Chapter 1 Fisher Separation Theorem A Consumption and

- Slides: 21

Chapter 1 Fisher Separation Theorem

A. Consumption and investment without capital markets 1. Assumptions 1) All outcomes from investment are known with certainty, i. e Ri=a 1 u 1+a 2 u 2+…+anun 2) No transaction costs, no exchange 3) No taxes 4) Two-period model

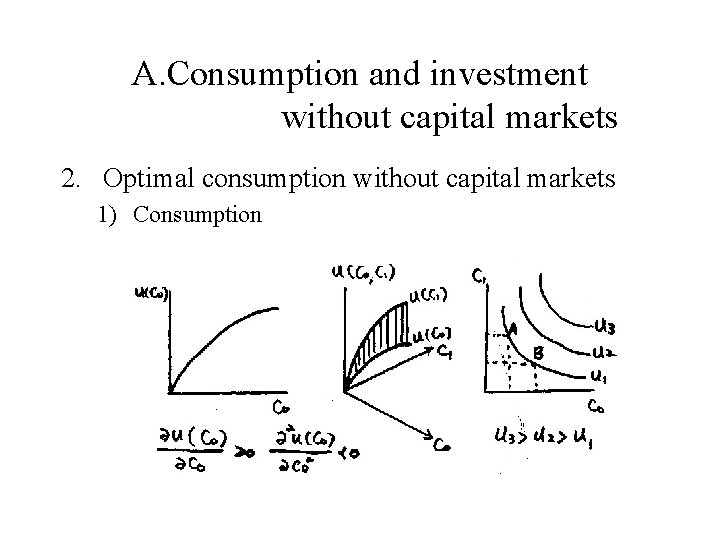

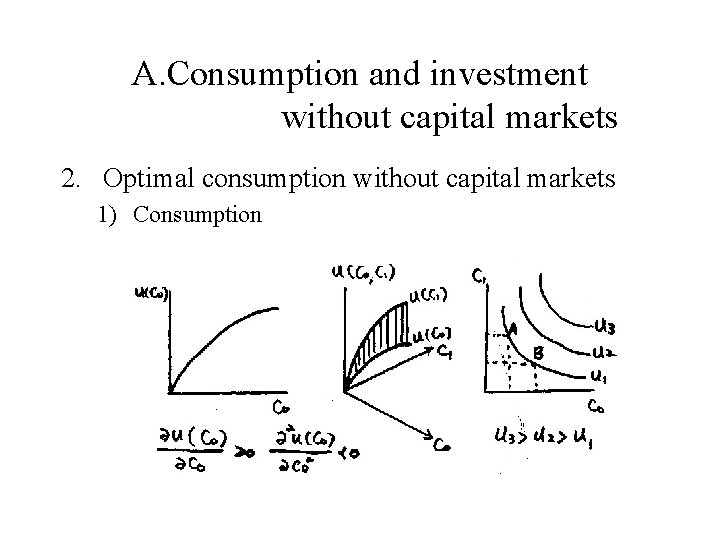

A. Consumption and investment without capital markets 2. Optimal consumption without capital markets 1) Consumption

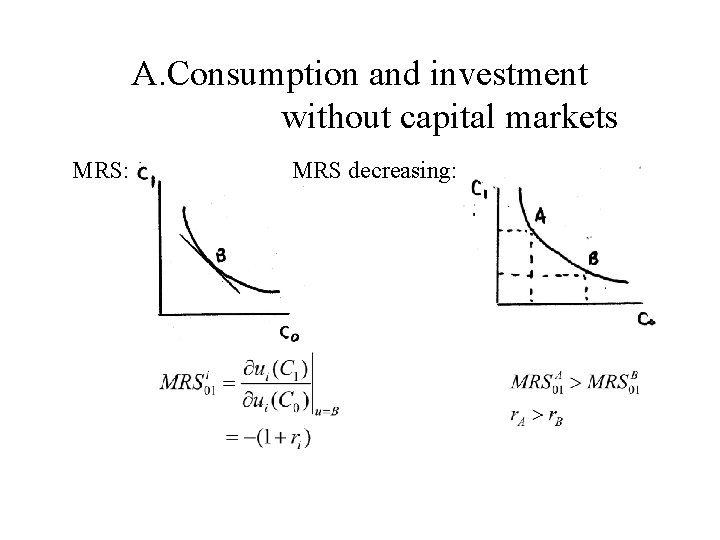

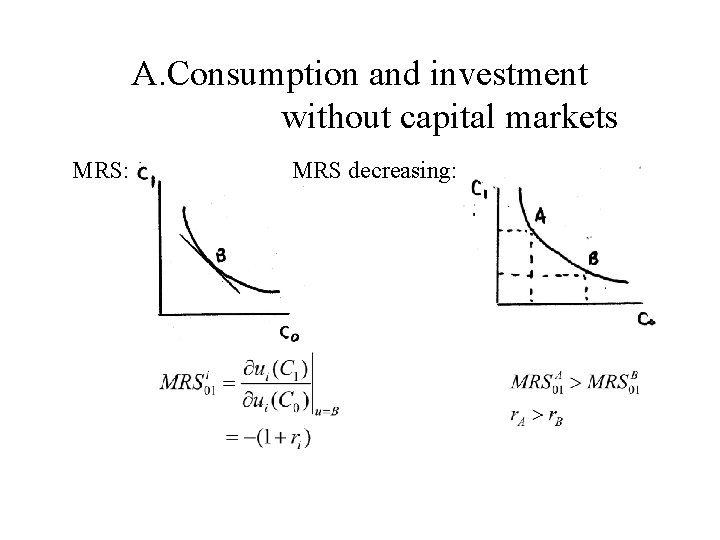

A. Consumption and investment without capital markets MRS: MRS decreasing:

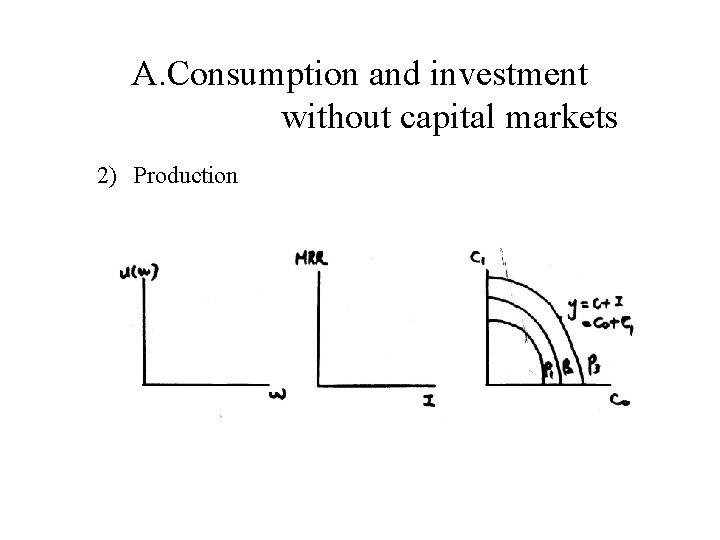

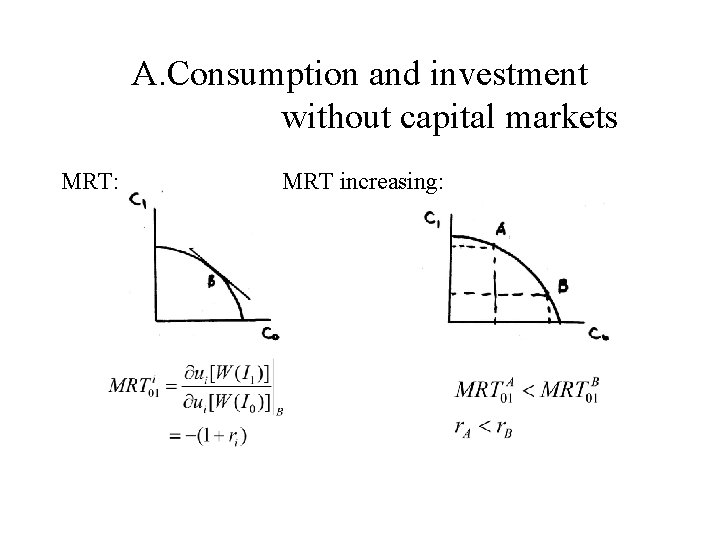

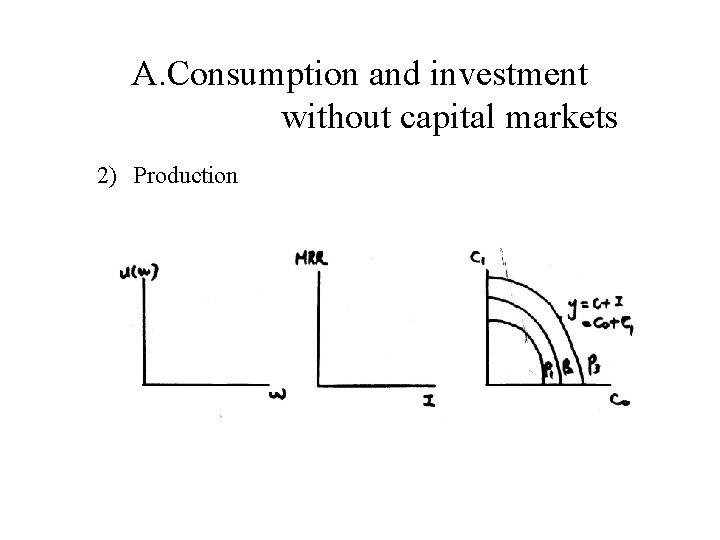

A. Consumption and investment without capital markets 2) Production

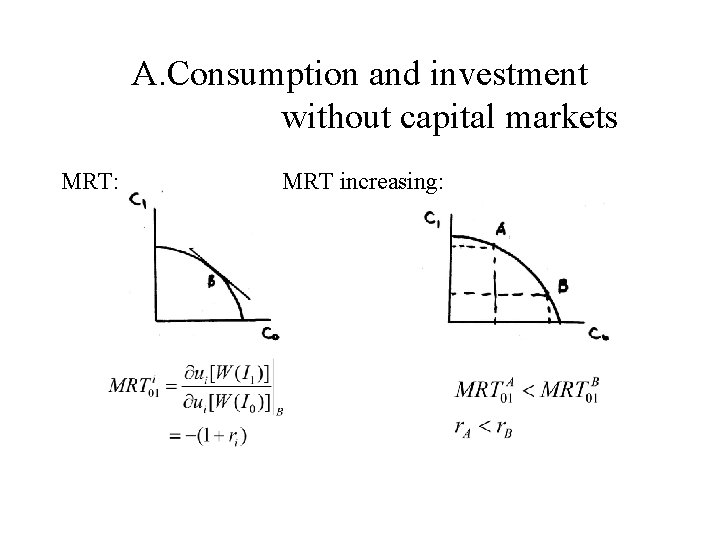

A. Consumption and investment without capital markets MRT: MRT increasing:

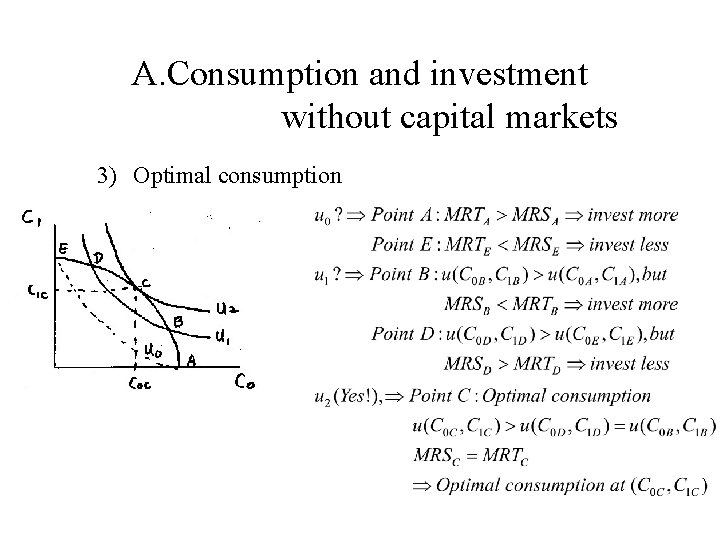

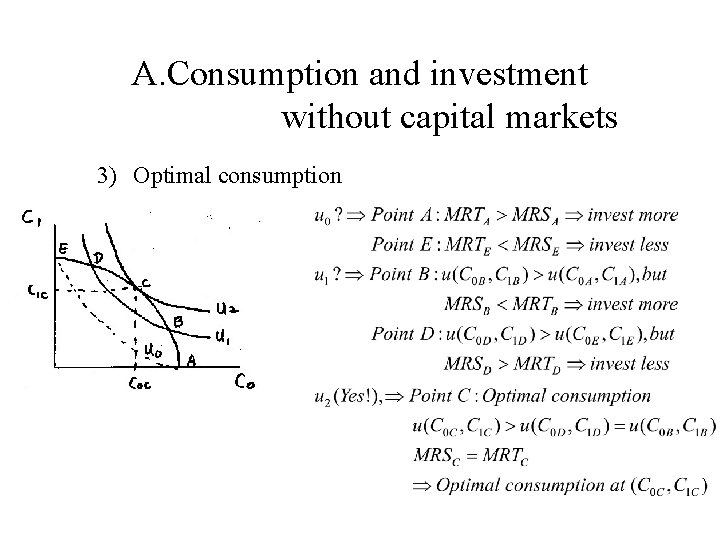

A. Consumption and investment without capital markets 3) Optimal consumption

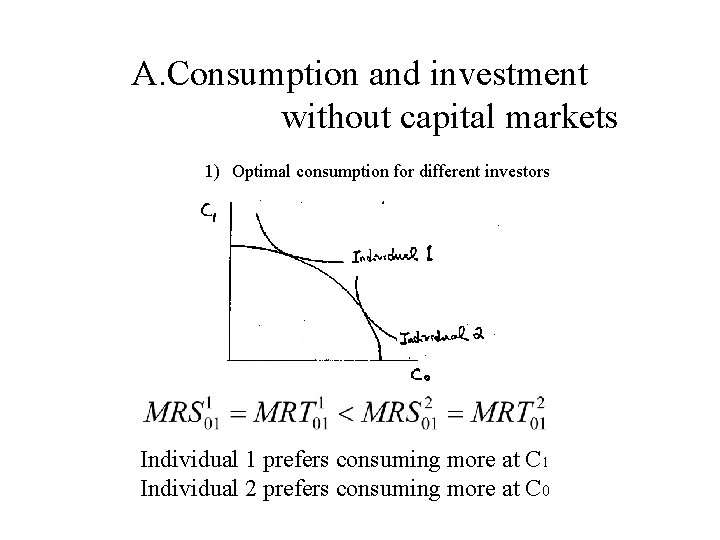

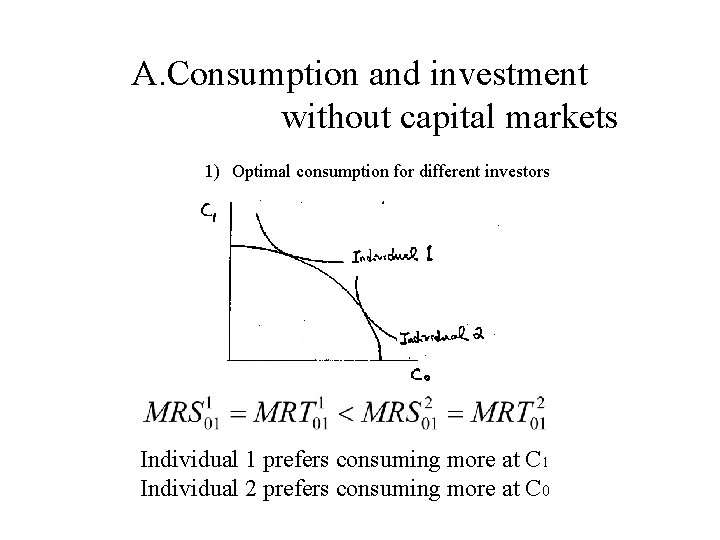

A. Consumption and investment without capital markets 1) Optimal consumption for different investors Individual 1 prefers consuming more at C 1 Individual 2 prefers consuming more at C 0

B. Consumption and investment with capital markets 1. Assumptions 1) All outcomes from investment are known with certainty. 2) Inter-temporal exchange rate of consumption bundles, r>0 is known. No transaction costs. 3) No taxes. 4) Two-period model

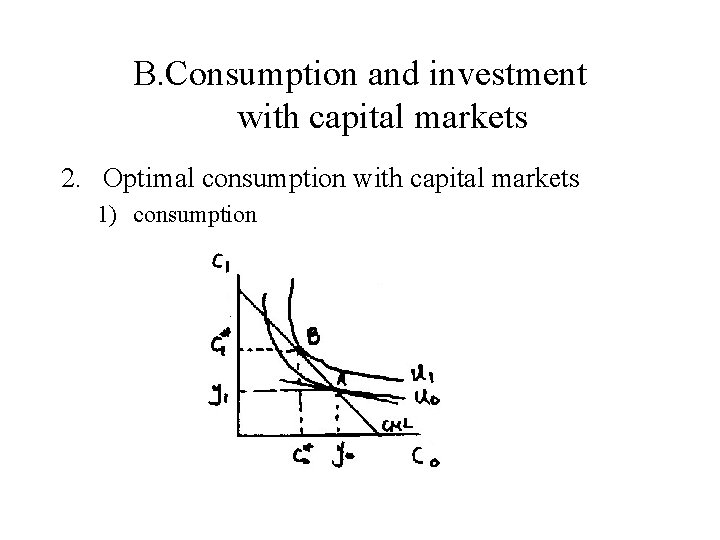

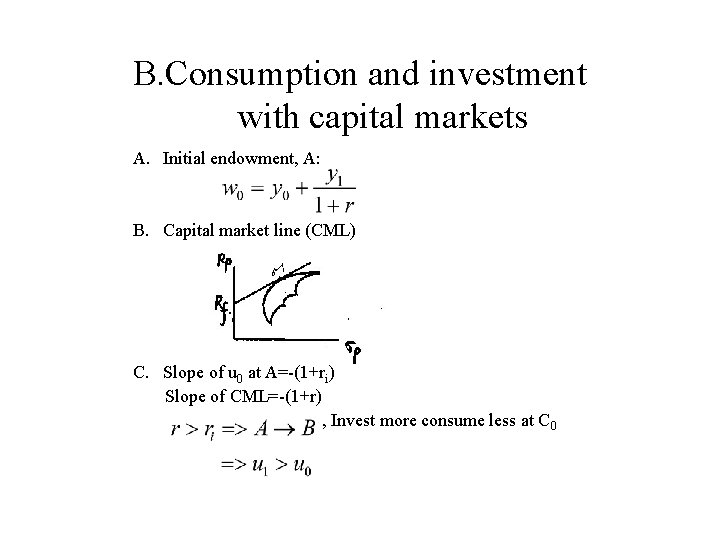

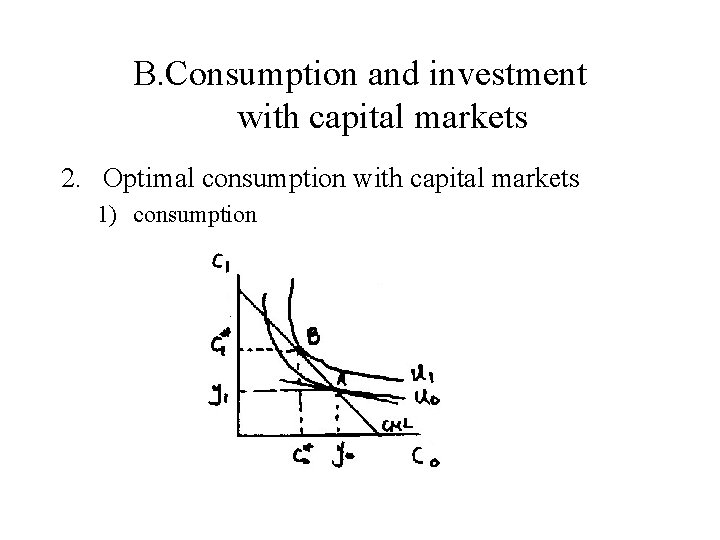

B. Consumption and investment with capital markets 2. Optimal consumption with capital markets 1) consumption

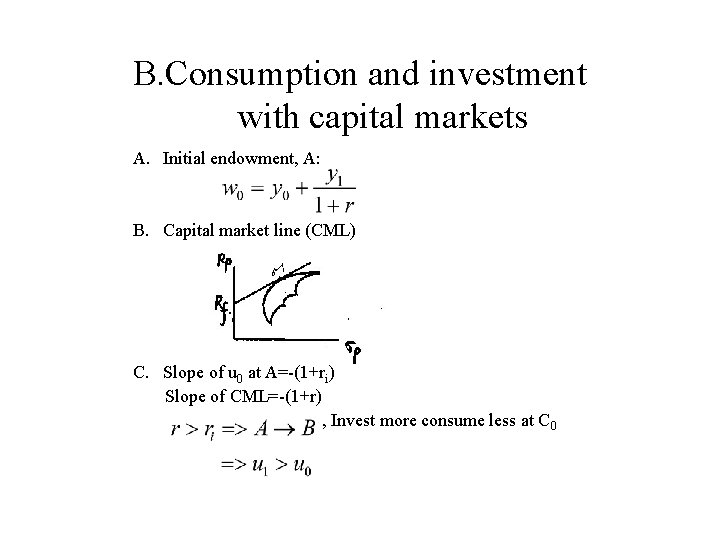

B. Consumption and investment with capital markets A. Initial endowment, A: B. Capital market line (CML) C. Slope of u 0 at A=-(1+ri) Slope of CML=-(1+r) , Invest more consume less at C 0

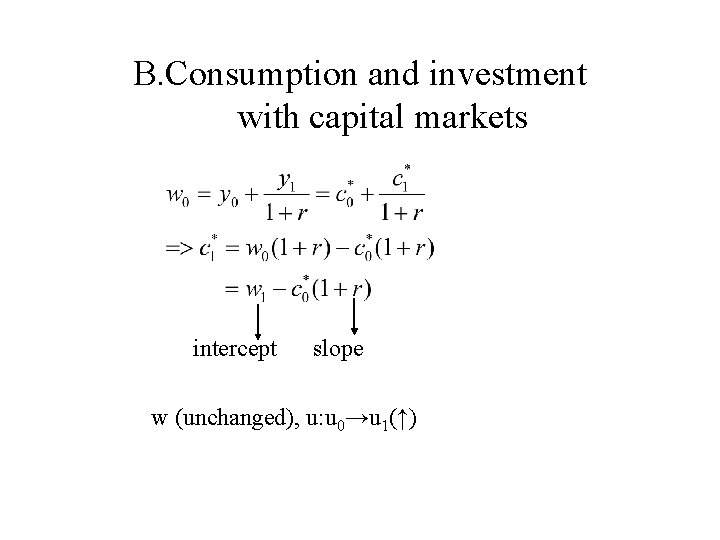

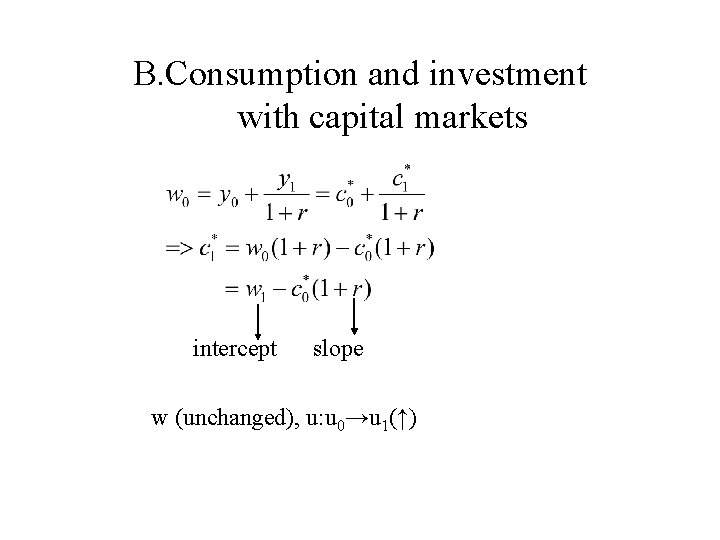

B. Consumption and investment with capital markets intercept slope w (unchanged), u: u 0→u 1(↑)

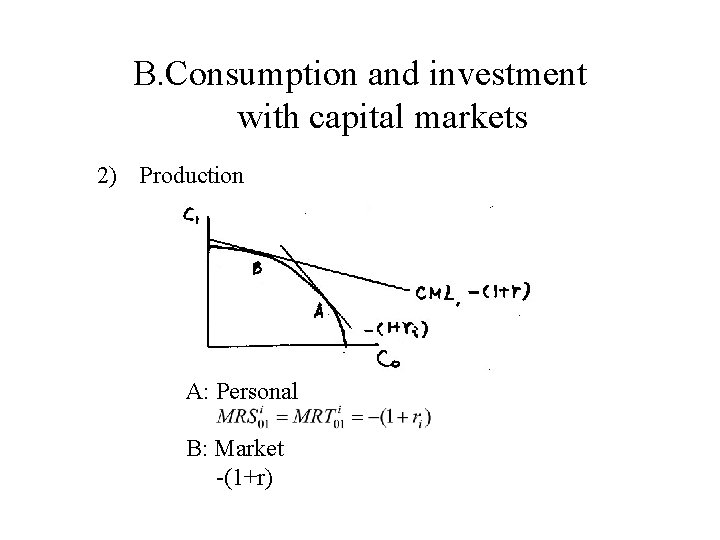

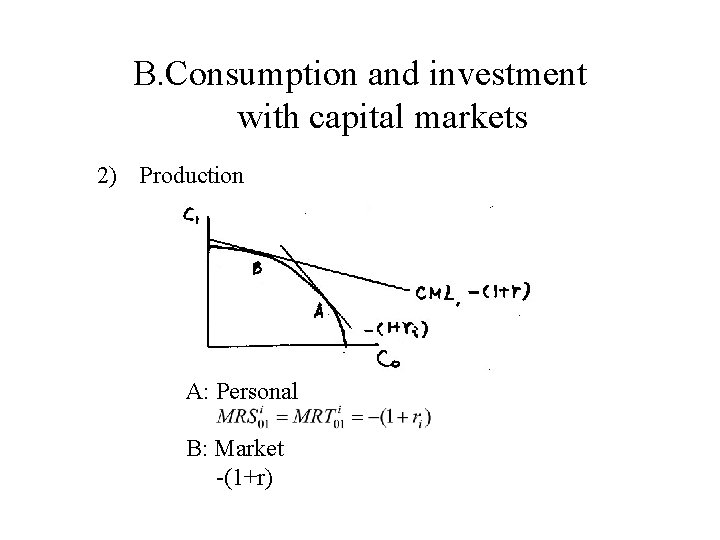

B. Consumption and investment with capital markets 2) Production A: Personal B: Market -(1+r)

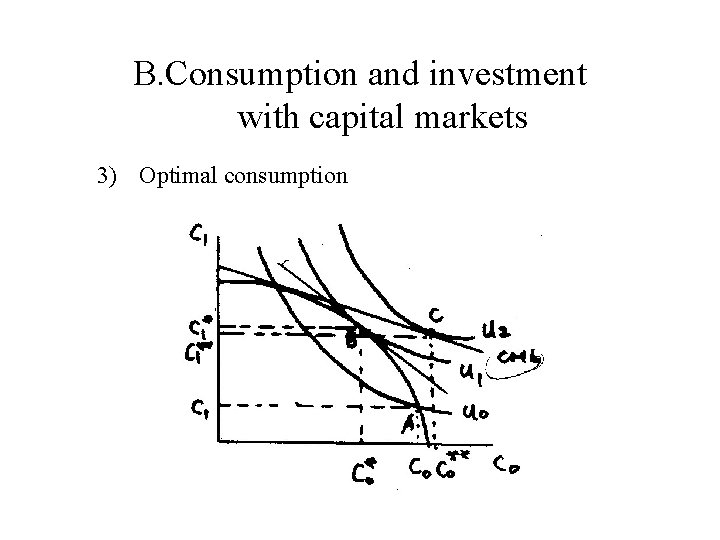

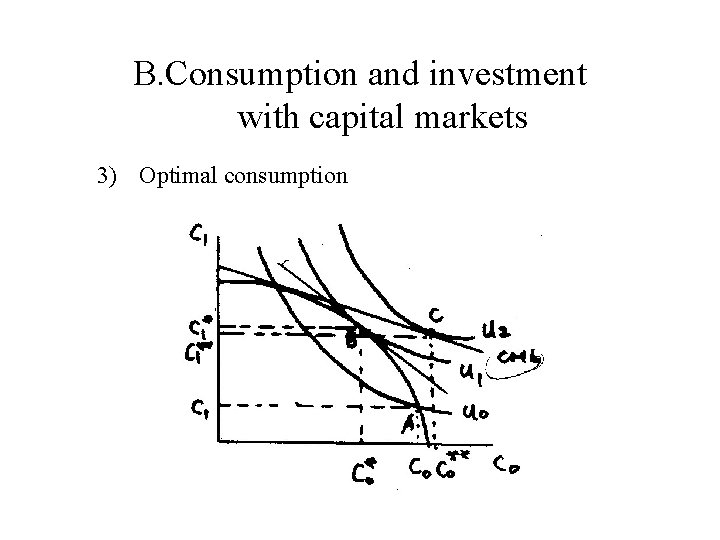

B. Consumption and investment with capital markets 3) Optimal consumption

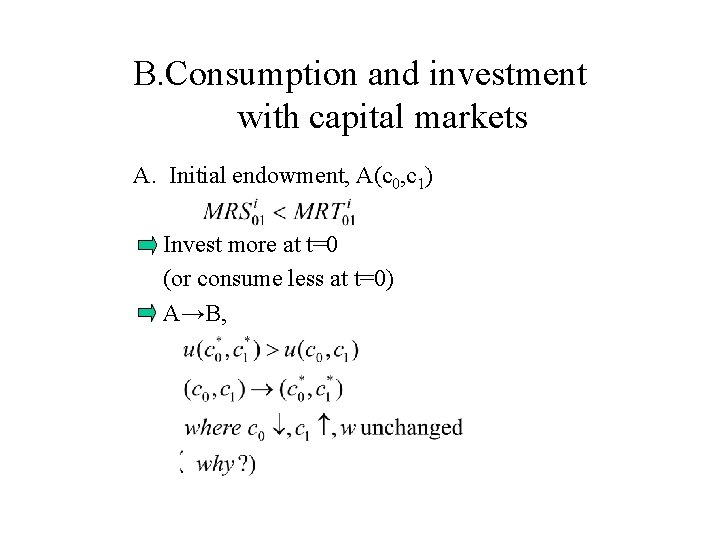

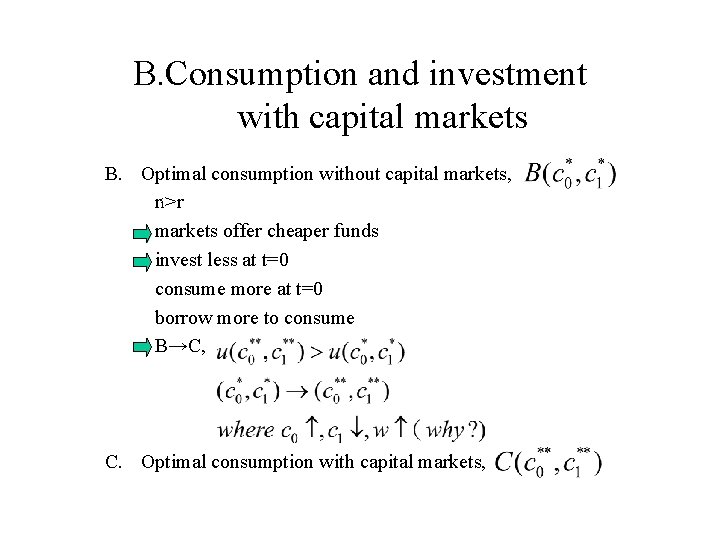

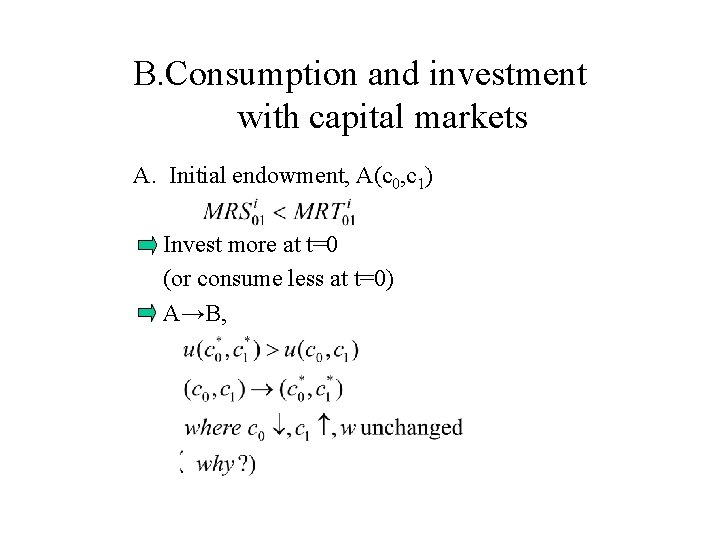

B. Consumption and investment with capital markets A. Initial endowment, A(c 0, c 1) Invest more at t=0 (or consume less at t=0) A→B,

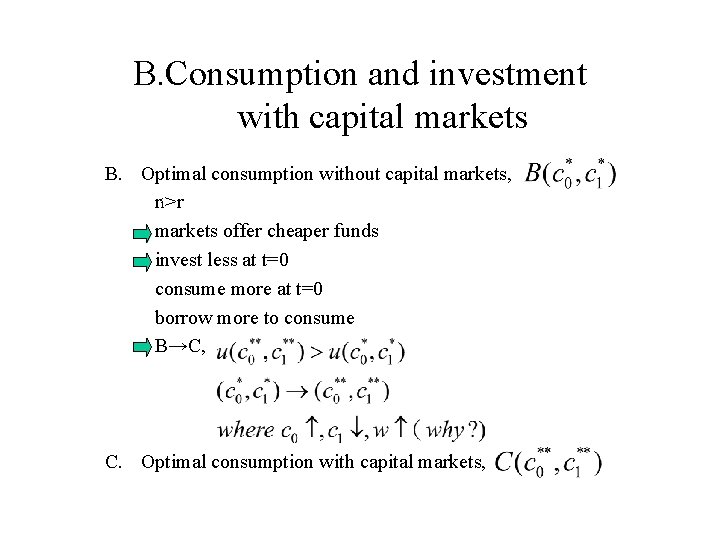

B. Consumption and investment with capital markets B. Optimal consumption without capital markets, ri>r markets offer cheaper funds invest less at t=0 consume more at t=0 borrow more to consume B→C, C. Optimal consumption with capital markets,

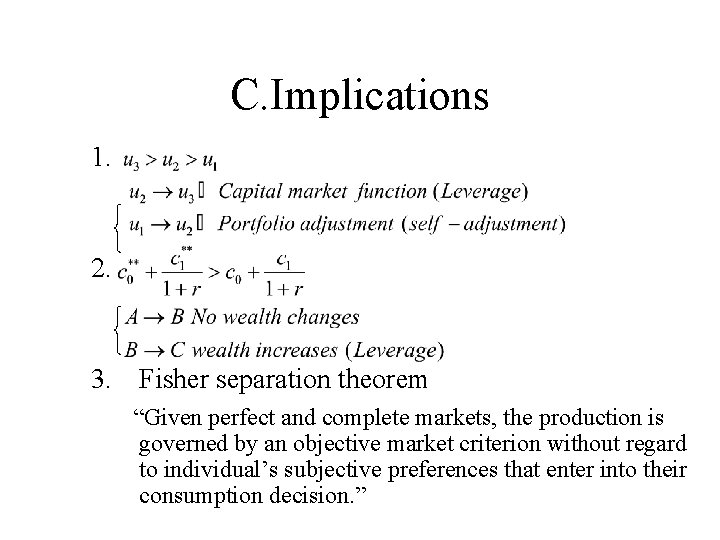

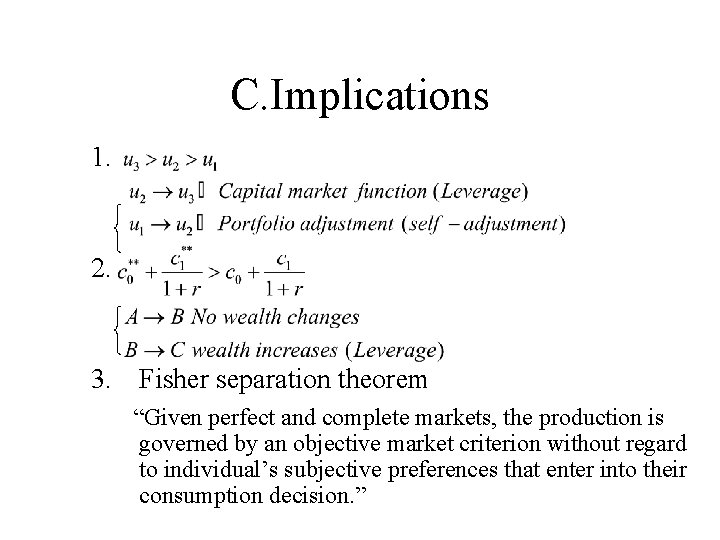

C. Implications 1. 2. 3. Fisher separation theorem “Given perfect and complete markets, the production is governed by an objective market criterion without regard to individual’s subjective preferences that enter into their consumption decision. ”

C. Implications 1) Complete market Basis Span, linear combination Linear independent 2) Perfect market A. B. C. D. No transaction costs, No taxes(Market frictionless) No short sell restriction Perfect competition, price takers Perfect information, no information cost, asymmetric.

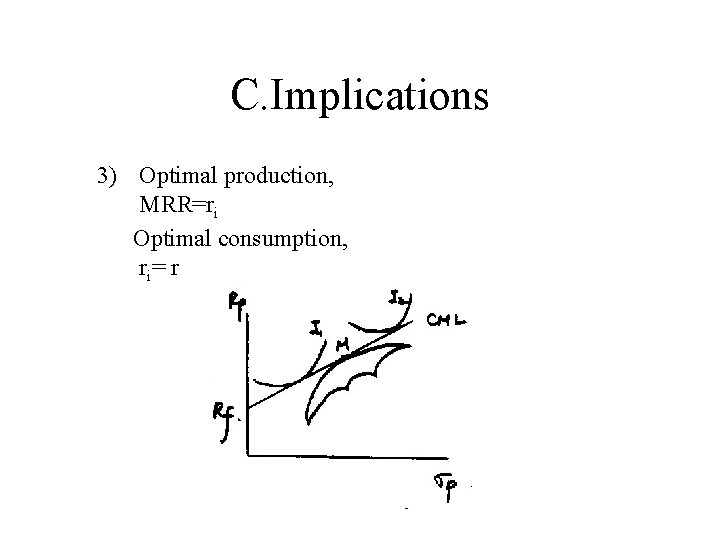

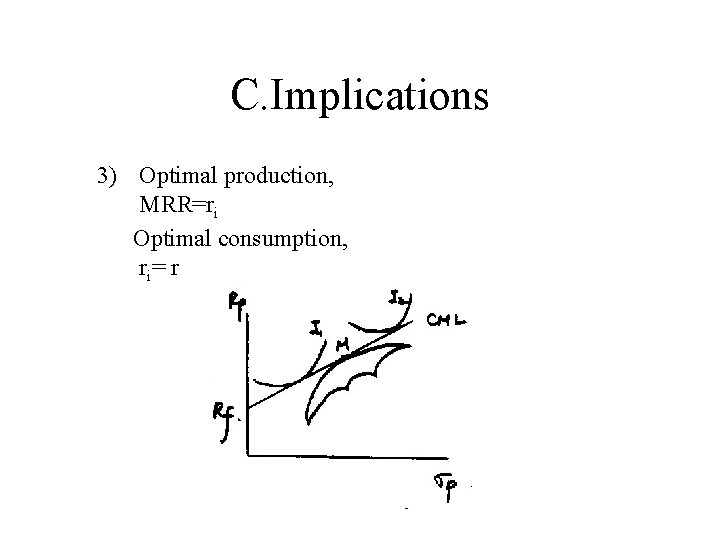

C. Implications 3) Optimal production, MRR=ri Optimal consumption, ri = r

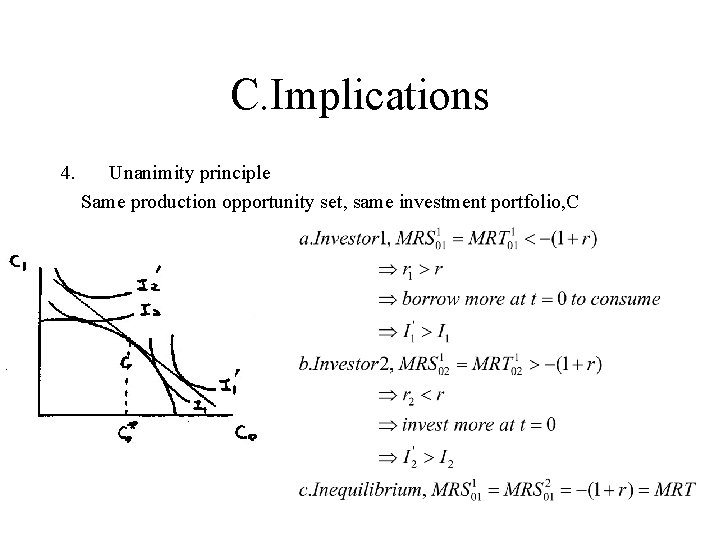

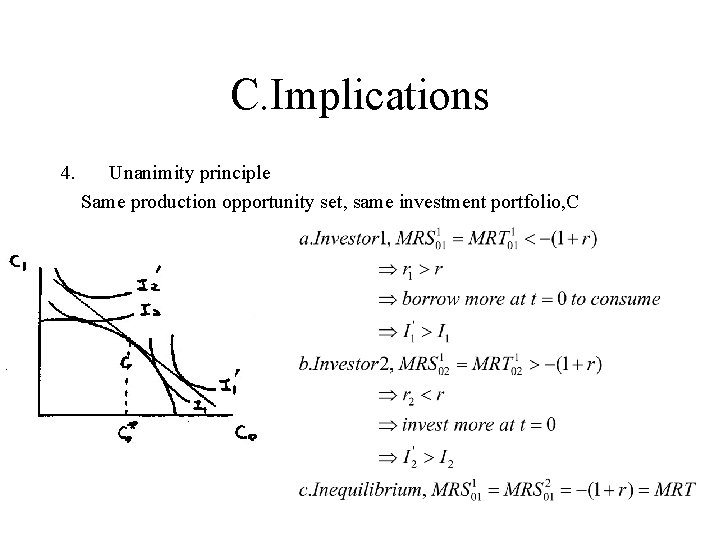

C. Implications 4. Unanimity principle Same production opportunity set, same investment portfolio, C

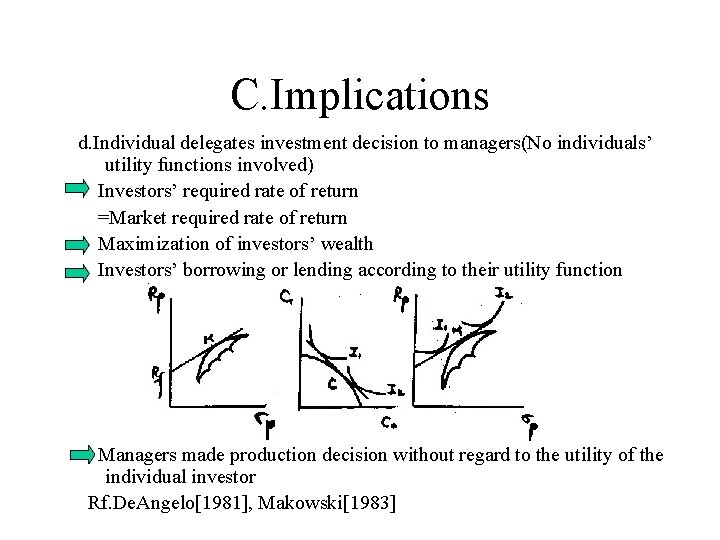

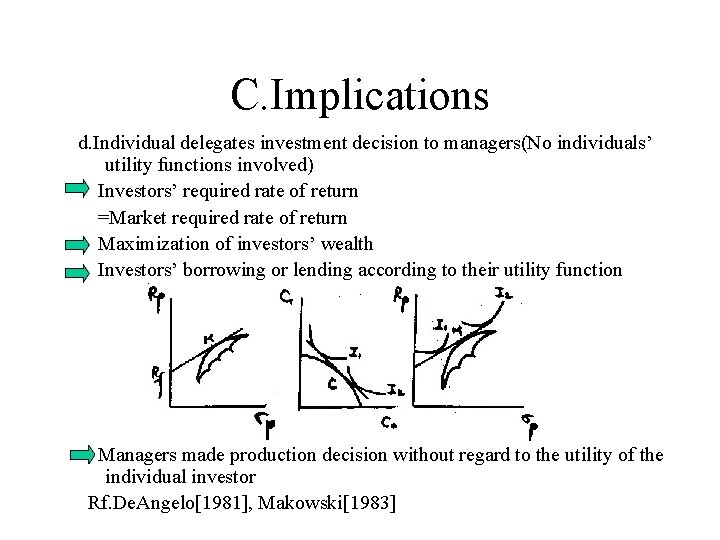

C. Implications d. Individual delegates investment decision to managers(No individuals’ utility functions involved) Investors’ required rate of return =Market required rate of return Maximization of investors’ wealth Investors’ borrowing or lending according to their utility function Managers made production decision without regard to the utility of the individual investor Rf. De. Angelo[1981], Makowski[1983]