Center of Islamic Finance COMSATS Institute of Information

- Slides: 17

Center of Islamic Finance COMSATS Institute of Information Technology Lahore Campus Diminishing Musharakah Adopted from open source lecture of Meezan Bank. 1

2

Musharakah is a form of partnership (Shirkat) There are two types of Shirkah: 1. Shirkat-ul-Milk Joint ownership of two or more persons in a particular property. 2. Shirkat-ul-Aqd A partnership affected by mutual contract. It can also be translated as a joint commercial enterprise. 3

Diminishing Musharakah v In Diminishing Musharakah the financier and the client participate either in joint ownership of a property or an equipment, or in a joint commercial enterprise. v The share of the financier will be divided into a number of units. v The client will purchase these units one by one periodically until he is the sole owner of the property. 4

Diminishing Musharakah Three components of Diminishing Musharaka 1. Joint ownership of the Bank and customer. 2. Customer as a lessee uses the share of the bank. 3. Redemption of the share of the Bank by the customer. 5

Diminishing Musharakah Mode of Fixed Asset Financing. Diminishing Musharakah is commonly used for the purpose of financing of fixed assets by various Islamic banks. • House financing • Car Financing • Plant and machinery financing • All other fixed Assets 6

Basic Structure 7

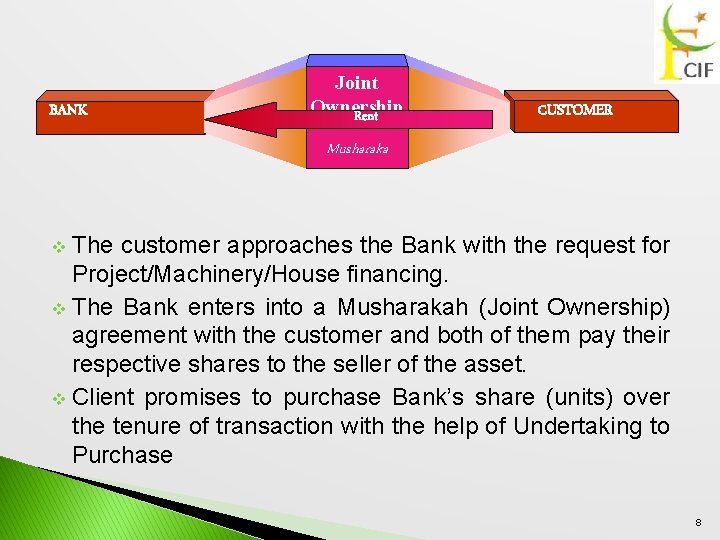

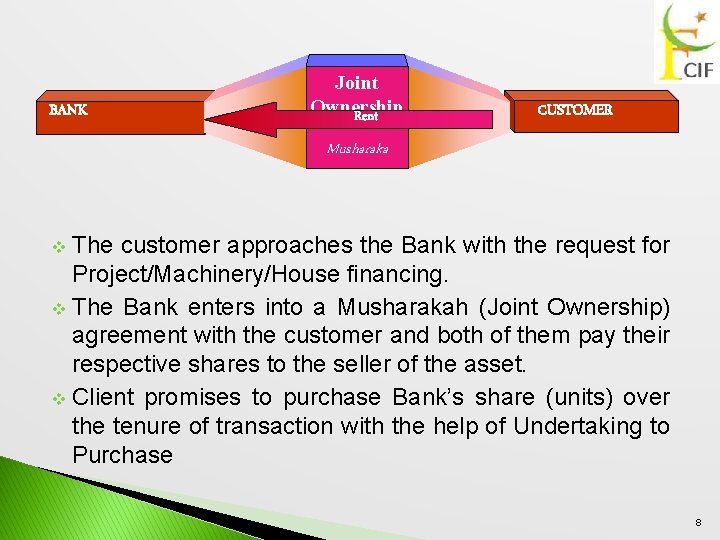

BANK Joint Ownership Rent CUSTOMER Musharaka The customer approaches the Bank with the request for Project/Machinery/House financing. v The Bank enters into a Musharakah (Joint Ownership) agreement with the customer and both of them pay their respective shares to the seller of the asset. v Client promises to purchase Bank’s share (units) over the tenure of transaction with the help of Undertaking to Purchase v 8

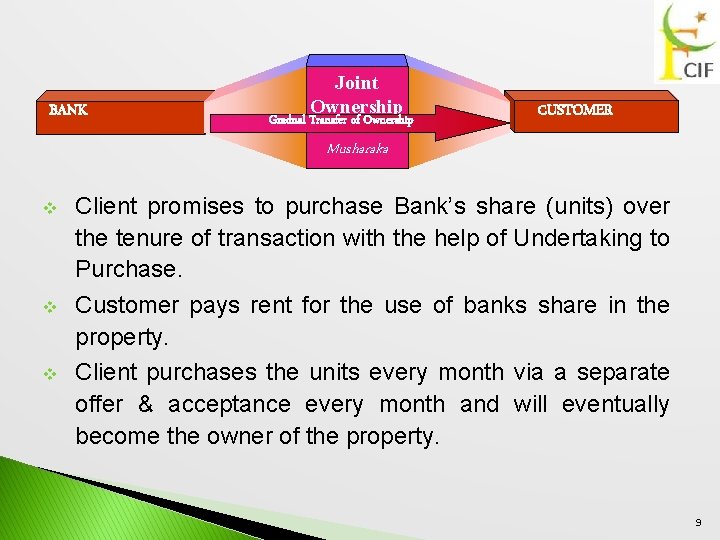

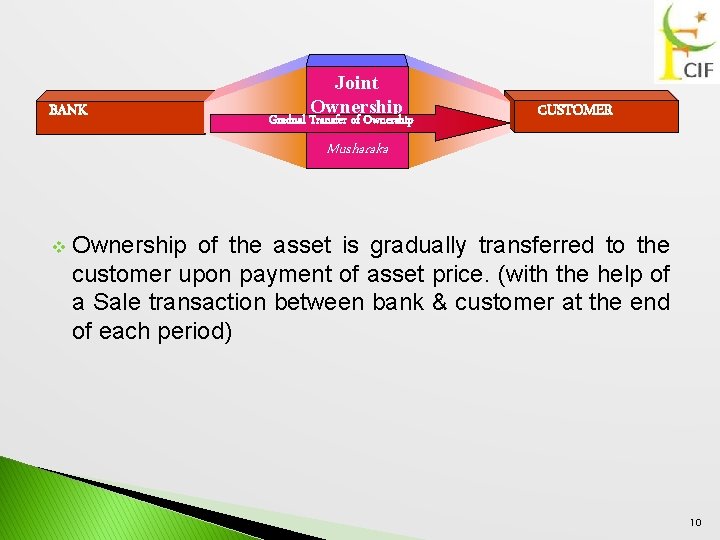

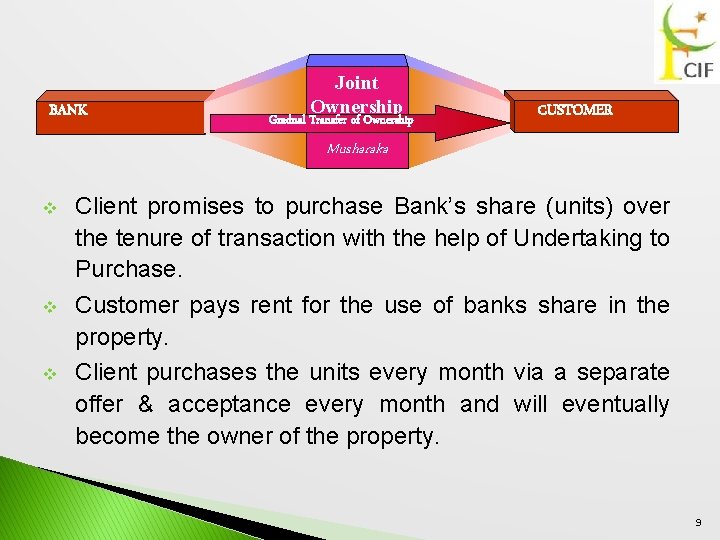

BANK Joint Ownership Gradual Transfer of Ownership CUSTOMER Musharaka v v v Client promises to purchase Bank’s share (units) over the tenure of transaction with the help of Undertaking to Purchase. Customer pays rent for the use of banks share in the property. Client purchases the units every month via a separate offer & acceptance every month and will eventually become the owner of the property. 9

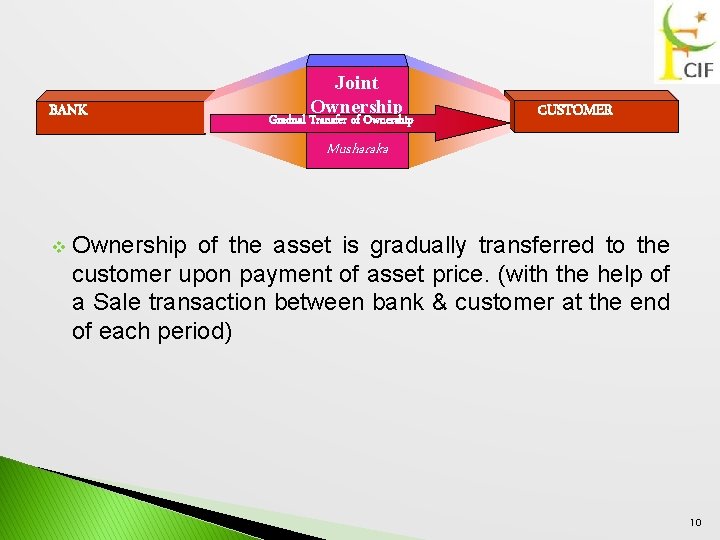

BANK Joint Ownership Gradual Transfer of Ownership CUSTOMER Musharaka v Ownership of the asset is gradually transferred to the customer upon payment of asset price. (with the help of a Sale transaction between bank & customer at the end of each period) 10

Shariah Principles 11

Shariah Principles v To create joint ownership in property is called Shirkat-ul. Milk and is expressly allowed by all schools of Islamic Jurisprudence. v All Muslim Jurists agree on the permissibility of the Financier leasing his share in property to client and charging him rent i. e. the permissibility of leasing one’s share to his partner. v There is difference of opinion among leasing one’s share to a third part But there is no difference on permissibility on leasing to a partner. 12

Shariah Principles v Promise of client to purchase units of share of financier is also allowed. v The Transactions cannot be combined in a single arrangements and they have to be executed independently. v This is because it is a well settled rule of Islamic Jurisprudence that one transaction cannot be made a condition for another. v Instead of making the transactions a pre-condition for one anothere can be one-sided promises from one party to another 13

Illustration 14

DM - Illustration 1. Customer request financing for a fixed Asset costing Rs. 300 million. 2. Islamic Bank agrees to provide financing up to 90% of the cost. 3. Joint Ownership Agreement is executed between the bank and the Customer. 4. Bank will purchase 90% share in the asset by paying Rs. 270 million to supplier. 5. Customers pays its share of Rs. 30 million. 15

DM - Illustration 6. Bank’s share is divided into five units. 7. Customer agrees to buyout Bank’s share (units) on yearly basis and the Undertaking is executed by the customer. 8. Customer pays the rent for the usage of the Bank’s units. 9. Rental reduces after purchase of each unit by the customer. 10. After five years ownership of the asset is completely transferred to the customer. 16

THANK YOU 17