Ch 13 Monopolistic Competition and Oligopoly 13 1

- Slides: 26

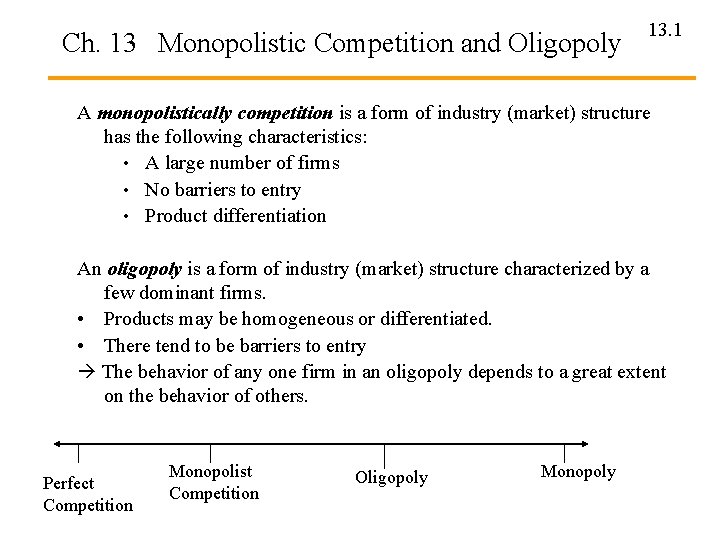

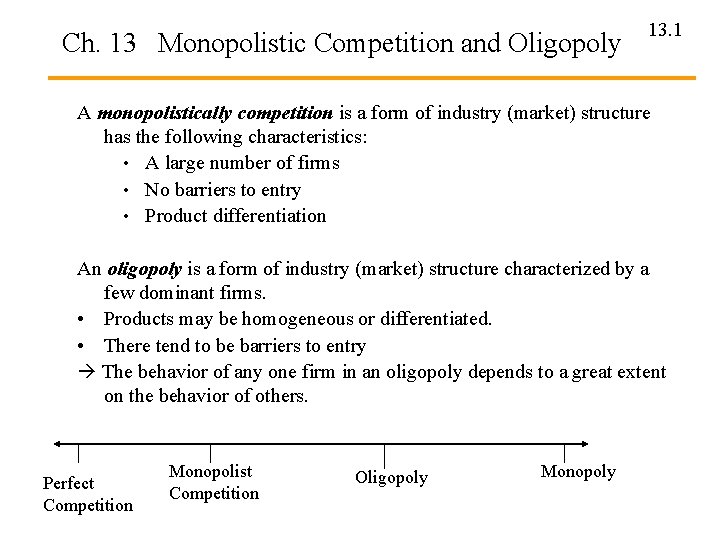

Ch. 13 Monopolistic Competition and Oligopoly 13. 1 A monopolistically competition is a form of industry (market) structure has the following characteristics: • A large number of firms • No barriers to entry • Product differentiation An oligopoly is a form of industry (market) structure characterized by a few dominant firms. • Products may be homogeneous or differentiated. • There tend to be barriers to entry The behavior of any one firm in an oligopoly depends to a great extent on the behavior of others. Perfect Competition Monopolist Competition Oligopoly Monopoly

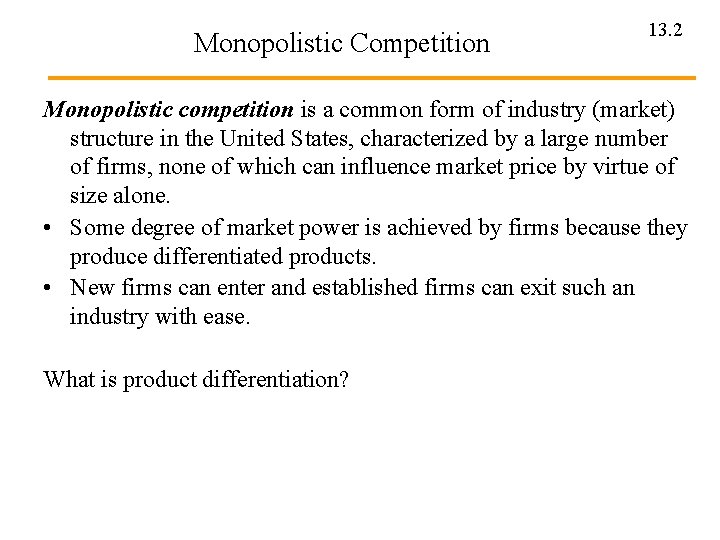

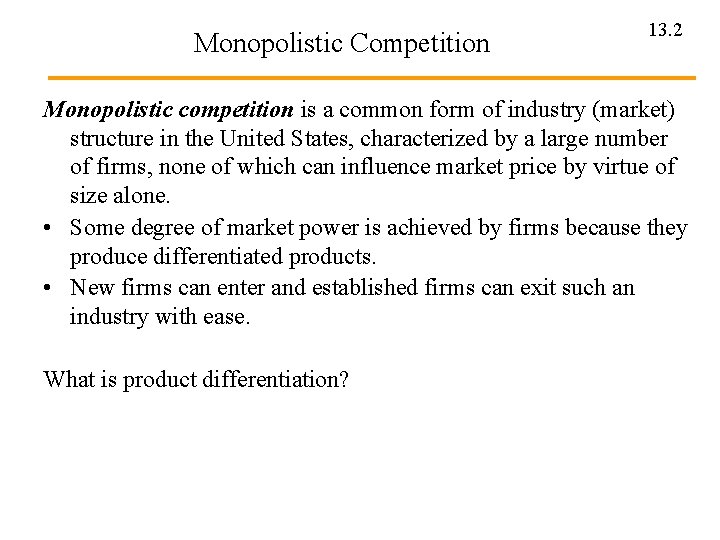

Monopolistic Competition 13. 2 Monopolistic competition is a common form of industry (market) structure in the United States, characterized by a large number of firms, none of which can influence market price by virtue of size alone. • Some degree of market power is achieved by firms because they produce differentiated products. • New firms can enter and established firms can exit such an industry with ease. What is product differentiation?

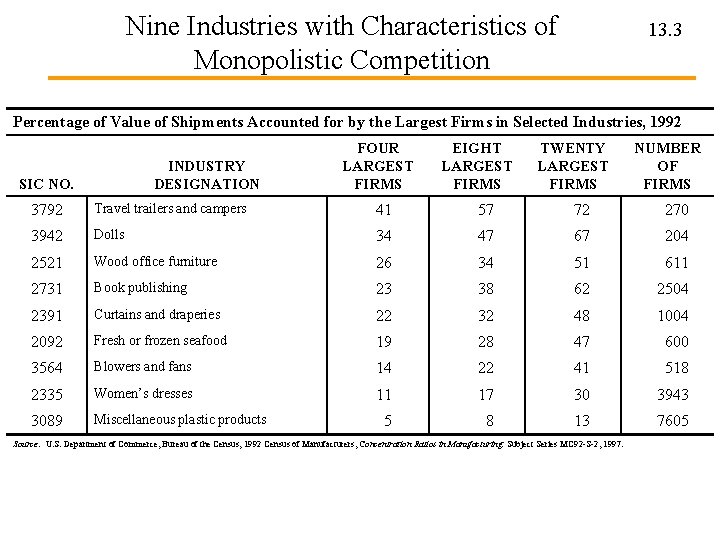

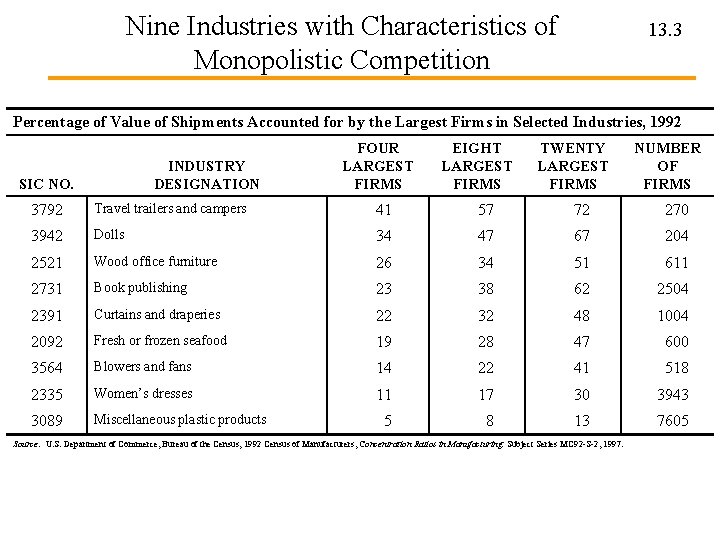

Nine Industries with Characteristics of Monopolistic Competition 13. 3 Percentage of Value of Shipments Accounted for by the Largest Firms in Selected Industries, 1992 INDUSTRY DESIGNATION SIC NO. FOUR LARGEST FIRMS EIGHT LARGEST FIRMS TWENTY LARGEST FIRMS NUMBER OF FIRMS 3792 Travel trailers and campers 41 57 72 270 3942 Dolls 34 47 67 204 2521 Wood office furniture 26 34 51 611 2731 Book publishing 23 38 62 2504 2391 Curtains and draperies 22 32 48 1004 2092 Fresh or frozen seafood 19 28 47 600 3564 Blowers and fans 14 22 41 518 2335 Women’s dresses 11 17 30 3943 3089 Miscellaneous plastic products 5 8 13 7605 Source: U. S. Department of Commerce, Bureau of the Census, 1992 Census of Manufacturers, Concentration Ratios in Manufacturing, Subject Series MC 92 -S-2, 1997.

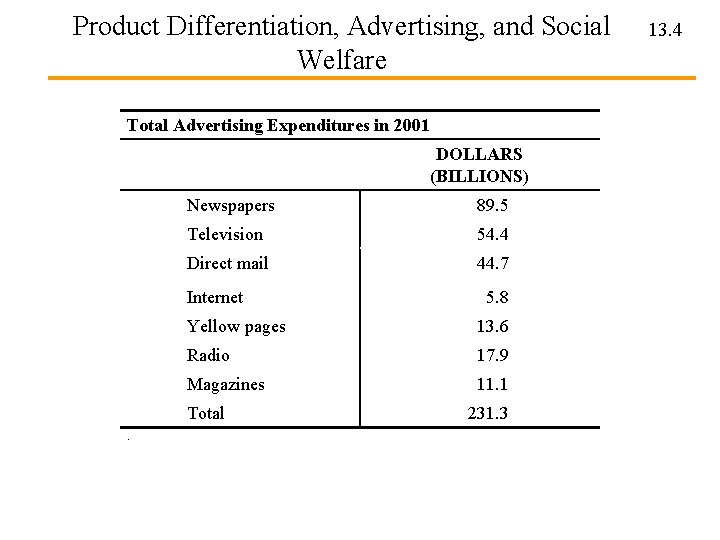

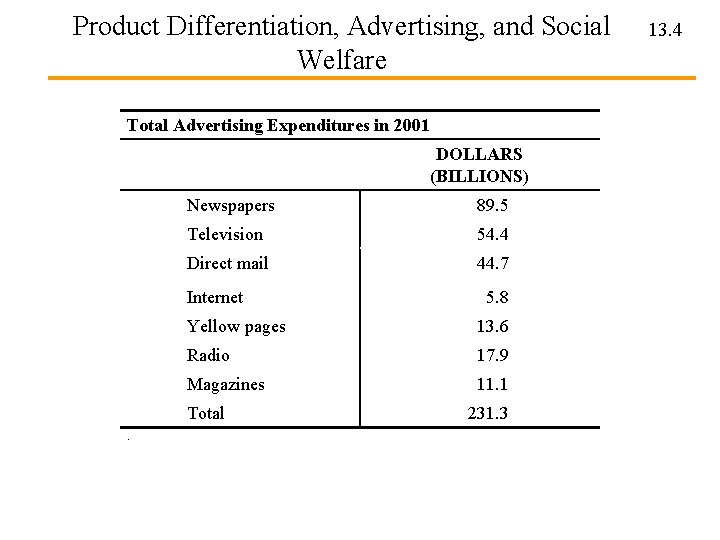

Product Differentiation, Advertising, and Social Welfare Total Advertising Expenditures in 2001 DOLLARS (BILLIONS) Newspapers 89. 5 Television 54. 4 Direct mail 44. 7 Internet Yellow pages 13. 6 Radio 17. 9 Magazines 11. 1 Total. 5. 8 231. 3 13. 4

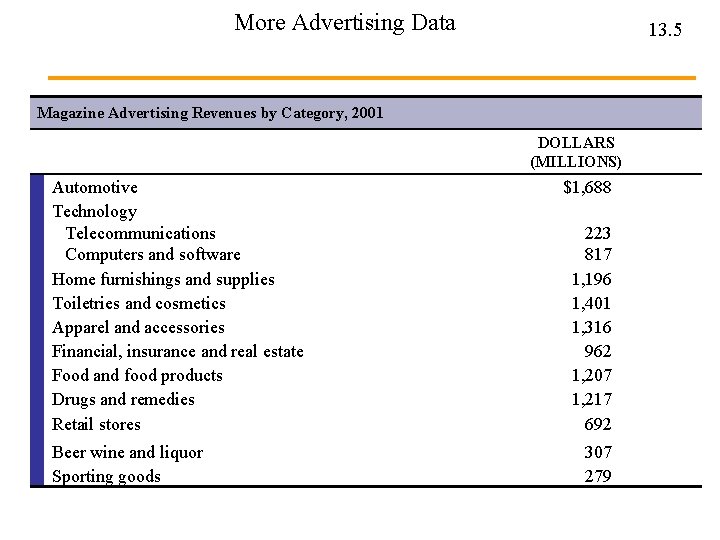

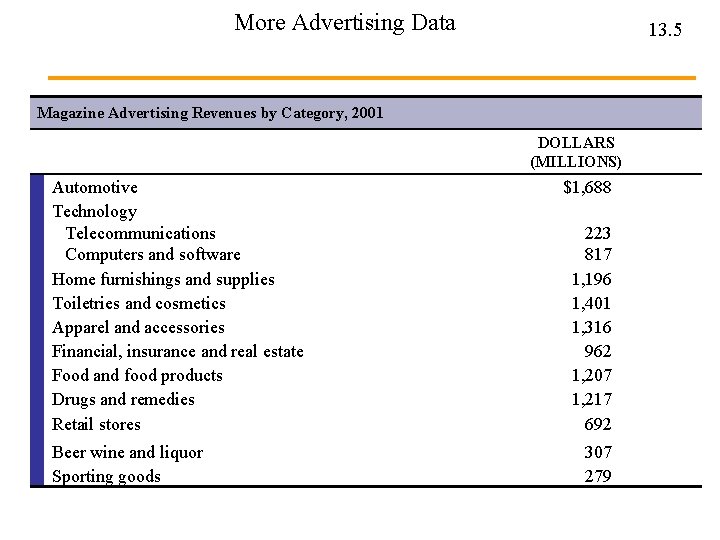

More Advertising Data 13. 5 Magazine Advertising Revenues by Category, 2001 DOLLARS (MILLIONS) Automotive Technology Telecommunications Computers and software Home furnishings and supplies Toiletries and cosmetics Apparel and accessories Financial, insurance and real estate Food and food products Drugs and remedies Retail stores Beer wine and liquor Sporting goods $1, 688 223 817 1, 196 1, 401 1, 316 962 1, 207 1, 217 692 307 279

The Case for Product Differentiation and Advertising • The advocates of free and open competition believe that differentiated products and advertising give the market system its vitality and are the basis of its power. • Product differentiation helps to ensure high quality and efficient production. • Advertising provides consumers with the valuable information on product availability, quality, and price that they need to make efficient choices in the market place. 13. 6

The Case Against Product Differentiation and Advertising 13. 7 • Critics of product differentiation and advertising argue that they amount to nothing more than waste and inefficiency. • Enormous sums are spent to create minute, meaningless, and possibly nonexistent differences among products. • Advertising raises the cost of products and frequently contains very little information. Often, it is merely an annoyance. • People exist to satisfy the needs of the economy, not vice versa. • Advertising can lead to unproductive warfare and may serve as a barrier to entry, thus reducing real competition.

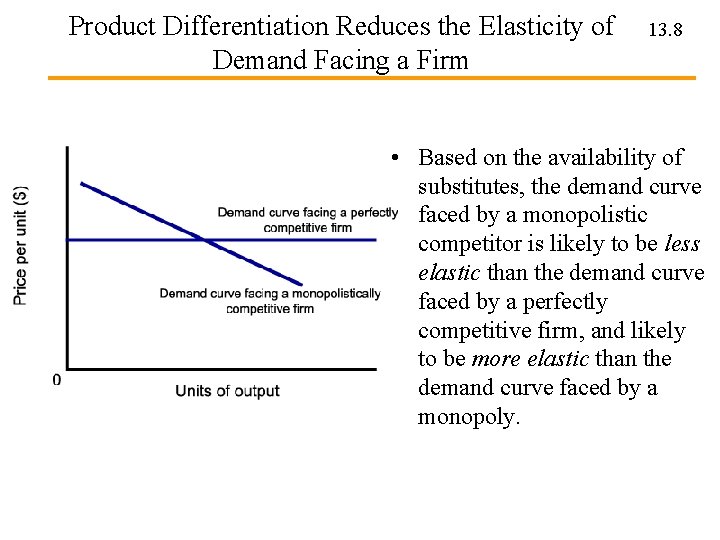

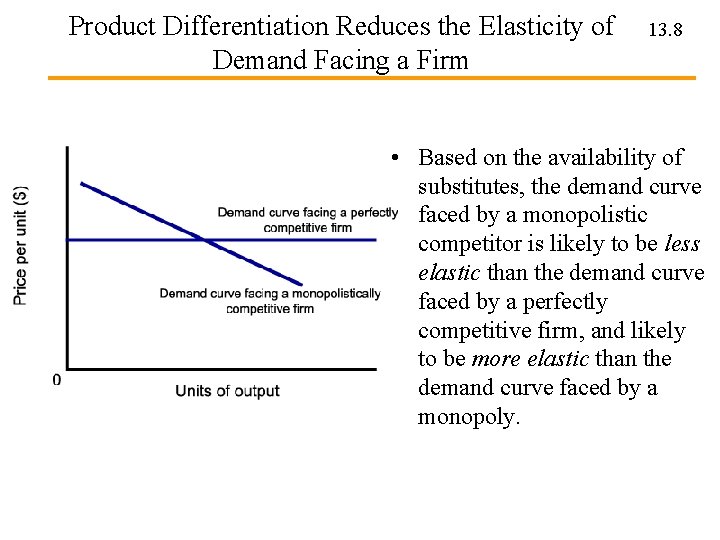

Product Differentiation Reduces the Elasticity of Demand Facing a Firm 13. 8 • Based on the availability of substitutes, the demand curve faced by a monopolistic competitor is likely to be less elastic than the demand curve faced by a perfectly competitive firm, and likely to be more elastic than the demand curve faced by a monopoly.

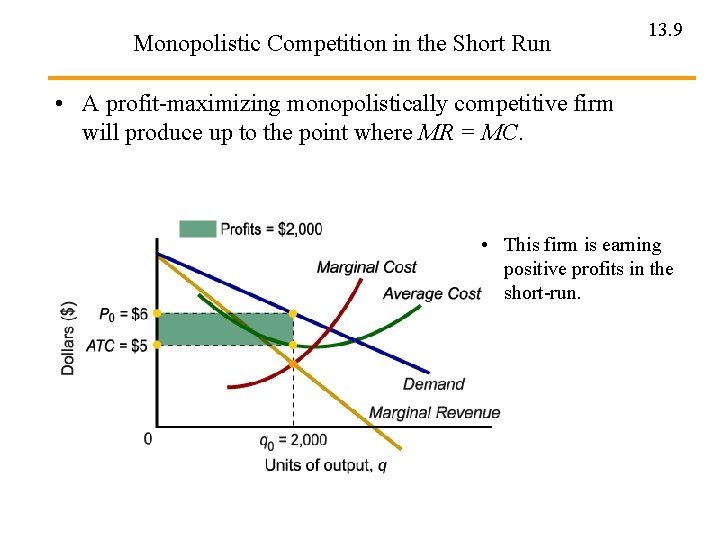

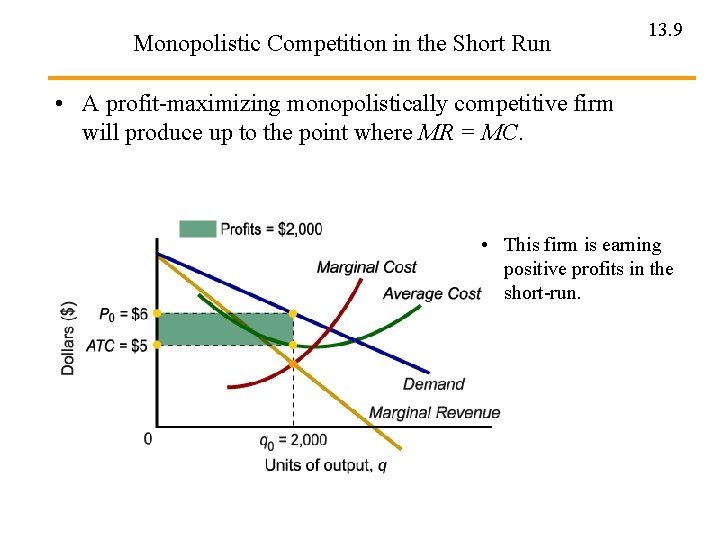

Monopolistic Competition in the Short Run 13. 9 • A profit-maximizing monopolistically competitive firm will produce up to the point where MR = MC. • This firm is earning positive profits in the short-run.

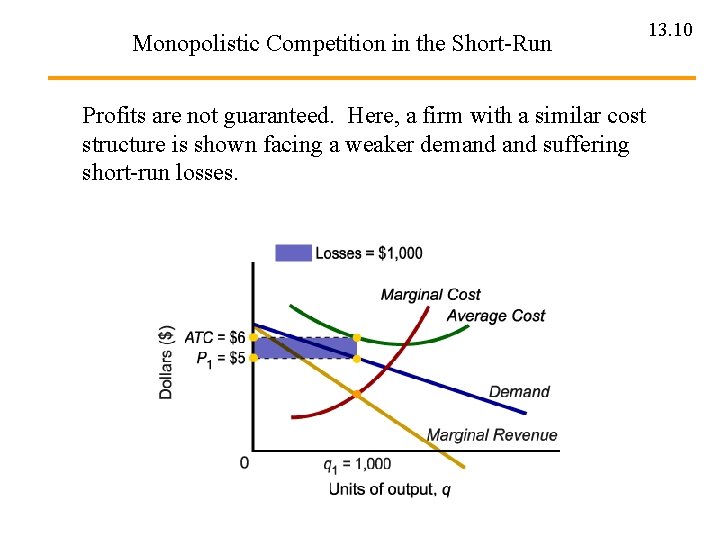

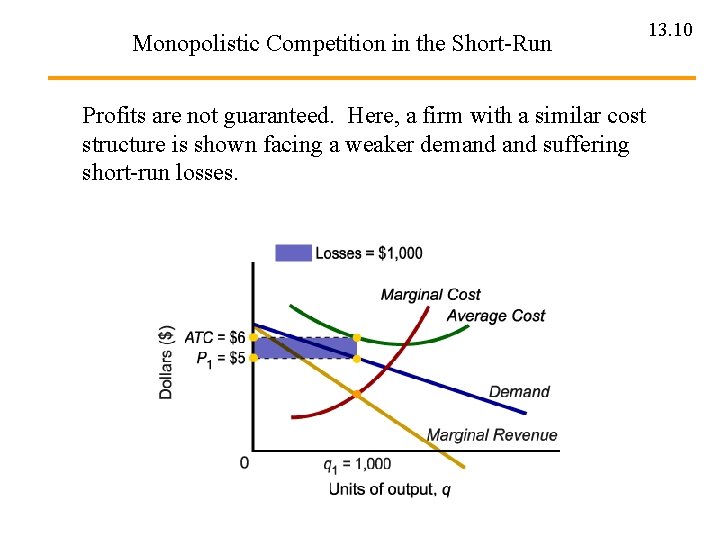

Monopolistic Competition in the Short-Run Profits are not guaranteed. Here, a firm with a similar cost structure is shown facing a weaker demand suffering short-run losses. 13. 10

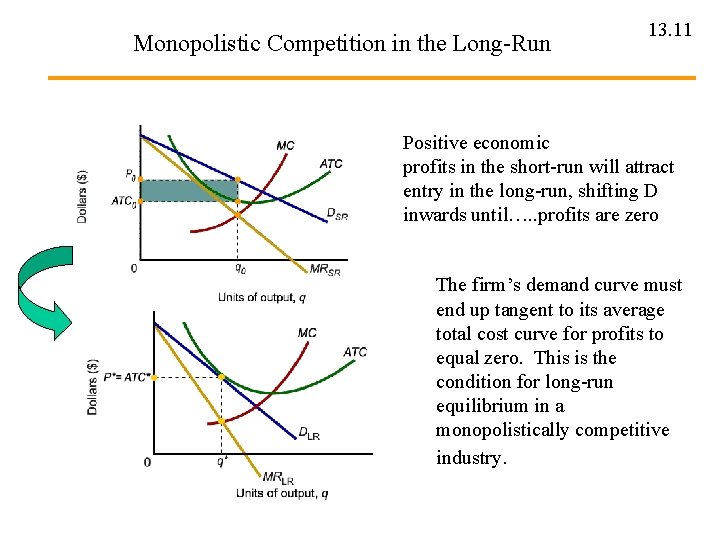

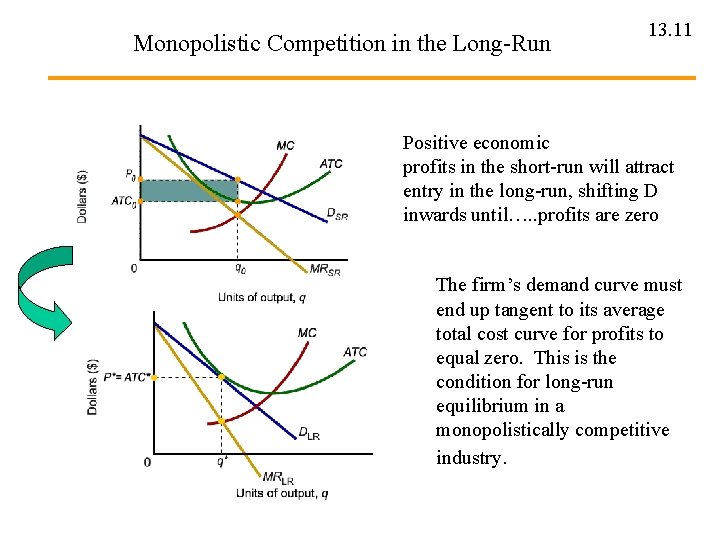

Monopolistic Competition in the Long-Run 13. 11 Positive economic profits in the short-run will attract entry in the long-run, shifting D inwards until…. . profits are zero The firm’s demand curve must end up tangent to its average total cost curve for profits to equal zero. This is the condition for long-run equilibrium in a monopolistically competitive industry.

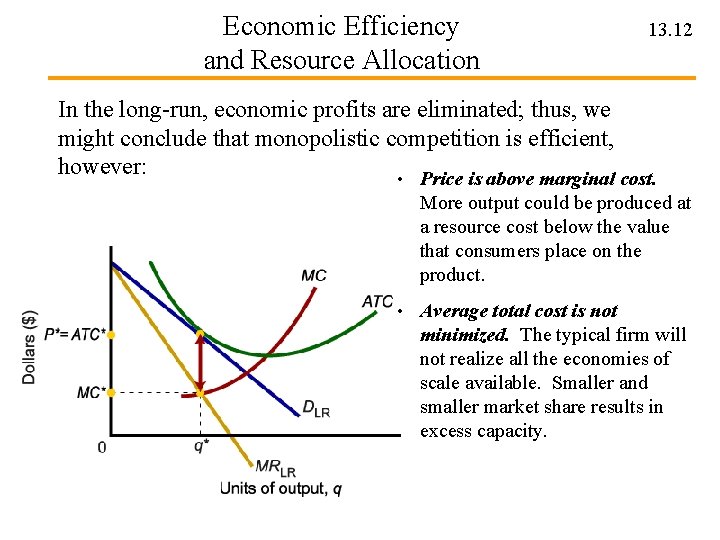

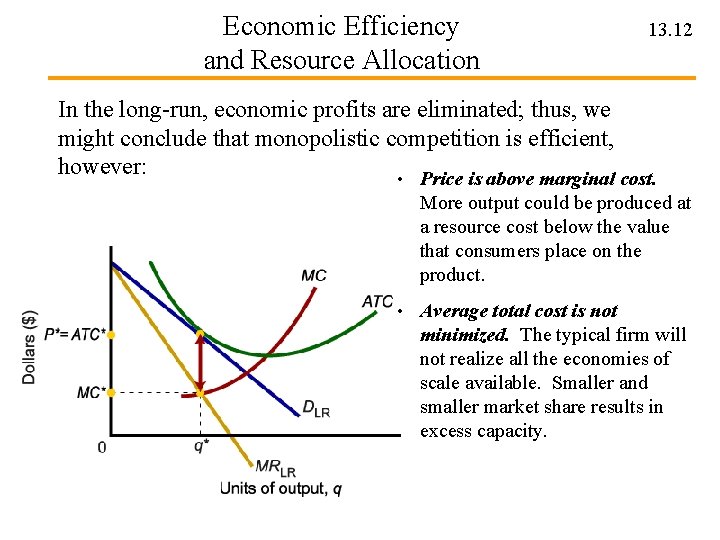

Economic Efficiency and Resource Allocation 13. 12 In the long-run, economic profits are eliminated; thus, we might conclude that monopolistic competition is efficient, however: • Price is above marginal cost. More output could be produced at a resource cost below the value that consumers place on the product. • Average total cost is not minimized. The typical firm will not realize all the economies of scale available. Smaller and smaller market share results in excess capacity.

Oligopoly 13. 13 • An oligopoly is a form of industry (market) structure characterized by a few dominant firms, causing a high degree of concentration. Products may be homogeneous or differentiated. • The behavior of any one firm in an oligopoly depends to a great extent on the behavior of others.

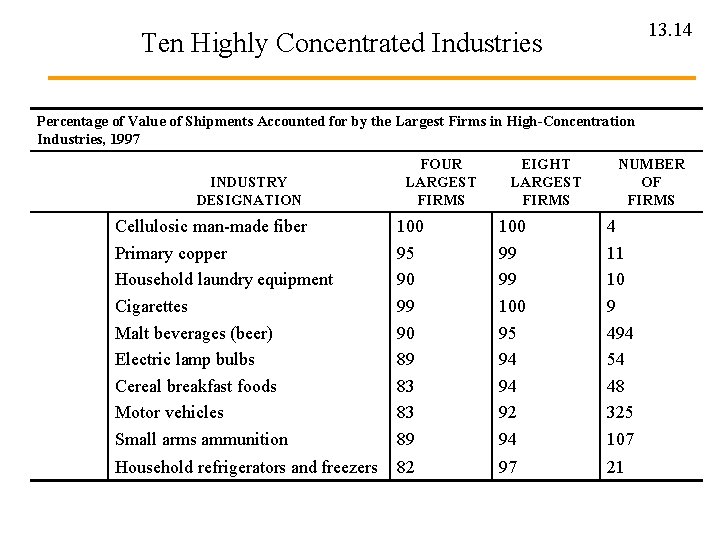

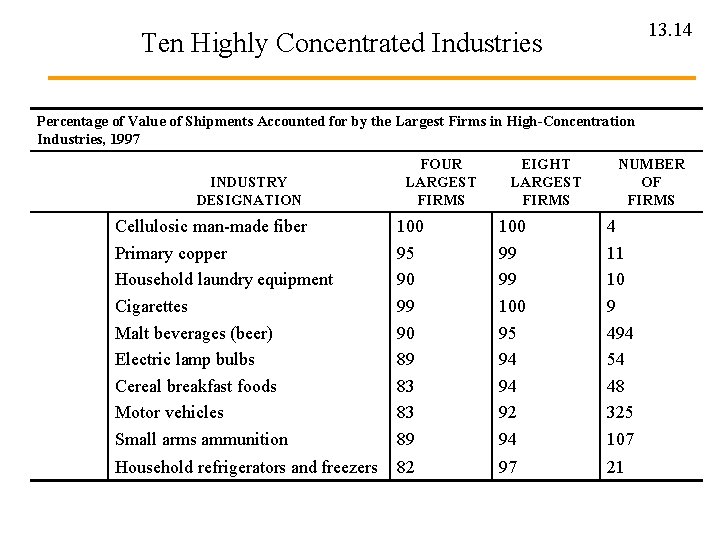

13. 14 Ten Highly Concentrated Industries Percentage of Value of Shipments Accounted for by the Largest Firms in High-Concentration Industries, 1997 INDUSTRY DESIGNATION FOUR LARGEST FIRMS EIGHT LARGEST FIRMS NUMBER OF FIRMS Cellulosic man-made fiber Primary copper Household laundry equipment Cigarettes Malt beverages (beer) Electric lamp bulbs Cereal breakfast foods Motor vehicles Small arms ammunition 100 95 90 99 90 89 83 83 89 100 99 99 100 95 94 94 92 94 4 11 10 9 494 54 48 325 107 Household refrigerators and freezers 82 97 21

The Collusion Model 13. 15 • A group of firms that gets together and makes price and output decisions jointly is called a cartel. • Collusion occurs when price- and quantity-fixing agreements are explicit. • Tacit collusion occurs when firms end up fixing price without a specific agreement, or when agreements are implicit.

The Price-Leadership Model 13. 16 Price-leadership is a form of oligopoly in which one dominant firm sets prices and all the smaller firms in the industry follow its pricing policy. Assumptions of the price-leadership model: 1. The industry is made up of one large firm and a number of smaller, competitive firms; 2. The dominant firm maximizes profit subject to the constraint of market demand subject to the behavior of the smaller firms; 3. The dominant firm allows the smaller firms to sell all they want at the price the leader has set. Outcome of the price-leadership model: 1. The quantity demanded in the industry is split between the dominant firm and the group of smaller firms. 2. This division of output is determined by dominant firm’s power 3. The dominant firm has an incentive to push smaller firms out of the industry in order to establish a monopoly.

Predatory Pricing 13. 17 • The practice of a large, powerful firm driving smaller firms out of the market by temporarily selling at an artificially low price is called predatory pricing. • Such behavior became illegal in the United States with the passage of antimonopoly legislation around the turn of the century.

Game Theory 13. 18 • Game theory analyzes oligopolistic behavior as a complex series of strategic moves and reactive countermoves among rival firms. • In game theory, firms are assumed to anticipate rival reactions.

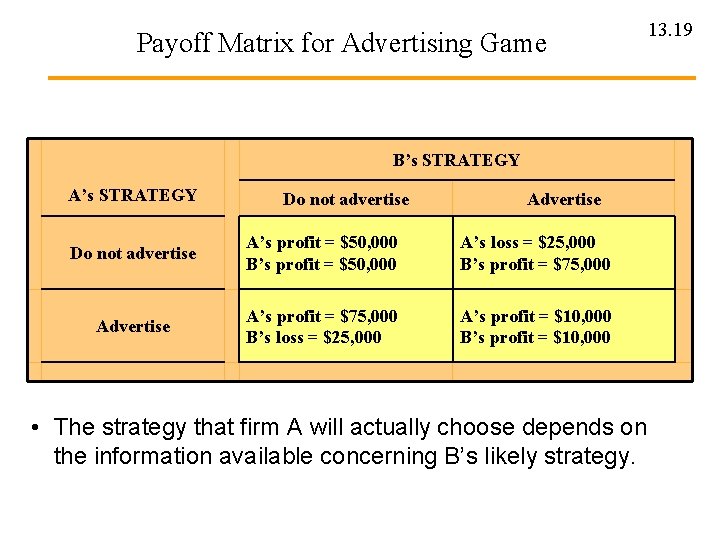

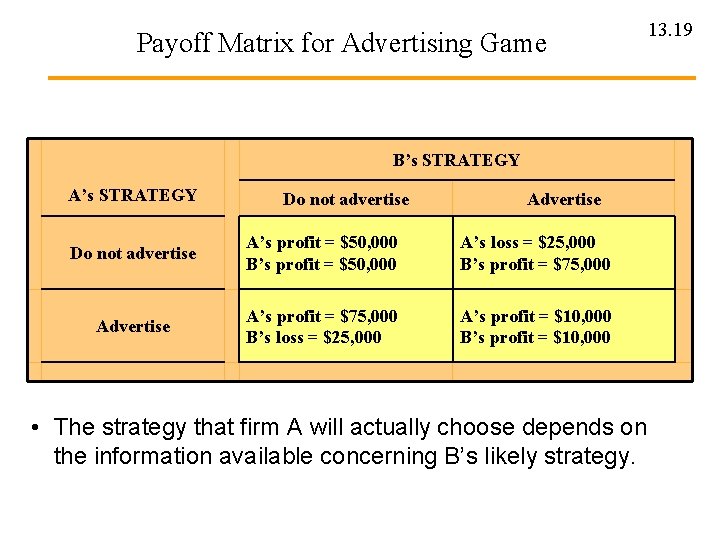

Payoff Matrix for Advertising Game B’s STRATEGY A’s STRATEGY Do not advertise Advertise Do not advertise A’s profit = $50, 000 B’s profit = $50, 000 A’s loss = $25, 000 B’s profit = $75, 000 Advertise A’s profit = $75, 000 B’s loss = $25, 000 A’s profit = $10, 000 B’s profit = $10, 000 • The strategy that firm A will actually choose depends on the information available concerning B’s likely strategy. 13. 19

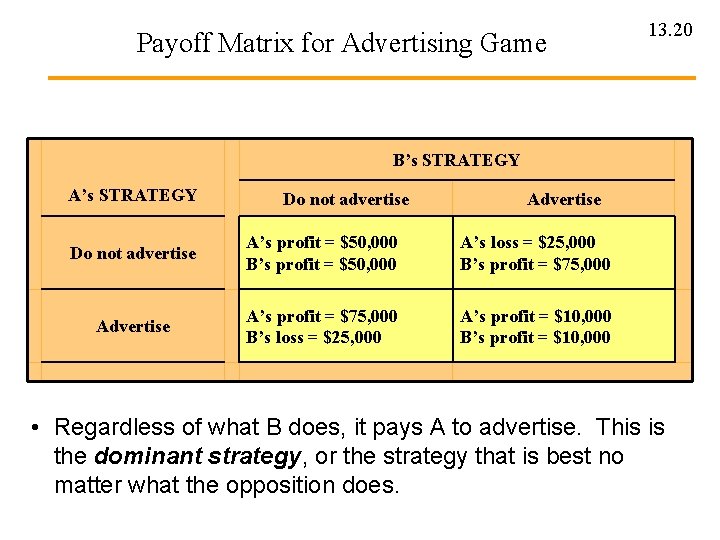

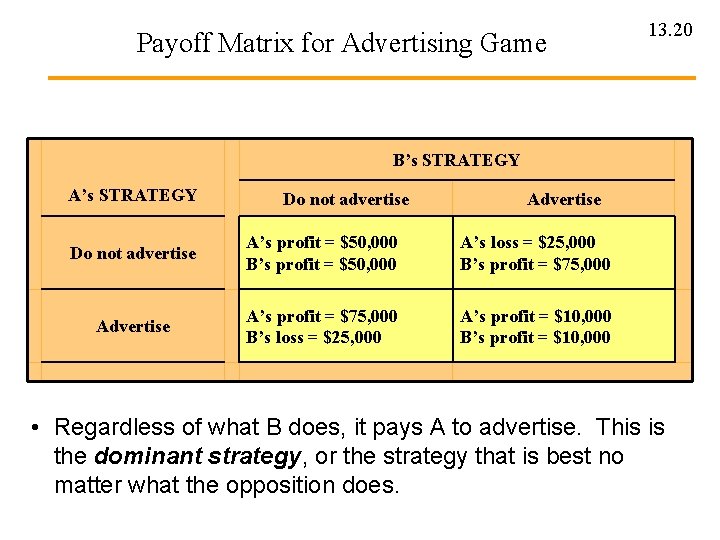

Payoff Matrix for Advertising Game 13. 20 B’s STRATEGY A’s STRATEGY Do not advertise Advertise Do not advertise A’s profit = $50, 000 B’s profit = $50, 000 A’s loss = $25, 000 B’s profit = $75, 000 Advertise A’s profit = $75, 000 B’s loss = $25, 000 A’s profit = $10, 000 B’s profit = $10, 000 • Regardless of what B does, it pays A to advertise. This is the dominant strategy, or the strategy that is best no matter what the opposition does.

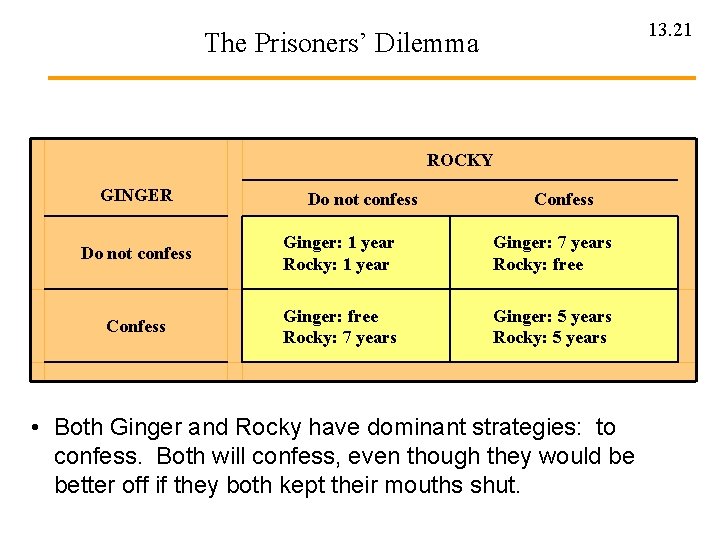

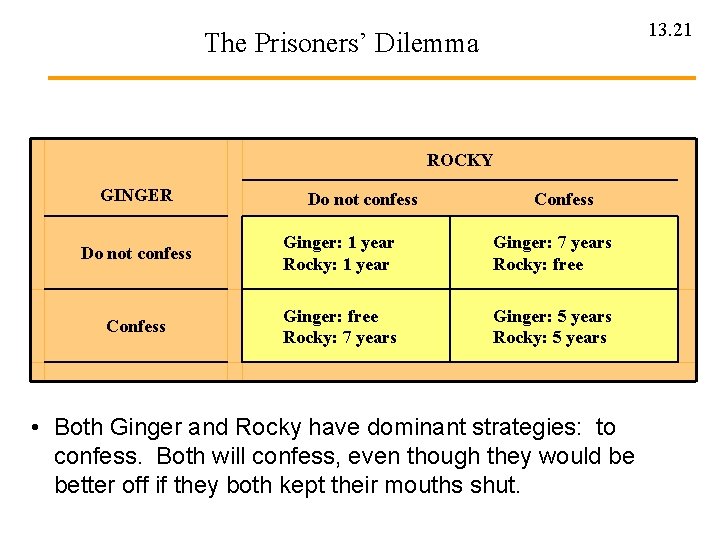

13. 21 The Prisoners’ Dilemma ROCKY GINGER Do not confess Confess Do not confess Ginger: 1 year Rocky: 1 year Ginger: 7 years Rocky: free Confess Ginger: free Rocky: 7 years Ginger: 5 years Rocky: 5 years • Both Ginger and Rocky have dominant strategies: to confess. Both will confess, even though they would be better off if they both kept their mouths shut.

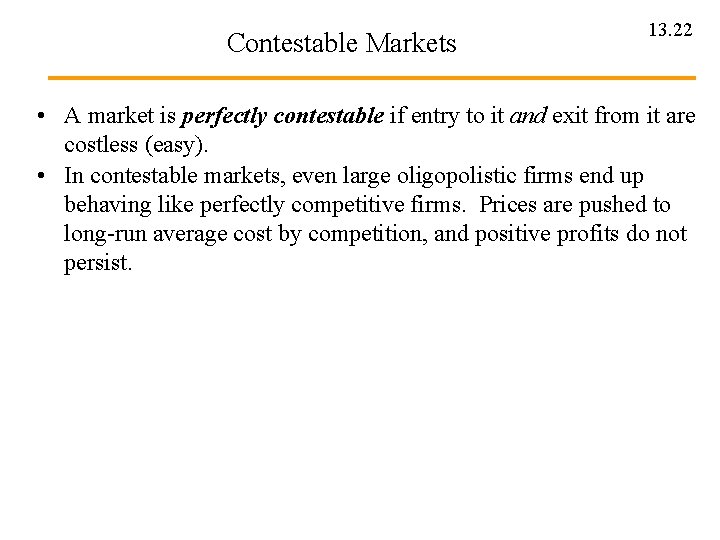

Contestable Markets 13. 22 • A market is perfectly contestable if entry to it and exit from it are costless (easy). • In contestable markets, even large oligopolistic firms end up behaving like perfectly competitive firms. Prices are pushed to long-run average cost by competition, and positive profits do not persist.

Oligopoly is Consistent with a Variety of Behaviors 13. 23 • The only necessary condition of oligopoly is that firms are large enough to have some control over price. • Oligopolies are concentrated industries. At one extreme is the cartel, in essence, acting as a monopolist. At the other extreme, firms compete for small contestable markets in response to observed profits. In between are a number of alternative models, all of which stress the interdependence of oligopolistic firms.

Oligopoly and Economic Performance 13. 24 • Oligopolies, or concentrated industries, are likely to be inefficient for the following reasons: • They are likely to price above marginal cost. This means that there would be underproduction from society’s point of view. • Strategic behavior can force firms into deadlocks that waste resources. • Product differentiation and advertising may pose a real danger of waste and inefficiency.

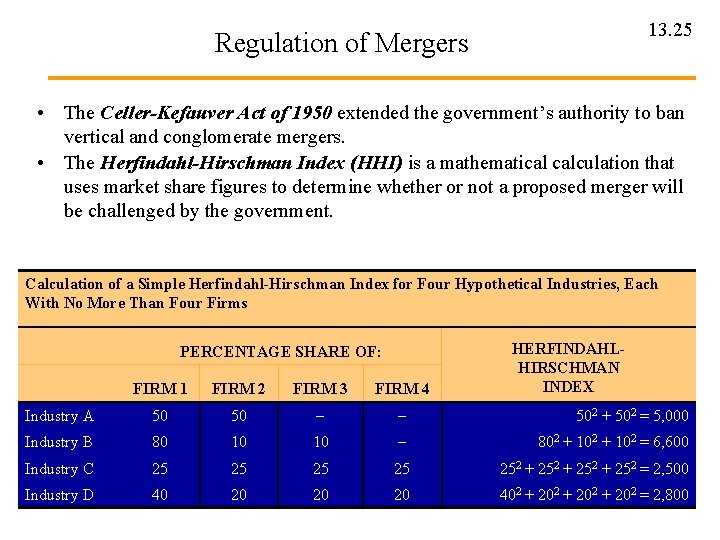

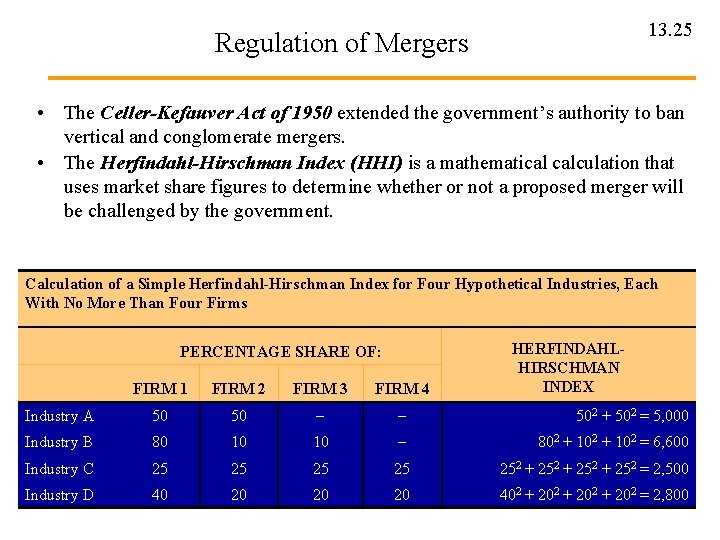

13. 25 Regulation of Mergers • The Celler-Kefauver Act of 1950 extended the government’s authority to ban vertical and conglomerate mergers. • The Herfindahl-Hirschman Index (HHI) is a mathematical calculation that uses market share figures to determine whether or not a proposed merger will be challenged by the government. Calculation of a Simple Herfindahl-Hirschman Index for Four Hypothetical Industries, Each With No More Than Four Firms PERCENTAGE SHARE OF: HERFINDAHLHIRSCHMAN INDEX FIRM 1 FIRM 2 FIRM 3 FIRM 4 Industry A 50 50 - - 502 + 502 = 5, 000 Industry B 80 10 10 - 802 + 102 = 6, 600 Industry C 25 25 252 + 252 = 2, 500 Industry D 40 20 20 20 402 + 202 = 2, 800

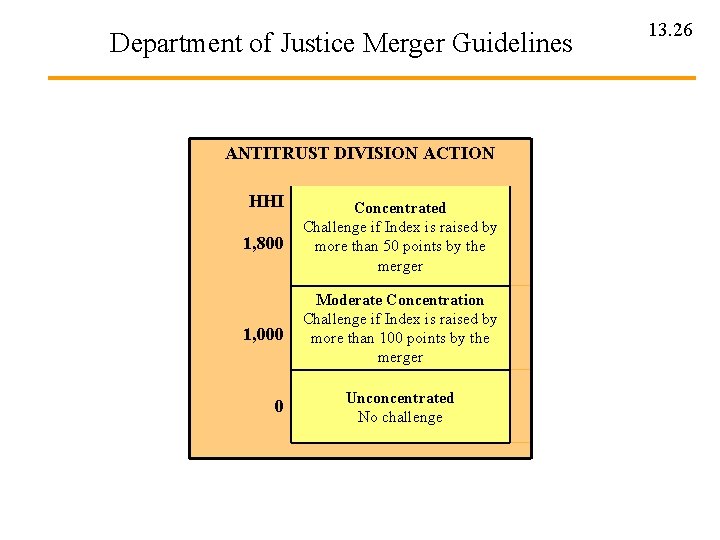

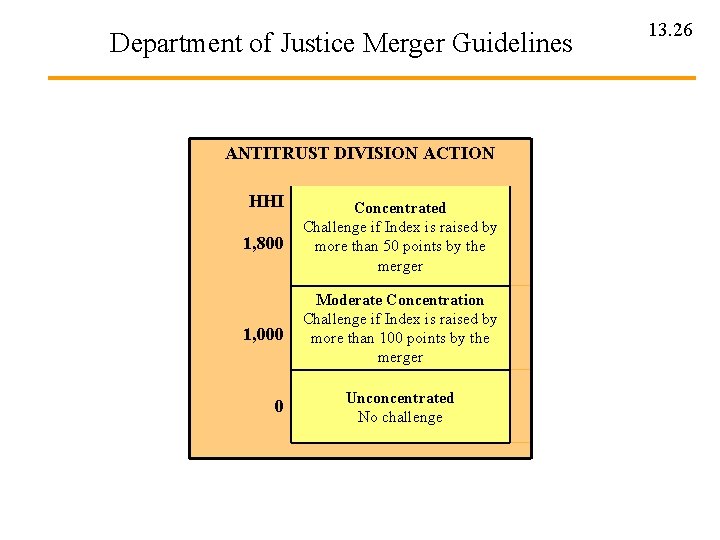

Department of Justice Merger Guidelines ANTITRUST DIVISION ACTION HHI 1, 800 Concentrated Challenge if Index is raised by more than 50 points by the merger 1, 000 Moderate Concentration Challenge if Index is raised by more than 100 points by the merger 0 Unconcentrated No challenge 13. 26

Chapter 7 section 3 monopolistic competition and oligopoly

Chapter 7 section 3 monopolistic competition and oligopoly Difference between monopolistic competition and oligopoly

Difference between monopolistic competition and oligopoly Starbucks monopoly

Starbucks monopoly Advantage of monopolistic competition

Advantage of monopolistic competition Monopoly characteristics

Monopoly characteristics Monopoly vs monopolistic competition

Monopoly vs monopolistic competition Monopoly vs oligopoly venn diagram

Monopoly vs oligopoly venn diagram Perfect competition vs monopolistic competition

Perfect competition vs monopolistic competition Monopolistic competition pictures

Monopolistic competition pictures Pros and cons of monopolistic competition

Pros and cons of monopolistic competition Example of pure competition

Example of pure competition 7dynamics

7dynamics Characteristics of monopoly

Characteristics of monopoly Hhi monopolistic competition

Hhi monopolistic competition Non price competition in oligopoly

Non price competition in oligopoly Excess capacity graph

Excess capacity graph Monopolistic competition characteristics

Monopolistic competition characteristics Price output determination under monopolistic competition

Price output determination under monopolistic competition Consumer surplus in monopolistic competition

Consumer surplus in monopolistic competition Monopolistic competition short run

Monopolistic competition short run Oligopoly characteristics

Oligopoly characteristics Monopolistic competition in long run

Monopolistic competition in long run Monopolistic competition short run

Monopolistic competition short run Consumer surplus in monopolistic competition

Consumer surplus in monopolistic competition Lesson quiz 7-1 market structures

Lesson quiz 7-1 market structures Monopoly business examples

Monopoly business examples Monopolistic competition characteristics

Monopolistic competition characteristics