Chapter 10 OPERATIONAL ASSETS ACQUISITION AND DISPOSITION Mc

- Slides: 40

Chapter 10 OPERATIONAL ASSETS: ACQUISITION AND DISPOSITION Mc. Graw-Hill /Irwin © 2009 The Mc. Graw-Hill Companies, Inc.

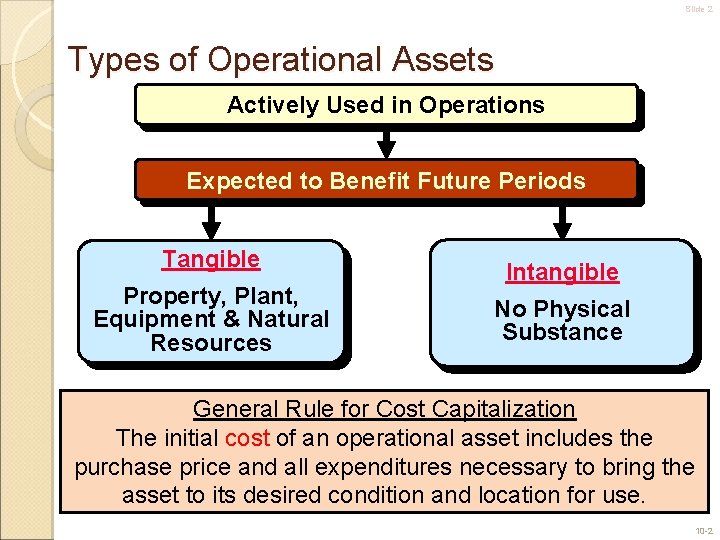

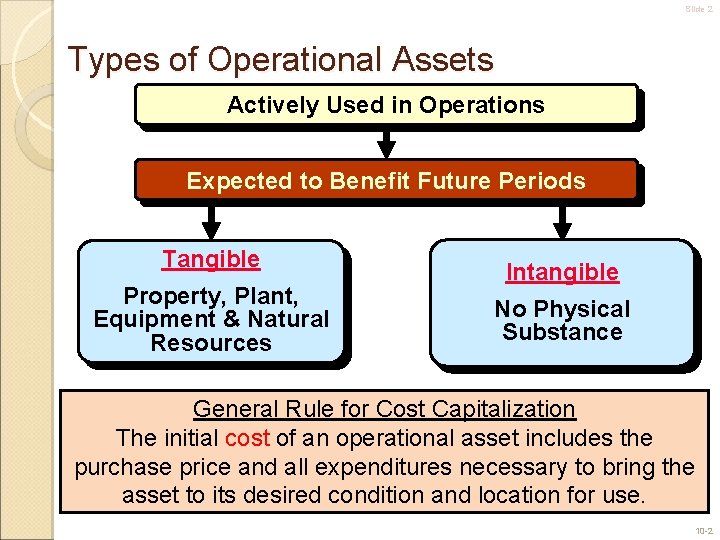

Slide 2 Types of Operational Assets Actively Used in Operations Expected to Benefit Future Periods Tangible Property, Plant, Equipment & Natural Resources Intangible No Physical Substance General Rule for Cost Capitalization The initial cost of an operational asset includes the purchase price and all expenditures necessary to bring the asset to its desired condition and location for use. 10 -2

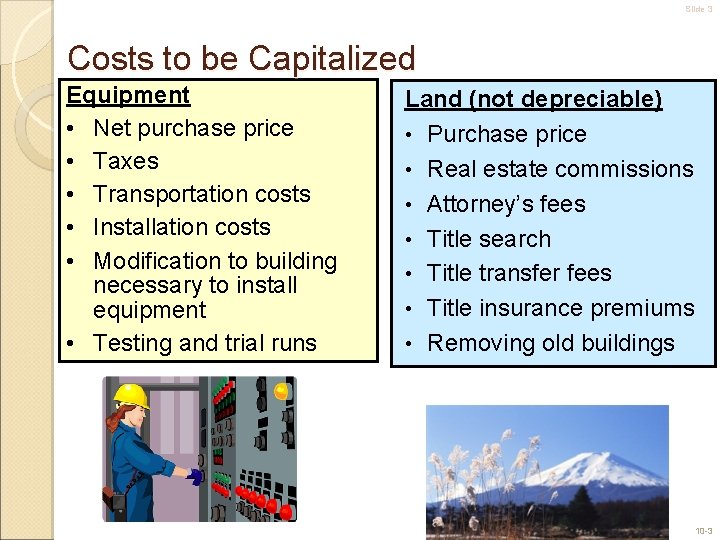

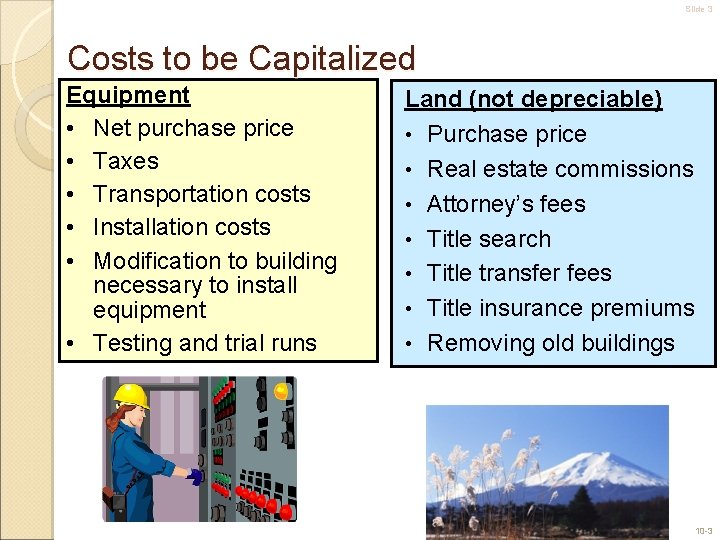

Slide 3 Costs to be Capitalized Equipment • Net purchase price • Taxes • Transportation costs • Installation costs • Modification to building necessary to install equipment • Testing and trial runs Land (not depreciable) • Purchase price • Real estate commissions • Attorney’s fees • Title search • Title transfer fees • Title insurance premiums • Removing old buildings 10 -3

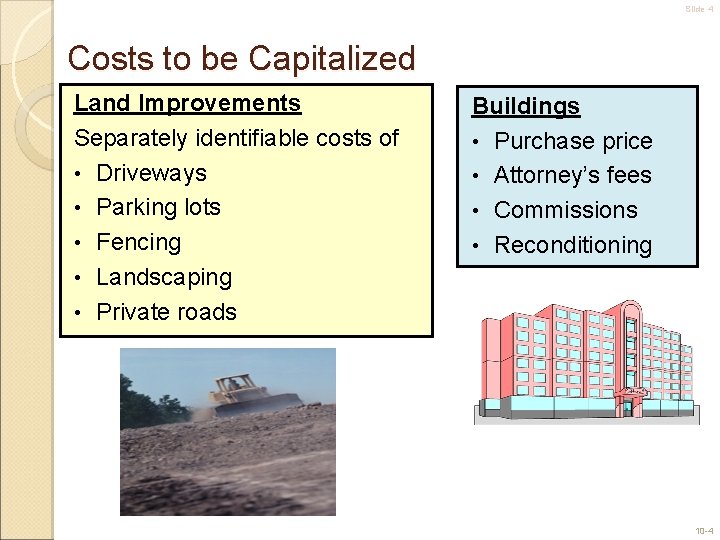

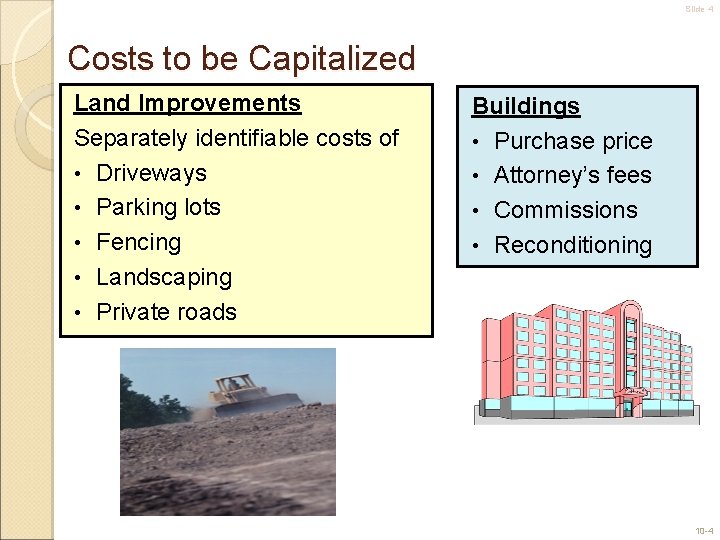

Slide 4 Costs to be Capitalized Land Improvements Separately identifiable costs of • Driveways • Parking lots • Fencing • Landscaping • Private roads Buildings • Purchase price • Attorney’s fees • Commissions • Reconditioning 10 -4

Slide 5 Costs to be Capitalized Natural Resources • Acquisition costs • Exploration costs • Development costs • Restoration costs Intangible Assets • Patents • Copyrights • Trademarks • Franchises • Goodwill The initial cost of an intangible asset includes the purchase price and all other costs necessary to bring it to condition and location for use, such as legal and filing fees. 10 -5

Slide 6 Asset Retirement Obligations Often encountered with natural resource extraction when the land must be restored to a useable condition. Recognize the restoration costs as a liability and a corresponding increase in the related asset. Record at fair value, usually the present value of future cash outflows associated with the reclamation or restoration. 10 -6

Slide 7 Intangible Assets Lack physical substance. Exclusive Rights. Intangible Assets Future benefits less certain than tangible assets. 10 -7

Slide 8 Intangible Assets ─ Patents An exclusive right recognized by law and granted by the US Patent Office for 20 years. Holder has the right to use, manufacture, or sell the patented product or process without interference or infringement by others. R & D costs that lead to an internally developed patent are expensed in the period incurred. Torch, Inc. has developed a new device. Research and development costs totaled $30, 000. Patent registration costs consisted of $2, 000 in attorney fees and $1, 000 in federal registration fees. What is Torch’s patent cost? Torch’s cost for the new patent is $3, 000. The $30, 000 R & D cost is expensed as incurred. 10 -8

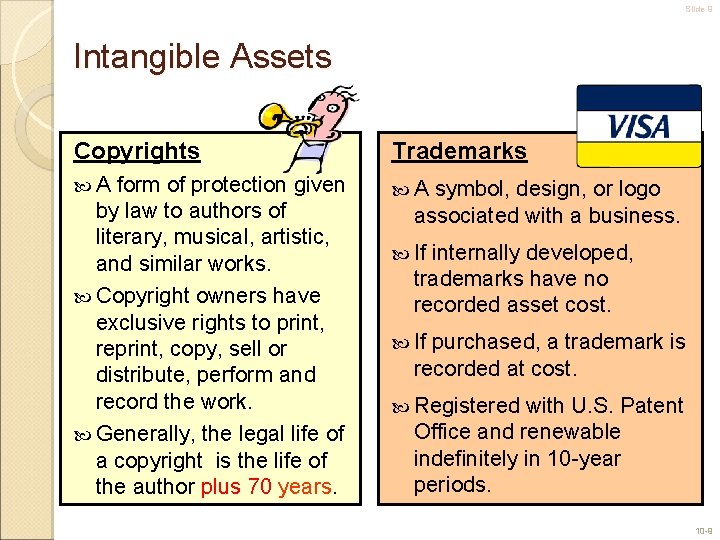

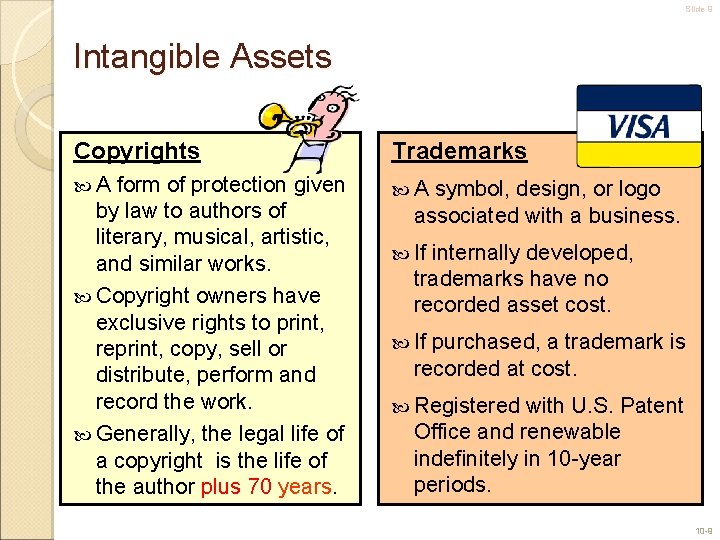

Slide 9 Intangible Assets Copyrights Trademarks A A form of protection given by law to authors of literary, musical, artistic, and similar works. Copyright owners have exclusive rights to print, reprint, copy, sell or distribute, perform and record the work. Generally, the legal life of a copyright is the life of the author plus 70 years. symbol, design, or logo associated with a business. If internally developed, trademarks have no recorded asset cost. If purchased, a trademark is recorded at cost. Registered with U. S. Patent Office and renewable indefinitely in 10 -year periods. 10 -9

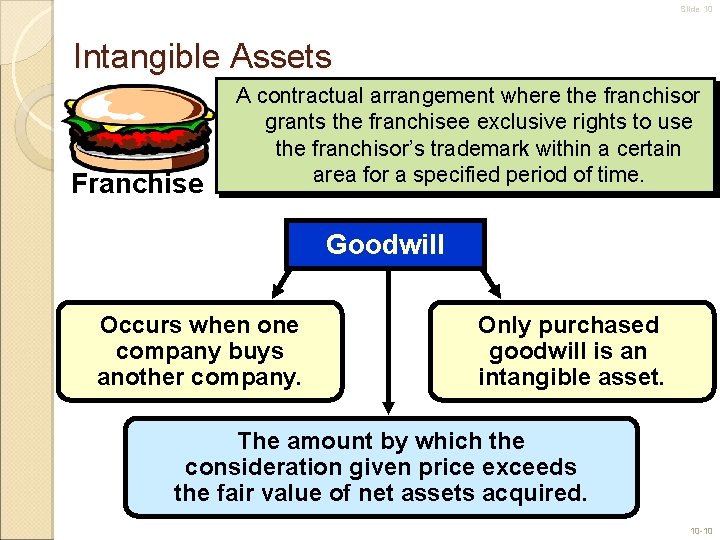

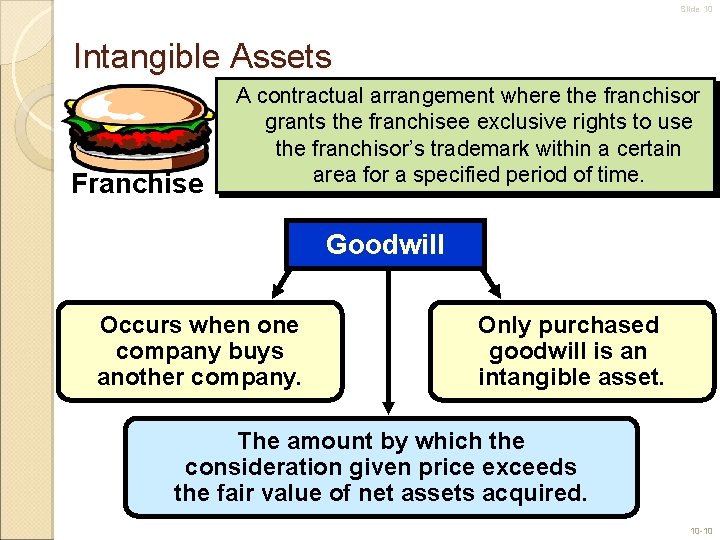

Slide 10 Intangible Assets Franchise A contractual arrangement where the franchisor grants the franchisee exclusive rights to use the franchisor’s trademark within a certain area for a specified period of time. Goodwill Occurs when one company buys another company. Only purchased goodwill is an intangible asset. The amount by which the consideration given price exceeds the fair value of net assets acquired. 10 -10

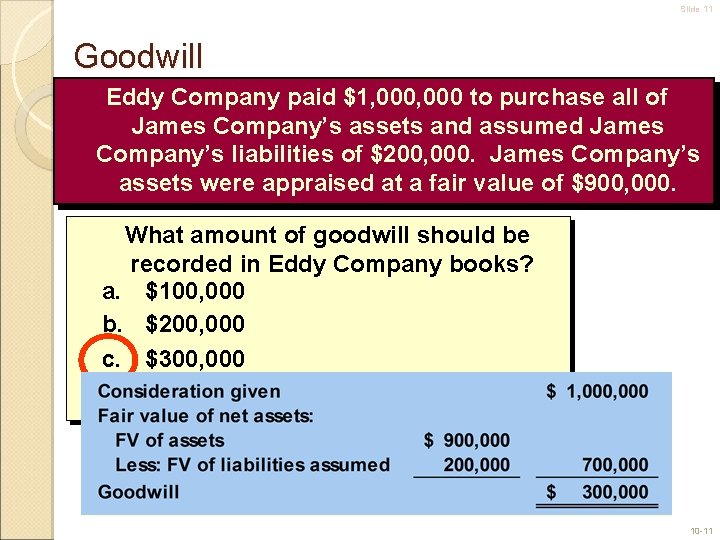

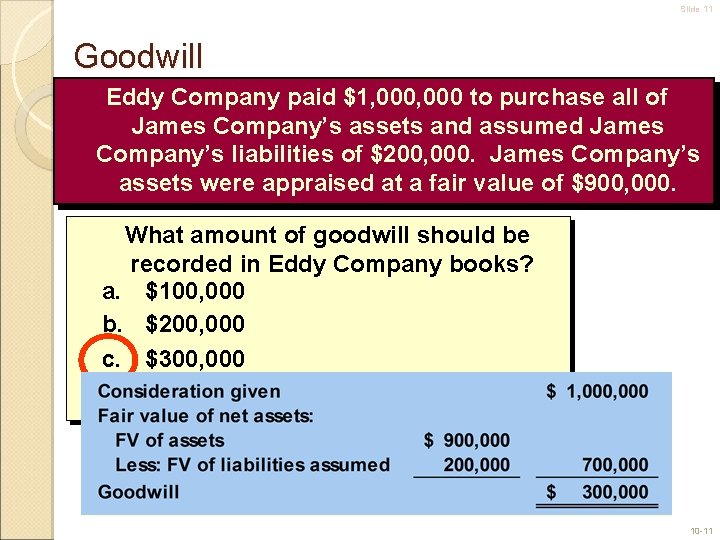

Slide 11 Goodwill Eddy Company paid $1, 000 to purchase all of James Company’s assets and assumed James Company’s liabilities of $200, 000. James Company’s assets were appraised at a fair value of $900, 000. What amount of goodwill should be recorded in Eddy Company books? a. $100, 000 b. $200, 000 c. $300, 000 d. $400, 000 10 -11

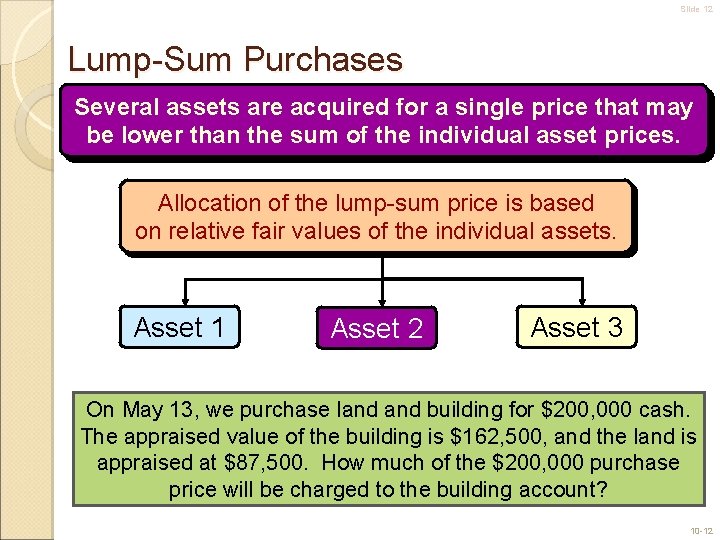

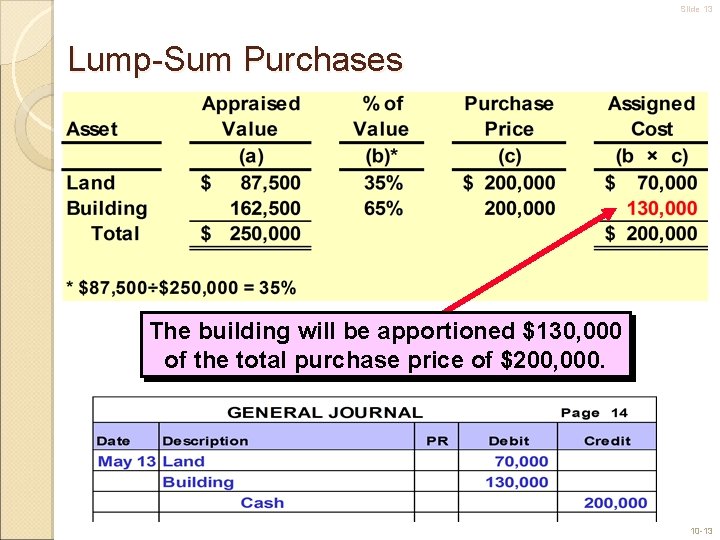

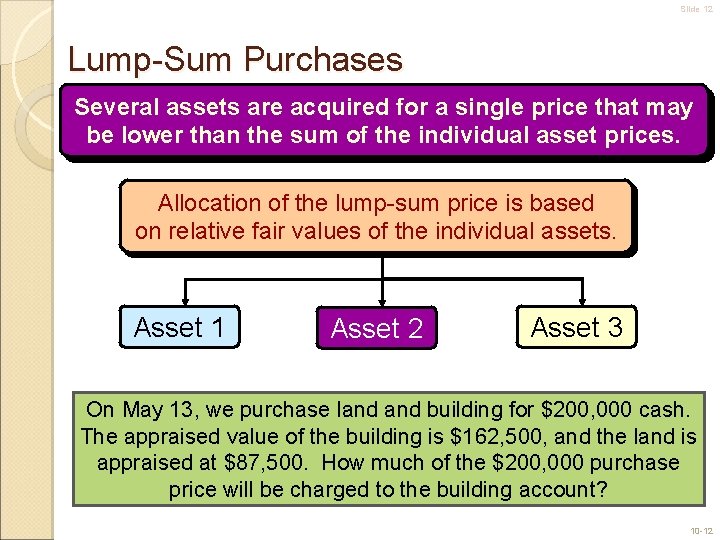

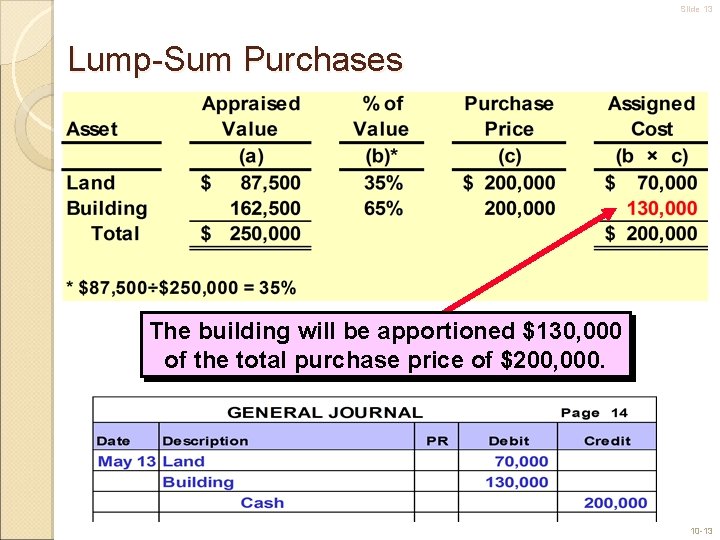

Slide 12 Lump-Sum Purchases Several assets are acquired for a single price that may be lower than the sum of the individual asset prices. Allocation of the lump-sum price is based on relative fair values of the individual assets. Asset 1 Asset 2 Asset 3 On May 13, we purchase land building for $200, 000 cash. The appraised value of the building is $162, 500, and the land is appraised at $87, 500. How much of the $200, 000 purchase price will be charged to the building account? 10 -12

Slide 13 Lump-Sum Purchases The building will be apportioned $130, 000 of the total purchase price of $200, 000. 10 -13

Slide 14 Noncash Acquisitions Issuance of equity securities Deferred payments Donated Assets Exchanges The asset acquired is recorded at the fair value of the consideration given or the fair value of the asset acquired, whichever is more clearly evident. 10 -14

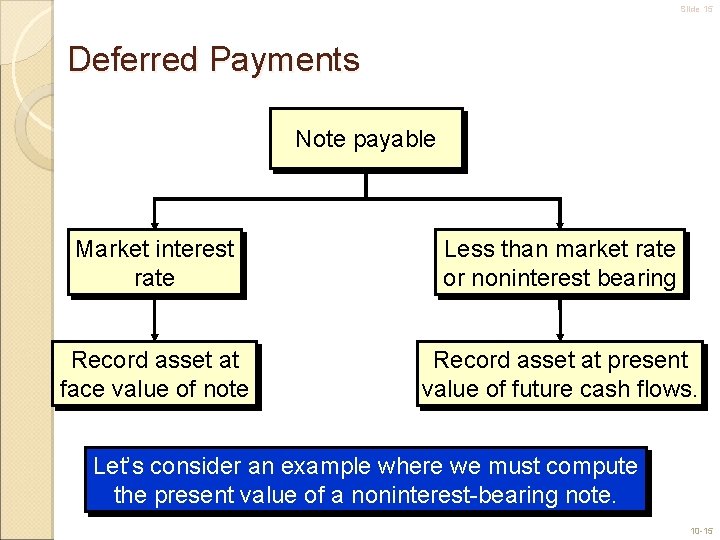

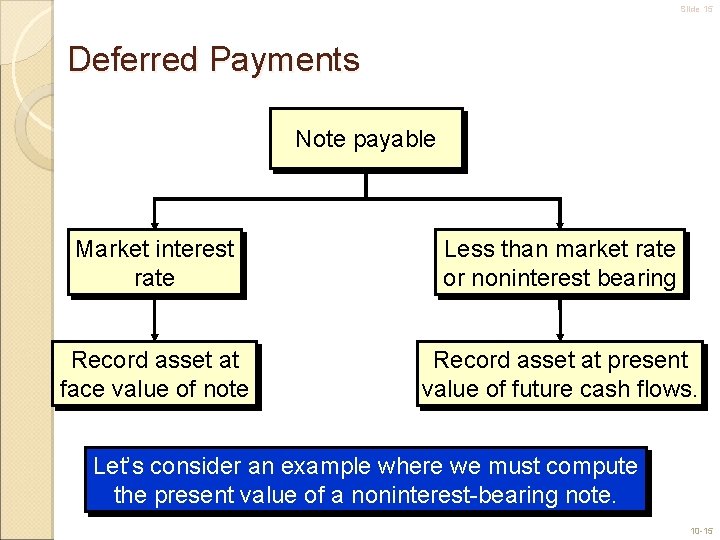

Slide 15 Deferred Payments Note payable Market interest rate Less than market rate or noninterest bearing Record asset at face value of note Record asset at present value of future cash flows. Let’s consider an example where we must compute the present value of a noninterest-bearing note. 10 -15

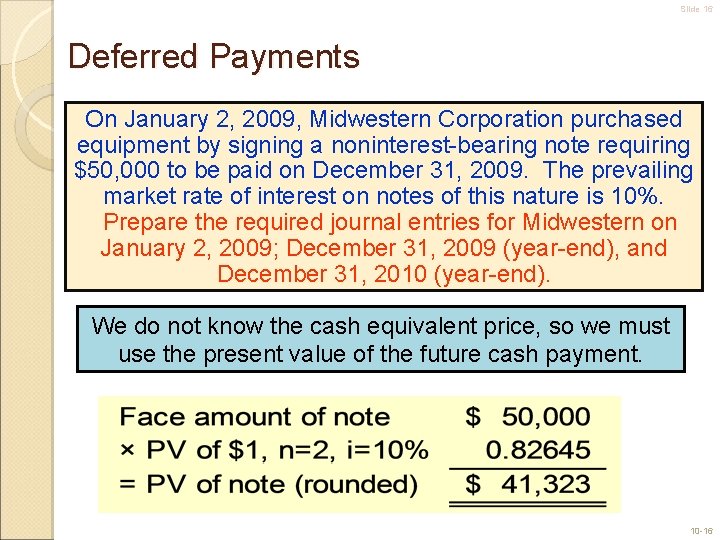

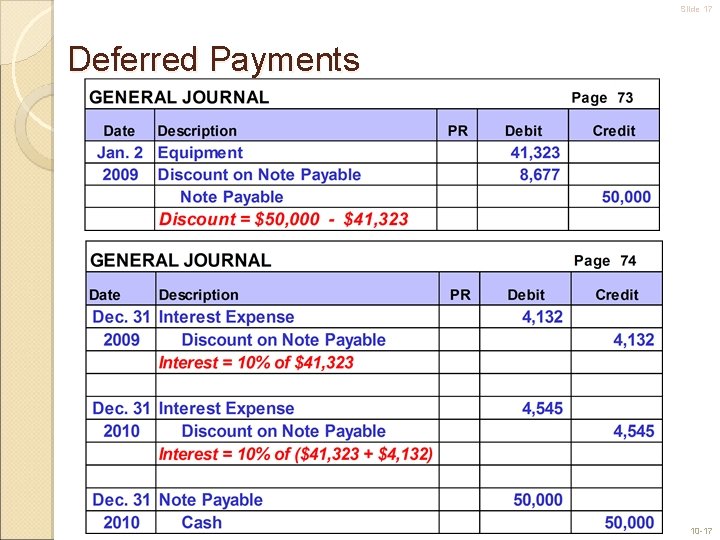

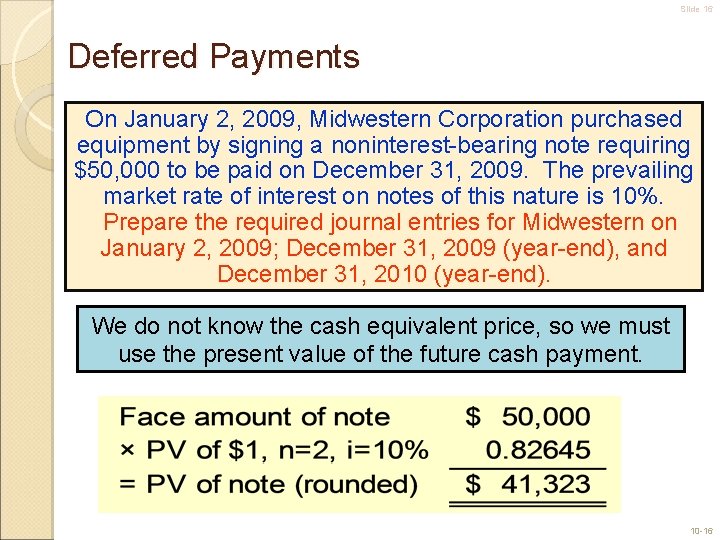

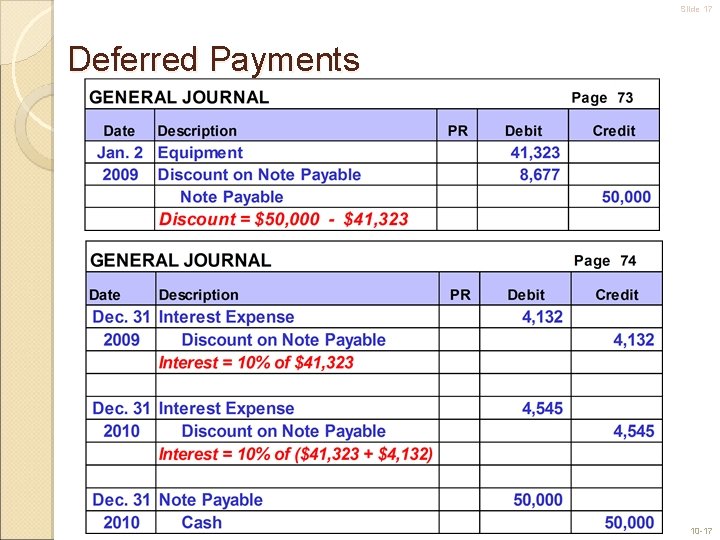

Slide 16 Deferred Payments On January 2, 2009, Midwestern Corporation purchased equipment by signing a noninterest-bearing note requiring $50, 000 to be paid on December 31, 2009. The prevailing market rate of interest on notes of this nature is 10%. Prepare the required journal entries for Midwestern on January 2, 2009; December 31, 2009 (year-end), and December 31, 2010 (year-end). We do not know the cash equivalent price, so we must use the present value of the future cash payment. 10 -16

Slide 17 Deferred Payments 10 -17

Slide 18 Issuance of Equity Securities Asset acquired is recorded at the fair value of the asset or the market value of the securities, whichever is more clearly evident. If the securities are actively traded, market value can be easily determined. If no objective and reliable value can be determined, board of directors assigns a “reasonable value. ” Donated Assets On occasion, companies acquire operational assets through donation. SFAS No. 116 requires the receiving company to • Record the donated asset at fair value. • Record revenue equal to the fair value of the donated asset. 10 -18

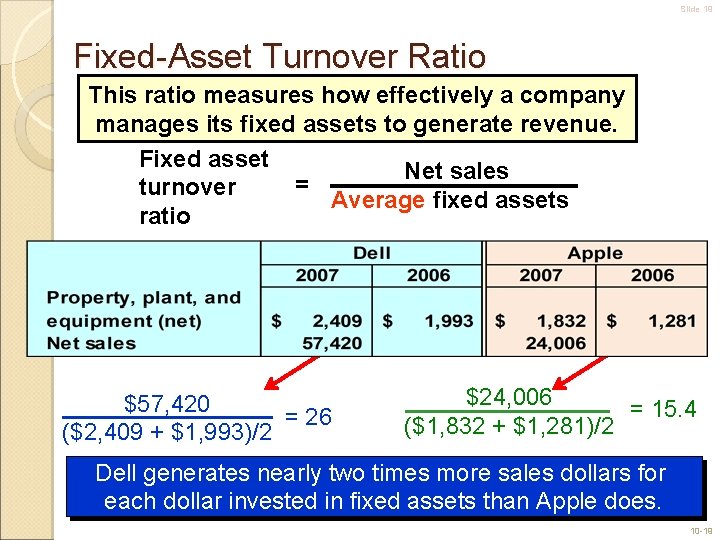

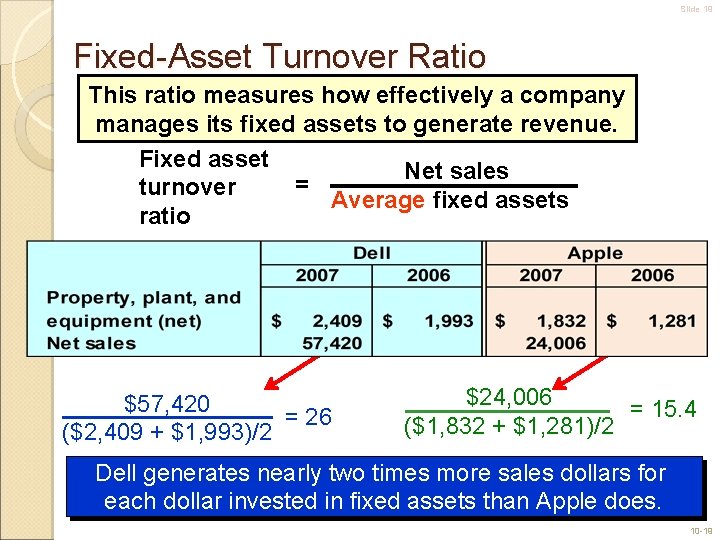

Slide 19 Fixed-Asset Turnover Ratio This ratio measures how effectively a company manages its fixed assets to generate revenue. Fixed asset Net sales = turnover Average fixed assets ratio $57, 420 = 26 ($2, 409 + $1, 993)/2 $24, 006 = 15. 4 ($1, 832 + $1, 281)/2 Dell generates nearly two times more sales dollars for each dollar invested in fixed assets than Apple does. 10 -19

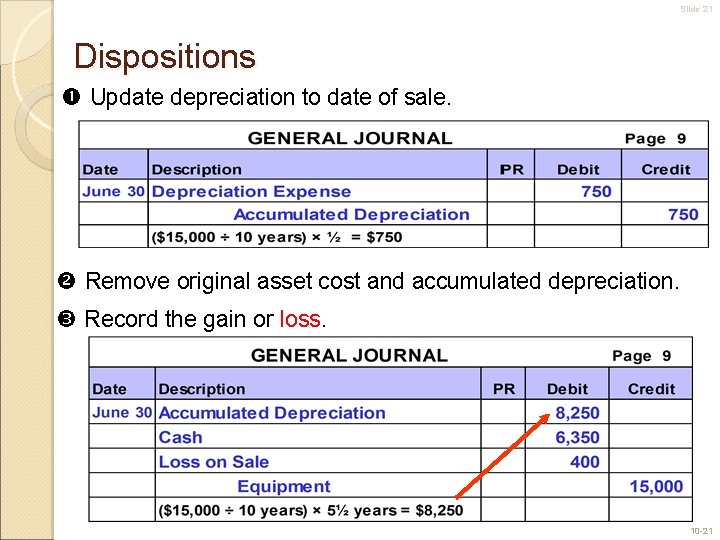

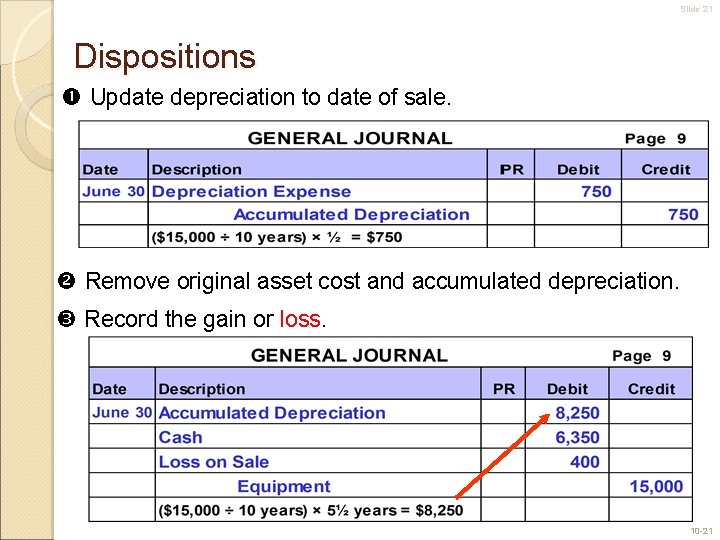

Slide 20 Dispositions Update depreciation to date of disposal. Remove original cost of asset and accumulated depreciation from the books. The difference between book value of the asset and the amount received is recorded as a gain or loss. On June 30, 2009, Me. Lo, Inc. sold equipment for $6, 350 cash. The equipment was purchased on January 1, 2004 at a cost of $15, 000. The equipment was depreciated using the straight-line method over an estimated ten-year life with zero salvage value. Me. Lo last recorded depreciation on the equipment on December 31, 2008, its year-end. Prepare the journal entries necessary to record the disposition of this equipment. 10 -20

Slide 21 Dispositions Update depreciation to date of sale. Remove original asset cost and accumulated depreciation. Record the gain or loss. 10 -21

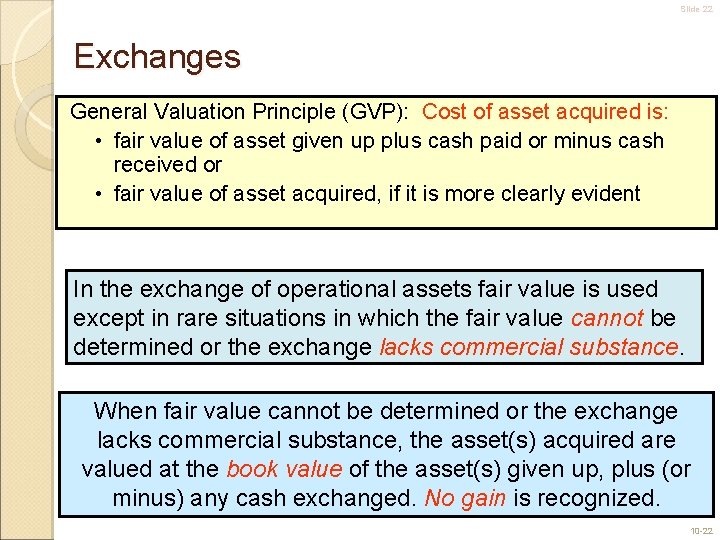

Slide 22 Exchanges General Valuation Principle (GVP): Cost of asset acquired is: • fair value of asset given up plus cash paid or minus cash received or • fair value of asset acquired, if it is more clearly evident In the exchange of operational assets fair value is used except in rare situations in which the fair value cannot be determined or the exchange lacks commercial substance. When fair value cannot be determined or the exchange lacks commercial substance, the asset(s) acquired are valued at the book value of the asset(s) given up, plus (or minus) any cash exchanged. No gain is recognized. 10 -22

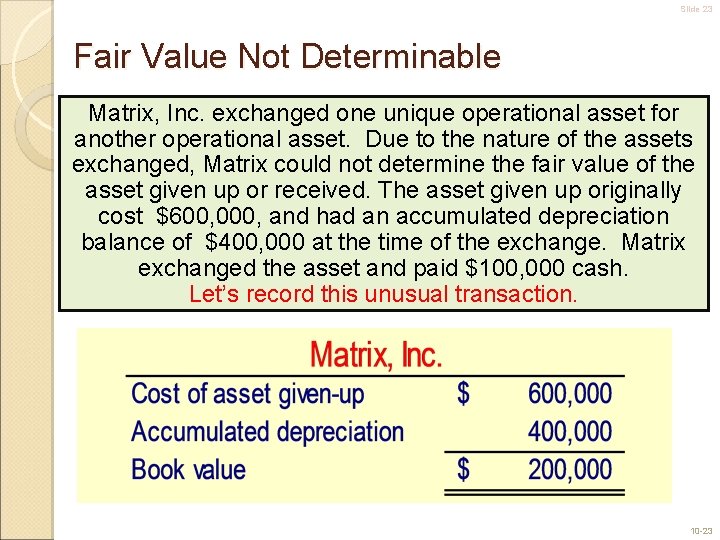

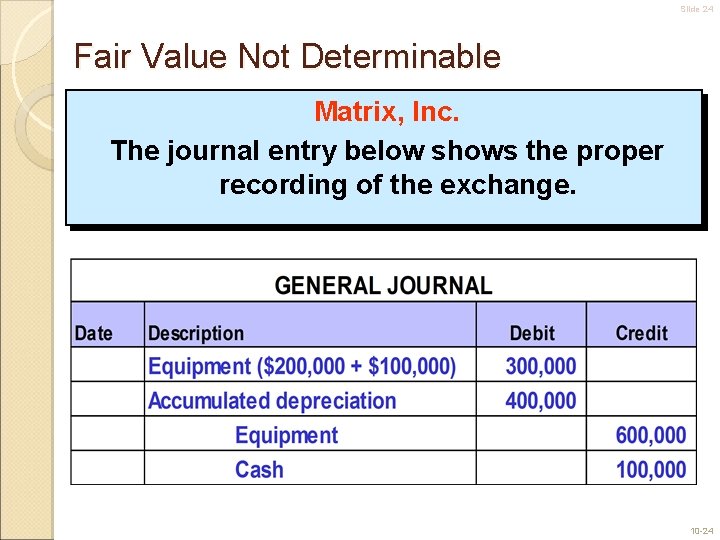

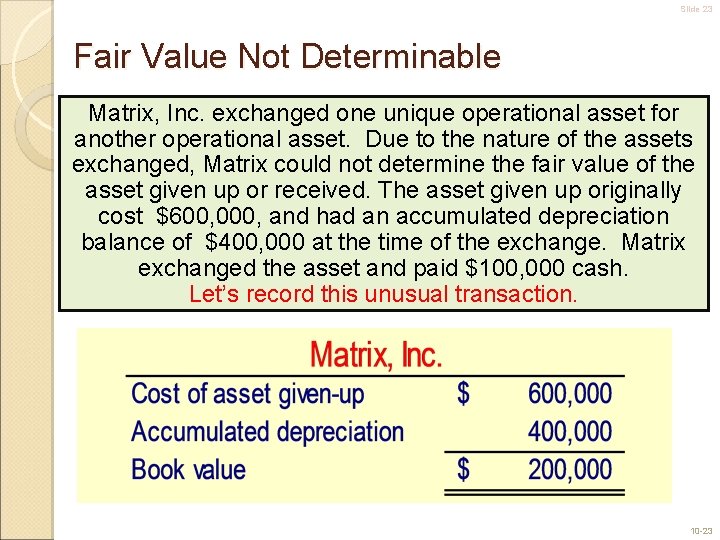

Slide 23 Fair Value Not Determinable Matrix, Inc. exchanged one unique operational asset for another operational asset. Due to the nature of the assets exchanged, Matrix could not determine the fair value of the asset given up or received. The asset given up originally cost $600, 000, and had an accumulated depreciation balance of $400, 000 at the time of the exchange. Matrix exchanged the asset and paid $100, 000 cash. Let’s record this unusual transaction. 10 -23

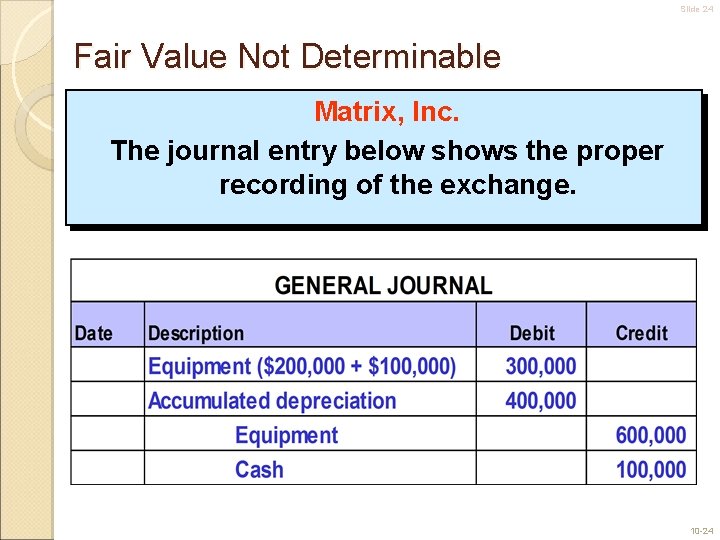

Slide 24 Fair Value Not Determinable Matrix, Inc. The journal entry below shows the proper recording of the exchange. 10 -24

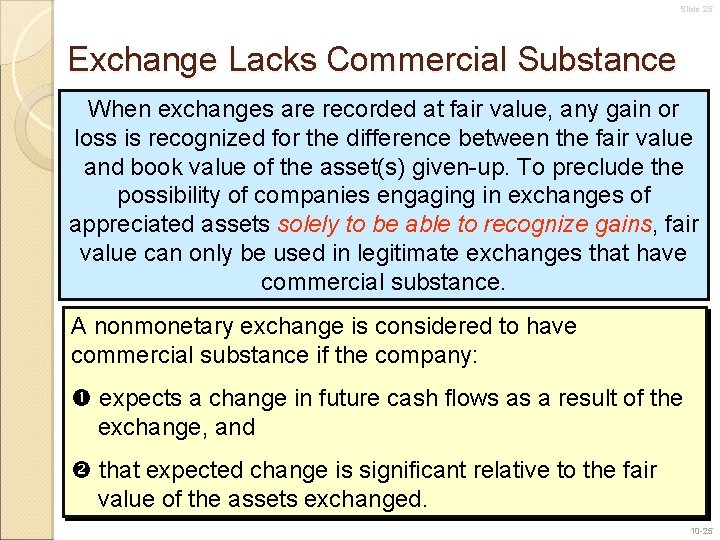

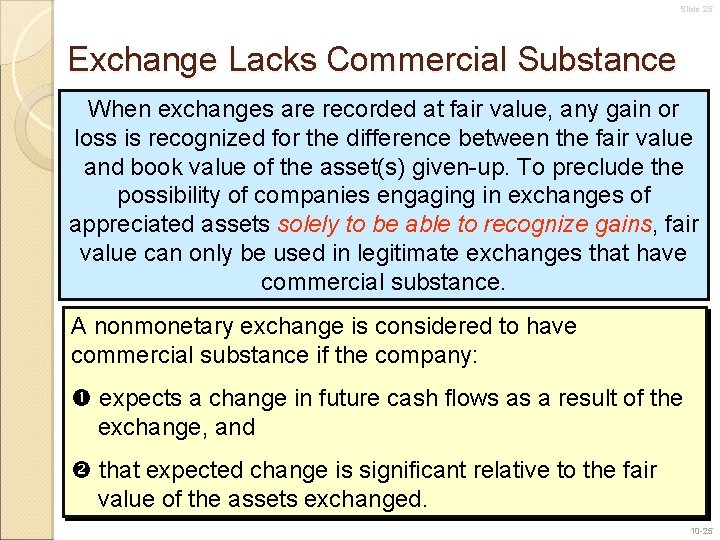

Slide 25 Exchange Lacks Commercial Substance When exchanges are recorded at fair value, any gain or loss is recognized for the difference between the fair value and book value of the asset(s) given-up. To preclude the possibility of companies engaging in exchanges of appreciated assets solely to be able to recognize gains, fair value can only be used in legitimate exchanges that have commercial substance. A nonmonetary exchange is considered to have commercial substance if the company: expects a change in future cash flows as a result of the exchange, and that expected change is significant relative to the fair value of the assets exchanged. 10 -25

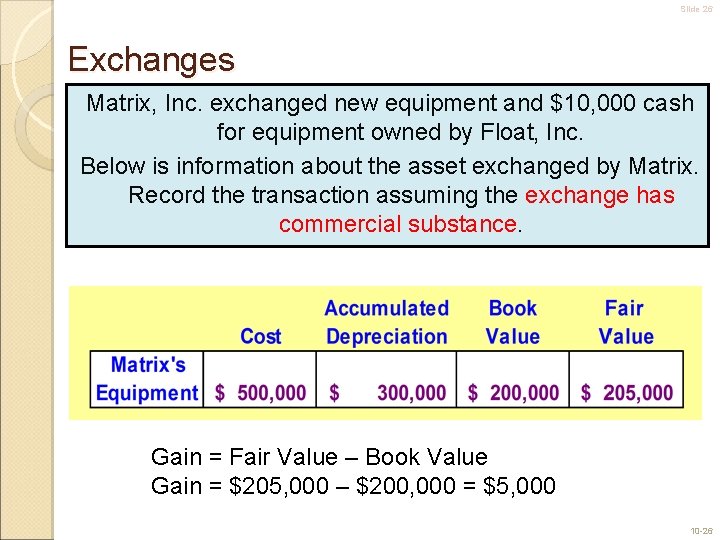

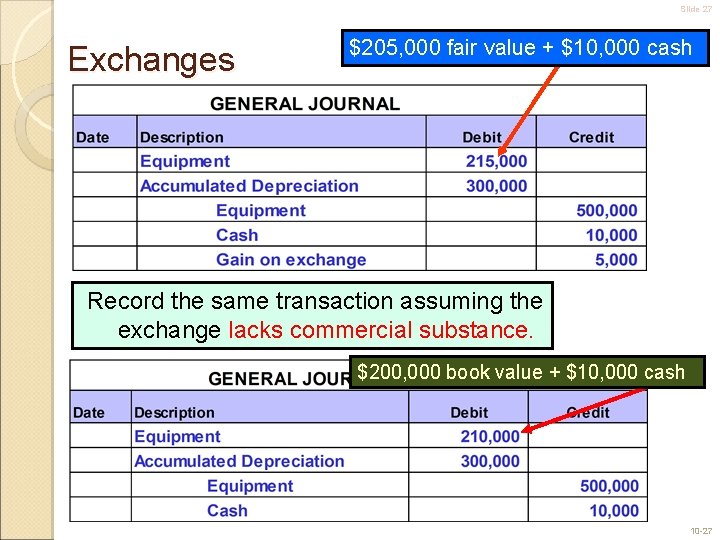

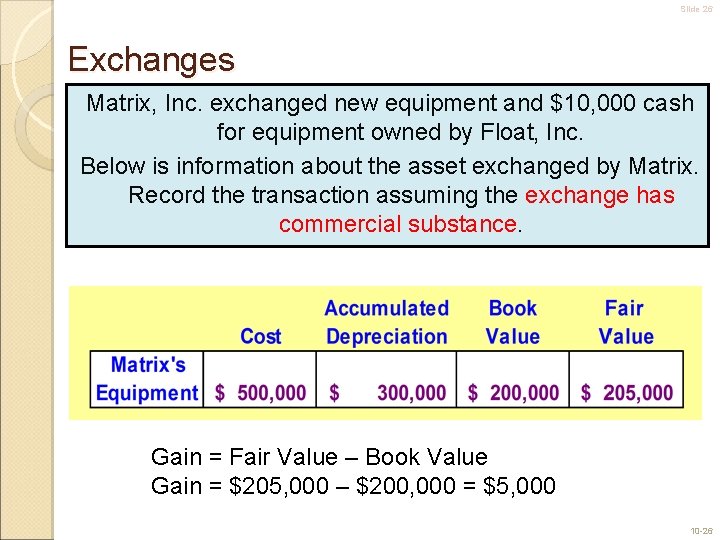

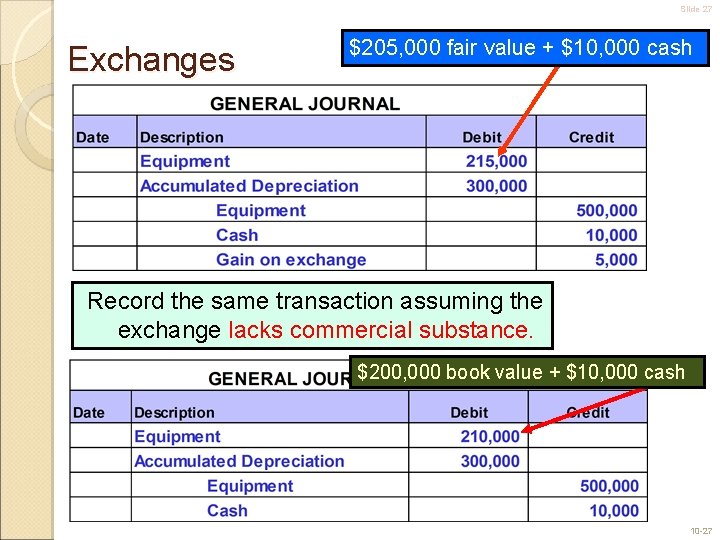

Slide 26 Exchanges Matrix, Inc. exchanged new equipment and $10, 000 cash for equipment owned by Float, Inc. Below is information about the asset exchanged by Matrix. Record the transaction assuming the exchange has commercial substance. Gain = Fair Value – Book Value Gain = $205, 000 – $200, 000 = $5, 000 10 -26

Slide 27 Exchanges $205, 000 fair value + $10, 000 cash Record the same transaction assuming the exchange lacks commercial substance. $200, 000 book value + $10, 000 cash 10 -27

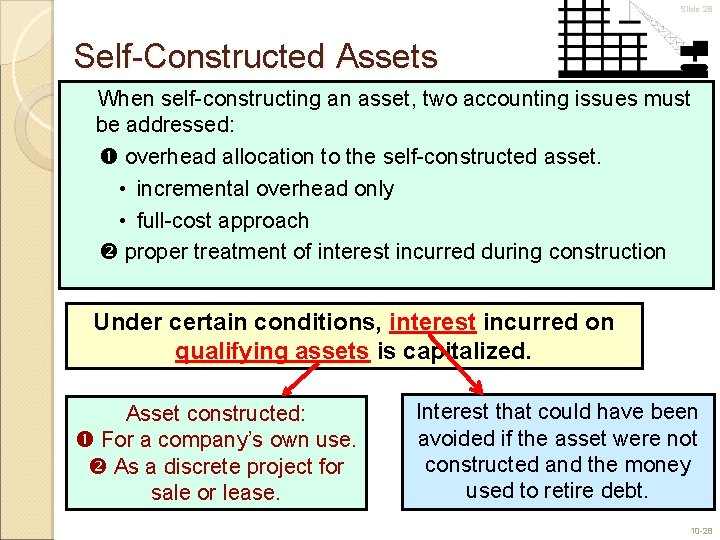

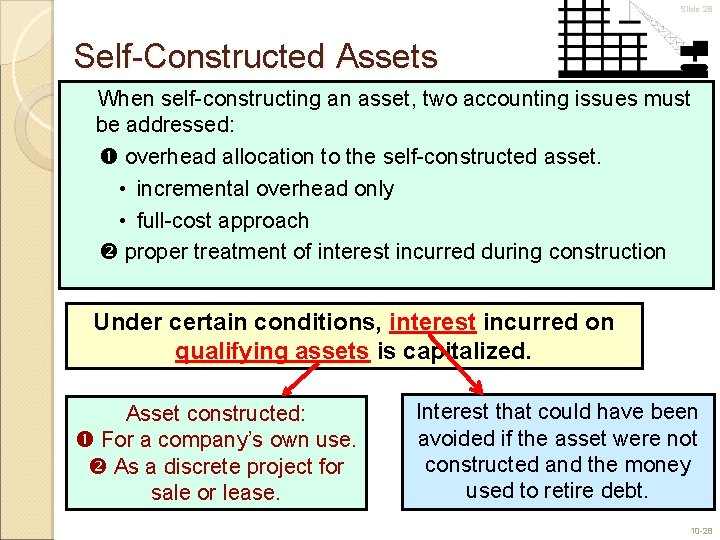

Slide 28 Self-Constructed Assets When self-constructing an asset, two accounting issues must be addressed: overhead allocation to the self-constructed asset. • incremental overhead only • full-cost approach proper treatment of interest incurred during construction Under certain conditions, interest incurred on qualifying assets is capitalized. Asset constructed: For a company’s own use. As a discrete project for sale or lease. Interest that could have been avoided if the asset were not constructed and the money used to retire debt. 10 -28

Slide 29 Interest Capitalization begins when: • construction begins • interest is incurred, and • qualifying expenses are incurred. Capitalization ends when: • the asset is substantially complete and ready for its intended use, or • when interest costs no longer are being incurred. 10 -29

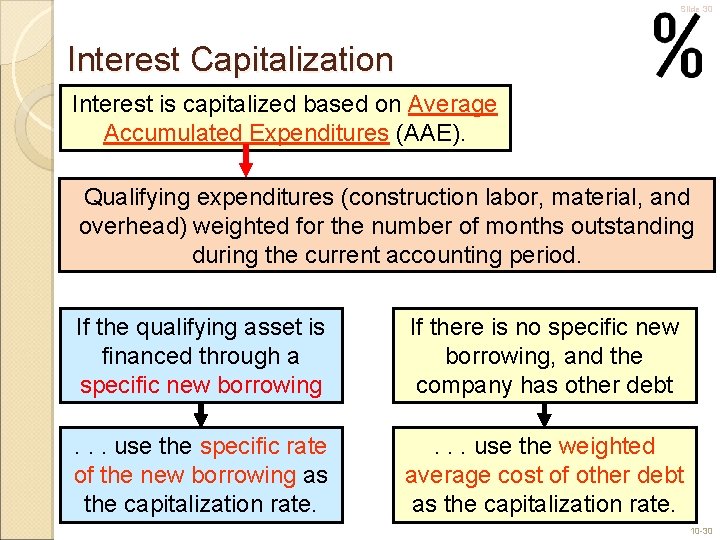

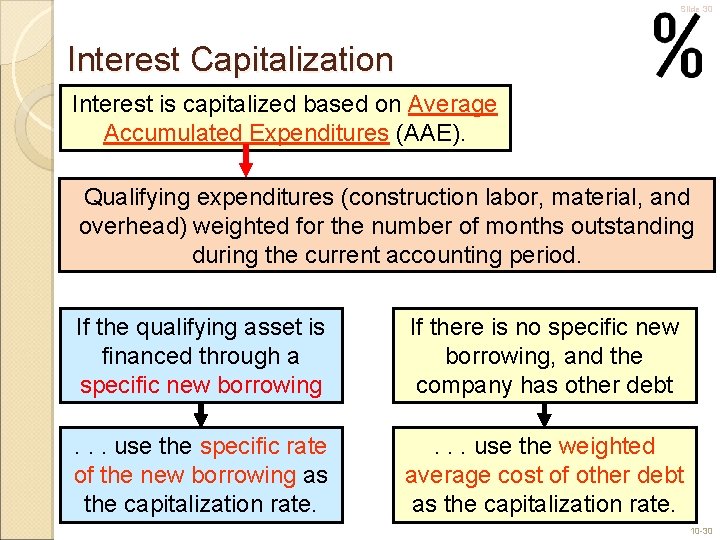

Slide 30 Interest Capitalization Interest is capitalized based on Average Accumulated Expenditures (AAE). Qualifying expenditures (construction labor, material, and overhead) weighted for the number of months outstanding during the current accounting period. If the qualifying asset is financed through a specific new borrowing If there is no specific new borrowing, and the company has other debt . . . use the specific rate of the new borrowing as the capitalization rate. . use the weighted average cost of other debt as the capitalization rate. 10 -30

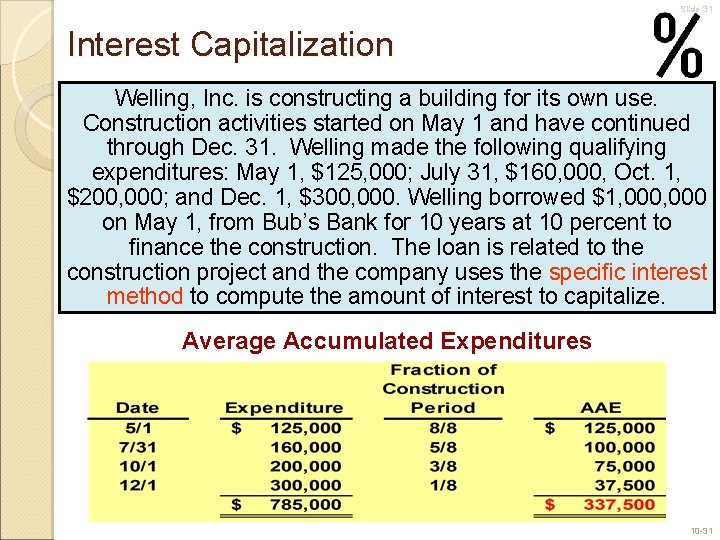

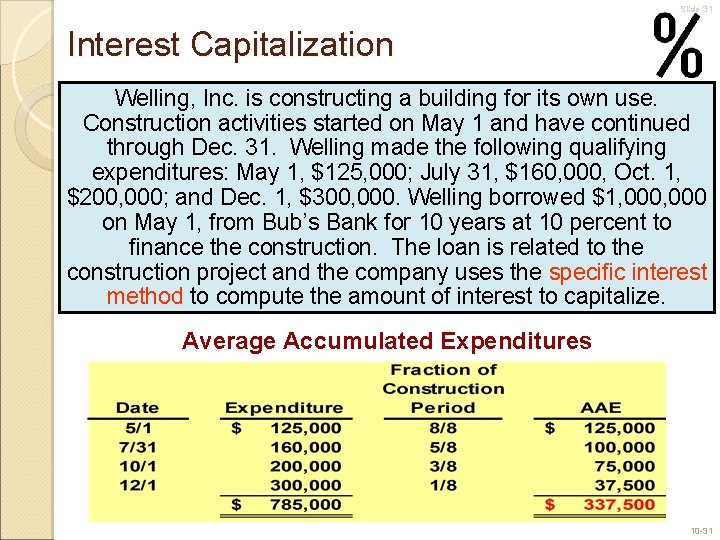

Slide 31 Interest Capitalization Welling, Inc. is constructing a building for its own use. Construction activities started on May 1 and have continued through Dec. 31. Welling made the following qualifying expenditures: May 1, $125, 000; July 31, $160, 000, Oct. 1, $200, 000; and Dec. 1, $300, 000. Welling borrowed $1, 000 on May 1, from Bub’s Bank for 10 years at 10 percent to finance the construction. The loan is related to the construction project and the company uses the specific interest method to compute the amount of interest to capitalize. Average Accumulated Expenditures 10 -31

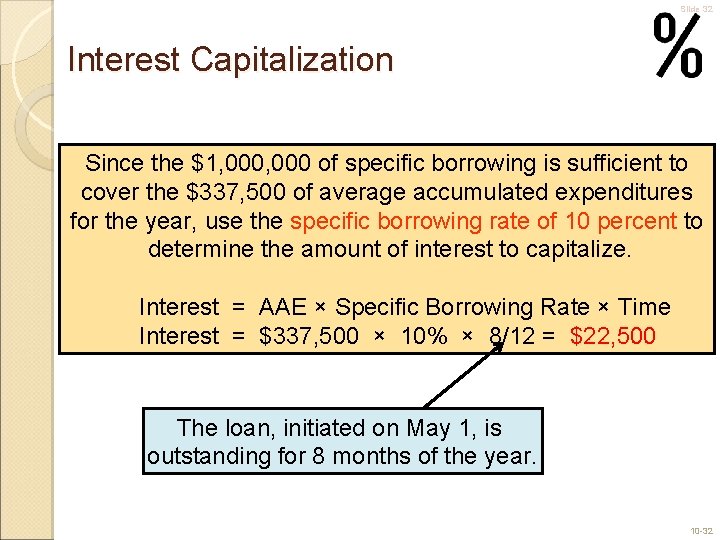

Slide 32 Interest Capitalization Since the $1, 000 of specific borrowing is sufficient to cover the $337, 500 of average accumulated expenditures for the year, use the specific borrowing rate of 10 percent to determine the amount of interest to capitalize. Interest = AAE × Specific Borrowing Rate × Time Interest = $337, 500 × 10% × 8/12 = $22, 500 The loan, initiated on May 1, is outstanding for 8 months of the year. 10 -32

Slide 33 Interest Capitalization If Welling had not borrowed specifically for this construction project, it would have used the weighted-average interest method. The weighted average interest rate on other debt would have been used to compute the amount of interest to capitalize. For example, if the weighted-average interest rate on other debt is 12 percent, the amount of interest capitalized would be: Interest = AAE × Weighted-average Rate × Time Interest = $337, 500 × 12% × 8/12 = $27, 000 10 -33

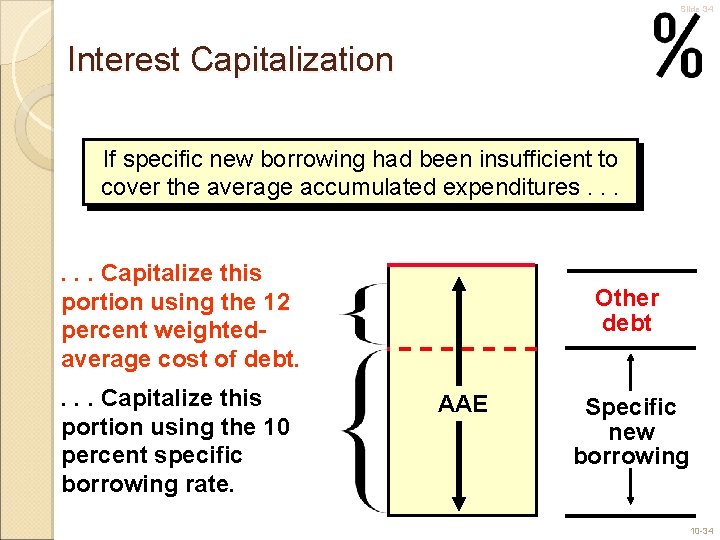

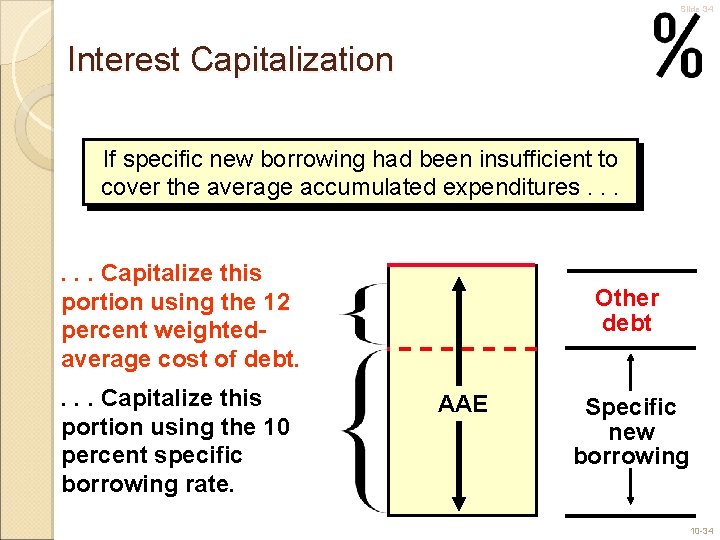

Slide 34 Interest Capitalization If specific new borrowing had been insufficient to cover the average accumulated expenditures. . . Capitalize this portion using the 12 percent weightedaverage cost of debt. . Capitalize this portion using the 10 percent specific borrowing rate. Other debt AAE Specific new borrowing 10 -34

Slide 35 Research and Development (R&D) Research • Planned search or critical investigation aimed at discovery of new knowledge. . . Development • The translation of research findings or other knowledge into a plan or design. . . Most R&D costs are expensed as incurred. (Must be disclosed if material. ) R&D costs incurred under contract for other companies are expensed against revenue from the contract. Operational assets used in R&D should be capitalized if they have alternative future uses. 10 -35

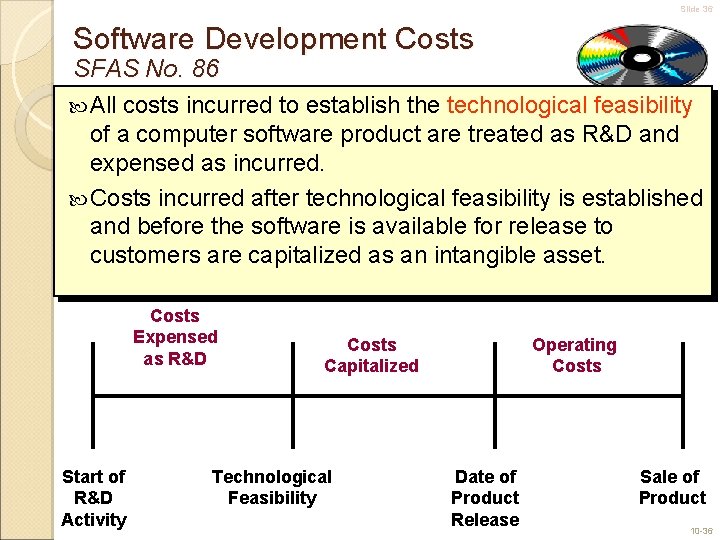

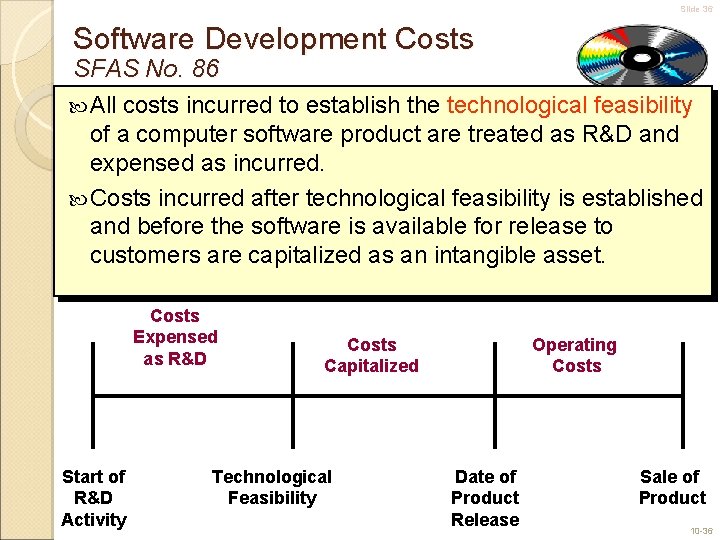

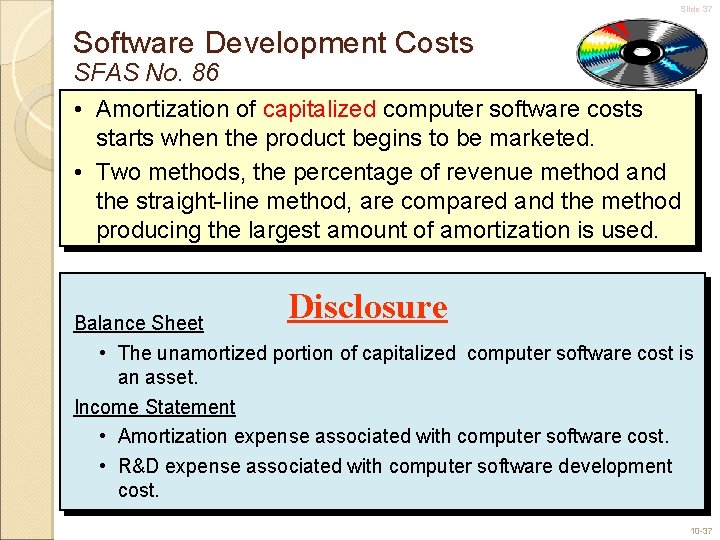

Slide 36 Software Development Costs SFAS No. 86 All costs incurred to establish the technological feasibility of a computer software product are treated as R&D and expensed as incurred. Costs incurred after technological feasibility is established and before the software is available for release to customers are capitalized as an intangible asset. Costs Expensed as R&D Start of R&D Activity Costs Capitalized Technological Feasibility Operating Costs Date of Product Release Sale of Product 10 -36

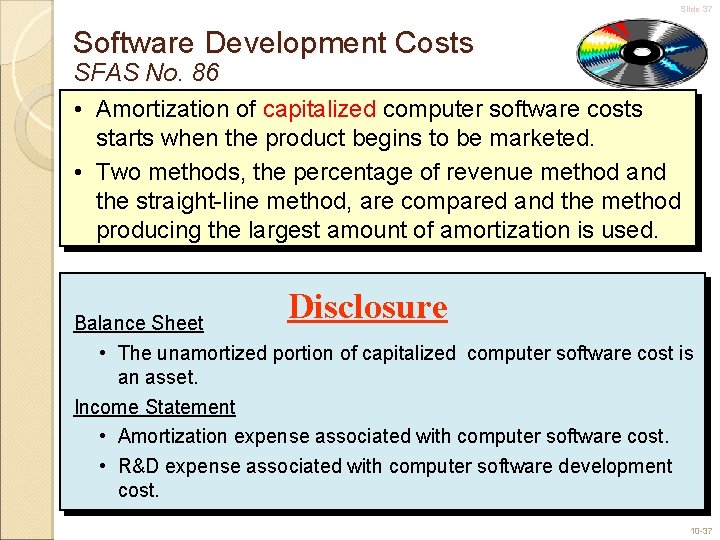

Slide 37 Software Development Costs SFAS No. 86 • Amortization of capitalized computer software costs starts when the product begins to be marketed. • Two methods, the percentage of revenue method and the straight-line method, are compared and the method producing the largest amount of amortization is used. Disclosure Balance Sheet • The unamortized portion of capitalized computer software cost is an asset. Income Statement • Amortization expense associated with computer software cost. • R&D expense associated with computer software development cost. 10 -37

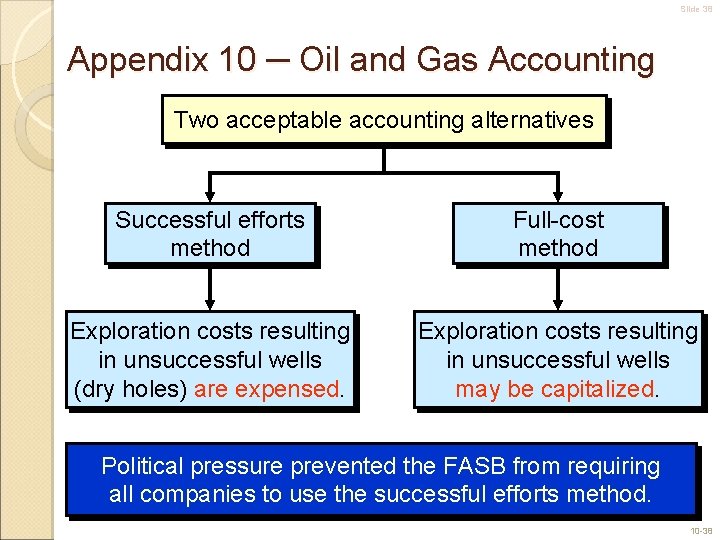

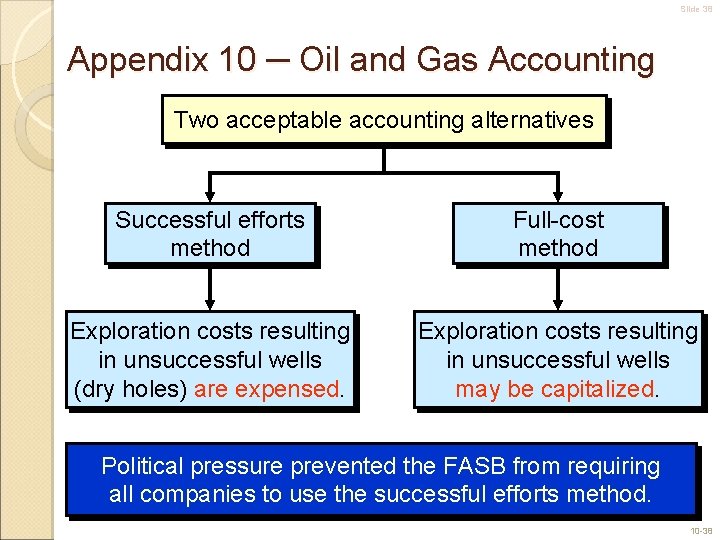

Slide 38 Appendix 10 ─ Oil and Gas Accounting Two acceptable accounting alternatives Successful efforts method Full-cost method Exploration costs resulting in unsuccessful wells (dry holes) are expensed. Exploration costs resulting in unsuccessful wells may be capitalized. Political pressure prevented the FASB from requiring all companies to use the successful efforts method. 10 -38

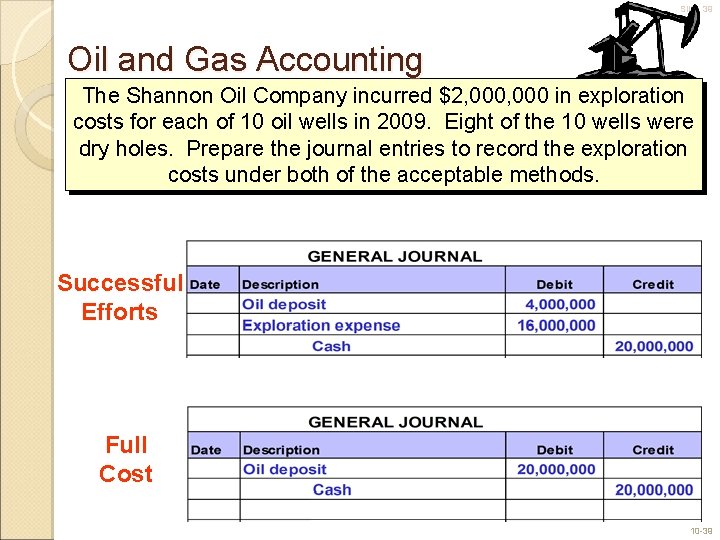

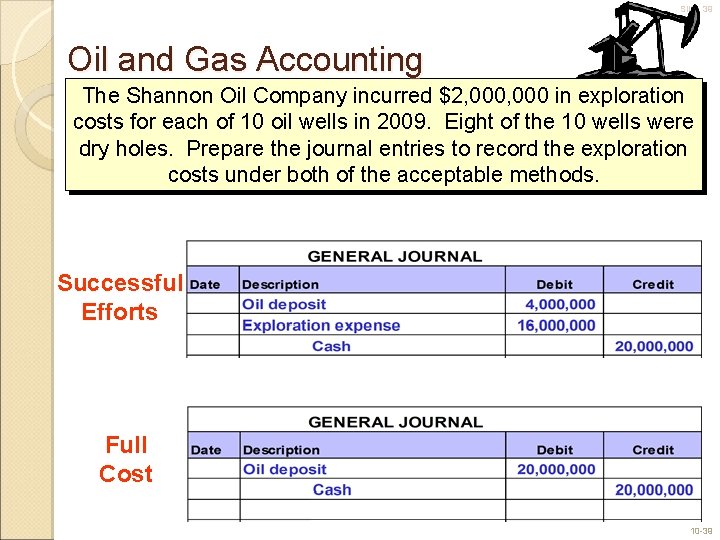

Slide 39 Oil and Gas Accounting The Shannon Oil Company incurred $2, 000 in exploration costs for each of 10 oil wells in 2009. Eight of the 10 wells were dry holes. Prepare the journal entries to record the exploration costs under both of the acceptable methods. Successful Efforts Full Cost 10 -39

End of Chapter 10 Mc. Graw-Hill /Irwin © 2009 The Mc. Graw-Hill Companies, Inc.