CHAPTER 10 Externalities Economics N Gregory Mankiw PRINCIPLES

- Slides: 41

CHAPTER 10 Externalities Economics N. Gregory Mankiw PRINCIPLES OF N. Gregory Mankiw Premium Power. Point Slides by Ron Cronovich © 2009 South-Western, a part of Cengage Learning, all rights reserved

In this chapter, look for the answers to these questions: § What is an externality? 외부효과란? § Why do externalities make market outcomes inefficient? 왜 외부효과는 시장의 결과를 비효율적으로 만드는가? § What public policies aim to solve the problem of externalities? 어떤 공공정책이 외부효과 문제를 해결하려고 하는가? § How can people sometimes solve the problem of externalities on their own? Why do such private solutions not always work? 어떻게 사람들은 가끔 외부효과 문제를 스스로 해결할 수 있는가? 왜 이러한 사적 해결은 항상 작동하지 않는가? 1

Introduction § One of the principles from Chapter 1: Markets are usually a good way to organize economy activity. In absence of market failures, the competitive market outcome is efficient, maximizes total surplus. 시장실패가 없다면 경 쟁 시장의 결과는 효율적이며 총 잉여를 극대화한다. § One type of market failure: 시장 실패의 한 유형인 외부효과는 externality, the uncompensated impact of one person’s actions on the well-being of a bystander. 한 사람의 행동이 옆 사람의 후생에 영향을 미치고 그에 대한 보상이 이루어지지 않은 현상을 말한다. § Externalities can be negative or positive, depending on whether impact on bystander is adverse or beneficial. 외부효과는 옆 사람에 대한 영향이 해로우냐 혹은 이로우냐에 따라 부정적 일 수도 있고 긍정적일 수도 있다. EXTERNALITIES 2

Introduction § Self-interested buyers and sellers neglect the external costs or benefits of their actions, so the market outcome is not efficient. 이기적인 구매자 와 판매자들은 자신들의 행위가 가져오는 외부적 비용이나 편익을 무시하며, 따라서 시장의 결과는 비효율적이게 된다. § Another principle from Chapter 1: Governments can sometimes improve market outcomes. In presence of externalities, public policy can improve efficiency. 외부효과가 존재할 때 공공정책은 효율성을 개선할 수 있다. EXTERNALITIES 3

Examples of Negative Externalities부정적 외부효과의 예 § Air pollution from a factory § The neighbor’s barking dog § Late-night stereo blasting from the dorm room next to yours § Noise pollution from construction projects § Health risk to others from second-hand smoke § Talking on cell phone while driving makes the roads less safe for others EXTERNALITIES 4

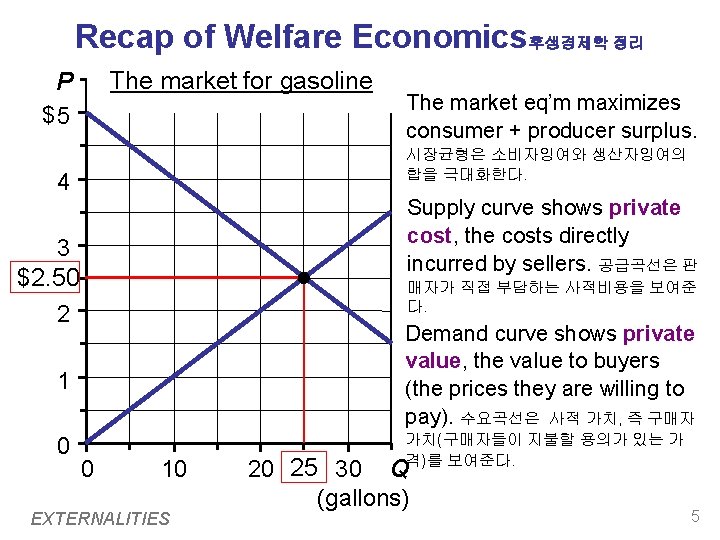

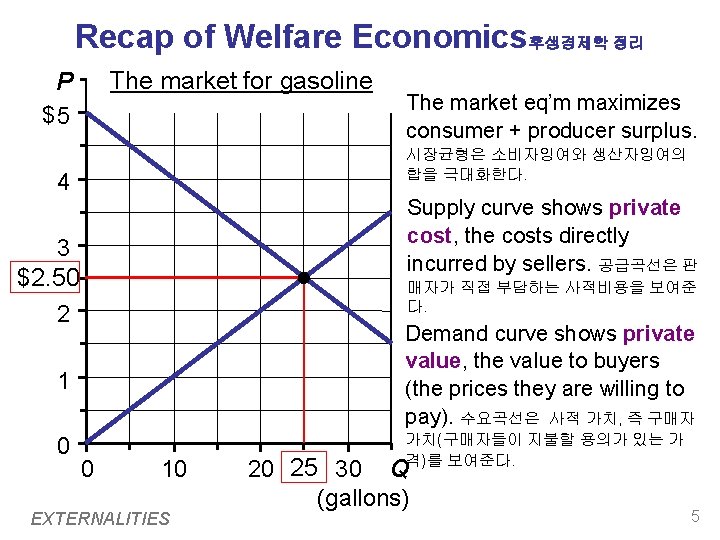

Recap of Welfare Economics후생경제학 정리 The market for gasoline P $5 The market eq’m maximizes consumer + producer surplus. 시장균형은 소비자잉여와 생산자잉여의 합을 극대화한다. 4 Supply curve shows private cost, the costs directly incurred by sellers. 공급곡선은 판 3 $2. 50 매자가 직접 부담하는 사적비용을 보여준 다. 2 1 Demand curve shows private value, the value to buyers (the prices they are willing to pay). 수요곡선은 사적 가치, 즉 구매자 0 가치(구매자들이 지불할 용의가 있는 가 격)를 보여준다. 0 10 EXTERNALITIES 20 25 30 Q (gallons) 5

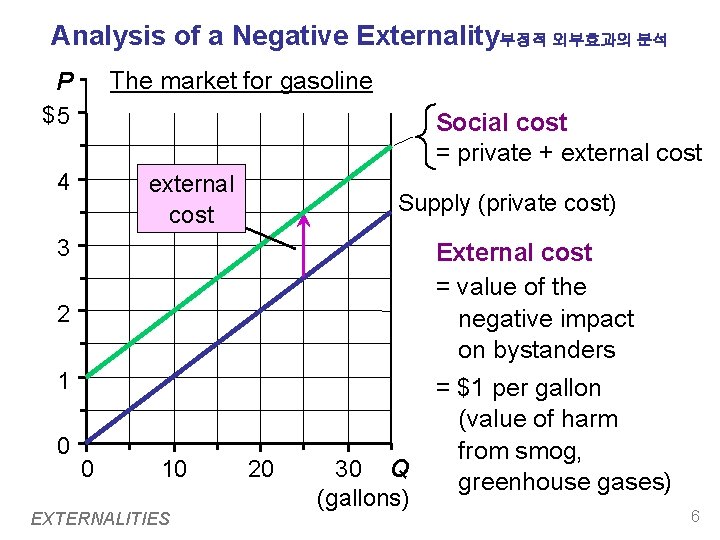

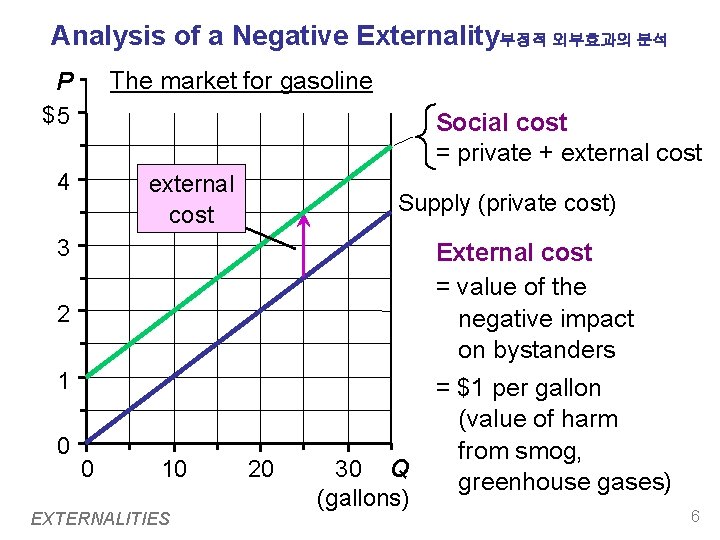

Analysis of a Negative Externality부정적 외부효과의 분석 The market for gasoline P $5 Social cost = private + external cost 4 external cost Supply (private cost) 3 External cost = value of the negative impact on bystanders 2 1 0 0 10 EXTERNALITIES 20 30 Q (gallons) = $1 per gallon (value of harm from smog, greenhouse gases) 6

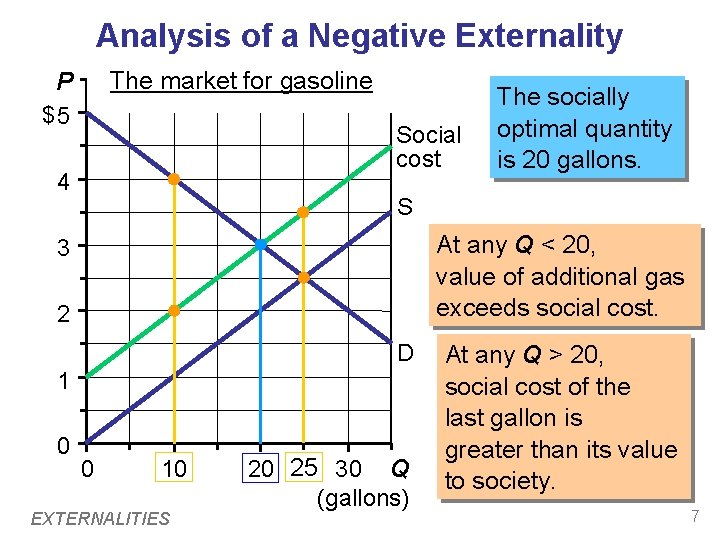

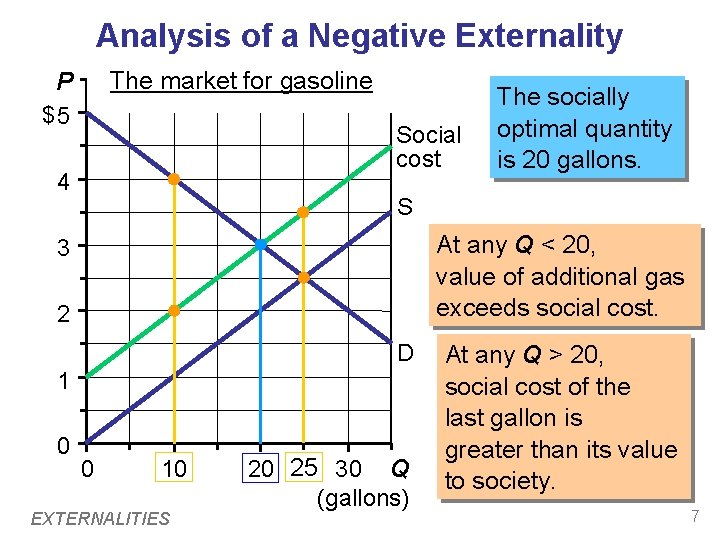

Analysis of a Negative Externality The market for gasoline P $5 Social cost 4 S At any Q < 20, value of additional gas exceeds social cost. 3 2 D 1 0 The socially optimal quantity is 20 gallons. 0 10 EXTERNALITIES 20 25 30 Q (gallons) At any Q > 20, social cost of the last gallon is greater than its value to society. 7

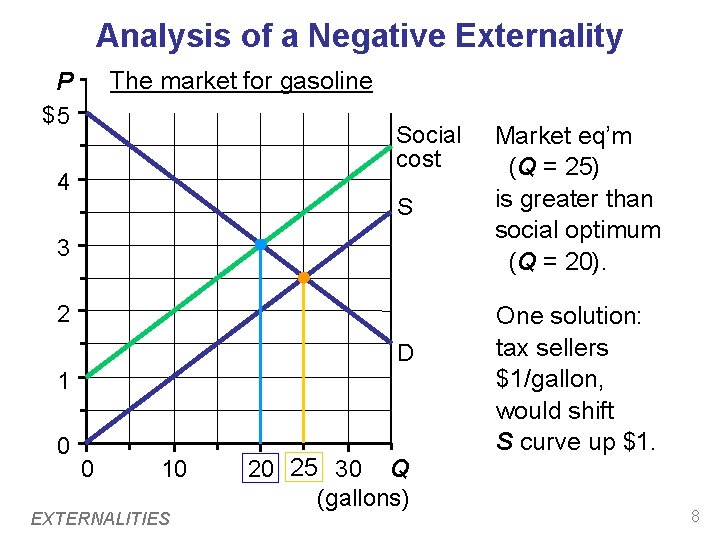

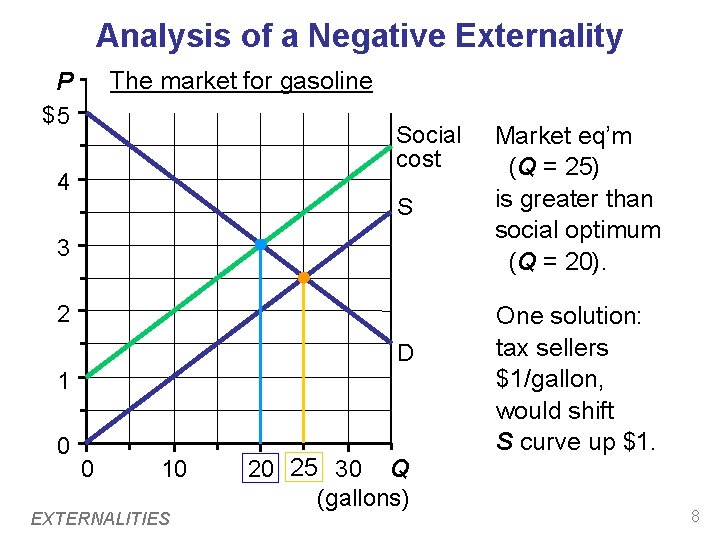

Analysis of a Negative Externality The market for gasoline P $5 Social cost 4 S 3 2 D 1 0 0 10 EXTERNALITIES 20 25 30 Q (gallons) Market eq’m (Q = 25) is greater than social optimum (Q = 20). One solution: tax sellers $1/gallon, would shift S curve up $1. 8

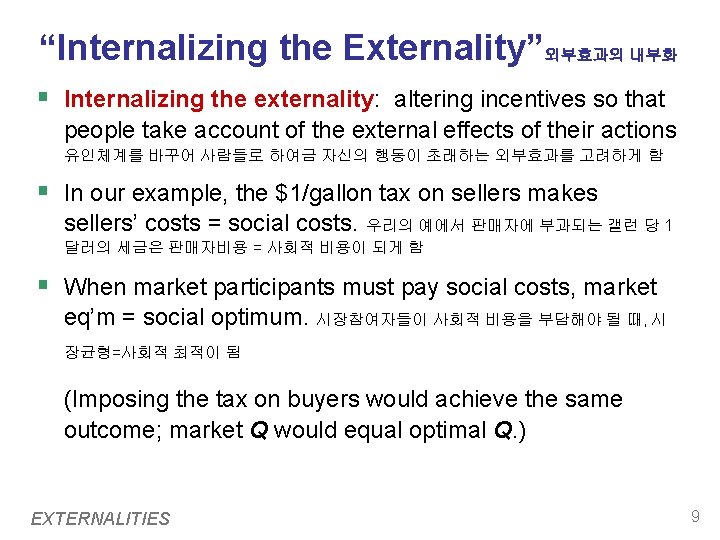

“Internalizing the Externality”외부효과의 내부화 § Internalizing the externality: altering incentives so that people take account of the external effects of their actions 유인체계를 바꾸어 사람들로 하여금 자신의 행동이 초래하는 외부효과를 고려하게 함 § In our example, the $1/gallon tax on sellers makes sellers’ costs = social costs. 우리의 예에서 판매자에 부과되는 갤런 당 1 달러의 세금은 판매자비용 = 사회적 비용이 되게 함 § When market participants must pay social costs, market eq’m = social optimum. 시장참여자들이 사회적 비용을 부담해야 될 때, 시 장균형=사회적 최적이 됨 (Imposing the tax on buyers would achieve the same outcome; market Q would equal optimal Q. ) EXTERNALITIES 9

Examples of Positive Externalities 긍정적 외부효과의 예 § Being vaccinated against contagious diseases protects not only you, but people who visit the salad bar or produce section after you. 전염병 예방 접종을 하는 것은 당신 뿐만 아니라 당신 다음으로 샐러드 바나 상품 진열대를 방문하는 사람들까지도 지켜준다. § R&D creates knowledge others can use. 연구개발은 다른 사람들도 사용할 수 있는 지식을 창출한다. § People going to college raise the population’s education level, which Thank you for reduces crime and improves not contaminating government. 대학을 가는 것은 국민의 교육수준을 높 the fruit supply! 여 범죄를 줄이고 통치상태를 개선한다. EXTERNALITIES 10

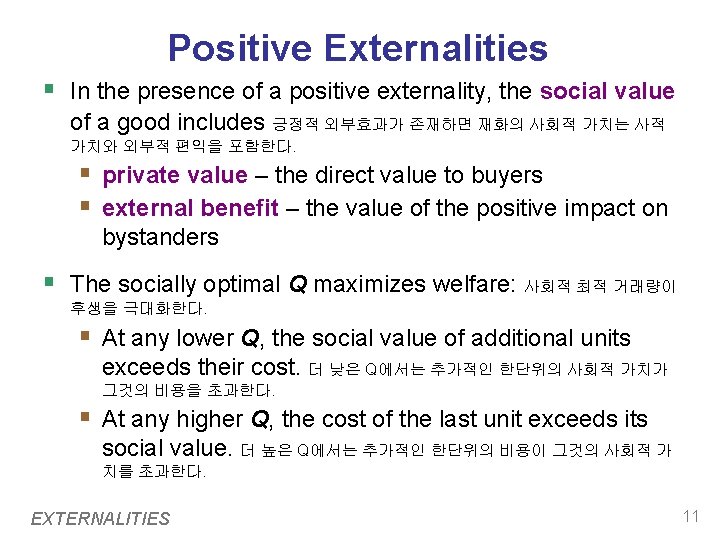

Positive Externalities § In the presence of a positive externality, the social value of a good includes 긍정적 외부효과가 존재하면 재화의 사회적 가치는 사적 가치와 외부적 편익을 포함한다. § private value – the direct value to buyers § external benefit – the value of the positive impact on bystanders § The socially optimal Q maximizes welfare: 사회적 최적 거래량이 후생을 극대화한다. § At any lower Q, the social value of additional units exceeds their cost. 더 낮은 Q에서는 추가적인 한단위의 사회적 가치가 그것의 비용을 초과한다. § At any higher Q, the cost of the last unit exceeds its social value. 더 높은 Q에서는 추가적인 한단위의 비용이 그것의 사회적 가 치를 초과한다. EXTERNALITIES 11

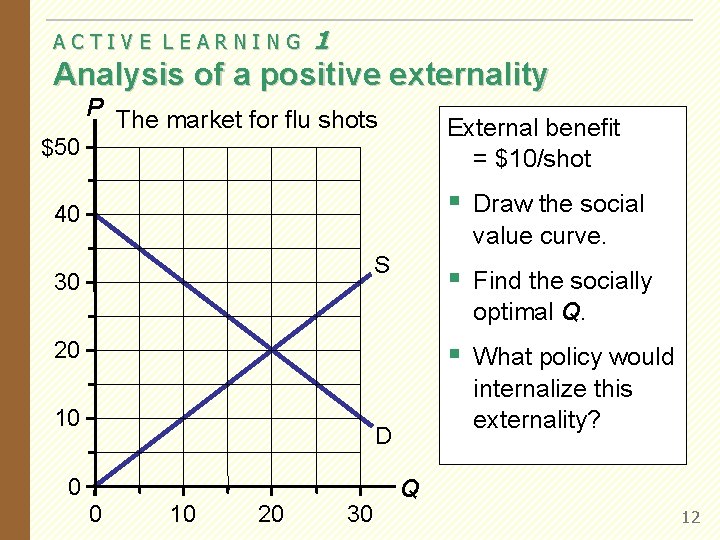

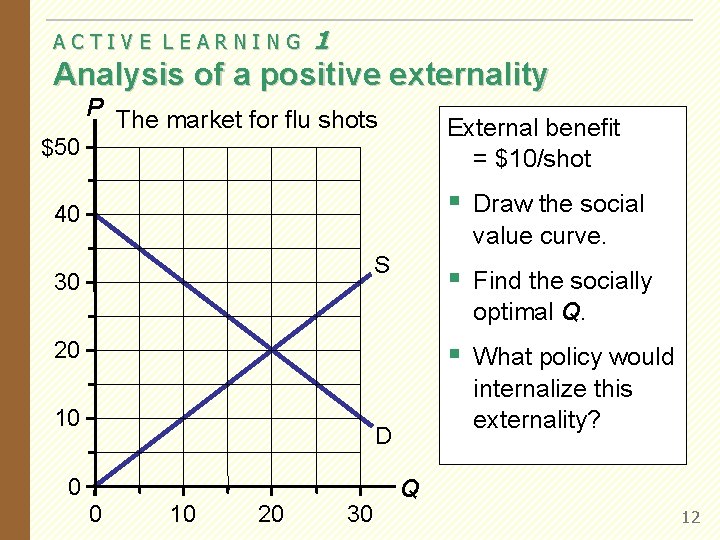

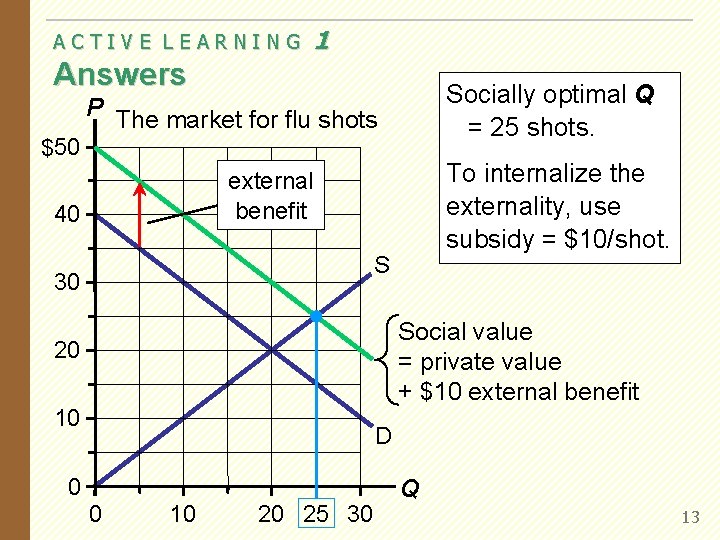

ACTIVE LEARNING 1 Analysis of a positive externality P The market for flu shots External benefit = $10/shot $50 § Draw the social 40 value curve. S 30 § Find the socially optimal Q. 20 § What policy would 10 internalize this externality? D 0 0 10 20 30 Q 12

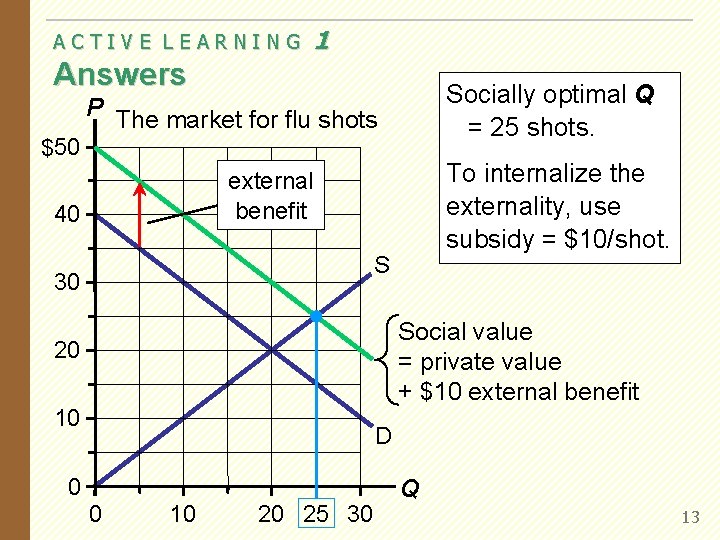

ACTIVE LEARNING 1 Answers Socially optimal Q = 25 shots. P The market for flu shots $50 To internalize the externality, use subsidy = $10/shot. external benefit 40 S 30 Social value = private value + $10 external benefit 20 10 D 0 0 10 20 25 30 Q 13

Effects of Externalities: Summary If negative externality § market quantity larger than socially desirable If positive externality § market quantity smaller than socially desirable To remedy the problem, “internalize the externality” § tax goods with negative externalities § subsidize goods with positive externalities EXTERNALITIES 14

Public Policies Toward Externalities Two approaches: § Command-control policies regulate behavior directly. Examples: § limits on quantity of pollution emitted § requirements that firms adopt a particular technology to reduce emissions § Market-based policies provide incentives so that private decision-makers will choose to solve the problem on their own. Examples: § corrective taxes and subsidies § tradable pollution permits EXTERNALITIES 15

Corrective Taxes & Subsidies 교정적 조세와 보조금 § Corrective tax: a tax designed to induce private decision -makers to take account of the social costs that arise from a negative externality 교정적 조세란 사적 의사결정자들로 하여금 부정적 외 부효과에서 발생하는 사회적 비용을 고려하게끔 유도하는 조세를 말한다. § Also called Pigouvian taxes after Arthur Pigou (18771959). 피구세라고 불리기도 한다. § The ideal corrective tax = external cost § For activities with positive externalities, ideal corrective subsidy = external benefit EXTERNALITIES 16

Corrective Taxes & Subsidies § Other taxes and subsidies distort incentives and move economy away from the social optimum. 다른 조세나 보조금들은 유인체계를 왜곡하여 경제를 사회적 최적으로부터 멀어지게 만든다. § Corrective taxes & subsidies 교정적 조세와 보조금은 § align private incentives with society’s interests 사적 인센티 브를 사회의 이익에 맞게 조정하고 § make private decision-makers take into account the external costs and benefits of their actions 사적 의사결정자 들로 하여금 자신들의 행위가 초래하는 외부비용과 편익을 고려하게 하며 § move economy toward a more efficient allocation of resources. EXTERNALITIES 경제를 자원의 보다 효율적인 배분상태로 이동하게 한다. 17

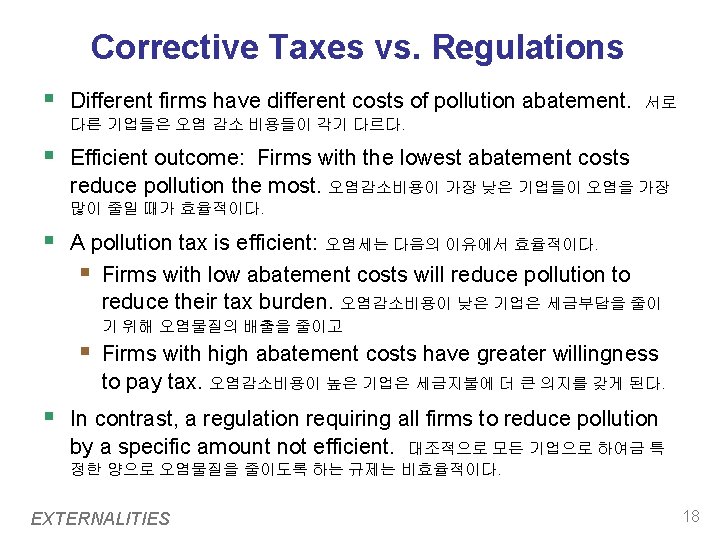

Corrective Taxes vs. Regulations § Different firms have different costs of pollution abatement. 서로 다른 기업들은 오염 감소 비용들이 각기 다르다. § Efficient outcome: Firms with the lowest abatement costs reduce pollution the most. 오염감소비용이 가장 낮은 기업들이 오염을 가장 많이 줄일 때가 효율적이다. § A pollution tax is efficient: 오염세는 다음의 이유에서 효율적이다. § Firms with low abatement costs will reduce pollution to reduce their tax burden. 오염감소비용이 낮은 기업은 세금부담을 줄이 기 위해 오염물질의 배출을 줄이고 § Firms with high abatement costs have greater willingness to pay tax. 오염감소비용이 높은 기업은 세금지불에 더 큰 의지를 갖게 된다. § In contrast, a regulation requiring all firms to reduce pollution by a specific amount not efficient. 대조적으로 모든 기업으로 하여금 특 정한 양으로 오염물질을 줄이도록 하는 규제는 비효율적이다. EXTERNALITIES 18

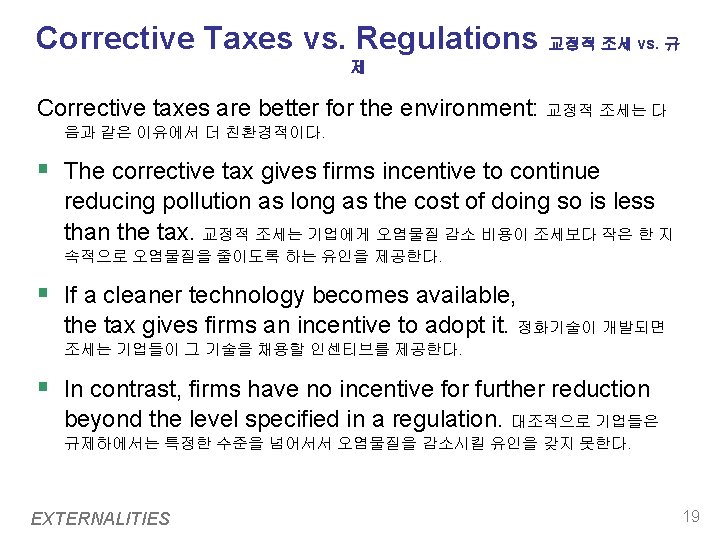

Corrective Taxes vs. Regulations 교정적 조세 vs. 규 제 Corrective taxes are better for the environment: 교정적 조세는 다 음과 같은 이유에서 더 친환경적이다. § The corrective tax gives firms incentive to continue reducing pollution as long as the cost of doing so is less than the tax. 교정적 조세는 기업에게 오염물질 감소 비용이 조세보다 작은 한 지 속적으로 오염물질을 줄이도록 하는 유인을 제공한다. § If a cleaner technology becomes available, the tax gives firms an incentive to adopt it. 정화기술이 개발되면 조세는 기업들이 그 기술을 채용할 인센티브를 제공한다. § In contrast, firms have no incentive for further reduction beyond the level specified in a regulation. 대조적으로 기업들은 규제하에서는 특정한 수준을 넘어서서 오염물질을 감소시킬 유인을 갖지 못한다. EXTERNALITIES 19

Example of a Corrective Tax: The Gas Tax The gas tax targets three negative externalities: 유류세 는 다음의 세가지 부정적 외부효과를 겨냥한다. § Congestion The more you drive, the more you contribute to congestion. 운전을 많이 할수록 혼잡에 기여한다. § Accidents Larger vehicles cause more damage in an accident. 큰 차일수록 한번의 사고에서 더 많은 피해를 야기한다. § Pollution Burning fossil fuels produces greenhouse gases. 화석연료를 태우는 것은 온실 가스를 유발한다. EXTERNALITIES 20

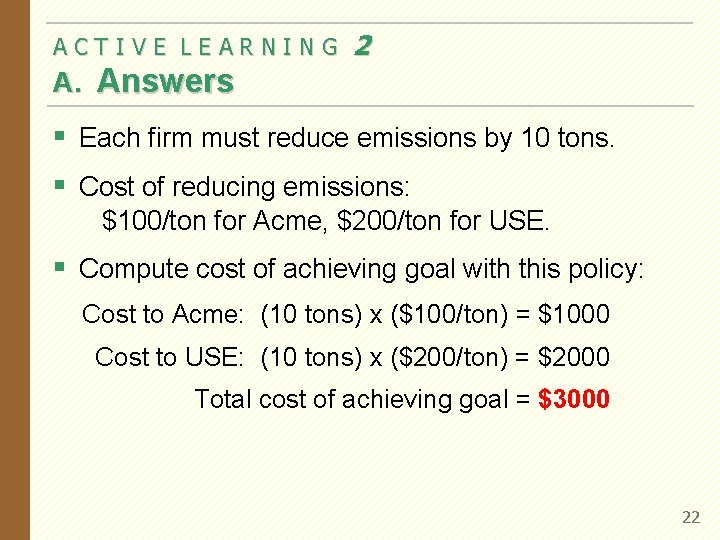

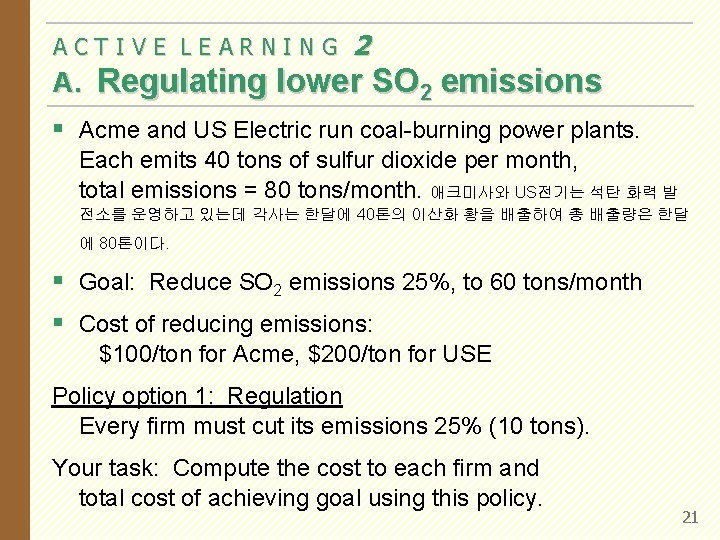

ACTIVE LEARNING 2 A. Regulating lower SO 2 emissions § Acme and US Electric run coal-burning power plants. Each emits 40 tons of sulfur dioxide per month, total emissions = 80 tons/month. 애크미사와 US전기는 석탄 화력 발 전소를 운영하고 있는데 각사는 한달에 40톤의 이산화 황을 배출하여 총 배출량은 한달 에 80톤이다. § Goal: Reduce SO 2 emissions 25%, to 60 tons/month § Cost of reducing emissions: $100/ton for Acme, $200/ton for USE Policy option 1: Regulation Every firm must cut its emissions 25% (10 tons). Your task: Compute the cost to each firm and total cost of achieving goal using this policy. 21

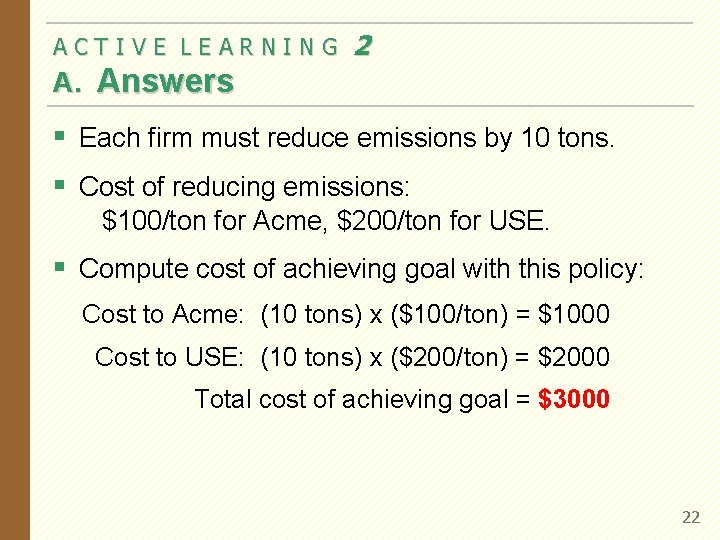

ACTIVE LEARNING 2 A. Answers § Each firm must reduce emissions by 10 tons. § Cost of reducing emissions: $100/ton for Acme, $200/ton for USE. § Compute cost of achieving goal with this policy: Cost to Acme: (10 tons) x ($100/ton) = $1000 Cost to USE: (10 tons) x ($200/ton) = $2000 Total cost of achieving goal = $3000 22

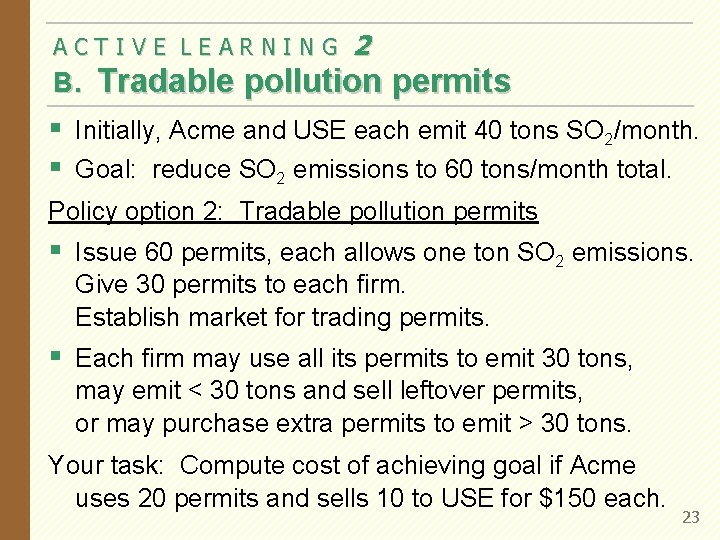

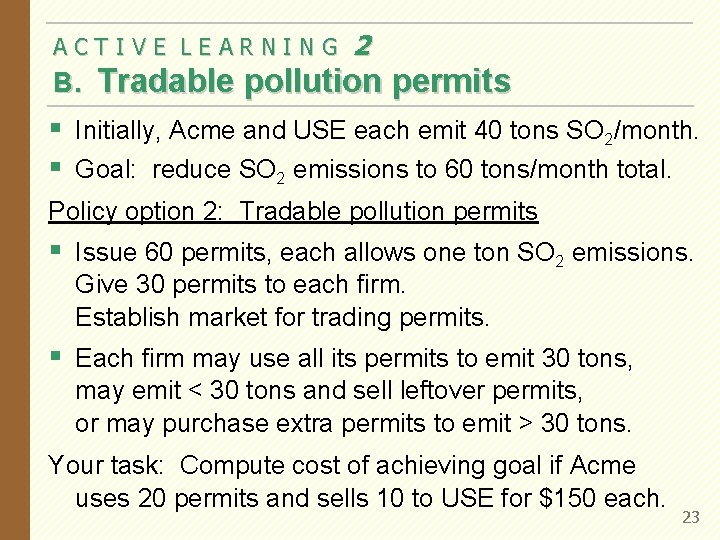

ACTIVE LEARNING 2 B. Tradable pollution permits § Initially, Acme and USE each emit 40 tons SO 2/month. § Goal: reduce SO 2 emissions to 60 tons/month total. Policy option 2: Tradable pollution permits § Issue 60 permits, each allows one ton SO 2 emissions. Give 30 permits to each firm. Establish market for trading permits. § Each firm may use all its permits to emit 30 tons, may emit < 30 tons and sell leftover permits, or may purchase extra permits to emit > 30 tons. Your task: Compute cost of achieving goal if Acme uses 20 permits and sells 10 to USE for $150 each. 23

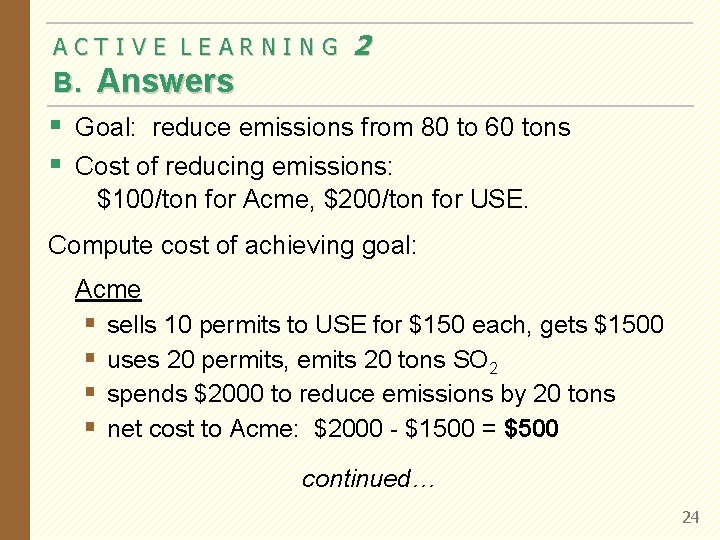

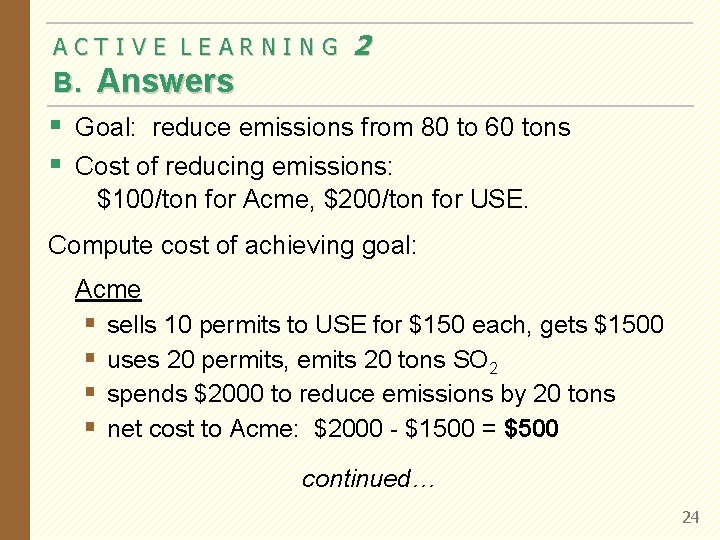

ACTIVE LEARNING 2 B. Answers § Goal: reduce emissions from 80 to 60 tons § Cost of reducing emissions: $100/ton for Acme, $200/ton for USE. Compute cost of achieving goal: Acme § sells 10 permits to USE for $150 each, gets $1500 § uses 20 permits, emits 20 tons SO 2 § spends $2000 to reduce emissions by 20 tons § net cost to Acme: $2000 - $1500 = $500 continued… 24

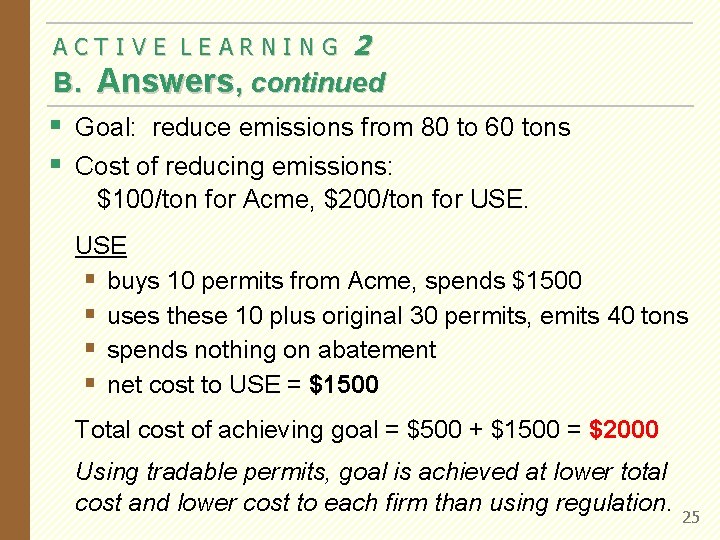

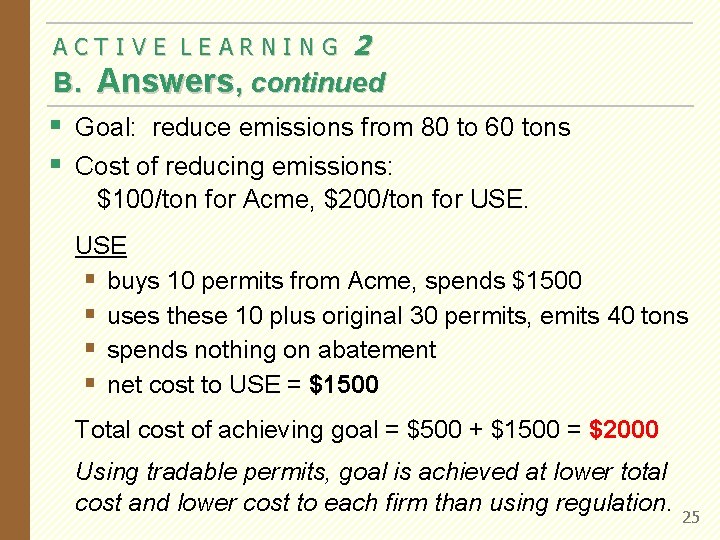

2 B. Answers, continued ACTIVE LEARNING § Goal: reduce emissions from 80 to 60 tons § Cost of reducing emissions: $100/ton for Acme, $200/ton for USE § buys 10 permits from Acme, spends $1500 § uses these 10 plus original 30 permits, emits 40 tons § spends nothing on abatement § net cost to USE = $1500 Total cost of achieving goal = $500 + $1500 = $2000 Using tradable permits, goal is achieved at lower total cost and lower cost to each firm than using regulation. 25

Tradable Pollution Permits오염배출권의 거래 § A tradable pollution permits system reduces pollution at lower cost than regulation. 오염배출권 거래제도는 규제보다 낮은 비용으 . 로 오염을 줄인다 § Firms with low cost of reducing pollution sell whatever permits they can. 오염감축비용이 낮은 기업들은 배 출권을 팔고 § Firms with high cost of reducing pollution buy permits. 오염감축비용이 높은 기업들은 배출권을 산다. § Result: Pollution reduction is concentrated among those firms with lowest costs. 오염감축비용이 가장 낮은 기업에서 집중적으로 오 염을 줄인다. EXTERNALITIES 26

Tradable Pollution Permits in the Real World 현실세계에서의 오염배출권 거래 § SO 2 permits traded in the U. S. since 1995. § Nitrogen oxide permits traded in the northeastern U. S. since 1999. § Carbon emissions permits traded in Europe since January 1, 2005. § As of June 2008, Barack Obama and John Mc. Cain each propose “cap and trade” systems to reduce greenhouse gas emissions. EXTERNALITIES 27

Corrective Taxes vs. Tradable Pollution Permits 교정적 조세 vs. 오염배출권 거래 § Like most demand curves, firms’ demand for the ability to pollute is a downward-sloping function of the “price” of polluting. 다른 수요곡선과 마찬가지로 오염권리에 대한 수요도 오염 “가격”의 감소함수 이다. § A corrective tax raises this price and thus reduces the quantity of pollution firms demand. 교정적 조세는 이 가격을 상승시켜 기업이 수요하는 오염량을 감소시킨다. § A tradable permits system restricts the supply of pollution rights, has the same effect as the tax. 오염배출권 거래제도는 오염 권의 공급을 제한하여 조세와 동일한 효과를 얻는다. § When policymakers do not know the position of this demand curve, the permits system achieves pollution reduction targets more precisely. 만약 정책결정자가 수요곡선의 위치를 모른다면 배출권 제도가 보다 정확하게 오염 감축 목표를 달성한다. 28 EXTERNALITIES

Objections to the Economic Analysis of Pollution 오염의 경제적 분석에 대한 반대 § Some politicians, many environmentalists argue that no one should be able to “buy” the right to pollute, cannot put a price on the environment. 일부 정치가들과 많은 환경주의자들 은 누구도 오염시킬 권리를 “구매”할 수 없으며 환경에 가격을 붙일 수도 없다고 주장 한다. § However, people face tradeoffs. The value of clean air & water must be compared to their cost. 그러나 사람들은 선택에 직 면하고 있다. 맑은 공기와 물의 가치는 그것의 비용과 비교되어야 한다. § The market-based approach reduces the cost of environmental protection, so it should increase the public’s demand for a clean environment. 시장에 기초한 접근은 환경보호의 비용을 감소시켜 깨끗한 환경에 대한 공공의 수요를 증대시킨다. EXTERNALITIES 29

Private Solutions to Externalities 외부효과에 대한 사적 해결 Types of private solutions: 사적 해결의 유형으로는 다음 세가지 § Moral codes and social sanctions, 도덕적 규범과 사회적 제 재 e. g. , the “Golden Rule” 예컨대 “황금율” § Charities, e. g. , the Sierra Club 자선 예컨대 시에라 클럽 § Contracts between market participants and the affected bystanders 시장참여자들과 영향 받는 이웃들 간의 계약 EXTERNALITIES 30

Private Solutions to Externalities § The Coase theorem: 코즈 정리 If private parties can costlessly bargain over the allocation of resources, they can solve the externalities problem on their own. 만약 사적 주체들이 자원 배분에 대해 비용 없이 거래할 수 있다면 그들은 외부효과 문제를 스스로 해결할 수 있 다. EXTERNALITIES 31

The Coase Theorem: An Example Dick owns a dog named Spot. 딕은 스팟이라는 개를 소유 Negative externality: 부정적 외부효과 Spot’s barking disturbs Jane, Dick’s neighbor. 스팟의 짖는 소리는 딕의 이웃인 제인을 괴롭힘 The socially efficient outcome maximizes Dick’s + Jane’s well-being. 사회적으로 효율적인 결과는 딕과 제인의 후생의 합계를 극대화할 것이다. § If Dick values having Spot more See Spot bark. than Jane values peace & quiet, 만약 딕이 스팟의 보유에 부여하는 the dog should stay. 가치가 제인이 평화와 고요에 부여하는 가치보다 크 다면 개는 계속 있어도 된다. Coase theorem: The private market will reach the efficient outcome on its own… 사적 시장은 스스로 효율적 결과에 도달할 것이다 32

The Coase Theorem: An Example § CASE 1: Dick has the right to keep Spot. Benefit to Dick of having Spot = $500 Cost to Jane of Spot’s barking = $800 § Socially efficient outcome: Spot goes bye-bye. § Private outcome: Jane pays Dick $600 to get rid of Spot, both Jane and Dick are better off. § Private outcome = efficient outcome. EXTERNALITIES 33

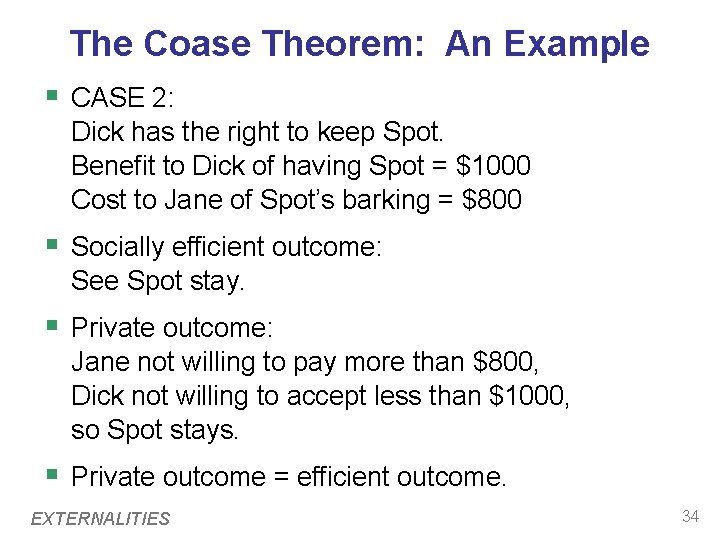

The Coase Theorem: An Example § CASE 2: Dick has the right to keep Spot. Benefit to Dick of having Spot = $1000 Cost to Jane of Spot’s barking = $800 § Socially efficient outcome: See Spot stay. § Private outcome: Jane not willing to pay more than $800, Dick not willing to accept less than $1000, so Spot stays. § Private outcome = efficient outcome. EXTERNALITIES 34

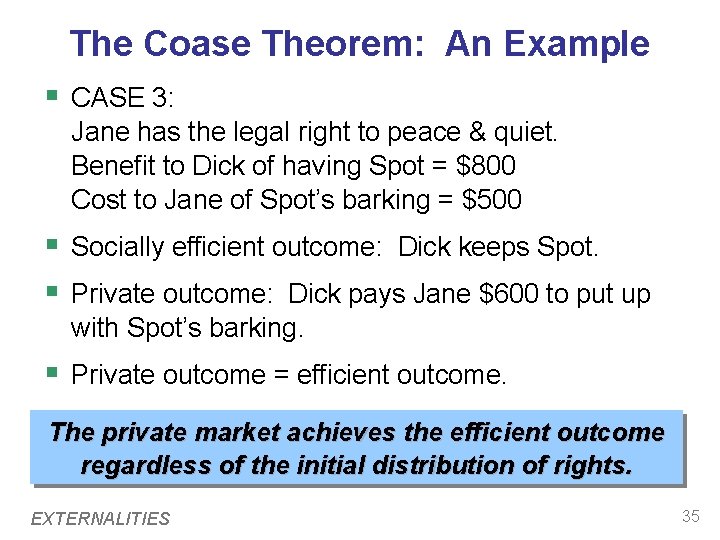

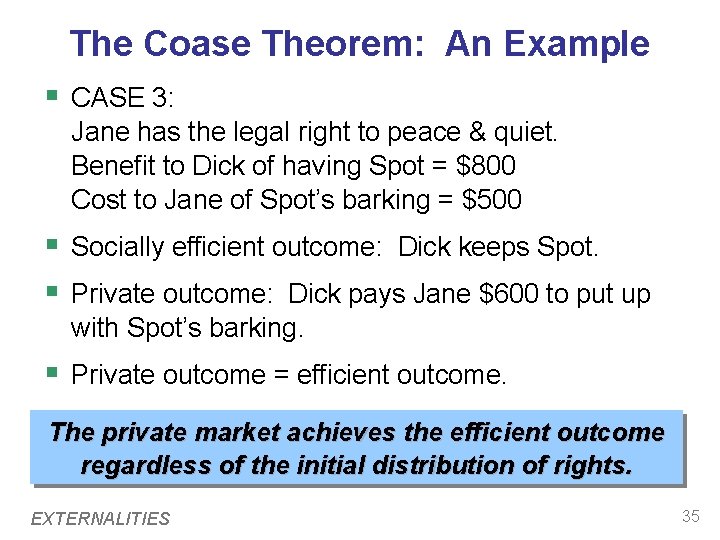

The Coase Theorem: An Example § CASE 3: Jane has the legal right to peace & quiet. Benefit to Dick of having Spot = $800 Cost to Jane of Spot’s barking = $500 § Socially efficient outcome: Dick keeps Spot. § Private outcome: Dick pays Jane $600 to put up with Spot’s barking. § Private outcome = efficient outcome. The private market achieves the efficient outcome regardless of the initial distribution of rights. EXTERNALITIES 35

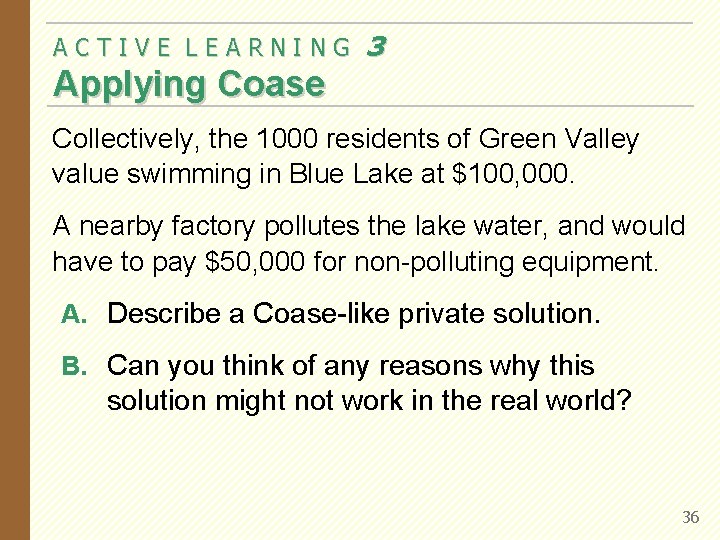

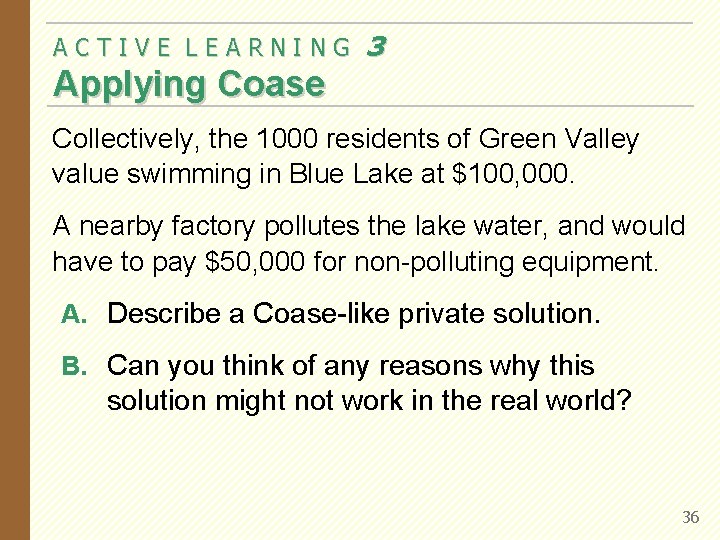

ACTIVE LEARNING 3 Applying Coase Collectively, the 1000 residents of Green Valley value swimming in Blue Lake at $100, 000. A nearby factory pollutes the lake water, and would have to pay $50, 000 for non-polluting equipment. A. Describe a Coase-like private solution. B. Can you think of any reasons why this solution might not work in the real world? 36

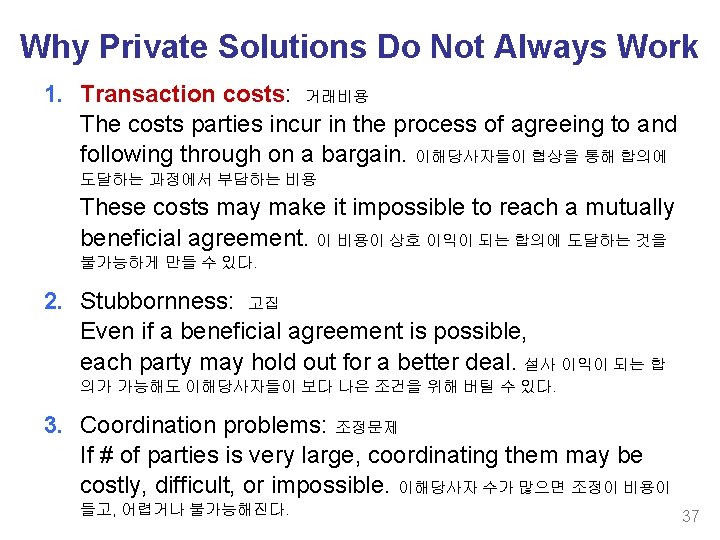

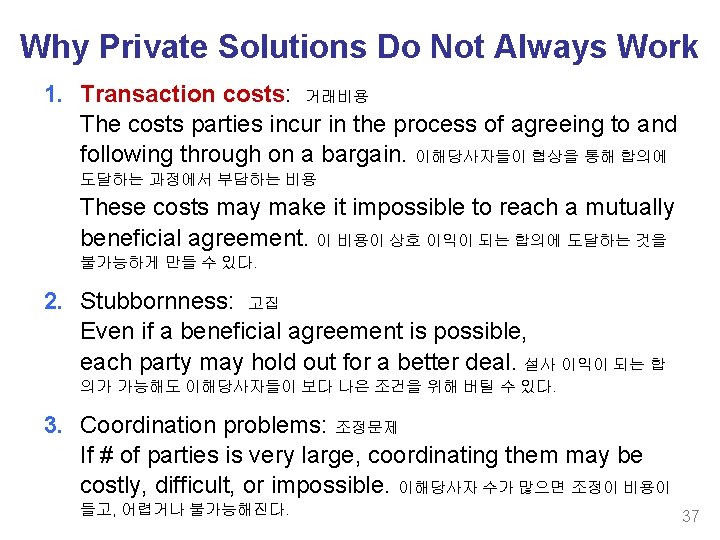

Why Private Solutions Do Not Always Work 1. Transaction costs: 거래비용 The costs parties incur in the process of agreeing to and following through on a bargain. 이해당사자들이 협상을 통해 합의에 도달하는 과정에서 부담하는 비용 These costs may make it impossible to reach a mutually beneficial agreement. 이 비용이 상호 이익이 되는 합의에 도달하는 것을 불가능하게 만들 수 있다. 2. Stubbornness: 고집 Even if a beneficial agreement is possible, each party may hold out for a better deal. 설사 이익이 되는 합 의가 가능해도 이해당사자들이 보다 나은 조건을 위해 버틸 수 있다. 3. Coordination problems: 조정문제 If # of parties is very large, coordinating them may be costly, difficult, or impossible. 이해당사자 수가 많으면 조정이 비용이 들고, 어렵거나 불가능해진다. 37

CHAPTER SUMMARY § An externality occurs when a market transaction affects a third party. If the transaction yields negative externalities (e. g. , pollution), the market quantity exceeds the socially optimal quantity. If the externality is positive (e. g. , technology spillovers), the market quantity falls short of the social optimum. 38

CHAPTER SUMMARY § Sometimes, people can solve externalities on their own. The Coase theorem states that the private market can reach the socially optimal allocation of resources as long as people can bargain without cost. In practice, bargaining is often costly or difficult, and the Coase theorem does not apply. 39

CHAPTER SUMMARY § The government can attempt to remedy the problem. It can internalize the externality using corrective taxes. It can issue permits to polluters and establish a market where permits can be traded. Such policies often protect the environment at a lower cost to society than direct regulation. 40