Ch 15 Sec 1 Learning Targets I can

- Slides: 35

Ch 15 Sec 1 Learning Targets: I can answer the following: • What fiscal policy should our government use now? • What are our tools for measuring a good economy? • What tools does our government have to affect the economy? • I can define economic terms.

What are our tools for measuring a good economy?

Fiscal Policy • Fiscal policy is the federal government’s use of taxes and government spending to affect the economy. 1. Expand aggregate(overall) demand 2. Constrict aggregate(overall) demand (Fight inflation)

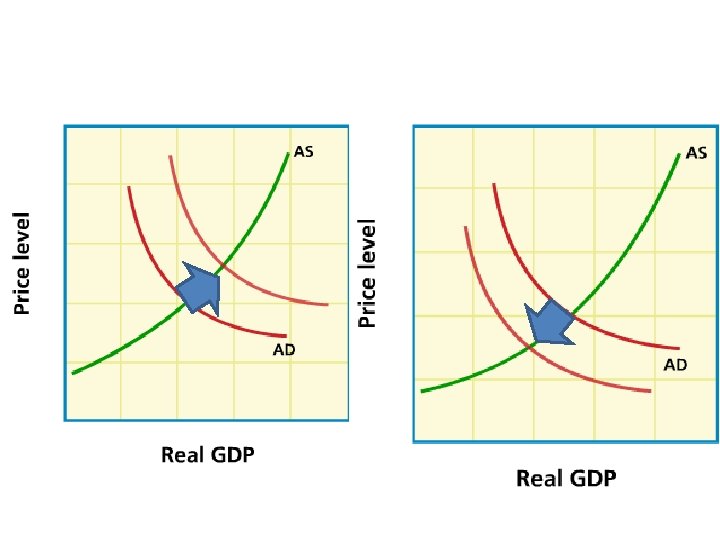

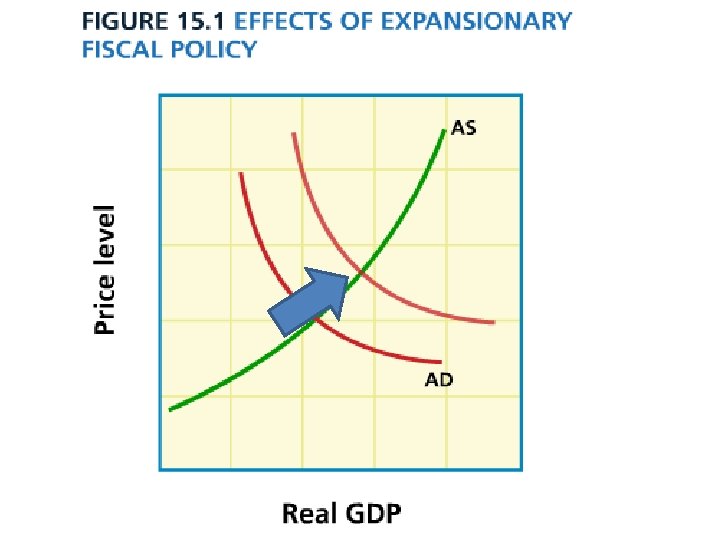

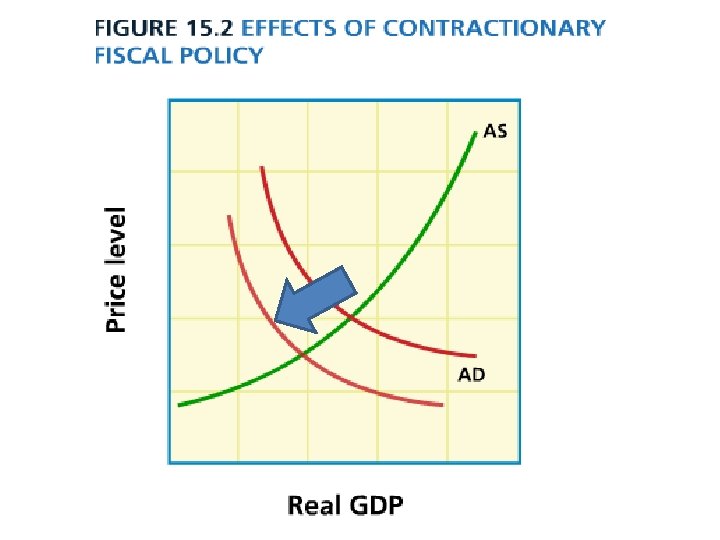

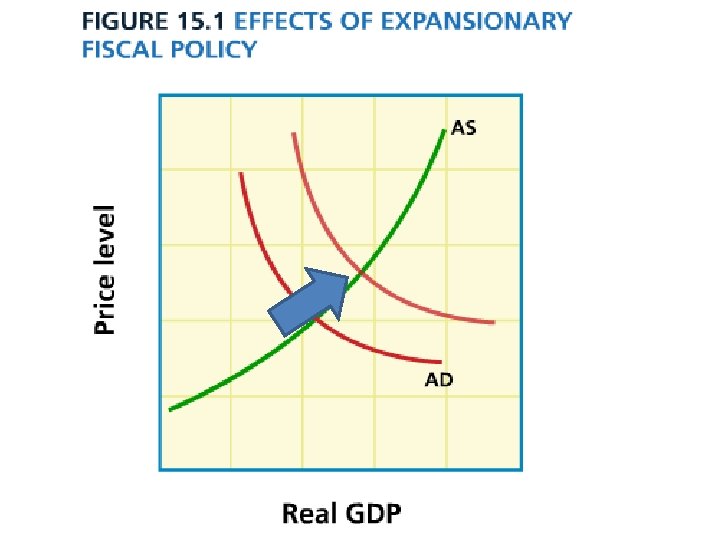

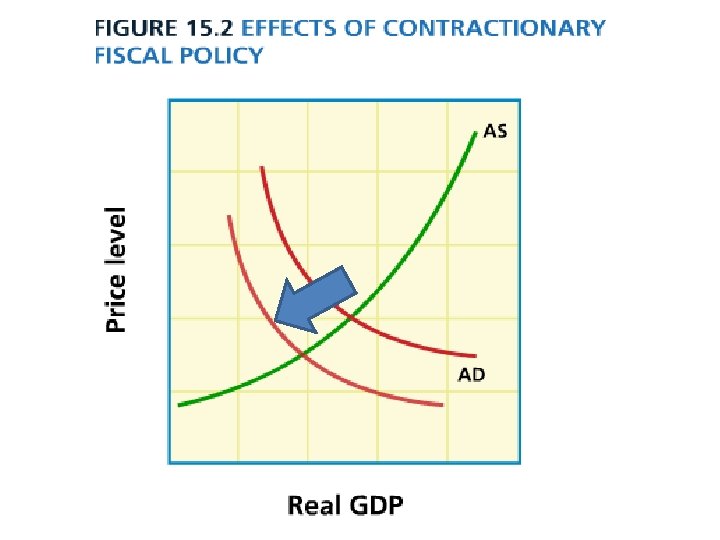

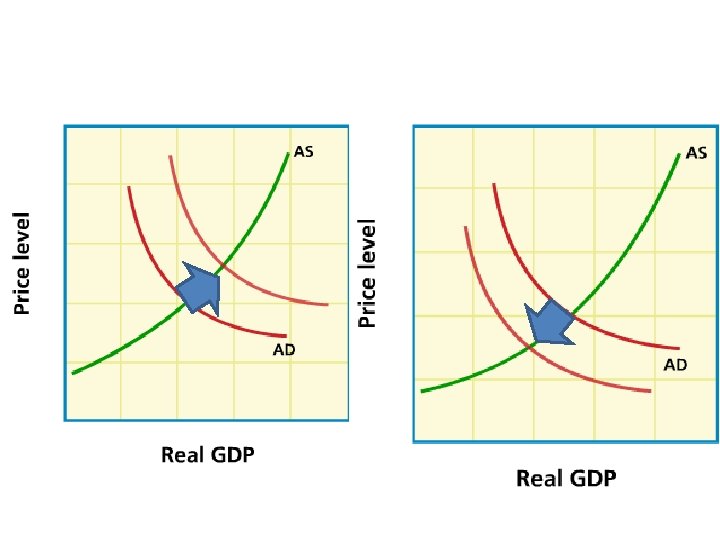

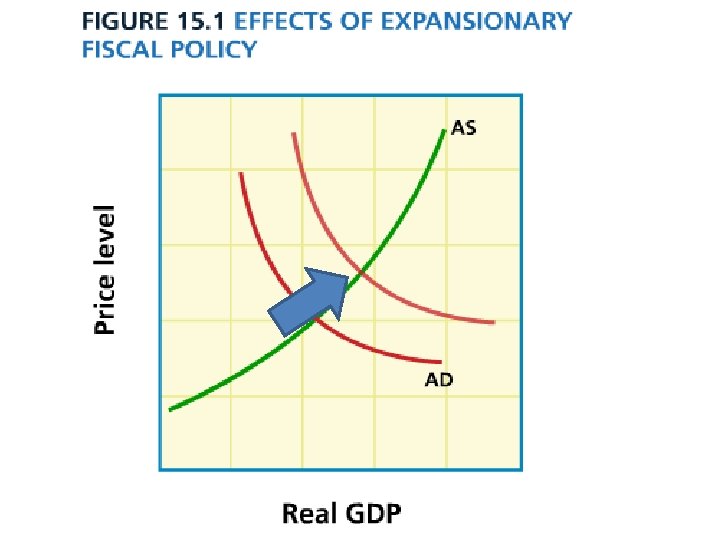

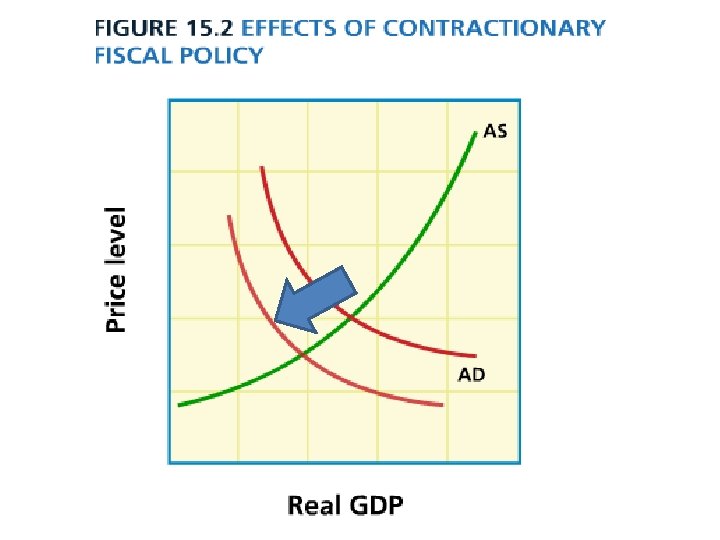

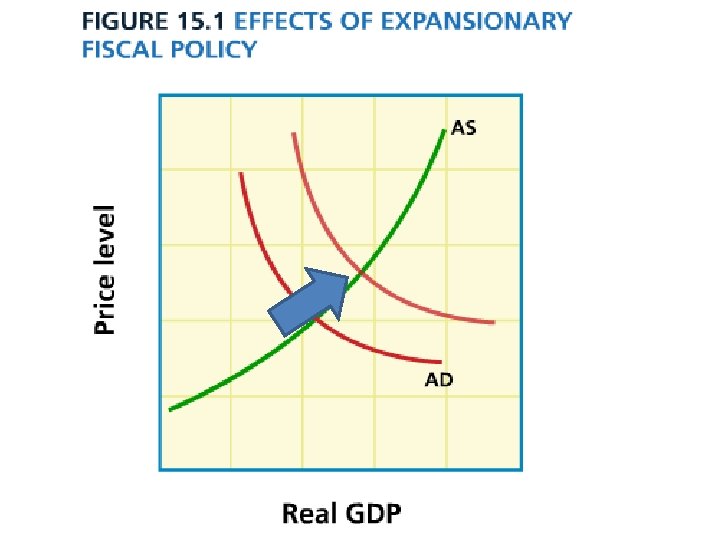

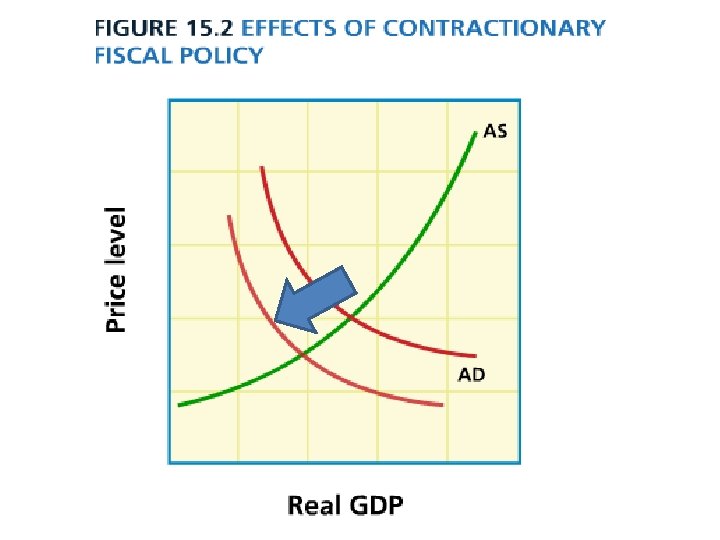

When the government is. . • Increasing aggregate demand, it is called Expansionary Policy • Decreasing aggregate demand, it is called Contractionary Policy

Two types of Fiscal Policy • Expansionary policy stimulates the economy(increase aggregate DEMAND) • Contractionary policy slows the economy(decrease aggregate DEMAND)

Expansionary Fiscal Policy • Increases government spending • Decreases taxes

Contractionary Fiscal Policy • Decreasing government spending • Increasing taxes

Discretionary Fiscal Policy • What does it imply? Automatic Stabilizers • What does it imply?

Homework • Finish wksht packet Ch 15. 1 • Start Reading pages 446 -452

Learning Targets: I can answer the following: • What fiscal policy should our government use now? • What are our tools for measuring a good economy? • What tools does our government have to affect the economy? • I can define economic terms.

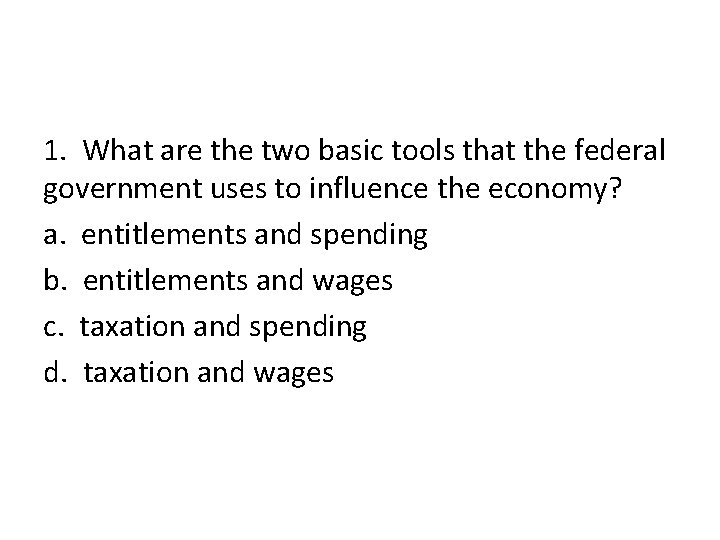

1. What are the two basic tools that the federal government uses to influence the economy? a. entitlements and spending b. entitlements and wages c. taxation and spending d. taxation and wages

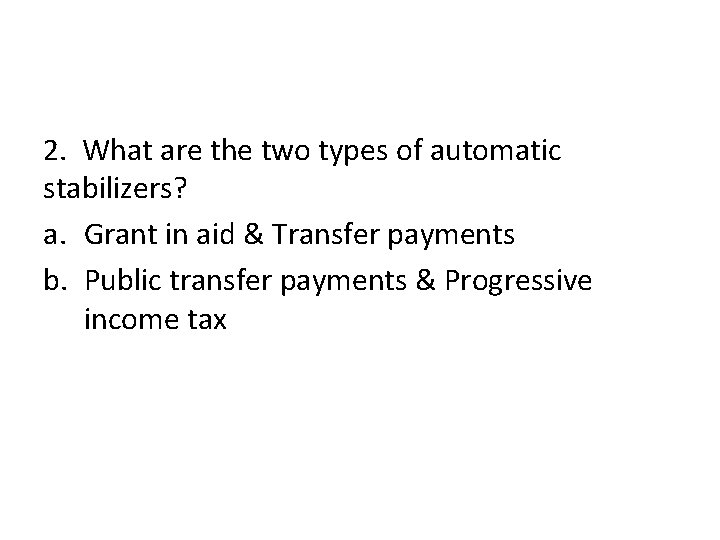

2. What are the two types of automatic stabilizers? a. Grant in aid & Transfer payments b. Public transfer payments & Progressive income tax

3. In a bad economy the majority of people become _______. a. Richer b. Poorer c. Filthy rich d. Ugly

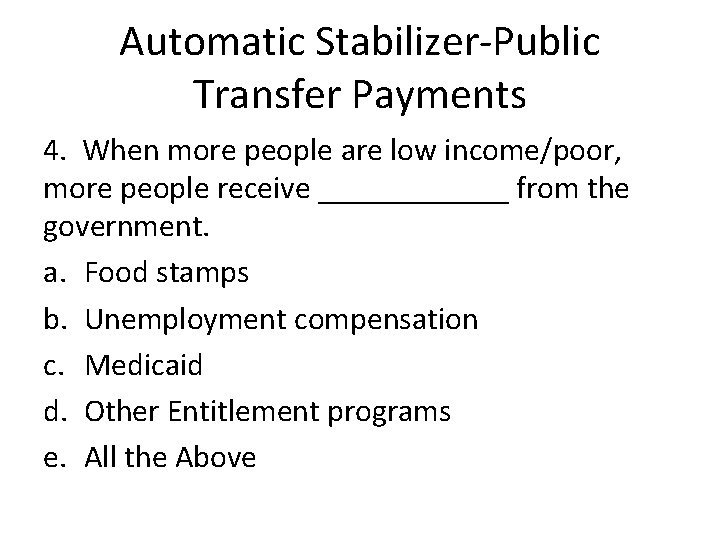

Automatic Stabilizer-Public Transfer Payments 4. When more people are low income/poor, more people receive ______ from the government. a. Food stamps b. Unemployment compensation c. Medicaid d. Other Entitlement programs e. All the Above

Automatic Stabilizer-Progressive Taxes 5. In a good economy the majority of people become _______. a. Richer b. Poorer c. Filthy ugly d. Ugly

Automatic Stabilizer-Progressive Taxes 6. When people become poorer, they receive ______ from the government. a. More beatings b. More taxes c. Less taxes d. Lower wages

7. Knowing what you know now, if you wanted to create more Automatic Stabilizers for the economy what might you increase? a. Entitlement programs b. Progressive Income taxes c. Both A and B

Discretionary Fiscal Policy 8. If the economy was starting to experience inflation what should you do to fix it quickly? a. Increase taxes b. Decrease taxes c. Increase spending d. Decrease spending

Limitations of Fiscal Policy. Timing Issue 9. What do you think would happen if you cut taxes during an economic boom? a. Low GDP b. High unemployment c. Negligible inflation d. Hyper inflation

Limitations of Fiscal Policy. Political Issues • Is it popular to increase taxes? • Is it popular to cut spending? • Wisdom teeth extraction • Surgery • Giving birth

Limitations of Fiscal Policy. Rational Expectations Theory • The government creates fiscal policy to create more; – Spending • This can create the opposite intention – More Saving • People don’t always follow the Rational Expectations of the government

Limitations of Fiscal Policy. Regional Issues – Silicon Valley in California might be having inflation because of a tech boom. – The Midwest might be suffering from a recent record number of tornados hitting major cities and creating destruction. • Therefore broad fiscal-policies may not be a good idea or work as expected

Limitations of Fiscal Policy • • Timing Issues Political Issues Rational Expectation Theory Regional Issues

• http: //www. frbsf. org/education/activities/cha irman/