Chapter 15 Administrative Procedures 1 ADMINISTRATIVE PROCEDURES 1

- Slides: 28

Chapter 15: Administrative Procedures 1

ADMINISTRATIVE PROCEDURES (1 of 2) ® Role of the IRS ® Audits of tax returns ® Requests for rulings ® Due dates ® Failure-to-file/pay-penalties ® Estimated taxes 2

ADMINISTRATIVE PROCEDURES (2 of 2) ® Severe penalties ® Statute of limitations ® Liability for tax ® Tax practice issues 3

Role of the IRS (1 of 2) ® Enforcement of tax laws ® Collection of taxes due ® Interpretation of Internal Revenue Code 4

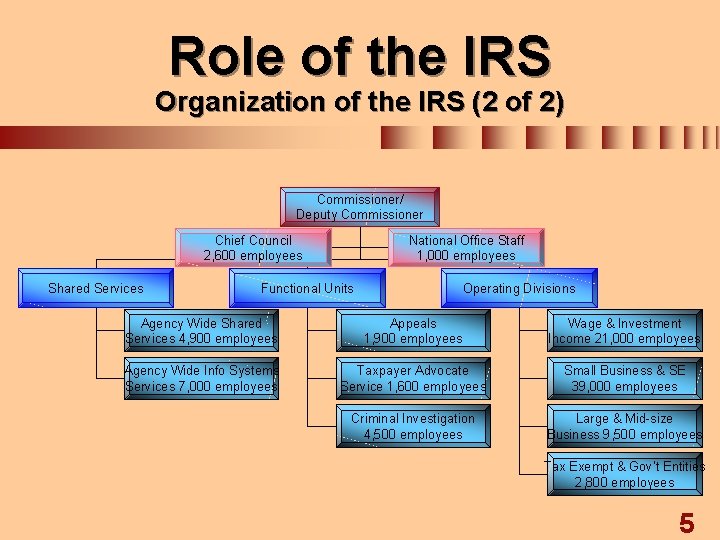

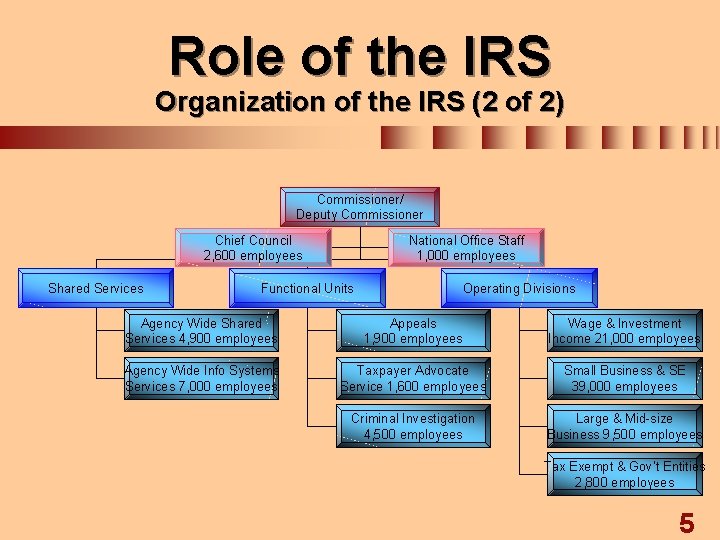

Role of the IRS Organization of the IRS (2 of 2) Commissioner/ Deputy Commissioner National Office Staff 1, 000 employees Chief Council 2, 600 employees Shared Services Functional Units Operating Divisions Agency Wide Shared Services 4, 900 employees Appeals 1, 900 employees Wage & Investment Income 21, 000 employees Agency Wide Info Systems Services 7, 000 employees Taxpayer Advocate Service 1, 600 employees Small Business & SE 39, 000 employees Criminal Investigation 4, 500 employees Large & Mid-size Business 9, 500 employees Tax Exempt & Gov’t Entities 2, 800 employees 5

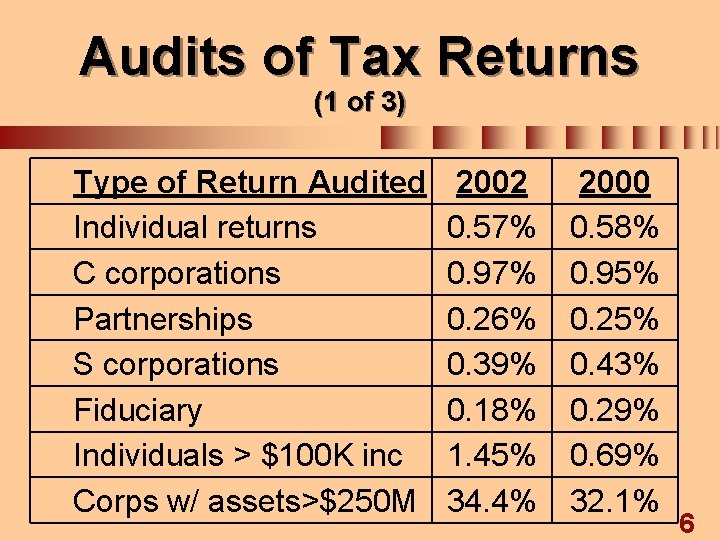

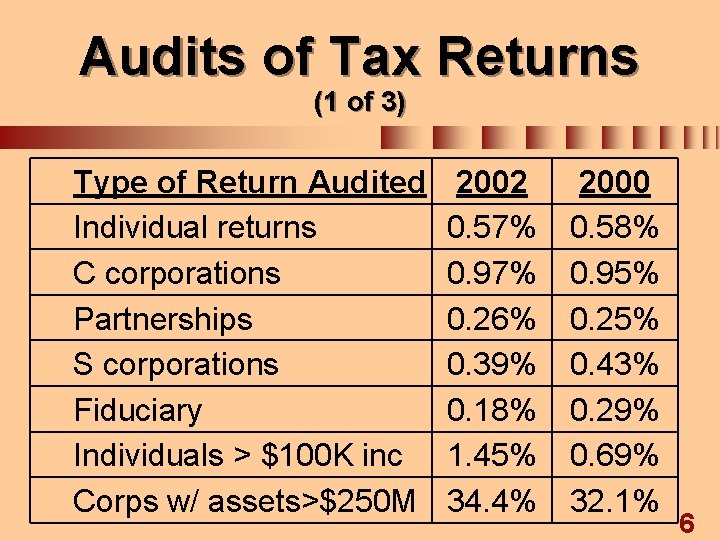

Audits of Tax Returns (1 of 3) Type of Return Audited Individual returns C corporations Partnerships S corporations Fiduciary Individuals > $100 K inc Corps w/ assets>$250 M 2002 0. 57% 0. 97% 0. 26% 0. 39% 0. 18% 1. 45% 34. 4% 2000 0. 58% 0. 95% 0. 25% 0. 43% 0. 29% 0. 69% 32. 1% 6

Audits of Tax Returns (2 of 3) ® Returns selected for audit by discriminant function & other means 39% of returns selected by using DIF NRP exams less intrusive than TCMP 7

Audits of Tax Returns (3 of 3) ® Types of audits Correspondence Office audit Field audit ® Appeals process ® Burden of proof 8

Appeals Process (1 of 3) ® Taxpayer first meet w/ revenue agent ® If taxpayer disagrees w/ findings, IRS sends thirty-day letter Taxpayer has 30 days to request a conference w/ appeals officer ® Taxpayer meets with appeals officer 9

Appeals Process (2 of 3) ® If no agreement with appeals officer reached, IRS issues ninety-day letter Taxpayer has 90 days to file petition w/ Tax Court or pay the tax Taxpayer must pay tax first to litigate in either District Court or U. S. Court of Federal Claims 10

Appeals Process (3 of 3) ® Either party may appeal court decision to Circuit Court Usually final appeal as Supreme Court rarely hears tax cases 11

Burden of Proof (1 of 2) ® In civil court cases burden of proof on factual matters shifts to IRS if taxpayer does all of the following: Introduces “credible evidence” Complies w/ recordkeeping & substantiation requirements of IRC 12

Burden of Proof (2 of 2) ® Burden of proof (continued) Cooperates w/ reasonable requests Qualifies as a natural person or legal person w/ net worth $7 million 13

Requests for Rulings ® Allows taxpayer to learn how IRS will treat a particular transaction before the transaction is completed ® Request made in writing ® IRS has option whether or not to respond 14

Due Dates ® Returns for individuals, fiduciaries and partnerships are due on or before fifteenth day of fourth month following year-end of entity ® Extensions for filing deadline available, but tax must be paid by original due date to avoid penalties ® Interest due on tax not timely paid 15

Failure-to-File/Pay. Penalties ® Failure to file penalty 5% per month or fraction thereof of net tax due w/ a 25% maximum Fraudulent failure to file is 15% per month or fraction thereof w/ maximum of 75% ® Failure to pay incurs a penalty of 0. 5% per month up to 25% ® See Topic Review C 15 -1 16

Estimated Taxes (1 of 2) ® Taxpayers receiving income other than salaries & wages should pay quarterly estimated tax installments Payments should equal lesser of 90% of tax due or 100% (110% if AGI > $150 K) of last year’s tax 17

Estimated Taxes (2 of 2) ® Penalty for underpayment of ES taxes based on interest on underpayment times amount of time outstanding 18

Severe Penalties (1 of 3) ® Penalty for underpayment due to negligence or disregard of rules or regulations is 20% of underpayment ® Penalty for substantial understatement exceeding greater of 10% of tax liability or $5, 000 ($10, 000 for a C corp) is 20% of underpayment 19

Severe Penalties (2 of 3) ® Civil fraud IRS has burden of proof Systematic omission from gross income or fictitious deductions or dependency claims. . . Civil fraud penalty is 75% of portion of underpayment attributable to fraud 20

Severe Penalties (3 of 3) ® Criminal fraud IRS has burden of proof Prosecution may result from willful attempts to evade any tax, willful failure to file or willfully making returns taxpayer does not believe to be true and correct. . . Maximum penalty is a fine of $25, 000 ($100 K for corp), five years in jail or both. 21

Statute of Limitations (1 of 2) ® Normal time limit is three years from later of due date or date filed ® For substantial omissions, time limit is six years ® No statute of limitations for fraud ® No statute of limitations if a tax return is not filed 22

Statute of Limitations (2 of 2) ® Refund claims Taxpayer not entitled to refund for overpayments unless claim for refund filed by later of ¬Three years from date original return is filed, OR ¬Two years from date they pay tax 23

Liability for Tax (1 of 2) ® If spouses file a joint return, liability for taxes is joint and several Government can collect from either spouse regardless of who has income Tax may be collected from transferees and fiduciaries 24

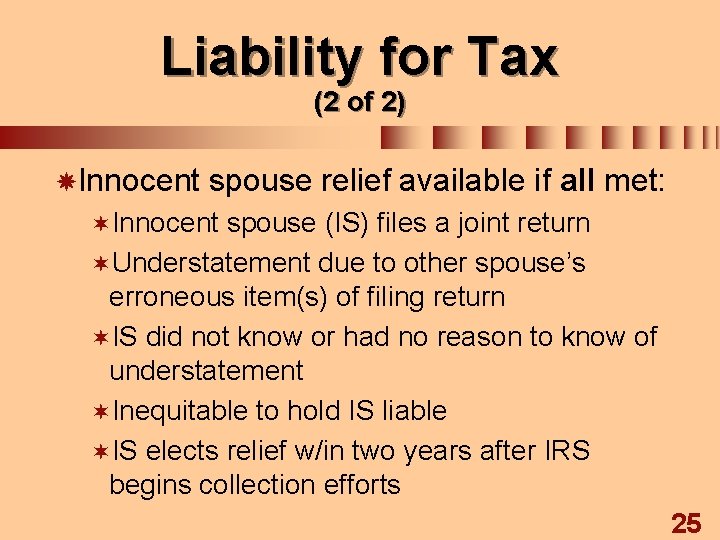

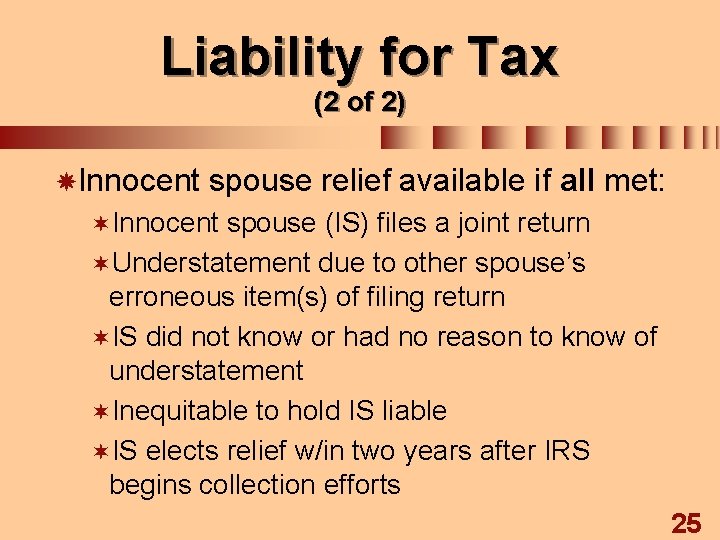

Liability for Tax (2 of 2) Innocent spouse relief available if all met: ¬Innocent spouse (IS) files a joint return ¬Understatement due to other spouse’s erroneous item(s) of filing return ¬IS did not know or had no reason to know of understatement ¬Inequitable to hold IS liable ¬IS elects relief w/in two years after IRS begins collection efforts 25

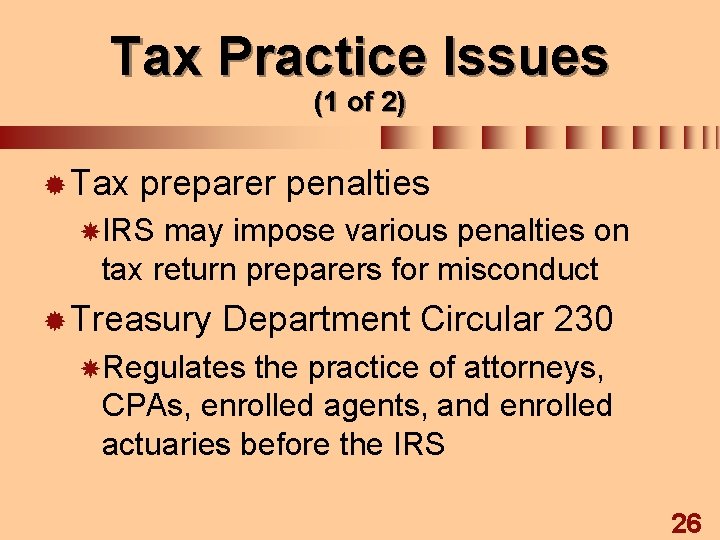

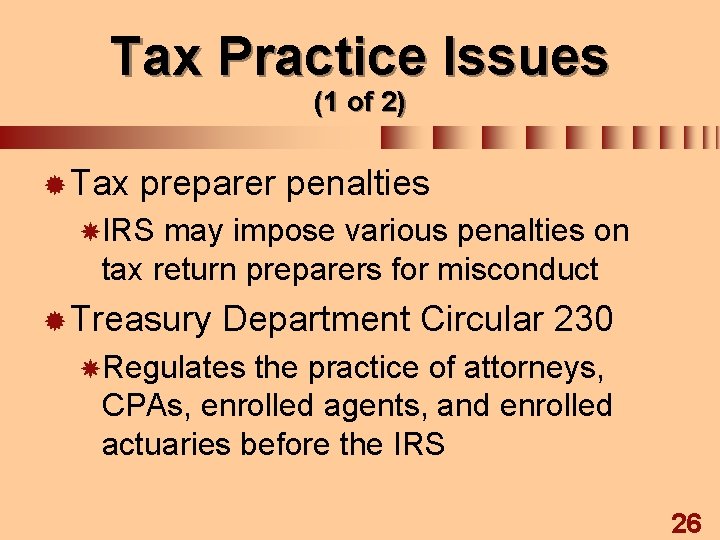

Tax Practice Issues (1 of 2) ® Tax preparer penalties IRS may impose various penalties on tax return preparers for misconduct ® Treasury Department Circular 230 Regulates the practice of attorneys, CPAs, enrolled agents, and enrolled actuaries before the IRS 26

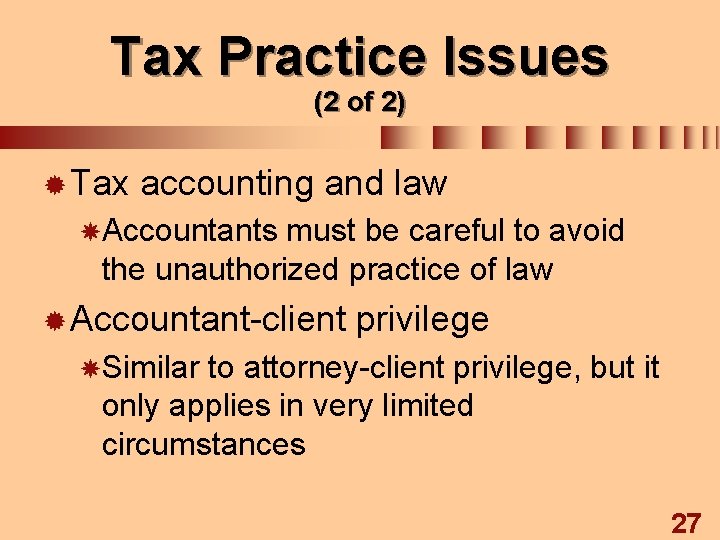

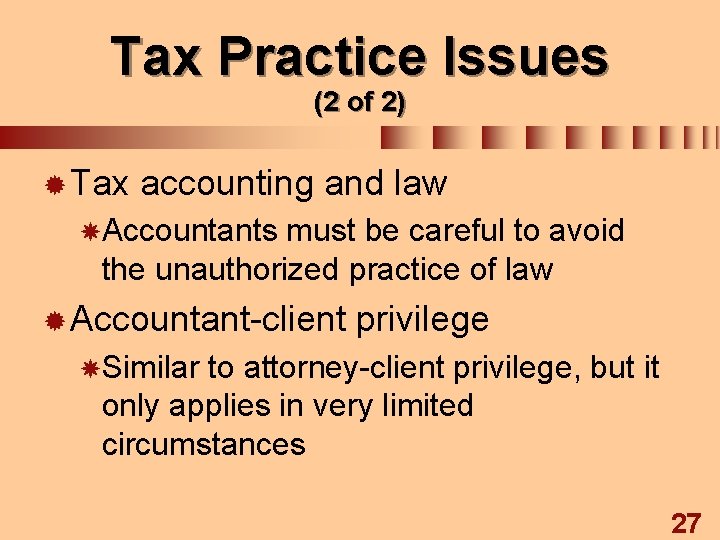

Tax Practice Issues (2 of 2) ® Tax accounting and law Accountants must be careful to avoid the unauthorized practice of law ® Accountant-client privilege Similar to attorney-client privilege, but it only applies in very limited circumstances 27

Comments or questions about Power. Point Slides? Contact Dr. Richard Newmark at University of Northern Colorado’s Kenneth W. Monfort College of Business richard. newmark@Ph. Duh. com 28