Chapter 12 The Macroeconomic Environment for Investment Decisions

- Slides: 37

Chapter 12 The Macroeconomic Environment for Investment Decisions Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

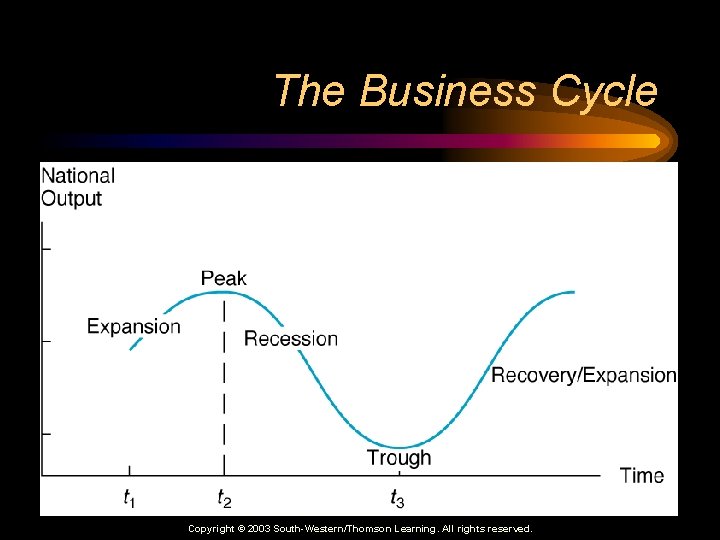

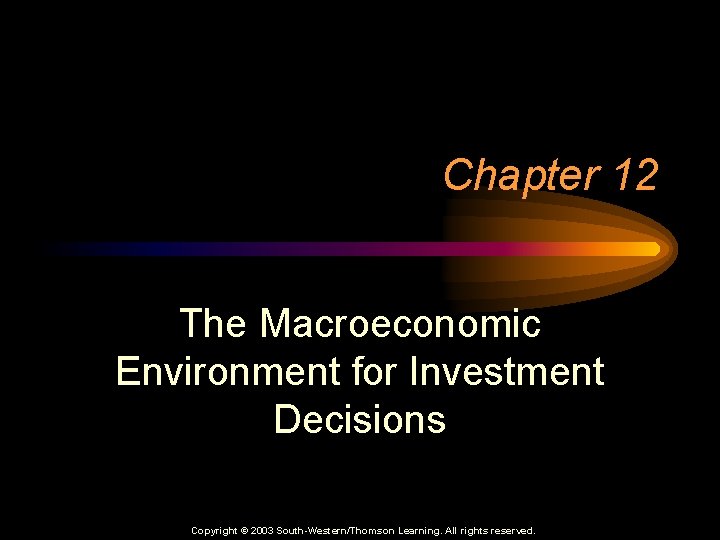

The Business Cycle Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Business Cycle • The economy – does not follow regular, predictable patterns – does have periods of expansion and contraction Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Business Cycle • 1972 - 1999: only four periods of recession • 1991 - 2001: ten years of unbroken economic growth • Second quarter of 2002: economy sustained negative growth Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Business Cycle • During recessions the level of unemployment rises Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Business Cycle • During most economic expansions – tendency for prices to increase (inflation) • The late 1990’s have been an exception to this pattern – modest inflation Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Measures of Economic Activity • Gross domestic product (GDP) – total value of all final goods produced with domestic factors of production • GDP is the summation of expenditures: – GDP = C + I + G + E Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

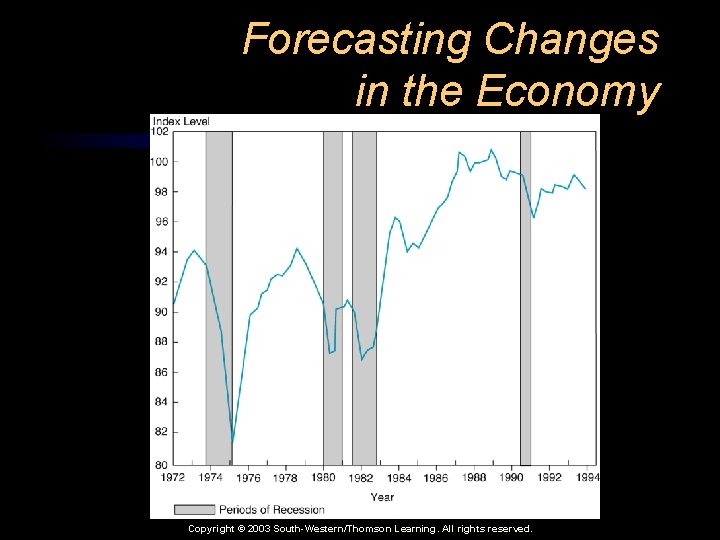

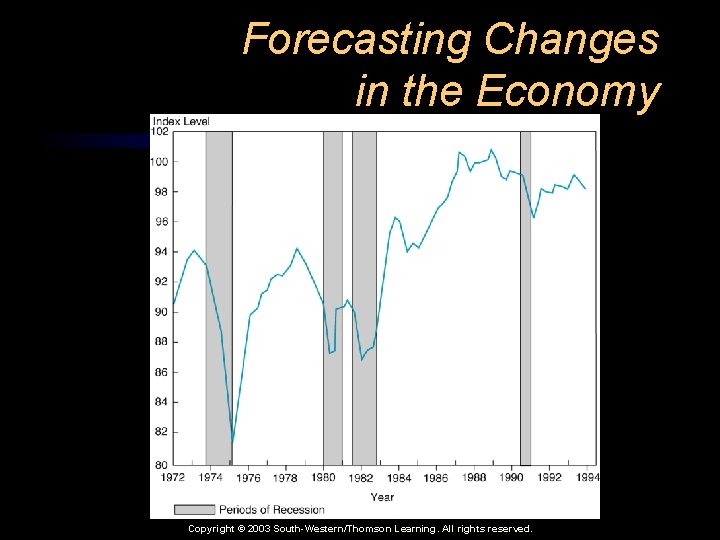

Forecasting Changes in the Economy • Leading indicators • The figure shows that the length of recessions and expansions varies Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Forecasting Changes in the Economy Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Measures of Inflation • Consumer price index (CPI) • Producer price index (PPI) Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Federal Reserve (the Fed) • The nation's central bank • Purpose: to control the supply of money in order to achieve – stable prices – full employment – economic growth Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

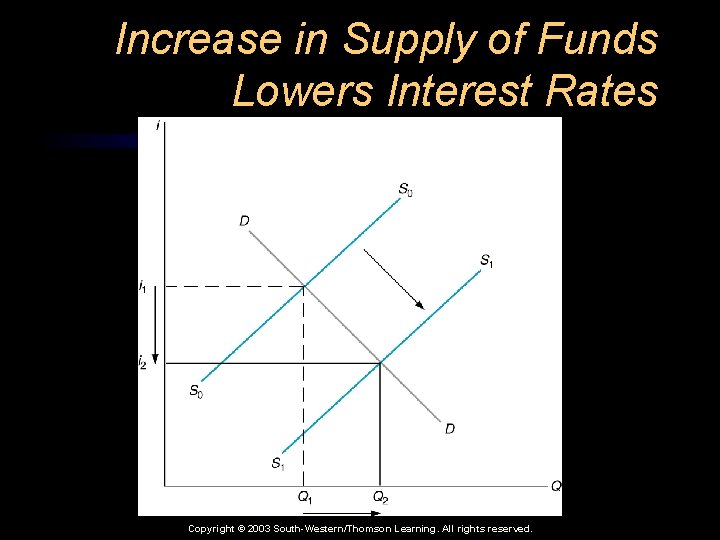

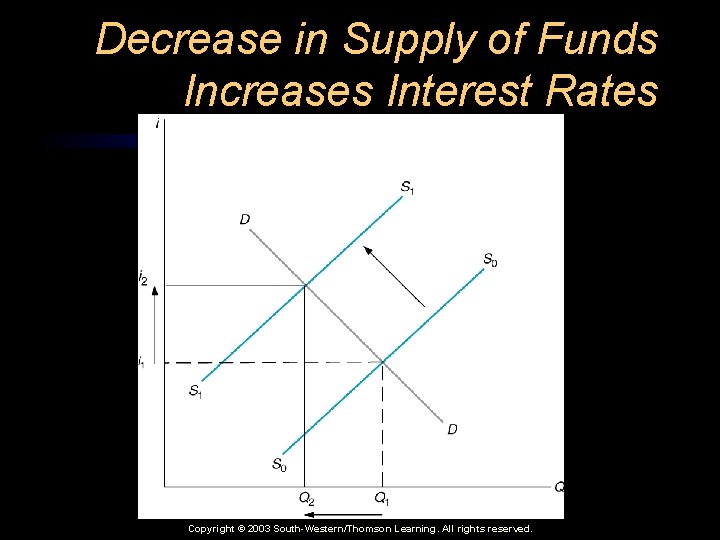

Interest Rates • Depend on the demand for and supply of loanable funds • Affected by the actions of the Fed Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

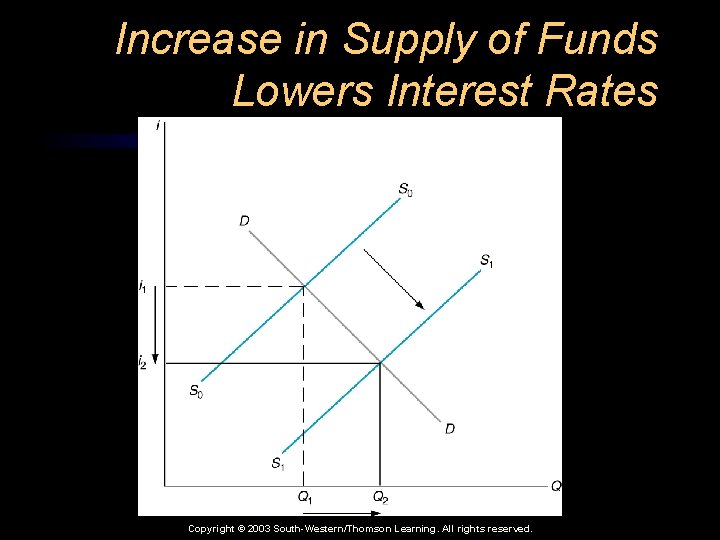

Increase in Supply of Funds Lowers Interest Rates Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

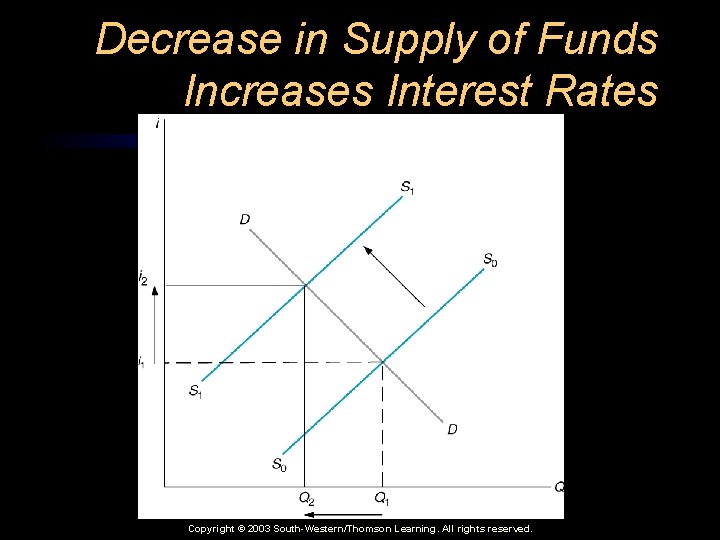

Decrease in Supply of Funds Increases Interest Rates Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

A Specific Interest Rate • Depends on a series of risk premiums – expected inflation – possibility of default – liquidity – term to maturity Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Impact of The Federal Reserve • The Fed affects interest rates through its impact on the ability of the banking system to lend Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Tools of Monetary Policy • The reserve requirement – changing commercial banks' reserves • The discount rate – rate the Fed charges banks to borrow reserves Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Tools of Monetary Policy • The federal funds rate: – the rate banks charge each other for borrowing reserves • The Fed sets a target federal funds rate Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Tools of Monetary Policy • Open market operations – The buying and selling of federal government securities • By far the most important tool of monetary policy is open market operations Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Monetary Expansion • To expand the money supply, the Fed buys government securities • The purchases reduce interest rates • Paying for the securities puts reserves into the banking system Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Monetary Contraction • To contract the money supply, the Fed sells government securities • The sales increase interest rates • Receiving payment for the securities removes reserves from the banking system Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Impact on Stock Prices • A change in interest rates is transferred to stock prices • Impact occurs through changes in the required return Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Money Supply • M-1 sum of cash, coin, and checking accounts • M-2 sum of cash, coin, checking accounts, plus savings accounts Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Money Supply • M-2 is a broader definition – M-2 is not affected by shift funds between checking and savings accounts Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Money Supply • Over time the money supply increases • The rate of increases varies • M-1 and M-2 do not always move together Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Fiscal Policy • The federal government's – taxation – spending – debt management Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Deficit Spending • Government spending exceeds revenues • Sources of funds to finance the deficit – commercial banks – non-bank public – Federal Reserve Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Surplus • Government revenues exceed revenues • Question of how to use any surplus Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Fiscal Policy • The possible impact of deficit spending or a surplus on – the money supply – the reserves of the banking system – security prices Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

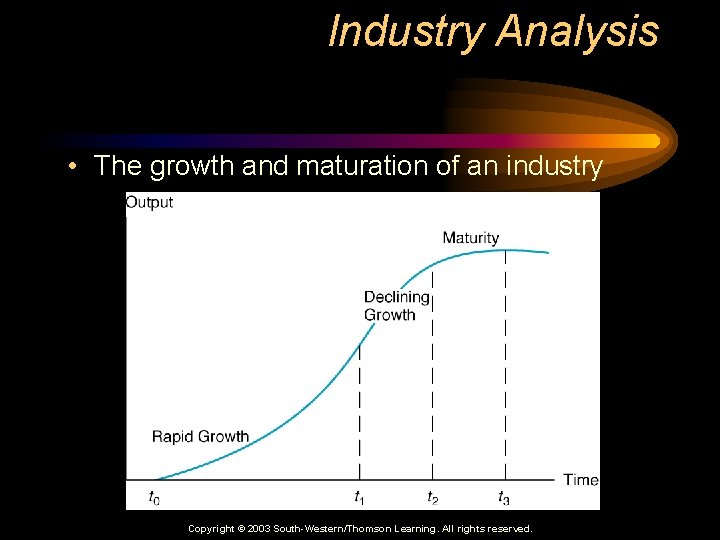

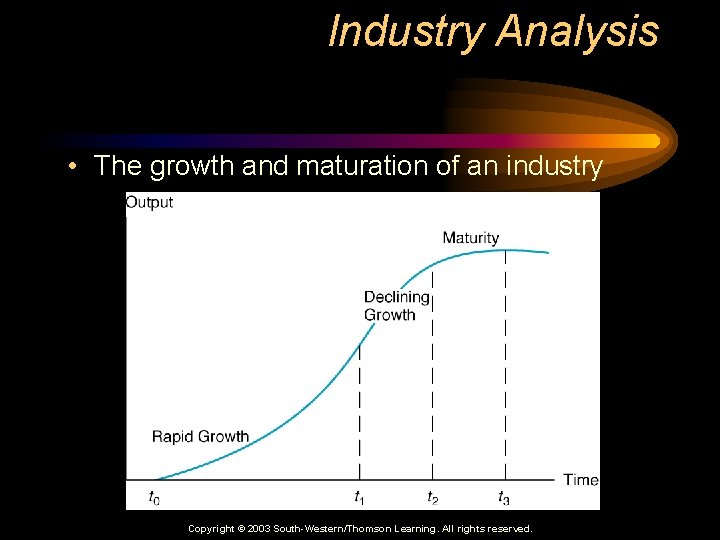

Industry Analysis • The growth and maturation of an industry Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Cyclical & Non-cyclical Industries • Cyclical firms are more sensitive to changes in the level of economic activity • Non-cyclical firms are less sensitive to changes in the level of economic activity Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

The Economic Environment and Investment Strategies • Firms respond differently to economic changes • Changes that damage one firm or industry may help other firms and industries • For example, higher oil prices may help oil producing and exploration firms but hurt utilities and airlines Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Changes in Interest Rates • Affect firms with substantial amount of debt such as – utilities – banks – airlines Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Changes in Interest Rates • Affect demand for some products – Consumer durables – Housing – Automobiles – Deferrable purchases Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Changes in Inflation • Affect firms with natural resources – Oil – Precious metals (e. g. , gold) • Some firms are better able to pass on price increases Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Deflation • A general decline in prices • Opposite impact of inflation • Hurts debtors and helps creditors Copyright © 2003 South-Western/Thomson Learning. All rights reserved.

Recession and Economic Stagnation • Help firms producing consumer necessities • Importance of anticipation – Fed lowering interest rates to stimulate the economy – changes in fiscal policy to stimulate the economy Copyright © 2003 South-Western/Thomson Learning. All rights reserved.