Chapter 11 Replacement Decisions q Replacement Analysis Fundamentals

- Slides: 41

Chapter 11 Replacement Decisions q Replacement Analysis Fundamentals q Economic Service Life q Replacement Analysis When a Required Service is Long 1

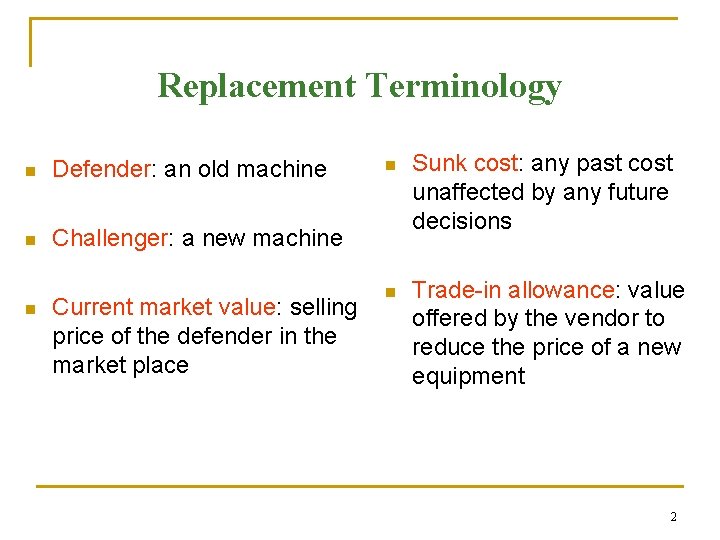

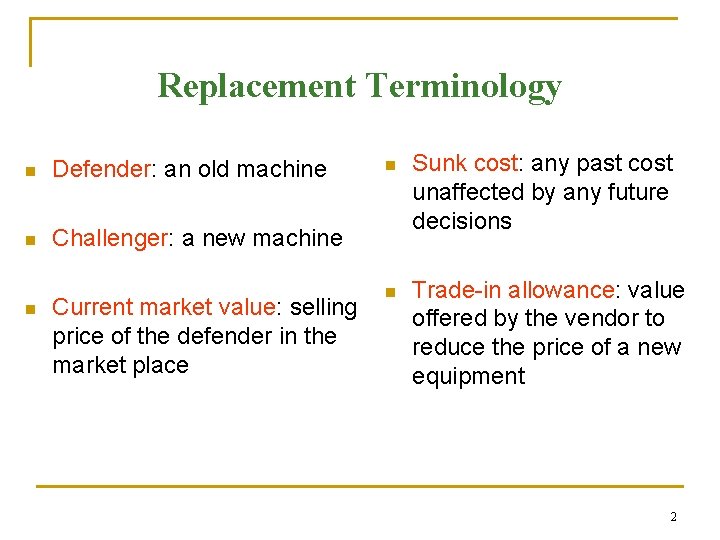

Replacement Terminology n Defender: an old machine n Challenger: a new machine n Current market value: selling price of the defender in the market place n Sunk cost: any past cost unaffected by any future decisions n Trade-in allowance: value offered by the vendor to reduce the price of a new equipment 2

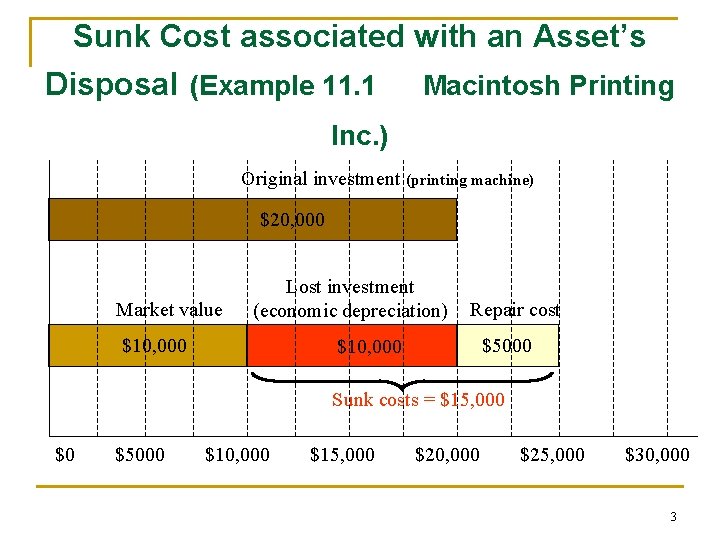

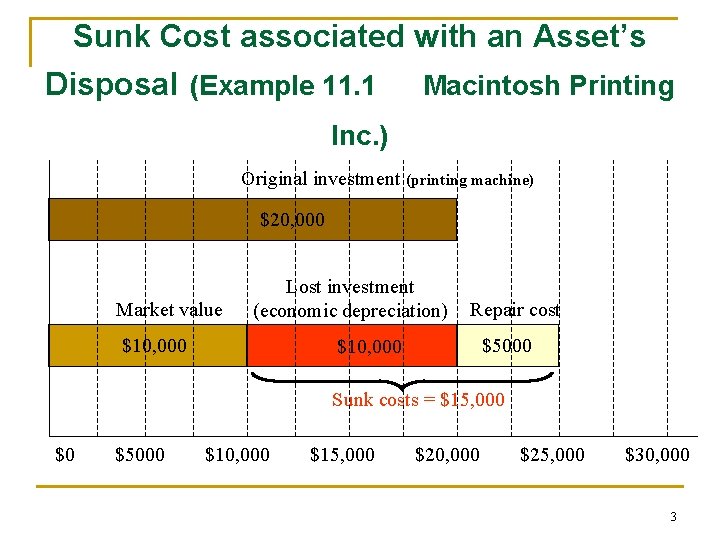

Sunk Cost associated with an Asset’s Disposal (Example 11. 1 Macintosh Printing Inc. ) Original investment (printing machine) $20, 000 Market value Lost investment (economic depreciation) $10, 000 Repair cost $5000 $10, 000 Sunk costs = $15, 000 $0 $5000 $10, 000 $15, 000 $20, 000 $25, 000 $30, 000 3

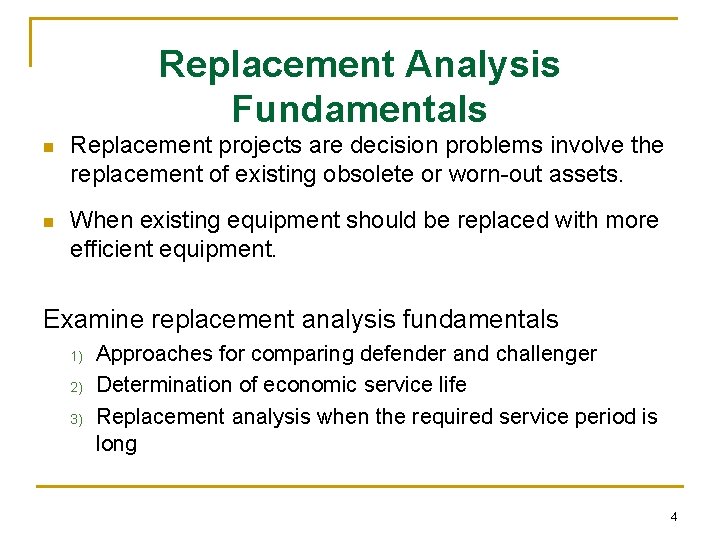

Replacement Analysis Fundamentals n Replacement projects are decision problems involve the replacement of existing obsolete or worn-out assets. n When existing equipment should be replaced with more efficient equipment. Examine replacement analysis fundamentals 1) 2) 3) Approaches for comparing defender and challenger Determination of economic service life Replacement analysis when the required service period is long 4

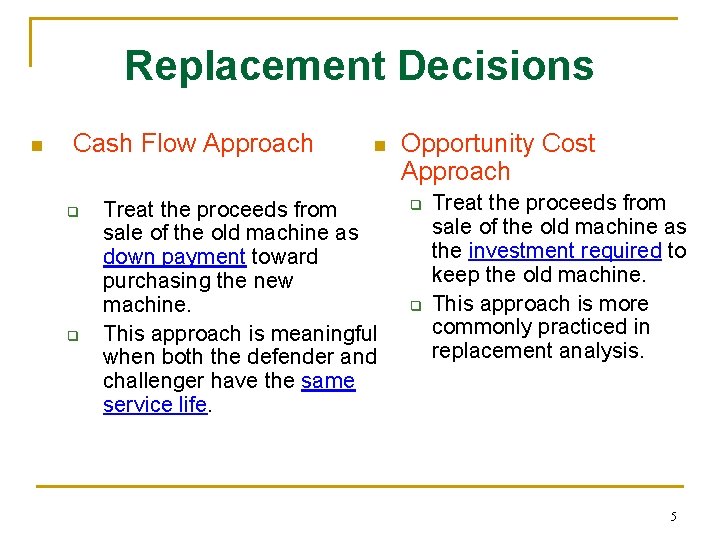

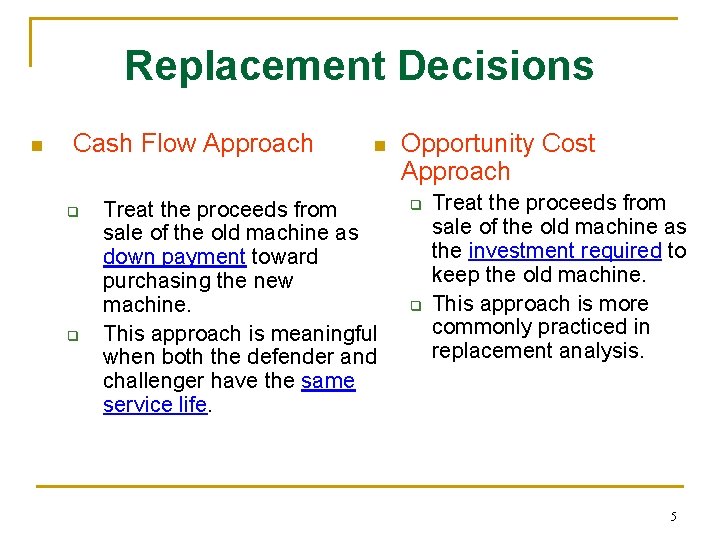

Replacement Decisions n Cash Flow Approach q q n Treat the proceeds from sale of the old machine as down payment toward purchasing the new machine. This approach is meaningful when both the defender and challenger have the same service life. Opportunity Cost Approach q q Treat the proceeds from sale of the old machine as the investment required to keep the old machine. This approach is more commonly practiced in replacement analysis. 5

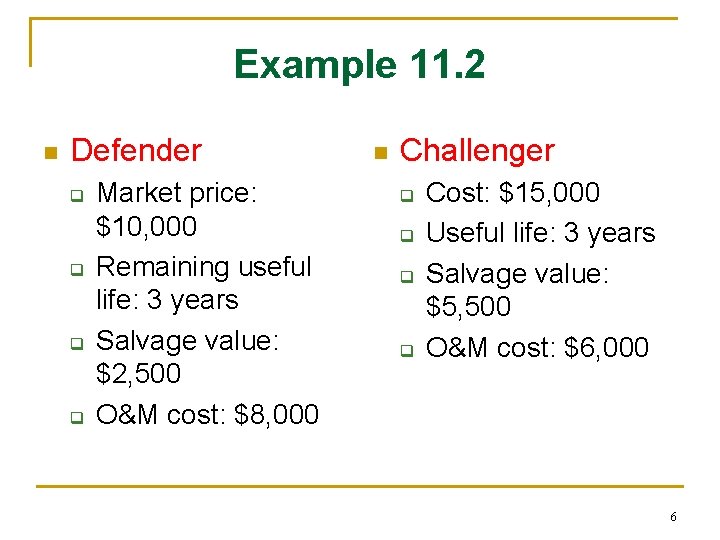

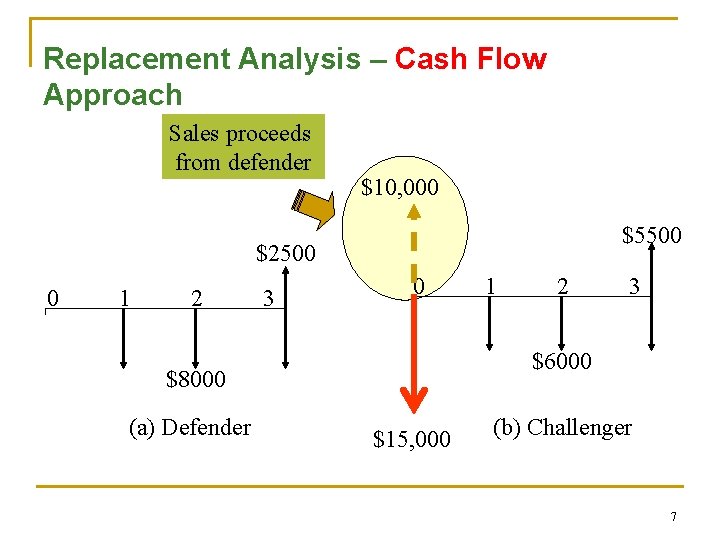

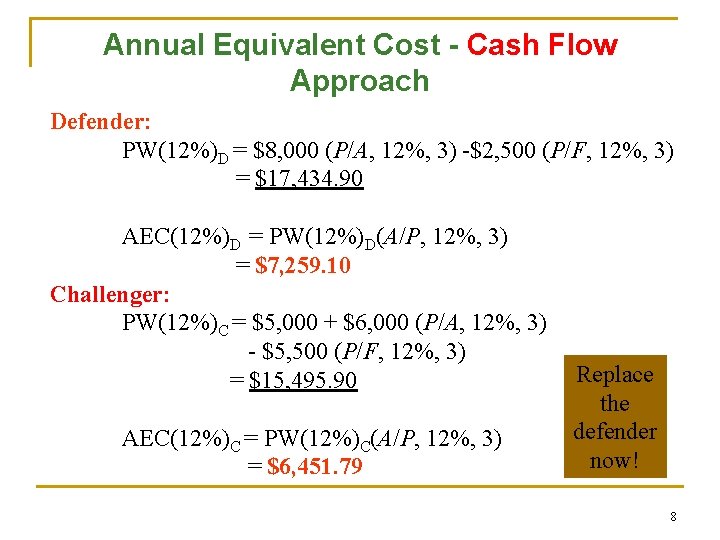

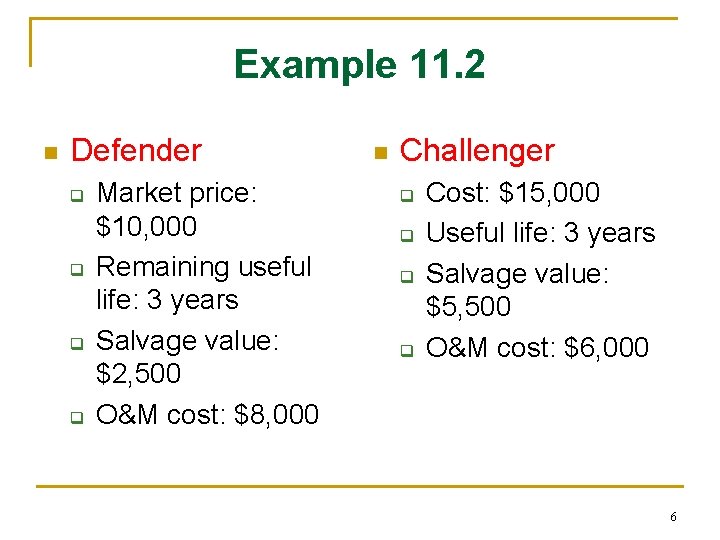

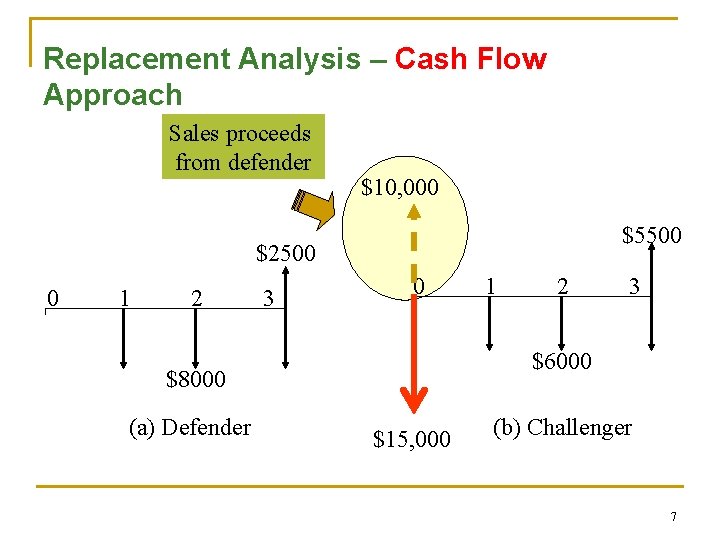

Example 11. 2 n Defender q q Market price: $10, 000 Remaining useful life: 3 years Salvage value: $2, 500 O&M cost: $8, 000 n Challenger q q Cost: $15, 000 Useful life: 3 years Salvage value: $5, 500 O&M cost: $6, 000 6

Replacement Analysis – Cash Flow Approach Sales proceeds from defender $10, 000 $5500 $2500 0 1 2 3 0 2 3 $6000 $8000 (a) Defender 1 $15, 000 (b) Challenger 7

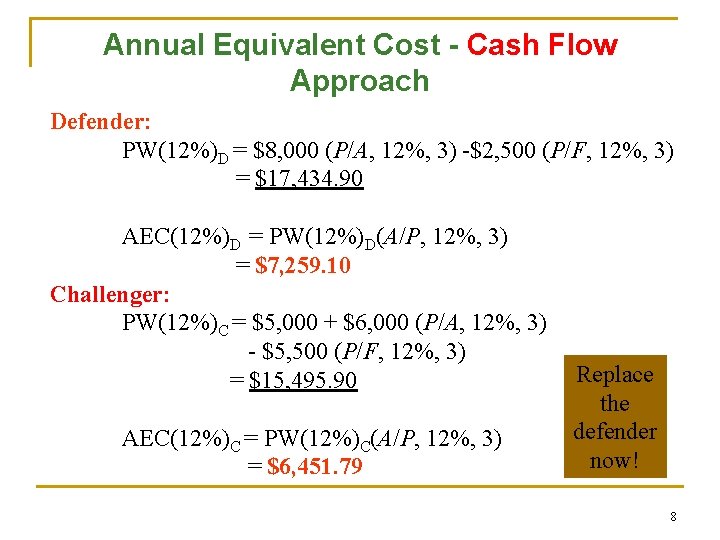

Annual Equivalent Cost - Cash Flow Approach Defender: PW(12%)D = $8, 000 (P/A, 12%, 3) -$2, 500 (P/F, 12%, 3) = $17, 434. 90 AEC(12%)D = PW(12%)D(A/P, 12%, 3) = $7, 259. 10 Challenger: PW(12%)C = $5, 000 + $6, 000 (P/A, 12%, 3) - $5, 500 (P/F, 12%, 3) = $15, 495. 90 AEC(12%)C = PW(12%)C(A/P, 12%, 3) = $6, 451. 79 Replace the defender now! 8

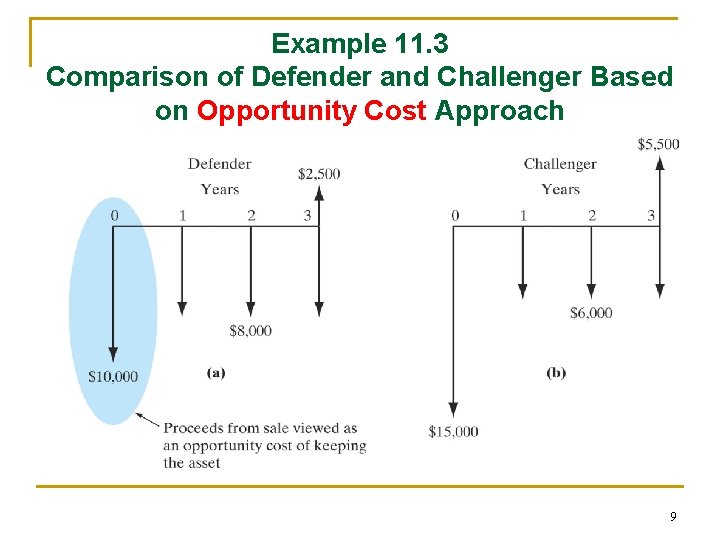

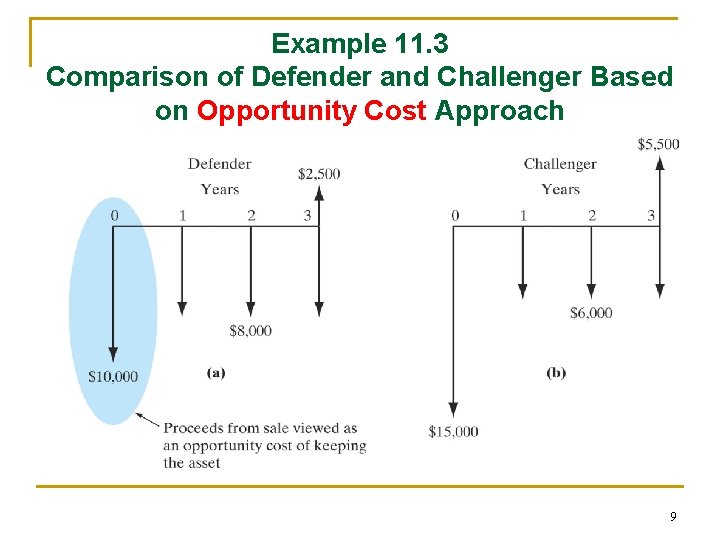

Example 11. 3 Comparison of Defender and Challenger Based on Opportunity Cost Approach 9

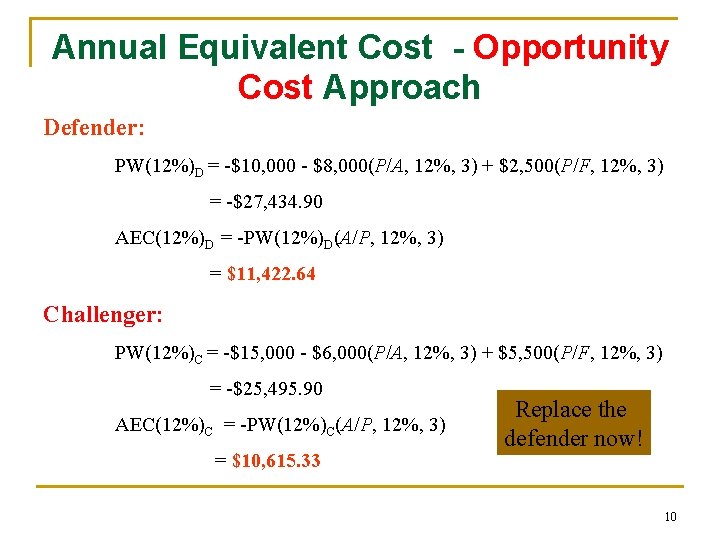

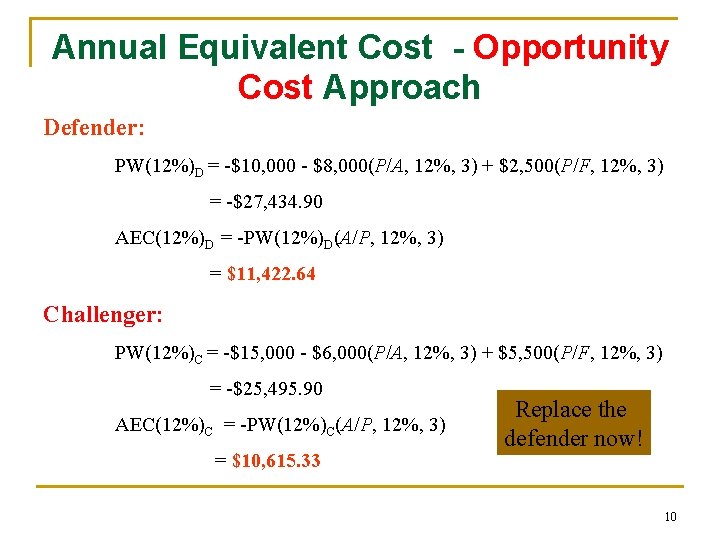

Annual Equivalent Cost - Opportunity Cost Approach Defender: PW(12%)D = -$10, 000 - $8, 000(P/A, 12%, 3) + $2, 500(P/F, 12%, 3) = -$27, 434. 90 AEC(12%)D = -PW(12%)D(A/P, 12%, 3) = $11, 422. 64 Challenger: PW(12%)C = -$15, 000 - $6, 000(P/A, 12%, 3) + $5, 500(P/F, 12%, 3) = -$25, 495. 90 AEC(12%)C = -PW(12%)C(A/P, 12%, 3) = $10, 615. 33 Replace the defender now! 10

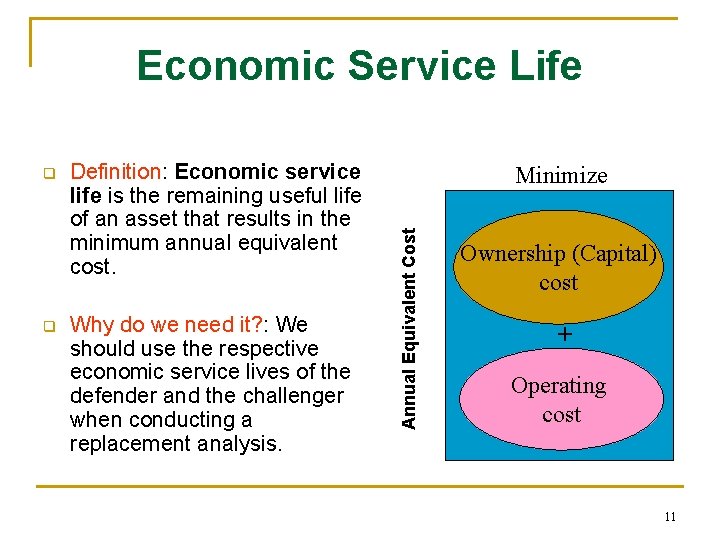

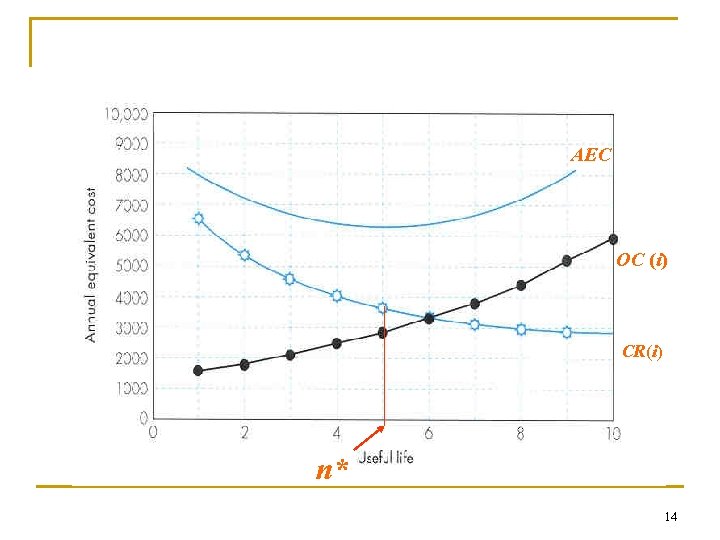

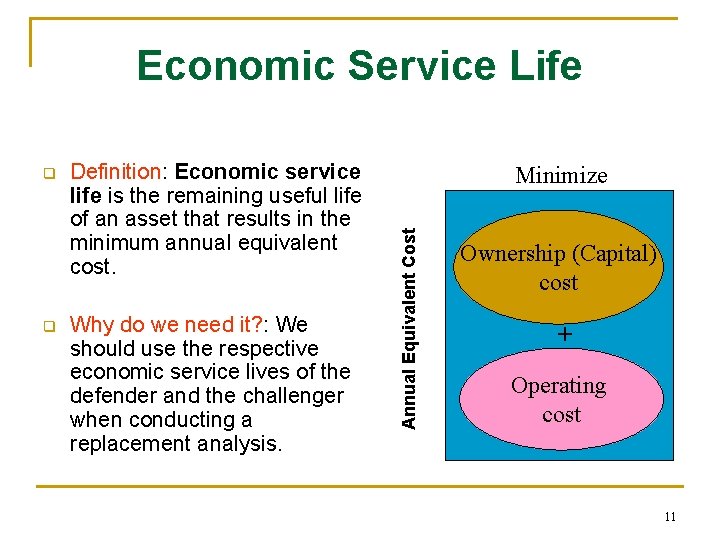

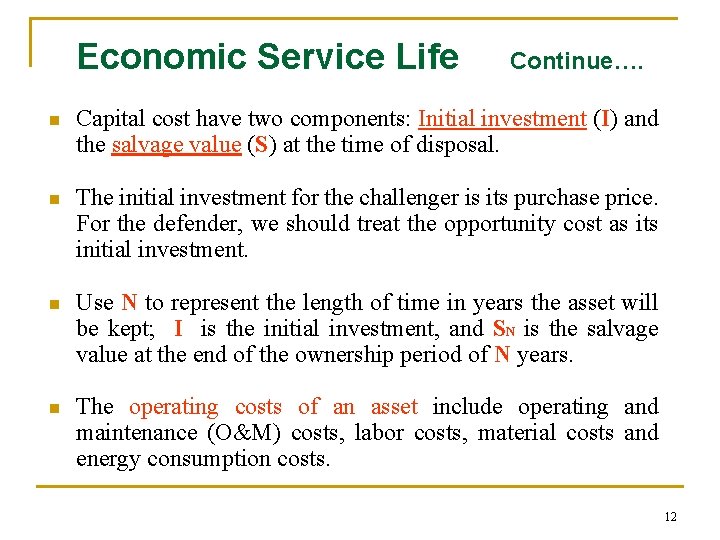

Economic Service Life q Definition: Economic service life is the remaining useful life of an asset that results in the minimum annual equivalent cost. Why do we need it? : We should use the respective economic service lives of the defender and the challenger when conducting a replacement analysis. Minimize Annual Equivalent Cost q Ownership (Capital) cost + Operating cost 11

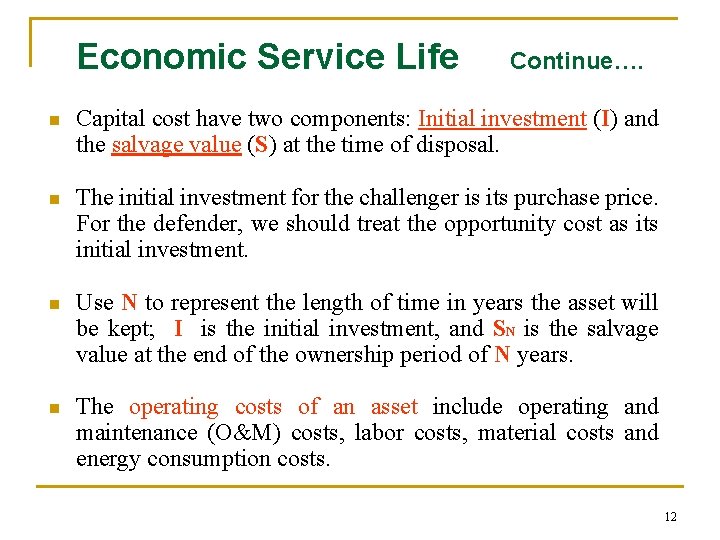

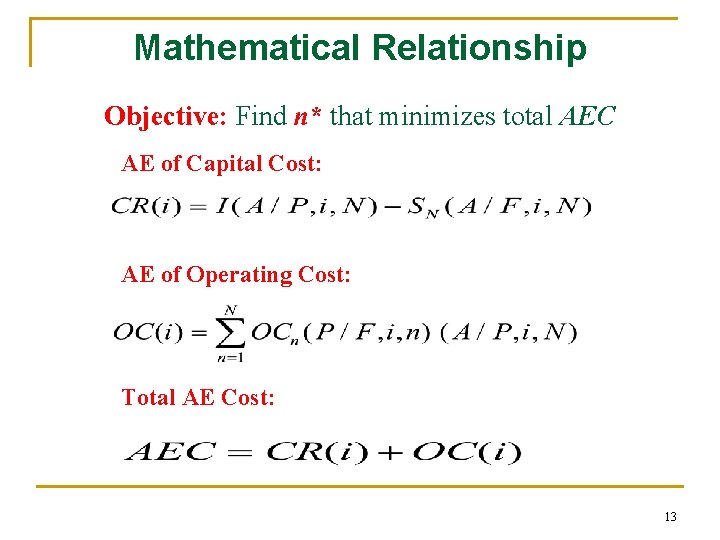

Economic Service Life Continue…. n Capital cost have two components: Initial investment (I) and the salvage value (S) at the time of disposal. n The initial investment for the challenger is its purchase price. For the defender, we should treat the opportunity cost as its initial investment. n Use N to represent the length of time in years the asset will be kept; I is the initial investment, and SN is the salvage value at the end of the ownership period of N years. n The operating costs of an asset include operating and maintenance (O&M) costs, labor costs, material costs and energy consumption costs. 12

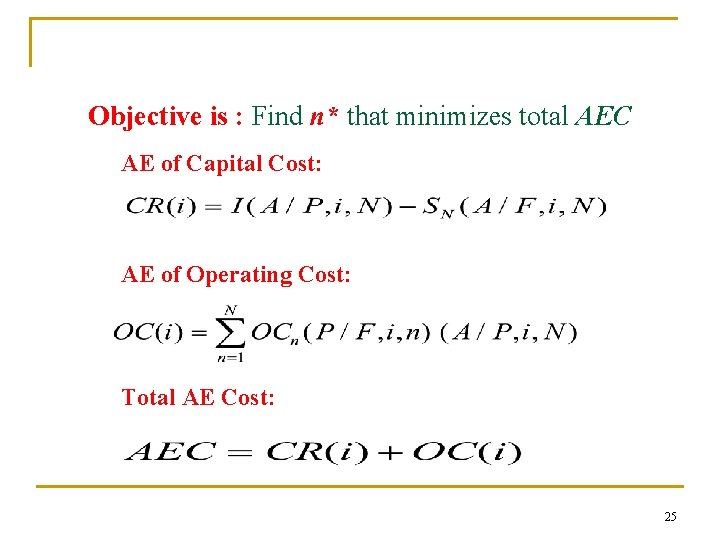

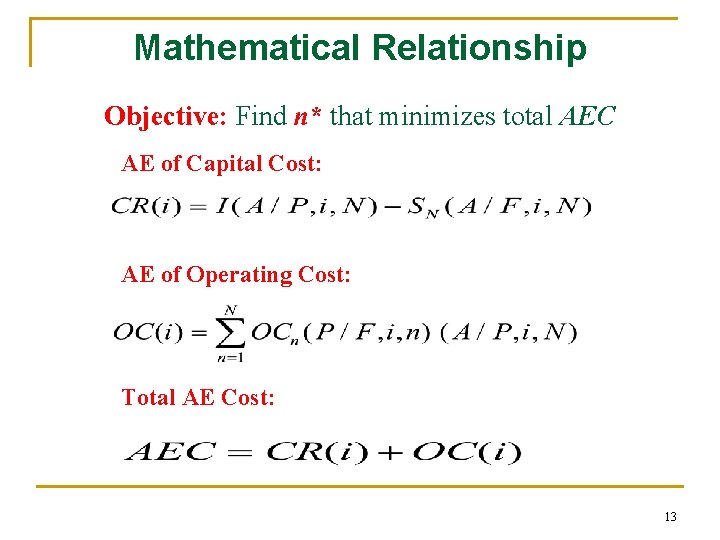

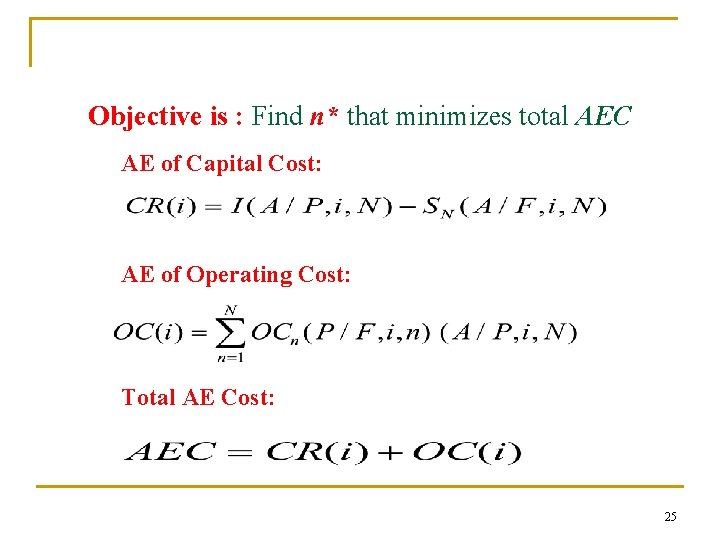

Mathematical Relationship Objective: Find n* that minimizes total AEC AE of Capital Cost: AE of Operating Cost: Total AE Cost: 13

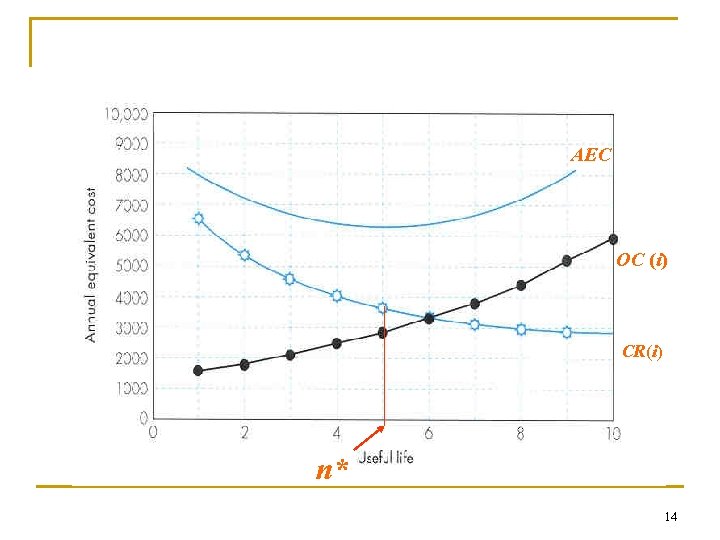

AEC OC (i) CR(i) n* 14

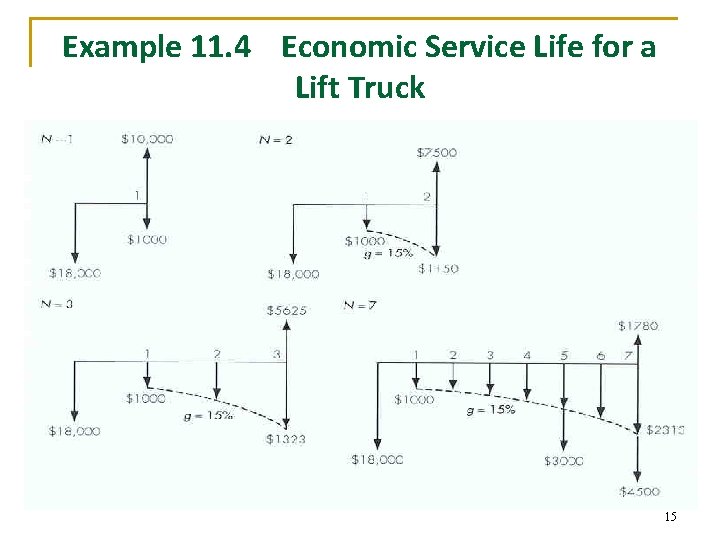

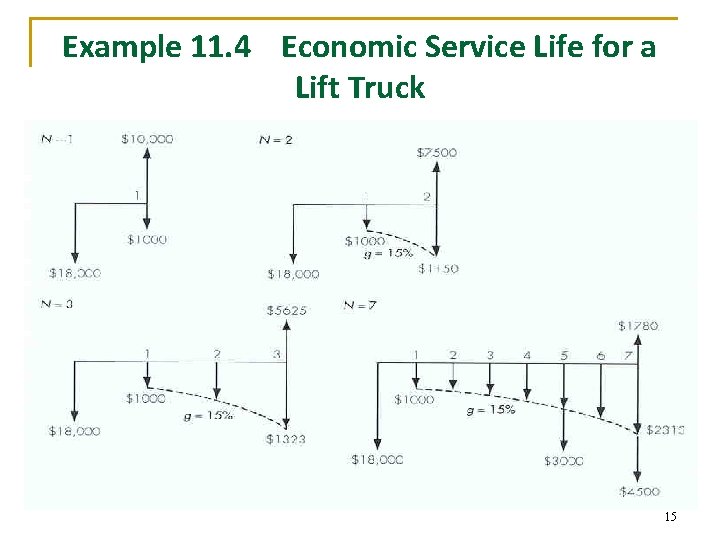

Example 11. 4 Economic Service Life for a Lift Truck 15

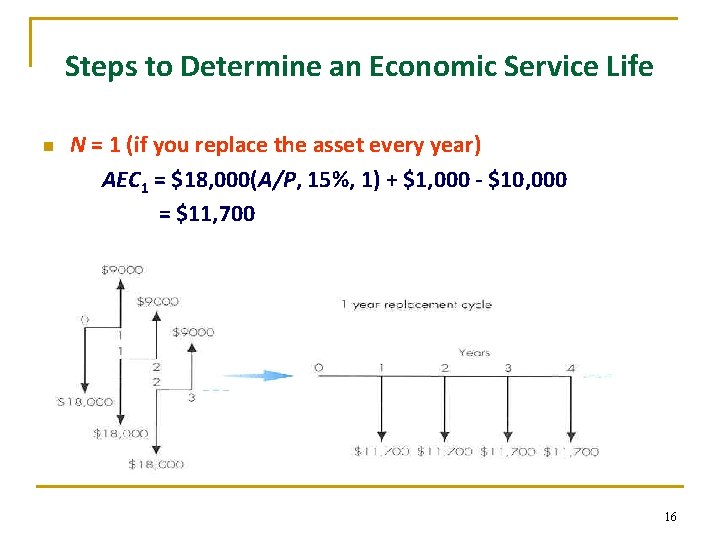

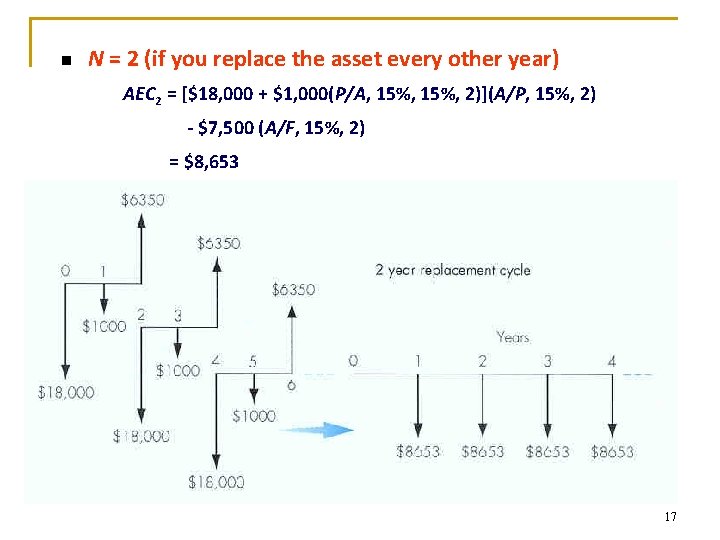

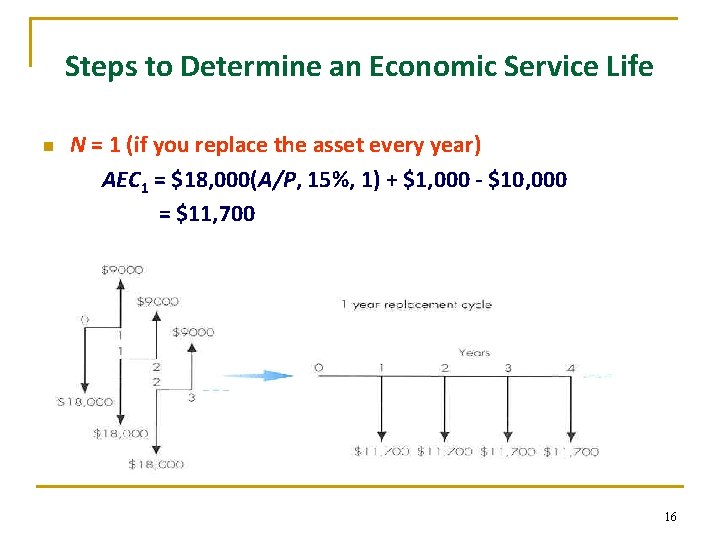

Steps to Determine an Economic Service Life n N = 1 (if you replace the asset every year) AEC 1 = $18, 000(A/P, 15%, 1) + $1, 000 - $10, 000 = $11, 700 16

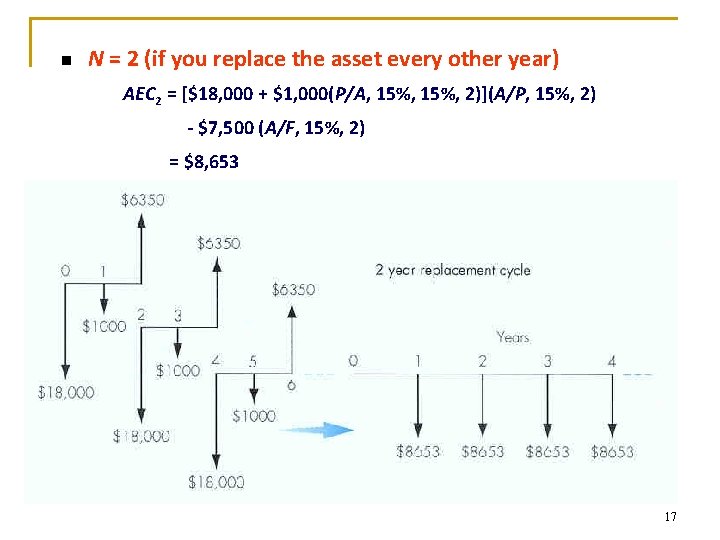

n N = 2 (if you replace the asset every other year) AEC 2 = [$18, 000 + $1, 000(P/A, 15%, 2)](A/P, 15%, 2) - $7, 500 (A/F, 15%, 2) = $8, 653 17

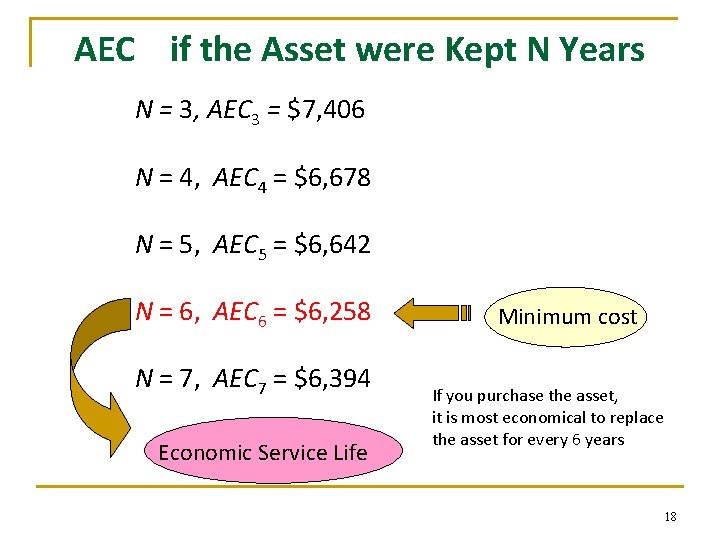

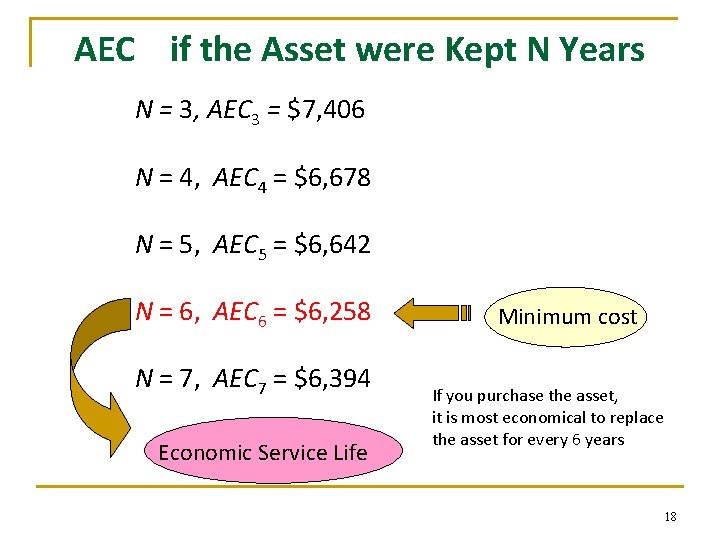

AEC if the Asset were Kept N Years N = 3, AEC 3 = $7, 406 N = 4, AEC 4 = $6, 678 N = 5, AEC 5 = $6, 642 N = 6, AEC 6 = $6, 258 N = 7, AEC 7 = $6, 394 Economic Service Life Minimum cost If you purchase the asset, it is most economical to replace the asset for every 6 years 18

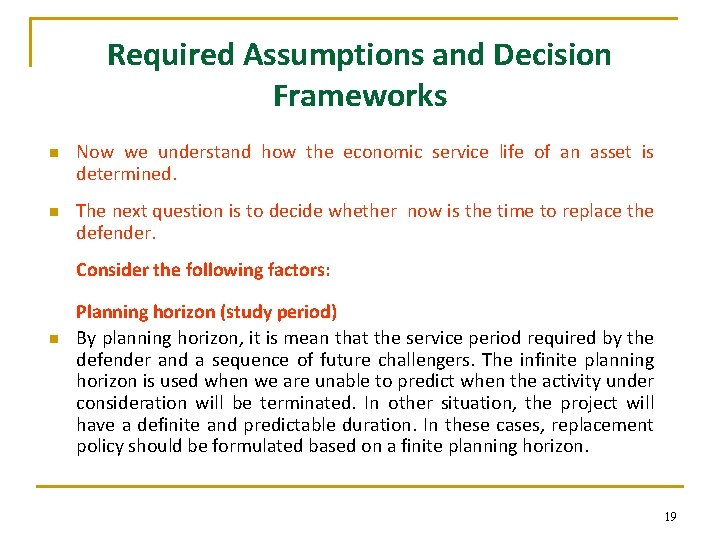

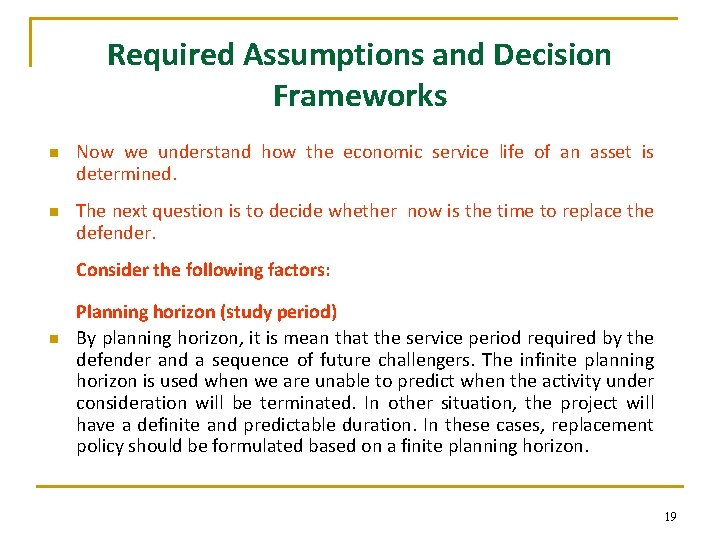

Required Assumptions and Decision Frameworks n n Now we understand how the economic service life of an asset is determined. The next question is to decide whether now is the time to replace the defender. Consider the following factors: n Planning horizon (study period) By planning horizon, it is mean that the service period required by the defender and a sequence of future challengers. The infinite planning horizon is used when we are unable to predict when the activity under consideration will be terminated. In other situation, the project will have a definite and predictable duration. In these cases, replacement policy should be formulated based on a finite planning horizon. 19

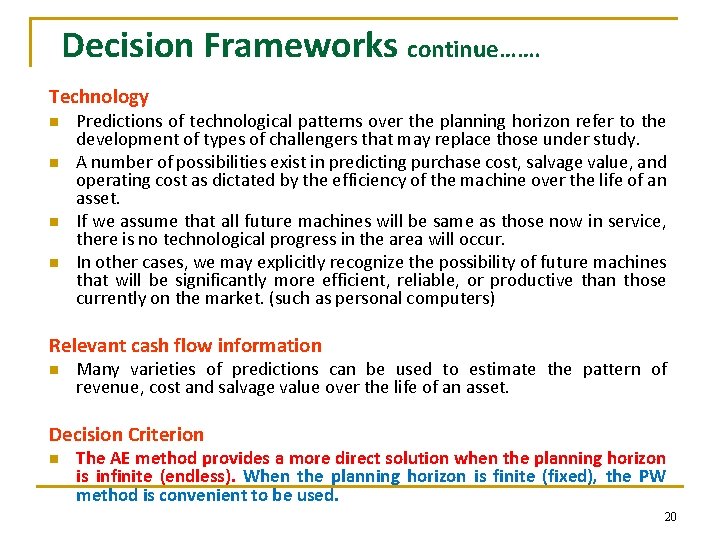

Decision Frameworks continue……. Technology n n Predictions of technological patterns over the planning horizon refer to the development of types of challengers that may replace those under study. A number of possibilities exist in predicting purchase cost, salvage value, and operating cost as dictated by the efficiency of the machine over the life of an asset. If we assume that all future machines will be same as those now in service, there is no technological progress in the area will occur. In other cases, we may explicitly recognize the possibility of future machines that will be significantly more efficient, reliable, or productive than those currently on the market. (such as personal computers) Relevant cash flow information n Many varieties of predictions can be used to estimate the pattern of revenue, cost and salvage value over the life of an asset. Decision Criterion n The AE method provides a more direct solution when the planning horizon is infinite (endless). When the planning horizon is finite (fixed), the PW method is convenient to be used. 20

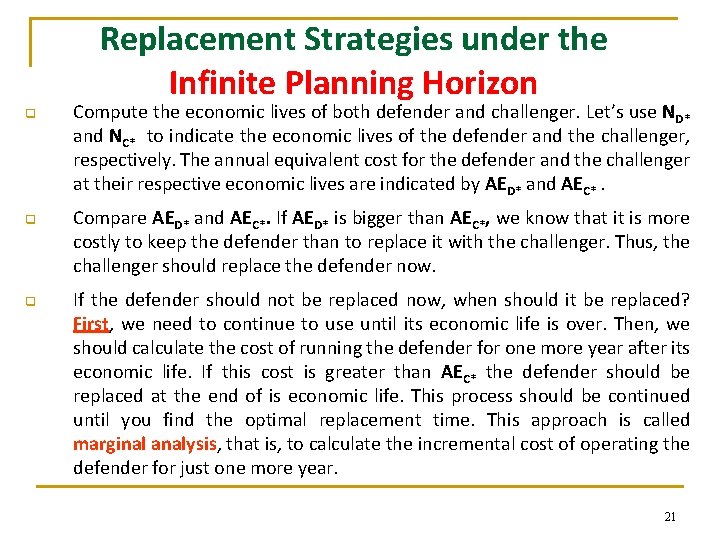

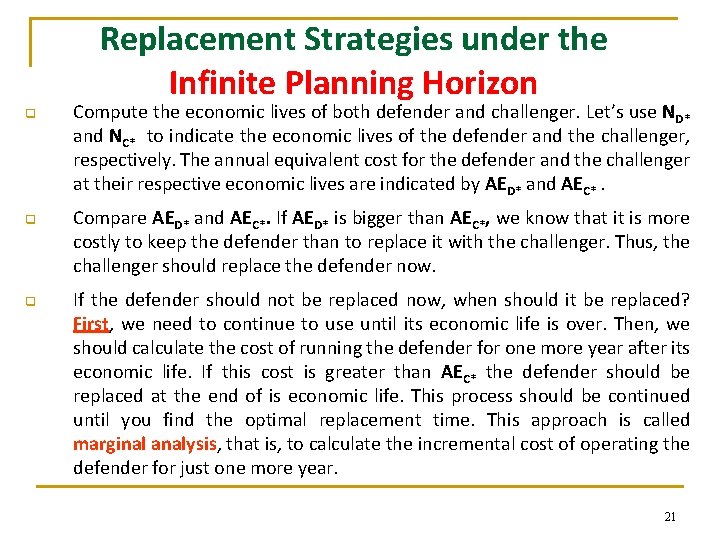

Replacement Strategies under the Infinite Planning Horizon q q q Compute the economic lives of both defender and challenger. Let’s use ND* and NC* to indicate the economic lives of the defender and the challenger, respectively. The annual equivalent cost for the defender and the challenger at their respective economic lives are indicated by AED* and AEC*. Compare AED* and AEC*. If AED* is bigger than AEC*, we know that it is more costly to keep the defender than to replace it with the challenger. Thus, the challenger should replace the defender now. If the defender should not be replaced now, when should it be replaced? First, we need to continue to use until its economic life is over. Then, we should calculate the cost of running the defender for one more year after its economic life. If this cost is greater than AEC* the defender should be replaced at the end of is economic life. This process should be continued until you find the optimal replacement time. This approach is called marginal analysis, that is, to calculate the incremental cost of operating the defender for just one more year. 21

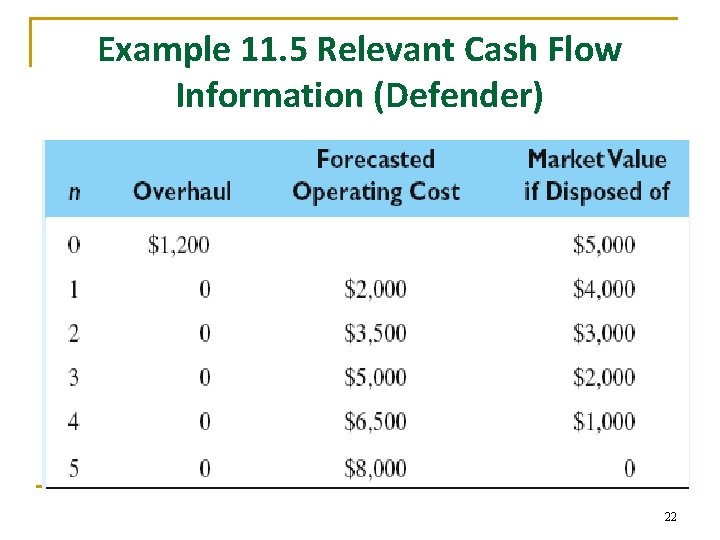

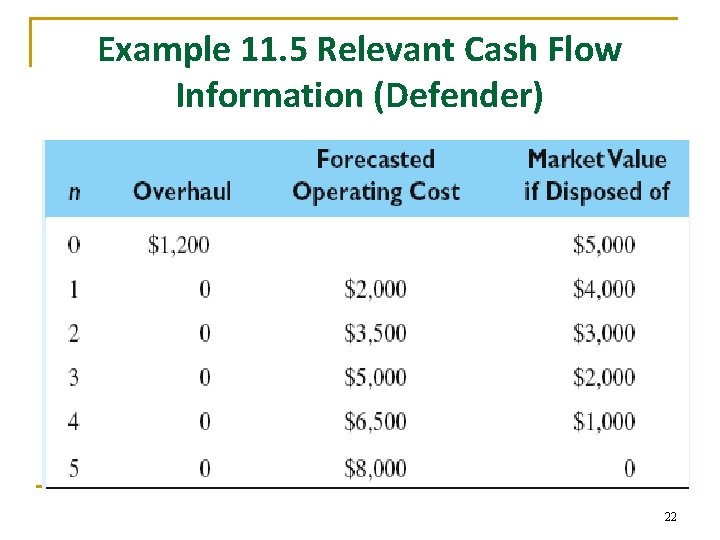

Example 11. 5 Relevant Cash Flow Information (Defender) 22

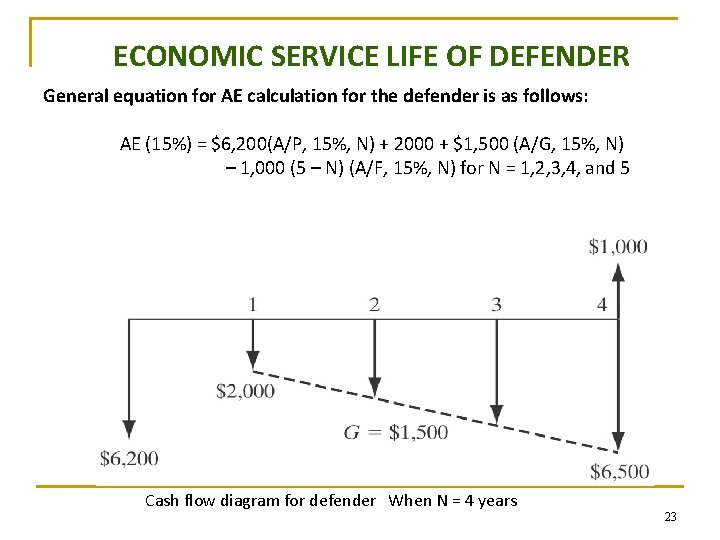

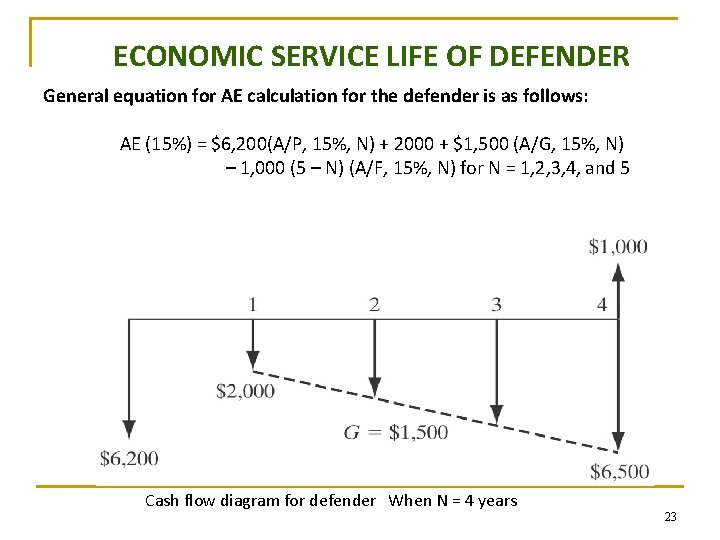

ECONOMIC SERVICE LIFE OF DEFENDER General equation for AE calculation for the defender is as follows: AE (15%) = $6, 200(A/P, 15%, N) + 2000 + $1, 500 (A/G, 15%, N) – 1, 000 (5 – N) (A/F, 15%, N) for N = 1, 2, 3, 4, and 5 Cash flow diagram for defender When N = 4 years 23

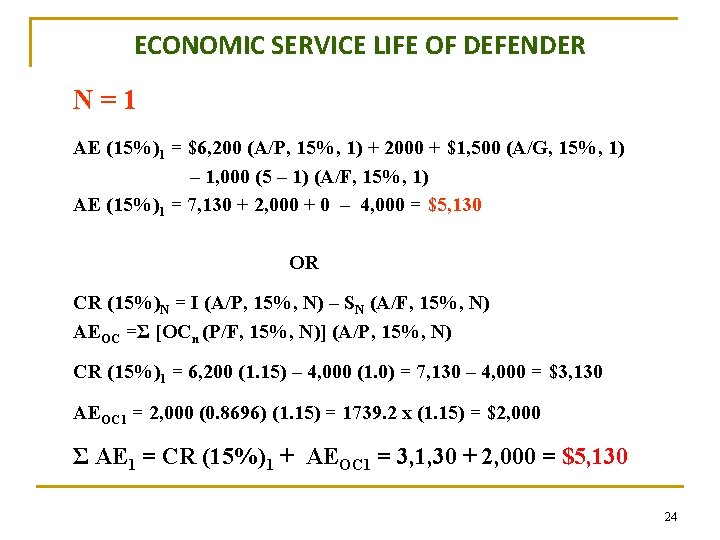

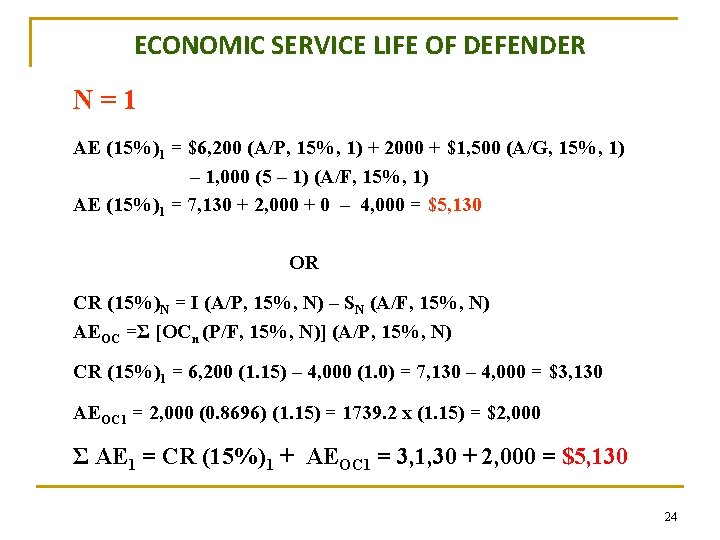

ECONOMIC SERVICE LIFE OF DEFENDER N = 1 AE (15%)1 = $6, 200 (A/P, 15%, 1) + 2000 + $1, 500 (A/G, 15%, 1) – 1, 000 (5 – 1) (A/F, 15%, 1) AE (15%)1 = 7, 130 + 2, 000 + 0 – 4, 000 = $5, 130 OR CR (15%)N = I (A/P, 15%, N) – SN (A/F, 15%, N) AEOC =Σ [OCn (P/F, 15%, N)] (A/P, 15%, N) CR (15%)1 = 6, 200 (1. 15) – 4, 000 (1. 0) = 7, 130 – 4, 000 = $3, 130 AEOC 1 = 2, 000 (0. 8696) (1. 15) = 1739. 2 x (1. 15) = $2, 000 Σ AE 1 = CR (15%)1 + AEOC 1 = 3, 1, 30 + 2, 000 = $5, 130 24

Objective is : Find n* that minimizes total AEC AE of Capital Cost: AE of Operating Cost: Total AE Cost: 25

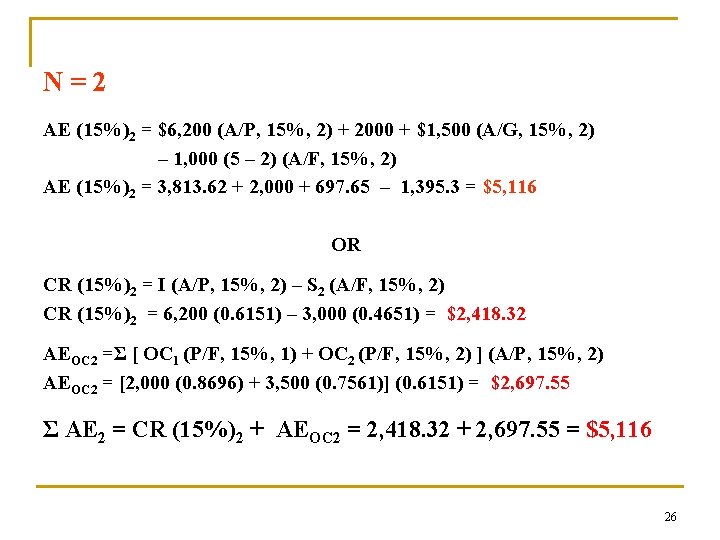

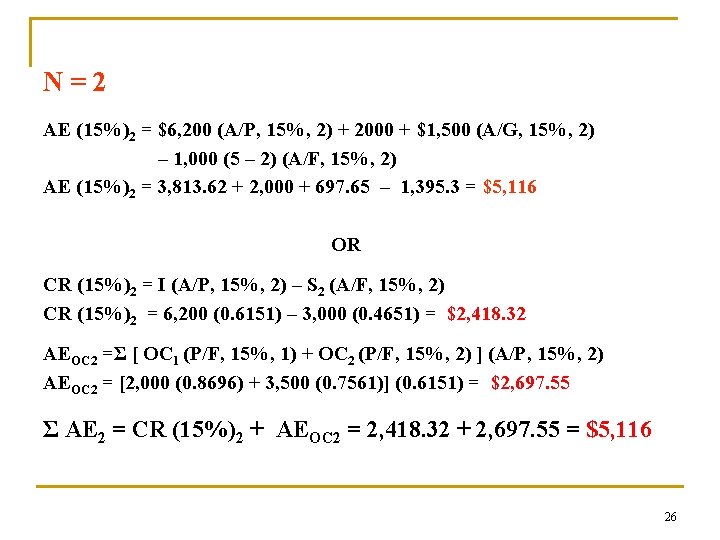

N = 2 AE (15%)2 = $6, 200 (A/P, 15%, 2) + 2000 + $1, 500 (A/G, 15%, 2) – 1, 000 (5 – 2) (A/F, 15%, 2) AE (15%)2 = 3, 813. 62 + 2, 000 + 697. 65 – 1, 395. 3 = $5, 116 OR CR (15%)2 = I (A/P, 15%, 2) – S 2 (A/F, 15%, 2) CR (15%)2 = 6, 200 (0. 6151) – 3, 000 (0. 4651) = $2, 418. 32 AEOC 2 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) ] (A/P, 15%, 2) AEOC 2 = [2, 000 (0. 8696) + 3, 500 (0. 7561)] (0. 6151) = $2, 697. 55 Σ AE 2 = CR (15%)2 + AEOC 2 = 2, 418. 32 + 2, 697. 55 = $5, 116 26

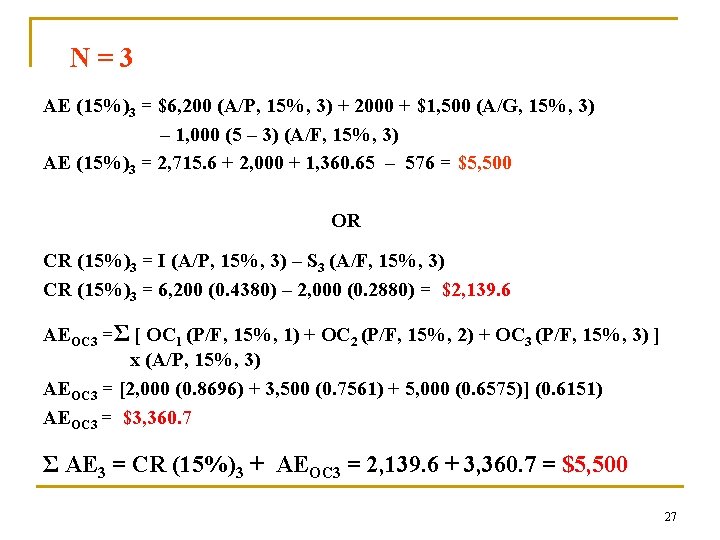

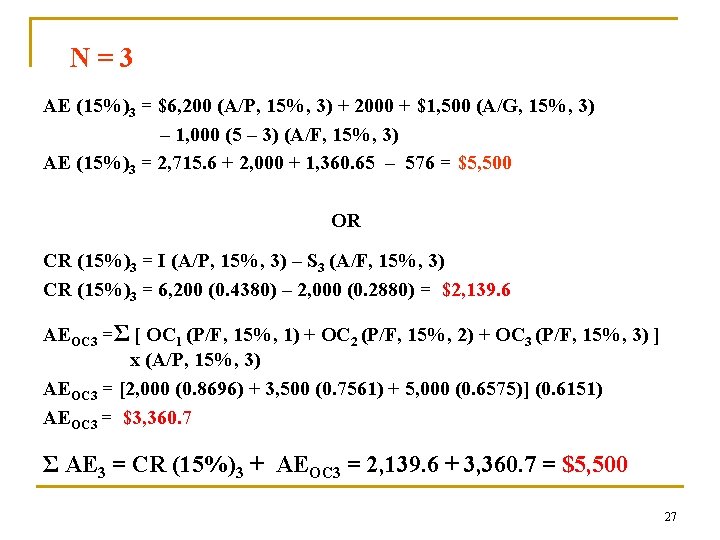

N = 3 AE (15%)3 = $6, 200 (A/P, 15%, 3) + 2000 + $1, 500 (A/G, 15%, 3) – 1, 000 (5 – 3) (A/F, 15%, 3) AE (15%)3 = 2, 715. 6 + 2, 000 + 1, 360. 65 – 576 = $5, 500 OR CR (15%)3 = I (A/P, 15%, 3) – S 3 (A/F, 15%, 3) CR (15%)3 = 6, 200 (0. 4380) – 2, 000 (0. 2880) = $2, 139. 6 AEOC 3 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) ] x (A/P, 15%, 3) AEOC 3 = [2, 000 (0. 8696) + 3, 500 (0. 7561) + 5, 000 (0. 6575)] (0. 6151) AEOC 3 = $3, 360. 7 Σ AE 3 = CR (15%)3 + AEOC 3 = 2, 139. 6 + 3, 360. 7 = $5, 500 27

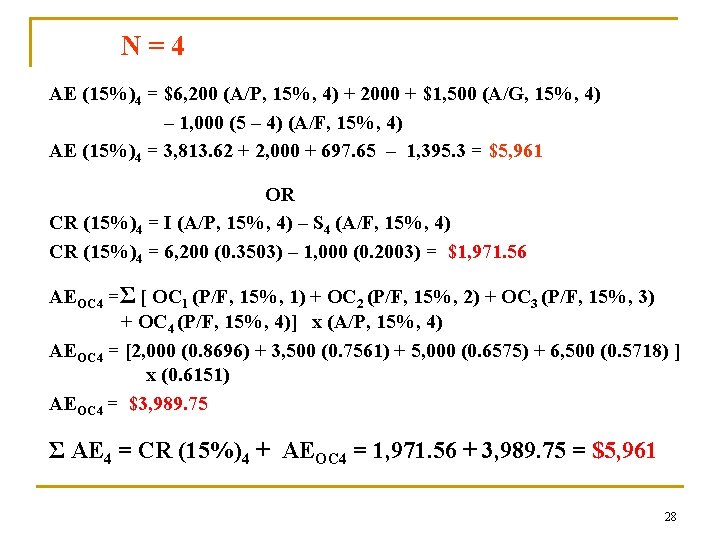

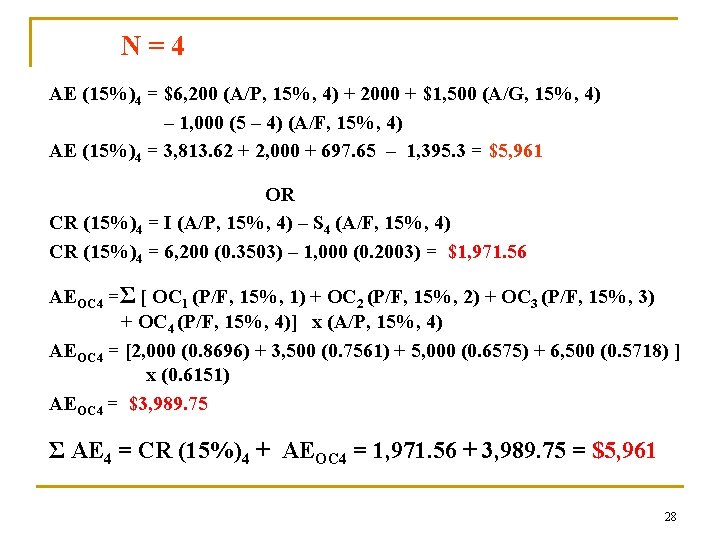

N = 4 AE (15%)4 = $6, 200 (A/P, 15%, 4) + 2000 + $1, 500 (A/G, 15%, 4) – 1, 000 (5 – 4) (A/F, 15%, 4) AE (15%)4 = 3, 813. 62 + 2, 000 + 697. 65 – 1, 395. 3 = $5, 961 OR CR (15%)4 = I (A/P, 15%, 4) – S 4 (A/F, 15%, 4) CR (15%)4 = 6, 200 (0. 3503) – 1, 000 (0. 2003) = $1, 971. 56 AEOC 4 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) + OC 4 (P/F, 15%, 4)] x (A/P, 15%, 4) AEOC 4 = [2, 000 (0. 8696) + 3, 500 (0. 7561) + 5, 000 (0. 6575) + 6, 500 (0. 5718) ] x (0. 6151) AEOC 4 = $3, 989. 75 Σ AE 4 = CR (15%)4 + AEOC 4 = 1, 971. 56 + 3, 989. 75 = $5, 961 28

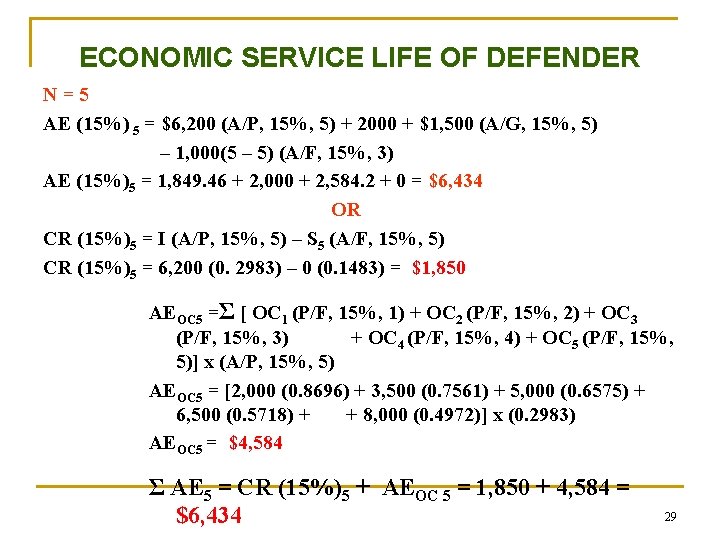

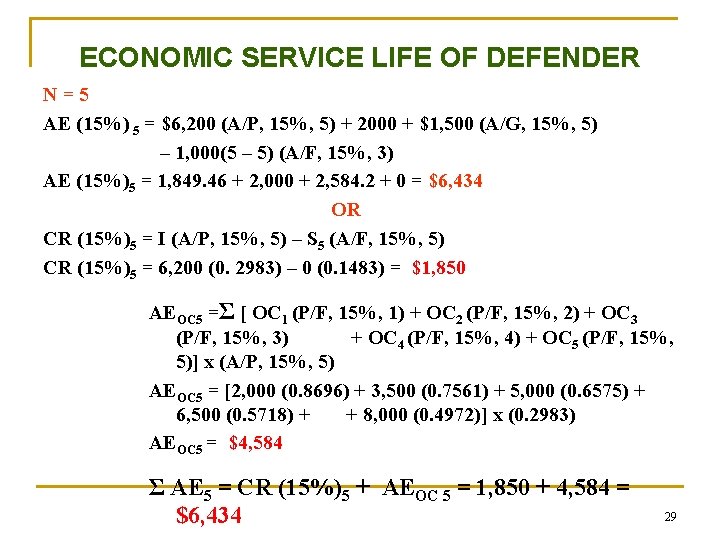

ECONOMIC SERVICE LIFE OF DEFENDER N = 5 AE (15%) 5 = $6, 200 (A/P, 15%, 5) + 2000 + $1, 500 (A/G, 15%, 5) – 1, 000(5 – 5) (A/F, 15%, 3) AE (15%)5 = 1, 849. 46 + 2, 000 + 2, 584. 2 + 0 = $6, 434 OR CR (15%)5 = I (A/P, 15%, 5) – S 5 (A/F, 15%, 5) CR (15%)5 = 6, 200 (0. 2983) – 0 (0. 1483) = $1, 850 AEOC 5 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) + OC 4 (P/F, 15%, 4) + OC 5 (P/F, 15%, 5)] x (A/P, 15%, 5) AEOC 5 = [2, 000 (0. 8696) + 3, 500 (0. 7561) + 5, 000 (0. 6575) + 6, 500 (0. 5718) + + 8, 000 (0. 4972)] x (0. 2983) AEOC 5 = $4, 584 Σ AE 5 = CR (15%)5 + AEOC 5 = 1, 850 + 4, 584 = $6, 434 29

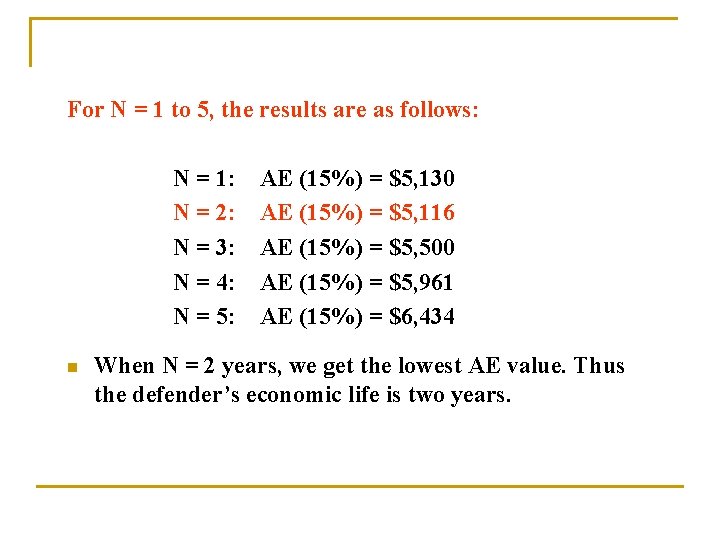

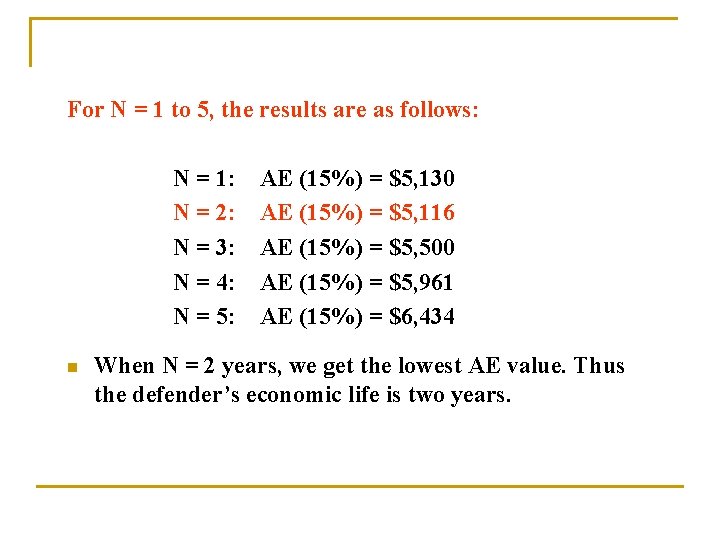

For N = 1 to 5, the results are as follows: N = 1: AE (15%) = $5, 130 N = 2: AE (15%) = $5, 116 N = 3: AE (15%) = $5, 500 N = 4: AE (15%) = $5, 961 N = 5: AE (15%) = $6, 434 n When N = 2 years, we get the lowest AE value. Thus the defender’s economic life is two years.

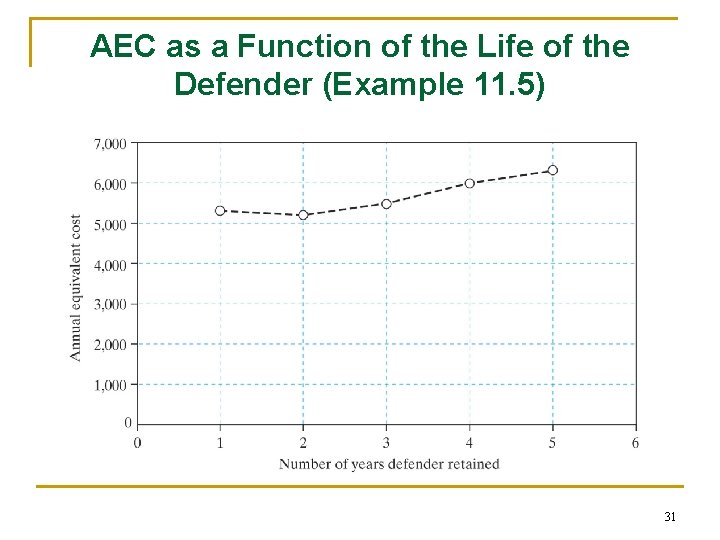

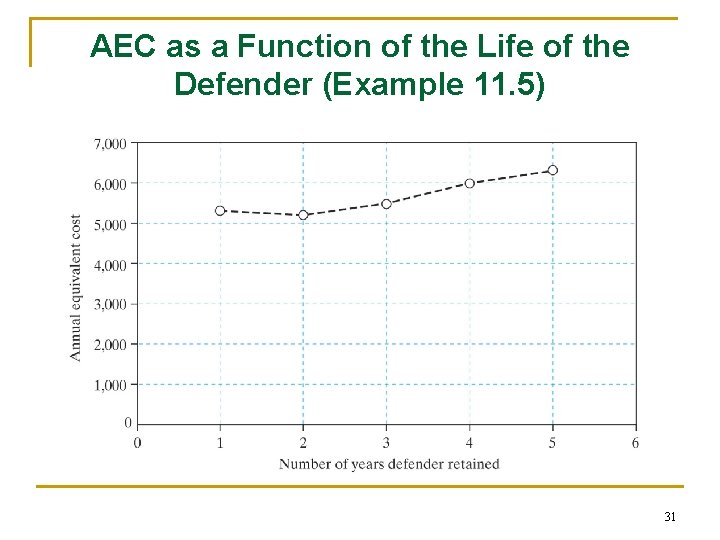

AEC as a Function of the Life of the Defender (Example 11. 5) 31

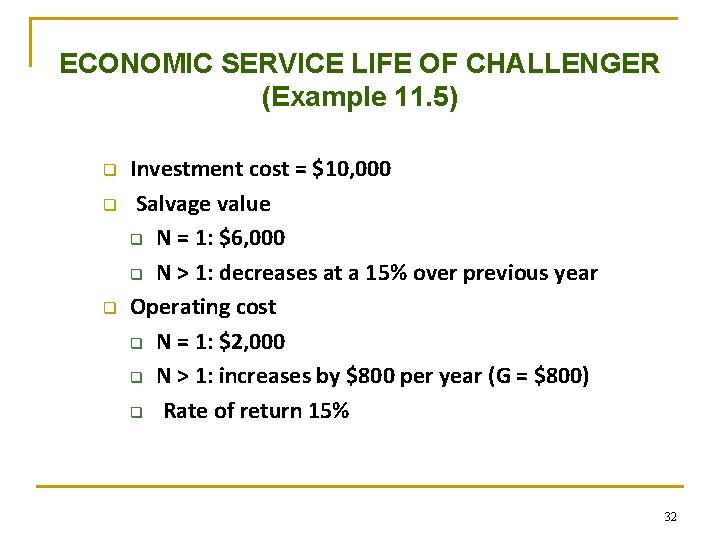

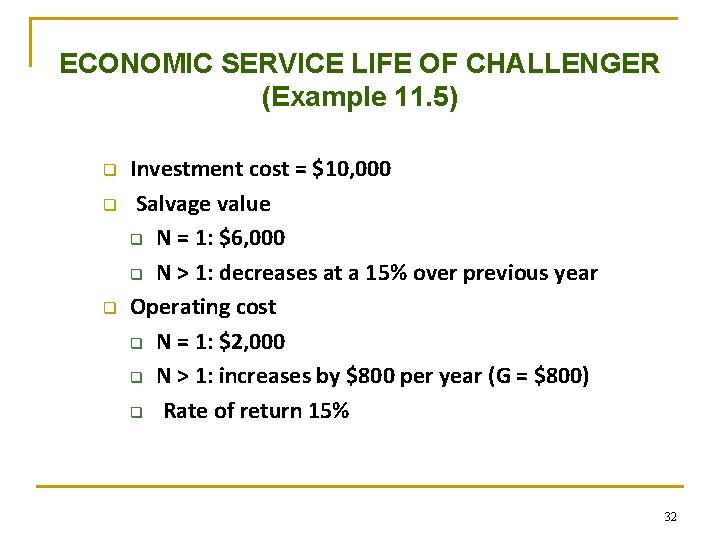

ECONOMIC SERVICE LIFE OF CHALLENGER (Example 11. 5) q q q Investment cost = $10, 000 Salvage value q N = 1: $6, 000 q N > 1: decreases at a 15% over previous year Operating cost q N = 1: $2, 000 q N > 1: increases by $800 per year (G = $800) q Rate of return 15% 32

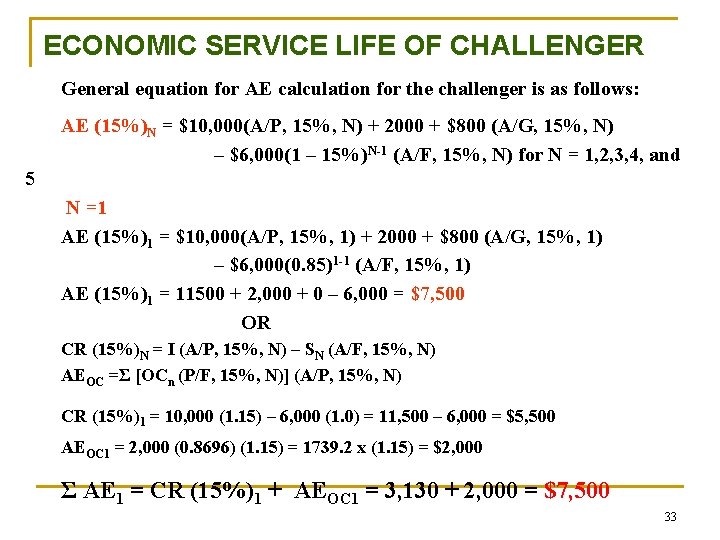

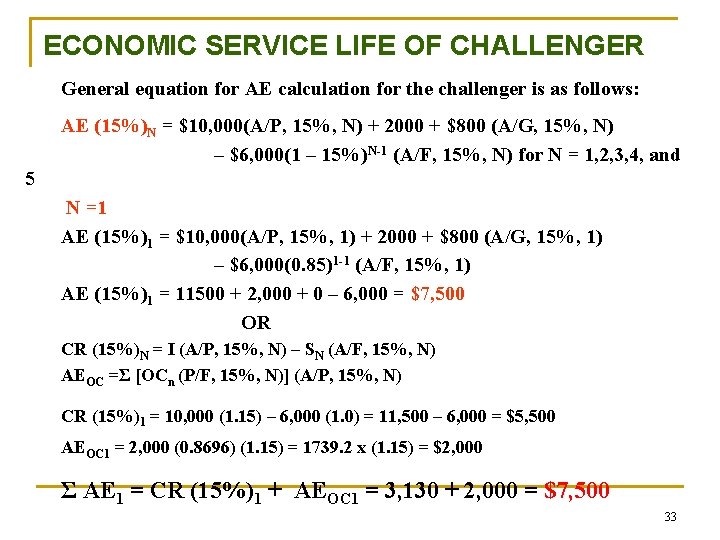

ECONOMIC SERVICE LIFE OF CHALLENGER General equation for AE calculation for the challenger is as follows: AE (15%)N = $10, 000(A/P, 15%, N) + 2000 + $800 (A/G, 15%, N) – $6, 000(1 – 15%)N-1 (A/F, 15%, N) for N = 1, 2, 3, 4, and 5 N =1 AE (15%)1 = $10, 000(A/P, 15%, 1) + 2000 + $800 (A/G, 15%, 1) – $6, 000(0. 85)1 -1 (A/F, 15%, 1) AE (15%)1 = 11500 + 2, 000 + 0 – 6, 000 = $7, 500 OR CR (15%)N = I (A/P, 15%, N) – SN (A/F, 15%, N) AEOC =Σ [OCn (P/F, 15%, N)] (A/P, 15%, N) CR (15%)1 = 10, 000 (1. 15) – 6, 000 (1. 0) = 11, 500 – 6, 000 = $5, 500 AEOC 1 = 2, 000 (0. 8696) (1. 15) = 1739. 2 x (1. 15) = $2, 000 Σ AE 1 = CR (15%)1 + AEOC 1 = 3, 130 + 2, 000 = $7, 500 33

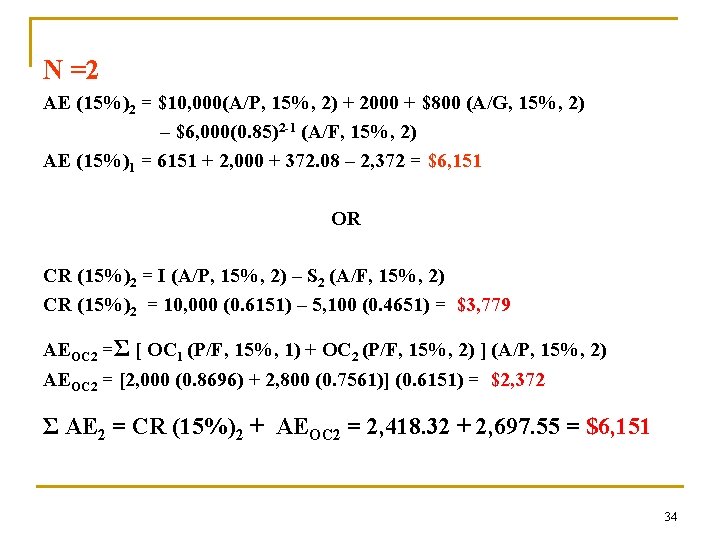

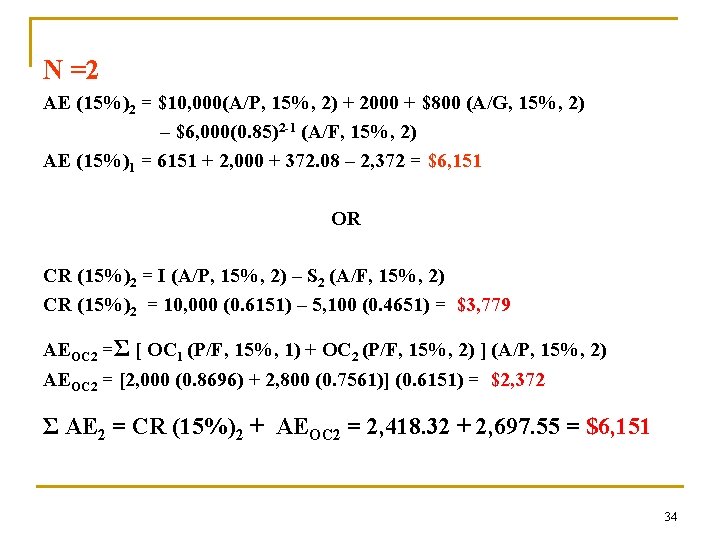

N =2 AE (15%)2 = $10, 000(A/P, 15%, 2) + 2000 + $800 (A/G, 15%, 2) – $6, 000(0. 85)2 -1 (A/F, 15%, 2) AE (15%)1 = 6151 + 2, 000 + 372. 08 – 2, 372 = $6, 151 OR CR (15%)2 = I (A/P, 15%, 2) – S 2 (A/F, 15%, 2) CR (15%)2 = 10, 000 (0. 6151) – 5, 100 (0. 4651) = $3, 779 AEOC 2 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) ] (A/P, 15%, 2) AEOC 2 = [2, 000 (0. 8696) + 2, 800 (0. 7561)] (0. 6151) = $2, 372 Σ AE 2 = CR (15%)2 + AEOC 2 = 2, 418. 32 + 2, 697. 55 = $6, 151 34

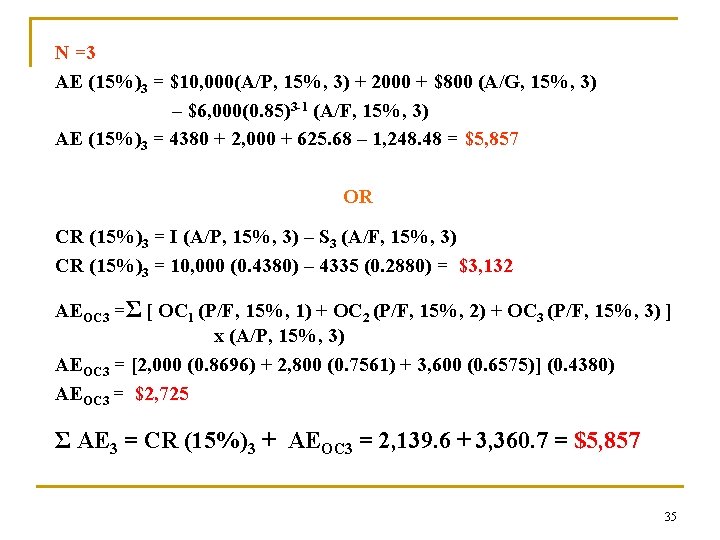

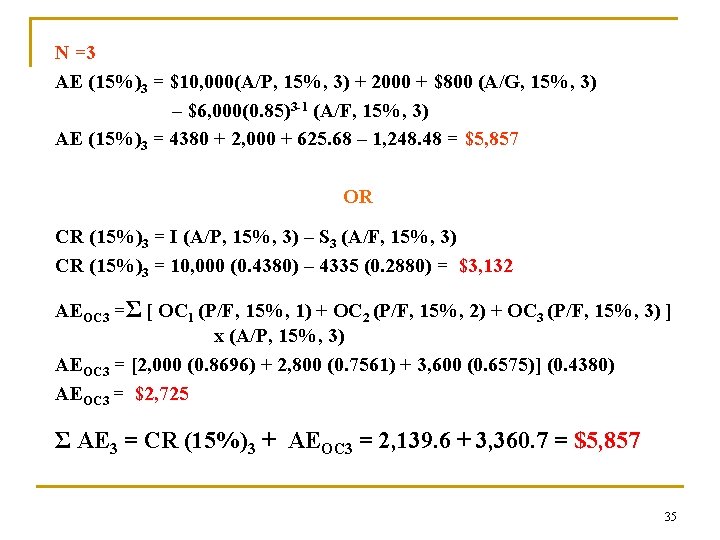

N =3 AE (15%)3 = $10, 000(A/P, 15%, 3) + 2000 + $800 (A/G, 15%, 3) – $6, 000(0. 85)3 -1 (A/F, 15%, 3) AE (15%)3 = 4380 + 2, 000 + 625. 68 – 1, 248. 48 = $5, 857 OR CR (15%)3 = I (A/P, 15%, 3) – S 3 (A/F, 15%, 3) CR (15%)3 = 10, 000 (0. 4380) – 4335 (0. 2880) = $3, 132 AEOC 3 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) ] x (A/P, 15%, 3) AEOC 3 = [2, 000 (0. 8696) + 2, 800 (0. 7561) + 3, 600 (0. 6575)] (0. 4380) AEOC 3 = $2, 725 Σ AE 3 = CR (15%)3 + AEOC 3 = 2, 139. 6 + 3, 360. 7 = $5, 857 35

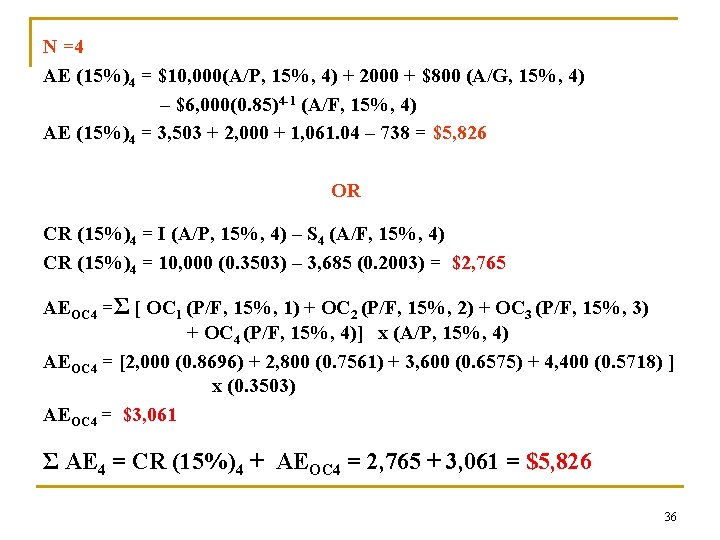

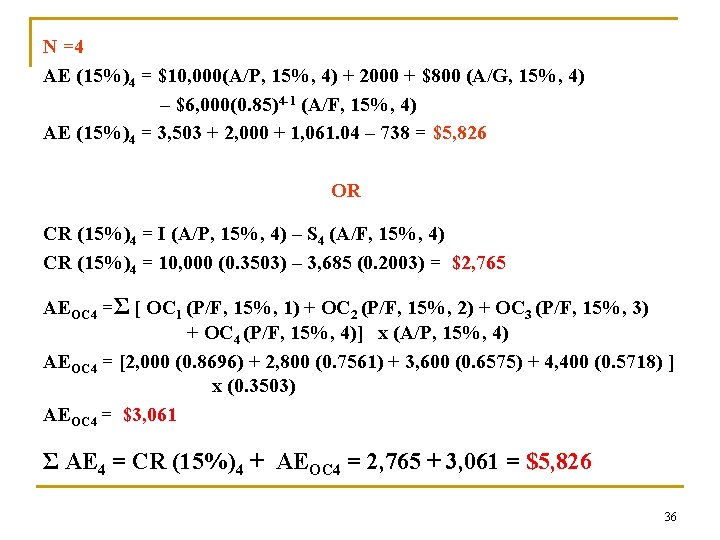

N =4 AE (15%)4 = $10, 000(A/P, 15%, 4) + 2000 + $800 (A/G, 15%, 4) – $6, 000(0. 85)4 -1 (A/F, 15%, 4) AE (15%)4 = 3, 503 + 2, 000 + 1, 061. 04 – 738 = $5, 826 OR CR (15%)4 = I (A/P, 15%, 4) – S 4 (A/F, 15%, 4) CR (15%)4 = 10, 000 (0. 3503) – 3, 685 (0. 2003) = $2, 765 AEOC 4 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) + OC 4 (P/F, 15%, 4)] x (A/P, 15%, 4) AEOC 4 = [2, 000 (0. 8696) + 2, 800 (0. 7561) + 3, 600 (0. 6575) + 4, 400 (0. 5718) ] x (0. 3503) AEOC 4 = $3, 061 Σ AE 4 = CR (15%)4 + AEOC 4 = 2, 765 + 3, 061 = $5, 826 36

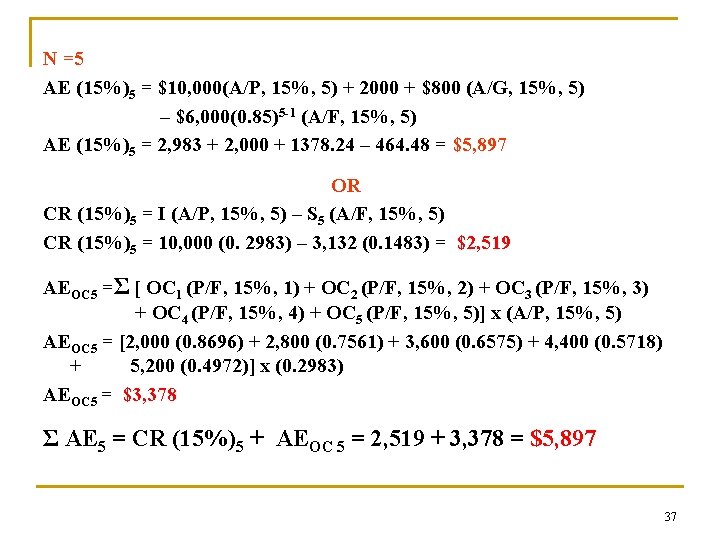

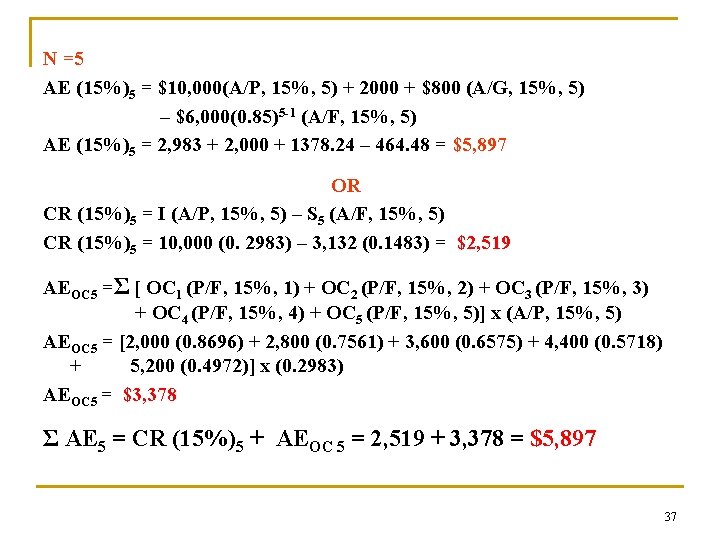

N =5 AE (15%)5 = $10, 000(A/P, 15%, 5) + 2000 + $800 (A/G, 15%, 5) – $6, 000(0. 85)5 -1 (A/F, 15%, 5) AE (15%)5 = 2, 983 + 2, 000 + 1378. 24 – 464. 48 = $5, 897 OR CR (15%)5 = I (A/P, 15%, 5) – S 5 (A/F, 15%, 5) CR (15%)5 = 10, 000 (0. 2983) – 3, 132 (0. 1483) = $2, 519 AEOC 5 =Σ [ OC 1 (P/F, 15%, 1) + OC 2 (P/F, 15%, 2) + OC 3 (P/F, 15%, 3) + OC 4 (P/F, 15%, 4) + OC 5 (P/F, 15%, 5)] x (A/P, 15%, 5) AEOC 5 = [2, 000 (0. 8696) + 2, 800 (0. 7561) + 3, 600 (0. 6575) + 4, 400 (0. 5718) + 5, 200 (0. 4972)] x (0. 2983) AEOC 5 = $3, 378 Σ AE 5 = CR (15%)5 + AEOC 5 = 2, 519 + 3, 378 = $5, 897 37

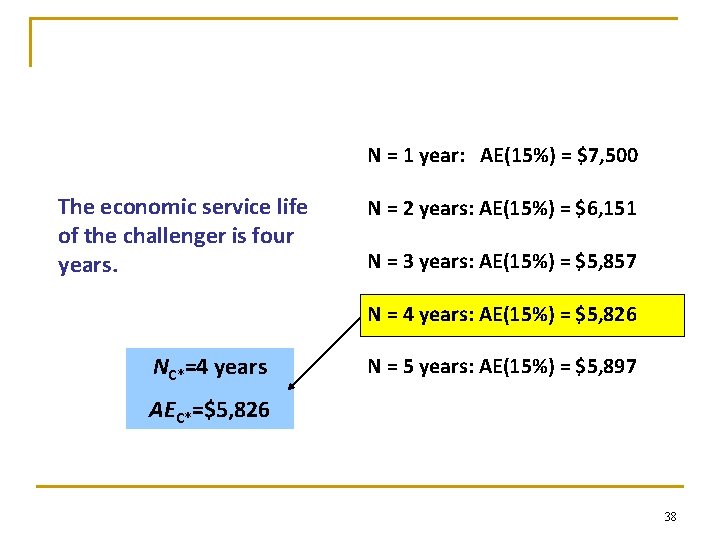

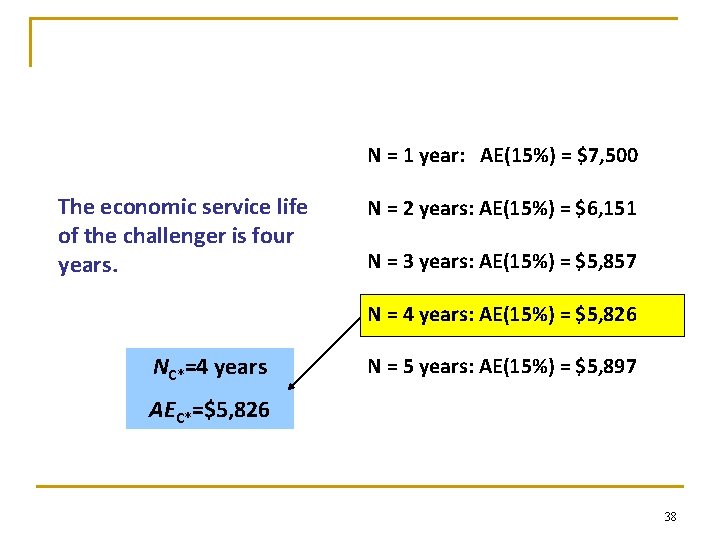

N = 1 year: AE(15%) = $7, 500 The economic service life of the challenger is four years. N = 2 years: AE(15%) = $6, 151 N = 3 years: AE(15%) = $5, 857 N = 4 years: AE(15%) = $5, 826 NC*=4 years N = 5 years: AE(15%) = $5, 897 AEC*=$5, 826 38

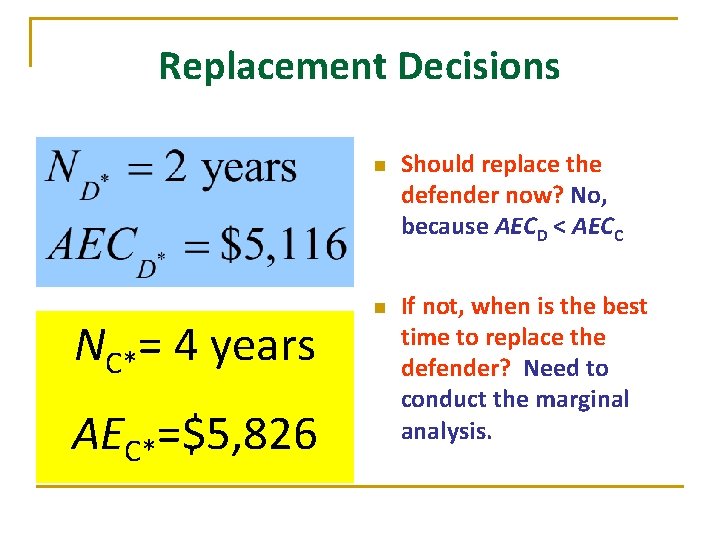

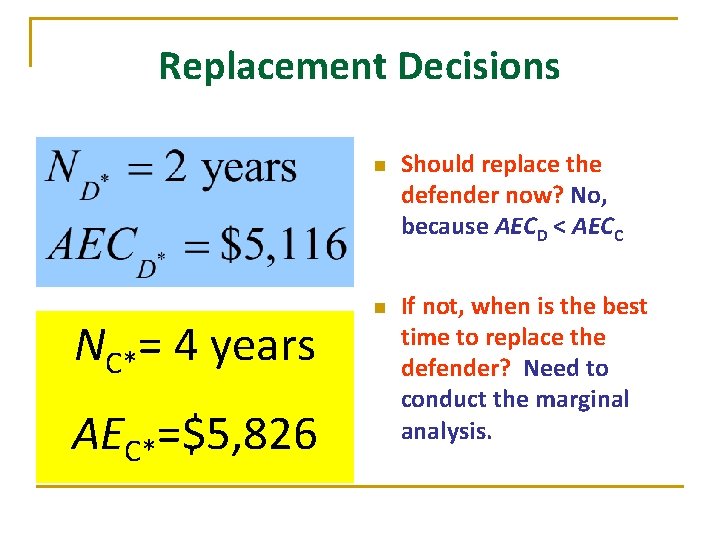

Replacement Decisions n NC*= 4 years AEC*=$5, 826 n Should replace the defender now? No, because AECD < AECC If not, when is the best time to replace the defender? Need to conduct the marginal analysis.

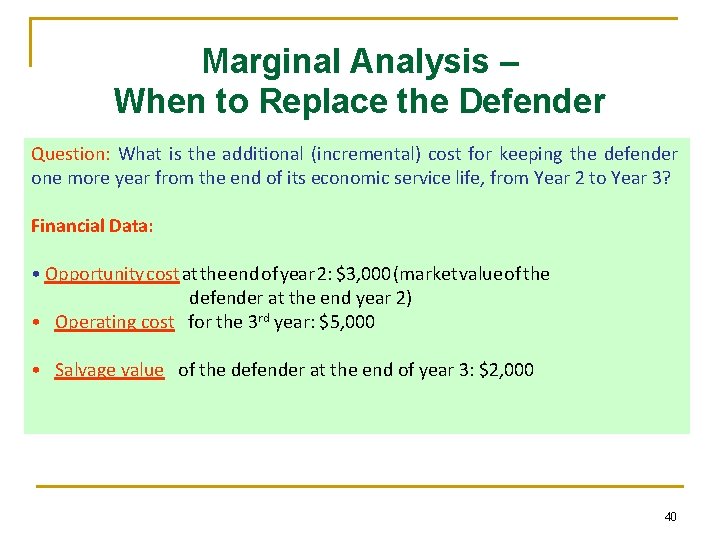

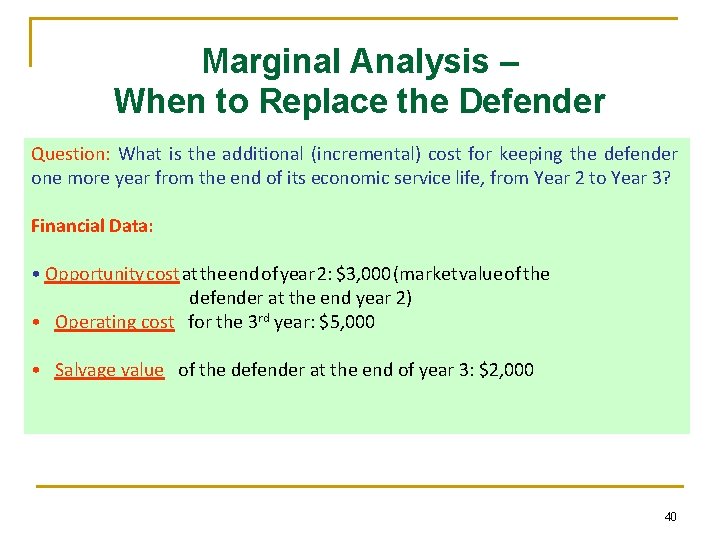

Marginal Analysis – When to Replace the Defender Question: What is the additional (incremental) cost for keeping the defender one more year from the end of its economic service life, from Year 2 to Year 3? Financial Data: • Opportunity cost at the end of year 2: $3, 000 (market value of the defender at the end year 2) • Operating cost for the 3 rd year: $5, 000 • Salvage value of the defender at the end of year 3: $2, 000 40

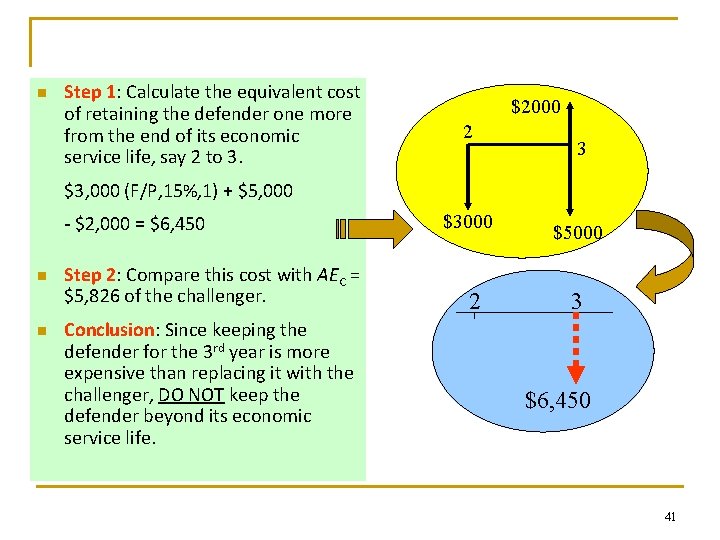

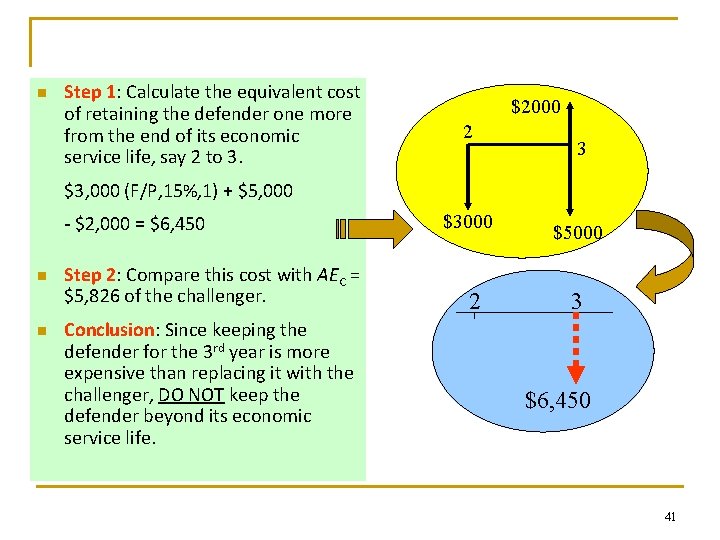

n Step 1: Calculate the equivalent cost of retaining the defender one more from the end of its economic service life, say 2 to 3. $2000 2 3 $3, 000 (F/P, 15%, 1) + $5, 000 - $2, 000 = $6, 450 n n Step 2: Compare this cost with AEC = $5, 826 of the challenger. Conclusion: Since keeping the defender for the 3 rd year is more expensive than replacing it with the challenger, DO NOT keep the defender beyond its economic service life. $3000 2 $5000 3 $6, 450 41