Chapter 10 The Basics Of Capital Budgeting The

Chapter 10: The Basics Of Capital Budgeting

The Basics Of Capital Budgeting : 2

Chapter Outline: u Introduction. u Capital Budgeting Decision Rules: t Payback Period. t Discounted payback Period. t Net Present Value (NPV). t Internal Rate of Return (IRR). t Profitability Index (PI). 3

Capital Budgeting: u The process of planning expenditures on assets whose cash flows are expected to extend beyond one year. 4

Capital Budgeting: u Analysis of potential additions to fixed assets. u Long-term decisions; involve large expenditures. u Very important to firm’s future. 5

Steps to Capital Budgeting: 1. 2. 3. 4. 5. Estimate Cash Flow (inflows & outflows). Assess riskiness of CFs. Determine the appropriate cost of capital. Find NPV and/or IRR. Accept if NPV > 0 and/or IRR > WACC. 6

Payback Period: u The number of years required to recover a project’s cost, or “How long does it take to get our money back? ” 7

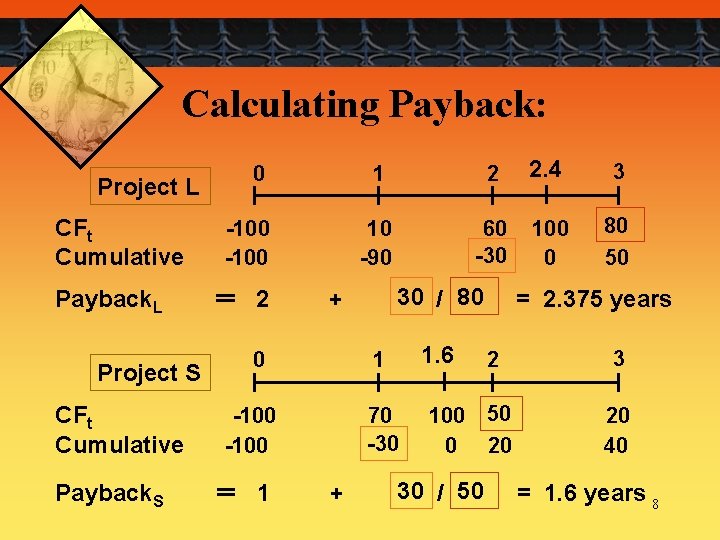

Calculating Payback: Project L CFt Cumulative Payback. L Project S CFt Cumulative Payback. S 0 1 2 2. 4 3 -100 10 -90 60 -30 100 0 80 50 == 2 0 1. 6 1 -100 == 1 30 / 80 + 70 -30 + = 2. 375 years 2 100 50 0 20 30 / 50 3 20 40 = 1. 6 years 8

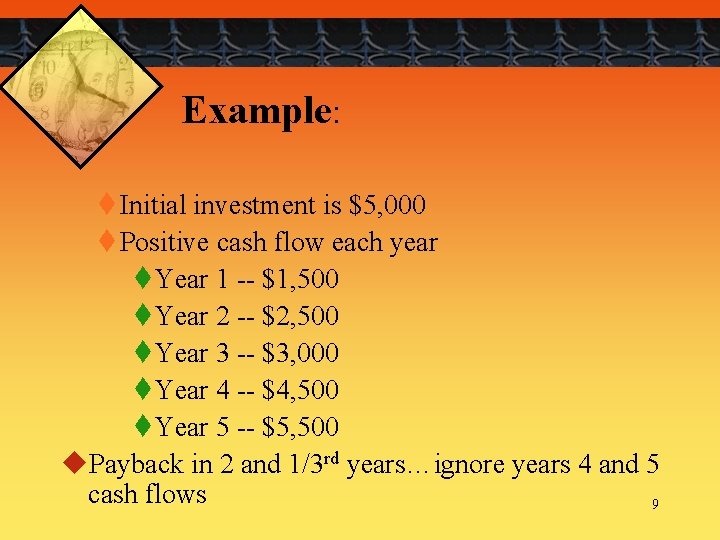

Example: t Initial investment is $5, 000 t Positive cash flow each year t. Year 1 -- $1, 500 t. Year 2 -- $2, 500 t. Year 3 -- $3, 000 t. Year 4 -- $4, 500 t. Year 5 -- $5, 500 u. Payback in 2 and 1/3 rd years…ignore years 4 and 5 cash flows 9

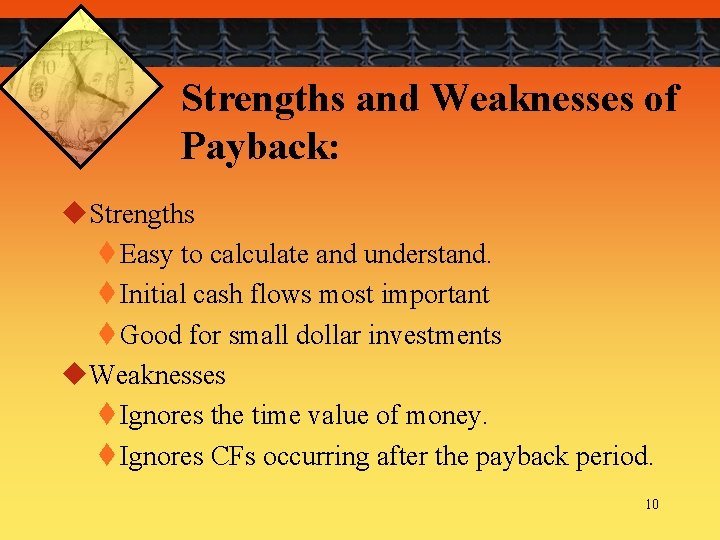

Strengths and Weaknesses of Payback: u. Strengths t Easy to calculate and understand. t Initial cash flows most important t Good for small dollar investments u. Weaknesses t Ignores the time value of money. t Ignores CFs occurring after the payback period. 10

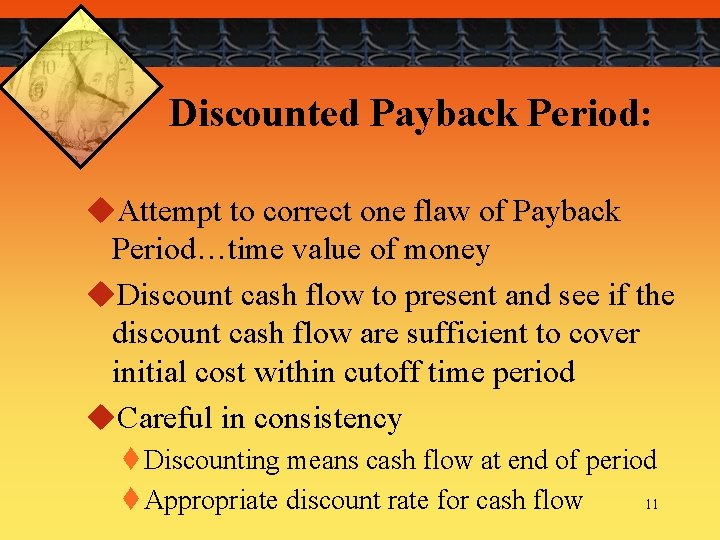

Discounted Payback Period: u. Attempt to correct one flaw of Payback Period…time value of money u. Discount cash flow to present and see if the discount cash flow are sufficient to cover initial cost within cutoff time period u. Careful in consistency t Discounting means cash flow at end of period 11 t Appropriate discount rate for cash flow

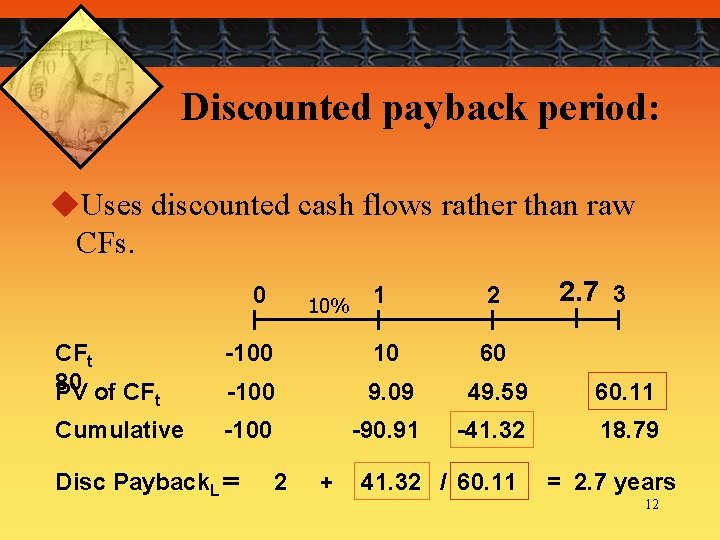

Discounted payback period: u. Uses discounted cash flows rather than raw CFs. 0 CFt 80 PV of CF t Cumulative 2. 7 3 1 2 -100 10 60 -100 9. 09 49. 59 60. 11 -100 -90. 91 -41. 32 18. 79 Disc Payback. L == 10% 2 + 41. 32 / 60. 11 = 2. 7 years 12

Net Present Value (NPV): u Correction to discounted cash flow t. Includes all cash flow in decision t. Changes decision (go vs. no-go) to dollars, not arbitrary cutoff period u Need all cash flow u Need appropriate discount rate 13

Net Present Value (NPV): u. NPV = PV of inflows minus Cost = Net gain in wealth. u. Acceptance of a project with a NPV > 0 will add value to the firm. u. Decision Rule: t Accept if NPV >0, t Reject if NPV < 0 14

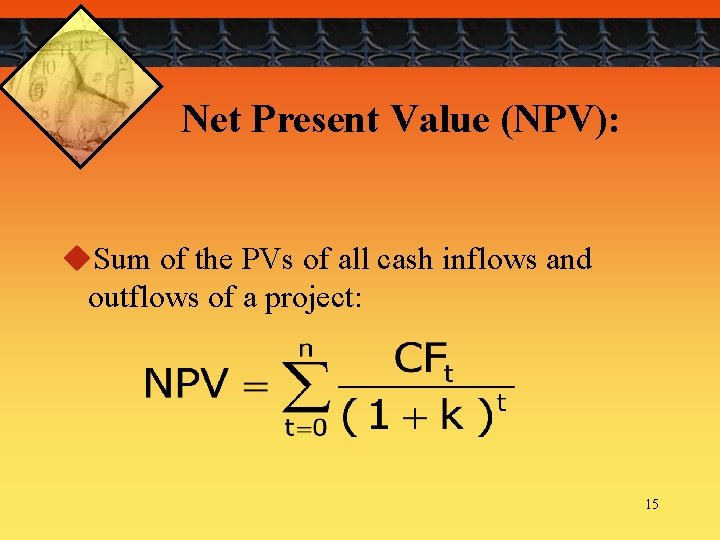

Net Present Value (NPV): u. Sum of the PVs of all cash inflows and outflows of a project: 15

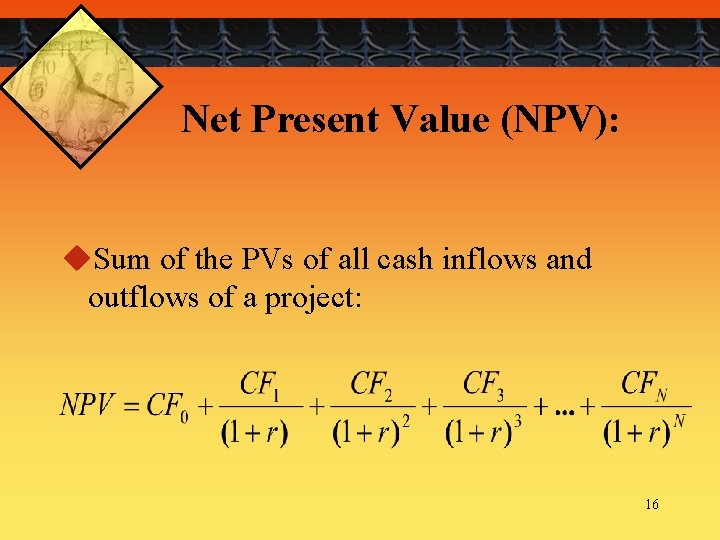

Net Present Value (NPV): u. Sum of the PVs of all cash inflows and outflows of a project: 16

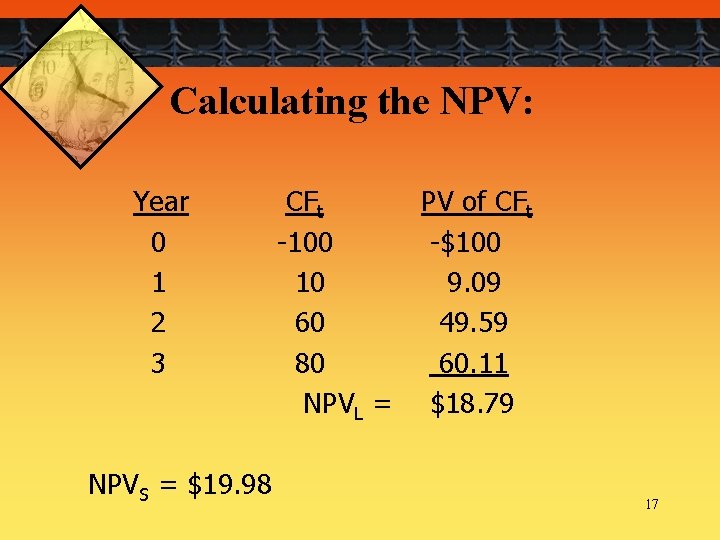

Calculating the NPV: Year 0 1 2 3 NPVS = $19. 98 CFt -100 10 60 80 NPVL = PV of CFt -$100 9. 09 49. 59 60. 11 $18. 79 17

Net Present Value (NPV): u. The Decision Model t. Incorporates risk and return t. Incorporates time value of money t. Incorporates all cash flow 18

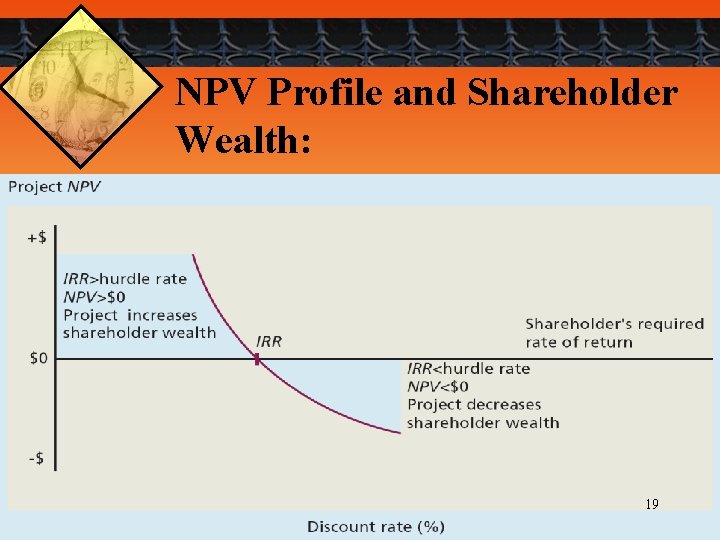

NPV Profile and Shareholder Wealth: 19

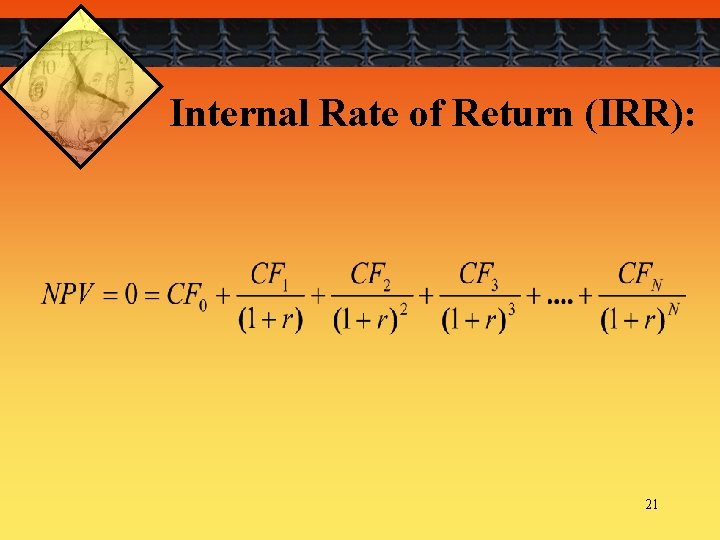

Internal Rate of Return (IRR): u. Model closely resembles NPV but… t Finding the discount rate (Internal Rate) that implies an NPV of zero t Internal rate used to accept or reject project t. If IRR > Cost of Capital, accept t. If IRR < Cost of Capital, reject u. Very popular model as “managers” like the single return variable when evaluating projects 20

Internal Rate of Return (IRR): 21

Calculating the IRR: 22

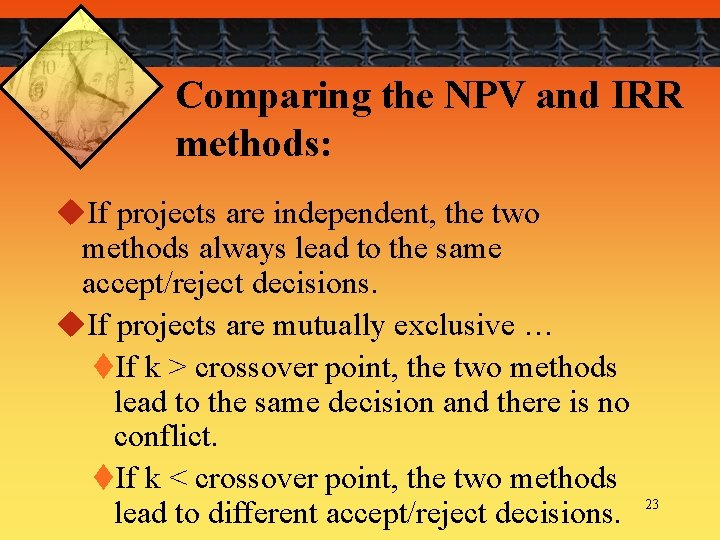

Comparing the NPV and IRR methods: u. If projects are independent, the two methods always lead to the same accept/reject decisions. u. If projects are mutually exclusive … t. If k > crossover point, the two methods lead to the same decision and there is no conflict. t. If k < crossover point, the two methods lead to different accept/reject decisions. 23

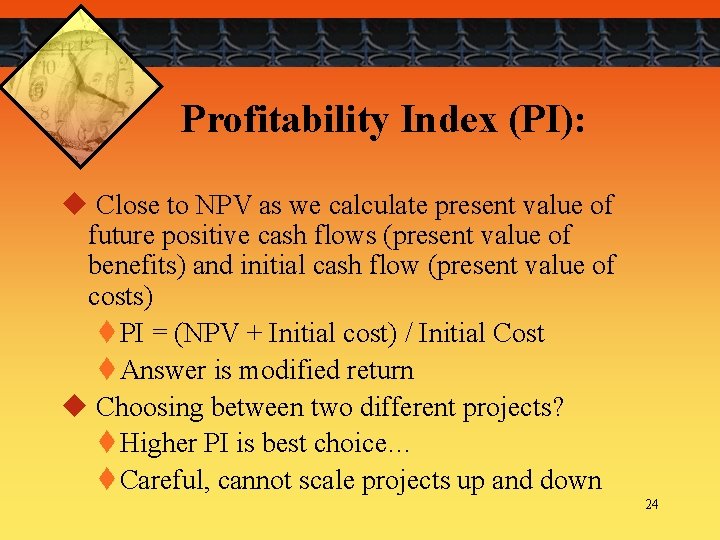

Profitability Index (PI): u Close to NPV as we calculate present value of future positive cash flows (present value of benefits) and initial cash flow (present value of costs) t PI = (NPV + Initial cost) / Initial Cost t Answer is modified return u Choosing between two different projects? t Higher PI is best choice… t Careful, cannot scale projects up and down 24

Profitability Index (PI): u. Modified version of NPV u. Decision Criteria t PI > 1. 0, accept project t PI < 1. 0, reject project 25

Capital Budgeting: Methods to generate, review, analyze, select, and implement long-term investment proposals: u. Payback Period u. Discounted payback period u. Net Present Value (NPV) u. Internal rate of return (IRR) u. Profitability index (PI) 26

27

- Slides: 27