Chapter 14 Financial Ratios and Firm Performance 1

- Slides: 29

Chapter 14 Financial Ratios and Firm Performance 1

LEARNING OBJECTIVES 1. Create, understand, and interpret common-size financial statements. 2. Calculate and interpret financial ratios. 3. Compare different company performances using financial ratios, historical financial ratio trends, and industry ratios. 14 -2

14. 1 Financial Statements Just like a doctor takes a look at a patient’s x-rays or catscan when diagnosing health problems, a manager or analyst can take a look at a firm’s primary financial statements, the income statement and the balance sheet, when trying to gauge the status or performance of a firm. Income statement: periodic recording of the sources of revenue and expenses of a firm, Balance sheet: provides a point in time snap shot of the firm’s assets, liabilities and owner’s equity. 14 -3

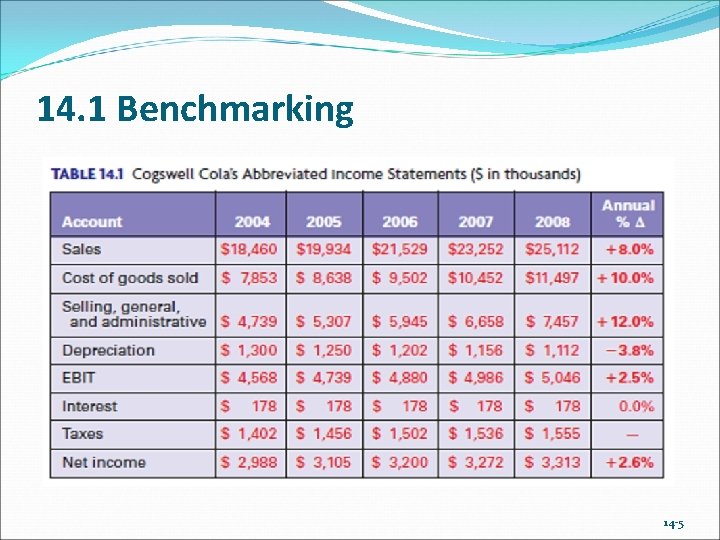

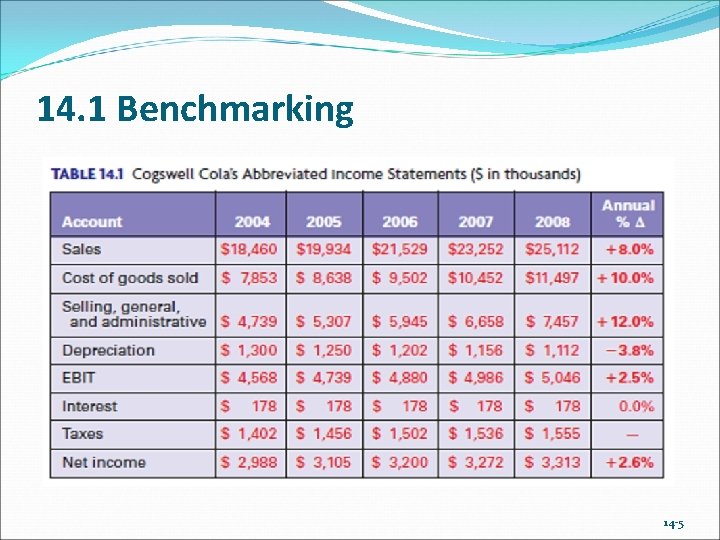

14. 1 Benchmarking The financial statements constitute a fairly complex set of documents involving a whole bunch of numbers. They tell us in absolute values something about the amount of assets, liabilities, equity, revenues, expenses, and taxes of a firm, But it is difficult to really gauge what’s going on, primarily because of size and maturity differences among firms. requires “benchmarking” against some standard. One common method of benchmarking a is to compare a firm’s current performance against that of its own performance over a 3 -5 year period (trend analysis), by looking at the growth rate in various key items such as sales, costs, and profits. 14 -4

14. 1 Benchmarking 14 -5

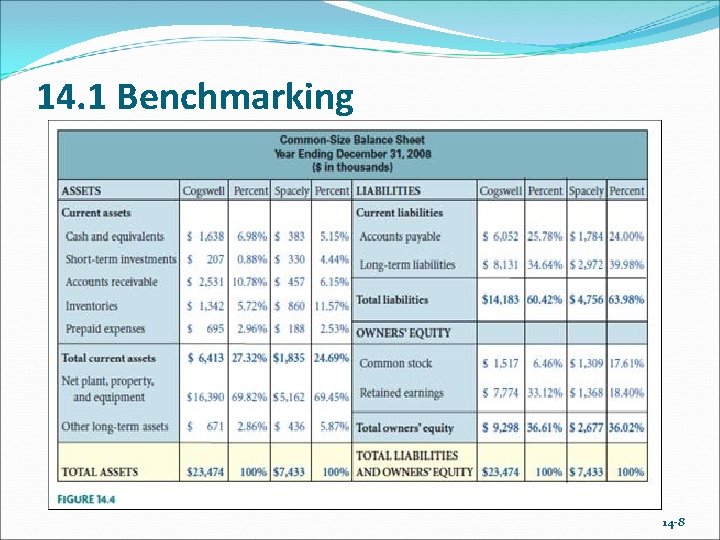

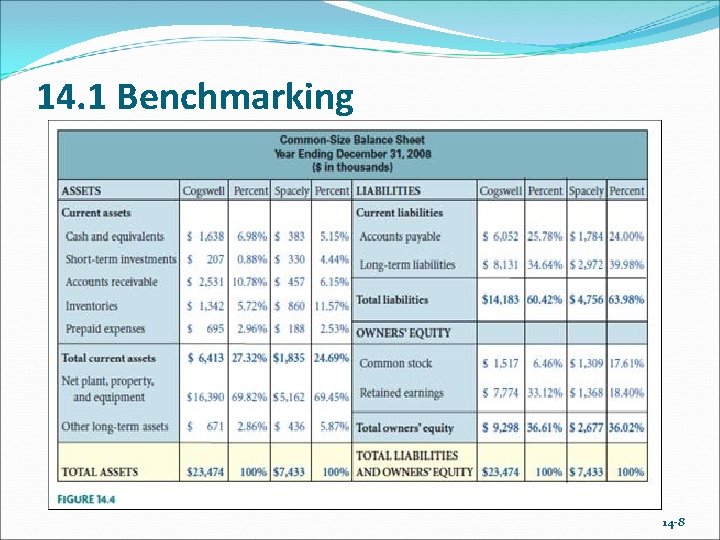

14. 1 Benchmarking Another useful way to make some sense out of this mess of numbers, is to re-cast the income statement and the balance sheet into common size statements, by expressing each income statement item as a percent of sales and each balance sheet item as a percent of total assets. 14 -6

14. 1 Benchmarking 14 -7

14. 1 Benchmarking 14 -8

14. 1 Benchmarking • Benchmarking is a good starting point to detect trends (if any) in a firm’s performance and to make quick comparisons of key financial statement values with competitors on a relative basis. • More in-depth diagnosis requires individual item analyses and comparisons which are best done by conducting ratio analysis. 14 -9

14. 2 Financial Ratios • Financial ratios are relationships between different accounts from financial statements—usually the income statement and the balance sheet—that serve as performance indicators • Being relative values, financial ratios allow for meaningful comparisons across time, between competitors, and with industry averages. 14 -10

14. 2 Financial Ratios FIVE key areas of a firm’s performance can be analyzed using financial ratios: 1. Liquidity ratios: Can the company meet its obligations over the short term? 2. Solvency ratios: (also known as financial leverage ratios): Can the company meet its obligations over the long term? 3. Asset management ratios: How efficiently is the company managing its assets to generate sales? 4. Profitability ratios: How well has the company performed overall? 5. Market value ratios: How does the market (investors) view the company’s financial prospects? Can also conduct a Du Pont analysis which involves a breakdown of the return on equity into its three components, i. e. profit margin, turnover, and leverage. 14 -11

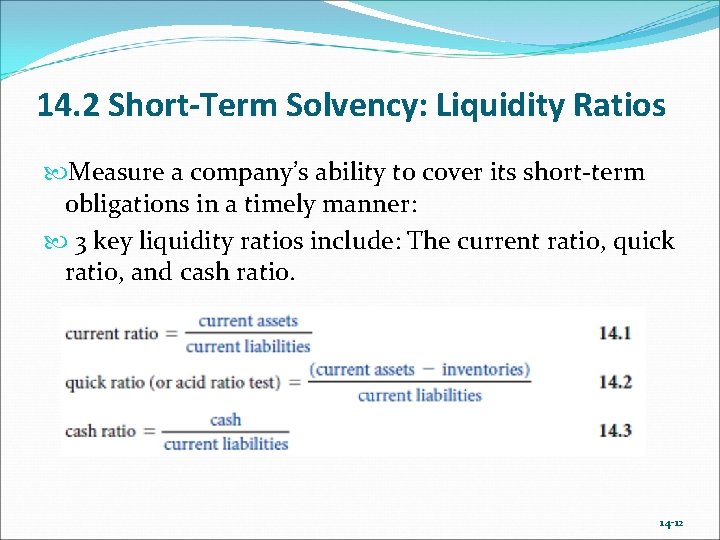

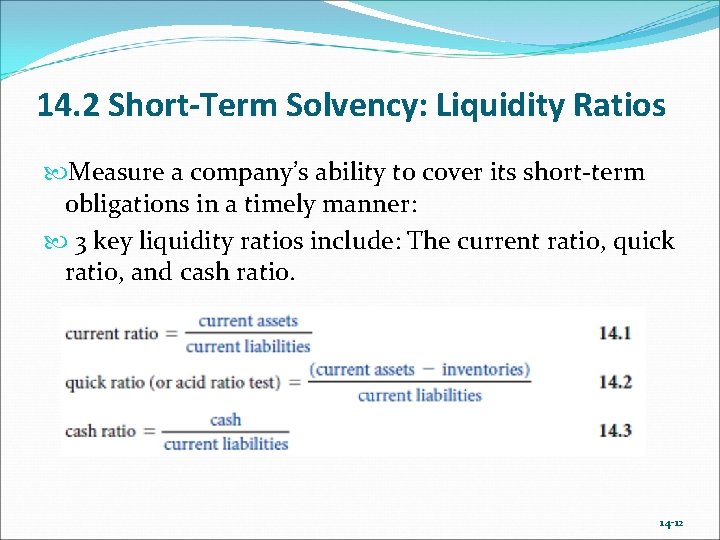

14. 2 Short-Term Solvency: Liquidity Ratios Measure a company’s ability to cover its short-term obligations in a timely manner: 3 key liquidity ratios include: The current ratio, quick ratio, and cash ratio. 14 -12

14. 2 Short-Term Solvency: Liquidity Ratios Cogswell has better liquidity and short-term solvency than Spacely, but, higher investment in current assets also means that lower yields are being realized since current assets are typically low yielding assets. So, we need to look at the other areas and inter-related effects of the firm’s various accounting items. 14 -13

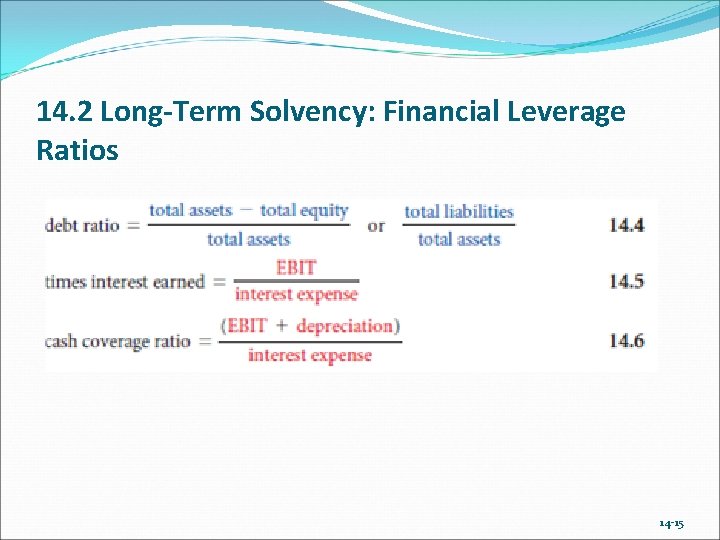

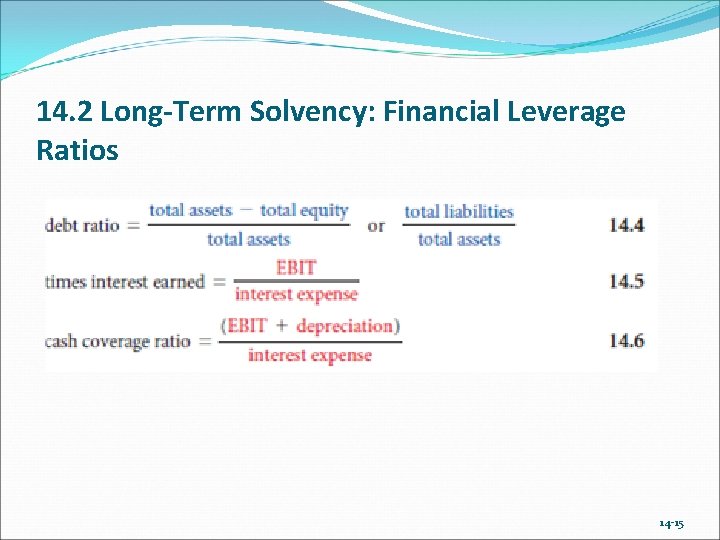

14. 2 Long-Term Solvency: Financial Leverage Ratios • Measure a company’s ability to meet its long-term debt obligations based on its overall debt level and earnings capacity. • Failure to meet its interest obligation could put a firm into bankruptcy. • Equations 14. 4, 14. 5, and 14. 6 can be used to calculate 3 key financial leverage ratios: the debt ratio, times interest earned ratio, and cash coverage ratio. 14 -14

14. 2 Long-Term Solvency: Financial Leverage Ratios 14 -15

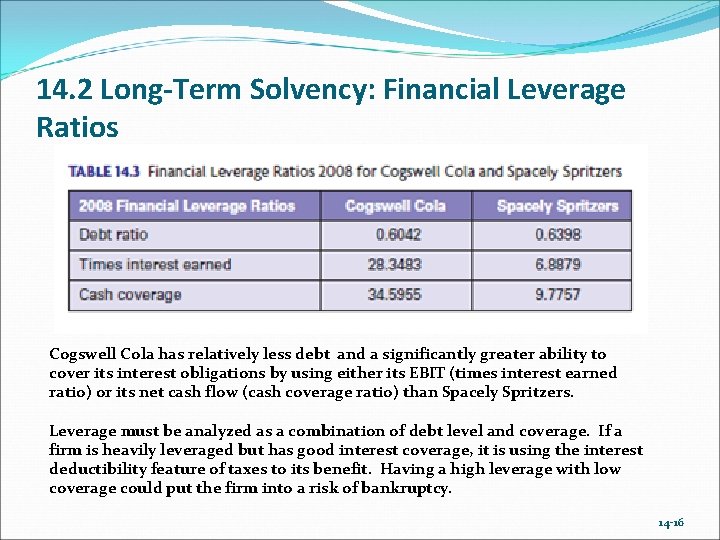

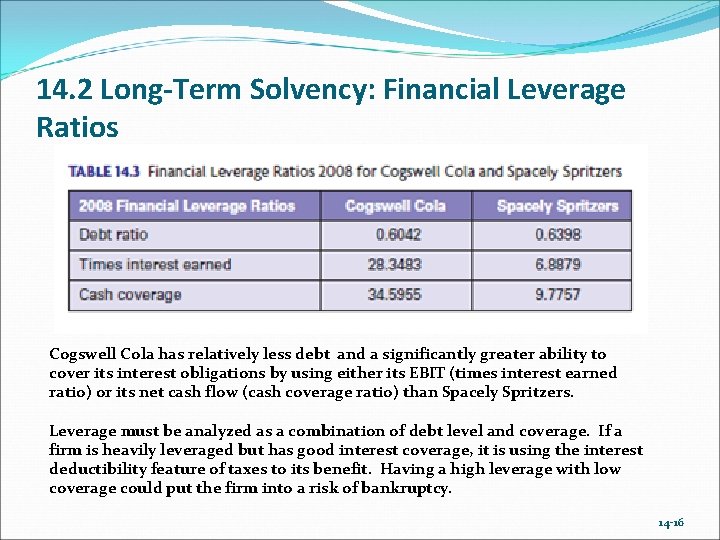

14. 2 Long-Term Solvency: Financial Leverage Ratios Cogswell Cola has relatively less debt and a significantly greater ability to cover its interest obligations by using either its EBIT (times interest earned ratio) or its net cash flow (cash coverage ratio) than Spacely Spritzers. Leverage must be analyzed as a combination of debt level and coverage. If a firm is heavily leveraged but has good interest coverage, it is using the interest deductibility feature of taxes to its benefit. Having a high leverage with low coverage could put the firm into a risk of bankruptcy. 14 -16

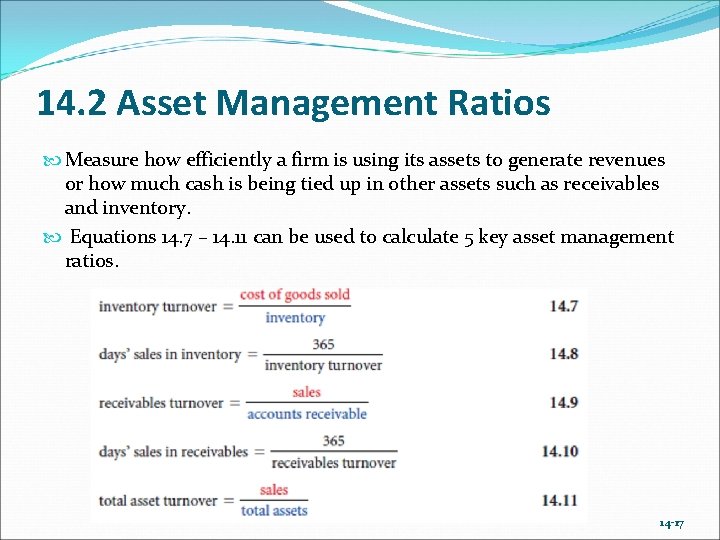

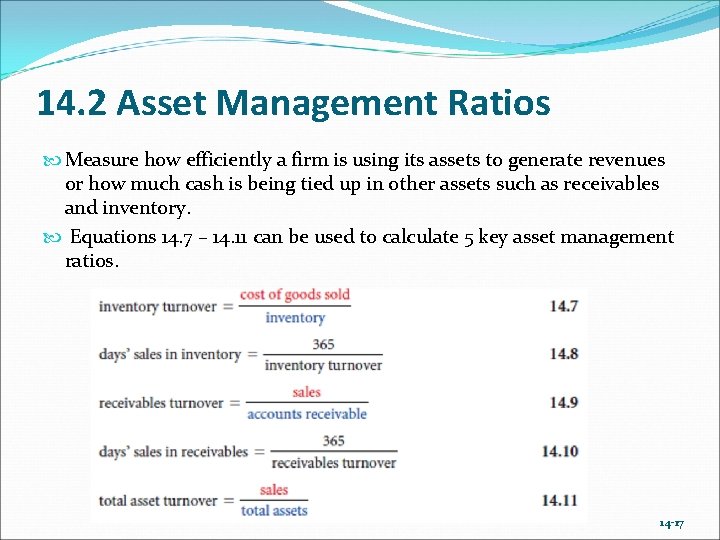

14. 2 Asset Management Ratios Measure how efficiently a firm is using its assets to generate revenues or how much cash is being tied up in other assets such as receivables and inventory. Equations 14. 7 – 14. 11 can be used to calculate 5 key asset management ratios. 14 -17

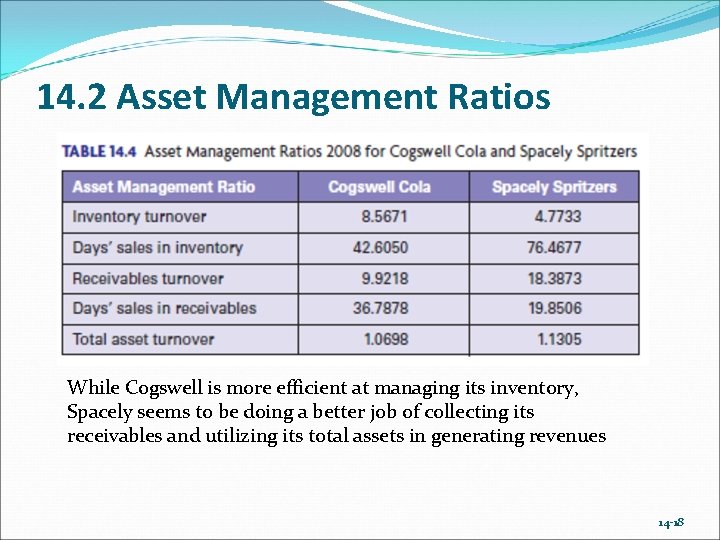

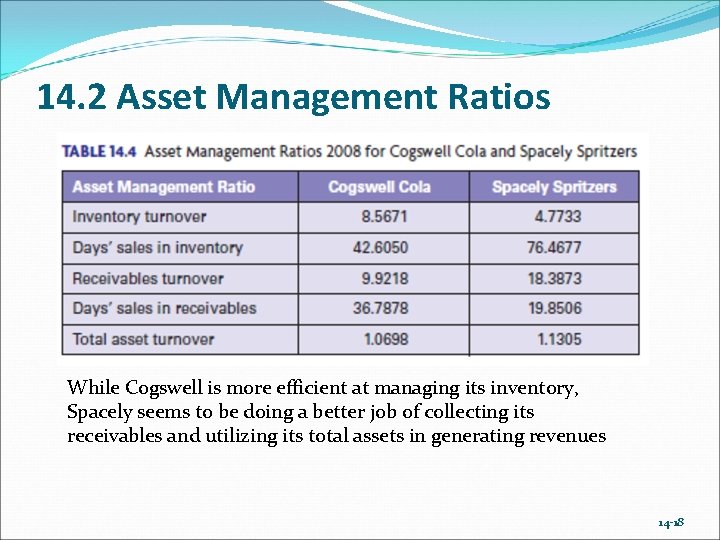

14. 2 Asset Management Ratios While Cogswell is more efficient at managing its inventory, Spacely seems to be doing a better job of collecting its receivables and utilizing its total assets in generating revenues 14 -18

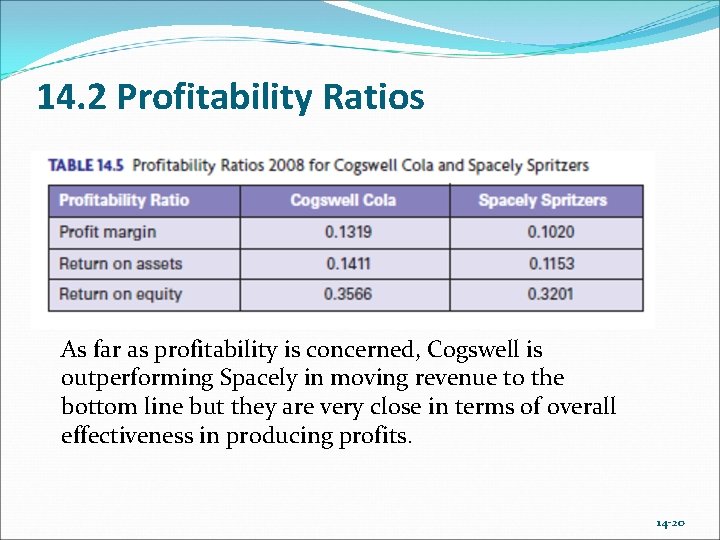

14. 2 Profitability Ratios Profitability ratios such as net profit margin, returns on assets, and return on equity, measure a firm’s effectiveness in turning sales or assets into profits. 14 -19

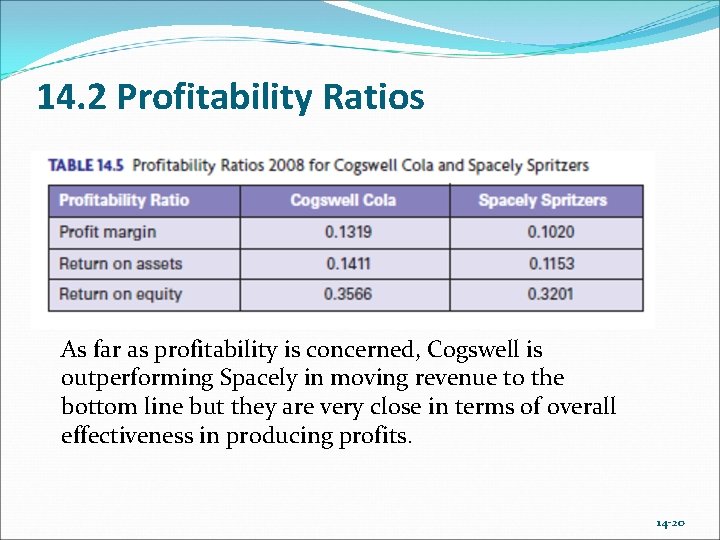

14. 2 Profitability Ratios As far as profitability is concerned, Cogswell is outperforming Spacely in moving revenue to the bottom line but they are very close in terms of overall effectiveness in producing profits. 14 -20

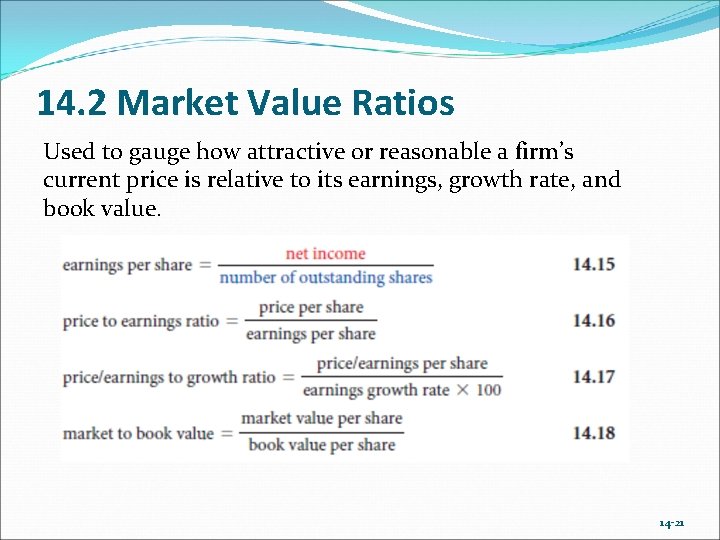

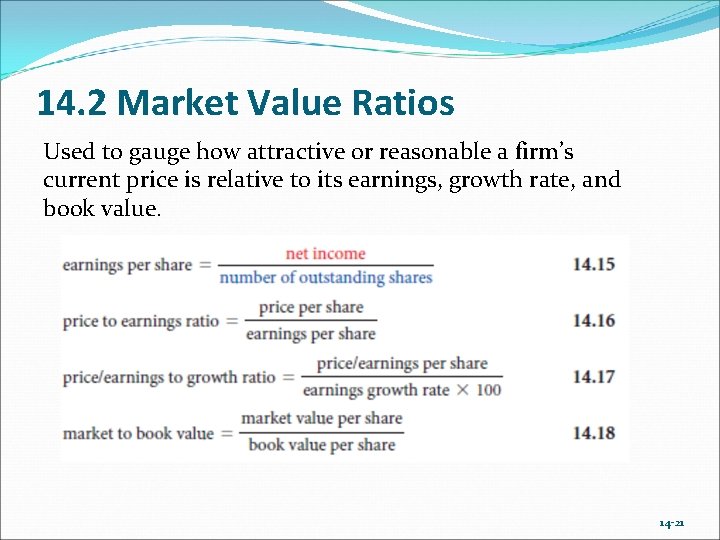

14. 2 Market Value Ratios Used to gauge how attractive or reasonable a firm’s current price is relative to its earnings, growth rate, and book value. 14 -21

14. 2 Market Value Ratios • Potential investors and analysts often use these • • • ratios as part of their valuation analysis. Typically, if a firm has a high price to earnings and a high market to book value ratio, it is an indication that investors have a good perception about the firm’s performance. However, if these ratios are very high it could also mean that a firm is over-valued. With the price/earnings to growth ratio (PEG ratio), the lower it is, the more of a bargain it seems to be trading at, vis-à-vis its growth expectation. 14 -22

14. 2 Market Value Ratios Ratio Cogswell Cola P/E PEG P/B 15. 41 1. 28 5. 49 Spacely Spritzers 13. 01 0. 86 4. 17 The ratios seem to indicate that investors in both firms seem to have good expectations about their performance and are therefore paying fairly high prices relative to their earnings book values. 14 -23

14. 2 Du Pont analysis Involves breaking down ROE into three components of the firm: (1) operating efficiency, as measured by the profit margin (net income/sales); (2) asset management efficiency, as measured by asset turnover (sales/total assets); and (3) financial leverage, as measured by the equity multiplier (total assets/total equity). Equation 14. 19 shows that if we multiply a firm’s net profit margin by its total asset turnover ratio and its equity multiplier, we will get its return on equity. 14 -24

14. 2 Du Pont analysis Cogswell has better operational efficiency and is better able to move sales dollars into income, but Spritzer is more efficient at utilizing its assets, and since it uses more debt, it is able to get more of its earnings to its shareholders. Although these 14 ratios are not the only ones that can be used to assess a firm’s performance, they are some of the most popular ones. It is important to look at the overall picture of the firm in all five areas and accordingly reach conclusions or make recommendations for changes. 14 -25

14. 3 External Uses of Financial Statements and Industry Averages Financial statements of publicly traded companies and industry averages of key items provide the raw material for analysts and investors to make investment recommendations and decisions 14 -26

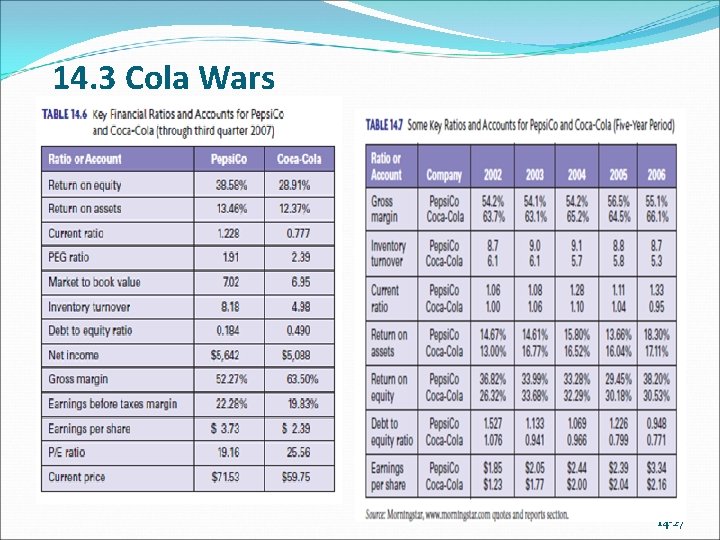

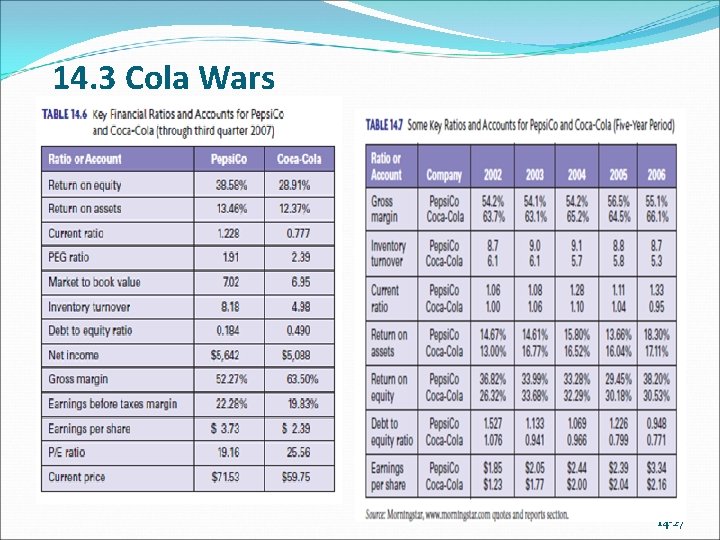

14. 3 Cola Wars 14 -27

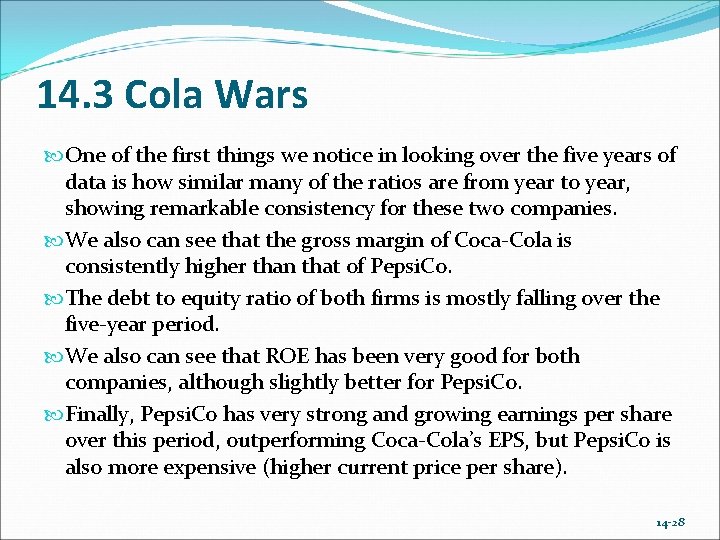

14. 3 Cola Wars One of the first things we notice in looking over the five years of data is how similar many of the ratios are from year to year, showing remarkable consistency for these two companies. We also can see that the gross margin of Coca-Cola is consistently higher than that of Pepsi. Co. The debt to equity ratio of both firms is mostly falling over the five-year period. We also can see that ROE has been very good for both companies, although slightly better for Pepsi. Co. Finally, Pepsi. Co has very strong and growing earnings per share over this period, outperforming Coca-Cola’s EPS, but Pepsi. Co is also more expensive (higher current price per share). 14 -28

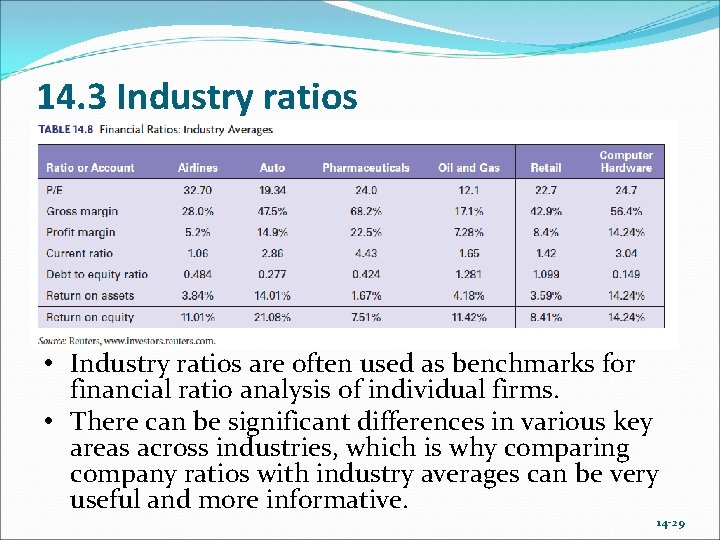

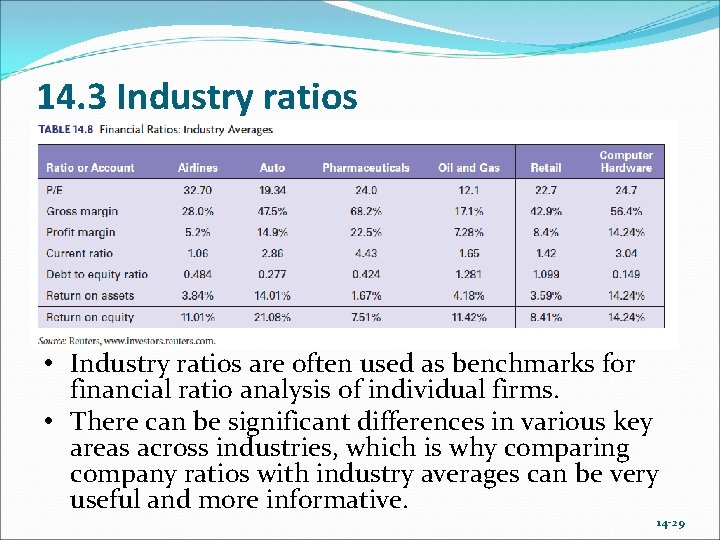

14. 3 Industry ratios • Industry ratios are often used as benchmarks for financial ratio analysis of individual firms. • There can be significant differences in various key areas across industries, which is why comparing company ratios with industry averages can be very useful and more informative. 14 -29