Chapter 12 Market Microstructure and Strategies Financial Markets

- Slides: 27

Chapter 12 Market Microstructure and Strategies Financial Markets and Institutions, 7 e, Jeff Madura Copyright © 2006 by South-Western, a division of Thomson Learning. All rights reserved. 1

Chapter Outline Stock market transactions n How trades are executed n Regulation of stock trading n How barriers to international stock trading have decreased n 2

Stock Market Transactions n Placing an order ¨ Brokerage firms: n n ¨ Full-service brokers offer advice to customers on stocks to buy or sell n ¨ Charge about 4 percent of the transaction amount Discount brokers only execute the transactions n ¨ Serve as financial intermediaries between buyers an sellers of stock Receive orders from customers and pass the orders on to the exchange through a telecommunications network Charge about 1 percent of the transaction amount The larger the transaction amount the lower the percentage charged by many brokers 3

Stock Market Transactions (cont’d) n Placing an order (cont’d) ¨ Investors communicate their order to brokers by specifying: n n The name of the stock Whether to buy or sell that stock The number of shares to be bought or sold Whether the order is a market order or a limit order A market order to buy or sell a stock means to execute the transaction at the best possible price ¨ A limit order differs from a market order in that a limit is placed on the price at which a stock should be purchased or sold ¨ 4

Stock Market Transactions (cont’d) n Placing an order (cont’d) ¨ Stop-loss n n orders: Are orders where the investor specifies a selling price that is below the current market price of the stock Are typically placed by investors to either protect gains or limit losses ¨ Stop-buy orders are orders where the investor specifies a purchase price that is above the current market price 5

Stock Market Transactions (cont’d) n Placing an order (cont’d) ¨ Placing an order online n n n Many brokers accept orders online, provide real-time quotes, and provide access to information Individual investors maintain more than 5 million online brokerage accounts About one of every seven stock transactions is initiated online Traditional brokers have started to offer some online services Some of the more popular online brokers include Ameritrade, Charles Schwab, Datek, E*Trade, and National Discount Brokers Average execution speed is about 8 seconds 6

Stock Market Transactions (cont’d) n Margin trading ¨A margin trade involves cash along with funds borrowed from the broker ¨ The Federal Reserve imposes margin requirements which limit the amount of credit brokers can extend to their customers n n Currently, at least 50 percent of an investor’s invested funds must be paid in cash Margin requirements are intended to ensure that investors can cover their position if the value of their investment declines over time 7

Stock Market Transactions (cont’d) n Margin trading (cont’d) ¨ Investors: n n n Must establish a margin account with their broker Are required to satisfy a maintenance margin Initially satisfy the maintenance margin with the initial margin ¨ Impact n on returns The return on stocks purchased on margin is: 8

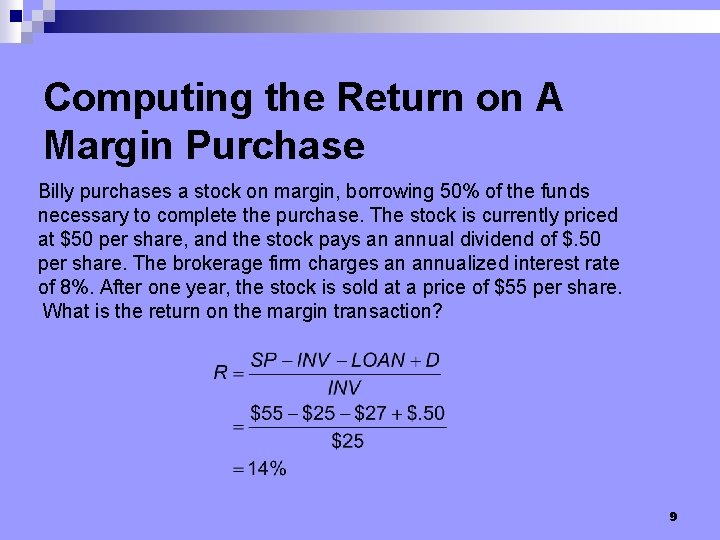

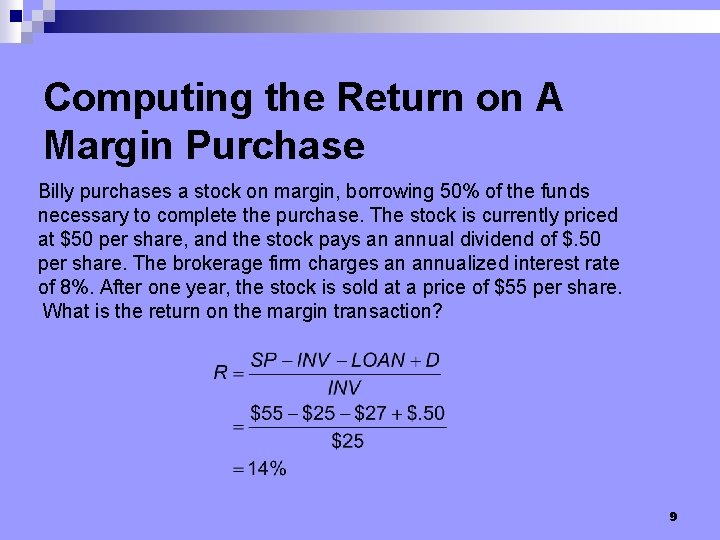

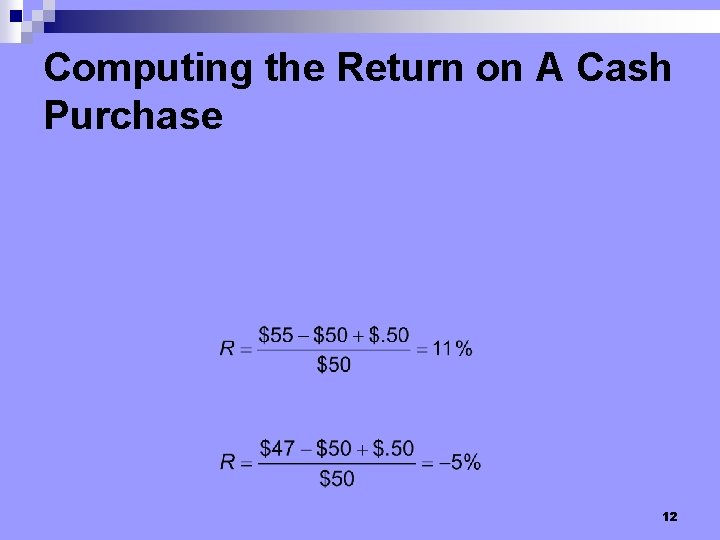

Computing the Return on A Margin Purchase Billy purchases a stock on margin, borrowing 50% of the funds necessary to complete the purchase. The stock is currently priced at $50 per share, and the stock pays an annual dividend of $. 50 per share. The brokerage firm charges an annualized interest rate of 8%. After one year, the stock is sold at a price of $55 per share. What is the return on the margin transaction? 9

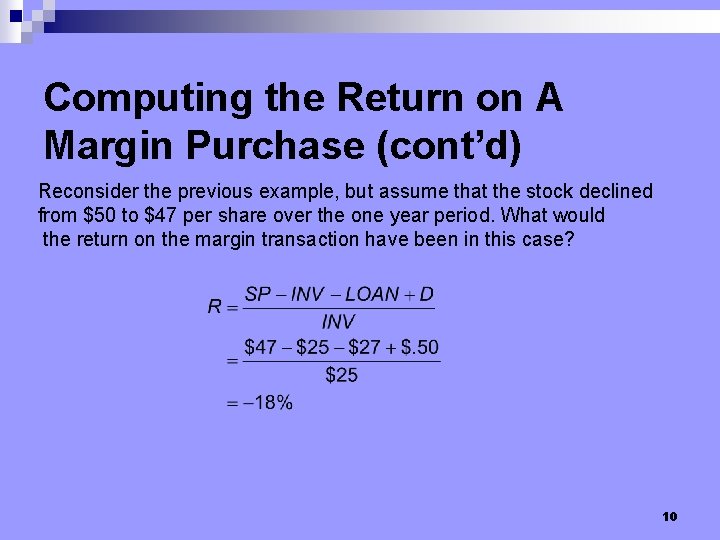

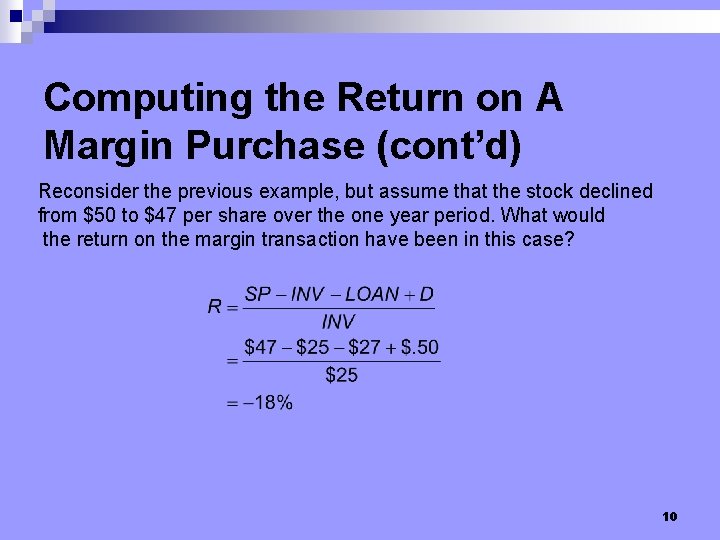

Computing the Return on A Margin Purchase (cont’d) Reconsider the previous example, but assume that the stock declined from $50 to $47 per share over the one year period. What would the return on the margin transaction have been in this case? 10

Stock Market Transactions (cont’d) n Margin trading (cont’d) ¨ Impact n on returns (cont’d) Purchasing stock on margin increases the potential return but magnifies the potential losses 11

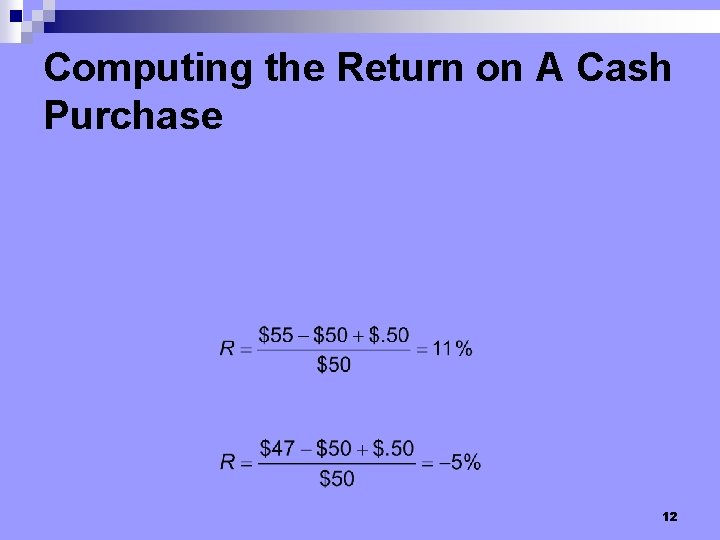

Computing the Return on A Cash Purchase 12

Stock Market Transactions (cont’d) n Margin trading (cont’d) ¨ Margin n calls If the investor’s equity no longer represents the minimum percentage of the stock’s value required by the broker, the investor may receive a margin call With a margin call, the investor is required to provide more collateral (cash or stocks) or sell the stock The volume of margin lending on the NYSE reached a peak of $278 billion in March 2000 and declined to $165 billion by August 2001 13

Stock Market Transactions (cont’d) n Short selling ¨ In a short sale, investors place an order to sell a stock that they do not own ¨ Short sellers: n n n Anticipate a price decline Essentially borrow the stock from another investor and will ultimately have to provide that stock back to the investor Make a profit equal to the difference between the original sell price and the price paid for the stock after subtracting any dividend payments made 14

Stock Market Transactions (cont’d) n Short selling (cont’d) ¨ Measuring n n the short position of a stock The ratio of the number of shares sold short divided by the total number of shares outstanding is a measure of the degree of short positions The short interest ratio is the shares sold short divided by the average daily trading volume ¨ ¨ The higher the short interest ratio, the higher the level of short sales The short interest ratio is also measured for the market to determine the level of short sales for the market overall 15

Stock Market Transactions (cont’d) n Short selling (cont’d) ¨ Using n n a stop-buy order to offset short selling Investors who have established a short position commonly request a stop-buy order to limit their losses e. g. , an investor sells shares short for $50 per share and places a stop-buy order with a purchase price of $60 ¨ If the stock price rises to $60 or over, the investor will pay approximately $60 per share 16

Stock Market Transactions (cont’d) n Investing in stock indexes (cont’d) ¨ Comparison of ETFs to mutual funds n The share price adjusts over time in response to the change in the index level for both ETFs and index funds n Both pay dividends in the form of additional shares to investors n Both involve relatively simple portfolio management n Unlike mutual funds, ETFs can be traded throughout the day ¨ ¨ n n Can be purchased on margin Can be sold short ETF holders can defer capital gains to the time they sell shares A disadvantage of ETFs is that there are transaction costs every time shares are purchased 17

How Trades Are Executed n Floor brokers: ¨ Are situated on the floor of stock exchanges ¨ Receive requests from brokerage firms to fulfill orders and execute them 18

How Trades Are Executed (cont’d) n Specialists and market-makers ¨ Specialists: n n n n Can serve a broker function Gain from the bid-ask spread Take position in specific stocks to which they are assigned Have access to the limit order book Typically handle between 5 and 8 stocks each Are mostly employed by one of seven specialist firms Are required to signal floor brokers if they have unfilled orders 19

How Trades Are Executed (cont’d) n Specialists and market-makers (cont’d) ¨ Specialists n n n (cont’d): Make a market in stock they are assigned by standing ready to buy or sell assigned stocks if no other investors are willing to participate Participate in about 10 percent of the value of all shares traded Can set the spread to reflect their preferences 20

How Trades Are Executed (cont’d) n Specialists and market-makers (cont’d) ¨ Front running involves the specialist setting a price below the price offered by other investors n n ¨ May prevent other investors from having their orders executed if the price reverses as a result The “trade-through rule” on the NYSE requires that an order for stocks must be executed on the exchange that offers the best price In 2004: n n The SEC investigated several specialist firms for various illegal activities The SEC allows investors to circumvent the trade-through rule 21

How Trades Are Executed (cont’d) n Specialists and market-makers (cont’d) ¨ Transactions in the Nasdaq market are facilitated by market makers, who: n n Stand ready to buy stocks in response to customer orders made through a telecommunications network Benefit from the spread between the bid and ask prices Can take positions in stocks Often take positions to capitalize on the discrepancy between the prevailing stock price and their own valuation 22

How Trades Are Executed (cont’d) n Effect of the spread on transactions costs ¨ The n n n spread: Is the difference between the ask and bid prices and is commonly measured as a percentage of the ask price Is separate from the commission charged by the broker Has declined substantially over time due to increased efficiency of executing orders and increased competition from ECNs 23

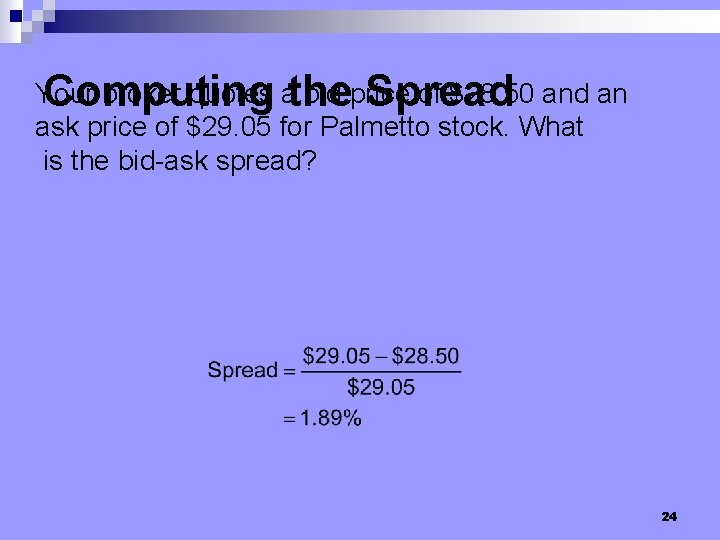

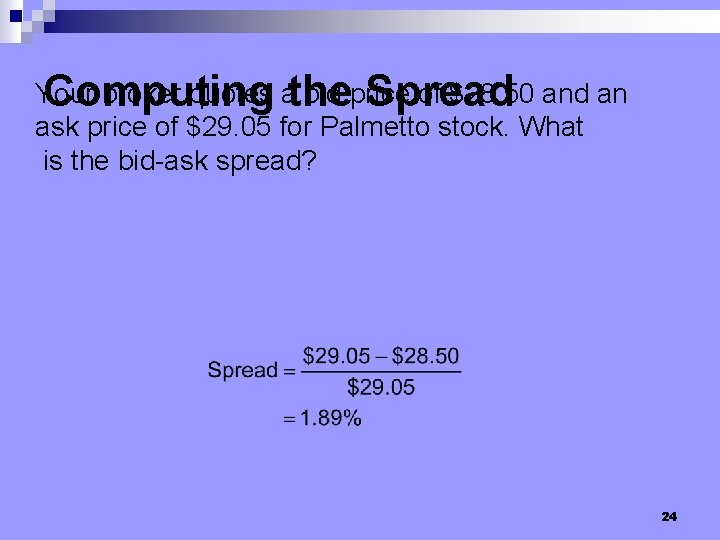

Your broker quotes athe bid price of $28. 50 and an Computing Spread ask price of $29. 05 for Palmetto stock. What is the bid-ask spread? 24

How Trades Are Executed (cont’d) n Effect of the spread on transactions costs (cont’d) ¨ The spread is influenced by the following factors: n Order costs (+) represent the cost of processing orders, including clearing costs and recording transactions n Inventory costs (+) represent the cost of maintaining an inventory of a particular stock ¨ n n n If interest rates are high, the opportunity cost of holding inventory is high Competition (–) reduces the spread Volume (–) increases liquidity and reduces the risk of a sudden decline in the stock’s price Risk (+) increases volatility and the risk for the specialist or market-maker 25

Regulation of Stock Trading (cont’d) n Circuit breakers: Are restrictions on trading when stock prices or a stock index reaches a specified threshold level ¨ Currently have three levels on the NYSE for a daily change in the DJIA from its previous closing price: ¨ n n Level 1 (10%) resulting in a 30 - or 60 -minute trading halt Level 2 (20%) resulting in a 1 - to 2 -hour trading halt Level 3 (30%) resulting in the market closing for the day Trading halts: Can be imposed for individual stocks if the stock exchange believes market participants need more time to receive and absorb material information ¨ Are intended to reduce stock price volatility ¨ 26

How Barriers to International Stock Trading Have Decreased n Reduction in transaction costs ¨ Some countries have consolidated their exchange, increasing efficiency and reducing transaction costs n n n Reduction in information costs ¨ ¨ n Eurolist The Swiss stock exchange Information via the Internet Attempts to make accounting standards uniform across countries Reduction in exchange rate risk ¨ The euro should lead to more stock offerings in Europe by U. S. and European-based firms 27

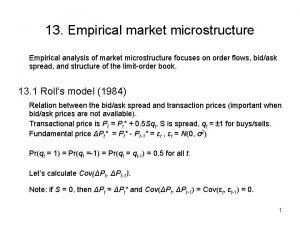

Market microstructure trading strategies

Market microstructure trading strategies High frequency market microstructure

High frequency market microstructure Roll's model bid ask spread

Roll's model bid ask spread Why study financial markets and institutions chapter 1

Why study financial markets and institutions chapter 1 What is macrostructure

What is macrostructure Lever rule fe-c phase diagram

Lever rule fe-c phase diagram Development of microstructure in isomorphous alloys

Development of microstructure in isomorphous alloys Microstructure of ferrous metals

Microstructure of ferrous metals Strategies for mature and declining markets

Strategies for mature and declining markets Segmentation, targeting, positioning

Segmentation, targeting, positioning Market follower strategy

Market follower strategy Rank the strategies for reaching global markets

Rank the strategies for reaching global markets Two drawbacks of a think local act local

Two drawbacks of a think local act local Marketing strategies for emerging markets

Marketing strategies for emerging markets Financial markets and institutions jeff madura ppt

Financial markets and institutions jeff madura ppt Financial markets and institutions - ppt

Financial markets and institutions - ppt Financial intermediaries and markets

Financial intermediaries and markets International financial markets and instruments

International financial markets and instruments Capital markets and financial intermediation

Capital markets and financial intermediation How do primary and secondary financial markets differ

How do primary and secondary financial markets differ Financial markets and the allocation of capital

Financial markets and the allocation of capital Foreign exchange and international financial markets

Foreign exchange and international financial markets Basic flow of funds through the financial system

Basic flow of funds through the financial system Madura j. financial markets and institutions

Madura j. financial markets and institutions Pilbeam k. finance and financial markets

Pilbeam k. finance and financial markets Keith pilbeam

Keith pilbeam Equity securities

Equity securities Madura j financial markets and institutions

Madura j financial markets and institutions