Chapter 10 Mergers and Acquisitions Copyright 2012 Pearson

- Slides: 24

Chapter 10 Mergers and Acquisitions Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall. 10 -

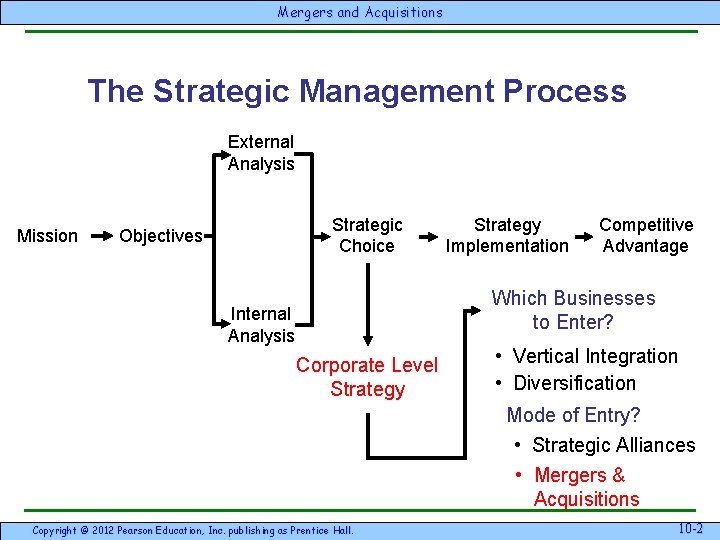

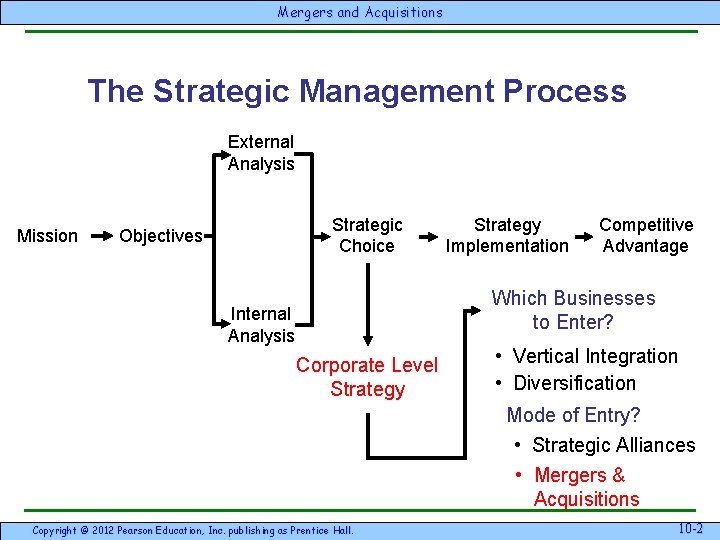

Mergersand & Acquisitions The Strategic Management Process External Analysis Mission Strategic Choice Objectives Strategy Implementation Competitive Advantage Which Businesses to Enter? Internal Analysis Corporate Level Strategy • Vertical Integration • Diversification Mode of Entry? • Strategic Alliances • Mergers & Acquisitions Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -22

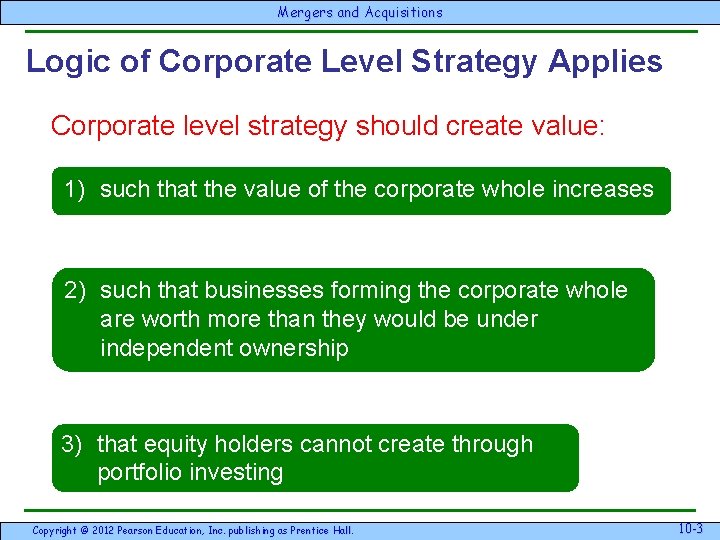

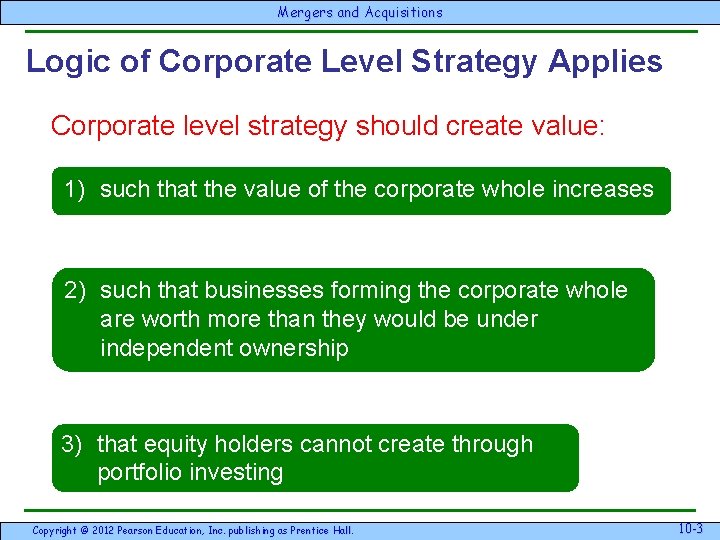

Mergersand & Acquisitions Logic of Corporate Level Strategy Applies Corporate level strategy should create value: 1) such that the value of the corporate whole increases 2) such that businesses forming the corporate whole are worth more than they would be under independent ownership 3) that equity holders cannot create through portfolio investing Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -33

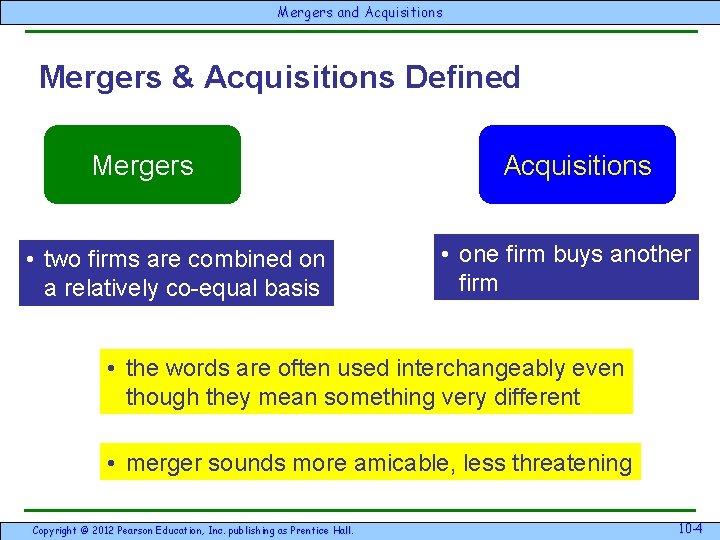

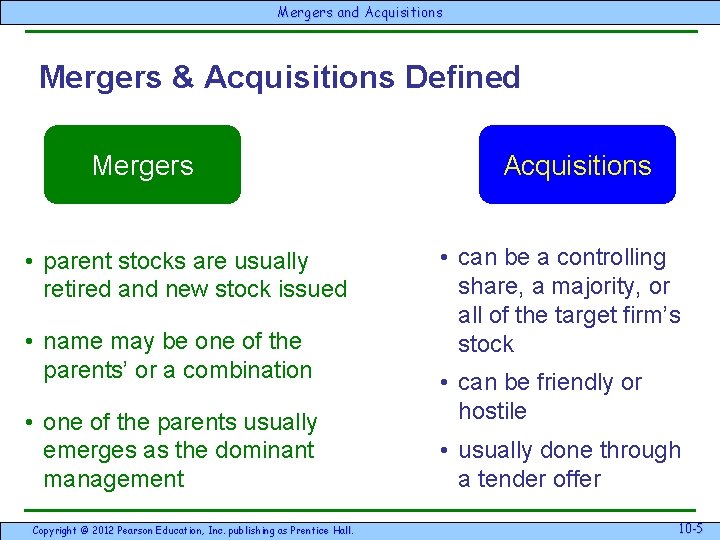

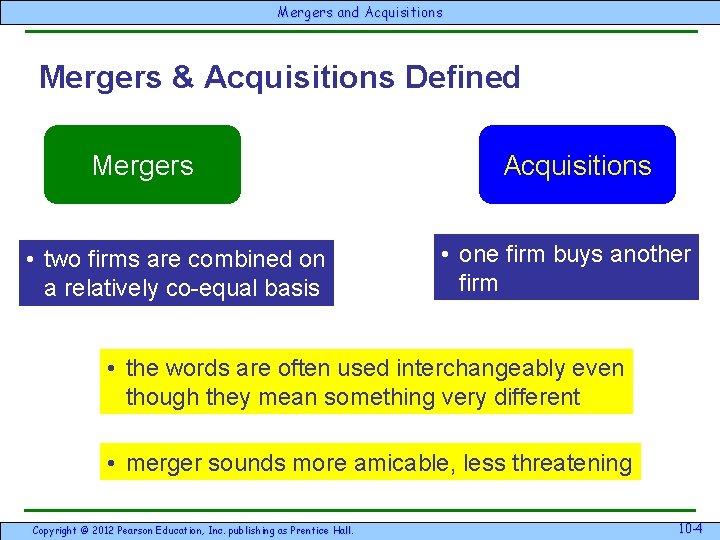

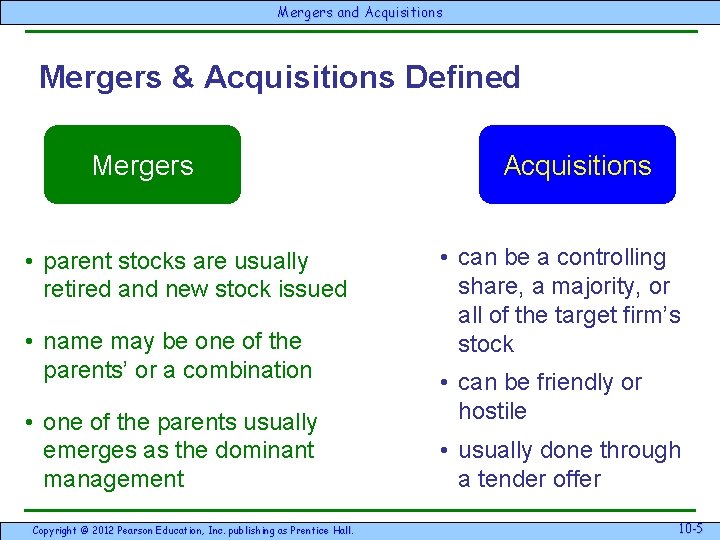

Mergersand & Acquisitions Mergers & Acquisitions Defined Mergers • two firms are combined on a relatively co-equal basis Acquisitions • one firm buys another firm • the words are often used interchangeably even though they mean something very different • merger sounds more amicable, less threatening Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -44

Mergersand & Acquisitions Mergers & Acquisitions Defined Mergers • parent stocks are usually retired and new stock issued • name may be one of the parents’ or a combination • one of the parents usually emerges as the dominant management Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Acquisitions • can be a controlling share, a majority, or all of the target firm’s stock • can be friendly or hostile • usually done through a tender offer Advantage – Barney & Hesterly 10 -55

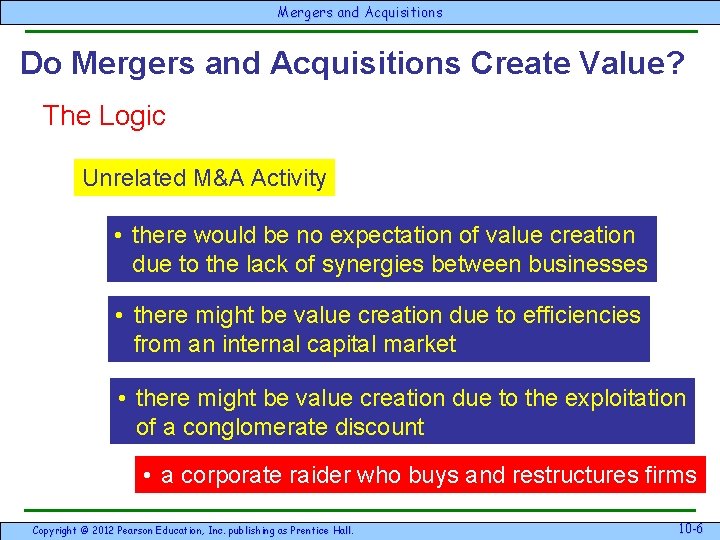

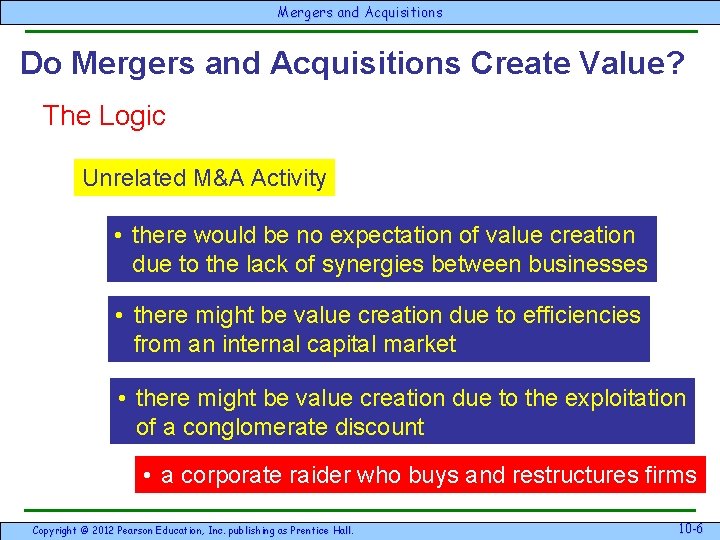

Mergersand & Acquisitions Do Mergers and Acquisitions Create Value? The Logic Unrelated M&A Activity • there would be no expectation of value creation due to the lack of synergies between businesses • there might be value creation due to efficiencies from an internal capital market • there might be value creation due to the exploitation of a conglomerate discount • a corporate raider who buys and restructures firms Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -66

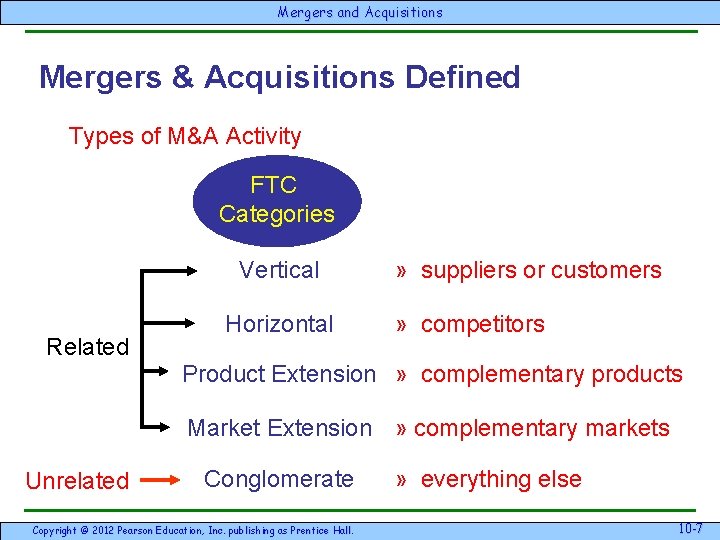

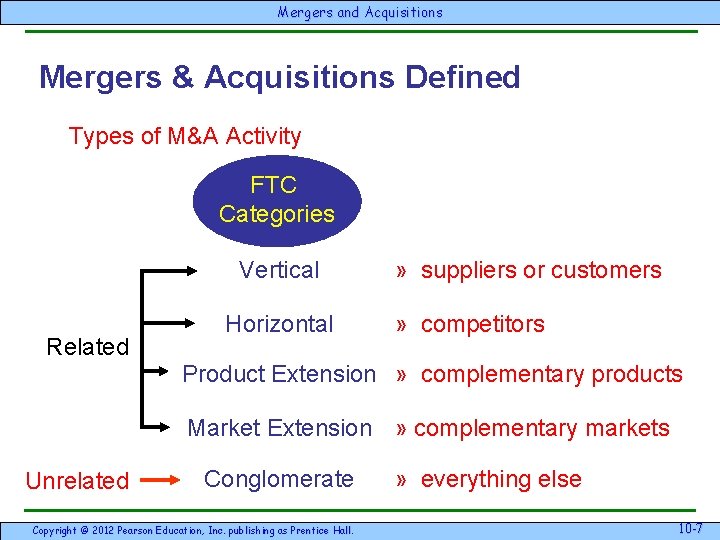

Mergersand & Acquisitions Mergers & Acquisitions Defined Types of M&A Activity FTC Categories Vertical Related Horizontal » suppliers or customers » competitors Product Extension » complementary products Market Extension » complementary markets Unrelated Conglomerate Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive » everything else Advantage – Barney & Hesterly 10 -77

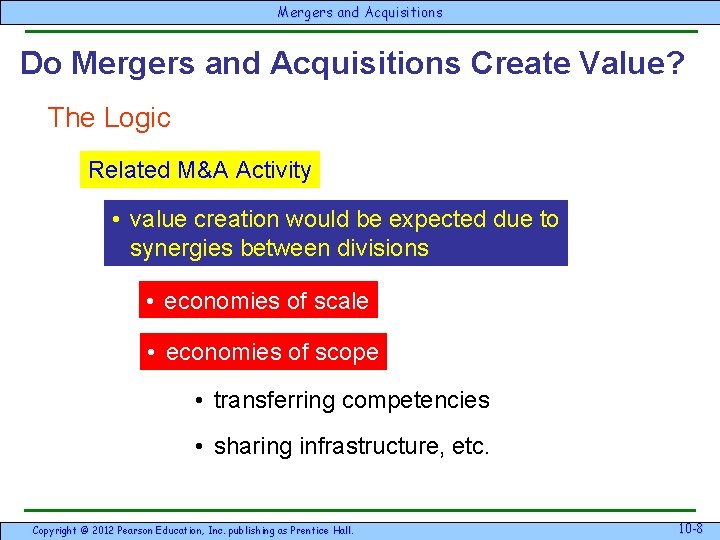

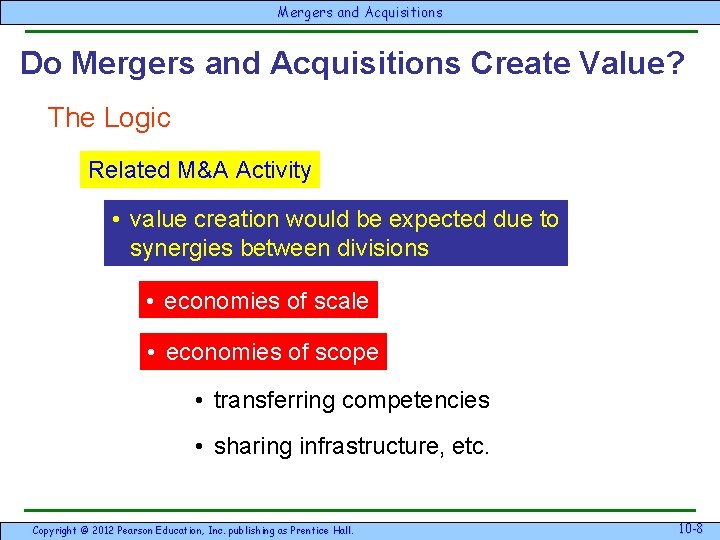

Mergersand & Acquisitions Do Mergers and Acquisitions Create Value? The Logic Related M&A Activity • value creation would be expected due to synergies between divisions • economies of scale • economies of scope • transferring competencies • sharing infrastructure, etc. Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -88

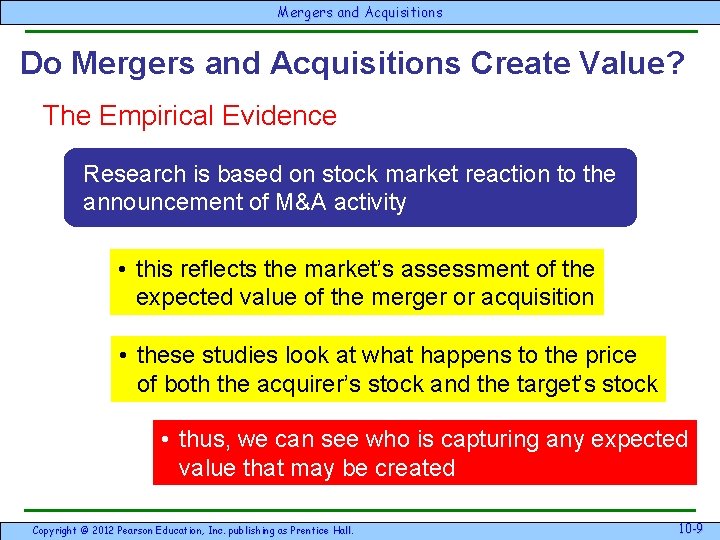

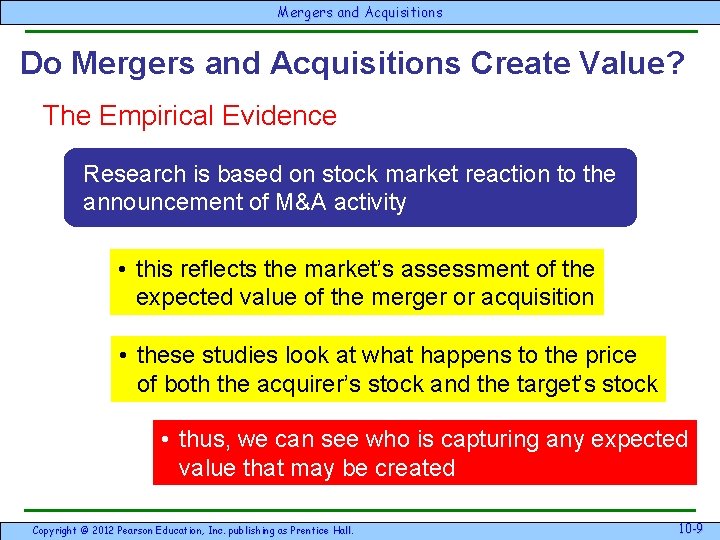

Mergersand & Acquisitions Do Mergers and Acquisitions Create Value? The Empirical Evidence Research is based on stock market reaction to the announcement of M&A activity • this reflects the market’s assessment of the expected value of the merger or acquisition • these studies look at what happens to the price of both the acquirer’s stock and the target’s stock • thus, we can see who is capturing any expected value that may be created Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -99

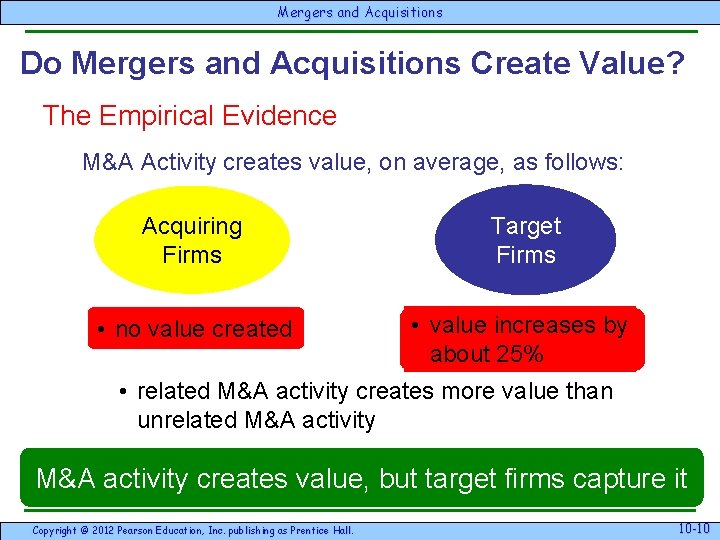

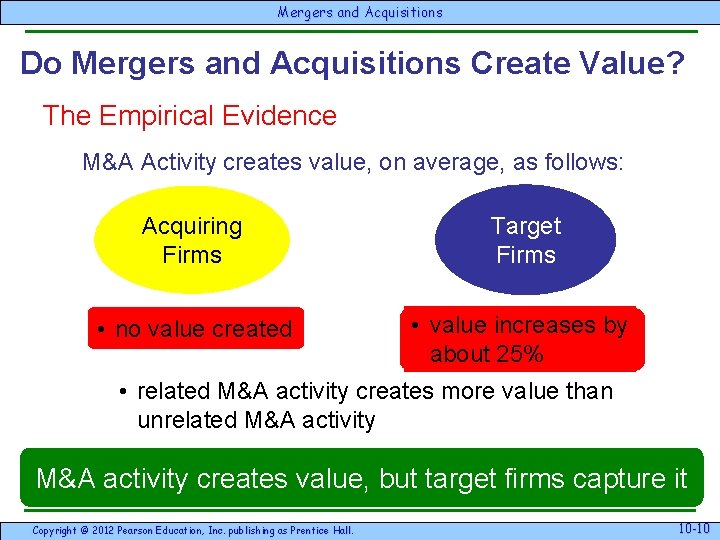

Mergersand & Acquisitions Do Mergers and Acquisitions Create Value? The Empirical Evidence M&A Activity creates value, on average, as follows: Acquiring Firms Target Firms • no value created • value increases by about 25% • related M&A activity creates more value than unrelated M&A activity creates value, but target firms capture it Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -10 10

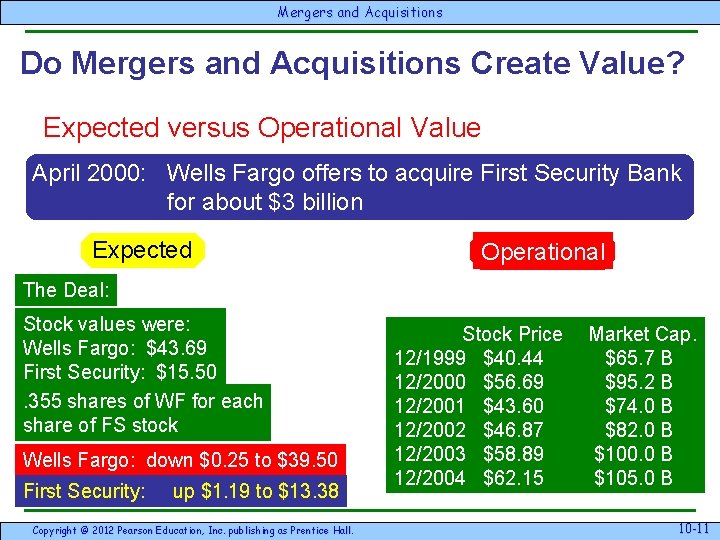

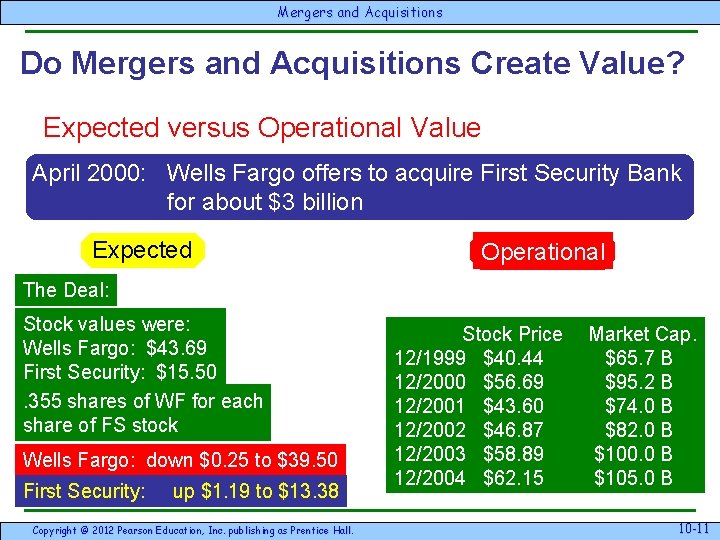

Mergersand & Acquisitions Do Mergers and Acquisitions Create Value? Expected versus Operational Value April 2000: Wells Fargo offers to acquire First Security Bank for about $3 billion Expected Operational The Deal: Stock values were: Wells Fargo: $43. 69 First Security: $15. 50. 355 shares of WF for each share of FS stock Wells Fargo: down $0. 25 to $39. 50 First Security: up $1. 19 to $13. 38 Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Stock Price 12/1999 $40. 44 12/2000 $56. 69 12/2001 $43. 60 12/2002 $46. 87 12/2003 $58. 89 12/2004 $62. 15 Advantage – Barney & Hesterly Market Cap. $65. 7 B $95. 2 B $74. 0 B $82. 0 B $100. 0 B $105. 0 B 10 -11 11

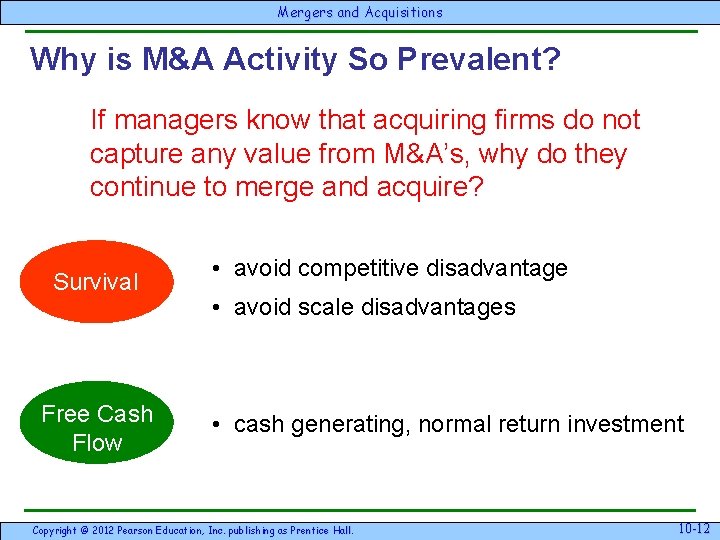

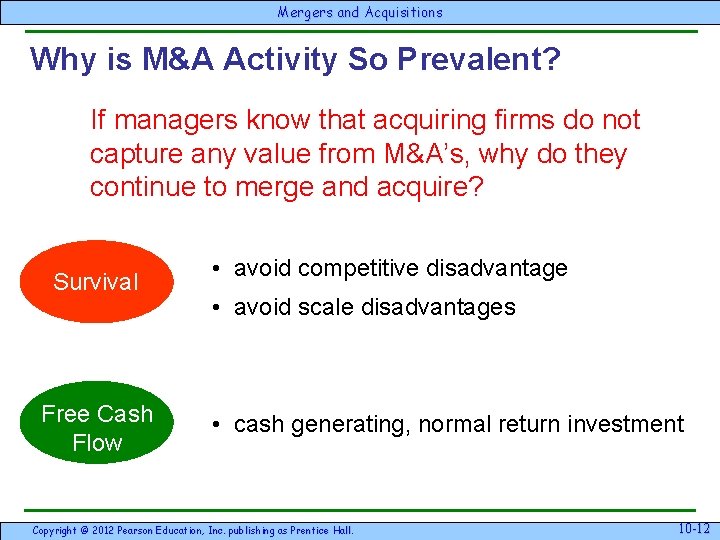

Mergersand & Acquisitions Why is M&A Activity So Prevalent? If managers know that acquiring firms do not capture any value from M&A’s, why do they continue to merge and acquire? Survival Free Cash Flow • avoid competitive disadvantage • avoid scale disadvantages • cash generating, normal return investment Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -12 12

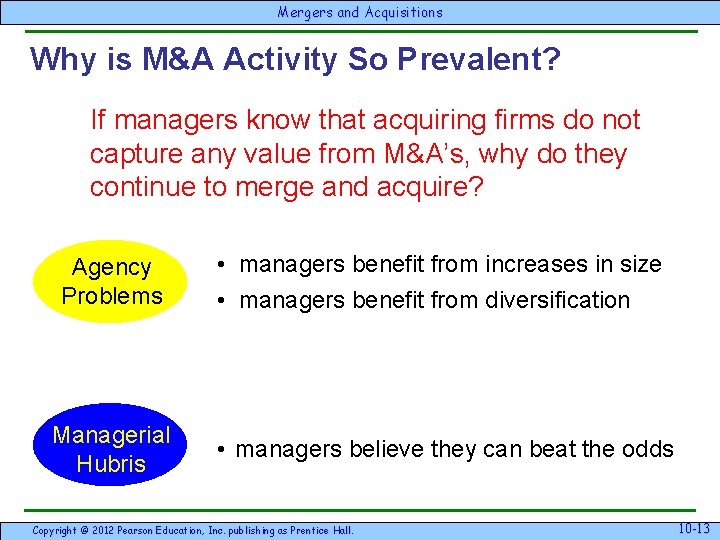

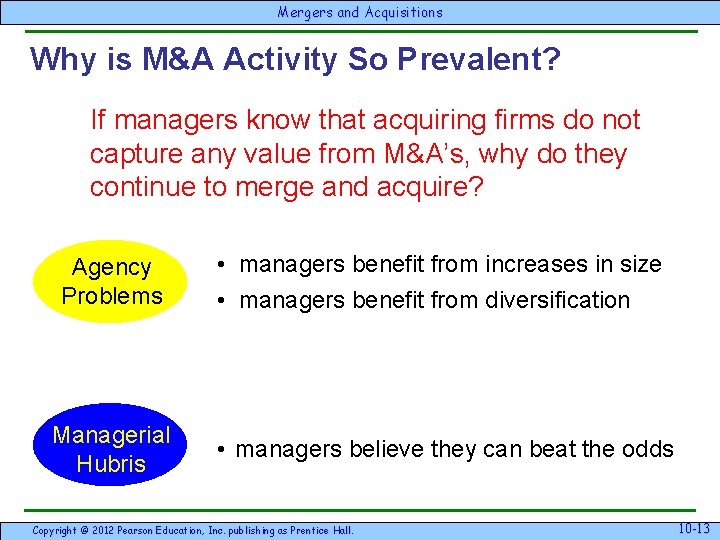

Mergersand & Acquisitions Why is M&A Activity So Prevalent? If managers know that acquiring firms do not capture any value from M&A’s, why do they continue to merge and acquire? Agency Problems Managerial Hubris • managers benefit from increases in size • managers benefit from diversification • managers believe they can beat the odds Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -13 13

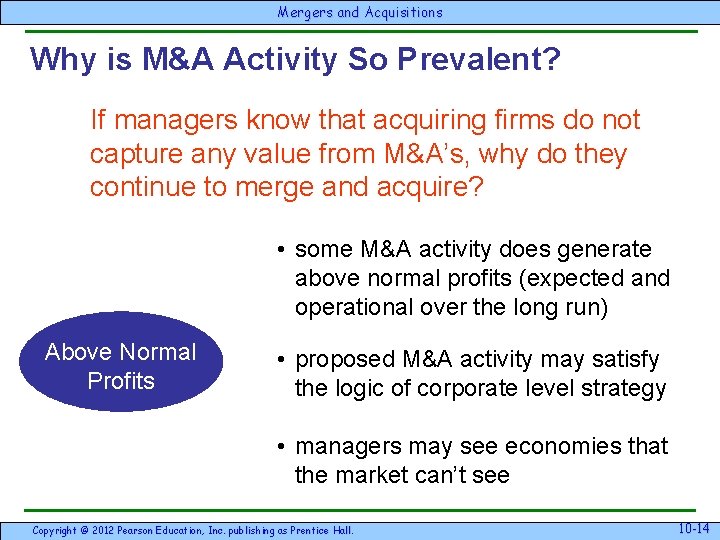

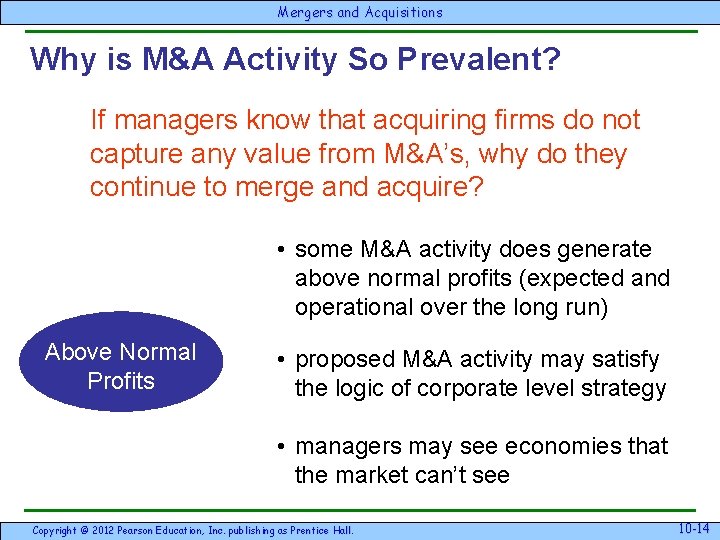

Mergersand & Acquisitions Why is M&A Activity So Prevalent? If managers know that acquiring firms do not capture any value from M&A’s, why do they continue to merge and acquire? • some M&A activity does generate above normal profits (expected and operational over the long run) Above Normal Profits • proposed M&A activity may satisfy the logic of corporate level strategy • managers may see economies that the market can’t see Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -14 14

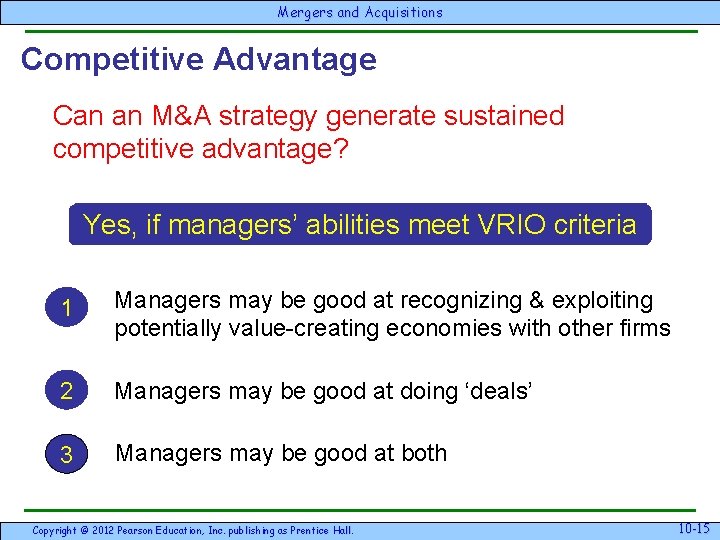

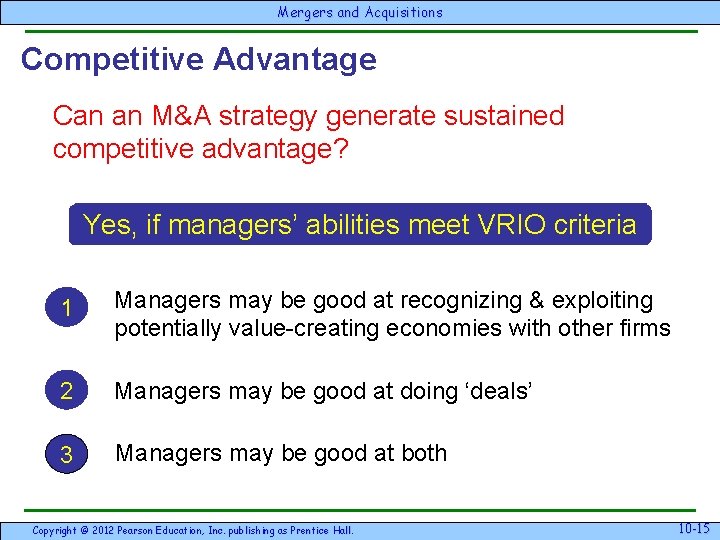

Mergersand & Acquisitions Competitive Advantage Can an M&A strategy generate sustained competitive advantage? Yes, if managers’ abilities meet VRIO criteria 1 Managers may be good at recognizing & exploiting potentially value-creating economies with other firms 2 Managers may be good at doing ‘deals’ 3 Managers may be good at both Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -15 15

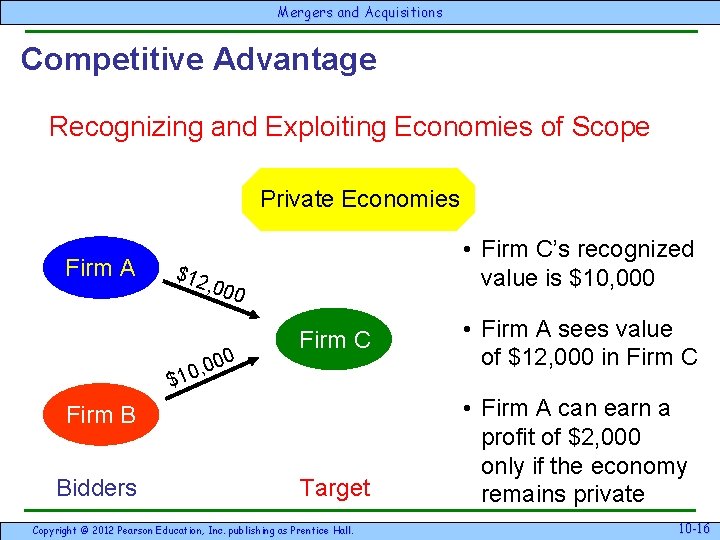

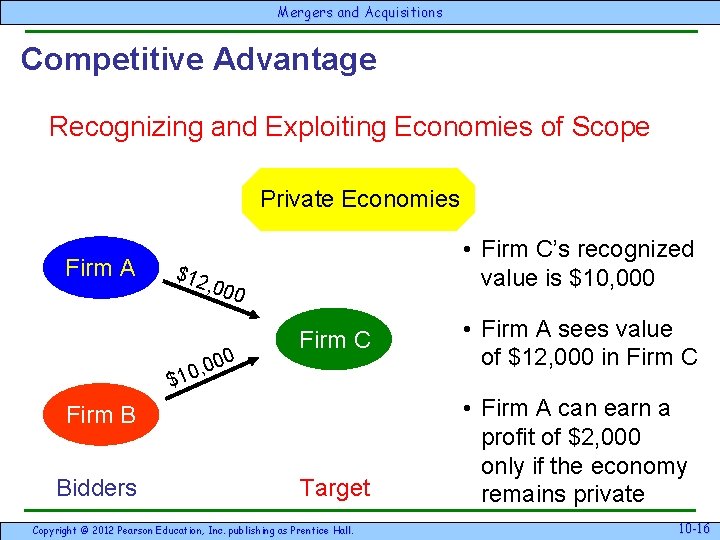

Mergersand & Acquisitions Competitive Advantage Recognizing and Exploiting Economies of Scope Private Economies Firm A • Firm C’s recognized value is $10, 000 $12 , 000 , 0 $1 Firm C Firm B Bidders Target Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive • Firm A sees value of $12, 000 in Firm C • Firm A can earn a profit of $2, 000 only if the economy remains private Advantage – Barney & Hesterly 10 -16 16

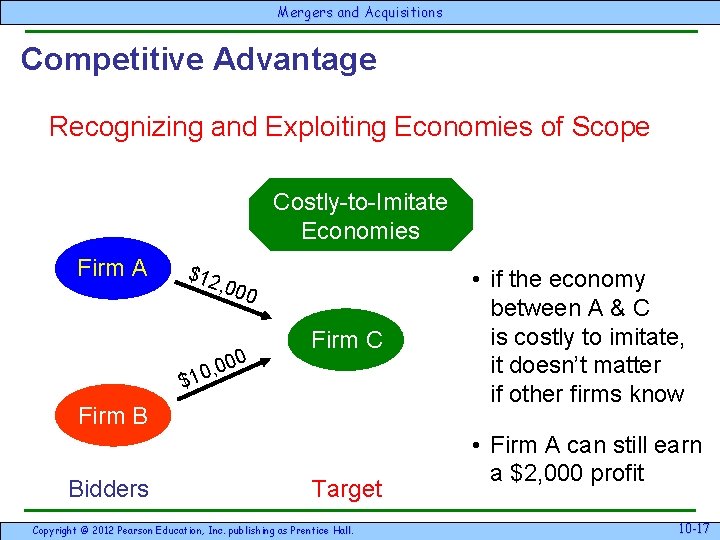

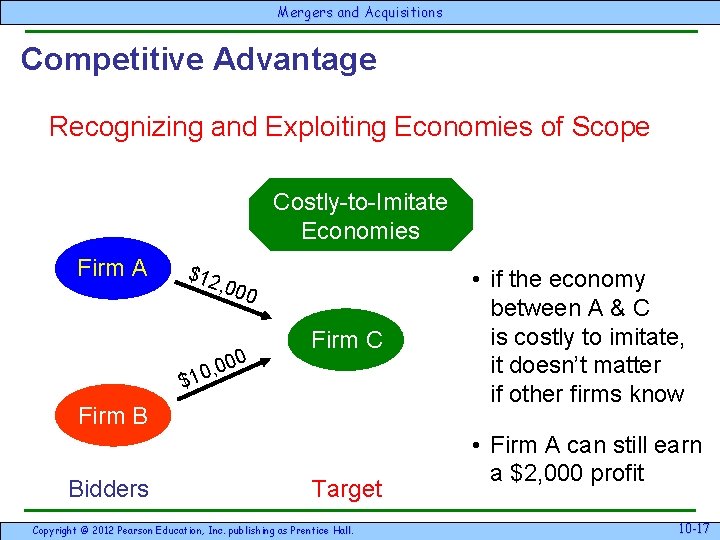

Mergersand & Acquisitions Competitive Advantage Recognizing and Exploiting Economies of Scope Costly-to-Imitate Economies Firm A $12 , 000 00 0 , 10 Firm C $ Firm B Bidders Target Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive • if the economy between A & C is costly to imitate, it doesn’t matter if other firms know • Firm A can still earn a $2, 000 profit Advantage – Barney & Hesterly 10 -17 17

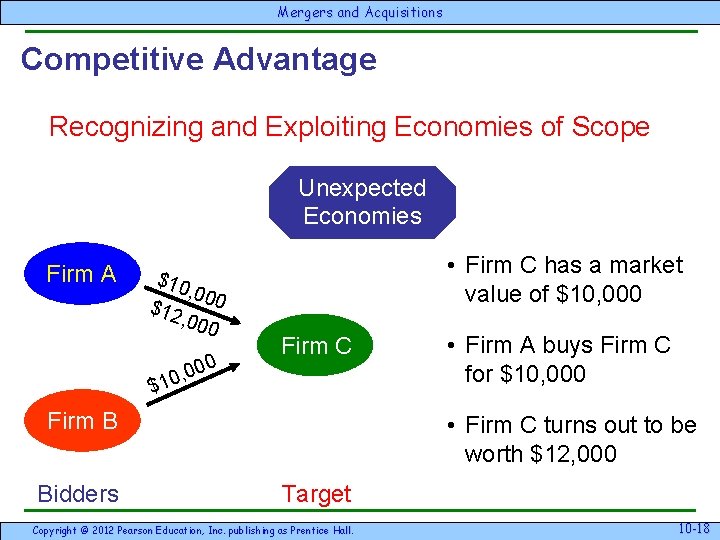

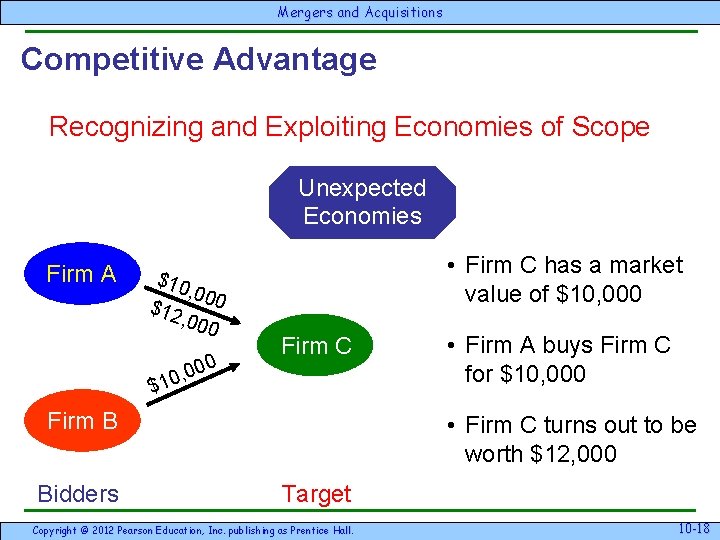

Mergersand & Acquisitions Competitive Advantage Recognizing and Exploiting Economies of Scope Unexpected Economies Firm A $10 , 000 $12 , 000 00 0 , 10 • Firm C has a market value of $10, 000 Firm C $ Firm B Bidders • Firm A buys Firm C for $10, 000 • Firm C turns out to be worth $12, 000 Target Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -18 18

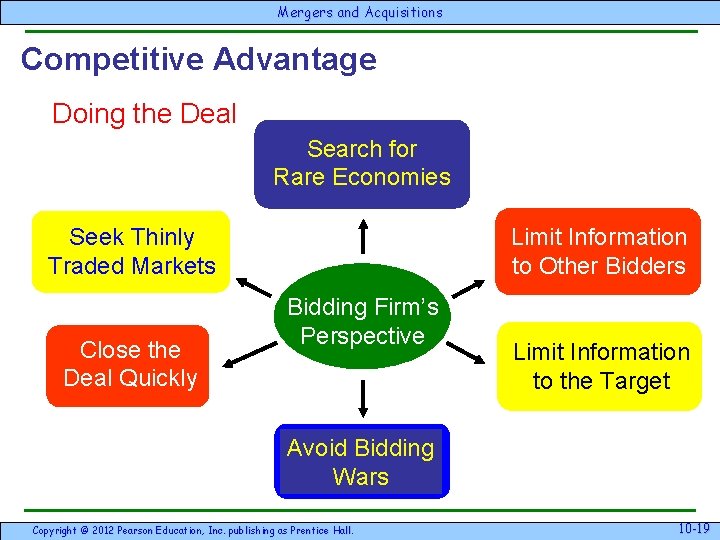

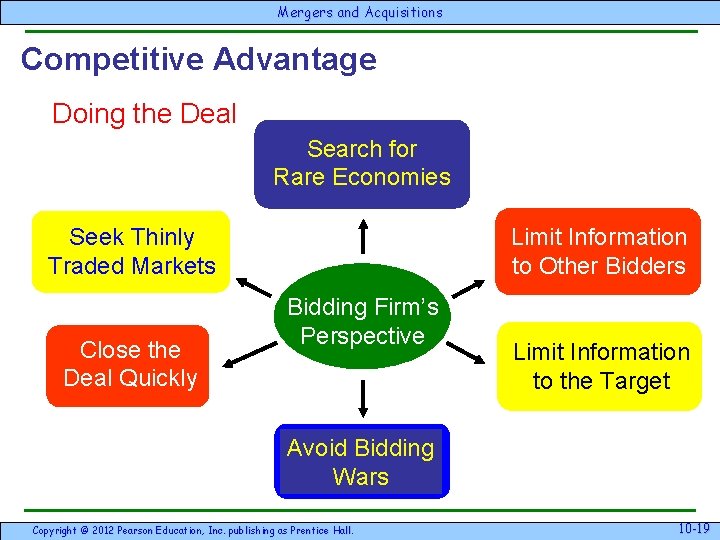

Mergersand & Acquisitions Competitive Advantage Doing the Deal Search for Rare Economies Limit Information to Other Bidders Seek Thinly Traded Markets Close the Deal Quickly Bidding Firm’s Perspective Limit Information to the Target Avoid Bidding Wars Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -19 19

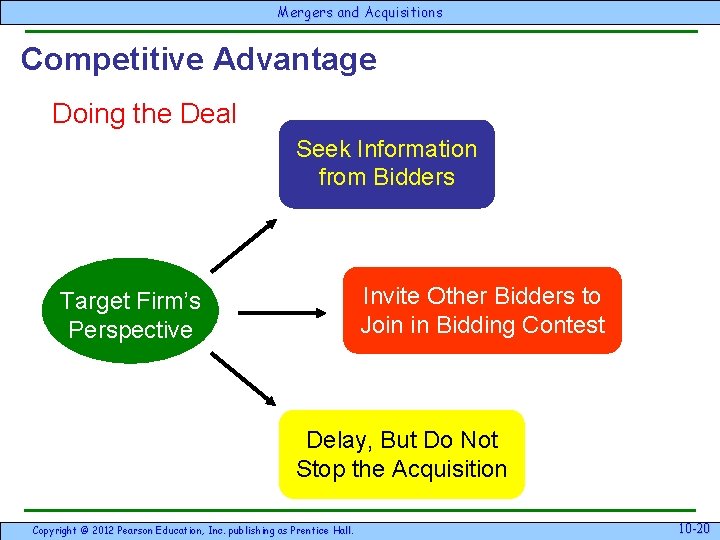

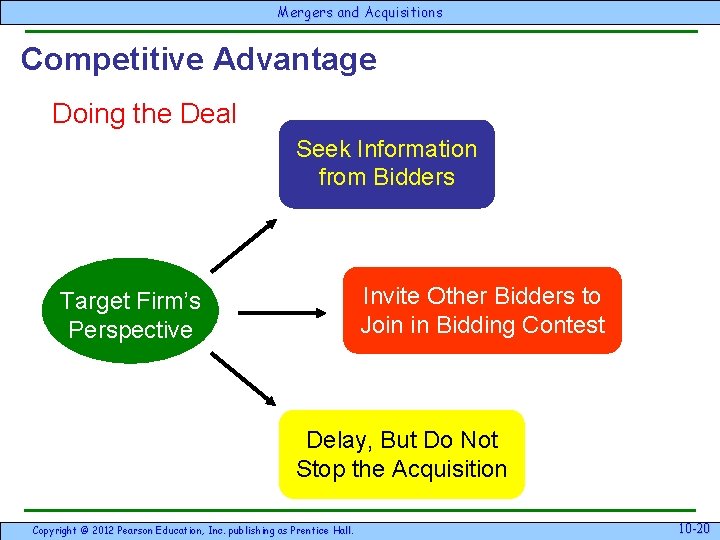

Mergersand & Acquisitions Competitive Advantage Doing the Deal Seek Information from Bidders Target Firm’s Perspective Invite Other Bidders to Join in Bidding Contest Delay, But Do Not Stop the Acquisition Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -20 20

Mergersand & Acquisitions Implementation Issues Structure, Control, and Compensation M&A activity requires responses to these issues: • m-form structure is typically used • management controls & compensation policies are similar to those used in diversification strategies Managers must decide on the level of integration: • target firm may remain somewhat autonomous • target firm may be completely integrated Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -21 21

Mergersand & Acquisitions Implementation Issues Cultural Differences • high levels of integration require greater cultural blending • cultural blending may be a matter of: • combining elements of both cultures • essentially replacing one culture with the other • integration may be very costly, often unanticipated • the ability to integrate efficiently may be a source of competitive advantage Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -22 22

Mergersand & Acquisitions Summary M&A activity is a mode of entry for vertical integration and diversification strategies A firm’s M&A strategy should satisfy the logic of corporate level strategy M&A activity can create economic value at announcement, but target firms usually capture that value M&A activity can create value over the long term for the acquiring firm Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -23 23

Mergersand & Acquisitions All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording, or otherwise, without the prior written permission of the publisher. Printed in the United States of America. Copyright © 2012 Pearson Education, Inc. publishing as Prentice Hall Copyright © 2012 Pearson Education, Inc. Management publishing as Prentice Hall. Strategic & Competitive Advantage – Barney & Hesterly 10 -24 24