Capital Structure and Value Optimal capital structure is

- Slides: 29

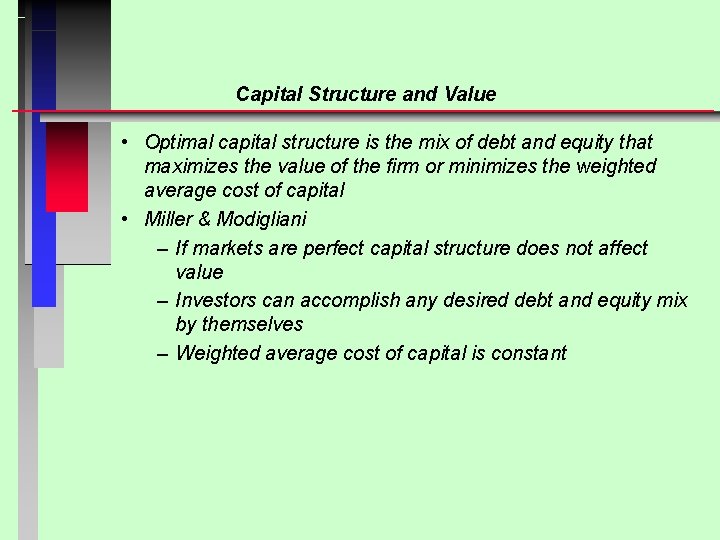

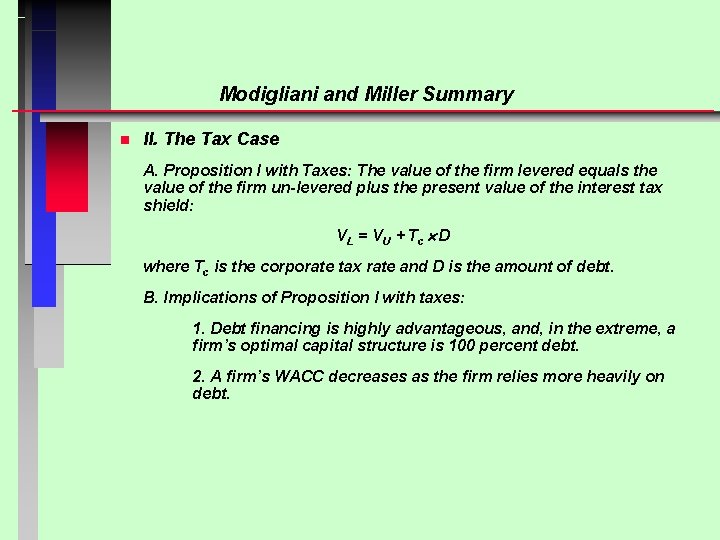

Capital Structure and Value • Optimal capital structure is the mix of debt and equity that maximizes the value of the firm or minimizes the weighted average cost of capital • Miller & Modigliani – If markets are perfect capital structure does not affect value – Investors can accomplish any desired debt and equity mix by themselves – Weighted average cost of capital is constant

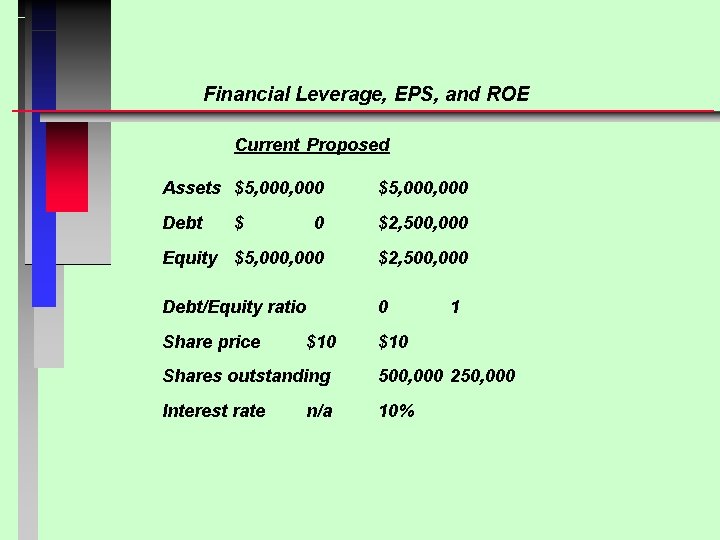

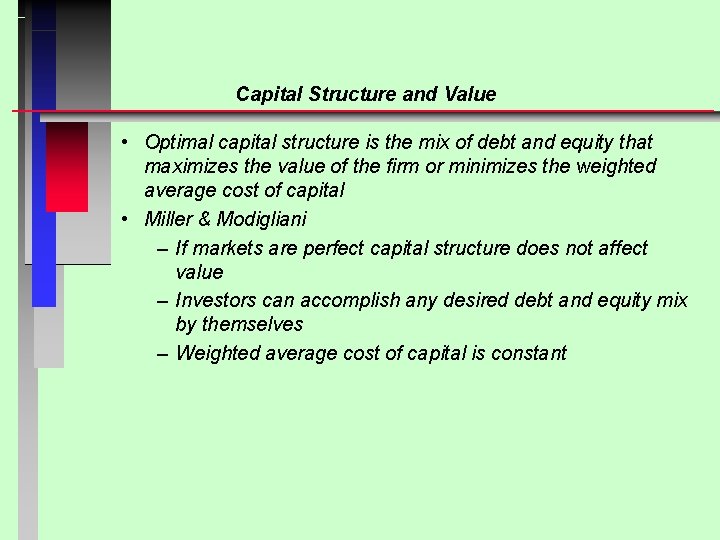

Financial Leverage, EPS, and ROE Current Proposed Assets $5, 000, 000 Debt 0 $2, 500, 000 Equity $5, 000 $2, 500, 000 Debt/Equity ratio 0 $ Share price $10 1 $10 Shares outstanding 500, 000 250, 000 Interest rate 10% n/a

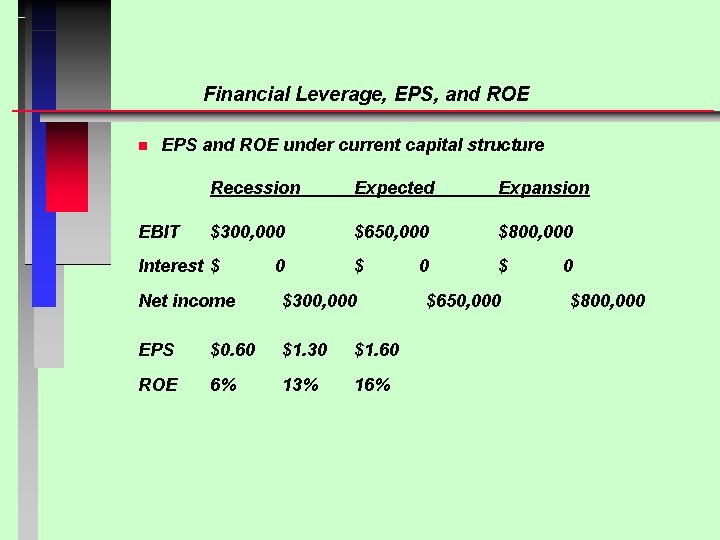

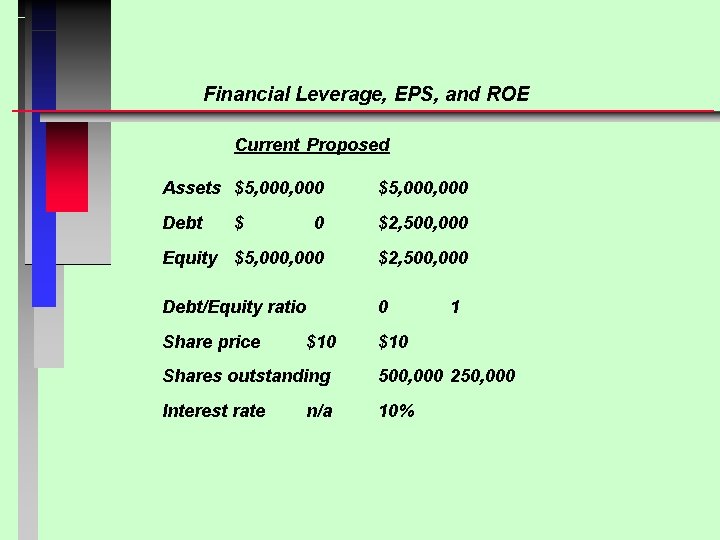

Financial Leverage, EPS, and ROE n EPS and ROE under current capital structure EBIT Recession Expected Expansion $300, 000 $650, 000 $800, 000 $ $ Interest $ 0 Net income $300, 000 EPS $0. 60 $1. 30 $1. 60 ROE 6% 13% 16% 0 $650, 000 0 $800, 000

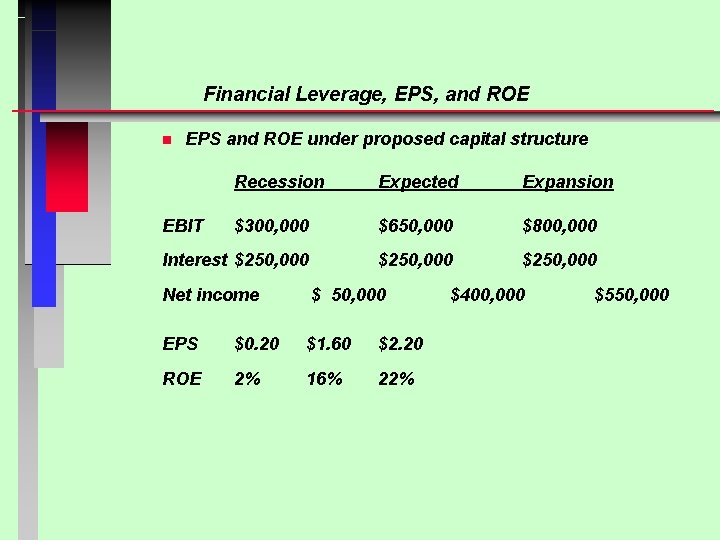

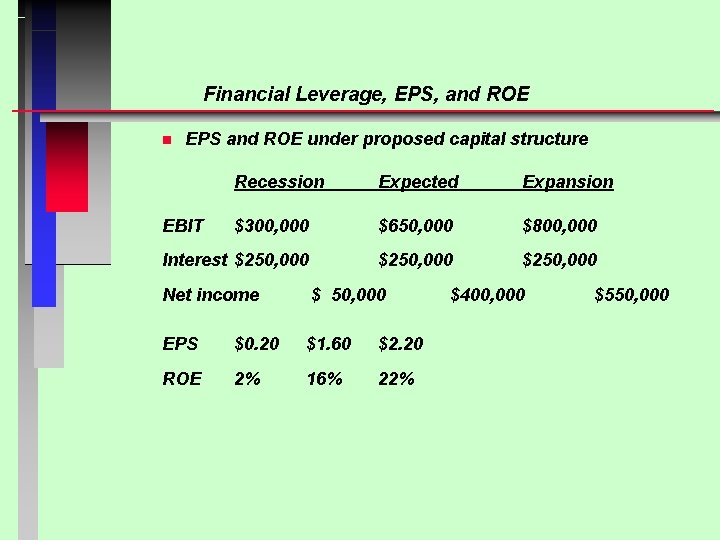

Financial Leverage, EPS, and ROE n EPS and ROE under proposed capital structure Recession Expected Expansion $300, 000 $650, 000 $800, 000 Interest $250, 000 EBIT Net income $ 50, 000 EPS $0. 20 $1. 60 $2. 20 ROE 2% 16% 22% $400, 000 $550, 000

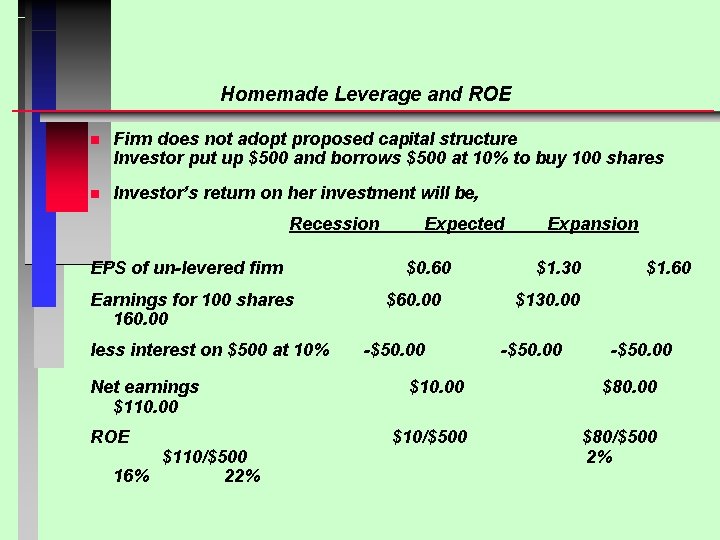

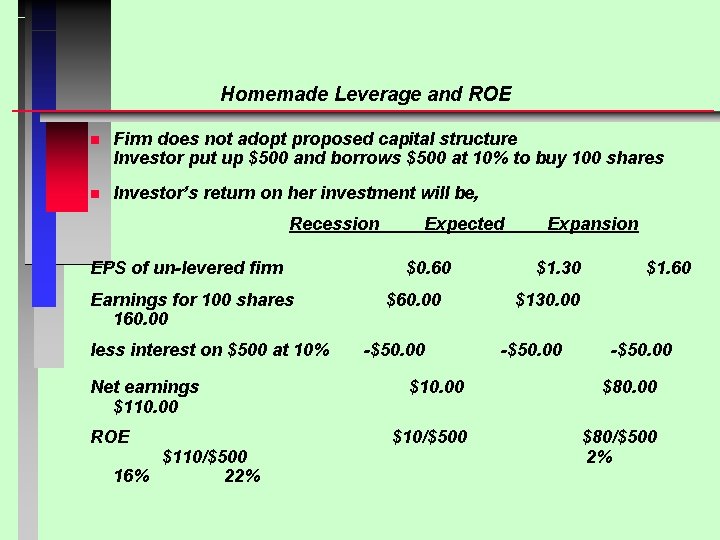

Homemade Leverage and ROE n Firm does not adopt proposed capital structure Investor put up $500 and borrows $500 at 10% to buy 100 shares n Investor’s return on her investment will be, Recession EPS of un-levered firm Earnings for 100 shares 160. 00 less interest on $500 at 10% Net earnings $110. 00 ROE $110/$500 16% 22% Expected $0. 60 $60. 00 -$50. 00 Expansion $1. 30 $1. 60 $130. 00 -$50. 00 $10. 00 $80. 00 $10/$500 $80/$500 2%

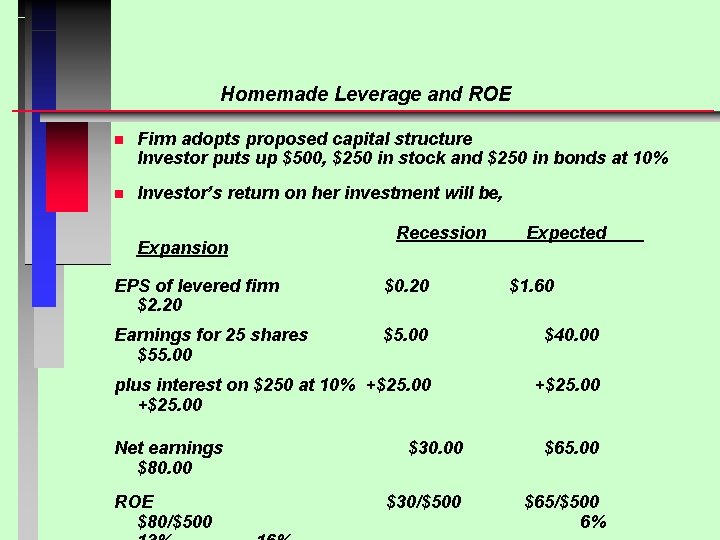

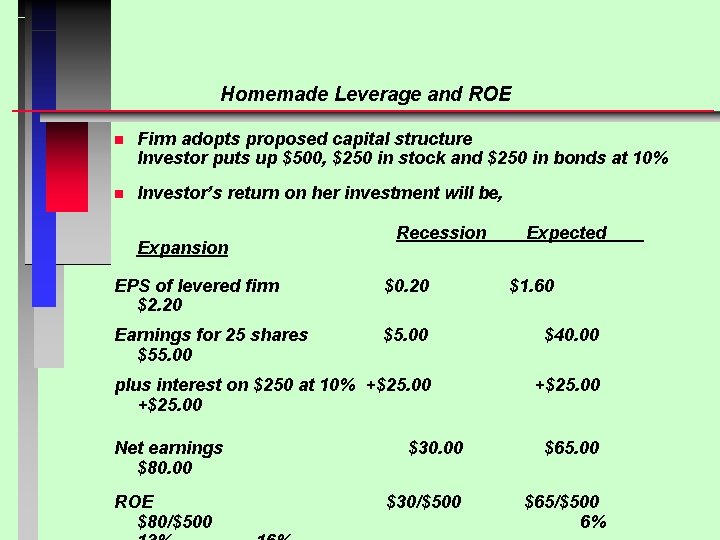

Homemade Leverage and ROE n Firm adopts proposed capital structure Investor puts up $500, $250 in stock and $250 in bonds at 10% n Investor’s return on her investment will be, Expansion Recession Expected EPS of levered firm $2. 20 $0. 20 Earnings for 25 shares $55. 00 $40. 00 plus interest on $250 at 10% +$25. 00 Net earnings $80. 00 ROE $80/$500 $30/$500 $1. 60 $65. 00 $65/$500 6%

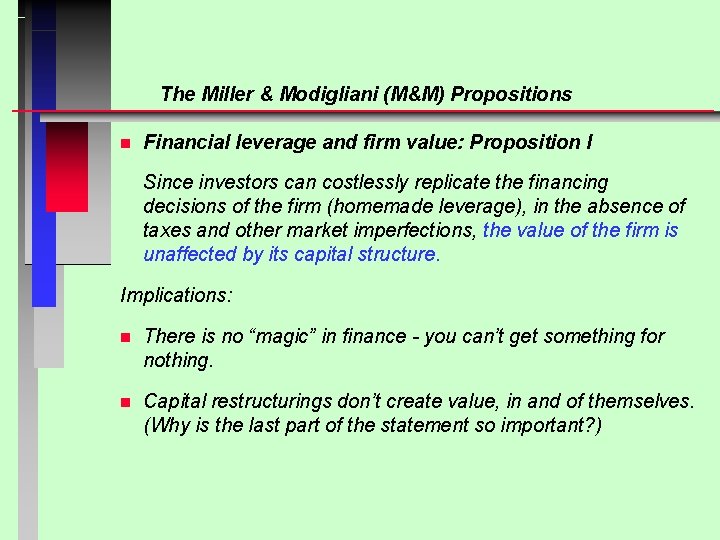

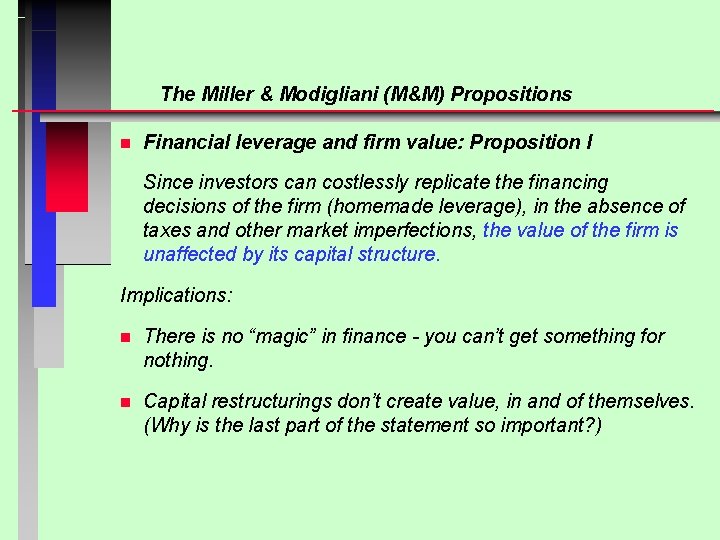

The Miller & Modigliani (M&M) Propositions n Financial leverage and firm value: Proposition I Since investors can costlessly replicate the financing decisions of the firm (homemade leverage), in the absence of taxes and other market imperfections, the value of the firm is unaffected by its capital structure. Implications: n There is no “magic” in finance - you can’t get something for nothing. n Capital restructurings don’t create value, in and of themselves. (Why is the last part of the statement so important? )

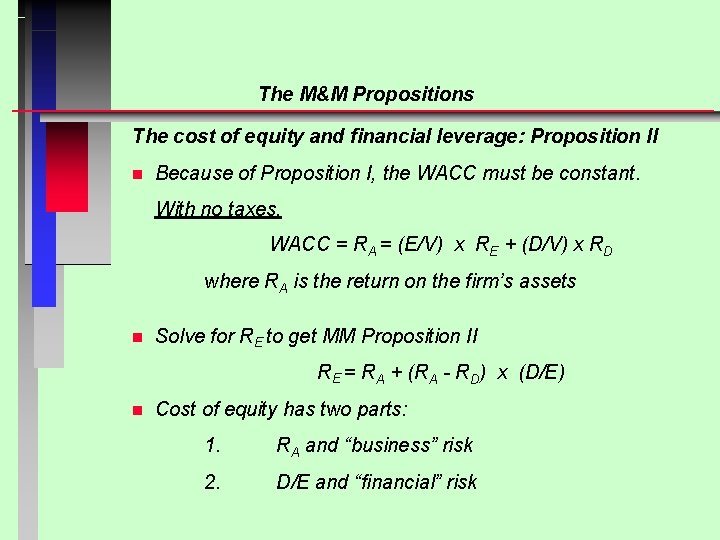

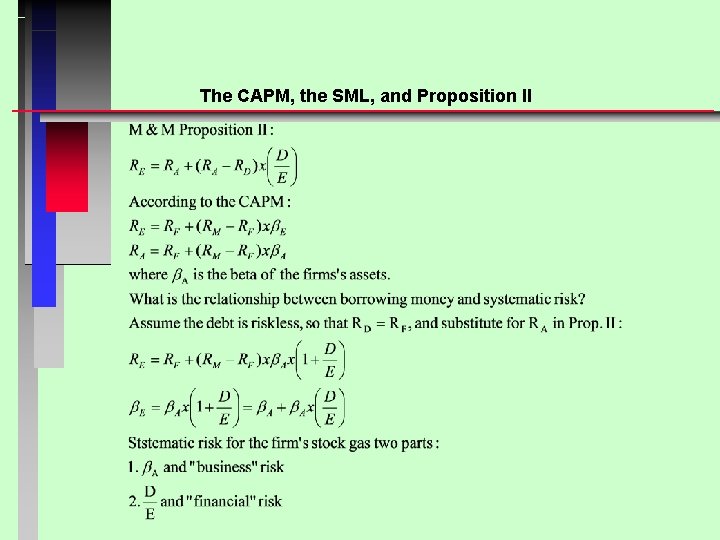

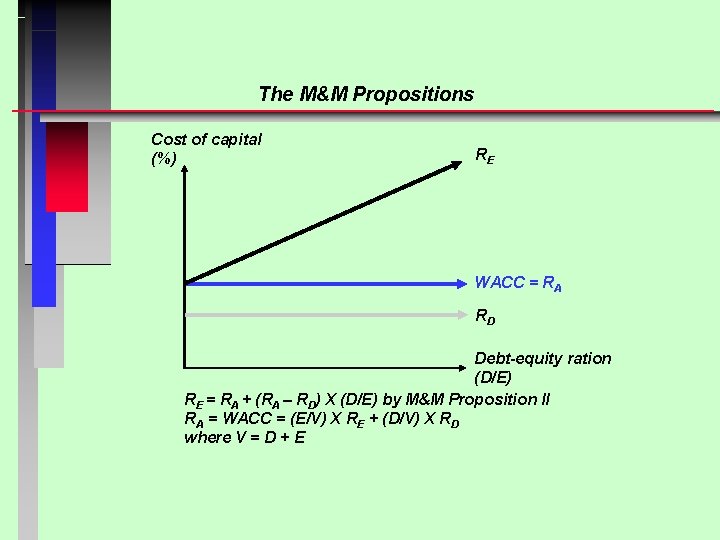

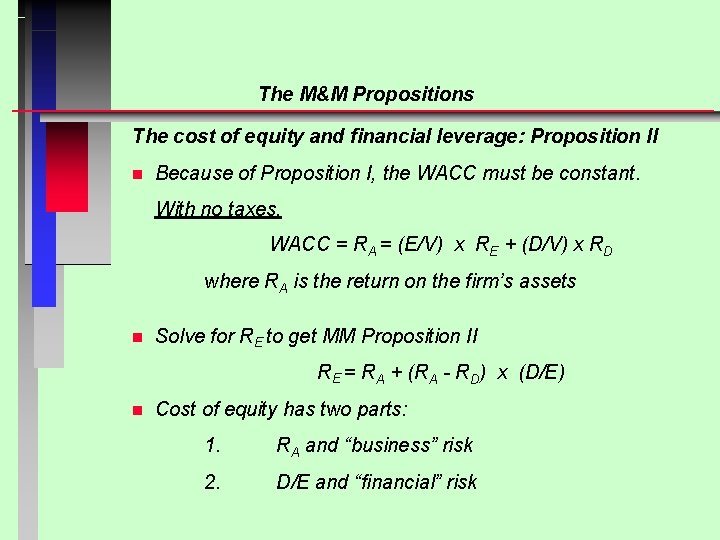

The M&M Propositions The cost of equity and financial leverage: Proposition II n Because of Proposition I, the WACC must be constant. With no taxes, WACC = RA = (E/V) x RE + (D/V) x RD where RA is the return on the firm’s assets n Solve for RE to get MM Proposition II RE = RA + (RA - RD) x (D/E) n Cost of equity has two parts: 1. RA and “business” risk 2. D/E and “financial” risk

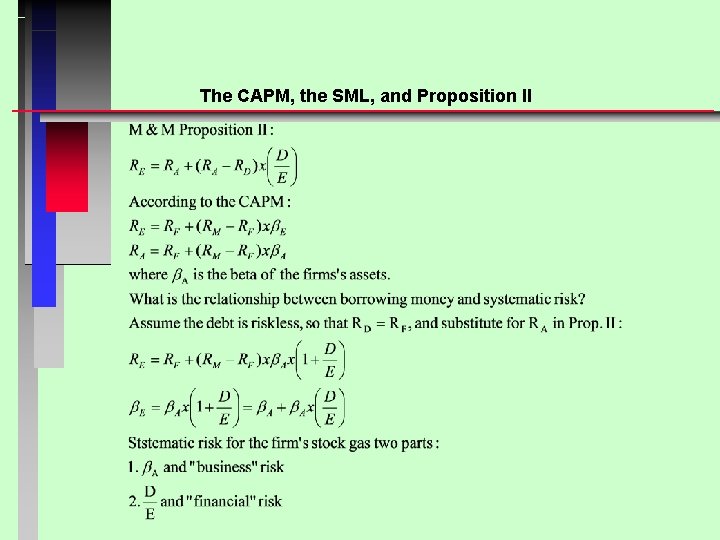

The CAPM, the SML, and Proposition II

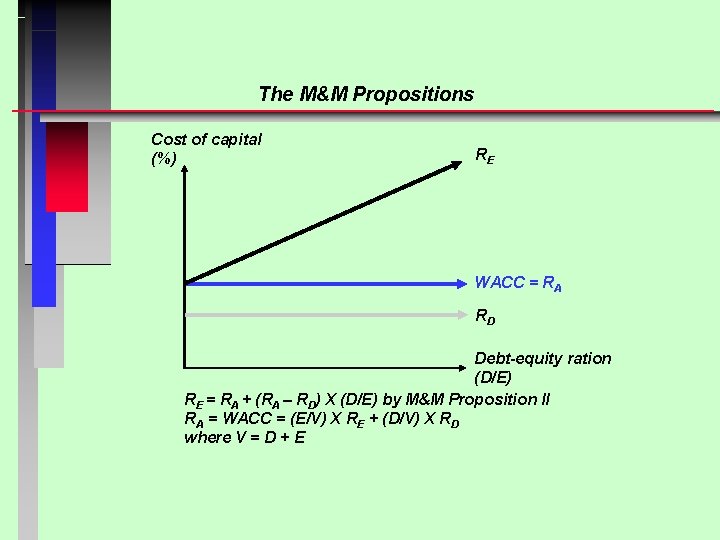

The M&M Propositions Cost of capital (%) RE WACC = RA RD Debt-equity ration (D/E) RE = RA + (RA – RD) X (D/E) by M&M Proposition II RA = WACC = (E/V) X RE + (D/V) X RD where V = D + E

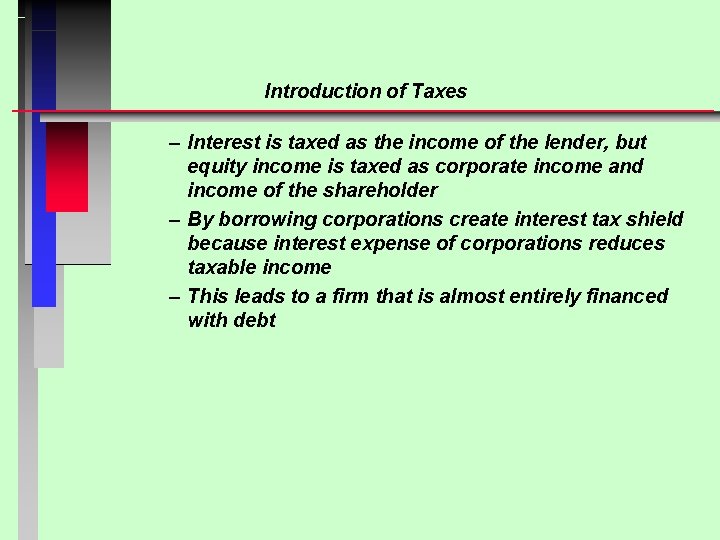

Introduction of Taxes – Interest is taxed as the income of the lender, but equity income is taxed as corporate income and income of the shareholder – By borrowing corporations create interest tax shield because interest expense of corporations reduces taxable income – This leads to a firm that is almost entirely financed with debt

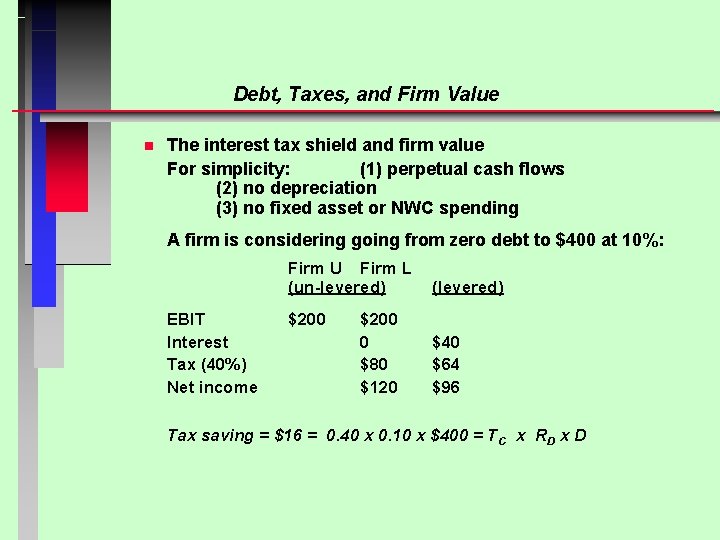

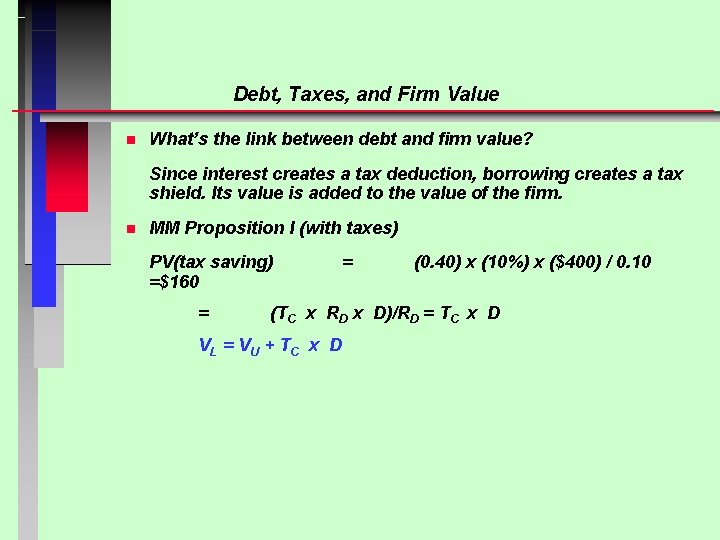

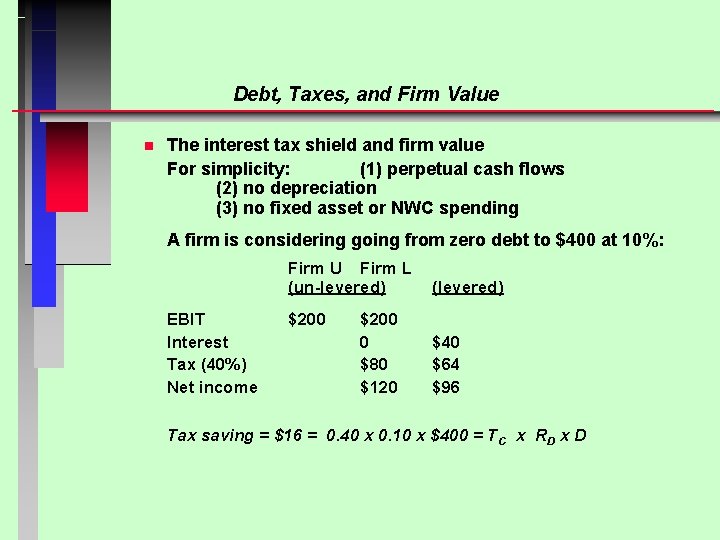

Debt, Taxes, and Firm Value n The interest tax shield and firm value For simplicity: (1) perpetual cash flows (2) no depreciation (3) no fixed asset or NWC spending A firm is considering going from zero debt to $400 at 10%: Firm U Firm L (un-levered) EBIT Interest Tax (40%) Net income $200 0 $80 $120 (levered) $40 $64 $96 Tax saving = $16 = 0. 40 x 0. 10 x $400 = TC x RD x D

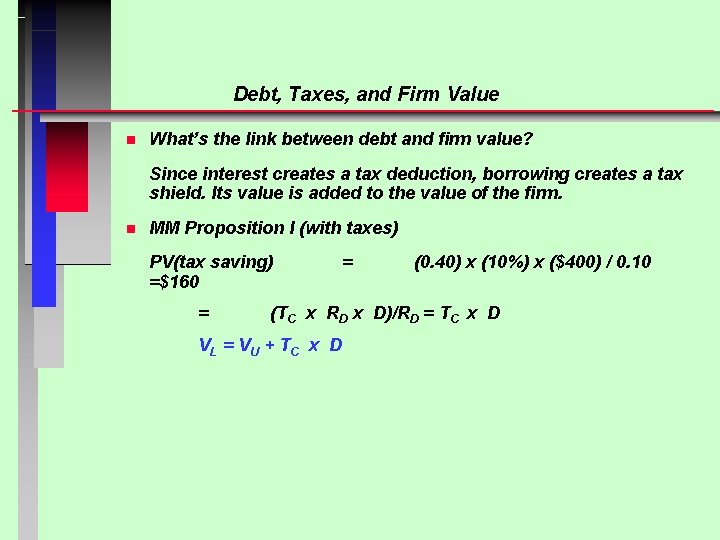

Debt, Taxes, and Firm Value n What’s the link between debt and firm value? Since interest creates a tax deduction, borrowing creates a tax shield. Its value is added to the value of the firm. n MM Proposition I (with taxes) PV(tax saving) =$160 = = (0. 40) x (10%) x ($400) / 0. 10 (TC x RD x D)/RD = TC x D VL = V U + T C x D

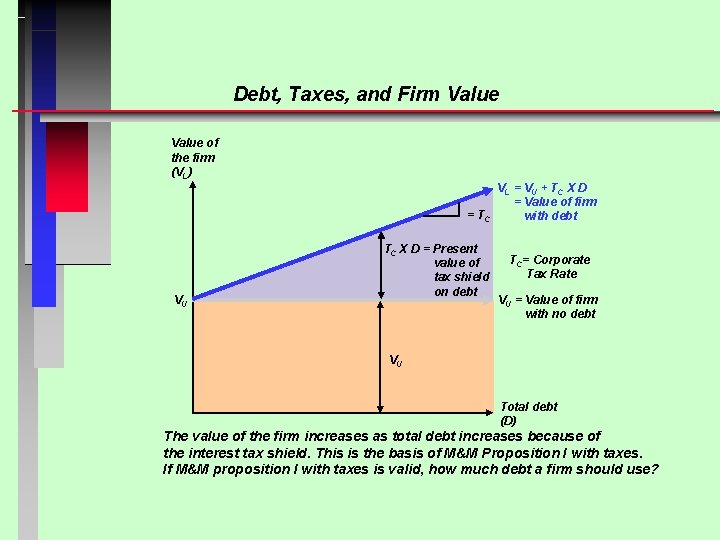

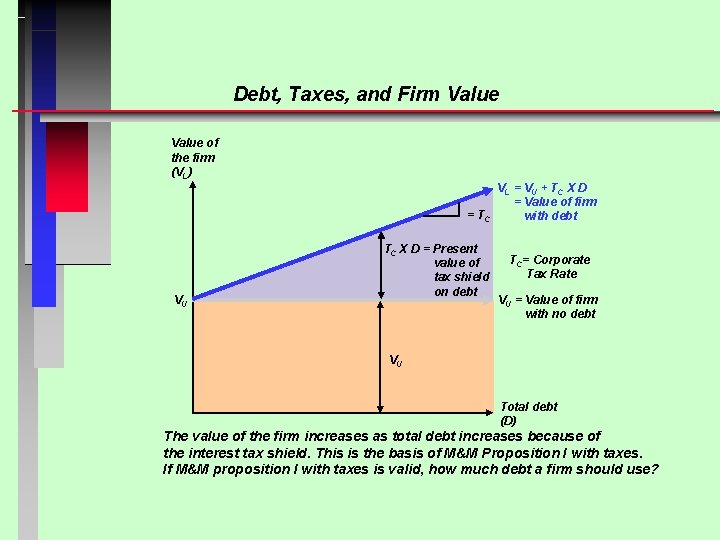

Debt, Taxes, and Firm Value of the firm (VL) = TC VU TC X D = Present value of tax shield on debt VL = V U + T C X D = Value of firm with debt TC= Corporate Tax Rate VU = Value of firm with no debt VU Total debt (D) The value of the firm increases as total debt increases because of the interest tax shield. This is the basis of M&M Proposition I with taxes. If M&M proposition I with taxes is valid, how much debt a firm should use?

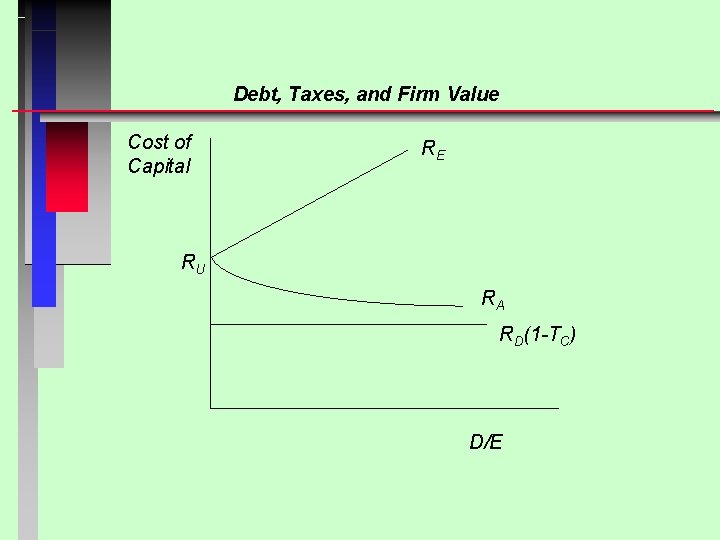

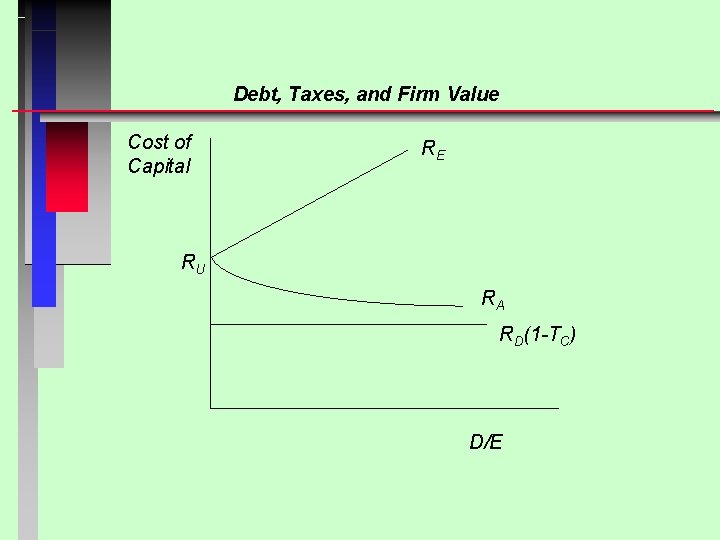

Debt, Taxes, and Firm Value Cost of Capital RE RU RA RD(1 -TC) D/E

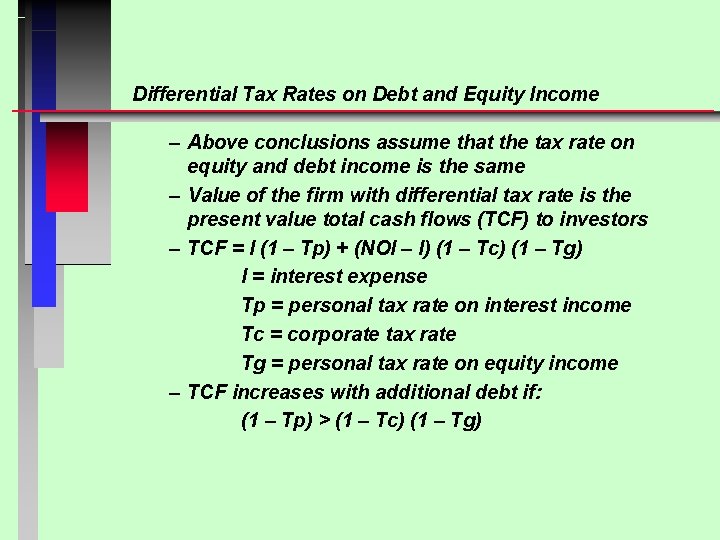

Differential Tax Rates on Debt and Equity Income – Above conclusions assume that the tax rate on equity and debt income is the same – Value of the firm with differential tax rate is the present value total cash flows (TCF) to investors – TCF = I (1 – Tp) + (NOI – I) (1 – Tc) (1 – Tg) I = interest expense Tp = personal tax rate on interest income Tc = corporate tax rate Tg = personal tax rate on equity income – TCF increases with additional debt if: (1 – Tp) > (1 – Tc) (1 – Tg)

Tax Clientele Effect – Tax rates of investors vary causing preference toward debt or equity – If all companies have the same tax rate but investors experience different tax rates, companies as a group would maximize value by issuing enough debt to accommodate those investor for whom (1 – Tp) > (1 – Tc) (1 – Tg) holds • Differential Tax Rates Among Corporations – High tax rate of a corporation increases benefits of debt financing

Bankruptcy Costs n n As the D/E ratio increases, the probability of bankruptcy increases – likelihood of operating income shortage to cover interest expense on the debt This increased probability will increase the expected bankruptcy costs At some point, the additional value of the interest tax shield will be offset by the expected bankruptcy cost At this point, the value of the firm will start to decrease and the WACC will start to increase as more debt is added

Bankruptcy Costs • Bankruptcy Costs – Direct costs: legal and administrative fees • Legal costs – Indirect costs: • Lost sales of products requiring future service • Loss of best employees • Low employee morale • Inability of credit purchases • Higher financing costs and restrictions – As the amount of debt increases, the probability of bankruptcy and therefore expected costs of bankruptcy increases, reducing firm value

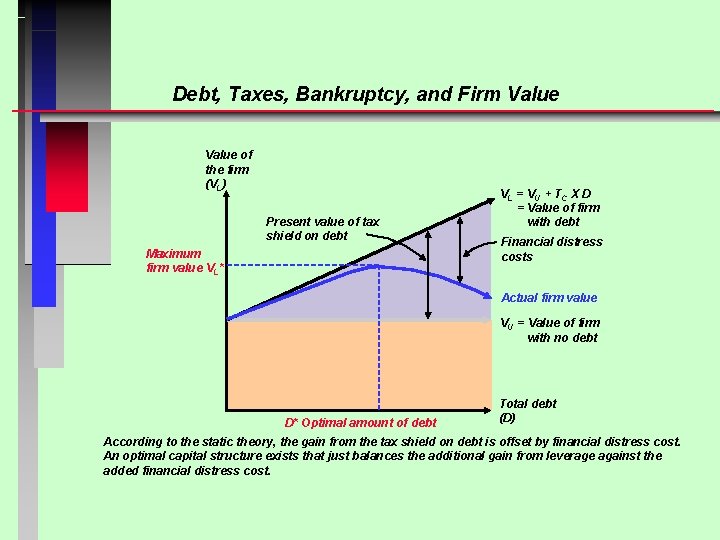

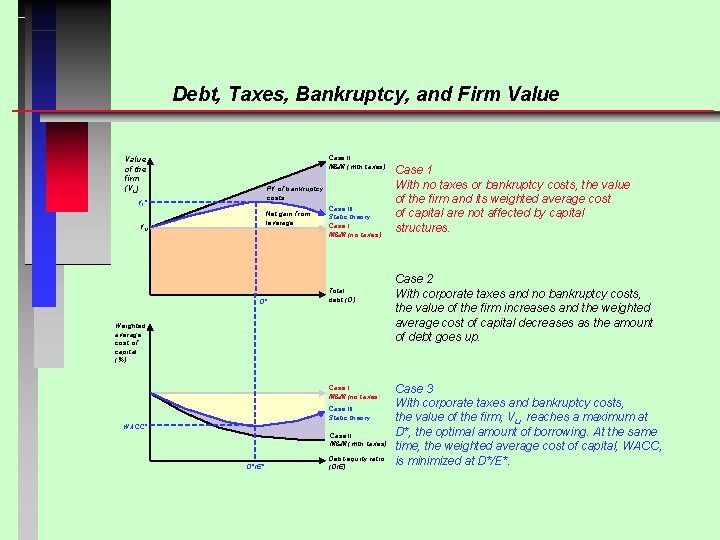

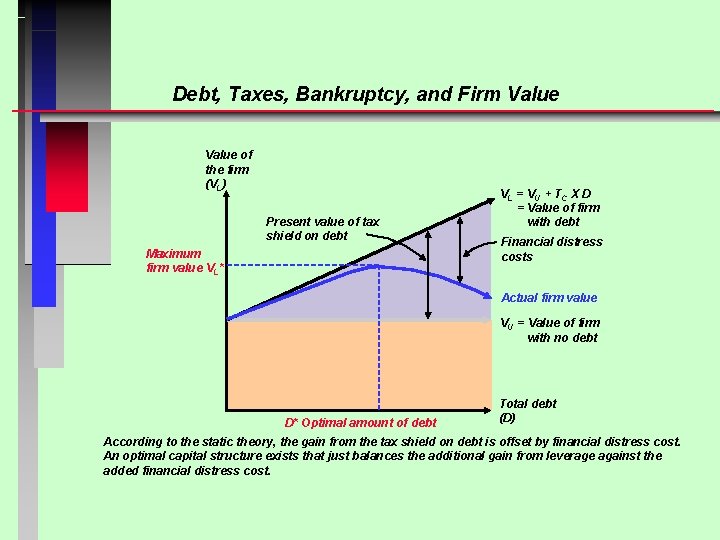

Debt, Taxes, Bankruptcy, and Firm Value of the firm (VL) Present value of tax shield on debt Maximum firm value VL* VL = V U + T C X D = Value of firm with debt Financial distress costs Actual firm value VU = Value of firm with no debt D* Optimal amount of debt Total debt (D) According to the static theory, the gain from the tax shield on debt is offset by financial distress cost. An optimal capital structure exists that just balances the additional gain from leverage against the added financial distress cost.

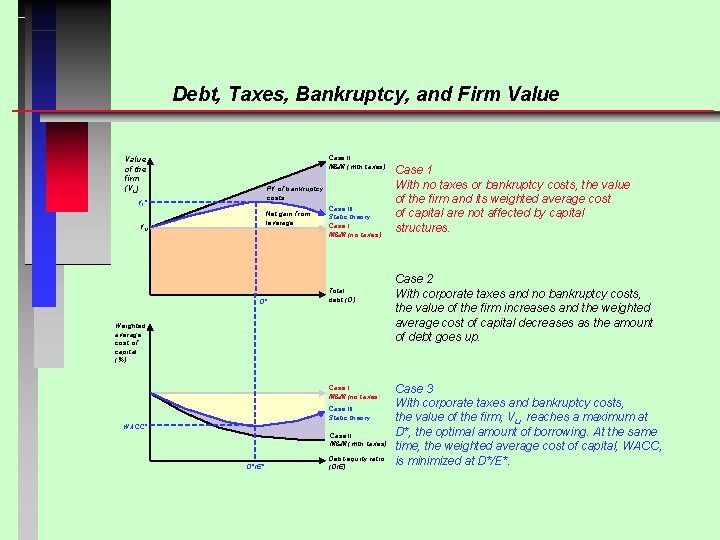

Debt, Taxes, Bankruptcy, and Firm Value Case II M&M (with taxes) Value of the firm (VL) PV of bankruptcy costs VL* Net gain from leverage VU D* Case III Static theory Case I M&M (no taxes) Total debt (D) Weighted average cost of capital (%) Case I M&M (no taxes) Case III Static theory WACC* Case II M&M (with taxes) D*/E* Debt-equity ratio (D/E) Case 1 With no taxes or bankruptcy costs, the value of the firm and its weighted average cost of capital are not affected by capital structures. Case 2 With corporate taxes and no bankruptcy costs, the value of the firm increases and the weighted average cost of capital decreases as the amount of debt goes up. Case 3 With corporate taxes and bankruptcy costs, the value of the firm, VL, reaches a maximum at D*, the optimal amount of borrowing. At the same time, the weighted average cost of capital, WACC, is minimized at D*/E*.

Agency Costs – Agency costs of debt: • Managers can increase shareholders’ wealth at the expense of creditors by taking risky projects • If level of debt is low, risks are also low. High debt level requires monitoring by creditors, increasing agency costs even further – Agency costs of equity • Managers’ self fulfilling prophecies, conservatism or over-optimism in investment decisions • Higher debt level prevents managers from value reducing activities

Information Signaling – Managers convey their private information to the investors by changing capital structure – High debt levels reflect managers’ information on improved future prospects of the company – Firms with bad news cannot replicate because they won’t have resources to support high debt level

Additional Considerations – Unequal costs of borrowing – Higher risk of personal borrowing – Institutional restrictions on leverage

Capital Structure with Informed Investors • Study the market response to determine optimal capital structure • Study the relationship between different capital structures and the weighted average cost of capital • Information from market participants Investment bankers Bond ratings and wacc Security analysts • Disequilibrium

Capital Structure with Uninformed Investors • If investors are not well-informed, managers should consider future profitability, earnings variability and bankruptcy risk • Pro forma analysis of alternative capital structures • Risk analysis Ratio measures Break-even point is the sales level below which the company has a loss Crossover point is the sales or EBIT level at which the company would earn the same EPS with two different capital structures Debt capacity analysis

Empirical Evidence – Bankruptcy costs are important in determining optimal capital structure – The more the physical assets the more the debt level in capital structure – Announcement of equity issues cause negative abnormal returns – Announcement of debt for equity exchange increases stock value – Announcement of equity for debt exchange decreases stock value – Abnormal price drops following leverage decreasing capital structure exchanges are positively related to unexpected earnings decreases – Stock repurchases via tender offers result in sharp price increases – If a firm becomes a takeover target, it increases debt level Harris and Raviv (1991), Theory of Capital Structure, JOF.

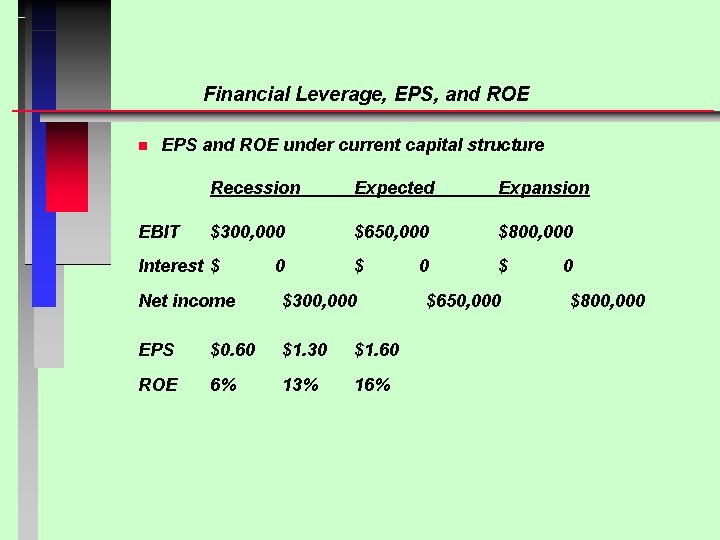

Modigliani and Miller Summary n I. The No-Tax Case A. Proposition I: The value of the firm levered equals the value of the firm un -levered: VL = VU B. Implications of Proposition I: 1. A firm’s capital structure is irrelevant. 2. A firm’s WACC is the same no matter what mix of debt and equity is used. C. Proposition II: The cost of equity, RE, is RE = RA + (RA - RD) ´ D/E where RA is the WACC, RD is the cost of debt, and D/E is the debt/equity ratio. D. Implications of Proposition II 1. The cost of equity rises as the firm increases its use of debt financing. 2. Equity risk depends on the risk of firm operations (business risk) and the degree of financial leverage (financial risk).

Modigliani and Miller Summary n II. The Tax Case A. Proposition I with Taxes: The value of the firm levered equals the value of the firm un-levered plus the present value of the interest tax shield: VL = V U + Tc ´ D where Tc is the corporate tax rate and D is the amount of debt. B. Implications of Proposition I with taxes: 1. Debt financing is highly advantageous, and, in the extreme, a firm’s optimal capital structure is 100 percent debt. 2. A firm’s WACC decreases as the firm relies more heavily on debt.