Chapter 1 The Real Estate Space Market Asset

- Slides: 74

Chapter 1 The Real Estate Space Market & Asset Market © 2014 On. Course Learning. All Rights Reserved. 1

What’s a “market”? … A mechanism for the voluntary exchange of goods and services among owners. © 2014 On. Course Learning. All Rights Reserved. 2

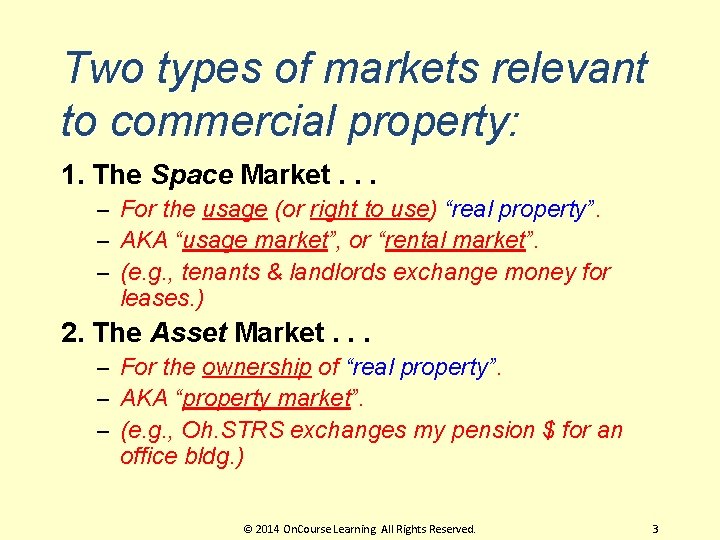

Two types of markets relevant to commercial property: 1. The Space Market. . . – For the usage (or right to use) “real property”. – AKA “usage market”, or “rental market”. – (e. g. , tenants & landlords exchange money for leases. ) 2. The Asset Market. . . – For the ownership of “real property”. – AKA “property market”. – (e. g. , Oh. STRS exchanges my pension $ for an office bldg. ) © 2014 On. Course Learning. All Rights Reserved. 3

What’s “real property”? … Ans: Land & built space. © 2014 On. Course Learning. All Rights Reserved. 4

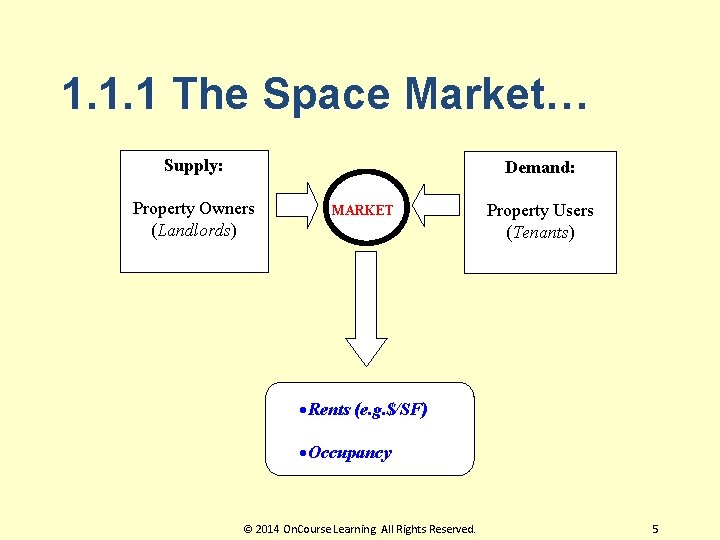

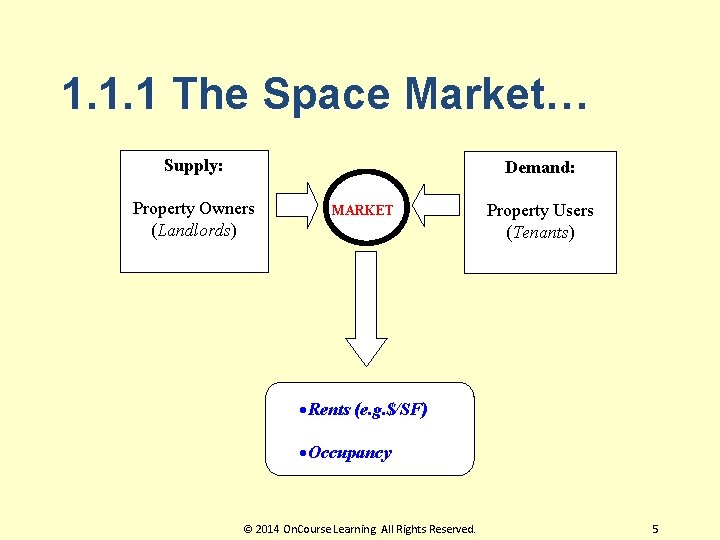

1. 1. 1 The Space Market… Supply: Demand: Property Owners (Landlords) MARKET Property Users (Tenants) ·Rents (e. g. $/SF) ·Occupancy © 2014 On. Course Learning. All Rights Reserved. 5

1. 1. 2 “Segmentation” in the Space Market… l A market is “segmented” if it breaks up into sub-markets, or market segments. l Within each sub-market or segment, the same good may have a different equilibrium price. l The real estate space market is highly segmented. l Why? … © 2014 On. Course Learning. All Rights Reserved. 6

Demand side: Users require specific types of space… A lawyer can’t use a warehouse. A trucking firm can’t use a high-rise office bldg. l Users require specific locations (or types of locations)… A lawyer won’t get much business at the intersection of I-70 and I-77. A trucking firm’s trucks would spend all their time stuck in traffic if their warehouse were located in downtown Cincinnati. l © 2014 On. Course Learning. All Rights Reserved. 7

Supply side: l Buildings are of specific physical types (warehouses high-rise offices). l Buildings are in specific locations (and they can’t move!). © 2014 On. Course Learning. All Rights Reserved. 8

Concept check… 1. Is there a functioning market for apartment rental in Cambridge? … 2. Is there a functioning market for apartment rental in the Boston metro area as a whole? … 3. Is there a functioning market for apartment rental in the United States as a whole? … © 2014 On. Course Learning. All Rights Reserved. 9

Concept check… 4. Is there a functioning market for “building rental” in Cambridge? … 5. Is there a functioning market for gasoline in the United States as a whole? … 6. Is there a functioning market for apartment property ownership (investment, as distinct from rental) in the United States as a whole? … [Hint: this is the asset market, not the space market. ] © 2014 On. Course Learning. All Rights Reserved. 10

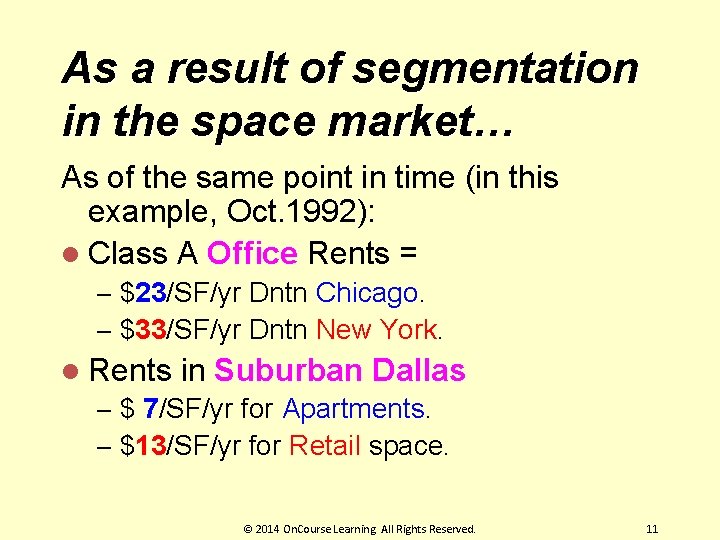

As a result of segmentation in the space market… As of the same point in time (in this example, Oct. 1992): l Class A Office Rents = – $23/SF/yr Dntn Chicago. – $33/SF/yr Dntn New York. l Rents in Suburban Dallas – $ 7/SF/yr for Apartments. – $13/SF/yr for Retail space. © 2014 On. Course Learning. All Rights Reserved. 11

1999 prices for a typical (same) house: 2200 SF, 4 BR/2 B, 2 -car Garage… City Price Index Houston, TX $115, 000 50 Pittsburgh, PA $163, 000 70 Dallas, TX $180, 000 78 Atlanta, GA $200, 000 87 Cleveland, OH $201, 000 87 Cincinnati $231, 000 100 Chicago, IL (Schaumburg) $300, 000 130 New York, NY (Westchstr) $353, 000 153 Chicago, IL (Lincoln Pk) $409, 000 177 Boston, MA $421, 000 182 Los Angeles, CA (Hollywd) $530, 000 229 San Francisco, CA (city) $720, 000 311 $1, 144, 000 495 New York, NY (Manhattan) Source: Caldwell-Banker New York is 10 -times Houston… Boston is almost 3 -times Pittsburgh: “Location, location…” © 2014 On. Course Learning. All Rights Reserved. 12

Two major dimensions of space mkt segmentation: l Geographic location l Property type © 2014 On. Course Learning. All Rights Reserved. 13

Geographic location: l Basic unit is the “metropolitan area” (“MSA”) l Sub-markets (e. g. , CBD, Suburban, neighborhoods) also important © 2014 On. Course Learning. All Rights Reserved. 14

Property type: l Residential (apartment) l Office l Industrial (warehouse) l Retail l Other (hotels, health-care, etc…) © 2014 On. Course Learning. All Rights Reserved. 15

Example space market: Cincinnati CBD Class A Office Mkt, 1980 s-90 s… © 2014 On. Course Learning. All Rights Reserved. 16

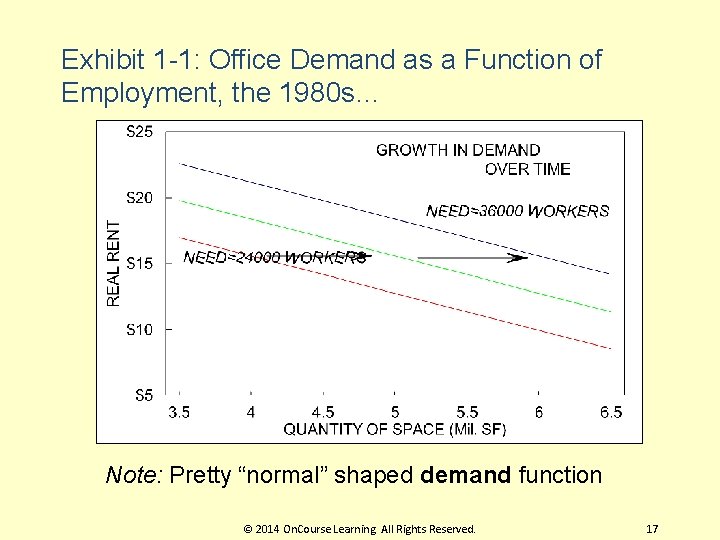

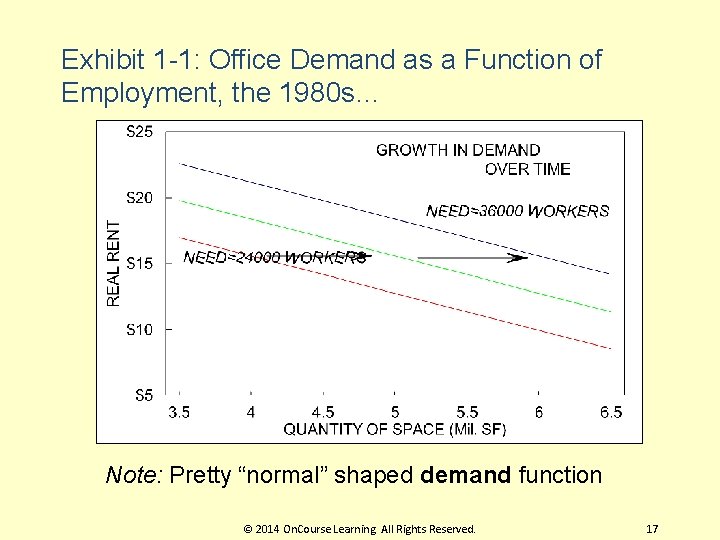

Exhibit 1 -1: Office Demand as a Function of Employment, the 1980 s… Note: Pretty “normal” shaped demand function © 2014 On. Course Learning. All Rights Reserved. 17

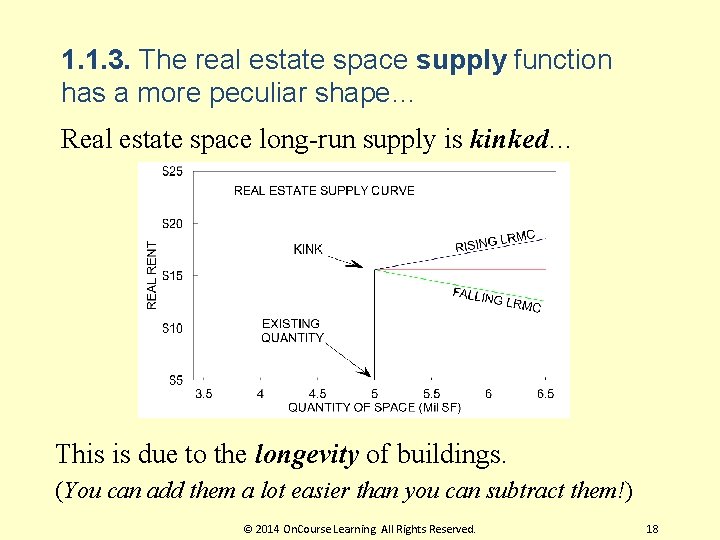

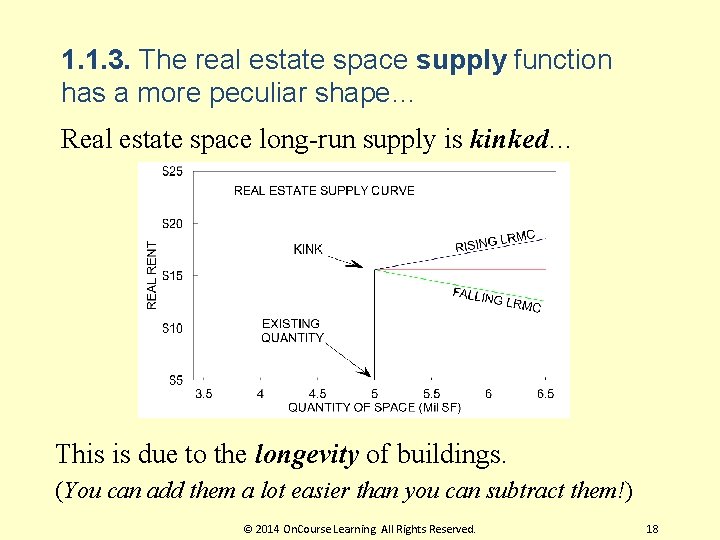

1. 1. 3. The real estate space supply function has a more peculiar shape… Real estate space long-run supply is kinked… This is due to the longevity of buildings. (You can add them a lot easier than you can subtract them!) © 2014 On. Course Learning. All Rights Reserved. 18

1. 1. 4 Supply, Development, & Rent… Supply function = Long-run Marginal Cost function (LRMC) LRMC = Virtually zero (at and below existing supply) LRMC = Development cost (beyond existing supply) Development cost = Construction + Land (including developer profit) © 2014 On. Course Learning. All Rights Reserved. 19

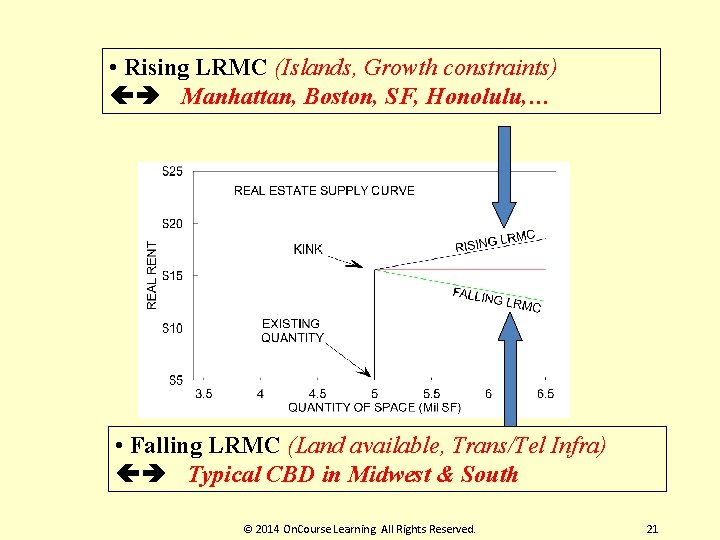

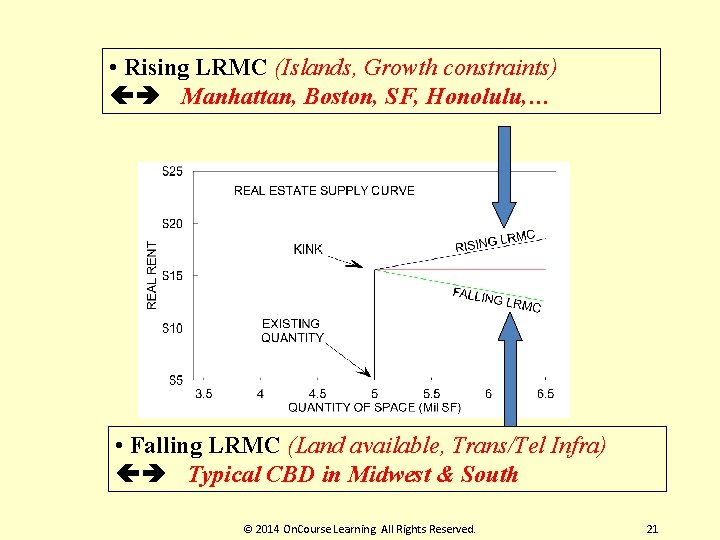

• Rising LRMC (costs more to build next than last) Land scarcity, Location demand growth • Falling LRMC (costs less to build next than last) Loss of centrality, Location demand decline © 2014 On. Course Learning. All Rights Reserved. 20

• Rising LRMC (Islands, Growth constraints) Manhattan, Boston, SF, Honolulu, … • Falling LRMC (Land available, Trans/Tel Infra) Typical CBD in Midwest & South © 2014 On. Course Learning. All Rights Reserved. 21

In a market with expanding demand: LR equilibrium rent = “Replacement cost rent”. = Rent the market tends to return to. = Rent just sufficient to make new development profitable. © 2014 On. Course Learning. All Rights Reserved. 22

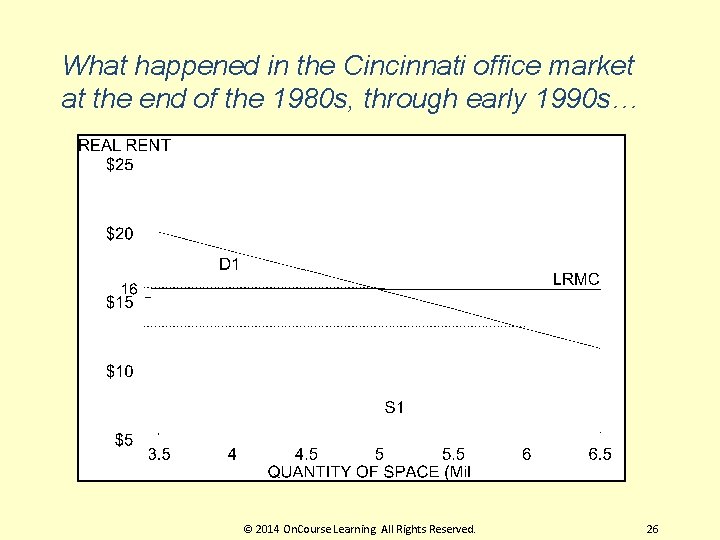

Example: Cincinnati CBD office market, 1980 s-90 s… Devlpt Cost = $200/SF (of blt space, inclu land + construction) l Mid-1980 s CBD office bldgs were selling at “ 8% cap rates. ” l That means investors at that time were willing to pay l $1 / 0. 08 = $12. 50 per dollar of current net income produced by the bldg. © 2014 On. Course Learning. All Rights Reserved. 23

Example: Cincinnati CBD office market, 1980 s-90 s… Thus, if office bldgs could generate $16/SF of net rent, then it would be just profitable to develop new buildings: $16 / 0. 08 = $200 = Devlpt Cost l Thus, $16/SF is the LR equilibrium (“Replacement Cost”) rent. l Rents at $16/SF or more, with cap rates at 8% or less, would tend to trigger new development of downtown office buildings in Cincinnati in the 1980 s. l But would this new development really turn out to be profitable? … © 2014 On. Course Learning. All Rights Reserved. 24

1. 1. 5. Forecasting Future Rents… You need to forecast changes in both future demand future supply, and consider that the “kink point” moves out with increases in current stock of supply… © 2014 On. Course Learning. All Rights Reserved. 25

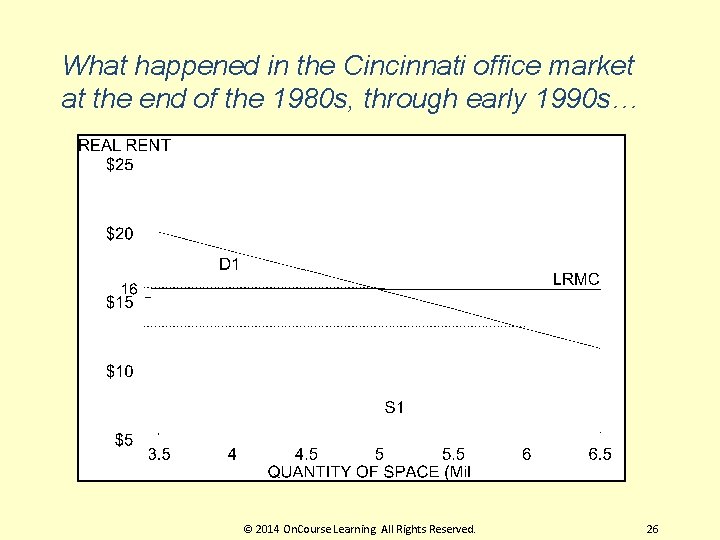

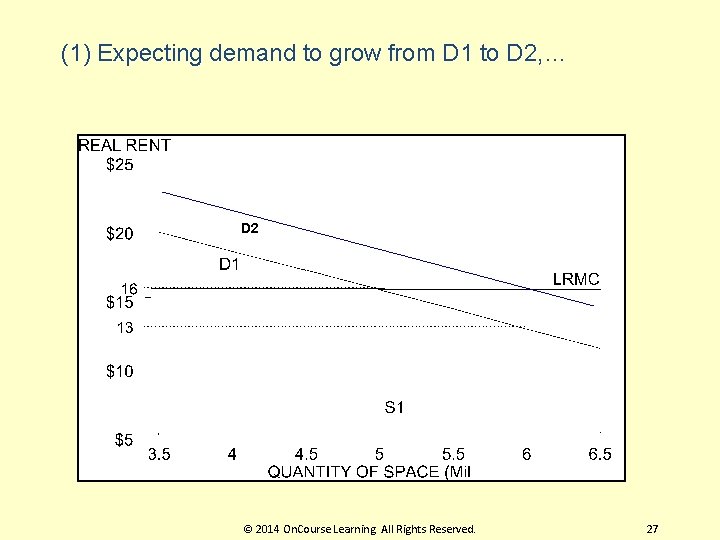

What happened in the Cincinnati office market at the end of the 1980 s, through early 1990 s… © 2014 On. Course Learning. All Rights Reserved. 26

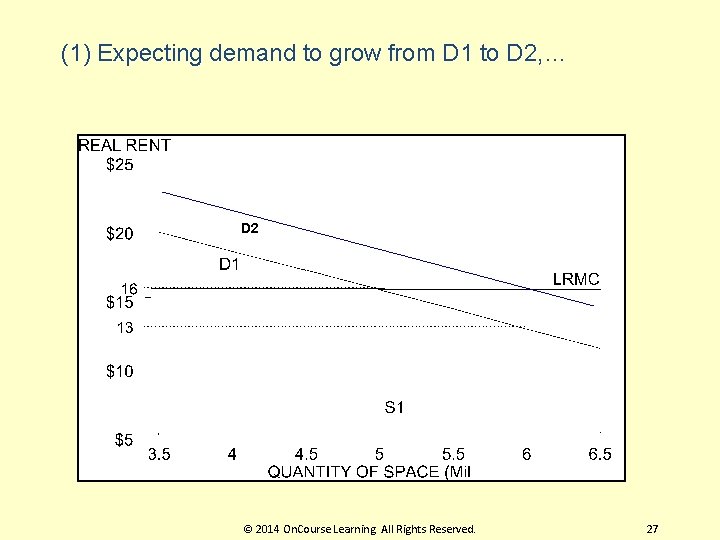

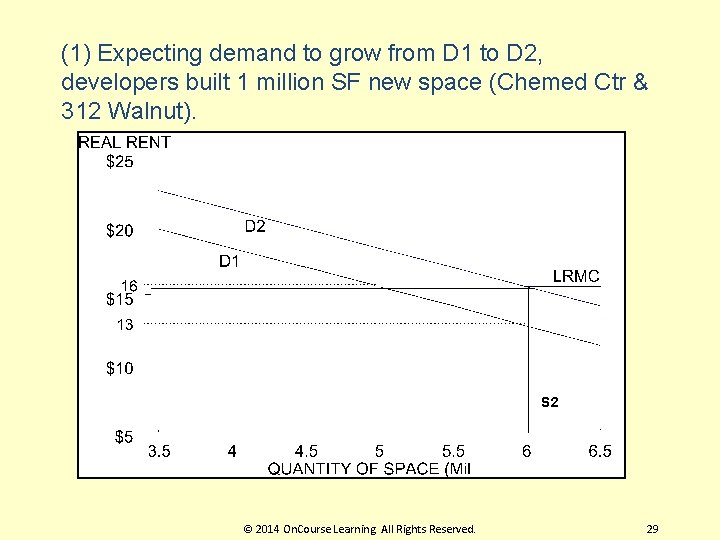

(1) Expecting demand to grow from D 1 to D 2, … D 2 © 2014 On. Course Learning. All Rights Reserved. 27

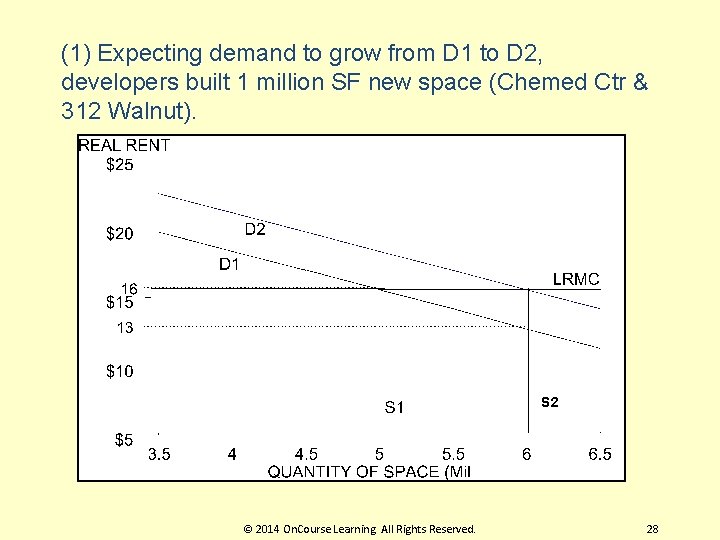

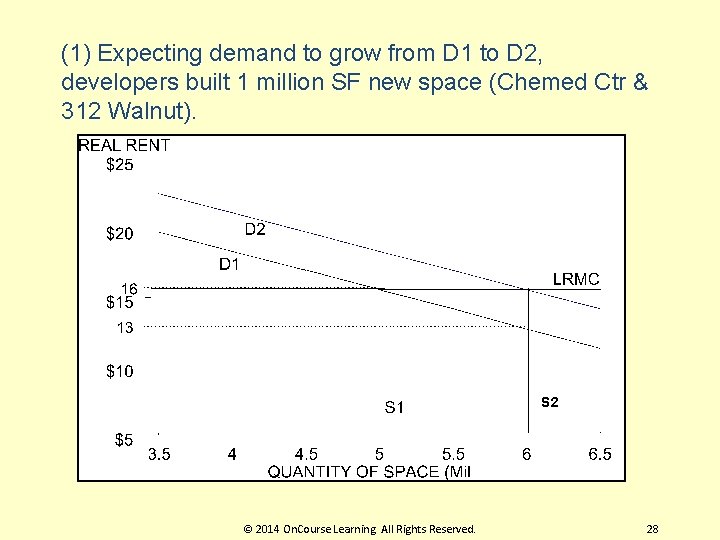

(1) Expecting demand to grow from D 1 to D 2, developers built 1 million SF new space (Chemed Ctr & 312 Walnut). S 2 © 2014 On. Course Learning. All Rights Reserved. 28

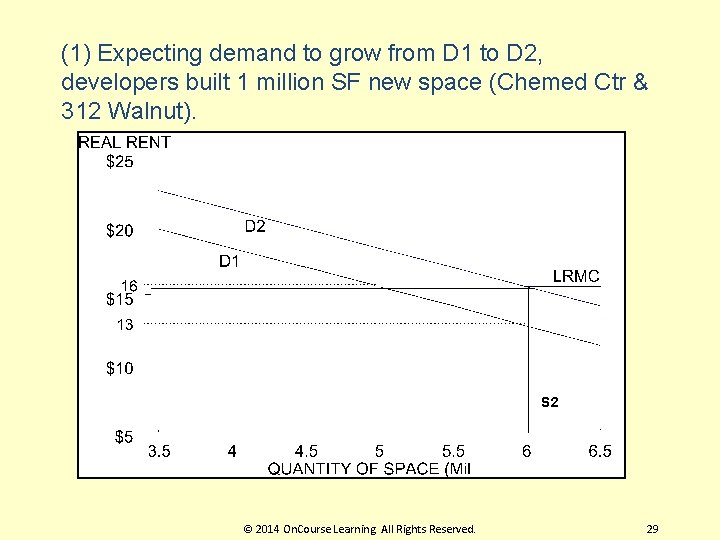

(1) Expecting demand to grow from D 1 to D 2, developers built 1 million SF new space (Chemed Ctr & 312 Walnut). S 2 © 2014 On. Course Learning. All Rights Reserved. 29

Chemed Center + 312 Walnut = 1 MSF Spec, 1990 © 2014 On. Course Learning. All Rights Reserved. 30

(1) Expecting demand to grow from D 1 to D 2, developers built 1 million SF new space (Chemed Ctr & 312 Walnut). S 2 © 2014 On. Course Learning. All Rights Reserved. 31

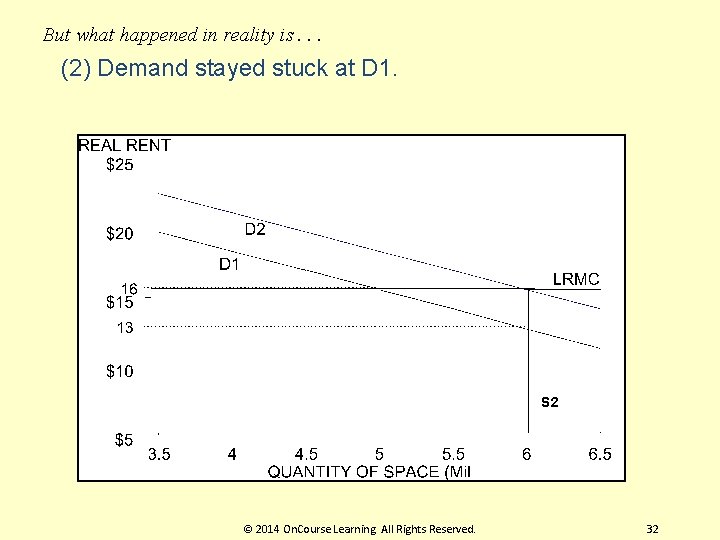

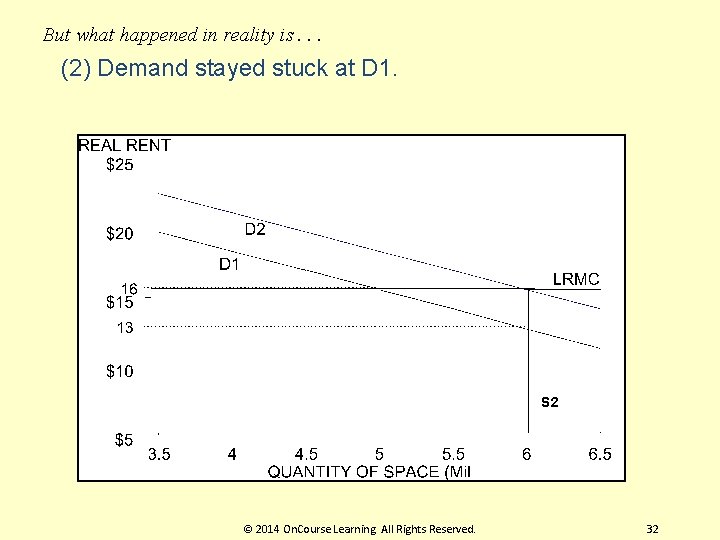

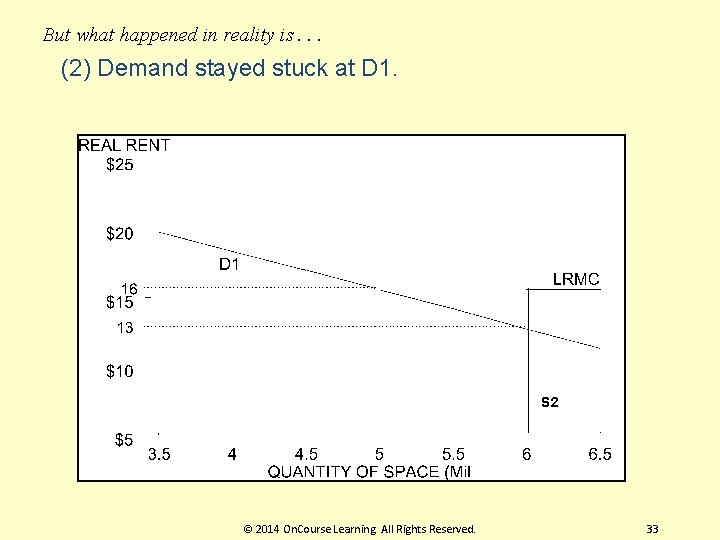

But what happened in reality is. . . (2) Demand stayed stuck at D 1. S 2 © 2014 On. Course Learning. All Rights Reserved. 32

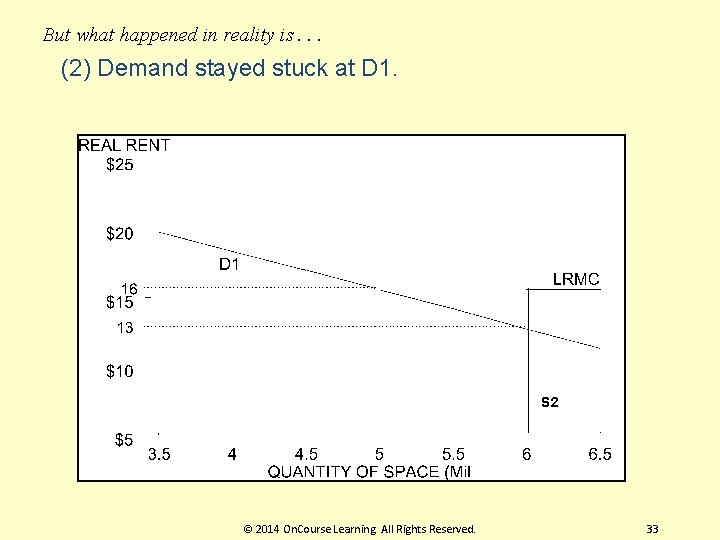

But what happened in reality is. . . (2) Demand stayed stuck at D 1. S 2 © 2014 On. Course Learning. All Rights Reserved. 33

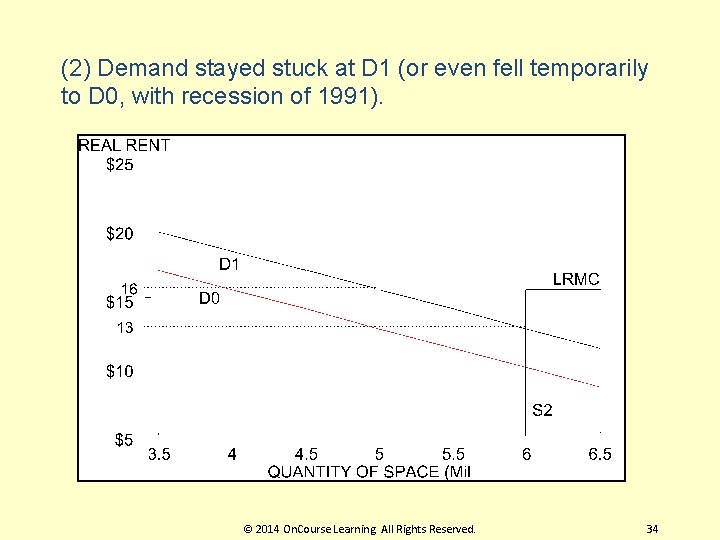

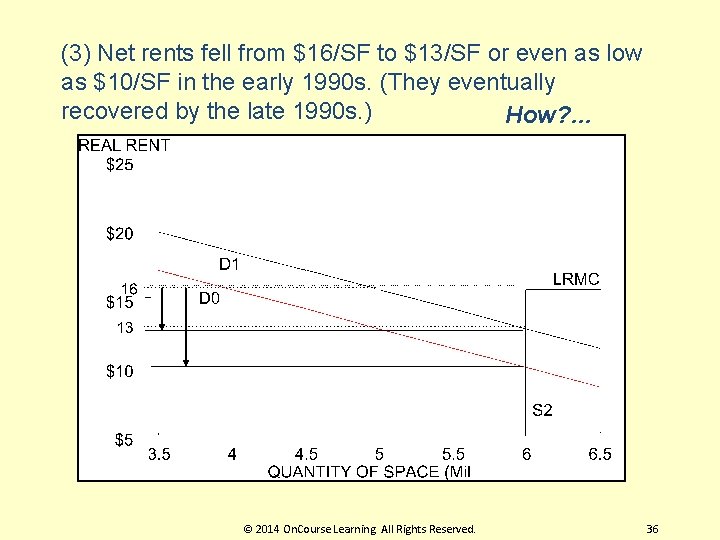

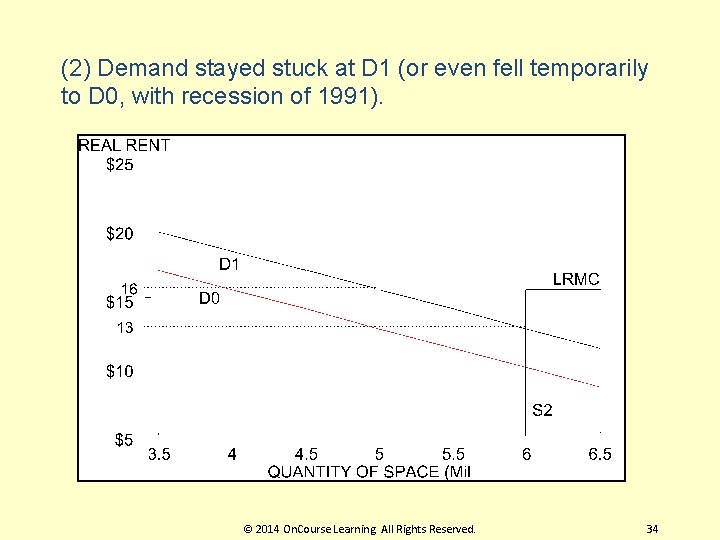

(2) Demand stayed stuck at D 1 (or even fell temporarily to D 0, with recession of 1991). © 2014 On. Course Learning. All Rights Reserved. 34

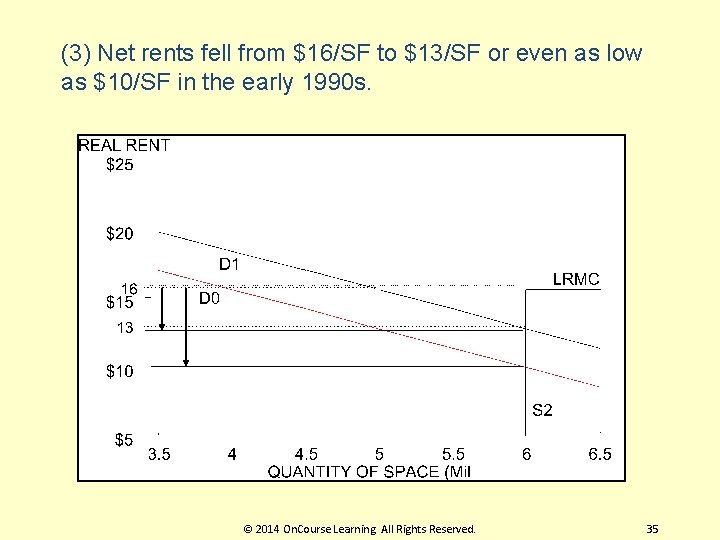

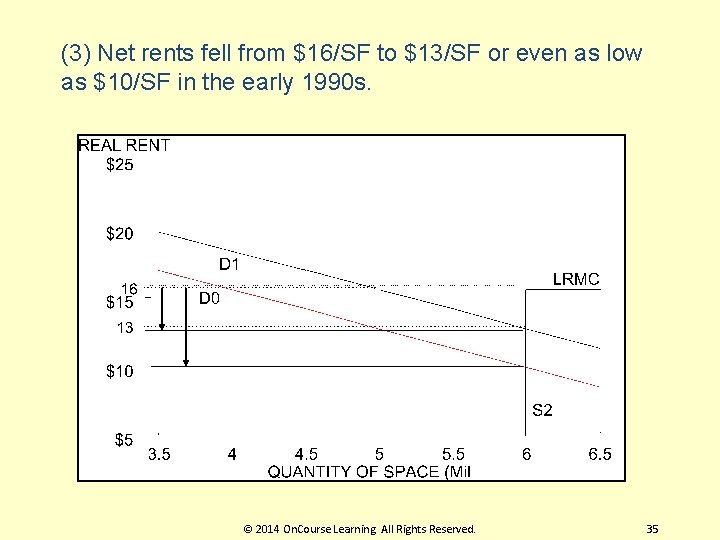

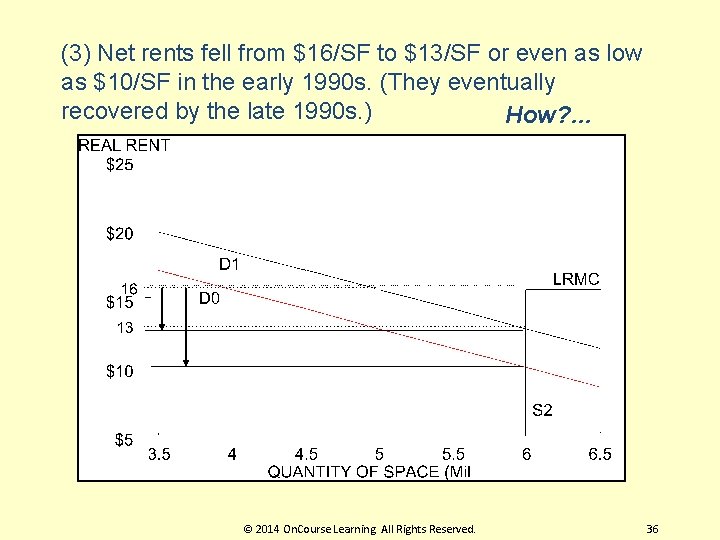

(3) Net rents fell from $16/SF to $13/SF or even as low as $10/SF in the early 1990 s. © 2014 On. Course Learning. All Rights Reserved. 35

(3) Net rents fell from $16/SF to $13/SF or even as low as $10/SF in the early 1990 s. (They eventually recovered by the late 1990 s. ) How? … © 2014 On. Course Learning. All Rights Reserved. 36

Exhibit 1 -3: Change in Supply & Demand & Rent over Time © 2014 On. Course Learning. All Rights Reserved. 37

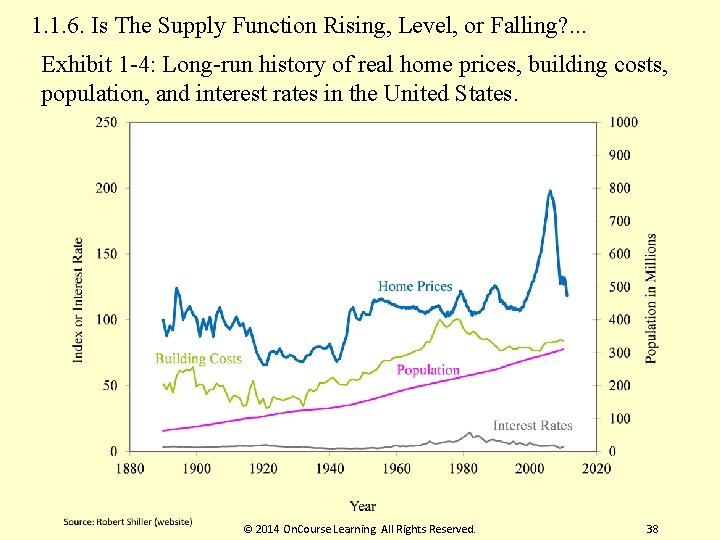

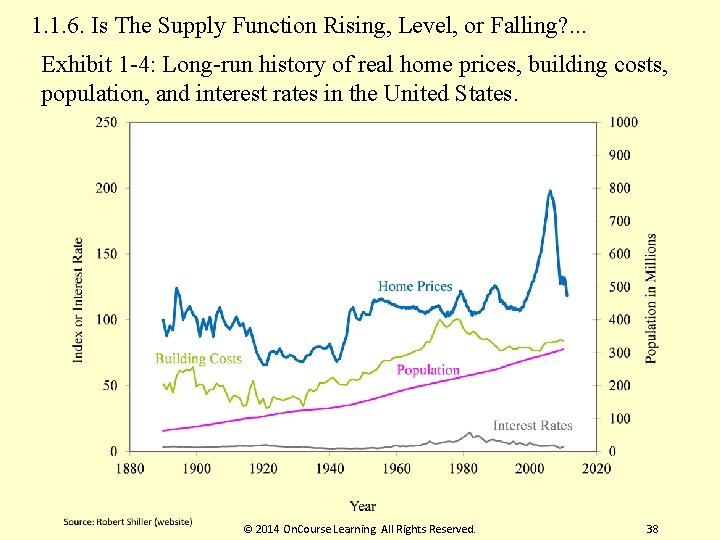

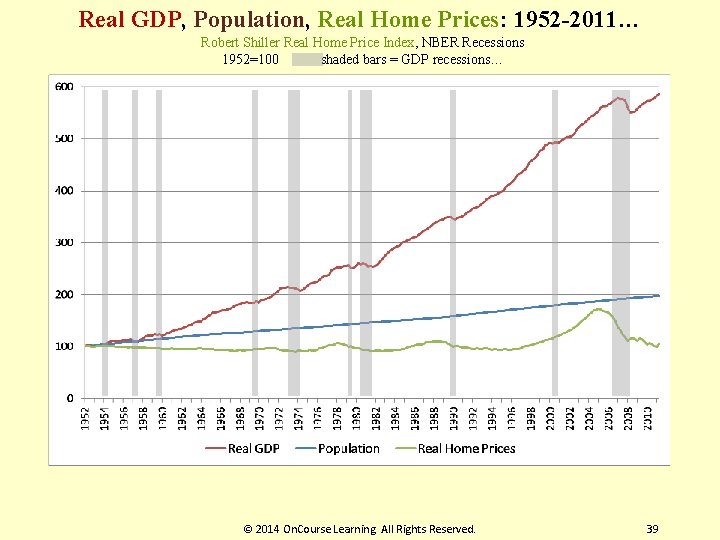

1. 1. 6. Is The Supply Function Rising, Level, or Falling? . . . Exhibit 1 -4: Long-run history of real home prices, building costs, population, and interest rates in the United States. © 2014 On. Course Learning. All Rights Reserved. 38

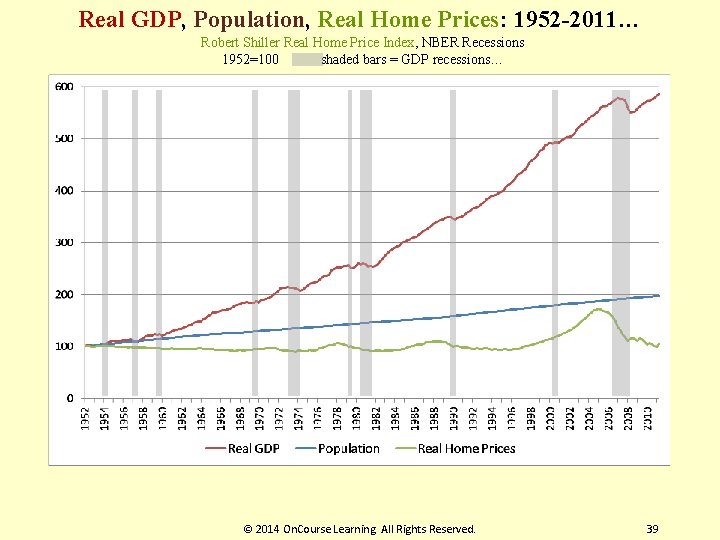

Real GDP, Population, Real Home Prices: 1952 -2011… Robert Shiller Real Home Price Index, NBER Recessions 1952=100 shaded bars = GDP recessions… © 2014 On. Course Learning. All Rights Reserved. 39

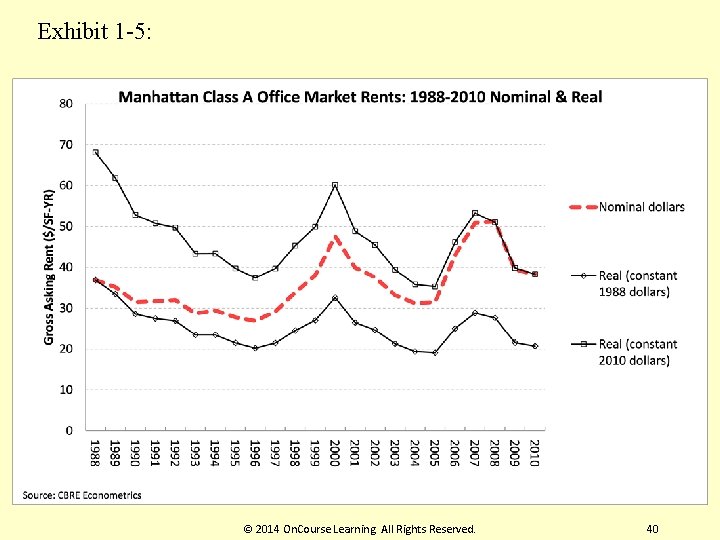

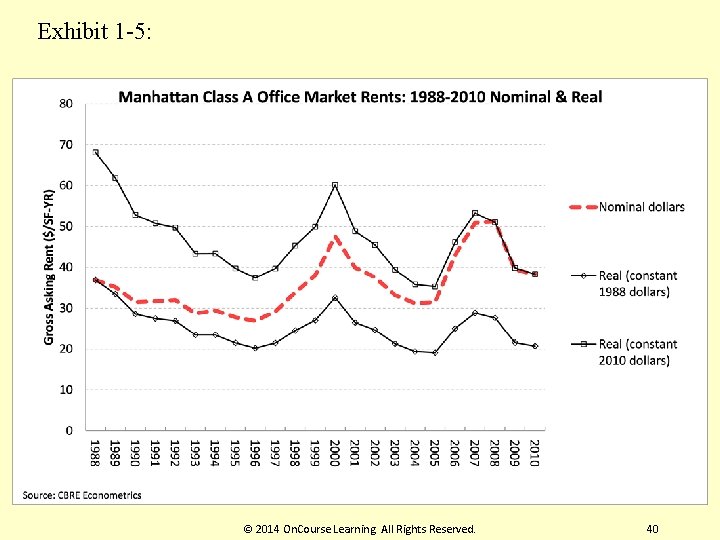

Exhibit 1 -5: © 2014 On. Course Learning. All Rights Reserved. 40

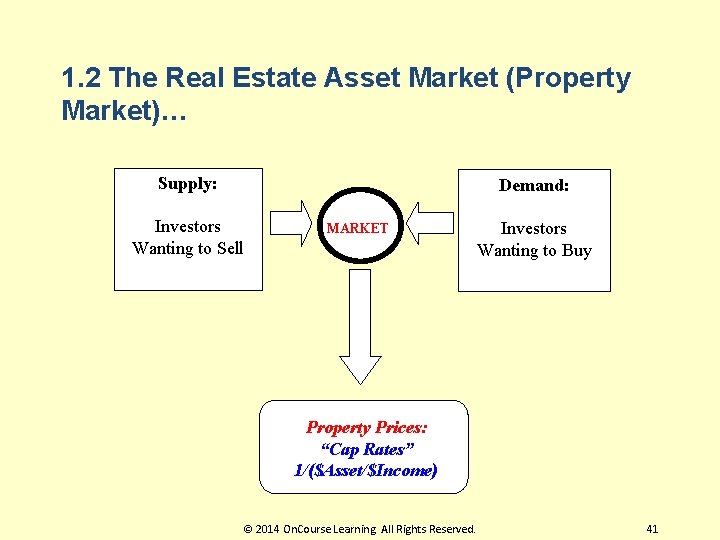

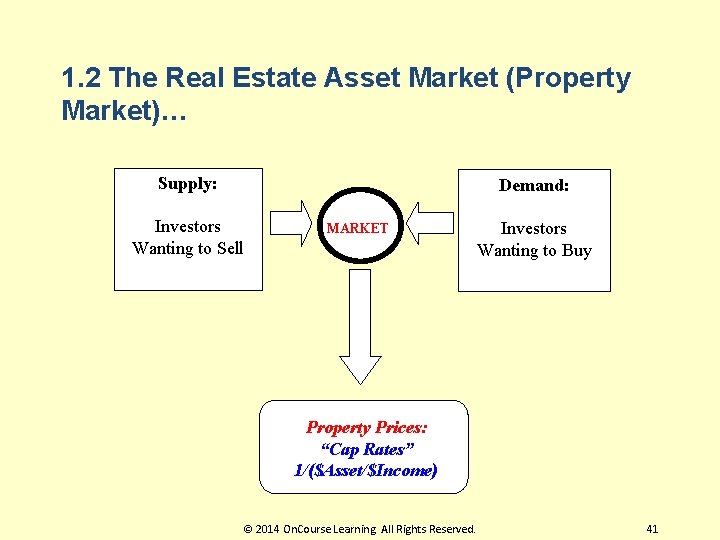

1. 2 The Real Estate Asset Market (Property Market)… Supply: Demand: Investors Wanting to Sell MARKET Investors Wanting to Buy Property Prices: “Cap Rates” 1/($Asset/$Income) © 2014 On. Course Learning. All Rights Reserved. 41

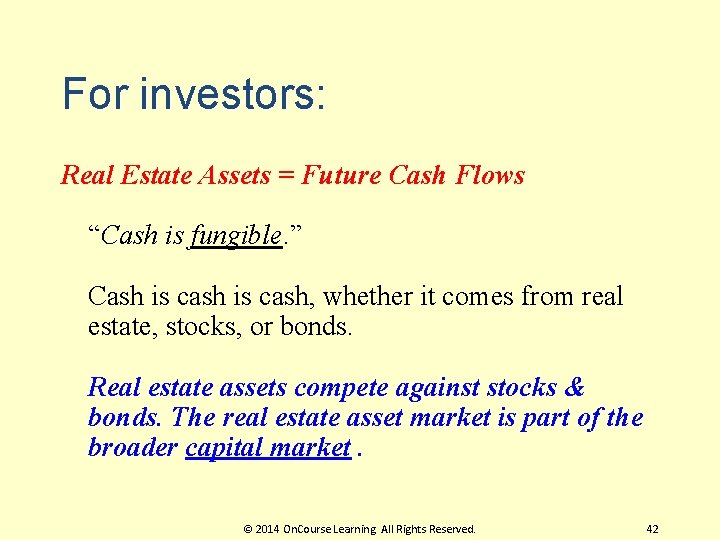

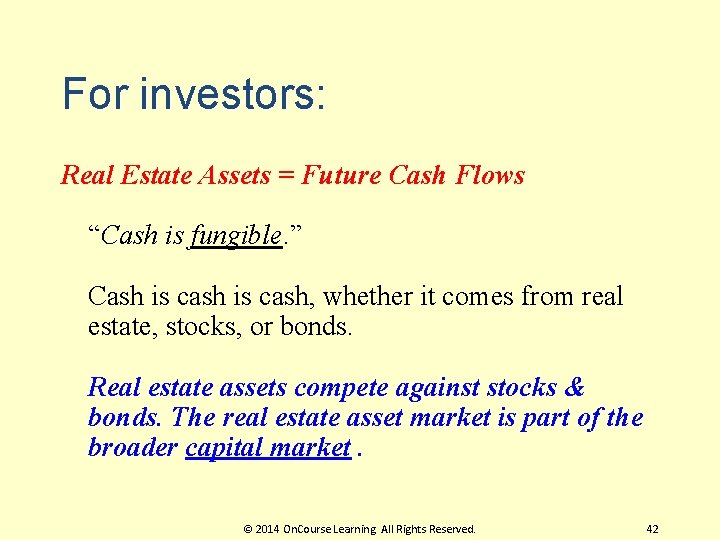

For investors: Real Estate Assets = Future Cash Flows “Cash is fungible. ” Cash is cash, whether it comes from real estate, stocks, or bonds. Real estate assets compete against stocks & bonds. The real estate asset market is part of the broader capital market. © 2014 On. Course Learning. All Rights Reserved. 42

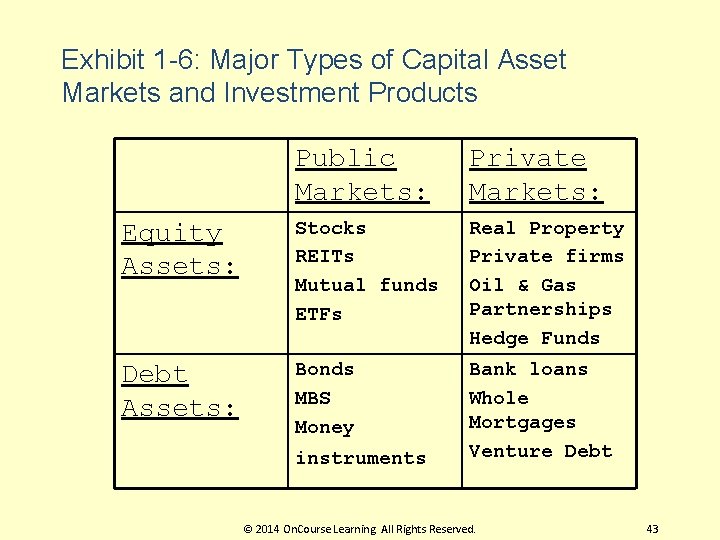

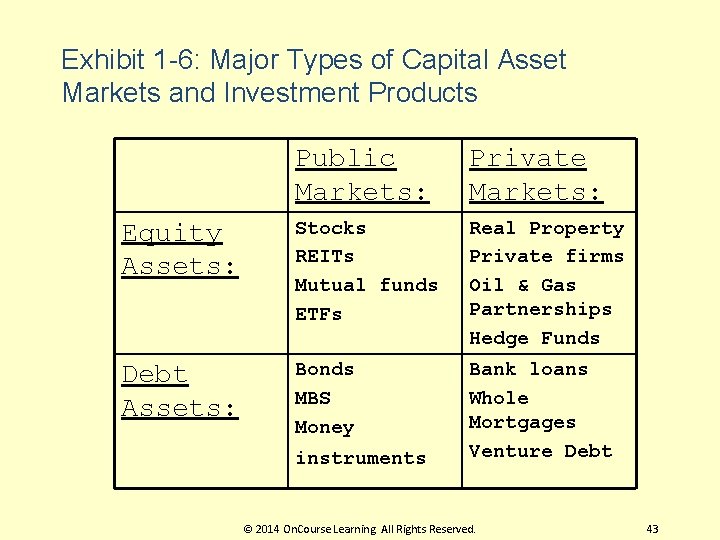

Exhibit 1 -6: Major Types of Capital Asset Markets and Investment Products Public Markets: Private Markets: Equity Assets: Stocks REITs Mutual funds ETFs Real Property Private firms Oil & Gas Partnerships Hedge Funds Debt Assets: Bonds MBS Money Bank loans Whole Mortgages Venture Debt instruments © 2014 On. Course Learning. All Rights Reserved. 43

Concept check… 1. 2. What is the difference between “equity” and “debt” assets (investment products)? … What is the difference between “public” and “private” asset markets? … © 2014 On. Course Learning. All Rights Reserved. 44

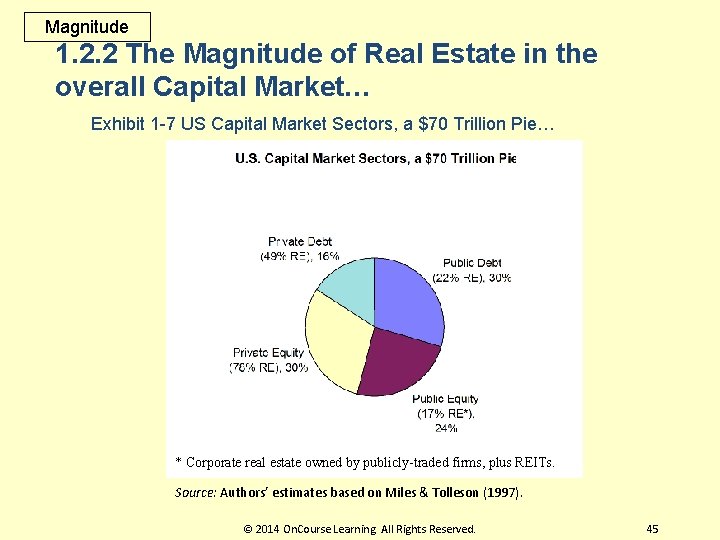

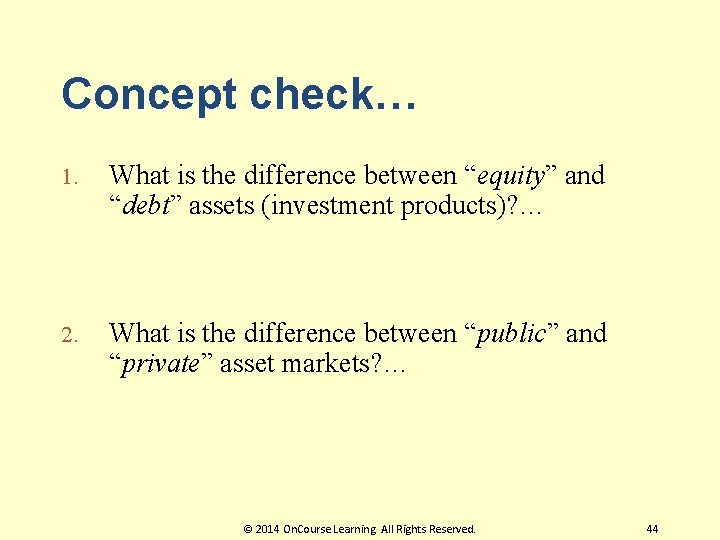

Magnitude 1. 2. 2 The Magnitude of Real Estate in the overall Capital Market… Exhibit 1 -7 US Capital Market Sectors, a $70 Trillion Pie… * Corporate real estate owned by publicly-traded firms, plus REITs. Source: Authors’ estimates based on Miles & Tolleson (1997). © 2014 On. Course Learning. All Rights Reserved. 45

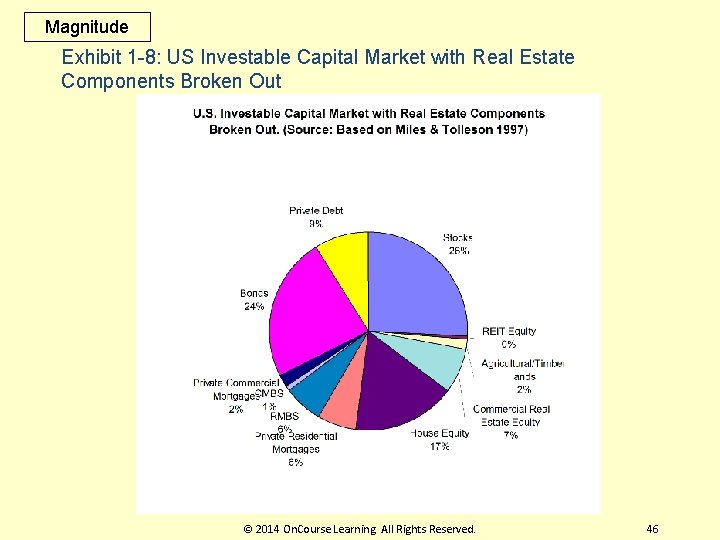

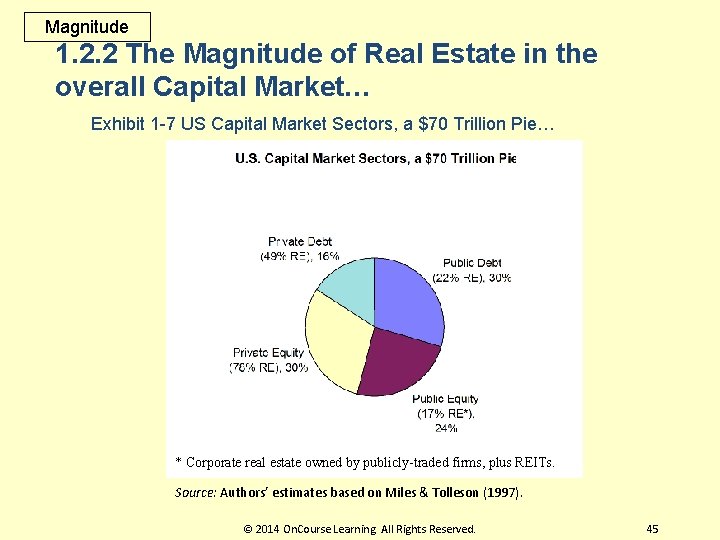

Magnitude Exhibit 1 -8: US Investable Capital Market with Real Estate Components Broken Out © 2014 On. Course Learning. All Rights Reserved. 46

Real estate asset classes are: Private Commercial Mortgages (2%) CMBS (1%) RMBS (6%) Private Residential Mortgages (6%) House Equity (17%) Commercial Real Estate Equity (7%) Agricultural/Timberlands (2%) REITs (0. 5%) © 2014 On. Course Learning. All Rights Reserved. 47

Another perspective on magnitude of real estate in the overall capital market ($ trillion as of 2012) US Investable Asset Sectors, a $82 Trillion Pie… Houses; 20 Bonds; 38 CRE; 9 Stocks; 15 Note: CRE = Commercial Real Estate. There is some double-counting here, betw MBS bonds & RE ($5 T), & between REIT stocks & CRE ($0. 5 T). © 2014 On. Course Learning. All Rights Reserved. 48

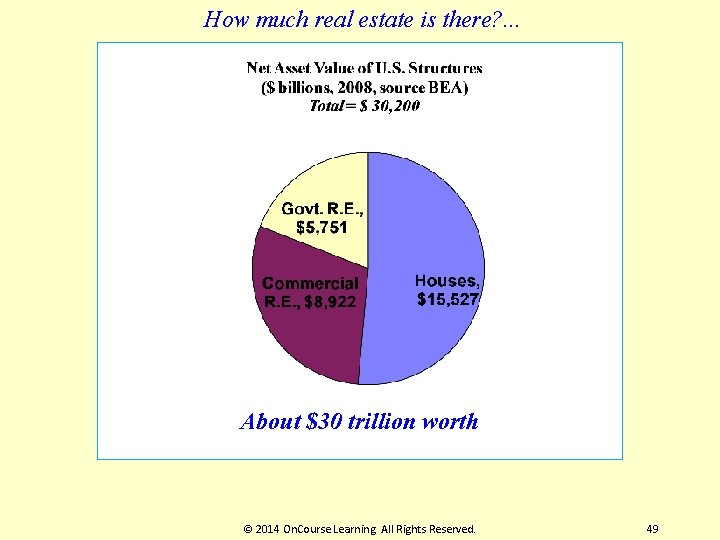

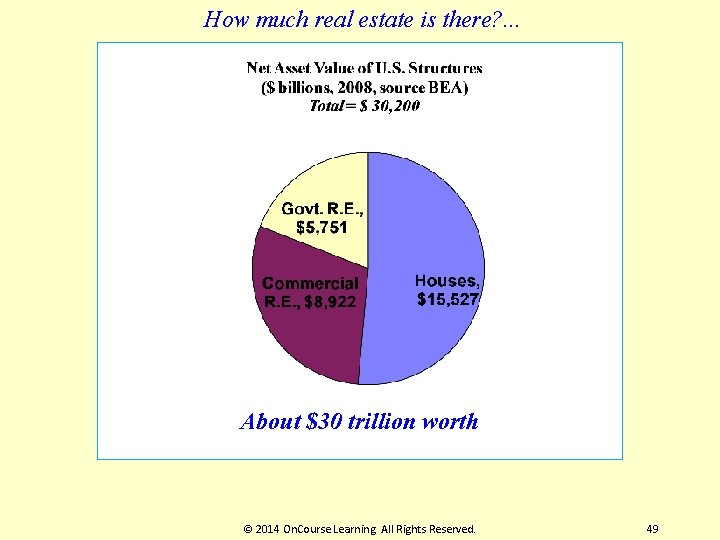

How much real estate is there? . . . About $30 trillion worth © 2014 On. Course Learning. All Rights Reserved. 49

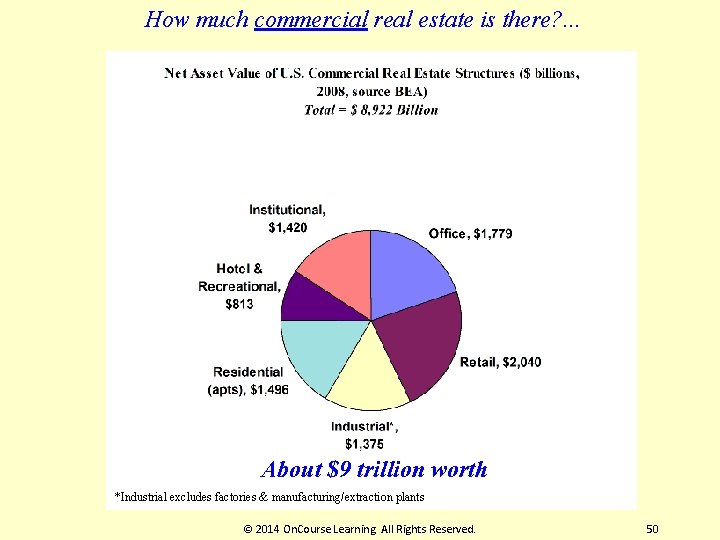

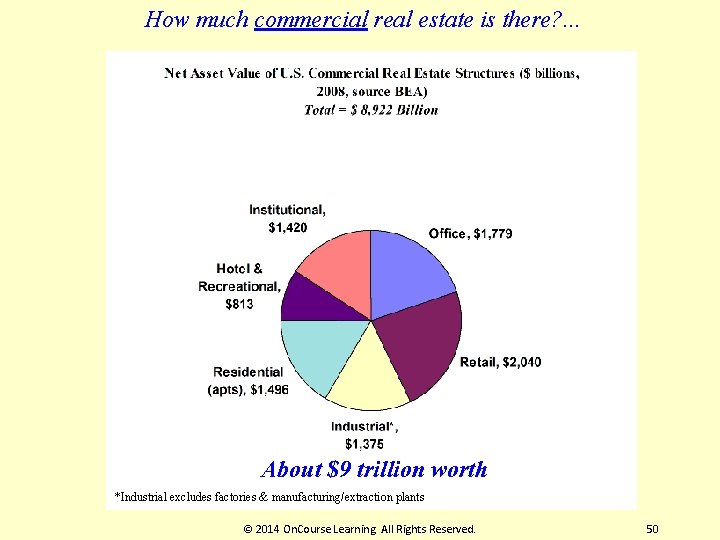

How much commercial real estate is there? . . . About $9 trillion worth *Industrial excludes factories & manufacturing/extraction plants © 2014 On. Course Learning. All Rights Reserved. 50

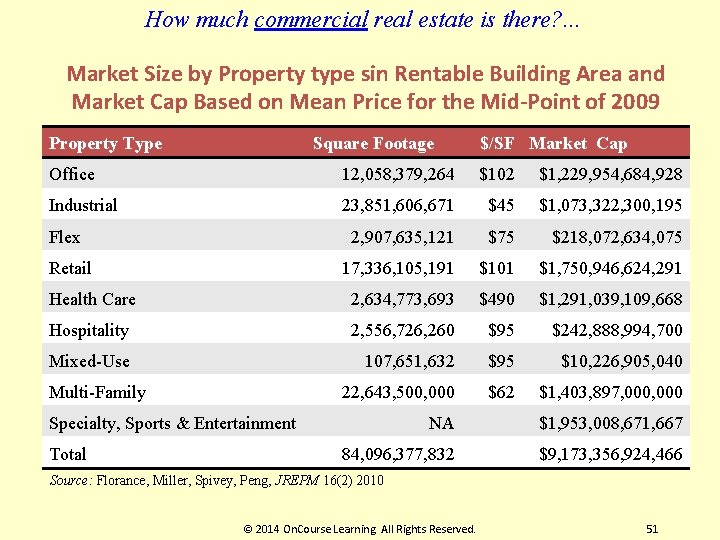

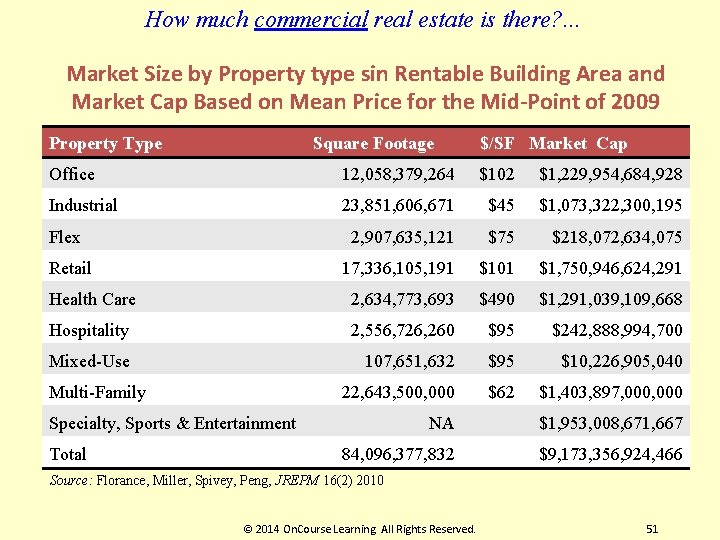

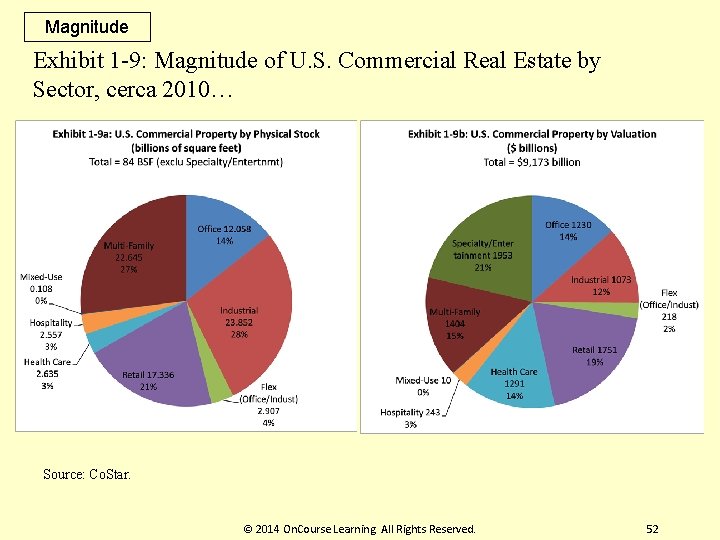

How much commercial real estate is there? . . . Market Size by Property type sin Rentable Building Area and Market Cap Based on Mean Price for the Mid-Point of 2009 Property Type Square Footage $/SF Market Cap Office 12, 058, 379, 264 $102 $1, 229, 954, 684, 928 Industrial 23, 851, 606, 671 $45 $1, 073, 322, 300, 195 2, 907, 635, 121 $75 $218, 072, 634, 075 17, 336, 105, 191 $101 $1, 750, 946, 624, 291 Health Care 2, 634, 773, 693 $490 $1, 291, 039, 109, 668 Hospitality 2, 556, 726, 260 $95 $242, 888, 994, 700 Mixed-Use 107, 651, 632 $95 $10, 226, 905, 040 22, 643, 500, 000 $62 $1, 403, 897, 000 Flex Retail Multi-Family Specialty, Sports & Entertainment Total NA 84, 096, 377, 832 $1, 953, 008, 671, 667 $9, 173, 356, 924, 466 Source: Florance, Miller, Spivey, Peng, JREPM 16(2) 2010 © 2014 On. Course Learning. All Rights Reserved. 51

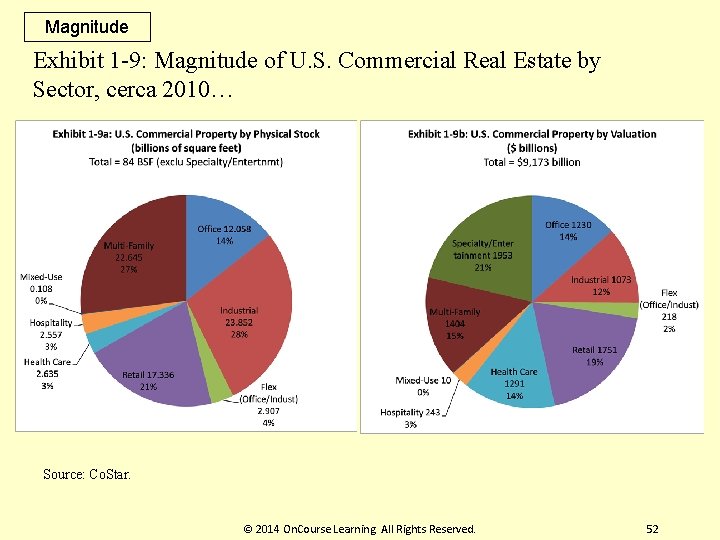

Magnitude Exhibit 1 -9: Magnitude of U. S. Commercial Real Estate by Sector, cerca 2010… Source: Co. Star. © 2014 On. Course Learning. All Rights Reserved. 52

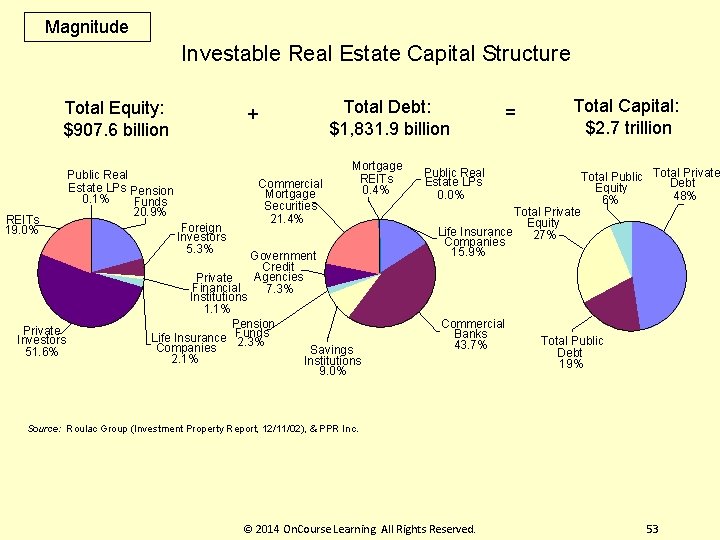

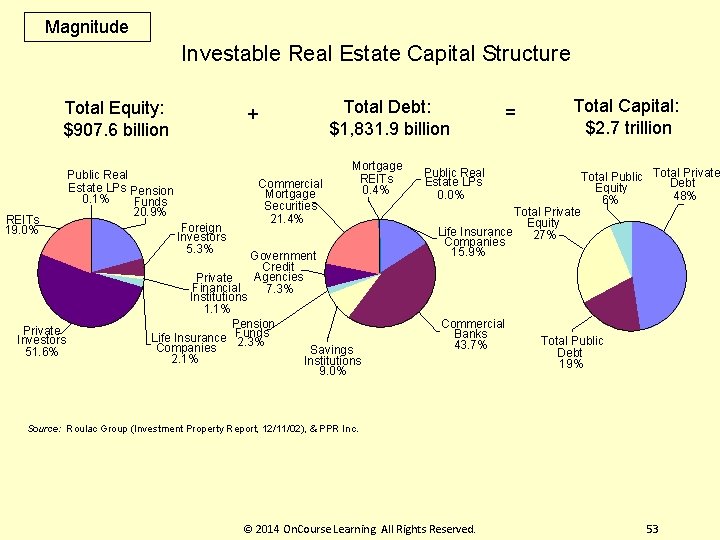

Magnitude Investable Real Estate Capital Structure Total Equity: $907. 6 billion REITs 19. 0% Private Investors 51. 6% + Public Real Estate LPs Pension 0. 1% Funds 20. 9% Foreign Investors 5. 3% Total Debt: $1, 831. 9 billion Commercial Mortgage Securities 21. 4% Mortgage REITs 0. 4% Government Credit Private Agencies Financial 7. 3% Institutions 1. 1% Pension Life Insurance Funds 2. 3% Companies Savings 2. 1% Institutions 9. 0% = Total Capital: $2. 7 trillion Public Real Estate LPs 0. 0% Total Public Total Private Debt Equity 48% 6% Total Private Equity Life Insurance 27% Companies 15. 9% Commercial Banks 43. 7% Total Public Debt 19% Source: Roulac Group (Investment Property Report, 12/11/02), & PPR Inc. © 2014 On. Course Learning. All Rights Reserved. 53

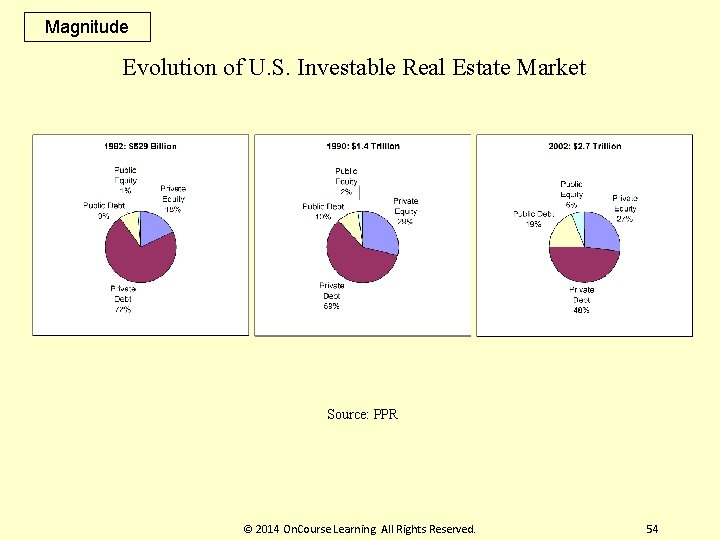

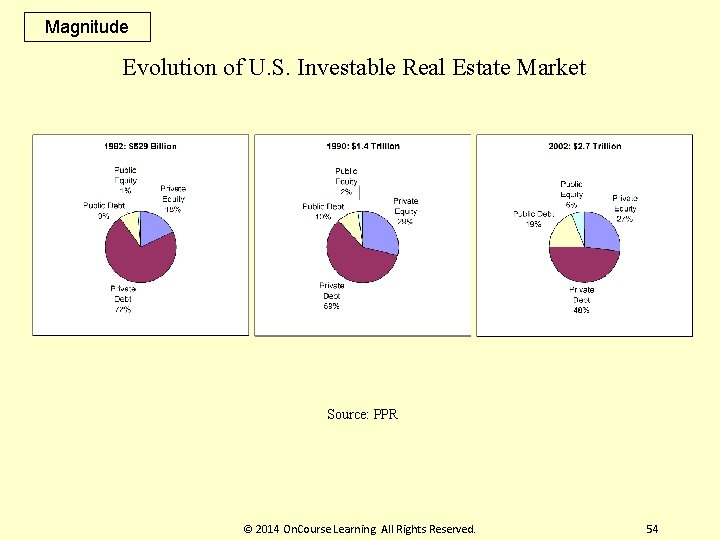

Magnitude Evolution of U. S. Investable Real Estate Market Source: PPR © 2014 On. Course Learning. All Rights Reserved. 54

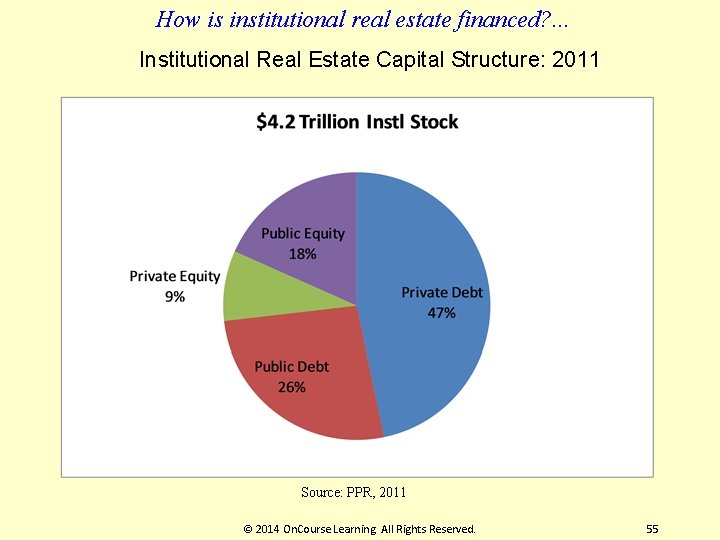

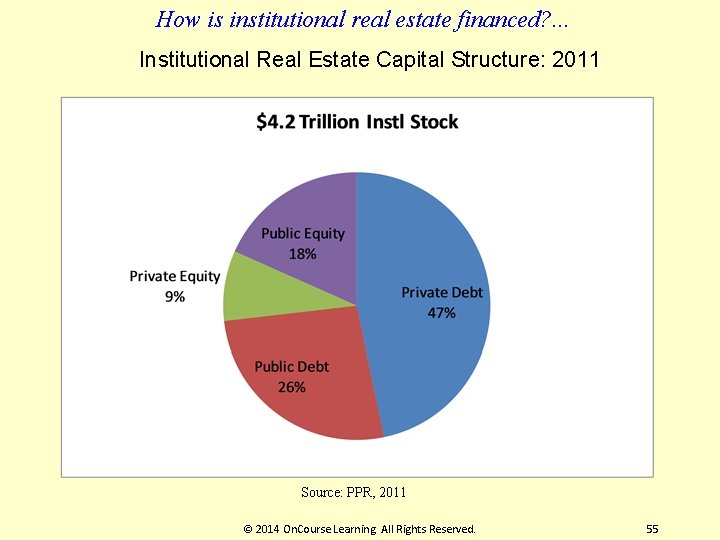

How is institutional real estate financed? . . . Institutional Real Estate Capital Structure: 2011 Source: PPR, 2011 © 2014 On. Course Learning. All Rights Reserved. 55

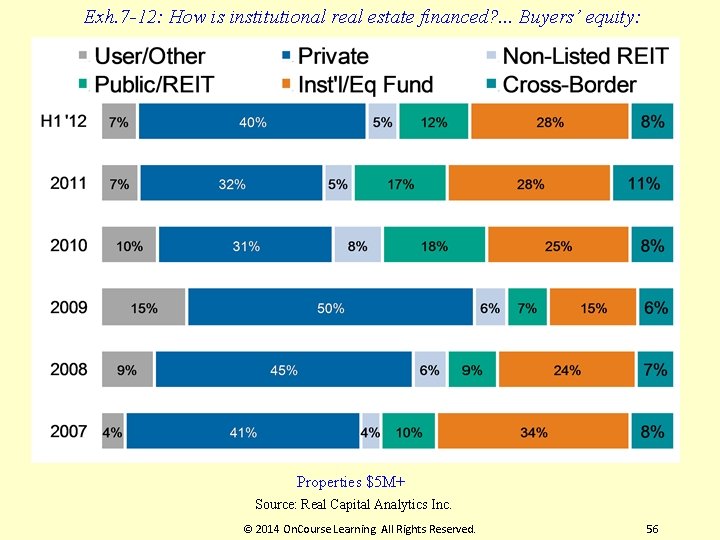

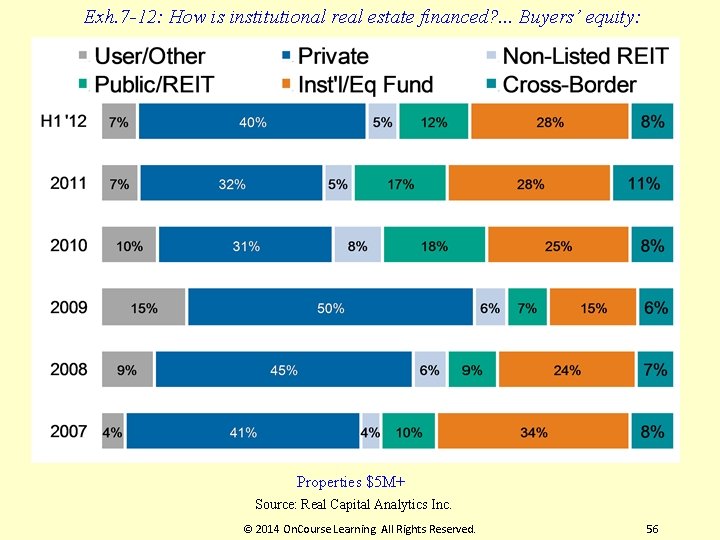

Exh. 7 -12: How is institutional real estate financed? . . . Buyers’ equity: Properties $5 M+ Source: Real Capital Analytics Inc. © 2014 On. Course Learning. All Rights Reserved. 56

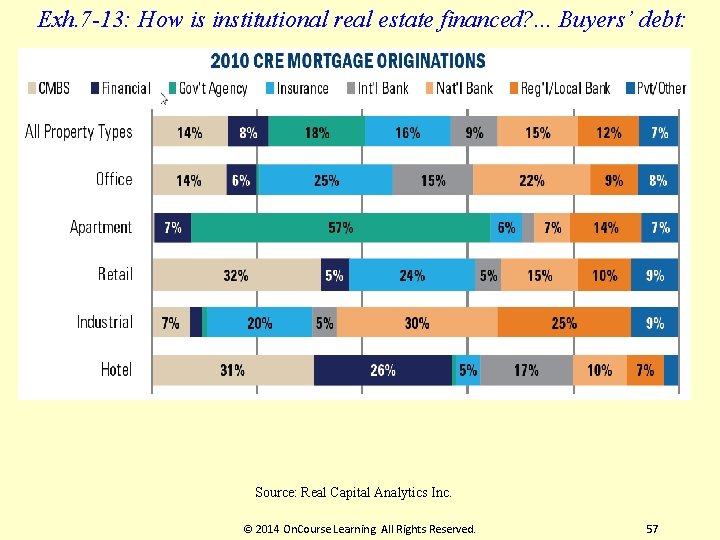

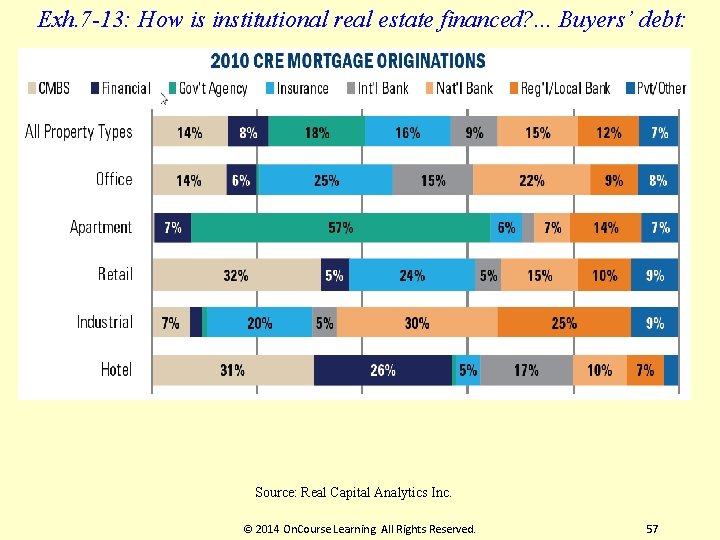

Exh. 7 -13: How is institutional real estate financed? . . . Buyers’ debt: Source: Real Capital Analytics Inc. © 2014 On. Course Learning. All Rights Reserved. 57

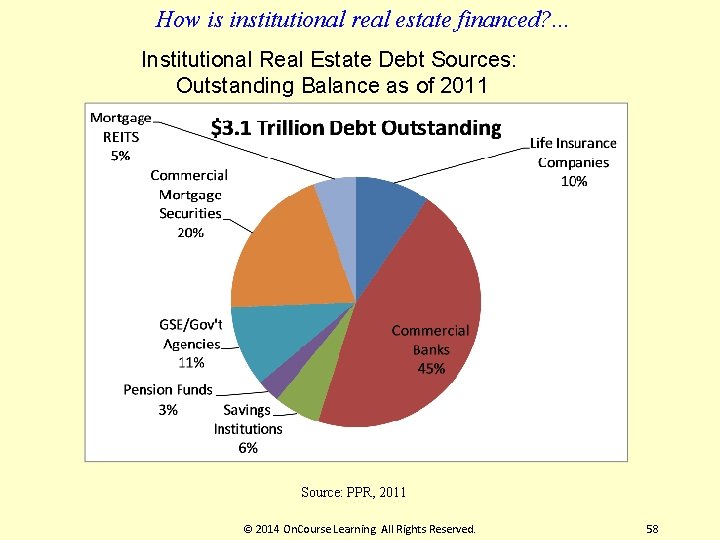

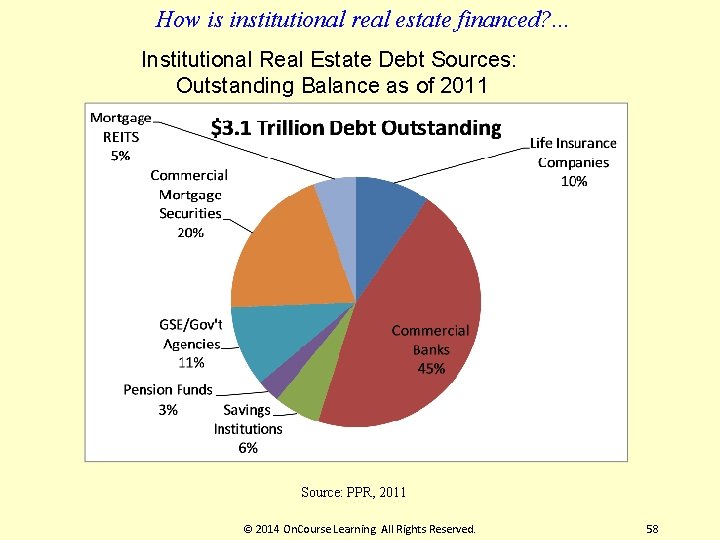

How is institutional real estate financed? . . . Institutional Real Estate Debt Sources: Outstanding Balance as of 2011 Source: PPR, 2011 © 2014 On. Course Learning. All Rights Reserved. 58

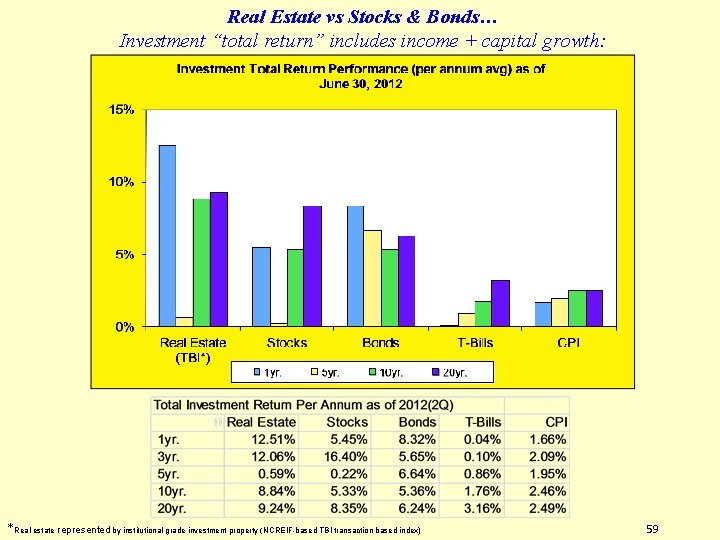

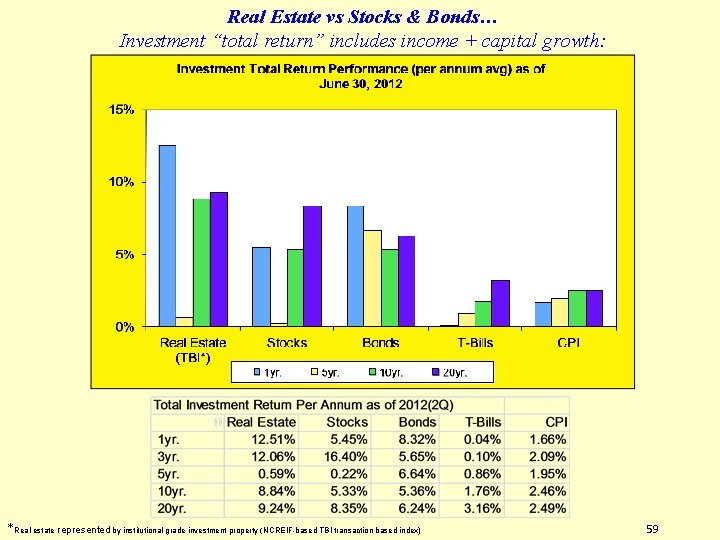

Real Estate vs Stocks & Bonds… Investment “total return” includes income + capital growth: *Real estate represented by institutional grade investment property (NCREIF-based TBI transaction based index) 59

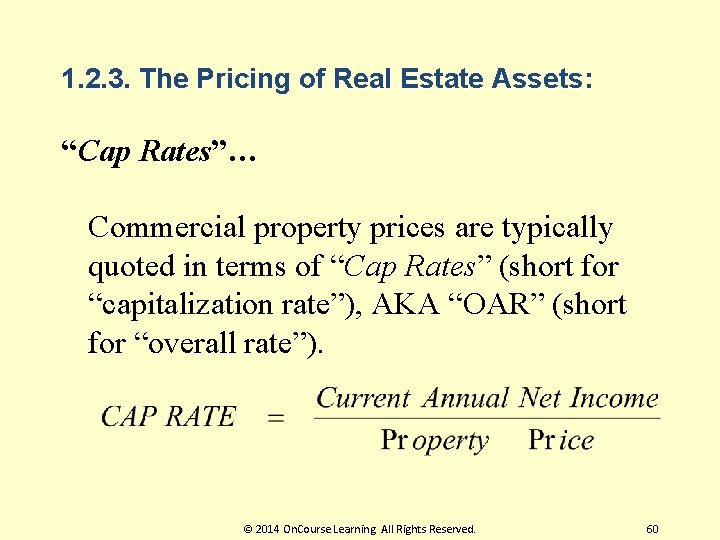

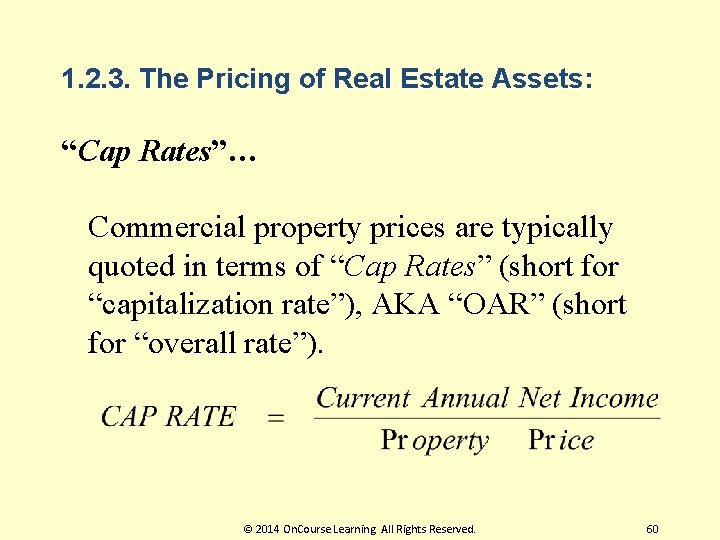

1. 2. 3. The Pricing of Real Estate Assets: “Cap Rates”… Commercial property prices are typically quoted in terms of “Cap Rates” (short for “capitalization rate”), AKA “OAR” (short for “overall rate”). © 2014 On. Course Learning. All Rights Reserved. 60

The Cap Rate is like: l Current yield on the investment. l Inverse of “Price/Earnings” Multiple. © 2014 On. Course Learning. All Rights Reserved. 61

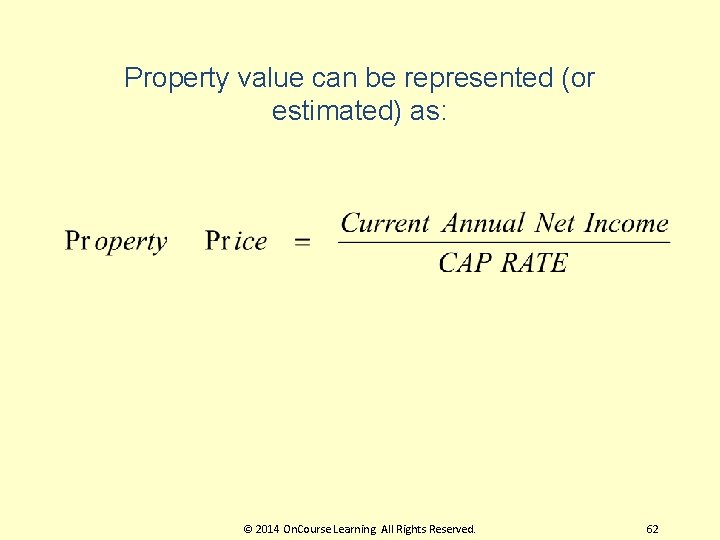

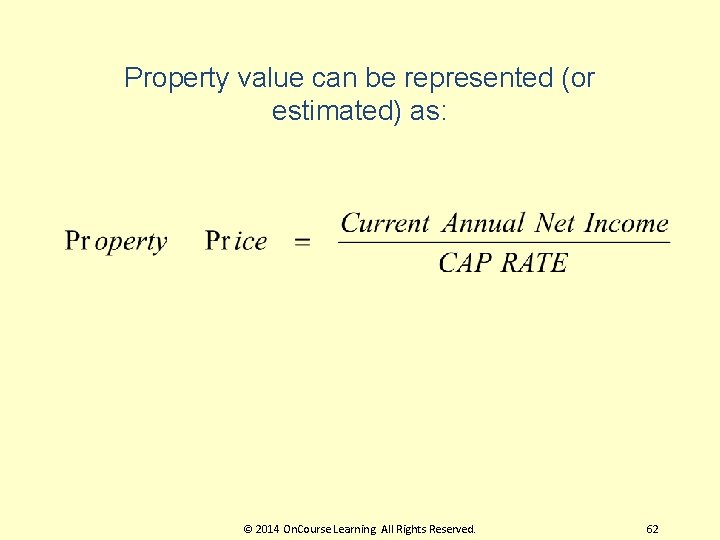

Property value can be represented (or estimated) as: © 2014 On. Course Learning. All Rights Reserved. 62

Three major determinants of cap rates … 1) The Opportunity Cost of Capital (OCC) This comes from the capital market. How much return can investor’s expect to earn in other types of investments, like stocks, bonds, money mkt? … Higher real interest rates or higher expected returns in other types of investments will require higher expected returns in real estate, and therefore higher cap rates, other things being equal. © 2014 On. Course Learning. All Rights Reserved. 63

Three major determinants of cap rates … 2) Growth Expectations in the property’s future cash flows This comes from the space market. How much can investor’s expect that this property’s net cash flow (rents - expenses) will be able to grow over the coming years? … Higher (realistic) growth expectations will allow a lower cap rate, as investors will be willing to pay more $ today for a given amount of current net income, in order to own the property (since this income is expected to grow). © 2014 On. Course Learning. All Rights Reserved. 64

Three major determinants of cap rates … 3) Risk perceptions and preferences among investors, regarding the property. This comes from both the space market and the capital market (risk is relative). How risky is an investment in this property, and how much do investors care about that risk? … Greater risk, and greater sensitivity to risk, will require higher cap rates (lower asset values per $ of current income). © 2014 On. Course Learning. All Rights Reserved. 65

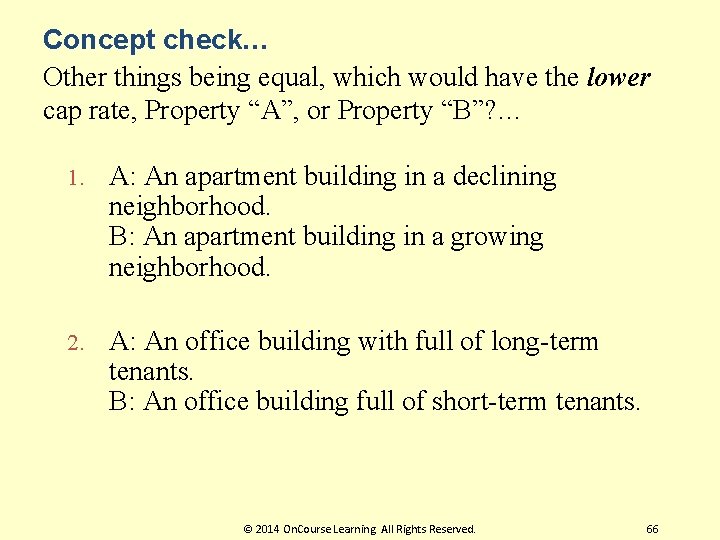

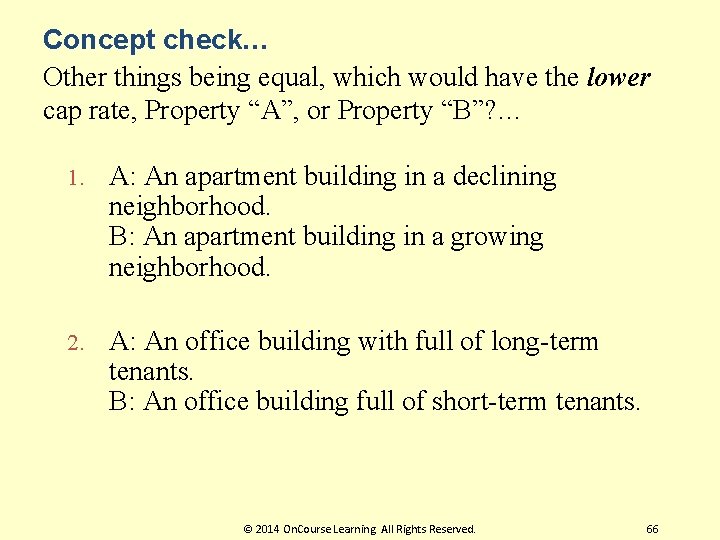

Concept check… Other things being equal, which would have the lower cap rate, Property “A”, or Property “B”? … 1. A: An apartment building in a declining neighborhood. B: An apartment building in a growing neighborhood. 2. A: An office building with full of long-term tenants. B: An office building full of short-term tenants. © 2014 On. Course Learning. All Rights Reserved. 66

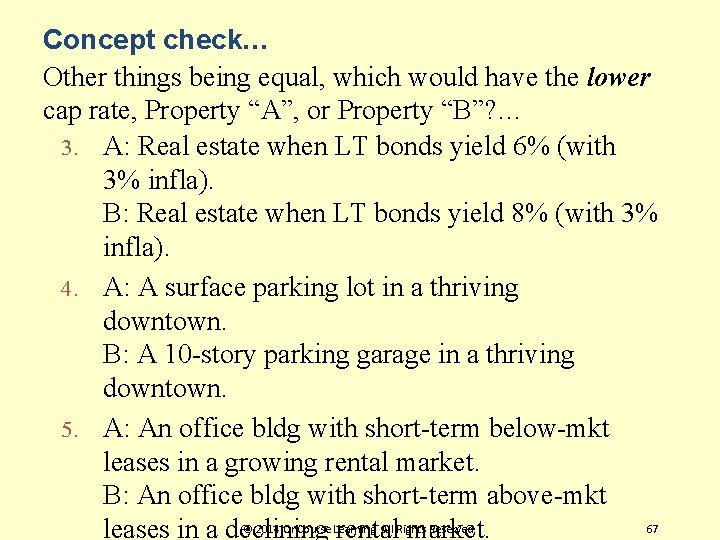

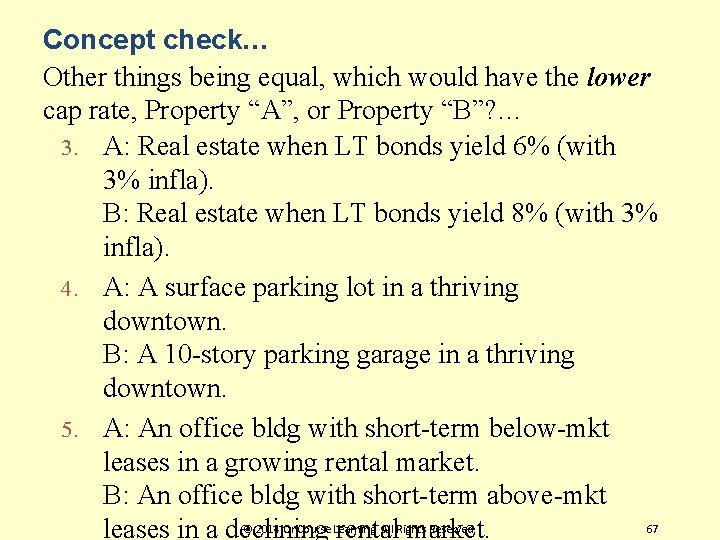

Concept check… Other things being equal, which would have the lower cap rate, Property “A”, or Property “B”? … 3. A: Real estate when LT bonds yield 6% (with 3% infla). B: Real estate when LT bonds yield 8% (with 3% infla). 4. A: A surface parking lot in a thriving downtown. B: A 10 -story parking garage in a thriving downtown. 5. A: An office bldg with short-term below-mkt leases in a growing rental market. B: An office bldg with short-term above-mkt © 2014 On. Course Learning. All Rights Reserved. 67 leases in a declining rental market.

1. 2. 4 Asset Markets Are Not (very) Segmented… “Physical Capital” = Real physical assets that produce real goods or services over an extended period of time. l “Financial Capital” = Money. l Physical capital is specific and relatively immobile. l Financial capital is fungible (homogeneous) and very mobile. l © 2014 On. Course Learning. All Rights Reserved. 68

Physical Capital and Financial Capital l In the real estate asset market, financial capital is used to purchase physical capital assets. l The real estate space market deals with physical capital. l The real estate asset market deals with financial capital. © 2014 On. Course Learning. All Rights Reserved. 69

Financial Capital Financial capital can quickly and easily flow from a Manhattan office bldg to a Chicago office bldg or a Dallas apt bldg. Returns are returns, because $$$ are $$$, whether those $$$ come from New York office rents, Chicago office rents, or Dallas apartment rents. Therefore: © 2014 On. Course Learning. All Rights Reserved. 70

THE REAL ESTATE ASSET MARKET IS NOT SEGMENTED LIKE THE SPACE MARKET Integrated (not segmented) real estate asset market Asset prices are such that expected returns are the same for properties with the same risk, across different property market segments… © 2014 On. Course Learning. All Rights Reserved. 71

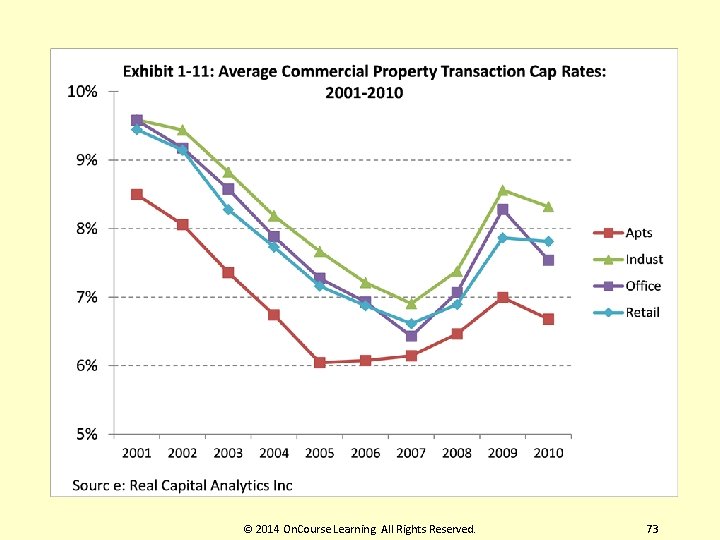

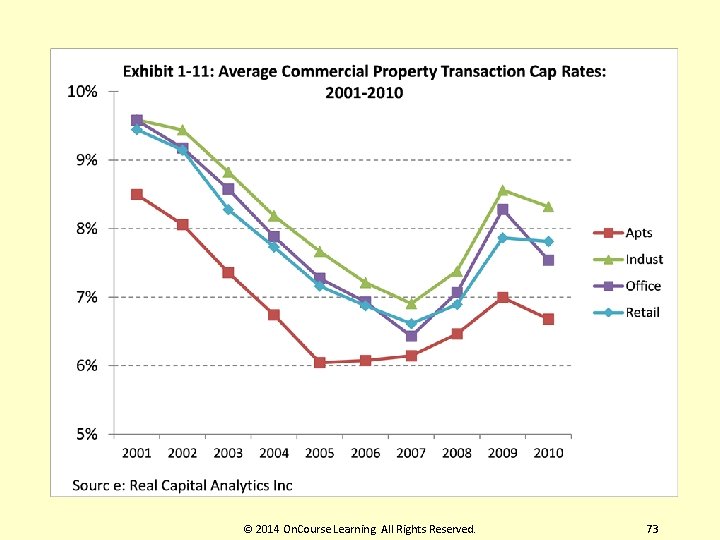

Exhibit 1 -10: Typical Cap Rates, 3 rd Qtr 1994: © 2014 On. Course Learning. All Rights Reserved. 72

© 2014 On. Course Learning. All Rights Reserved. 73

Concept check… 1) Why are the cap rates lower for mall? … 2) Why are the cap rates higher for hotels and offices in “oversupplied” markets? … © 2014 On. Course Learning. All Rights Reserved. 74

What is space market in real estate

What is space market in real estate Greek real estate market

Greek real estate market Bhubaneswar real estate market

Bhubaneswar real estate market Moldova real estate market

Moldova real estate market Estonian real estate market

Estonian real estate market Estonian real estate market

Estonian real estate market 11245 lantern road fishers in 46038

11245 lantern road fishers in 46038 Chapter 11 real estate and other investments

Chapter 11 real estate and other investments Leader follower challenger nicher

Leader follower challenger nicher Define market segmentation targeting and positioning

Define market segmentation targeting and positioning 60 second elevator pitch

60 second elevator pitch Kwueval

Kwueval Real estate stakeholders

Real estate stakeholders Sandy miller realtor

Sandy miller realtor Littoral rights real estate

Littoral rights real estate What are the 4 types of real estate

What are the 4 types of real estate Real estate financial analysis

Real estate financial analysis Strategicerp-real estate erp software

Strategicerp-real estate erp software The four quadrant model real estate

The four quadrant model real estate Involuntary alienation

Involuntary alienation Blind ad real estate

Blind ad real estate Emblements real estate

Emblements real estate Manoj chatlani

Manoj chatlani Encumbered real estate

Encumbered real estate What do you mean by industrial estate

What do you mean by industrial estate Irs audit real estate professional

Irs audit real estate professional Real property definition

Real property definition Florida real estate principles practices & law

Florida real estate principles practices & law Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Erp for real estate developers

Erp for real estate developers Arizona real estate law book

Arizona real estate law book Millionaire real estate investor worksheets

Millionaire real estate investor worksheets Buyers packet real estate

Buyers packet real estate Tucker school of real estate

Tucker school of real estate The student handbook to the appraisal of real estate

The student handbook to the appraisal of real estate Conclusion of real estate management system

Conclusion of real estate management system Urban economics and real estate markets

Urban economics and real estate markets Haji real estate

Haji real estate Modern real estate practice in pennsylvania

Modern real estate practice in pennsylvania Modern real estate practice in illinois

Modern real estate practice in illinois Real estate lecture

Real estate lecture Thanandpaul

Thanandpaul La real estate appraisers board

La real estate appraisers board Free real estate powerpoint templates

Free real estate powerpoint templates Florida real estate principles practices & law 43rd edition

Florida real estate principles practices & law 43rd edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Denver real estate investment associations

Denver real estate investment associations Property development proposal

Property development proposal Pro forma real estate

Pro forma real estate Real estate principles a value approach

Real estate principles a value approach Easton v strassburger real estate

Easton v strassburger real estate Closing statements real estate

Closing statements real estate Non performing notes investing

Non performing notes investing Hud.gov homesforsale

Hud.gov homesforsale Unlimited funding for real estate

Unlimited funding for real estate Seizen real estate

Seizen real estate Osbe meaning real estate

Osbe meaning real estate Rti meaning real estate

Rti meaning real estate Psak 44

Psak 44 Ebrd real estate

Ebrd real estate Unruh civil rights act real estate

Unruh civil rights act real estate Guidance note on accounting for real estate transactions

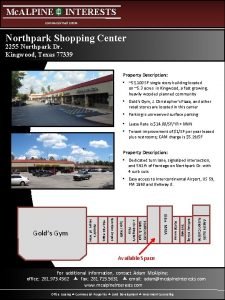

Guidance note on accounting for real estate transactions Alpine commercial investment

Alpine commercial investment Dan duffy united real estate

Dan duffy united real estate Real estate assessment center

Real estate assessment center Strategic real estate services

Strategic real estate services Florida real estate principles

Florida real estate principles Florida real estate principles practices & law

Florida real estate principles practices & law Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide 6th edition

Florida real estate broker's guide 6th edition Florida real estate broker's guide

Florida real estate broker's guide Best entity for real estate

Best entity for real estate Touchbase real estate

Touchbase real estate