Chapter 15 19 th Leases Edition Intermediate Accounting

- Slides: 72

Chapter 15 19 th Leases Edition Intermediate Accounting James D. Stice Earl K. Stice Power. Point presented by Douglas Cloud Professor Emeritus of Accounting, Pepperdine University © 2014 Cengage Learning 15 -1

Introduction • • A lease is a contract specifying the terms under which the owner of property, the lessor, transfers the right to use the property to a lessee. A major challenge for the accounting profession has been to establish standards that prevent companies from using the legal form of a lease to avoid recognizing future payment obligations as a liability. 15 -2

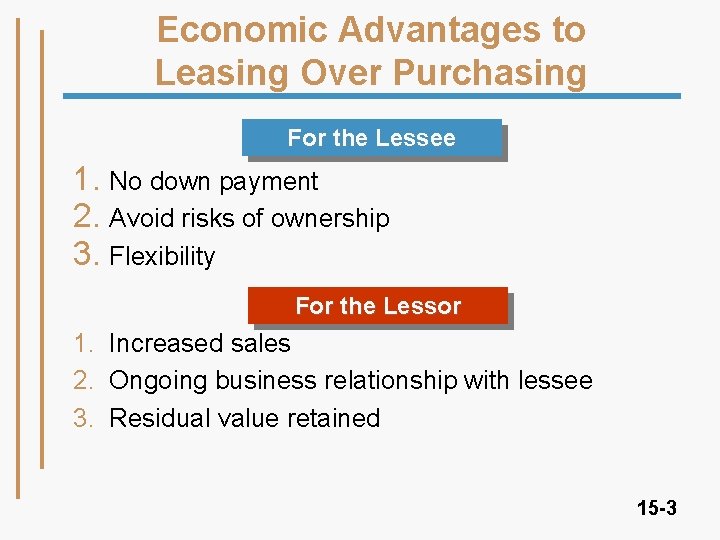

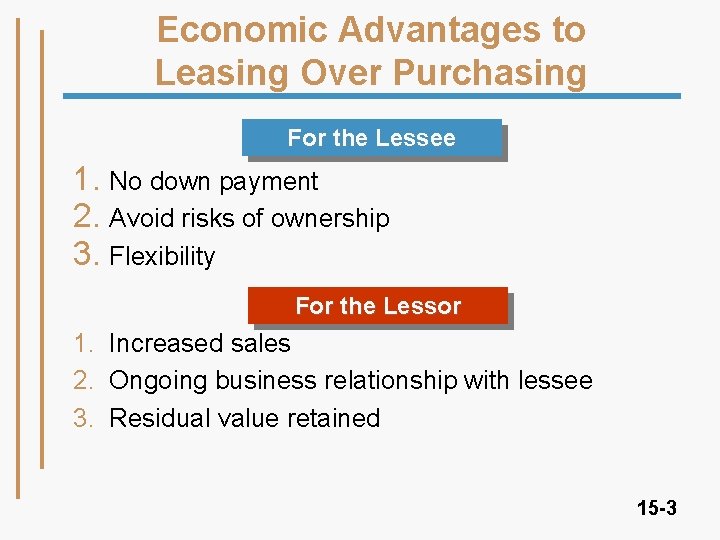

Economic Advantages to Leasing Over Purchasing For the Lessee 1. No down payment 2. Avoid risks of ownership 3. Flexibility For the Lessor 1. Increased sales 2. Ongoing business relationship with lessee 3. Residual value retained 15 -3

Simple Example • Owner Company owns a piece of equipment with a market value of $10, 000 and an estimated useful life of five years. • User Company wishes to acquire the equipment. • User Company can borrow $10, 000 from the bank at 10% interest. Payments for principal and interest would be five equal annual installments of $2, 638. (continued) 15 -4

Simple Example • Alternatively, User Company can lease the equipment from Owner Company for five years and make five annual “rental” payments of $2, 638. • User will still use the equipment for five years and will still make payments of $2, 638 per year. • The primary difference is that now Owner is not just selling the equipment but is also substituting for the bank in providing financing. (continued) 15 -5

Simple Example On the date the lease is signed, should Owner Company recognize an equipment sale? The key accounting issues for the lessor are: • Has effective ownership of the equipment been passed from Owner to User? • Is the transaction complete, meaning does Owner have any significant responsibilities remaining in regard to the equipment? • Is Owner Company reasonably certain the five annual payments can be collected from User Company? 15 -6 (continued)

Simple Example • Question: On the date the lease is signed, should User recognize the lease equipment as an asset and the obligation to make the lease payment as a liability? • Answer: The answer hinges on whether effective ownership, as opposed to legal ownership, of the equipment changes hands when Owner and User sign the lease agreement. (continued) 15 -7

Simple Example • The economic substance of the lease is that the lease signing is equivalent to the transfer of effective ownership, and the fact that Owner retains legal title of the equipment during the lease period is a mere technicality. 15 -8

Capital vs. Operating Lease • Capital leases are accounted for as if the lease agreement transfers ownership of the asset from the lessor to lessee. • Operating leases are accounted for as rental agreements, with no transfer of effective ownership associated with the lease. 15 -9

Why Leasing Over Purchasing? • Keeping the asset off the balance sheet improves financial ratio measures of efficiency. • Keeping the liability off the balance sheet improves measures of leverage. • For companies that lease a large portion of the assets they use, the accounting standards associated with leasing are the most critical standards that they apply. 15 -10

Cancellation Provisions • • • Some leases are noncancelable, meaning that these lease contracts are cancelable only on the outcome of some remote contingency or that the cancellation provisions and penalties of these leases are so costly to the lessee that cancellation will not occur. All cancelable leases are accounting for as operating leases. Some, but not all noncancelable leases are accounted for as capital leases. 15 -11

Bargain Purchase Option • If the specified purchase option price is expected to be considerably less than the fair value at the date the purchase option may be exercised, the option is called a bargain purchase option. • By definition, a bargain purchase option is one that is expected to be exercised. • Noncancelable leases with BPO are accounted for as capital leases. 15 -12

Lease Term • The lease term is the time period from the beginning to the end of the lease. • The beginning of the lease term occurs when the leased property is transferred to the lessee. • The end of the lease term is more flexible because many leases include provisions allowing the lessee to extend the lease period. (continued) 15 -13

Lease Term • The end of the lease term is at the end of the fixed noncancelable lease period plus all renewal option periods that are likely to be exercised. • A bargain purchase option is one with such an attractive lease rate, or other favorable provision, that at the inception of the lease, it is likely that the lease will be renewed beyond the fixed lease period. 15 -14

Residual Value • The market value of the leased property at the end of the lease term is referred to as its residual value. • Some lease contracts require the lessee to guarantee a minimum residual value. If the market value falls below the guaranteed residual value, the lessee must pay the difference. (continued) 15 -15

Residual Value • If there is no bargain purchase option or guarantee of the residual value, the lessor reacquires the property. • If the actual amount of the residual value is unknown until the end of the lease term, it must be estimated at the inception of the lease. The residual value under these circumstances is referred to as an unguaranteed residual value. 15 -16

Minimum Lease Payments • The rental payments required over the lease term plus any amount to be paid for the residual value are referred to as the minimum lease payments. • Lease payments sometimes include charges for items such as insurance, maintenance, and taxes on the leased property. These are referred to as executory costs and they are not included as part of the minimum lease payment. 15 -17

Nature of Leases • The implicit interest rate is the rate used by the lessor in calculating the desired lease payment. • For purposes of computing the present value of the minimum lease payments, the lessee uses the lower of the implicit interest rate used by the lessor and the lessee’s own incremental borrowing rate. (continued) 15 -18

Nature of Leases • The lessee’s incremental borrowing rate is the rate at which the lessee could borrow the amount of money necessary to purchase the leased asset, taking into consideration the lessee’s financial situation and current conditions in the marketplace. 15 -19

General Classification Criteria— Lessee and Lessor The four general criteria that apply to all leases for both the lessee and lessor relate to transfer of ownership, bargain purchase option, economic life, and fair value. 1. The lease transfers ownership of the leased asset to the lessee by the end of the lease term. 2. The lease contains a bargain purchase option making it reasonably assured that the property will be purchased by the lessee at a future date. (continued) 15 -20

General Classification Criteria— Lessee and Lessor 3. The lease term is equal to 75% or more of the estimated economic life of the leased property. 4. The present value of the minimum lease payments at the beginning of the lease equals or exceeds 90% or more of the fair market value of the leased asset. 15 -21

IASB Approach • • IAS 17, “Accounting for Leases, ” states simply: A lease is classified as a finance (i. e. , capital) lease if it transfers substantially all the risks and rewards incident to ownership. This type of standard places the responsibility of distinguishing the type of lease on the accountant. (continued) 15 -22

IASB Approach IAS 17 gives the following examples of situations that “would normally lead to a lease being classified as a finance lease”: a) The lease transfers ownership of the asset to the lessee at the end of the lease term. b) The lessee has the option to purchase the asset at a price that is expected to be sufficiently lower than the fair value at the date the option becomes exercisable. (continued) 15 -23

IASB Approach c) The lease term is for the major part of the economic life of the asset even if title is not transferred. d) At the inception of the lease the present value of the minimum lease payments amount to at least substantially all of the fair value of the leased asset. Note the similarity between the IAS 17 guidelines and those of the FASB. They are the same in spirit. 15 -24

Revenue Recognition Criteria—Lessor In addition to meeting one of the four general criteria, a lease must meet two additional revenue recognition criteria to be classified by the lessor as a capital lease: 1. Collection of the minimum lease payments must be reasonably predictable. 2. Any unreimbursable costs yet to be incurred by the lessor under the terms of the lease are known or can be reasonably estimated at the lease inception date. 15 -25

Accounting for Leases—Lessee • • • All leases as viewed by the lessee may be divided into two types: operating leases and capital leases. If the lease meets any one of the four criteria, it is treated as a capital lease. Otherwise, it is an operating lease. Accounting for operating leases involves the recognition of rent expense over the term of the lease. (continued) 15 -26

Accounting for Leases—Lessee • • Accounting for a capital lease essentially requires the lessee to report on the balance sheet the present value of the future lease payments, both as an asset and a liability. The asset is amortized as though it had been purchased by the lessee. 15 -27

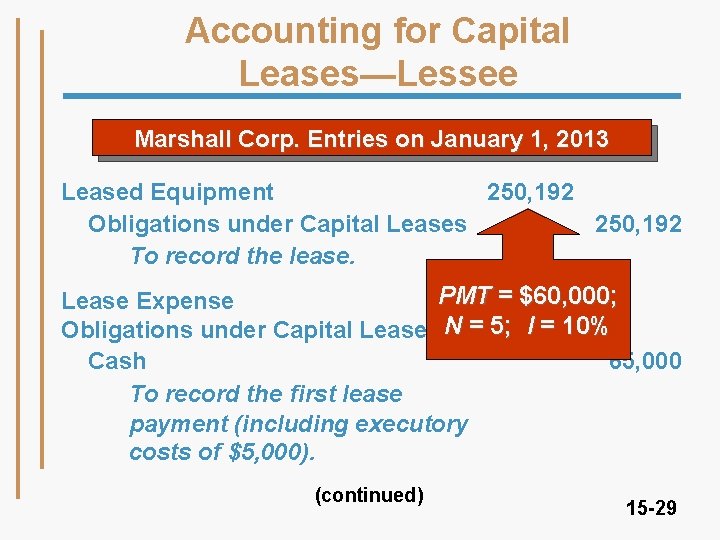

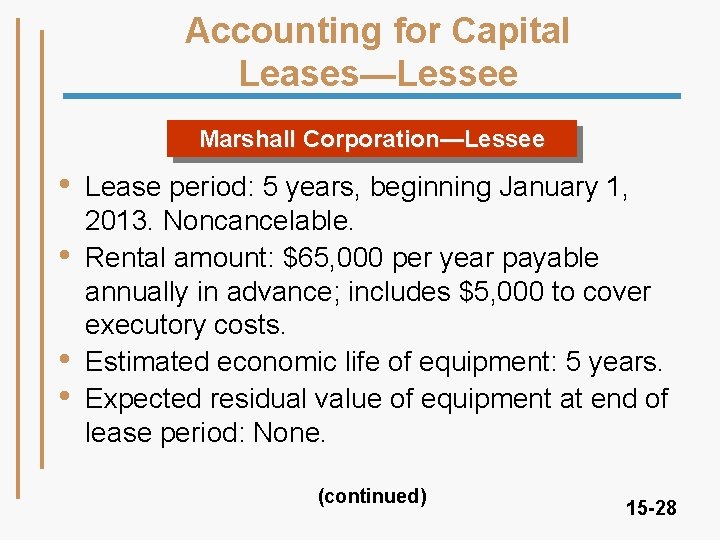

Accounting for Capital Leases—Lessee Marshall Corporation—Lessee • • Lease period: 5 years, beginning January 1, 2013. Noncancelable. Rental amount: $65, 000 per year payable annually in advance; includes $5, 000 to cover executory costs. Estimated economic life of equipment: 5 years. Expected residual value of equipment at end of lease period: None. (continued) 15 -28

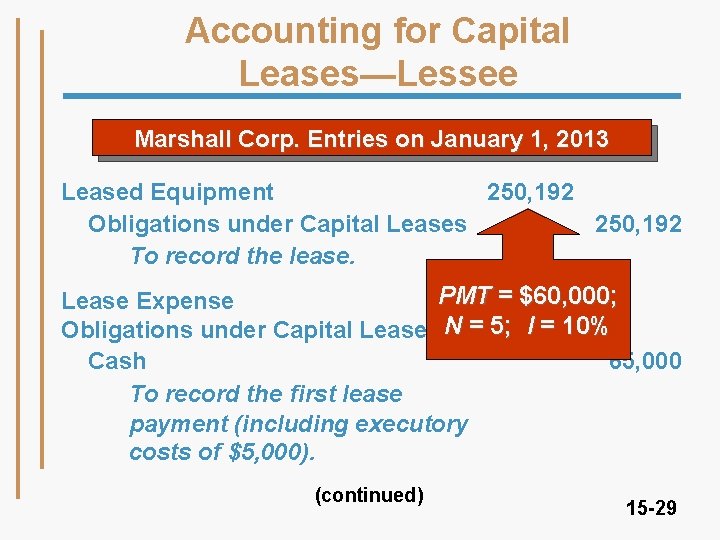

Accounting for Capital Leases—Lessee Marshall Corp. Entries on January 1, 2013 Leased Equipment 250, 192 Obligations under Capital Leases 250, 192 To record the lease. PMT = 5, 000 $60, 000; Lease Expense I = 10% Obligations under Capital Leases N = 5; 60, 000 Cash 65, 000 To record the first lease payment (including executory costs of $5, 000). (continued) 15 -29

Accounting for Capital Leases—Lessee • • The term lease expense is used to record the executory costs related to the leased equipment, such as insurance and taxes. When a lease is capitalized, the asset is included on the balance sheet and written off over time. The word amortization, instead of depreciation, is typically used when describing the systematic expensing of the cost of a leased asset. (continued) 15 -30

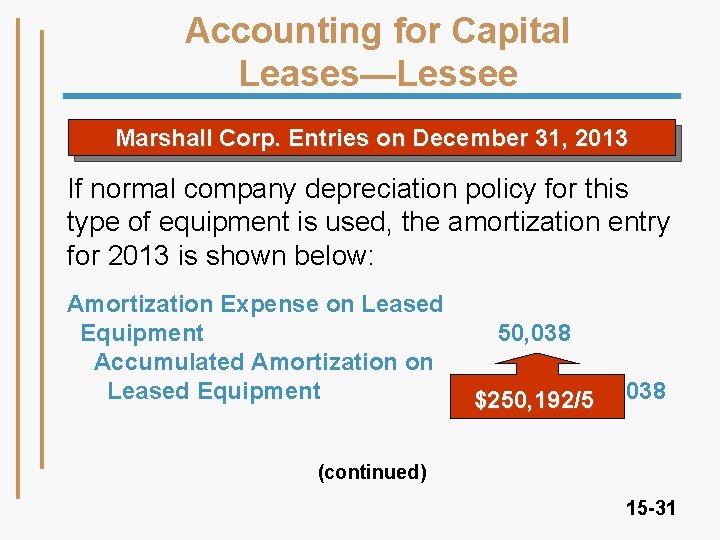

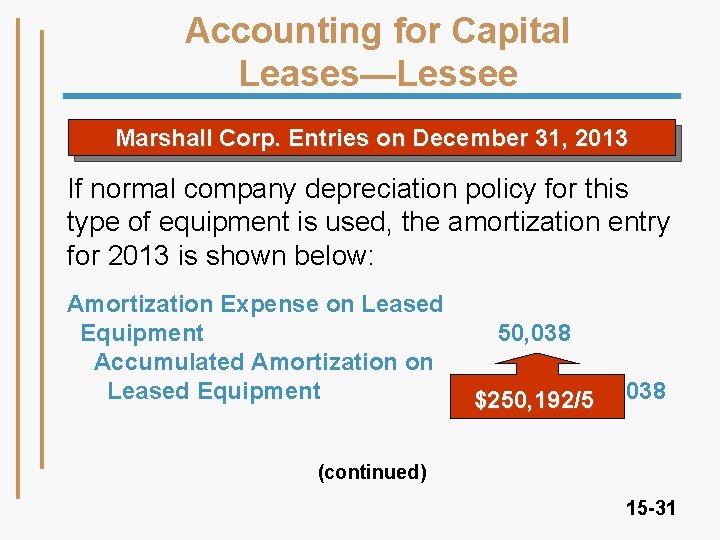

Accounting for Capital Leases—Lessee Marshall Corp. Entries on December 31, 2013 If normal company depreciation policy for this type of equipment is used, the amortization entry for 2013 is shown below: Amortization Expense on Leased Equipment Accumulated Amortization on Leased Equipment 50, 038 $250, 192/550, 038 (continued) 15 -31

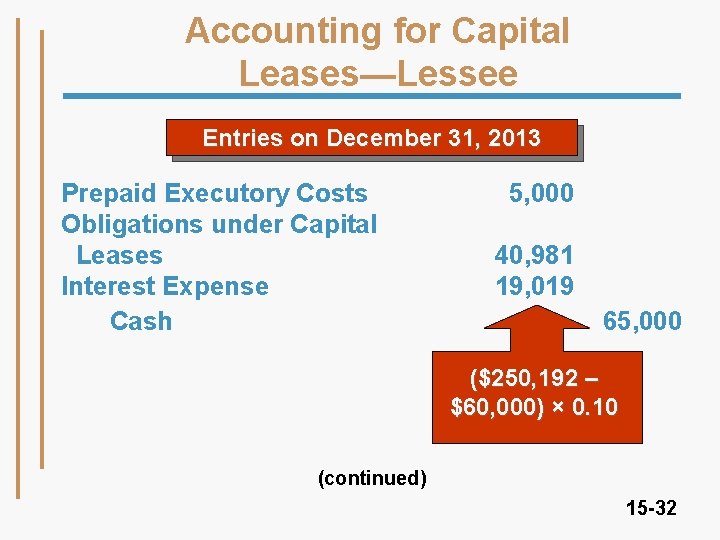

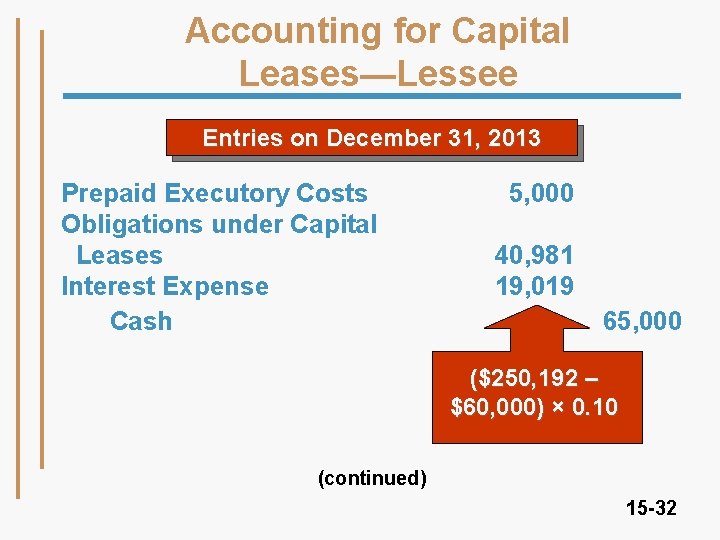

Accounting for Capital Leases—Lessee Entries on December 31, 2013 Prepaid Executory Costs Obligations under Capital Leases Interest Expense Cash 5, 000 40, 981 19, 019 65, 000 ($250, 192 – $60, 000) × 0. 10 (continued) 15 -32

Accounting for Capital Leases—Lessee • As the amount of interest expense declines each period, the total expense will be reduced and, for the last two years, will be less than the $65, 000 payments. • The total amount debited to expense over the life of the lease will be the same regardless of whether the lease is accounted for as an operating lease or a capital lease. (continued) 15 -33

Accounting for Leases with a Bargain Purchase Option • Frequently, the lessee is given the option of purchasing the property in the future at what appears to be a bargain price. • The present value of the bargain purchase option is part of the minimum lease payments and should be included in the capitalized value of the lease. (continued) 15 -34

Accounting for Leases with a Bargain Purchase Option Lessee • • Lease period: 5 years, beginning January 1, 2013, noncancelable. Rental amount: $65, 000 per year payable annually in advance; includes $5, 000 to cover executory costs. Estimated economic life of equipment: 5 years. Expected residual value of equipment at end of lease period: None. (continued) 15 -35

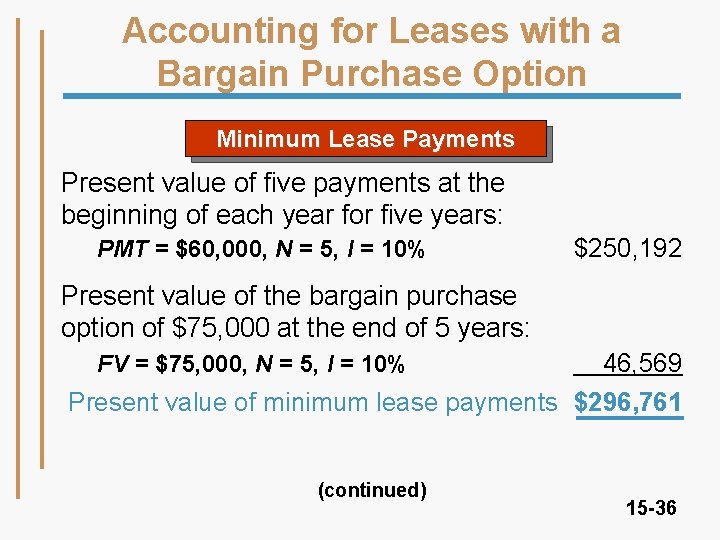

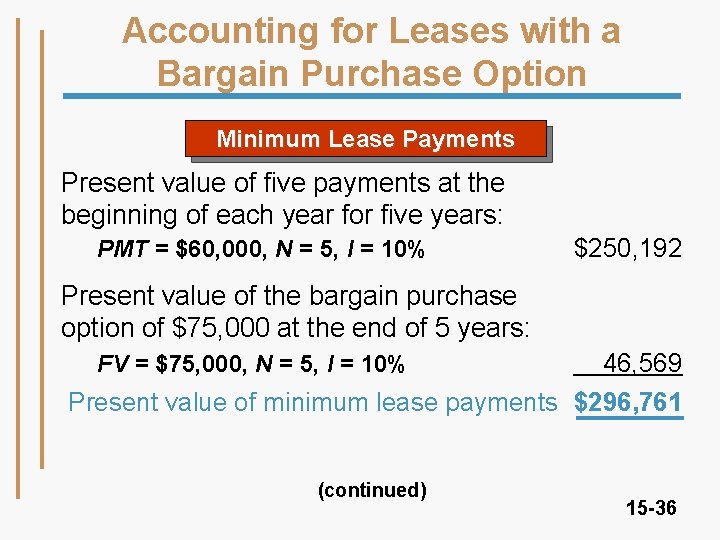

Accounting for Leases with a Bargain Purchase Option Minimum Lease Payments Present value of five payments at the beginning of each year for five years: PMT = $60, 000, N = 5, I = 10% $250, 192 Present value of the bargain purchase option of $75, 000 at the end of 5 years: 46, 569 Present value of minimum lease payments $296, 761 FV = $75, 000, N = 5, I = 10% (continued) 15 -36

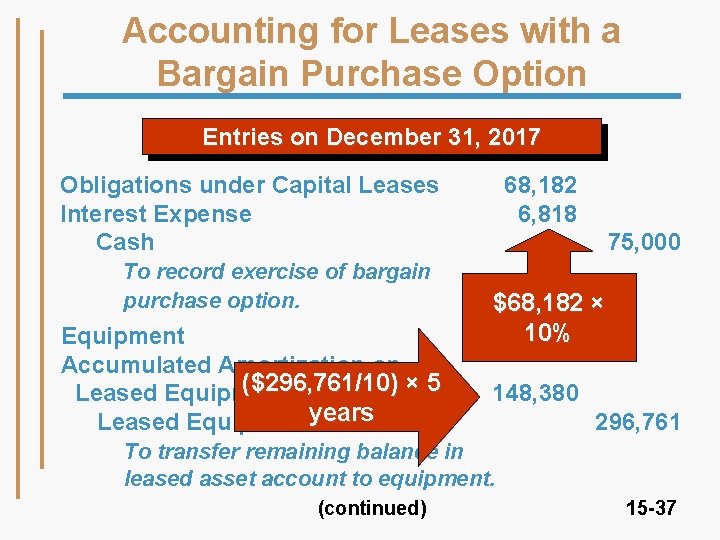

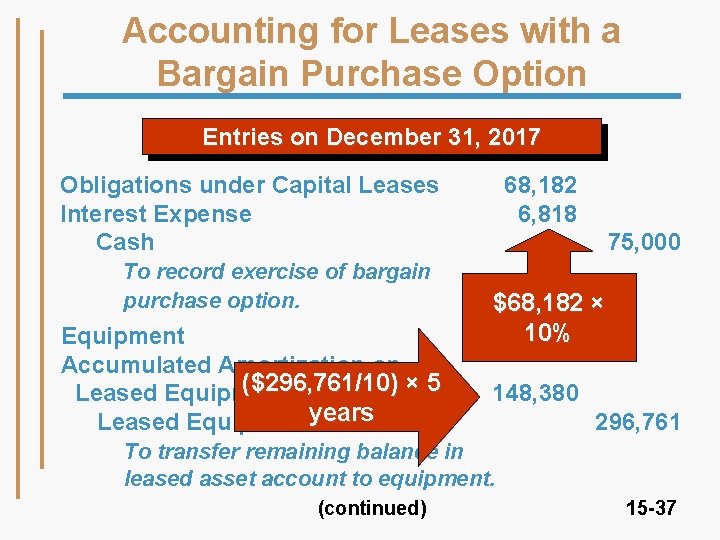

Accounting for Leases with a Bargain Purchase Option Entries on December 31, 2017 Obligations under Capital Leases Interest Expense Cash To record exercise of bargain purchase option. Equipment Accumulated Amortization on ($296, 761/10) × 5 Leased Equipmentyears 68, 182 6, 818 75, 000 $68, 182 × 10% 148, 381 148, 380 296, 761 To transfer remaining balance in leased asset account to equipment. (continued) 15 -37

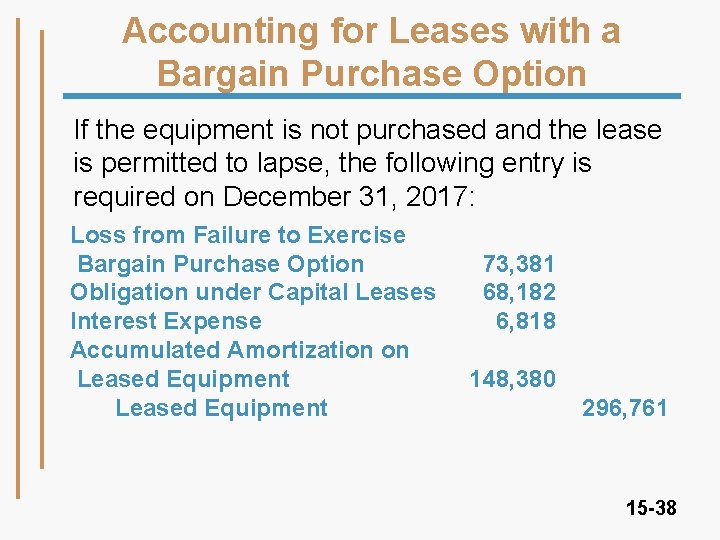

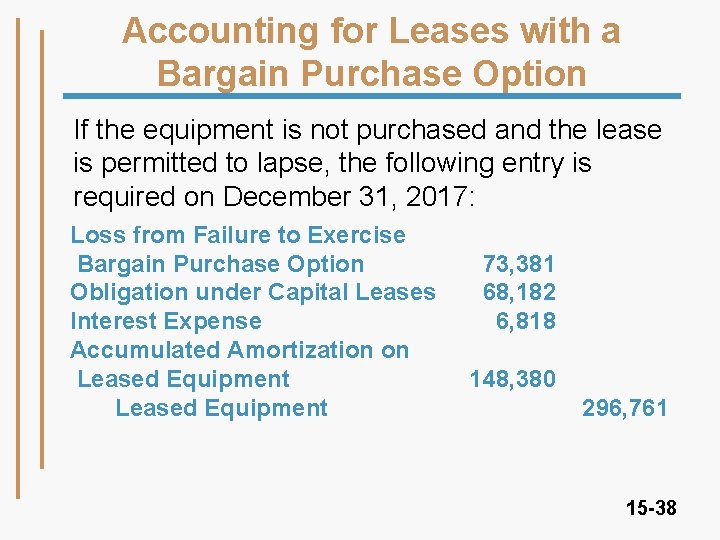

Accounting for Leases with a Bargain Purchase Option If the equipment is not purchased and the lease is permitted to lapse, the following entry is required on December 31, 2017: Loss from Failure to Exercise Bargain Purchase Option Obligation under Capital Leases Interest Expense Accumulated Amortization on Leased Equipment 73, 381 68, 182 6, 818 148, 380 296, 761 15 -38

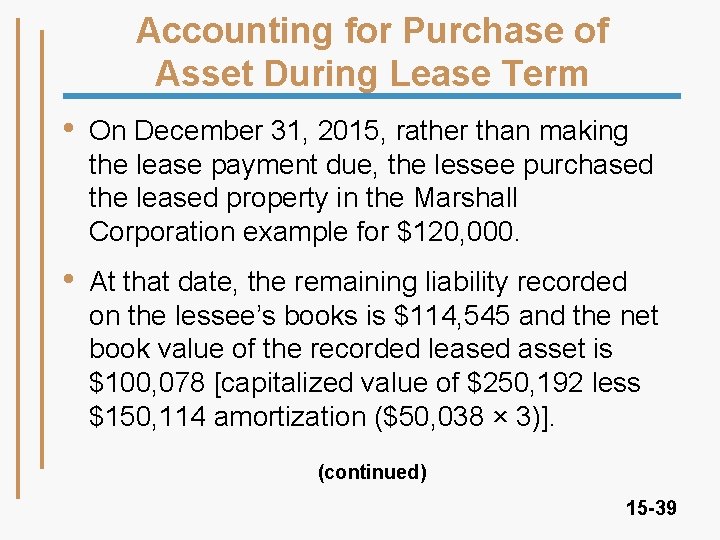

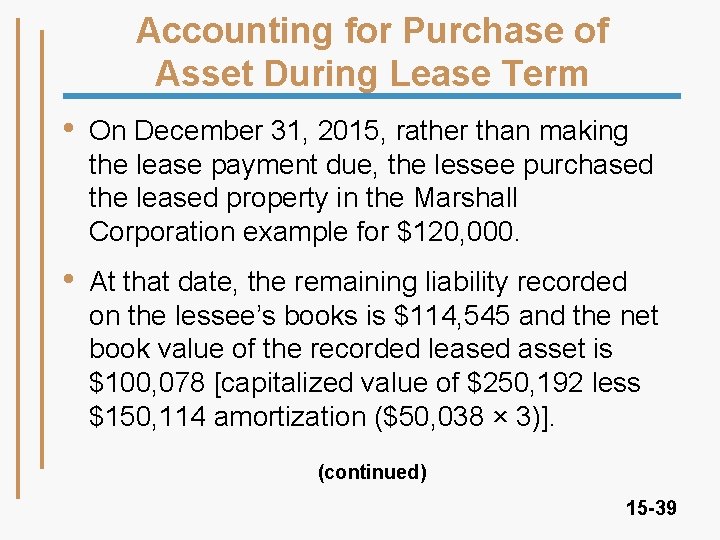

Accounting for Purchase of Asset During Lease Term • On December 31, 2015, rather than making the lease payment due, the lessee purchased the leased property in the Marshall Corporation example for $120, 000. • At that date, the remaining liability recorded on the lessee’s books is $114, 545 and the net book value of the recorded leased asset is $100, 078 [capitalized value of $250, 192 less $150, 114 amortization ($50, 038 × 3)]. (continued) 15 -39

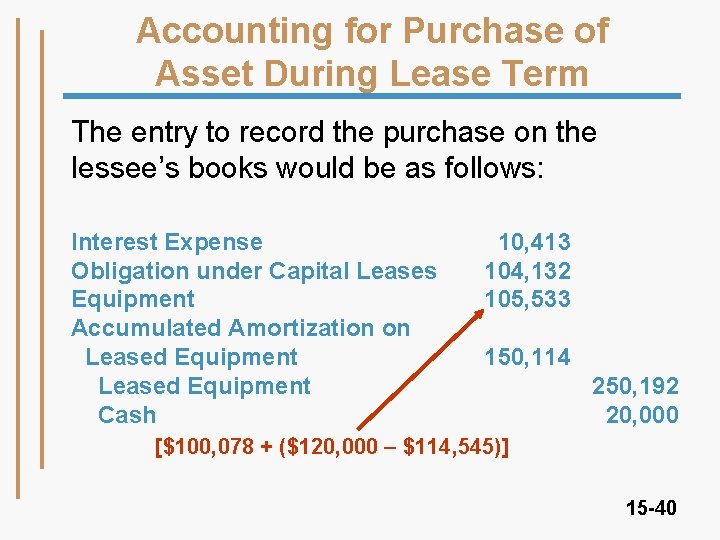

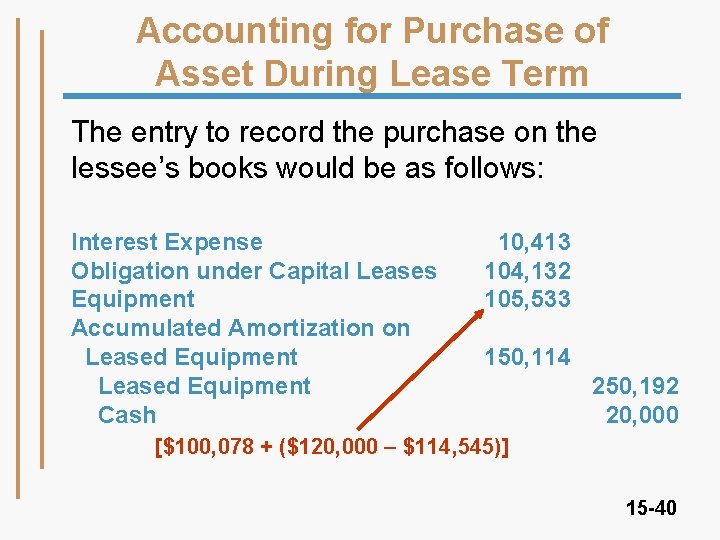

Accounting for Purchase of Asset During Lease Term The entry to record the purchase on the lessee’s books would be as follows: Interest Expense Obligation under Capital Leases Equipment Accumulated Amortization on Leased Equipment Cash 10, 413 104, 132 105, 533 150, 114 250, 192 20, 000 [$100, 078 + ($120, 000 – $114, 545)] 15 -40

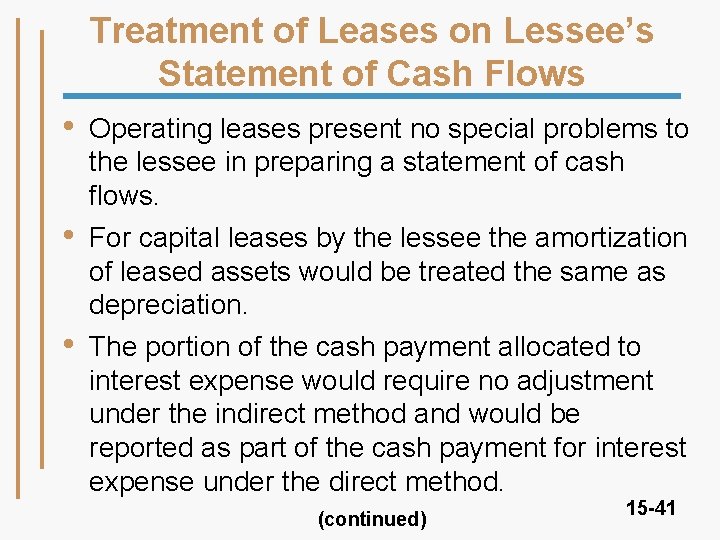

Treatment of Leases on Lessee’s Statement of Cash Flows • • • Operating leases present no special problems to the lessee in preparing a statement of cash flows. For capital leases by the lessee the amortization of leased assets would be treated the same as depreciation. The portion of the cash payment allocated to interest expense would require no adjustment under the indirect method and would be reported as part of the cash payment for interest expense under the direct method. (continued) 15 -41

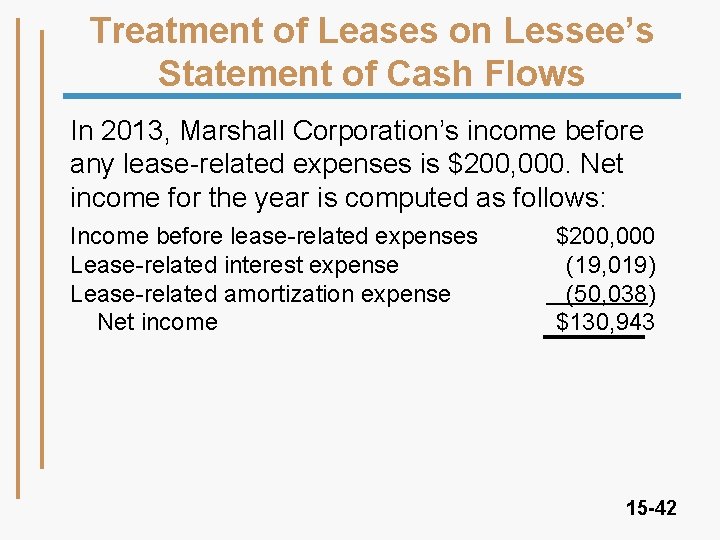

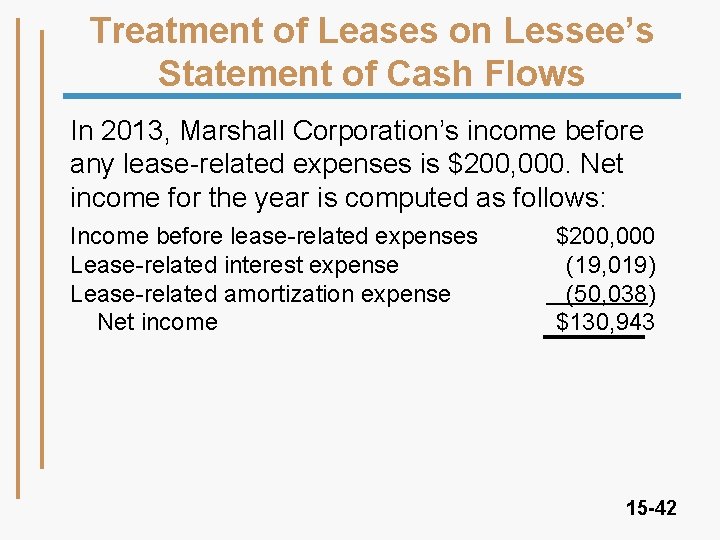

Treatment of Leases on Lessee’s Statement of Cash Flows In 2013, Marshall Corporation’s income before any lease-related expenses is $200, 000. Net income for the year is computed as follows: Income before lease-related expenses Lease-related interest expense Lease-related amortization expense Net income $200, 000 (19, 019) (50, 038) $130, 943 15 -42

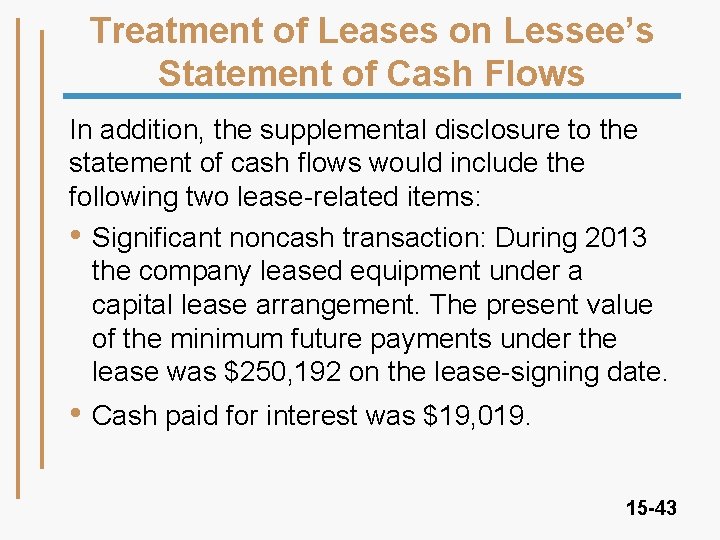

Treatment of Leases on Lessee’s Statement of Cash Flows In addition, the supplemental disclosure to the statement of cash flows would include the following two lease-related items: • Significant noncash transaction: During 2013 the company leased equipment under a capital lease arrangement. The present value of the minimum future payments under the lease was $250, 192 on the lease-signing date. • Cash paid for interest was $19, 019. 15 -43

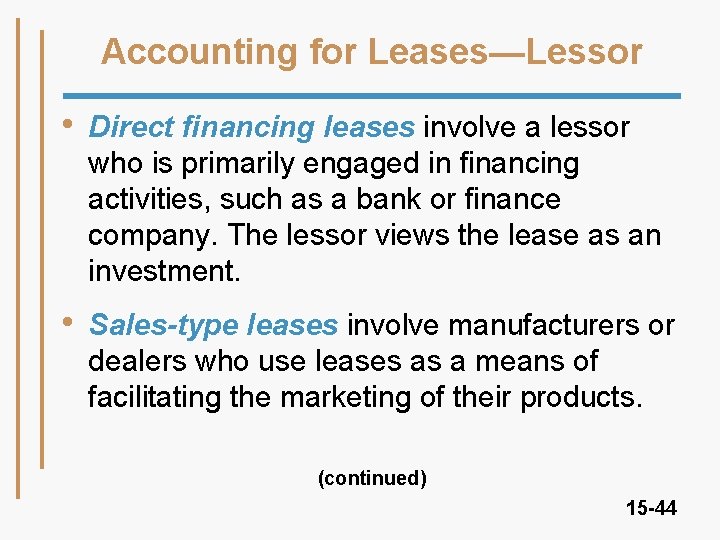

Accounting for Leases—Lessor • Direct financing leases involve a lessor who is primarily engaged in financing activities, such as a bank or finance company. The lessor views the lease as an investment. • Sales-type leases involve manufacturers or dealers who use leases as a means of facilitating the marketing of their products. (continued) 15 -44

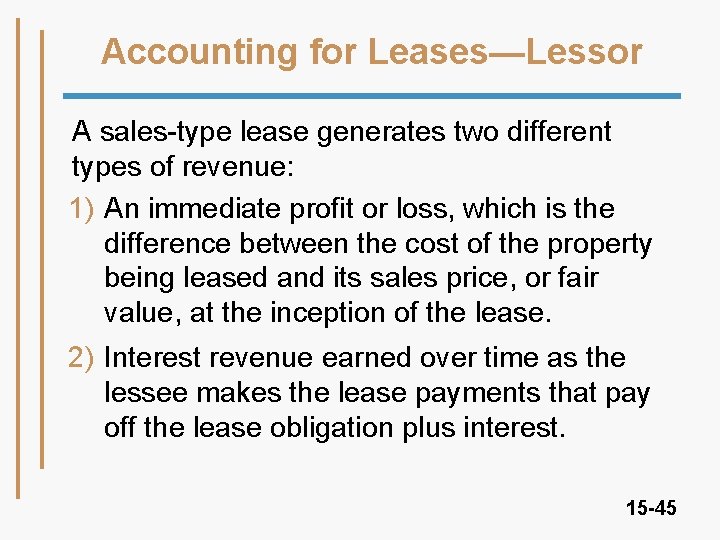

Accounting for Leases—Lessor A sales-type lease generates two different types of revenue: 1) An immediate profit or loss, which is the difference between the cost of the property being leased and its sales price, or fair value, at the inception of the lease. 2) Interest revenue earned over time as the lessee makes the lease payments that pay off the lease obligation plus interest. 15 -45

Initial Direct Costs • For either an operating, direct financing, or sales-type lease, a lessor may incur certain costs, referred to as initial direct costs, in connection with obtaining the lease. • These costs include the costs to negotiate the lease, perform the credit check on the lessee, and prepare the lease documents. (continued) 15 -46

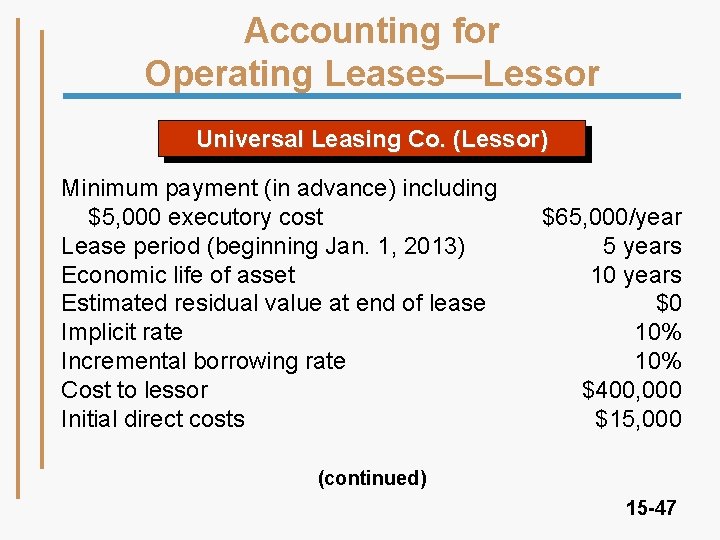

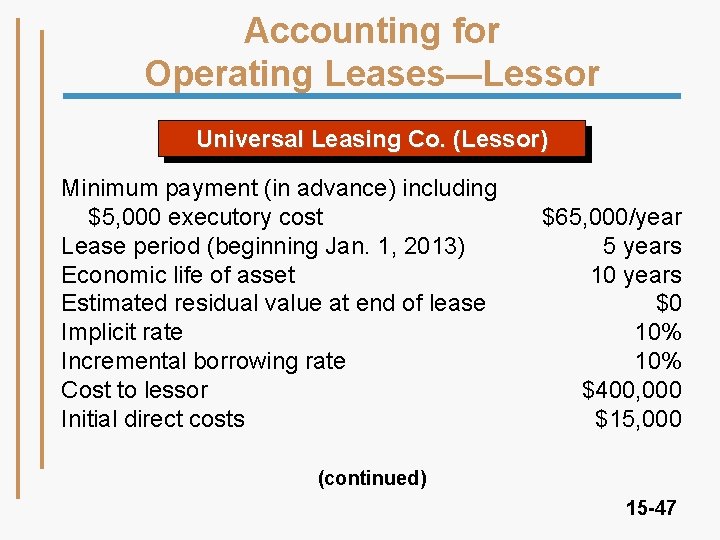

Accounting for Operating Leases—Lessor Universal Leasing Co. (Lessor) Minimum payment (in advance) including $5, 000 executory cost Lease period (beginning Jan. 1, 2013) Economic life of asset Estimated residual value at end of lease Implicit rate Incremental borrowing rate Cost to lessor Initial direct costs $65, 000/year 5 years 10 years $0 10% $400, 000 $15, 000 (continued) 15 -47

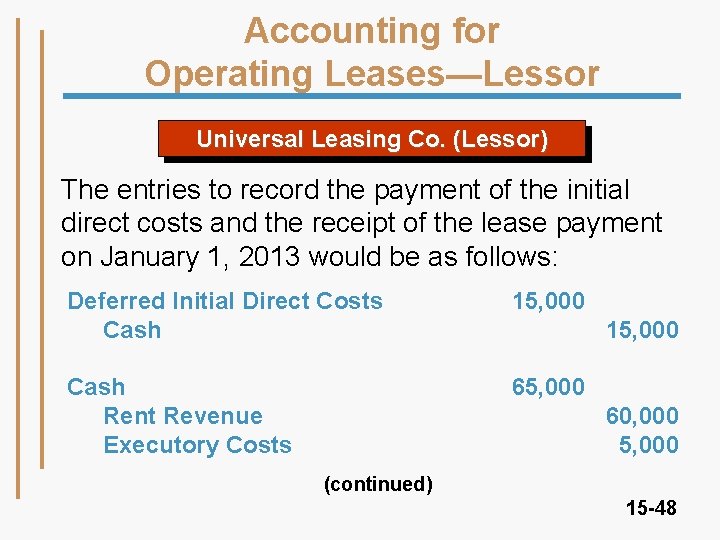

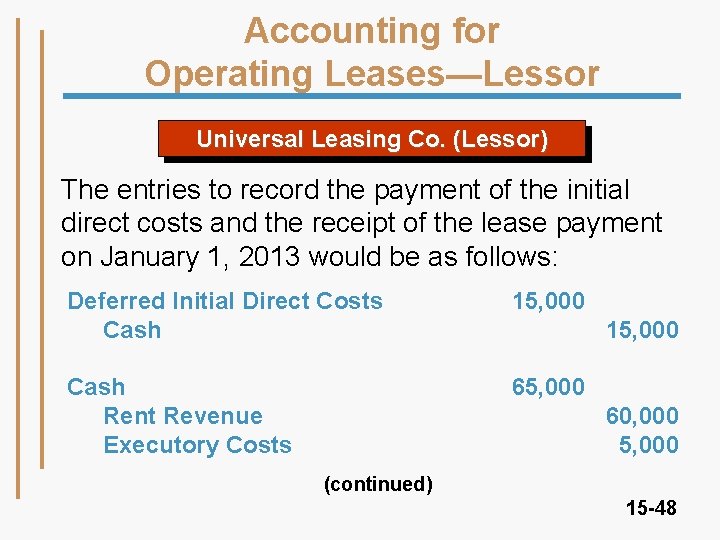

Accounting for Operating Leases—Lessor Universal Leasing Co. (Lessor) The entries to record the payment of the initial direct costs and the receipt of the lease payment on January 1, 2013 would be as follows: Deferred Initial Direct Costs Cash 15, 000 Cash Rent Revenue Executory Costs 65, 000 15, 000 60, 000 5, 000 (continued) 15 -48

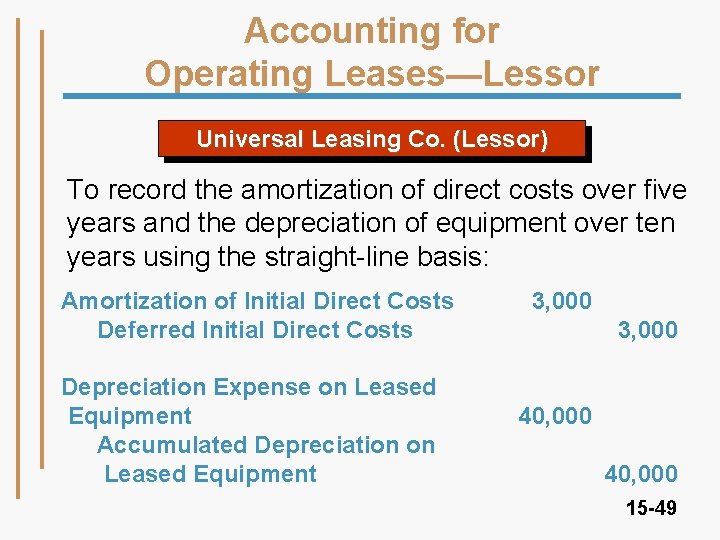

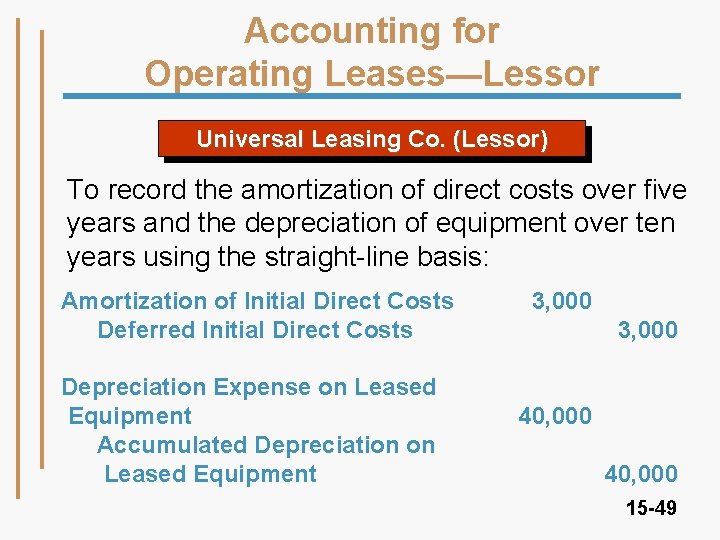

Accounting for Operating Leases—Lessor Universal Leasing Co. (Lessor) To record the amortization of direct costs over five years and the depreciation of equipment over ten years using the straight-line basis: Amortization of Initial Direct Costs Deferred Initial Direct Costs Depreciation Expense on Leased Equipment Accumulated Depreciation on Leased Equipment 3, 000 40, 000 15 -49

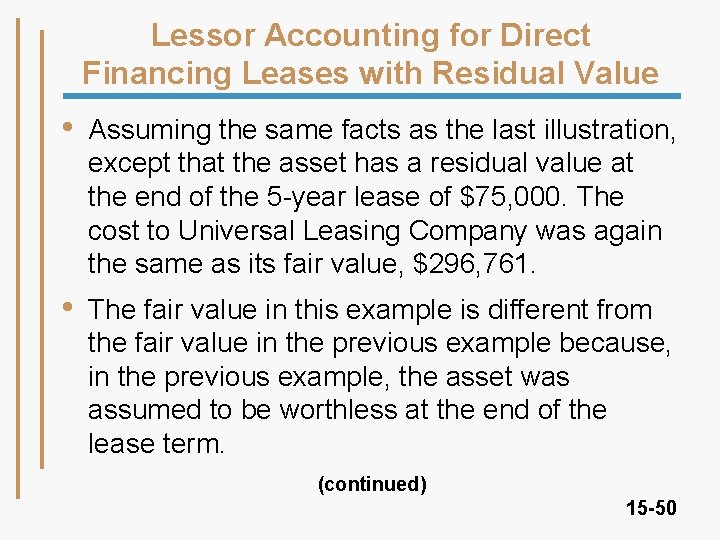

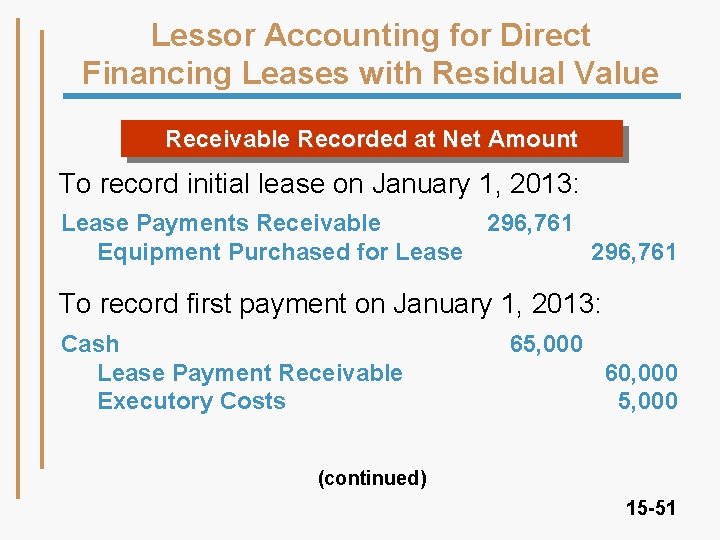

Lessor Accounting for Direct Financing Leases with Residual Value • Assuming the same facts as the last illustration, except that the asset has a residual value at the end of the 5 -year lease of $75, 000. The cost to Universal Leasing Company was again the same as its fair value, $296, 761. • The fair value in this example is different from the fair value in the previous example because, in the previous example, the asset was assumed to be worthless at the end of the lease term. (continued) 15 -50

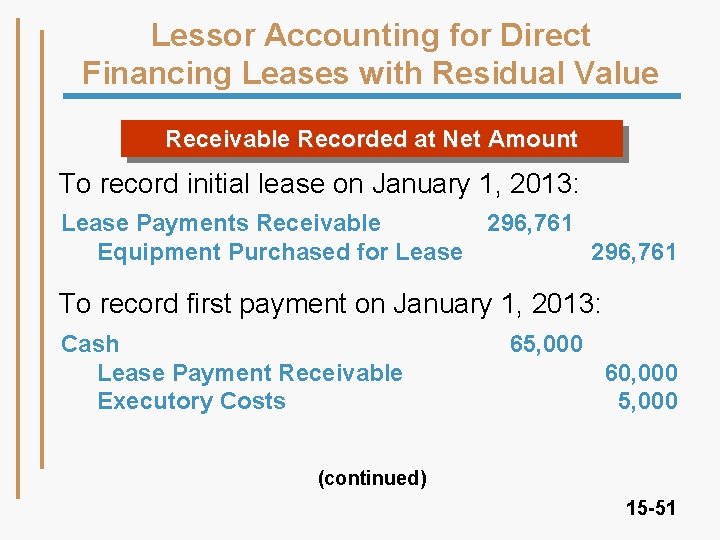

Lessor Accounting for Direct Financing Leases with Residual Value Receivable Recorded at Net Amount To record initial lease on January 1, 2013: Lease Payments Receivable 296, 761 Equipment Purchased for Lease 296, 761 To record first payment on January 1, 2013: Cash Lease Payment Receivable Executory Costs 65, 000 60, 000 5, 000 (continued) 15 -51

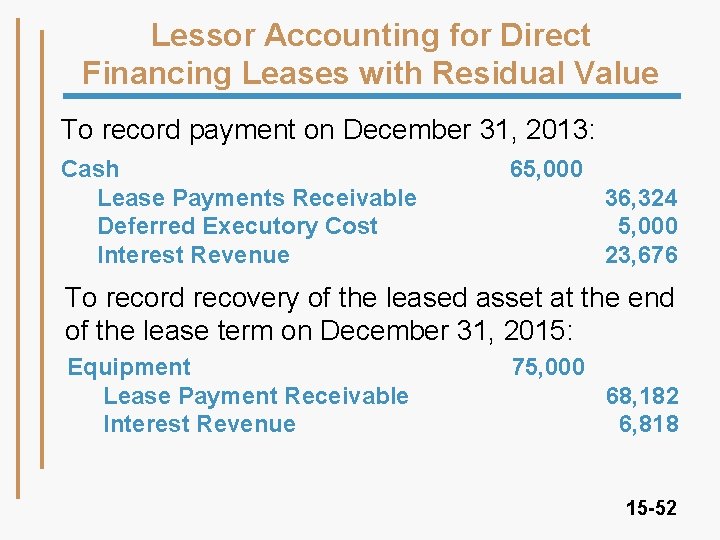

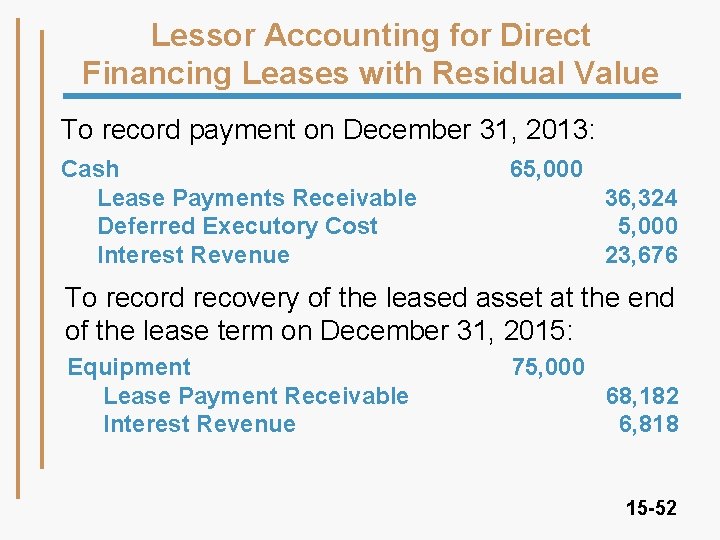

Lessor Accounting for Direct Financing Leases with Residual Value To record payment on December 31, 2013: Cash Lease Payments Receivable Deferred Executory Cost Interest Revenue 65, 000 36, 324 5, 000 23, 676 To record recovery of the leased asset at the end of the lease term on December 31, 2015: Equipment Lease Payment Receivable Interest Revenue 75, 000 68, 182 6, 818 15 -52

Accounting for Sales-Type Leases —Lessor • In a sales-type lease, an immediate profit or loss arises from the difference between the sales price of the leased property and the lessor’s cost to manufacture or purchase the asset. • If there is no difference between the sales price and the lessor’s cost, the lease is not a sales-type lease. (continued) 15 -53

Accounting for Sales-Type Leases —Lessor • The lessor will also recognize interest revenue over the lease term for the difference between the sales price and the gross amount of the minimum lease payments. (continued) 15 -54

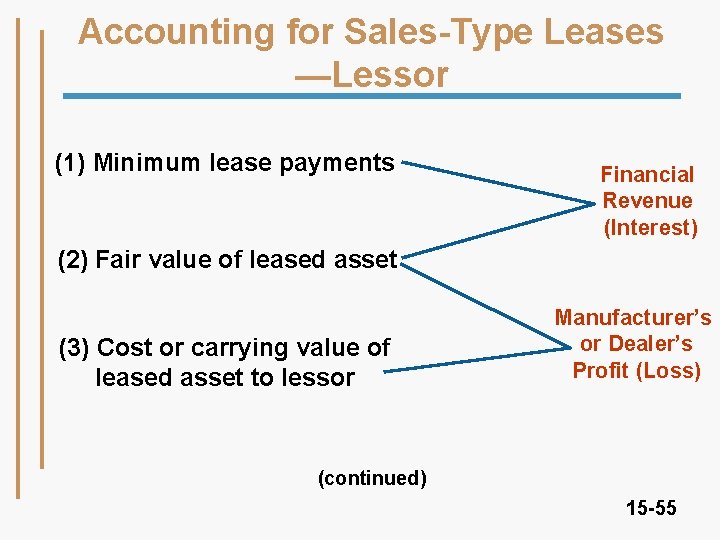

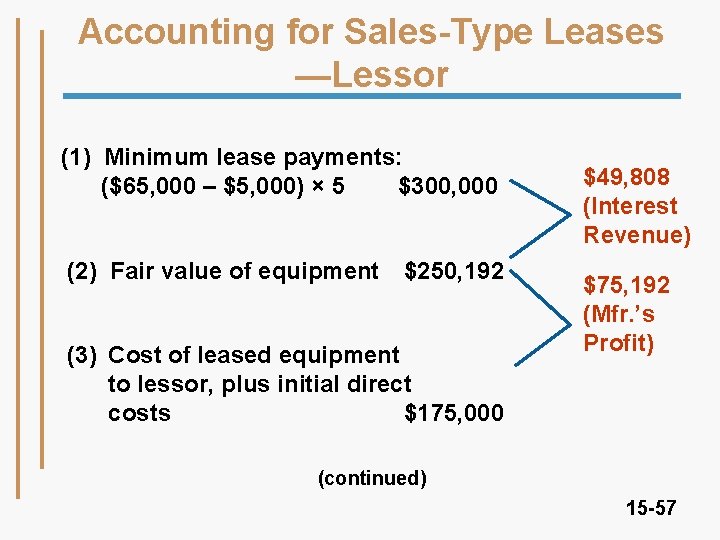

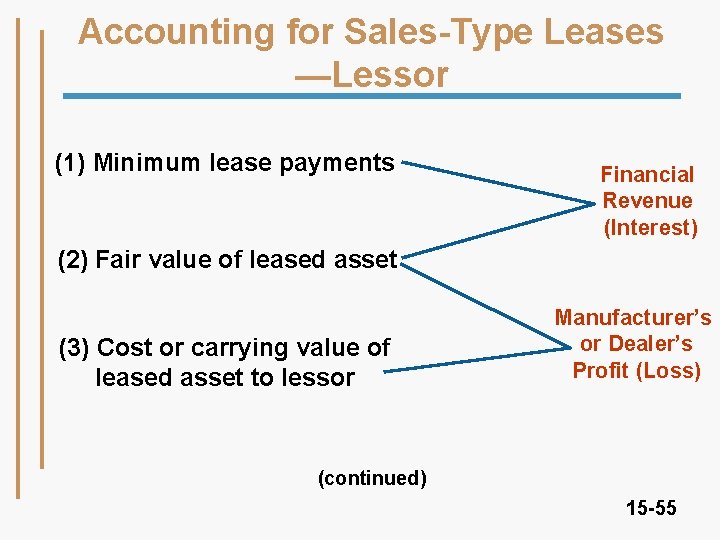

Accounting for Sales-Type Leases —Lessor (1) Minimum lease payments Financial Revenue (Interest) (2) Fair value of leased asset (3) Cost or carrying value of leased asset to lessor Manufacturer’s or Dealer’s Profit (Loss) (continued) 15 -55

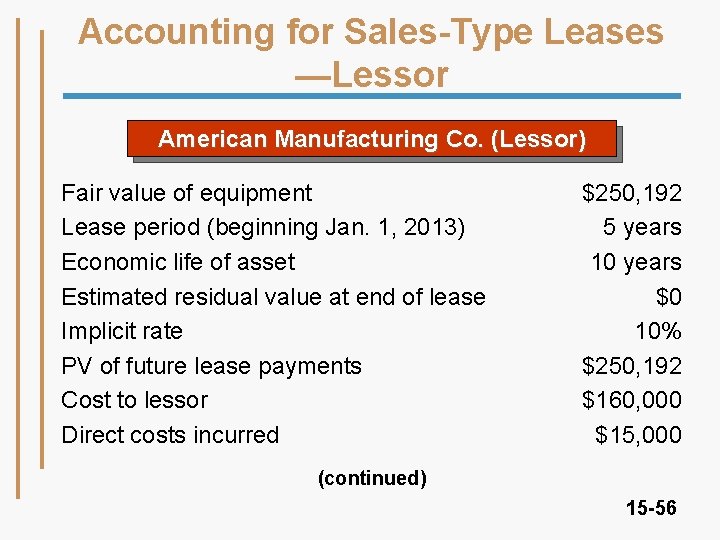

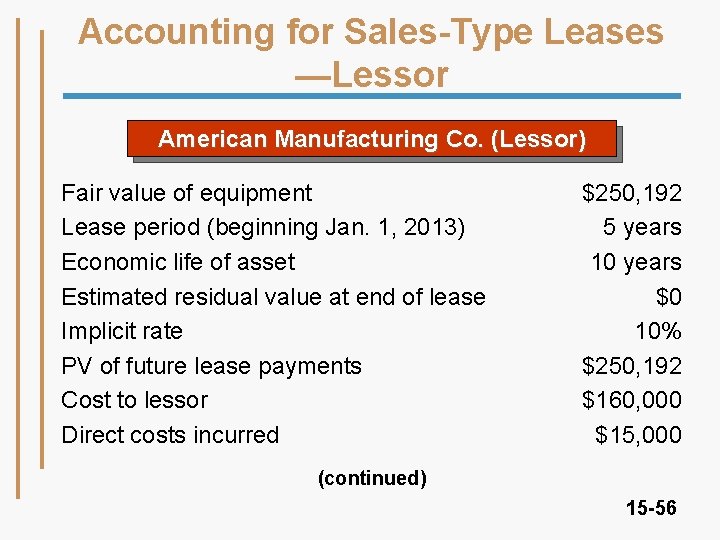

Accounting for Sales-Type Leases —Lessor American Manufacturing Co. (Lessor) Fair value of equipment Lease period (beginning Jan. 1, 2013) Economic life of asset Estimated residual value at end of lease Implicit rate PV of future lease payments Cost to lessor Direct costs incurred $250, 192 5 years 10 years $0 10% $250, 192 $160, 000 $15, 000 (continued) 15 -56

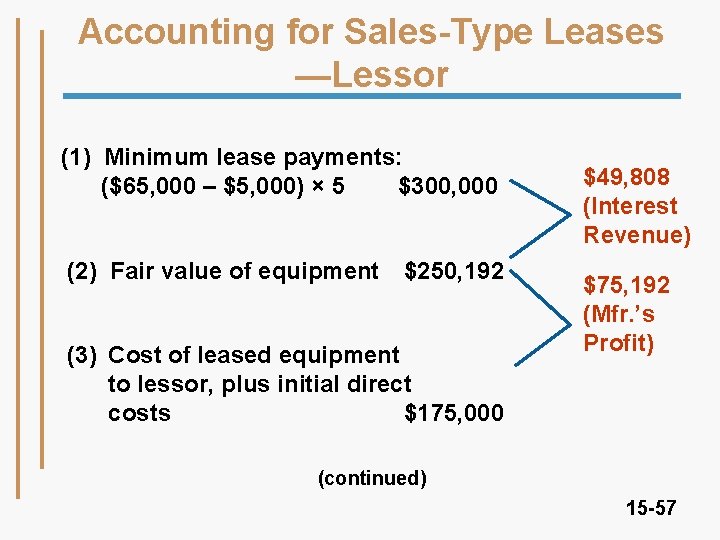

Accounting for Sales-Type Leases —Lessor (1) Minimum lease payments: ($65, 000 – $5, 000) × 5 $300, 000 (2) Fair value of equipment $250, 192 (3) Cost of leased equipment to lessor, plus initial direct costs $175, 000 $49, 808 (Interest Revenue) $75, 192 (Mfr. ’s Profit) (continued) 15 -57

Accounting for Sales-Type Leases —Lessor American Manufacturing Co. (Lessor) To record entries on January 1, 2013: Lease Payments Receivable Sales 250, 192 Cost of Goods Sold Finished Goods Inventory Deferred Initial Direct Costs 175, 000 Cash Lease Payments Receivable Executory Costs 65, 000 250, 192 160, 000 15, 000 60, 000 5, 000 15 -58

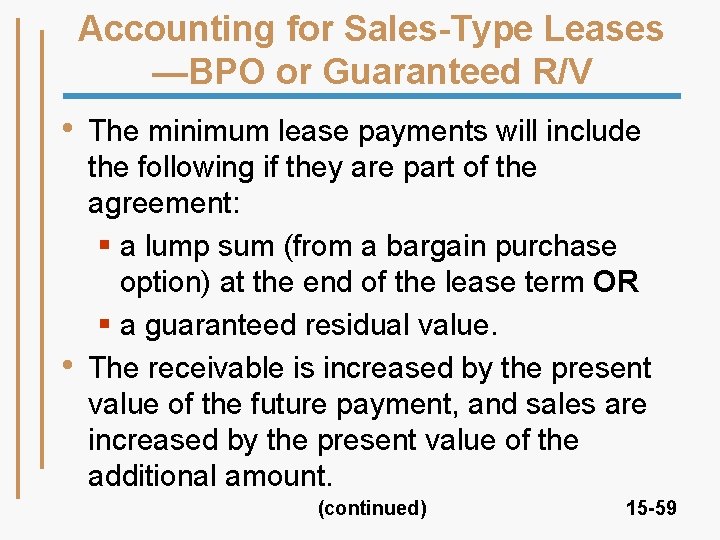

Accounting for Sales-Type Leases —BPO or Guaranteed R/V • • The minimum lease payments will include the following if they are part of the agreement: § a lump sum (from a bargain purchase option) at the end of the lease term OR § a guaranteed residual value. The receivable is increased by the present value of the future payment, and sales are increased by the present value of the additional amount. (continued) 15 -59

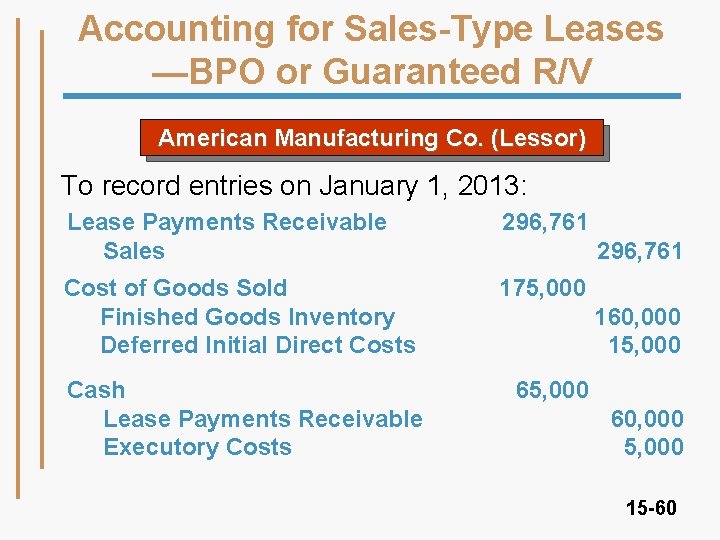

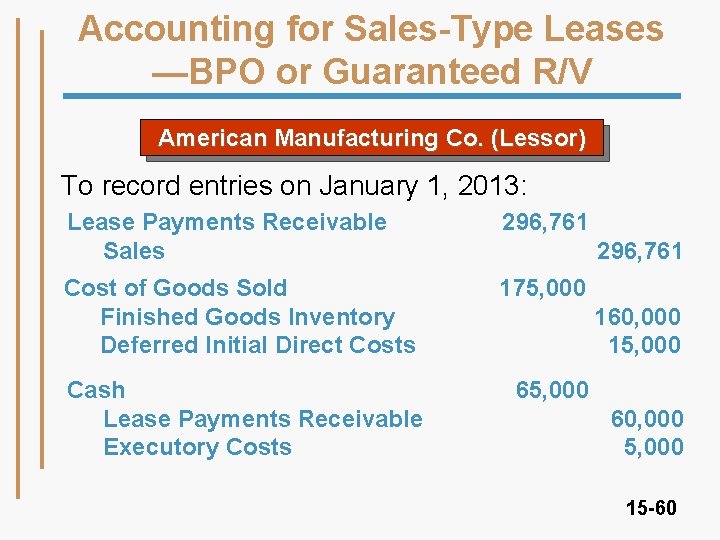

Accounting for Sales-Type Leases —BPO or Guaranteed R/V American Manufacturing Co. (Lessor) To record entries on January 1, 2013: Lease Payments Receivable Sales 296, 761 Cost of Goods Sold Finished Goods Inventory Deferred Initial Direct Costs 175, 000 Cash Lease Payments Receivable Executory Costs 65, 000 296, 761 160, 000 15, 000 60, 000 5, 000 15 -60

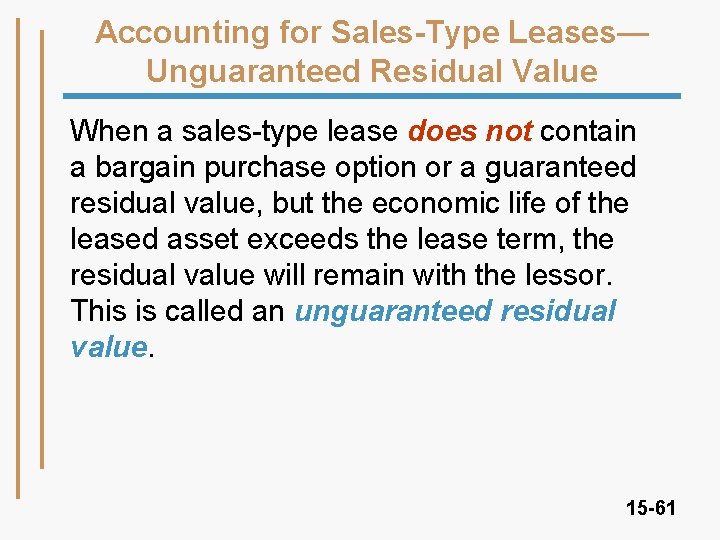

Accounting for Sales-Type Leases— Unguaranteed Residual Value When a sales-type lease does not contain a bargain purchase option or a guaranteed residual value, but the economic life of the leased asset exceeds the lease term, the residual value will remain with the lessor. This is called an unguaranteed residual value. 15 -61

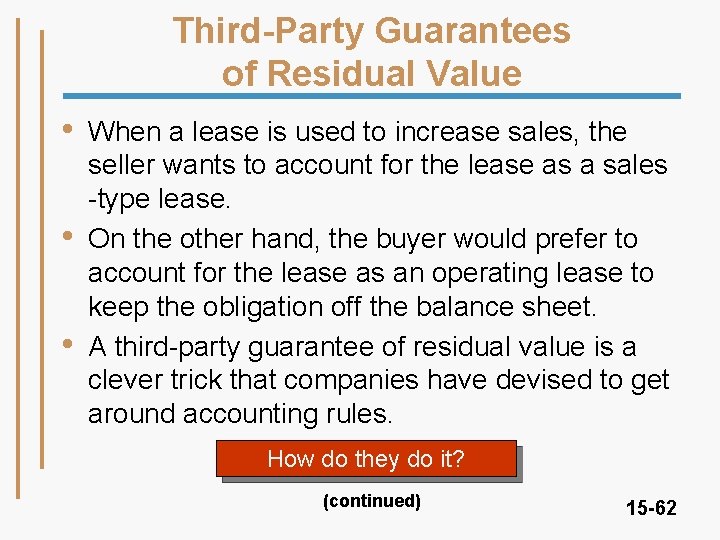

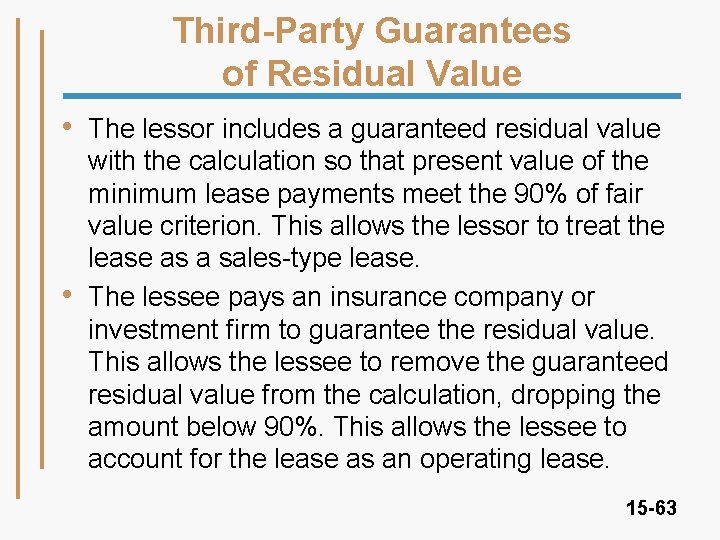

Third-Party Guarantees of Residual Value • • • When a lease is used to increase sales, the seller wants to account for the lease as a sales -type lease. On the other hand, the buyer would prefer to account for the lease as an operating lease to keep the obligation off the balance sheet. A third-party guarantee of residual value is a clever trick that companies have devised to get around accounting rules. How do they do it? (continued) 15 -62

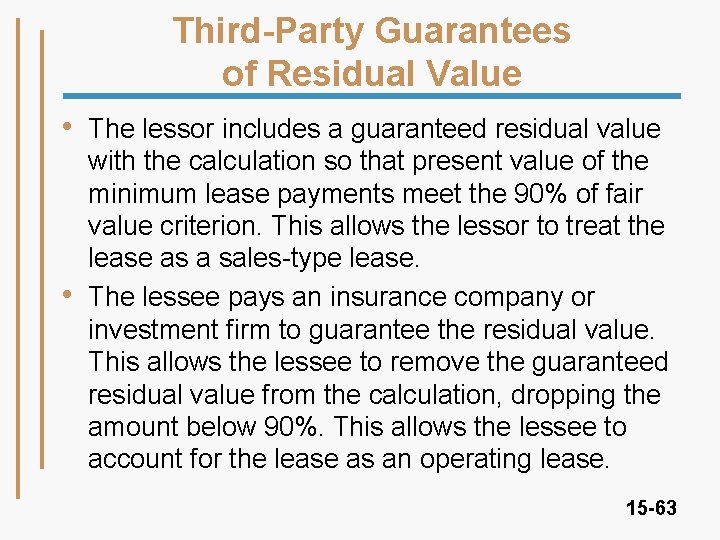

Third-Party Guarantees of Residual Value • • The lessor includes a guaranteed residual value with the calculation so that present value of the minimum lease payments meet the 90% of fair value criterion. This allows the lessor to treat the lease as a sales-type lease. The lessee pays an insurance company or investment firm to guarantee the residual value. This allows the lessee to remove the guaranteed residual value from the calculation, dropping the amount below 90%. This allows the lessee to account for the lease as an operating lease. 15 -63

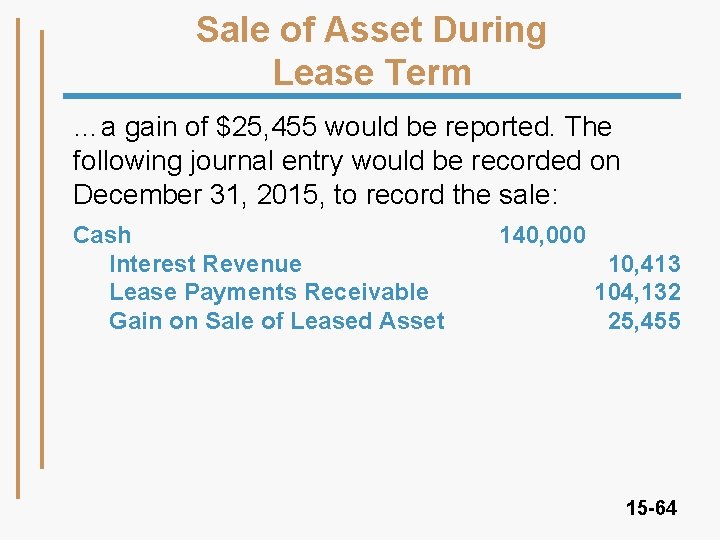

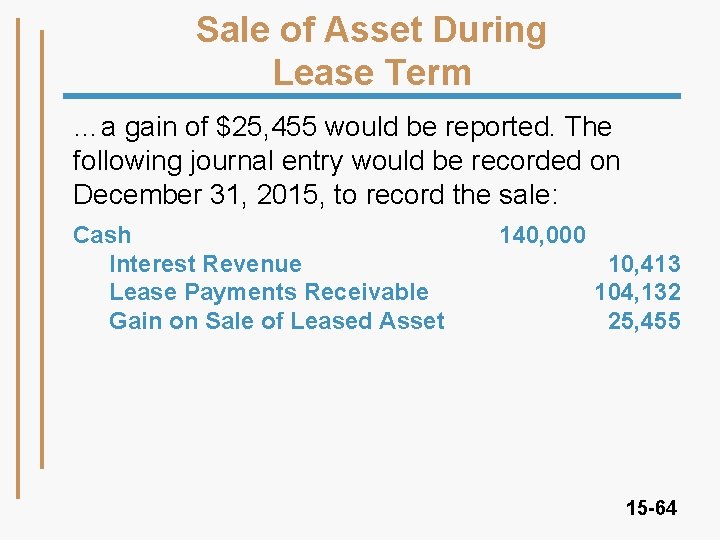

Sale of Asset During Lease Term …a gain of $25, 455 would be reported. The following journal entry would be recorded on December 31, 2015, to record the sale: Cash Interest Revenue Lease Payments Receivable Gain on Sale of Leased Asset 140, 000 10, 413 104, 132 25, 455 15 -64

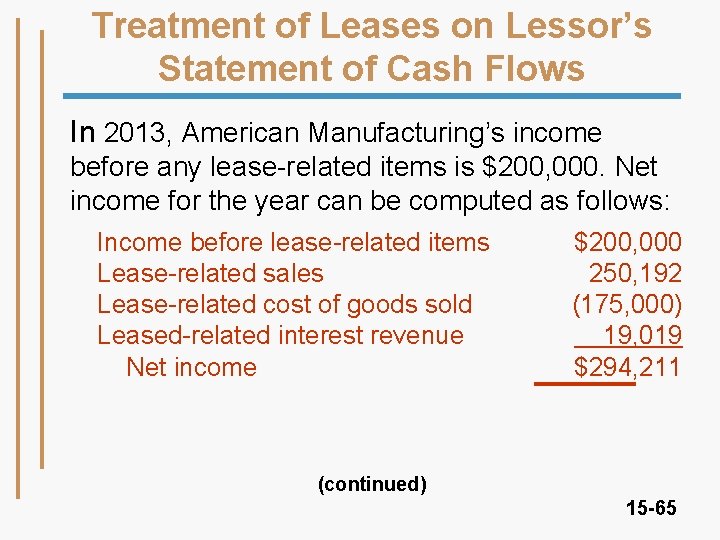

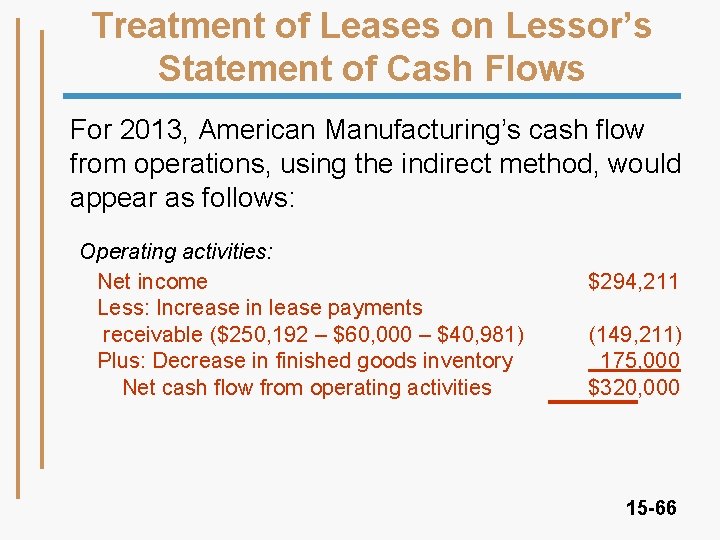

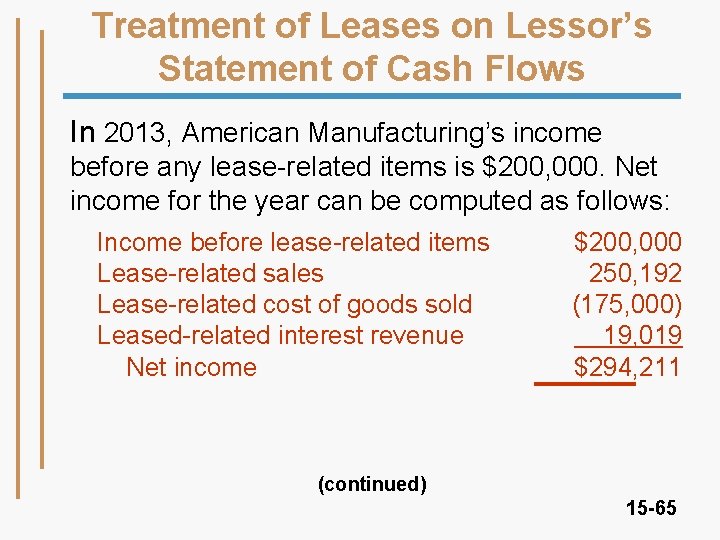

Treatment of Leases on Lessor’s Statement of Cash Flows In 2013, American Manufacturing’s income before any lease-related items is $200, 000. Net income for the year can be computed as follows: Income before lease-related items Lease-related sales Lease-related cost of goods sold Leased-related interest revenue Net income $200, 000 250, 192 (175, 000) 19, 019 $294, 211 (continued) 15 -65

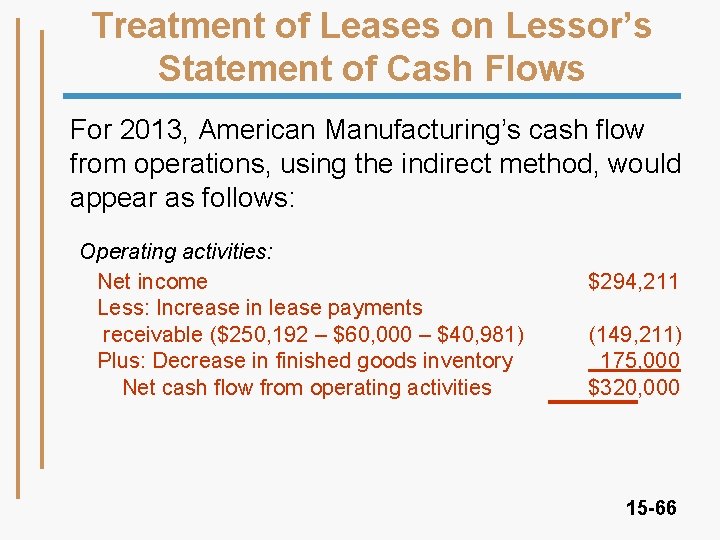

Treatment of Leases on Lessor’s Statement of Cash Flows For 2013, American Manufacturing’s cash flow from operations, using the indirect method, would appear as follows: Operating activities: Net income Less: Increase in lease payments receivable ($250, 192 – $60, 000 – $40, 981) Plus: Decrease in finished goods inventory Net cash flow from operating activities $294, 211 (149, 211) 175, 000 $320, 000 15 -66

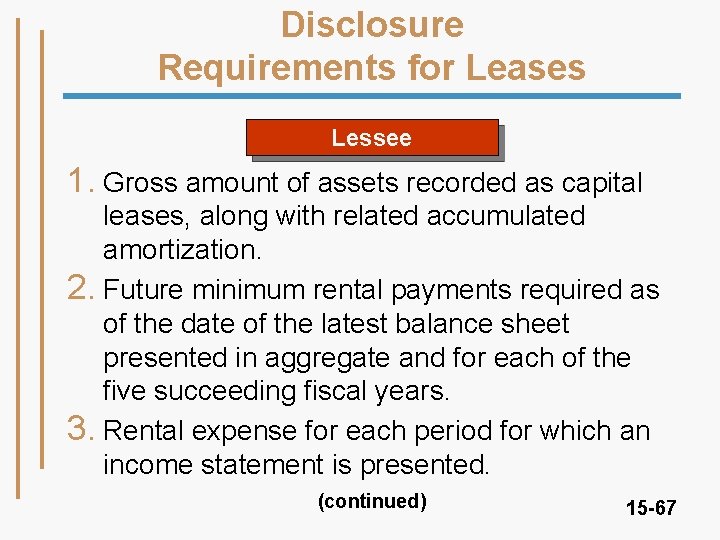

Disclosure Requirements for Leases Lessee 1. Gross amount of assets recorded as capital leases, along with related accumulated amortization. 2. Future minimum rental payments required as of the date of the latest balance sheet presented in aggregate and for each of the five succeeding fiscal years. 3. Rental expense for each period for which an income statement is presented. (continued) 15 -67

Disclosure Requirements for Leases 4. A general description of the lease contracts, including information about restrictions on such items as dividends, additional debt, and further leasing. 5. For capital leases, the amount of imputed interest necessary to reduce the lease payments to present value. (continued) 15 -68

International Accounting of Leases • • IAS 17 relies on the exercise of accounting judgment to distinguish between operating and capital leases. A proposal, titled “Accounting for Leases: A New Approach, ” notes that current lease accounting standards fail in their objective of requiring companies to recognize significant rights and obligations as assets and liabilities in the balance sheet. (continued) 15 -69

International Accounting of Leases • This proposal suggests that the lease accounting rule be simplified as follows: All lease contracts are to be accounted for as capital leases. 15 -70

Chapter 15 ₵ The End $ 15 -71

15 -72