Capital Rationing Mark FieldingPritchard mefielding com 1 The

- Slides: 12

Capital Rationing Mark Fielding-Pritchard mefielding. com 1

The Meaning Placing restrictions on the amount of new investments or projects undertaken by a company. This is accomplished by imposing a higher cost of capital for investment consideration or by setting a ceiling on the specific sections of the budget. mefielding. com 2

Why ? Companies may want to implement capital rationing in situations where past returns of investment were lower than expected. For example, suppose ABC Corp. has a cost of capital of 10% but that the company has undertaken too many projects, many of which are incomplete. This causes the company's actual return on investment to drop well below the 10% level. As a result, management decides to place a cap on the number of new projects by raising the cost of capital for these new projects to 15%. Starting fewer new projects would give the company more time and resources to complete existing projects. mefielding. com 3

Types Soft Capital Rationing: It is when the restriction is imposed by the management. Hard Capital Rationing: It is when the capital infusion is limited by external sources. mefielding. com 4

Hard capital rationing. Economic conditions (recession). No security. No track record. mefielding. com 5

Soft capital rationing. Lack of management skills. Focus on Key areas. Too many projects undertaken. mefielding. com 6

Selecting the best. It is not wrong to say that all the investments with positive NPV should be accepted but at the same time the ground reality prevails that the availability of capital is limited. The calculation and method prescribes arranging projects in descending order of their profitability based on IRR, NPV and PI and selecting the optimal combination. mefielding. com 7

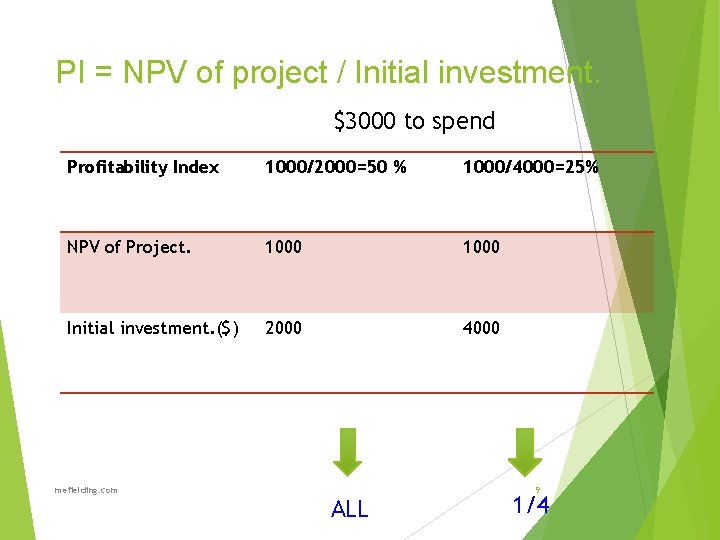

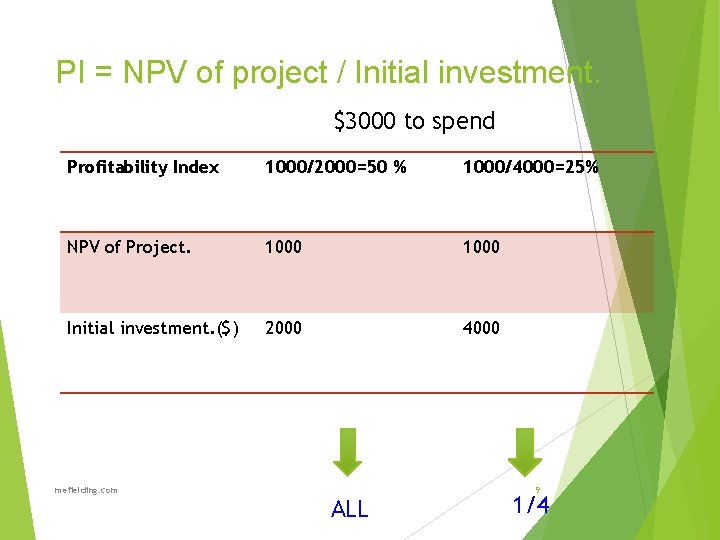

Divisible projects. In case of projects which are divisible (in which we can complete some part of the project). We use the profitability index in order to find the optimal project mix. mefielding. com 8

PI = NPV of project / Initial investment. $3000 to spend Profitability Index 1000/2000=50 % 1000/4000=25% NPV of Project. 1000 Initial investment. ($) 2000 4000 mefielding. com ALL 9 1/4

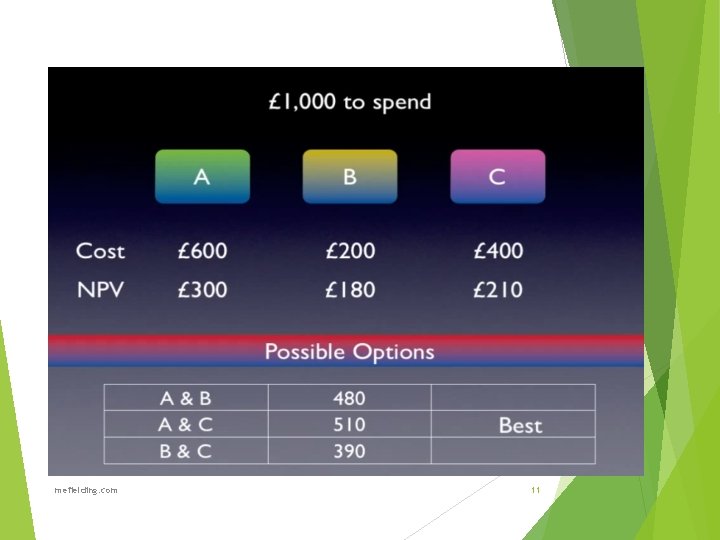

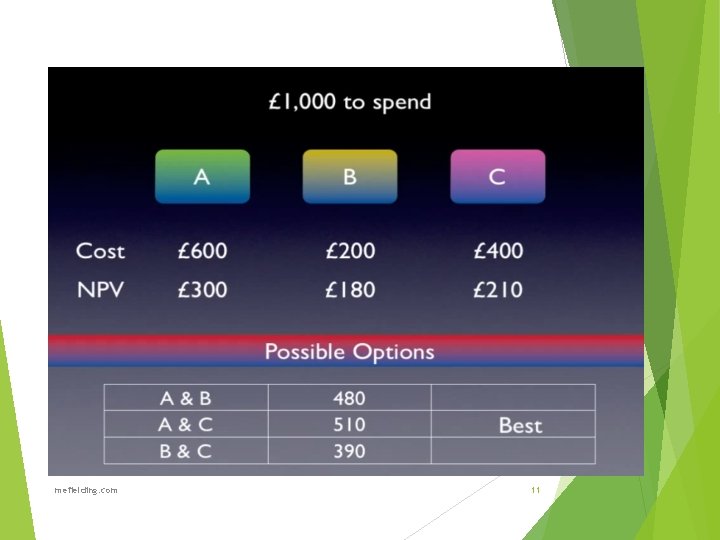

Non Divisible. In case of non divisible projects we don’t have the option of completing a part of the project. So in this case we have to use the trial and approach method to find out the best possible alternatives given the limited amount of capital. mefielding. com 10

mefielding. com 11

The Big Picture. In the previous slides we saw the working of capital rationing at a micro scale but the scope of capital rationing is not limited to that. One of the most effective ways to control economic fluctuations is capital rationing itself. For example – The Bank of England increases the CRR and Repo rates, places restrictions, uses moral suasion in order to limit the amount of investments in the country in order to curb inflation and prevent growth bubbles. mefielding. com 12