Chapter 11 Cash Control and Banking Activities What

Chapter 11 Cash Control and Banking Activities What You’ll Learn § Describe the internal controls used to protect cash. § Describe the forms needed to open and use a checking account. § Record information on check stubs. § Prepare a check. § Prepare bank deposits. § Reconcile a bank statement. § Journalize and post entries relating to bank service charges. § Describe the uses of the electronic funds transfer system. § Define the terms introduced in this chapter. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 0

Chapter 11, Section 1 Banking Procedures What Do You Think? What happens if a business fails to take steps to protect its assets and keep reliable records? Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 1

SECTION 11. 1 Banking Procedures Main Idea Internal controls are steps taken to protect assets and keep reliable records. You Will Learn § how a business protects cash. § how to use a checking account. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 2

Banking Procedures SECTION 11. 1 Key Terms § § § § § internal controls external controls checking account check depositor signature card deposit slip endorsement blank endorsement special endorsement Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 3

Banking Procedures SECTION 11. 1 Key Terms § § § restrictive endorsement payee drawer drawee voiding a check Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 4

SECTION 11. 1 Banking Procedures Protecting Cash In any business, cash is used in daily transactions; it is important to track cash received and paid out. Cash should be protected. There are two ways to protect cash: § internal controls (e. g. limiting the number of people handling cash) § external controls (e. g. verify accuracy of signatures on checks) Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 5

SECTION 11. 1 Banking Procedures The Checking Account A checking account holds cash deposits made by the depositor, whether a person or business, and allows them to write a check against the balance. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 6

SECTION 11. 1 Banking Procedures Opening a Checking Account A checking account helps a person or business § protect cash, and § provides a record of cash transactions. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 7

SECTION 11. 1 Banking Procedures The Signature Card A signature card and a cash deposit are needed to open a checking account. A signature card is kept on file at the bank to verify that signatures on checks are valid. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 8

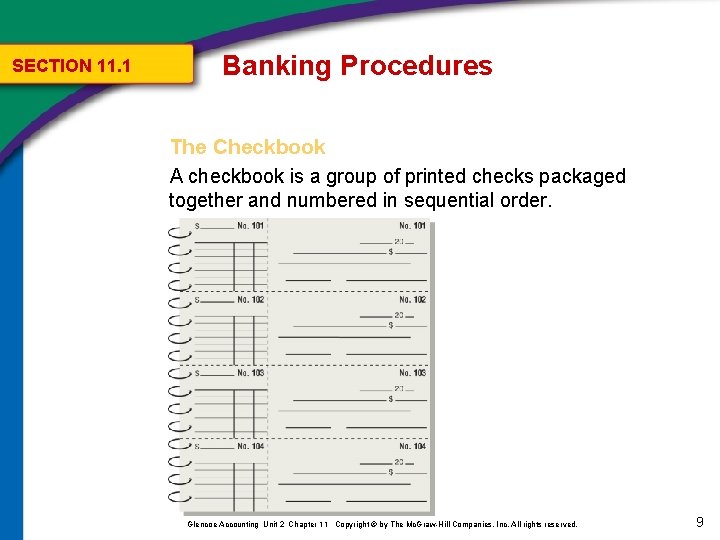

SECTION 11. 1 Banking Procedures The Checkbook A checkbook is a group of printed checks packaged together and numbered in sequential order. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 9

SECTION 11. 1 Banking Procedures The ABA Number Each check is printed with a check number, the bank account number, and an American Bankers Association (ABA) number. The ABA number: § identifies the bank. § speeds the hand sorting of checks. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 10

SECTION 11. 1 Banking Procedures Making Deposits Most businesses make daily deposits to protect the cash it receives. A deposit slip containing a detailed record of the deposits accompanies them. To complete a deposit slip: § Write the date on the Date line. § Indicate the total currency and coins on the Cash line. § List checks separately by their ABA numbers. § Add the amounts and enter the total on the Total line. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 11

SECTION 11. 1 Banking Procedures Endorsing Checks A business acquires the right to a check when it receives a check. The depositor’s endorsement is needed to deposit the check in the checking account. The endorsement transfers check ownership to the bank. There are three types of endorsements a business can use. § A blank endorsement does not indicate the new owner of the check. § A special endorsement transfers ownership of the check to a specific individual or business. § a restrictive endorsement places limitations on how a check may be handled after ownership is transferred. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 12

SECTION 11. 1 Banking Procedures Recording Deposits To record a deposit in the checkbook, follow these steps: § Enter the date of deposit in the Add deposits line on the check stub for the next unused check. § Enter the total amount of the deposit. § Add the deposit amounts to the amount on the Balance brought forward line and enter the total on the Total line. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 13

SECTION 11. 1 Banking Procedures Writing Checks Here a few important rules to writing checks: § Complete checks in ink. § Complete the check stub before writing the check. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 14

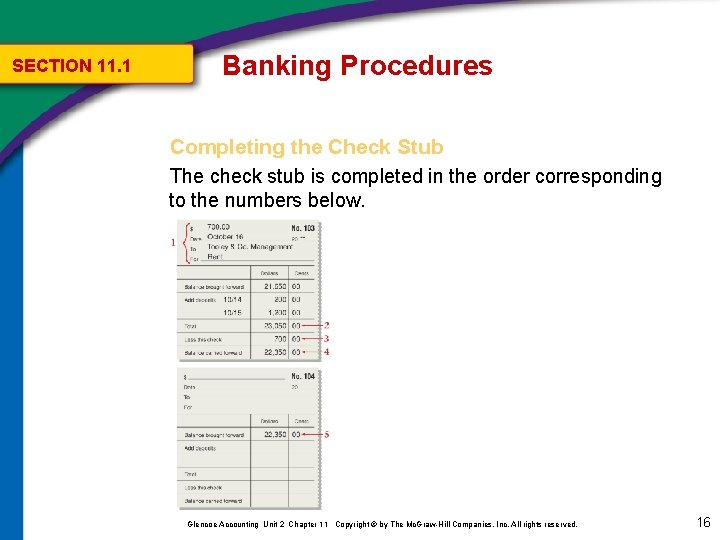

SECTION 11. 1 Banking Procedures Completing the Check Stub The stub serves as a permanent record of the check and must be complete and accurate. The two parts to the check stub include § the upper part containing the amount of the check, the date, the name of the payee, and the purpose of the check, and § the lower part containing a record of how the transaction affects the checking account. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 15

SECTION 11. 1 Banking Procedures Completing the Check Stub The check stub is completed in the order corresponding to the numbers below. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 16

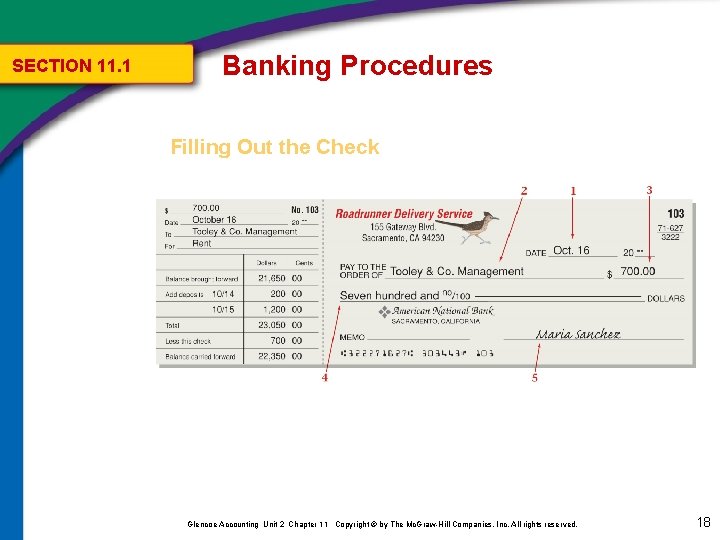

SECTION 11. 1 Banking Procedures Filling Out the Check To write a check, follow these steps: 1. Write the date the check is being issued. 2. Enter the payee’s name on the Pay To The Order Of line. 3. Enter the amount of the check in numbers. 4. On the next line, write the dollar amount of the check in words. 5. The drawer signs the check. The drawee is the bank on which the check is written. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 17

SECTION 11. 1 Banking Procedures Filling Out the Check Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 18

SECTION 11. 1 Banking Procedures Voiding a Check Voiding a check is necessary if a mistake is made while writing a check. Write Void in big letters across the front in ink and prepare a new check. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 19

SECTION 11. 1 Banking Procedures Key Terms Review § internal controls Procedures within the business that are designed to protect cash and other assets and to keep reliable records. § external controls Measures and procedures provided outside the business to protect cash and other assets. § checking account An account that allows a person or business to deposit cash in a bank and then write checks and make ATM withdrawals and purchases against the account balance. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 20

SECTION 11. 1 Banking Procedures Key Terms Review § check A written order from a depositor telling the bank to pay a stated amount of cash to the person or business named on the check. § depositor A person or business that has cash on deposit in a bank. § signature card A bank form containing the signature(s) of the person(s) authorized to write checks on a checking account. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 21

SECTION 11. 1 Banking Procedures Key Terms Review § deposit slip A bank form used to list the cash and checks to be deposited. § endorsement An authorized signature written or stamped on the back of a check that transfers ownership of the check. § blank endorsement A check endorsement that includes only the signature or stamp of the depositor. It does not specify the new owner of the check. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 22

SECTION 11. 1 Banking Procedures Key Terms Review § special endorsement A check endorsement that a transfers ownership of the check to a specific individual or business. § restrictive endorsement A check endorsement that transfers ownership to a specific owner and limits how the check may be handled (for example, For Deposit Only). § payee The person or business to whom a check is written or a note is payable. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 23

SECTION 11. 1 Banking Procedures Key Terms Review § drawer The person who signs a check. § drawee The bank on which a check is written. § voiding a check Making a check unusable by writing the word Void in ink across the front of the check. Glencoe Accounting Unit 2 Chapter 11 Copyright © by The Mc. Graw-Hill Companies, Inc. All rights reserved. 24

- Slides: 25