Liabilities + Stockholders’ Equity The job cost sheet for Job #101 is marked finished and removed from the goods-in process supporting job records to the finished goods supporting records 18

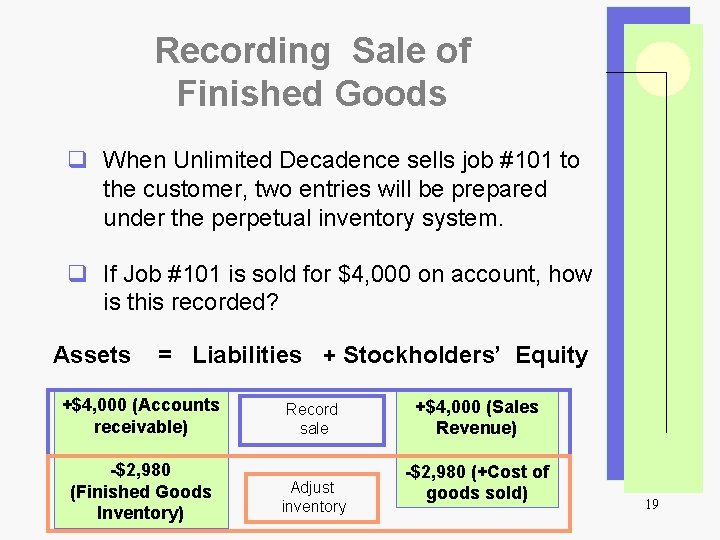

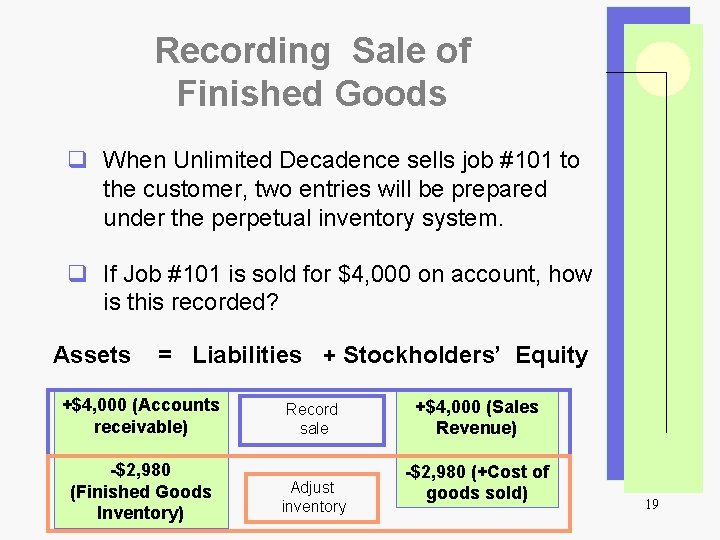

Recording Sale of Finished Goods q When Unlimited Decadence sells job #101 to the customer, two entries will be prepared under the perpetual inventory system. q If Job #101 is sold for $4, 000 on account, how is this recorded? Assets = Liabilities + Stockholders’ Equity +$4, 000 (Accounts receivable) -$2, 980 (Finished Goods Inventory) Record sale Adjust inventory +$4, 000 (Sales Revenue) -$2, 980 (+Cost of goods sold) 19

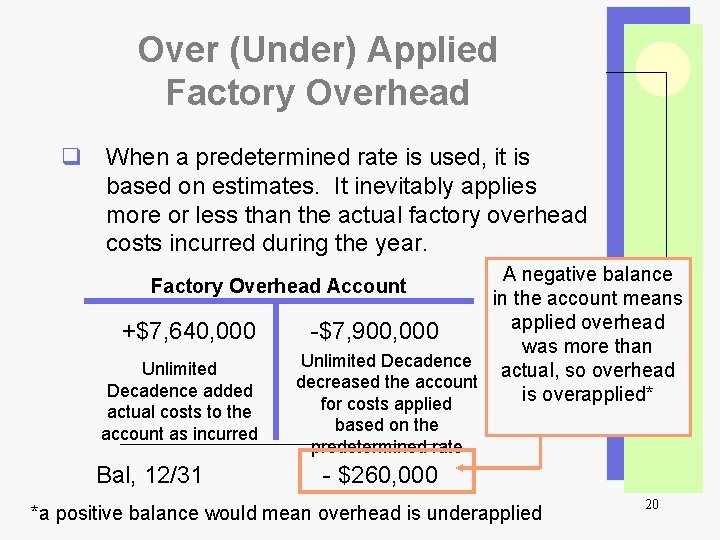

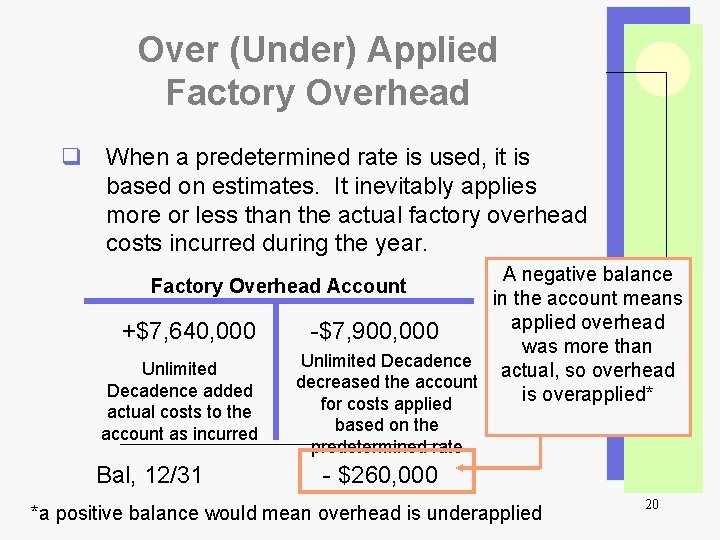

Over (Under) Applied Factory Overhead q When a predetermined rate is used, it is based on estimates. It inevitably applies more or less than the actual factory overhead costs incurred during the year. A negative balance in the account means applied overhead -$7, 900, 000 was more than Unlimited Decadence actual, so overhead decreased the account is overapplied* for costs applied Factory Overhead Account +$7, 640, 000 Unlimited Decadence added actual costs to the account as incurred Bal, 12/31 based on the predetermined rate - $260, 000 *a positive balance would mean overhead is underapplied 20

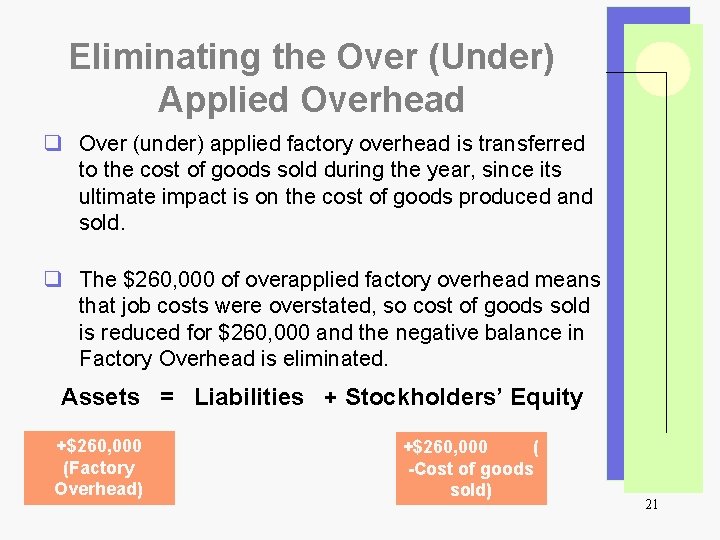

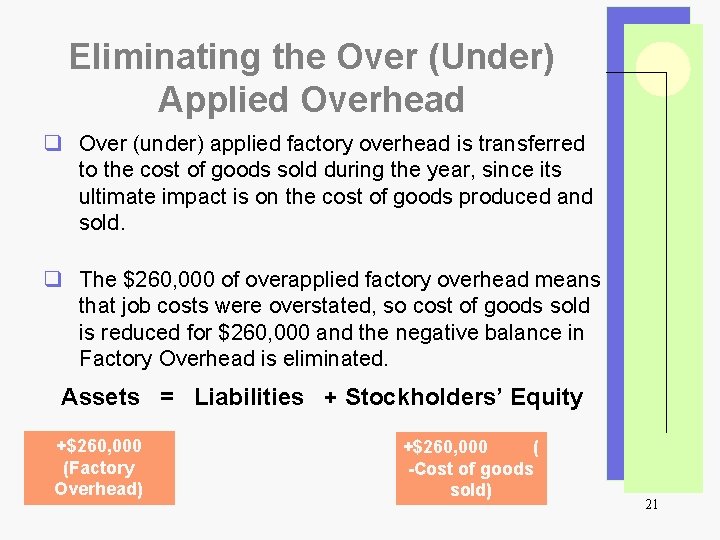

Eliminating the Over (Under) Applied Overhead q Over (under) applied factory overhead is transferred to the cost of goods sold during the year, since its ultimate impact is on the cost of goods produced and sold. q The $260, 000 of overapplied factory overhead means that job costs were overstated, so cost of goods sold is reduced for $260, 000 and the negative balance in Factory Overhead is eliminated. Assets = Liabilities + Stockholders’ Equity +$260, 000 (Factory Overhead) +$260, 000 ( -Cost of goods sold) 21

Process Cost Systems q When a company manufactures large volumes of identical units of products, a process cost accounting system is used. q A process cost accounting system keeps track of the costs applied through one or more manufacturing processes until the finished product is made. Costs are accumulated by process, not by job. q In a process cost system, direct labor and factory overhead are grouped together as “conversion costs. ” This becomes important when there are unfinished units in the inventory. 22

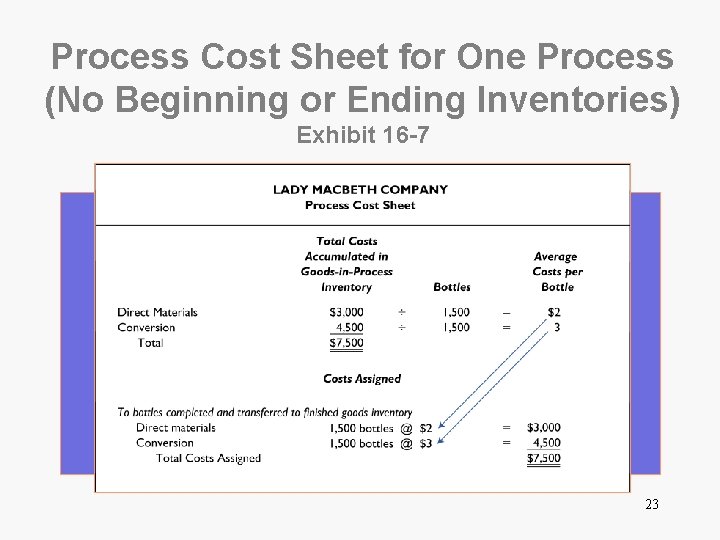

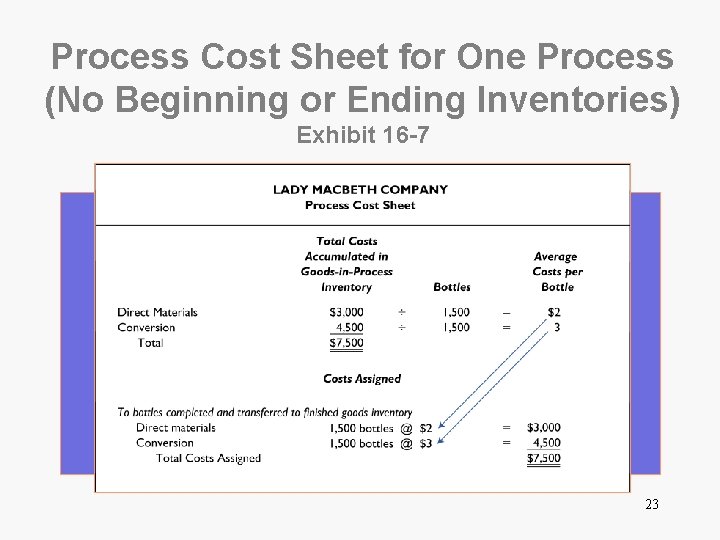

Process Cost Sheet for One Process (No Beginning or Ending Inventories) Exhibit 16 -7 23

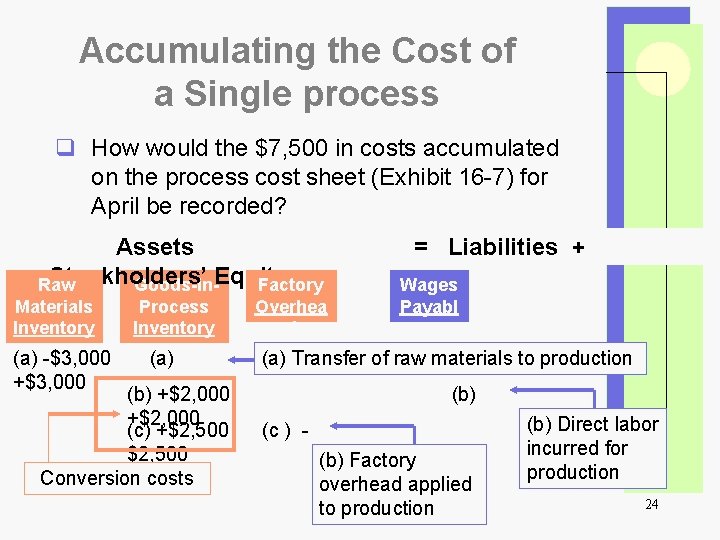

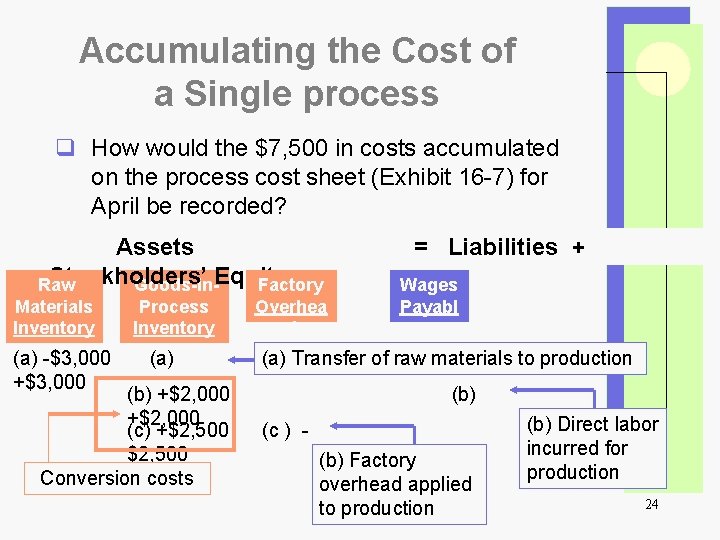

Accumulating the Cost of a Single process q How would the $7, 500 in costs accumulated on the process cost sheet (Exhibit 16 -7) for April be recorded? Assets Stockholders’ Raw Goods-in-Equity Factory Materials Inventory (a) -$3, 000 +$3, 000 Process Inventory (a) (b) +$2, 000 (c) +$2, 500 Conversion costs Overhea d = Liabilities + Wages Payabl e (a) Transfer of raw materials to production (b) (c ) (b) Factory overhead applied to production (b) Direct labor incurred for production 24

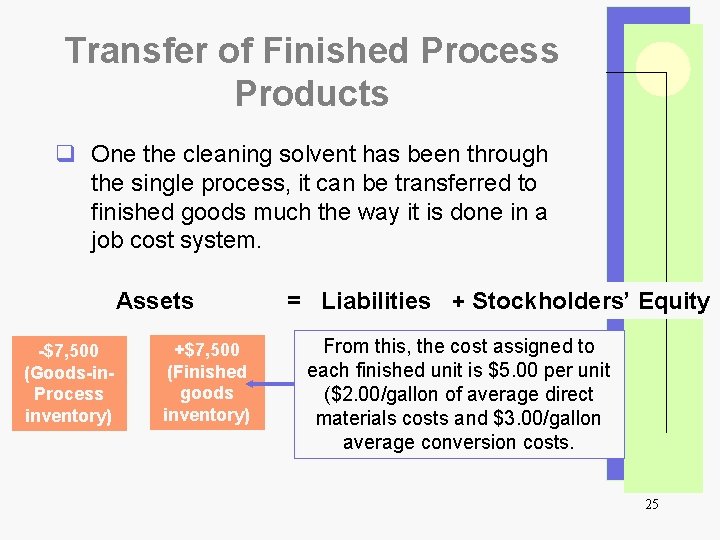

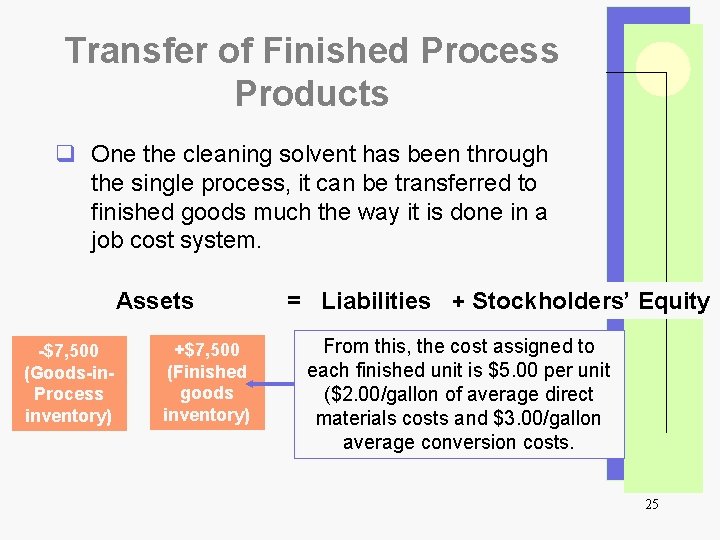

Transfer of Finished Process Products q One the cleaning solvent has been through the single process, it can be transferred to finished goods much the way it is done in a job cost system. Assets -$7, 500 (Goods-in. Process inventory) +$7, 500 (Finished goods inventory) = Liabilities + Stockholders’ Equity From this, the cost assigned to each finished unit is $5. 00 per unit ($2. 00/gallon of average direct materials costs and $3. 00/gallon average conversion costs. 25

Equivalent Units q Because manufacturing a product takes time and because production is continuous, often there are unfinished units in the ending Goods-in-Process Inventory account. q When this occurs, a company must modify the cost-assignment procedure to be sure that costs are assigned to both finished products and those that remain in the ending inventory. q Unfinished units do not have the same amount of cost inputs as finished units and so one method of assigning the costs does not work. 26

Equivalent Units q To handle this problem, a company that uses a process cost system counts each finished unit as a whole unit. q Unfinished units are counted as a part of a whole unit, that part being the estimated percent that the product is complete. q For example, if Lady Macbeth had a bottle of solvent that was 80% complete in the ending Goods-in-Process Inventory, it would be counted as 80% of a whole bottle of solvent. q When physical products in a process are counted this way, they are called equivalent units. 27

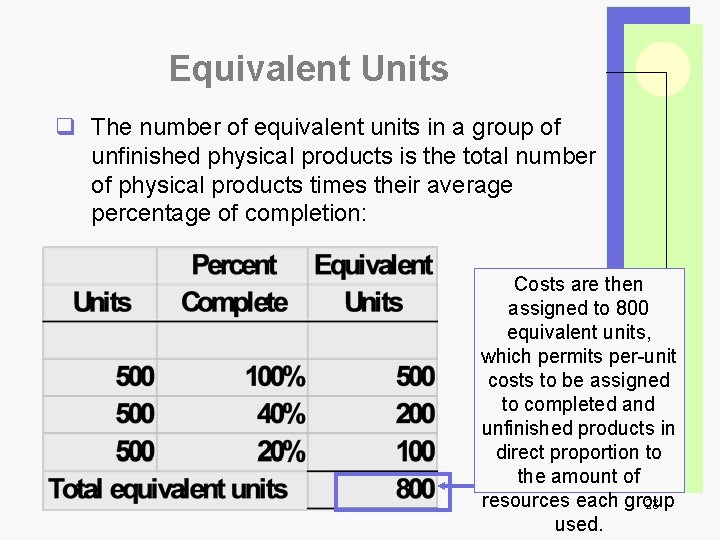

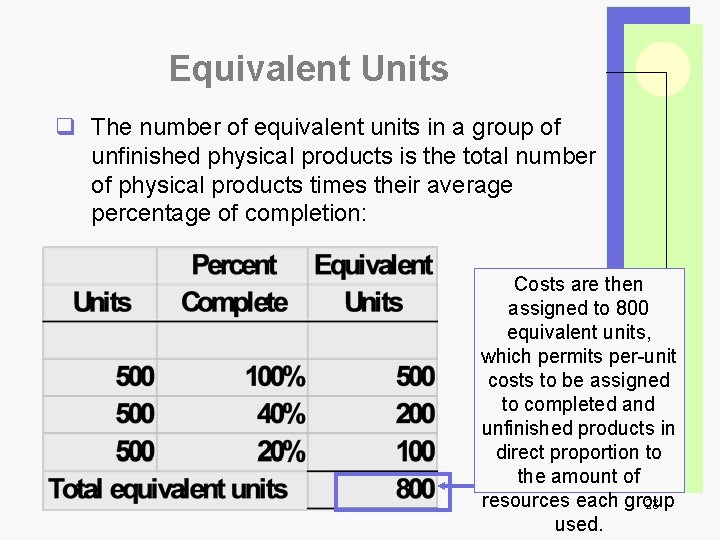

Equivalent Units q The number of equivalent units in a group of unfinished physical products is the total number of physical products times their average percentage of completion: Costs are then assigned to 800 equivalent units, which permits per-unit costs to be assigned to completed and unfinished products in direct proportion to the amount of resources each group 28 used.

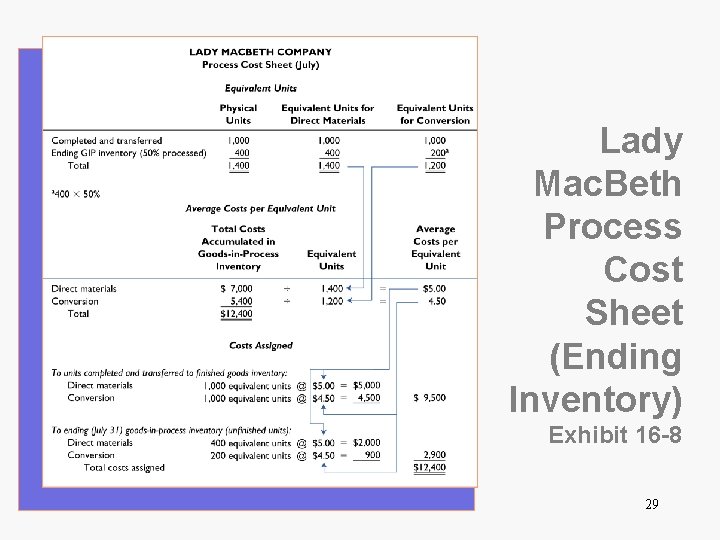

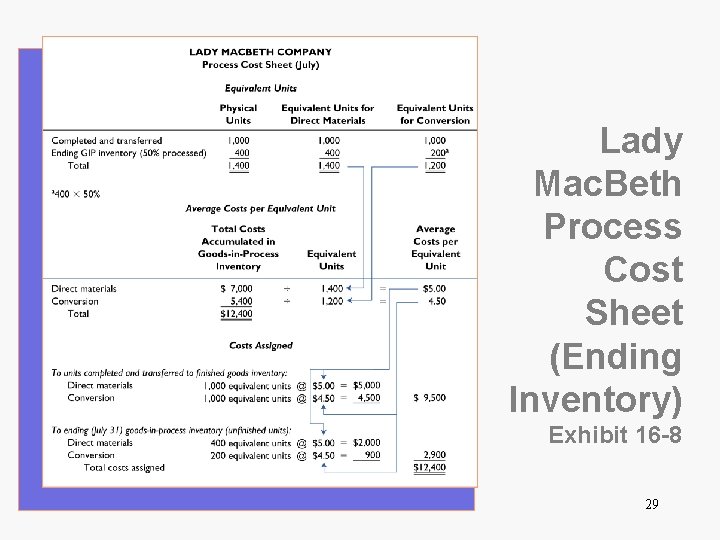

Lady Mac. Beth Process Cost Sheet (Ending Inventory) Exhibit 16 -8 29

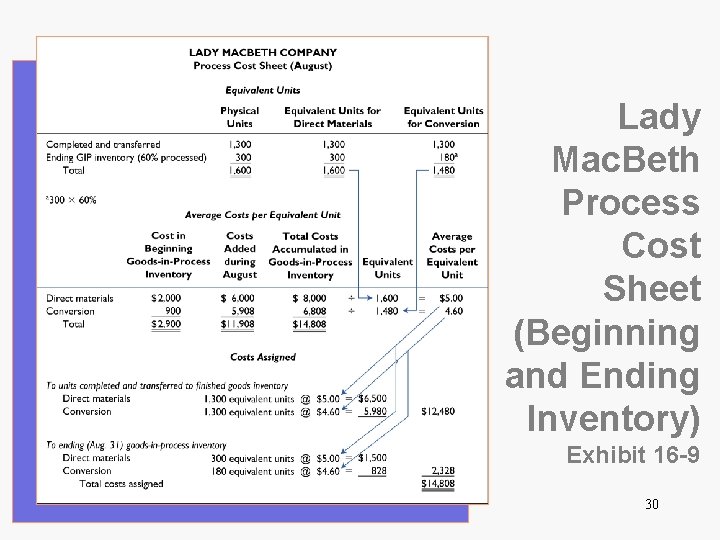

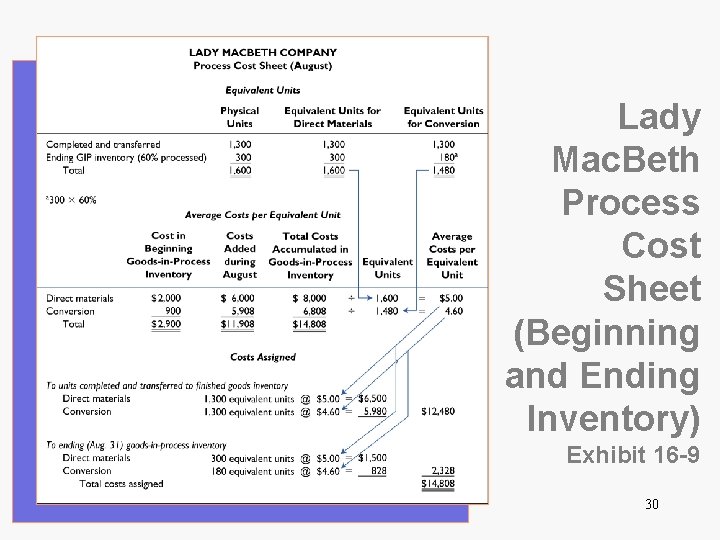

Lady Mac. Beth Process Cost Sheet (Beginning and Ending Inventory) Exhibit 16 -9 30