Captives Formation How and When Charlie Woodman CPA

- Slides: 44

Captives Formation: How and When Charlie Woodman, CPA André Lefebvre, FCAS, MAAA Credit & Market Risk Executive Royal & Sun. Alliance SVP, Risk Finance Marsh CAS Ratemaking Seminar March 27, 2003

Discussion Points Ø Risk and Risk Financing Perspectives Ø Single Parent Captive Ø Group Approach Ø Critical Considerations Ø Stop us at any time for questions 1

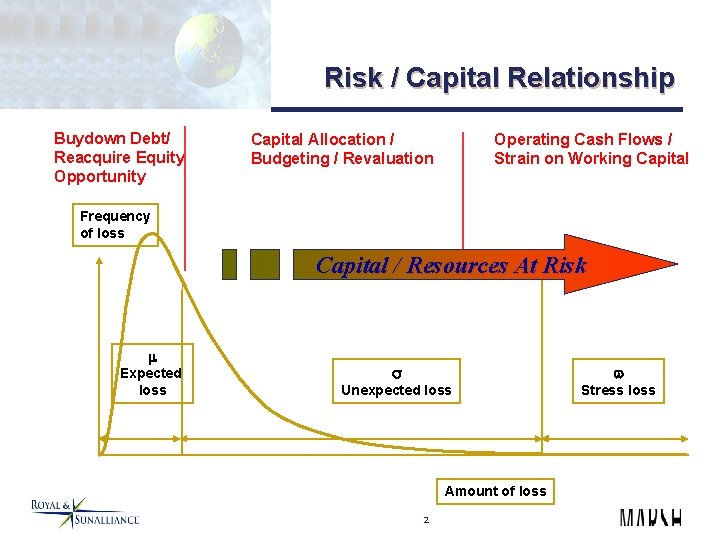

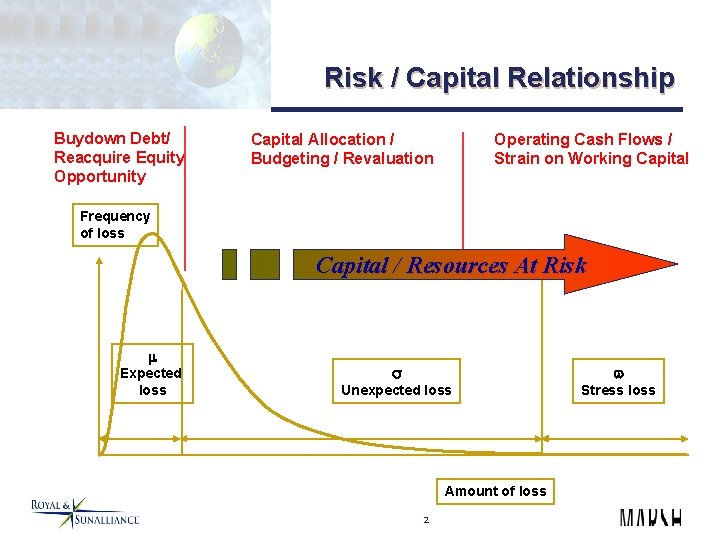

Risk / Capital Relationship Buydown Debt/ Reacquire Equity Opportunity Capital Allocation / Budgeting / Revaluation Operating Cash Flows / Strain on Working Capital Frequency of loss Capital / Resources At Risk Expected loss Unexpected loss Stress loss Amount of loss 2

Universe of Risk Finance From the Insured’s Perspective Ø Risk Transfer • Becomes someone else’s risk Ø Risk Funding Efficiencies • Our risk, our balance sheet, more cost and timing efficient Ø Off-Balance Sheet • Our risk, someone else’s balance sheet Ø “Planet Killer” Protection • Our risk, our balance sheet, save our lives. 3

Captive Insurance Company Defined Ø An Insurance Company, typically owned by non-insurance parent(s), insuring the risks or interests of its owner(s) Ø Incorporated, Regulated, Capitalized and Accountable Ø May or May not be a replacement for insurance. Depends on Form (ownership and insured relationship) • Emphasizes the ‘Insurance Transaction’ • Insurance Company Operations 4

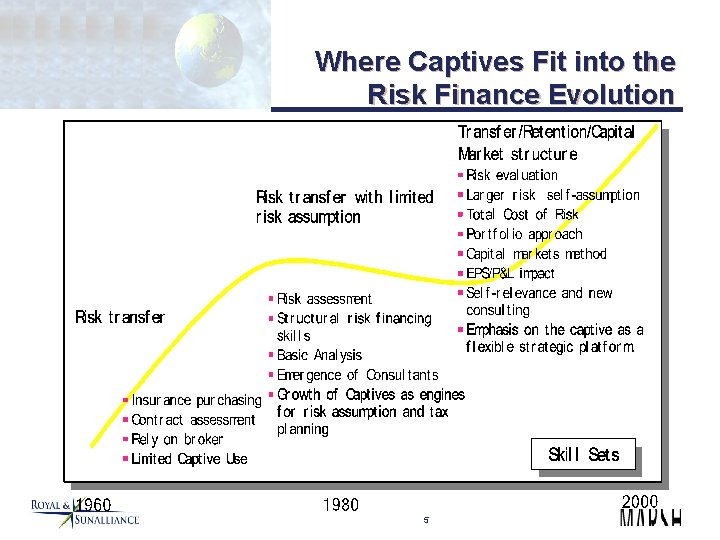

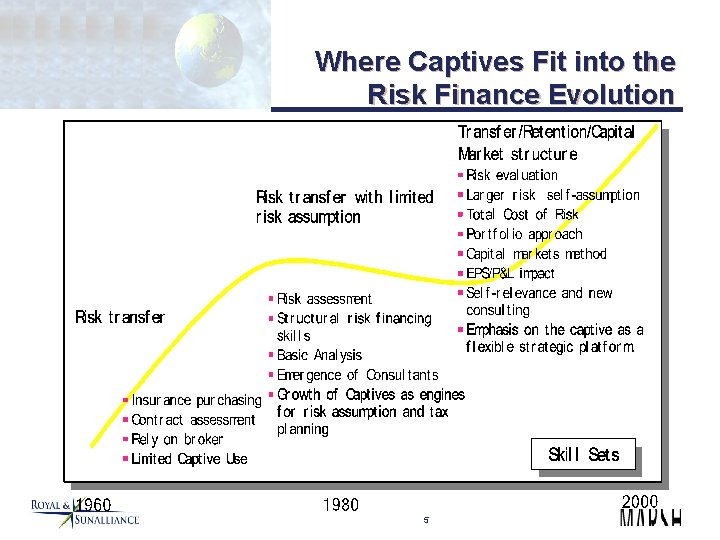

Where Captives Fit into the Risk Finance Evolution 5

Captive Insurance Company Forms Ø Single Parent - Non Risk Pooling • Wholly-owned, Rent-A-Captive, Trusts • Emphasis on Risk Funding and Cost / Funding Efficiencies Ø Group Owned- Risk Sharing / Risk Pooling • Group, Association Captive, Risk Retention Group • Emphasis on Risk Transfer replacement / Alternative “insurance” Ø This distinction is critical in assessing the merits of a program. 6

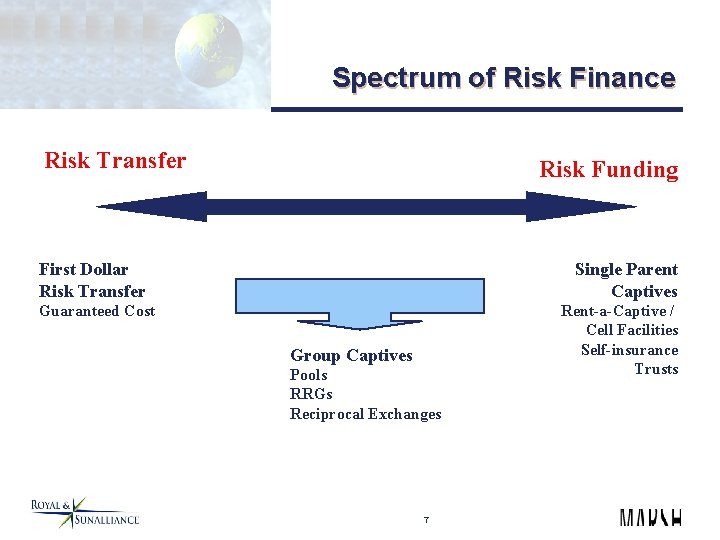

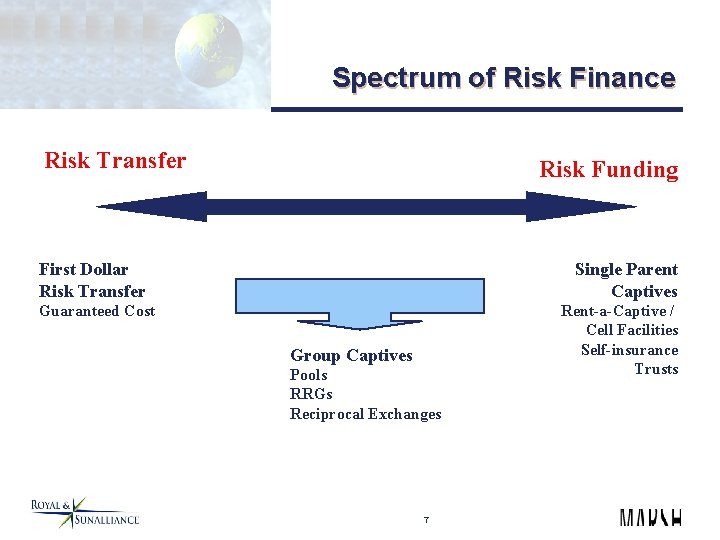

Spectrum of Risk Finance Risk Transfer Risk Funding First Dollar Risk Transfer Single Parent Captives Guaranteed Cost Group Captives Pools RRGs Reciprocal Exchanges 7 Rent-a-Captive / Cell Facilities Self-insurance Trusts

Current Captive Insurance Program Emphases Ø Cost Savings Ø Risk Management Facilitation Ø Business Enhancement Ø Insurance / Risk Transfer Replication (Group Emphasis) 8

Single Parent Captive Reality Ø Individual Reporting Concern and a Consolidated Entity Ø A Single-Parent Captive Insurance Subsidiary, insuring the risks of the parent and affiliated operating brothersister concerns, is only self-insurance in its most sophisticated form. • Risk Retention Levels and Captive Utilization are two • Ø different considerations. If a concern cannot afford to increase its risk retention levels without a captive, then they certainly cannot afford to assume more risk with one. No one needs a captive insurance subsidiary. 9

Current Single Parent Captive Insurance Program Emphases Ø Cost Savings Ø Risk Management Facilitation Ø Business Enhancement 10

Cost Savings Ø Long-term: “Seasoning” / Risk Management Point Facility Ø Short-term: “Business Case” 11

Seasoning Ø “Seasoning” / Risk Management Point Facility Ø Extends the Corporate Risk Management “Commitment” to It’s Own Risks Ø Engages in Insurance under the Insurance Industry’s Mechanisms and Measurements Ø Regulated and “Grounded” Ø Reinforces Relationships with (Re)insurance Markets Ø Hard to quantify 12

How (Re)insurers evaluate captives as Risk Partners Ø Where domiciled Ø How long in existence Ø Strength of captive’s financials Ø Who manages captive Ø Insurance program dynamics Ø Actuarial support Ø Owner proactivity and commitment 13

Business Case Ø NPV of Cash Flows - Short Term Business Case cost Savings • Accelerated Tax Benefits - Qualified Insurer • State (& International) Tax Arbitrage • Operating Costs • Opportunity Cost of Capital Ø Other Quantitative & Qualitative 14

Tax Reality Ø The underlying issues which define whether an insurance transaction has occurred or whether a transaction is selffunding are: • “Insurance Risk” - Insurer must assume a reasonable possibility of incurring significant loss. • Notions of Risk - Form • Risk Transfer / Risk Distribution - Risk of loss must be legally transferred from one legal entity to another, which pools the risk among other risks so as to increase predictability, and reduce adverse loss uncertainty. 15

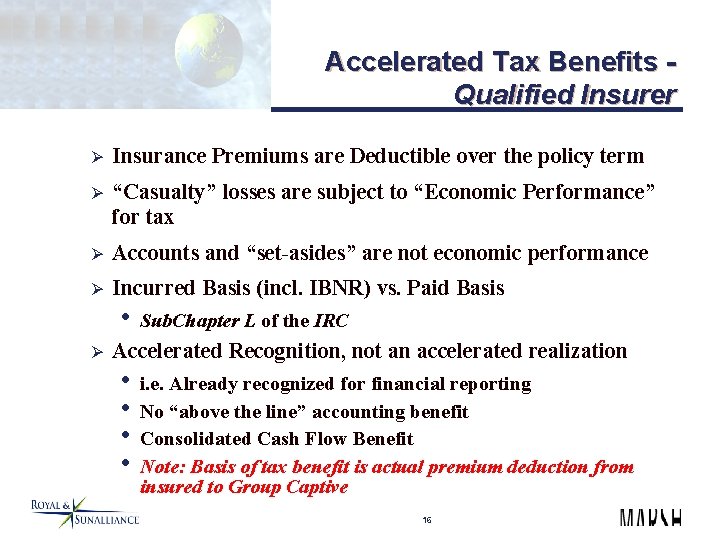

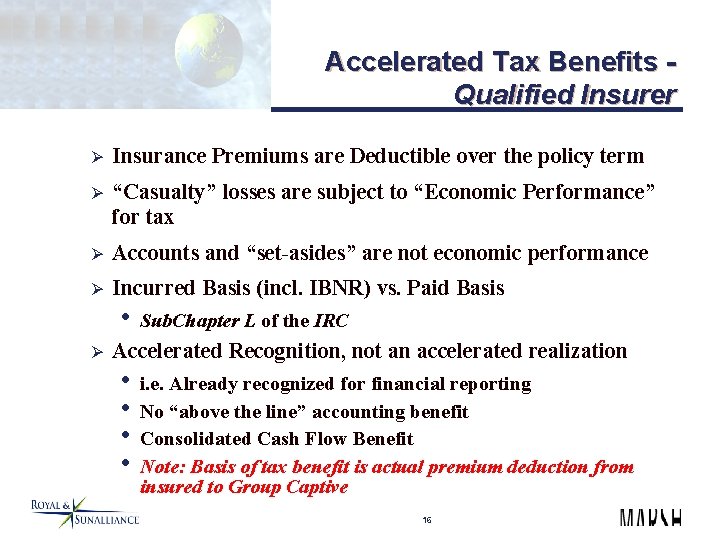

Accelerated Tax Benefits Qualified Insurer Ø Insurance Premiums are Deductible over the policy term Ø “Casualty” losses are subject to “Economic Performance” for tax Ø Accounts and “set-asides” are not economic performance Ø Incurred Basis (incl. IBNR) vs. Paid Basis • Sub. Chapter L of the IRC Ø Accelerated Recognition, not an accelerated realization • i. e. Already recognized for financial reporting • No “above the line” accounting benefit • Consolidated Cash Flow Benefit • Note: Basis of tax benefit is actual premium deduction from insured to Group Captive 16

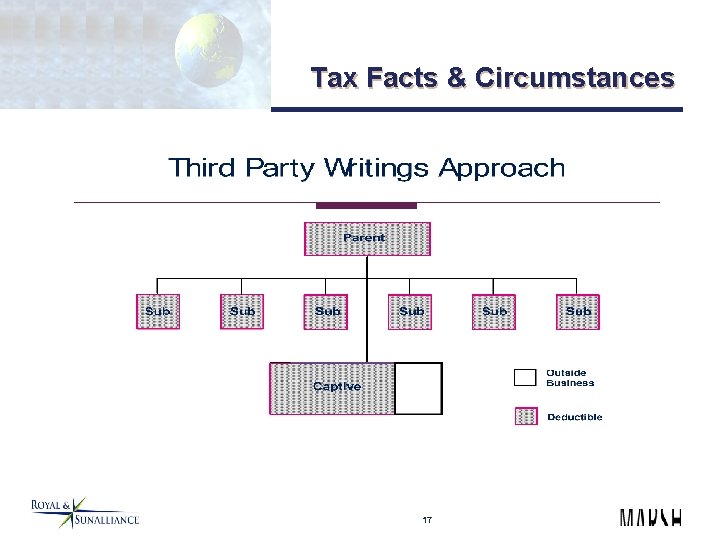

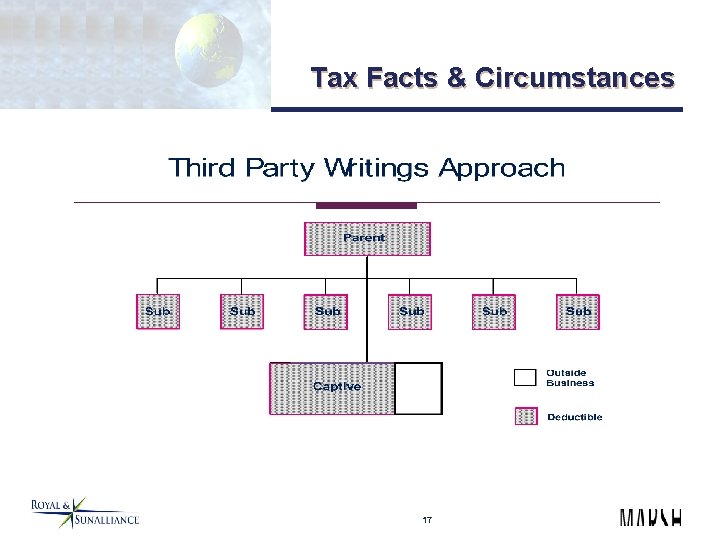

Tax Facts & Circumstances 17

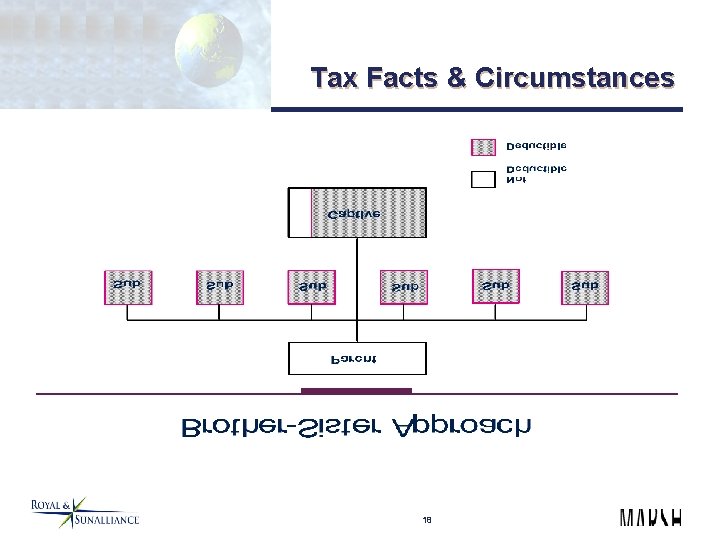

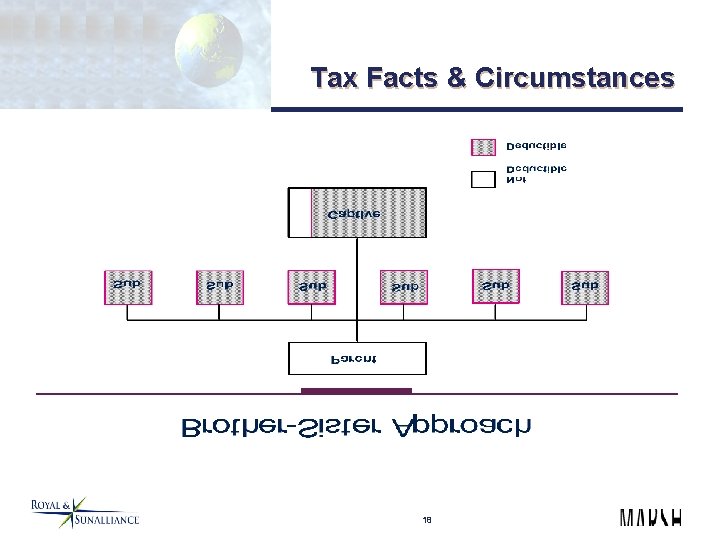

Tax Facts & Circumstances 18

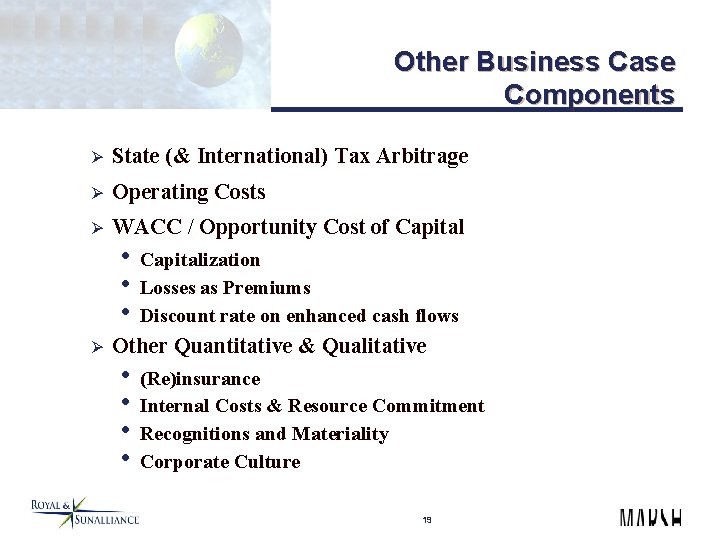

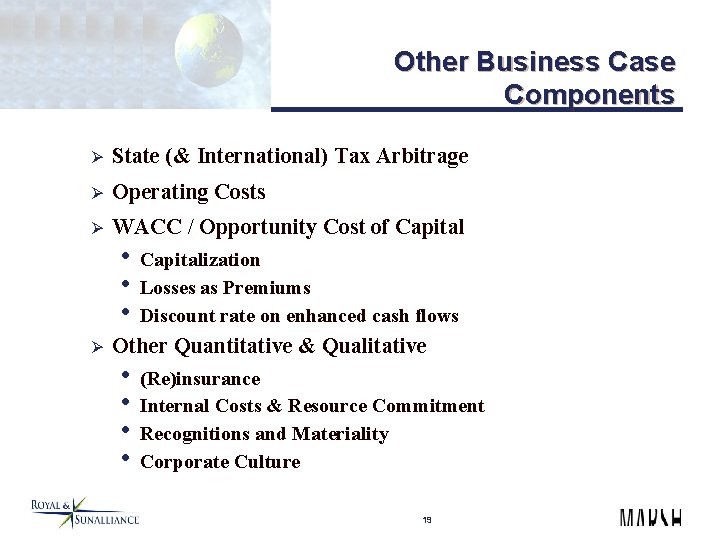

Other Business Case Components Ø State (& International) Tax Arbitrage Ø Operating Costs Ø WACC / Opportunity Cost of Capital • Capitalization • Losses as Premiums • Discount rate on enhanced cash flows Ø Other Quantitative & Qualitative • (Re)insurance • Internal Costs & Resource Commitment • Recognitions and Materiality • Corporate Culture 19

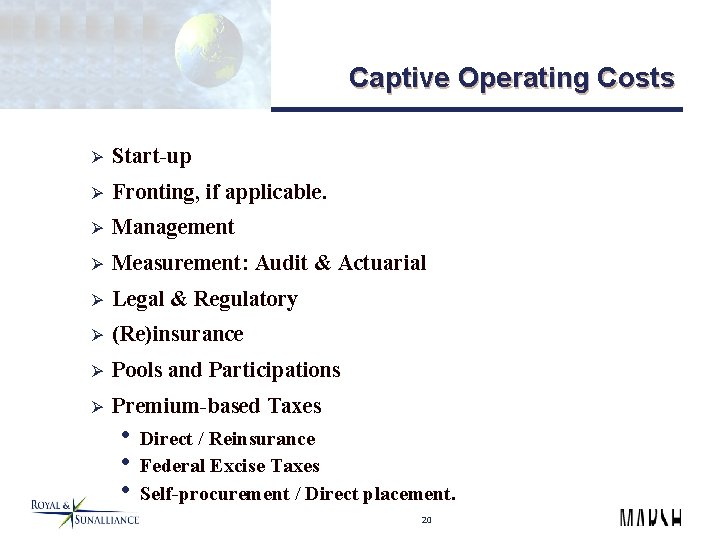

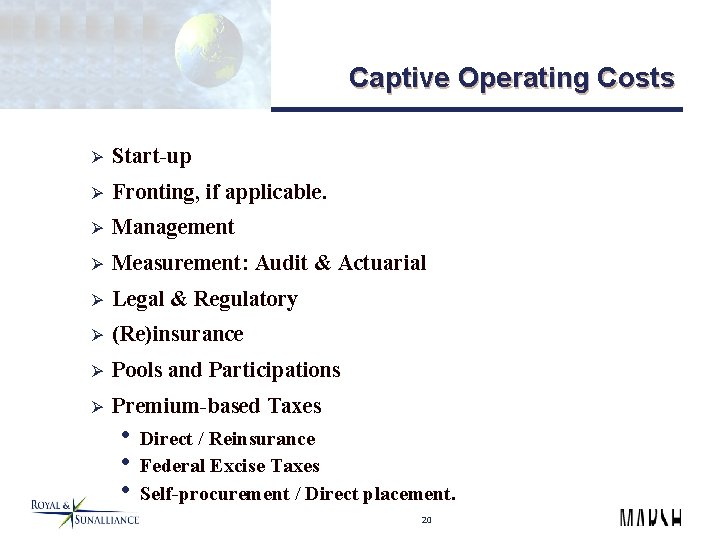

Captive Operating Costs Ø Start-up Ø Fronting, if applicable. Ø Management Ø Measurement: Audit & Actuarial Ø Legal & Regulatory Ø (Re)insurance Ø Pools and Participations Ø Premium-based Taxes • Direct / Reinsurance • Federal Excise Taxes • Self-procurement / Direct placement. 20

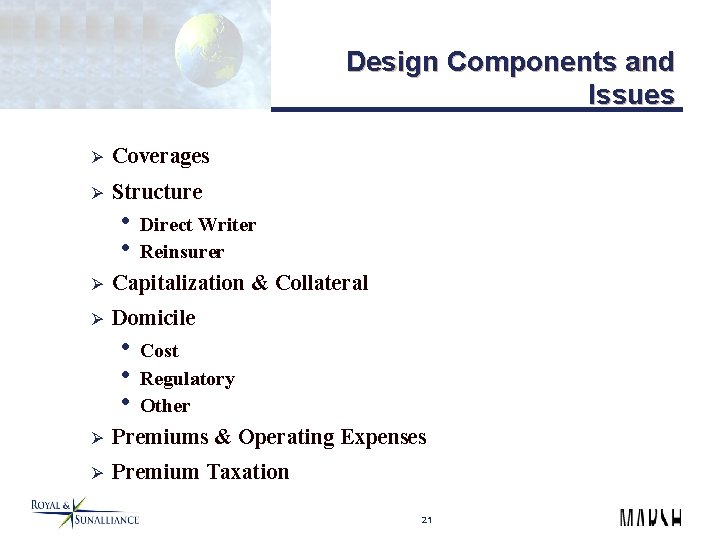

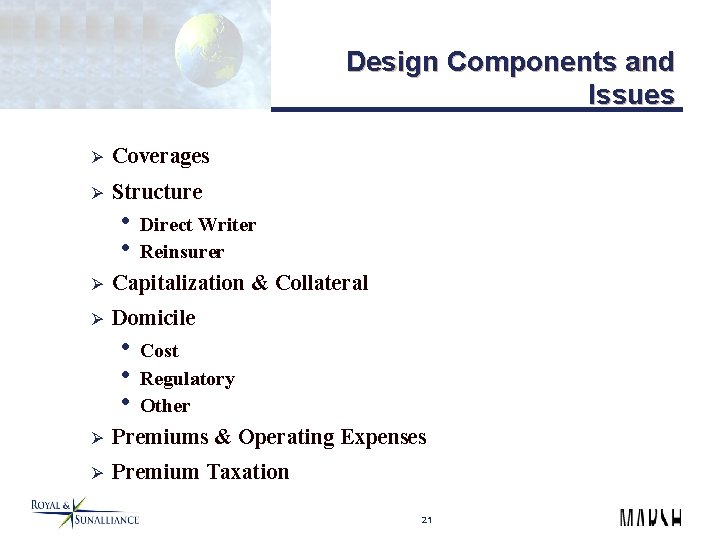

Design Components and Issues Ø Coverages Ø Structure • Direct Writer • Reinsurer Ø Capitalization & Collateral Ø Domicile • Cost • Regulatory • Other Ø Premiums & Operating Expenses Ø Premium Taxation 21

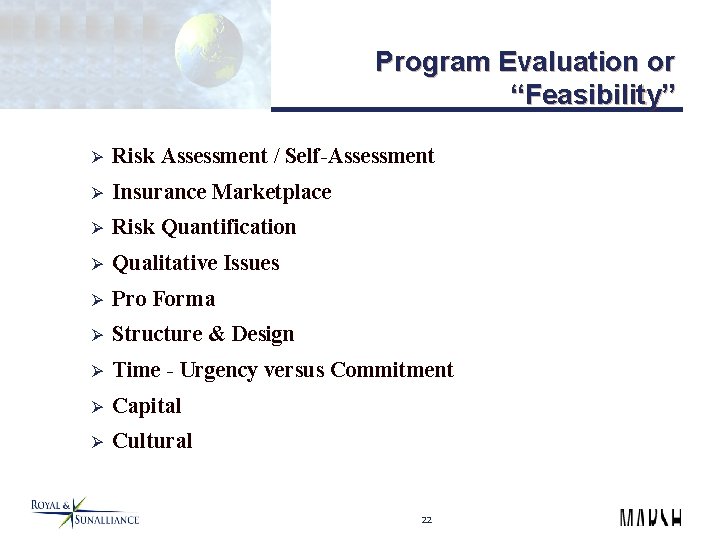

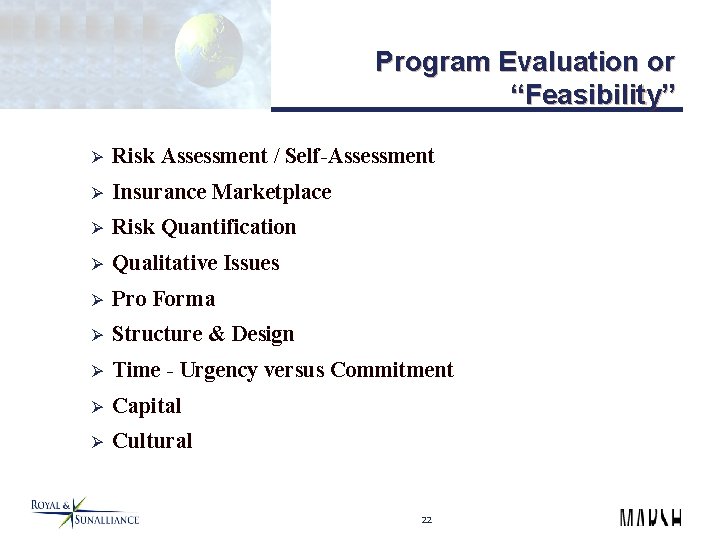

Program Evaluation or “Feasibility” Ø Risk Assessment / Self-Assessment Ø Insurance Marketplace Ø Risk Quantification Ø Qualitative Issues Ø Pro Forma Ø Structure & Design Ø Time - Urgency versus Commitment Ø Capital Ø Cultural 22

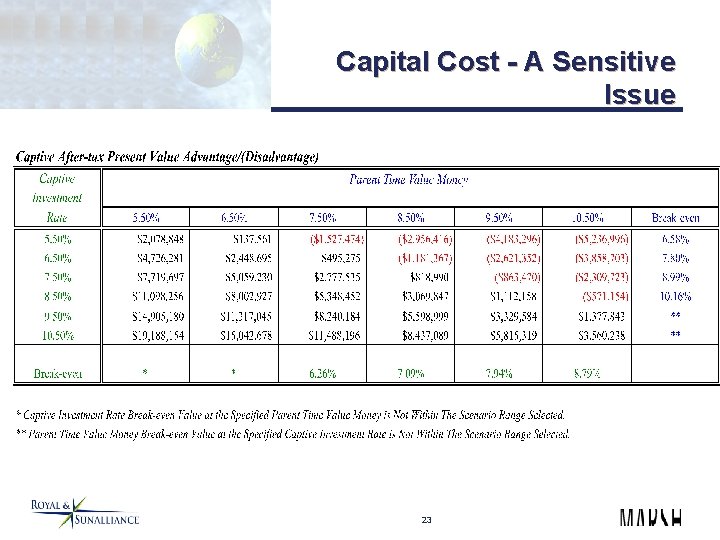

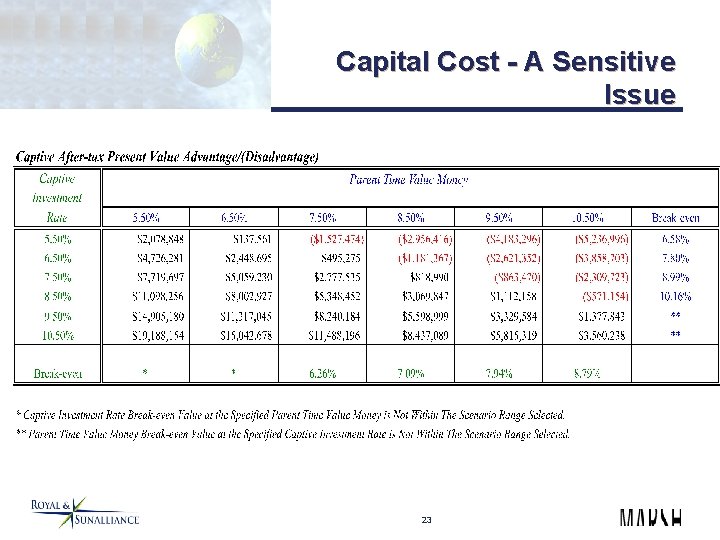

Capital Cost - A Sensitive Issue 23

Underwriting Ø Traditional risk • Professional Liability/Medical Malpractice • Workers compensation, auto and general liability • Products/completed operations, errors & omissions, environmental • D&O, Surety, Property? • Employee Benefits: Voluntary LTD, Optional Life, Health coverages? 24

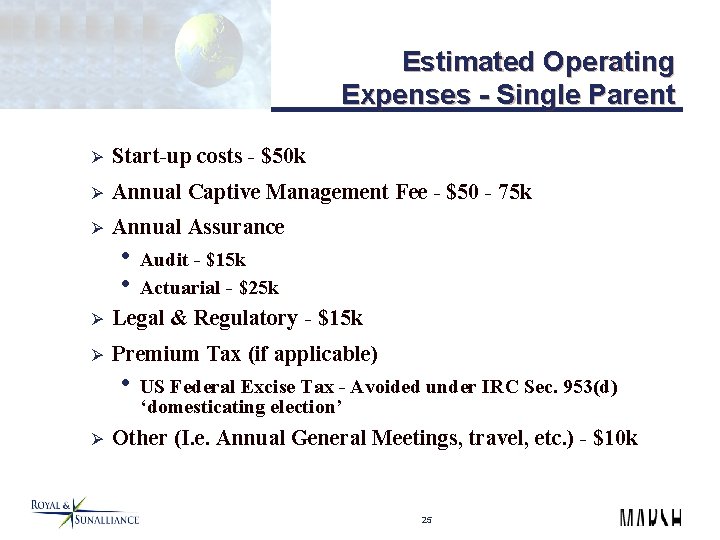

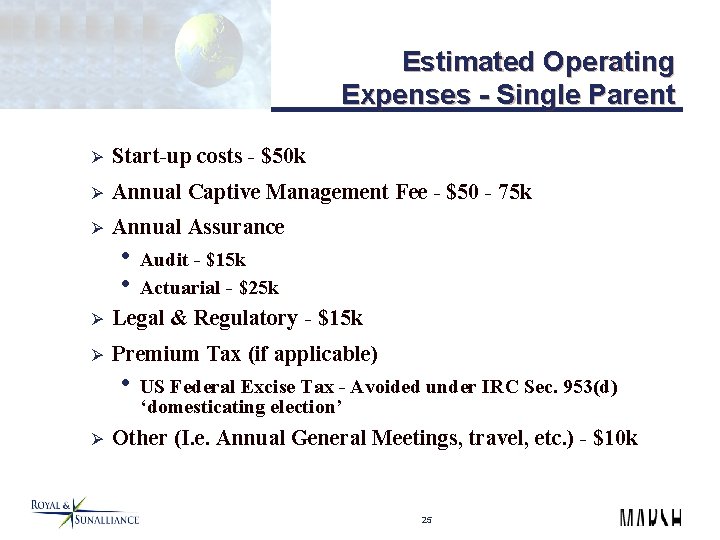

Estimated Operating Expenses - Single Parent Ø Start-up costs - $50 k Ø Annual Captive Management Fee - $50 - 75 k Ø Annual Assurance • Audit - $15 k • Actuarial - $25 k Ø Legal & Regulatory - $15 k Ø Premium Tax (if applicable) • US Federal Excise Tax - Avoided under IRC Sec. 953(d) ‘domesticating election’ Ø Other (I. e. Annual General Meetings, travel, etc. ) - $10 k 25

Other Considerations Ø Operational • Directors & Officers • Committees • Meeting Structure & Timing Ø Financial • Timing, Distribution & Format • Investments Ø Structural for Group Emphasis • Fronted / Reinsurance • Retro rated • Capitalization Ø Administrative Ø Consensus, Agreement, Voice, Relevance, Commitment 26

Group Captive Reality Ø A Group Captive is dependent on its members and its advisors. • Risks of the few may become the risks of the many. • The Assets of the many may become the assets of the few. Ø The goal is the replication and replacement of insurance and a group purchase of excess coverages / reinsurance • Can be a problem to insurers, due to risk concentration. Ø Works best when the ‘motivation’ is high. • Industry abandonment or extreme over-pricing. • Commitment to changing industry risk practices. • Creating a group “voice. ” • Communication and consensus already exists or a centralizing entity coordinates the efforts. 27

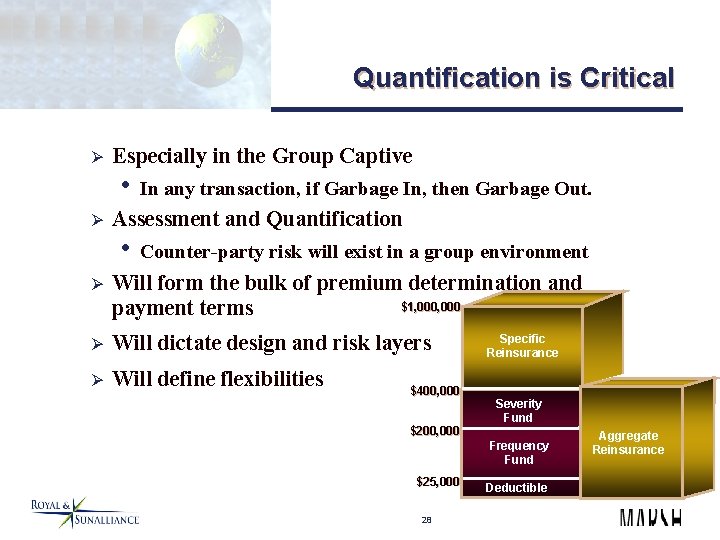

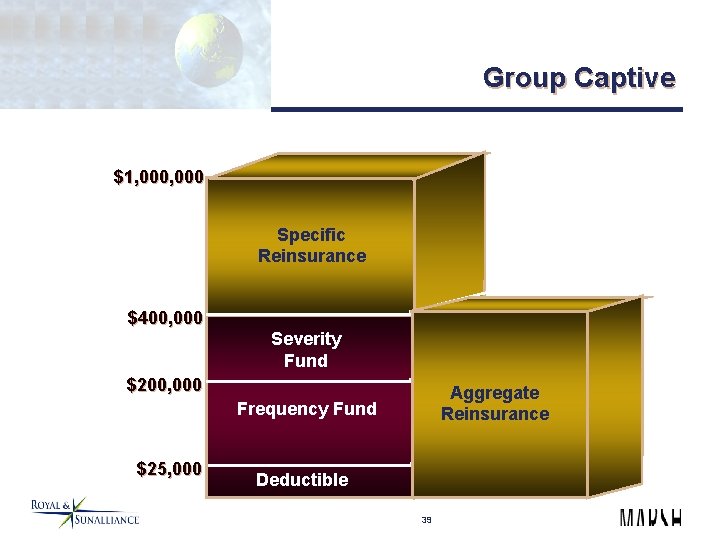

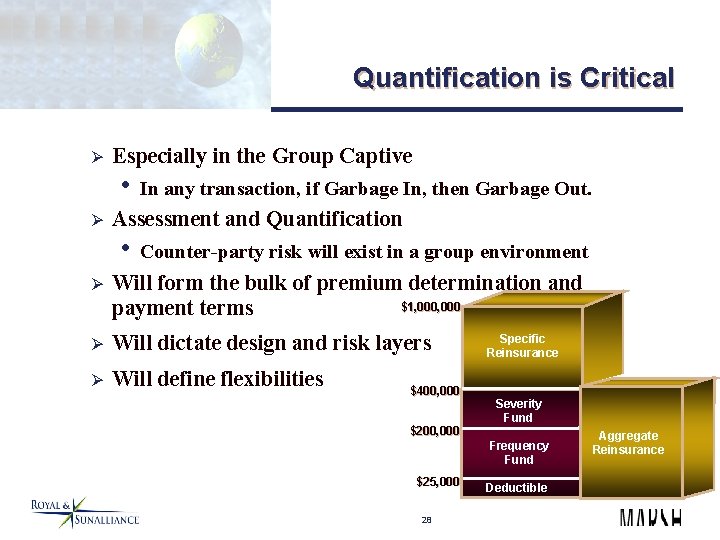

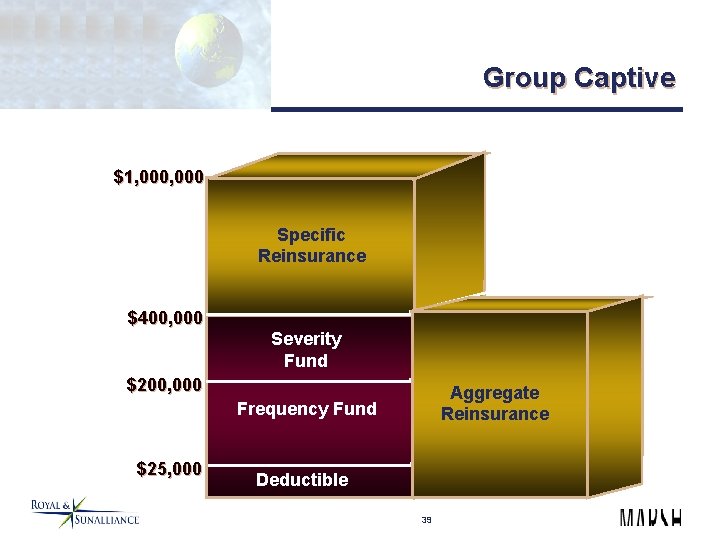

Quantification is Critical Ø Especially in the Group Captive • In any transaction, if Garbage In, then Garbage Out. Ø Assessment and Quantification • Counter-party risk will exist in a group environment Ø Will form the bulk of premium determination and $1, 000 payment terms Ø Will dictate design and risk layers Ø Will define flexibilities $400, 000 $200, 000 Specific Reinsurance Severity Fund Frequency Fund $25, 000 28 Deductible Aggregate Reinsurance

Actuarial Issues Ø Retention Level • Attachment Point • Per Occurrence Limit • Aggregate Limit Ø Pricing • Pure Premium • Expenses • Profit & Contingency Ø Dynamic Financial Analysis 29

Factors Influencing Retention Level Ø Financial Wherewithal of the Insured Ø Financial Wherewithal of Insurers Ø Risk Philosophies Ø Insurance Market Conditions Ø Cost / Benefit Analysis 30

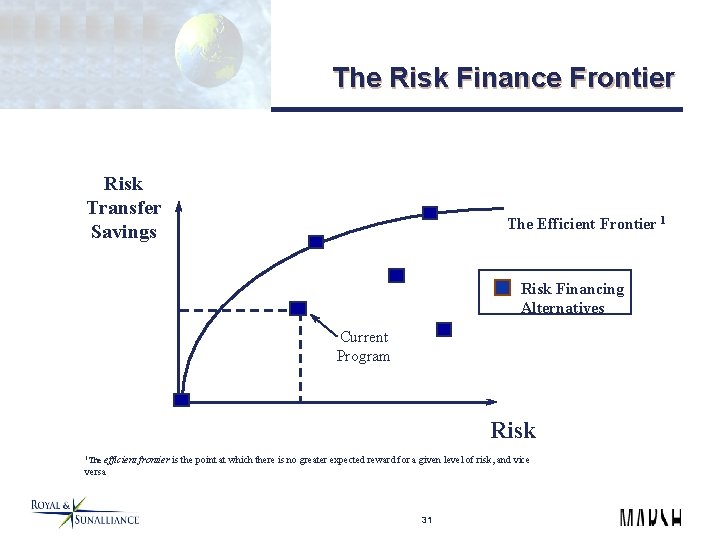

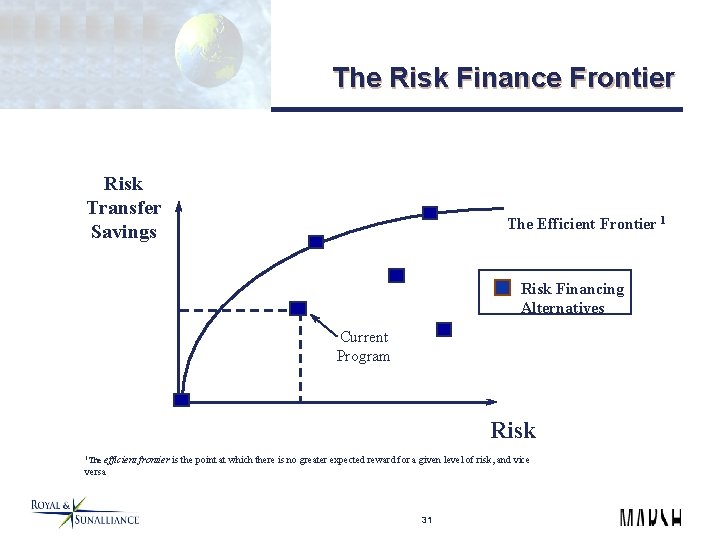

The Risk Finance Frontier Risk Transfer Savings The Efficient Frontier 1 Risk Financing Alternatives Current Program Risk efficient frontier is the point at which there is no greater expected reward for a given level of risk, and vice versa 1 The 31

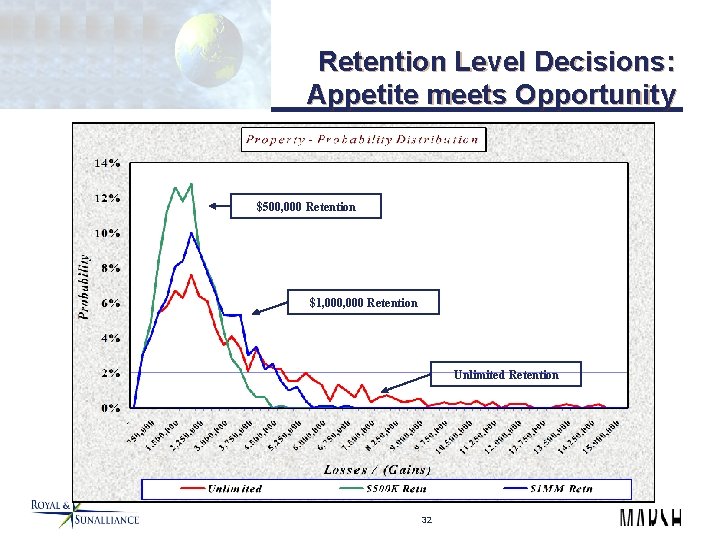

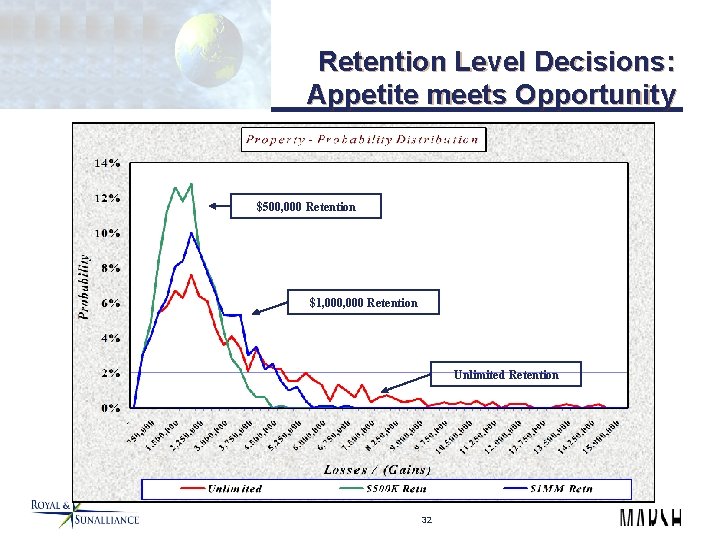

Retention Level Decisions: Appetite meets Opportunity $500, 000 Retention $1, 000 Retention Unlimited Retention 32

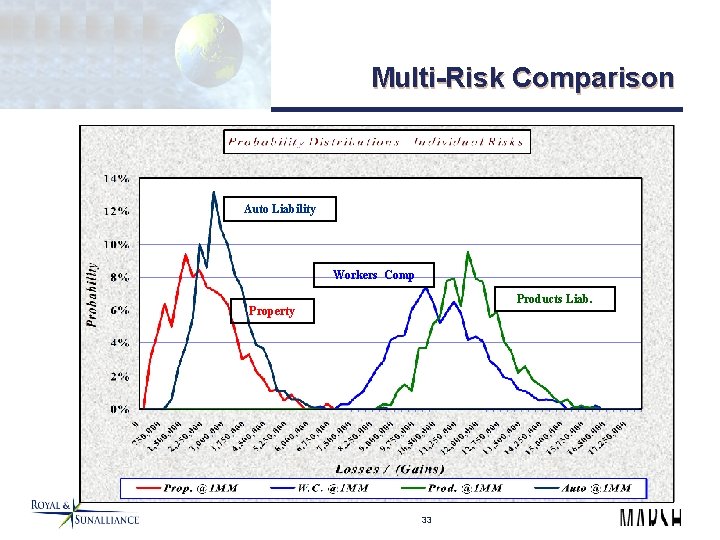

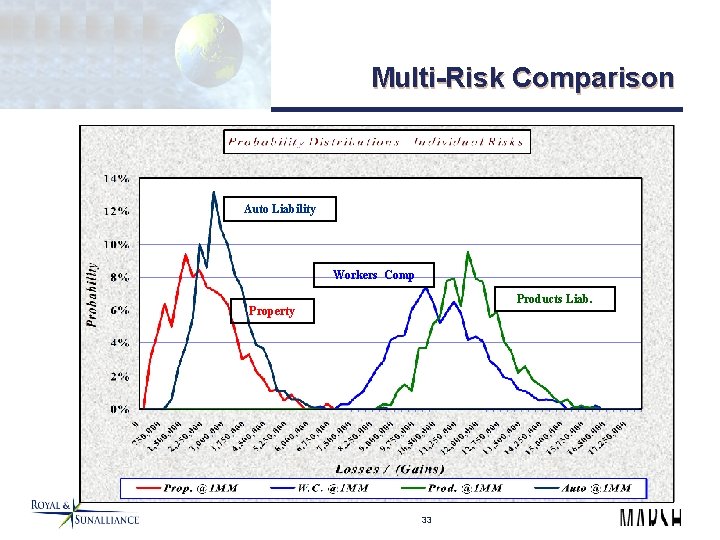

Multi-Risk Comparison Auto Liability Workers Comp Products Liab. Property 33

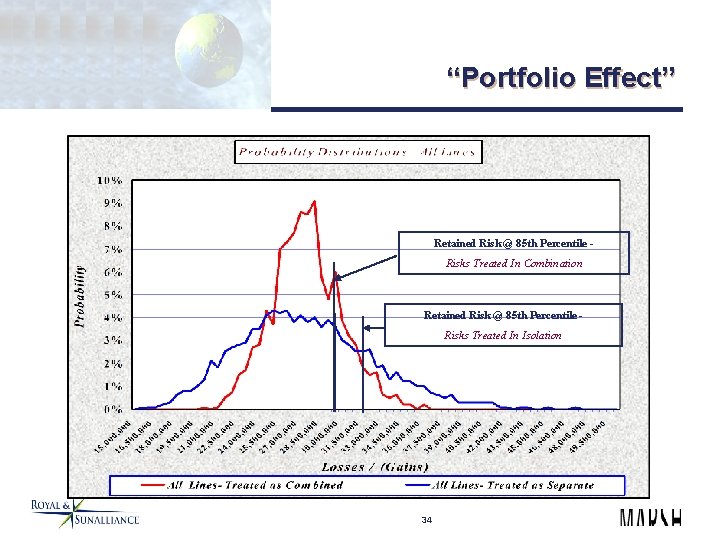

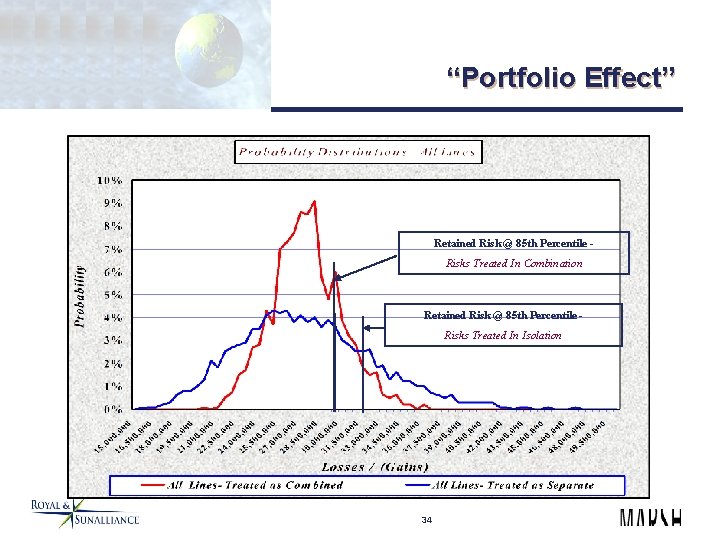

“Portfolio Effect” Retained Risk @ 85 th Percentile Risks Treated In Combination Retained Risk @ 85 th Percentile Risks Treated In Isolation 34

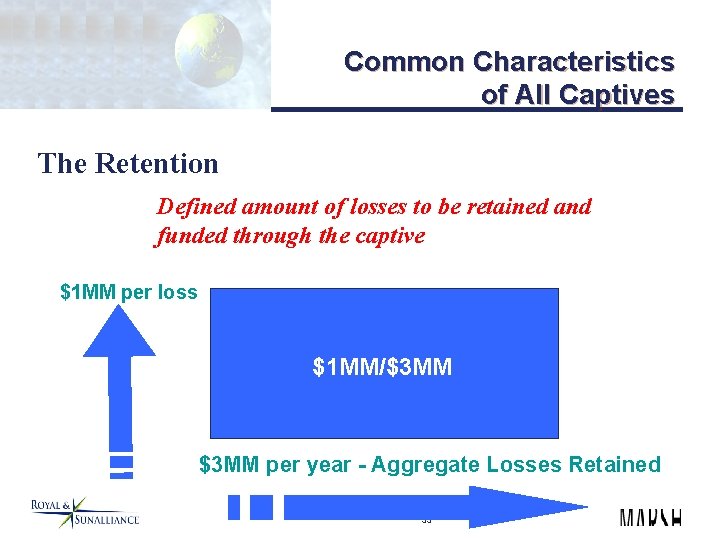

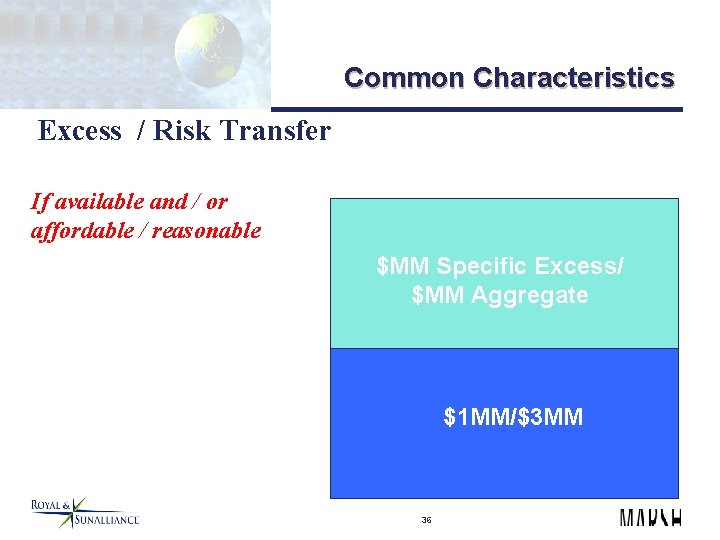

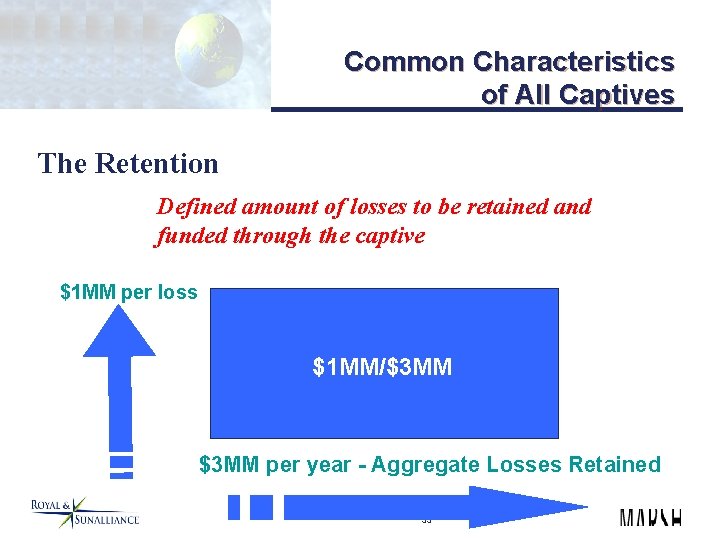

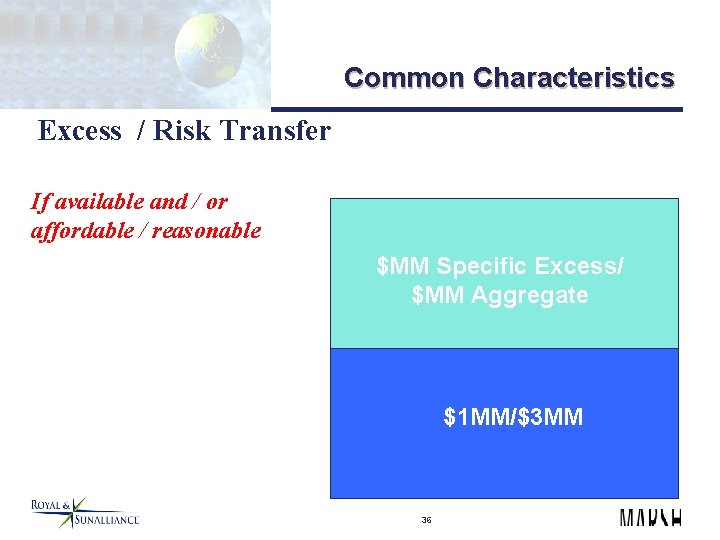

Common Characteristics of All Captives The Retention Defined amount of losses to be retained and funded through the captive $1 MM per loss $1 MM/$3 MM per year - Aggregate Losses Retained 35

Common Characteristics Excess / Risk Transfer If available and / or affordable / reasonable $MM Specific Excess/ $MM Aggregate $1 MM/$3 MM 36

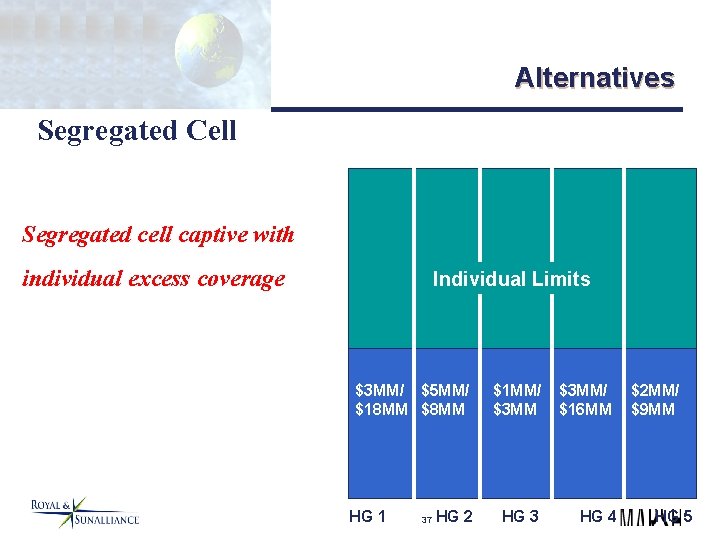

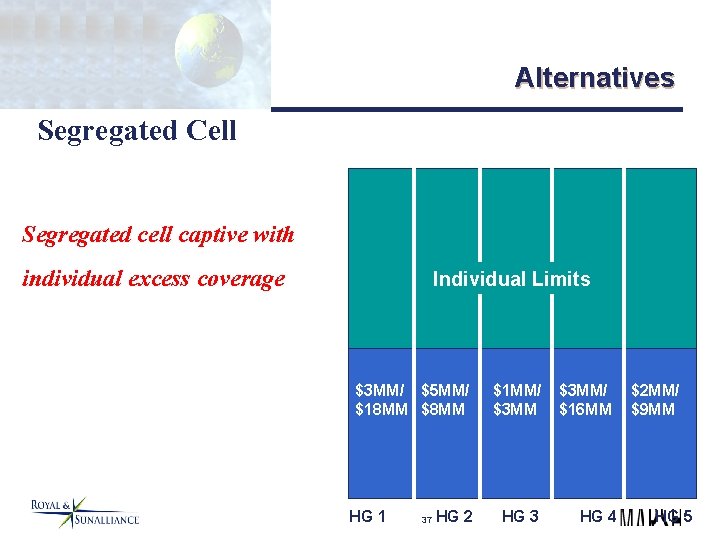

Alternatives Segregated Cell Segregated cell captive with individual excess coverage Individual Limits $3 MM/ $5 MM/ $18 MM $8 MM HG 1 37 HG 2 $1 MM/ $3 MM HG 3 $3 MM/ $16 MM HG 4 $2 MM/ $9 MM HG 5

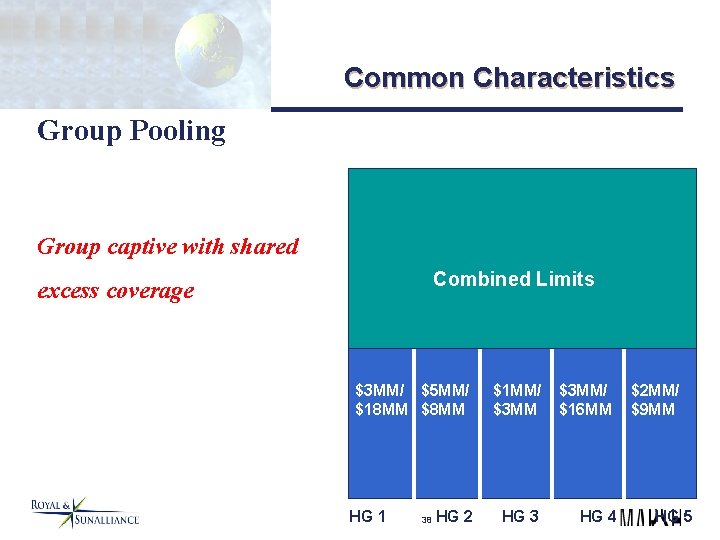

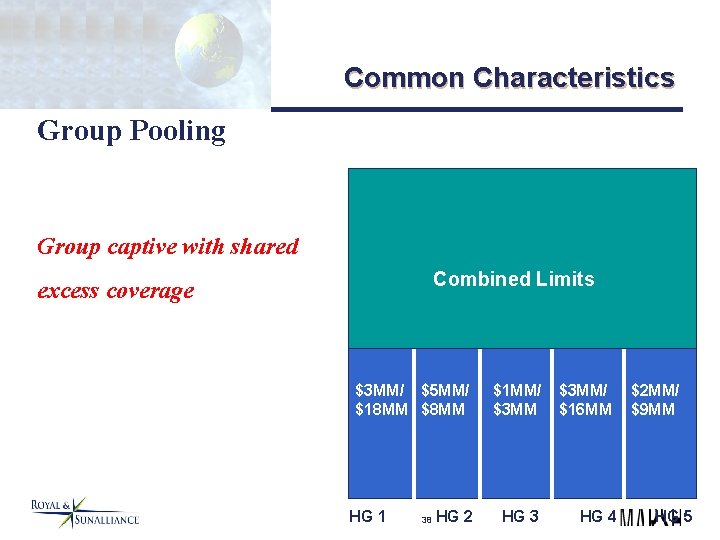

Common Characteristics Group Pooling Group captive with shared Combined Limits excess coverage $3 MM/ $5 MM/ $18 MM $8 MM HG 1 38 HG 2 $1 MM/ $3 MM HG 3 $3 MM/ $16 MM HG 4 $2 MM/ $9 MM HG 5

Group Captive $1, 000 Specific Reinsurance $400, 000 Severity Fund $200, 000 Aggregate Reinsurance Frequency Fund $25, 000 Deductible 39

Pricing Issues Ø Similar to Pricing • “High Deductible” • “Excess Reinsurance” Ø Methodology • Traditional methods o o Aggregate Frequency / Severity • Monte Carlo simulation models 40

Pricing Issues - Cont’d Ø Data • Use insured own experience • Supplement using “industry” data o o Similar company/industry Bureau Ø Correlation of Risks Ø Risk Loads • Captives which only insure the risks of the parent and affiliates / subsidiaries are only self-insurance in its most sophisticated form (i. e. , no real risk transfer) 41

Dynamic Financial Analysis Ø DFA’s goal is to provide management with: • solid information about the interaction of decisions from all • • Ø areas of company operations; a quantitative look at the risk-and-return trade-offs inherent in emerging strategic opportunities; and a structured process for evaluating alternative operating plans. Captive insurance companies are well-suited for DFA application 42

Conclusion Ø Questions Thank you 43